Market Overview

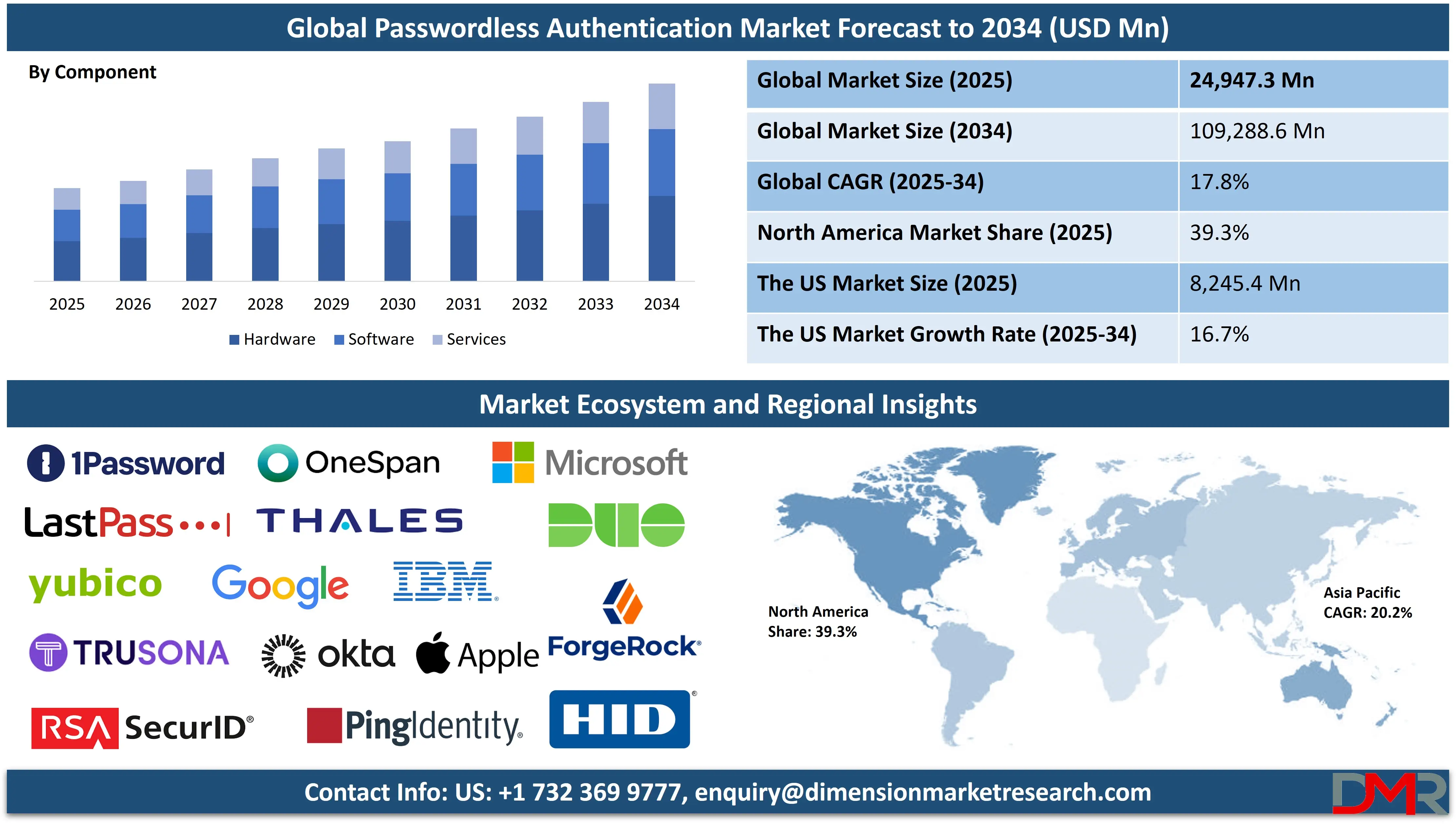

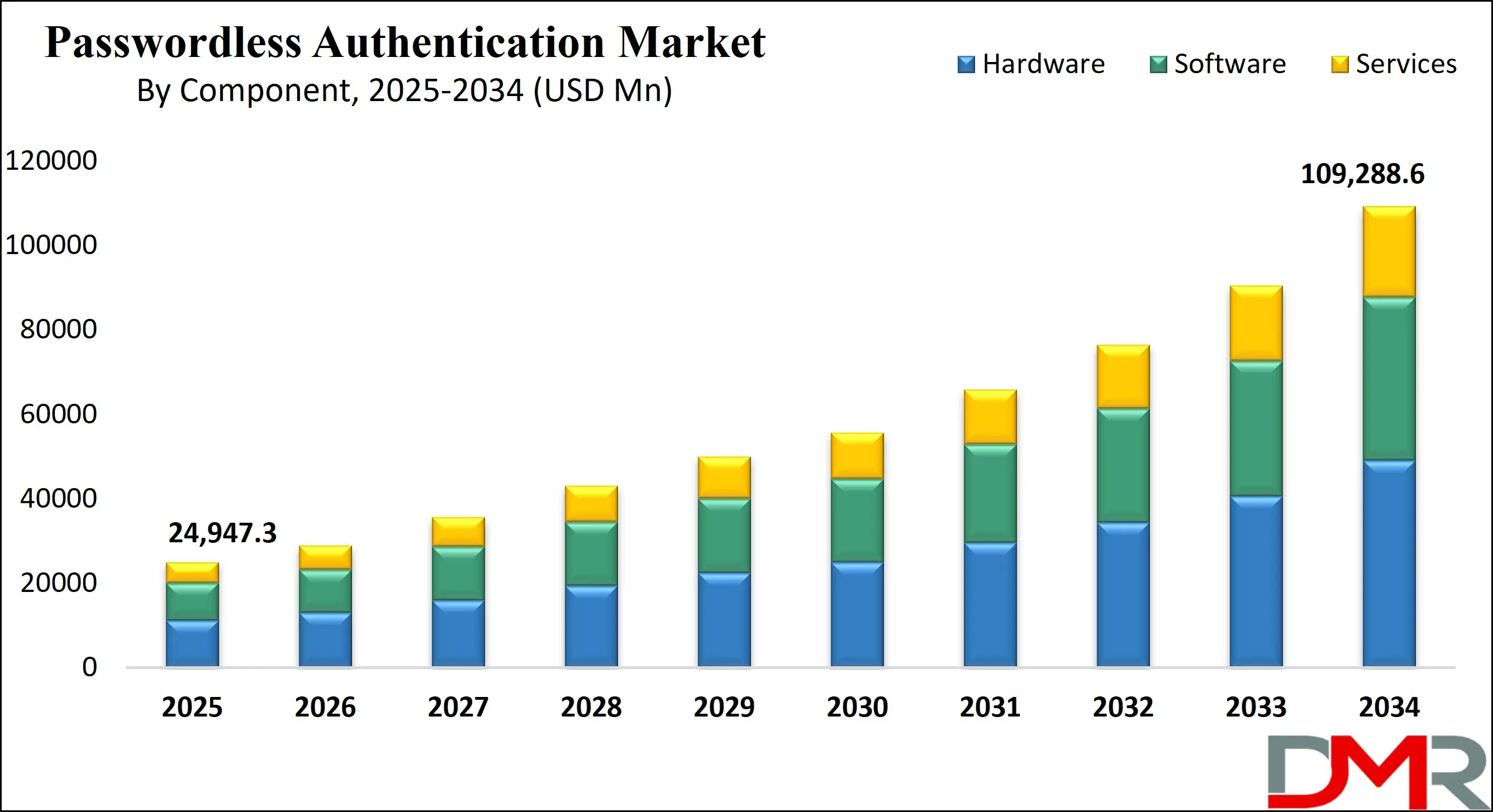

The Global Passwordless Authentication Market is projected to reach USD 24,947.3 million in 2025 and grow at a compound annual growth rate of 17.8% from there until 2034 to reach a value of USD 109,288.6 million.

The global passwordless authentication market is experiencing a paradigm shift as cybersecurity demands intensify amid the digital transformation of enterprises. This market’s growth is driven by rising phishing attacks, credential stuffing incidents, and compliance mandates such as GDPR, CCPA, and PSD2. Organizations are increasingly adopting biometric recognition, cryptographic authentication, and FIDO2-based protocols to eliminate traditional passwords and secure access to critical systems and data. Many enterprises are also leveraging Security as a Service solutions to streamline implementation and reduce infrastructure costs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Prevailing trends include the integration of multi-factor authentication (MFA) with identity orchestration, adoption of zero-trust architecture, and enterprise-grade public key infrastructure (PKI) for cryptographic login. Innovations in biometric hardware, mobile authentication, and device-based security tokens are revolutionizing workforce access management and customer identity verification across banking, healthcare, and government domains. Additionally, cloud-native authentication platforms are gaining traction due to the growth in remote work, SaaS ecosystems, and edge computing. The surge in Mobile Banking adoption is driving demand for secure, passwordless authentication for financial transactions on smartphones.

Opportunities lie in enhancing UX through frictionless authentication, implementing decentralized identity (DID) frameworks using blockchain, and scaling passwordless login for consumer applications like digital banking, e-commerce, and IoT. Countries with advanced digital public infrastructure are seeing early adoption by both public and private sector entities. Meanwhile, AI-driven anomaly detection is being embedded into authentication platforms for adaptive security. Some industries, including agriculture, are exploring integrations with Commercial Greenhouse management systems to secure IoT devices and operational data.

However, restraints include high implementation costs, integration complexities with legacy systems, and privacy concerns around biometric data. Developing economies face skill shortages and infrastructure constraints that inhibit full-scale adoption. Furthermore, standardization gaps and limited vendor interoperability delay seamless deployment across heterogeneous IT environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Overall, the market outlook remains robust due to enterprise digitalization, increasing mobile workforce, and government backing for secure identity initiatives. Market leaders are focusing on partnerships, identity lifecycle automation, and FIDO Alliance compliance to capitalize on the growing need for secure, scalable, and password-free authentication solutions.

The US Passwordless Authentication Market

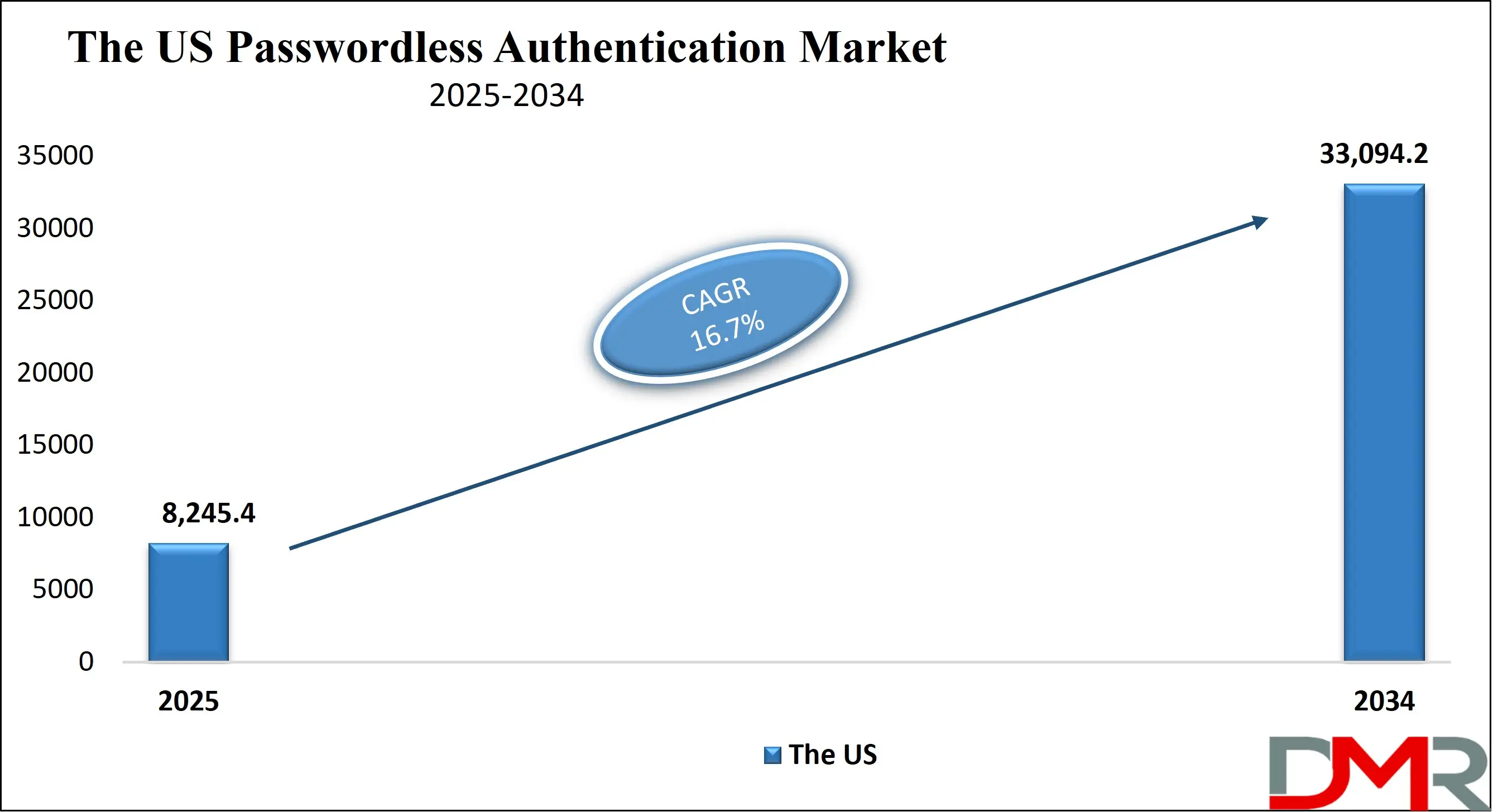

The US Passwordless Authentication Market is projected to reach USD 8,245.4 million in 2025 at a compound annual growth rate of 16.7% over its forecast period.

The U.S. passwordless authentication market is at the forefront of global innovation, supported by a mature cybersecurity ecosystem, stringent compliance mandates, and digital transformation across sectors. Government-backed frameworks such as the National Institute of Standards and Technology (NIST) guidelines particularly NIST SP 800-63B have accelerated adoption of phishing-resistant authentication protocols like FIDO2 and WebAuthn in federal and commercial systems. The Federal Risk and Authorization Management Program (FedRAMP) also promotes secure cloud authentication architectures in federal agencies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. Department of Homeland Security and Cybersecurity & Infrastructure Security Agency (CISA) advocate for zero-trust frameworks and passwordless access to mitigate identity-related threats. These efforts align with Executive Order 14028, which prioritizes identity modernization within national cybersecurity strategy. The U.S. Census Bureau highlights the rapid growth in mobile and remote work adoption, driving demand for seamless, device-based biometric and token-based authentication.

High digital literacy, widespread use of smartphones with embedded biometric sensors, and advanced mobile infrastructure further support the proliferation of facial recognition, fingerprint scanning, and device-bound credentials. The country's dynamic fintech sector, reinforced by Federal Financial Institutions Examination Council (FFIEC) guidelines, also plays a key role in pushing passwordless adoption in banking applications.

Moreover, U.S. universities and hospitals supported by the Department of Health and Human Services (HHS) and National Institutes of Health (NIH) are deploying password-free access to patient and academic portals to boost efficiency and privacy compliance. With an emphasis on both national security and individual privacy, the U.S. market benefits from an unmatched combination of policy, infrastructure, and technical expertise in advancing the passwordless ecosystem.

The Europe Passwordless Authentication Market

The Europe Passwordless Authentication Market is estimated to be valued at USD 3,742.1 million in 2025 and is further anticipated to reach USD 16,276.2 million by 2034 at a CAGR of 17.0%.

Europe’s passwordless authentication market is growing steadily, driven by strong data protection regulations, digital identity initiatives, and technological readiness. The General Data Protection Regulation (GDPR) and the eIDAS Regulation have laid a firm foundation for secure and compliant identity verification systems, including passwordless solutions. Countries across the EU are adopting FIDO2, WebAuthn, and biometric security standards to enhance digital trust while reducing data breach liabilities.

The European Commission's Digital Decade policy and its emphasis on secure and interoperable digital identities encourage the implementation of passwordless systems in public and private sectors. Programs like the European Digital Identity Wallet initiative are pushing member states to provide password-free access to government services, banking platforms, and healthcare systems. The EU Agency for Cybersecurity (ENISA) further supports these goals by advocating for phishing-resistant authentication and risk-based access controls.

Europe’s diverse language and identity ecosystems make multi-modal biometric authentication (e.g., iris, fingerprint, and voice) particularly valuable, especially for cross-border public services. The European Central Bank promotes secure financial authentication under PSD2, reinforcing the need for strong customer authentication (SCA) in fintech and e-commerce.

National digital inclusion efforts and increasing mobile usage, as shown by Eurostat, provide a favorable demographic environment for adoption. Smartcard-based digital identities in countries like Estonia and Germany, supported by governmental programs, enable secure authentication without passwords. Challenges include integration with legacy infrastructure and data localization constraints across EU states. However, ongoing investments in digital public infrastructure and AI-based threat mitigation tools indicate a high-potential trajectory for Europe's passwordless authentication market.

The Japan Passwordless Authentication Market

The Japan Passwordless Authentication Market is projected to be valued at USD 1,496.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6,352.4 million in 2034 at a CAGR of 17.6%.

Japan’s passwordless authentication market is advancing with momentum, backed by government digitization strategies and a population adept with technology. The Ministry of Internal Affairs and Communications (MIC) supports digital government services through the Digital Agency, which advocates for secure and efficient access via biometric and token-based authentication. The My Number System (a national identification system) is being integrated with digital identity apps, facilitating secure passwordless access to various government and financial services.

Japan’s aging population presents a unique opportunity for biometric-based authentication such as facial recognition and iris scanning, which offer user-friendly and secure alternatives to passwords for the elderly. The Ministry of Economy, Trade and Industry (METI) promotes digital transformation in small and medium-sized enterprises, where passwordless login helps mitigate cybersecurity skill shortages and improve operational efficiency.

Smartphone penetration in Japan exceeds 90%, as reported by the Statistics Bureau of Japan, creating a solid foundation for mobile-based authentication using device biometrics and cryptographic keys. Public transportation systems, smart city initiatives, and financial institutions are adopting NFC-enabled smartcards and FIDO-compliant authentication to minimize fraud and improve user experience.

Challenges remain in terms of harmonizing authentication standards across government and private systems. However, the government’s commitment to creating a cashless society and digitized infrastructure under its Society 5.0 initiative strongly supports the passwordless authentication movement. Local tech giants and academic institutions are also collaborating to integrate AI-powered anomaly detection with biometric and behavioral authentication methods, enabling scalable and secure access management across digital ecosystems in Japan.

Global Passwordless Authentication Market: Key Takeaways

- Global Market Size Insights: The Global Passwordless Authentication Market size is estimated to have a value of USD 24,947.3 million in 2025 and is expected to reach USD 109,288.6 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 17.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Passwordless Authentication Market is projected to be valued at USD 8,245.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 33,094.2 million in 2034 at a CAGR of 16.7%.

- Regional Insights: North America is expected to have the largest market share in the Global Passwordless Authentication Market with a share of about 39.3% in 2025.

- Key Players: Some of the major key players in the Global Passwordless Authentication Market are Microsoft, Google, Apple, IBM, Okta, Yubico, Duo Security (Cisco), Thales Group, ForgeRock, and many others.

Global Passwordless Authentication Market: Use Cases

- Banking & Finance Login Security: Leading banks now deploy FIDO2-based passwordless login using biometrics and device cryptographic keys, reducing account takeovers while meeting PSD2 and FFIEC regulations. These methods improve customer trust and meet evolving regulatory demands.

- Healthcare Staff Authentication: Hospitals integrate biometric fingerprint scanners and smartcards for password-free EMR system access, enabling fast, secure login for medical professionals while preserving HIPAA compliance and minimizing identity-based breaches.

- Remote Work Access Control: Corporations use biometric MFA and PKI certificates for employee access to internal applications via VPNs or VDI environments, ensuring zero-trust enforcement and reducing risks from compromised credentials in remote settings.

- E-commerce Checkout Optimization: Retailers utilize passwordless login with email magic links or mobile push verification, improving customer experience, reducing cart abandonment, and safeguarding transactions from credential phishing attacks.

- Government Digital Services: Public service portals employ facial recognition and QR-based secure login for citizens accessing social security, tax, and healthcare data, ensuring secure identity validation while simplifying user journeys under national digital ID frameworks.

Global Passwordless Authentication Market: Stats & Facts

National Institute of Standards and Technology (NIST) – USA

- 86% of cyberattacks involve stolen or weak credentials, according to NIST guidelines on digital identity (SP 800-63-3). This finding underscores the systemic vulnerability of password-based systems and validates the urgent shift to phishing-resistant and passwordless authentication mechanisms.

- NIST recommends passwordless methods such as biometrics, public key infrastructure (PKI), and hardware tokens under its Special Publication 800-63B, defining them as stronger alternatives to conventional usernames and passwords.

- NIST’s Zero Trust Architecture framework (SP 800-207) defines passwordless authentication as a key component of eliminating implicit trust and implementing continuous identity verification in modern enterprise networks.

FIDO Alliance

- Over 4 billion devices worldwide now support FIDO-based authentication protocols, including smartphones, laptops, and hardware tokens, representing a growing global infrastructure ready for passwordless access.

- A FIDO user behavior report indicates 90% of consumers abandon account creation if it requires password creation, highlighting the need for frictionless, intuitive login alternatives.

- FIDO2 protocols reduce the success rate of phishing and replay attacks to nearly zero by binding user credentials to the device, rather than transmitting reusable secrets.

U.S. Cybersecurity & Infrastructure Security Agency (CISA)

- CISA states that nearly 80% of hacking-related breaches across federal IT systems involve compromised credentials, illustrating the vulnerabilities of legacy authentication frameworks.

- The agency’s cybersecurity directives promote passwordless authentication methods including FIDO2 and PIV (Personal Identity Verification) cards as key tools in implementing Zero Trust security architectures.

- Under Binding Operational Directive (BOD) 23-02, federal agencies are required to transition to phishing-resistant authentication, preferably passwordless, for privileged and non-privileged users by the specified compliance deadline.

UK National Cyber Security Centre (NCSC)

- The NCSC reports that weak or reused passwords remain the top contributing factor to online fraud and identity theft across digital services in the UK.

- Studies conducted by NCSC found that 15% of UK users reuse the same password across more than 20 sites, significantly increasing exposure to credential-stuffing attacks.

- NCSC strongly encourages the adoption of passwordless solutions like WebAuthn, security keys, and biometric logins as safer alternatives to traditional knowledge-based authentication.

European Union Agency for Cybersecurity (ENISA)

- ENISA notes that 42% of cyber incidents in EU institutions during 2023 were tied to weaknesses in identity and access management, with password theft and misconfiguration being prime vectors.

- The agency's Threat Landscape 2023 report calls on both the private and public sectors to phase out passwords in favor of biometrics, PKI, and cryptographic logins by 2026 to achieve regulatory compliance and stronger digital trust.

U.S. Executive Order 14028 (White House)

- Issued in 2021, Executive Order 14028 mandates all federal agencies to implement phishing-resistant multifactor authentication (MFA), including biometric and hardware-token based passwordless methods, to safeguard critical national infrastructure.

- The Executive Order also directs federal contractors and IT service providers to integrate passwordless authentication across their platforms and cloud environments, establishing it as a security baseline in the national cybersecurity strategy.

Federal Financial Institutions Examination Council (FFIEC)

- The FFIEC urges banks and credit unions to incorporate layered security, which includes biometrics, hardware tokens, and device-binding techniques to reduce reliance on passwords in digital banking environments.

- Financial institutions are encouraged to comply with Strong Customer Authentication (SCA) regulations and protect against man-in-the-middle attacks by leveraging passwordless login frameworks.

U.S. Department of Health and Human Services (HHS)

- According to HHS, approximately 50% of healthcare data breaches are caused by credential compromise, mostly involving weak or stolen passwords used by staff or third-party vendors.

- HIPAA guidelines strongly support the use of smartcards, biometrics, and certificate-based authentication to limit unauthorized access to electronic health records (EHRs) and digital patient systems.

Estonian Information System Authority (RIA)

- Estonia has implemented one of the world’s most advanced digital identity systems, with over 98% of the population using smartcards or mobile-ID for passwordless access to more than 650 public and private digital services, including voting, banking, and tax filing.

- The system uses PKI-based authentication, enabling secure login without traditional passwords and serving as a model for digital identity infrastructure globally.

Eurostat – European Union Statistics

- 93% of EU households have internet access, creating an enabling infrastructure for cloud-based passwordless systems.

- 87% of EU citizens aged 16–74 use smartphones, a key factor in the adoption of mobile-based biometric authentication solutions across government and consumer platforms.

Ministry of Internal Affairs and Communications – Japan

- Japan’s smartphone penetration exceeds 91%, with users leveraging facial recognition and fingerprint scanning for mobile payments, e-government services, and healthcare apps paving the way for rapid passwordless adoption.

- The government has issued more than 40 million My Number Cards, which enable digital identity and passwordless smartcard login across public services.

Digital Identity and Authentication Council of Canada (DIACC)

- According to DIACC research, 78% of Canadians prefer using digital services that do not require traditional passwords, reflecting a strong consumer push for seamless authentication.

- The Pan-Canadian Trust Framework outlines policy and technology standards to support passwordless authentication via biometrics and decentralized identity models.

Australian Cyber Security Centre (ACSC)

- ACSC reports that 70% of business-related cyber incidents in Australia stem from identity-based vulnerabilities, including compromised passwords.

- The agency recommends organizations shift toward passwordless mechanisms, such as device biometrics, passkeys, and client-side certificates, to meet national risk mitigation standards.

World Bank – ID4D Global Dataset

- More than 1 billion people globally lack formal identity, yet two-thirds of them own mobile phones, offering a pathway to secure passwordless digital identity using mobile biometrics and QR-based identity systems.

- Several nations, including India, Estonia, and the UAE, are pioneering national ID programs that offer smartcard or biometric access to digital services without the use of passwords.

UK Department for Digital, Culture, Media & Sport (DCMS)

- According to DCMS surveys, 74% of UK businesses now implement some form of multifactor authentication, with growing interest in transitioning to passwordless via FIDO2-compliant solutions.

- Government-supported initiatives such as One Login for Government are being developed to offer password-free access to citizen-facing portals using mobile identity and biometric verification.

Global Passwordless Authentication Market: Market Dynamic

Driving Factors in the Global Passwordless Authentication Market

Acceleration of Remote Work, BYOD, and Cloud-Native Infrastructure Adoption

The widespread and sustained shift toward remote work, combined with the growing adoption of bring-your-own-device (BYOD) policies and cloud-native architectures, has significantly accelerated demand for passwordless authentication solutions. Enterprises operating in distributed and hybrid work environments must now secure endpoints, SaaS platforms, and cloud workloads without relying on legacy perimeter-based models. This shift necessitates strong authentication methods that ensure access only to verified users, irrespective of physical location or device. Password-based systems are inadequate for such decentralized access due to their vulnerability to phishing, reuse, and compromise. Passwordless solutions using biometric scans, FIDO2-compliant tokens, or mobile push authentication provide the necessary assurance while delivering better user experiences.

They also reduce helpdesk costs related to password resets and forgotten credentials. In the cloud-first ecosystem, where applications are accessed over the internet and APIs connect various microservices, strong identity verification is a prerequisite for Zero Trust and secure DevSecOps practices. Enterprises leveraging platforms like AWS, Azure, and Google Cloud are integrating passwordless technologies into IAM and CIAM (Customer IAM) platforms to meet evolving cybersecurity, privacy, and compliance standards. This infrastructural transformation, accelerated by post-pandemic digital resilience strategies, makes passwordless authentication a critical driver in securing modern digital workplaces.

Government Mandates, Regulatory Pressure, and Compliance Frameworks

Government directives and evolving regulatory frameworks worldwide are acting as strong catalysts in propelling the passwordless authentication market. In the U.S., federal agencies are bound by the Cybersecurity Executive Order 14028 and directives from the Office of Management and Budget (OMB), which mandate the use of phishing-resistant and passwordless multi-factor authentication (MFA) across all systems. Similar mandates exist in the European Union under eIDAS and PSD2 regulations, which require secure customer authentication (SCA) in financial transactions, pushing banks and fintech platforms toward biometric and cryptographic login solutions. In the healthcare sector, compliance with HIPAA and HITECH laws increasingly necessitates strong access controls that protect sensitive patient data from breaches arising from weak passwords.

Regulators in Asia-Pacific, such as Japan’s Ministry of Internal Affairs and India’s Ministry of Electronics & IT (MeitY), are encouraging the adoption of biometric-enabled digital identity platforms integrated with passwordless access. These mandates are also shaping procurement decisions in the public sector, especially in defense, energy, and critical infrastructure, where secure identity verification is paramount. Compliance frameworks such as ISO/IEC 27001, NIST 800-63B, and GDPR require authentication systems to meet high standards for access control, privacy, and risk mitigation. Organizations looking to avoid fines and reputation loss are proactively adopting passwordless systems to stay audit-ready and compliant, making regulations a pivotal market growth driver.

Restraints in the Global Passwordless Authentication Market

Integration Challenges with Legacy Systems and Heterogeneous IT Environments

One of the most critical restraints in the widespread deployment of passwordless authentication is the complexity of integrating these systems into existing legacy infrastructure. Many organizations, particularly in manufacturing, healthcare, government, and utilities, operate mission-critical applications built on outdated architectures that lack support for modern authentication protocols like FIDO2 or WebAuthn. Incorporating passwordless solutions into these environments often requires custom connectors, middleware, or identity federation tools, significantly increasing time, cost, and technical complexity. Moreover, many older applications rely on traditional LDAP or Active Directory structures that are not compatible with biometric or cryptographic login methods without extensive reconfiguration. This often deters organizations from upgrading due to the risk of downtime, regulatory non-compliance, or disruption of business operations.

In addition, workforce inertia and a lack of skilled personnel capable of managing identity migration processes further exacerbate the challenge. Enterprises undergoing digital transformation frequently face the dilemma of balancing business continuity with modern security implementations. Without seamless interoperability between passwordless authentication tools and legacy systems, full-scale deployment becomes fragmented or limited to certain segments of the organization. This not only slows ROI but also undermines the holistic zero-trust framework many companies aim to build. Vendors that do not offer backward compatibility or hybrid integration support may be excluded from enterprise procurement pipelines, limiting adoption in critical verticals.

Biometric Privacy Concerns and Regulatory Hurdles

As passwordless authentication increasingly incorporates biometrics such as facial recognition, fingerprint scans, and voice recognition, rising privacy concerns and data protection laws are becoming significant restraints. Biometric data is considered sensitive personal information under global privacy laws including the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and India’s Digital Personal Data Protection Act (DPDPA). Unlike passwords, biometric traits cannot be changed once compromised. Therefore, consumers and privacy advocates are concerned about misuse, unauthorized sharing, or biometric data breaches especially in centralized systems. Many regions now require explicit informed consent, localized data storage, and robust encryption of biometric templates, which increase the technical and compliance burden for solution providers. In addition, there is rising legislative scrutiny around facial recognition use in public spaces, adding uncertainty for vendors that use facial biometrics as a core authentication method.

Class-action lawsuits in jurisdictions like Illinois under BIPA (Biometric Information Privacy Act) have resulted in multi-million dollar penalties, further cautioning businesses about biometric adoption. Also, cultural and regional norms in markets like Germany, South Korea, or Japan may influence public acceptance of biometric scanning, affecting consumer adoption rates. Vendors must therefore design systems that are privacy-preserving, decentralized, and transparent in data handling. Until these challenges are resolved through standardized privacy frameworks, regulatory harmonization, and technological trust-building, biometric-driven passwordless systems will face resistance from both enterprise buyers and end-users.

Opportunities in the Global Passwordless Authentication Market

Expansion of Decentralized Identity (DID) and Self-Sovereign Identity (SSI) Ecosystems

A transformative opportunity in the passwordless authentication market lies in the global shift toward decentralized identity (DID) frameworks and self-sovereign identity (SSI) models. These systems allow users to own and control their digital identities without relying on centralized authorities or third-party password managers. Enabled by blockchain and cryptographic verification, SSI creates verifiable credentials that users can present to authenticate across multiple platforms without revealing excessive personal data. Governments in Estonia, Canada, and Singapore are already piloting SSI frameworks integrated with mobile digital IDs, offering passwordless access to e-government services, healthcare systems, and public utilities. Enterprises also benefit from SSI by reducing reliance on federated login systems and mitigating risk associated with storing and managing user credentials.

Integration with verifiable credentials and decentralized identifiers allows for seamless cross-border identity verification, which is particularly critical in industries like international finance, travel, and education. As Web3 and digital credential ecosystems evolve, there's significant opportunity for startups and large providers to offer platforms and SDKs that support passwordless authentication using DIDs and encrypted biometric payloads. Moreover, the combination of decentralized ID with AI-based behavioral authentication further enhances identity assurance while upholding user privacy. This model aligns with global data protection laws such as GDPR and CCPA, enabling secure identity access management at scale and opening lucrative markets in both enterprise and citizen services.

Growth in Consumer Applications: E-Commerce, Fintech, and Mobile Banking

The consumer-facing side of the passwordless authentication market holds immense potential, particularly across industries such as e-commerce, mobile banking, streaming media, and fintech. As users demand faster, frictionless digital experiences, businesses are looking to eliminate passwords during onboarding, checkout, and transaction verification. E-commerce platforms are adopting magic links, biometric payment authentication, and app-based push verification to reduce cart abandonment and transaction failures caused by password fatigue or incorrect OTPs. In mobile banking and fintech apps, biometric login via fingerprint or facial recognition is rapidly replacing password and PIN entry, improving security while enhancing convenience. This trend is reinforced by smartphone OEMs embedding secure enclaves (e.g., Apple’s Secure Enclave, Android's StrongBox) that support FIDO2-native authentication flows.

Consumer trust is further enhanced by eliminating the need to remember passwords or store them insecurely. In subscription platforms such as video streaming, gaming, and digital wallets, passwordless methods reduce account sharing and unauthorized access, enabling better revenue retention and security. Emerging use cases also include travel and hospitality apps, where users log in via facial scans linked to verified IDs, expediting access to ticketing and reservations. As mobile-first and app-centric digital behavior continues to dominate globally, companies that offer secure yet seamless password-free experiences stand to differentiate their brand and increase retention rates. This creates a fertile landscape for passwordless solution providers to expand integrations, SDK offerings, and partnerships across the consumer digital experience ecosystem.

Trends in the Global Passwordless Authentication Market

Rise of FIDO2 and WebAuthn as Global Standards for Passwordless Authentication

The adoption of FIDO2 and WebAuthn is rapidly becoming the gold standard in passwordless authentication frameworks across both public and private sectors. Backed by major players like Microsoft, Google, Apple, and the FIDO Alliance, these protocols offer cryptographic login experiences that are resistant to phishing, man-in-the-middle (MitM) attacks, and credential stuffing. The trend is gaining momentum due to mandates from regulatory bodies such as the U.S. federal government, which has ordered compliance with phishing-resistant multifactor authentication methods under Executive Order 14028. Additionally, the W3C's endorsement of WebAuthn has accelerated its adoption across browsers, operating systems, and cloud services. Enterprises are now shifting towards integrating FIDO2 into their IAM strategies, creating a seamless user experience that ties authentication to devices or biometrics.

The ubiquity of smartphones, combined with operating system-level support for public key cryptography, has further lowered the barrier to implementation. These standards enable passwordless access through built-in platform authenticators, USB tokens, or mobile devices, creating a diverse ecosystem of login options that improve security without compromising usability. As passwordless protocols become embedded in enterprise and consumer environments, organizations across industries, including BFSI, healthcare, education, and e-commerce, are replacing legacy MFA and OTP systems with more secure and user-friendly alternatives, thus establishing FIDO2/WebAuthn as foundational components in modern cybersecurity architectures.

Convergence of Identity Verification, Behavioral Biometrics, and AI-Powered Access Control

Another prominent trend in the passwordless authentication market is the convergence of AI-based behavioral biometrics, continuous authentication, and decentralized identity verification. Enterprises are increasingly integrating artificial intelligence and machine learning into identity access management systems to enable continuous authentication models, replacing static login credentials with dynamic behavior-driven access mechanisms. Behavioral biometric systems analyze keystroke dynamics, mouse movement, device telemetry, gait recognition, and usage patterns to create real-time risk scores for authentication decisions. This trend is driven by the need for frictionless, non-intrusive security that aligns with Zero Trust frameworks and adaptive authentication policies. Simultaneously, the rise of self-sovereign identity (SSI) models backed by blockchain and decentralized identifiers (DIDs) is empowering users to own and control their identity attributes without centralized password stores.

AI enables risk-based authentication policies that grant or deny access based on contextual cues such as time, location, and historical usage trends. This fusion of technologies is creating an ecosystem where traditional passwords become obsolete, and identity is continuously verified in a privacy-preserving manner. Especially in high-compliance sectors like healthcare, fintech, and critical infrastructure, organizations are shifting toward identity platforms that support AI-driven trust scores, continuous monitoring, and regulatory alignment with frameworks like GDPR, HIPAA, and PSD2. The result is a more intelligent, adaptive, and resilient approach to authentication that meets the demands of hybrid and decentralized workforces.

Global Passwordless Authentication Market: Research Scope and Analysis

By Component Analysis

Software is anticipated to dominate the component segment of the passwordless authentication market due to its flexibility, scalability, and centrality in managing user identities across digital ecosystems. Organizations increasingly rely on Identity and Access Management (IAM) systems, Multifactor Authentication (MFA) platforms, and risk-based authentication software to enforce secure access policies without relying on traditional credentials. Software-based passwordless solutions can be easily integrated into existing cloud infrastructure and scaled across hybrid or remote work environments, making them highly attractive for both SMEs and large enterprises.

Unlike hardware, software solutions are continuously updated to meet new compliance mandates such as GDPR, HIPAA, and PSD2. Cloud-native authentication platforms also offer zero-trust security integration, seamless SSO (Single Sign-On) experiences, and adaptive risk assessment capabilities powered by AI and behavioral analytics. IAM and MFA platforms enable contextual access control, factoring in location, device, user behavior, and time-of-access to determine legitimacy capabilities not offered by hardware alone.

Furthermore, software providers often bundle advanced dashboards, reporting tools, and user analytics that help IT administrators identify anomalies, track access logs, and manage privileged credentials. Vendors such as Okta, Microsoft, Ping Identity, and ForgeRock are leading innovation in this space by providing plug-and-play APIs and SDKs for developers to embed passwordless flows in web and mobile applications.

In sectors such as BFSI, healthcare, and retail, where compliance, agility, and user experience are top priorities, software-driven passwordless authentication is proving to be more cost-efficient and operationally sustainable. As businesses scale digitally, software will continue to lead this segment by addressing both end-user convenience and enterprise-grade security.

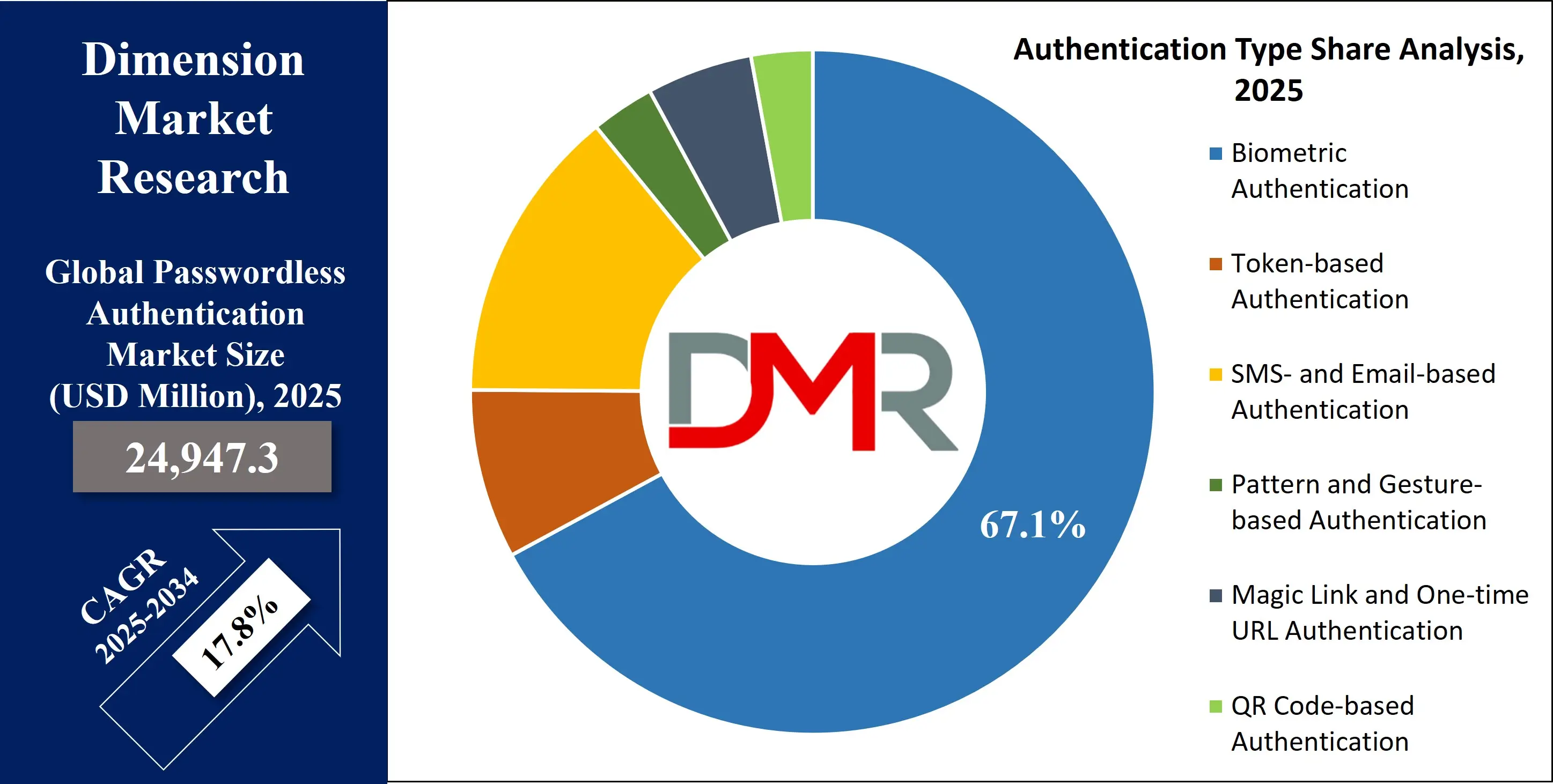

By Authentication Type Analysis

Biometric authentication is poised to dominate the authentication type segment in the passwordless authentication market due to its ability to combine high security, user convenience, and phishing resistance in a single method. Biometrics leverage unique physiological or behavioral traits such as fingerprints, facial features, iris patterns, or voiceprints to verify identity. These traits are difficult to replicate or steal, making biometrics an ideal solution in an environment where traditional passwords are increasingly vulnerable to phishing, brute-force attacks, and credential reuse.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fingerprint recognition leads adoption in mobile devices, point-of-sale systems, and corporate access controls, thanks to its affordability and ease of use. Facial recognition, meanwhile, is gaining momentum in smartphones, kiosks, border control, and remote verification scenarios, supported by advancements in camera and sensor technology. Biometric methods are frequently integrated with secure hardware modules such as TPMs (Trusted Platform Modules) or Secure Enclaves to enhance privacy and secure local storage of templates.

Sectors such as banking, healthcare, defense, and law enforcement rely heavily on biometric authentication for both physical and logical access control. In customer-facing applications, biometric login improves user experience while reducing drop-offs, password fatigue, and helpdesk dependencies. Compliance requirements like FIDO2, GDPR, HIPAA, and PSD2 have also accelerated biometric deployments by mandating strong, user-bound, non-reusable credentials.

Moreover, biometric solutions align with zero-trust principles and enable continuous identity verification. The proliferation of biometric sensors in consumer electronics, their native integration in OS-level authentication flows, and the growing maturity of biometric algorithms have all contributed to widespread acceptance. With the ability to support secure, scalable, and seamless authentication across diverse use cases, biometrics continues to dominate this category within the passwordless authentication landscape.

By Deployment Mode Analysis

Cloud-based deployment is expected to dominate the deployment mode segment in the passwordless authentication market due to its scalability, agility, and alignment with the modern digital infrastructure of businesses. As organizations shift toward cloud-first strategies and hybrid work models, they require authentication solutions that are not limited by on-premise dependencies. Cloud-native passwordless authentication platforms provide dynamic provisioning, centralized policy management, and global accessibility, enabling seamless integration with SaaS applications, multi-cloud environments, and remote endpoints.

Enterprises and SMBs alike leverage cloud deployment to support multi-tenant identity platforms, unified endpoint management, and real-time threat detection. These platforms are typically faster to implement, more cost-effective over time, and offer better resilience through automatic updates and built-in redundancy. Vendors such as Okta, Ping Identity, Microsoft Azure Active Directory, and Auth0 provide cloud-based passwordless identity solutions that support FIDO2, biometrics, magic links, mobile push, and risk-based authentication, all via secure APIs and SDKs.

Additionally, cloud-based deployments empower organizations to implement Zero Trust Architecture, where access is verified continuously across identity, device, location, and behavioral context. This model is essential for modern enterprises with globally distributed teams and decentralized IT environments.

Regulatory frameworks such as GDPR, SOC 2, ISO 27001, and HIPAA have also evolved to recognize and support cloud-hosted authentication models, provided that data encryption, access logs, and compliance features are maintained. The ability to integrate with DevOps pipelines, customer identity systems (CIAM), and secure access service edge (SASE) tools further accelerates cloud preference.

Given the shift to digital transformation, rising SaaS adoption, and the need for flexible security infrastructure, cloud-based passwordless authentication solutions continue to lead the deployment segment by a significant margin.

By Organization Size Analysis

Large enterprises are projected to dominate the organization size segment in the passwordless authentication market due to their extensive security needs, complex infrastructure, and early adoption of advanced cybersecurity frameworks. These organizations operate across multiple locations, cloud platforms, and legacy systems, requiring robust identity and access management (IAM) tools that support seamless, secure, and scalable authentication mechanisms without relying on vulnerable password-based systems.

With rising threats such as credential phishing, ransomware, insider breaches, and social engineering, large enterprises are rapidly embracing passwordless solutions, including FIDO2 authentication, biometric login, risk-based access control, and mobile push verification to safeguard workforce and customer identities. They are also at the forefront of implementing Zero Trust Architectures, where continuous authentication and strict access governance are essential, and passwordless systems play a central role.

These enterprises typically possess the budget and technical resources to deploy sophisticated solutions across departments, endpoints, and third-party vendors. Integration of passwordless authentication with IAM platforms, SSO portals, and endpoint detection and response (EDR) systems ensures unified security across devices and networks.

Moreover, large organizations in verticals like banking, healthcare, retail, IT services, and energy are mandated to comply with regulations like SOX, HIPAA, GDPR, and PSD2, all of which require strong, phishing-resistant authentication.

Additionally, passwordless approaches help reduce IT overhead, particularly related to password resets and credential management, resulting in cost savings and a better user experience. With growing investments in cybersecurity infrastructure and global compliance requirements, large enterprises continue to lead the charge in adopting passwordless authentication, setting benchmarks for security maturity and innovation across the identity access landscape.

By Application Analysis

Workforce authentication is projected to dominate the application segment of the passwordless authentication market, primarily due to the urgent need for secure, frictionless, and scalable access control in enterprise environments. As hybrid and remote work models become permanent features of modern business, organizations must protect critical systems and data from unauthorized access without relying on outdated and vulnerable password-based logins.

Passwordless workforce authentication solutions such as biometric logins, smartcard access, mobile push authentication, and FIDO2 security keys enable employees to authenticate securely across desktops, mobile devices, and cloud platforms. This not only enhances productivity and user satisfaction but also aligns with Zero Trust and identity-first security models, where verification is enforced continuously, regardless of network location.

Large and mid-sized organizations in sectors like IT & telecom, BFSI, government, and healthcare are the primary adopters of workforce passwordless systems. These solutions are integrated into enterprise-wide IAM platforms, allowing centralized policy enforcement, real-time access analytics, and federated identity management. As digital ecosystems expand to include contractors, third-party vendors, and remote staff, secure workforce access becomes even more critical.

Moreover, workforce authentication systems significantly reduce IT support costs by minimizing password resets and eliminating credential fatigue among employees. They also support compliance with mandates such as NIST 800-63B, GDPR, HIPAA, and PCI DSS, which demand strong, multi-factor, and phishing-resistant authentication methods.

The ability to combine convenience with high-security assurance makes passwordless workforce authentication the most deployed and mission-critical application across industries. With the rise of endpoint diversity and distributed workforces, its dominance is expected to strengthen further in the coming years.

By Industry Vertical Analysis

The Banking, Financial Services, and Insurance (BFSI) sector is poised to dominate the industry vertical segment of the passwordless authentication market due to its acute security needs, regulatory mandates, and rapid digital transformation. Financial institutions manage sensitive customer data, high-value transactions, and mission-critical systems, making them prime targets for phishing, credential theft, and account takeovers. In response, banks and insurers are shifting toward passwordless authentication technologies that offer superior security and user convenience.

BFSI firms are at the forefront of deploying biometric authentication, mobile push-based verification, hardware security tokens, and FIDO2-compliant login mechanisms to replace vulnerable static passwords. These solutions are increasingly integrated with core banking applications, mobile apps, ATM systems, and online financial portals, enabling secure and seamless customer and employee access.

The sector is heavily influenced by strict compliance requirements such as PSD2 (Payment Services Directive 2) in the EU, FFIEC and GLBA guidelines in the U.S., and data localization and identity protection rules in Asia-Pacific. These frameworks mandate strong customer authentication (SCA) and resistance to phishing criteria that passwordless technologies meet by design.

Additionally, with the proliferation of mobile and online banking, financial institutions are focused on delivering frictionless user experiences while reducing abandonment rates and fraud losses. Passwordless methods allow customers to authenticate with biometrics or a single tap, enhancing satisfaction and brand trust.

Internally, banks also adopt passwordless systems for workforce IAM, especially for privileged access and risk-based transaction verification. As digital banking continues to grow globally, the BFSI industry’s investment in passwordless authentication will deepen, reinforcing its dominance in this market vertical.

The Global Passwordless Authentication Market Report is segmented on the basis of the following

By Component

- Hardware

- Biometric Authentication Devices

- Security Keys

- Smart Cards and Tokens

- Software

- Biometric Authentication Software

- Multifactor Authentication (MFA) Platforms

- Identity & Access Management (IAM) Solutions

- Risk-based Authentication Software

- Services

- Implementation & Integration

- Consulting Services

- Support & Maintenance

- Managed Security Services

By Authentication Type

- Biometric Authentication

- Fingerprint Recognition

- Facial Recognition

- Voice Recognition

- Iris and Retina Scanning

- Palm and Vein Recognition

- Token-based Authentication

- Hardware Tokens

- Mobile Push Authentication

- Smart Cards

- SMS- and Email-based Authentication

- Pattern and Gesture-based Authentication

- Magic Link and One-time URL Authentication

- QR Code-based Authentication

By Deployment Mode

- On-premise

- Cloud-based

- Hybrid

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Application

- Workforce Authentication

- Customer Authentication

- Transaction Authentication

- Privileged Access Management

- Remote Access

By Industry Vertical

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Government & Defense

- Education

- Energy & Utilities

- Other Industry Vertical

Impact of Artificial Intelligence in the Global Passwordless Authentication Market

- Behavioral Biometrics Optimization: AI enhances passwordless systems by analyzing user behavior patterns like keystroke dynamics and mouse movements for continuous authentication, enabling dynamic identity verification without user intervention and reducing the risk of account takeover or impersonation attacks.

- Adaptive Risk-Based Authentication: Artificial intelligence powers adaptive access decisions by evaluating contextual signals such as location, device, and time of login. This allows organizations to approve, challenge, or deny authentication attempts based on real-time risk scoring.

- Fraud Detection and Anomaly Response: AI-driven analytics detect anomalies in user behavior, enabling real-time identification of suspicious activity during authentication. This proactive fraud prevention strengthens access control without adding friction to legitimate users’ login experiences.

- User Experience Personalization: AI tailors authentication flows by learning user habits, simplifying login methods based on confidence levels. Low-risk users may get frictionless access, while high-risk scenarios trigger additional authentication layers, balancing convenience and security.

- AI-Powered Identity Lifecycle Management: AI automates credential provisioning and revocation by continuously monitoring user roles, behavior, and access patterns. This streamlines identity governance, ensuring only authorized users maintain access, especially in dynamic enterprise environments with evolving privileges.

Global Passwordless Authentication Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global passwordless authentication market as it holds 39.3% of the total revenue by the end of 2025, due to its mature cybersecurity ecosystem, rapid technological adoption, and strong regulatory emphasis on identity protection. The region is home to many of the world's largest technology companies, including Microsoft, IBM, Okta, Cisco, and Ping Identity, all of which are key innovators and solution providers in passwordless technologies. These organizations invest heavily in biometric authentication, FIDO2 standards, and AI-based risk analysis, establishing North America as a development hub for cutting-edge authentication frameworks.

The U.S. government and its agencies enforce rigorous cybersecurity protocols under regulations such as NIST 800-63B, HIPAA, and FISMA, driving enterprises in sectors like BFSI, healthcare, and government to adopt secure, passwordless identity systems. Additionally, the prevalence of hybrid and remote workforces post-pandemic accelerated the deployment of passwordless solutions, particularly cloud-based and mobile-push authentication methods.

The region also benefits from strong digital infrastructure, high smartphone penetration, and widespread use of IAM platforms and Zero Trust models in both public and private sectors. Increasing incidences of phishing attacks and credential theft further push enterprises toward passwordless security frameworks that include behavioral biometrics and adaptive authentication.

Region with the Highest CAGR

Asia Pacific records the highest CAGR in the passwordless authentication market due to rapid digitization, expanding internet penetration, and a growing emphasis on data security in emerging economies. Countries such as China, India, Japan, South Korea, and Singapore are investing aggressively in digital transformation across banking, healthcare, education, and government services. As a result, demand for secure, frictionless identity verification methods has surged.

The region’s strong push toward mobile-first services, especially in financial technology and digital wallets, has accelerated the adoption of biometric and token-based passwordless authentication methods. In India, the Aadhaar-based biometric identity infrastructure provides a foundation for passwordless systems in banking and public services. In China, facial recognition and mobile push authentication are deeply integrated into e-commerce, payments, and citizen ID systems.

Regulatory frameworks in Asia Pacific are also evolving, with governments tightening data privacy laws. For instance, Japan’s Act on the Protection of Personal Information (APPI) and India’s Digital Personal Data Protection Act promote stronger authentication and data protection practices. Organizations are thus turning to passwordless security frameworks to ensure compliance while offering seamless user experiences.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Passwordless Authentication Market: Competitive Landscape

The global passwordless authentication market is highly competitive, with a mix of established technology giants and emerging identity security providers vying for market share. Leading players include Microsoft, Okta, Ping Identity, IBM, Thales Group, Cisco, Duo Security, ForgeRock, and HID Global. These companies provide comprehensive authentication platforms leveraging biometrics, token-based methods, and adaptive risk-based access controls.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Microsoft’s Azure Active Directory and its integration of FIDO2 and Windows Hello technologies have made it a pivotal player in passwordless enterprise adoption. Similarly, Okta and Ping Identity have built strong market positions through IAM and CIAM capabilities, offering seamless user experiences and Zero Trust alignment.

Startups like Auth0, HYPR, Trusona, Secret Double Octopus, and Transmit Security are also disrupting the market with lightweight, developer-friendly platforms that enable rapid deployment of passwordless authentication across mobile, web, and cloud environments. Their innovation in behavioral biometrics, mobile push, and decentralized identity positions them as agile competitors to legacy security firms.

Strategic partnerships and acquisitions are intensifying. For instance, Okta’s acquisition of Auth0 expanded its CIAM portfolio, while Ping Identity continues to collaborate with cloud providers to extend its reach. Global expansion, especially into Asia Pacific and Latin America, is also a priority for several players, as is enhancing support for regulatory compliance.

To remain competitive, vendors are increasingly integrating AI and machine learning for adaptive authentication, enhancing real-time risk analysis, and offering API-first solutions that simplify enterprise adoption. The evolving nature of identity threats ensures continued innovation and intense rivalry within this market.

Some of the prominent players in the Global Passwordless Authentication Market are

- Microsoft

- Google

- Apple

- IBM

- Okta

- Yubico

- Duo Security (Cisco)

- Thales Group

- ForgeRock

- Ping Identity

- HID Global

- RSA Security

- OneSpan

- Auth0 (by Okta)

- HYPR

- Secret Double Octopus

- LastPass

- Daon

- 1Password

- Trusona

- Other Key Players

Recent Developments in the Global Passwordless Authentication Market

July 2024

- Microsoft & Yubico Collaboration: Microsoft expanded its partnership with Yubico to integrate YubiKey’s hardware-based authentication into Microsoft Entra ID, enabling phishing-resistant MFA for enterprises. The move aims to accelerate zero-trust adoption globally.

- RSA Conference 2024: Passwordless authentication dominated discussions, with Okta demonstrating FIDO2-based logins, Ping Identity unveiling AI-driven behavioral biometrics, and ForgeRock showcasing cross-industry passwordless deployments in healthcare and finance.

June 2024

- Thales Acquires OneSpan: Thales finalized a USD 2.3B acquisition of OneSpan, merging its digital identity solutions with OneSpan’s anti-fraud tech to create a comprehensive passwordless and transaction security platform for banks and enterprises.

- Gartner Security Summit: Analysts highlighted passwordless authentication as a top 5 security trend, with Beyond Identity presenting ROI metrics and Secret Double Octopus demonstrating passwordless workforce access in Fortune 500 companies.

May 2024

- Google’s Passkey Rollout: Google expanded passkey support to Google Workspace, impacting 3B+ accounts. The update allows businesses to enforce passwordless logins via biometrics or security keys, reducing credential theft risks.

- Identiverse 2024: Duo Security (Cisco) showcased zero-trust passwordless adoption in banking, emphasizing FIDO2 compliance. Keynote speakers highlighted regulatory pressures driving financial institutions toward phishing-resistant authentication.

April 2024

- Ping Identity & AWS Partnership: Ping Identity deepened its integration with AWS IAM, enabling passwordless MFA for cloud workloads. The solution supports WebAuthn and biometrics for frictionless access to AWS environments.

- CyberArk’s Acquisition of Idaptive: CyberArk completed its purchase of Idaptive to enhance privileged access management (PAM) with passwordless capabilities, targeting enterprises transitioning from legacy VPNs to zero-trust models.

March 2024

- FIDO Alliance’s New Standards: The FIDO Alliance released FIDO3 specifications, improving biometric and device-bound authentication. Updates include enhanced multi-device sync and broader OS compatibility, accelerating enterprise adoption.

- RSA & ForgeRock Collaboration: RSA and ForgeRock launched a joint solution for government agencies, combining ForgeRock’s identity platform with RSA’s phishing-resistant authentication for secure, passwordless citizen services.

February 2024

- IBM’s Investment in HYPR: IBM led a funding round for HYPR, a decentralized passwordless authentication provider, to expand its use in healthcare, addressing HIPAA compliance and reducing ransomware risks.

- Mobile World Congress (MWC) 2024: Entrust and HID Global demoed passwordless solutions for telecom operators, including SIM-bound passkeys and biometric authentication for 5G network access.

January 2024

- Okta’s Auth0 Passwordless Expansion: Okta released new Auth0 SDKs for developers, simplifying biometric and security key integrations. The update targets industries like e-commerce seeking checkout friction reduction.

- Mastercard’s Biometric Checkout Program: Mastercard expanded its passwordless payments initiative, partnering with retailers to deploy facial recognition and palm-vein authentication at POS systems globally.

December 2023

- Apple & FIDO Alliance: Apple deepened FIDO2 integration, enabling cross-platform passkeys for iOS/macOS. The update allowed iCloud Keychain to sync passkeys across Apple devices, boosting consumer adoption.

November 2023

- Microsoft Ignite 2023: Microsoft reported 60% enterprise adoption of passwordless in Azure AD, citing phishing resistance as the key driver. New features included temporary passkeys for shared devices.

October 2023

- RSA Acquires SecureAuth: RSA’s USD 500M SecureAuth buyout combined behavioral analytics with passwordless authentication, targeting hybrid workforce security. The deal expanded RSA’s footprint in adaptive access control.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 24,947.3 Mn |

| Forecast Value (2034) |

USD 109,288.6 Mn |

| CAGR (2025–2034) |

17.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8,245.4 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Authentication Type (Biometric Authentication, Token-based Authentication, SMS- and Email-based Authentication, Pattern and Gesture-based Authentication, Magic Link and One-time URL Authentication, QR Code-based Authentication), By Deployment Mode (On-premise, Cloud-based, Hybrid), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By Application (Workforce Authentication, Customer Authentication, Transaction Authentication, Privileged Access Management, Remote Access), By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), IT & Telecom, Healthcare, Retail & E-commerce, Government & Defense, Education, Energy & Utilities, Other Industry Vertical) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, Google, Apple, IBM, Okta, Yubico, Duo Security (Cisco), Thales Group, ForgeRock, Ping Identity, HID Global, RSA Security, OneSpan, Auth0, HYPR, Secret Double Octopus, LastPass, Daon, 1Password, and Trusona., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global passwordless authentication market?

▾ The Global Passwordless Authentication Market size is estimated to have a value of USD 24,947.3 million in 2025 and is expected to reach USD 109,288.6 million by the end of 2034.

What is the growth rate in the Global Passwordless Authentication Market in 2025?

▾ The market is growing at a CAGR of 17.8 percent over the forecasted period of 2025.

What is the size of the US passwordless authentication market?

▾ The US Passwordless Authentication Market is projected to be valued at USD 8,245.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 33,094.2 million in 2034 at a CAGR of 16.7%.

Which region accounted for the largest Global Passwordless Authentication Market?

▾ North America is expected to have the largest market share in the Global Passwordless Authentication Market with a share of about 39.3% in 2025.

Who are the key players in the Global Passwordless Authentication Market?

▾ Some of the major key players in the Global Passwordless Authentication Market are Microsoft, Google, Apple, IBM, Okta, Yubico, Duo Security (Cisco), Thales Group, ForgeRock, and many others.