Market Overview

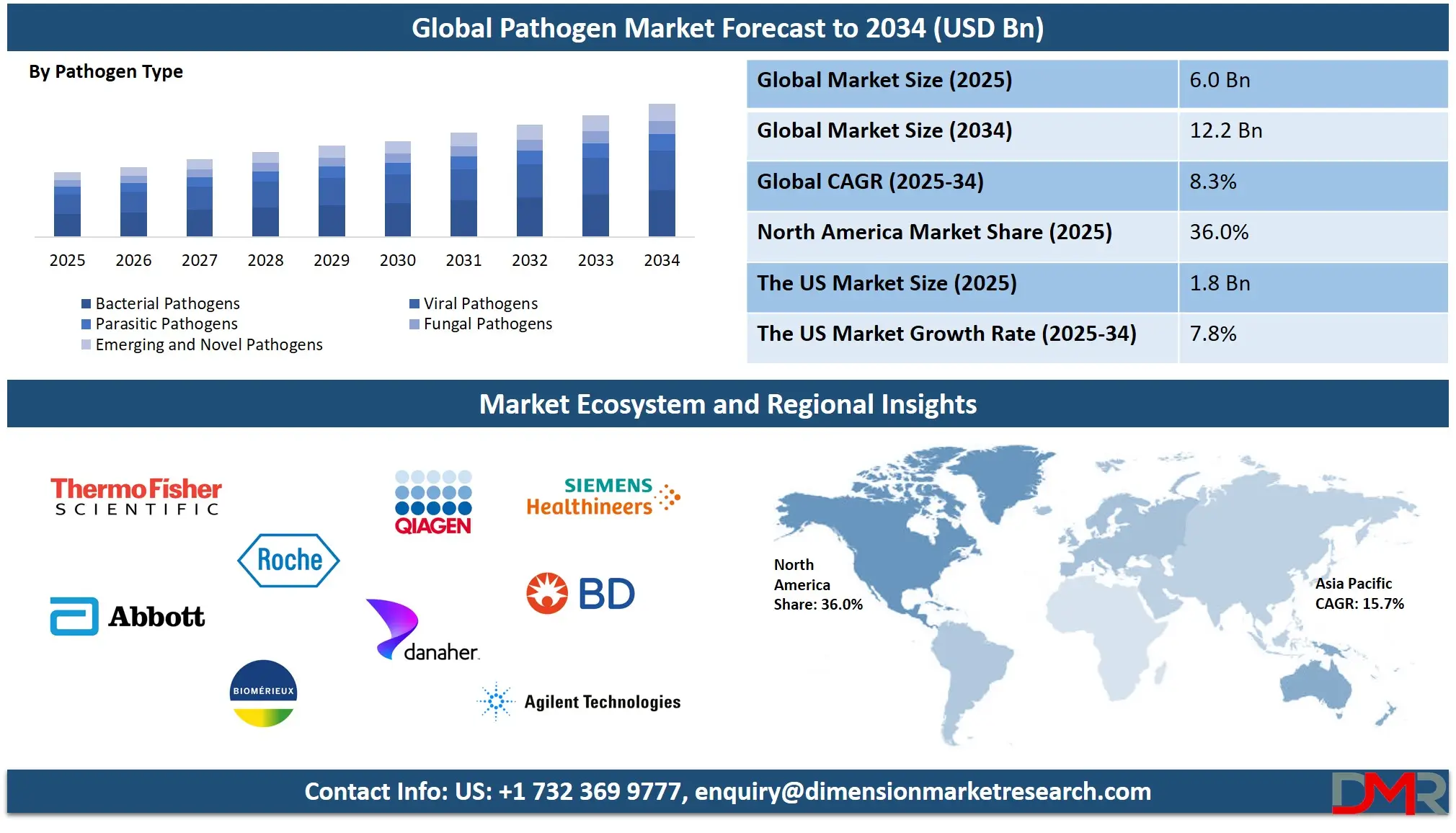

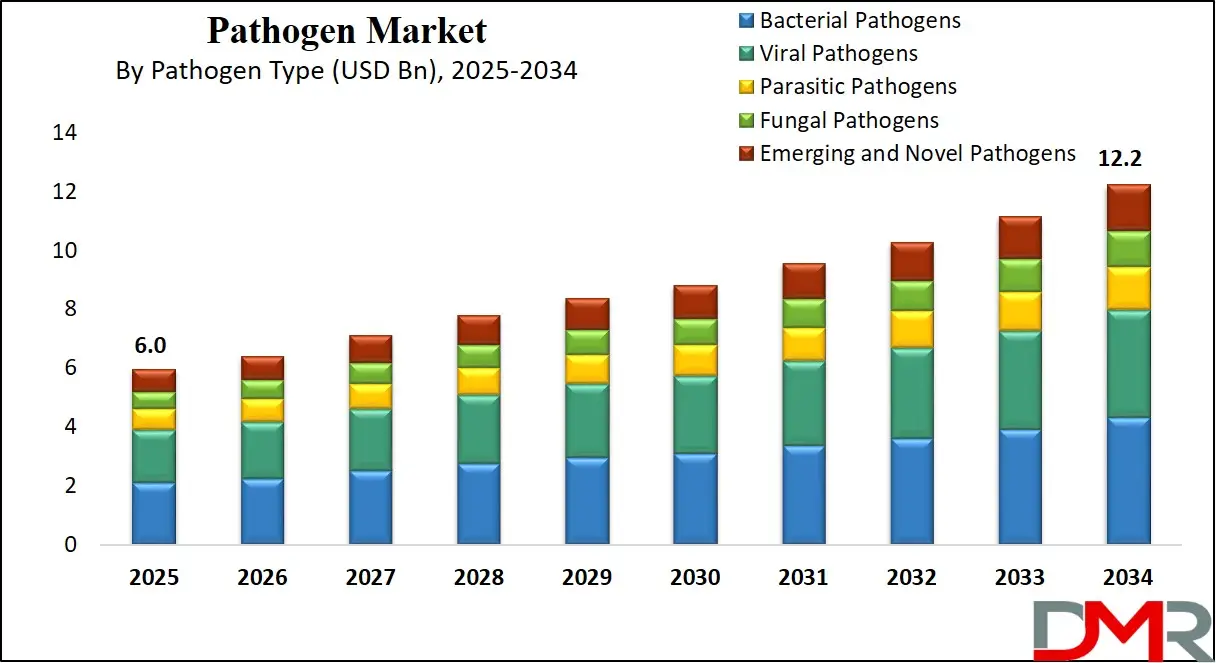

The Global Pathogen Market size is projected to reach USD 6.0 billion in 2025 and is expected to grow to USD 12.2 billion by 2034, reflecting a CAGR of 8.3%. This growth outlook highlights rising demand for infectious disease diagnostics, rapid pathogen detection technologies, molecular testing solutions, biosurveillance systems and advanced microbiology tools across healthcare, food safety, environmental monitoring and pharmaceutical applications.

A pathogen is any biological agent capable of causing disease in humans animals or plants through infection and disruption of normal physiological functions. These disease-causing microorganisms include bacteria viruses fungi and parasites that invade host tissues multiply and trigger immune responses that may range from mild symptoms to life-threatening conditions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Pathogens spread through diverse transmission pathways such as contaminated food water air surfaces or vectors and their ability to adapt mutate and resist treatment makes them a central focus of public health microbiology epidemiology and infection control. Understanding pathogen behavior and detection is essential for preventing outbreaks improving diagnostic accuracy strengthening biosurveillance systems and ensuring global health security.

The global pathogen market refers to the industry ecosystem involved in detecting managing monitoring and mitigating the impact of harmful microorganisms across clinical food environmental and industrial settings. It encompasses advanced diagnostic platforms molecular testing solutions sequencing technologies rapid detection kits and laboratory systems designed to identify infectious agents with speed and precision.

Growing concerns around emerging diseases antimicrobial resistance foodborne contamination and water quality monitoring have increased the demand for reliable pathogen testing capabilities. Industries such as healthcare biotechnology pharmaceuticals agriculture and food processing rely on these solutions to safeguard populations and maintain regulatory compliance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This market is also shaped by rising investments in disease surveillance programs technological innovation in point-of-care testing the integration of artificial intelligence in diagnostics and the expansion of genomic tools for outbreak tracking. Increasing globalization climate-driven pathogen evolution and cross-border trade have amplified the need for timely detection and containment strategies. As nations strengthen public health infrastructure and adopt next generation molecular platforms the global pathogen market continues to evolve as a critical component of modern healthcare readiness and bio-risk management.

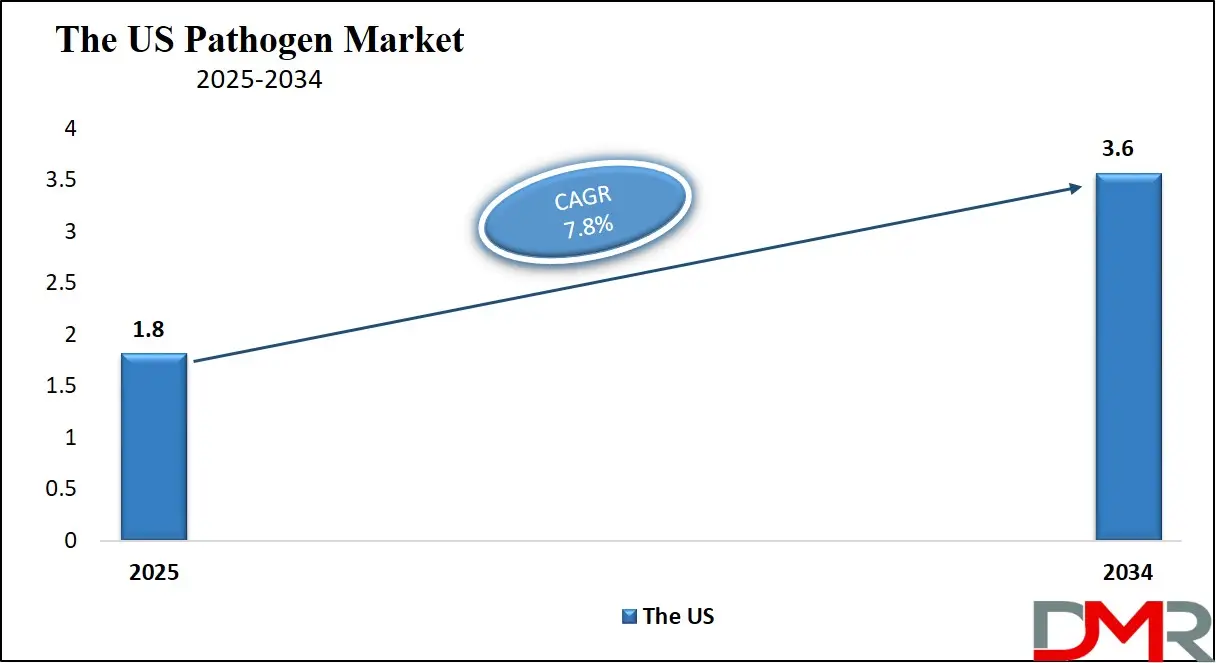

The US Pathogen Market

The U.S. Pathogen market size is projected to be valued at USD 1.8 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.6 billion in 2034 at a CAGR of 7.8%.

The United States pathogen market is expanding steadily as the country intensifies investments in infectious disease diagnostics, molecular testing technologies and rapid pathogen detection platforms across hospitals, laboratories and public health networks. Growing concerns surrounding antimicrobial resistance, hospital-acquired infections, foodborne illnesses and vector-borne diseases are driving greater adoption of PCR-based assays, immunoassay systems, point-of-care diagnostic devices and genomic sequencing tools.

The presence of advanced healthcare infrastructure, strong regulatory frameworks and significant R&D funding from agencies such as the CDC, NIH and BARDA further support innovation in pathogen surveillance, biosafety solutions and high-throughput laboratory automation. Increasing integration of digital health, artificial intelligence and data-driven epidemiology is redefining how pathogens are tracked, analyzed and contained within the United States.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, the U.S. market benefits from a robust ecosystem of biotechnology companies, diagnostic manufacturers and pharmaceutical developers focused on vaccine development, therapeutic pipeline expansion and next-generation pathogen monitoring technologies. Growing demand from food and beverage industries for microbial testing, environmental monitoring requirements in water quality systems and the rise of decentralized testing models are strengthening commercial opportunities.

The country’s push toward preparedness for emerging infectious diseases, biothreat detection and nationwide biosurveillance has accelerated adoption of advanced pathogen testing solutions across clinical, industrial and research settings. As public health priorities evolve and technological capabilities advance, the U.S. pathogen market continues to position itself as a global leader in disease detection, outbreak management and microbial risk mitigation.

Europe Pathogen Market

The European pathogen market is projected to reach approximately USD 1.6 billion in 2025, reflecting steady growth driven by rising awareness of infectious diseases, increasing prevalence of antimicrobial resistance, and expanding adoption of advanced diagnostic solutions. Hospitals, diagnostic laboratories, and public health agencies across the region are investing in molecular diagnostics, nucleic acid amplification techniques, immunoassays, and next-generation sequencing platforms to improve early pathogen detection, enhance patient outcomes, and strengthen disease surveillance. The presence of well-established healthcare infrastructure, robust regulatory frameworks, and high research and development activity further supports market expansion.

Key factors contributing to this growth include increasing government initiatives for infectious disease monitoring, stringent food safety regulations, and heightened demand for point-of-care diagnostic devices. European healthcare providers are increasingly adopting AI-assisted pathogen detection tools, automated laboratory workflows, and high-throughput testing systems to optimize operational efficiency and ensure timely outbreak response. These combined trends are expected to sustain a compound annual growth rate of 7.3%, positioning Europe as a significant and technologically advanced segment within the global pathogen market.

Japan Pathogen Market

The Japanese pathogen market is projected to reach approximately USD 1.1 billion in 2025, driven by increasing government initiatives for infectious disease control, rising awareness of hospital-acquired infections, and growing demand for advanced diagnostic solutions. Hospitals, clinical laboratories, and research institutions across the country are adopting molecular diagnostics, PCR-based assays, immunoassays, and next-generation sequencing technologies to ensure rapid and accurate pathogen detection. The presence of a technologically advanced healthcare system, strong regulatory frameworks, and significant investment in life sciences R&D supports the market’s growth and adoption of innovative testing solutions.

Key factors contributing to this expansion include the rising need for point-of-care diagnostic devices, AI-assisted microbial analysis, and automated laboratory workflows to enhance efficiency and improve outbreak management. The increasing prevalence of emerging infectious diseases and heightened focus on public health surveillance are prompting Japanese healthcare providers to adopt high-throughput pathogen detection platforms and rapid testing solutions. These combined trends are expected to drive a compound annual growth rate of 13.7%, positioning Japan as one of the fastest-growing markets within the global pathogen landscape.

Global Pathogen Market: Key Takeaways

- Market Value: The global Pathogen market size is expected to reach a value of USD 12.2 billion by 2034 from a base value of USD 6.0 billion in 2025 at a CAGR of 8.3%.

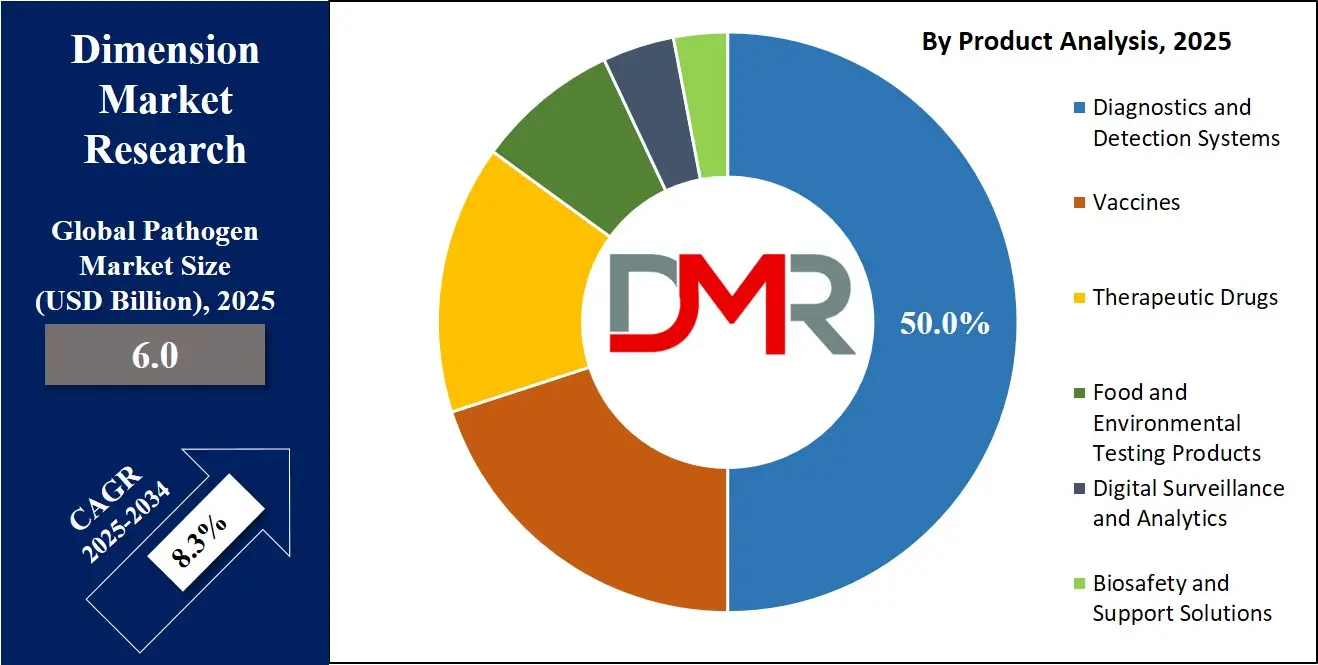

- By Product Analysis: Diagnostics and Detection Systems are anticipated to dominate the product segment, capturing 50.0% of the total market share in 2025.

- By Technology Segment Analysis: Polymerase Chain Reaction and Nucleic Acid Amplification are expected to maintain their dominance in the technology segment, capturing 35.0% of the total market share in 2025.

- By Pathogen Type Segment Analysis: Bacterial Pathogens will dominate the pathogen type segment, capturing 35.0% of the market share in 2025.

- By Deployment Mode Segment Analysis: Central Laboratory Systems will account for the maximum share in the deployment mode segment, capturing 60.0% of the total market value.

- By Application Segment Analysis: Clinical Diagnostics will dominate the application segment, capturing 45.0% of the market share in 2025.

- By End User Segment Analysis: Diagnostic Laboratories will capture the maximum share in the end user segment, capturing 30.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Pathogen market landscape with 36.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Pathogen market are Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, BioMérieux, Qiagen, Danaher Corporation, Siemens Healthineers, Becton Dickinson and Company, Agilent Technologies, PerkinElmer, Illumina, Bio-Rad Laboratories, Merck KGaA, Takara Bio, QuidelOrtho, Cepheid, Hologic, 3M Health Care, and Others.

Global Pathogen Market: Use Cases

- Clinical Infectious Disease Diagnostics: Pathogen detection technologies such as PCR assays, rapid antigen tests and next generation sequencing enable faster and more accurate diagnosis of bacterial, viral and fungal infections in hospitals. These tools support early treatment decisions, reduce hospital-acquired infections and strengthen antimicrobial stewardship across clinical settings.

- Food Safety and Contamination Monitoring: Food manufacturers use pathogen testing to identify contaminants like Salmonella, Listeria and E. coli in raw materials, production lines and packaged goods. Rapid microbiology platforms and environmental monitoring systems help prevent foodborne outbreaks and ensure compliance with global safety regulations.

- Environmental and Water Quality Surveillance: Water utilities and environmental agencies rely on pathogen analytics to detect harmful microorganisms in drinking water, wastewater and natural ecosystems. Portable PCR devices, biosensors and lab-based molecular tests improve outbreak prediction, public health monitoring and microbial risk assessment.

- Biopharmaceutical and Vaccine Development: Biopharma companies use pathogen detection solutions for contamination control, process monitoring and vaccine research. High-sensitivity molecular assays and sequencing tools help maintain product safety, accelerate therapeutic development and support reliable biologics manufacturing.

Impact of Artificial Intelligence on the global Pathogen market

Artificial intelligence is reshaping the global pathogen market by enhancing the speed, precision and scale of infectious disease detection. AI-powered analytics improve the interpretation of PCR tests, sequencing outputs and digital imaging data, allowing laboratories to identify pathogens, mutation patterns and antimicrobial resistance markers with greater accuracy. Machine learning algorithms automate result validation, reduce manual errors and optimize diagnostic workflows, enabling faster clinical decision-making and improved infectious disease management across hospitals and diagnostic laboratories.

AI-driven predictive modeling is also strengthening biosurveillance and outbreak forecasting. Real-time data from wastewater monitoring, environmental sensors, electronic health records and genomic surveillance systems can be analyzed to detect early warning signals of emerging pathogens and potential epidemic hotspots. In biotechnology and vaccine development, AI accelerates drug discovery, protein modeling, genomic interpretation and quality control by identifying contamination risks and optimizing bioprocess parameters. As AI integrates with molecular diagnostics, point-of-care devices, digital labs and public health systems, it pushes the global pathogen market toward more automated, scalable and proactive pathogen detection ecosystems.

Global Pathogen Market: Stats & Facts

- WHO / GLASS (Global Antimicrobial Resistance and Use Surveillance System)

- In 2023, 104 countries reported AMR data to WHO’s GLASS system (up from 25 in 2016).

- Between 2018 and 2023, resistance increased in over 40% of the pathogen‑antibiotic combinations monitored.

- Average annual increase in antibiotic resistance during that period was between 5 % and 15 %.

- As of December 2023, 98 countries / territories (CTAs) were enrolled in GLASS‑AMU (antimicrobial use surveillance).

- In 2023, only 34% of those CTAs (22 of 65) met WHO’s target of having ≥ 70% of antibiotic use from “Access” antibiotics.

- In 2022, only 58% of CTAs (35/60) reached the WHO target of ≥ 60% “Access” antibiotic use.

- Globally in 2022, of 16.6 billion defined daily doses (DDD) of antibiotics, only 52% belonged to the WHO “Access” category.

- GLASS provides standardized data for 8 high‑priority bacterial pathogens for bloodstream, urinary, gastrointestinal and genital infections.

- GLASS promotes using not just laboratory resistance data but also epidemiological and population-level AMR data across countries.

- ECDC / European Surveillance Data

- Each year, approximately 4.3 million patients in hospitals across the EU/EEA acquire at least one healthcare‑associated infection (HAI).

- According to the 2022‑2023 ECDC point-prevalence survey, 35.5% of hospitalized patients in the EU/EEA received at least one antimicrobial agent on a given day.

- In the same survey, a composite index of AMR (resistance to key first‑line markers) among isolates from HAIs was 56.3%.

- Among HAI isolates, some countries reported very high resistance: for example, > 80% carbapenem resistance in Klebsiella pneumoniae in certain hospitals.

- Percentage of Staphylococcus aureus (from HAIs) that is MRSA (meticillin‑resistant) was reported in the survey; in some countries, the MRSA rate in isolates was very high.

Global Pathogen Market: Market Dynamics

Global Pathogen Market: Driving Factors

Growing Demand for Rapid and Precise Pathogen Detection

Artificial Intelligence is transforming the pathogen market by enabling rapid diagnostics, automated microbial identification, and real-time infectious disease analytics. Healthcare systems increasingly prefer AI tools that enhance accuracy, reduce testing delays, and minimize manual errors. This shift toward algorithm-driven lab workflows, AI diagnostic platforms, and genomic interpretation tools is accelerating global adoption as organizations seek faster, more reliable pathogen detection methods.

Escalating Global Burden of Infectious Diseases

The rising prevalence of emerging pathogens, antimicrobial resistance, and global outbreaks is compelling governments and hospitals to adopt AI-powered microbial surveillance. These technologies support predictive outbreak modelling, epidemiological forecasting, and early detection of high-risk pathogens. As health agencies prioritize digital disease surveillance and proactive risk response, AI’s role in improving pathogen intelligence continues to expand.

Global Pathogen Market: Restraints

High Cost and Infrastructure Limitations

AI integration in pathogen diagnostics demands advanced computing infrastructure, trained technical staff, and continuous model updates. Many laboratories—especially in developing regions—lack cloud-based diagnostic platforms, AI-friendly data systems, and secure computational environments. The financial burden associated with implementation, maintenance, and cybersecurity significantly slows adoption across smaller institutions.

Data Quality, Privacy, and Regulatory Concerns

AI models rely heavily on high-quality datasets for accurate pathogen interpretation. Inconsistent clinical data, privacy restrictions, and fragmented healthcare systems make it challenging to train reliable algorithms. Additionally, stringent regulatory requirements for AI-driven diagnostics delay approvals and limit rapid deployment of AI-supported clinical decision systems.

Global Pathogen Market: Opportunities

Growing Adoption of AI in Genomic Sequencing and Precision Medicine

Expanding use of next-generation sequencing, digital pathogen profiling, and AI-assisted genome interpretation presents strong growth prospects. As precision medicine advances, AI will help identify pathogen variants, predict treatment response, and guide targeted antimicrobial therapies. This opens substantial opportunities for companies building integrated genomic-AI ecosystems.

Expansion of AI Solutions in Public Health Surveillance

Governments globally are investing in AI-enabled biosurveillance networks, automated reporting systems, and global outbreak monitoring tools. Integrating AI into national disease control systems offers significant market growth potential. The trend toward real-time pathogen intelligence creates opportunities for scalable platforms that support pandemic preparedness.

Global Pathogen Market: Trends

Shift toward Automated, AI-Driven Laboratory Workflows

Clinical microbiology labs are adopting AI for automated slide analysis, colony identification, sample triaging, and digital microscopy. This trend is reshaping lab operations by reducing workload, improving consistency, and enabling remote diagnostics. The movement toward smart laboratories is becoming a defining feature of the future pathogen market.

Integration of AI with IoT and Edge Devices for Pathogen Monitoring

A growing trend involves combining AI with IoT-enabled sensors, point-of-care devices, and portable diagnostic platforms. These systems provide real-time pathogen detection, environmental monitoring, and on-site infectious disease screening. The rise of connected diagnostics is creating a new generation of decentralized, AI-driven pathogen monitoring ecosystems.

Global Pathogen Market: Research Scope and Analysis

By Product Analysis

Diagnostics and detection systems are expected to dominate the product segment, capturing 50.0% of the total market share in 2025. Their leadership comes from the rising demand for rapid pathogen identification, high-accuracy molecular testing and real-time monitoring of infectious diseases. Clinical laboratories and healthcare facilities are adopting advanced PCR platforms, sequencing-based assays, immunoassay analyzers and AI-supported diagnostic workflows to accelerate decision-making and reduce turnaround times. Growing emphasis on early diagnosis, antimicrobial resistance surveillance and emergency outbreak response continues to boost the adoption of these high-efficiency detection solutions across global healthcare ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Vaccines also remain a critical component of the pathogen market as immunization programs expand and research accelerates toward next-generation formulations. Continuous advancements in mRNA vaccines, viral vector technologies and recombinant platforms are enabling faster development cycles and more targeted immune responses. Increasing global awareness of preventive healthcare, government investments in pandemic readiness and rising demand for broad-spectrum and variant-resistant vaccines are further strengthening the role of vaccines within the pathogen landscape, ensuring they stay integral to long-term disease control strategies.

By Technology Analysis

Polymerase Chain Reaction and other nucleic acid amplification technologies are expected to maintain their dominance in the technology segment, capturing 35.0% of the total market share in 2025. These technologies are widely adopted due to their high sensitivity, specificity and ability to detect even low concentrations of pathogens in clinical, food, and environmental samples. Laboratories and healthcare facilities rely on PCR and other nucleic acid amplification methods for rapid identification of bacteria, viruses, fungi, and parasites, enabling early diagnosis and effective disease management. The integration of automated workflows, high-throughput platforms, and AI-driven data analysis has further enhanced the efficiency and accuracy of these testing solutions, making them central to pathogen detection and surveillance globally.

Immunoassay technologies are also a key component of the pathogen market, providing rapid, reliable and cost-effective detection of pathogens through antigen or antibody-based tests. Techniques such as enzyme-linked immunosorbent assays, lateral flow assays, and chemiluminescent immunoassays are widely used in hospitals, diagnostic labs, and point-of-care settings. These technologies are essential for quick screening, routine monitoring, and large-scale epidemiological studies, offering versatility across clinical diagnostics, food safety, and public health applications. Their ease of use, scalability, and adaptability to different sample types continue to drive strong adoption in the global pathogen detection market.

By Pathogen Type Analysis

Bacterial pathogens are expected to dominate the pathogen type segment, capturing 35.0% of the market share in 2025, driven by their widespread prevalence and significant impact on public health, food safety, and clinical outcomes. Healthcare facilities, diagnostic laboratories, and food testing organizations prioritize rapid detection of bacteria such as Salmonella, Escherichia coli, and Staphylococcus species to prevent infections, outbreaks, and contamination. Advanced molecular diagnostics, PCR-based assays, culture techniques, and automated microbial identification systems are widely employed to enhance detection speed and accuracy. Growing concerns over antimicrobial resistance and hospital-acquired infections further reinforce the demand for reliable bacterial pathogen testing across clinical, environmental, and industrial settings.

Viral pathogens also represent a significant portion of the market as viruses continue to cause seasonal outbreaks, pandemics, and chronic infections globally. Detection of viral agents like influenza, hepatitis, HIV, and emerging zoonotic viruses relies on molecular diagnostics, antigen and antibody immunoassays, and sequencing technologies. Hospitals, public health agencies, and research laboratories utilize these technologies for early diagnosis, surveillance, and monitoring of viral spread. Increasing investment in rapid viral testing, point-of-care diagnostics, and AI-assisted detection platforms supports timely interventions, disease management, and improved patient outcomes, making viral pathogen detection a critical segment within the global pathogen market.

By Deployment Mode Analysis

Central laboratory systems are expected to account for the maximum share in the deployment mode segment, capturing 60.0% of the total market value. These systems are widely adopted in hospitals, reference laboratories, and research centers due to their high throughput, advanced automation, and ability to handle complex testing workflows. Central laboratories leverage molecular diagnostics, nucleic acid amplification techniques, immunoassays, and sequencing platforms to provide accurate and reliable pathogen detection across clinical, environmental, and food safety applications. The integration of digital data management, AI-driven analysis, and standardized testing protocols enhances efficiency, reduces errors, and supports large-scale disease surveillance, making central laboratory systems a backbone of the global pathogen market.

Point-of-care diagnostic devices are increasingly used alongside central laboratory systems to deliver rapid, on-site pathogen detection in hospitals, clinics, and remote healthcare settings. These portable and easy-to-use devices enable immediate testing for bacterial, viral, and other infectious agents, supporting timely clinical decision-making and outbreak response. Immunoassay kits, lateral flow tests, and small-scale PCR instruments are commonly deployed in point-of-care settings to provide quick results without the need for complex laboratory infrastructure. The growing demand for decentralized testing, emergency diagnostics, and accessible healthcare solutions is driving the adoption of point-of-care diagnostic devices within the global pathogen detection market.

By Application Analysis

Clinical diagnostics are expected to dominate the application segment, capturing 45.0% of the market share in 2025, as hospitals, diagnostic laboratories, and healthcare centers increasingly rely on advanced pathogen detection technologies to identify infections accurately and rapidly. Molecular diagnostics, PCR-based assays, immunoassays, and sequencing platforms are extensively used for detecting bacterial, viral, fungal, and parasitic pathogens. The growing need for early disease detection, antimicrobial resistance monitoring, and effective patient management is driving adoption, while integration of AI and automated lab workflows further enhances accuracy, reduces turnaround times, and supports large-scale epidemiological surveillance.

Food safety pathogen testing is also a crucial application within the global market, focusing on detecting harmful microorganisms in raw materials, production lines, and finished food products. Bacteria such as Salmonella, Listeria, and Escherichia coli are routinely screened using rapid microbiology techniques, immunoassays, and molecular diagnostic platforms. Food and beverage manufacturers, regulatory agencies, and testing laboratories rely on these solutions to ensure compliance with safety standards, prevent outbreaks, and maintain consumer confidence. The rising emphasis on global food safety, supply chain monitoring, and contamination prevention continues to drive investment in advanced pathogen detection technologies for the food industry.

By End User Analysis

Diagnostic laboratories are expected to capture the maximum share in the end user segment, accounting for 30.0% of the market in 2025, due to their central role in conducting large-scale pathogen testing across clinical, food, and environmental samples. These laboratories utilize advanced molecular diagnostics, nucleic acid amplification techniques, immunoassays, and sequencing platforms to deliver accurate and timely results. Their ability to process high volumes of samples, integrate automated workflows, and adopt AI-driven data analysis makes them indispensable for outbreak monitoring, antimicrobial resistance surveillance, and public health initiatives. The demand for centralized, high-throughput testing continues to strengthen the dominance of diagnostic laboratories in the global pathogen market.

Hospitals and clinics also represent a significant end user segment, relying on pathogen detection solutions for timely diagnosis and patient management. Point-of-care devices, rapid immunoassays, PCR-based platforms, and molecular diagnostics are increasingly deployed to identify bacterial, viral, and fungal infections at the bedside. These facilities focus on early detection, reducing hospital-acquired infections, and guiding treatment decisions. The integration of AI-based diagnostic tools and digital lab connectivity allows healthcare providers to enhance workflow efficiency, improve patient outcomes, and contribute to epidemiological surveillance, reinforcing the importance of hospitals and clinics in the pathogen market ecosystem.

The Pathogen Market Report is segmented on the basis of the following:

By Product

- Diagnostics and Detection Systems

- Molecular test kits

- Rapid immunoassays

- Automated analyzers

- Vaccines

- Therapeutic Drugs

- Food and Environmental Testing Products

- Digital Surveillance and Analytics

- Biosafety and Support Solutions

By Technology

- Polymerase Chain Reaction and Other Nucleic Acid Amplification Technologies

- Immunoassay Technologies

- Antigen-based tests

- Antibody-based tests

- Next Generation Sequencing Technologies

- Culture-based Microbiology Techniques

- Biosensor-based Detection Technologies

- Mass Spectrometry Systems

- Emerging and Hybrid Detection Technologies

By Pathogen Type

- Bacterial Pathogens

- Salmonella

- Escherichia coli

- Staphylococcus species

- Viral Pathogens

- Parasitic Pathogens

- Fungal Pathogens

- Emerging and Novel Pathogens

By Deployment Mode

- Centralized Laboratory Systems

- Point-of-Care Diagnostic Devices

- Portable Field Testing Systems

- Home-based Testing Kits

By Application

- Clinical Diagnostic Testing

- Food Safety Pathogen Testing

- Public Health Surveillance

- Pharmaceutical and Bioprocess Quality Control

- Environmental and Water Testing

- Agricultural and Veterinary Pathogen Management

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Food and Beverage Quality Control Departments

- Pharmaceutical and Biotechnology Companies

- Government Health and Surveillance Agencies

- Academic and Research Institutes

- Agricultural and Veterinary Stakeholders

Global Pathogen Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to hold the largest revenue share in the global pathogen market due to its advanced healthcare infrastructure, well-established diagnostic laboratories, and strong public health systems. The region benefits from high adoption of molecular diagnostics, PCR-based platforms, immunoassays, and next-generation sequencing technologies for rapid pathogen detection and disease monitoring.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing concerns over emerging infectious diseases, hospital-acquired infections, and antimicrobial resistance drive significant investment in AI-supported diagnostics, automated lab workflows, and biosurveillance programs. The presence of key market players, robust research and development activities, and supportive regulatory frameworks further strengthen North America’s leading position in the global pathogen market.

Region with significant growth

Asia Pacific is expected to witness significant growth in the global pathogen market due to rising healthcare expenditure, expanding diagnostic infrastructure, and increasing awareness of infectious disease prevention. Rapid urbanization, growing population density, and frequent outbreaks of bacterial, viral, and parasitic infections are driving demand for rapid pathogen detection technologies, molecular diagnostics, and point-of-care testing solutions. Governments in countries such as China, India, and Japan are investing heavily in public health surveillance, biosafety programs, and laboratory modernization, while the expansion of pharmaceutical and food testing industries further supports market growth. Increasing adoption of AI-assisted diagnostics and next-generation sequencing platforms is also fueling the region’s robust growth trajectory.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Pathogen Market: Competitive Landscape

The competitive landscape in the global pathogen market is highly dynamic, characterized by intense rivalry among diagnostic‑platform providers, molecular‑assay developers, sequencing‑technology innovators, and contract research organizations. Players compete on the basis of technological innovation, such as next‑generation sequencing, point‑of‑care assays, and AI‑driven detection systems, while also seeking to establish scale through high-throughput laboratory automation. Rapid R&D cycles, strategic partnerships, licensing agreements, mergers and acquisitions, and intellectual‑property portfolios form critical levers for differentiation. At the same time, regulatory approval timelines, cost of goods, and pressures to lower test prices challenge new entrants and incumbents alike, driving a continuous push toward operational efficiency and value-based testing.

Some of the prominent players in the global Pathogen market are:

- Thermo Fisher Scientific

- Roche Diagnostics

- Abbott Laboratories

- BioMérieux

- Qiagen

- Danaher Corporation

- Siemens Healthineers

- Becton Dickinson and Company

- Agilent Technologies

- PerkinElmer

- Illumina

- Bio-Rad Laboratories

- Merck KGaA

- Takara Bio

- QuidelOrtho

- Cepheid

- Hologic

- 3M Health Care

- Neogen Corporation

- Charles River Laboratories

- ayers

Global Pathogen Market: Recent Developments

- June 2025: One life-sciences giant announced a new ultra-sensitive digital PCR system aimed at environmental and pathogen surveillance, suitable for detecting low-abundance DNA and RNA from water, wastewater and clinical samples.

- April 2025: A large science and technology corporation agreed to acquire a U.S.-based biopharma firm in a deal valued around USD 3.9 billion, in a move expected to bolster its healthcare business.

- December 2024: That same German company closed another acquisition, this time buying a next-generation biology firm specializing in 3D cell culture and organoid tech to enhance its life‑science research and development capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.0 Bn |

| Forecast Value (2034) |

USD 12.2 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 1.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Diagnostics and Detection Systems, Vaccines, Therapeutic Drugs, Food and Environmental Testing Products, Digital Surveillance and Analytics, Biosafety and Support Solutions); By Technology (Polymerase Chain Reaction and Other Nucleic Acid Amplification Technologies, Immunoassay Technologies, Next Generation Sequencing Technologies, Culture-based Microbiology Techniques, Biosensor-based Detection Technologies, Mass Spectrometry Systems, Emerging and Hybrid Detection Technologies); By Pathogen Type (Bacterial Pathogens, Viral Pathogens, Parasitic Pathogens, Fungal Pathogens, Emerging and Novel Pathogens); By Deployment Mode (Centralized Laboratory Systems, Point-of-Care Diagnostic Devices, Portable Field Testing Systems, Home-based Testing Kits); By Application (Clinical Diagnostic Testing, Food Safety Pathogen Testing, Public Health Surveillance, Pharmaceutical and Bioprocess Quality Control, Environmental and Water Testing, Agricultural and Veterinary Pathogen Management); and By End User (Diagnostic Laboratories, Hospitals and Clinics, Food and Beverage Quality Control Departments, Pharmaceutical and Biotechnology Companies, Government Health and Surveillance Agencies, Academic and Research Institutes, Agricultural and Veterinary Stakeholders). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, BioMérieux, Qiagen, Danaher Corporation, Siemens Healthineers, Becton Dickinson and Company, Agilent Technologies, PerkinElmer, Illumina, Bio-Rad Laboratories, Merck KGaA, Takara Bio, QuidelOrtho, Cepheid, Hologic, 3M Health Care, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Pathogen market?

▾ The global Pathogen market size is estimated to have a value of USD 6.0 billion in 2025 and is expected to reach USD 12.2 billion by the end of 2034.

What is the size of the US Pathogen market?

▾ The US Pathogen market is projected to be valued at USD 1.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.6 billion in 2034 at a CAGR of 7.8%.

Which region accounted for the largest global Pathogen market?

▾ North America is expected to have the largest market share in the global Pathogen market, with a share of about 36.0% in 2025.

Who are the key players in the global Pathogen market?

▾ Some of the major key players in the global Pathogen market are Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, BioMérieux, Qiagen, Danaher Corporation, Siemens Healthineers, Becton Dickinson and Company, Agilent Technologies, PerkinElmer, Illumina, Bio-Rad Laboratories, Merck KGaA, Takara Bio, QuidelOrtho, Cepheid, Hologic, 3M Health Care, and Others.

What is the growth rate of the global Pathogen market?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period.