Market Overview

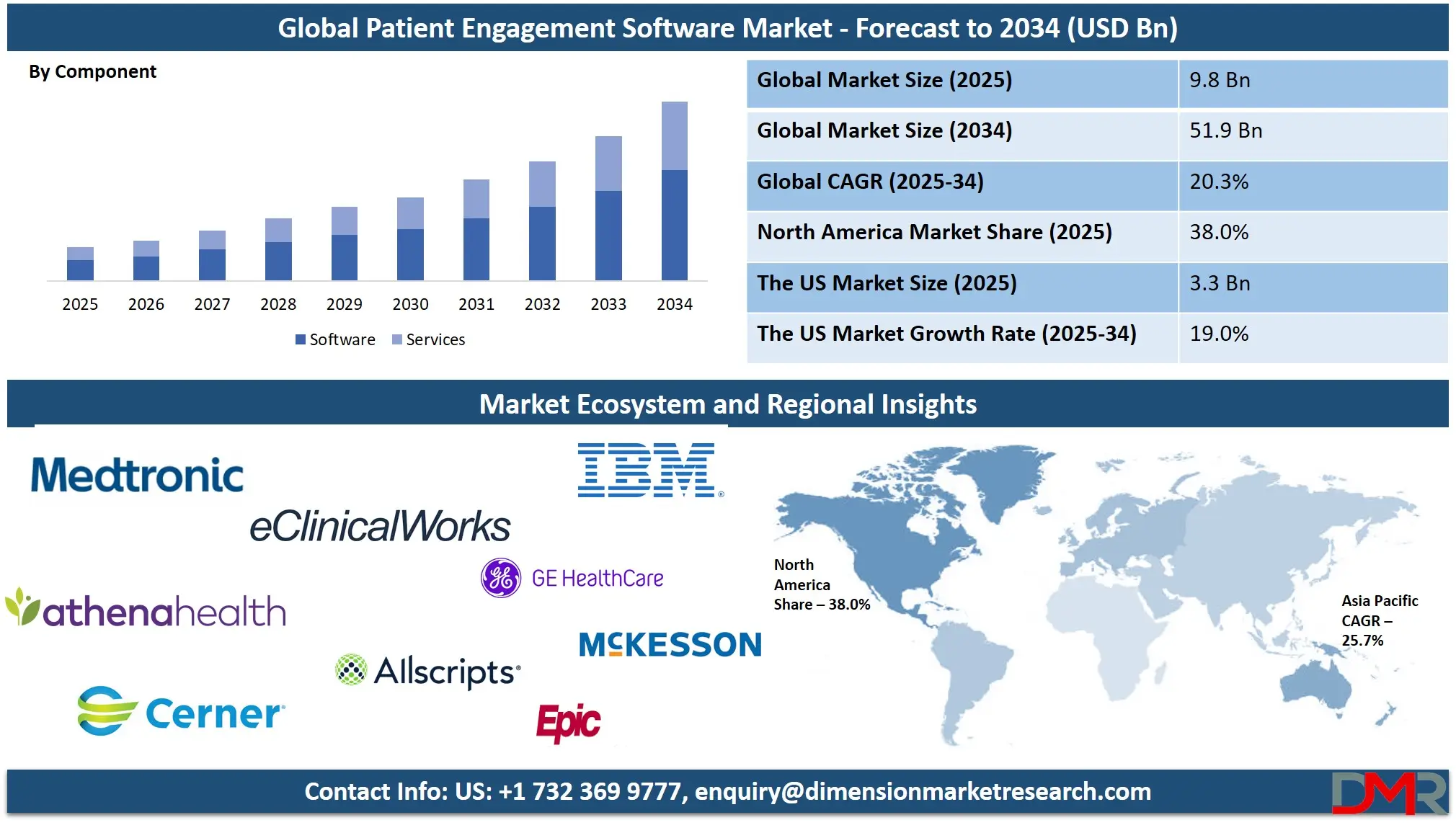

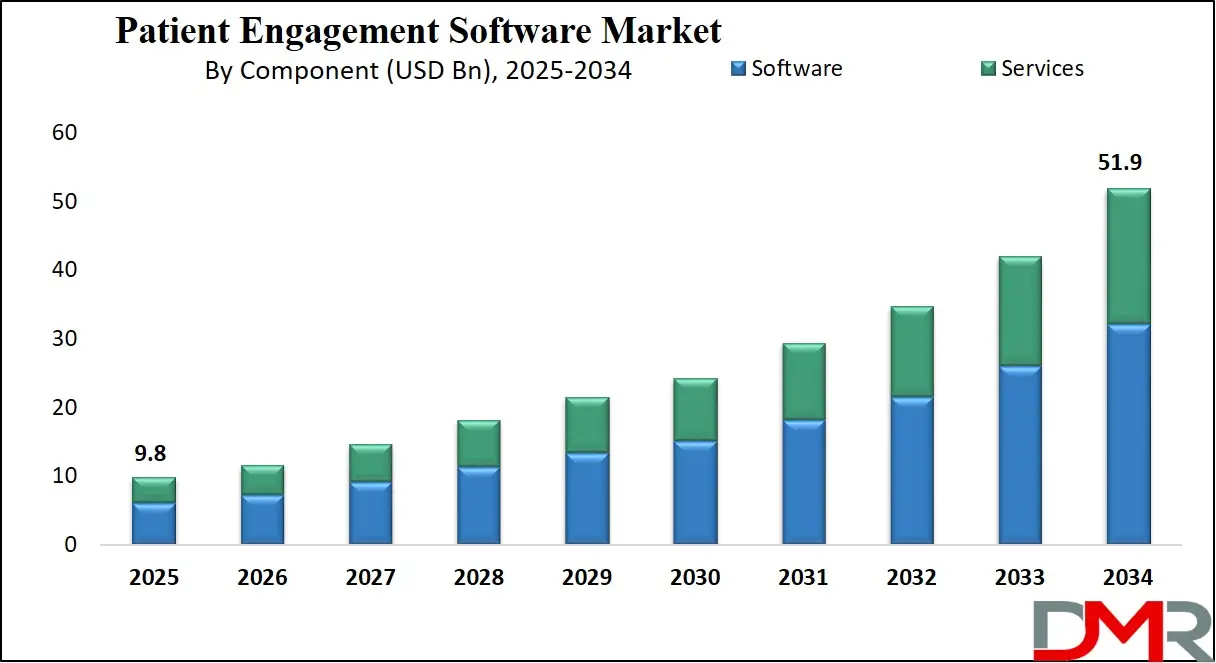

The Global Patient Engagement Software Market size is projected to reach USD 9.8 billion in 2025 and grow at a compound annual growth rate of 20.3% to reach a value of USD 51.9 billion in 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Patient Engagement Software market refers to digital platforms and tools designed to help patients interact more actively with their healthcare providers. These include patient portals, secure messaging, remote monitoring, and appointment scheduling applications. As healthcare shifts toward value-based care, such software empowers patients to manage their health more directly and providers to monitor outcomes more efficiently.

Globally, the market is growing rapidly, driven by increased digital health adoption, higher patient expectations for convenient care, and regulatory push for patient-centered models. Advances in cloud computing, interoperability, and mobile health have made engagement platforms more scalable and accessible. Concurrently, health systems are wrestling with data privacy, integration, and workflow disruption, which remain significant hurdles.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key developments include the integration of AI for predictive communication, automated reminders, and personalized health content, as well as tighter integration with EHRs. Vendors are packaging continuous engagement ecosystems—combining portals, remote monitoring, messaging, and billing—to target long-term patient lifetime value. As remote care and telehealth persist post-pandemic, engagement software is becoming a central part of modern care delivery.

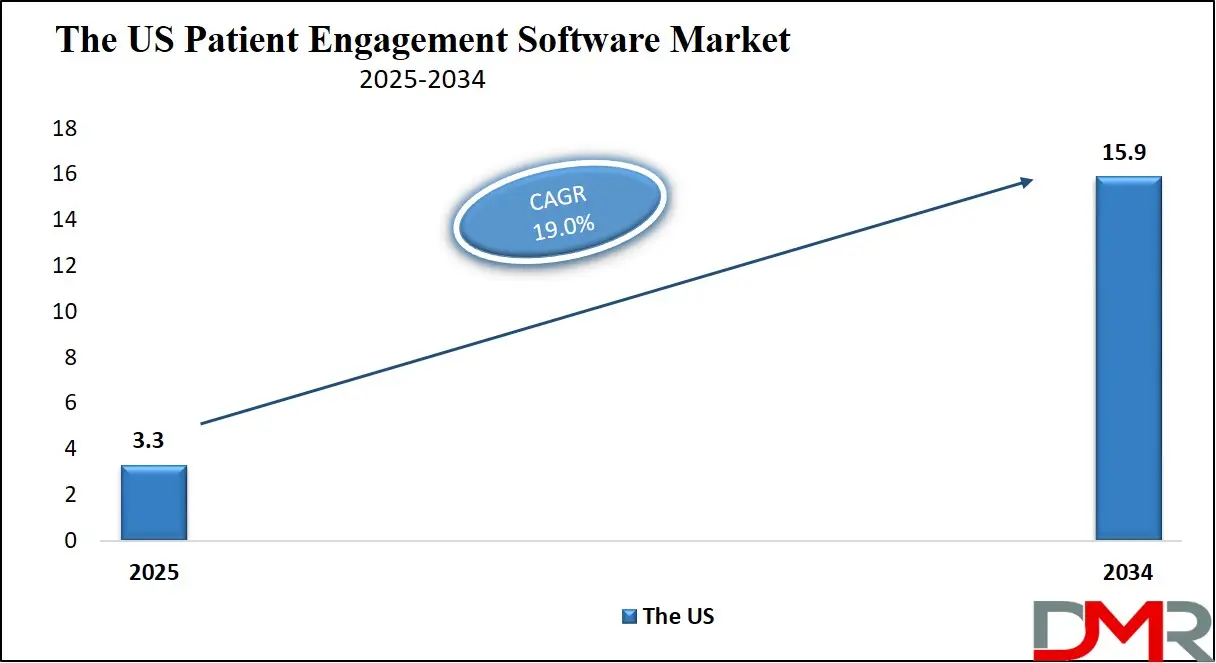

The US Patient Engagement Software Market

The US Patient Engagement Software Market size is projected to reach USD 3.3 billion in 2025 at a compound annual growth rate of 19.0% over its forecast period.

The U.S. patient engagement software market is supported by strong regulations and advanced digital health infrastructure. Hospitals widely offer online access, secure messaging, and clinical note sharing, promoting patient-centered care.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Regulatory initiatives encouraging app-based access further drive digital engagement, while robust EHR systems enable seamless integration of engagement platforms. These factors make the U.S. a leading market in adoption and innovation, with healthcare organizations leveraging technology to improve communication, care coordination, and patient self-management.

Europe Patient Engagement Software Market

Europe Patient Engagement Software Market size is projected to reach USD 2.5 billion in 2025 at a compound annual growth rate of 19.4% over its forecast period.

In Europe, the patient engagement software market is shaped by strong policy frameworks, data protection regulation (like GDPR), and coordinated eHealth strategies by governments. The emphasis is on interoperability across health systems, integration with national health records, and enabling patient access via secure portals. Adoption is growing steadily, driven by a commitment to digital transformation in public health systems and the rising burden of chronic diseases.

Japan Patient Engagement Software Market

Japan Patient Engagement Software Market size is projected to reach USD 490 million in 2025 at a compound annual growth rate of 20.9% over its forecast period.

In Japan, demographic pressures—especially an aging population—and rising healthcare costs are key drivers for patient engagement tools. There is growing uptake of remote monitoring and home-health engagement platforms to manage chronic conditions. Digital health infrastructure and mobile penetration support adoption, though integration with traditional hospital-based systems poses a challenge. Cultural factors also influence how patients interact with such software.

Patient Engagement Software Market: Key Takeaways

- Market Growth: The Patient Engagement Software Market size is expected to grow by USD 40.3 billion, at a CAGR of 20.3%, during the forecasted period of 2026 to 2034.

- By Component: The Software segment is anticipated to get the majority share of the Patient Engagement Software Market in 2025.

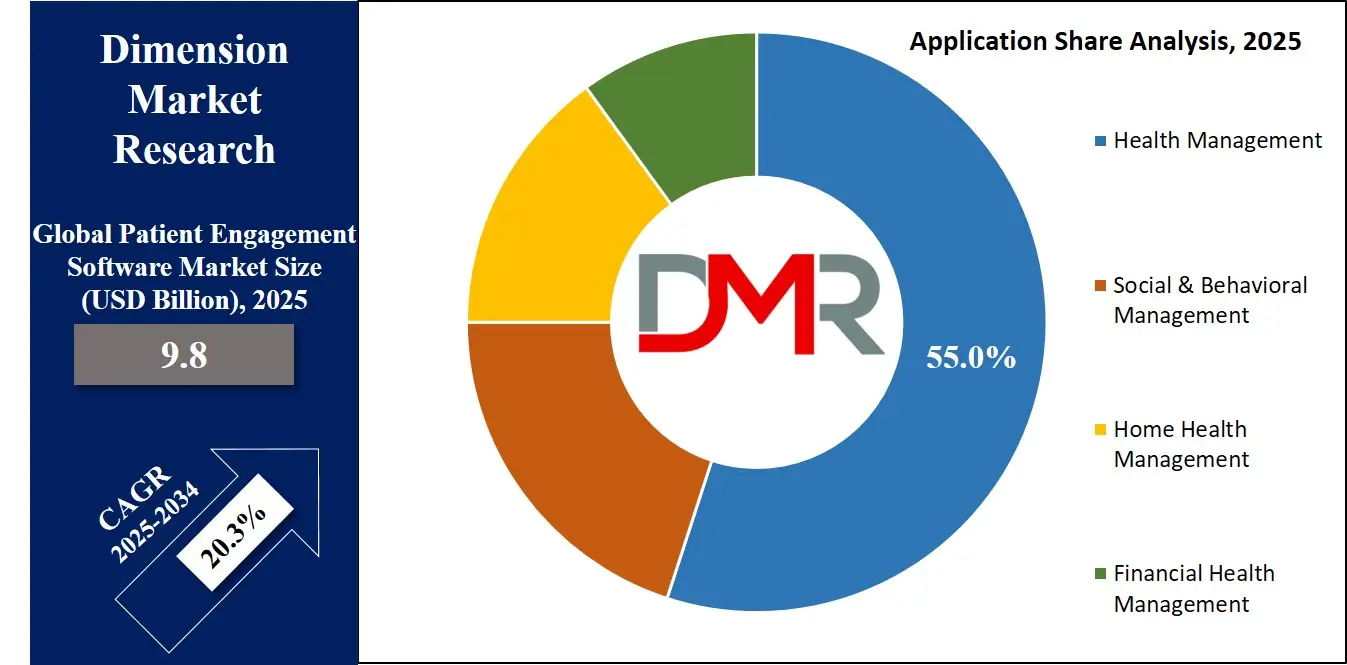

- By Application: The Health Management segment is expected to get the largest revenue share in 2025 in the Patient Engagement Software Market.

- Regional Insight: North America is expected to hold a 38.0% share of revenue in the Global Patient Engagement Software Market in 2025.

- Use Cases: Some of the use cases of Patient Engagement Software include patient education, secure messaging, and more

Patient Engagement Software Market: Use Cases

- Appointment Scheduling: Software that allows patients to book, reschedule, and cancel appointments online or via mobile.

- Secure Messaging: Platforms for two-way messaging between patients and providers, including sharing test results and clinical notes.

- Remote Patient Monitoring (RPM): Tools that collect data from wearables or home devices and send it to providers for chronic disease management.

- Patient Education: Interactive portals offering tailored health content, preventive-care information, and self-management resources.

Market Dynamic

Driving Factors in the Patient Engagement Software Market

Rising Demand for Digital, Value-Based Care

There’s an increasing shift toward value-based care models that emphasize outcomes and patient satisfaction over the volume of service. Patient engagement software supports this transformation by promoting self-management, improving adherence, and collecting patient-reported outcome measures, which align directly with value-based care goals.

Technological Advancements and Interoperability

Advances in cloud computing, APIs, and data analytics are making engagement platforms more powerful and accessible. Regulations like the U.S. 21st Century Cures Act incentivize interoperability, encouraging EHR vendors and software providers to create seamless, integrated patient engagement ecosystems.

Restraints in the Patient Engagement Software Market

Data Privacy and Security Concerns

Because engagement platforms handle sensitive health information, there are major cybersecurity risks. Compliance with stringent regulations like HIPAA in the U.S. and GDPR in Europe requires high investment in encryption, secure messaging, and identity management, which slows adoption.

High Implementation Cost & Workflow Disruption

Deploying patient engagement solutions involves considerable expenditures—not just software, but training, integration, and maintenance. Integration with legacy EHR systems can be complex, and such change may disrupt established clinical workflows, creating resistance from healthcare providers.

Opportunities in the Patient Engagement Software Market

Growth of Remote Monitoring & Telehealth

The adoption of telehealth and remote patient monitoring (RPM) offers a big opportunity—engagement platforms can serve as hubs for RPM data, two-way communication, and continuous care outside the hospital.

AI-Powered Personalization

AI and ML can bring personalized health content, predictive analytics (e.g. identifying patients at risk), and automated engagement (chatbots, reminders), boosting both clinical effectiveness and patient satisfaction.

Trends in the Patient Engagement Software Market

Cloud & Mobile-First Deployment

There is a clear movement toward cloud-based, mobile-first engagement platforms — driven by cost efficiencies, scalability, and increasing patient comfort with smartphone use.

Integration with Wearables and Remote Devices

Integration of patient engagement software with wearable devices and remote monitoring tools is increasing, enabling continuous data collection and real-time health tracking.

Impact of Artificial Intelligence in Patient Engagement Software Market

- Personalized Communication: AI enables hyper-personalized messages, nudges, and health coaching based on patient behavior and risk profiles.

- Predictive Analytics: Machine learning models can flag patients at risk of non-compliance or deterioration, enabling proactive outreach.

- Automated Support: Chatbots and virtual assistants provide 24/7 support for appointment booking, FAQs, and simple triage.

- Behavioral Insights: AI analyses engagement patterns to identify what motivates a particular patient, tailoring interventions for better outcomes.

- Operational Efficiency: Automation reduces administrative burden on providers (e.g., reminders, follow-ups), freeing up staff to focus on care.

Research Scope and Analysis

By Component Analysis

The Software segment is leading the Patient Engagement Software market, accounting for 62% in 2025, reflecting the widespread deployment of cloud-based portals, mobile applications, and integrated health platforms designed to improve patient-provider interactions. Software solutions include patient portals, appointment scheduling systems, automated reminders, and educational content delivery, which are increasingly essential in both outpatient and inpatient settings. Their prominence is also driven by regulatory requirements for secure patient data management and interoperability standards across electronic health record (EHR) systems.

The Services segment is the fastest-growing, driven by the increasing demand for customized onboarding, system integration, ongoing technical support, and training for healthcare providers. As organizations adopt patient engagement platforms, services become critical to ensure smooth deployment, interoperability with existing health IT infrastructure, and optimization of workflow efficiency.

By Delivery Mode Analysis

On-Premise solutions lead the market with a share of 58% in 2025, largely due to large hospitals and healthcare systems prioritizing data control, security, and compliance with regulations such as HIPAA. On-premise deployment allows organizations to maintain internal IT governance while integrating deeply with legacy EHR systems.

Cloud-Based solutions are the fastest-growing segment, as they provide scalability, lower upfront capital costs, seamless updates, and easy integration with remote monitoring tools and mobile apps. Cloud adoption is further accelerated by telehealth initiatives and multi-location hospital networks that require centralized patient engagement systems.

By Application Analysis

The Health Management application segment leads with 55% in 2025, driven by the need to manage chronic diseases, coordinate care, and maintain regular communication with patients. Applications include tools for medication reminders, disease tracking, and wellness monitoring, which are critical for improving outcomes and reducing hospital readmissions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Home Health Management is the fastest-growing segment, supported by the rising adoption of telehealth services, remote patient monitoring devices, and patient preference for in-home care. Platforms allow caregivers and clinicians to track vital signs, deliver educational content, and maintain regular communication without requiring hospital visits.

By Functionality Analysis

Patient Communication is the leading functionality, with 60% in 2025, encompassing secure messaging, patient portals, and automated notifications. Communication tools form the foundation of engagement platforms, ensuring patients receive timely reminders, educational materials, and feedback from providers.

Remote Patient Monitoring is the fastest-growing functionality segment, fueled by wearable devices, connected health sensors, and IoT-enabled tools. It allows continuous tracking of chronic conditions, elderly care monitoring, and early detection of complications, significantly enhancing patient engagement and adherence.

By End User Analysis

Hospitals & Clinics are the leading end users, representing 65% in 2025, as they deploy engagement systems extensively across inpatient and outpatient workflows. Hospitals leverage these platforms to improve patient satisfaction, streamline care coordination, and comply with regulatory requirements.

Patients are the fastest-growing end-user segment, reflecting rising self-service adoption. Individuals are increasingly using digital portals, mobile apps, and wearable-integrated platforms to manage appointments, track personal health metrics, and access educational content.

By Therapeutics Area Analysis

Chronic Disease Management leads with 57% in 2025, driven by the high prevalence of long-term conditions such as diabetes, cardiovascular diseases, and respiratory illnesses. Patient engagement software in this area ensures adherence to care plans, remote monitoring, and timely interventions to reduce complications and hospital readmissions.

Fitness & Wellness is the fastest-growing therapeutic area, reflecting increased patient focus on preventive care, lifestyle interventions, and overall well-being. Engagement platforms in this segment provide exercise tracking, nutrition guidance, and wellness coaching to support healthier lifestyles.

The Patient Engagement Software Market Report is segmented on the basis of the following:

By Component

By Delivery Mode

By Application

- Health Management

- Social & Behavioral Management

- Home Health Management

- Financial Health Management

By Functionality

- Appointment Scheduling

- Patient Communication

- Billing & Payments

- Health Tracking

- Remote Patient Monitoring

- Patient Education

By End User

- Hospitals & Clinics

- Healthcare Payers

- Pharmacies

- Patients

By Therapeutic Area

- Chronic Disease Management

- Fitness & Wellness

- Women's Health

- Mental Health

- Patient Education & Preventive Care

Regional Analysis

Leading Region in the Patient Engagement Software Market

North America remains the leading region in the global patient engagement software market, with 38% of the market share in 2025, according to one analysis. The U.S. drives this leadership with high digital health infrastructure, favorable regulation, and widespread EHR adoption. Hospitals in this region are rapidly implementing engagement capabilities like secure messaging, app-based record access, and remote monitoring. Adoption is supported by strong reimbursement models, value-based care initiatives, and heavy investment in health IT. These factors combined have made North America a highly mature and competitive market for patient engagement software.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Patient Engagement Software Market

The Asia-Pacific region is emerging as the fastest-growing in the patient engagement software market. Rapid digital health adoption, rising mobile penetration, growing investments in telemedicine, and increasing healthcare infrastructure development are major drivers. Aging populations in countries like Japan and China, paired with rising chronic disease burden, are fueling demand for remote monitoring and home-based engagement platforms. As both public and private sectors invest in scalable, cloud-native engagement solutions, adoption in the region is accelerating sharply.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the patient engagement software market is fragmented, featuring established health-IT companies and nimble startups. Key players include Epic Systems, Cerner, Allscripts, IBM, Orion Health, and MEDHOST, all offering varying mixes of portals, messaging, EHR integration, and remote monitoring. Vendors differentiate on usability, AI features, interoperability, and security. Strategic partnerships (e.g., between EHR vendors and remote-monitoring device makers) are common. As demand grows, companies also focus on expanding into home health and chronic care, investing in R&D to bring more predictive, personalized engagement solutions to market.

Some of the prominent players in the global Patient Engagement Software are:

- Epic Systems

- Cerner

- Allscripts

- Athenahealth

- McKesson

- GE Healthcare

- Medtronic

- Philips Healthcare

- IBM

- Salesforce

- Cognizant

- Oracle

- Meditech

- eClinicalWorks

- NextGen Healthcare

- GetWellNetwork

- Lumeon

- Wolters Kluwer Health

- CureMD

- Teladoc Health

- Other Key Players

Recent Developments

- In August 2025, Oracle formally launched its next-generation Oracle Health EHR for ambulatory providers in the U.S. This new EHR has context-aware, conversational AI built in, including voice-activated navigation so clinicians can ask for lab results, medications, and other patient data using their voice.

- In March 2025, Oracle Health (formerly Cerner) announced that its Clinical AI Agent — a voice- and screen-driven assistant embedded in its EHR — is now available across more than 30 medical specialty areas. Physicians using this AI agent reported a roughly 30% reduction in documentation time.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.8 Bn |

| Forecast Value (2034) |

USD 51.9 Bn |

| CAGR (2025–2034) |

20.3% |

| The US Market Size (2025) |

USD 3.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Services), By Delivery Mode (On-Premise and Cloud-Based), By Application (Health Management, Social & Behavioral Management, Home Health Management, and Financial Health Management), By Functionality (Appointment Scheduling, Patient Communication, Billing & Payments, Health Tracking, Remote Patient Monitoring, and Patient Education), By End User (Hospitals & Clinics, Healthcare Payers, Pharmacies, and Patients), By Therapeutic Area (Chronic Disease Management, Fitness & Wellness, Women's Health, Mental Health, and Patient Education & Preventive Care) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Epic Systems, Cerner, Allscripts, Athenahealth, McKesson, GE Healthcare, Medtronic, Philips Healthcare, IBM, Salesforce, Cognizant, Oracle, Meditech, eClinicalWorks, NextGen Healthcare, GetWellNetwork, Lumeon, Wolters Kluwer Health, CureMD, Teladoc Health, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Patient Engagement Software Market?

▾ The Global Patient Engagement Software Market size is expected to reach a value of USD 9.8 billion in 2025 and is expected to reach USD 51.9 billion by the end of 2034.

Which region accounted for the largest Global Patient Engagement Software Market?

▾ North America is expected to have the largest market share in the Global Patient Engagement Software Market, with a share of about 38.0% in 2025.

How big is the Patient Engagement Software Market in the US?

▾ The Patient Engagement Software Market in the US is expected to reach USD 3.3 billion in 2025.

Who are the key players in Patient Engagement Software Market?

▾ Some of the major key players in the Global Patient Engagement Software Market include IBM, Oracle, Cerner and others

What is the growth rate in the Global Patient Engagement Software Market?

▾ The market is growing at a CAGR of 20.3 percent over the forecasted period.