Market Overview

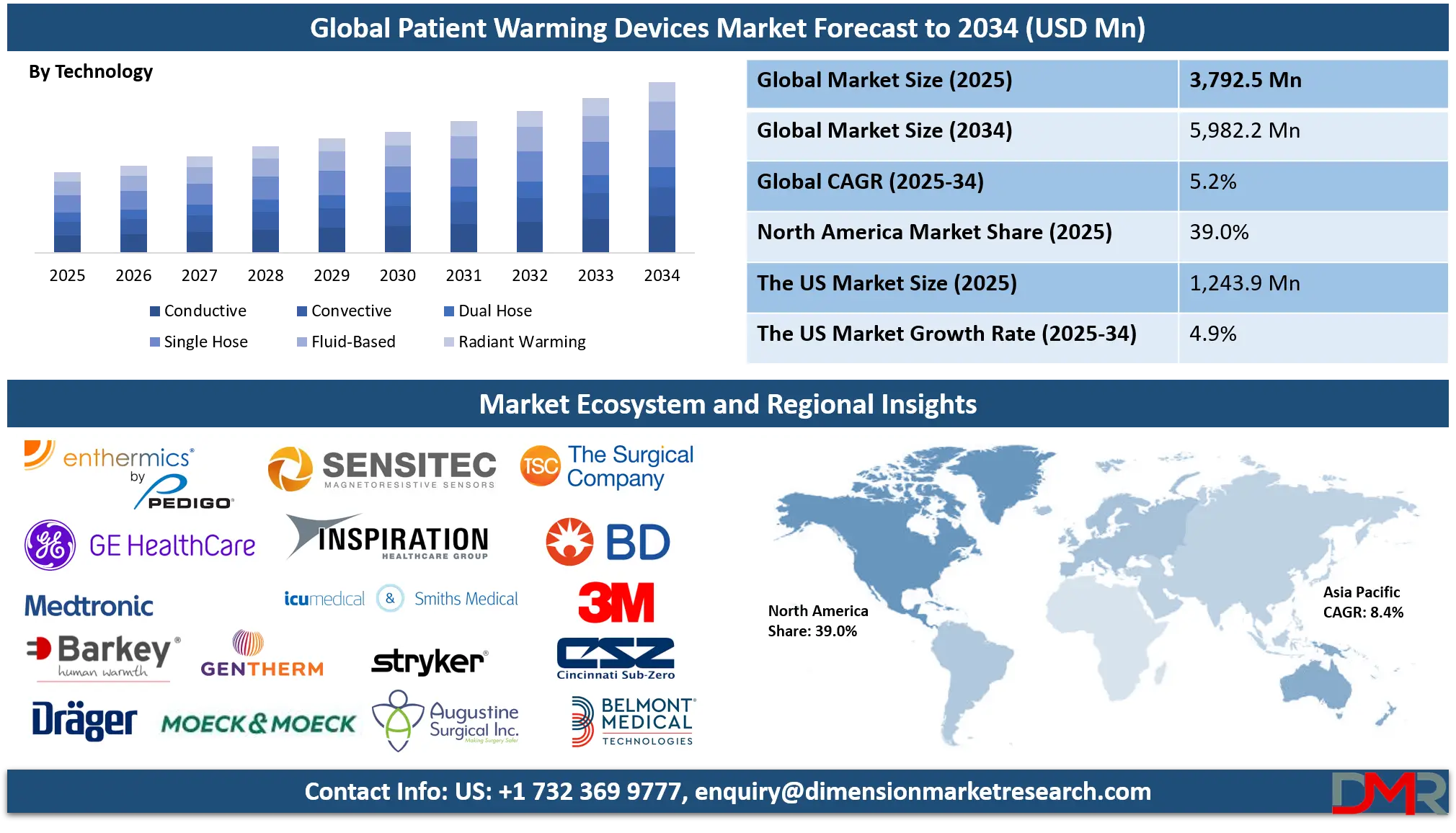

The Global Patient Warming Devices Market is projected to reach USD 3,792.5 million in 2025 and is expected to grow steadily at a compound annual growth rate (CAGR) of 5.2% through 2034, ultimately attaining a market value of USD 5,982.2 million.

This growth trajectory reflects rising demand for perioperative temperature management systems, increased adoption of advanced warming technologies in operating rooms and intensive care units, and a surge in the use of forced-air warming systems, fluid warming devices, and conductive warming products. The market expansion is further supported by an aging population, higher surgical volumes, and growing awareness of preventing hypothermia-related surgical complications.

The global patient warming devices market is poised for substantial growth as hospitals, clinics, and home care settings prioritize temperature management to improve patient outcomes. Rising surgical volumes worldwide, particularly in cardiovascular, orthopedic, and general surgeries, are a key driver, as hypothermia during procedures can significantly increase complications. The prevalence of aging populations in developed and emerging economies amplifies demand for both acute and chronic care thermal solutions, from advanced forced-air systems to conductive and fluid-based warming technologies.

Advancements in design, portability, and smart temperature monitoring are expanding use cases beyond operating rooms into emergency transport, neonatal care, and home rehabilitation. Opportunities exist in emerging markets where healthcare infrastructure is expanding, creating openings for cost-efficient devices that still meet clinical standards. However, restraints include the high initial costs of advanced systems, maintenance requirements, and stringent regulatory compliance, which can slow adoption in cost-sensitive regions.

Another challenge is the limited awareness among smaller healthcare facilities about the benefits of standardized patient warming protocols. Growth prospects remain strong as clinical guidelines increasingly recommend active warming to reduce perioperative risks, while technological innovations like wireless sensors and integrated monitoring platforms further improve usability and safety.

In addition, the increasing adoption of minimally invasive surgeries where patient exposure to cold is prolonged will drive further need for precise warming solutions. With growing recognition of hypothermia’s impact on recovery time, infection rates, and overall healthcare costs, patient warming devices are becoming an integral part of modern treatment pathways.

The US Patient Warming Devices Market

The US Patient Warming Devices Market is projected to reach USD 1,243.9 million in 2025 at a compound annual growth rate of 4.9% over its forecast period.

The U.S. patient warming devices market benefits from a combination of high surgical demand, advanced healthcare infrastructure, and a rapidly aging population. Public health data confirms that the United States performs millions of surgical procedures annually, ranging from cardiac bypasses to orthopedic replacements, all of which require careful thermal management to prevent perioperative hypothermia.

An expanding elderly demographic now exceeding 55 million Americans aged 65 and older drives higher hospitalization rates and complex interventions, further increasing demand for advanced warming systems. Hospitals and ambulatory surgery centers across the country implement strict clinical protocols for temperature management, with devices such as forced-air warming blankets, fluid warmers, and conductive pads widely adopted in operating rooms, recovery suites, and intensive care units.

The U.S. also leads in integrating patient warming into pre-hospital emergency care, enabling paramedics to stabilize trauma patients through portable warming solutions before arrival at medical facilities. Strong funding for healthcare modernization and adoption of connected medical devices supports the integration of real-time monitoring, enabling precise and safe warming throughout the patient journey.

Additionally, the U.S. sees high utilization of neonatal warming systems in specialized care units, ensuring safe thermal regulation for premature and low-birth-weight infants. The combination of demographic trends, procedural volume, and advanced technology adoption continues to secure the U.S. as one of the most lucrative markets for patient warming devices globally.

The Europe Patient Warming Devices Market

The Europe Patient Warming Devices Market is estimated to be valued at USD 568.8 million in 2025 and is further anticipated to reach USD 882.5 million by 2034 at a CAGR of 5.2%.

The European patient warming devices market is underpinned by a growing elderly population, extensive public healthcare systems, and strong surgical safety protocols. With a significant proportion of the population over 65, the prevalence of chronic diseases such as cardiovascular conditions, cancer, and orthopedic disorders continues to rise, increasing the need for surgical and long-term patient care.

Many European countries have integrated perioperative temperature management into hospital safety guidelines, driving steady adoption of devices such as forced-air warming units, fluid-based warmers, and radiant heating systems. Publicly funded healthcare systems ensure broad access to these devices, particularly in countries with universal health coverage, where prevention of surgical complications like hypothermia is a cost-effective strategy.

Neonatal and pediatric care in Europe is also a major driver, with advanced radiant warmer technologies widely deployed in maternity and children’s hospitals to support safe thermal regulation for vulnerable newborns. The region’s strong regulatory environment ensures high safety standards, which fosters patient trust and device reliability, but it can also lengthen product approval times for new innovations.

Moreover, training programs for healthcare professionals on best practices in temperature management contribute to a growing awareness of the benefits of patient warming. Overall, demographic pressures combined with well-established healthcare systems create sustained demand for patient warming devices, making Europe a stable and mature but steadily expanding market.

The Japan Patient Warming Devices Market

The Japan Patient Warming Devices Market is projected to be valued at USD 227.5 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 356.0 million in 2034 at a CAGR of 5.1%.

Japan’s patient warming devices market is shaped by its unique demographic profile and highly advanced healthcare infrastructure. The country has one of the world’s highest life expectancies and the largest proportion of elderly citizens, with nearly one in three people aged 65 or older. This demographic reality significantly increases surgical volumes, particularly for cardiovascular, orthopedic, and gastrointestinal procedures, where temperature management is critical.

Hospitals in Japan are equipped with state-of-the-art perioperative facilities, and patient warming protocols are widely integrated into surgical care pathways. Neonatal care is another important driver, with advanced radiant warmers and incubators deployed in both public and private hospitals to provide stable thermal environments for premature infants. Japan’s universal healthcare system ensures that most citizens have access to advanced warming technologies, supporting widespread utilization across rural and urban regions.

Furthermore, government initiatives to support aging populations have encouraged the adoption of devices that enhance recovery outcomes and reduce hospital stays, including portable and home-based warming systems. Japanese manufacturers and healthcare providers also prioritize compact and energy-efficient designs to accommodate space constraints in hospitals without compromising on performance.

The market benefits from rapid technology adoption, with innovations in wireless monitoring, automated temperature adjustment, and integration with electronic medical records gaining traction. Combined, these factors create a high-demand environment where both domestic and international manufacturers find opportunities to introduce advanced, patient-focused warming solutions.

Global Patient Warming Devices Market: Key Takeaways

- Global Market Size Insights: The Global Patient Warming Devices Market size is estimated to have a value of USD 3,792.5 million in 2025 and is expected to reach USD 5,982.2 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Patient Warming Devices Market is projected to be valued at USD 1,243.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,910.9 million in 2034 at a CAGR of 4.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Patient Warming Devices Market with a share of about 39.0% in 2025.

- Key Players: Some of the major key players in the Global Patient Warming Devices Market are 3M Company, Stryker Corporation, Smiths Medical (ICU Medical, Inc.), Medtronic plc, Gentherm Incorporated, The Surgical Company, Cincinnati Sub-Zero Products LLC (CSZ), Moeck & Moeck GmbH, and many others.

Global Patient Warming Devices Market: Use Cases

- Operating Room Temperature Control: Maintaining patient normothermia during surgery reduces blood loss, stabilizes vital signs, and lowers infection risks. Forced-air and conductive warming devices are routinely used in operating rooms to prevent perioperative hypothermia, especially in lengthy or complex procedures.

- Neonatal Intensive Care Support: In neonatal intensive care units, radiant warmers and conductive warming pads protect premature infants from heat loss, stabilizing their core temperature and supporting healthy growth and development during critical early stages of life.

- Pre-Hospital Emergency Care: Ambulances and air rescue units use portable fluid warmers and thermal blankets to treat hypothermic trauma patients, helping stabilize their condition before they reach the hospital and improving survival chances.

- Postoperative Recovery: During recovery after surgery, underbody warming mattresses and warming gowns maintain stable temperatures, reducing shivering, easing discomfort, and promoting faster healing in postoperative care units.

- Home-Based Rehabilitation: For patients recovering from injury or surgery at home, portable resistive heating pads and warming blankets offer safe, consistent thermal therapy, improving comfort and aiding circulation for faster rehabilitation.

Global Patient Warming Devices Market: Stats & Facts

AHRQ / HCUP (U.S. Agency for Healthcare Research and Quality – Healthcare Cost & Utilization Project)

- U.S. hospitals recorded ~14.4 million operating-room procedures in a recent reported year.

- These occurred during ~9.6 million inpatient stays that included at least one OR procedure.

- The 20 most frequent OR procedures accounted for ~52% of all OR procedures.

- Ambulatory surgery databases capture millions of same-day surgical encounters annually across hospital-owned facilities.

CDC (U.S. Centers for Disease Control and Prevention)

- Unintentional hypothermia–related deaths peak in winter months, with the highest share in January.

- Cold-related mortality rates are consistently higher among males than females and are higher in rural than metro areas.

CMS (U.S. Centers for Medicare & Medicaid Services) – National Health Expenditure

- U.S. health spending recently exceeded USD 4.8– USD 4.9 trillion.

- Health spending represents about 17–18% of U.S. GDP.

- Per-capita health expenditure in the U.S. exceeds USD 14,000.

- Hospital care is the largest NHE category, representing roughly one-third of total spending.

U.S. Census Bureau

- The population aged 65+ in the U.S. is ~56 million, about 17% of the population.

- The 65+ cohort is projected to reach ~1 in 5 Americans within the next decade.

- Median age in the U.S. has risen to ~38–39 years, reflecting steady population aging.

NCHS / CDC (National Center for Health Statistics)

- The U.S. records ~3.6–3.7 million births annually.

- The cesarean delivery rate in the U.S. is ~32% of live births.

- Preterm births account for roughly 1 in 10 U.S. live births.

NHS England / NHS Digital (England)

- Finished Consultant Episodes (FCEs) exceed 20 million per year in England.

- Finished Admission Episodes (FAEs) exceed 17 million annually.

- Adult critical care episode records number in the hundreds of thousands each year, reflecting substantially high-acuity caseloads.

Eurostat (European Union)

- The EU-27 population aged 65+ is ~21% of the total population.

- The EU records over one million caesarean sections annually.

- Several high-volume surgical categories (e.g., cataract, joint replacements) each total hundreds of thousands of procedures per year EU-wide.

- Median age in the EU is ~44 years, underscoring advanced population aging.

OECD (Organisation for Economic Co-operation and Development)

- Hip replacement rate averages ~170 per 100,000 population across OECD countries.

- Knee replacement rate averages ~120 per 100,000 population across OECD countries.

- Hospital beds per 1,000 vary widely, from ~2–3 in some nations to >12 in others.

- Average length of stay (acute care) in OECD systems typically ranges ~5–8 days, affecting perioperative warming needs.

WHO (World Health Organization) – Maternal/Newborn Health

- ~75% of neonatal deaths occur in the first week of life, with ~1 million on the first day.

- Leading causes of neonatal mortality include preterm complications, intrapartum events, and infections.

- Without thermal protection, a newborn can lose ~2–4 °C in 10–20 minutes after birth.

- Neonatal causes account for ~4 in 10 under-5 deaths globally.

UNICEF (United Nations Children’s Fund)

- Under-five deaths number ~4.8–4.9 million annually worldwide.

- The neonatal share of under-five mortality has risen to ~48%, highlighting the importance of early thermal care.

Japan Statistics Bureau / Cabinet Office (Japan)

- Japan’s 65+ population share is about 29%, among the highest globally.

- Median age in Japan is ~49 years, reflecting advanced aging.

- Annual live births in Japan have fallen below 0.8 million, a historic low, intensifying focus on neonatal care quality.

Japan MHLW (Ministry of Health, Labour and Welfare)

- Hospital beds per 1,000 population in Japan are >12, among the highest in the OECD.

- General hospital beds account for well over half of all beds nationwide.

- A large majority of private hospitals in Japan have fewer than 200 beds, shaping device purchasing patterns.

Global Patient Warming Devices Market: Market Dynamic

Driving Factors in the Global Patient Warming Devices Market

Rising Prevalence of Hypothermia and Perioperative Complications

One of the major growth drivers for the Patient Warming Devices Market is the increasing incidence of hypothermia during surgical and post-surgical care. Perioperative hypothermia, defined as a core body temperature below 36°C, can lead to adverse outcomes such as wound infections, prolonged hospitalization, and increased mortality risk. This growing clinical concern has prompted hospitals and surgical centers to adopt patient warming devices such as forced-air warming systems, fluid warmers, and radiant warmers as a preventive standard of care.

Additionally, the elderly population, which is more susceptible to hypothermia due to reduced thermoregulation, is expanding globally. With surgical procedures like orthopedic, cardiovascular, and transplant surgeries becoming more common, the risk of temperature-related complications has grown significantly.

Government healthcare guidelines in countries like the U.S., U.K., and Australia have incorporated perioperative temperature management into surgical safety protocols, further driving adoption. In the U.S., the Centers for Medicare & Medicaid Services (CMS) indirectly incentivizes compliance through patient outcome-based reimbursements, encouraging investment in advanced warming systems.

Expansion of Surgical Volumes Globally

The rapid increase in surgical procedures worldwide is a key growth driver for the patient warming devices market. According to the World Health Organization (WHO), an estimated 330 million major surgeries are performed globally each year, and this number is rising due to an aging population, improved healthcare access, and advancements in surgical techniques.

Surgeries, especially those lasting over 60 minutes, carry a significant risk of hypothermia, making warming devices essential for maintaining normothermia throughout the perioperative phase. In high-income countries, the adoption of warming protocols is already standard practice, but in emerging markets such as India, China, and Brazil, the demand is growing as healthcare infrastructure improves and surgical safety standards align with global best practices. The rise in minimally invasive surgeries, which often require patients to remain in cool, controlled operating room environments, also necessitates active warming interventions.

Restraints in the Global Patient Warming Devices Market

High Cost of Advanced Warming Systems

One of the primary restraints on the growth of the patient warming devices market is the high cost associated with advanced systems, which can limit adoption, particularly in low- and middle-income countries. Sophisticated devices such as microprocessor-controlled forced-air warming units, integrated fluid warming systems, and dual-mode conductive-convective systems involve significant upfront investment.

Hospitals operating under budget constraints may opt for basic warming blankets or reusable solutions instead of upgrading to newer models with enhanced safety and efficiency features. Furthermore, ongoing maintenance, staff training, and the cost of consumables such as disposable blankets and tubing can add to the total cost of ownership.

In regions where reimbursement for temperature management devices is not standardized or is considered a non-essential expense, procurement decisions are heavily influenced by price sensitivity. Smaller healthcare facilities and rural hospitals often face additional financial challenges, making them reluctant to invest in premium warming technologies despite their clinical benefits.

Infection Control Concerns with Forced-Air Warming Systems

Infection control issues, particularly associated with forced-air warming devices, present a significant challenge to the patient warming devices market. Studies and reports from certain healthcare institutions have raised concerns that forced-air systems could disrupt sterile airflow in operating rooms, potentially increasing the risk of surgical site infections (SSIs).

While research findings on this topic are mixed, the perception of possible contamination risk has led some surgeons and hospitals to limit or avoid the use of forced-air warming during certain procedures, particularly orthopedic implant surgeries.

Infection control policies have become more stringent globally, especially after the COVID-19 pandemic, prompting facilities to scrutinize all equipment that interacts closely with patients. Disposable components such as blankets and hoses must be replaced after each use, adding cost and logistical challenges to infection prevention efforts. Additionally, reusable warming systems require meticulous cleaning and maintenance, and failure to adhere to protocols can result in microbial contamination.

Opportunities in the Global Patient Warming Devices Market

Technological Advancements in Warming Systems

Technological innovation presents a major opportunity for market expansion, as manufacturers focus on creating patient warming devices that are safer, more efficient, and easier to integrate into various clinical workflows. Advancements such as self-regulating heating elements, smart temperature monitoring systems, and microprocessor-controlled warming units are improving device accuracy and reducing the risk of overheating or burns.

Additionally, the development of portable and battery-powered warming devices opens opportunities in emergency medical services, field surgeries, and disaster response scenarios where traditional plug-in systems are not feasible. Wearable warming devices, such as conductive warming blankets and warming gowns with embedded sensors, are gaining traction for use in both acute care and home healthcare settings.

The integration of IoT technology allows real-time temperature monitoring and device performance tracking, enabling better patient safety and predictive maintenance for hospitals. Energy-efficient designs are also becoming important in markets where hospital operating costs are under scrutiny, while single-use disposables address infection control concerns.

Expanding Adoption in Non-Hospital Healthcare Settings

The patient warming devices market has traditionally been hospital-centric, but the expansion of advanced warming technologies into non-hospital settings offers substantial growth opportunities. Ambulatory surgical centers (ASCs), which are performing an increasing volume of outpatient surgeries, are becoming major consumers of portable, cost-effective warming devices.

These centers prioritize patient comfort and quick recovery, making forced-air warming blankets, compact fluid warmers, and lightweight radiant systems attractive investments. Similarly, long-term care facilities and nursing homes are adopting warming systems for elderly residents, who are more vulnerable to hypothermia, especially during the winter months or in air-conditioned environments.

Home healthcare services represent another growing segment, as patients recovering from surgery or those with chronic conditions such as cancer often require temperature management to improve comfort and healing. The rising prevalence of home-based dialysis and chemotherapy treatments, where maintaining patient warmth is crucial, further boosts demand.

Trends in the Global Patient Warming Devices Market

Integration of IoT and AI for Personalized Temperature Management

Patient warming devices are increasingly incorporating Internet of Things-enabled sensors and AI-driven algorithms to enable real-time monitoring and personalized temperature regulation during surgical and recovery procedures. These systems gather continuous patient data, including core temperature, skin temperature, and environmental conditions, to adjust heating levels dynamically.

This enhances patient safety by preventing hypothermia while reducing the risk of hyperthermia, particularly during lengthy or complex surgeries. Hospitals adopting AI-powered warming systems report higher operational efficiency, as automated adjustments reduce the workload on healthcare providers. Furthermore, cloud connectivity allows remote monitoring and data analytics, enabling hospital management to track usage patterns and optimize device performance.

Shift Towards Energy-Efficient and Environmentally Sustainable Warming Solutions

Healthcare facilities are under growing pressure to adopt greener technologies, and patient warming devices are no exception. Manufacturers are innovating to create energy-efficient systems with reduced heat loss, improved insulation, and low-power operational modes without compromising warming efficacy. Many modern devices now utilize advanced heating elements that distribute warmth more evenly, reducing energy consumption while maintaining consistent performance.

Additionally, there is a rising demand for eco-friendly disposable components, such as warming blankets and drapes made from biodegradable or recyclable materials. This is partly driven by stricter healthcare sustainability guidelines in regions like the EU and North America, where waste reduction and carbon footprint minimization are high priorities. Hospitals are increasingly factoring energy efficiency into procurement decisions, recognizing that it not only reduces environmental impact but also cuts long-term operational costs.

Global Patient Warming Devices Market: Research Scope and Analysis

By Product Type Analysis

Fluid warming systems are projected to hold the largest share in the patient warming devices market due to their critical function in preventing hypothermia during a wide range of medical situations, including surgeries, trauma management, and emergency transfusions. In surgical environments, particularly those involving high blood loss or large-volume fluid administration, maintaining the body’s core temperature is essential to reducing complications such as coagulopathy and postoperative infections.

Fluid warming systems rapidly heat intravenous fluids and blood products to physiologically safe levels, ensuring immediate readiness and compatibility with various infusion setups. Their importance is especially evident in operating rooms, emergency departments, and intensive care units, where rapid patient stabilization is vital. Additionally, the rise in elective and emergency surgeries globally, fueled by an aging population and the increasing incidence of accidents, has expanded their usage.

The systems’ compatibility with modern infusion pumps and integration with patient monitoring equipment further enhances their adoption. Many manufacturers now design compact, portable fluid warmers, enabling their use in ambulances and field hospitals. Their proven clinical efficacy, combined with the medical community’s strong emphasis on reducing perioperative hypothermia, has cemented their position as the most indispensable product category in this market.

By Technology Analysis

Conductive warming technology is poised to dominate the market because it provides consistent, direct heat transfer to patients, ensuring rapid and precise warming without relying on airflow. This method involves direct contact between the patient and the warming element, such as blankets, mattresses, or pads, which are embedded with electric heating elements or circulating warm water channels.

Conductive warming is particularly valued in perioperative and postoperative settings, where patient immobility allows for continuous and stable warming without heat loss. One of its major advantages is that it minimizes the risk of airborne contamination, making it a safer choice in infection-sensitive environments like operating rooms and intensive care units. Hospitals also appreciate the relatively low maintenance requirements of conductive systems, as they do not require the filtration systems or hose connections associated with convective units.

Additionally, modern conductive devices are designed with precise temperature controls, automatic shut-off features, and pressure-distribution surfaces that prevent localized overheating or skin burns. Their adaptability across different patient care environments, from surgical suites to recovery rooms, and compatibility with a variety of patient positions further enhance their demand. As healthcare facilities seek reliable, cost-effective, and low-risk warming methods, conductive technology continues to lead due to its proven clinical outcomes, ease of use, and integration into existing hospital workflows.

By Distribution Channel Analysis

Direct sales are projected to remain the dominant distribution channel in the patient warming devices market because hospitals, clinics, and large healthcare networks often prefer purchasing directly from manufacturers. This model offers several strategic advantages, including negotiated bulk pricing, priority delivery schedules, and comprehensive after-sales support. Direct procurement ensures hospitals receive training for staff on proper device operation and maintenance, which is critical for safety and regulatory compliance.

Additionally, direct sales allow healthcare providers to customize device configurations, ensuring compatibility with existing infrastructure. For medical equipment requiring periodic calibration and technical servicing, such as warming devices, having a direct relationship with the manufacturer reduces downtime and ensures consistent performance. Large-scale healthcare systems often enter into multi-year contracts that bundle the purchase of warming devices with accessories, consumables, and service agreements.

Manufacturers also use direct sales to introduce the latest innovations quickly, offering demonstration units and pilot programs that help facilities evaluate technology before large-scale adoption. This channel’s dominance is further reinforced by stringent procurement protocols in hospitals, where decision-making often prioritizes vendor credibility, technical support, and warranty terms over purely cost-based considerations. By maintaining close partnerships with healthcare providers, manufacturers ensure a steady supply chain, quick troubleshooting, and continuous product upgrades, making direct sales the preferred and most secure route for acquiring patient warming equipment.

By Application Analysis

Perioperative care is anticipated to account for the largest share of the patient warming devices market due to the high clinical priority of maintaining normothermia during surgical procedures. Hypothermia during surgery can significantly increase the risk of wound infections, cardiac stress, blood clotting disorders, and delayed recovery. To prevent these risks, operating rooms routinely deploy multiple warming solutions such as fluid warmers, conductive blankets, and forced-air warming systems starting from the preoperative phase through postoperative recovery.

In high-risk surgeries, such as cardiac, orthopedic, and abdominal operations, the importance of temperature control is even greater due to extended exposure times and large fluid volumes. Global surgical volumes continue to rise, driven by aging populations, increasing access to healthcare, and growing demand for elective procedures. As a result, the perioperative segment has seen sustained investment in advanced warming technologies, including IoT-enabled monitoring and automatic temperature adjustment systems.

Hospitals also integrate perioperative warming protocols into surgical checklists, ensuring consistent use of warming devices across all operating rooms. The segment’s leadership is reinforced by clinical guidelines from organizations such as the World Health Organization and national surgical associations, which recommend active warming for most surgical patients. This medical consensus, combined with the large and growing number of surgical procedures performed annually, ensures perioperative care remains the most significant application for patient warming technologies.

By End User Analysis

Hospitals are poised to dominate the end-user segment because they manage the highest volume of surgical, trauma, and critical care cases, where patient warming is essential. Unlike smaller clinics or home care settings, hospitals possess the infrastructure, staff, and budget to operate a wide range of warming devices simultaneously. They also handle complex cases that require multiple warming methods, from preoperative warming blankets to intravascular fluid heating during prolonged surgeries.

The scale of hospital operations allows them to invest in advanced systems with higher capacity, greater energy efficiency, and integration into central monitoring systems. Hospitals also benefit from economies of scale in purchasing, enabling them to adopt the latest warming technologies faster than other care providers. Their role as referral centers for severe trauma cases and specialized surgeries further increases demand for reliable, high-performance warming equipment.

Additionally, hospitals often have dedicated biomedical engineering departments to maintain and service warming devices, ensuring optimal performance and compliance with safety standards. As more countries expand healthcare infrastructure and surgical capacity, hospital demand for patient warming systems is expected to grow steadily. Combined with their central role in emergency preparedness and mass casualty response, where rapid warming can be life-saving, hospitals remain the most influential and well-resourced buyers in the patient warming devices market.

The Global Patient Warming Devices Market Report is segmented on the basis of the following:

By Product Type

- Fluid Warming Systems

- Blood Warmers

- IV Fluid Warmers

- Surface Warming Systems

- Conductive Warming Systems

- Forced-air Warming Systems

- Intravascular Warming Systems

- Patient Warming Accessories

- Warming gowns

- Thermal socks/blankets

- Underbody warming mattresses

- Radiant Warmers

- Resistive Heating Pads

By Technology

- Conductive

- Convective

- Dual Hose

- Single Hose

- Fluid-Based

- Radiant Warming

By Distribution Channel

- Direct Sales

- Online Channels

- National Distributors

- Regional Distributors

- Third-Party Distributors

By Application

- Acute Care

- Perioperative Care

- Newborn & Pediatric Care

- Postoperative Care

- Therapeutic Applications

- Other Application

By End User

- Hospitals

- Clinics

- Nursing Facilities

- Home Care

- Other End Users

Impact of Artificial Intelligence in the Global Patient Warming Devices Market

- Predictive Temperature Management: AI algorithms analyze patient vitals in real-time, enabling automated adjustments in warming device settings to maintain optimal body temperature, improving surgical outcomes and reducing the risk of perioperative hypothermia.

- Personalized Warming Protocols: AI systems develop individualized warming strategies based on patient health data, surgical procedure type, and duration, ensuring efficient heat distribution while preventing overheating or burns.

- Enhanced Device Diagnostics: AI-enabled monitoring predicts device maintenance needs and detects faults early, reducing downtime and ensuring uninterrupted patient warming during critical care or surgery.

- Integration with Smart Healthcare Systems: AI-powered patient warming devices integrate with hospital EHRs and surgical suites, enabling synchronized temperature management alongside anesthesia and vital sign monitoring for better patient safety.

- Data-Driven Research and Innovation: AI analyzes large datasets from patient warming device usage to identify new clinical patterns, driving innovations in design, safety, and efficiency, ultimately advancing evidence-based warming protocols.

Global Patient Warming Devices Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global patient warming devices market with 39.0% of total revenue by the end of 2025, due to its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and significant investments in perioperative care. The region’s hospitals and surgical centers extensively integrate patient warming solutions to minimize perioperative hypothermia, enhance patient recovery, and reduce post-surgical complications.

The prevalence of chronic diseases, an aging population, and a high volume of surgical procedures, particularly in the United States, drive continuous demand for efficient thermal management systems. Additionally, favorable reimbursement policies for surgical care and the presence of regulatory frameworks from bodies like the U.S. FDA ensure quality, safety, and innovation in warming devices. Leading global manufacturers are headquartered or have significant operations in North America, enabling rapid product launches and clinical adoption.

The region also benefits from extensive clinical research and trials that validate device efficacy, encouraging healthcare providers to adopt advanced solutions such as forced-air warming systems and conductive warming technologies.

Furthermore, high awareness among healthcare professionals regarding patient temperature management and its impact on surgical outcomes accelerates adoption. Strategic collaborations between healthcare facilities and manufacturers foster tailored solutions for specialized surgical needs. Strong supply chain networks, high per capita healthcare expenditure, and the region’s focus on patient-centric care consolidate its leadership in the patient warming devices market, making it the most lucrative region for industry stakeholders.

Region with the Highest CAGR

Asia Pacific is projected to record the highest CAGR in the patient warming devices market due to rapid healthcare modernization, rising surgical volumes, and increasing awareness of perioperative temperature management. Countries such as China, India, Japan, and South Korea are witnessing significant investments in hospital infrastructure, enabling wider adoption of advanced patient warming technologies. The growing middle-class population, coupled with improved access to healthcare services, is boosting demand for surgeries, particularly orthopedic, cardiac, and obstetric procedures, where warming devices play a vital role in patient safety and comfort.

Government initiatives to expand healthcare coverage and modernize public hospitals further accelerate market penetration. In addition, rising medical tourism in countries like Thailand, Singapore, and Malaysia fuels demand for state-of-the-art medical equipment, including patient warming systems, to meet international treatment standards. Technological advancements such as portable warming units, cost-effective conductive warming solutions, and battery-powered devices cater to resource-limited settings, increasing accessibility in rural and semi-urban areas.

Furthermore, the growing geriatric population and higher incidence of chronic conditions create a steady patient base requiring surgical interventions. International manufacturers are expanding their footprint in the region through partnerships, local manufacturing, and competitive pricing strategies. Increasing training programs for healthcare professionals on the benefits of patient temperature regulation contributes to rapid adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Patient Warming Devices Market: Competitive Landscape

The patient warming devices market is moderately consolidated, with key players competing through technological innovation, product diversification, and strategic partnerships. Major manufacturers focus on developing advanced solutions such as forced-air warming systems, conductive warming blankets, and fluid warming devices that ensure precision temperature control during the surgical and recovery phases.

Companies leverage R&D investments to introduce portable, energy-efficient, and multi-functional warming systems catering to both hospital and ambulatory care settings. Strategic acquisitions and collaborations enhance global reach, strengthen product portfolios, and enable integration of advanced monitoring features. North America-based companies maintain dominance through strong brand presence, established distribution networks, and adherence to stringent regulatory standards.

However, Asia Pacific players are increasingly competitive, offering cost-effective devices with comparable performance. Market leaders emphasize training programs and after-sales services to strengthen customer loyalty. Emerging trends such as AI-driven temperature regulation, wireless control systems, and eco-friendly designs are shaping competitive strategies. Furthermore, manufacturers are aligning product development with enhanced infection control measures, given rising concerns over cross-contamination in warming systems.

Distribution partnerships with hospitals, surgical centers, and e-commerce medical platforms expand market accessibility. Competition is also influenced by the ability to meet diverse end-user needs from large tertiary hospitals to remote clinics through scalable, adaptable product designs. Pricing strategies remain crucial in emerging markets, while in developed economies, innovation, safety certifications, and brand reputation dictate purchasing decisions. Overall, the competitive landscape is evolving toward greater technological sophistication, customer-centric solutions, and geographic expansion to capture growing demand worldwide.

Some of the prominent players in the Global Patient Warming Devices Market are:

- 3M Company

- Stryker Corporation

- Smiths Medical (ICU Medical, Inc.)

- Medtronic plc

- Gentherm Incorporated

- The Surgical Company

- Becton, Dickinson and Company (BD)

- Cincinnati Sub-Zero Products, LLC (CSZ)

- Moeck & Moeck GmbH

- Augustine Surgical Inc.

- Inspiration Healthcare Group plc

- Belmont Medical Technologies

- Enthermics Medical Systems

- Draegerwerk AG & Co. KGaA

- Barkey GmbH & Co. KG

- Inditherm Medical (Inspiration Healthcare)

- Care Essentials Pty Ltd

- GE Healthcare Technologies Inc.

- Medline Industries, LP

- SENSITEC GmbH

- Other Key Players

Recent Developments in the Global Patient Warming Devices Market

- July 2024: Smiths Medical launched an advanced conductive warming blanket equipped with integrated AI temperature regulation technology. This innovation enables continuous, real-time adjustments to patient body temperature, enhancing perioperative care and significantly reducing post-surgical hypothermia risk. The blanket is designed for seamless integration with operating room systems, offering customizable heat settings and built-in safety alarms to prevent overheating.

- May 2024: 3M announced a strategic partnership with a major hospital network to deploy its Bair Hugger warming systems across multiple surgical facilities. This initiative aims to standardize perioperative temperature management protocols, improve patient recovery times, and lower postoperative complication rates. The rollout includes staff training programs and ongoing technical support to maximize operational efficiency.

- March 2024: Stryker unveiled its next-generation forced-air warming device featuring advanced airflow control technology and an intuitive touchscreen interface. The system offers multiple heat distribution modes for different patient profiles, improving comfort and reducing variability in warming efficiency. Its compact design and low noise output enhance suitability for crowded operating rooms.

- January 2024: Gentherm Medical expanded its U.S. manufacturing capacity to meet growing demand for automated patient warming systems. The facility upgrade includes state-of-the-art assembly lines, quality control labs, and advanced testing units, ensuring consistent production for emergency, surgical, and critical care applications.

- November 2023: Medtronic presented its innovative intravascular warming catheter system at the Medica Trade Fair. Designed for trauma and emergency use, the device enables rapid core temperature restoration, particularly for severe hypothermia patients, and integrates with standard ICU monitoring equipment.

- September 2023: Belmont Medical Technologies introduced a portable IV fluid warmer for pre-hospital care, military field use, and ambulance services. Lightweight and battery-operated, it delivers warmed fluids in seconds, crucial for preventing shock during emergency transfusions.

- July 2023: The Arizant Healthcare division of 3M received FDA clearance for a next-gen surface warming system specifically engineered for bariatric patients. The device features expanded coverage areas, reinforced material durability, and precise temperature controls to address unique challenges in high-BMI surgical cases.

- May 2023: Becton, Dickinson and Company (BD) acquired a thermal medical device startup specializing in precision warming pads for neonatal intensive care units (NICUs). This acquisition strengthens BD’s neonatal care portfolio, enabling safer, more targeted warming for premature and low-birth-weight infants.

- February 2023: Enthermics Medical Systems launched a dual-function warming cabinet capable of heating both IV fluids and blankets simultaneously. Ideal for multi-department hospital settings, the unit improves workflow efficiency while maintaining strict temperature accuracy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,792.5 Mn |

| Forecast Value (2034) |

USD 5,982.2 Mn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 1,243.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Fluid Warming Systems, Surface Warming Systems, Intravascular Warming Systems, Patient Warming Accessories, Radiant Warmers, and Resistive Heating Pads), By Technology (Conductive, Convective, Dual Hose, Single Hose, Fluid-Based, and Radiant Warming), By Distribution Channel (Direct Sales, Online Channels, National Distributors, Regional Distributors, and Third-Party Distributors), By Application (Acute Care, Perioperative Care, Newborn & Pediatric Care, Postoperative Care, Therapeutic Applications, and Other Application), By End User (Hospitals, Clinics, Nursing Facilities, Home Care, and Other Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M Company, Stryker Corporation, Smiths Medical (ICU Medical, Inc.), Medtronic plc, Gentherm Incorporated, The Surgical Company, Becton Dickinson and Company (BD), Cincinnati Sub-Zero Products LLC (CSZ), Moeck & Moeck GmbH, Augustine Surgical Inc., Inspiration Healthcare Group plc, Belmont Medical Technologies, Enthermics Medical Systems, Draegerwerk AG & Co. KGaA, Barkey GmbH & Co. KG, Inditherm Medical (Inspiration Healthcare), Care Essentials Pty Ltd, GE Healthcare Technologies Inc., Medline Industries LP, SENSITEC GmbH., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Patient Warming Devices Market size is estimated to have a value of USD 3,792.5 million in 2025 and is expected to reach USD 5,982.2 million by the end of 2034.

The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

The US Patient Warming Devices Market is projected to be valued at USD 1,243.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,910.9 million in 2034 at a CAGR of 4.9%.

North America is expected to have the largest market share in the Global Patient Warming Devices Market with a share of about 39.0% in 2025.

Some of the major key players in the Global Patient Warming Devices Market are 3M Company, Stryker Corporation, Smiths Medical (ICU Medical, Inc.), Medtronic plc, Gentherm Incorporated, The Surgical Company, Becton Dickinson and Company (BD), Cincinnati Sub-Zero Products LLC (CSZ), Moeck & Moeck GmbH, , and many others.