Market Overview

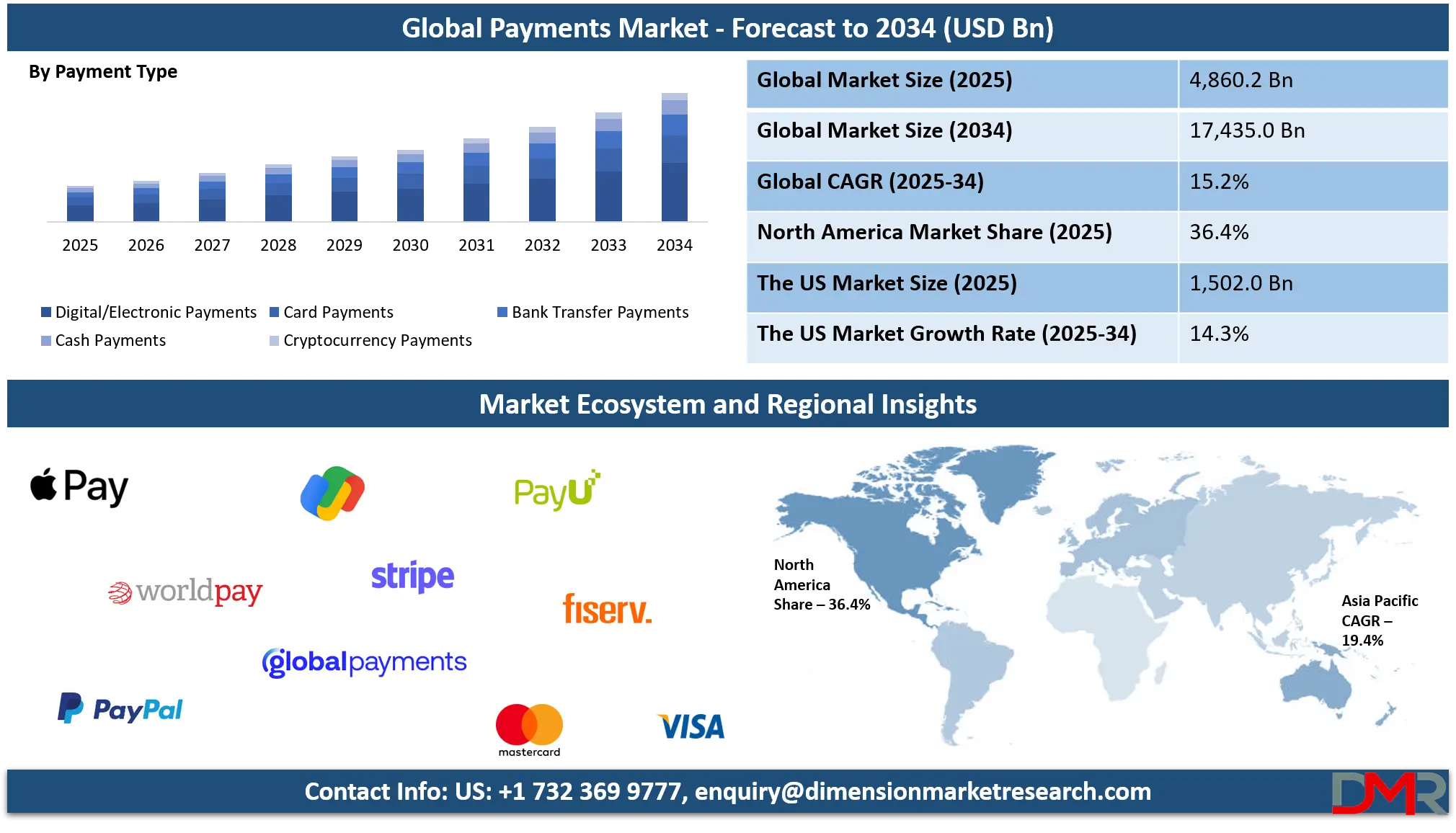

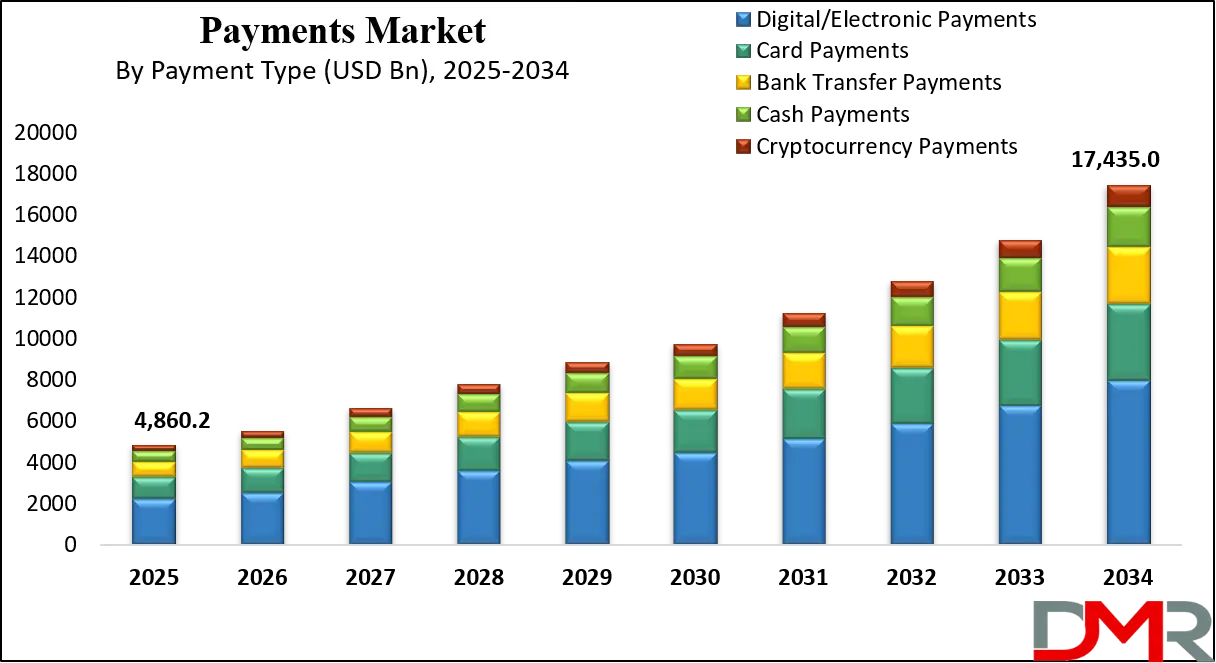

The Global Payments Market size is projected to reach USD 4,860.2 5 billion in 2025 and grow at a compound annual growth rate of 15.2% to reach a value of USD 17,435.0 billion in 2034.

The Payments market refers to the ecosystem of technologies, platforms, services, and financial instruments that enable the transfer of monetary value between individuals, businesses, and institutions. It includes card-based payments, digital wallets, bank transfers, real-time payments, cash alternatives, and emerging digital assets. This market forms the backbone of global commerce by facilitating retail transactions, cross-border trade, bill payments, and financial inclusion. Its importance extends across banking, retail, e-commerce, government services, and capital markets, making it a core pillar of the global financial system and digital economy.

Multiple forces are shaping how payment systems function and evolve. Advancements in

cloud computing, APIs, mobile technology, and cybersecurity have expanded the scope and speed of transactions while reducing dependency on physical infrastructure. Regulatory frameworks focused on transparency, consumer protection, and open banking have altered competitive structures and encouraged innovation. At the same time, shifting consumer behavior toward contactless, mobile-first, and instant payment experiences has accelerated adoption across developed and emerging economies.

Further, the market continues to progress toward greater interoperability, speed, and intelligence. Real-time settlement, embedded finance, and platform-based payment orchestration are becoming mainstream. Investments in scalable infrastructure, fraud prevention, and cross-border efficiency signal a transition from legacy payment rails to digitally native systems. These changes position payments as both a utility and a strategic differentiator across industries.

The US Payments Market

The US Payments Market size is projected to reach USD 1,502.0 billion in 2025 at a compound annual growth rate of 14.3% over its forecast period.

The US Payments market is shaped by a mature financial ecosystem, high consumer spending, and widespread adoption of card and digital payment solutions. Credit and debit cards remain dominant, supported by extensive POS infrastructure and strong issuer–acquirer networks. Mobile wallets and real-time payment systems are gaining traction due to demand for convenience and speed. Regulatory oversight from federal agencies promotes security and consumer protection, while initiatives supporting faster payments encourage innovation. Large-scale merchants, fintech firms, and financial institutions play a critical role in driving modernization and adoption.

Europe Payments Market

Europe Payments Market size is projected to reach USD 1,215.1 billion in 2025 at a compound annual growth rate of 14.6% over its forecast period.

The European Payments market is heavily influenced by regulatory harmonization and digital-first policies. Frameworks such as PSD2 and open banking mandates have encouraged competition, interoperability, and innovation. Account-to-account payments and real-time transfer systems are widely adopted, reducing reliance on cards in several countries. The European Green Deal and digitalization initiatives further support cashless economies. Strong adoption across retail, transport, and public services, combined with high consumer trust in digital banking, sustains steady growth across the region.

Japan Payments Market

Japan Payments Market size is projected to reach USD 243.0 billion in 2025 at a compound annual growth rate of 17.1% over its forecast period.

The Japan Payments market combines advanced technological infrastructure with a traditionally cash-oriented culture that is rapidly shifting. Government initiatives promoting cashless transactions, especially ahead of major events and to improve productivity, have accelerated adoption. Mobile payments, QR-based systems, and contactless cards are the fastest-growing areas. Urbanization, high smartphone penetration, and strong participation from domestic technology firms support innovation. However, aging demographics and legacy systems present challenges that also create opportunities for next-generation payment platforms.

Payments Market: Key Takeaways

- Market Growth: The Payments Market size is expected to grow by USD 11,909.7 billion, at a CAGR of 15.2%, during the forecasted period of 2026 to 2034.

- By Payment Type: The digital/electronic payments segment is anticipated to get the majority share of the Payments Market in 2025.

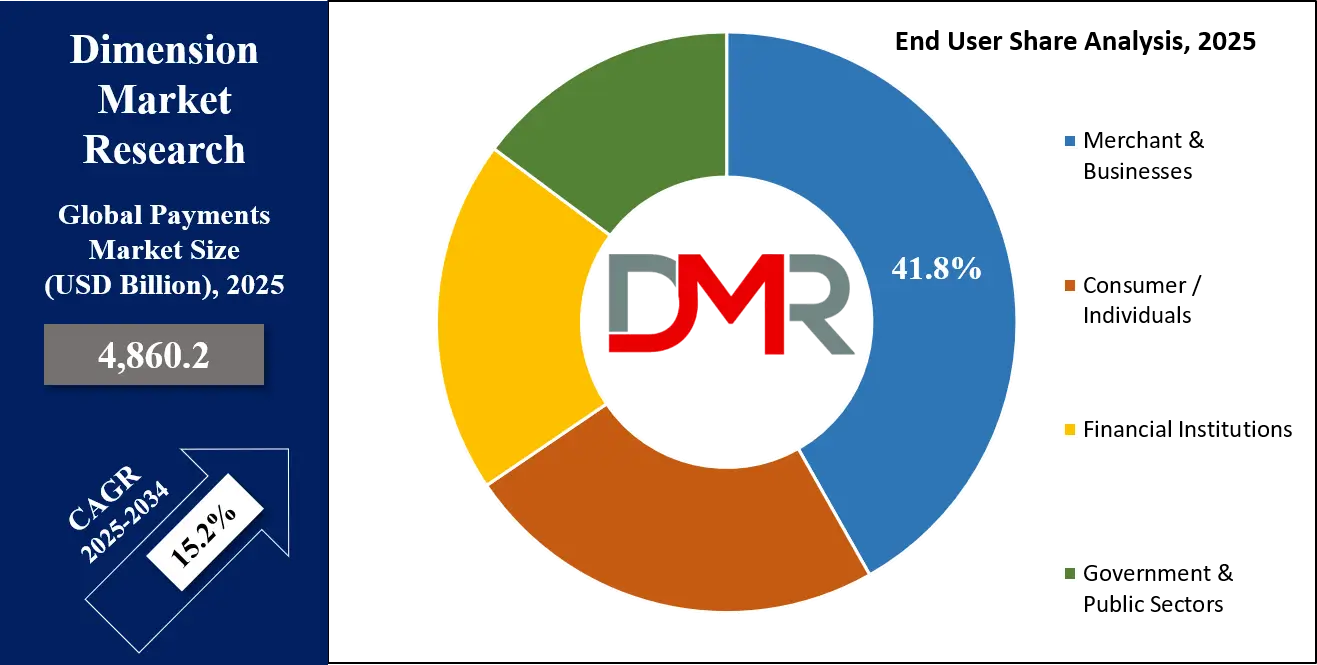

- By End User: The merchant & businesses segment is expected to get the largest revenue share in 2025 in the Payments Market.

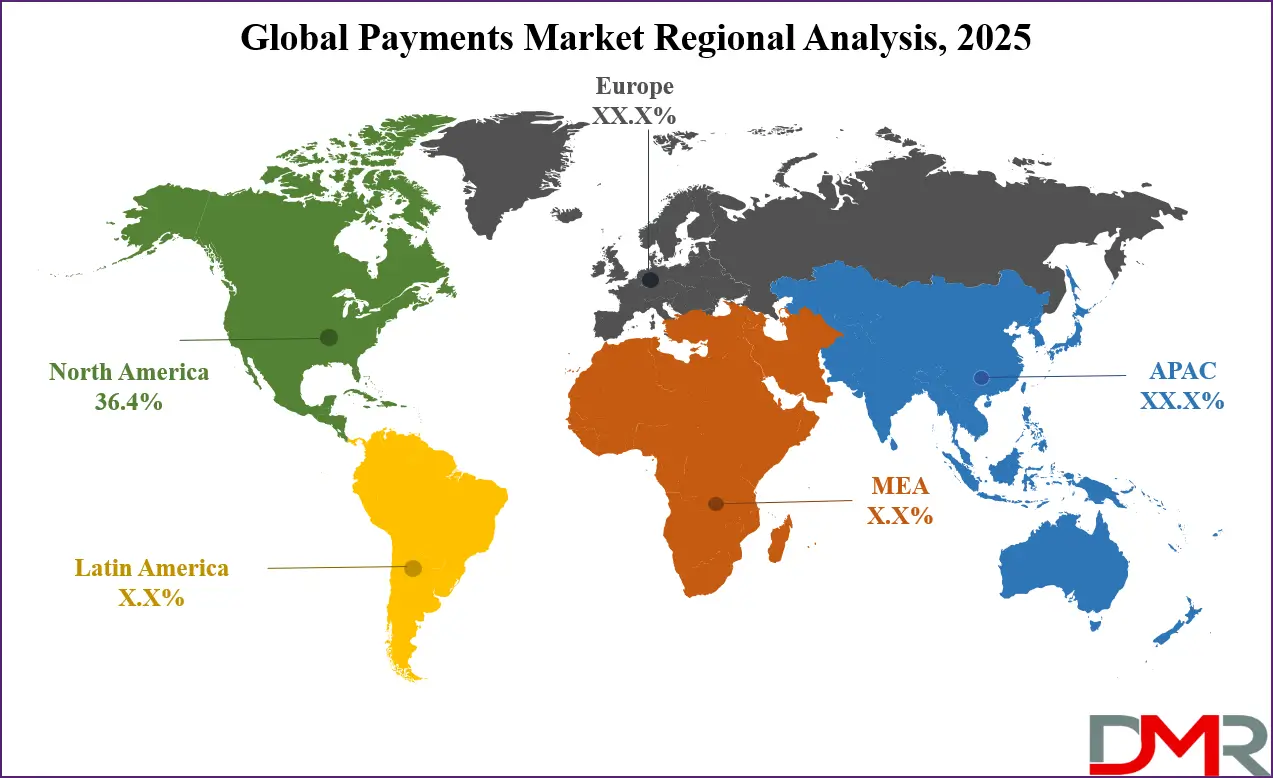

- Regional Insight: North America is expected to hold a 36.4% share of revenue in the Global Payments Market in 2025.

- Use Cases: Some of the use cases of Payments include retail transactions, peer-to-peer transfers, and more.

Payments Market: Use Cases

- Retail Transactions: Enables fast, secure in-store and online purchases using cards, wallets, and QR codes, improving checkout efficiency and customer experience.

- E-commerce & Marketplaces: Supports digital commerce through payment gateways, fraud detection, and multi-currency settlement for global sellers.

- Peer-to-Peer Transfers: Allows individuals to send and receive money instantly via mobile apps and real-time payment rails.

- Government & Utilities: Facilitates tax collection, subsidies, and bill payments through secure digital channels, improving transparency and efficiency.

Stats & Facts

- U.S. Federal Reserve reported that real-time payments in the United States exceeded 200 million transactions in 2024, reflecting strong adoption of instant payment rails.

- European Central Bank recorded that cashless payments accounted for over 70% of total retail transactions in the euro area in 2024, indicating widespread use of digital payment methods.

- Bank for International Settlements indicated that cross-border payment costs declined by approximately 10% globally between 2023 and 2025 due to digital infrastructure upgrades.

- Reserve Bank of India noted that digital payment volumes grew by more than 40% year-over-year in fiscal 2024, driven by rapid adoption of mobile and real-time payment systems.

- Ministry of Economy, Trade and Industry Japan reported that cashless payment penetration reached nearly 40% in 2025, up from low-30% levels in earlier years.

Market Dynamic

Driving Factors in the Payments Market

Digitalization of Commerce

The rapid digitalization of commerce is a primary driver of growth in the Payments market. Consumers increasingly prefer online shopping, mobile apps, and contactless transactions, which require reliable and secure digital payment solutions. Businesses are investing in integrated payment systems to streamline operations, reduce cash handling, and improve data visibility. The expansion of e-commerce, subscription services, and digital marketplaces directly fuels demand for advanced payment processing, settlement, and fraud prevention technologies across industries.

Government-Led Financial Inclusion

Government initiatives aimed at financial inclusion and transparency significantly influence payment adoption. Policies encouraging cashless transactions, digital identity systems, and direct benefit transfers have expanded access to formal financial services. Incentives for merchants to accept digital payments and investments in national payment infrastructure reduce barriers to entry. These measures not only increase transaction volumes but also strengthen trust in electronic payment systems, accelerating market growth.

Restraints in the Payments Market

Security and Fraud Risks

Security concerns remain a major constraint in the payments market. As transaction volumes increase, so do risks related to data breaches, identity theft, and payment fraud. High-profile cyber incidents can undermine consumer trust and lead to regulatory scrutiny. Payment providers must continuously invest in encryption, authentication, and monitoring systems, increasing operational costs. Smaller players may struggle to meet compliance and security standards, limiting broader market participation.

Infrastructure Fragmentation

Fragmented payment infrastructure across regions and institutions poses challenges to scalability and interoperability. Legacy systems coexist with modern platforms, creating inefficiencies and integration complexities. Cross-border transactions are particularly affected by inconsistent standards, settlement delays, and higher costs. These structural limitations slow innovation and make it difficult for unified payment experiences to emerge globally, constraining market efficiency.

Opportunities in the Payments Market

Expansion of Real-Time Payments

Real-time payment systems present a major growth opportunity for the payments market. Demand for instant fund availability is rising across retail, corporate, and government use cases. Businesses benefit from improved cash flow, while consumers gain convenience and transparency. As more countries deploy or enhance real-time infrastructure, payment providers can develop value-added services such as instant credit, request-to-pay, and embedded finance solutions.

Growth in Emerging Economies

Emerging economies offer substantial untapped potential due to rising smartphone usage, expanding internet access, and supportive government policies. Large unbanked and underbanked populations are rapidly adopting mobile and digital payments. Localized solutions tailored to regional needs can scale quickly, enabling providers to capture new user bases and transaction volumes while supporting economic development.

Trends in the Payments Market

Embedded Payments and Finance

Embedded payments are reshaping the market by integrating transaction capabilities directly into non-financial platforms such as e-commerce sites, mobility apps, and enterprise software. This trend reduces friction, improves user experience, and creates new revenue streams. Businesses increasingly view payments as a strategic feature rather than a backend function, driving demand for API-based and modular payment solutions.

Shift Toward Cashless Societies

The global shift toward cashless societies continues to influence the payments market. Contactless cards, mobile wallets, and qr payments are replacing physical cash in daily transactions. Public transport, retail, and government services are adopting digital-first payment models. This trend supports efficiency, traceability, and sustainability while encouraging continuous innovation in payment technologies.

Impact of Artificial Intelligence in Payments Market

- Fraud Detection: AI-driven analytics identify unusual transaction patterns in real time, reducing fraud losses and false declines.

- Risk Scoring: Machine learning models improve credit and transaction risk assessments using behavioral data.

- Personalization: AI enables tailored payment offers, loyalty programs, and preferred payment routing for users.

- Operational Automation: Intelligent systems streamline reconciliation, dispute management, and settlement processes.

- Customer Support: AI-powered chatbots and assistants enhance user experience through faster issue resolution.

Research Scope and Analysis

By Payment Type Analysis

Digital and electronic payments are the leading segment, accounting for 45.6% of the market share in 2025, driven by widespread smartphone adoption, expanding internet penetration, and a strong consumer preference for speed and convenience. Solutions such as mobile wallets, online banking, and QR-based payment systems support seamless, contactless transactions across retail, hospitality, transportation, and service sectors. Businesses increasingly favor this segment due to reduced cash handling costs, faster settlement, improved transaction visibility, and integration with data analytics and customer engagement tools.

Additionally, continuous improvements in encryption, biometric authentication, and interoperability across platforms enhance security and trust. These factors collectively reinforce the long-term dominance of digital and electronic payment methods.

Cryptocurrency payments represent the fastest-growing segment as interest in decentralized finance and borderless transactions continues to rise. Adoption is expanding across cross-border commerce, digital content, gaming, and select retail niches where speed and global accessibility are prioritized. Blockchain-based payments offer advantages such as lower transaction fees, reduced reliance on intermediaries, and enhanced transparency.

However, price volatility, scalability challenges, and regulatory uncertainty remain key constraints. The growing use of stablecoins, improved custody solutions, and integration with traditional payment gateways are mitigating these risks. As regulatory clarity improves and infrastructure matures, cryptocurrency payments are expected to gain wider acceptance among merchants and consumers.

By Transaction Mode Analysis

E-commerce payments lead this category with a 38.2% market share in 2025, supported by sustained growth in online retail, digital services, and platform-based business models. Secure payment gateways, multiple payment options, and advanced fraud prevention tools are critical to enabling smooth online transactions. Consumers increasingly demand fast checkouts, flexible payment methods, and strong data security, pushing merchants to adopt optimized e-commerce payment solutions. The rise of global marketplaces, cross-border selling, and subscription-based services further strengthens this segment. Integration with analytics, personalization tools, and recurring billing systems also enhances merchant efficiency and customer retention, supporting continued growth.

Mobile payments are the fastest-growing transaction mode as consumers increasingly rely on smartphones for everyday financial activities. Convenience, contactless functionality, and intuitive app-based ecosystems drive rapid adoption across both developed and emerging markets. Mobile wallets, QR codes, and in-app payments enable quick transactions for retail purchases, transportation, peer-to-peer transfers, and bill payments. High smartphone penetration, improved mobile internet access, and growing trust in digital security mechanisms support this expansion. Merchants benefit from faster checkouts, reduced hardware dependency, and better customer engagement. As super-app ecosystems expand, mobile payments are expected to become a primary transaction channel.

By Business Model Analysis

Payment processing holds a 34.5% share in 2025, driven by increasing transaction volumes and the critical need for reliable clearing and settlement across payment networks. This segment forms the operational backbone of the payments ecosystem, ensuring authorization, reconciliation, and fund transfers occur securely and efficiently.

Scalable infrastructure, compliance with regulatory standards, and high system availability are key factors supporting its dominance. As digital transactions grow, processors invest heavily in automation, fraud detection, and real-time capabilities. Their ability to handle large volumes across multiple payment types and geographies positions payment processing as an essential and resilient business model.

Payment aggregators and PSPs are expanding rapidly due to strong demand from SMEs seeking simplified onboarding and bundled payment services. These providers enable merchants to accept multiple payment methods without establishing direct banking relationships, reducing complexity and costs. Value-added services such as analytics, fraud management, and unified reporting enhance their appeal. Growth is further supported by e-commerce expansion and digital entrepreneurship.

By End User Analysis

Merchants and businesses account for 41.8% of the market share in 2025, driven by accelerated digital transformation and the adoption of omnichannel strategies. Efficient payment acceptance is critical for improving checkout experiences, reducing cart abandonment, and supporting customer loyalty. Businesses increasingly invest in integrated payment solutions that support online, in-store, and mobile channels. Advanced features such as real-time settlement, analytics, and fraud prevention enable better cash flow management and operational efficiency. As competition intensifies, payments are viewed not just as a transaction tool but as a strategic asset for revenue growth and customer engagement.

Consumer adoption is rising rapidly as digital wallets, peer-to-peer transfers, and mobile banking apps become integral to everyday financial activity. Convenience, speed, and ease of use are key drivers influencing payment preferences. Consumers increasingly expect instant transfers, contactless payments, and seamless integration across devices. Growing awareness of digital security and government-backed digital payment initiatives further support adoption. As lifestyles become more digital, consumer-driven demand continues to shape innovation across the payments ecosystem.

The Payments Market Report is segmented on the basis of the following:

By Payment Type

- Card Payments

- Credit Cards

- Debit Cards

- Prepaid Cards

- Digital / Electronic Payments

- Mobile Wallets

- Online Banking / Net Banking

- QR Code Payments

- Bank Transfer Payments

- Real-Time Payments

- ACH / EFT

- Wire Transfers

- Cash Payments

- Cryptocurrency Payments

By Transaction Mode

- Point of Sale (POS) Payments

- E-commerce Payments

- Mobile Payments

- Peer-to-Peer (P2P) Payments

- Recurring / Subscription Payments

By Business Model

- Merchant Acquiring

- Bank Acquirers

- Non-bank Acquirers

- Issuing

- Card Issuers

- Wallet Issuers

- Payment Gateways

- Hosted / Redirect Gateways

- API-based Gateways

- Payment Aggregators / PSPs

- Third-party Aggregators

- Merchant-of-Record (MoR) Providers

- Payment Processing

- Transaction Processing

- Clearing & Settlement

By End User

- Consumers / Individuals

- Merchants & Businesses

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Financial Institutions

- Government & Public Sector

Regional Analysis

Leading Region in the Payments Market

North America leads the Payments market with an expected 36.4% share in 2025, supported by its highly developed financial infrastructure and strong consumer purchasing power. The region has been an early adopter of advanced payment technologies, including contactless cards, mobile wallets, and real-time payment systems.

A well-established regulatory environment enhances transaction security, consumer protection, and operational transparency, fostering trust among users and businesses. Continuous investment by financial institutions and payment service providers in modernization initiatives further accelerates adoption. Additionally, the presence of large-scale merchants, digital platforms, and technology-driven financial institutions strengthens ecosystem maturity, reinforcing North America’s dominant position in the global payments landscape.

Fastest Growing Region in the Payments Market

Asia-Pacific is the fastest-growing region in the Payments market, driven by rapid economic development, expanding middle-class populations, and a strong shift toward digital-first financial behavior. Governments across the region actively promote cashless transactions through national payment systems, regulatory support, and financial inclusion programs.

High smartphone penetration, improving internet connectivity, and a booming e-commerce sector significantly accelerate adoption. Local innovation, particularly in mobile wallets and QR-based payments, enables scalable and cost-effective solutions. The region’s diverse economies and large consumer base create substantial transaction volumes, positioning Asia-Pacific as a key growth engine for the global payments industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Payments market is highly competitive, characterized by continuous innovation and strategic differentiation. Market participants focus on expanding acceptance networks, enhancing security capabilities, and offering value-added services. High entry barriers exist due to regulatory compliance and infrastructure requirements. Strategic partnerships, technology integration, and investment in R&D are central to maintaining competitiveness. Providers emphasize scalability, interoperability, and customer experience to strengthen market positioning.

Some of the prominent players in the global Payments are:

- Visa

- Mastercard

- PayPal

- Stripe

- Fiserv (First Data/Clover)

- Global Payments

- Worldpay

- JPMorgan Chase (Chase Paymentech)

- American Express

- Adyen

- Square (Block)

- Worldline

- PayU

- Payoneer

- Ant Group (Alipay)

- Tencent (WeChat/ Tenpay)

- Apple Pay

- Google Pay

- Amazon Pay

- Authorize.Net

- Other Key Players

Recent Developments

- In December 2025, Google introduced Introducing Flex by Google Pay, a UPI-powered, digital, co-branded credit card designed to simplify and elevate the entire card experience for India’s financial needs. With Flex, making everyday credit as ubiquitous as UPI payments, offering a simplified experience that enables users to apply and receive their card within minutes, manage costs, earn and redeem reward points with every Flex transaction, and avail flexible repayment options seamlessly, all backed by the trusted and secure experience of the Google Pay app.

- In December 2025, Visa Inc. launched USDC settlement in the US, marking a major milestone in the company’s stablecoin settlement pilot program and strategy to modernize its settlement layer underpinning global commerce. With USDC settlement, issuers can benefit from faster funds movement over blockchains, seven‑day availability, and enhanced operational resilience across weekends and holidays - without any change to the consumer card experience.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4,860.2 Bn |

| Forecast Value (2034) |

USD 17,435.0 Bn |

| CAGR (2025–2034) |

15.2% |

| The US Market Size (2025) |

USD 1,502.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Payment Type (Card Payments, Digital / Electronic Payments, Bank Transfer Payments, Cash Payments, Cryptocurrency Payments), By Transaction Mode (Point of Sale (POS) Payments, E-commerce Payments, Mobile Payments, Peer-to-Peer (P2P) Payments, Recurring / Subscription Payments), By Business Model (Merchant Acquiring, Issuing, Payment Gateways, Payment Aggregators / PSPs, and Payment Processing), By End User (Consumers / Individuals, Merchants & Businesses, Financial Institutions, and Government & Public Sector) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Visa, Mastercard, PayPal, Stripe, Fiserv (First Data/Clover), Global Payments, Worldpay, JPMorgan Chase (Chase Paymentech), American Express, Adyen, Square (Block), Worldline, PayU, Payoneer, Ant Group (Alipay), Tencent (WeChat/ Tenpay), Apple Pay, Google Pay, Amazon Pay, Authorize.Net, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Payments Market size is expected to reach USD 4,860.2 billion by 2025 and is projected to reach USD 17,435.0 billion by the end of 2034.

North America is expected to have the largest market share in the Global Payments Market, with a share of about 36.4% in 2025.

The US Payments market is expected to reach USD 1,502.0 billion by 2025.

Some of the major key players in the Global Payments Market include Visa, PayPal, Google Pay, and others

The market is growing at a CAGR of 15.2 percent over the forecasted period.