Market Overview

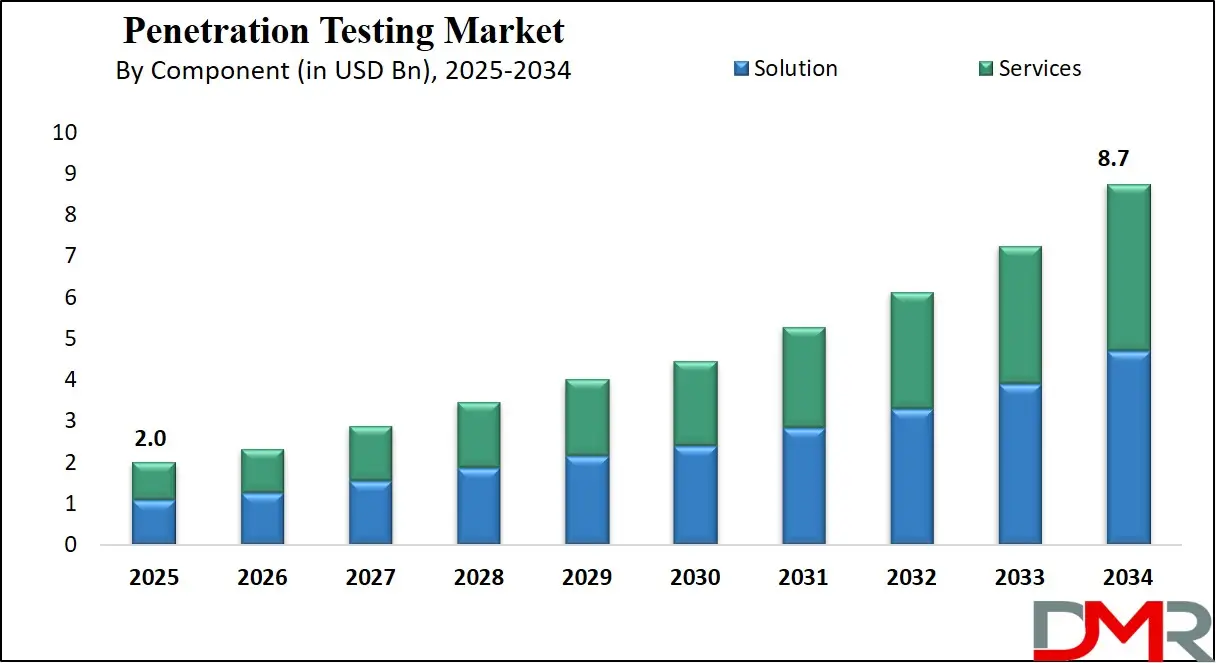

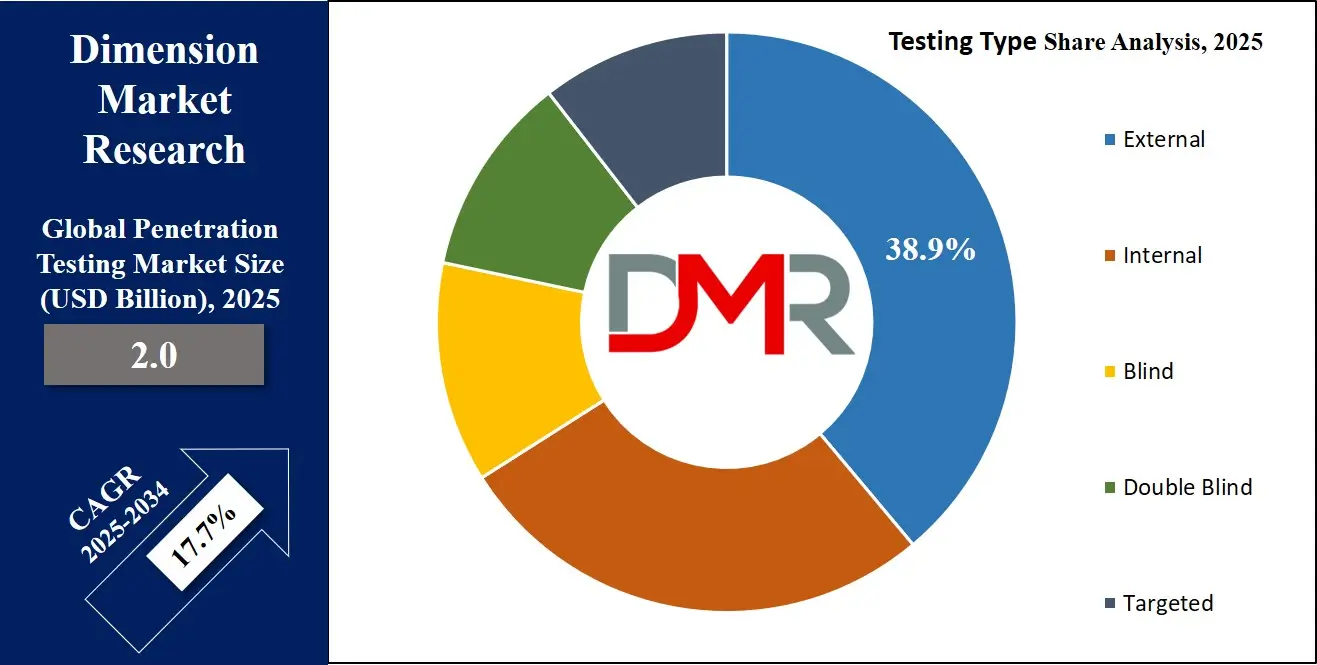

The Global Penetration Testing Market size is projected to reach USD 2.0 billion in 2025 and grow at a compound annual growth rate of 17.7% from there until 2034 to reach a value of USD 8.7 billion.

Penetration testing, often called "pen testing," is a process where cybersecurity professionals try to find weaknesses in a system, network, or application by simulating cyberattacks. The goal is to discover security issues before real attackers do. It's like hiring ethical hackers to break into your systems, not to cause harm, but to help improve security. Penetration testing helps organizations understand where they are vulnerable and what needs to be fixed to prevent data breaches or other security incidents.

In recent years, the need for penetration testing has grown a lot. As more companies move their operations online and use digital tools, they become more exposed to cyber threats. With sensitive data like customer information, financial records, and intellectual property being stored online, the need to protect this data has increased. Businesses, governments, and healthcare organizations are all paying more attention to cybersecurity, and penetration testing has become a key part of their defense strategy.

Several trends are driving this growth. One major trend is remote work, which became popular during the COVID-19 pandemic. With employees working from home, the security of home networks, personal devices, and cloud-based tools became a major concern. Cyber attackers took advantage of this shift, leading to a rise in cyber threats. As a result, companies began investing more in tools and services like penetration testing to stay protected.

There have also been many important events in recent years that highlighted the importance of penetration testing. Data breaches at large companies, ransomware attacks on hospitals, and hacking of government systems have shown how damaging cyberattacks can be. These events often result in financial loss, damage to reputation, and loss of customer trust. In many cases, these attacks happened because of overlooked vulnerabilities that could have been found through proper testing.

Another important insight is that many organizations still don’t test their systems regularly. Some companies either lack the knowledge, resources, or the right mindset to make cybersecurity a priority. This opens the door for attackers. Experts agree that penetration testing should not be a one-time task but a regular part of a company’s security routine, especially as threats keep changing and becoming more advanced.

To keep up with evolving risks, penetration testing tools and methods are also improving. New technologies use automation, artificial intelligence, and machine learning to help testers find and analyze vulnerabilities faster. As cybercrime continues to grow, penetration testing is expected to remain one of the most important ways for organizations to stay ahead of attackers and protect their systems.

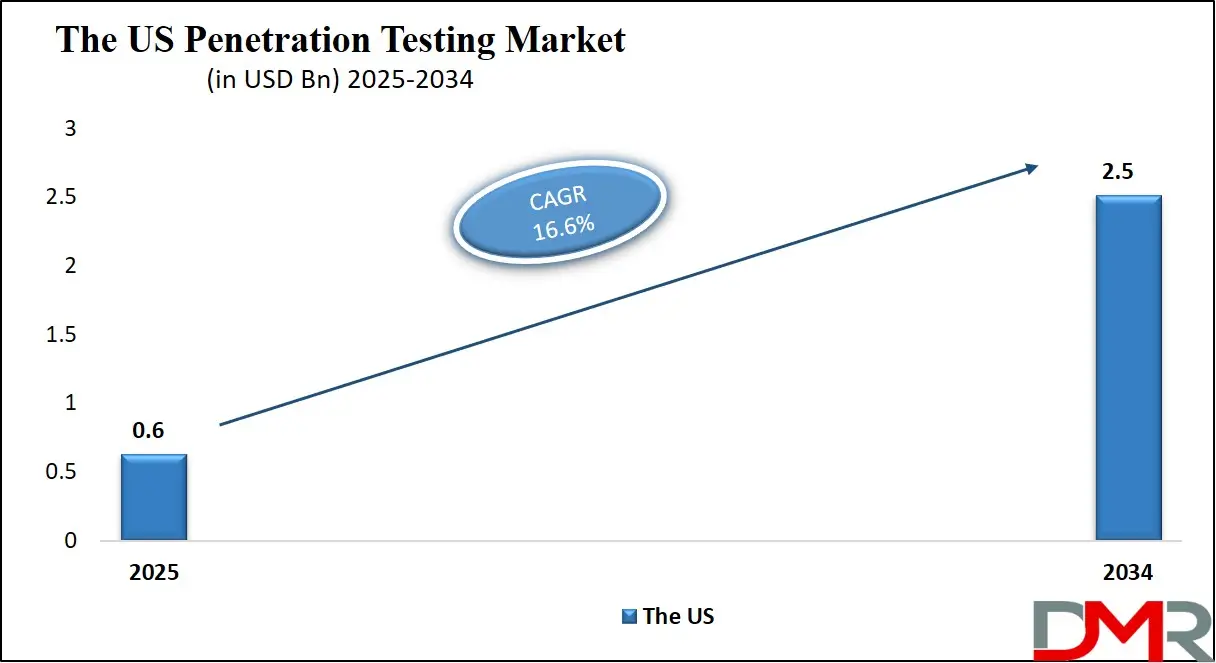

The US Penetration Testing Market

The US Penetration Testing Market size is projected to reach USD 0.6 billion in 2025 at a compound annual growth rate of 16.6% over its forecast period.

The US plays a vital role in the penetration testing market due to its advanced technology infrastructure and high cybersecurity awareness. Many US-based organizations prioritize securing their digital assets, driving strong demand for penetration testing services. The country hosts a large number of cybersecurity firms and skilled professionals who develop cutting-edge testing tools and techniques.

Additionally, strict regulations and compliance requirements in the US encourage businesses to conduct regular security assessments. The US government also invests heavily in cybersecurity initiatives, further boosting the market. As cyber threats continue to evolve, the US remains at the forefront of innovation and adoption in penetration testing, influencing global trends and setting high standards for security practices worldwide.

Europe Penetration Testing Market

Europe Penetration Testing Market size is projected to reach USD 0.5 billion in 2025 at a compound annual growth rate of 17.1% over its forecast period.

Europe will also play a significant role in the penetration testing market, driven by strong regulatory frameworks like the GDPR that require organizations to protect sensitive data and maintain robust cybersecurity measures. Many European companies across industries such as finance, healthcare, and manufacturing actively invest in penetration testing to comply with these regulations and avoid hefty penalties.

The region also benefits from a growing pool of cybersecurity experts and service providers specializing in identifying and fixing security weaknesses. Additionally, Europe’s increasing focus on digital transformation and cloud adoption creates new opportunities for penetration testing services. Governments and businesses in Europe are prioritizing cybersecurity to safeguard critical infrastructure and customer data, making the region a key player in the global penetration testing market.

Japan Penetration Testing Market

Japan Penetration Testing Market size is projected to reach USD 0.1 billion in 2025 at a compound annual growth rate of 19.6% over its forecast period.

Japan will play an important role in the penetration testing market as it rapidly adopts advanced technologies and digital solutions across industries. With a strong focus on innovation and manufacturing, Japanese companies are increasingly aware of cybersecurity risks and the need to protect their critical systems from cyberattacks. The country is also responding to a rise in cyber threats by investing more in penetration testing services to identify vulnerabilities before attackers can exploit them.

Additionally, Japan’s government supports cybersecurity initiatives and promotes compliance with international security standards, encouraging businesses to strengthen their defenses. As Japan continues to expand its digital infrastructure and smart technologies, penetration testing is becoming an essential part of maintaining secure operations and ensuring business continuity in the region.

Penetration Testing Market: Key Takeaways

- Market Growth: The Penetration Testing Market size is expected to grow by USD 6.4 billion, at a CAGR of 17.7%, during the forecasted period of 2026 to 2034.

- By Component: TheSolution segment is anticipated to get the majority share of the Penetration Testing Market in 2025.

- By Testing Type: The External segment is expected to get the largest revenue share in 2025 in the Penetration Testing Market.

- Regional Insight: North America is expected to hold a 35.8% share of revenue in the Global Penetration Testing Market in 2025.

- Use Cases: Some of the use cases of Penetration Testing include web application security, network infrastructure protection, and more.

Penetration Testing Market: Use Cases:

- Web Application Security: Penetration testing helps identify vulnerabilities in websites and online applications, such as broken authentication or insecure data storage. This ensures that sensitive user data is protected from hackers. Regular testing also supports compliance with data privacy standards.

- Network Infrastructure Protection: Testing network systems reveals gaps like open ports, weak firewalls, or unsecured connections. It helps organizations strengthen their internal and external networks against unauthorized access. This is especially important for preventing large-scale breaches.

- Cloud Environment Assessment: As more businesses move to cloud platforms, pen testing helps ensure cloud configurations are secure. It checks for misconfigurations, exposed APIs, and unauthorized access points. This protects cloud-stored data from exploitation.

- Remote Work Security Check: With employees accessing systems from various locations, pen testing verifies the security of remote access tools and VPNs. It detects risks tied to remote connections and weak endpoint defenses. This helps organizations secure their hybrid work models.

Stats & Facts

-

As per the Ponemon Institute, despite the growing threat landscape, 1 in every 5 companies still neglects to test their software for security vulnerabilities, leaving them susceptible to potential exploits and cyberattacks that could have otherwise been mitigated through regular penetration testing.

- A report from Kaspersky indicates that 40% of companies globally admit to lacking adequate cybersecurity measures, a concerning statistic especially when paired with the reality of increasing remote work and the associated rise in attack surfaces for threat actors.

- According to CheckPoint Software Technologies, a significant 81% of organizations have adopted remote working models, and 74% plan to continue operating remotely indefinitely, further emphasizing the need for resilient security frameworks and regular penetration assessments.

- The (ISC)’s 2021 Cyber Workforce Report stresses the urgency in cybersecurity workforce expansion, revealing that the global cybersecurity labor force needs to grow by 65% to effectively safeguard organizations’ critical assets from evolving threats.

- Astra notes that the practice of penetration testing is gaining substantial traction, and its growth trajectory reflects a broader industry realization that identifying vulnerabilities before attackers do is essential in a robust defense plan.

- Based on data from the Ponemon Institute, a troubling 20% of businesses are still operating without conducting vulnerability testing on their software, indicating a major gap in their security postures despite mounting cyber risks.

- According to a report from CheckPoint Software Technologies, the pivot to remote operations during the pandemic has had a lasting effect, with most businesses either having already embraced or planning to maintain remote working models permanently.

- Kaspersky’s findings that 40% of businesses fall short in cybersecurity readiness highlight a pressing need for broader adoption of security measures like penetration testing to address blind spots before they’re exploited.

- In Canada, 45% of organizations have conducted penetration testing initiatives as a preventative measure to detect cyber risks and curb potential cybercrime, suggesting a growing awareness of proactive defense measures in national security strategies.

- The 2021 Cyber Workforce Report by (ISC) shows the growing talent gap in cybersecurity, underlining the need for not just more professionals but also a deeper integration of automated security solutions like pentesting tools to fill the void.

- According to a report cited by Astra, 76% of global cybersecurity professionals have observed a rise in cyberattacks as a direct consequence of the increased remote work culture, which introduces more entry points for attackers and amplifies the importance of thorough, regular security assessments.

Market Dynamic

Driving Factors in the Penetration Testing Market

Rise in Cybersecurity Threats Across Digital Platforms

One of the major growth drivers of the penetration testing market is the rapid increase in cyberattacks targeting digital platforms. As businesses continue to adopt digital tools and cloud-based services, they expose themselves to a wider range of security threats, such as ransomware, phishing, and data breaches. Hackers are also becoming more skilled, using advanced techniques to exploit vulnerabilities in software, networks, and applications, which has created an urgent need for regular and thorough security testing.

Penetration testing allows organizations to proactively identify weaknesses before attackers can exploit them. It helps build stronger defenses, maintain customer trust, and ensure data protection. The growing awareness of these risks is pushing more companies to invest in professional pen testing services.

Adoption of Remote and Hybrid Work Models

The global shift towards remote and hybrid work arrangements has significantly increased the number of endpoints and networks companies need to protect. Employees now access company systems from home devices and various internet connections, making it harder to maintain consistent security controls, which has expanded the potential attack surface, making organizations more vulnerable to cyber threats.

Penetration testing plays a key role in evaluating the safety of remote work environments, including VPNs, cloud tools, and personal device security. As remote work becomes a permanent fixture in many industries, businesses are investing in pen testing to secure new digital workflows. This shift has created ongoing demand for flexible, scalable testing solutions tailored to distributed workforces.

Restraints in the Penetration Testing Market

High Cost and Limited Budget for Small Enterprises

One of the major restraints in the penetration testing market is the high cost associated with professional testing services. Many small and medium-sized businesses operate on tight budgets and often find it difficult to afford regular, comprehensive security testing. Hiring skilled cybersecurity professionals or subscribing to advanced testing tools can be expensive, mainly when tests need to be performed frequently.

As a result, these organizations may delay or skip penetration testing altogether, increasing their exposure to cyber threats. Additionally, smaller companies may lack in-house expertise to interpret the results or act on the findings, reducing the effectiveness of any testing that is done. The financial barrier limits the adoption of penetration testing across the broader market.

Lack of Skilled Cybersecurity Professionals

Another key challenge facing the penetration testing market is the shortage of trained and experienced cybersecurity professionals. While automated tools can assist in identifying basic vulnerabilities, complex environments often require human testers to simulate real-world attacks accurately. Unfortunately, the current demand for cybersecurity talent far exceeds the supply, leading to delays in service delivery and increased costs for businesses.

Organizations may also struggle to find experts with specific skills needed for different types of testing, such as cloud, mobile, or IoT security assessments. This talent gap slows down the adoption of high-quality testing services and limits the ability of providers to scale operations. Addressing this issue is crucial for the market to grow effectively.

Opportunities in the Penetration Testing Market

Expansion of Cloud and IoT Security Testing

As more businesses adopt cloud computing and Internet of Things (IoT) devices, the penetration testing market has a significant opportunity to grow by focusing on these emerging areas. Cloud environments often have complex configurations that can create new security gaps if not properly managed. Similarly, IoT devices, which connect everything from home appliances to industrial machinery, frequently have weak security protections, making them attractive targets for attackers.

Penetration testing services that specialize in identifying vulnerabilities in cloud infrastructures and IoT ecosystems can help organizations protect sensitive data and maintain operational integrity. By developing expertise and tailored testing solutions for these technologies, providers can tap into a rapidly expanding market segment.

Increasing Regulatory Compliance Requirements

Growing government regulations and industry standards related to data protection and cybersecurity present a strong opportunity for the penetration testing market. Many laws require organizations to demonstrate they have taken steps to secure their systems against cyber threats. Penetration testing is often a critical part of meeting these compliance demands.

As regulations become stricter and more widespread globally, companies across all sectors will need to adopt regular testing practices to avoid penalties and maintain customer trust. This regulatory pressure encourages investment in penetration testing services, making compliance a powerful driver for market expansion. Providers that help clients navigate and fulfill these requirements can build long-term relationships and stable revenue streams.

Trends in the Penetration Testing Market

Integration of Artificial Intelligence and Automation

A significant trend in the penetration testing market is the increasing incorporation of artificial intelligence (AI) and automation. AI-powered tools can analyze vast amounts of data to identify vulnerabilities more quickly and accurately than traditional methods. Automation streamlines repetitive tasks, allowing security professionals to focus on more complex issues.

This shift not only enhances the efficiency of penetration testing but also enables continuous monitoring, which is crucial in today's fast-paced digital environments. By integrating AI and automation, organizations can proactively address potential security threats before they escalate. This trend is particularly beneficial for businesses with limited resources, as it makes advanced security measures more accessible.

Expansion into Cloud and IoT Security

As businesses mainly adopt cloud computing and the Internet of Things (IoT), the scope of penetration testing is expanding to address the unique vulnerabilities associated with these technologies. Cloud environments present challenges such as shared responsibility models and dynamic infrastructures, requiring specialized testing approaches.

Similarly, IoT devices often have limited security features, making them attractive targets for cyberattacks. Penetration testing services are evolving to include assessments of cloud configurations, APIs, and IoT devices to ensure comprehensive security coverage. This expansion is driven by the need to protect sensitive data and maintain the integrity of interconnected systems in an increasingly digital world.

Research Scope and Analysis

By Component Analysis

Solution as a component will be leading the penetration testing market in 2025 with a share of 53.8%. This strong position comes from organizations increasingly adopting advanced software tools designed to detect and fix security weaknesses quickly and effectively. These solutions help businesses identify risks in networks, applications, and cloud environments before hackers can exploit them. Easy-to-use automated tools allow companies to perform regular testing without needing large security teams, which saves time and money.

The growing complexity of cyber threats has also pushed demand for smarter, more comprehensive penetration testing solutions. By offering detailed insights and real-time vulnerability detection, these solutions play a crucial role in helping companies strengthen their cybersecurity defenses and maintain trust with customers and partners.

Further services are showing significant growth over the forecast period because many organizations require expert help to conduct thorough penetration tests. Skilled cybersecurity professionals provide customized testing based on the unique needs of each business, uncovering hidden vulnerabilities that automated tools might miss.

Companies often lack the in-house expertise or resources to handle complex security assessments, so they rely on service providers for guidance and support. These services include planning tests, simulating real-world attacks, and advising on how to fix the issues found. As cyber threats become more sophisticated, demand for professional penetration testing services continues to rise, making this segment a key driver of market growth.

By Type Analysis

Web application as a type is set to dominate the penetration testing market in 2025 with a share of 29.7%, which is due to web applications are widely used by businesses to connect with customers, handle transactions, and manage sensitive data. Since these applications are accessible over the internet, they are often targeted by hackers looking to exploit weaknesses.

Penetration testing for web applications helps identify security flaws such as broken authentication, cross-site scripting, and data leaks before attackers can take advantage. As more companies rely on online platforms, the demand for thorough testing of web apps grows steadily. This type of testing ensures better protection for both the business and its users, making web application testing a vital part of the overall cybersecurity strategy.

Further, mobile applications as a type are showing significant growth over the forecast period due to the increasing use of smartphones and mobile apps for everyday activities. As businesses launch more apps for shopping, banking, and communication, security risks related to these mobile platforms have also increased. Penetration testing for mobile applications helps find vulnerabilities like insecure data storage and weak encryption that could lead to data theft or fraud. With users expecting safe and smooth app experiences, companies are investing more in mobile app security.

By Testing Type Analysis

External testing as a type will be leading the penetration testing market in 2025 with a share of 38.9%. This testing focuses on evaluating the security of an organization’s systems from outside their network, simulating attacks by real hackers trying to gain unauthorized access. Since external threats are common and can cause significant damage, businesses prioritize this type of testing to protect their public-facing assets like websites, servers, and firewalls.

External penetration testing helps uncover vulnerabilities that attackers could exploit remotely, providing insights into weaknesses that need immediate attention. As cyberattacks become more sophisticated, the demand for thorough external testing grows, helping organizations strengthen their defenses against potential breaches and safeguard sensitive information from outside threats.

Blind testing as a type is showing significant growth over the forecast period due to its realistic approach to security assessment. In blind testing, testers receive very limited information about the target system, just like real attackers would. This makes it a valuable method for evaluating how well an organization can detect and respond to unknown threats.

Because it mimics real-world conditions, blind testing uncovers hidden vulnerabilities and tests the effectiveness of security monitoring and incident response. With increasing cyber risks, many businesses are adopting blind testing to better prepare for unexpected attacks. This approach provides deeper insights into security gaps and helps improve overall protection, driving growth in the penetration testing market.

By Deployment Mode Analysis

Cloud as a deployment mode is set to be prominent in the penetration testing market in 2025 with a share of 60.9%. This strong position is driven by the rapid adoption of cloud services across industries, as more businesses move their applications and data to cloud platforms. Cloud environments are flexible and scalable, but also introduce unique security challenges, such as misconfigurations and shared responsibility issues.

Penetration testing in the cloud helps organizations identify these risks and secure their infrastructure against cyber threats. The ease of access, remote capabilities, and cost-effectiveness of cloud-based testing solutions make them popular among companies of all sizes. As cloud adoption continues to rise, the demand for penetration testing to ensure cloud security grows, making this deployment mode a key factor in the overall market expansion.

In addition, on-premises as a deployment mode is showing significant growth over the forecast period due to ongoing concerns around data privacy and control. Many organizations prefer to keep their critical systems and data within their facilities to maintain full oversight and comply with strict regulatory requirements.

On-premises penetration testing allows companies to assess their security measures in a controlled environment, tailored specifically to their internal network setup. Despite the rise of cloud computing, certain industries such as finance, government, and healthcare continue to rely heavily on on-premises solutions. This steady demand for traditional, location-based testing helps drive growth in the penetration testing market by addressing unique security needs.

By Organization Size Analysis

In terms of organization size, large enterprises as an organization size are leading the penetration testing market in 2025 with a share of 63.8%. These organizations handle vast amounts of sensitive data and operate complex IT infrastructures, which makes them prime targets for cyberattacks. Large enterprises invest heavily in cybersecurity measures, including regular penetration testing, to protect their systems and comply with industry regulations.

They often require comprehensive testing services that cover multiple departments, networks, and applications. Due to their size and resources, these organizations can afford advanced tools and skilled security experts to identify and fix vulnerabilities. The increasing frequency and sophistication of cyber threats further push large enterprises to prioritize penetration testing, driving significant growth in this segment of the market.

SMEs, as an organizational size, will show a significant growth over the forecast period because they are becoming more aware of the cybersecurity risks they face. Although smaller in scale, SMEs often lack dedicated security teams, making them vulnerable to attacks. Many SMEs are adopting penetration testing to better protect their business operations and customer information.

Affordable and easy-to-use testing solutions are making it possible for SMEs to regularly check their security posture. Growing regulatory requirements and the rise of digital transformation in smaller companies are also encouraging them to invest in penetration testing. This increasing adoption among SMEs contributes notably to the overall expansion of the penetration testing market.

By Industrial Vertical Analysis

BFSI as an industry vertical will domiante the penetration testing market in 2025 with a share of 24.7%. This sector deals with highly sensitive financial data and personal information, making it a prime target for cybercriminals. Banks, insurance companies, and financial institutions face constant threats like data breaches, fraud, and ransomware attacks. To protect their assets and comply with strict regulatory requirements, BFSI organizations invest heavily in penetration testing.

These tests help identify vulnerabilities in their networks, applications, and payment systems before attackers can exploit them. The need for strong security measures to maintain customer trust and avoid costly penalties drives continuous demand for penetration testing services in the BFSI sector. As cyber threats grow more sophisticated, this industry remains a key driver of market growth.

Further, healthcare as an industry vertical is showing significant growth over the forecast period due to the increasing digitization of patient records and healthcare services. Hospitals, clinics, and other medical organizations store vast amounts of sensitive health data that require strict protection. Cyberattacks targeting healthcare can have severe consequences, including data theft and disruption of critical services.

Penetration testing helps healthcare providers identify weak points in their security systems and comply with healthcare regulations. With rising awareness about cybersecurity risks, more healthcare organizations are investing in penetration testing to safeguard patient information and ensure uninterrupted care. This growing focus on security in the healthcare sector is fueling the expansion of the penetration testing market.

The Penetration Testing Market Report is segmented on the basis of the following:

By Component

By Type

- Network Penetration Testing

- Web Application Penetration Testing

- Mobile Application Penetration Testing

- Wireless Penetration Testing

- Social Engineering

- Cloud Penetration Testing

By Testing Type

- External Testing

- Internal Testing

- Blind Testing

- Double Blind Testing

- Targeted Testing

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Mode

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Government & Defense

- Retail & E-commerce

- Energy & Utilities

- Manufacturing

- Others

Regional Analysis

Leading Region in the Penetration Testing Market

North America will be leading the penetration testing market in 2025 with an estimated share of 35.8%, which comes from its advanced technology infrastructure and high awareness of cybersecurity risks among businesses and government agencies. Organizations in North America are mainly adopting penetration testing to protect sensitive data, comply with strict regulations, and defend against growing cyber threats.

The presence of various cybersecurity firms and skilled professionals also supports market growth by providing innovative testing solutions and services. Additionally, the rise of remote work and digital transformation in the region has increased the demand for penetration testing to secure networks, applications, and cloud environments. With continuous investments in cybersecurity and the increasing complexity of cyberattacks, North America remains a key driver of growth in the penetration testing market.

Fastest Growing Region in the Penetration Testing Market

Asia Pacific is expected to show significant growth in the penetration testing market over the forecast period, driven by rapid digitalization and increased internet penetration across the region. Many businesses are adopting cloud computing, mobile technologies, and online services, which increases the need for strong cybersecurity measures. Rising cyber threats and data breaches are pushing organizations to invest more in penetration testing to identify vulnerabilities and protect sensitive information.

Governments are also enforcing stricter regulations, encouraging companies to improve their security posture. The growing presence of cybersecurity service providers and increased awareness about cyber risks further support market expansion. Overall, Asia Pacific is becoming a key region for penetration testing due to its fast-paced technological growth and evolving security challenges.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The penetration testing market is becoming more competitive as the need for stronger cybersecurity grows across all industries. Many companies now offer testing services, each trying to stand out by providing faster, more accurate, and more affordable solutions. Some focus on automated tools that scan systems, while others provide hands-on testing done by security experts.

Cloud security, mobile apps, and remote work have created new areas for testing, which has led to more specialized services. As cyber threats become more advanced, businesses are looking for reliable partners who can help them stay secure. This growing demand is pushing service providers to constantly improve their tools, stay updated with the latest threats, and offer better support to keep their clients safe.

Some of the prominent players in the global Penetration Testing are:

- IBM

- Accenture

- Cisco

- McAfee

- Trustwave

- NCC Group

- HackerOne

- Bugcrowd

- NetSPI

- TrustNet

- Blueliv

- Secureworks

- AT&T

- Optiv

- Fortinet

- FireEYe

- Rapid7

- Palo Alto Networks

- Other Key Players

Recent Developments

- In March 2025, CISO Global successfully deployed Skanda, an AI-driven penetration testing and security analysis tool. Valued at USD 50 million in 2024, Skanda uses AI and machine learning to deliver continuous, on-demand security assessments. Already integrated into all external tests by CISO Global’s team, the tool is evolving into a real-time testing solution to detect and fix vulnerabilities instantly. Skanda also supports compliance with frameworks like CMMC, boosting efficiency, profit margins, and overall network security responsiveness through automation.

- In December 2024, Sensiba LLP launched a new Penetration Testing service to help organizations identify security vulnerabilities and boost cyber resilience, which enhances Sensiba’s existing offerings, including ISO 27001, SOC, HIPAA, and NIST, and supports mandates like FedRAMP and PCI. By simulating real-world attacks, the service provides clients with deep threat insights and actionable fixes. It reflects Sensiba’s commitment to delivering scalable, end-to-end cybersecurity solutions tailored to modern business needs.

- In July 2024, Kinetic announced its partnership with Stripe OLT, a certified CREST Penetration Test Partner, to improve its cybersecurity posture. As cyber threats grow more complex, Kinetic aims to safeguard its systems and ensure resilience for its clients. The need is clear—according to the 2024 Cyber Security Breaches Survey, 97% of higher education institutions faced attacks last year, with nearly 60% reporting negative impacts, highlighting the critical importance of strong security measures.

- In July 2024, Horizon3.ai launched NodeZero™ Cloud Pentesting to help organizations detect and fix complex vulnerabilities and hidden attack paths in their cloud setups, which advanced solution that supports thorough security assessments across both AWS and Azure environments. Designed for use in public and private sectors, NodeZero™ delivers a comprehensive autonomous penetration testing experience, empowering organizations to strengthen their cloud security and uncover risks that could otherwise go unnoticed.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.0 Bn |

| Forecast Value (2034) |

USD 8.7 Bn |

| CAGR (2025–2034) |

17.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Type (Network Penetration Testing, Web Application Penetration Testing, Mobile Application Penetration Testing, Wireless Penetration Testing, Social Engineering, and Cloud Penetration Testing), By Testing Type (External Testing, Internal Testing, Blind Testing, Double Blind Testing, and Targeted Testing), By Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Deployment Mode (On-Premises and Cloud-Based), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Government & Defense, Retail & E-commerce, Energy & Utilities, Manufacturing, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM, Accenture, Cisco, McAfee, Trustwave, NCC Group, HackerOne, Bugcrowd, NetSPI, TrustNet, Blueliv, Secureworks, AT&T, Optiv, Fortinet, FireEYe, Rapid7, Palo Alto Networks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Penetration Testing Market size is expected to reach a value of USD 2.0 billion in 2025 and is expected to reach USD 8.7 billion by the end of 2034.

North America is expected to have the largest market share in the Global Penetration Testing Market, with a share of about 35.8% in 2025.

The Penetration Testing Market in the US is expected to reach USD 0.6 billion in 2025.

Some of the major key players in the Global Penetration Testing Market are Cisco, AT&T, IBM, and others

The market is growing at a CAGR of 17.7 percent over the forecasted period.