Market Overview

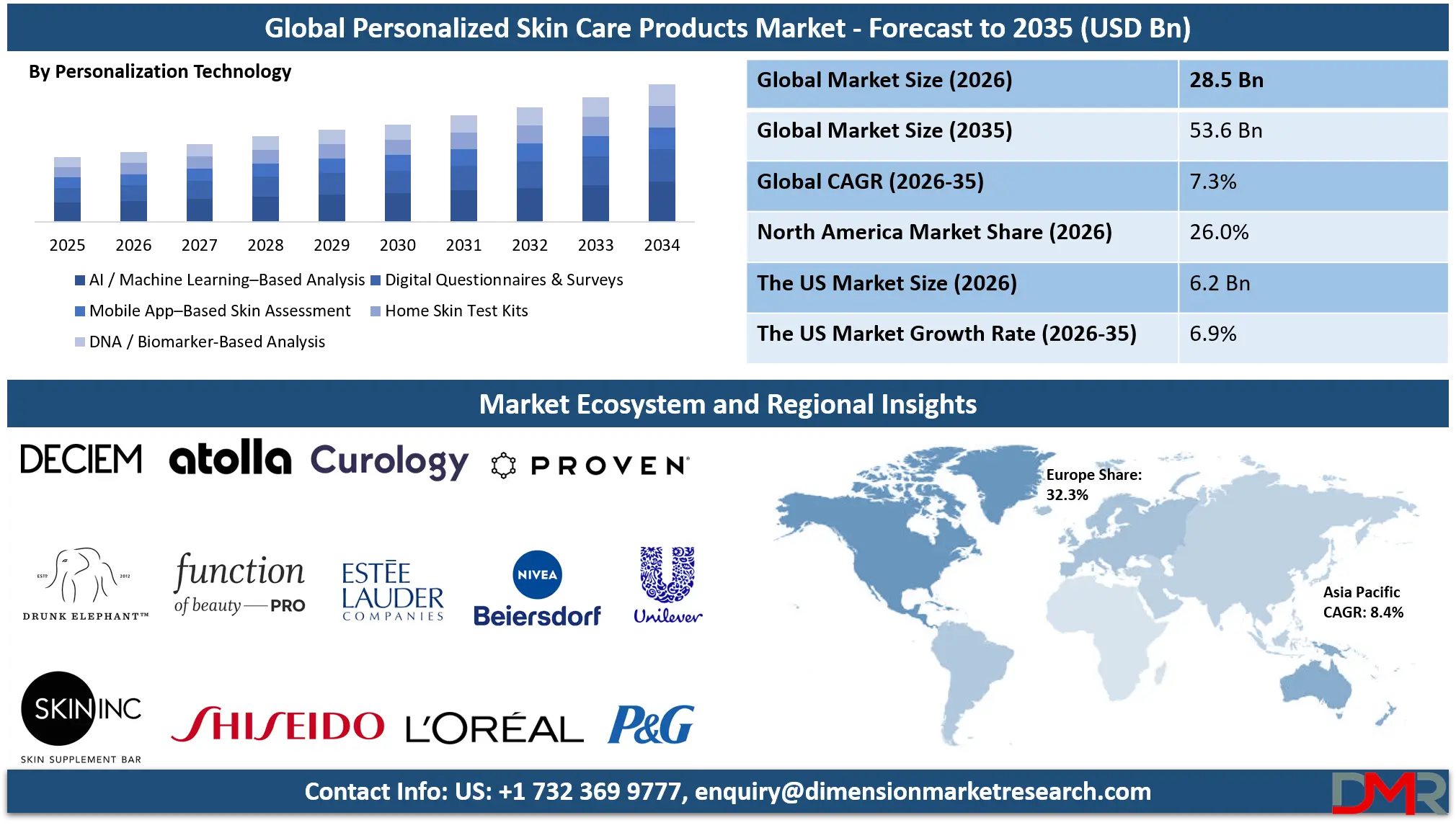

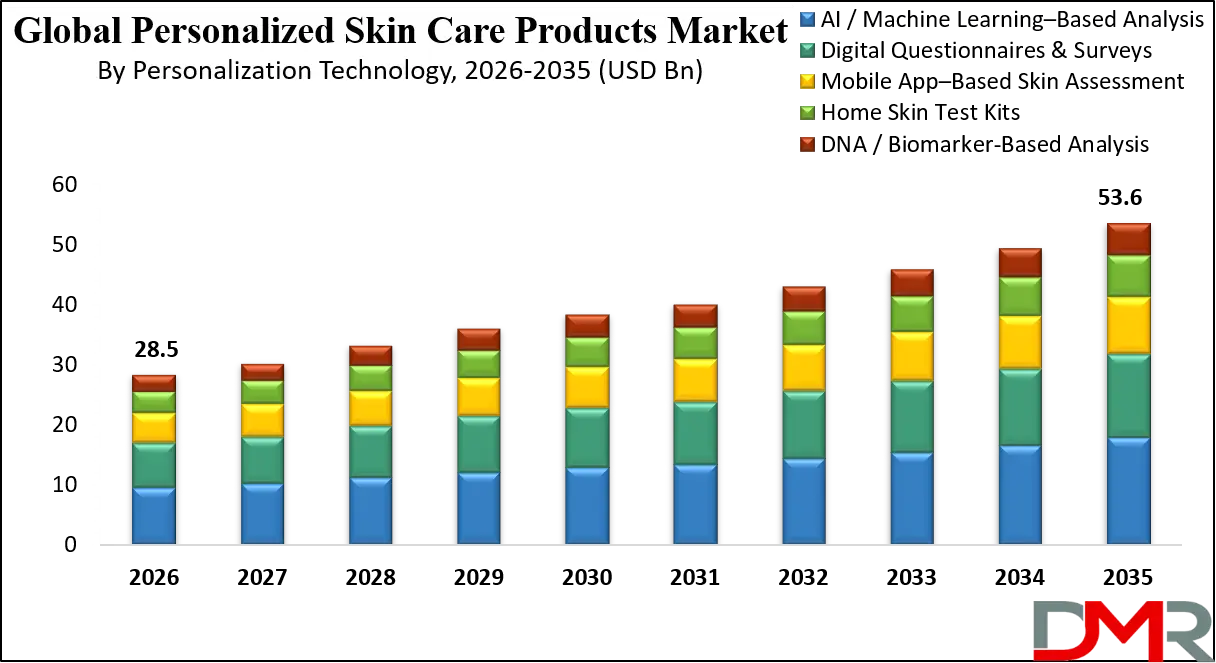

The Global Personalized Skin Care Products market is projected to reach USD 28.5 billion in 2026 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2026 to 2035, reaching an estimated USD 53.6 billion by 2035. This transformative growth is driven by a fundamental shift from one-size-fits-all cosmetics to precision skincare, empowered by advancements in biotechnology, artificial intelligence, and consumer demand for individuality. The modern consumer, equipped with greater knowledge and digital access, seeks solutions tailored to their unique skin genotype, phenotype, lifestyle, and environmental factors.

Unlike conventional skincare, personalized products are created using diagnostic data from at-home skin analysis tools and genetic testing to AI-powered questionnaires to formulate products with exact ingredient combinations and concentrations. This approach promises higher efficacy, reduced irritation, and optimized results. The market's expansion is underpinned by key drivers: the rise of consumer genomics, increasing demand for clean and sustainable beauty, the proliferation of direct-to-consumer (DTC) digital brands, and the integration of telehealth and dermatology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The evolution of personalized skincare is marked by rapid technological diversification. Innovations such as real-time skin sensors, microbiome-balancing prebiotics and postbiotics, and 3D bioprinting of tissue-matched actives are unlocking new frontiers in cosmetic science. Concurrently, digitalization through AI-driven skin diagnostic platforms and IoT-enabled smart applicators is enabling continuous product adjustment and outcome tracking, creating a closed-loop system between consumer and brand.

While the market faces challenges from high product costs, data privacy concerns, and regulatory complexity for bio-customized products, the long-term value proposition is compelling. Supported by robust investment in beauty tech and a cultural shift toward wellness and self-care, personalized skincare is transitioning from a luxury niche to a mainstream expectation, positioning itself as a central pillar of the future beauty industry through 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

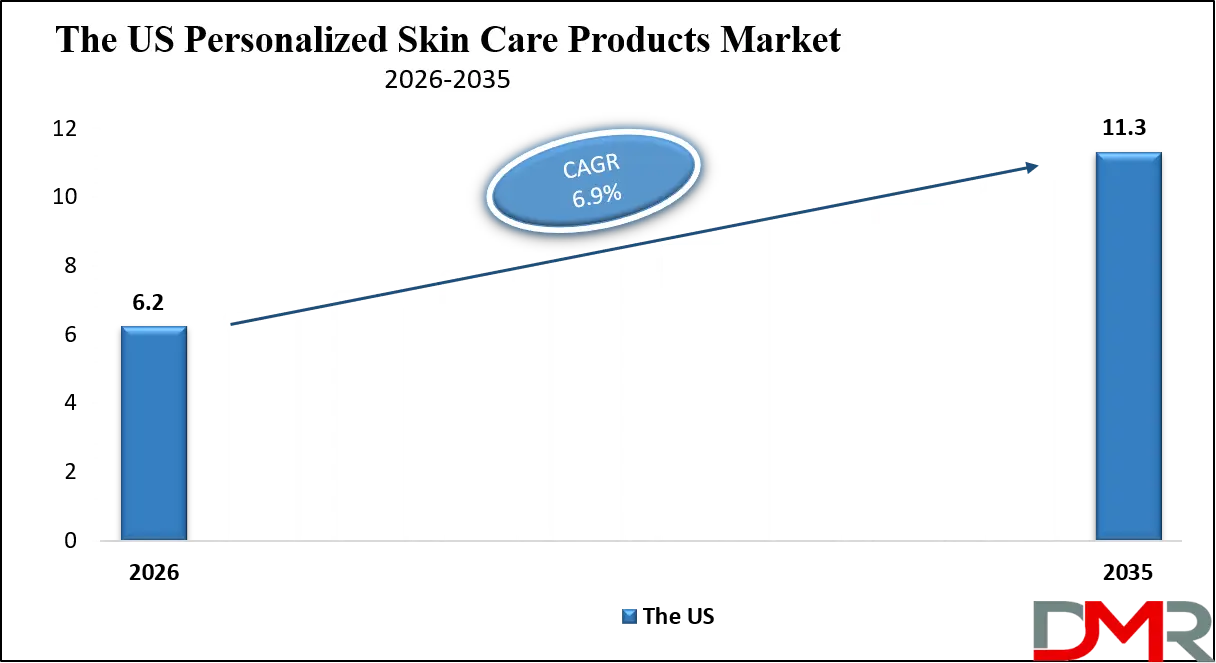

The US Personalized Skin Care Products Market

The U.S. Personalized Skin Care Products Market is projected to reach USD 6.2 billion in 2026 and grow at a CAGR of 6.9%, reaching USD 11.3 billion by 2035. The United States market is a dynamic engine of innovation, driven by a potent mix of tech entrepreneurship, venture capital investment, and a highly engaged consumer base. The convergence of Silicon Valley tech and beauty serves as a foundational catalyst, with AI startups and biotech firms partnering with established cosmetic giants to develop next-generation diagnostic and formulation platforms.

States like California and New York continue to set trends with high concentrations of beauty incubators, influencer marketing agencies, and early-adopter consumers. Beyond trends, a powerful driver is the consumer shift toward wellness and preventative skincare, viewing personalized products as health-adjacent necessities rather than mere cosmetics. Major retailers (Sephora, Ulta), tech firms (Apple, Google via health platforms), and direct-to-consumer brands (Proven, Curology, Function of Beauty) are increasingly integrating personalization into their core offerings, valuing its role in driving customer loyalty, lifetime value, and data-driven product development.

The innovation landscape is vibrant. Companies like L'Oréal with its Perso device and Atolla with its data-driven serum subscriptions are iterating on the at-home experience. Startups like Nutrigene and SkinDNA are commercializing DNA-based skincare recommendations, while others leverage smartphone hyper-spectral imaging for precise skin analysis.

Furthermore, the convergence of personalized skincare with wearable health trackers, environmental sensors, and virtual dermatology consultations is creating a holistic ecosystem where skincare becomes an integrated component of personal health management. This blend of consumer demand, technological entrepreneurship, and retail integration solidifies the U.S. as a global leader in both personalized skincare product innovation and market adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Personalized Skin Care Products Market

The Europe Personalized Skin Care Products Market is projected to be valued at approximately USD 9.2 billion in 2026 and is projected to reach around USD 16.1 billion by 2035, growing at a CAGR of about 6.8% from 2026 to 2035. Europe is a established leader in cosmetic science, luxury beauty, and stringent regulatory frameworks, creating a market built on trust, efficacy, and sustainability. The region's strong pharmaceutical and dermatological heritage provides a foundation for clinically-backed personalization. The EU's Cosmetics Regulation ensures high safety standards, which, while stringent, build consumer confidence in novel bio-ingredients and diagnostic tools.

National markets amplify this effect. France's legacy in luxury perfumery and cosmetics fuels high-end, bespoke skincare services. Germany's expertise in medical-grade skincare (dermocosmetics) drives the B2B2C model through pharmacy channels. The UK and Scandinavia are hubs for digital-first, sustainable brands. Europe's strength lies in its integrated value chain, where established cosmetic houses (L'Oréal, Beiersdorf, LVMH) collaborate with biotech research institutes and tech startups to deliver compliant, high-efficacy solutions.

The region also leads in the convergence of sustainability and personalization, responding to strong consumer demand for clean, green, and waste-reducing beauty. Brands offer refillable modular systems, locally sourced ingredients, and waterless concentrates tailored to individual needs. Furthermore, EU-funded research initiatives under Horizon Europe advance next-generation technologies like AI for predicting skin aging trajectories and biomarker discovery for sensitive skin. This combination of scientific rigor, luxury positioning, and sustainability focus ensures Europe's sustained dominance in market value and premium brand perception.

The Japan Personalized Skin Care Products Market

The Japan Personalized Skin Care Products Market is anticipated to be valued at approximately USD 2.5 billion in 2026 and is expected to attain nearly USD 4.3 billion by 2035, expanding at a CAGR of about 6.2% during the forecast period. Japan's market is uniquely shaped by its advanced technological culture, meticulous skincare rituals, and aging demographic. Japanese consumers are early adopters of precision beauty tools and show a strong preference for high-quality, innovative, and gentle formulations backed by cutting-edge research.

Japan's technological prowess is a key differentiator. Companies like Shiseido, Kao, and Pola have deep expertise in skin bio-science, material innovation, and sophisticated diagnostic devices found in department stores and dedicated beauty counters. The cultural concept of "bidan" (beauty tech) and "omotenashi" (high-touch service) creates a perfect environment for blended offline-online personalization experiences. Japan is pioneering the integration of robotics and AI in beauty consultations, both in-store and via augmented reality apps.

Social and demographic trends also fuel growth. An aging population with high disposable income seeks effective, personalized anti-aging solutions. The cultural emphasis on preventative care, flawless skin, and ingredient purity aligns perfectly with personalized skincare's value proposition. The market ranges from mass-market drugstore brands offering customized foundations based on skin tone analysis, to luxury department store services providing full genome sequencing and bespoke regimen creation. Japan thus represents a high-growth market where cutting-edge technology meets deep-seated beauty culture, driving rapid and sophisticated adoption.

Global Personalized Skin Care Products Market: Key Takeaways

- Market Growth from Tech & Demand Insights: The market is projected to be valued USD 28.5 billion in 2026 to USD 53.6 billion by 2035 (CAGR 7.3%), primarily driven by the democratization of diagnostic technology (AI, genomics) and the consumer demand for efficacy, individuality, and wellness-integrated beauty.

- Asia-Pacific as the Volume & Growth Frontier: The APAC region will exhibit the highest CAGR, fueled by massive digitally-native populations, rising disposable incomes, the influence of K-beauty and J-beauty trends, and strong government support for biotechnology and e-commerce.

- Technology Diversification Beyond Questionnaires: While AI-powered quizzes and skin imaging maintain dominance for accessibility, deeper personalization by genomic testing, microbiome analysis, and continuous sensor data is capturing the high-efficacy, premium segment.

- From Product to Ecosystem Service: The competitive edge is shifting from selling standalone products to providing ongoing skin health membership programs, integrating telehealth consultations, and leveraging customer data for iterative product improvement, creating long-term loyalty.

- The Rise of Ethical Personalization: Leading brands are increasingly addressing data privacy, algorithmic bias, and inclusive formulation across diverse skin tones and types, responding to consumer demand for transparent, fair, and responsible personalization.

Global Personalized Skin Care Products Market: Use Cases

- Hyper-Personalized Acne Treatment Plans: Digital platforms combine user-reported data, daily skin selfies, and environmental factors to dynamically adjust prescription-strength (or OTC) ingredient formulas (like niacinamide, salicylic acid, azelaic acid percentages) in response to breakouts, reducing trial and error.

- DNA-Based Anti-Aging Regimens: Consumers submit genetic tests to identify predispositions for collagen breakdown, antioxidant capacity, or sun sensitivity, receiving tailor-made serums and creams with specific peptide combinations and antioxidant cocktails designed for their genetic profile.

- Modular Skincare Systems for Sustainable Customization: Brands offer a base product (e.g., a moisturizer gel) and a suite of single-ingredient "boosters" (e.g., hyaluronic acid, vitamin C, ceramides). Consumers mix their own daily formula based on real-time skin needs, reducing waste from unused products.

- In-Clinic to At-Home Continuum: A dermatologist performs an in-depth skin analysis (using tools like a VISIA complexion analysis) and prescribes a regimen. The patient then uses a connected app and at-home device to monitor progress and receive automatic formula refinements and refills.

- Cultural & Climate-Specific Formulations: Personalization algorithms account for geographic location, local pollution levels, humidity, and cultural skincare habits to recommend or create products suited for specific environmental challenges and lifestyle routines.

Global Personalized Skin Care Products Market: Stats & Facts

Cosmetics Europe / EU Industry Data

- European cosmetics retail sales reached USD 112 billion in 2024.

- Skin care constituted the largest product category at approximately USD 32 billion in 2024.

- Toiletries contributed around USD 26 billion in Europe in 2024.

- Hair care products accounted for about USD 19 billion in European retail in 2024.

- The European cosmetics industry supports more than 3.5 million jobs.

- Direct employment in cosmetics manufacturing in Europe was over 270,000 in 2023.

US Food and Drug Administration (FDA) – Regulatory Context (US Government)

- Cosmetics imported into the United States must meet the same safety standards as domestically manufactured products.

- The Modernization of Cosmetics Regulation Act (MoCRA) expanded the FDA’s regulatory authority over cosmetics.

- Color additives used in cosmetics in the United States must be specifically approved for safety by the FDA.

Central Drugs Standard Control Organisation (CDSCO) – India (Government Regulator)

- India’s national drug regulator oversees safety and regulation of cosmetics to protect consumers.

Invest India / Government of India Data (Government Agency)

- The skin care category in India grew on average annually by over 10 percent between 2016 and 2021.

- Sun care products in India registered growth of over 10 percent annually during the same period.

- Dermocosmetics (specialized skin care) in India grew at approximately 13 percent annually.

Government of India – Trade Statistics (Official Import Figures)

- India’s skincare and cosmetics imports totaled approximately USD 172 million in recent fiscal reporting.

- Face cream imports into India reached about USD 54 million in the same period.

- Eye makeup imports into India were around USD 35 million during the referenced fiscal year.

Global Consumer Preferences (Official Survey Data)

- About 60 percent of consumers prefer hypoallergenic or fragrance‑free personal care products, from official consumer preference reporting.

- Women’s personal care accounts for roughly 60 percent of industry revenue in official consumption surveys.

- Approximately 45 percent of consumers actively seek skincare tailored to their skin type or concerns, based on official consumer studies.

- E‑commerce use for personal care purchases increased by more than 20 percent in the latest consumer purchasing surveys.

- Men’s personal care segment has been growing at around 7 percent annually in official tracking data.

- Urban consumers are about 30 percent more likely to buy premium skin care, according to official consumer trend reports.

- Awareness and use of personalized skin care products increased by roughly 25 percent in recent years in official trend reporting.

- Clean beauty products represented over 35 percent of new skincare product introductions in official product launch data.

- Sixty‑seven percent of consumers express a preference for biodegradable packaging in skincare products based on official surveys.

- Demand for sensitive‑skin‑oriented products grew by about 15 percent in the latest official purchase statistics.

EU Cosmetics Regulation – Official Compliance Requirements (Government Regulation)

- Manufacturers in the European Union are required to maintain safety documentation for every cosmetic product sold in the EU.

- Under EU regulation, products must undergo safety assessments by qualified professionals before reaching consumers.

- EU authorities enforce regular testing to ensure product safety compliance across all member states.

Global Personalized Skin Care Products Market: Market Dynamic

Driving Factors in the Global Personalized Skin Care Products Market

Advancements in Diagnostic Technology & Data Science

The proliferation of affordable at-home testing (genetic, microbiome), high-resolution smartphone imaging, and sophisticated AI algorithms capable of analyzing complex skin datasets are the primary enablers. This technology democratizes access to precise skin insights previously available only in clinical settings, creating a data foundation for effective personalization.

Shift in Consumer Values: Efficacy, Individuality, and Control

Modern consumers, especially Millennials and Gen Z, prioritize products that deliver visible results ("skin-vestments"), express their individuality, and give them control over their ingredients and routines. They distrust generic marketing claims and seek transparent, evidence-based solutions tailored to their unique identity and concerns.

Restraints in the Global Personalized Skin Care Products Market

High Cost and Complexity of Delivery

Personalized products often involve small-batch production, expensive diagnostic tools, and complex logistics for on-demand formulation and delivery. This results in a significant price premium over mass-market products, limiting accessibility to affluent, early-adopter consumers.

Data Privacy, Security, and Ethical Concerns

The collection and use of highly sensitive biometric and genetic data raise serious concerns about privacy, potential misuse, and cybersecurity. Regulatory frameworks like GDPR are stringent, and consumer trust is fragile. Ensuring ethical data practices and transparent algorithms is a significant challenge for brands.

Opportunities in the Global Personalized Skin Care Products Market

Expansion into Men's Skincare and Underserved Demographics

The men's grooming market remains under-penetrated by sophisticated personalization. Similarly, opportunities exist to create inclusive algorithms and formulations for a wider diversity of skin tones, types (e.g., highly sensitive, mature), and cultural beauty norms, addressing significant unmet needs.

Integration with Broader Health, Wellness, and Nutrition Ecosystems

Personalized skincare can integrate with nutrigenomics, sleep trackers, and stress monitors to offer holistic "inside-out" beauty solutions. Partnerships with wellness apps, fitness brands, and functional nutrition companies can create comprehensive lifestyle-based personalization platforms.

Trends in the Global Personalized Skin Care Products Market

"Skin Streaming" and Minimalist, High-Precision Routines

The trend is moving away from 10-step routines towards "skin streaming" curating a minimal number of highly potent, perfectly matched products that address core concerns efficiently. Personalization is key to identifying these exact product matches, reducing clutter, cost, and potential irritation.

Hyper-Transparency and "Ingredient Sovereignty"

Consumers demand full visibility into ingredient sourcing, formulation logic, and the science behind their personalization. Brands are responding with blockchain-enabled supply chain tracking, open-source algorithm audits, and educational content that explains why each ingredient was chosen for the individual.

Global Personalized Skin Care Products Market: Research Scope and Analysis

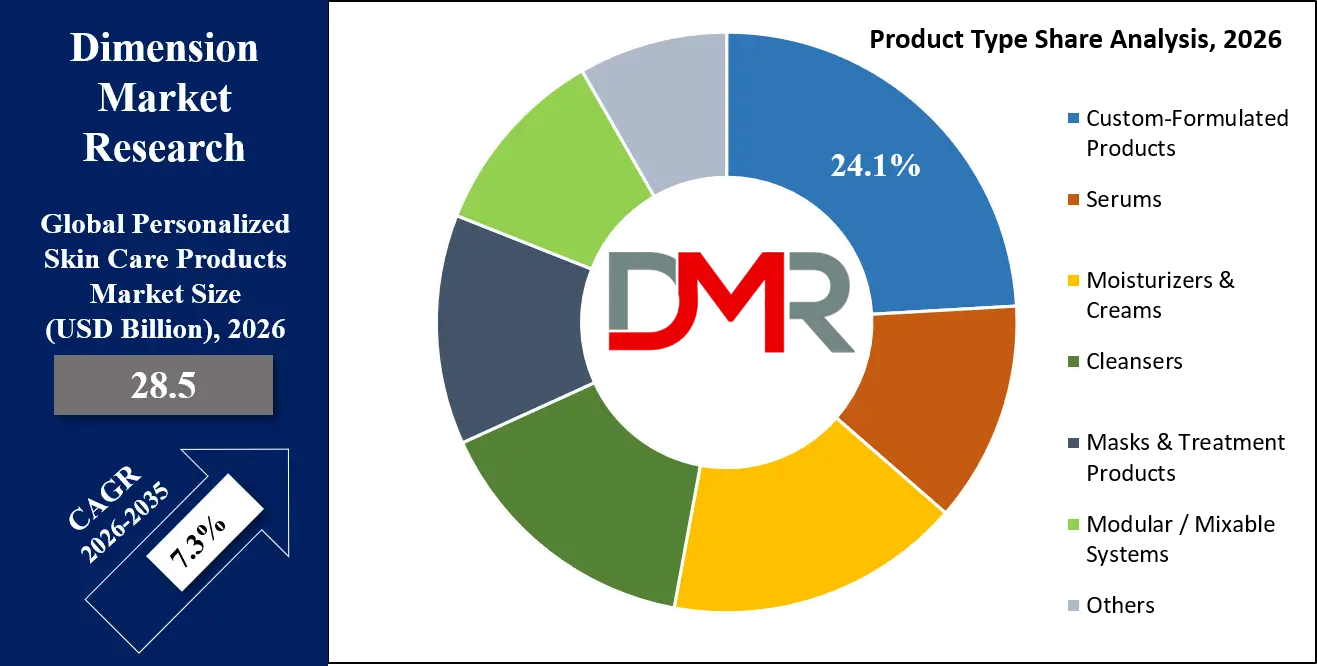

By Product Type Analysis

In the personalized skin care market, custom-formulated products and serums are projected to dominate due to their alignment with the core principle of personalization: delivering targeted solutions for individual skin concerns. Custom-formulated products are highly appealing to digitally native and premium consumers because they offer tailored ingredient combinations based on lifestyle, environmental factors, and precise skin diagnostics.

These products are often distributed through direct-to-consumer channels or subscription services, which strengthen brand engagement, improve customer retention, and extend lifetime value. Their adoption is further bolstered by consumer willingness to pay a premium for products that promise measurable, visible results.

Serums capture a significant share as well, driven by their high-efficacy, concentrated formulations that can be personalized with active ingredients such as retinol, peptides, antioxidants, and niacinamide. Their flexibility allows brands to fine-tune solutions for specific skin concerns, making serums one of the most versatile formats in personalization strategies.

Moisturizers and creams follow closely due to their essential daily use and widespread acceptance. While personalization in this category is often lighter than in serums, customized textures, hydration levels, and functional ingredients help maintain strong volume sales. Cleansers and masks are complementary offerings, with personalization focused mainly on skin type and sensitivity rather than complex formulations. Modular or mixable systems are emerging but remain niche, typically targeting early adopters and premium buyers.

Overall, leave-on, high-efficacy products dominate the market, as consumers perceive personalized skin care as solutions that deliver tangible, results-driven benefits rather than basic cleansing or maintenance functions. This preference reinforces the strategic importance of serums and custom formulations for brand positioning in this space.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Skin Type Analysis

Combination and sensitive skin types are expected to dominate demand in the personalized skin care market, as consumers with these skin types often struggle to find effective solutions in mass-market offerings. Combination skin requires multi-functional products that balance oil control, hydration, and texture, making it an ideal candidate for personalized solutions. Brands leverage diagnostic tools, surveys, and AI-powered analysis to adjust ingredient ratios, formulations, and textures to address the nuanced needs of combination skin, enhancing efficacy and reducing trial-and-error purchasing.

Sensitive skin represents a rapidly expanding segment, driven by rising awareness of skin barrier health, ingredient transparency, and the risks posed by pollution, harsh actives, and environmental stressors. Consumers with sensitive skin are more likely to adopt personalized routines because tailored formulations reduce irritation and enhance comfort, encouraging higher spending and brand loyalty.

Dry skin maintains a stable presence, particularly in colder climates and among aging populations, where personalized hydration, lipid replenishment, and barrier repair are highly valued. Products targeting dry skin often emphasize emollients, humectants, and soothing botanicals, making personalization a critical differentiator in consumer satisfaction.

Oily and normal skin types are less dominant, as conventional products often suffice for these users. Personalization for these segments tends to be more limited, focusing on maintenance, oil regulation, or minor skin tone adjustments rather than intensive customization.

Overall, the market demonstrates that consumers with complex, reactive, or sensitive skin drive the largest share of personalization demand, positioning this category as a problem-solving, rather than convenience-focused, segment in the broader skin care industry.

By Personalization Technology Analysis

In personalized skin care, AI and machine learning–based analysis are poised to dominate technology adoption, providing scalable, data-driven solutions without requiring clinical infrastructure. AI platforms integrate inputs such as user questionnaires, selfies, environmental data, and behavioral information to deliver real-time product recommendations, making them central to direct-to-consumer (DTC) and subscription-based models. These systems allow brands to refine formulations iteratively, track consumer feedback, and adjust personalization parameters, ensuring a high degree of efficacy and consumer satisfaction.

Digital questionnaires and surveys remain widely used, especially for early-stage or cost-sensitive personalization offerings. They are effective for mass adoption, providing sufficient accuracy for many users, and are often integrated into AI or app-based platforms to enhance engagement.

Mobile app based skin assessments are growing rapidly, leveraging smartphone cameras and AI image processing to provide consumers with visual feedback and personalized recommendations. These tools increase engagement, encourage repeat interactions, and complement other AI-driven personalization methods, although they rarely replace the core analytical engine.

Home skin test kits and DNA/biomarker-based analysis represent premium, niche technologies. They provide high scientific credibility and precise personalization but face adoption barriers due to cost, logistical complexity, and regulatory oversight.

Overall, the market shows that software-driven, scalable technologies dominate, while hardware- and biology-dependent methods are secondary, primarily supporting premium and niche segments. AI platforms, digital surveys, and mobile apps are becoming the backbone of personalized skin care, enabling brands to efficiently scale solutions while maintaining accuracy, engagement, and consumer satisfaction.

By Distribution Channel Analysis

Direct-to-consumer (DTC) online platforms are expected to dominate distribution for personalized skin care products because they allow brands to capture consumer data, manage customization workflows, and maintain ongoing interactions essential for personalization. DTC models facilitate direct control over diagnostics, formulation adjustments, pricing, and customer education, ensuring a higher level of engagement and brand loyalty. Subscription-based models reinforce this dominance by providing replenishment of personalized products, improving retention, and allowing brands to refine product formulations using customer feedback over time.

Clinics, spas, and medical aesthetic centers dominate the clinical-grade and DNA-based personalization niche, benefiting from professional trust, expert consultation, and diagnostic credibility. However, their scale is limited due to operational and geographical constraints.

Retail stores and e-commerce marketplaces are secondary channels, offering semi-personalized or quiz-driven products rather than fully customized formulations. These channels are important for brand visibility and accessibility but lack the capability for full personalization workflows.

Overall, digitally native, owned channels dominate, as personalized skin care relies heavily on data collection, consumer engagement, and iterative product refinement. Brands that can control the end-to-end personalization journey through DTC platforms are best positioned to capture market share, drive consumer loyalty, and expand adoption in both premium and mainstream segments.

By Application Analysis

Anti-aging and acne management are anticipated to dominate applications in personalized skin care, reflecting high consumer investment in solutions that deliver visible, tangible outcomes. Anti-aging products are especially popular among aging populations seeking wrinkle reduction, pigmentation control, and skin resilience. Personalized approaches allow brands to tailor active ingredients, concentrations, and delivery systems to maximize efficacy and consumer satisfaction.

Acne and blemish management is equally dominant, driven by both younger consumers and adults experiencing hormonal or stress-related breakouts. Personalization reduces irritation, improves targeted treatment efficacy, and encourages repeat purchases, strengthening brand loyalty.

Hyperpigmentation, hydration, and barrier repair represent secondary but strong segments, particularly in regions with high UV exposure, pollution, or dry climates. These categories benefit from precision formulations that combine multiple active ingredients and targeted delivery systems.

Sensitivity and redness relief is fast-growing, often bundled with other personalized treatments. Consumers in this segment increasingly demand gentle, functional products that address multiple skin concerns simultaneously.

Overall, applications that offer visible, persistent results dominate, reinforcing the positioning of personalized skin care as a precision-treatment category rather than a lifestyle or convenience product. Consumers are willing to pay a premium for measurable outcomes, driving adoption across these high-impact segments.

By End User Analysis

Women are projected to dominate the personalized skin care market, accounting for the largest share due to higher skincare awareness, routine complexity, and willingness to invest in premium solutions. Women are also more engaged with digital diagnostics, AI-based personalization tools, and subscription-based product models. The female segment drives innovation adoption and sets trends for personalization, influencing both product development and marketing strategies.

Men represent a fast-growing but secondary segment, primarily in urban and premium categories. Demand is driven by simplified personalized solutions, acne treatments, and anti-aging concerns. Male consumers increasingly seek products that deliver measurable results with minimal routine complexity, and brands are responding with tailored messaging and formats.

Unisex products are strategically important for inclusivity and broad market appeal, especially among younger consumers who prefer gender-neutral branding. However, unisex products currently occupy a smaller market share compared with female-focused offerings.

Overall, female consumers remain the primary demand driver, while male and unisex segments contribute incremental growth. Brands that effectively engage women through personalization platforms, education, and subscription models are best positioned to maximize adoption, loyalty, and revenue in the evolving personalized skin care market.

The Global Personalized Skin Care Products Market Report is segmented on the basis of the following:

By Product Type

- Custom-Formulated Products

- Serums

- Moisturizers & Creams

- Cleansers

- Masks & Treatment Products

- Modular / Mixable Systems

- Others

By Skin Type

- Combination

- Dry

- Oily

- Sensitive

- Normal

By Personalization Technology

- AI / Machine Learning–Based Analysis

- Digital Questionnaires & Surveys

- Mobile App–Based Skin Assessment

- Home Skin Test Kits

- DNA / Biomarker-Based Analysis

By Distribution Channel

- Direct-to-Consumer (DTC) Online Platforms

- Online Subscription Services

- Clinics, Spas & Medical Aesthetic Centers

- Retail Stores

- E-commerce Marketplaces

By Application

- Anti-Aging & Prevention

- Acne & Blemish Management

- Hyperpigmentation & Brightening

- Hydration & Barrier Repair

- Sensitivity & Redness Relief

- Others

By End User

Impact of Artificial Intelligence in the Global Personalized Skin Care Products Market

- Generative AI for Novel Formulation Discovery: AI models are being trained on vast datasets of ingredient chemistry, skin biology, and clinical outcomes to propose new, effective ingredient combinations for specific skin concerns, accelerating R&D for hyper-personalized actives.

- Computer Vision for Real-Time Skin Analysis: Smartphone apps using advanced computer vision can analyze user-submitted photos or video to track pore size, wrinkle progression, erythema (redness), hyperpigmentation spots, and hydration levels over time, providing dynamic feedback for regimen adjustment.

- Predictive Analytics for Demand Forecasting & Inventory: AI predicts regional trends in skin concerns (e.g., seasonal dryness, pollution effects) and individual customer refill cycles, optimizing small-batch production schedules, reducing waste, and ensuring timely delivery.

- Natural Language Processing (NLP) for Customer Insight Mining: NLP tools analyze thousands of customer reviews, chatbot interactions, and social media mentions to uncover unmet needs, emerging concerns, and sentiment toward ingredients, informing product development and personalization algorithms.

- AI-Driven Dynamic Pricing & Personalization Bundles: Algorithms can create personalized product bundles and dynamic pricing based on a customer's lifetime value, purchase history, and current skin regimen needs, maximizing conversion and average order value.

Global Personalized Skin Care Products Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to dominate this market as it holds 32.3% of the market share in 2026, because its market fundamentals are primed for leadership today. Europe dominates the personalized skin care products market due to a convergence of strong consumer sophistication, regulatory trust, and premium beauty heritage. European consumers display high awareness of ingredient safety, skin biology, and long-term skin health, which aligns naturally with personalized formulations that emphasize precision, transparency, and efficacy. The region’s strict cosmetic regulations and data-protection frameworks foster confidence in AI-driven diagnostics, skin assessments, and customized formulations, encouraging adoption of advanced personalization models.

Europe is also home to several global beauty leaders and dermatology-backed brands that actively invest in skin science, AI research, and sustainable formulation technologies. These companies leverage deep R&D ecosystems and clinical validation to scale personalization across both mass-premium and luxury segments. In addition, Europe’s aging population significantly fuels demand for customized anti-aging, barrier-repair, and pigmentation solutions, where personalization delivers measurable benefits over standardized products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific achieves the highest CAGR because it represents the world's most powerful convergence of digital adoption, beauty-conscious populations, and manufacturing innovation. The region is home to the world's largest e-commerce markets and populations deeply engaged with beauty content on social platforms (Douyin, Xiaohongshu, KakaoTalk). The influence of K-beauty's innovation and J-beauty's precision has primed consumers for sophisticated, multi-step, and ingredient-focused routines, making the leap to personalization a natural evolution.

The growth catalyst is the scale of digitally-native youth populations and the rapid rise of local beauty-tech champions in China, South Korea, and India. While North America's growth is driven by Silicon Valley tech, Asia-Pacific's is driven by super-app integration, live-stream commerce, and a relentless focus on product innovation and packaging.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Personalized Skin Care Products Market: Competitive Landscape

The competitive landscape is dynamic and stratified, characterized by collaboration between traditional beauty conglomerates, agile DTC startups, and technology firms.

Established Beauty & Personal Care companies like L'Oréal (via brands like Lancôme, La Roche-Posay, and acquisition of ModiFace), Estée Lauder, Shiseido, and Unilever leverage their vast R&D resources, global supply chains, and brand trust. Their strategy is to acquire or partner with tech startups and integrate personalization into their premium brand portfolios through devices (L'Oréal Perso), apps, and in-store diagnostic tech.

Digital-Native DTC Disruptors companies like Proven, Curology, Function of Beauty, and Atolla compete on algorithm sophistication, customer experience, and community engagement. They own the direct customer relationship and data, allowing for rapid, data-driven product iteration. Their focus is on scaling their diagnostic platforms and expanding into new skincare categories and demographics.

Technology & Diagnostic Platform Providers Firms like InsideTracker, Nutrigene, and Haut.AI provide the underlying AI, genetic testing, or skin analysis technology as a B2B service to larger brands seeking to enter personalization without building capabilities in-house. They compete on the accuracy, speed, and scalability of their diagnostic tools and data insights.

Specialist Medical & Clinical Brands Companies like SkinCeuticals (L'Oréal) and Dermalogica, often distributed through professional channels, are incorporating personalization via in-clinic diagnostic tools and tele-dermatology partnerships. They compete on clinical validation, professional endorsement, and efficacy for serious skin concerns.

The competitive battleground is shifting from a purely product-centric competition to a technology-and-data competition. Winning requires: superior and ethically-managed algorithms, seamless omnichannel diagnostic experiences (online + in-store), defensible IP around formulation logic, and building a trusted community around the brand. Mergers and acquisitions, like conglomerates buying DTC brands or tech firms, are ongoing as players strive to offer end-to-end personalized beauty ecosystems.

Some of the prominent players in the Global Personalized Skin Care Products Market are:

- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Unilever Plc

- Beiersdorf AG (Nivea)

- Procter & Gamble Co.

- Proven Skincare

- Curology

- Function of Beauty

- Atolla

- Skin Inc

- Drunk Elephant (Shiseido)

- DECIEM (The Ordinary, Niod)

- Nutrigene

- Haut.AI

- Amorepacific Corporation

- Kao Corporation

- Johnson & Johnson (Neutrogena)

- Olay (Procter & Gamble)

- Dermalogica

- Other Key Players

Recent Developments in the Global Personalized Skin Care Products Market

- February 2026: L'Oréal and 23andMe Announce Strategic Data Partnership. The collaboration aims to leverage 23andMe's anonymized genetic research database to discover new links between genotypes and skin aging phenotypes, informing next-generation DNA-based product development for L'Oréal's luxury brands.

- January 2026: Sephora Launches "Skin360" In-Store & App Ecosystem. The new service combines in-store augmented reality mirror analysis with at-home skin sensor data syncing, creating a unified profile that recommends products from both Sephora's assortment and exclusive personalized brands.

- December 2024: First AI-Formulated, Bioprinted Skin Serum Enters Clinical Trial. A biotech startup in collaboration with a major university completed phase I trials for a serum where actives are bioprinted in patterns matching the user's own skin microtopography, promising unprecedented absorption and targeting.

- November 2024: New GDPR-Compliant Framework for Beauty Data Launched by EU Consortium. A group of European brands, tech firms, and regulators published a code of conduct for the ethical collection, use, and storage of biometric skin data, aiming to standardize privacy practices and boost consumer trust.

- October 2024: Function of Beauty Expands into Personalized Men's Grooming. The DTC leader launched a new vertical offering personalized shampoos, conditioners, and facial moisturizers for men, using a simplified diagnostic focused on scalp health, beard care, and lifestyle factors.

- September 2024: Amorepacific Invests USD 500M in Personalized Beauty Tech R&D Center. The South Korean giant announced a major investment to build a facility dedicated to integrating AI, genomics, and traditional Korean herbal medicine (Hanbang) for the development of culturally-attuned personalized skincare.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28.5 Bn |

| Forecast Value (2034) |

USD 53.6 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 6.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Custom-Formulated Products, Serums, Moisturizers & Creams, Cleansers, Masks & Treatment Products, Modular/Mixable Systems, And Others), By Skin Type (Combination, Dry, Oily, Sensitive, And Normal), By Personalization Technology (AI/ML-Based Analysis, Digital Questionnaires & Surveys, Mobile App-Based Skin Assessment, Home Skin Test Kits, And DNA/Biomarker-Based Analysis), By Distribution Channel (Direct-To-Consumer Online Platforms, Online Subscription Services, Clinics/Spas/Medical Aesthetic Centers, Retail Stores, And E-Commerce Marketplaces), By Application (Anti-Aging & Prevention, Acne & Blemish Management, Hyperpigmentation & Brightening, Hydration & Barrier Repair, Sensitivity & Redness Relief, And Others), And By End User (Women, Men, And Unisex)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

L’Oréal S.A., The Estée Lauder Companies Inc., Shiseido Company, Limited, Unilever Plc, Beiersdorf AG (Nivea), Procter & Gamble Co., Proven Skincare, Curology, Function of Beauty, Atolla, Skin Inc, Drunk Elephant (Shiseido), DECIEM (The Ordinary, NIOD), Nutrigena, Haut.AI, Amorepacific Corporation, Kao Corporation, Johnson & Johnson (Neutrogena), Olay (Procter & Gamble), and Dermalogica, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Personalized Skin Care Products Market?

▾ The Global Personalized Skin Care Products Market size is estimated to have a value of USD 28.5 billion in 2026 and is expected to reach USD 53.6 billion by the end of 2035.

What is the growth rate in the Global Personalized Skin Care Products Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2026 to 2035.

What is the size of the US Personalized Skin Care Products Market?

▾ The US Personalized Skin Care Products Market is projected to be valued at USD 6.2 billion in 2026. It is expected to reach USD 11.3 billion in 2035, growing at a CAGR of 6.9%.

Which region accounted for the largest Global Personalized Skin Care Products Market?

▾ Europe is expected to have the largest market share in the Global Personalized Skin Care Products Market, driven by high consumer spending, tech adoption, and a strong DTC brand ecosystem.

Who are the key players in the Global Personalized Skin Care Products Market?

▾ Some of the major key players in the Global Personalized Skin Care Products Market are L'Oréal S.A., The Estée Lauder Companies Inc., Proven Skincare, Curology, Function of Beauty, Shiseido Company, Limited, and Unilever Plc, among others.