Overview

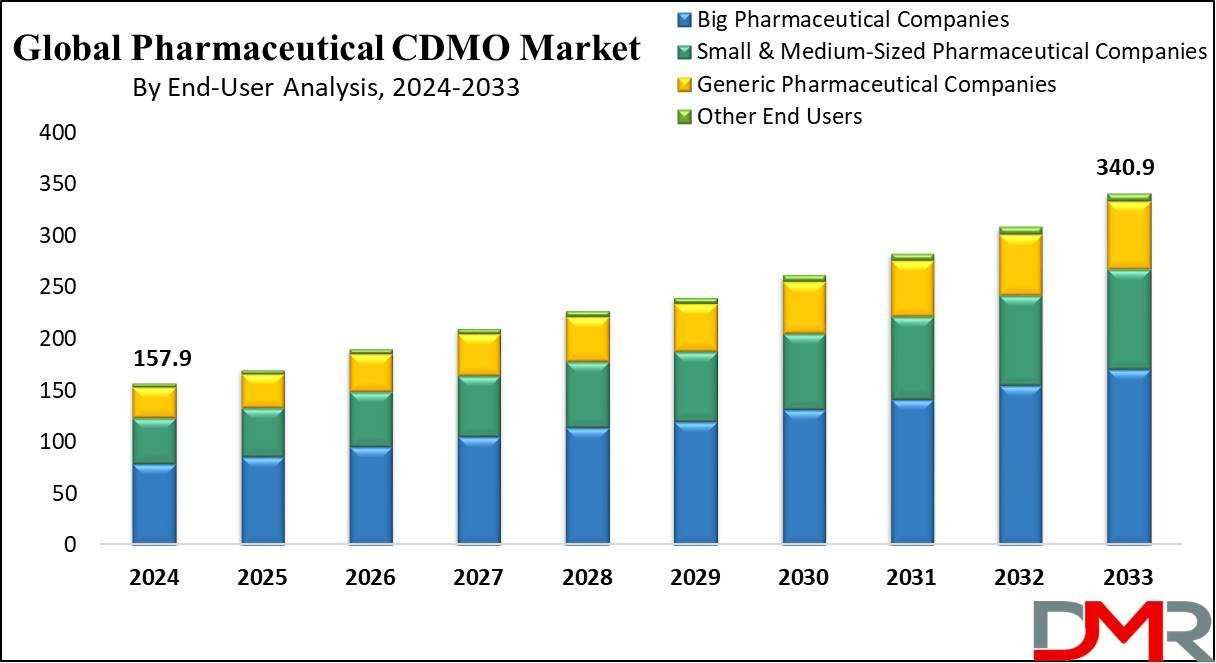

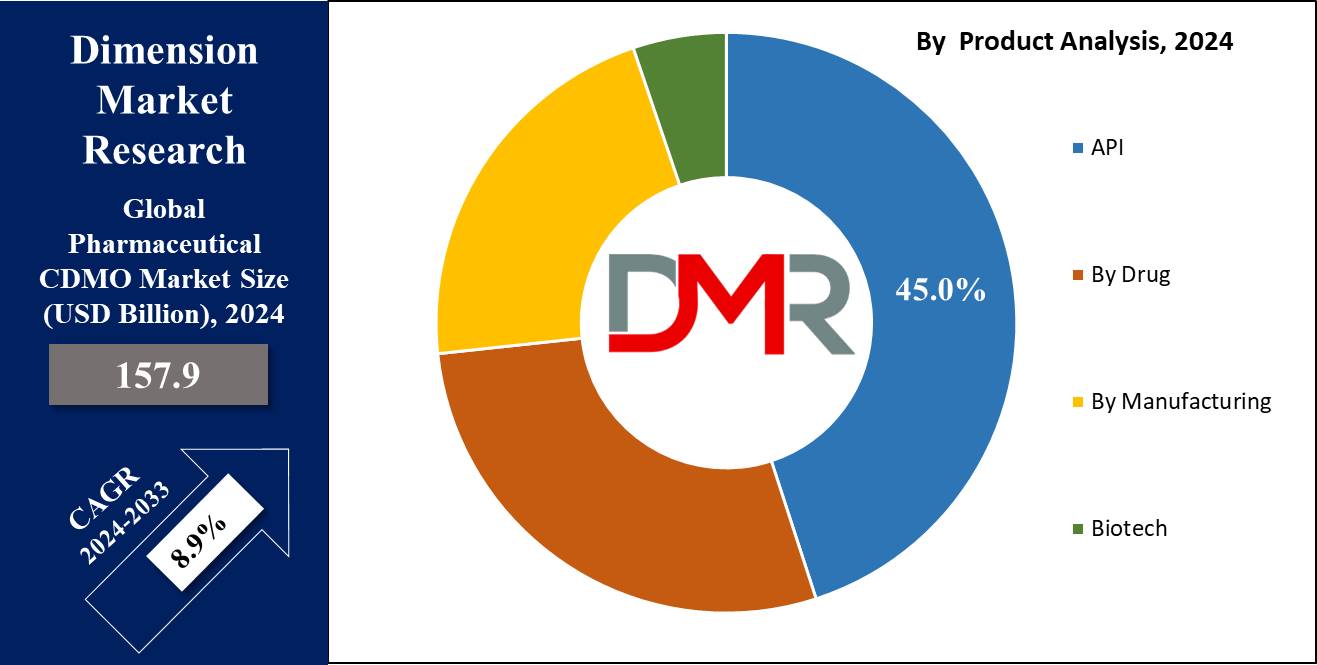

The Global Pharmaceutical CDMO Market size is estimated to reach USD 157.9 billion in 2024 and is further anticipated to value USD 340.9 billion by 2033, at a CAGR of 8.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The pharmaceutical CDMO market is experiencing rapid expansion due to a variety of key factors, including an increasing use of generic drugs, advances in CMO (Contract Manufacturing Organization) technologies, the high cost of in-house drug discovery, regulatory filings by CMOs and AI in drug development and manufacturing as major innovations.

For example, Lonza introduced their AI-powered Route Scouting Service using Elsevier AI's Reaxys platform in April 2024 for expediting artificial routes identification for new APIs by combining chemical supply chain expertise with advanced AI tools.

Though advancements exist, the market still faces numerous hurdles to growth due to tight regulatory frameworks that restrict growth. AI's predictive analytics are revolutionizing supply chain management by optimizing production schedules, inventory levels and clinical trials; improving candidate selection processes by aiding with outcome prediction, monitoring patient compliance and cost reduction which ultimately lowers trial failure rates while increasing success rates and success rates for trials.

AI integration is revolutionizing pharmaceutical contract manufacturing by improving efficiency while guaranteeing product quality and shortening development timelines.

This market plays an invaluable role in expanding production, complying with regulatory requirements, and offering expertise in formulation and large-scale production. Focusing on innovation and cost effectiveness, CDMO (Contract Development and Manufacturing Organization) sector plays a key role in meeting the dynamic demands of global pharmaceutical industry.

Global distribution of clinical trials is also driving market expansion. Trials are increasingly conducted worldwide due to factors like disease prevalence, regulatory requirements, healthcare infrastructure development, and cost efficiency. By February 2024, over half of registered clinical trials had taken place outside the U.S. while 35% remained exclusively within its borders - reflecting growing international cooperation in medical research.

Key Takeaways

- Market Size & Share: Global Pharmaceutical CDMO Market size is estimated to reach USD 157.9 billion in 2024 and is further anticipated to value USD 340.9 billion by 2033, at a CAGR of 8.6%.

- Product Analysis: In 2023, API (Active Pharmaceutical Ingredient) manufacturing held approximately 45% of the Pharmaceutical CDMO Market share.

- Drug Analysis: Pharmaceutical Contract Development and Manufacturing Organization (CDMO) Market research indicates that, by 2023, oral solid dose forms held approximately 38% market share.

- Dosage Form Analysis: Solid Dose Formulation was the market leader in 2023 among Pharmaceutical CDMO (Contract Development and Manufacturing Organization) Market segments, accounting for roughly 40% market share.

- Indication Analysis: Cancer drugs accounted for 35% of market revenue in 2023.

- End-User Analysis: Big Pharmaceutical Companies dominated in 2023, capturing approximately 50% of the market share.

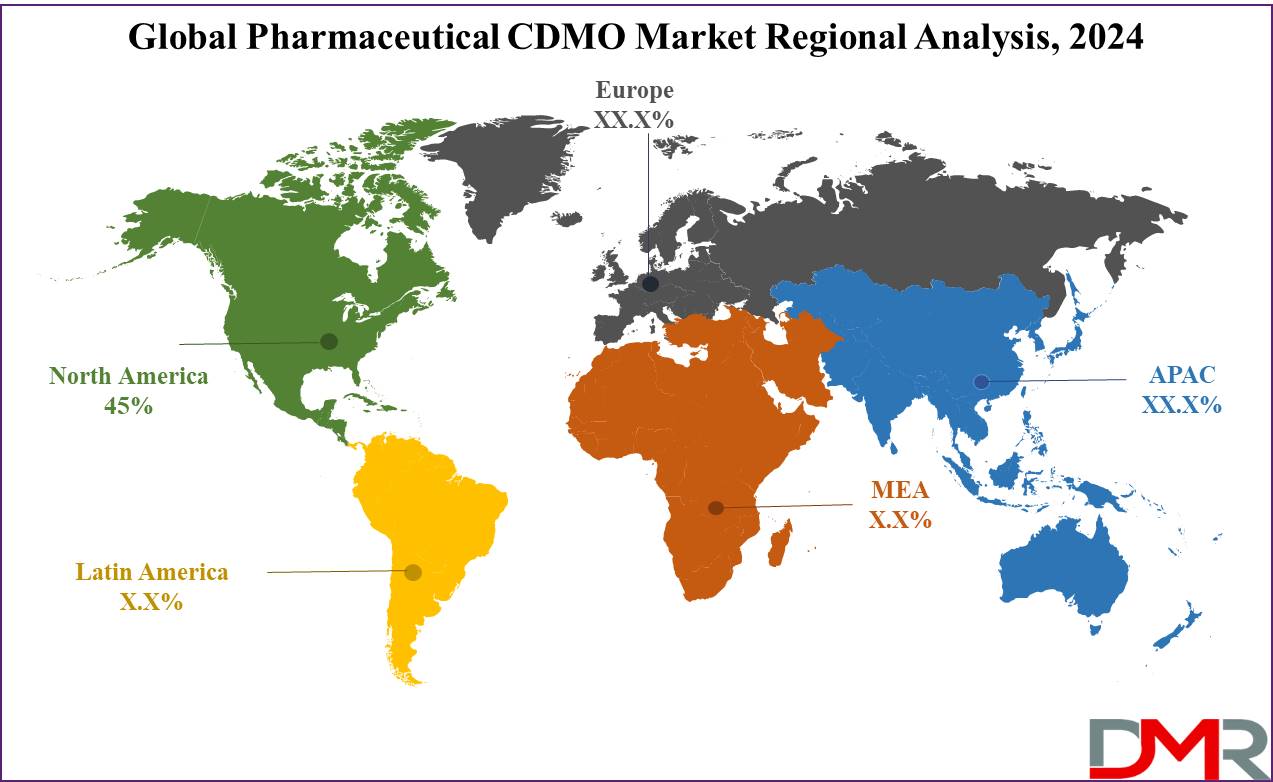

- Regional Analysis: North America emerged as the dominant region in the Pharmaceutical Contract Development and Manufacturing Organization (CDMO) Market, accounting for approximately 45% of global market share.

Use Cases

- Drug Development and Formulation: Pharmaceutical companies often outsource drug formulation development to Contract Development Manufacturing Organizations (CDMOs). CDMOs possess expertise in optimizing drug forms (e.g. tablets, capsules or injectables) so as to meet regulatory and quality standards before commercial production begins.

- Clinical Trial Material Production: Contract Development and Manufacturing Organizations (CDMOs) are often relied upon for producing small batches of drugs for clinical trials, from active pharmaceutical ingredients (APIs) and finished dosages to be used during Phase I, II, and III trials allowing pharmaceutical companies to focus more on research and data collection.

- Large-Scale Commercial Manufacturing: Once a drug receives regulatory approval, CDMOs can scale up production for mass distribution. They offer advanced manufacturing capabilities - including sterile manufacturing for biologics - so the drug can be produced efficiently at commercial level.

- Supply Chain and Logistics Management: CDMOs specialize in managing complex supply chains for pharmaceutical firms, from procuring raw materials and managing inventory to packaging, labeling and distribution coordination - helping pharmaceutical firms reduce operational costs while remaining focused on innovation.

- Regulatory and Compliance Support: CDMOs provide comprehensive regulatory and compliance support services, including documentation, auditing and adhering to Good Manufacturing Practices (GMP). This helps pharmaceutical companies navigate global regulatory requirements, ensuring their products adhere to safety and efficacy standards across markets.

Report Dynamics

Driver: Outsourcing for Cost Efficiency and Focus on Core Competencies

One key driver for the Pharmaceutical CDMO Market is the increased outsourcing of drug development and manufacturing processes. Pharmaceutical companies are turning to CDMOs to reduce costs and focus on innovation. By outsourcing, companies gain access to advanced technologies, expertise in regulatory compliance, and scalable production without heavy investments in infrastructure.

This also speeds up the time-to-market for new drugs. Particularly for small and mid-sized pharmaceutical firms, CDMOs are essential partners that handle manufacturing complexities, allowing them to focus on core competencies like research and drug discovery.

Trend: Rising Demand for Biologics and Advanced Therapies

A major trend in the Pharmaceutical CDMO Market is the growing demand for biologics and advanced therapies such as gene therapy, cell therapy, and personalized medicine. As the industry shifts towards more complex, targeted treatments, CDMOs are expanding their capabilities to support biologics development and manufacturing.

This trend is driven by the rising prevalence of chronic diseases like cancer and autoimmune disorders, pushing pharmaceutical companies to invest more in biologics. CDMOs with expertise in biologics and advanced therapies are in high demand due to their specialized knowledge and manufacturing capabilities.

Restraint: Regulatory Complexities and Compliance Challenges

A key restraint in the Pharmaceutical CDMO Market is the regulatory complexity involved in drug manufacturing. CDMOs must comply with strict global regulations governing drug development, quality control, and manufacturing practices.

Navigating various international regulations, such as those from the U.S. FDA or the European Medicines Agency (EMA), can be time-consuming and expensive. Non-compliance can lead to significant delays or even product recalls, increasing operational risks for CDMOs. These regulatory challenges can slow the expansion of CDMOs into new markets and limit growth opportunities.

Opportunity: Expansion into Emerging Markets

The Pharmaceutical CDMO Market has significant opportunities for growth in emerging markets like China, India, and Brazil. These regions are seeing rising demand for pharmaceutical products due to growing populations and increasing chronic diseases. Pharmaceutical companies are seeking CDMOs to establish local manufacturing facilities, ensuring a robust supply chain and reducing costs.

The regulatory environment in many of these emerging markets is also becoming more favorable, making it easier for CDMOs to enter and expand. This presents a major growth opportunity for CDMOs looking to capitalize on the pharmaceutical boom in these regions.

Research Scope and Analysis

Product Analysis

In 2023, API (Active Pharmaceutical Ingredient) manufacturing held approximately 45% of the Pharmaceutical CDMO Market share. This trend can be explained by rising chronic disease prevalence rates as well as innovative drug formulation needs driving API demand. Meanwhile, drug product segments including oral solids, injectables and liquids played significant roles but were far behind API manufacturing in terms of market dominance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Small molecule manufacturing remains the predominant approach in both generic and brand pharmaceutical production, but biotech manufacturing (especially for biologics and biosimilars ) has recently gained considerable momentum due to advances in personalized medicine and complex biologic drugs.

With technology rapidly developing and therapeutic demands shifting, however, biotech may become the leader. The future looks bright for biotech drugs & specialized APIs as more attention is drawn toward them in future years.

Drug Analysis

Pharmaceutical Contract Development and Manufacturing Organization (CDMO) Market research indicates that, by 2023, oral solid dose forms held approximately 38% market share. Oral solid dosage forms, such as tablets and capsules are highly sought after due to their ease of administration, stability and cost-effectiveness - thus making them the go-to form for CDMO services.

Liquid Dose products such as syrups, solutions and injectables follow closely behind oral and liquid formulations in terms of market share. Biologic treatments often rely on injectable medications, while semi-solid dosing methods like creams gels and ointments hold lesser market shares than oral and liquid formulations.

Other dosage forms, including transdermal patches and inhalables, represent a small but rapidly expanding segment of the market due to increased interest in innovative drug delivery systems. Oral solid doses remain dominant due to their widespread usage in various therapeutic areas and global demand.

Dosage Form Analysis

Solid Dose Formulation was the market leader in 2023 among Pharmaceutical CDMO (Contract Development and Manufacturing Organization) Market segments, accounting for roughly 40% market share. Solid dosage forms like tablets and capsules are highly preferred due to their stability, patient compliance, cost effectiveness and wide use in treating chronic disease treatments - thus making them the ideal candidate for outsourcing pharmaceutical contracts.

Liquid Dose Formulation, including injectables, syrups and solutions is the second-largest segment. This growth is being fuelled by an increase in demand for injectable biologics, vaccines and other liquid treatments within healthcare.

Semi-Solid Dose Formulations include creams, ointments and gels formulated for topical treatments in dermatology. Meanwhile, gas dosing products (inhalable products) remain niche but growing, particularly due to innovations in respiratory therapy; but solid dose formulations remain the industry standard due to their wide applications and cost-efficiency.

Indication Analysis

Cancer drugs accounted for 35% of market revenue in 2023 in terms of Contract Development and Manufacturing Organization (CDMO) sales, driven by rising incidence worldwide and demand for complex therapies like biologics, targeted drugs and personalized treatments - driving this segment's prominence within this market. Oncology drugs require special production capabilities which are often outsourced to CDMOs due to their expertise and scalability.

The Cardiovascular Disease segment is propelled by the global burden of heart diseases and ongoing demand for both generic and novel cardiovascular drugs. Diabetes and Pain Management segments are also significant but have smaller market shares due to an increasing need for innovative delivery systems and chronic disease management solutions.

The Respiratory Disease segment, including treatments for conditions such as asthma and COPD, has seen increasing attention post-pandemic. Cancer remains the largest indication segment due to its need for advanced pharmaceutical development and manufacturing capabilities.

End-User Analysis

In the Pharmaceutical CDMO (Contract Development and Manufacturing Organization) Market, Big Pharmaceutical Companies dominated in 2023, capturing approximately 50% of the market share. These large enterprises frequently outsource their manufacturing needs to CDMOs to enhance operational efficiency, reduce costs, and focus on research and development. Their demand for high-quality and scalable manufacturing solutions drives substantial business to CDMOs.

The Small and Medium-Sized Pharmaceutical Companies segment follows, accounting for around 30% of the market. These companies rely heavily on CDMOs to access advanced manufacturing technologies and expertise that they may not have in-house, enabling them to bring innovative therapies to market more rapidly. Generic Pharmaceutical Companies also represent a significant portion of the market, focusing on cost-effective manufacturing solutions to compete effectively.

The Other End Users category includes biotech firms and research institutions, which collectively hold the remaining market share. However, the strong reliance of big pharmaceutical companies on CDMOs for outsourcing remains the leading factor in shaping the market dynamics.

The Global Pharmaceutical CDMO Market Report is segmented based on the following:

By Product

- API

- By Synthetic

- Solid

- Liquid

- By Type

- Traditional Active Pharmaceutical Ingredient (Traditional API)

- Highly Potent Active Pharmaceutical Ingredient (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

- By Drug

- By Manufacturing

- Continuous manufacturing

- Batch manufacturing

- Biotech

By Drug Product

- Oral Solid Dose

- Semi-solid dose

- Liquid Dose

- Others

By Dosage Form

- Solid

- Semi-Solid

- Liquid Dose Formulation

- Injectables

- Sterile Vials

- Single Use/Single Dose

- Multi-Use

- Ampules

- Prefilled Syringes

- Suspension

- Emulsion

- Gas Dose Formulation

By Indication

-

- Cancer

- Cardiovascular Disease

- Diabetes

- Pain

- Respiratory disease

- Other Disease

By End-User

- Big Pharmaceutical Companies

- Small & Medium-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users

Regional Analysis

North America emerged as the dominant region in the Pharmaceutical Contract Development and Manufacturing Organization (CDMO) Market, accounting for approximately 45% of global market share. This dominance can be attributed to major pharmaceutical companies' presence, active R&D activities, well-developed healthcare infrastructure and advanced manufacturing technologies combined with strong regulatory frameworks that enhance CDMO services' appeal.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe accounts for around 30% of market share, driven by robust pharmaceutical innovation and an expanding focus on biologics. Asia-Pacific is rapidly growing due to rising demand for cost-effective manufacturing solutions.

By Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Pharmaceutical CDMO Market players include several key players that specialize in various services like drug development, manufacturing and analytical testing. Leveraging advanced technology they employ various strategies to increase process efficiencies while remaining compliant. Biologics and complex formulations have become a driving force of expansion for firms as they expand capabilities to meet growing demands for innovative therapies.

Strategic partnerships, mergers, and acquisitions are popular means of expanding market presence and broadening service portfolios. Furthermore, placing strong emphasis on quality assurance and customer-centric solutions is imperative to remaining competitive in today's ever-evolving landscape.

Some of the prominent players in the global Pharmaceutical CDMO Market are:

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Samsung Biologics

- Laboratory Corporation of America Holdings

- Siegfried Holding Ag

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Piramal Pharma Solutions

- Cordenpharma International

- Cambrex Corporation

- Wuxi Apptec

Recent Development

- Bushu Pharmaceuticals Ltd.September 2023 - Bushu Pharmaceuticals Ltd. announced its acquisition of a small biotechnology firm specializing in innovative drug delivery systems. This strategic move aims to enhance Bushu's capabilities in the growing field of complex biologics and improve their offerings in the pharmaceutical contract manufacturing sector.

- Nipro Corporation August 2023 - Nipro Corporation launched a new line of advanced pre-filled syringes designed for biologics and vaccines. This product features enhanced stability and ease of use, aiming to meet the increasing demand for efficient drug delivery solutions within the Pharmaceutical CDMO sector.

- Thermo Fisher Scientific Inc. October 2023 - Thermo Fisher Scientific Inc. completed its merger with a prominent European CDMO, expanding its global footprint and enhancing its service capabilities in biomanufacturing. This merger is expected to accelerate innovation and improve efficiency across their integrated service offerings in the pharmaceutical sector.

- Samsung Biologics July 2023- Samsung Biologics announced the launch of a new cell culture media product aimed at streamlining the production of biologics. This innovative solution enhances yield and quality, positioning Samsung as a key player in the pharmaceutical CDMO market, particularly for biotech companies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 157.9 Bn |

| Forecast Value (2033) |

USD 340.9 Bn |

| CAGR (2024-2033) |

8.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (API, By Synthetic, Solid, Liquid, By Type, Traditional Active Pharmaceutical Ingredient (Traditional API), Highly Potent Active Pharmaceutical Ingredient (HP-API), Antibody Drug Conjugate (ADC), Others) By Drug (Innovative, Generics) By Manufacturing, Continuous manufacturing, Batch manufacturing, Biotech) By Drug Product (Oral Solid Dose, Semi-solid dose, Liquid Dose, Others) By Dosage Form (Solid, Tablets, Capsules, Powder, Semi-Solid, Cream, Paste, Gel, Liquid Dose Formulation, Injectables, Sterile Vials, Single Use/Single Dose, Multi-Use, Ampules, Prefilled Syringes, Suspension, Emulsion, Gas Dose Formulation, Inhaler, Aerosols) By Indication (Cancer, Cardiovascular Disease, Diabetes, Pain, Respiratory disease, Other Disease) By End-User (Big Pharmaceutical Companies, Small & Medium-Sized Pharmaceutical Companies, Generic Pharmaceutical Companies, Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Bushu Pharmaceuticals Ltd., Nipro Corporation, Thermo Fisher Scientific Inc., Samsung Biologics, Laboratory Corporation of America Holdings, Siegfried Holding Ag, Catalent, Inc, Lonza Group AG, Recipharm Ab, Piramal Pharma Solutions, Cordenpharma International, Cambrex Corporation, Wuxi Apptec |

| |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |