Market Overview

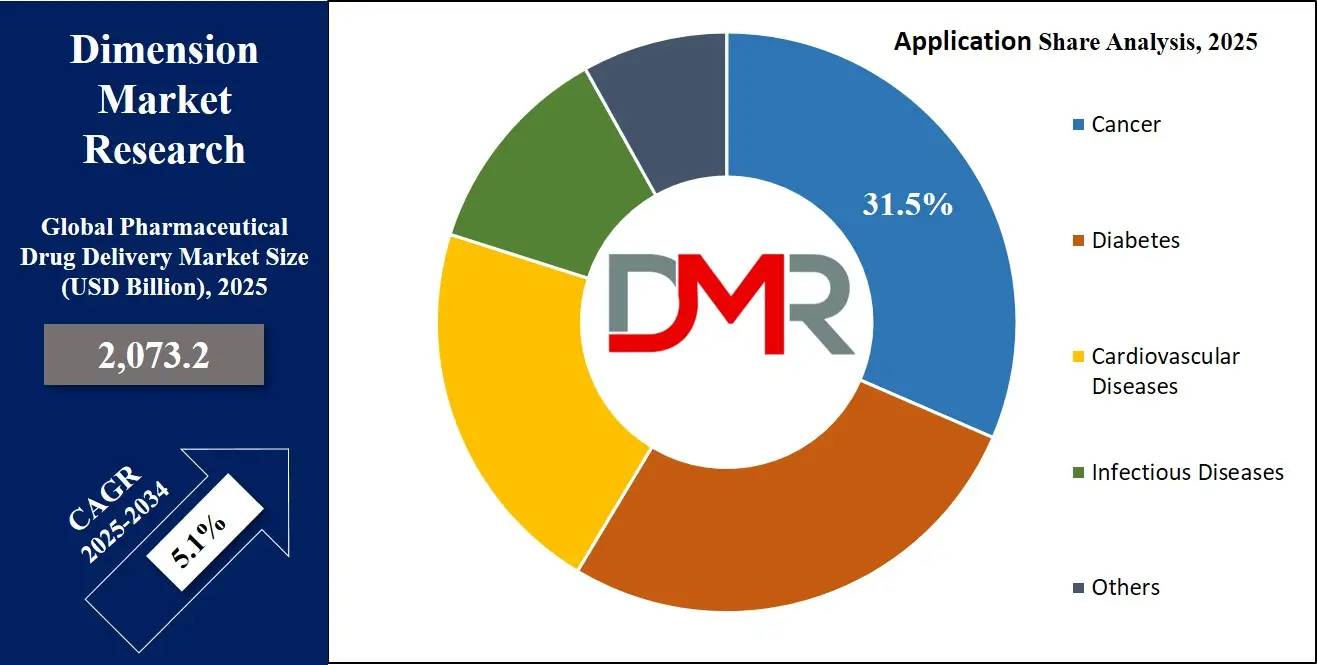

The Global Pharmaceutical Drug Delivery Market is projected to reach

USD 2,073.2 billion in 2025 and grow at a compound annual growth rate of

5.1% from there until 2034 to reach a value of

USD 3,241.4 billion.

Pharmaceutical drug delivery refers to the methods, processes, and systems used for administering pharmaceutical medicines into the body for therapeutic effects, which can take many forms, from swallowing pills or injections of liquid medication through swallowing pills or injections or applying patches or inhalers. Drug delivery ensures medicines reach their targets with sufficient amounts at their intended destinations, thus making treatment comfortable and hassle-free. Drug delivery plays an important role in how effective, long-lasting, safe, or even dangerous medication treatments may be for their respective patients.

Further, the demand for superior drug delivery systems has grown for various reasons. One is owing to a growth in the number of chronic diseases like diabetes, cancer, and heart problems requiring long-term treatments; more effective delivery systems could make these easier and more effective. Another factor is modern medicines containing biologic ingredients require advanced delivery systems to work effectively; additionally, patients are demanding treatments that are more comfortable, convenient, and less painful, thus allowing companies to develop novel forms of drug delivery technology.

Recent years have experienced several trends that are shaping drug delivery systems. Such an important trend is the creation of smart drug delivery systems that only release medication when necessary and nanotechnology, which allows very tiny particles to transport it directly to where it needs to go in the body. Furthermore, personalized medicine, where treatments are tailored mainly for individual patients, has also become more widespread, and companies are developing non-invasive delivery methods like skin patches and nasal sprays to make treatments simpler and more comfortable for their clients.

Recently, several key events have affected pharmaceutical drug delivery. As recent pandemic saw the accelerated development of mRNA vaccines that required special delivery systems to protect their fragile molecules until they reached cells within the body. New biologic therapies for cancer and autoimmune disorders led to innovations in delivery systems; there have also been breakthroughs with implantable devices that gradually release medicine over months or years, along with updates by regulatory agencies like FDA that promotes innovation within drug delivery technologies.

Pharmaceutical drug delivery creates many difficulties and opportunities simultaneously. One major challenge lies in making advanced delivery systems safe, affordable, and easy to produce at scale; another hurdle involves designing delivery methods for more sensitive drugs like gene therapies; on the other hand, wearable health devices have opened up new possibilities for drug delivery systems that integrate seamlessly with these devices; with further research companies can find even smarter and more effective means of getting medicine to their recipients.

Also, pharmaceutical drug delivery holds great promise. Researchers are exploring technologies like artificial intelligence and 3D printing to develop personalized drug delivery devices, while scientists research ways of harnessing natural processes like the immune system to administer medicine more efficiently. With a growing focus on patient-centric care, future drug delivery systems should make treatments effective, simple, painless, and tailored specifically to each person's needs. Pharmaceutical drug delivery will continue playing an essential part in improving healthcare around the world.

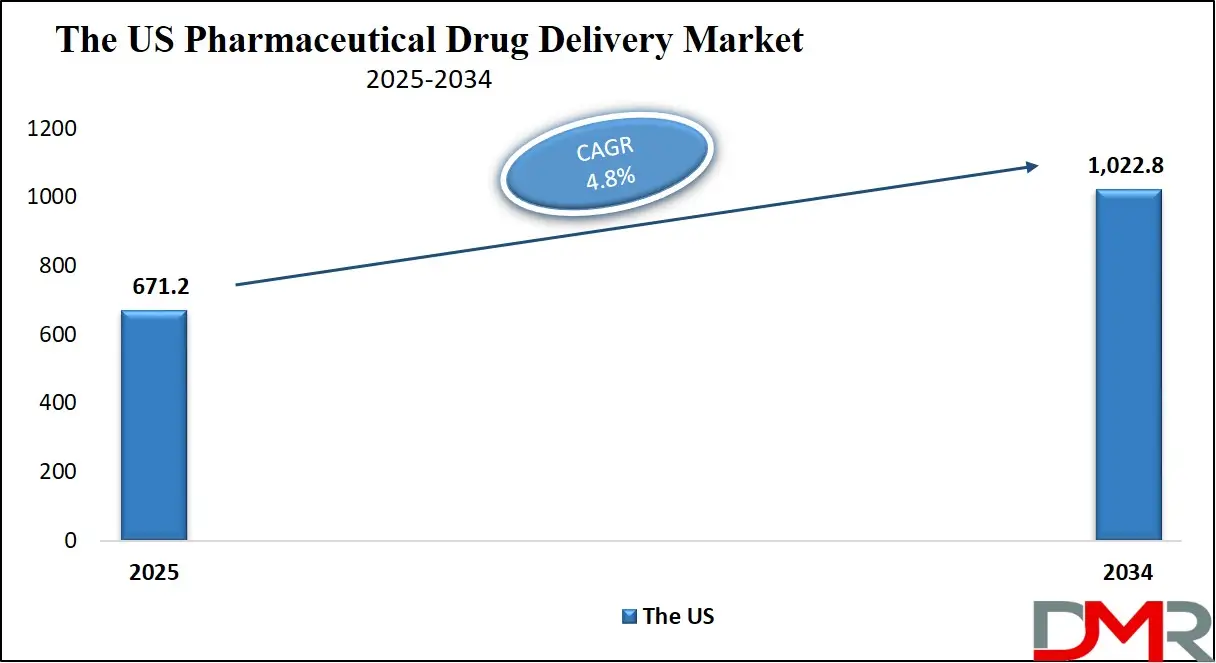

The US Pharmaceutical Drug Delivery Market

The US Pharmaceutical Drug Delivery Market is projected to reach USD 671.2 billion in 2025 at a compound annual growth rate of 4.8% over its forecast period.

The US pharmaceutical drug delivery market provides strong growth opportunities due to the growth in demand for personalized medicines, rapid advancements in drug delivery technologies, and a rise in focus on biologics and gene therapies. In addition, growing cases of chronic diseases and the presence of leading pharmaceutical companies investing in innovative delivery systems further fuel market expansion across the country.

Further, the market is driven by the rising prevalence of chronic diseases, the growing demand for advanced drug delivery systems, and strong investment in biologics and personalized medicine. However, the market faces restraints like strict regulatory approvals, high development costs, and product recalls due to safety concerns. Balancing innovation with regulatory compliance remains a key challenge for companies operating in this competitive and rapidly evolving market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Pharmaceutical Drug Delivery Market: Key Takeaways

- Market Growth: The Pharmaceutical Drug Delivery Market size is expected to grow by USD 1,073.6 billion, at a CAGR of 5.1%, during the forecasted period of 2026 to 2034.

- By Application: The Cancer segment is anticipated to get the majority share of the Pharmaceutical Drug Delivery Market in 2025.

- By End User: The Hospitals segment is expected to get the largest revenue share in 2025 in the Pharmaceutical Drug Delivery Market.

- Regional Insight: North America is expected to hold a 37.0% share of revenue in the Global Pharmaceutical Drug Delivery Market in 2025.

- Use Cases: Some of the use cases of Pharmaceutical Drug Delivery include oral drug delivery, injectable delivery, and more.

Pharmaceutical Drug Delivery Market: Use Cases

- Oral Drug Delivery: Tablets and capsules deliver medicine through the digestive system, making them the most common & convenient method for patients.

- Injectable Delivery: Injections are used for fast action or for medicines like vaccines & biologics that cannot survive the digestive tract.

- Targeted Cancer Treatment: Nanoparticles & liposomes help deliver chemotherapy directly to cancer cells, reducing damage to healthy tissues.

- Transdermal Patches: Patches placed on the skin deliver medicine slowly over time, useful for pain relief, hormone therapy, or nicotine replacement.

Stats & Facts

- According to the Ministry of Chemicals and Fertilizers (India), applications for clinical trials and new drugs must be processed within 90 days, while applications specifically for clinical trials related to new drug discovery or manufacturing in India must be decided within 30 days. If CDSCO does not respond within these timelines, the application is automatically approved. To support companies, pre-submission and post-submission meetings are allowed for discussing regulatory pathways. Special accelerated approvals are also available for drugs addressing unmet needs, orphan drugs, and rare diseases.

- For pharmaceutical exports, drugs must be produced under a valid manufacturing license as per the Drugs and Cosmetics Act and must comply with importing country regulations, as stated by the Ministry of Chemicals and Fertilizers. Meanwhile, DPIIT clarified that there are no specific intellectual property initiatives tailored for the pharmaceutical industry, although general IP-strengthening initiatives apply across all industries.

- According to IBEF, India has become a global medical tourism hub by providing affordable, technology-enabled treatments backed by government reforms. India also plays a crucial role as one of the world’s largest suppliers of low-cost vaccines and medicines, with its affordable HIV treatment becoming a global success story, further solidifying India’s reputation as the ‘Pharmacy of the World’.

- India’s pharmaceutical manufacturing costs are 30-35% lower than in the US and Europe, and R&D costs are about 87% lower than in developed markets, providing a significant cost advantage to the industry, according to IBEF.

- Further, India hosts the largest number of USFDA-approved pharmaceutical plants outside the US, with over 2,000 WHO-GMP compliant facilities and more than 10,500 manufacturing units, exporting medicines to over 150 countries.

- To strengthen domestic manufacturing, the Strengthening of Pharmaceutical Industry (SPI) scheme allocated INR 500 crore (USD 60.9 million) to help MSMEs and pharma clusters improve productivity, quality, and sustainability. Additionally, the PLI scheme with an outlay of INR. 15,000 crore (USD 2.04 billion), focusing on boosting manufacturing capacity, investment, and product diversification between 2020-21 and 2028-29.

- The Government of India also targets 10,500 Pradhan Mantri Bhartiya Jan Aushadhi Kendras by March 2025, which will offer 1,451 drugs and 240 surgical products to make affordable medicines more accessible.

- In terms of FDI, IBEF confirms that 100% FDI is allowed under the automatic route for Greenfield pharma projects, while up to 74% FDI is permitted for Brownfield projects under the automatic route, with government approval required for higher stakes.

- According to Access to Medicine Foundation, Novartis ranked first and GSK second in the 2024 Access to Medicine Index, excelling across Governance of Access, R&D, and Product Delivery, with patient reach tracking introduced as a key measure of success.

- Further, the 2024 Access to Medicine Index evaluates 20 leading pharmaceutical companies across 113 countries, including new ones like Jamaica and Lebanon, covering 81 priority diseases. The Index assigns 15% weight to Governance of Access, 30% to R&D, and 55% to Product Delivery, with patient reach now recognized as an independent performance indicator, according to Access to Medicine Foundation.

Market Dynamic

Driving Factors in the Pharmaceutical Drug Delivery Market

Increasing Prevalence of Chronic Diseases

Chronic diseases like diabetes, cancer, and cardiovascular conditions are growing around the world. These diseases often need long-term medication, increasing the need for effective drug delivery systems. Patients prefer convenient options like auto-injectors, inhalers, and skin patches. Advanced delivery methods enhance patient compliance and reduce hospital visits. As chronic diseases grow, so does the demand for innovative delivery solutions. This trend significantly drives market growth.

Advancements in Drug Formulations and Technologies

Pharmaceutical companies are developing complex drugs, like biologics and gene therapies, which need specialized delivery methods. New technologies like nanotechnology & smart delivery devices are transforming drug administration. These innovations ensure drugs are delivered accurately to the target site, improving effectiveness. Personalized medicine also increases the demand for customized delivery solutions. Constant technological progress opens new opportunities for drug delivery, which fuels strong market growth.

Restraints in the Pharmaceutical Drug Delivery Market

High Development and Manufacturing Costs

Developing advanced drug delivery systems, mainly for biologics and gene therapies, is expensive. Specialized materials, advanced technology, and strict regulatory demands add to the cost. Manufacturing these systems on a large scale while maintaining quality is challenging. Smaller pharmaceutical companies may struggle to afford such high investments. High costs also lead to expensive treatments, limiting affordability for patients. These financial barriers slow down market growth.

Regulatory and Safety Challenges

Drug delivery systems must meet strict safety & performance standards set by health authorities like the FDA and EMA. The approval process can be long, complex, and costly, delaying product launches. New delivery technologies, like nanocarriers or implantable devices, face additional scrutiny due to potential safety risks. Unexpected side effects related to the delivery method can create recalls or bans. These regulatory hurdles make it difficult for companies to innovate quickly. Such challenges can limit market expansion.

Opportunities in the Pharmaceutical Drug Delivery Market

Growth in Biologics and Personalized Medicine

The growth in the development of biologics, like monoclonal antibodies and gene therapies, creates a demand for advanced delivery systems. These drugs often require targeted delivery and special handling to maintain stability. Personalized medicine is also growing, demanding customized delivery methods for individual patients. Companies can develop smart devices that adjust doses based on patient data. This trend opens doors for innovative and personalized delivery technologies. Combining biologics with advanced delivery provides a strong growth opportunity.

Rising Demand for Patient-Friendly and Home-Based Delivery Systems

Patients today prefer treatments that are easy to use at home, minimizing the need for hospital visits, which creates demand for delivery devices like auto-injectors, wearable pumps, and transdermal patches. Digital health tools that connect with delivery devices can further improve adherence. Self-administration options enhance patient comfort, mainly for chronic disease management. Companies can focus on user-friendly, portable devices to meet this demand, which creates major growth potential.

Trends in the Pharmaceutical Drug Delivery Market

Smart and Connected Drug Delivery Devices

The use of smart delivery devices, like digital inhalers and connected insulin pens, is increasing. These devices can track medication usage and send data to healthcare providers. Patients receive reminders and personalized guidance through mobile apps. This helps improve medication adherence and overall treatment outcomes. The integration of IoT (Internet of Things) with drug delivery is a growing trend. Such smart solutions enhance both convenience and patient safety.

Increasing Use of Nanotechnology in Drug Delivery

Nanotechnology is mainly used to create drug carriers like nanoparticles and liposomes. These tiny carriers help deliver drugs directly to the target site, improving effectiveness. Nanotechnology also protects sensitive drugs, like biologics, from breaking down too early, which allows for lower doses and fewer side effects. Many new cancer therapies now rely on nanotechnology-based delivery.

Research Scope and Analysis

By Route of Administration

Oral drug delivery will become the dominant force within the global pharmaceutical drug delivery market in 2025, as tablets, capsules, and liquids remain the easiest and most common way that people take their medications. Oral delivery is easy, painless, and convenient compared to other delivery methods, like injections, which require sterile conditions and medical supervision, so patients can easily take their medicine themselves at home. Plus, oral delivery is mainly more affordable.

Another factor driving the growth of this segment is the constant launching of innovative oral drugs with greater effectiveness and fewer adverse side effects. Tablet and capsule formulations of medications being developed to treat chronic illnesses like diabetes, high blood pressure, and some cancers are increasingly being used as effective forms of therapy for their patients. Biopharmaceutical drugs, including biologics and biosimilars, taken orally are contributing to the expansion of this segment. With oral drug delivery having become widely accepted among both patients and physicians alike, this segment should maintain its dominance for some time to come.

Further, topical drug delivery is projected to experience the fastest growth over the forecast period. Topical delivery includes applying medication directly onto the skin via creams, gels, patches or ointments, which becomes highly popular owing to being noninvasive, painless, and convenient for patients to use at home. Many skin conditions like eczema, psoriasis, and fungal infections have already been successfully treated using topical drugs. Topical delivery has now usage beyond pain relief to cover hormone therapy and cardiovascular treatments, among others.

A key driver behind its higher use is time-controlled systems where medicine is slowly released over a set period. As people mainly desire convenient and long-lasting treatments without requiring frequent applications, this area should experience rapid growth over the coming years. People highly demand user-friendly therapies like skin patches and advanced topical formulations; therefore, their adoption could accelerate this segment's expansion rapidly.

By Application

In 2025, cancer cases around the world will likely cause it to lead the global pharmaceutical drug delivery device market, which could propel it as the top revenue earner. Since more people are being diagnosed with different forms of cancer each year, the demand for effective therapies and advanced drug delivery methods is also on the rise. Cancer therapies like chemotherapy, immunotherapy and targeted therapy often need special delivery devices to ensure drugs reach the appropriate location in the body.

These devices ensure that medicines directly reach cancer cells while limiting damage to healthy tissues. Pharmaceutical companies have also increased their efforts in creating innovative drug delivery technologies like implantable pumps, infusion systems, and smart injectors to make cancer treatment more effective and comfortable for patients, which has become one of the main drivers behind its expected dominance within the market.

Further, cardiovascular is expected to experience the fastest growth over the forecast period, owing to more pharmaceutical companies creating medications & delivery systems for heart-related conditions. Cardiovascular diseases like heart attacks, high blood pressure, and strokes have become more common due to lifestyle choices that lead to unhealthy hearts. Poor diet, lack of exercise, obesity, alcohol consumption, and smoking all play a part in raising cardiovascular problems.

As more individuals suffer from cardiovascular conditions, there has been a higher demand for advanced drug delivery devices that can better manage these conditions. Devices like drug-eluting stents, wearable drug delivery systems, and controlled-release medications have grown highly popular. As cardiovascular diseases can be life-threatening, there has been major interest in technologies that allow continuous drug delivery at home to decrease hospital visits and save patients' time and money, which could make the cardiovascular segment of pharmaceutical drug delivery devices market the fastest-growing segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User

Hospitals are expected to hold the largest revenue share in the global pharmaceutical drug delivery devices market by 2025, as both public and private hospitals are available globally, providing access to advanced treatments for large populations. Governments across various nations are investing significantly in building new hospitals and upgrading existing ones with modern technologies, while private healthcare companies spend billions to create advanced hospital facilities providing hi-tech care and specialized treatments.

Another key contributor to this growth is an increase in hospital admissions due to chronic illnesses, infectious illnesses, and complex surgeries requiring hospitalization. Hospitals utilize various drug delivery devices, ranging from intravenous (IV) systems and infusion pumps to inhalers, to manage patient care effectively, making the hospital industry one of the leaders in drug delivery technologies.

Further, home care settings are projected to experience rapid expansion over the coming years, likely driven by an aging population requiring long-term care for chronic illnesses like diabetes, cardiovascular issues, and respiratory conditions. Many patients and families now opt for home healthcare over extended hospital stays due to its convenience, lower costs, and comfort features. Furthermore, awareness regarding hospital-acquired infections is growing, prompting many individuals to choose home healthcare whenever possible.

Higher disposable incomes and healthcare spending allow more families to invest in home-based treatments, like advanced drug delivery devices like insulin pens, nebulizers, and wearable infusion pumps. As technology progresses, smart drug delivery devices that connect with mobile apps and notify caregivers about medication schedules have also seen great growth within home healthcare. All these factors combined are creating an excellent opportunity for growth within the pharmaceutical drug delivery devices market.

The Pharmaceutical Drug Delivery Market Report is segmented on the basis of the following:

By Route of Administration

- Injectable Drug Delivery

- Conventional Injection

Self-Injection

- Oral Drug Delivery

- Topical Drug Delivery

- Semi Solid

- Liquid

- Solid

- Transdermal

- Ocular Drug Delivery

- Liquid Formulation

- Semi-solid Formulations

- Ocular Devices

- Pulmonary Drug Delivery

- Metered-dose Inhalers

- Dry Powder Inhalers

- Nebulizers

- Nasal Drug Delivery

- Nasal Sprays

- Nasal Drops

- Nasal Gels

- Nasal Powders

- Transmucosal Drug Delivery

- Oral Formulations

- Buccal Drug Delivery

- Others

- Implantable Drug Delivery

By Application

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Diabetes

- Others

By End User

- Hospitals

- Ambulatory Surgery Centers

- Home Care Settings

- Diagnostic Centers

Regional Analysis

Leading Region in the Pharmaceutical Drug Delivery Market

North America is expected to lead the global pharmaceutical drug delivery market with around

37% share in 2025, driven by chronic diseases like diabetes, heart issues and cancer that are prevalent there. More people need long-term treatment so the demand for innovative and effective drug delivery solutions increases accordingly. With biopharmaceuticals providing new medicines that require advanced delivery systems as well as personalized medicine becoming an increasing trend all these factors come together in driving this demand for innovative and effective pharmaceutical drug delivery systems across this region.

Fastest Growing Region in the Pharmaceutical Drug Delivery Market

Asia Pacific is forecasted to become one of the most promising markets for pharmaceutical drug delivery during its forecast period, which is likely due to growing chronic illnesses such as diabetes, cardiovascular issues, and respiratory illnesses caused by poor lifestyle choices, diet issues, lack of physical activity, biotechnology growth in Asia Pacific region as well as better healthcare access across low and middle income countries bolstering growth across Asia Pacific market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The pharmaceutical drug delivery market is highly competitive, with global and regional companies working hard to develop innovative drug delivery systems. Large pharmaceutical firms invest highly in research to create cutting-edge devices to simplify medicine administration to patients; biotechnology firms create targeted delivery methods for biologics and gene therapies, while smaller players provide affordable solutions for developing countries. With constant technological advancements and an increase in patient-friendly deliveries being demanded from companies, companies strive for greater market dominance.

Some of the prominent players in the Global Pharmaceutical Drug Delivery are:

- Pfizer

- BD

- GSK

- Novartis

- Johnson & Johnson

- Sanofi

- Bayer AG

- Amgen

- AbbVie

- AstraZeneca

- Other Key Players

Recent Developments

- In February 2025, BD unveiled its board of directors, which has unanimously authorized BD management to pursue a plan to separate BD's Biosciences and Diagnostic Solutions business from the rest of BD to improve strategic focus and growth-oriented investments and capital allocation for both BD and the separated business and improve value creation for shareholders.

- In December 2024, Baxter International Inc. introduced five new injectable pharmaceutical product launches in the U.S., joining the previous five launches announced in April, marking a total of 10 U.S. injectable product launches in 2024.

- In April 2024, Nipro and Haselmeier announced strategic cooperation to promote and distribute the PiccoJect autoinjector in the Japanese market, and expands its distribution channels in Japan with Nipro as a strong and experienced partner.

- In April 2024, Amylyx Pharmaceuticals, Inc. announced that the company started a process with the U.S. Food and Drug Administration (FDA) and Health Canada to voluntarily discontinue the marketing authorizations for RELYVRIO®/ALBRIOZATM (sodium phenylbutyrate and taurursodiol [also known as ursodoxicoltaurine]; also known as AMX0035) and remove the product from the market in the U.S. and Canada based on topline results from the Phase 3 PHOENIX trial. RELYVRIO/ALBRIOZA will no longer be available for new patients.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,073.2 Bn |

| Forecast Value (2034) |

USD 3,241.4 Bn |

| CAGR (2025–2034) |

5.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 671.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Route of Administration (Injectable Drug Delivery, Oral Drug Delivery, Topical Drug Delivery, Ocular Drug Delivery, Pulmonary Drug Delivery, Nasal Drug Delivery, Transmucosal Drug Delivery, and Implantable Drug Delivery), By Application (Infectious Diseases, Cancer, Cardiovascular Diseases, Diabetes, and Others), By End User (Hospitals, Ambulatory Surgery Centers, Home Care Settings, and Diagnostic Centers) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Pfizer, BD, GSK, Novartis, Johnson & Johnson, Sanofi, Bayer AG, Amgen, AbbVie, AstraZeneca, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Pharmaceutical Drug Delivery Market?

▾ The Global Pharmaceutical Drug Delivery Market size is expected to reach a value of USD 2,073.2 billion in 2025 and is expected to reach USD 3,241.4 billion by the end of 2034.

Which region accounted for the largest Global Pharmaceutical Drug Delivery Market?

▾ North America is expected to have the largest market share in the Global Pharmaceutical Drug Delivery Market with a share of about 37.0% in 2025.

How big is the Pharmaceutical Drug Delivery Market in the US?

▾ The Pharmaceutical Drug Delivery Market in the US is expected to reach USD 671.2 billion in 2025.

Who are the key players in the Global Pharmaceutical Drug Delivery Market?

▾ Some of the major key players in the Global Pharmaceutical Drug Delivery Market are Pfizer, BD, GSK, and others

What is the growth rate in the Global Pharmaceutical Drug Delivery Market?

▾ The market is growing at a CAGR of 5.1 percent over the forecasted period.