Market Overview

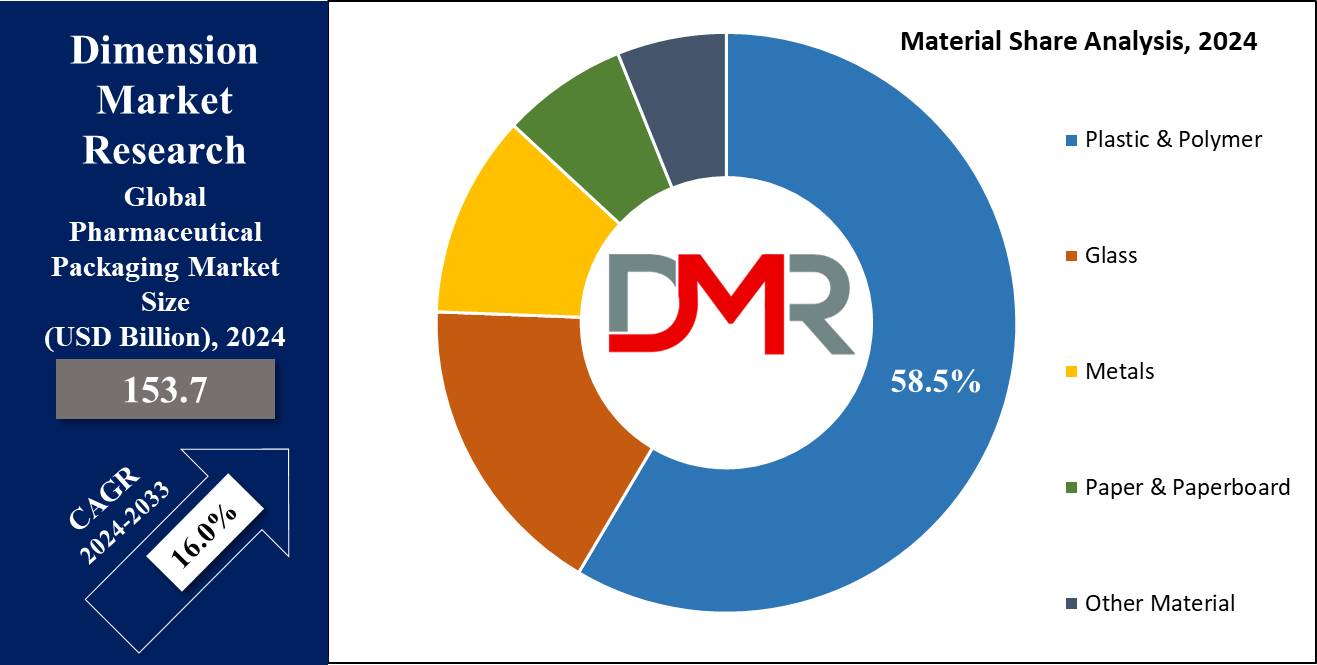

The Global Pharmaceutical Packaging Market size is expected to reach a value of USD 153.7 billion in 2024, and it is further anticipated to reach a market value of USD 583.5 billion by 2033 at a CAGR of 16.0%.

The market for pharmaceutical packaging is expanding rapidly, responding to increased consumer needs for effective secure, and sustainable packaging and the development of the industry to meet its own needs. Pharmaceutical biologics and specialty drugs will fuel this market mainly because such products must be packaged in special packaging materials like prefilled syringes, vials, and temperature-sensitive containers for safe transportation, reflecting broader growth across the drug packaging solutions market.

The growing importance of generic drugs and improved access to healthcare services are expected to create lucrative opportunities for the pharmaceutical packaging market in the coming years. In the United States, the 21st Century Cures Act (Cures Act), signed into law on December 13, 2016, aims to accelerate medical product development and foster innovation in the pharmaceutical industry.

This legislation is anticipated to drive advancements in product development, subsequently boosting the demand for pharmaceutical packaging and supporting ongoing trends in the healthcare packaging industry.

Teva Pharmaceuticals is one of the leading suppliers of generic medications in the United States, with approximately 500 generic prescription products in its market portfolio. Globally, the company has 1,100 generic pharmaceuticals in its pre-approved pipeline.

In 2023, Teva reported a total revenue of US$ 8,734 million from its generic drug segment, with contributions of US$ 3,475 million from North America, US$ 3,664 million from Europe, and US$ 1,594 million from other regions. As of 2024, Teva's global market share in the generic drug industry stands at US$ 43 billion.

According to rules of the U.S. FDA and European Medicines Agency, the pharmaceutical packaging has to be very safe, labeled, and traceable – which means that pharmaceutical companies must constantly seek new packaging solutions that have tamper-proof child-locked or temperature-sensitive features.

However, looking at the different trends that are now being observed regarding the packaging of pharmaceuticals, sustainability comes out strikingly.

The focus on environmental issues leads manufacturers to use recyclable or environmentally friendly materials for their production, which will expand the global market even more. Prime materials include plastics and polymers related to poly-ethylene and poly-propylene due to their low cost, durability, and lightweight.

There is a demand for pharmaceutical packaging solutions that can safely contain these system-complex drugs on the one hand, and conform to sustainability parameters on the other, resulting in the segment driving growth of the pharmaceutical packaging market over the forecast period. From a geographical standpoint, North America has the largest share of this global growth market which is followed by Europe and a more emerging Asia-Pacific region.

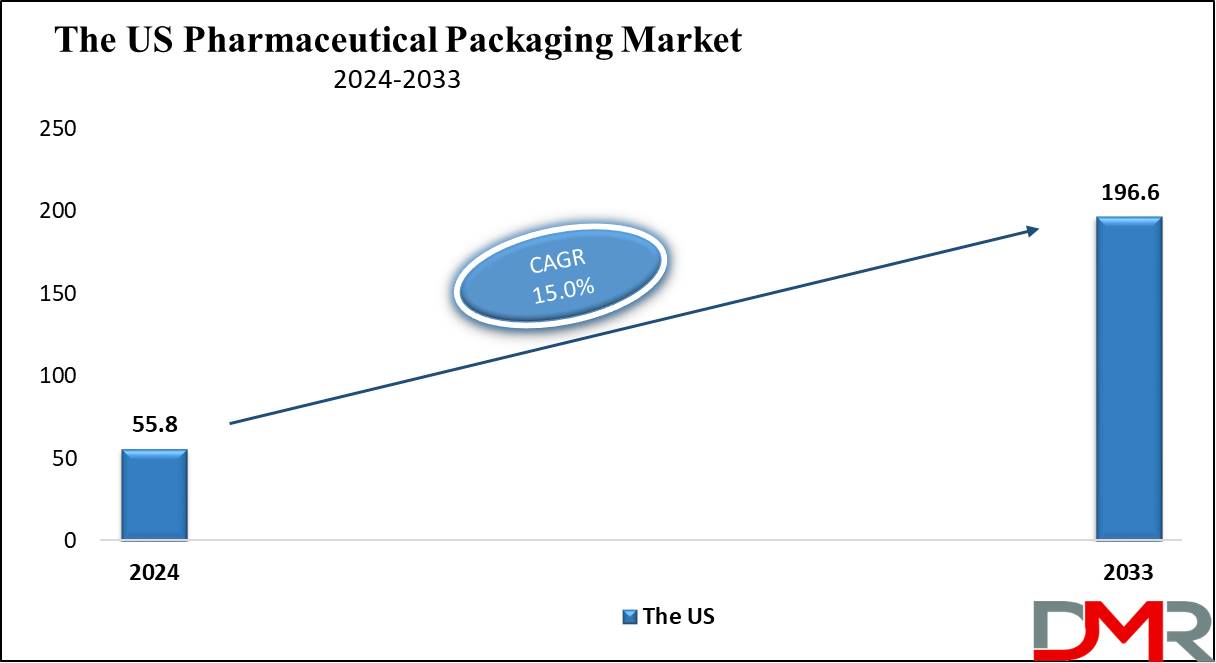

The US Pharmaceutical Packaging Market

The US Pharmaceutical Packaging Market is projected to be valued at USD 55.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 196.6 billion in 2033 at a CAGR of 15.0%. The US market for pharmaceutical packaging is the most significant international market, contributing to the largest share of total packaging market revenue globally.

The U.S. remains the world's largest pharmaceutical market due to factors like its sophisticated healthcare system, high per capita income and investments in drug development. Furthermore, generic drugs and improved access to healthcare services will likely present lucrative packaging opportunities over time.

The 21st Century Cures Act, signed into law on December 13, 2016, seeks to accelerate medical product development and encourage innovation within the pharmaceutical industry. This legislation should help accelerate product advancements while driving demand for packaging within the U.S.

The demand for high-quality evolving structures for bottling pharmaceutical products such as biologics and injectables together with more advanced drug delivery formulations also provides the needed boost for the company and determines industry trends, especially considering that biologic drugs have to be well protected due to temperature and other factors; increased demand in pharmaceutical products due to aging population and chronic diseases also creates demand for oral and injectable packaging, further supported by growing initiatives in

Chronic Disease Management that emphasize reliable and safe pharmaceutical delivery systems.

Another trend pretty popular in this area is the ones concerning sustainability, which include recyclable packaging materials, plastics, and paper solutions. Packaging firms are gradually moving toward having the least environmental effects while still maintaining safety requirements with the help of real-time information systems that help in maintaining product & drug integrity and compliance with the U.S. FDA regulations have become popular as a trend.

Customers’ demand for pharmaceutical contract packaging services plays a role in cost pressures throughout supply networks, cost implications, and demand for service in the U.S. pharmaceutical packaging industry. The major markets of this region are West Pharmaceutical Services, Berry Global, and Amcor and they are expected to remain stable over this forecast period due to advancements in technology, increased regulation, and mainly the need for more environmentally friendly packaging.

Key Takeaways

- Global Market Value: The global pharmaceutical packaging market size is estimated to have a value of USD 153.7 billion in 2024 and is expected to reach USD 583.5 billion by the end of 2033.

- The US Market Size: The US Pharmaceutical Packaging Market is projected to be valued at USD 196.6 billion in 2033 from a base value of USD 55.8 billion in 2024 at a CAGR of 15.0%.

- By Packaging Type Segment Analysis: Primary packaging is projected to dominate the packaging type segment in this market with 61.9% of the market share in 2024.

- By Material Segment Analysis: Plastic and polymer materials are anticipated to dominate the material segment with 58.5% of the market share in 2024.

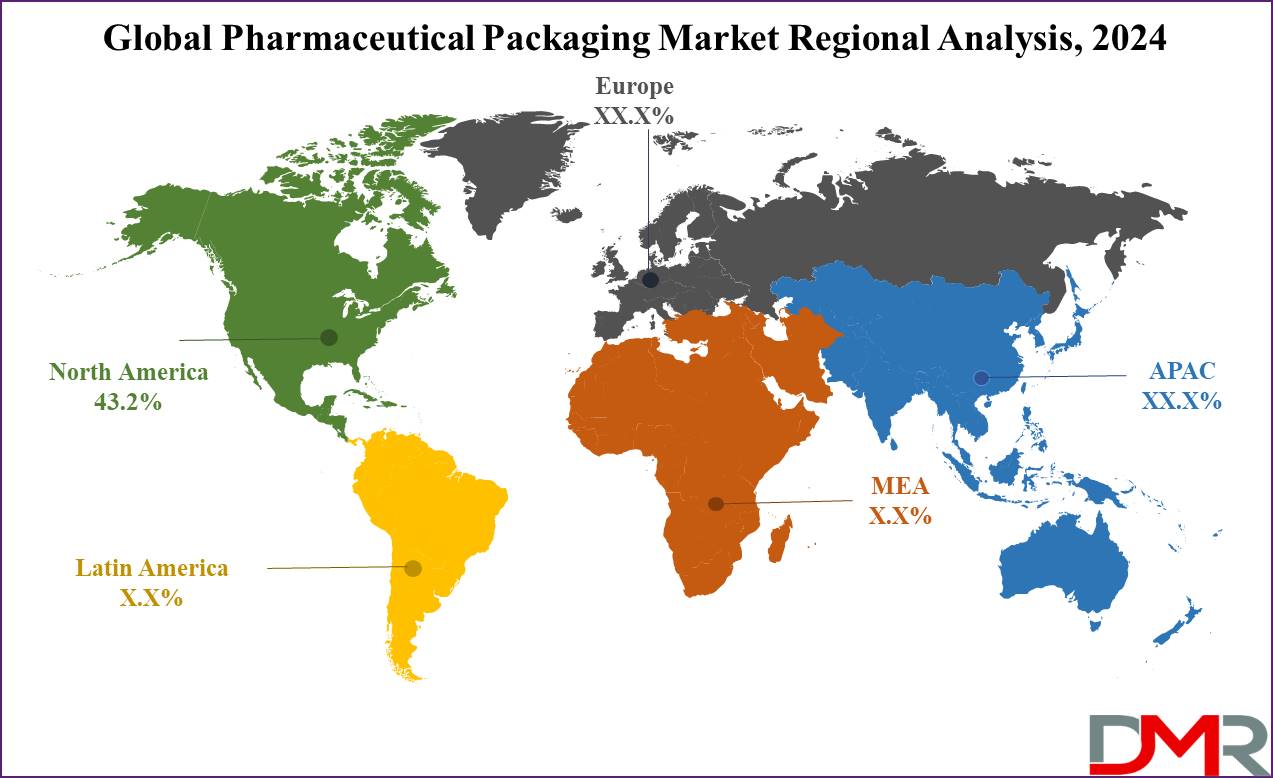

- Regional Analysis: North America is expected to have the largest market share in the global pharmaceutical packaging market with a share of about 43.2% in 2024.

- Key Players: Some of the major key players in the Global Pharmaceutical Packaging Market are Amcor plc, Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc., Berry Global Group Inc., AptarGroup Inc., SGD Pharma, Catalent Inc., and many others.

- Global Growth Rate: The market is growing at a CAGR of 16.0 percent over the forecasted period.

Use Cases

- Blister Packaging for Oral Tablets: Blister packaging is widely applied to solid-dose pharmaceuticals and ensures product protection, tamper evidence, and patient compliance by enhancing the shelf life of tablets and capsules through protection against moisture, light, and contamination.

- Vial Packaging for Injectable Drugs: Glass or plastic vials in these sterile packings of injectables protect the integrity and stability of the liquid medication. Vials are very important to biologics and vaccines, which usually need strict temperature control.

- Sustainable Packaging Solutions: Single-use pharmaceutical packaging uses recyclable and biodegradable materials that are in high demand. Sustainable solutions minimize waste and further reduce the environmental footprint of the pharmaceutical industry.

- Smart Packaging for Drug Adherence: Smart packaging technologies include sensors and other indicators compromise, giving real-time data on the condition of the drug, such as temperature or even tamper evidence. Moreover, this is highly important in some biologics and specialty drugs that demand strict monitoring.

Market Dynamic

Trends

Sustainability and Eco-Friendly Packaging Solutions

The global trend for sustainable packaging solutions is a consideration in the pharmaceutical packaging market. Companies are increasingly working on recyclable materials, biodegradable materials, and eco-friendly materials that will have a lesser environmental impact. Stringent government regulations mandating reduced carbon footprints and waste management remain the driving force behind this trend.

Therefore, pharmaceutical companies turn their attention to the growing demand for green packaging, hence laying strong emphasis on developing bio-based plastics and recyclable polymers. Packaging companies are working their way into striking a balance of safety, efficacy, and sustainability while meeting the high standards of the industry.

Smart Packaging Technologies

Pharmaceutical packaging has lately evidenced one of the crucial trends in the integration of some sort of smart technologies. The intelligent solution for this segment includes radio-frequency identification tags, temperature-sensitive sensors, and anti-tampering features that have transformed the industry to offer less vulnerability to an illegal supply chain, improvement in quality, real-time monitoring of drug conditions, and assurance of patient safety.

These technologies ensure the most favorable storage and transportation conditions of the pharmaceutical product, minimizing the risks of damage or contamination. In addition, advanced

transportation services integrated with intelligent packaging solutions further enhance the secure movement of pharmaceutical goods across the supply chain. Another contribution of intelligent packaging is the more effective tracking and authentication of products, which is one of the main issues in combating counterfeit drugs worldwide.

Growth Drivers

Increasing Pharmaceutical Production and Innovation

Population growth and chronic illnesses like cancer, diabetes, and cardiovascular disorders have driven rapid increases in pharmaceutical production around the globe, driving demand for packaging solutions within this industry at a fast clip. Furthermore, biologics and specialty drugs that require advanced packaging technologies - like prefilled syringes, blister packs, or vials drive this market further. Such packaging must conform to stability, safety, and regulatory demands associated with each specific pharmaceutical.

Stringent Regulatory Requirements

Pharmaceutical packaging regulations such as those set out by the Food and Drug Administration or the European Medicines Agency drive pharmaceutical packaging innovations. Both organizations have put into effect rigorous safety requirements that cover drug traceability, traceability, and tamper evidence.

Packaging technology; forcing pharmaceutical companies to utilize high-quality materials and technologies such as childproof or tamper-evident containers with serialization for patient compliance purposes and child-proof features in packaging solutions that will drive continuous packaging innovations for pharmaceutical packaging solutions. The current focus on patient safety will continue driving packaging innovations.

Growth Opportunities

Rising Demand in Emerging Markets

Emerging markets such as Asia-Pacific, Latin America, and Africa present enormous growth potential for the pharmaceutical packaging market. Rising healthcare expenditure, improved infrastructure for healthcare provision, and growing patient demand have stimulated an expanding pharmaceutical industry to meet increasing demands for cost-efficient packaging innovations that meet rising healthcare expenditure levels in these regions. Contract manufacturing organizations as well as contract packaging organizations operating within them also create demand.

Innovations in Biologics and Personalized Medicine Packaging

Recent innovations in packaging within biologics and personalized medicines: The increasing development of biologics and biosimilars within the pharmaceutical packaging market presents significant avenues for growth. Biologics are highly sensitive to temperature and light, hence these require very specialized packaging. Advanced packaging technologies in high demand include prefilled syringes, temperature-controlled packaging, and injectable packaging solutions.

Additionally, the rise of personalized medicine and new drug delivery methods, such as personalized medicine, new drug-delivery methods of microneedle patches, and transdermal delivery systems present more growth opportunities for this market in the forthcoming period.

Restraints

High Costs of Advanced Packaging Materials

One of the key constraints in the pharmaceutical packaging market is the high cost of investment involved in advanced packaging materials and technologies. Biodegradable plastics, smart packaging technologies, temperature-sensitive packaging, and other innovative solutions are highly costly to manufacture. The cost of these solutions further increases the cost for pharmaceutical companies as they are expensive to produce. Smaller and mid-sized companies may find this quite unaffordable, especially in cost-sensitive markets.

Environmental and Regulatory Challenges

While the trend of sustainability continues in the pharmaceutical packaging market, it often becomes challenging to adhere to both safety and environmental regulations. Mainly, pharmaceutical products contain plastic packaging for durability and protection, but regulatory bodies take rigid measures to restrict the use of plastic materials, apart from favoring recyclable ones.

This challenges packaging companies in their effort to balance environmental concerns with packaging solutions, given that the materials used will have to meet the highest safety and regulatory demands of the pharmaceutical industry.

Research Scope and Analysis

By Packaging Type

Primary packaging is projected to dominate the packaging type segment in the pharmaceutical packaging market with 61.9% of the market share in 2024. The Primary packaging segment dominates the pharmaceutical packaging market owing to its critical nature for ensuring the safety, and stability of drugs, and patient compliance.

Primary packaging solutions, therefore, are packages that come into direct contact with the actual pharmaceutical product, like a blister pack, bottle, vial, or syringe and are quite crucial in giving protection to the drug from environmental factors like moisture, oxygen, and light that could render it ineffective. This is further enhanced by the growing complexity of pharmaceuticals, such as biologics and specialty drugs, which require leading-edge primary packaging solutions to ensure product integrity throughout shelf life.

For instance, biologics require special vials or pre-filled syringes to protect the barrier and prevent contamination. Main packaging also forms the basis for several drug delivery modes, and other useful inventions such as child-resistant closures and tamper-evident seals do much to meet both safety and regulatory needs.

Other major factors in the dominance of primary packaging are the rising demands observed in patient-centric packaging for oral and injectable drug delivery. Patient-friendly designs- such as an easy-to-open blister pack and single-dose packaging- offer improved adherence to prescribed treatments, particularly for the aging population.

By Material

Plastic and polymer materials are anticipated to dominate the material segment of the global pharmaceutical packaging market with 58.5% of the market share in 2024 due to their versatility, relatively lower cost, and suitability for a wide range of pharmaceutical packaging applications. The core uses of these materials are in the manufacture of bottles, blister packs, vials, syringes, and pouches, which are widely needed in both solid and liquid dosage forms.

Besides, the stability and safety of the product could be guaranteed in storage and transportation with such high-barrier protection against moisture, oxygen, and contamination. One of the prime advantages of plastic packaging is its lightweight, so it reduces transportation costs and improves logistics efficiency. Added to this, plastic materials like PE, PP, and PVC have excellent resistance properties, flexibility, and transparency in view, making them suitable for various modes of drug delivery, injectable, and topical pharmaceuticals.

Growing demand for value-added packaging in innovative forms such as multi-layer blister packs and tamper-evident packaging propels the dominance of plastic and polymer materials in pharmaceutical packaging.

By Drug Delivery Mode

Oral drug delivery packaging is expected to lead to this segment of drug delivery mode in the pharmaceutical packaging market because oral drugs are being demanded widely due to increasing concerns for better patient compliance packaging. It is a popular and preferred route of pharmaceutical product delivery particularly in the long-term management of chronic diseases.

This has led to a continually increasing trend for packaging solutions that will guarantee oral drugs including tablets, capsules, and powders are safe, stable, and effective. Blister packaging is one of the best examples of oral drug delivery packaging that has emerged into prominence because it can protect each dosage from moisture, oxygen, and contamination. It will also facilitate better patient compliance with medication because of unit-dose packaging, which is particularly important in elderly patients or when there are several medications to manage.

Additionally, most oral liquid formulations are supplied in bottles that have child-resistant closures and tamper-evident seals, thus offering both safety and convenience. The increase in the prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and neurological disorders, has further fanned the demand for oral drug delivery packaging.

Many of these conditions require daily medication, and the pharmaceutical packaging market is responding with creative, user-friendly solutions that support patient compliance and improve therapeutic outcomes. However, there is an increasing focus on personalized medicine, and with the development of new oral formulations, fast-dissolving tablets, and controlled-release capsules, oral drug delivery packaging is continuing to maintain dominance within the global pharmaceutical packaging market.

By Sustainability

Recyclable packaging leads the sustainability segment in the pharmaceutical packaging market, with the increasingly weighing environmentally friendly solutions in light of expanding regulatory pressures and consumer demand for sustainable practices. This puts pharmaceutical firms under pressure to reduce their ecological footprint while ensuring that the packaging materials meet stern safety and regulatory demands.

Consequently, one of the key trends in the global pharmaceutical packaging market has been the adoption of recyclable packaging materials such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE). Recyclable packaging offers several benefits beyond just waste reduction and resource conservation.

Materials that can be easily recycled and remade into other products help the circular economy and decrease the negative impacts of packaging on the environment. It surely aligns with the broader movement in the healthcare and packaging industries toward huge reductions of plastic waste, with increasing usage of highly recyclable materials.

Government authorities are also implementing stringent environmental regulations, which, in turn, fuels the demand for recyclable packaging solutions globally. Reciprocating to this, pharmaceutical packaging companies are involved in the development of advanced packaging technologies using eco-friendly material to maintain the safety and integrity of pharmaceutical products.

This trend will be accelerated further in the coming years, as both consumers and regulatory agencies are focusing on sustainability. Recyclable packaging not only supports environmental goals but also enhances the brand reputation and compliance within the pharmaceutical industry.

By End-User

Pharmaceutical manufacturing is projected to dominate the end-user segment in the pharmaceutical packaging market in 2024 due packaging plays a very crucial role both in the production and distribution of pharmaceutical products and also in their regulatory compliance. Pharmaceutical manufacturers highly utilize advanced packing solutions to help the pharmaceutical product meet the necessary stringent standards for safety, quality, and regulation.

Indeed, packaging is an integral part that helps drugs from getting contaminated, deteriorating, and tampered with, among other aspects, while ensuring accurate labeling and traceability. Increased chronic diseases, an aging population, and demand for both biologics and specialty drugs are stimulating this huge growth in the global pharmaceutical industry.

As the global pharmaceutical industry is growing due to chronic diseases, an aging population, and increasing demands for biologics and specialty drugs, so too needs innovative pharmaceutical packaging solutions increased.

Pharmaceutical investment also goes into special packaging for new formulations, including biologics, vaccines, and personalized medicines that require specific packaging to maintain product stability and effectiveness.

The Pharmaceutical Packaging Market Report is segmented on the basis of the following

By Packaging Type

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Pre-Fillable Inhalers

- Pre-Fillable Syringes

- Vials & Ampoules

- Blister Packs

- Bags & Pouches

- Jars & Canisters

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Material

- Plastic & Polymer

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo-Polypropylene

- Random-Polypropylene

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-density polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polystyrene (PS)

- Others

- Glass

- Type I (Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Regular Soda-Lime Glass)

- Metals

- Aluminum

- Stainless Steel

- Tin

- Other Metal Alloys

- Paper & Paperboard

- Other Material

By Drug Delivery Mode

- Oral Drug Delivery Packaging

- Injectable Packaging

- Topical Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Transdermal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Other Drug Delivery Mode

By Sustainability

- Recyclable Packaging

- Biodegradable Packaging

- Compostable Packaging

By End-user

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Packaging Organizations (CPOs)

How Does Artificial Intelligence Contribute To Improve Pharmaceutical Packaging Market ?

- Quality Control: AI-powered vision systems detect defects in packaging with high precision.

- Smart Packaging: AI integrates track-and-trace solutions to combat counterfeiting.

- Supply Chain Optimization: AI forecasts packaging demand to reduce inventory waste.

- Personalization: AI enables customized packaging for personalized medicines.

- Sustainability: AI identifies eco-friendly materials to reduce packaging waste.

- Predictive Maintenance: AI monitors equipment to predict and prevent failures.

- Regulatory Compliance: AI ensures packaging meets stringent regulations via data analysis.

- Enhanced Customer Experience: AI-driven insights improve user-friendly packaging designs.

Regional Analysis

North America is projected to dominate the global pharmaceutical packaging market as it will hold

43.2% of market revenue in 2024. Among these, North America leads the global pharmaceutical packaging market, specifically the U.S., which contains several conducive factors to position the region ahead of others.

The region has a highly developed pharmaceutical industry with leading pharmaceutical companies, robust pharmaceutical drug development infrastructure, and huge healthcare expenditures, which significantly drive the demand for pharmaceutical packaging solutions. With its very mature pharmaceutical industry, North America is home to a host of innovative drugs, biologics, and specialty pharmaceuticals-classes of pharmaceuticals that demand highly sophisticated packaging to ensure safety and regulatory compliance.

One of the major reasons for this dominance is the rigid regulatory environment laid down by institutions such as the U.S. Food and Drug Administration. The companies must adhere to requirements that ensure the drugs present on the market are safe, effective, and traceable. This makes drug companies in the region embrace innovative technologies in packaging, such as tamper-evident packaging, child-resistant closures, and smart packaging solutions.

Other factors contributing to the growth of this region are attention to sustainability and ecological impact, boosting demand for recyclable and eco-friendly packaging solutions. Continuous innovation in the pharmaceutical packaging market of the region is due to advanced R&D infrastructure; West Pharmaceutical Services is one of the leading companies in the region, including Berry Global.

Apart from that, chronic diseases like diabetes and cardiovascular diseases will also increase pharmaceutical consumption, thereby increasing the demand for pharmaceutical packaging in the North American region. This leading position of the region is also likely to uninterruptedly go beyond the forecast period due to high levels of ongoing investment in drug development and innovative packaging.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major key players in the market include West Pharmaceutical Services, Berry Global Inc., Amcor Plc, and Gerresheimer AG. These companies are very instrumental in setting trends in the market, contingent upon continuous investment in research and development to produce advanced packaging materials and technologies that meet the diverse requirements of the growing pharmaceutical industry. West Pharmaceutical Services, is known for its breadth of experience in injectable packaging-product solutions like prefilled syringes and vials, which are crucial to biologics and vaccines.

Berry Global Inc. primarily focuses on sustainable packaging solutions due to growing demands in the market for recyclable and biodegradable packaging materials. Amcor Plc is another leading name in the legal listing, known for its innovative ideas in flexible and rigid pharmaceutical packaging solutions for oral and injectable applications. The competitive landscape is also defined by high investments in sustainable and smart packaging technologies.

Players are also expanding their portfolios with value additions such as recyclable materials, tamper evidence packaging, and temperature-sensitive solutions. Besides this, the increase in contract packaging services, mainly in the U.S. and Europe, heightens competition because pharmaceutical companies are outsourcing a greater part of their packaging needs to third-party specialists. This can be expected to continue as companies seek to expand their capabilities and presence in many of the global pharmaceutical packaging markets through strategic acquisitions and partnerships.

Some of the prominent players in the Global Pharmaceutical Packaging Market are

Recent Developments

- September 2024: West Pharmaceutical Services launched a new line of smart, connected packaging solutions, focusing on enhancing patient adherence and drug safety through integrated monitoring technologies.

- July 2024: Amcor Plc announced the introduction of a new range of fully recyclable flexible packaging solutions for oral medications, furthering their commitment to sustainable packaging innovations.

- June 2024: Gerresheimer AG expanded its pharmaceutical glass packaging capacity in Europe to meet the increasing demand for vials and ampoules, particularly for biologics and vaccines.

- May 2024: Berry Global Inc. completed the acquisition of a sustainable packaging technology company to enhance its offerings in recyclable and biodegradable pharmaceutical packaging solutions.

- April 2024: West Pharmaceutical Services formed a strategic partnership with a leading biotech company to co-develop advanced injectable drug packaging solutions tailored for biologic therapies.

- March 2024: Amcor Plc expanded its pharmaceutical packaging division in Asia-Pacific, launching a new facility focused on high-performance packaging for emerging markets.

- February 2024: Gerresheimer AG introduced a new line of prefilled syringes made from bio-based plastics, targeting environmentally conscious pharmaceutical companies.

- December 2023: Berry Global Inc. launched a new series of child-resistant closures for oral medications, aimed at improving safety and compliance with regulatory standards.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 153.4 Bn |

| Forecast Value (2033) |

USD 583.5 Bn |

| CAGR (2024-2033) |

16.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 55.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Packaging Type (Primary, Secondary, and Tertiary), By Material (Plastic & Polymer, Glass, Metals, Paper & Paperboard, and Other Material), By Drug Delivery Mode (Oral Drug Delivery Packaging, Injectable Packaging, Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging, Transdermal Drug Delivery Packaging, Ocular Drug Delivery Packaging, Nasal Drug Delivery Packaging, Other Drug Delivery Mode), By Sustainability (Recyclable Packaging, Biodegradable Packaging, and Compostable Packaging), By End-user (Pharmaceutical Companies, Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), and Contract Packaging Organizations (CPOs)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amcor plc, Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc., Berry Global Group Inc., AptarGroup Inc., SGD Pharma, Catalent Inc., WestRock Company, CCL Industries Inc., Nipro Corporation, Bemis Healthcare Packaging |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Pharmaceutical Packaging Market size is estimated to have a value of USD 153.7 billion in 2024 and is expected to reach USD 583.5 billion by the end of 2033.

The US Pharmaceutical Packaging Market is projected to be valued at USD 55.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 196.6 billion in 2033 at a CAGR of 15.0%.

North America is expected to have the largest market share in the Global Pharmaceutical Packaging Market with a share of about 43.2% in 2024.

Some of the major key players in the Global Pharmaceutical Packaging Market are Amcor plc, Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc., Berry Global Group Inc., AptarGroup Inc., SGD Pharma, Catalent Inc., and many others.

The market is growing at a CAGR of 16.0 percent over the forecasted period.