Market Overview

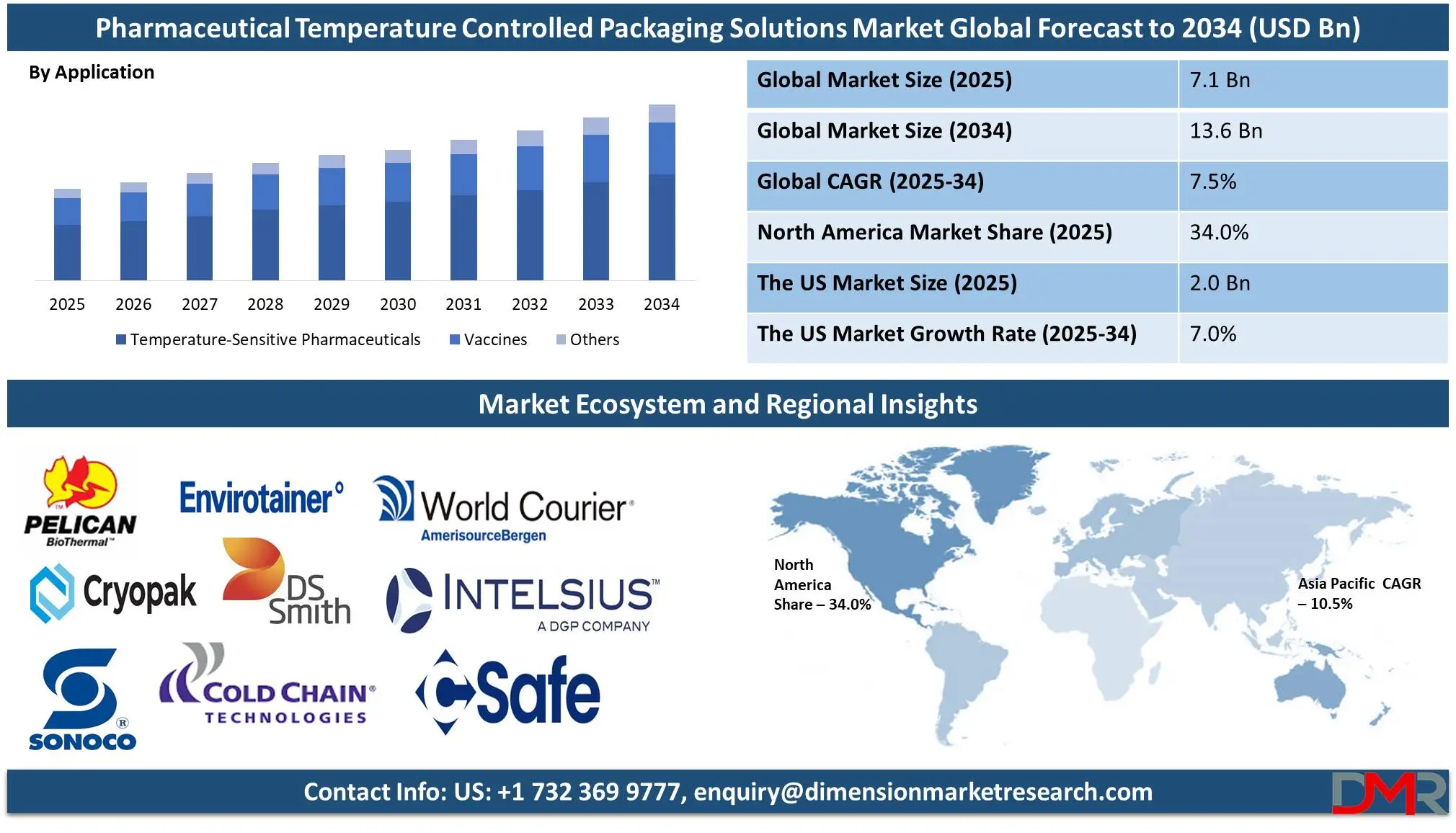

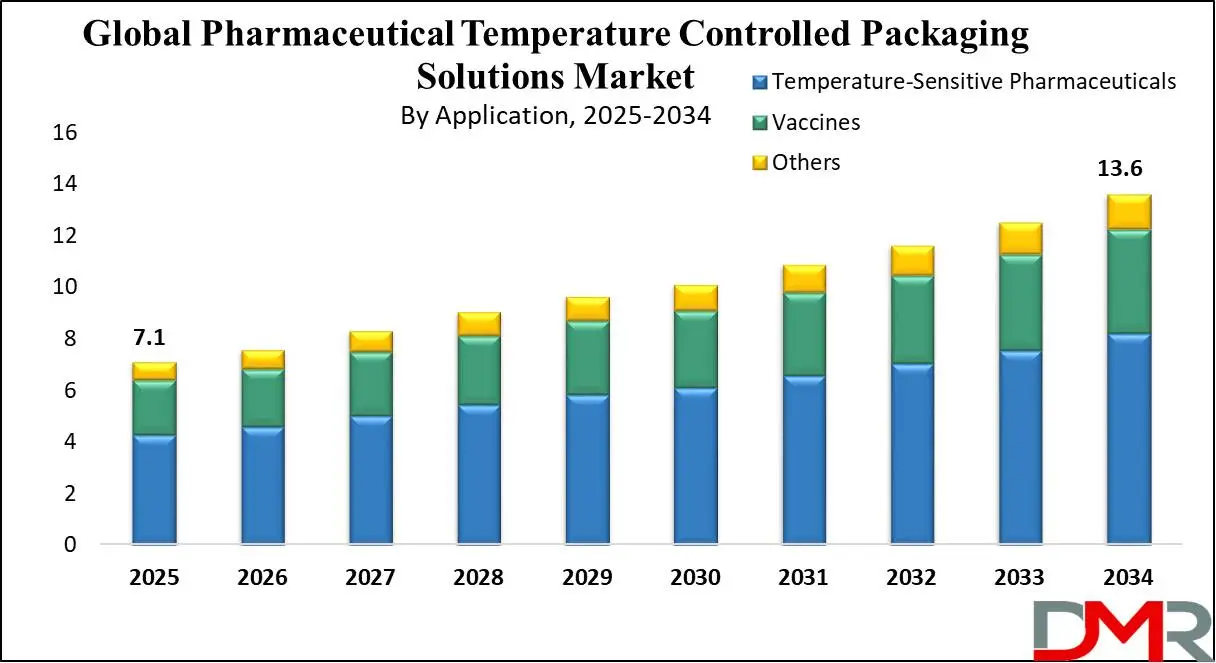

The Global Pharmaceutical Temperature Controlled Packaging Solutions Market size is expected to be valued at USD 7.1 billion in 2025, and it is further anticipated to reach a market value of USD 13.6 billion by 2034 at a CAGR of 7.5%.

The global pharmaceutical temperature-controlled packaging solutions market is a vital subsegment of the overall pharmaceutical packaging industry, concentrating on the design and use of systems specifically meant to maintain integrity, safety, and efficacy for temperature-sensitive pharmaceutical products.

These medicines include vaccines, biologics, insulin, oncology drugs, blood products, and other specialty medications that require storage, transport, and distribution in temperature-controlled environments. Temperature excursions, even for brief periods, can cause degradation of active pharmaceutical ingredients (APIs), rendering products either ineffective or unsafe for patient use.

As a result, pharmaceutical companies, logistics providers, and healthcare distributors rely heavily on advanced temperature-controlled packaging solutions to preserve both stability and potency throughout the supply chain.

Active systems typically operate on electricity or batteries and feature accurate temperature control with integrated cooling and heating mechanisms, making them suitable for long-haul shipments. Passive systems rely on materials like insulation, phase change materials (PCMs), and refrigerants such as dry ice or gel packs to achieve temperature regulation without external power sources.

The growth of the pharmaceutical temperature-controlled packaging solutions market is driven by several key drivers. A growth in biologics, personalized medicines, and specialty drugs that are extremely sensitive to temperature variations, has driven the need for robust cold chain infrastructure.

Additionally, the globalization of pharmaceutical supply chains, the rise in clinical trials, and the expansion of e-commerce within healthcare have presented temperature-controlled packaging providers with both opportunities and challenges that have necessitated investments in innovative technologies and eco-friendly materials to meet changing industry demands.

Compliance regulations play an integral part in shaping the market landscape. Organizations such as the Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the International Air Transport Association (IATA) have issued strict guidelines regarding the storage and transport of temperature-sensitive pharmaceuticals.

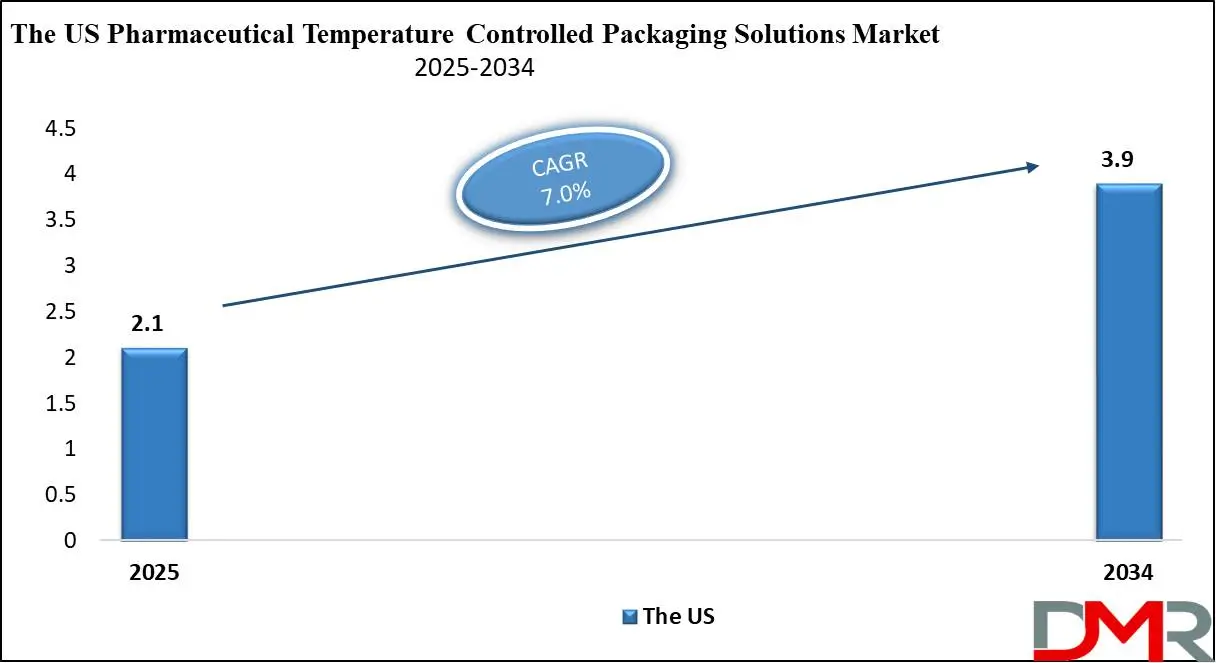

The US Pharmaceutical Temperature Controlled Packaging Solutions Market

The US Pharmaceutical Temperature Controlled Packaging Solutions Market is projected to be valued at USD 2.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.9 billion in 2034 at a CAGR of 7.0%.

The US pharmaceutical temperature-controlled packaging solutions market is an integral component of healthcare logistics and pharmaceutical supply chains. As one of the largest pharmaceutical markets, the US boasts an expansive infrastructure that requires sophisticated packaging solutions for temperature-sensitive drugs to maintain their integrity, safety, and efficacy.

US pharmaceutical products holds a significant variety of biologics, vaccines, gene therapies, blood products, and specialty medications that require temperature-controlled packaging solutions at every stage of storage and distribution to safeguard product stability and avoid health risks to patients due to change in temperature.

The US market features a variety of temperature-controlled packaging technologies, from active to passive and hybrid systems. Active packaging solutions are widely utilized for high-value shipments and long-distance transportation due to their improved temperature regulation capabilities, provided by specialized cooling and heating systems.

Passive solutions such as insulation materials, phase change materials (PCMs), and refrigerants are being adopted highly to provide cost-effective and dependable thermal protection along shorter distribution routes or last-mile deliveries. Hybrid systems that combine active and passive technologies are getting popularity in the US market, especially for shipments requiring flexible handling in changing environmental conditions. Furthermore, its extensive transportation network of air, ground, and cold chain logistics necessitates adaptable packaging solutions that ensure continuous temperature regulation.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Key Takeaways

- Market Value: The global pharmaceutical temperature-controlled packaging solutions market size is expected to reach a value of USD 13.6 billion by 2034 from a base value of USD 7.1 billion in 2025 at a CAGR of 7.5%.

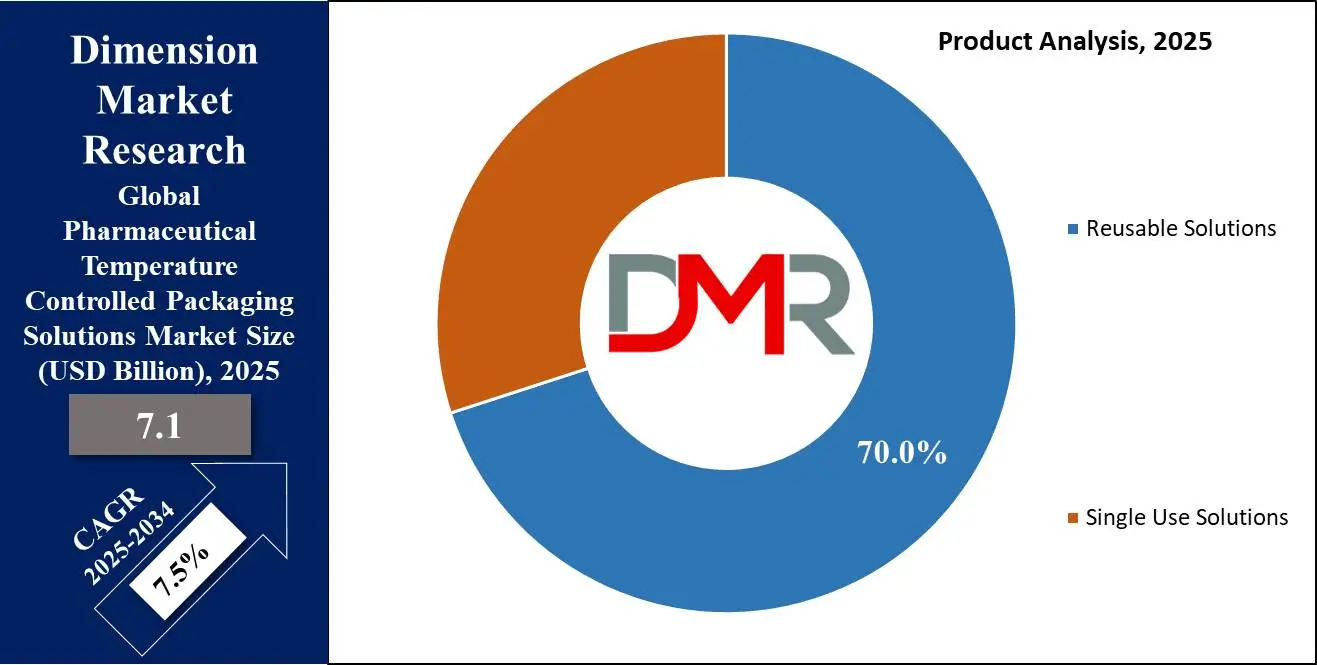

- By Product Type Segment Analysis: Reusable Solutions are anticipated to lead in the product type segment, capturing 70.0% of the market share in 2025.

- By Application Type Segment Analysis: Temperature-Sensitive Pharmaceuticals is poised to consolidate its market position in the application type segment capturing 60.4% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global pharmaceutical temperature-controlled packaging solutions market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some major key players in the global pharmaceutical temperature-controlled packaging solutions market are Pelican Biothermal, Cryopak, Sonoco Products Company, Envirotainer, DS Smith Pharma, Cold Chain Technologies, and Other Key Players.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Use Cases

- Vaccine Distribution: One of the most critical use cases is the distribution of vaccines, many of which require highly regulated temperature control to maintain their efficacy. Temperature-controlled packaging solutions, such as active containers with refrigeration units and passive insulated shippers using phase change materials (PCMs) and dry ice, played a pivotal role in ensuring vaccine stability from manufacturing facilities to vaccination centers globally.

- Biologics and Specialty Drugs Transportation: Biologic drugs, including monoclonal antibodies, cell and gene therapies, and insulin, are highly sensitive to temperature fluctuations and often require storage conditions ranging from 2°C to 8°C or even colder. These products are transported in specialized packaging solutions equipped with advanced insulation and temperature monitoring devices. The use of hybrid packaging systems, which combine active and passive cooling technologies, ensures the integrity of biologics during long-haul transportation across international supply chains.

- Clinical Trials Supply Chain: The clinical trials process involves shipping investigational drugs, biologics, and lab samples to and fro from trial sites across different geographic locations. These products often require proper temperature control to maintain their stability for accurate trial results. Temperature-controlled packaging solutions are used to ensure that samples such as blood, plasma, and tissue, as well as investigational medicinal products, remain within the temperature ranges, preventing data loss or trial delays due to compromised product integrity.

- Direct-to-Patient Pharmaceutical Deliveries: With the rise of personalized medicine, e-commerce, and telehealth services, there is a growing demand for direct-to-patient pharmaceutical deliveries. Medications that require cold chain handling, such as fertility treatments, oncology drugs, and certain hormone therapies, are now being shipped directly to patients’ homes. Temperature-controlled packaging solutions, particularly passive systems with advanced insulation and portable temperature monitoring devices, enable safe last-mile delivery, ensuring patients receive effective medications without compromising quality during transit.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Stats & Facts

- The World Health Organization (WHO) emphasizes that adequate facilities, trained personnel, and approved procedures are essential for sampling, inspecting, and testing starting materials, packaging materials, and finished products. This includes monitoring environmental conditions to ensure Good Manufacturing Practices (GMP) are upheld.

- In the US, the Food and Drug Administration (FDA) mandates that drug product manufacturers implement inspection programs for incoming packaging components and materials. This includes performing appropriate identification tests and periodically validating suppliers' test data to ensure consistent quality of packaging components.

- Furthermore, the FDA advises that drug products subjected to improper storage conditions, such as extreme temperatures, humidity, or exposure to smoke and fumes, should not be salvaged and returned to the marketplace unless there is evidence from laboratory testing confirming that the drugs meet all applicable standards of identity, strength, quality, and purity.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Market Dynamic

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Driving Factors

Rising demand for biologics and specialty drugs

Rising demand for biologics and specialty drugs has been one of the primary drivers behind the expansion of the global pharmaceutical temperature-controlled packaging solutions market. Biologics are complex, large-molecule drugs derived from living cells, such as vaccines, monoclonal antibodies, recombinant proteins, gene therapies, and cell-based treatments. These therapies have revolutionized the treatment processes for chronic and life-threatening illnesses like cancer, autoimmune disorders, diabetes, and rare genetic conditions.

Biosimilar drugs differ significantly from their small-molecule counterparts as they are much more sensitive to environmental conditions, particularly temperature changes, which can alter their structure, potency, and efficacy. Due to this sensitivity, they require temperature-controlled environments at all stages in their supply chain from manufacturing through storage to transportation and final delivery to healthcare facilities or patients.

Increasing global regulatory requirements

Regulatory bodies such as the Food and Drug Administration (FDA), European Medicines Agency (EMA), and World Health Organization (WHO) have developed strict guidelines and standards for the storage, transportation, and distribution of pharmaceuticals that require temperature control. These regulations aim to ensure that biologics, vaccines, and certain specialty drugs maintain their efficacy and safety from manufacturing to end-user use.

As demand for temperature-sensitive drugs such as biologics and vaccines continue to increase, regulatory frameworks have become more comprehensive and stringent. For instance, the FDA's Good Distribution Practice (GDP) guidelines outline requirements for maintaining product quality during transport and distribution, including temperature monitoring, proper packaging, and documentation.

As pharmaceutical companies face regulatory demands, they are turning to temperature-controlled packaging solutions that meet or surpass these specifications. These solutions help ensure compliance with temperature monitoring, data logging, and reporting standards to minimize risks associated with temperature excursions.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Restraints

High cost associated with advanced temperature-controlled packaging systems and cold chain logistics

Maintaining the integrity of temperature-sensitive pharmaceutical products requires special packaging materials, advanced technologies, and a complex cold chain infrastructure that requires considerable investments. High-performance packaging solutions like active temperature-controlled containers, vacuum-insulated panels (VIPs), phase change materials (PCMs), and real-time temperature monitoring devices require large fundings both for procurement and maintenance costs.

Additional investments may include refrigerated vehicles, cold storage facilities, or ultra-low temperature freezers that further contribute to operational expenses. Transporting biologics, vaccines, and gene therapies that require precise temperature regulation is even more expensive due to labor and training costs. Also due to a lack of appropriate cold chain infrastructure in remote or underdeveloped regions ensuring delivery can become logistically complex and financially taxing.

Complexity of cold chain logistics and risk of temperature excursions

Pharmaceutical products, especially biologics, vaccines, and other temperature-sensitive drugs, require proper temperature regulation throughout their supply chains. These cold chains requires multiple stakeholders, including manufacturers, logistics providers, distributors, and healthcare facilities, each stage can present potential risks such as delays in transportation or equipment failure, human errors, or exposure to extreme weather conditions which could cause temperature excursions that compromise product quality, safety, and efficacy.

Complexity increases when dealing with global supply chains, where products frequently cross borders to be subjected to various regulatory requirements, customs delays, and infrastructure challenges in each country. Factors like inadequate cold storage facilities, unreliable power supplies, and limited access to temperature-controlled transportation in emerging markets only compound these risks further. Real-time monitoring systems may assist but cannot always detect temperature deviations immediately while responding to temperature deviations in transit can prove challenging.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Opportunities

Growing demand for personalized medicine and biologics in emerging markets

Personalized medicine customizing treatments specifically to individual patient profiles based on genetic, environmental, and lifestyle factors has quickly gained momentum in recent years. Many forms of personalized medicine such as biologics, cell and gene therapies, and mRNA-based treatments are extremely sensitive to temperature fluctuations and require reliable cold-chain solutions to preserve their efficacy. With healthcare systems improving in emerging markets, the need for reliable temperature-controlled packaging solutions supporting distribution has grown.

Emerging economies across Asia-Pacific, Latin America, the Middle East, and Africa are also witnessing tremendous growth of pharmaceutical manufacturing and distribution networks. Governments in these regions are making investments in healthcare infrastructure, expanding vaccination programs, and strengthening regulatory frameworks to meet international standards, creating an ideal environment for the adoption of advanced cold chain technologies such as innovative packaging materials, real-time monitoring devices, and sustainable solutions.

Advancement of smart packaging technologies and IoT-enabled cold chain monitoring systems

Integrating IoT technologies, real-time data loggers, and smart sensors into temperature-controlled packaging solutions is revolutionizing pharmaceutical cold chains.

These advanced systems enable real-time monitoring of critical parameters such as temperature, humidity, shock exposure, light exposure, and other indicators across all supply chains, providing real-time visibility with instant alerts in case of temperature excursions and providing continuous visibility and alerts in case of product spoilage risk, major regulatory compliance and optimize supply chain efficiency.

Pharmaceutical companies are adopting these technologies to comply with stringent Good Distribution Practice (GDP) regulations and ensure the safety of high-value temperature-sensitive products like biologics, vaccines, and specialty drugs. Blockchain technology offers secure data sharing and enhanced traceability, adding another layer of transparency and security in pharmaceutical logistics.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Trends

Shift towards sustainable and eco-friendly packaging solutions

With a rising awareness of environmental concerns and mounting regulatory pressures to reduce carbon footprints, the pharmaceutical industry is actively searching for sustainable alternatives in its cold chain operations. Traditional temperature-controlled packaging materials like expanded polystyrene (EPS) and polyurethane contribute significantly to plastic waste and environmental pollution. Consequently, companies are developing eco-friendly packaging options that are recyclable, biodegradable, and reusability without compromising thermal performance.

Innovations in sustainable materials such as plant-based insulation, phase change materials (PCMs) from renewable sources, and vacuum-insulated panels with minimal environmental impacts have become popular in recent years. Reusable packaging systems designed for multiple shipping cycles have also gained prominence in reducing waste and overall costs. Companies are also exploring ways to optimize package designs to minimize material use while still maintaining temperature stability, thus further lowering emissions associated with transportation emissions.

Growing adoption of passive temperature-controlled packaging systems over active systems

Passive packaging systems that utilize advanced insulation materials, phase change materials (PCMs), and vacuum-insulated panels (VIPs) to maintain desired temperatures without external power sources have become popular over the past several years due to rising demands for cost-effective, reliable, and flexible cold chain solutions for last-mile delivery or transport to remote or limited resource locations.

Passive systems offer greater portability compared to active refrigeration solutions requiring mechanical refrigeration units and a constant power source for proper functioning. Passive packaging proved a reliable option, maintaining temperature stability for a longer duration without incurring logistical complexities associated with powered refrigeration units. Moreover, innovations in material science have significantly enhanced the thermal efficiency of passive systems so they can maintain strict temperatures (including ultra-cold conditions).

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Research Scope and Analysis

By Product Type

Reusable Solutions are anticipated to lead in the product type segment, capturing 70.0% of the market share in 2025 due to various key factors that align with its evolving needs and preferences. One primary driver is cost efficiency over time, while initial investment may be higher for reusable solutions, they can be reused multiple times over different shipping cycles thus significantly decreasing cost per shipment in time and making them an appealing option for large pharmaceutical companies operating large supply chains requiring temperature-controlled products for distribution across global supply chains.

Reusable solutions are known for their superior durability and performance, offering proper temperature regulation over extended periods. Reliability is of utmost importance for maintaining product integrity, particularly with highly valued biologics, vaccines, and specialty drugs requiring stringent temperature management. Reusable systems often incorporate advanced technologies, including vacuum-insulated panels (VIPs) and phase change materials (PCMs), as well as real-time temperature monitoring devices, to meet regulatory requirements such as Good Distribution Practices (GDP).

On the other hand, single-use packaging may still play an integral part in the market expansion. They're especially suitable in scenarios that prioritize operational flexibility, convenience, and cost-effectiveness for one-time shipments eliminating reverse logistics (which can be complex and expensive when shipping goods back from remote areas, emerging markets, or humanitarian missions with limited return infrastructure) makes single-use packages particularly suitable for last-mile delivery, clinical trials or emergency medical shipments requiring rapid deployment.

Developments in material science have considerably enhanced the thermal efficiency of single-use solutions, allowing them to maintain tight temperature ranges for extended periods. With the industry emphasizing on environmental sustainability, manufacturers are creating eco-friendly single-use packaging made of recyclable and biodegradable materials to minimize waste generation concerns.

By Application Type

Temperature-Sensitive Pharmaceuticals is poised to consolidate its market position in the application type segment capturing 60.4% of the total market share in 2025. This dominance can be explained by the increasing demand for biologics, specialty drugs, and complex formulations that necessitate tight temperature control throughout their supply chains to protect efficacy, safety, and stability. Biopharmaceuticals such as monoclonal antibodies, blood products, hormones, and insulin can be extremely sensitive to temperature variations and degradation risks, as a result, they require temperature-controlled packaging solutions.

Increased incidence of chronic illnesses like cancer, diabetes, and autoimmune disorders has further spurred demand for temperature-sensitive drugs as patients require high-value, precision medicines delivered under tight cold chain conditions. Regulatory bodies such as the FDA, EMA, and WHO have implemented strict guidelines regarding the storage, handling, and transportation of temperature-sensitive pharmaceuticals. Complying with these regulations has led pharmaceutical companies to invest in specialized packaging solutions with real-time monitoring, temperature stability, and data logging capabilities. Global pharmaceutical supply chains add complexity to cold chain logistics, necessitating reliable temperature-controlled packaging solutions.

Temperature-sensitive pharmaceuticals currently dominate this segment, yet vaccines will play a prominent role in the market growth. Vaccines are particularly vulnerable to temperature variations, requiring storage temperatures between 2°C to 8°C. Some vaccines, for instance, necessitate ultra-low temperatures as low as -70°C for optimal storage conditions. Additionally, countries prioritizing immunization programs for diseases like measles, polio, and influenza continues to create a strong demand for vaccine cold chain solutions.

The Pharmaceutical Temperature Controlled Packaging Solutions Market Report is segmented on the basis of the following:

By Product Type

- Reusable Solutions

- Single-Use Solutions

By Application

- Temperature-Sensitive Pharmaceuticals

- Vaccines

- Others

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Regional Analysis

Region with the largest Revenue Share

North America is anticipated to lead the global pharmaceutical temperature-controlled packaging solutions market with

34.0% of total global market revenue in 2025. This dominant position can be attributed to several key factors, including North America's highly advanced pharmaceutical industry, strong regulatory framework, advanced cold chain infrastructure, and significant investments made into biopharmaceutical research and development.

As the largest pharmaceutical market globally, the US plays an instrumental role in driving this growth. Among its top industries includes pharmaceutical giants, biotech firms, and contract manufacturing organizations (CMOs) producing temperature-sensitive medicines such as biologics, vaccines, gene therapies, and specialty drugs. With a growing need for biologics and personalized medicine that requires strict temperature regulation, demand has been raised for advanced packaging solutions that maintain product stability in transit. Meanwhile, chronic conditions like cancer, diabetes, and autoimmune disorders have spurred on temperature-sensitive drug development.

Region with the highest CAGR

Asia-Pacific is projected to experience the highest growth rate in the global pharmaceutical temperature-controlled packaging solutions market, driven by several dynamic factors shaping its pharmaceutical and healthcare industries like rapid pharmaceutical manufacturing growth, increased healthcare demands, and improving infrastructure. Asia-Pacific is home to some of the fastest-growing pharmaceutical markets, particularly among countries like China, India, Japan and South Korea.

These nations are witnessing an exponential increase in the production and consumption of biopharmaceuticals such as vaccines and biologics which require cold chain logistics for efficacy and safety purposes driven by chronic diseases like cancer, diabetes, and cardiovascular disorders which has further fueled demand. Temperature-controlled packaging solutions designed specifically for transporting and storing such high-value drugs are growing at an impressive rate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Competitive Landscape

The global pharmaceutical temperature-controlled packaging solutions market is comprised of established global packaging providers, specialist logistics firms, and emerging technology developers. Pelican BioThermal, Sonoco ThermoSafe, Va-Q-tec, and Cold Chain Technologies are among the key players dominating this market followed by DHL and AmerisourceBergen. These companies provide a variety of packaging solutions designed to maintain optimal temperature conditions for pharmaceuticals such as biologics, vaccines, and gene therapies. Their solutions range from insulated shipping containers to temperature-controlled pallets as well as advanced materials like vacuum-insulated panels (VIPs) and phase change materials (PCMs).

Competition among pharmaceutical manufacturers, distributors, and logistics providers can often be determined by how each business caters to the different needs. Large companies tend to favor cost-effective reusable solutions while single-use packaging systems may be better suited for clinical trials, emergencies, or regions with less-developed cold chain infrastructure. By segmenting their offerings businesses can target different customer bases with large operations preferring cost-effective reusable systems.

Technological innovation plays a crucial role in differentiating competitors in the market. Companies are adopting smart packaging solutions, utilizing IoT sensors and real-time monitoring systems that track environmental conditions during transit. This data ensures pharmaceuticals are stored and transported according to regulatory guidelines as well as providing transparency and traceability between manufacturer and end consumer. As with other industries, pharmaceutical manufacturers face a high pressure to minimize their environmental footprint. Companies offering eco-friendly packaging made of recyclable and biodegradable materials may attract customers seeking greener alternatives.

Some of the prominent players in the global pharmaceutical temperature-controlled packaging solutions are:

- Pelican Biothermal

- Cryopak

- Sonoco Products Company

- Envirotainer

- DS Smith Pharma

- Cold Chain Technologies

- World Courier

- Intelsius

- CSafe

- Softbox Systems

- Skycell

- Va-Q-tec AG

- Sofrigam

- Other Key Players

Global Pharmaceutical Temperature Controlled Packaging Solutions Market: Recent Developments

- September 2024: UPS expanded its healthcare logistics operations by acquiring two Germany-based providers, Frigo-Trans and BPL. This acquisition aims to bolster UPS's capabilities in temperature-controlled logistics across Europe, reflecting a strategic move to enhance its healthcare division.

- March 2023: Cryopak, a leading provider of cold chain packaging and temperature monitoring devices, partnered with M. Chasen & Son, Inc. to establish Chasen Fiber Technologies. This collaboration focuses on developing sustainable, fiber-based solutions aimed at enhancing the efficiency of cold chain packaging.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 7.1 Bn |

| Forecast Value (2034) |

USD 13.6 Bn |

| CAGR (2025-2034) |

7.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Reusable Solutions, and Single Use Solutions), and By Application (Temperature-Sensitive Pharmaceuticals, Vaccines, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Pelican Biothermal, Cryopak, Sonoco Products Company, Envirotainer, DS Smith Pharma, Cold Chain Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global pharmaceutical temperature-controlled packaging solutions market size is estimated to have a value of USD 7.1 billion in 2025 and is expected to reach USD 13.6 billion by the end of 2034.

The US pharmaceutical temperature-controlled packaging solutions is projected to be valued at USD 2.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.9 billion in 2034 at a CAGR of 7.0%.

North America is expected to have the largest market share in the global pharmaceutical temperature-controlled packaging solutions with a share of about 34.0% in 2025.

Some of the major key players in the global pharmaceutical temperature-controlled packaging solutions market are Pelican Biothermal, Cryopak, Sonoco Products Company, Envirotainer, DS Smith Pharma, Cold Chain Technologies, and many others.

The market is growing at a CAGR of 7.5 percent over the forecasted period.