Market Overview

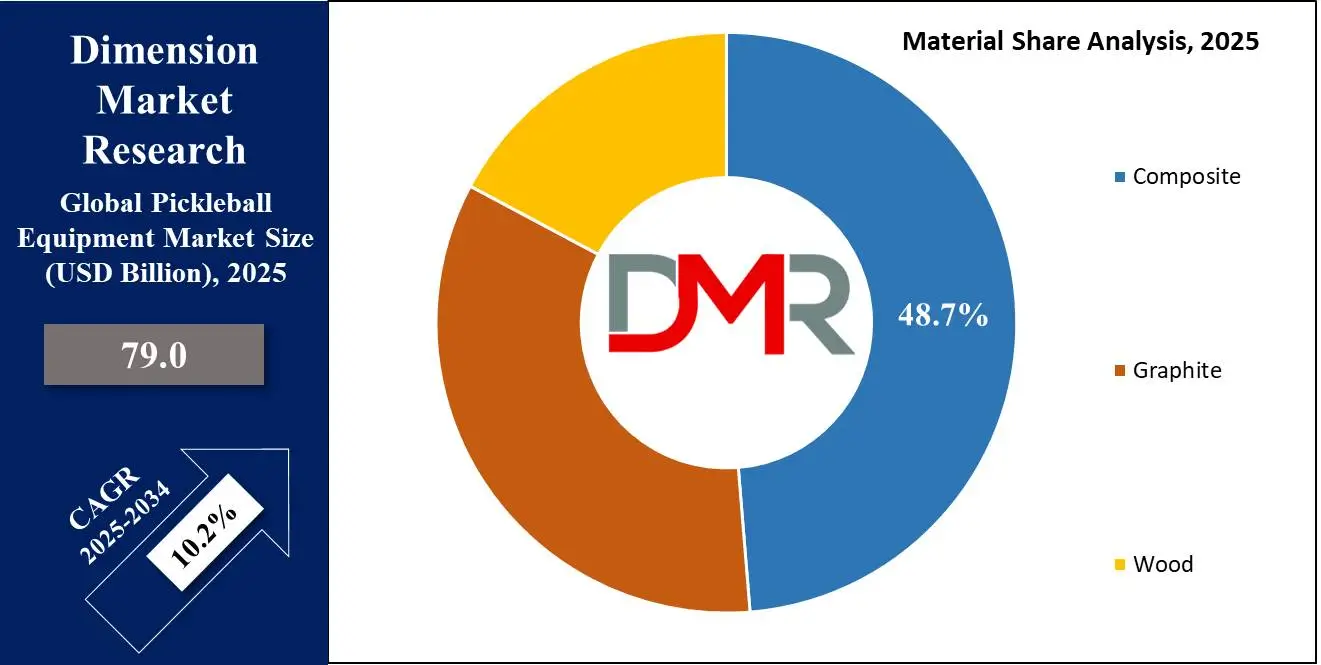

The Global Pickleball Equipment Market is projected to reach

USD 79.0 billion in 2025 and grow at a compound annual growth rate of

10.2% from there until 2034 to reach a value of

USD 188.9 billion.

Pickleball is a fast-growing sport that combines elements of tennis, badminton, and table tennis. The equipment used in pickleball includes paddles, balls, nets, and court accessories. Paddles are usually made of wood, composite, or graphite, with different sizes and weights to suit players of all skill levels. The balls are lightweight, plastic, and have holes, making them different from regular tennis or ping-pong balls. The net is similar to a tennis net but is lower in height. Other accessories include court markers, bags, and shoes designed for better grip on the court surface.

The need for pickleball equipment has grown in recent years due to the sport’s popularity among all age groups, mainly older adults looking for a fun and low-impact activity. Many communities and recreational centers are adding pickleball courts, growing the need for equipment. The growth of professional and competitive pickleball leagues has also contributed to growth, as more players look for high-quality paddles and gear. In addition, schools and fitness centers are incorporating pickleball into their programs, further expanding the market.

Pickleball equipment has evolved with technology and innovation. Manufacturers now use advanced materials like carbon fiber and polymer cores to create durable and lightweight paddles. Players prefer equipment that improves control, spin, and power. Customization is another trend, with players choosing paddles based on grip size, weight, and surface texture. Smart technology is also emerging, with some paddles featuring sensors to track performance.

Shoe companies are designing footwear with better traction and support, recognizing the unique movements of pickleball players. These trends reflect innovation across the broader Sports Equipment Market and align with the growing demand for performance-based gear seen in other sectors such as the

Construction Equipment Market.

In recent years, major sporting brands have entered the

pickleball market, launching their lines of paddles and gear. Several professional tournaments, like the Major League Pickleball (MLP) and the Professional Pickleball Association (PPA) events, have helped showcase new equipment innovations. There have also been regulatory changes, with governing bodies setting standards for paddle thickness and ball specifications to ensure fair play. The growing popularity of televised pickleball matches has boosted sponsorship deals and product endorsements.

Despite rapid growth, the pickleball equipment industry faces some challenges. Supply chain disruptions have affected the availability of certain materials, leading to higher prices. There is also competition among manufacturers, with new brands entering the market regularly. However, there are many opportunities, like the rise of e-commerce, which makes equipment more accessible worldwide. The development of new training tools and accessories can also help beginners learn the sport more easily, further expanding the market.

The growing interest in pickleball has greatly increased the demand for high-quality equipment. Manufacturers are focusing on innovation, offering lighter and more durable paddles with advanced features. The growth of professional leagues and televised matches has brought more attention to the sport, attracting sponsorships and investments.

While challenges like supply chain issues exist, the overall market outlook remains positive. As more people discover pickleball, the industry is expected to continue evolving with new trends and improved products. The

Sports Equipment Market as a whole is experiencing similar tailwinds, with increased attention to product differentiation and performance customization.

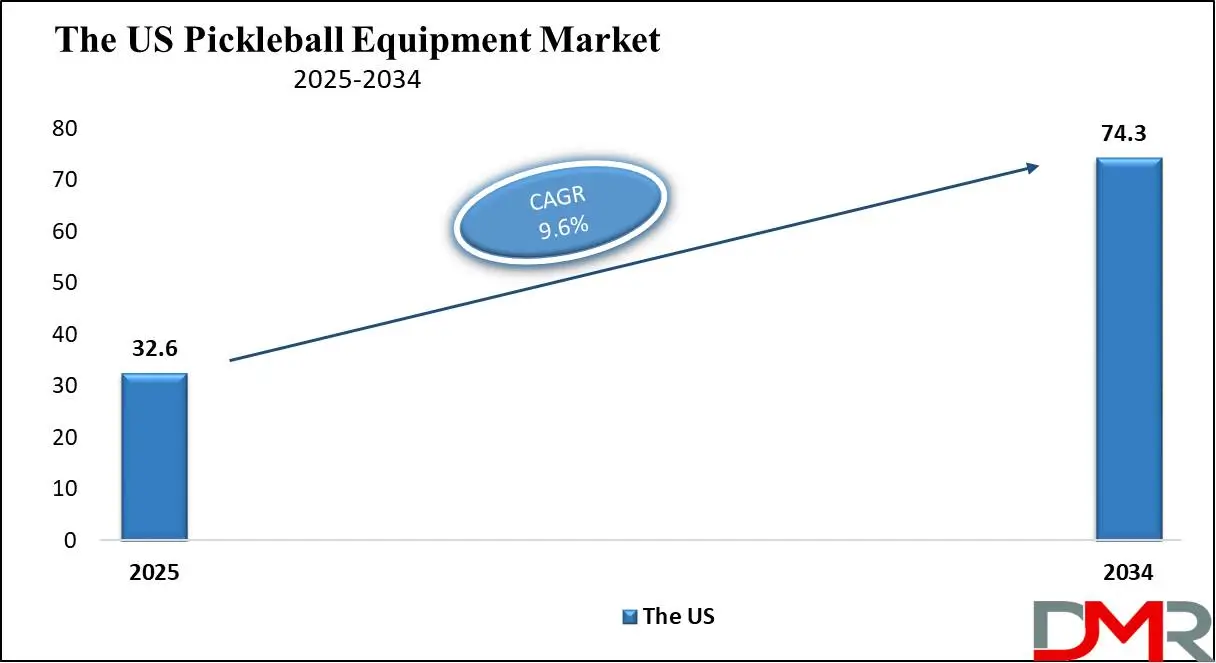

The US Pickleball Equipment Market

The US Pickleball Equipment Market is projected to reach

USD 32.6 billion in 2025 at a compound annual growth

rate of 9.6% over its forecast period.

The pickleball equipment market in the US has strong growth opportunities due to the sport’s surging popularity, expanding player base, and increasing investments in facilities. Demand for high-performance paddles, durable balls, and smart equipment is rising. Retail and e-commerce sales are booming, with opportunities in customization, sustainable materials, and tech-integrated gear. Sponsorships, tournaments, and youth programs further drive market expansion.

Further, the market is driven by the sport’s rapid growth, increasing participation across all age groups, rising investments in courts, and growing media coverage. Demand for advanced paddles, accessories, and smart gear fuels innovation. However, restraints include high competition, pricing pressure, and limited awareness in some regions. Supply chain disruptions and fluctuating material costs also pose challenges for manufacturers and retailers.

Pickleball Equipment Market: Key Takeaways

- Market Growth: The Pickleball Equipment Market size is expected to grow by 102.7 billion, at a CAGR of 10.2%, during the forecasted period of 2026 to 2034.

- By Product Type: The paddles segment is anticipated to get the majority share of the Pickleball Equipment Market in 2025.

- By Material: The composite segment is expected to get the largest revenue share in 2025 in the Pickleball Equipment Market.

- Regional Insight: North America is expected to hold a 47.4% share of revenue in the Global Pickleball Equipment Market in 2025.

- Use Cases: Some of the use cases of Pickleball Equipment include recreational play, competitive matches, and more.

Pickleball Equipment Market: Use Cases

- Recreational Play: Casual players use pickleball equipment for fun and fitness in community centers, parks, and backyards.

- Competitive Matches: Professional and amateur tournaments require high-quality paddles, balls, and nets that meet official standards.

- Training & Coaching: Coaches and trainers use specialized equipment like ball machines and training paddles to improve player skills.

- School & Fitness Programs: Schools and gyms incorporate pickleball equipment to promote physical activity and social engagement.

Stats & Facts

- Pickleball’s infrastructure is expanding at an unprecedented pace, with Pickleheads reporting a total of 68,458 courts nationwide after adding 18,455 new locations in 2024 alone.

- The sport continues to dominate as America’s fastest-growing activity, as SFIA highlights, with participation skyrocketing by 223.5% over the last three years.

- Competitive play is at an all-time high, with USA Pickleball sanctioning 142 tournaments in 2024, including the prestigious Biofreeze USA Pickleball National Championships and 13 Golden Ticket events.

- While the game is thrilling, injuries are a growing concern. Piasta Walker’s study reveals that 90% of pickleball-related ER visits involve players over 50, with sprains and fractures being the most common.

- The rapid rise in participation has also led to a 200% spike in bone fractures over the last 20 years, according to the American Academy of Orthopaedic Surgeons, with 92% of injuries caused by falls.

- Younger players are embracing pickleball like never before. SFIA reports that the 25–34 age group now leads participation with 2.3 million players, and over 1 million children under 18 have taken up the sport since 2022.

- Refereeing standards are improving, as USA Pickleball confirms, with over 1,100 members in its officiating program, a 9% rise in Certified Referees, and a 7% increase in Level 1 and Level 2 referees.

- Despite a 55% growth in dedicated courts, demand continues to outpace supply. Pickleheads estimates that $855 million is still needed to develop enough facilities in the next 5–7 years.

- Equipment innovation is thriving, with USA Pickleball approving 1,225 paddles and 81 balls in 2024 after testing 1,713 new paddle and ball submissions.

- Major U.S. cities are finally catching up in infrastructure, as SFIA & Pickleheads report, with New York, Los Angeles, and Chicago doubling their dedicated courts per 10,000 people—though they still lag 92% behind the national average.

- Passionate ambassadors are helping the sport flourish, with USA Pickleball recognizing 2,051 dedicated representatives promoting pickleball across the country.

- Coaching is evolving rapidly, as Pickleball Coaching International (PCI) reveals, with 1,037 U.S. members, 1,422 global members, and 895 new signups for its latest Level 1 coaching course.

- The 2024 Biofreeze USA Pickleball National Championships was a massive success, according to USA Pickleball, attracting 2,600 players from 47 states and 13 countries, 10,000 spectators, and generating $3.6 million in economic impact.

- Some regions are experiencing explosive participation rates, with SFIA highlighting the South Atlantic as the fastest-growing, seeing a 50% rise in players in 2023, totaling 2.8 million.

- Inclusivity in the sport reached a major milestone, as USA Pickleball proudly introduced wheelchair pickleball at the 2024 Biofreeze USA Pickleball National Championships, giving adaptive players a chance to compete at the highest level.

Market Dynamic

Driving Factors in the Pickleball Equipment Market

Rising Popularity Across Age GroupsPickleball has gained higher popularity among all age groups, from young players to older adults. Its easy-to-learn rules and lower physical impact make it accessible to seniors, while younger athletes enjoy its competitive aspects. As more people take up the sport, the need for paddles, balls, nets, and accessories continues to grow. Community centers, retirement communities, and schools are mainly adopting pickleball programs, further fueling equipment sales. In addition, social media and televised tournaments have introduced the sport to a broader audience, encouraging new players to invest in quality gear.

Technological Advancements & Product Innovation

Manufacturers are constantly improving pickleball equipment with advanced materials and innovative designs. Graphite and carbon fiber paddles provide better durability, while polymer cores enhance control and power. Some brands are launching smart paddles with built-in sensors to track performance metrics, appealing to tech-savvy players. Customization options, like grip size, paddle weight, and surface texture, allow players to choose equipment that suits their playing style. In addition, improvements in ball design and court accessories contribute to a better playing experience, driving further interest in the sport and increasing sales.

Restraints in the Pickleball Equipment Market

High Equipment Costs & Price Sensitivity

One of the main challenges in the pickleball equipment market is the high cost of premium paddles and accessories. Advanced paddles made from graphite or carbon fiber can be expensive, making them less accessible to casual or beginner players. While there are budget-friendly options, serious players often look for high-performance gear, which comes at a premium price. In addition, price-sensitive consumers may hesitate to invest in costly equipment, mainly when starting, which slows market growth, particularly in regions where pickleball is still emerging and lacks widespread accessibility.

Limited Court Availability & Infrastructure Challenges

Despite the sport’s growth in popularity, the availability of dedicated pickleball courts remains a challenge in many areas. Many communities depend on repurposed tennis or basketball courts, which may not provide the best playing conditions. The slow development of proper infrastructure limits participation, which in turn affects the demand for equipment. In addition, in regions where sports like tennis and badminton dominate, local governments and recreational centers may prioritize funding for those sports instead of building new pickleball facilities. Without sufficient playing spaces, the growth of the equipment market may face restrictions.

Opportunities in the Pickleball Equipment Market

Expansion of E-Commerce & Online Sales

The expansion of e-commerce platforms has made it easier for players to access a wide range of pickleball equipment from anywhere. Online marketplaces allow brands to reach global customers, providing various paddles, balls, and accessories at different price points. Direct-to-consumer sales models help manufacturers engage with buyers and provide customized recommendations. In addition, online reviews and tutorials support new players in making informed purchasing decisions. Subscription-based models for accessories and gear maintenance could also create recurring revenue streams. With digital marketing and influencer promotions, brands can further expand their reach and boost sales.

Growing Investment in Professional Leagues & Sponsorships

The growth in the number of professional pickleball tournaments and leagues is driving demand for high-quality equipment. Major sporting brands and investors are recognizing the sport’s potential and are entering the market with sponsorships and endorsements. Televised matches and streaming services are bringing more visibility to pickleball, encouraging new players to buy equipment. In addition, the development of youth and amateur leagues is creating a long-term customer base. As more corporate sponsors and sports organizations invest in pickleball, the market for premium gear, customized paddles, and performance-enhancing accessories is expected to grow significantly.

Trends in the Pickleball Equipment Market

Innovation in Paddle Technology & Customization

Pickleball paddle technology is evolving rapidly, with manufacturers introducing advanced materials like carbon fiber, fiberglass, and polymer cores to improve performance. Players now have access to paddles that offer better control, power, and spin, catering to different playing styles. Customization has also become a key trend, allowing players to choose paddle weight, grip size, and surface texture based on their preferences. Some brands are even offering personalized designs and color options. Additionally, edge guard technology and vibration-dampening features are being incorporated to enhance durability and comfort. These innovations are making high-performance paddles more appealing to both casual and competitive players.

Integration of Smart Technology & Data Tracking

Smart technology is making its way into pickleball equipment, with paddles featuring built-in sensors to track performance metrics like swing speed, shot accuracy, and impact force. These data-driven insights help players analyze their gameplay and improve their techniques. Mobile apps connected to smart paddles provide real-time feedback and coaching tips, making training more efficient. Wearable technology, such as smart wristbands, is also being explored to monitor player movements and endurance. As technology continues to advance, the integration of data analytics in pickleball equipment is expected to attract more tech-savvy athletes and coaches, further driving market growth.

Research Scope and Analysis

By Product Type Analysis

In terms of product type, the paddles segment will be leading in 2025 with a share of 38.2% and will play a key role in the growth of the pickleball equipment market. Paddles are the most important piece of equipment, directly impacting a player’s performance. With the development of materials like carbon fiber, fiberglass, and polymer cores, modern paddles provide better control, power, and durability. Players of all skill levels, from beginners to professionals, continuously look for paddles that enhance their game, driving demand. Customization options like grip size, weight, and surface texture have also boosted sales. As pickleball grows in popularity, the need for high-quality paddles will continue to expand, making this segment a major market driver.

Further, the footwear segment will have significant growth over the forecast period, as it is becoming an important part of the pickleball equipment market. As the sport requires quick movements, players need shoes with proper grip, cushioning, and lateral support to prevent injuries. Leading brands are now designing shoes specifically for pickleball, focusing on durability and comfort. With more players recognizing the benefits of proper footwear, the need is rising. The growth of professional tournaments and casual participation is further driving sales. As awareness of pickleball-specific footwear increases, this segment is expected to see continuous expansion in the coming years.

By Material Analysis

The composite material will lead with a share of 48.7% in 2025, driving the growth of the pickleball equipment market. Composite paddles, made from materials like fiberglass and carbon fiber, provide a perfect balance of power, control, and durability, making them the preferred choice for both casual and professional players. These paddles are lighter than wood but more durable, providing better performance and reducing arm strain. The growing popularity of competitive pickleball and the demand for high-performance gear continue to boost the adoption of composite paddles. With ongoing innovations in material technology, the composite segment is expected to dominate the market, attracting players looking for advanced equipment.

Having an expected significant growth over the forecast period, the wood segment remains popular among beginners and recreational players due to its affordability and durability. Wooden paddles are heavier than composite ones, providing strong hits but requiring more effort to maneuver. Schools, community centers, and budget-conscious players often choose wooden paddles as an entry-level option. While they lack the advanced features of composite paddles, their cost-effectiveness keeps them relevant in the market. As pickleball grows worldwide, the need for budget-friendly wooden paddles will continue, especially for beginners looking to explore the sport without a high initial investment.

By Distribution Channel Analysis

In 2025, the offline segment will lead with a share of 54.9%, as it plays a crucial role in the growth of the pickleball equipment market. Sporting goods stores, specialty shops, and large retail chains provide customers with the advantage of trying out paddles, balls, and other gear before purchasing. Many players prefer in-store shopping for expert guidance and personalized recommendations based on their playing style. Offline stores also host demo events and workshops, allowing players to test equipment before committing. In addition, partnerships between manufacturers and physical retailers ensure a steady supply of high-quality gear. As pickleball expands globally, the offline segment will continue to thrive, offering hands-on shopping experiences that online platforms cannot replicate.

Moreover, the online segment's significant growth over the forecast period is rapidly transforming the pickleball equipment market. E-commerce platforms provide easy access to a wide variety of paddles, balls, footwear, and accessories, often at competitive prices. Online shopping offers convenience, detailed product descriptions, and customer reviews, helping buyers make informed decisions. Many brands are investing in direct-to-consumer sales, offering exclusive deals and customization options. Social media promotions and influencer marketing are also boosting online sales. With the rise of digital shopping trends and global accessibility, the online segment will continue to grow, making pickleball equipment more accessible to players worldwide.

By End User Analysis

In terms of end users, the intermediate segment plays a key role in driving the growth of the pickleball equipment market and will be leading in 2025 with a share of 39.3%. These players have moved beyond the beginner stage and are looking for better-quality paddles, balls, and footwear to improve their game. As they invest in higher-performance gear, the need for mid-range and advanced equipment continues to rise. Many intermediate players participate in local leagues and tournaments, which has led to a growth in the need for durable and well-balanced paddles. Brands are catering to this segment with lightweight, customizable paddles and enhanced court shoes. With the sport’s growing popularity, more players are transitioning to the intermediate level, making this segment a significant market driver.

Further, the professional segment will have significant growth over the forecast period, driving demand for top-tier pickleball equipment. Professional players need high-performance paddles, specialized footwear, and premium accessories to compete at the highest level. The growth of professional leagues, sponsorships, and televised matches has fueled interest in advanced equipment. Brands are investing in research & development to create paddles with enhanced spin, power, and control. As more athletes enter competitive pickleball, the demand for professional-grade gear will continue to grow. The expansion of tournaments and prize money is further pushing the market for high-end equipment.

The Pickleball Equipment Market Report is segmented on the basis of the following

By Product Type

- Paddles

- Balls

- Apparel

- Accessories

- Footwear

By Material

By Distribution Channel

By End User

- Beginners

- Intermediate

- Professionals

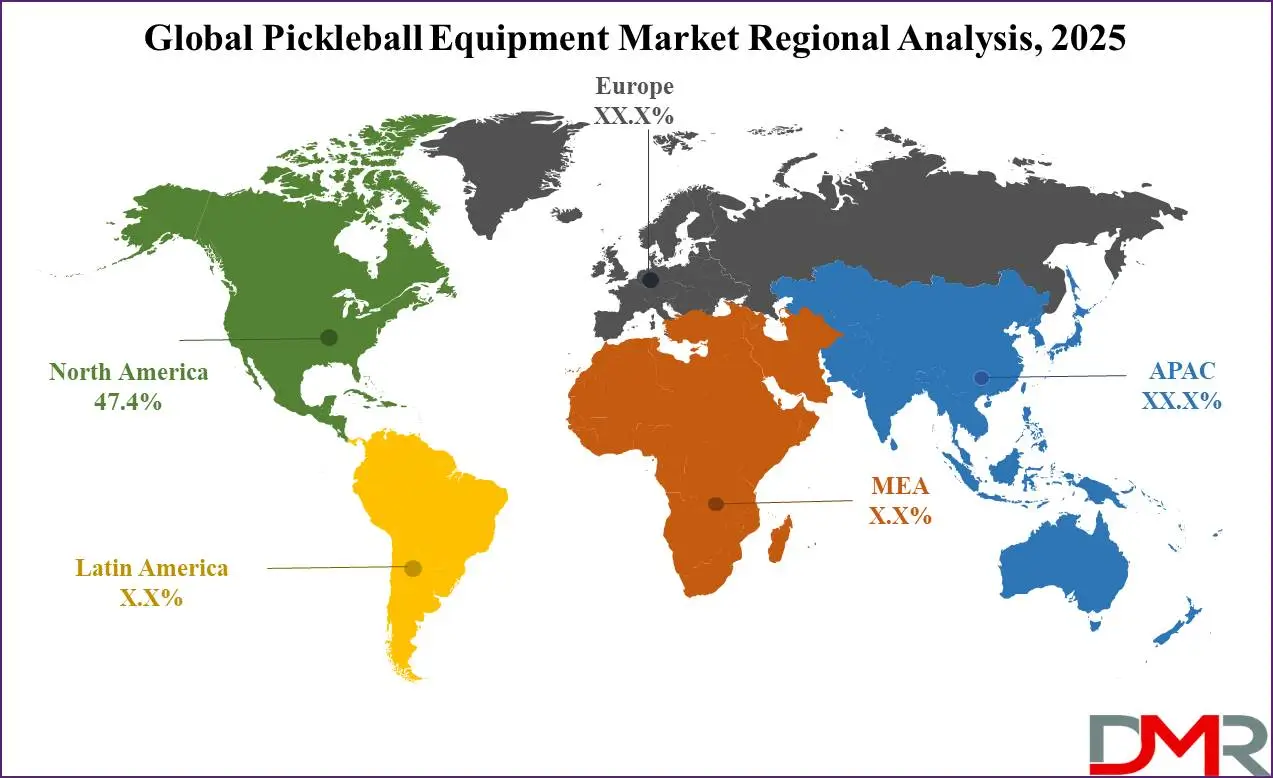

Regional Analysis

Leading Region in the Pickleball Equipment Market

North America is expected to dominate the pickleball equipment market in 2025, holding a substantial share of 47.4%, contributing significantly to the market’s growth which is projected to reach USD 37.4 billion. The sport has rapidly gained popularity in the U.S. and Canada, with millions of players joining recreational clubs and competitive leagues. The growth in the number of pickleball courts, community programs, and school initiatives has fueled demand for paddles, balls, nets, and footwear. Major sporting brands are investing in high-quality equipment, while retailers are expanding their offerings to meet growing interest.

The rise of professional tournaments, media coverage, and celebrity endorsements has further boosted awareness. Additionally, e-commerce platforms and specialty stores make it easy for players to access a wide range of gear. With continuous investments in infrastructure and the sport’s strong presence in both urban and suburban areas, North America will remain a dominant market for pickleball equipment, attracting new players and increasing sales in the coming years.

Fastest Growing Region in the Pickleball Equipment Market

Asia Pacific is emerging as a key region in the pickleball equipment market. The sport is gaining popularity in countries like China, Japan, India, and Australia, driven by increasing awareness and growing sports infrastructure. More recreational centers and schools are introducing pickleball, boosting demand for paddles, balls, and accessories. International tournaments and promotional efforts are further accelerating interest. E-commerce platforms are making high-quality equipment more accessible to players across the region. With rising participation, government support, and growing investments in sports, the Asia Pacific is set to become one of the fastest-growing markets for pickleball equipment in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The pickleball equipment market is growing fast, driven by the sport’s increasing popularity across all age groups. The market includes paddles, balls, nets, and accessories, with companies competing on quality, technology, and price. There’s a mix of high-end brands offering advanced materials for professional players and budget-friendly options for beginners. Innovation is key, with new designs focusing on durability, lightweight materials, and better control. Online sales and specialty stores play a big role, but local sports retailers also capture a share. Demand is rising globally, especially in North America, Europe, and Asia. Competition is intense, with brands trying to stand out through unique features, endorsements, and marketing. Overall, the market is expanding rapidly with new players constantly entering.

Some of the prominent players in the Global Pickleball Equipment are

- Onix Sports

- Franklin Sports

- Selkirk Sport

- Paddle

- CRBN

- Nettie

- Civile

- Pickleball Tutor

- Pickleball Central

- Slinger Bag

- Spinshot Sports

- Lobster Sports

- Nike

- Mizuno

- Prince

- Babolat

- Other Key Players

Recent Developments

- In March 2025, Life Time, North America's largest operator of permanent pickleball courts, announced the Inaugural Agassi Open Play Day, which will feature simultaneous open play across its 785 dedicated courts. Further, the event focuses on uniting players of all levels, with participants having chances to win the new Agassi x JOOLA Pro paddle.

- In April 2024, the United Pickleball Association and Global Sports announced a deal to bring the PPA Tour and Major League Pickleball to the world’s most populous country. It’s the first international deal and major announcement for the United Pickleball Association, which was created after a merger between Major League Pickleball and the Professional Pickleball Association. The PPA Tour and Major League Pickleball retained their distinct brands after the merger. The PPA Tour features an individual bracket-style tour, while MLP is a team-based format.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 79.0 Bn |

| Forecast Value (2034) |

USD 188.9 Bn |

| CAGR (2025-2034) |

10.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 32.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Paddles, Balls, Apparel, Accessories, and Footwear), By Material (Composite, Graphite, and Wood), By Distribution Channel (Offline and Online), By End User (Beginners, Intermediate, and Professionals) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Onix Sports, Franklin Sports, Selkirk Sport, Paddle, CRBN, Nettie, Civile, Pickleball Tutor, Pickleball Central, Slinger Bag, Spinshot Sports, Lobster Sports, Nike, Mizuno, Prince, Babolat, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Pickleball Equipment Market size is expected to reach a value of USD 79.0 billion in 2025 and is expected to reach USD 188.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Pickleball Equipment Market with a share of about 47.4% in 2025.

The Pickleball Market in the US is expected to reach USD 32.6 billion in 2025.

Some of the major key players in the Global Pickleball Equipment Market are Nike, Onix Sports, Franklin Sports, and others

The market is growing at a CAGR of 10.2 percent over the forecasted period.