Market Overview

The

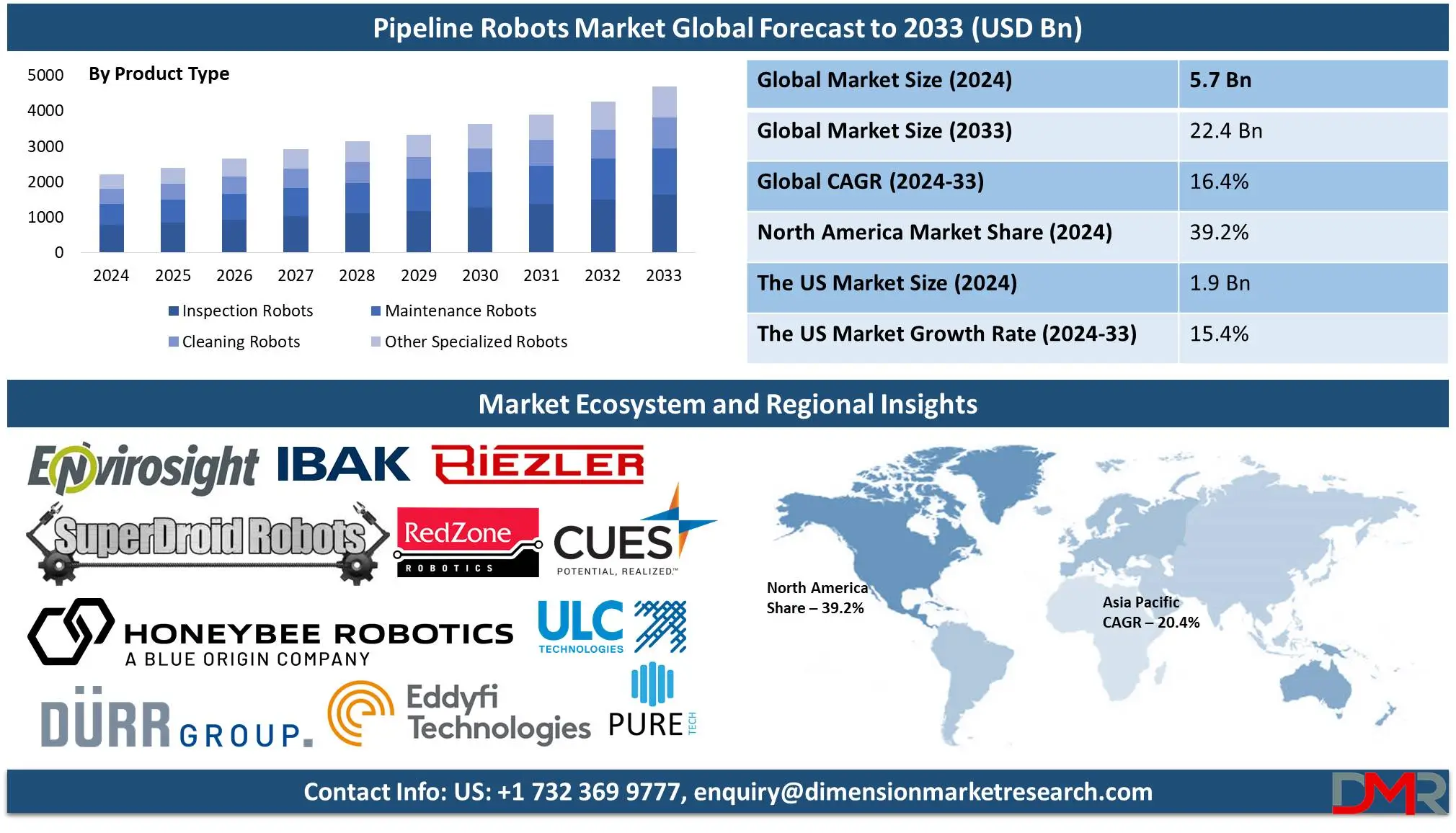

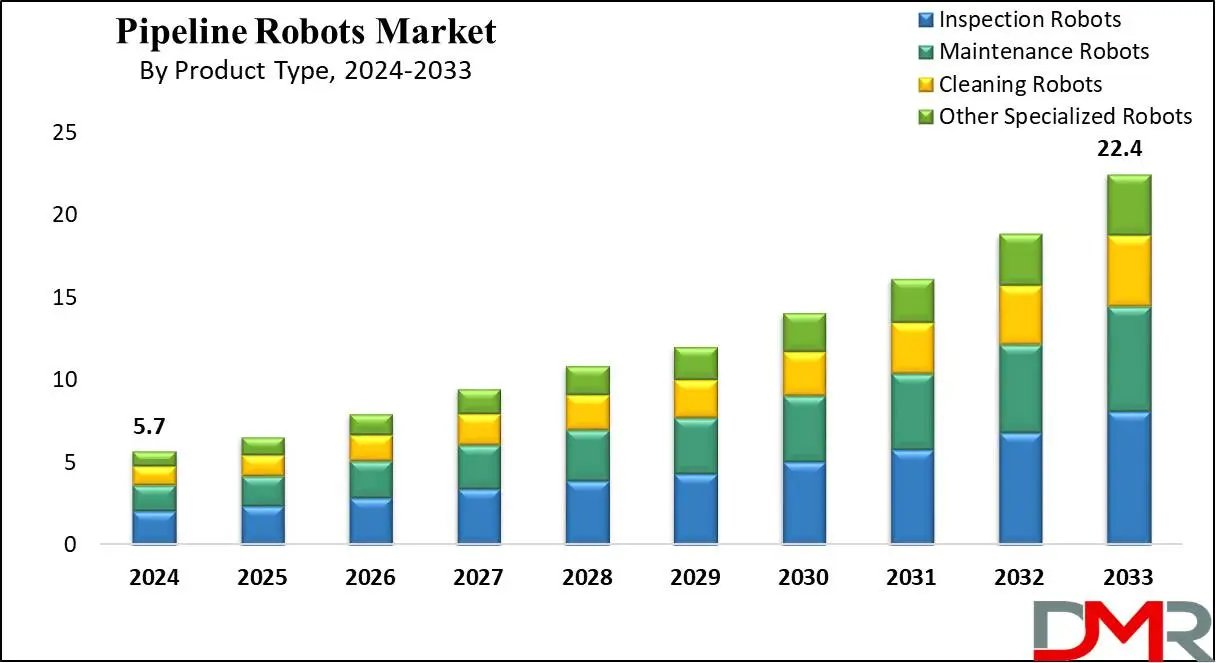

Global Pipeline Robots Market size is expected to reach a

value of USD 5.7 billion in 2024, and it is further anticipated to reach a market

value of USD 22.4 billion by 2033 at a

CAGR of 16.4%.

The global pipeline robot market is one of the fastest-evolving segments in the robotics industry, driven by the ever-growing demand for efficient and safe solutions for pipeline inspection and maintenance. Pipeline robots are designed with several special features to fit all the activities like inspection, cleaning, repair, and maintenance of pipeline systems used in quite a considerable number of industries that involve oil & gas, water utilities, and energy.

While these robots address the critical issues of pipeline integrity and safety on one hand, they also reduce human risks associated with hazardous inspection activities. Pipelines often run along long distances across challenging terrains and extreme environments, where access by a robot to a remote or confined area proves very effective. It is further enhanced through robotic technologies of AI, IoT, and machine learning, which extend the capabilities of pipeline robots by great magnitude in autonomous and precise operations.

These technologies have improved the flexibility and performance of robots in carrying out critical tasks related to leak detection, corrosion, and structural damage of pipelines. Pipeline safety is getting more attention from regulatory bodies in North America and Europe. Therefore, more often than not, industries are obliged in operation to run periodic inspections, which helps in preventing environmental hazards and also keep operations running continuously.

Also, the trend of digitization in industries such as energy and utilities is compelling companies to adopt robotic solutions for real-time monitoring and data analytics. As industries are gradually realizing the importance of pipeline robots in maintaining the reliability of infrastructure, the market is likely to see steady growth. North America is currently leading owing to its vast pipeline networks and strong regulatory landscape.

The pipeline robot market is likely to have significant avenues of growth since decaying infrastructure in developed regions requires continuous inspection and maintenance solutions, especially in North America and Europe. In addition, demand for pipeline robots is likely to be seen in emerging economies that are heavily investing in pipeline networks regarding energy distribution.

New opportunities are arising in the global pipeline robot market advances in ROV and future self-maintained pipeline inspection technologies make these systems more attractive for continuous, long-distance, and low-cost monitoring. The continuous development related to sensor technologies and integration of AI into sensor systems opens new perspectives in increasing efficiency and scalability in operations.

This is because the sector is highly risky as well as a critical infrastructure, and different industries in the pipeline robotics market are showing demand for their products. The range of pipeline failures, leaks, or damage usually impacts the environment and public health, so preciseness in the inspection has become very necessary. The growing automation in most industries to reduce the exposure of humans in hazardous environments is another factor that acts as a driver for the global pipeline robot market.

The water and wastewater sectors also are driving demand as municipalities and utility providers take advantage of pipeline robots to conduct regular maintenance and repair: to ensure water quality and efficiency in their distribution. Although growth and developments are recorded in the pipeline robot market, there are many restraints ahead. Key restraints include high initial investment costs for advanced robotics technology in the pipeline robot market. Many organizations, especially small utility companies, may find it a little difficult to justify these costs against limited budgets, thus affecting adoption rates. Second, complex regulatory standards within industries such as oil & gas and water utilities require pipeline robots to meet specific compliance criteria before usage, further slowing the deployment process.

These also include maintenance and operational challenges, whereby these robots operate in harsh pipeline environments that affect their durability, hence leading to frequent repairs or replacements. One of the major concerns for the global pipeline robot market is that the robotic solution works in a wide range of pipeline diameters, materials, and environments. It is a costly and cumbersome process to develop customized robots for all types of pipeline configurations. Another challenge is the deficiency of skilled operators and technicians who are specifically trained in the special requirements of pipeline robots, which affects their operational efficiency and hence scalability.

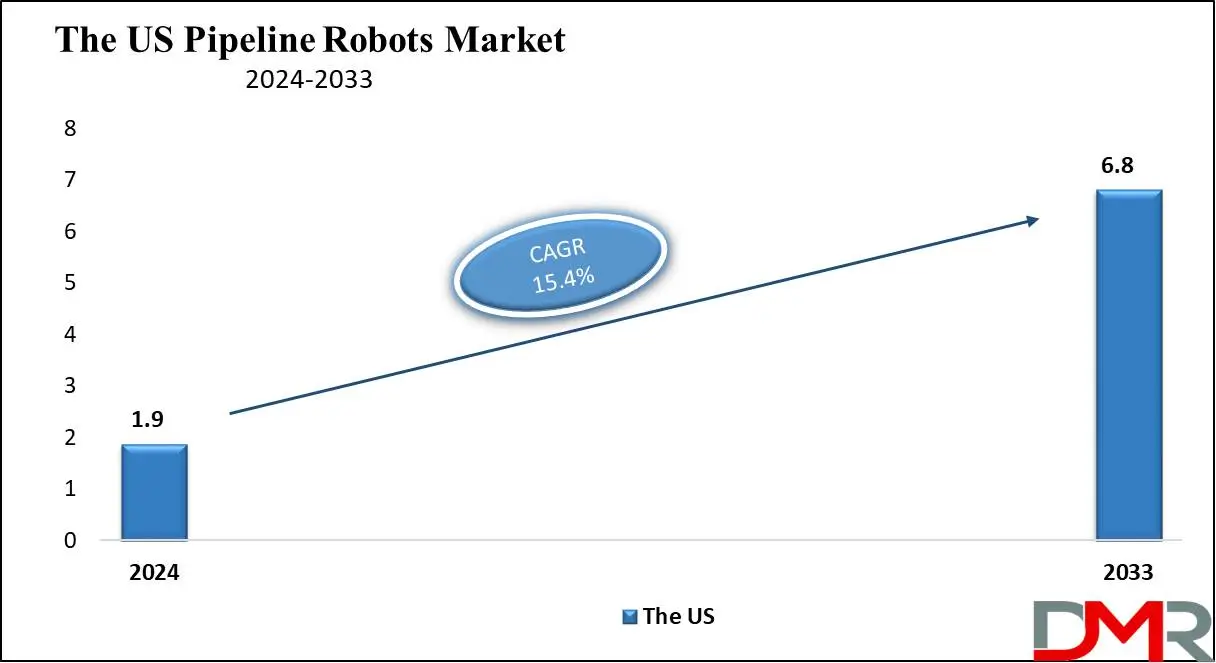

The US Pipeline Robots Market

The US Pipeline Robots Market Is projected to be valued at USD 1.9 billion in 2024. It is expected to witness subsequent growth in the upcoming period, holding USD 6.8 billion in 2033 at a CAGR of 15.4%.

The huge infrastructure for pipelines and regulatory focus on the safety and environmental protection aspect in the U.S. is one of the major contributors to the pipeline robot market globally. Pipelines spanning more than 2.6 million miles in length transport oil, natural gas, and other hazardous materials across the U.S.; the pipeline infrastructure requires frequent inspection and maintenance to ensure that safety and operational efficiency are achieved in an environmentally compliant manner. Pipeline robots have considerable potential to operate effectively in such regulated environments, with agencies such as PHMSA enforcing strict regulations that call for frequent inspection.

Recent trends within the U.S. market have shown a strong movement toward autonomous and semi-autonomous robots, driven by increasing the need to cut down on human exposure in dangerous environments and further improve efficiency in operations. Advanced inspection robots are catching up pretty fast, increasingly deploying AI and machine learning to enable instant real-time data analysis that will facilitate quicker decision-making. Innovation-leading, US-based companies like General Electric Inspection Robotics and Honeybee Robotics have come up with multi-functional robots-inspection and maintenance-that can reduce the operational downtimes of pipeline operators to a minimum.

Another key trend in the country includes the use of IoT in pipeline robots. IoT-enabled robots are able to send real-time data to a centralized system. These provide very important inputs to the operators regarding pipeline health and its likely problems. Due to increasing investments in R&D, and a strong focus on technological advancements, the U.S. is likely to continue with a leading share in the global pipeline robot market during the forecast period.

Key Takeaways

- Global Market Value: The Global Pipeline Robots Market is estimated to have a value of USD 5.7 billion in 2024 and is expected to reach USD 22.4 billion by the end of 2033.

- The US Market Value: The US Pipeline Robots Market Is projected to be valued at USD 6.8 billion in 2033 from a base value of USD 1.9 billion in 2024 at a CAGR of 15.4%.

- Regional Analysis: North America is expected to have the largest market share in the Global Pipeline Robots Market with a share of about 39.2% in 2024.

- Key Players: Some of the major key players in the Global Pipeline Robots Market Are GE Inspection Robotics, Pure Technologies Ltd., Envirosight LLC, IBAK Helmut Hunger GmbH & Co. KG, Honeybee Robotics, CUES Inc., SuperDroid Robots, Inc., ULC Robotics, and many others.

- Global Growth Rate: The market is growing at a CAGR of 16.4 percent over the forecasted period.

Use Cases

- Oil & Gas Pipeline Inspection: Robots highly deployed in performing inspections of oil and gas pipelines, detecting corrosion, cracks, and even the tiniest leaks that could result in large environmental and financial impacts.

- Water and Wastewater Pipeline Maintenance: Municipalities use robots to inspect and perform maintenance on the water pipelines to ensure that the water is distributed safely and avoids any potential risks of contamination.

- Chemical Pipeline Monitoring: Within the chemical industries, pipeline robots help in monitoring and cleaning pipes through which hazardous materials are transmitted, hence decreasing the rate of exposure among human workers.

- Nuclear Pipeline Maintenance: Robots are put to work in nuclear plants to monitor and repair the pipelines transporting radioactive material so that it guarantees neither harm to the worker nor violations of legislation.

Market Dynamic

Trends

Integration of AI and Machine Learning The integration of artificial intelligence and machine learning into the systems of robots is one of the key trends in the pipeline robots market. Each of these technologies extends the capabilities of robots by conducting real-time data analysis, detecting potential issues including corrosion, leakages, and blockages, and even predicting future failures before they happen in the first place. AI-powered robots can do condition monitoring for predictive maintenance by identifying the pattern from inspection data. According to the latest developments in AI and ML, these robots will be made more autonomous, which will enhance their operational performance to handle high-profile tasks. Thus, these kinds of robots are crucial in industries dealing with oil & gas, utilities, and chemicals.

Miniaturization and Increased Mobility

Another key trend that is going on is the miniaturization of pipeline robots. In an attempt at cost economy and efficiency, most industries today make use of smaller-sized and compact pipeline robots to navigate nearly every narrow area within the pipelines. The dynamics involved in miniaturizing these robots have greatly increased their mobility options, crawlers, or wheels in navigating complex pipeline geometry with difficulties in tight spaces. With increased mobility, these robots can inspect more efficiently, especially through pipelines with irregular diameters or those that are difficult to reach. Smaller-sized robots are also cheaper and hence attractive to small and medium-sized firms, as they have pipeline inspection and maintenance needs but have limited budgets.

Growth Drivers

Rising Demand for Pipeline Safety and Integrity

The increasing demand for the safety and integrity of pipelines is another major factor that influences growth in the pipeline robotics market. Pipelines in the oil and gas, water treatment, and chemical industries are deteriorating with age, which increases the likelihood of pipeline failure through leakage, corrosion, and rupture. Pipeline robots are equipped with state-of-the-art sensors and imaging equipment, which enable the real-time monitoring of conditions inside pipelines, thus helping in the determination of weaknesses that might cause major failures. For these reasons, industries have resorted to increased robotic solutions as a means of ascertaining pipeline safety due to the increasing regulatory pressures and ways of minimizing environmental risks. Besides, there is increased regulation by governments around pipeline inspections, further accelerating the application of robotic systems in compliance with requirements.

Technological Advancements in Robotics

The continuous technological development in robotics is another main growth driver for the pipeline robots market. Innovation in motor efficiency, mobility mechanisms, and sensor technologies creates more possibilities for the capabilities of pipeline robots by enabling them to perform increasingly complex tasks in a more precise manner. Examples are given by robots fitted with high-definition cameras, ultrasonic sensors, and magnetic flux leakage technology that will be able to scan early signs of wear or damage in pipes.

This helps in cutting down on what is usually costly repairs apart from enhancing operational safety. These developments do make the robots efficient, reliable, and even economical; hence, the rate of deployment across all industries relying on pipelines is growing. With the advancement of new technologies, pipeline robots are very likely to play a more significant role in automation and maintenance processes in the future, thus driving the market further.

Growth Opportunities

Expanding Adoption in Emerging Markets

A significant growth opportunity for the pipeline robots market includes increasing adoption of robotic solutions in emerging markets. As infrastructure development continues to evolve in various countries across the Asia-Pacific, Latin America, and Africa regions, greater demand will be placed on efficient and reliable pipeline inspection and maintenance solutions. These developing regions are investing more and more in the modernization of their oil and gas, water, and chemical industries, with increased emphasis on safety and environmental concerns.

Such developing markets are thus ideal for pipeline robots, given their cost-effectiveness and increasing dependability in pipeline inspection and maintenance. This is likely to drive the use of pipeline robots higher with increasing demand for sustainable energy and infrastructure in these regions, hence opening vast opportunities for market participants to expand their presence.

Collaborations with Industry Players

The other important growth area for pipeline robots involves strategic collaboration opportunities with industry players. Pipeline operators, engineering firms, as well as robotic solution providers, have increased their working together to develop tailored solutions suitable for specific industries. Collaboration could also offer next-generation robotic systems with value-added features like real-time data analytics, advanced predictive maintenance tools, and the handling of more complex pipeline configurations. Besides, the partnership with research institutions and universities will lead to the development of advanced technologies for pipeline robot enhancement. This will bring an ongoing evolution in the field of robot technology by the company through established relationships with key stakeholders that ensure the company's long-term success in the pipeline robotics market.

Restraints

High Initial Investment Costs

One of the major restraints of the pipeline robots market involves the high initial investment cost for advanced robotic systems. Although long-term cost benefits could be obtained from these robots due to better efficiency and lesser downtime, the high initial cost of procurement, integration, and maintenance of pipeline robots is acting as a deterrent to SMEs. While such sensors, cameras, motors, and other special parts are expensive, operation and maintenance are also done by highly competent personnel. The result is robotic solutions that could be pretty well beyond the means of some companies. In the end, pipeline robots have a high demand, but due to entry barriers, they form the main finite costs, hence restricting their application in some fields.

Limited Standardization Across Regions

Another challenge the pipeline robot market faces is a lack of standardization across geographies. This makes the deployment and scalability of robotic systems particularly difficult. With different countries and industries coming with different regulations, safety standards, and infrastructural requirements, there can hardly be one-size-fits-all. Many times, pipeline robots need customization to fit into the requirements of various industries, increasing development time and cost. Besides, standardization of the communication protocols and interfaces between robots and traditional pipeline infrastructure will make the penetration of robotic systems into legacy infrastructure smoother. The market may still bear the brunt in terms of a lack of adequate standardization, leading to limited global acceptance and scalability of pipeline robots.

Research Scope and Analysis

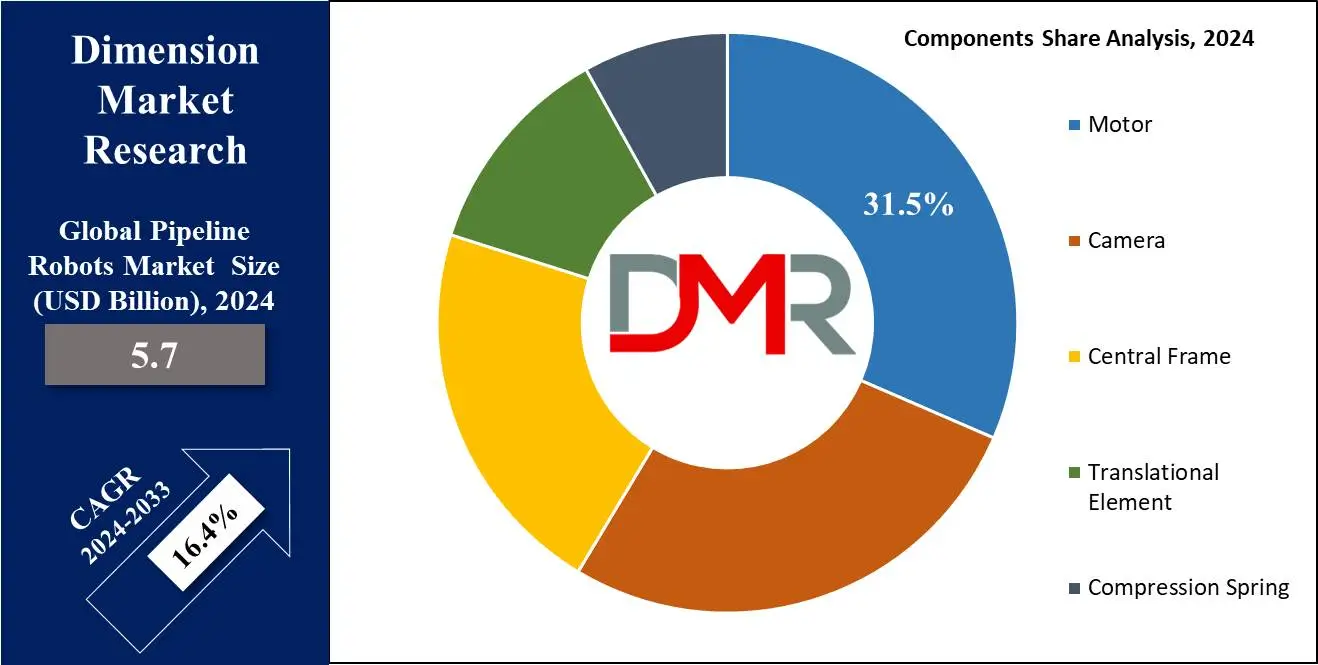

By Component

Motors are projected to dominate the component segment in the pipeline robot market as they hold 31.5% of market share in 2024. By component, the segmentation of the market is dominated by motors as they provide the vital ability of motion and power to the robotic systems for carrying out their inspection and maintenance work.

They drive the wheels and tracks or other mobility parts to push the robot inside the pipeline, often under harsh conditions. Because robots are to operate autonomously or semi-autonomously over long distances, powerful and efficient motors are quite necessary to guarantee that the robots will be able to fulfill their tasks without too much interruption for recharging or other mechanical problems.

With the further development of electric motors and increasing efficiency in their operation, their share is only enhanced. These motors are compact, energy-efficient, and can be manipulated with great accuracy; thus, they are suitable for robot use in narrow areas, such as pipes. Motors also provide the torque required for the robots to climb obstacles such as pipe joints or bends without losing mobility.

Besides, motors dominate, as their integration into robotic systems is much easier compared to other components like sensors and cameras, considering sophisticated data processing capability. Available from high-torque DC motors down to more energy-efficient stepper motors, a variety of motor choices lets the manufacturer adapt the robotic design so easily for specific pipeline applications. This flexibility and efficiency make motors an integral part; hence, giving them the lead role in the pipeline robot market component segment.

By Type

Remotely Operated Vehicles (ROVs) are anticipated to dominate the type segment of the pipeline robot market owing to their ability to perform complex inspection maintenance and repair operations in hazardous or unreachable pipeline environments. ROVs fitted with various tools and sensors can provide real-time data and visual inspection, and can even conduct minor repairs at sites without the involvement of humans in dangerous areas. This in turn reduces the risks associated with sending personnel into dangerous sections of pipelines, such as those underwater or other pipelines with extreme internal pressure.

Another reason ROVs will be dominant involves their versatility. The use of ROVs in such industries as oil & gas, water utilities, and chemical processing is considered to perform all sorts of inspection and maintenance jobs. ROVs can be deployed either from offshore, underground or from high-pressure pipelines; hence, their application encompasses a wide field. This makes ROVs very ideal for pipeline systems that are inaccessible by traditional means, due to advanced maneuverability, sometimes operating autonomously or controlled remotely.

The ROV capability improvements alone through the development of high-tech sensors, cameras, and communication systems quite clearly made their application in pipeline inspection quite effective. Such new technology assures that the ROVs will not only be able to collect more detailed information but also delve into leak detection and repair tasks, consequently holding their dominant position in the pipeline robot market.

By Product Type

Inspection robots are projected to emerge as the dominant product type in the global pipeline robot market as they hold 36.0% of the market share in 2024. This is due to their value for critical infrastructure pipeline maintenance. These are designed to search out defects such as cracks, corrosion, leaks, and other defects that threaten the safety and efficiency of pipelines. Inspection robots find applications in industries ranging from oil and gas to water utilities and chemicals for monitoring and maintaining large pipeline networks for operational continuity and regulatory compliance. With advanced sensors and imaging technologies, including ultrasonic, magnetic flux, and high-resolution cameras, for precise identification, these robots can heighten their precision and reliability in finding potential issues.

Environmental protection and public safety have come to the fore now, which, in turn, fuels the demand for inspection robots. In most countries, several regulatory bodies require periodic pipeline inspections to prevent leakages and spills. In the oil & gas sector, this is very important, as damage that is not detected could lead to disastrous consequences. Besides, inspection robots can also be used in remote and hazardous environments, eliminating the need for human inspection in hazardous operation areas and reducing costs. This ability of inspection robots to perform real-time data analysis for actionable insight, enabled by advancements in AI and IoT, makes predictive maintenance possible. The whole technological progress and support by regulatory bodies reinforce the dominance of inspection robots in the product type segment.

By Mobility Type

The crawler-type pipeline robots are projected to dominate the mobility-type segment, as they are fitted with continuous tracks or crawlers that enable their ability to negotiate in most of the pipelines, which may have bends, joints, or any other related issues, with stability and traction. This mobility is essential for maintaining uniform motion along difficult pipeline layouts and ensuring that the robot can cover long distances for inspection, cleaning, and minor repairs.

The crawlers do very well in limited or irregular spaces, a common feature in most pipeline systems. Their design makes them capable of overcoming a variety of obstacles and adapting to changes in surface conditions, hence perfect for lines laid underground, under waterways, or across normally difficult terrains. They can perform under conditions where other forms of robots, wheeled or legged, may not be able to.

Besides the fact that crawler-type robots have pretty good weight distribution, this enables these systems to support heavy payloads which come in the form of sensors, cameras, and repair tools without their getting immobilized. This, in turn, allows access and the execution of repairs over hard-to-reach areas of pipelines. Strong build and performance for extreme conditions make crawler-type robots the go-to mobility solution for pipeline operators, hence the leading position in the mobility type segment.

By Application

Most of the revenue generated in the application category comes from the industrial segment of the pipeline robot market since pipelines are used in every other industry, including oil & gas, chemicals, utilities, and manufacturing. Industrial pipelines may be laid over long distances and may operate under severe conditions such as high pressure, extreme temperatures, and corrosive action. All these factors make maintenance and inspection regularly quite essential to avoid leakage, corrosion, and other safety hazards. Among others, industrial pipeline robots are becoming important in the integrity and safety of pipelines by ensuring minimal or zero downtime, an action that evades a costly disruption.

The reason is, that there is continuous growth in infrastructure and to meet stringent regulatory standards for the safety of pipelines in industries. Therefore, industrial pipelines have to conform to national and international standards of safety, and one of the most efficient and cost-effective means is through robotic systems. Industrial applications, on the other hand, require pipeline robots to carry out critical sessions of pipeline cleaning, inspection, or repair in hazardous conditions. Such tasks become considerably less hazardous to human workers when robots can execute them autonomously or teleoperatively.

Furthermore, the increased development of sustainability, coupled with a focus on the reduction of environmental impacts within industrial operations, thereby strengthens demands for robotic solutions. The utilization of robots reduces dangerous conditions requiring manual labor, improves pipeline safety, and further ensures resource transport efficiency; hence, this is considered an industrial application dominance in the pipeline robot market.

The Pipeline Robots Market Report is segmented on the basis of the following

By Component

- Motor

- Camera

- Central Frame

- Translational Element

- Compression Spring

By Type

- Remotely Operated Vehicles

- Autonomous Underwater Vehicles

- Unmanned Aerial Vehicles

- Unmanned Ground Vehicles

By Product Type

- Inspection Robots

- Maintenance Robots

- Cleaning Robots

- Other Specialized Robots

By Mobility Type

- Crawler-type Pipeline Robot

- Wheel Type Pipeline Robot

By Application

- Industrial

- Oil and Gas

- Chemical

- Others

Regional Analysis

North America is projected to presently hold the largest share in the pipeline robot market with 39.2% of total market revenue in 2024 due to its vast infrastructure for pipelines, as well as stringent pipeline safety regulations within the area. For example, in the United States alone, there are a few of the largest pipeline networks hosted globally. In turn, these have sparked a considerable amount of demand for constant maintenance and inspections needed in compliance with federal safety laws such as those posed by PHMSA; this, in turn, drives the market.

The oil and gas industry in the U.S. also highly relies on robotic solutions to track and inspect pipelines, especially in offshore and remote areas where traditional methodology is difficult and dangerous. North American companies are among the leaders in integrating more advanced pipeline robots that also possess AI, IoT, and machine learning capabilities to improve accuracy in pipeline inspection and decrease operational costs.

The vast oil sand and gas pipeline networks of Canada, further help in the growth of the North American market. The environmental protection and pipeline safety regulations of the country further give a boost to the demand for robotic solutions. Also, advancements in robotics technologies and growing trends towards automation of industrial processes are likely to continue the growth in the pipeline robot market in the region. Continuous investments in research and development are likely to keep North America at the forefront of the global pipeline robot market in the coming years, setting the pace in innovation and adoption in other key regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The pipeline robot market is fiercely competitive and represents the focus of key players to innovate and advance the technology further, while also ramping up product portfolios in the face of the growing demand for pipeline inspection and maintenance solutions. Key players within the pipeline robots market include GE Inspection Robotics, Honeybee Robotics, and Ives, Inc., among other firms. These companies spearhead technology with a wide range of robotic system developments for several pipeline applications, including inspection, cleaning, maintenance, and repair.

GE Inspection Robotics is leading the market in providing robotic solutions for indoor and outdoor pipeline applications. Its robots are designed for utilization in particularly unforgiving environments using sophisticated sensors and imaging to realize detailed pipeline inspections. Honeybee Robotics is also an important player, credited for innovations within robotic systems used in pipeline inspection, mapping, and repair.

Undue competition is also getting strong in the market from new entrants primarily specializing in autonomous robotics and AI-powered solutions. Most such companies are leveraging AI, machine learning, and IoT technologies for smarter robots capable of performing complex tasks with lesser human intervention. Besides this, there are numerous collaborations between robotic manufacturers and industrial operators, followed by partnerships with the firms operating pipelines, and huge R&D investments to enhance robotic systems. Going ahead, only those companies that can offer scalable, multi-functional, and cost-effective robotic solutions will continue to have the edge regarding competitiveness in the market.

Some of the prominent players in the Global Pipeline Robots Market are

- GE Inspection Robotics

- Pure Technologies Ltd.

- Envirosight LLC

- IBAK Helmut Hunger GmbH & Co. KG

- Honeybee Robotics

- CUES Inc.

- SuperDroid Robots, Inc.

- ULC Robotics

- Eddyfi Technologies

- RIEZLER Inspektionssysteme GmbH & Co. KG

- RedZone Robotics

- Dürr Group

- Other Key Players

Recent Developments

In 2024

- March 2024: Honeybee Robotics launched an advanced pipeline inspection robot equipped with AI-powered data analytics. This robot is designed for real-time pipeline monitoring and features a suite of advanced sensors, including ultrasonic and visual inspection capabilities. The integration of AI will allow for predictive maintenance and early fault detection, significantly reducing pipeline downtime and preventing potential environmental hazards.

In 2023

- November 2023: Ulc Robotics announced the successful deployment of a new pipeline crawler robot in the oil & gas sector. The robot utilizes high-resolution cameras and corrosion detection tools to inspect pipelines in real time, reducing the need for manual inspections. This advancement is expected to improve operational efficiency and reduce maintenance costs for pipeline operators.

- August 2023: Ge Inspection Robotics developed an autonomous robotic platform designed for the inspection of subsea pipelines. This robot features a robust mobility system, allowing it to access hard-to-reach areas of underwater pipelines. It is equipped with various sensors to detect cracks, leaks, and other structural issues, providing critical data to ensure pipeline safety and operational continuity.

In 2022

- December 2022: Epson Robots launched a new line of compact and high-mobility pipeline robots designed specifically for inspecting smaller-diameter pipes. These robots come with advanced ultrasonic testing equipment and are highly maneuverable, making them ideal for narrow and confined pipeline sections often found in urban infrastructure projects.

- July 2022: Honeybee Robotics secured a multi-year contract with a major utility provider to deploy their pipeline robots for regular inspections across a nationwide network. The agreement is a significant milestone in expanding the use of robotic inspection technology in critical infrastructure maintenance.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.7 Bn |

| Forecast Value (2033) |

USD 22.4 Bn |

| CAGR (2024-2033) |

16.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Motor, Camera, Central Frame, Translational Element, and Compression Spring), By Type (Remotely Operated Vehicles, Autonomous Underwater Vehicles, Unmanned Aerial Vehicles, Unmanned Ground Vehicles), By Product Type (Inspection Robots, Maintenance Robots, Cleaning Robots, and Other Specialized Robots), By Mobility Type (Crawler-type Pipeline Robot, and Wheel Type Pipeline Robot), By Application (Industrial, Oil and Gas, Chemical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

GE Inspection Robotics, Pure Technologies Ltd., Envirosight LLC, IBAK Helmut Hunger GmbH & Co. KG, Honeybee Robotics, CUES Inc., SuperDroid Robots, Inc., ULC Robotics, Eddyfi Technologies, RIEZLER Inspektionssysteme GmbH & Co. KG, RedZone Robotics, Dürr Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Pipeline Robots Market is estimated to have a value of USD 5.7 billion in 2024 and is expected to reach USD 22.4 billion by the end of 2033.

The US Pipeline Robots Market Is projected to be valued at USD 1.9 billion in 2024. It is expected to witness subsequent growth in the upcoming period, holding USD 6.8 billion in 2033 at a CAGR of 15.4%.

North America is expected to have the largest market share in the Global Pipeline Robots Market with a share of about 39.2% in 2024.

Some of the major key players in the Global Pipeline Robots Market Are GE Inspection Robotics, Pure Technologies Ltd., Envirosight LLC, IBAK Helmut Hunger GmbH & Co. KG, Honeybee Robotics, CUES Inc., SuperDroid Robots, Inc., ULC Robotics, and many others.

The market is growing at a CAGR of 16.4 percent over the forecasted period.