Market Overview

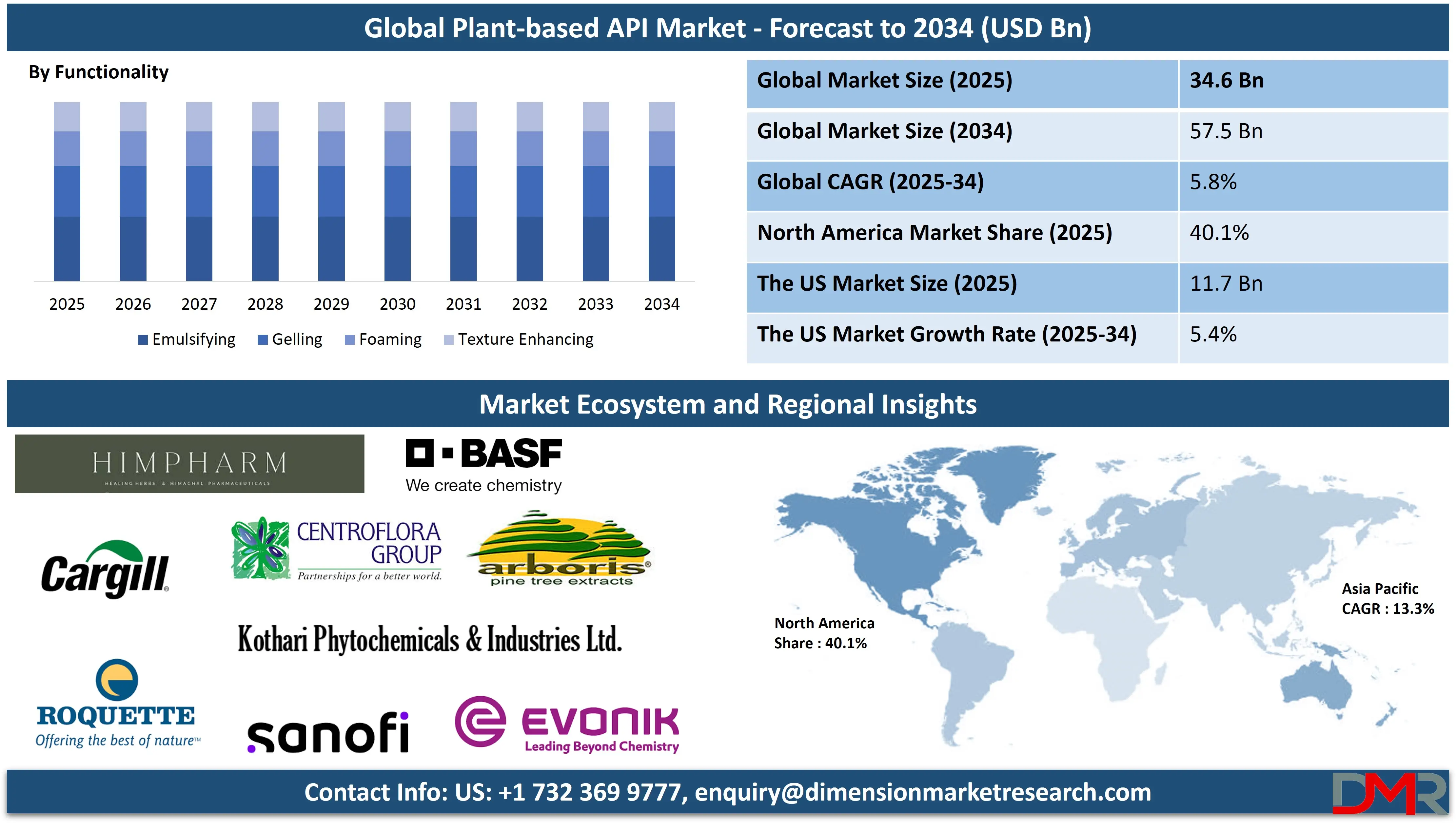

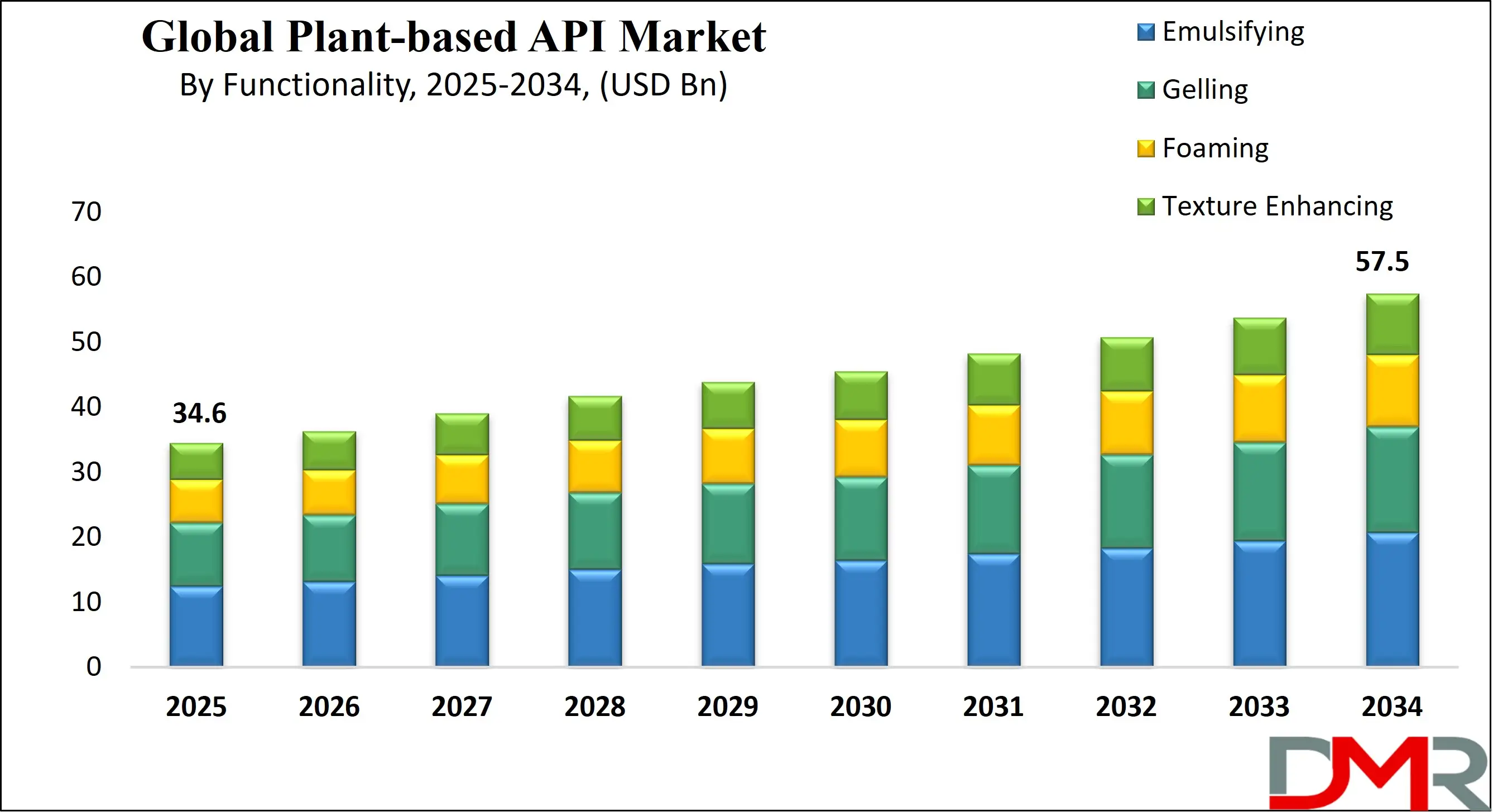

The Global Plant-based API Market is predicted to be valued at USD 34.6 billion in 2025 and is expected to grow to USD 57.5 billion by 2034, registering a compound annual growth rate (CAGR) of 5.8% from 2025 to 2034.

Plant-based Active Pharmaceutical Ingredients (APIs) are bioactive compounds derived from medicinal plants and botanicals, used in the formulation of pharmaceutical and nutraceutical products. Unlike synthetic APIs, these natural compounds are extracted from various parts of plants such as roots, leaves, bark, seeds, or flowers. They are known for their therapeutic properties and are used to treat a wide range of health conditions, including inflammation, cardiovascular diseases, infections, and digestive disorders. Plant-based APIs are gaining popularity due to increasing consumer preference for natural and sustainable products, along with advancements in extraction technologies that enhance purity, potency, and consistency in pharmaceutical applications.

The global plant-based APIs market is witnessing strong momentum due to the growing demand for natural and sustainable healthcare solutions. Innovations in eco-friendly extraction methods, such as ultrasonic-assisted and supercritical fluid techniques, are enhancing the purity and consistency of botanical compounds while minimizing environmental harm. With consumers leaning toward clean-label, organic formulations, the pharmaceutical industry is increasingly favoring plant-derived actives over synthetic ones. Additionally, rising collaborations between established pharmaceutical firms and emerging biotech companies are expanding research into plant-based molecules like flavonoids, alkaloids, and terpenes. These advancements align with the growing demand for safer alternatives in Cancer Immunotherapy and Neurological Disorder Drugs.

Opportunities in the market are expanding with increased applications in nutraceuticals, functional foods, and tailored medicine. The Asia-Pacific region, rich in medicinal flora and experiencing a surge in healthcare spending, offers a significant growth avenue. As sustainability becomes a strategic priority for companies, many are integrating plant-derived APIs to align with ESG goals and stand out in competitive markets. Regulatory shifts across regions, including more supportive pathways for botanical drug approvals, are also streamlining entry and encouraging product development.

Despite its promise, the market faces several challenges. These include regulatory complexities, seasonal variation in raw material availability, and difficulties in achieving uniformity across batches. Ensuring compliance with Good Manufacturing Practices (GMP) and maintaining rigorous quality assurance raise production costs. These hurdles can particularly burden small and mid-sized manufacturers, especially those dealing with sensitive formulations and strict Pharmaceutical Packaging standards.

Rising health concerns are increasing demand for botanicals with antioxidant, anti-inflammatory, and therapeutic properties. Advances in biotechnology and synthetic biology will help improve the efficiency and scalability of plant-based ingredients, boosting their role in pharmaceuticals, personal care, veterinary, and agri-biotech industries. The integration of plant-derived APIs with advanced medical devices is also expanding, allowing for innovative drug delivery systems and precision healthcare applications.

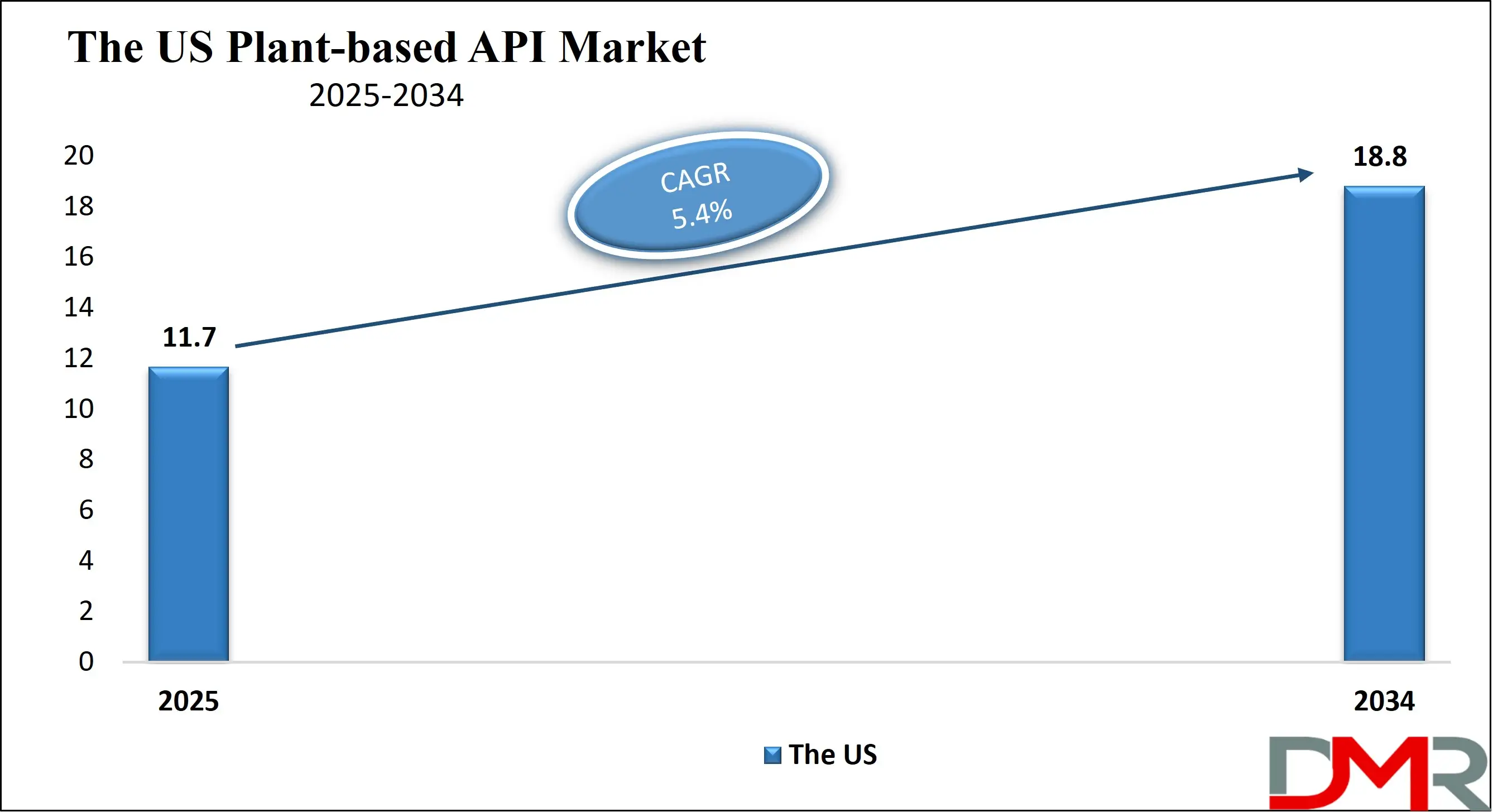

The US Plant-based API Market

The US Plant-based API Market is projected to be valued at USD 11.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 18.8 billion in 2034 at a CAGR of 5.4%.

The growing consumer inclination toward natural and clean-label pharmaceuticals is driving demand for plant-based APIs in the US. Increasing awareness regarding the side effects of synthetic drugs and a strong shift toward herbal and botanical alternatives support the market’s growth. Regulatory support for botanical drug development and an expanding base of chronic disease patients seeking safer treatment options further contribute to the surge.

Moreover, the presence of a mature nutraceuticals and pharmaceutical industry, combined with increasing investments in green chemistry and sustainable API manufacturing, reinforces the momentum of the US plant-based active pharmaceutical ingredients market.

A notable trend in the US plant-based APIs market is the integration of advanced extraction technologies like supercritical CO₂ and cold-press techniques to improve yield and potency. The market is also witnessing a surge in personalized plant-derived medicine development, aligning with precision healthcare initiatives. Collaborations between biotech firms and research institutions to explore therapeutic botanicals are on the rise. Additionally, the rise in vegan and organic product labeling is influencing pharmaceutical branding and product formulations. The growing use of AI in identifying plant compounds with therapeutic potential is further shaping innovation in this evolving and competitive landscape.

The Japan Plant-based API Market

The Japan Plant-based API Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.6 billion in 2034 at a CAGR of 6.5%.

Japan's plant-based APIs market is driven by the country's deep-rooted tradition of herbal medicine (Kampo) and increasing public preference for holistic health solutions. Government policies supporting the integration of traditional and modern medicine create a favorable environment for plant-derived pharmaceuticals. Aging population trends have increased the demand for safer, long-term therapeutic solutions, where plant-based APIs offer fewer side effects. Additionally, Japan’s advanced R&D infrastructure and emphasis on natural product innovation contribute significantly to the market's growth. Pharmaceutical firms are investing heavily in sourcing native botanical ingredients, ensuring quality, and aligning with consumer preferences for clean-label, sustainable medications.

In Japan, there is a growing trend toward standardizing Kampo-based plant APIs within modern pharmaceutical frameworks. Companies are enhancing research on the synergy between plant-based compounds and conventional drugs to develop combination therapies. There’s also rising integration of AI and biotechnology to identify bioactive compounds from native flora. Increased collaboration between universities, traditional medicine practitioners, and pharmaceutical companies is streamlining product development. Japanese firms are focusing on traceability and quality assurance from plant cultivation to final drug formulation. Furthermore, the cosmetic-pharmaceutical overlap is expanding, with many plant-based APIs being repurposed for cosmeceutical and functional beauty applications.

The Europe Plant-based API Market

The Europe Plant-based API Market is projected to be valued at USD 8.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14.6 billion in 2034 at a CAGR of 6.1%.

In Europe, the plant-based APIs market is fueled by strict regulations favoring environmentally sustainable pharmaceutical production and increased demand for organic and natural healthcare solutions. Consumer trust in herbal remedies, rooted in cultural acceptance and historical use, is a significant growth enabler. The market also benefits from strong governmental support for plant-derived drug development and funding for alternative medicine research. Additionally, the rising prevalence of lifestyle-related diseases has increased the adoption of phyto-pharmaceuticals, especially among aging populations. The presence of global pharmaceutical companies investing in green alternatives further supports the uptake of plant-based active pharmaceutical ingredients across the European region.

Key trends in the European plant-based APIs market include a rising focus on indigenous and traditional European medicinal plants for new drug formulations. Companies are increasingly adopting eco-friendly and solvent-free extraction processes to meet sustainability goals. There is growing interest in integrating plant-based APIs into dermatological and skincare pharmaceuticals due to demand for natural cosmetics. Biopharmaceutical firms are leveraging blockchain for transparent plant sourcing and traceability. Additionally, partnerships between pharmaceutical companies and botanical research centers are emerging to innovate therapeutic applications. The trend toward combining plant-based APIs with nanotechnology is also gaining traction for enhancing bioavailability and targeted drug delivery.

Plant-based API Market: Key Takeaways

- Market Overview: The global plant-based active pharmaceutical ingredients (API) market is anticipated to reach a valuation of USD 34.6 billion in 2025 and is forecasted to expand to USD 57.5 billion by 2034, registering a CAGR of 5.8% throughout the forecast period from 2025 to 2034.

- By Source Analysis: Soy is expected to lead the global plant-based API market in terms of source by 2025, making up nearly 38.6% of the overall market share.

- By Form Analysis: The powder form is projected to be the most widely used in the plant-based API market by the end of 2025, contributing around 45.2% to the total market.

- By Functionality Analysis: Emulsifying plant-based APIs are predicted to be the most dominant by functionality, accounting for approximately 41.8% of the global market share by 2025.

- By Distribution Channel Analysis: Online retail platforms are anticipated to emerge as the leading distribution channel, capturing about 36.4% of the plant-based API market share by 2025.

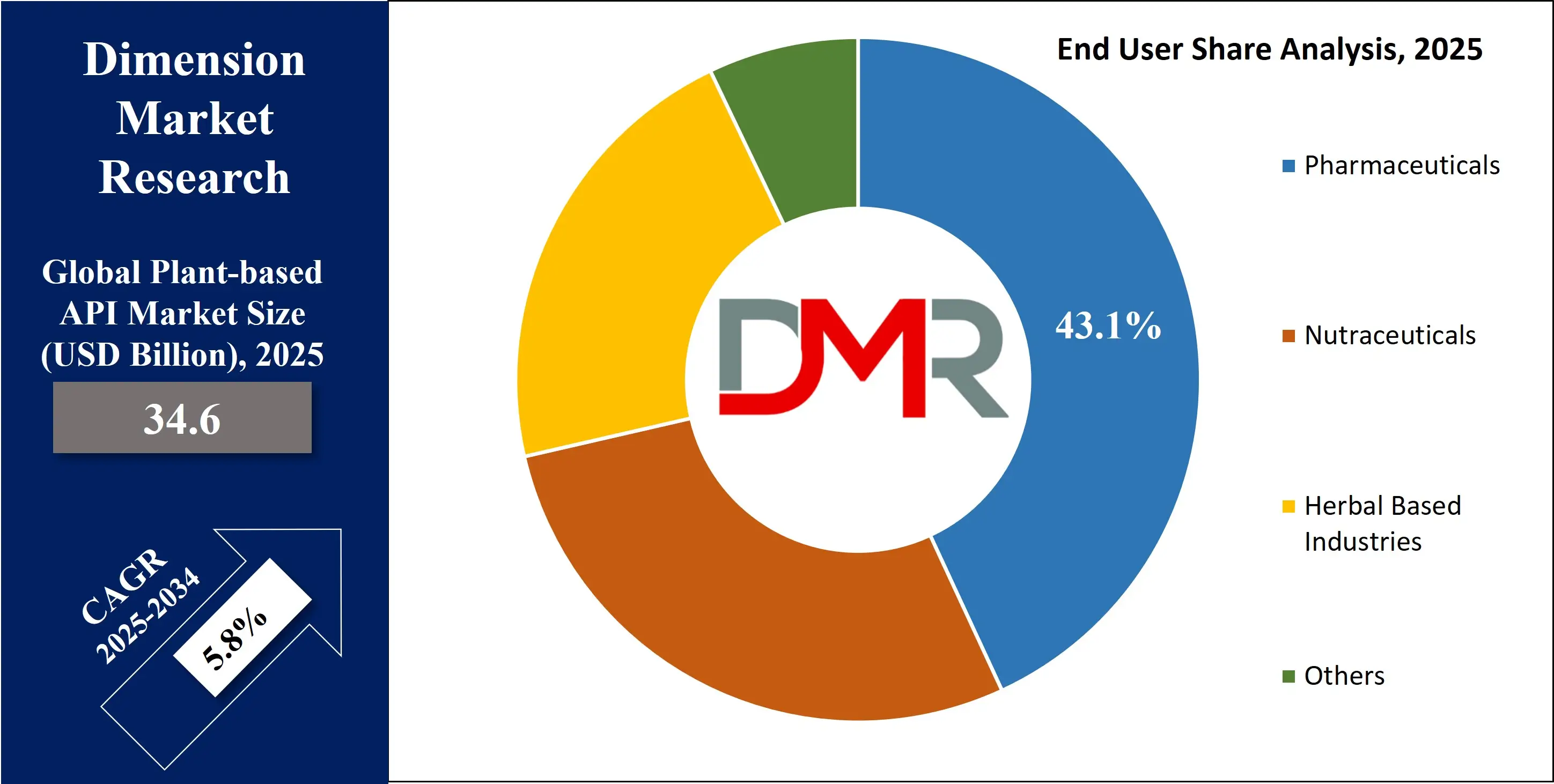

- By End User Analysis: The pharmaceutical industry is expected to remain the largest consumer of plant-based APIs, comprising nearly 43.1% of the market share by the end of 2025.

- Regional Insights: North America is projected to maintain its position as the leading region in the global plant-based API market, accounting for an estimated 40.1% of the total market share by 2025.

Plant-based API Market: Use Cases

- Pharmaceutical Formulations: Plant-based APIs are widely used in the development of natural and herbal medicines for treating chronic conditions like arthritis, hypertension, and diabetes. Their biocompatibility and minimal side effects make them preferred in modern and traditional pharmaceutical formulations focused on holistic health.

- Nutraceuticals and Dietary Supplements: Nutraceutical manufacturers utilize plant-derived active ingredients to produce supplements that promote immunity, digestion, and cognitive function. These plant-based APIs cater to the growing demand for natural health products, especially among consumers seeking preventive healthcare solutions and plant-sourced nutrition alternatives.

- Cosmeceuticals and Skincare: Plant-based APIs like aloe vera extract, curcumin, and green tea polyphenols are increasingly used in anti-aging, anti-inflammatory, and acne treatment skincare products. These bioactive ingredients appeal to clean beauty consumers looking for chemical-free, sustainable, and effective solutions in personal care and cosmetics.

- Veterinary Medicine: In veterinary applications, plant-based APIs serve as safer, natural alternatives to synthetic drugs for treating infections, inflammation, and digestive issues in animals. Their usage is rising due to fewer side effects, regulatory support, and the push for sustainable and organic animal healthcare.

- Traditional and Ayurvedic Medicine: Traditional medicine systems like Ayurveda and Traditional Chinese Medicine (TCM) rely on plant-based APIs such as ashwagandha, guggul, and licorice root. These APIs are integral in balancing bodily functions, treating chronic ailments, and supporting mental wellness through time-tested natural remedies.

Plant-based API Market: Stats & Facts

- World Health Organization (WHO): Over 80% of the global population relies on plant-based traditional medicine for primary healthcare needs, highlighting the importance of botanical sources in active pharmaceutical ingredient (API) development.

- National Center for Biotechnology Information (NCBI): More than 25% of prescribed drugs in developed countries are derived directly or indirectly from medicinal plants, demonstrating their role in modern pharmacology.

- U.S. Food & Drug Administration (FDA): Several FDA-approved drugs such as paclitaxel (from the Pacific yew tree) and morphine (from the opium poppy) are plant-based APIs, showcasing their clinical legitimacy and therapeutic efficacy.

- American Botanical Council: The global demand for herbal medicinal products containing plant-based APIs has steadily increased, driven by consumer preference for natural and holistic treatments.

- National Institutes of Health (NIH): Research shows that plant-derived APIs often exhibit fewer side effects and better biocompatibility than synthetic compounds, making them favorable for chronic disease management.

- European Medicines Agency (EMA): Phytopharmaceuticals containing plant-based APIs are gaining regulatory traction in Europe, with many included in the herbal monograph system, streamlining their approval process.

- United Nations Conference on Trade and Development (UNCTAD): Developing countries that are rich in biodiversity are primary exporters of raw plant materials for API extraction, contributing significantly to local economies and global supply chains.

- PubMed: Studies reveal that polyherbal formulations using multiple plant-based APIs can provide synergistic therapeutic effects, especially in treating conditions like inflammation, diabetes, and infections.

Plant-based API Market: Market Dynamics

Driving Factors in the Plant-based API Market

Growing Preference for Natural and Herbal Medications

The increasing consumer demand for clean-label, plant-derived pharmaceuticals is a major driving force for the plant-based APIs market. With rising awareness about the side effects of synthetic drugs, there is a notable shift toward natural active pharmaceutical ingredients (APIs). Consumers are more inclined toward herbal and botanical formulations, especially in regions with deep-rooted traditional medicine practices like Ayurveda and Traditional Chinese Medicine. Additionally, regulatory approvals for phyto-pharmaceuticals are gaining momentum, further boosting market penetration. Manufacturers are investing in plant extraction technologies to produce high-purity APIs, thereby meeting quality standards for pharmaceutical applications. The surge in demand for sustainable drug production methods also supports the adoption of plant-sourced bioactive compounds.

Rising Chronic Disease Burden and Aging Population

The global rise in chronic ailments such as cardiovascular diseases, diabetes, and cancer, coupled with an aging population, is fueling the need for long-term, safer treatment options. Plant-based APIs offer therapeutic benefits with reduced adverse effects, making them a preferred alternative in chronic disease management. The geriatric demographic is particularly responsive to natural treatments, pushing healthcare systems to incorporate phyto-pharmaceuticals into mainstream therapies. Increased funding in botanical drug research and support from nutraceutical and pharmaceutical sectors have amplified R&D efforts in plant-derived therapeutic compounds. This aligns with the market’s expansion into functional ingredients and personalized medicine, reinforcing its importance in global healthcare.

Restraints in the Plant-based API Market

Inconsistency in Plant-Based API Yield and Quality

One of the key restraints in the plant-based APIs market is the inconsistency in yield and quality of bioactive compounds due to environmental factors. Plant growth and compound synthesis are influenced by climatic conditions, soil quality, and harvesting practices. This variability often results in fluctuations in phytochemical content, posing challenges for standardization and quality control. Pharmaceutical companies require APIs with precise potency and purity, and inconsistencies can compromise formulation efficacy. Moreover, the lack of harmonized global regulations for botanical ingredient testing further complicates commercialization. These issues hinder scalability and limit the widespread adoption of phytopharmaceutical ingredients in regulated drug development environments.

Complex Extraction and Isolation Processes

Plant-based APIs often require intricate extraction and purification processes, which can be time-consuming and cost-intensive. Unlike synthetic APIs, where production follows controlled chemical synthesis routes, plant extraction depends on multiple variables such as solvent use, temperature, and plant part selection. The need for advanced technologies like supercritical fluid extraction or molecular distillation increases operational costs. Additionally, maintaining bioactivity during processing is challenging, which can affect therapeutic outcomes. These complexities reduce cost-efficiency and limit small- to mid-size pharmaceutical manufacturers from entering the plant-derived API space. As a result, the market faces barriers in achieving large-scale industrial production with consistent quality.

Opportunities in the Plant-based API Market

Increasing Integration with Nutraceuticals and Functional Foods

The convergence of plant-based APIs with the booming nutraceutical and functional food sectors offers immense growth opportunities. As consumers prioritize preventive healthcare, the demand for natural ingredients in dietary supplements, fortified foods, and herbal formulations is soaring. Phytochemicals like curcumin, resveratrol, and flavonoids are being incorporated into multinutrient blends to offer targeted health benefits such as immunity boosting, cognitive support, and anti-inflammatory effects. This cross-industry integration is enabling API manufacturers to tap into wellness-driven markets beyond pharmaceuticals. Additionally, food companies are collaborating with botanical extract suppliers to enhance product efficacy and appeal, opening new revenue channels for plant-derived API suppliers.

Advancements in Phytopharmaceutical Research and Biotechnological Innovation

Technological progress in plant biotechnology, including genetic engineering and metabolic pathway optimization, is expanding the potential of plant-based APIs. Scientists are now able to enhance the yield and bioavailability of specific compounds by modifying plant genes or using plant cell cultures in bioreactors. This not only ensures a stable supply of high-quality APIs but also supports eco-friendly production practices. Moreover, AI-driven phytochemical screening and molecular docking studies are accelerating drug discovery from botanical sources. As pharmaceutical R&D embraces green chemistry and sustainability, innovation in botanical API production is unlocking new therapeutic categories, from anti-viral drugs to neuroprotective agents.

Trends in the Plant-based API Market

Shift toward Sustainable and Ethical Sourcing of Plant Raw Materials

Sustainability has become a central theme in the pharmaceutical supply chain, leading to increased emphasis on ethical sourcing and traceability of botanical raw materials. Companies are adopting eco-friendly practices, such as organic farming, fair trade partnerships, and conservation of endangered medicinal plants. Blockchain and digital traceability platforms are being integrated to ensure transparency across the supply chain, from cultivation to API extraction. This trend reflects consumers' and regulators' growing concern over environmental impact and biodiversity preservation. Pharmaceutical firms that prioritize green sourcing and carbon neutrality in their plant-based API production gain a competitive edge in ethically driven markets.

Expanding Role of Traditional Medicine Systems in Modern Healthcare

There is a resurgence of interest in traditional medicine systems like Ayurveda, Traditional Chinese Medicine (TCM), and Kampo, which heavily rely on plant-based formulations. Governments across Asia, Europe, and Africa are integrating traditional medicinal knowledge into national healthcare frameworks. This institutional backing is propelling R&D in standardized botanical APIs derived from centuries-old medicinal plants. Pharmacopoeias are being updated to include validated monographs for plant-based compounds, enabling safer and more regulated use in clinical settings. The trend highlights a growing fusion between ancient healing practices and modern pharmacology, driving innovation and acceptance of herbal APIs in global therapeutics.

Plant-based API Market: Research Scope and Analysis

By Source Analysis

Soy is predicted to dominate the global plant-based active pharmaceutical ingredients (API) market by the end of 2025, accounting for approximately 38.6% of the total share. Its dominance is driven by its rich isoflavone content, established use in pharmaceutical formulations, and high protein concentration, making it a preferred botanical source. The growing demand for phytoestrogen-based therapeutics and anti-inflammatory agents further enhances soy's prominence. Additionally, soy-based compounds have gained traction in natural product drug development due to their proven efficacy and bioavailability. The increasing adoption of plant-derived medicinal compounds and clean-label therapeutics also supports the segment's expansion in the botanical API landscape, especially in nutraceutical manufacturing and herbal pharmaceutical formulations.

Pea is projected to register the highest CAGR in the plant-based API market by 2025. Its rapid expansion is fueled by increasing R&D investment in legume-based drug precursors and its functional bioactive compounds, such as peptides and antioxidants, which are finding broader applications in metabolic and cardiovascular treatments. The hypoallergenic nature of peas and their sustainable sourcing appeal to manufacturers shifting towards green pharmaceutical ingredients. Moreover, advancements in enzymatic extraction technologies have made it easier to isolate high-purity therapeutic compounds from peas, boosting their integration into advanced botanical formulations. The rise in demand for non-GMO and allergen-free pharmaceutical sources is accelerating pea’s growth within the evolving natural pharmaceutical ingredient industry.

By Form Analysis

Powder form is expected to dominate the global plant-based API market by the end of 2025, holding approximately 45.2% of the total market share. This dominance stems from its long shelf life, ease of transport, and high compatibility with various pharmaceutical delivery systems. Powdered botanical extracts are widely used in the formulation of tablets, capsules, and herbal blends due to their high solubility and stable bioactive concentration. The pharmaceutical sector increasingly prefers powdered phytochemicals for cost-effective bulk processing and formulation efficiency. Moreover, the growing use of traditional medicinal powders in personalized medicine, coupled with advancements in drying and milling technologies, continues to support its demand in the broader green medicine and botanical drug industries.

The liquid segment is projected to grow at the highest CAGR in the global plant-based API market by the end of 2025. This surge is largely due to the rising demand for fast-acting phytotherapeutic solutions and high bioavailability in drug formulations. Liquid plant-derived APIs offer enhanced absorption rates, making them ideal for pediatric, geriatric, and clinical settings where rapid action is critical. The increasing adoption of liquid herbal extracts in botanical syrups, tinctures, and injectable formulations further fuels growth. Additionally, the popularity of clean-label pharmaceutical ingredients and solvent-extracted liquid APIs in precision medicine is accelerating this trend, especially in markets seeking natural, easy-to-administer therapeutic agents derived from plant sources.

By Functionality Analysis

The emulsifying segment is predicted to dominate the global plant-based API market by the end of 2025, capturing an estimated 41.8% market share. Emulsifiers derived from natural plant sources are increasingly integrated into pharmaceutical and nutraceutical formulations for their ability to improve solubility and stability of active ingredients. Their role in enhancing drug delivery, especially for lipid-based systems, makes them indispensable in modern green pharmaceutical manufacturing. The growing preference for biocompatible and non-synthetic excipients further propels demand. Plant-based emulsifying agents also support the development of vegan drug formulations and allergen-free therapeutics, meeting evolving consumer expectations for clean-label and sustainable pharmaceutical ingredients across a variety of therapeutic applications.

The gelling segment is expected to grow at a high CAGR in the global plant-based API market by the end of 2025. This rapid growth is fueled by increasing use of natural gelling agents in controlled-release drug delivery systems and wound care products. Plant-derived hydrocolloids like pectin, guar gum, and agar are widely adopted in formulation science for their biocompatibility and functional versatility. Their ability to modulate viscosity, stabilize active compounds, and enable sustained drug release is gaining traction in both pharmaceutical and nutraceutical segments. The surge in demand for natural polymers in biodegradable drug carriers and transdermal patches is further accelerating the integration of gelling plant-based APIs into next-generation therapeutics.

By Distribution Channel Analysis

Online retailers are projected to dominate the global plant-based API market by the end of 2025, holding approximately 36.4% of the market share. The growing reliance on e-commerce platforms for purchasing pharmaceutical ingredients and nutraceutical supplements is driving this trend. Online channels offer consumers and businesses a broader range of plant-derived APIs with transparent ingredient information, certifications, and global availability. The surge in direct-to-consumer botanical products and subscription-based wellness models has also boosted sales via digital platforms. Additionally, the shift toward self-care, convenience, and price comparison across plant-based therapeutic agents is favoring e-commerce expansion in the botanical API supply chain, particularly in North America, Europe, and parts of Asia.

The foodservice segment is expected to witness the highest growth in the plant-based API market by the end of 2025. This growth is driven by the increasing incorporation of functional plant-based ingredients in health-focused menus offered by cafes, restaurants, and institutional catering. As demand rises for foodservice items with therapeutic benefits—such as anti-inflammatory teas, adaptogenic beverages, and plant-infused smoothies—there’s growing interest in sourcing botanical APIs directly from manufacturers. Plant-based APIs are also finding use in culinary wellness innovations, blending traditional herbal medicine with gourmet offerings. The expansion of functional foods and beverages in hospitality and the health-centric foodservice movement is accelerating this channel’s expansion.

By End User Analysis

The pharmaceuticals segment is expected to dominate the global plant-based API market by the end of 2025, accounting for approximately 43.1% of the total market share. This is driven by the increasing integration of botanical ingredients in mainstream drug development due to their proven therapeutic efficacy, minimal side effects, and natural origin. Pharmaceutical companies are increasingly turning to plant-derived active compounds for chronic disease treatment, including cardiovascular, neurological, and metabolic disorders. Additionally, advancements in extraction technologies and regulatory approvals for phytopharmaceuticals are further boosting adoption. The rise in demand for evidence-based herbal formulations in modern medicine, along with growing consumer trust in plant-origin medications, solidifies the pharmaceutical sector's leading role in the plant-based API landscape.

The nutraceuticals segment is projected to grow at the highest CAGR in the global plant-based API market by the end of 2025. This rapid growth is fueled by consumer preference for natural health supplements, functional foods, and preventative wellness solutions. Plant-based APIs are increasingly used in the formulation of immune-boosting capsules, antioxidant blends, and adaptogenic formulations. The growing trend toward clean-label and vegan-friendly dietary products has accelerated their demand in the nutraceutical space. Furthermore, rising awareness around holistic health, aging populations, and lifestyle-related disorders are driving investment in botanical ingredients for supplement innovation. The intersection of food and medicine continues to propel plant-based APIs in functional health product development.

The Plant-based API Market Report is segmented on the basis of the following:

By Source

- Soy

- Pea

- Hemp

- Sunflower

- Rice

By Form

By Functionality

- Emulsifying

- Gelling

- Foaming

- Texture Enhancing

By Distribution Channel

- Online Retailers

- Supermarkets/Hypermarkets

- Specialty Food Stores

- Foodservice

By End User

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share in the global plant-based API market by the end of 2025, accounting for approximately 40.1% of the market. This dominance is fueled by the region's advanced pharmaceutical infrastructure, increasing adoption of natural therapeutic alternatives, and strong presence of key botanical API manufacturers. Regulatory support for herbal drug development and the widespread use of plant-derived ingredients in mainstream medicine further contribute to market expansion. The U.S. leads in clinical trials involving phytopharmaceuticals, while growing consumer preference for clean-label, plant-based medications drives demand. Additionally, the popularity of nutraceuticals and functional botanicals, along with supportive healthcare policies, makes North America a major hub for plant-based API consumption and innovation.

Region with Highest CAGR

Asia Pacific is expected to register the highest CAGR in the global plant-based API market by the end of 2025. This surge is driven by increasing awareness of traditional medicine systems like Ayurveda, Traditional Chinese Medicine (TCM), and Kampo, which rely heavily on plant-based ingredients. Rising healthcare expenditures, coupled with rapid urbanization and growing demand for preventive healthcare solutions, are fueling regional growth. Additionally, abundant biodiversity and the availability of low-cost botanical raw materials support API manufacturing across countries like India, China, and Indonesia. With growing government support for herbal and alternative medicine integration and expanding pharmaceutical exports, Asia Pacific is quickly becoming a global leader in the production and consumption of plant-derived active pharmaceutical ingredients.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Plant-based API Market

- Optimizing Plant Extraction Processes: AI is revolutionizing the extraction of plant-based APIs by enabling precision in identifying optimal harvesting times, solvents, and extraction conditions. Machine learning algorithms help predict yields and quality based on environmental and genetic data, significantly improving consistency and reducing resource wastage in botanical pharmaceutical production.

- Accelerating Drug Discovery: Artificial intelligence accelerates the discovery of new plant-derived APIs by screening vast phytochemical databases rapidly. AI models predict bioactivity, toxicity, and pharmacokinetics, allowing researchers to focus on promising candidates. This shortens R&D timelines and opens doors to rare or underutilized plant species in natural drug development.

- Enhancing Quality Control and Compliance: AI-driven imaging and spectroscopy tools ensure real-time quality monitoring of plant-based APIs. These systems detect contamination, adulteration, and degradation, ensuring pharmaceutical-grade purity. AI also streamlines documentation and regulatory compliance by automating data logging, improving traceability and reducing the risk of human error in manufacturing.

- Personalized Plant-Based Medicine: AI supports the personalization of treatments involving plant-based APIs by analyzing patient genetics, microbiome, and lifestyle data. This facilitates customized formulations for improved therapeutic outcomes. With AI, the future of plant-based pharmaceuticals lies in delivering targeted, effective, and safer medications tailored to individual health profiles.

Competitive Landscape

The competitive landscape of the global plant-based API market is characterized by intense innovation, strategic collaborations, and a growing number of companies investing in natural therapeutic compounds. Key players are focusing on expanding their portfolios of botanical active ingredients through advanced extraction technologies, sustainable sourcing, and partnerships with herbal medicine manufacturers. Leading pharmaceutical and nutraceutical companies are actively investing in plant-derived bioactives to meet rising consumer demand for clean-label drugs and functional supplements.

Companies are also exploring green chemistry and eco-friendly processing to align with sustainability goals while ensuring the potency and safety of phytopharmaceutical ingredients. Firms such as Sabinsa Corporation, Indena S.p.A., and Alchem International are notable for their strong R&D capabilities in the standardization of herbal APIs. Moreover, new entrants and contract manufacturers are offering tailored formulations and organic plant-based extracts to cater to specialized therapeutic needs.

With increasing regulatory support and consumer awareness regarding plant-sourced APIs, the market is seeing accelerated activity in mergers, acquisitions, and regional expansions. Asia Pacific and North America remain key target regions due to their large herbal supplement markets and supportive healthcare ecosystems. As competition intensifies, innovation, quality assurance, and bioactive efficacy will be central to market leadership.

Some of the prominent players in the Global Plant-based API Market are

- BASF SE

- Brains

- Centrolflora

- HimPharm

- Arboris

- Cargill Inc

- Roquette Freres SA

- Kothari Phytochemicals & Industries Ltd

- Sanofi SA

- EVONIK Industries

- Indena S.p.A.

- Alchem International Pvt. Ltd.

- Phyto Life Sciences Pvt. Ltd.

- Sabinsa Corporation

- Green Stone Swiss Co., Ltd.

- Givaudan Active Beauty

- Plantnat

- Xi'an Lyphar Biotech Co., Ltd.

- Synthite Industries Pvt. Ltd.

- Organic Herb Inc.

- Other Key Players

Recent Developments

- In March 2025, the Natural API sector saw strong momentum with the market valued at USD 30 billion in 2023 and projected to reach USD 57.5 billion by 2034 (CAGR 6.1 %), fueled by investments in green extraction and sustainable bioreactor technologies.

- In July 2024, DSM-Firmenich launched CBtru, an advanced cannabidiol (CBD) drug intermediate optimized for oral solid formulations, aiming to improve bioavailability and set a new benchmark in plant-derived pharmaceutics.

- In April 2024, Roquette introduced its LYCAGEL hydroxypropyl pea‑starch excipient range at Vitafoods Europe, expanding its plant-based softgel API offerings and reinforcing its push into global vegetarian and vegan supplement formulations

- In August 2023, Capitol Wellness Solutions, in collaboration with Southern University, introduced Louisiana's first chewable THC product, a high-dose medical marijuana candy containing 40 milligrams of THC. This innovative product offers a new option for managing chronic pain, although it may result in longer wait times for patients seeking relief through this method.

- In August 2023, Mankind Pharma unveiled 120 Drug Master File (DMF) quality medicines in the Indian market, aiming to enhance public access to premium pharmaceuticals. This launch highlights the company’s ongoing commitment to delivering a wide array of high-quality medications to support the health and well-being of the Indian population.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 34.6 Bn |

| Forecast Value (2034) |

USD 57.5 Bn |

| CAGR (2025–2034) |

5.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 11.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source (Soy, Pea, Hemp, Sunflower, Rice), By Form (Liquid, Powder, Granules), By Functionality (Emulsifying, Gelling, Foaming, Texture Enhancing), By Distribution Channel (Online Retailers, Supermarkets/Hypermarkets, Specialty Food Stores, Foodservice), By End User (Pharmaceuticals, Nutraceuticals, Herbal Based Industries, Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

BASF SE, Brains, Centrolflora, HimPharm, Arboris, Cargill Inc, Roquette Freres SA, Kothari Phytochemicals & Industries Ltd, Sanofi SA, EVONIK Industries, Indena S.p.A., Alchem International Pvt. Ltd., Phyto Life Sciences Pvt. Ltd., Sabinsa Corporation, Green Stone Swiss Co., Ltd., Givaudan Active Beauty, Plantnat, Xi'an Lyphar Biotech Co., Ltd., Synthite Industries Pvt. Ltd., Organic Herb Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Plant-based API Market size is estimated to have a value of USD 34.6 billion in 2025 and is expected to reach USD 57.5 billion by the end of 2034.

North America is expected to be the largest market share for the Global Plant-based API Market with a share of about 40.1% in 2025.

Some of the major key players in the Global Plant-based API Market are BASF SE, Cargill Inc., Sanofi SA, and many others.

The market is growing at a CAGR of 5.8% over the forecasted period.

The US Plant-based API Market size is estimated to have a value of USD 11.7 billion in 2025 and is expected to reach USD 18.8 billion by the end of 2034.