Market Overview

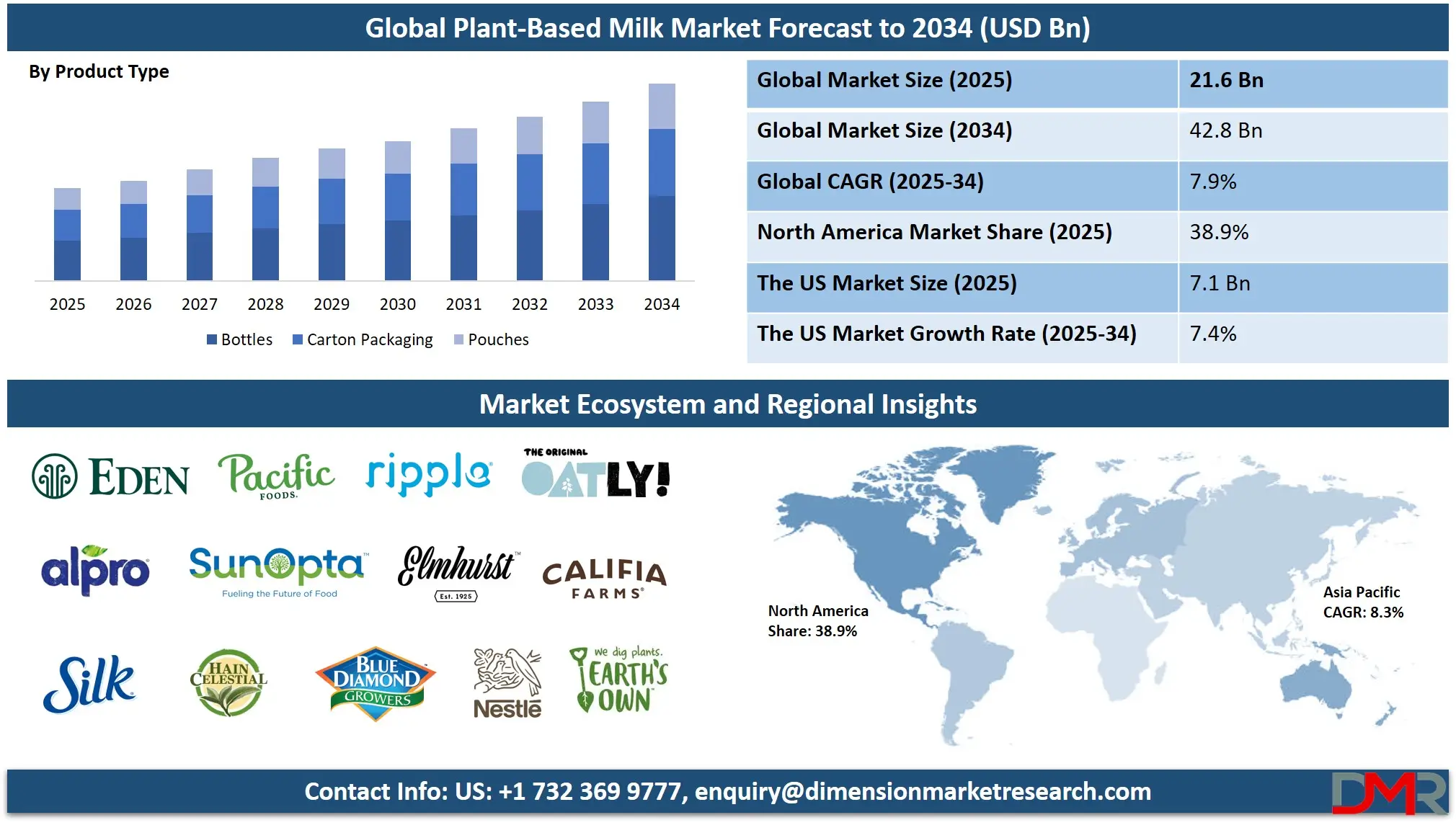

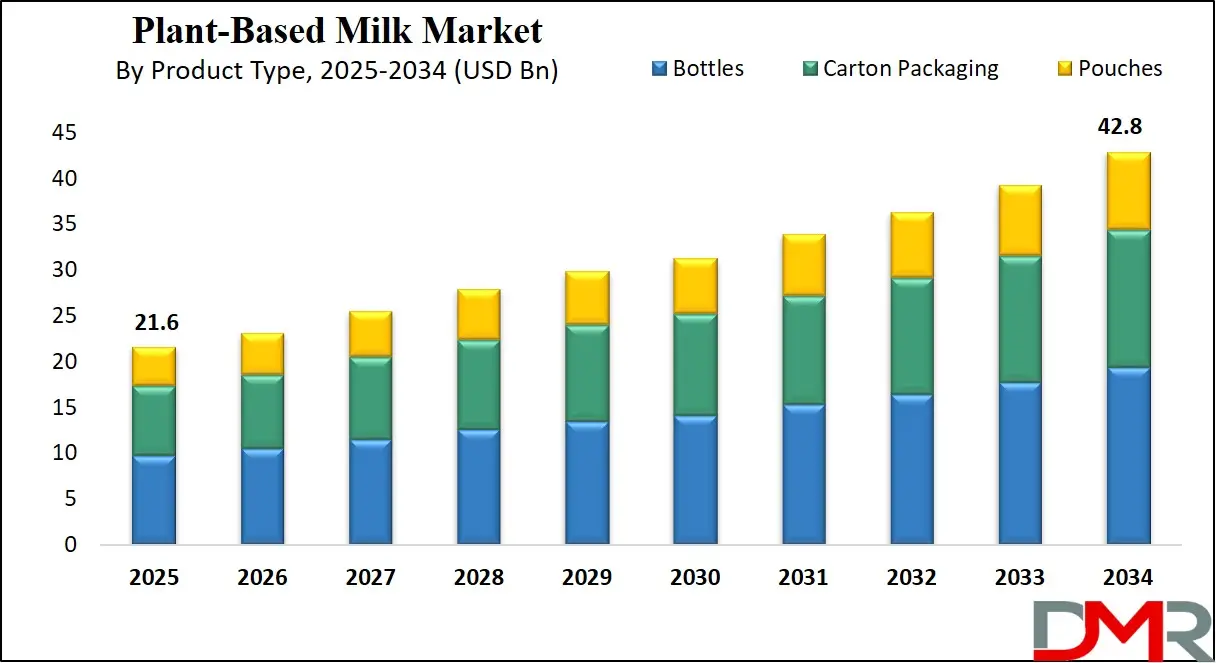

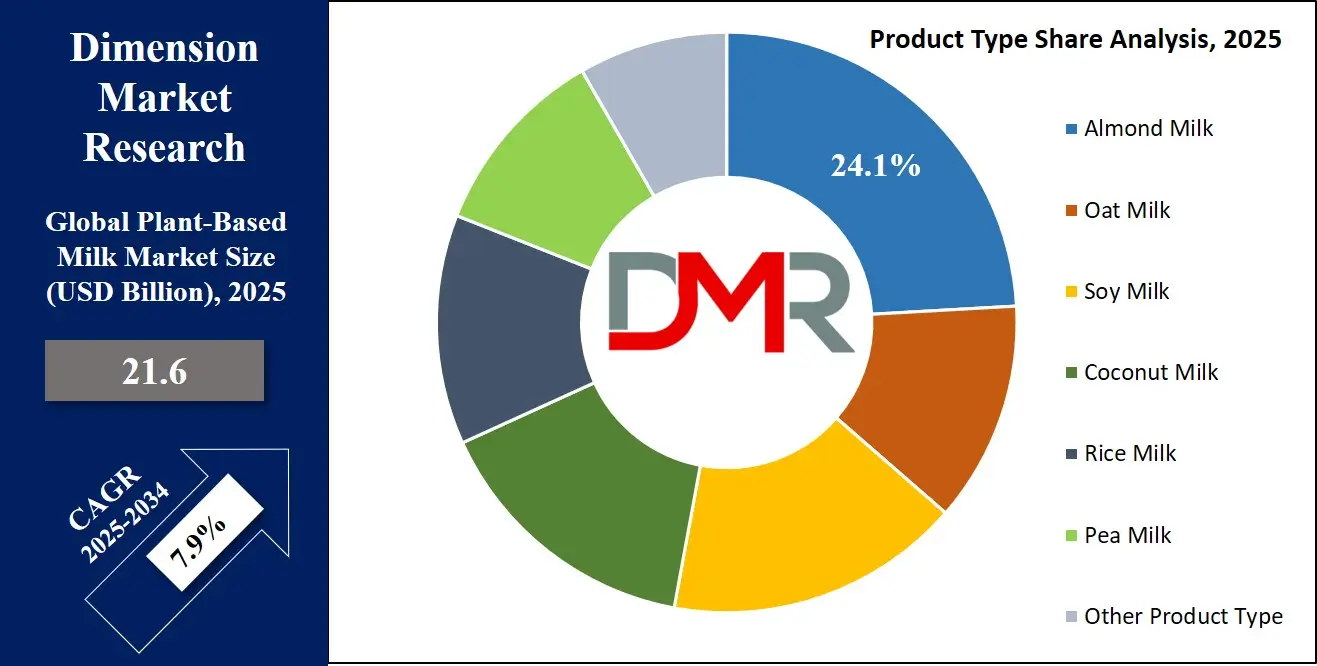

The Global Plant-Based Milk Market is projected to reach USD 21.6 billion in 2025 and grow at a compound annual growth rate of 7.9% from there until 2034 to reach a value of USD 42.8 billion.

The global plant-based milk market has witnessed a dynamic shift driven by consumer preferences for healthier, ethical, and environmentally sustainable alternatives to dairy milk. Growing awareness of lactose intolerance, dairy allergies, and lifestyle diseases such as obesity, high cholesterol, and diabetes is encouraging the adoption of plant-based milk options. Additionally, increasing global adoption of vegan and flexitarian diets is propelling market demand. Consumers are drawn to options like almond, oat, soy, coconut, and pea milk due to their unique nutritional profiles, including low saturated fat, added vitamins, and essential amino acids.

There is immense opportunity in the sector through innovation in formulation, such as fortifying plant-based milks with calcium, vitamin D, and protein to closely match the nutrition of cow's milk. The popularity of non-dairy products in cafés and quick-service restaurants has also created a commercial channel that fosters repeat demand. Furthermore, advancements in packaging and extended shelf-life technologies are broadening accessibility across emerging economies.

Despite its momentum, the plant-based milk market faces restraints. These include higher manufacturing costs, which make the products more expensive than conventional milk, and regulatory issues around the labeling of plant-based alternatives. Moreover, taste and texture variations from dairy milk can present adoption hurdles, especially in regions where dairy is deeply entrenched in culinary traditions.

The global plant-based milk market is projected to grow steadily, supported by demographic shifts, urbanization, and the evolving food preferences of younger generations. As climate change concerns intensify, and consumers increasingly seek ethical and eco-conscious products, plant-based milk is positioned not just as an alternative, but as the future standard in liquid nutrition.

The US Plant-Based Milk Market

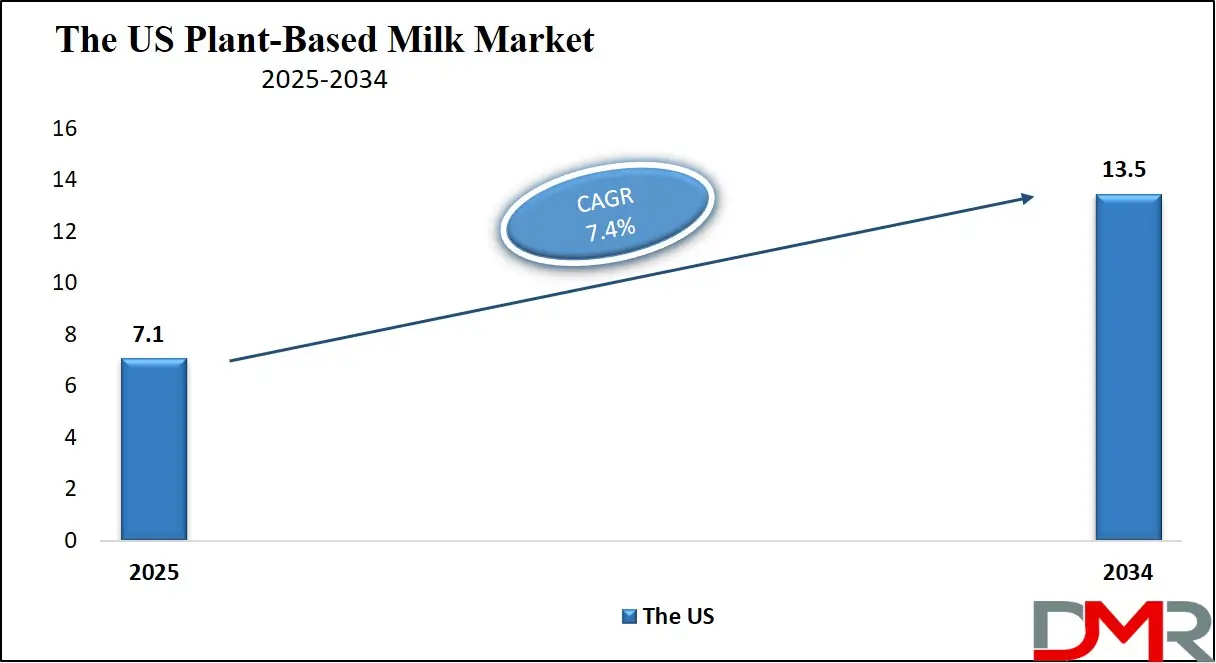

The US Plant-Based Milk Market is projected to reach USD 7.1 billion in 2025 at a compound annual growth rate of 7.4% over its forecast period.

The U.S. plant-based milk market is evolving rapidly, fueled by changing dietary habits, cultural diversity, and growing health consciousness. According to data from the U.S. Department of Agriculture, dairy consumption has shown a modest decline over the past decade, while plant-based alternatives have risen in popularity, particularly among younger generations. An increasing number of consumers are choosing options such as almond, oat, soy, and coconut milk to address lactose intolerance, improve heart health, or follow vegan or flexitarian diets.

The U.S. demographic landscape contributes significantly to market growth. Diverse ethnic communities, including Asian American and Hispanic populations, tend to consume less dairy and more plant-based beverages. Additionally, urban millennials and Gen Z consumers are prioritizing ethical consumption, including cruelty-free and sustainable food options, leading to increased demand for plant-based alternatives in grocery chains and foodservice outlets.

Government programs such as MyPlate and the Dietary Guidelines for Americans emphasize plant-based food consumption, indirectly promoting non-dairy milk products. Public school systems and healthcare institutions have also begun incorporating plant-based options into their menus to accommodate dietary needs and reduce saturated fat intake.

Innovation in flavors, protein content, and packaging has made plant-based milk more appealing to a broad consumer base. Brands are also expanding into low-sugar, high-protein variants and integrating functional ingredients such as probiotics and adaptogens. The U.S. market continues to diversify, with regional trends and lifestyle shifts playing a vital role. As climate awareness and dietary transparency grow, plant-based milk is becoming a mainstream choice, not just a niche alternative.

The European Plant-Based Milk Market

The Europe Plant-Based Milk Market is estimated to be valued at USD 3.80 billion in 2025 and is further anticipated to reach USD 6.70 billion by 2034 at a CAGR of 6.5%.

In Europe, the plant-based milk market has transformed from a niche health trend to a major component of everyday diets. Countries across the continent are witnessing a surge in consumer interest in dairy-free alternatives due to health awareness, lactose intolerance prevalence, and sustainability concerns. Many Europeans, especially in Northern and Western regions, are embracing flexitarian and vegan diets, replacing traditional dairy with almond, oat, rice, soy, and coconut milk.

Lactose intolerance is notably high in southern and eastern parts of Europe, influencing daily consumption patterns and boosting demand for non-dairy options. For instance, plant-based milks are increasingly present in school lunches, office canteens, and public healthcare facilities as consumer demand shifts toward inclusive dietary offerings. Additionally, urban populations, particularly in cities like Berlin, Paris, and Amsterdam, are driving market momentum with their preference for health-centric, eco-conscious foods.

Public awareness around climate change and environmental sustainability has reinforced the plant-based movement. Consumers are drawn to plant-based milks for their lower greenhouse gas emissions, reduced land use, and minimal water requirements compared to dairy farming. European consumers are particularly responsive to sustainability labels and product transparency, aligning with broader EU goals on climate neutrality and sustainable agriculture.

The market is supported by retail expansion and culinary innovation, with many cafés and restaurants now offering dairy-free milk as a default option. While certain taxation policies and regulatory classifications still pose challenges, the market outlook is robust. With increasing support from policymakers and retailers alike, plant-based milk is becoming an integral part of Europe’s evolving food culture.

The Japan Plant-Based Milk Market

The Japan Plant-Based Milk Market is projected to be valued at USD 1.30 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.38 billion in 2034 at a CAGR of 7.0%.

Japan’s plant-based milk market is steadily expanding, anchored in its deep-rooted cultural affinity for soy-based products and growing interest in health-conscious eating. Soy milk has long been consumed in Japanese households, traditionally viewed as a nutritious and functional beverage. Today, this legacy is being modernized with a wider range of plant-based milks, including almond, rice, coconut, and oat, appearing in retail and foodservice settings.

Japan's aging population, over 29% of its citizens are aged 65 or older, is increasingly adopting low-cholesterol, low-lactose diets. Plant-based milk, being heart-friendly and easy to digest, fits well with the dietary needs of this demographic. Additionally, the country's high rate of lactose intolerance is common across East Asian populations further strengthens consumer preference for dairy-free options.

Urbanization and Western lifestyle influences have contributed to the rise of alternative milks in Japanese cafés, supermarkets, and vending machines. Younger consumers, especially in major cities like Tokyo and Osaka, are embracing plant-based lifestyles driven by environmental and ethical considerations. Functional ingredients and health claims, such as added collagen or dietary fiber, are especially effective in appealing to the Japanese market.

While Japan still lags behind the West in terms of product variety and marketing scale, the market is gaining traction. Domestic food manufacturers are increasingly collaborating with global players to introduce innovative offerings tailored to Japanese tastes. Supported by government campaigns that promote reduced meat and dairy consumption, the plant-based milk market in Japan is expected to continue its upward trend, blending tradition with modern health and sustainability values.

Global Plant-Based Milk Market: Key Takeaways

- Global Market Size Insights: The Global Plant-Based Milk Market size is estimated to have a value of USD 21.6 billion in 2025 and is expected to reach USD 42.8 billion by the end of 2034.

- The US Market Size Insights: The US Plant-Based Milk Market is projected to be valued at USD 7 .1billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.5 billion in 2034 at a CAGR of 7.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Plant-Based Milk Market with a share of about 38.9% in 2025.

- Key Players: Some of the major key players in the Global Plant-Based Milk Market are Danone S.A., The Hain Celestial Group Inc., Blue Diamond Growers, Califia Farms LLC, Oatly Group AB, Ripple Foods PBC, Elmhurst Milked Direct LLC, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.9 percent over the forecasted period of 2025.

Global Plant-Based Milk Market: Use Cases

- Lactose Intolerance Relief: Individuals with lactose intolerance rely on plant-based milks like almond, oat, and soy milk as they provide dairy-free nutrition without gastrointestinal discomfort. These alternatives ensure calcium intake while maintaining digestive health and are now widely available even in schools, hospitals, and food service establishments.

- Heart-Healthy Lifestyle: Plant-based milks, especially oat and almond milk, are incorporated into cholesterol-lowering diets. Their low saturated fat content and absence of cholesterol make them ideal for managing heart health. Many of these milks are fortified with omega-3s and fiber, contributing to cardiovascular wellness and preventative healthcare routines.

- Vegan and Vegetarian Diets: For consumers following vegan, vegetarian, or flexitarian diets, plant-based milk acts as a cornerstone for nutritional balance. Used in smoothies, coffee, and breakfast cereals, they substitute dairy while offering essential nutrients like calcium, protein, and vitamin B12 when fortified.

- Children with Allergies: Soy and rice milk are commonly used in pediatric diets for children with cow milk allergies or multiple food sensitivities. These milks offer a safer alternative, particularly when formulated without added sugars or additives, helping ensure proper growth and nutrition during developmental stages.

- Sustainable Living: Environmentally conscious individuals choose plant-based milks for their lower carbon footprint and reduced water use compared to dairy. Oat and pea milk, for instance, are seen as sustainable alternatives, fitting into broader lifestyle goals of reducing ecological impact and supporting plant-based agriculture.t

Global Plant-Based Milk Market: Stats & Facts

U.S. Department of Agriculture (USDA)

- Plant-based milk alternatives made up approximately 16% of all milk sales in the United States in 2022. This marks a significant shift in consumer preferences and demonstrates increasing demand for dairy-free alternatives as consumers seek healthier or lactose-free products.

European Commission

- Across member countries in the European Union, there was a 7% year-over-year increase in the consumption of plant-based milk. This trend is largely driven by consumer awareness of sustainability, animal welfare, and health benefits associated with plant-based diets.

Australian Bureau of Statistics

- In Australia, 30% of households purchased plant-based milk products in 2022, compared to 23% in 2019. This upward trend reflects the growing popularity of almond, oat, soy, and other plant-based milks among Australians prioritizing plant-forward diets.

Health Canada

- National surveys revealed that 41% of Canadian consumers reported regularly consuming plant-based milk alternatives in 2022. This includes soy, almond, oat, rice, and other non-dairy options, especially among younger demographics and urban populations.

Food and Agriculture Organization (FAO) of the United Nations

- Global production of plant-based milk alternatives rose by 8% in 2022 compared to 2021, reflecting increasing global demand and production capacity expansion, particularly in Asia-Pacific, North America, and parts of Europe.

U.S. Food and Drug Administration (FDA)

- In 2023, the FDA issued guidance allowing plant-based beverages such as almond, oat, and soy to be labeled as “milk,” provided the plant origin is clearly stated on the label. This regulatory clarity has supported market growth and consumer trust.

National Library of Medicine

- Lactose intolerance affects more than 90% of adults of East Asian descent, making plant-based milk a nutritional necessity for many in this demographic.

- Additionally, lactose intolerance rates are high across African, Hispanic, Native American, and South Asian populations, ranging between 50% to 90%, further driving the demand for non-dairy milk substitutes.

Oatly Consumer Survey (2023)

- Among U.S. consumers, 54% of Generation Z and 49% of Millennials report preferring plant-based milk over dairy milk. Younger consumers are also more likely to align their purchasing decisions with sustainability and animal welfare values.

United Nations Environment Programme (UNEP)

- UNEP research has found that plant-based milk production requires significantly fewer resources, less water, less land, and lower energy input than traditional dairy milk, making it a preferred option in the fight against climate change.

World Health Organization (WHO)

- The WHO highlights that lactose intolerance and milk allergies are common worldwide and notes the increasing importance of non-dairy milk as a viable nutritional alternative for individuals facing such conditions.

United Nations Development Programme (UNDP)

- The growing adoption of plant-based milk directly supports global sustainability objectives, contributing to the UN’s Sustainable Development Goals (SDGs) related to zero hunger, climate action, and sustainable consumption.

Environmental Protection Agency (EPA), USA

- According to the EPA, plant-based milk production results in substantially lower greenhouse gas emissions compared to conventional dairy milk, due to the absence of methane-emitting livestock and reduced resource use.

U.S. Census Bureau

- Millennials and Gen Z now constitute a combined majority of the U.S. population, and these cohorts are showing a strong preference for plant-based diets, significantly shaping demand in the milk substitute market.

Centers for Disease Control and Prevention (CDC)

- The CDC recommends increasing dietary diversity and consumption of plant-derived foods. Plant-based milks, often fortified with vitamins and minerals, are seen as part of a broader move towards healthier eating patterns.

European Food Safety Authority (EFSA)

- EFSA endorses the consumption of fortified plant-based milk to ensure adequate intake of calcium, vitamin D, and other essential nutrients, particularly in populations avoiding animal-based foods.

Australian Government Department of Health

- Official guidelines state that fortified plant-based milks are a suitable dairy alternative for people with lactose intolerance or dairy allergies. These options are now commonly found in schools, hospitals, and public institutions.

Canadian Food Inspection Agency (CFIA)

- CFIA mandates clear and accurate labeling of plant-based milk alternatives, ensuring that consumers receive transparent information about nutritional content and source materials, thus building consumer trust in the product.

Food Safety and Standards Authority of India (FSSAI)

- FSSAI has issued a formal framework defining plant-based milk and ensuring it meets safety and nutritional standards. This supports product quality and encourages broader adoption across Indian consumers.

China National Health Commission

- China’s dietary guidelines now promote the inclusion of plant-based proteins and milks as part of a balanced, lower-carbon diet, aligning national policy with changing food consumption patterns.

Japan Ministry of Health, Labour and Welfare

- This ministry recognizes plant-based milk as a viable alternative for individuals with food allergies or lactose intolerance, and supports public education campaigns to promote diverse nutritional choices.

Brazilian Health Regulatory Agency (ANVISA)

- ANVISA enforces stringent safety standards and labeling protocols for plant-based milk alternatives to protect public health and encourage responsible product development.

South African Department of Health

- The department supports incorporating plant-based milk into national dietary guidelines, particularly for populations affected by lactose intolerance and economic constraints in accessing dairy.

New Zealand Ministry for Primary Industries

- Regulates and ensures that plant-based milk products meet national food safety laws, and supports local production and export of dairy-free alternatives, contributing to both public health and economic growth.

Singapore Food Agency

- Implements strict controls to ensure that plant-based milk products are safe, accurately labeled, and nutritionally adequate, reflecting growing local demand for healthier beverage choices.

Korean Ministry of Food and Drug Safety

- Oversees quality and safety standards for plant-based milk products. In South Korea, regulatory support has accelerated the development and market penetration of alternatives like rice and soy milk.

Mexican Federal Commission for the Protection against Sanitary Risk (COFEPRIS)

- Ensures that plant-based milk producers comply with food labeling and safety laws, as dairy-free beverages gain popularity among lactose-intolerant populations in Mexico.

Argentine National Food Institute (INAL)

- Monitors plant-based milk production and labeling to guarantee food safety and nutritional adequacy, supporting a trend toward dairy-free products in urban centers.

United Arab Emirates Ministry of Climate Change and Environment

- Promotes plant-based diets, including milk alternatives, as part of the country's long-term sustainability and climate resilience initiatives, with support for local manufacturing.

Global Plant-Based Milk Market: Market Dynamic

Driving Factors in the Global Plant-Based Milk Market

Increasing Prevalence of Lactose Intolerance and Dairy Allergies

A major driver propelling the plant-based milk market globally is the rising prevalence of lactose intolerance and dairy allergies. Lactose intolerance affects a significant portion of the world population, particularly among Asian, African, Hispanic, and Native American communities, where the inability to digest lactose leads to digestive discomfort and other health issues. This condition creates an essential demand for non-dairy alternatives that provide similar culinary versatility and nutritional benefits without adverse reactions. Additionally, milk protein allergies, especially in children, have heightened the need for safe and hypoallergenic substitutes.

Plant-based milks such as almond, soy, oat, and rice milk offer viable options that cater to these health concerns. Healthcare professionals and nutritionists often recommend plant-based milks as part of dietary management for individuals with such intolerances or allergies, further boosting consumer adoption. The expanding awareness and diagnosis of these conditions, coupled with the growing availability of plant-based options, are powerful growth catalysts. As more consumers seek alternatives that accommodate their health requirements without compromising taste or convenience, the plant-based milk segment is experiencing substantial growth across both developed and emerging markets.

Expansion of Vegan and Flexitarian Diets Globally

The growing global population adopting vegan and flexitarian diets is a pivotal driver for the plant-based milk market. Veganism, which excludes all animal-derived products, and flexitarianism, which reduces animal product consumption without eliminating it, have gained significant popularity due to ethical, environmental, and health reasons. These dietary patterns emphasize plant-based nutrition, naturally boosting the demand for dairy alternatives such as plant-based milks. Social media, celebrity endorsements, and documentary content highlighting the benefits of plant-based eating have contributed to increased consumer interest and awareness.

Food manufacturers and retailers are responding by expanding their portfolios to include a diverse range of plant-based milk options, including innovative blends and flavored variants, catering to varying taste preferences. Furthermore, flexitarians, who represent a large demographic, drive market growth by choosing plant-based milks as occasional substitutes for dairy milk to reduce their environmental footprint without fully committing to a vegan lifestyle.

This demographic’s influence has widened the target audience for plant-based milk products beyond strict vegans, enabling market penetration into mainstream grocery channels and foodservice establishments. The global expansion of these diet trends strongly supports continuous growth and innovation in the plant-based milk market.

Restraints in the Global Plant-Based Milk Market

High Production Costs and Price Sensitivity

Despite the growing demand for plant-based milk, one significant restraint hampering market growth is the relatively high production costs associated with these alternatives compared to conventional dairy milk. The cost of raw materials such as almonds, oats, and other plant-based bases can be volatile due to agricultural challenges like droughts, pests, and climate change.

Additionally, the manufacturing process for plant-based milks, especially those fortified with nutrients or utilizing clean-label ingredients, often requires specialized technology and higher quality control standards, contributing to increased production expenses. These factors result in retail prices for plant-based milks that are frequently higher than those of traditional dairy milk.

Price sensitivity among consumers, particularly in emerging markets or lower-income groups, limits the widespread adoption of plant-based milk products. While health-conscious and environmentally aware consumers may be willing to pay a premium, many price-sensitive customers still prioritize affordability, restricting market penetration. Retailers may also be hesitant to dedicate significant shelf space to higher-priced plant-based milks without guaranteed turnover. This price barrier necessitates continued innovation in cost-effective production techniques and scaling operations to reduce prices and make plant-based milks more competitive against traditional dairy options.

Consumer Skepticism and Limited Awareness in Emerging Markets

Another notable challenge for the global plant-based milk market is consumer skepticism and limited awareness, especially in emerging economies where traditional dairy consumption is deeply entrenched. In many regions, consumers perceive dairy milk as a staple with superior nutritional value and are unfamiliar with the benefits or taste profiles of plant-based alternatives.

This lack of awareness extends to nutritional concerns, such as the adequacy of protein, calcium, and vitamin content in plant-based milks, which some consumers doubt compared to conventional milk. Cultural preferences and dietary habits further influence acceptance, as dairy products often hold significant culinary and social importance.

Moreover, misinformation or confusion about ingredients and health benefits can deter adoption. The limited availability of plant-based milks in rural or less developed retail outlets also restricts consumer exposure. Educating consumers through marketing campaigns, in-store promotions, and nutritionist endorsements is crucial to overcoming skepticism. Without effective communication about the benefits and quality of plant-based milks, market growth may remain constrained in these regions. Brands must tailor strategies to local tastes and preferences while addressing informational gaps to build trust and foster wider acceptance.

Opportunities in the Global Plant-Based Milk Market

Product Innovation and Diversification in Plant-Based Milks

One of the most promising growth opportunities in the global plant-based milk market lies in ongoing product innovation and diversification. Consumers today seek not only dairy-free options but also products that cater to specific taste preferences, nutritional needs, and lifestyle choices.

Manufacturers are investing in research and development to improve texture, flavor profiles, and nutritional content, addressing past criticisms such as grainy textures or weak taste. Innovations include the introduction of new plant-based milks such as pea, hemp, and flax milk, broadening consumer choices beyond traditional almond, soy, and oat milks, along with the growing use of almond oil in functional and plant-based formulations.

Additionally, the fortification of plant-based milks with vitamins D, B12, calcium, and protein creates products that appeal to nutrition-conscious consumers, including children, athletes, and the elderly. Flavored and functional plant-based milks, such as those with probiotics for digestive health or antioxidants for immune support, are also emerging segments with significant potential, further aligning with the rising demand for digestive health supplements.

Packaging innovations that improve shelf life and convenience, such as single-serve cartons and resealable pouches, enhance consumer experience. Collaborations between plant-based milk brands and culinary or beverage companies for new product lines also open up additional market avenues. These innovations and product expansions not only attract new customers but also encourage repeat purchases, supporting long-term market growth.

Expansion of Distribution Channels and E-Commerce Platforms

The rapid growth of online retail and the expansion of diverse distribution channels present significant opportunities for the plant-based milk market. With increasing internet penetration and smartphone usage globally, e-commerce platforms offer consumers convenient access to a wide variety of plant-based milk products, including niche and premium brands that might not be readily available in traditional retail stores. Online marketplaces and direct-to-consumer models enable brands to reach wider audiences while providing opportunities for personalized marketing and subscription-based sales models. The COVID-19 pandemic accelerated the shift to online grocery shopping, a trend that continues to support plant-based milk sales growth through digital channels.

Moreover, expansion in physical retail, such as specialty health food stores and the increased presence of plant-based milk products in mainstream supermarkets and hypermarkets, enhances product visibility and accessibility. Partnerships with foodservice outlets, cafes, and restaurants offering plant-based milk alternatives also boost market penetration.

Geographic expansion into emerging markets through these channels allows brands to tap into new consumer bases, particularly in Asia-Pacific and Latin America. Strengthening distribution infrastructure and leveraging omnichannel strategies provide a substantial growth platform for plant-based milk manufacturers globally.

Trends in the Global Plant-Based Milk Market

Rising Consumer Shift Towards Health and Wellness

The global plant-based milk market is experiencing a notable shift driven by increasing consumer awareness of health and wellness. Modern consumers, particularly Millennials and Gen Z, are actively seeking alternatives to traditional dairy due to concerns about lactose intolerance, dairy allergies, and the desire to reduce cholesterol and saturated fat intake. This health-conscious mindset is further reinforced by the surge in lifestyle diseases such as obesity, diabetes, and heart ailments, prompting individuals to adopt plant-based milks such as almond, oat, and soy, which are perceived as cleaner and more natural options.

Additionally, the trend toward fortified plant-based milks enriched with vitamins, minerals, and proteins is gaining traction, appealing to consumers looking for functional foods that offer additional health benefits. This has led to product innovation, with brands introducing variants targeting specific nutritional needs like calcium fortification for bone health or added protein for muscle support. The demand for organic and non-GMO plant-based milk products is also increasing as consumers become more vigilant about ingredient sourcing and processing methods. This trend is poised to sustain the market’s momentum as consumers continue prioritizing healthy dietary choices.

Sustainability and Ethical Consumption Driving Market Growth

Environmental sustainability and ethical concerns surrounding animal welfare are significant trends reshaping the global plant-based milk market. Heightened awareness of the environmental impact of traditional dairy farming, including high greenhouse gas emissions, excessive water consumption, and land use, is leading consumers to opt for eco-friendly alternatives. Plant-based milks require substantially less water and emit fewer greenhouse gases, positioning them as sustainable dietary choices.

Moreover, the growing global discourse on climate change and responsible consumption encourages consumers to make conscious food choices that align with environmental goals. Ethical considerations related to animal rights also fuel the preference for plant-based milks, as the demand for cruelty-free products rises. Influencers, environmental campaigns, and documentary films have contributed to a cultural shift favoring plant-based lifestyles. This trend is reflected in the increasing number of foodservice outlets, cafes, and restaurants offering plant-based milk options, making these alternatives more accessible to the general population.

Global Plant-Based Milk Market: Research Scope and Analysis

By Product Type Analysis

Almond milk is projected to dominate the global plant-based milk market due to its widespread consumer acceptance, nutritional appeal, and versatility across dietary and culinary uses. It has become the most recognized and preferred alternative to dairy milk, particularly in North America and Europe, where health and wellness trends have reshaped consumption patterns. Almond milk is low in calories, free of saturated fats, and naturally lactose-free, making it an ideal choice for health-conscious individuals, vegans, and those with lactose intolerance or dairy allergies.

Its mild, slightly nutty flavor and smooth texture allow it to be easily integrated into various applications, from cereals and smoothies to coffee and baking. This versatility has led foodservice chains, coffee shops, and restaurants to adopt almond milk as a default non-dairy option, further reinforcing its position in consumer choices. Moreover, almond milk enjoys strong brand penetration with numerous global players offering a wide array of variants, including unsweetened, sweetened, fortified, and flavored options.

Consumer perception of almonds as a premium, nutrient-rich superfood has also contributed to almond milk’s dominance. It is often fortified with calcium, vitamins D and E, and sometimes protein, meeting the nutritional expectations of modern consumers. Despite concerns about almond farming’s water footprint, the demand remains strong due to effective marketing and the continual development of sustainable sourcing practices. Retail shelf space, promotional visibility, and early market entry by key brands have further consolidated almond milk’s leading status within the plant-based milk segment globally.

By Nature Analysis

Organic plant-based milk is anticipated to lead the market segment by nature due to increasing global awareness about clean-label nutrition, food safety, and environmental responsibility. Consumers are becoming more conscious about what they consume, prompting a strong shift toward products made from organically grown ingredients free from synthetic pesticides, genetically modified organisms (GMOs), artificial preservatives, and chemical fertilizers. This movement aligns perfectly with plant-based milk's value proposition of health and sustainability, making the organic variant a natural extension of consumer preference.

Organic plant-based milk is perceived as healthier and more environmentally friendly, contributing to its popularity across health-conscious demographics, particularly in developed regions like Europe and North America. It is especially favored by parents buying milk for children, pregnant women, and individuals with compromised immune systems due to its perceived safety and purity. Moreover, rising concerns over long-term exposure to chemical residues in conventionally farmed produce have led to a growing demand for organic-certified options.

The availability of certified organic plant-based milk has expanded rapidly in supermarkets, specialty health stores, and online platforms. Key players are increasingly launching organic lines and investing in certification processes to meet this demand. In addition, many governments and international food safety bodies promote organic farming practices, providing regulatory and financial support, which in turn fuels product availability and consumer trust.

Consumers also associate organic labeling with ethical practices, biodiversity protection, and animal welfare, adding emotional value to their purchase. This combination of health benefits, safety assurance, and environmental ethics ensures that organic plant-based milk continues to dominate its category.

By Flavour Analysis

Flavored plant-based milk is projected to dominate its segment due to its enhanced taste appeal, versatility, and ability to attract a broader consumer base, particularly children and new users transitioning from dairy milk. While the core advantage of plant-based milk lies in health and sustainability, flavored options make the product more enjoyable and accessible by masking the sometimes unfamiliar or earthy notes of raw plant-based milk bases like soy or oat. Popular flavors such as chocolate, vanilla, strawberry, and caramel help bridge the gap for consumers seeking both nutrition and indulgence.

This is especially effective in appealing to families with children, who often reject plain plant-based milk due to its taste or texture. By offering naturally flavored and lightly sweetened alternatives, brands make plant-based milk more acceptable as a daily beverage, encouraging repeat purchases. Additionally, flavored variants are often fortified with essential nutrients like calcium, vitamin D, and B12, allowing consumers to enjoy both taste and health benefits simultaneously.

The popularity of flavored plant-based milk has also been supported by cafés, smoothie chains, and ready-to-drink product segments. These products are often packaged in single-serve bottles and cartons, making them ideal for on-the-go consumption, lunchboxes, and fitness-oriented lifestyles. Brands are further experimenting with low-sugar and no-added-sugar formulations, plant-based protein inclusions, and clean-label flavorings to keep pace with consumer expectations.

Overall, flavored plant-based milk plays a crucial role in improving product palatability, expanding user demographics, and supporting brand loyalty, thus ensuring its dominance in the flavor segment of the global market.

By Packaging Analysis

Bottles are expected to dominate the packaging segment of the global plant-based milk market due to their superior convenience, portability, branding potential, and consumer familiarity. Rigid bottles, especially those made from recyclable plastics or glass, offer a user-friendly format that supports single-serve consumption and resealability, making them ideal for on-the-go lifestyles. As plant-based milk consumption expands beyond the breakfast table into snacks, smoothies, and ready-to-drink beverages, bottles emerge as the most practical choice for busy consumers.

Bottled packaging also supports clear labeling, vibrant design, and easy visibility on retail shelves, key factors in a competitive market where brand differentiation is critical. The wide surface area allows for attractive graphics, nutritional information, sustainability claims, and flavor identification, effectively enhancing product appeal. Many premium brands utilize transparent or eco-friendly bottle designs to highlight purity and reinforce brand values like health and sustainability.

Furthermore, bottles offer better structural integrity compared to cartons or pouches, which is important for maintaining product quality, especially for flavored and fortified varieties that may require additional protection. Resealable caps also make bottles ideal for multi-serve use, reducing waste and improving storage.

In addition, with the growing demand for e-commerce and home delivery, bottles provide enhanced durability and spill protection during transit. Their compatibility with vending machines, cafés, and gyms also makes them more versatile across sales channels. As plant-based milk continues to evolve into an everyday lifestyle beverage, bottles remain the dominant packaging choice due to their unmatched combination of utility, aesthetics, and consumer trust.

By Distribution Channel Analysis

Hypermarkets and supermarkets are expected to dominate the distribution channel segment in the global plant-based milk market due to their expansive reach, product variety, promotional visibility, and consumer preference for physical product inspection. These retail formats offer a one-stop solution for groceries and household needs, making them highly convenient for bulk or regular purchases, especially of staple items like plant-based milk. Their ability to stock a wide range of brands, flavors, and formats, ranging from almond and oat to flavored or organic variants, enables consumers to compare and select based on preference, budget, and dietary requirements.

In-store promotions, free sampling, and discounts offered in hypermarkets and supermarkets also play a vital role in encouraging first-time trials and brand switching. These outlets provide shelf space for both established global brands and emerging local players, giving consumers access to diverse options. Additionally, refrigerated and ambient sections in such stores support the sale of both shelf-stable and perishable plant-based milk variants, enhancing flexibility for manufacturers and consumers alike.

Retailers often collaborate with manufacturers for end-cap displays, health food aisles, and promotional placements, significantly increasing product visibility. Moreover, as health consciousness rises, supermarkets are dedicating more shelf space to plant-based and organic products, signaling broader mainstream acceptance.

The foot traffic in these outlets, especially in urban and suburban regions, ensures high product turnover and rapid brand exposure. With growing demand across demographics, hypermarkets and supermarkets remain the most influential and dominant distribution channels for plant-based milk products globally.

The Global Plant-Based Milk Market Report is segmented on the basis of the following:

By Product Type

- Almond Milk

- Oat Milk

- Soy Milk

- Coconut Milk

- Rice Milk

- Pea Milk

- Other Product Type

By Nature

By Flavor

- Flavored Milk

- Non-Flavored Milk

By Packaging

- Bottles

- Carton Packaging

- Pouches

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Retail Stores

- Online Channels

- Others

Global Plant-Based Milk Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global plant-based milk market as it commands over 38.9% of the total revenue by the end of 2025, due to its early adoption of plant-based diets, robust vegan and flexitarian populations, and well-established food innovation infrastructure. The U.S. and Canada have witnessed a sustained cultural shift toward health-conscious eating, driven by increasing lactose intolerance, rising awareness of animal welfare, and strong environmental activism. Regulatory clarity from bodies like the U.S. Food and Drug Administration (FDA) also allows for product differentiation and label transparency, fostering consumer trust.

Retail distribution in the region is highly developed, with major supermarket chains, hypermarkets, and online grocery platforms offering a wide variety of plant-based milk. Leading brands such as Silk, Califia Farms, and So Delicious are headquartered or have significant operations in North America, ensuring local manufacturing, high brand visibility, and aggressive marketing strategies.

The rise of functional beverages and fortified plant milks further aligns with American consumers' preferences for nutrient-enriched products. Celebrity endorsements, influencer-driven promotions, and the popularity of plant-based alternatives in restaurants and cafés also boost demand. Overall, strong consumer awareness, product innovation, and widespread availability contribute to North America's market leadership.

Region with the Highest CAGR

Asia Pacific holds the highest compound annual growth rate (CAGR) in the global plant-based milk market due to a rapidly expanding middle class, increased urbanization, and evolving dietary habits. The region benefits from traditional familiarity with non-dairy beverages like soy milk and rice milk, making it easier for consumers to accept newer formats such as almond and oat milk. Health concerns, including high lactose intolerance rates among Asian populations, further accelerate the transition to plant-based alternatives.

Countries like China, India, Japan, and Australia are witnessing a surge in health-conscious millennials and Gen Z consumers who prioritize sustainability and ethical consumption. Government support for plant-based industries, local manufacturing expansion, and the entry of global and regional players into emerging economies have intensified market competition and product accessibility. E-commerce growth and digital food retail platforms also enable brands to reach rural and underserved markets. These combined demographic, cultural, and economic factors are expected to fuel Asia Pacific’s accelerated growth and position it as the fastest-growing region for plant-based milk consumption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Plant-Based Milk Market: Competitive Landscape

The global plant-based milk market is characterized by intense competition and innovation, with both multinational corporations and emerging startups striving for market share through product differentiation, strategic partnerships, and sustainability initiatives. Leading players such as Danone S.A., Blue Diamond Growers, The Hain Celestial Group, Califia Farms, and Oatly dominate through broad product portfolios, extensive retail networks, and aggressive marketing campaigns. These companies focus on fortifying their products with essential nutrients, reducing sugar content, and offering a wide variety of flavors to meet diverse consumer preferences.

Private-label offerings by retail giants like Walmart and Costco are also gaining traction, offering price-competitive options and expanding the market beyond premium consumers. Startups and regional brands are disrupting the space by introducing niche ingredients like pea, hemp, and cashew milk, and by leveraging clean-label and organic certifications.

Sustainability is a key differentiator, with players investing in eco-friendly packaging, carbon-neutral supply chains, and water-efficient ingredient sourcing. Collaborations with baristas, foodservice chains, and vegan influencers further drive brand visibility and credibility. R&D investment in improved shelf stability, taste profiles, and health benefits continues to be a cornerstone of competitive advantage. The landscape remains dynamic, with ongoing innovation shaping the future of plant-based milk consumption globally.

Some of the prominent players in the Global Plant-Based Milk Market are:

- Danone S.A.

- The Hain Celestial Group, Inc.

- Blue Diamond Growers

- Califia Farms, LLC

- Oatly Group AB

- Ripple Foods

- Elmhurst 1925

- Earth’s Own Food Company

- SunOpta Inc.

- Nestlé S.A.

- Pacific Foods of Oregon, LLC

- Dream (The Hain Celestial Group)

- Silk (a Danone brand)

- Alpro (a Danone brand)

- Eden Foods, Inc.

- Good Karma Foods, Inc.

- Vitasoy International Holdings Ltd.

- Daiya Foods Inc.

- Nutriops S.L.

- Plenish Cleanse Ltd.

- Other Key Players

Recent Developments in the Global Plant-Based Milk Market

May 2025

- Danone launched an AI-driven consumer feedback system to optimize flavor formulations in its plant-based milk brands (e.g., Silk, Alpro), aiming to enhance product personalization and reduce time-to-market for new SKUs.

- Califia Farms announced a strategic investment of USD 25 million to expand its bottling and aseptic packaging capabilities at its Bakersfield, California, facility.

April 2025

- Blue Diamond Growers entered into a collaboration with Tetra Pak to develop next-gen sustainable plant-based milk cartons, aiming to reduce plastic by 35% and enhance recyclability.

- The Plant-Based World Expo Europe 2025 held in London featured over 40 exhibitors showcasing innovations in oat and pea milk, with keynotes emphasizing functional ingredients and digestive wellness.

March 2025

- Nestlé USA participated in the Natural Products Expo West 2025, unveiling a new line of flavored oat milks under its Wunda brand, with added fiber and calcium to appeal to health-focused millennials.

- Oatly AB and Minor Figures entered into a distribution alliance in Southeast Asia, targeting coffee chains and boutique cafés through plant-based barista formulations.

February 2025

- The U.S. Department of Agriculture (USDA) hosted a Plant-Based Innovation Roundtable with major dairy-alternative stakeholders to explore infrastructure support and labeling regulation harmonization.

- Ripple Foods acquired a pea protein extraction facility in Illinois, boosting control over raw material supply and vertical integration for its pea milk production.

January 2025

- The Hain Celestial Group announced a strategic restructuring of its plant-based beverage division, merging operations across its Dream and WestSoy product lines for cost efficiency and unified branding.

- MALK Organics secured a Series C investment round of USD 12 million, led by impact investors focused on organic, clean-label nutrition in plant-based beverages.

December 2024

- NotCo introduced a new line of AI-developed almond-coconut milk hybrids using its proprietary “Giuseppe” platform, targeting Latin American and European markets with improved texture and creaminess.

- The Asia-Pacific Plant-Based Dairy Summit 2024 in Singapore highlighted lactose intolerance rates and dairy-free adoption trends, with attendance from Japanese and Indian manufacturers exploring export opportunities.

November 2024

- Elmhurst 1925 entered a co-manufacturing agreement with a Canadian oat processor, enabling capacity expansion for North American markets and upcoming SKUs with enhanced protein content.

- Wicked Kitchen expanded its retail footprint in the UK by launching its plant-based milks in Tesco’s “Free From” aisle, backed by a USD 10 million marketing campaign.

October 2024

- Goodmylk Co. (India) participated in World Vegan Day Expo, promoting clean-label almond and cashew milk sachets tailored to urban Indian consumers with no refrigeration requirement.

- Vitasoy International unveiled plans for a new R&D hub in Guangzhou, focusing on high-protein soy milk and alternative sources like mung bean and quinoa.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.6 Bn |

| Forecast Value (2034) |

USD 42.8 Bn |

| CAGR (2025–2034) |

7.9% |

| The US Market Size (2025) |

USD 7.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Almond Milk, Oat Milk, Soy Milk, Coconut Milk, Rice Milk, Pea Milk, Other Product Type), By Nature (Organic, Conventional), By Flavor (Flavored Milk, Non-Flavored Milk), By Packaging (Bottles, Carton Packaging, Pouches), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Retail Stores, Online Channels, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Danone S.A., The Hain Celestial Group Inc., Blue Diamond Growers, Califia Farms LLC, Oatly Group AB, Ripple Foods PBC, Elmhurst Milked Direct LLC (Elmhurst 1925), Earth’s Own Food Company Inc., SunOpta Inc., Nestlé S.A., Pacific Foods of Oregon LLC, Dream (The Hain Celestial Group Inc.), Silk (Danone North America), Alpro (Danone S.A.), Eden Foods Inc., Good Karma Foods Inc., Vitasoy International Holdings Ltd., Daiya Foods Inc., Nutriops S.L., Plenish Cleanse Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Plant-Based Milk Market size is estimated to have a value of USD 21.6 billion in 2025 and is expected to reach USD 42.8 billion by the end of 2034.

The US Plant-Based Milk Market is projected to be valued at USD 7 .1billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.5 billion in 2034 at a CAGR of 7.4%.

North America is expected to have the largest market share in the Global Plant-Based Milk Market with a share of about 38.9% in 2025.

Some of the major key players in the Global Plant-Based Milk Market are Danone S.A., The Hain Celestial Group Inc., Blue Diamond Growers, Califia Farms LLC, Oatly Group AB, Ripple Foods PBC, Elmhurst Milked Direct LLC, and many others.

The market is growing at a CAGR of 7.9 percent over the forecasted period of 2025.