Market Overview

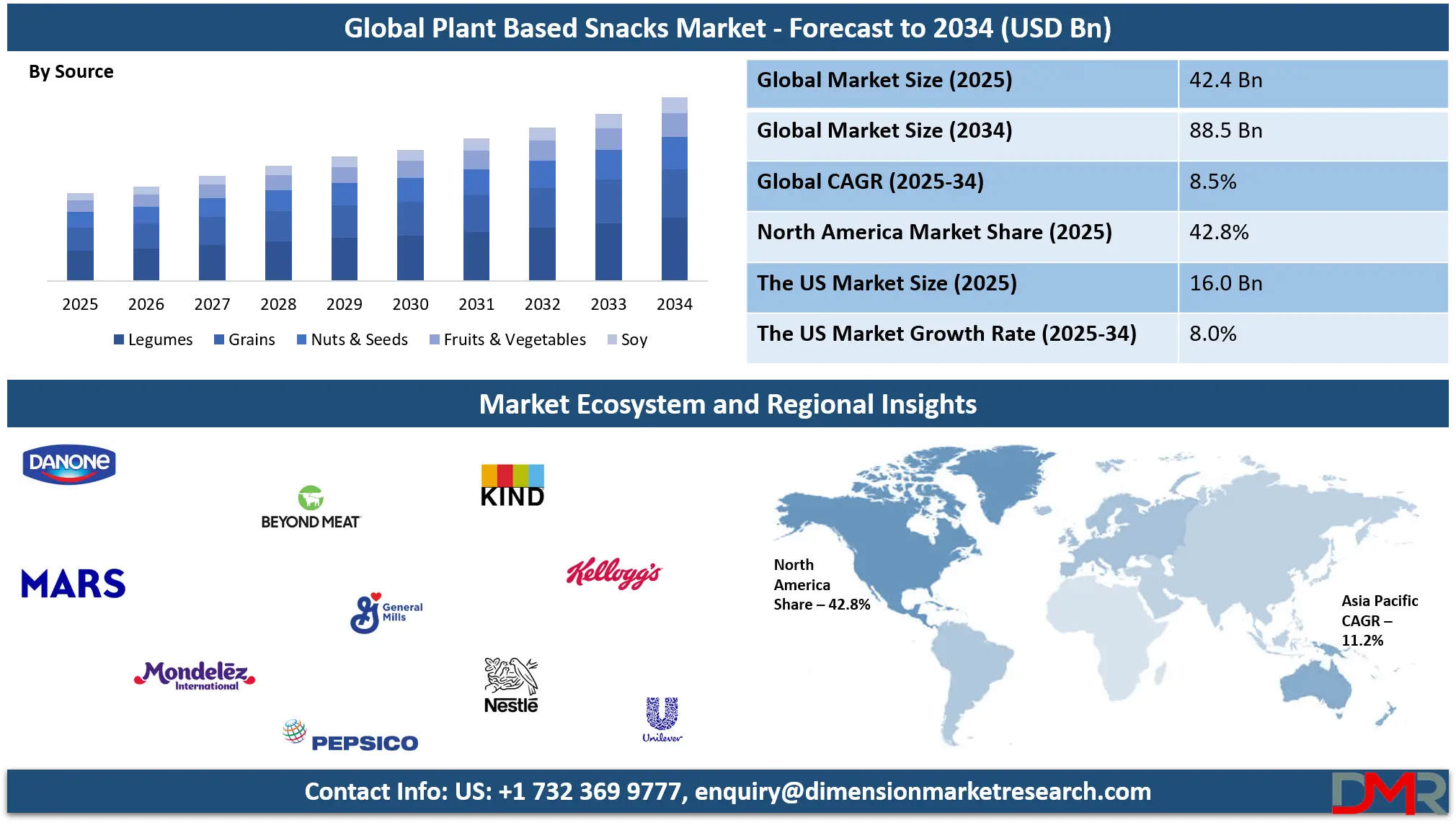

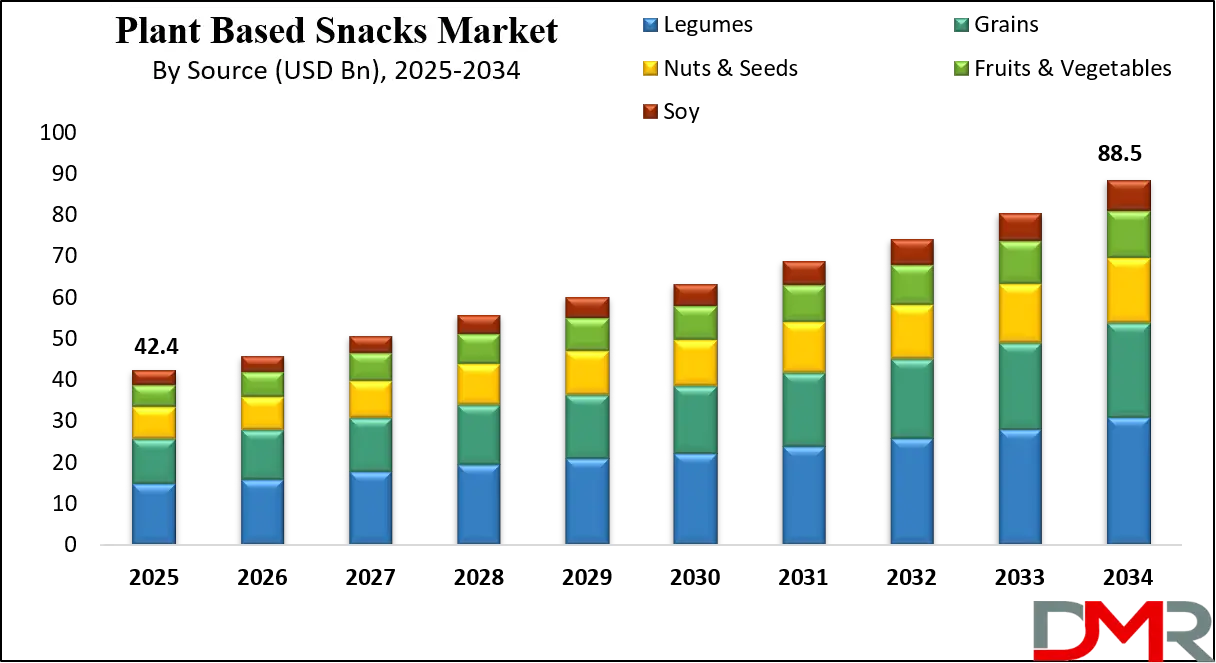

The Global Plant Based Snacks Market size is projected to reach USD 42.4 billion in 2025 and grow at a compound annual growth rate of 8.5% to reach a value of USD 88.5 billion in 2034.

Plant-based snacks are packaged, ready-to-eat food products made exclusively from plant-derived ingredients such as legumes, grains, nuts, seeds, fruits, vegetables, and soy. These include chips, crackers, protein bars, puffed snacks, fruit snacks, and plant-based jerky that provide convenient nutrition without animal-derived components. Within the food and beverage industry, plant-based snacks support healthier eating habits, sustainability goals, and ethical consumption trends. Improvements in ingredient processing, flavor development, and texture optimization have significantly enhanced product appeal and competitiveness.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, the growth in plant-based snacks is driven by rising health awareness, the expansion of flexitarian diets, and increasing concern over environmental impact. Consumers look for snacks high in protein and fiber with fewer artificial additives. Advancements in plant protein extraction, extrusion technologies, and clean-label formulations have improved taste, shelf life, and consistency. Regulatory emphasis on transparent labeling has also strengthened consumer trust and encouraged broader adoption.

Also, continuous innovation, investments in alternative proteins, and collaboration across supply chains are reshaping the industry. Manufacturers are expanding portfolios with functional ingredients and sustainable packaging, while retailers and foodservice providers increase shelf space. These shifts position plant-based snacks as a resilient and future-oriented segment of the global snack industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Plant Based Snacks Market

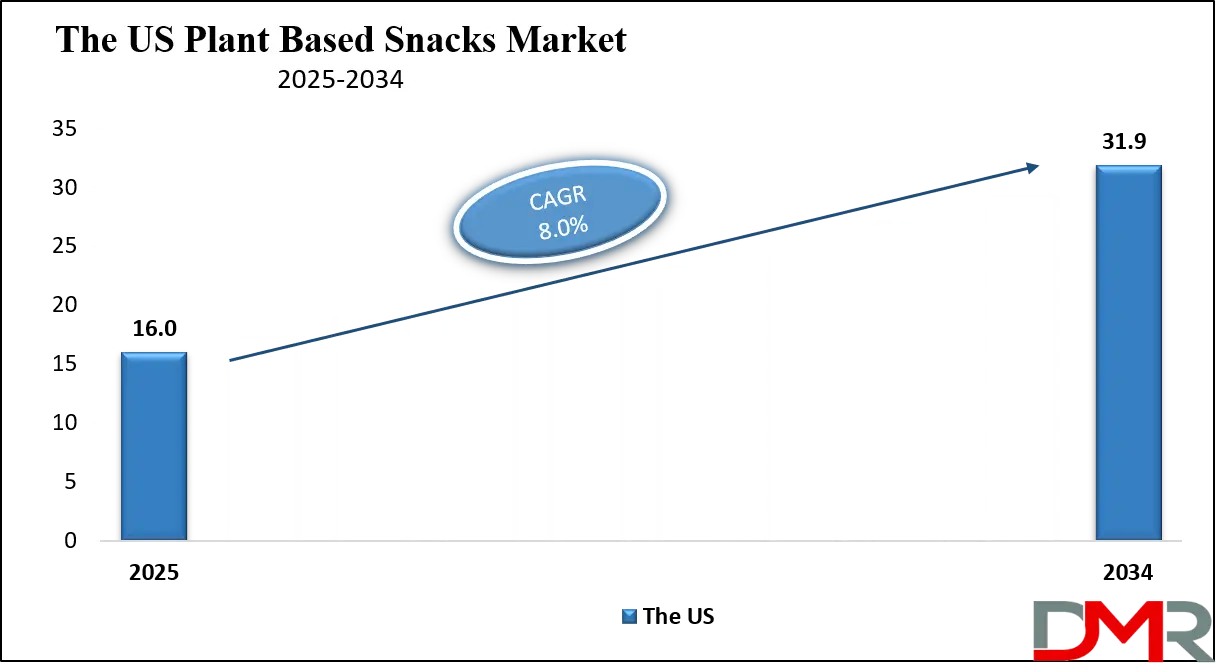

The US Plant Based Snacks Market size is projected to reach USD 16.0 billion in 2025 at a compound annual growth rate of 8.0% over its forecast period.

The US represents a mature and innovation-driven landscape for plant-based snacks, supported by a strong wellness culture and high consumer spending on functional foods. Wide retail penetration across supermarkets, convenience stores, and online platforms has accelerated adoption. Government nutrition guidelines promoting plant-forward diets indirectly support demand, while clear food labeling regulations enhance transparency. Product innovation focuses on protein enrichment, clean labels, and indulgent flavors. High levels of private investment and rapid commercialization of new snack formats continue to strengthen the country’s position as a leading consumption and innovation hub.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Plant Based Snacks Market

Europe Plant Based Snacks Market size is projected to reach USD 10.6 million in 2025 at a compound annual growth rate of 8.1% over its forecast period.

Europe’s plant-based snacks market is strongly influenced by sustainability-focused consumer behavior and supportive regional policies such as climate and food system initiatives. Countries including Germany, the UK, France, and the Netherlands lead adoption, driven by demand for organic, non-GMO, and ethically sourced snacks. Regulatory emphasis on food safety and environmental responsibility encourages manufacturers to invest in traceable supply chains. Innovation is steady, with a focus on natural ingredients and reduced salt and fat content. Retailers actively promote plant-based private labels, accelerating mainstream acceptance.

Japan Plant Based Snacks Market

Japan Plant Based Snacks Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 9.0% over its forecast period.

Japan’s plant-based snacks market is expanding due to urban lifestyles, an aging population, and strong interest in functional nutrition. Consumers favor portion-controlled, high-quality snacks with health benefits such as digestive support and sustained energy. Government initiatives supporting food innovation and sustainable agriculture encourage product development. Local flavors and advanced packaging technologies create differentiation. While traditional dietary preferences remain influential, rising awareness of plant nutrition and convenience-oriented consumption presents significant opportunities for growth in premium and functional snack categories.

Plant Based Snacks Market: Key Takeaways

- Market Growth: The Plant Based Snacks Market size is expected to grow by USD 42.8 billion, at a CAGR of 8.5%, during the forecasted period of 2026 to 2034.

- By Source: The legumes segment is anticipated to get the majority share of the Plant Based Snacks Market in 2025.

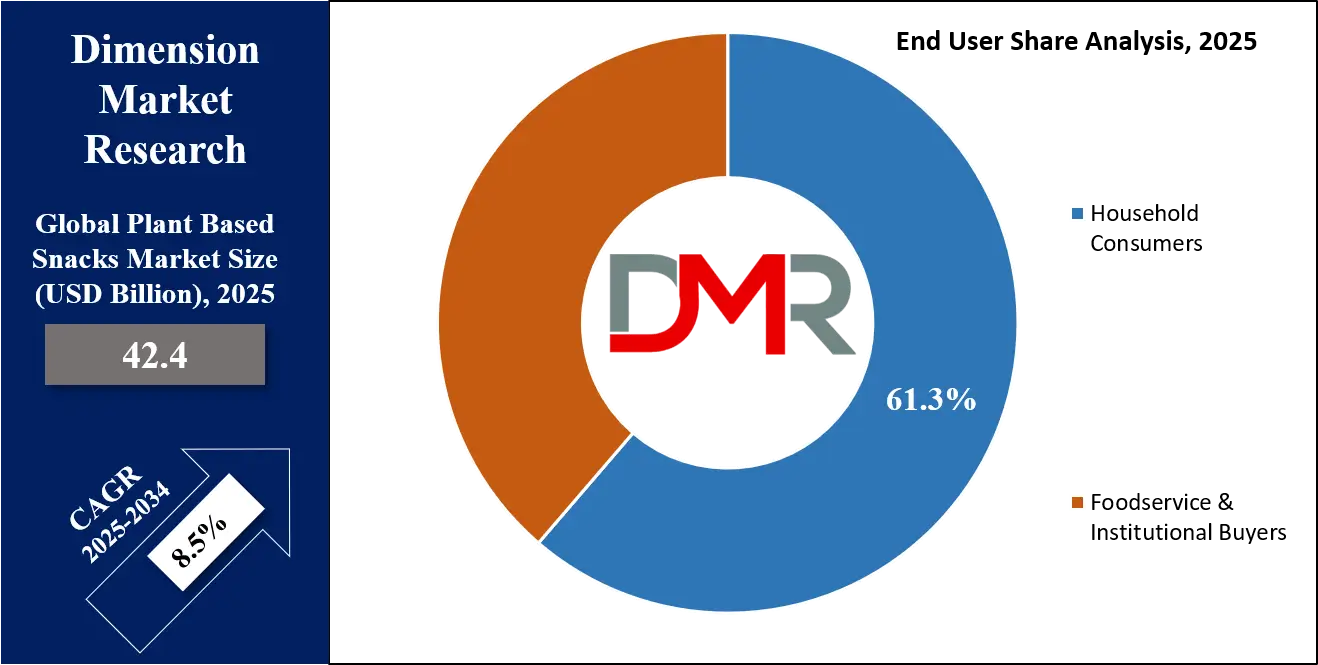

- By End User: The household consumers segment is expected to get the largest revenue share in 2025 in the Plant Based Snacks Market.

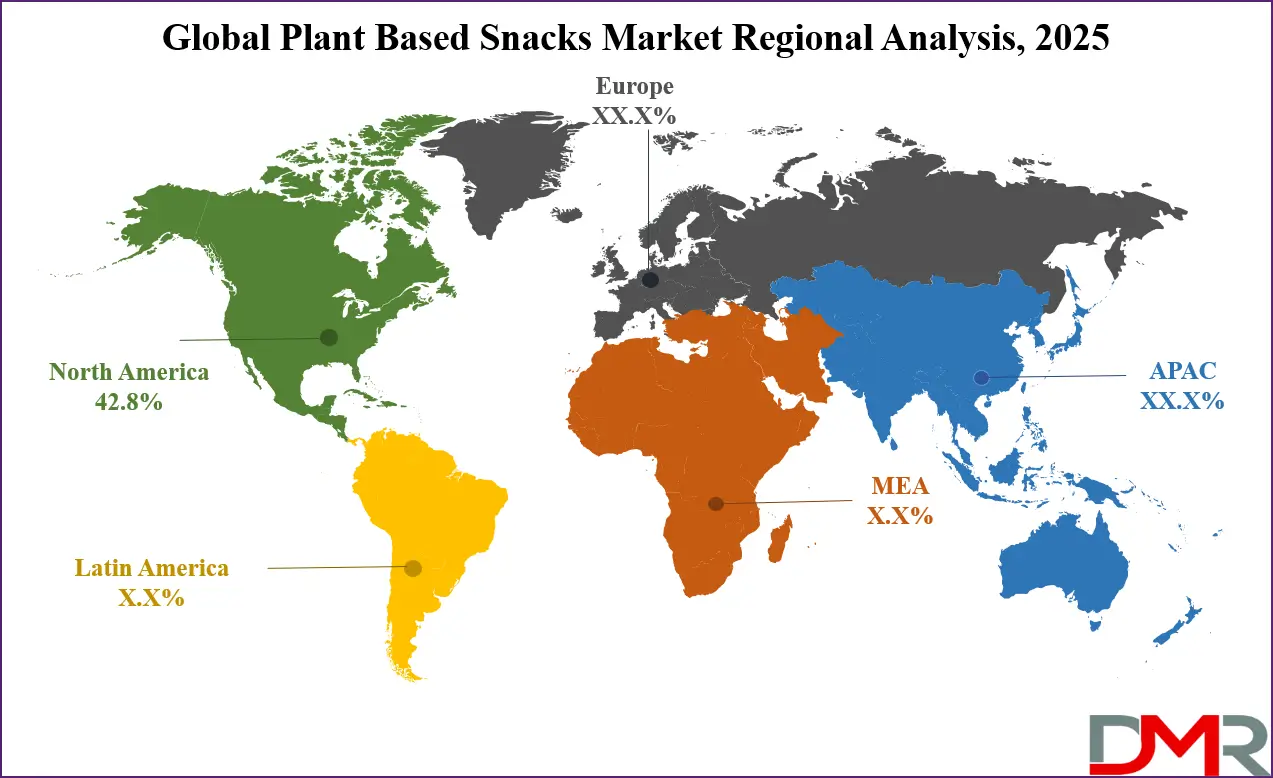

- Regional Insight: North America is expected to hold a 42.8% share of revenue in the Global Plant Based Snacks Market in 2025.

- Use Cases: Some of the use cases of Plant Based Snacks include fitness & sports nutrition, healthy on-the-go snacking, and more.

Plant Based Snacks Market: Use Cases

- Healthy On-the-Go Snacking: Convenient high-protein bars and chips offer nutritious alternatives to traditional snacks for busy consumers.

- Fitness & Sports Nutrition: Protein-rich plant snacks support post-workout recovery in fitness routines.

- Children’s Nutritious Snacks: Clean-label, nutrient-dense options for kids replace sugary treats in lunchboxes.

- Sustainable Retail Offerings: Grocery chains use plant-based snacks to meet consumer demand for eco-friendly products.

Stats & Facts

- U.S. Department of Agriculture reported that plant-derived ingredients accounted for over 38% of new snack product formulations in 2024.

- European Commission Directorate-General for Agriculture recorded a 21% increase in legume production for food applications across the EU in 2025.

- Japan Ministry of Agriculture, Forestry and Fisheries noted that plant-based processed food consumption rose by 17.4% year-on-year in 2024.

- Food and Agriculture Organization of the United Nations indicated that global pulse utilization in snack manufacturing increased by 19% in 2025.

- U.S. Census Bureau observed that household expenditure on health-oriented packaged snacks grew by 14.2% in 2024.

Market Dynamic

Driving Factors in the Plant Based Snacks Market

Health-Driven Consumer Behavior

Rising awareness of nutrition, lifestyle diseases, and preventive healthcare is a major driver for plant-based snacks. Consumers increasingly seek snacks with high protein, fiber, and micronutrient content while avoiding artificial additives and animal fats. Plant-based snacks align well with dietary preferences such as vegan, flexitarian, gluten-free, and allergen-sensitive diets. The convenience of ready-to-eat formats further amplifies adoption. As consumers integrate healthier snacking into daily routines, demand continues to shift away from traditional high-fat and high-sugar products.

Sustainability and Ethical Consumption

Environmental concerns related to carbon emissions, land use, and water consumption associated with animal agriculture are accelerating interest in plant-based snacks. Brands leveraging sustainable sourcing, recyclable packaging, and lower environmental footprints gain competitive advantage. Corporate sustainability commitments and retailer-led environmental targets also push manufacturers toward plant-based portfolios. This alignment with climate-conscious consumption patterns reinforces long-term market growth and encourages continuous innovation in ingredients and supply chains.

Restraints in the Plant Based Snacks Market

Higher Production and Ingredient Costs

Plant-based snack manufacturing often involves advanced processing techniques, specialty ingredients, and stringent quality controls, resulting in higher production costs. Premium pricing can limit adoption among price-sensitive consumers, particularly in emerging markets. Fluctuations in raw material availability, such as pulses and nuts, further impact margins. These cost pressures challenge scalability and require manufacturers to balance affordability with nutritional and sustainability claims.

Taste and Texture Perception

Despite technological progress, some consumers still perceive plant-based snacks as inferior in taste or mouthfeel compared to conventional snacks. Overcoming ingrained taste expectations remains a challenge, especially in regions with strong traditional snack cultures. Limited awareness and skepticism toward plant-based formulations can slow adoption. Continuous sensory innovation and consumer education are required to address these barriers effectively.

Opportunities in the Plant Based Snacks Market

Expansion in Emerging Markets

Rapid urbanization, rising disposable incomes, and growing health awareness in emerging economies present substantial opportunities. As modern retail infrastructure expands, access to packaged plant-based snacks improves. Localization of flavors and pricing strategies can unlock untapped demand. These regions offer long-term growth potential as dietary patterns gradually shift toward convenient and health-focused snack options.

Functional and Personalized Nutrition

The integration of functional ingredients such as probiotics, adaptogens, and plant-based proteins creates new value propositions. Personalized nutrition trends enable targeted snack formulations for energy, immunity, or weight management. Advances in food science allow brands to differentiate products and command premium pricing, supporting higher margins and deeper consumer engagement.

Trends in the Plant Based Snacks Market

Clean-Label and Minimal Processing

Consumers increasingly favor snacks with short ingredient lists, recognizable components, and minimal processing. Clean-label positioning drives reformulation efforts and transparency in sourcing. This trend encourages innovation in natural preservation, flavor enhancement, and nutrient retention, shaping future product development strategies.

Digital and Direct-to-Consumer Growth

E-commerce and direct-to-consumer channels are reshaping distribution strategies. Brands leverage digital platforms for personalized marketing, subscription models, and rapid product testing. This trend enhances consumer reach, data-driven innovation, and brand loyalty while reducing reliance on traditional retail intermediaries.

Impact of Artificial Intelligence in Plant Based Snacks Market

- Product Formulation Optimization: Artificial Intelligence accelerates ingredient selection and flavor balancing.

- Demand Forecasting: Predictive analytics improve inventory and supply chain efficiency.

- Quality Control: Machine vision systems enhance consistency and safety standards.

- Personalized Nutrition: AI enables customized snack recommendations and formulations.

- Marketing Intelligence: Consumer data analysis refines targeting and product positioning.

Research Scope and Analysis

By Product Type Analysis

Chips and crisps dominate the plant-based snacks category, accounting for 31.4% market share in 2025, primarily due to their deep-rooted consumer familiarity and frequent consumption across age groups. These products seamlessly adapt to plant-based formulations using vegetables, pulses, and whole grains without compromising taste or texture. Continuous innovations such as baking, air-frying, and low-oil extrusion techniques help reduce fat content while preserving crunch and flavor, making them appealing to health-conscious consumers.

Strong retail visibility, attractive packaging, and impulse buying behavior further reinforce demand. Additionally, experimentation with lentil, chickpea, beetroot, and mixed-vegetable bases sustains product differentiation and keeps consumer interest high across global markets.

Protein and energy bars represent the fastest-growing product segment within plant-based snacks, driven by increasing fitness awareness and the global shift toward functional nutrition. These bars are widely adopted by athletes, working professionals, and consumers seeking convenient meal replacements or post-workout nutrition.

Plant-based protein blends derived from peas, soy, nuts, and seeds offer clean-label alternatives to whey-based products, aligning with vegan and flexitarian preferences. Portability, extended shelf life, and targeted health benefits such as muscle recovery and sustained energy contribute to rapid adoption. Continuous flavor innovation, sugar reduction, and inclusion of functional ingredients further enhance their appeal across diverse demographic groups.

By Source Analysis

Legumes account for a 34.6% market share in 2025, making them the leading source in plant-based snacks due to their high protein content, cost-effectiveness, and functional versatility. Pea, chickpea, and lentil proteins are extensively used in extruded snacks, chips, and bars because they provide structure, nutritional density, and neutral flavor profiles. From a sustainability perspective, legumes require less water and nitrogen inputs, supporting environmentally responsible production. Stable global supply chains and growing agricultural output further reinforce their dominance. As food manufacturers continue prioritizing protein enrichment and affordability, legume-based formulations remain central to product development strategies.

Nuts and seeds represent the fastest-growing source segment, supported by premium positioning and strong consumer perception of natural nutrition. Ingredients such as almonds, pumpkin seeds, sunflower seeds, and flaxseeds enhance both flavor and texture while delivering healthy fats, protein, and micronutrients.

This segment benefits from rising demand for minimally processed, nutrient-dense snacks among health-conscious and affluent consumers. Nuts and seeds are commonly incorporated into bars, clusters, and coated snacks, enabling product differentiation. Although higher raw material costs present challenges, premium pricing and strong demand in developed markets continue to drive rapid expansion.

By Distribution Channel Analysis

Retail channels dominate plant-based snack distribution, commanding a 47.2% share in 2025, supported by extensive supermarket and hypermarket networks worldwide. Physical retail benefits from impulse purchasing, in-store promotions, and prominent shelf placement, which significantly influence consumer buying decisions.

Private-label offerings from large retailers also enhance accessibility and affordability, accelerating mainstream adoption. Specialty and health food stores play a complementary role by catering to niche dietary preferences. The ability to physically assess packaging, ingredients, and claims continues to make retail a preferred purchasing channel, especially for new product launches.

Online distribution is the fastest-growing channel for plant-based snacks, driven by convenience, wider product access, and evolving digital shopping habits. E-commerce platforms and direct-to-consumer models allow brands to reach targeted audiences efficiently while offering subscription services and personalized recommendations.

Online channels also enable rapid testing of new products and flavors, supported by consumer feedback and data analytics. Younger consumers and urban populations increasingly favor online purchases due to ease of comparison and home delivery. As digital infrastructure expands, online sales are expected to play a critical role in future market growth.

By Nature Analysis

Conventional plant-based snacks hold a 68.9% market share in 2025, largely due to their affordability and widespread availability across mass-market retail channels. Large-scale production and standardized sourcing allow manufacturers to maintain consistent quality while controlling costs. These products appeal to mainstream consumers who prioritize price and convenience over certification labels. Conventional offerings also benefit from broader flavor options and faster product innovation cycles. As demand for plant-based snacks expands beyond niche consumers, conventional products continue to serve as the primary entry point for new adopters.

Organic plant-based snacks are growing rapidly as consumers increasingly prioritize clean labels, pesticide-free ingredients, and transparent sourcing. This segment is particularly strong in developed markets where regulatory standards and consumer awareness support organic certification.

Organic snacks often command premium pricing, attracting health-conscious and environmentally aware consumers. Growth is further supported by rising availability through specialty stores and online platforms. Despite higher production costs, increasing trust in organic labels and alignment with sustainability values continue to drive adoption.

By End User Analysis

Household consumers account for 61.3% market share in 2025, driven by frequent snacking habits and the integration of plant-based snacks into daily routines. Families increasingly choose plant-based options for breakfast, lunchboxes, and between-meal consumption due to perceived health benefits. Variety packs, multi-serve packaging, and value pricing enhance household appeal. Growing awareness of nutrition among parents and younger consumers supports repeat purchases. As plant-based snacks become staple pantry items, household consumption remains the primary demand driver.

Foodservice and institutional buyers represent a rapidly expanding end-user segment as schools, workplaces, hospitals, and fitness centers incorporate plant-based snacks into menus. Demand is supported by wellness initiatives, dietary inclusion policies, and sustainability commitments. Bulk purchasing and standardized portion formats make plant-based snacks suitable for large-scale catering. Growth is particularly strong in corporate and educational settings, where healthy snacking options are increasingly prioritized.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Plant Based Snacks Market Report is segmented on the basis of the following:

By Product Type

- Chips & Crisps

- Vegetable-based

- Pulse-based

- Crackers & Biscuits

- Protein & Energy Bars

- Nuts & Seeds Snacks

- Puffed & Extruded Snacks

- Fruit-Based Snacks

- Plant-Based Jerky

By Source

- Legumes

- Grains

- Nuts & Seeds

- Fruits & Vegetables

- Soy

By Distribution Channel

- Retail

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty & Health Food Stores

- Online

- E-commerce Platforms

- Direct-to-Consumer

- Foodservice

By Nature

By End User

- Household Consumers

- Foodservice & Institutional Buyers

Regional Analysis

Leading Region in the Plant Based Snacks Market

North America leads the plant-based snacks market with an estimated 42.8% share in 2025, supported by strong consumer awareness and well-established health and wellness trends. High disposable incomes enable consumers to experiment with premium and functional snack options, while advanced retail infrastructure ensures widespread availability across supermarkets, convenience stores, and online platforms.

Regulatory frameworks emphasizing transparent labeling, nutritional disclosure, and sustainable sourcing further strengthen consumer trust and encourage adoption. The region also benefits from a robust innovation ecosystem, with continuous investment in alternative proteins, product reformulation, and packaging sustainability. Active participation from foodservice operators and institutional buyers reinforces demand, positioning North America as the most mature and dominant regional market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Plant Based Snacks Market

Asia-Pacific is the fastest-growing region in the plant-based snacks market, driven by rapid urbanization, expanding middle-class populations, and changing dietary preferences. Rising health awareness among younger consumers is accelerating demand for convenient, nutritious snack options. Government initiatives supporting food innovation, sustainable agriculture, and modern food processing are further stimulating market expansion.

Growth in modern retail formats, including supermarkets and e-commerce platforms, improves accessibility and product visibility. Localization of flavors, culturally relevant ingredients, and affordable pricing strategies enable brands to reach diverse consumer segments. As disposable incomes rise and lifestyle patterns evolve, Asia-Pacific offers significant long-term growth potential for plant-based snack manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competition in the plant-based snacks market is shaped by innovation speed, brand differentiation, and supply chain efficiency. Companies invest heavily in R&D to enhance taste, nutrition, and sustainability. Strategic partnerships with ingredient suppliers and retailers strengthen market presence. High entry barriers related to formulation expertise and distribution networks protect established players, while digital marketing and private labels intensify competition.

Some of the prominent players in the global Plant Based Snacks are:

- Nestlé

- PepsiCo

- Unilever

- Mondelez International

- General Mills

- Kellogg Company

- Mars, Incorporated

- Danone

- The Hain Celestial Group

- Conagra Brands

- KIND LLC

- Blue Diamond Growers

- SunOpta

- Maple Leaf Foods

- Greenleaf Foods

- Beyond Meat

- Hormel Foods

- Campbell Soup Company

- Amy’s Kitchen

- B&G Foods

- Other Key Players

Recent Developments

- In January 2026, CIRANDA launched two new baking chips: organic plant-based white chips and organic chocolate chips made with coconut sugar. The company’s new chips are produced in an allergen-free facility and are on trend with current consumer demands for plant-based sweets made without dairy.

- In February 2025, Goodness Plant launched its two product lines: Crunchy Protein Chips and Vegan Protein Jerky, which are designed for health-conscious consumers looking for a high-protein, low-carb snack option that fits an active lifestyle. Goodness Plant’s Crunchy Protein Chips are made from plant-derived ingredients and providing approximately 10 grams of protein per 1.05 oz bag. The chips are dairy-free and low in carbohydrates, appealing to individuals following vegan, vegetarian, or clean-eating diets, whiletThe Vegan Protein Jerky is available in three flavors,Barbecue, Smoky Bacon, and Spic, and provides between 14 and 18 grams of protein per pack.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 42.4 Bn |

| Forecast Value (2034) |

USD 88.5 Bn |

| CAGR (2025–2034) |

8.5% |

| The US Market Size (2025) |

USD 16.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Chips & Crisps, Crackers & Biscuits, Protein & Energy Bars, Nuts & Seeds Snacks, Puffed & Extruded Snacks, Fruit-Based Snacks, Plant-Based Jerky), By Source (Legumes, Grains, Nuts & Seeds, Fruits & Vegetables, and Soy), By Distribution Channel (Retail, Online, and Foodservice), By Nature (Conventional and Organic), By End User (Household Consumers and Foodservice & Institutional Buyers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Nestlé, PepsiCo, Unilever, Mondelez International, General Mills, Kellogg Company, Mars, Incorporated, Danone, The Hain Celestial Group, Conagra Brands, KIND LLC, Blue Diamond Growers, SunOpta, Maple Leaf Foods, Greenleaf Foods, Beyond Meat, Hormel Foods, Campbell Soup Company, Amy’s Kitchen, B&G Foods, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Plant Based Snacks Market?

▾ The Global Plant Based Snacks Market size is expected to reach USD 42.4 billion by 2025 and is projected to reach USD 88.5 billion by the end of 2034.

Which region accounted for the largest Global Plant Based Snacks Market?

▾ North America is expected to have the largest market share in the Global Plant Based Snacks Market, with a share of about 42.8% in 2025.

How big is the Plant Based Snacks Market in the US?

▾ The US Plant Based Snacks market is expected to reach USD 16.0 billion by 2025.

Who are the key players in the Plant Based Snacks Market?

▾ Some of the major key players in the Global Plant Based Snacks Market include Nestle, PepsiCo, Unilever and others

What is the growth rate in the Global Plant Based Snacks Market?

▾ The market is growing at a CAGR of 8.5 percent over the forecasted period.