Market Overview

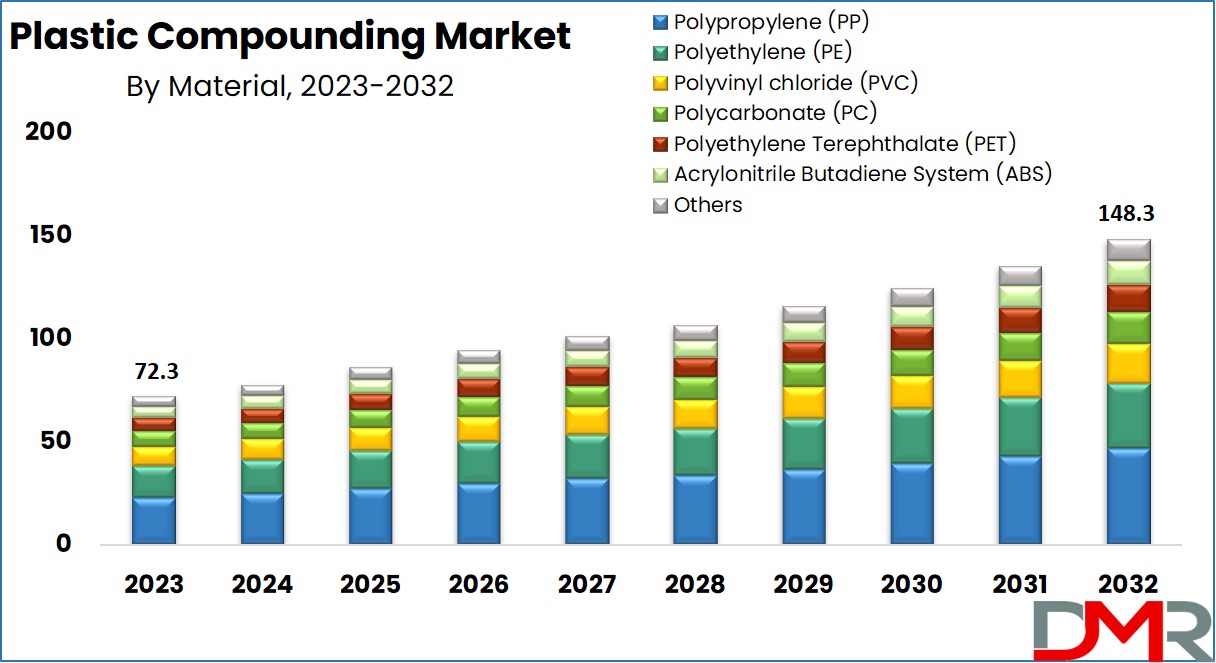

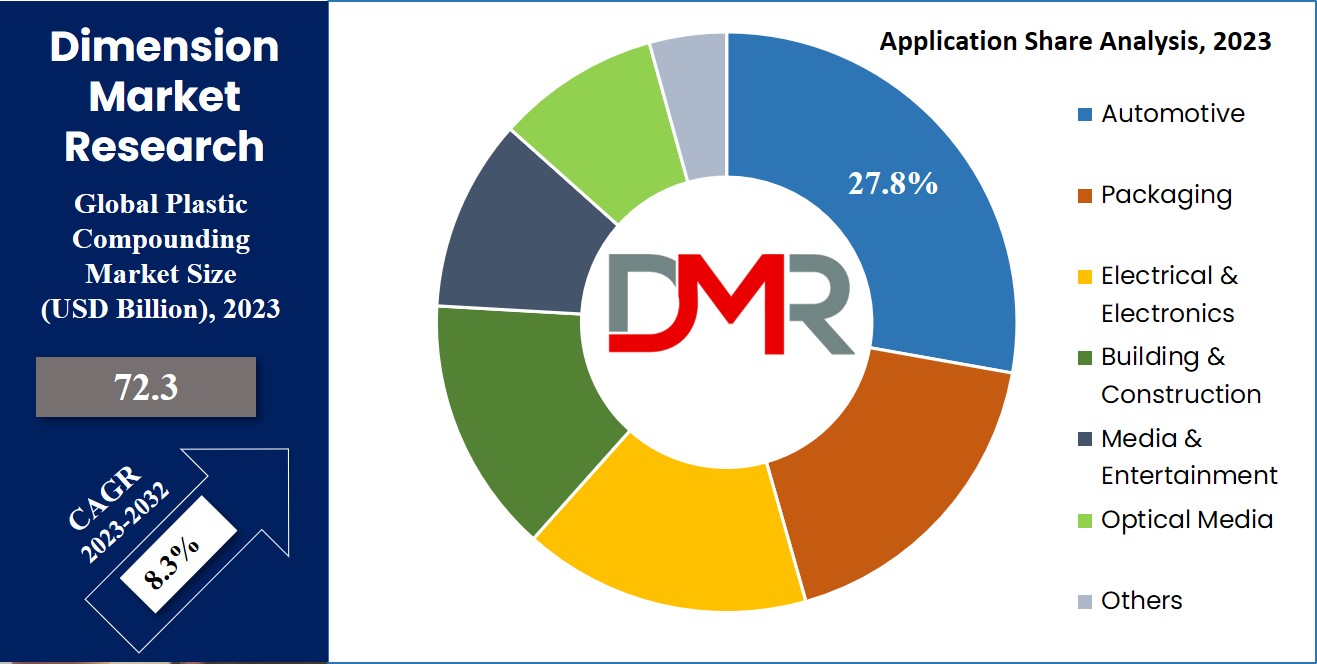

The Global Plastic Compounding Market size is expected to reach a value of USD 72.3 billion in 2023 and is anticipated to grow with a compounded annual growth rate of 8.3% for the forecasted period (2023-2032).

The rising demand across industries such as automotive, packaging, and construction highlights the strong potential of the polymer compounding industry in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With the increasing use of plastic in several places, the demand for customized plastic is rising nowadays. Mixing of various additives in molten state such as anti-oxidants, UV stabilizers, & other agents for adding value to the plastics. Various blending mixtures added, provide various properties to plastic.

These customizations of plastics are referred to as compounding of plastic. Compounding plastics is a complicated process with several steps, like fixing additive ratio, high-speed mixing with the help of twin screw extruders, melt mixing, & then cooling, and after that pellet cutting & packaging are done. This is why the thermoplastic compounding process is gaining more traction globally as industries look for durability and sustainability.

Key Takeaways

- The Global Plastic Compounding Market was valued at USD 72.3 billion in 2023 and is projected to grow at a CAGR of 8.3% from 2023 to 2032, fueled by rising demand in automotive, construction, and packaging sectors.

- Automotive applications dominate the market, driven by the replacement of metals with lightweight compounded plastics that improve fuel efficiency and reduce emissions.

- By material, Polypropylene (PP) leads the market due to its high chemical and heat resistance, while Polyethylene (PE) shows strong growth in construction, packaging, and electrical applications.

- The Packaging industry is witnessing rapid growth, particularly for polypropylene and PET compounds, supported by increasing demand for cost-efficient and sustainable food packaging solutions.

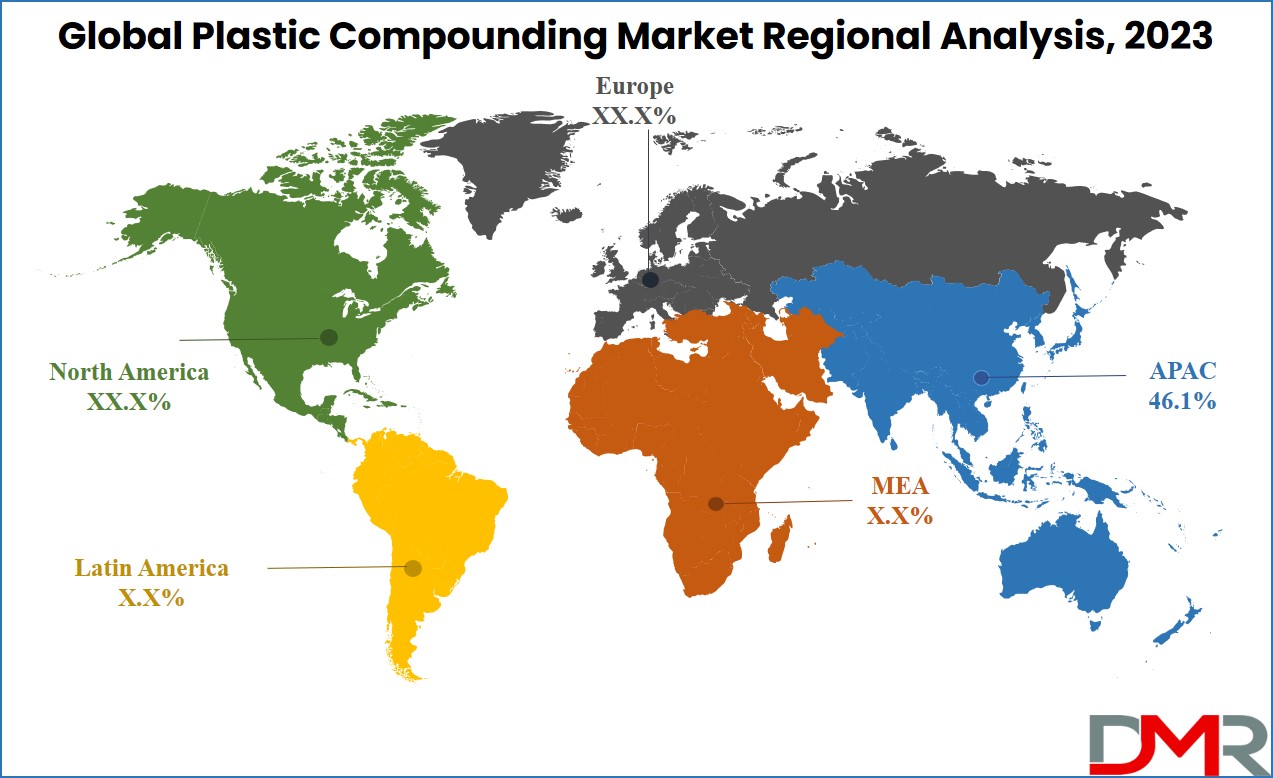

- Asia-Pacific accounted for 46.1% of the global share in 2023, with China, India, and Southeast Asia driving growth through rapid industrialization, infrastructure expansion, and automotive production.

Use Cases

- Automotive Components: Compounded plastics are extensively used in automotive parts such as bumpers, dashboards, fuel tanks, and under-the-hood components. Lightweight compounded plastics improve fuel efficiency, reduce emissions, and enhance overall vehicle performance.

- Packaging Solutions: Plastic compounding enables the production of customized packaging materials, including bottles, containers, and flexible films. Polypropylene (PP) and polyethylene terephthalate (PET) compounds are widely adopted for cost-effective, durable, and sustainable food and consumer goods packaging.

- Construction & Building Materials: Compounded plastics such as polyethylene (PE) and polyvinyl chloride (PVC) are applied in piping, insulation, roofing sheets, and other construction materials, providing durability, chemical resistance, and weatherproofing.

- Electrical & Electronics Applications: Plastics compounded for electrical insulation are used in cables, wiring, electrical cabinets, and enclosures. These materials ensure safety, heat resistance, and long-term performance in electronic and electrical devices.

- Industrial Machinery & Equipment: Compounded plastics are utilized in manufacturing machine components, gears, housings, and mechanical parts where chemical resistance, toughness, and dimensional stability are critical.

Market Dynamic

The property of plastic, to get molded easily in required shapes & sizes makes the Plastic Compounding market grow. With the easy availability of plastic, it has captured almost all industries. Plastic fittings form the major area where growth is noticed due to its wide availability in different color combinations, and easy fitting.

In Europe, Germany is the leading plastic producer which has its own plants in huge numbers & higher production capabilities to fulfill the demands of its local people. PVC and PET are the other plastics exported by Germany to other countries as they have better & higher quality. The raw materials are produced through the downstream process of several petrochemicals.

Crude oil non-availability, supply-demand mismatch, & political concerns result in price fluctuations of plastic compounding. Reduction in crude oil reserves & a shift towards more sustainable forms like products that are plant-based. Polymers made out of bio-based sources are; Polylactic acid (PA), polybutylene succinate (PS), & polyhydroxyalkanoate (PHA). These all have biodegradable properties & therefore, these products are being used in numerous biomedical applications, strengthening the trend toward Biodegradable Packaging solutions.

Research Scope and Analysis

By Material

The polypropylene (PP) sector leads the market with a major share in 2023. These are known to have high resistance towards temperature, & chemicals, and have longer duration service. Therefore, it finds its usage in the automotive industry. Growth in automotive sectors in markets such as in Latin America & Asia marks the growth of such segment.

Polyethylene in construction is the major growing area with respect to market share. Apart from construction, it’s used in several other sectors like electrical, packaging, electronics, etc. Various applications of it include bottles such as for fruit juice, shakes, milk, coffee, etc., Moreover, when we talk about PET, it’s expected to lead the United States plastics market & is mostly utilized in bottle manufacturing.

This material used in packaging & in the textile sector like, for manufacturing clothes, bags, etc. provides a huge market base for growth. Several binders like dyes, catalysts, lubricants, fillers, stabilizers, anti-blocking agents, etc. are being added to provide various properties & to make them usable by keeping in mind the demands & the needs of the market.

By Application

The automotive segment marks the highest revenue in 2023. Increased use of plastic in place of alloys, is the major reason behind the rise in growth of this segment. A substantial rise in automotive industries in major countries, such as China, & India has led to the demand for plastic compounding or customized plastic which can be seen in upcoming years as well.

Moreover, in the packaging segment, there is high demand for Polypropylene Compounds as it is cost-efficient. With rising globalization & growing consumerism in developed as well as developing countries, norms, & standard has also been introduced in food packaging.

Therefore, this segment shows the growth that deploys polypropylene compounding. Whereas when we talk about Building and construction, polyethylene compound makes up the major part of the construction area. As it is more durable & highly resistant to cracks & stress, its application in this segment is rising and is also expected to grow in the near future.

For the Electrical and electronics segment, electrical cabinets & enclosures, wires & cables, and other electronic devices use polyethylene polymers. With the emergence of small-scale manufacturers In the Asia Pacific area, the demand for such compounding has increased and will further drive the growth in this segment. Better government policies and tax incentives to foreign players are also driving the expansion in industrial manufacturing units and therefore, these factors are also fueling the market to expand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

For the Electrical and electronics segment, electrical cabinets and enclosures, wires and cables, and other electronic devices use polyethylene polymers. With the emergence of small-scale manufacturers In the Asia Pacific area, the demand for such compounding has increased and will further drive the growth in this segment. Better government policies and tax incentives to foreign players are also driving the expansion in industrial manufacturing units and therefore, these factors are also fueling the market to expand.

The Global Plastic Compounding Market Report is segmented on the basis of the following

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene System (ABS)

- Others

By Application

- Automotive

- Packaging

- Building & Construction

- Electrical & Electronics

- Optical Media

- Industrial Machinery

- Others

Regional Analysis

Asia Pacific region shows the maximum growth of over 46.1% in the year 2023. The increasing manufacturing units in the automobile, construction, packaging industries, & several other industries in the Asia Pacific region are driving the growth of automobiles, consumer goods, packaged materials, etc. resulting in the rise of compounded plastic use in recent years.

The growing urbanization & infrastructural developments in developed countries like the U.S. and in developing countries, such as Mexico, have led to an increase in demand for compounding plastic in the construction sector which is further fueling the growth of this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, in the Middle East region, UAE & Qatar are undergoing various infrastructural projects & hence the expansion in such projects led to a further rise in this market. However, Europe is not expected to show much rise in growth as the market is already said to be saturated.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market demonstrates a high degree of fragmentation, with Small and Medium Enterprises (SMEs). Companies are actively expanding their production capabilities to strengthen their position in the market. In China, the industry has experienced notable capacity expansions, particularly with the emergence of independent compounders operating as standalone entities.

Unlike major end-use corporations such as automotive manufacturers and Original Equipment Manufacturers (OEMs), who typically establish strategic agreements with compounders or extend their own compounding capabilities, Chinese compounders primarily serve a large pool of medium-sized enterprises.

An illustrative example is Dow, Inc.'s announcement in October 2021 regarding investment programs aimed at advancing circular plastics. These initiatives aim to combat plastic waste, reduce greenhouse gas emissions, and provide recycled plastics that possess similar properties to virgin plastics. By implementing these advancements, Dow, Inc. commenced the supply of circular plastics in 2022.

Some of the prominent players in the global plastic compounding market are:

- Dow, Inc.

- DuPont

- SABIC

- RTP Company

- Asahi Kasei Corporation

- Covestro AG

- BASF SE

- Washington Penn

- KURARAY CO. Ltd.

- TEIJIN LIMITED

- Other Key Players

Recent Developments

- August 2025: The global plastic compounding market is projected to reach approximately USD 148.3 Bn by 2032, rising from USD 72.3 bn in 2023 at a CAGR of 8.3% between 2023 and 2032.

- July 2025: Star Plastics LLC announced the merger with Trivalence Technologies, a supplier of custom-engineered plastic resin compounds using recycled and virgin sources.

- July 2025: The plastics industry has witnessed robust merger and acquisition activity during the first half of 2025, with deal volume maintaining strong momentum from the start of the year.

- August 2025: The global plastic compounding market size is expected to hit US$ 139.65 million by 2033.

- August 2025: Corporacion Sierra Madre showcased tailored solutions, quality, and service at Compounding World Expo 2025—adapting to customer needs with exceptional service and quality.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 72.3 Bn |

| Forecast Value (2032) |

USD 148.3 Bn |

| CAGR (2023-2032) |

8.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (PE, PP, PVC, PS, PET, PBT, PA, PC, ABS, TPV, TPO, Others), By Application (Automotive, Packaging, Building & Construction, Electrical & Electronics, Optical Media, Consumer Goods, Medical Devices, Industrial Machinery, Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Dow, Inc., DuPont, SABIC, RTP Company, Asahi Kasei Corporation, Covestro AG, BASF SE, Washington Penn, KURARAY Co. Ltd., TEIJIN LIMITED, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

What is the value of the Global Plastic Compounding Market?

▾ The Global Plastic Compounding Market size is anticipated to reach a value of USD 72.3 billion in 2023.

What is the expected CAGR for the Global Plastic Compounding Market?

▾ The Global Plastic Compounding Market is expected to grow with a compounded annual growth rate of 8.3% from 2023-2032.

What is the dominating segment (by material) in the Global Plastic Compounding Market?

▾ The Polypropylene Segment leads the Global Plastic Compounding Market in 2023.

Who are the prominent players in the Global Plastic Compounding Market?

▾ Some of the prominent players in this market include Dow, Inc., DuPont, SABIC, RTP Company, Asahi Kasei Corporation, Covestro AG, BASF SE, Washington Penn, KURARAY CO. Ltd., etc.