Market Overview

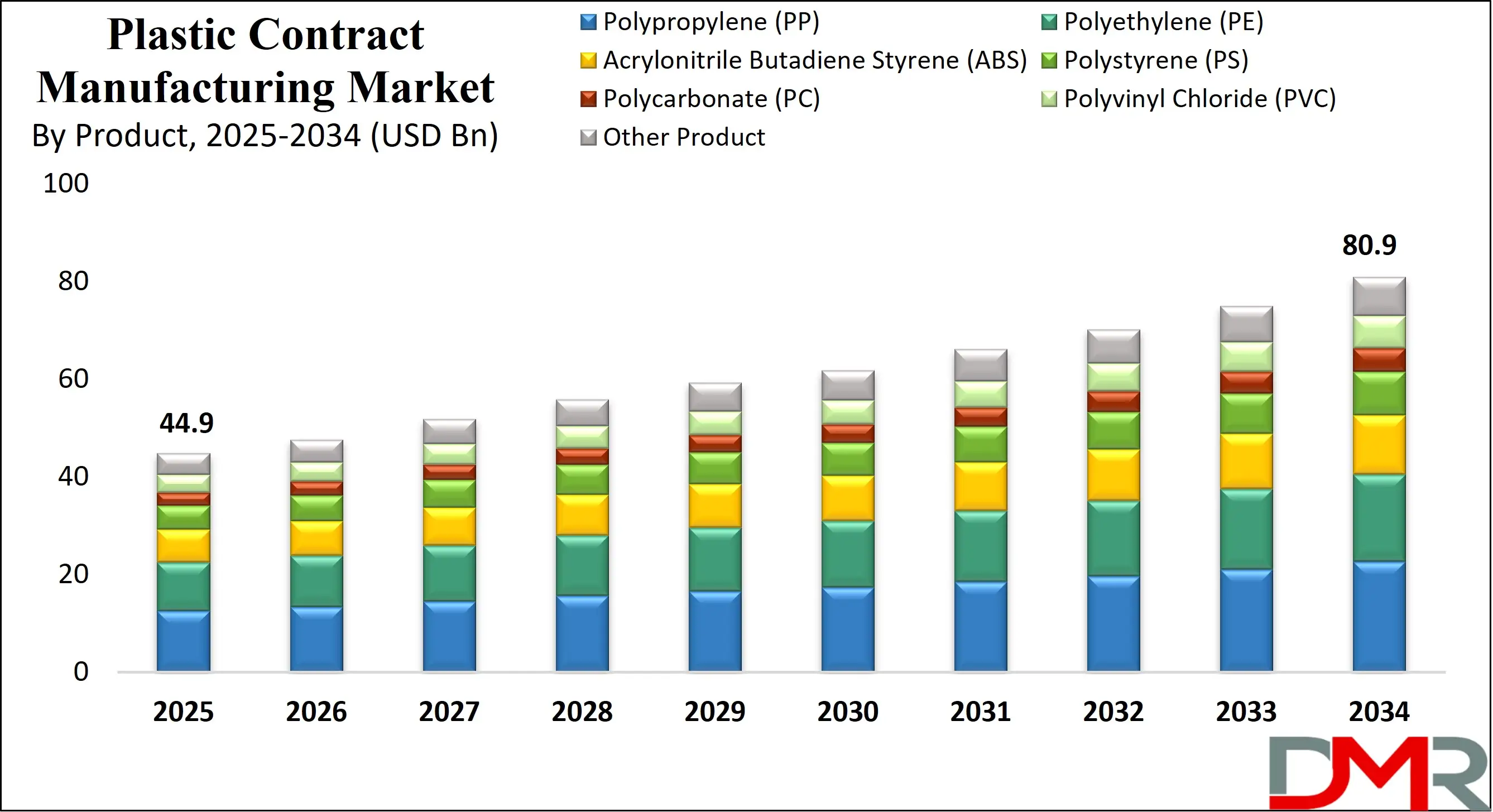

The Global Plastic Contract Manufacturing Market is projected to reach USD 44.9 billion in 2025 and grow at a compound annual growth rate of 6.8% from there until 2034 to reach a value of USD 80.9 billion.

The global plastic contract manufacturing market is undergoing a significant transformation driven by sustainability goals, industry 4.0 integration, and end-user diversification. A prevailing trend is the growing shift toward eco-friendly and recyclable plastics as governments across Europe, North America, and Asia enforce stricter environmental regulations. Companies are increasingly replacing traditional petroleum-based polymers with biodegradable or bio-based plastics in contract manufacturing to reduce their carbon footprint.

.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

At the same time, automation, robotics, and digital twins are transforming the production landscape, enhancing precision and scalability for plastic molders. This opens substantial opportunities in industries like healthcare, electronics, and automotive, which are moving toward lightweight, high-performance plastic components to meet energy efficiency and customization demands.

The market's potential is also supported by the rising trend of reshoring, where brands seek local contract manufacturing partners for greater supply chain resilience and reduced lead times. However, the industry faces considerable restraints such as the volatility in raw material prices, especially for specialty polymers and challenges in managing waste and emissions in line with regulatory compliance. In addition, small and mid-sized firms often lack the capital to invest in advanced technologies or cleanroom environments, which may limit their competitiveness.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these limitations, the outlook for plastic contract manufacturing remains positive. Emerging economies are investing heavily in localized plastic molding capabilities, and rising product complexity across sectors from minimally invasive surgical instruments to electric vehicle parts is ensuring long-term demand. Contract manufacturers that embrace sustainability, automation, and industry-specific expertise are expected to thrive in this evolving global market landscape.

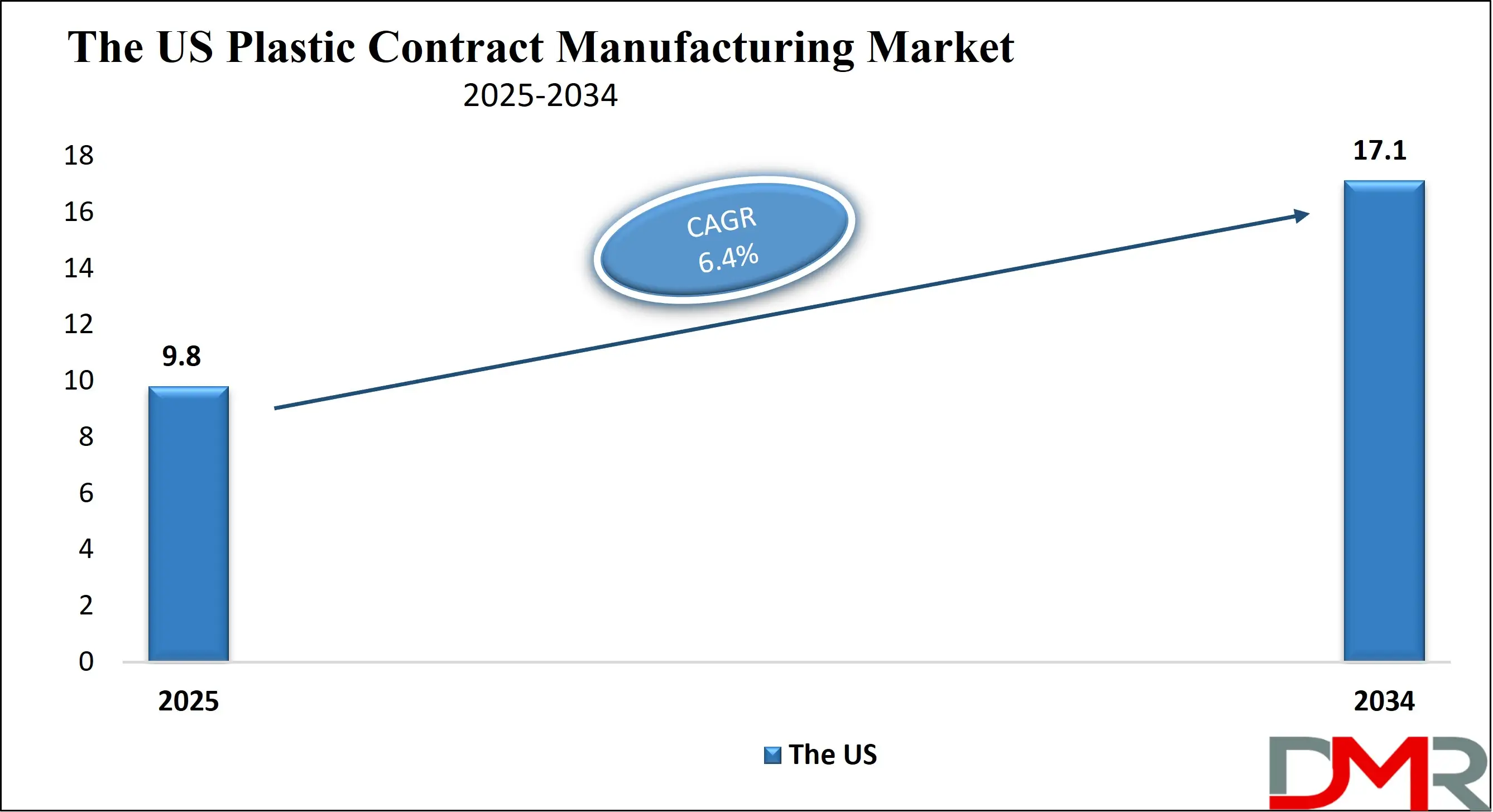

The US Plastic Contract Manufacturing Market

The US Plastic Contract Manufacturing Market is projected to reach USD 9.8 billion in 2025 at a compound annual growth rate of 6.4% over its forecast period.

The United States plastic contract manufacturing market benefits significantly from its expansive industrial base, advanced infrastructure, and well-established workforce. The plastics industry in the U.S. encompasses hundreds of thousands of employees across all 50 states, with notable concentrations in states like Texas, Indiana, and Ohio.

These states provide robust support for manufacturing through tax incentives, innovation hubs, and proximity to key end-use industries such as automotive, consumer goods, and healthcare. The U.S. government's promotion of reshoring and domestic production capacity especially in the wake of global supply chain disruptions has led to increased demand for local plastic molders who can offer just-in-time production and customized solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Agencies such as the Environmental Protection Agency (EPA) have launched initiatives encouraging recycling infrastructure, bio-based polymers, and sustainable manufacturing practices, all of which align with the strategic goals of contract manufacturers seeking long-term partnerships with eco-conscious brands.

Moreover, the Department of Energy and the National Institute of Standards and Technology continue to support research in advanced materials and manufacturing digitization, further boosting competitiveness. The U.S. also enjoys a significant demographic advantage, with a technically trained labor pool emerging from numerous vocational programs, engineering schools, and community colleges.

This ensures a steady supply of professionals skilled in injection molding, CNC operations, and materials science. Together, these strengths position the U.S. as a leading hub for plastic contract manufacturing, especially in high-margin sectors such as aerospace, medical devices, electronics, and electric mobility.

The Europe Plastic Contract Manufacturing Market

The Europe Plastic Contract Manufacturing Market is estimated to be valued at USD 6.7 billion in 2025 and is further anticipated to reach USD 10.9 billion by 2034 at a CAGR of 5.4%.

The European plastic contract manufacturing market is deeply rooted in its long-standing industrial tradition, strong regulatory frameworks, and high innovation standards. Europe houses thousands of plastic processing companies, many of which are small and medium-sized enterprises that serve as specialized contract manufacturers. Countries like Germany, Italy, France, and the Netherlands are at the forefront of this space, offering expertise in complex molding, precision engineering, and high-performance polymers.

Europe’s regulatory environment shaped by policies such as the European Green Deal and the Circular Economy Action Plan fosters sustainable manufacturing practices, including the use of recycled and biodegradable plastics. These policies incentivize both OEMs and contract manufacturers to adopt environmentally friendly processes and materials, encouraging technological advancement in areas like chemical recycling and energy-efficient molding equipment.

Despite higher energy costs and strict compliance requirements, Europe maintains its competitive edge through skilled labor, strong R&D infrastructure, and collaborative networks between industry, academia, and public institutions. Additionally, consumer preference for sustainable, high-quality products drives demand for premium contract manufacturing services.

European governments also support industrial innovation through funding programs and tax relief for sustainable initiatives. The region's compact geography and well-connected logistics infrastructure make it ideal for cross-border manufacturing collaboration, reducing lead times and enhancing supply chain integration. As demand for circular economy solutions and customized plastic products rises, European plastic contract manufacturers are well-positioned to lead in producing high-value, eco-compliant components for sectors like automotive, medical technology, aerospace, and consumer goods.

The Japan Plastic Contract Manufacturing Market

The Japan Plastic Contract Manufacturing Market is projected to be valued at USD 2.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.5 billion in 2034 at a CAGR of 5.7%.

Japan’s plastic contract manufacturing market is underpinned by its advanced technological base, precision engineering culture, and strong industrial clusters. The country’s manufacturing ecosystem is supported by its Ministry of Economy, Trade and Industry (METI), which actively promotes innovation, automation, and environmental sustainability.

Japanese firms excel in producing high-precision molded parts required in industries such as consumer electronics, automotive, and medical devices. The nation's contract manufacturers are known for their meticulous quality standards and ability to produce complex components using high-performance plastics like polycarbonate, polyamide, and specialty thermoplastics. A key demographic advantage is Japan's highly educated and skilled workforce, which emphasizes kaizen (continuous improvement) and lean manufacturing principles.

This makes it possible for manufacturers to deliver consistent quality while maintaining cost efficiency. Japan is also a leader in adopting smart factory technologies, with many contract manufacturers integrating robotics, IoT sensors, and AI-based quality control to boost productivity. Government-backed initiatives further encourage the use of recyclable materials and energy-efficient equipment in plastic processing.

In addition, the nation's strong supply chain integration allows tiered manufacturing systems, where contract suppliers work in close coordination with OEMs and component manufacturers to ensure seamless assembly and logistics. The cultural emphasis on precision, sustainability, and innovation positions Japan as a global center for plastic contract manufacturing excellence, particularly in high-tech applications that require exceptional material performance and compliance with international standards.

Global Plastic Contract Manufacturing Market: Key Takeaways

- Global Market Size Insights: The Global Plastic Contract Manufacturing Market size is estimated to have a value of USD 44.9 billion in 2025 and is expected to reach USD 80.9 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Plastic Contract Manufacturing Market is projected to be valued at USD 9.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.1 billion in 2034 at a CAGR of 6.4%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Plastic Contract Manufacturing Market with a share of about 46.0% in 2025.

- Key Players: Some of the major key players in the Global Plastic Contract Manufacturing Market are GW Plastics, McClarin Plastics, Inzign Pte Ltd, RSP Inc., Plastikon Industries, C&J Industries, EVCO Plastics, PTI Engineered Plastics, Mack Molding, Comar LLC, Jones Plastic & Engineering, and many others.

Global Plastic Contract Manufacturing Market: Use Cases

- Automotive Components: In the automotive sector, contract manufacturers produce custom interior and exterior parts like dashboards, bumpers, and grilles using high-performance polypropylene and ABS. These lightweight materials help carmakers meet fuel efficiency standards while achieving flexible designs and reducing vehicle weight.

- Medical Devices and Equipment: Medical device companies rely on plastic contract manufacturers to mold biocompatible parts for surgical instruments, diagnostic tools, and single-use components. These manufacturers meet stringent hygiene and quality standards by operating within ISO-certified cleanroom environments using sterilizable plastics like polycarbonate and medical-grade PE.

- Consumer Electronics: Consumer electronics brands outsource the production of durable plastic housings, keypads, and connectors to contract molders. Using ABS and TPE, these components are built for precision and aesthetic appeal, helping OEMs reduce time-to-market and scale manufacturing for new gadgets efficiently.

- Aerospace Interiors and Systems: Aerospace suppliers partner with contract manufacturers to create lightweight yet strong components such as cabin interior panels, air ducts, and cable management systems. High-performance polymers like PEEK and PPS are used to meet flame resistance and dimensional stability standards required by the aviation sector.

- Sustainable Packaging Solutions: Packaging firms collaborate with plastic contract manufacturers to produce custom PET bottles, containers, and caps. These items are made using post-consumer recycled plastics or biodegradable alternatives to meet regulatory demands for sustainable packaging and align with the shift toward a circular economy.

Global Plastic Contract Manufacturing Market: Stats & Facts

US Environmental Protection Agency (EPA)

- In 2018, the United States generated approximately 35.7 million tons of plastic waste, making up 12.2% of the total municipal solid waste (MSW). This highlights the vast consumption and disposal of plastic materials across consumer and industrial sectors.

- The proportion of plastics in U.S. municipal solid waste rose significantly from 0.4% in 1960 to over 12% in 2018, reflecting the widespread adoption of plastic products in packaging, construction, automotive, electronics, and more.

- The recycling rate for polyethylene terephthalate (PET) bottles and jars was 29.1% in 2018, while high-density polyethylene (HDPE) natural bottles had a recycling rate of 29.3%, indicating modest progress in recycling common plastic packaging.

- Only 13.6% of all plastic containers and packaging were recycled in 2018, while 16.9% were incinerated for energy recovery. A staggering 69% of these plastics ended up in landfills, highlighting inefficiencies in the U.S. recycling infrastructure.

- Plastic packaging alone contributed 14.5 million tons to total municipal waste in the U.S. in 2018, underscoring its dominance in short-life-cycle consumer product segments.

- Plastic bags, sacks, and wraps accounted for 4.2 million tons of waste in 2018, with a recycling rate of just 10%, making them one of the least-recycled plastic categories.

- Approximately 80,000 tons of polystyrene (such as EPS foam containers) were generated, but less than 6% was recycled, indicating extremely limited recovery of this common food packaging material.

Eurostat / European Environment Agency (EEA)

- In 2022, the European Union produced around 83.4 million tons of packaging waste, translating to about 186.5 kg per person. This reflects both high consumption patterns and the need for sustainable packaging solutions.

- Out of that total, plastic packaging waste alone accounted for 16.1 million tons, or roughly 19% of the total packaging waste, indicating plastics’ stronghold in the European packaging sector.

- The per capita generation of plastic packaging waste in the EU stood at 36.1 kg per person in 2022. Out of this, 14.7 kg per person was successfully recycled, pointing to an overall recycling efficiency of around 41%.

- Between 2012 and 2022, the recycling rate for plastic packaging waste in the EU improved from 38% to 41%, showing a gradual but consistent push toward sustainability.

- Of the total 16.16 million tons of plastic packaging waste in 2022, approximately 40.7% was recycled, while 35% was processed through energy recovery methods, with the remainder likely ending up in landfills.

Organisation for Economic Co-operation and Development (OECD)

- In 2019, emissions associated with the lifecycle of plastics including production, processing, and disposal accounted for about 3.4% of total global greenhouse gas emissions, underscoring the sector's environmental impact.

- If current production and consumption trends continue, plastic-related greenhouse gas emissions are expected to double by 2060, adding pressure on countries to decarbonize their manufacturing processes.

European Environment Agency (EEA)

- In 2020, 63% of the EU plastics industry’s greenhouse gas emissions were attributed to raw material production, while 22% came from processing and 15% from end-of-life treatment, indicating that most emissions occur before the products are even used.

- Since the year 2000, more than half of all plastics ever produced globally have been manufactured, but only 9% have been recycled, 12% incinerated, and the remaining majority either landfilled or still in use.

US National and Municipal Data

- In 2018, total municipal solid waste (MSW) generation in the U.S. reached 292.4 million tons, with only 32.1% of this waste recycled or composted, showing gaps in waste management efficiency.

- Of that total, 69 million tons were recycled, and 25 million tons composted. Additionally, 34.6 million tons were combusted with energy recovery, representing a diverse but heavily landfill-reliant waste treatment model.

- Plastics constituted 16% of all MSW combusted and 18% of MSW landfilled, indicating their high prevalence in non-recyclable or difficult-to-process waste streams.

Global Plastic Use & Pollution (UN/Intergovernmental)

- Annual global plastic production reached approximately 400 million tons in 2021, continuing its upward trajectory from earlier years. This reflects increasing demand across construction, packaging, consumer goods, and healthcare industries.

- Since the 1950s, over 9.2 billion tons of plastic have been produced globally, with more than half of that production occurring after 2004, showing rapid material expansion in the 21st century.

- An estimated 8 to 12 million tons of plastic enter the oceans each year, contributing to widespread marine pollution and long-term ecosystem damage.

- By the mid-2010s, it was estimated that 6.3 billion tons of plastic waste had been generated globally, with only around 9% recycled, suggesting a major backlog of unmanaged plastic waste.

United States and International Environmental Data

- Recent studies found that 26% of marine fish sampled contained microplastics in their digestive systems, which is twice the proportion observed a decade ago, highlighting growing ecological contamination.

- The economic cost of environmental and ecological impacts from global plastic pollution is projected to range between USD 268.5 billion to 1.86 trillion by 2040, depending on regulatory and waste management responses.

- Global plastic waste management costs are forecasted to reach between USD 643 billion to 1.61 trillion by 2040, accounting for collection, disposal, recycling, and associated environmental remediation.

- In the U.S. alone, the health-related costs attributed to exposure from plastic-related chemicals such as phthalates and bisphenol-A are estimated at USD 384–403 billion annually, placing a heavy burden on public health systems.

Plastic Production and Employment in Europe

- European plastic production volume declined by 8.3% between 2022 and 2023, dropping to around 54 million tons, which now represents just 12% of global plastic output, down from 22% in 2006.

- Europe’s plastics manufacturing industry includes over 51,700 companies, primarily small and medium-sized enterprises, employing approximately 1.5 million people across the continent.

PET Bottle Recycling in the United States

- The United States collected approximately 1.96 billion pounds of PET bottles in 2023, achieving a recycling rate of 33%, which marked the highest level in over a decade for this specific plastic stream.

Global Plastic Contract Manufacturing Market: Market Dynamics

Driving Factors in the Global Plastic Contract Manufacturing Market

Surge in Specialized End-Market Demand

Multiple high-growth sectors are driving demand for precision-engineered plastic parts. Electric vehicle (EV) manufacturers, for example, increasingly depend on lightweight, injection-molded polymer parts for battery housings, interior trim, and structural components to enhance range and performance.

The medical technology sector is similarly fueling demand for cleanroom manufacturing of sterile-grade components like ventilator parts, drug delivery systems, and implantable device housings made from advanced polymers like medical-grade PE, polycarbonate, and PPS. Packaging for pharmaceuticals and biotech products demands tamper-evident lids and precision-fit closures that contract manufacturers can produce consistently.

Additionally, the rise of smart consumer devices such as earbuds, health trackers, and home automation gadgets requires intricate ABS, TPE, and PC components with exacting surface finishes. This diversity of vertical demand allows contract manufacturers to build specialized competencies, invest in niche technologies, and buffer their revenue against downturns in any single industry.

Reshoring and Supply Chain Redundancy Focus

Global supply chain disruptions, including pandemics, natural disasters, and geopolitical tensions, have driven OEMs to adopt nearshoring strategies by relocating production closer to end markets. Nearshoring benefits include lower lead times, reduced freight risk, and improved inventory agility via just-in-time manufacturing.

Governments in the U.S., Canada, and the EU are incentivizing reshoring through grant programs, tax breaks, and digital innovation hubs targeted at bolstering local plastics manufacturing. Manufacturers in regions like Eastern Europe and Mexico are now attracting investment from Western European and North American brands due to favorable logistics, skilled labor, and trade agreements. This trend allows contract molders to move beyond purely price-based competition, focusing instead on reliability, proximity, and green supply chain advantages that align with overseeing corporate ESG and carbon footprint targets.

Restraints in the Global Plastic Contract Manufacturing Market

Volatile Resin Prices and Material Supply Challenges

Contract manufacturers often face margin pressure due to fluctuating costs of base resins like polypropylene and high-performance polymers. Volatility stems from oil prices, feedstock availability, and supply disruptions from geopolitics or weather events. Switching to recycled or bio-based resins introduces additional hurdles: inconsistent quality, contamination risk, and supply shortages.

These factors disrupt production consistency and complicate forward-price modeling. Smaller manufacturers particularly struggle, lacking the purchasing scale to lock in contracts or absorb volatility. When raw material costs spike, manufacturers either need to renegotiate prices with clients which can be difficult in competitive bidding or suffer margin declines, both of which can impact long-term viability.

Regulatory Burden and Compliance Overhead

Meeting strict standards across industries adds complexity and cost sharing. Medical, food-contact, pharmaceutical, and aerospace clients frequently require compliance with REACH, RoHS, FDA, ISO 13485, NSF, and GMP. Achieving and maintaining certifications demands significant investment in cleanroom infrastructure, intermediary testing, traceability systems, and audit processes.

Additionally, shifting requirements such as new substance bans or updated product standards necessitate ongoing monitoring and re-certification. Non-compliance can trigger recalls, legal liabilities, or contract termination, especially when working with global OEMs. Compliance overhead limits entry or expansion capabilities for smaller manufacturers lacking the technical or financial capability to maintain up-to-date certifications or implement robust quality systems.

Opportunities in the Global Plastic Contract Manufacturing Market

Vertical Integration and Service Bundling

Contract manufacturers are evolving from single-point suppliers to full-service partners, covering design for manufacturability (DFM), prototyping, tool engineering, molding, decorating, assembly, and packaging. This integration streamlines supply chains for OEMs and delivers higher-value services for manufacturers. Clients benefit from early product input that optimizes cycle times, reduces material waste, and minimizes production costs.

Some manufacturers now offer cleanroom assembly for Class II and III medical devices, in-line laser welding, fluid testing, and automated final assembly and packaging. These value-added services increase customer reliance and loyalty, enabling longer-term contracts. Bundled offerings enable contract manufacturers to improve margins and insulate against commoditization pressures.

Expansion into Advanced Polymer Niches

High-end applications in aerospace, electronics, and medical devices are seeking contract molders experienced with specialty polymers such as PEEK, PPS, PEI, bioresorbables, and electrostatic-dissipative plastics. These materials require precise thermal control, zero-contamination processing, and ISO/ASTM validation, which only capable manufacturers can provide.

Micro-molding creating sub-gram parts for nutrient delivery systems, micro-electronics, and hearing aids requires advanced tooling and robotics. Moreover, additive manufacturing (3D printing) is increasingly used for low-volume, complex geometries, providing another high-margin service. Manufacturers investing in cleanroom certification, high-precision processing lines, additive capabilities, and polymer validation labs are aligning themselves to command premium pricing and long-term contracts in specialized markets.

Trends in the Global Plastic Contract Manufacturing Market

Sustainability-Driven Material Evolution

Contract manufacturers are intensifying efforts to adopt recycled, bio-based, and compostable polymers amid mounting regulatory and consumer pressure. Extended Producer Responsibility (EPR) mandates are emerging globally, compelling brands to incorporate measurable recycled content and environmentally sustainable packaging into their products.

This shift has driven investment in processes like chemical depolymerization and closed-loop recycling systems, enabling manufacturers to reclaim high-purity feedstocks. Many partners now provide full traceability and lifecycle assessments to support OEMs’ sustainability claims, particularly in consumer-facing sectors such as beauty products, packaged foods, and wearable electronics.

Companies that successfully integrate recycled and bio-based materials without compromising quality or aesthetics are finding themselves preferred by major brands prioritizing green credentials. Additionally, some manufacturers offer certified carbon-neutral production lines, further differentiating themselves in competitive bids and allowing OEMs to fulfill scope 3 emissions targets.

Digital Transformation and Industry 4.0 Integration

Traditional manual molding operations are being transformed by advanced Industry 4.0 technologies. Smart-factory implementations use IoT sensors on molding machines for real-time performance tracking, enabling immediate alerts when a process deviates from specifications. Predictive analytics, powered by AI, proactively identifies maintenance windows to minimize downtime and extend tool life.

Digital twins simulate production digitally, optimizing machine parameters before actual runs and reducing scrap rates significantly. Automated robotics handles material feeding and part handling, decreasing labor costs and contamination risks. Such automation allows contract manufacturers to economically offer lower-volume runs, multi-material overmolding, and rapid color or design changeovers.

Quality systems with full lot-by-lot and component-level traceability also enable rapid recalls or compliance verification for regulated sectors like healthcare and aerospace. These digital capabilities make contract manufacturers agile, efficient, and better suited to support customized, complex product portfolios.

Global Plastic Contract Manufacturing Market: Research Scope and Analysis

By Product Type Analysis

Polypropylene (PP) is projected to hold the leading position in the plastic contract manufacturing market due to its exceptional balance of performance, versatility, and cost-effectiveness. As a semi-crystalline thermoplastic polymer, PP offers excellent chemical resistance, fatigue strength, and impact tolerance, making it an ideal choice for contract manufacturers serving multiple end-user industries. Its low density and lightweight characteristics make it highly suitable for applications where weight reduction is critical, such as automotive, consumer goods, and packaging.

One of the most significant advantages of PP is its moldability and ease of processing. It adapts well to various molding techniques like injection molding, blow molding, and thermoforming, all of which are fundamental to contract manufacturing operations. In addition, PP has good resistance to moisture and UV radiation, extending its suitability to outdoor applications and components requiring durability over time.

From a cost standpoint, PP is relatively inexpensive compared to high-performance engineering plastics, allowing manufacturers to deliver economical solutions at scale. Its recyclability also contributes to its growing demand, especially as OEMs push for circular economy integration. Contract manufacturers favor PP due to the material’s availability, adaptability to composite blends, and compatibility with filler materials for enhanced mechanical performance.

Furthermore, industries such as healthcare, food packaging, and electronics increasingly prefer PP for single-use products and housings, due to its chemical inertness and food-grade certifications. These cumulative benefits have positioned PP as the most preferred resin among plastic contract manufacturers seeking volume efficiency, performance reliability, and cost competitiveness across diversified applications.

By Application Analysis

The automotive sector is poised to be the dominant application in the plastic contract manufacturing market, primarily due to the industry's ongoing shift toward lightweighting, modular assembly, and electrification. Automakers globally are under immense pressure to reduce vehicle weight to meet fuel efficiency standards and emissions regulations. This has significantly increased the demand for advanced plastic components that offer strength and weight advantages over traditional materials like metal or glass.

.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Plastic contract manufacturers play a critical role in supplying custom-molded components such as bumpers, dashboards, air intake manifolds, HVAC housings, and structural underbody panels. These parts are typically made using materials like polypropylene (PP), ABS, and polyamide blends that offer excellent thermal, chemical, and mechanical properties while drastically reducing weight. The use of plastics in automotive interiors has also expanded due to the material’s ability to meet design flexibility and comfort expectations while adhering to strict safety and durability standards.

In electric vehicles (EVs), plastics enable lightweight battery enclosures, motor housings, and electronic connector systems that are critical for maintaining vehicle range and performance. Contract manufacturers equipped with specialized tooling and expertise in high-tolerance molding are vital to meeting automakers' stringent specifications, production timelines, and quality expectations.

Additionally, the automotive industry has well-established outsourcing practices, where Tier-1 and Tier-2 suppliers increasingly depend on plastic contract manufacturers for prototyping, tooling, and scaled production. The integration of smart systems, sensors, and infotainment modules in modern cars further elevates the demand for precise, high-performance plastic parts, solidifying the automotive industry’s dominance in this market segment.

The Global Plastic Contract Manufacturing Market Report is segmented on the basis of the following

By Product

- Polypropylene (PP)

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Polystyrene (PS)

- Polycarbonate (PC)

- Polyvinyl Chloride (PVC)

- Other Product

By Application

- Automotive

- Aerospace & Defense

- Consumer Goods & Appliances

- Medical

- Industrial Equipment

- Construction

- Other Application

Impact of Artificial Intelligence on the Global Plastic Contract Manufacturing Market

- Process Optimization and Predictive Maintenance: AI-driven machine learning algorithms analyze vast amounts of real-time production data to fine-tune injection molding and extrusion parameters such as temperature, pressure, and cycle times. This optimization minimizes defects, improves consistency, and reduces material waste. Predictive maintenance algorithms detect early signs of equipment wear or failure, allowing manufacturers to perform scheduled maintenance and avoid unexpected downtimes, improving equipment availability and lifecycle.

- Quality Assurance and Defect Detection: AI-powered vision systems are integrated into production lines to inspect components in real time. These systems use deep learning to detect micro-level defects like cracks, voids, or warping that human inspection might miss. This results in higher product reliability and reduced rework or scrap rates, which is especially crucial in regulated industries like medical devices and automotive components.

- Smart Supply Chain and Inventory Management: AI forecasts demand trends and raw material needs based on historical consumption, market behavior, and seasonal variations. This ensures optimal inventory levels and reduces material shortages or overstocking. AI tools also streamline logistics and vendor management, resulting in more agile, cost-efficient supply chains.

- Design for Manufacturability (DFM) and Simulation: AI-based design software helps optimize part geometry, mold flow, and material selection during the prototyping phase. Generative design tools suggest part structures that minimize weight while retaining strength, ideal for automotive and aerospace components. AI simulation also reduces prototyping iterations, accelerating time-to-market.

- Customization and Mass Personalization: Contract manufacturers can use AI to facilitate batch-of-one production. AI-powered CAD tools can process thousands of individual customization requirements (e.g., in consumer goods or wearables) and translate them into efficient, automated production instructions. This makes high-volume personalized plastic components a reality.

Global Plastic Contract Manufacturing Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is anticipated to dominate the global plastic contract manufacturing market with 46.0% of the market share in 2025, due to its massive industrial base, cost-effective labor, and established manufacturing infrastructure. Countries like China, India, Vietnam, and Thailand are major hubs for plastic component production owing to their low operational costs, skilled labor availability, and government-backed industrial policies. The presence of globally integrated supply chains makes the region favorable for high-volume production contracts from major OEMs in the automotive, electronics, and consumer goods sectors.

.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

China leads in plastic processing capacity, with a vast network of injection molding companies and tool-making vendors catering to both domestic and export demand. Meanwhile, India is emerging as a major player in medical and automotive component outsourcing due to growing domestic demand and the Make in India initiative. Japan and South Korea add technological edge and quality assurance, particularly in high-precision sectors like automotive and electronics.

Furthermore, the availability of raw materials such as polypropylene and polyethylene at competitive prices enhances the cost efficiency of contract manufacturing in this region. The rising demand for plastic components in APAC’s booming consumer markets further encourages OEMs to source components regionally. As a result, Asia-Pacific remains the most dominant and cost-efficient production hub for plastic contract manufacturing worldwide.

Region with the Highest CAGR

North America, led by the United States, is projected to witness the highest CAGR in the plastic contract manufacturing market due to the region’s increasing focus on nearshoring, automation, and high-value industries. In response to global supply chain disruptions and rising shipping costs, OEMs across the automotive, medical, and electronics sectors are shifting production closer to end-use markets. This reshoring trend is accelerating investments in regional contract manufacturing, especially among Tier-1 and Tier-2 suppliers.

The U.S. has a strong foothold in regulated industries like medical devices, aerospace, and defense sectors that demand precise, compliant, and traceable manufacturing processes. Plastic contract manufacturers in North America are responding by adopting Industry 4.0 technologies such as robotic automation, real-time quality monitoring, and digital twin simulations, which enhance production efficiency and reduce lead times.

Additionally, growing demand for electric vehicles (EVs), smart home devices, and advanced medical technologies is increasing the need for complex plastic components, often requiring cleanroom environments and specialized molding expertise. The region’s regulatory clarity, IP protection, and government incentives for domestic manufacturing further bolster this upward trend. As sustainability, speed-to-market, and product customization become priorities, North American manufacturers are capitalizing on these shifts, driving the highest growth rate in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Plastic Contract Manufacturing Market: Competitive Landscape

The global plastic contract manufacturing market is highly fragmented yet competitive, comprising a mix of multinational corporations and specialized regional players. Companies compete based on capabilities in design, tooling, volume scalability, regulatory compliance, and turnaround time. Leading players such as Röchling Group, Nolato AB, EVCO Plastics, McClarin Plastics, and Plastikon Industries maintain a strong global presence, offering end-to-end services ranging from design assistance to final assembly and packaging.

These firms are leveraging technologies like automation, high-cavitation tooling, and real-time process monitoring to enhance productivity and reduce cycle times. Strategic collaborations with OEMs in automotive, healthcare, and electronics are increasingly common, as companies aim to secure long-term, high-volume contracts. Many players are investing in cleanroom infrastructure and achieving ISO 13485 or FDA registrations to cater to high-margin medical and pharmaceutical clients.

Regional players across Asia-Pacific dominate in cost-sensitive mass production, while North American and European companies focus on precision manufacturing and value-added services. Mergers, acquisitions, and facility expansions are ongoing strategies for geographic and sectoral growth. As sustainability grows in importance, market leaders are also incorporating post-consumer resins and green molding practices, offering OEMs environmentally responsible manufacturing partnerships that align with ESG mandates.

Some of the prominent players in the Global Plastic Contract Manufacturing Market are

- GW Plastics

- McClarin Plastics

- Inzign Pte Ltd

- RSP, Inc.

- Plastikon Industries

- C&J Industries

- EVCO Plastics

- PTI Engineered Plastics

- Mack Molding

- Comar, LLC

- Jones Plastic & Engineering

- Cadence, Inc.

- Husky Injection Molding Systems

- Westfall Technik

- Pacific Plastics Injection Molding

- Plastek Group

- Nolato AB

- Phillips-Medisize (a Molex Company)

- Tessy Plastics Corp

- MedPlast (now Viant Medical)

- Other Key Players

Recent Developments in the Global Plastic Contract Manufacturing Market

May 2025

- Amcor & Berry Merger Finalization: Amcor and Berry Global made significant progress toward a merger valued at approximately USD 8.4 billion. The merger, which is set to finalize in mid-2025, will combine the operations of over 400 manufacturing facilities worldwide. It is expected to generate approximately USD 650 million in annual cost synergies. This move aims to create one of the largest global entities in packaging and plastic component manufacturing, enhancing capabilities in both contract manufacturing and sustainability-oriented packaging solutions.

April 2025

- Chinaplas 2025 – Global Plastic Innovation Showcase: Held in Shenzhen, Chinaplas 2025 became the largest plastics and rubber exhibition in Asia, attracting over 4,500 exhibitors and covering 380,000 square meters of display space. It featured 17 specialized zones, including recycled plastics, smart manufacturing, 3D printing, and advanced injection molding. The event served as a platform for launching innovations in plastic contract manufacturing, automation, and sustainable material usage.

March 2025

- Nippon Paint Acquires AOC Resins: Nippon Paint acquired AOC Resins, a Tennessee-based specialty resin manufacturer, for USD 4.4 billion. This acquisition expands Nippon Paint’s footprint in thermoset resins and composite solutions, enabling the company to enter high-value contract manufacturing segments like automotive and construction plastics.

- PAG Acquires Pravesha in India: Private equity firm PAG completed the acquisition of Indian pharmaceutical packaging specialist Pravesha for USD 162 million. The investment strengthens PAG’s position in pharmaceutical and medical plastic components, supporting expansion across Asia and the Middle East.

February 2025

- Berry Global Acquires Custom Molders Group: Berry Global acquired Custom Molders Group, enhancing its capabilities in complex injection molding and tool design for high-precision plastic components. This acquisition supports Berry’s strategy to serve sectors requiring strict compliance and customized component production, including medical, defense, and electronics.

- Bain Capital Acquires Milacron Molding & Extrusion Unit: Bain Capital completed the acquisition of Milacron’s molding and extrusion business from Hillenbrand. This deal boosts Bain’s position in contract plastic manufacturing by adding sophisticated extrusion technology and expanding operations across North America and Europe.

January 2025

- Tex Tech and Arlington Capital Acquire Fiber Materials Inc.In a USD 165 million deal, Tex Tech and Arlington Capital Partners acquired Fiber Materials Inc., a specialist in composite plastic materials for defense and aerospace applications. This acquisition allows for an integrated supply of advanced molded parts used in high-temperature, high-strength defense systems.

- Tiger Infrastructure Partners Invests in Bolder Industries: Tiger Infrastructure made a strategic investment in Bolder Industries to support the scaling of sustainable plastic recycling technologies. The funding will help expand production capacity and improve recovery processes for recycled polymers used in contract manufacturing.

October 2024

- Datro Acquires Zhejiang DunAn: Datro acquired Zhejiang DunAn, a manufacturer of advanced automotive plastic components, to enhance its power systems and thermal management offerings. The deal marks a strategic shift towards more specialized plastic molding applications in electric and hybrid vehicles.

- Hi-P International Acquired for Precision Molding: Hi-P International, a major player in high-precision plastic tooling and molding, was acquired to support vertically integrated electronics manufacturing. The acquisition provides key capabilities in micro-molding and sensor housing production.

- Polyformes Merges with Macfarlane Group: Polyformes, known for foam molding and protective packaging, merged with Macfarlane Group. The deal expanded their collective offerings in polyethylene foam molding and opened new opportunities in custom packaging and insulation materials.

- NN, Inc. Acquired for Precision Plastic Components: A merger involving NN, Inc. provided access to high-precision plastic component manufacturing for applications in automotive, healthcare, and industrial automation. The deal is set to enhance expertise in engineered plastic systems.

February 2024

- Berry Global Acquires F&S Tool: To improve its in-house tooling capabilities, Berry Global acquired F&S Tool. This investment supports faster prototyping, improved tool lifecycle management, and reduces the lead time for complex plastic part production across various sectors, including food and pharmaceuticals.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 44.9 Bn |

| Forecast Value (2034) |

USD 80.9 Bn |

| CAGR (2025–2034) |

6.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 9.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Polypropylene (PP), Polyethylene (PE), Acrylonitrile Butadiene Styrene (ABS), Polystyrene (PS), Polycarbonate (PC), Polyvinyl Chloride (PVC), and Other Product), By Application (Automotive, Aerospace & Defense, Consumer Goods & Appliances, Medical, Industrial Equipment, Construction, and Other Application) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

GW Plastics, McClarin Plastics, Inzign Pte Ltd, RSP Inc., Plastikon Industries, C&J Industries, EVCO Plastics, PTI Engineered Plastics, Mack Molding, Comar LLC, Jones Plastic & Engineering, Cadence Inc., Husky Injection Molding Systems, Westfall Technik, Pacific Plastics Injection Molding, Plastek Group, Nolato AB, Phillips-Medisize, Tessy Plastics Corp, MedPlast (Viant Medical), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Plastic Contract Manufacturing Market?

▾ The Global Plastic Contract Manufacturing Market size is estimated to have a value of USD 44.9 billion in 2025 and is expected to reach USD 80.9 billion by the end of 2034.

What is the growth rate in the Global Plastic Contract Manufacturing Market in 2025?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period of 2025.

What is the size of the US Plastic Contract Manufacturing Market?

▾ The US Plastic Contract Manufacturing Market is projected to be valued at USD 9.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.1 billion in 2034 at a CAGR of 6.4%.

Which region accounted for the largest Global Plastic Contract Manufacturing Market?

▾ Asia Pacific is expected to have the largest market share in the Global Plastic Contract Manufacturing Market with a share of about 46.0% in 2025.

Who are the key players in the Global Plastic Contract Manufacturing Market?

▾ Some of the major key players in the Global Plastic Contract Manufacturing Market are GW Plastics, McClarin Plastics, Inzign Pte Ltd, RSP Inc., Plastikon Industries, C&J Industries, EVCO Plastics, PTI Engineered Plastics, Mack Molding, Comar LLC, Jones Plastic & Engineering, and many others.