Market Overview

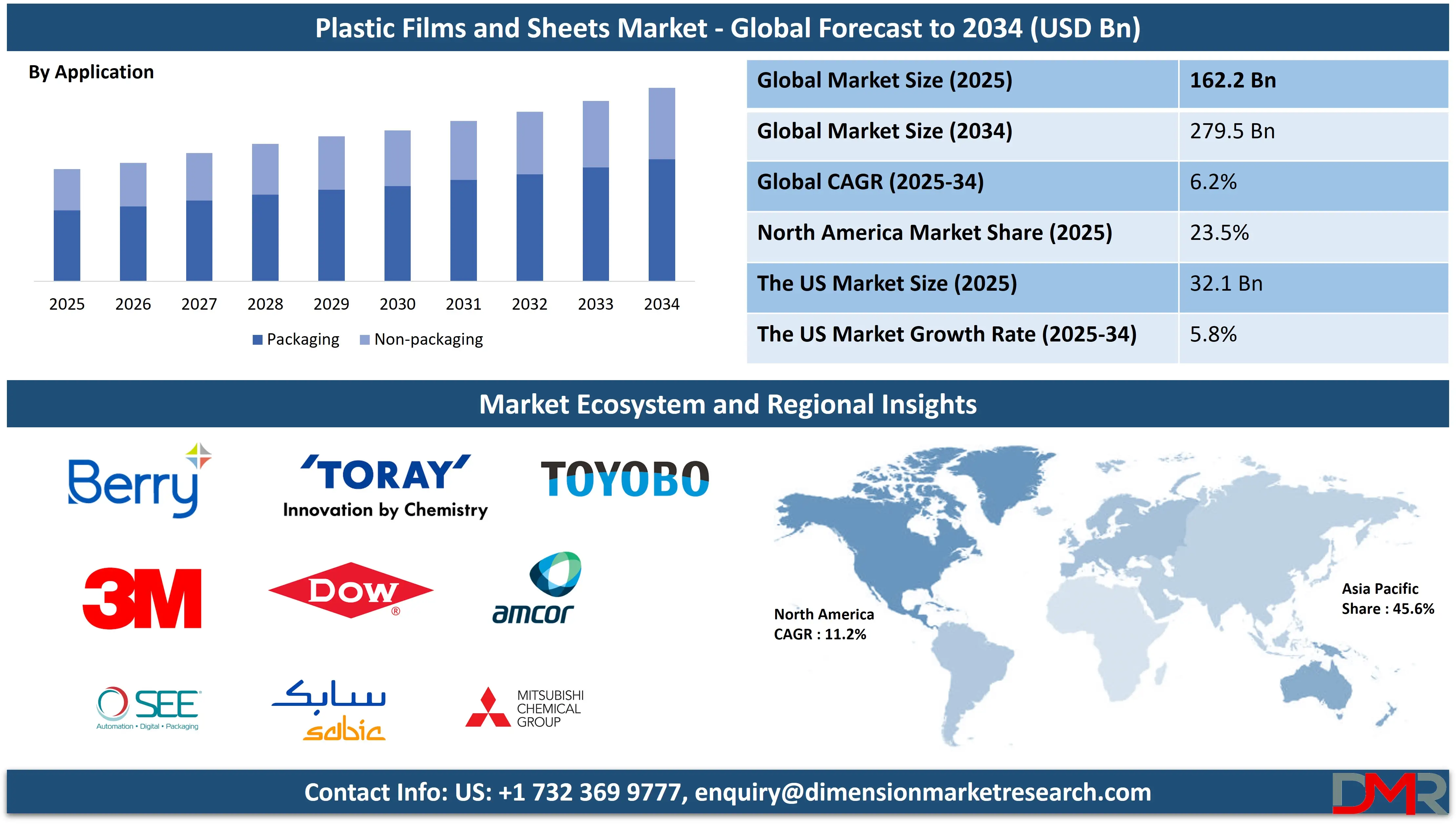

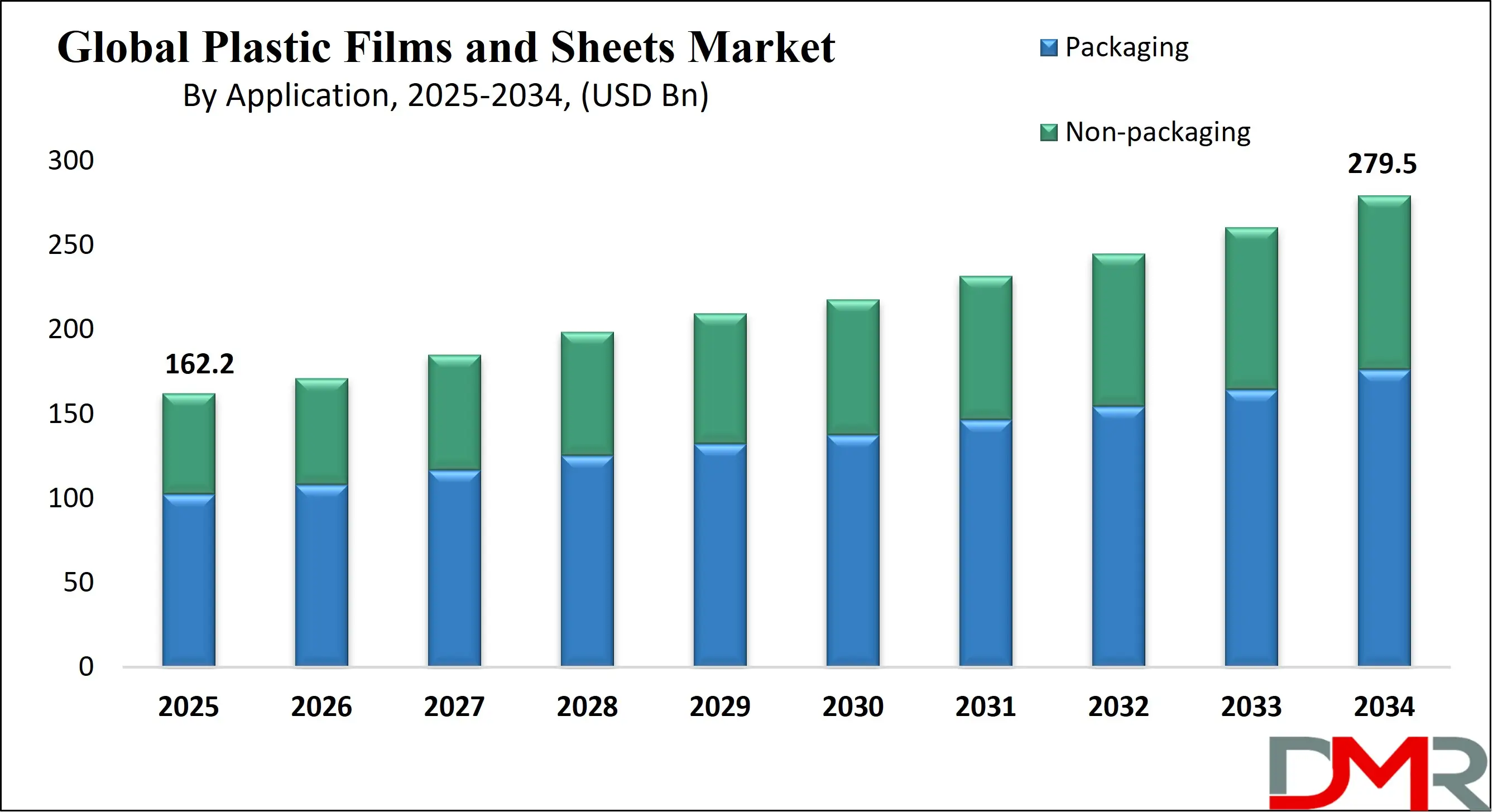

The Global Plastic Films and Sheets Market is predicted to be valued at USD 162.2 billion in 2025 and is expected to grow to USD 279.5 billion by 2034, registering a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034.

Plastic films and sheets are thin, continuous polymeric materials used widely in packaging, agriculture, construction, and industrial applications. Films are typically thinner and more flexible, while sheets are thicker and more rigid. They are produced using materials like polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polyethylene terephthalate (PET).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These materials offer properties such as transparency, moisture resistance, durability, and lightweight strength. Plastic films are often used in food wrapping, bags, and protective coverings, whereas sheets are used in signage, insulation, and protective barriers. Their versatility and cost-effectiveness make them essential across many industries.

The global plastic films and sheets market plays a crucial role in modern packaging, industrial, and agricultural practices. These materials are widely adopted due to their lightweight nature, high durability, and excellent barrier properties, making them ideal for protecting goods from moisture, contaminants, and physical damage. Plastic films and sheets are manufactured using various polymers such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC), each offering unique characteristics tailored to specific end-use applications.

One of the primary drivers of market growth is the rising demand for flexible packaging solutions in the food and beverage sector. Plastic films are preferred for their transparency, puncture resistance, and ability to preserve freshness. In addition, plastic sheets are used extensively in construction and infrastructure for insulation, vapor barriers, and protective layers. Their versatility also extends to agriculture, where they serve in mulching, greenhouse coverings, and silage wrapping.

The growing emphasis on sustainable packaging and lightweight materials has led to increasing interest in biodegradable films and recyclable plastic sheets. Technological advancements in polymer blends and extrusion techniques have enhanced the performance and functionality of these materials, contributing to their widespread adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Emerging economies are witnessing rapid industrialization and urbanization, further fueling demand across various sectors. Furthermore, regulatory shifts toward environmentally friendly materials are prompting innovation in bio-based plastic films. The market remains highly competitive, with manufacturers focusing on material efficiency, cost optimization, and enhanced mechanical properties to gain an edge in the global plastic films and sheets landscape.

The US Plastic Films and Sheets Market

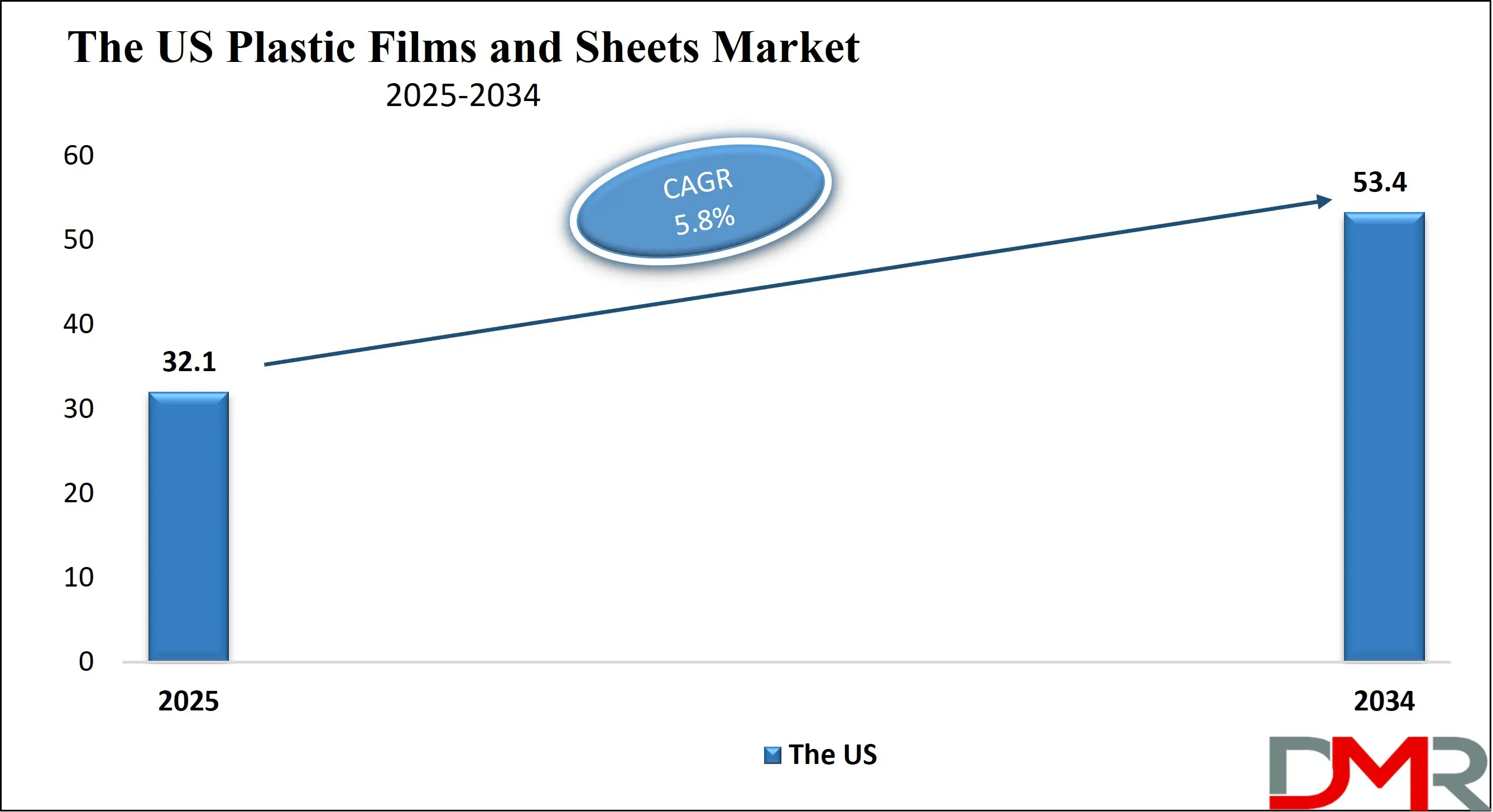

The US Plastic Films and Sheets Market is projected to be valued at USD 32.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 53.4 billion in 2034 at a CAGR of 5.8%.

The U.S. plastic films and sheets market is primarily driven by the rising demand for flexible packaging solutions in the food and pharmaceutical industries. Growing consumer preferences for lightweight, durable, and cost-effective materials are encouraging manufacturers to adopt plastic films for better product shelf life and presentation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, innovations in polymer science and enhanced mechanical properties of materials such as polyethylene and polypropylene are fueling market growth. Increased focus on sustainable packaging, including recyclable and biodegradable films, is further shaping the demand landscape. Moreover, the expansion of e-commerce and logistics sectors is accelerating the use of protective plastic sheets.

The U.S. market is witnessing a significant shift towards bio-based and compostable plastic films due to increasing environmental awareness and regulatory pressure. Manufacturers are investing in multilayer films with improved barrier properties to cater to diverse industrial applications. The rise of smart packaging technologies incorporating QR codes, freshness indicators, and temperature sensors is influencing product development.

Additionally, high-performance films designed for medical and agricultural use are gaining traction. Digital printing and advanced customization in packaging formats are also transforming consumer engagement. Overall, the market reflects a blend of eco-conscious innovation and demand for enhanced product functionality.

The Japan Plastic Films and Sheets Market

The Japan Plastic Films and Sheets Market is projected to be valued at USD 12.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.9 billion in 2034 at a CAGR of 6.4%.

Japan's plastic films and sheets market is largely propelled by technological innovation and the country's strong manufacturing ecosystem. There is significant demand for high-quality, precision-engineered films used in electronics, automotive interiors, and industrial applications. The food industry also drives the market, with a preference for aesthetic, durable, and hygienic packaging formats.

Government policies aimed at promoting eco-friendly alternatives are encouraging the use of biodegradable and recyclable materials. Moreover, Japan's emphasis on compact and high-efficiency packaging for convenience products boosts the need for multifunctional plastic films with superior barrier properties, transparency, and heat resistance.

In Japan, there is a growing trend toward ultra-thin and high-strength films suited for electronic displays and semiconductor packaging. Development of smart films with UV protection, anti-fog properties, and antimicrobial coatings is gaining traction across healthcare and food packaging segments. Recyclable mono-material films and plant-derived bioplastics are also being increasingly adopted due to sustainability commitments.

Companies are focusing on minimalistic yet high-performance packaging formats that cater to consumer preferences for compactness and ease of use. Additionally, automation in film manufacturing and a push for cleanroom-compatible materials are setting new benchmarks in quality and functionality.

The Europe Plastic Films and Sheets Market

The Europe Plastic Films and Sheets Market is projected to be valued at USD 30.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 50.2 billion in 2034 at a CAGR of 5.9%.

In Europe, the plastic films and sheets market is driven by strict environmental regulations and the push toward sustainable packaging. Consumer demand for recyclable, lightweight, and high-barrier materials is prompting innovation across the food, beverage, and personal care industries. Government-led initiatives to reduce single-use plastics have led to increased research in biodegradable films.

Furthermore, the automotive and construction sectors are increasingly utilizing engineered plastic sheets for insulation and protective purposes. Technological advancements in extrusion and lamination processes are enhancing product performance, encouraging broader industrial adoption. The circular economy approach is also playing a vital role in shaping demand.

The Europe Plastic Films and Sheets Market is embracing circular packaging models, with a surge in interest toward post-consumer recycled (PCR) plastic films. Brands are investing in mono-material films that are easier to recycle and meet the EU's sustainability goals. Innovation in solvent-free lamination and water-based coating technologies is gaining prominence.

Moreover, the use of bioplastics in food-grade applications is expanding. Printed films with traceability and tamper-evident features are also trending, especially in pharmaceuticals and retail. Customization for localized branding and smart film technologies that offer temperature or freshness indicators is gradually reshaping packaging strategies in the region

Plastic Films and Sheets Market: Key Takeaways

- Market Overview: The global plastic films and sheets market is anticipated to reach a value of USD 162.2 billion by 2025 and is forecasted to grow to USD 279.5 billion by 2034, reflecting a CAGR of 6.2% throughout the 2025–2034 period.

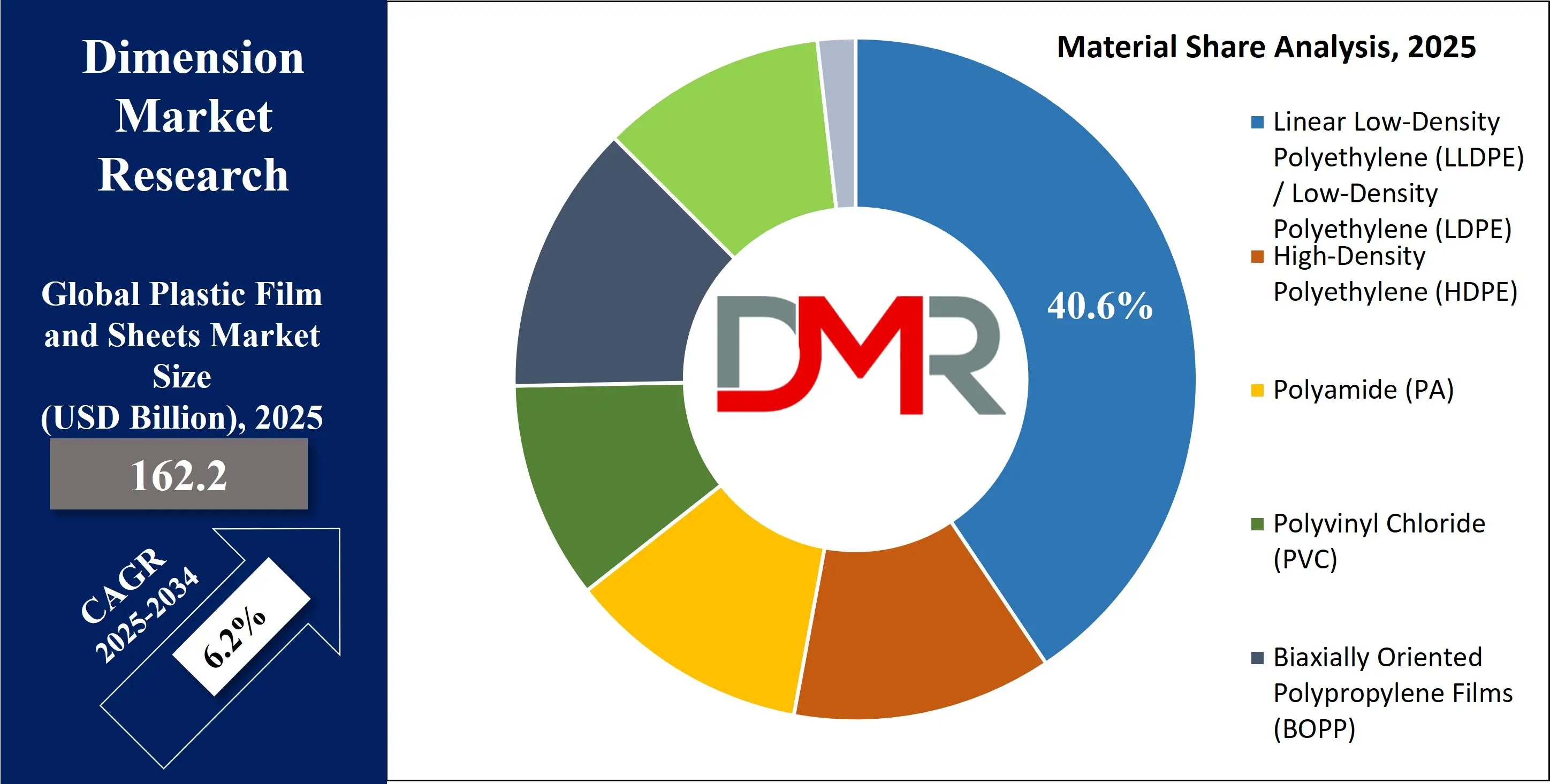

- By Material Analysis: LLDPE/LDPE (Linear Low-Density Polyethylene / Low-Density Polyethylene) is expected to lead the market by 2025, contributing around 40.6% of the overall market share, making it the most widely used material type in the industry.

- By Application Analysis: Packaging applications are set to remain the dominant segment, projected to account for approximately 68.3% of the global market share by the end of 2025, driven by high demand across food, consumer goods, and medical sectors.

- Leading Regional Market: The Asia Pacific region is expected to hold the largest portion of the global plastic films and sheets market, with an estimated 45.6% share by 2025, supported by robust manufacturing activity and rising demand in emerging economies.

Plastic Films and Sheets Market: Use Cases

- Food Packaging: Plastic films are widely used in food packaging to extend shelf life, prevent contamination, and improve product visibility. Materials like polyethylene and polypropylene offer excellent moisture barriers, flexibility, and sealing properties, making them ideal for wrapping fresh produce, snacks, frozen foods, and ready-to-eat meals.

- Agricultural Mulching: Plastic sheets are applied in agriculture for mulching, which helps conserve soil moisture, suppress weed growth, and regulate soil temperature. Black or transparent polyethylene films are commonly used to enhance crop yield and reduce pesticide usage, contributing to more sustainable and efficient farming practices.

- Medical and Pharmaceutical Packaging: In the healthcare industry, plastic films are used to package medical devices, tablets, and surgical supplies. These films ensure sterility, tamper resistance, and safe transport. Multi-layer barrier films with antimicrobial coatings also help in maintaining hygiene and protecting sensitive products from moisture and UV exposure.

- Construction and Insulation: Plastic sheets are used in construction as vapor barriers, insulation layers, and protective coverings. They prevent moisture penetration, improve energy efficiency, and protect building materials during transport and storage. Polyethylene and PVC films are commonly used due to their durability and resistance to water and chemicals.

- Industrial and Consumer Goods Packaging: Plastic films are employed to wrap and protect electronics, machinery, textiles, and household items. Shrink films and stretch wraps offer secure bundling and tamper-evidence, while protecting goods from dust, moisture, and physical damage during transportation and storage in various industrial and retail environments.

Plastic Films and Sheets Market: Stats & Facts

- PlasticsEurope: In 2023, plastic film production in Europe exceeded 7.2 million metric tons, representing a major share of flexible packaging output.

- U.S. Environmental Protection Agency (EPA): The U.S. generated 4.2 million tons of plastic film waste in 2021, of which only 9% was recycled, with the rest either landfilled or incinerated.

- Statista (via government sources): China alone accounted for over 40% of global polyethylene film consumption in 2022, driven by food packaging and agriculture demand.

- British Plastics Federation (BPF): Around 50% of all flexible plastic packaging in the UK is made from polyethylene films, used widely in food wrapping, pallet wrap, and carrier bags.

- National Renewable Energy Laboratory (NREL): Multi-layer plastic films used in food packaging can contain up to 12 different materials, making recycling economically and technically challenging.

- Flexible Packaging Association (FPA): Over 60% of flexible packaging materials in the U.S. consist of plastic films, particularly polyethylene, polypropylene, and PET.

- Plastindia Foundation: India consumed 3.6 million tons of plastic films in 2022, with a CAGR of over 9% forecasted through 2027 due to growth in e-commerce and food sectors.

- European Bioplastics: Biodegradable films made from PLA and starch blends accounted for over 20% of the global bioplastics film market in 2023, showing strong growth due to regulatory support.

- U.S. Department of Agriculture (USDA): The use of plastic mulch films in U.S. agriculture covers more than 180,000 hectares of farmland, primarily for vegetable and berry production.

- Japan Ministry of the Environment: Japan recycled approximately 27.5% of its plastic packaging waste in 2022, with much of the rest incinerated for energy recovery, plastic film being a key contributor.

Plastic Films and Sheets Market: Market Dynamic

Driving Factors in the Plastic Films and Sheets Market

Rising Demand from Packaging Industry

The rapid growth of the global packaging sector, especially in food, beverages, and pharmaceuticals, is a key driver for the plastic films and sheets market. With the increasing popularity of flexible packaging, plastic films made from polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) offer durability, cost-efficiency, and excellent barrier properties.

The need for lightweight, moisture-resistant, and tamper-proof packaging is fueling adoption across retail and e-commerce sectors. Additionally, demand for high-performance multilayer plastic films in frozen food and vacuum-sealed applications further accelerates market growth, making packaging innovation a vital force in expanding the global plastic sheets market.

Technological Advancements in Polymer Materials

Innovation in polymer science has significantly enhanced the mechanical and chemical properties of plastic films and sheets. The development of biodegradable and bio-based plastics, high-barrier films, and advanced laminates is promoting sustainable usage in various applications. These advancements support growth in agriculture, construction, and electronics, where specialty films such as geomembranes and optical films are gaining traction.

Increased R&D in polymer blends, nanocomposites, and multilayer extrusion technology further improves product performance, thereby encouraging manufacturers to shift towards more value-added applications. This technological evolution boosts demand for advanced plastic sheet materials across industrial and consumer segments.

Restraints in the Plastic Films and Sheets Market

Environmental Concerns and Stringent Regulations

The plastic films and sheets market faces substantial challenges due to growing environmental concerns related to plastic waste and pollution. Regulatory bans and restrictions on single-use plastics, especially in regions like Europe and North America, limit market expansion. Governments and environmental bodies are encouraging alternatives such as paper, jute, and biodegradable packaging materials.

Compliance with environmental regulations increases production costs and requires manufacturers to invest in eco-friendly materials and waste management systems. This regulatory pressure is affecting the usage of traditional petroleum-based plastic films and limiting their growth, particularly in the packaging and consumer goods sectors.

Volatility in Raw Material Prices

Fluctuations in the prices of petrochemical-based raw materials, including polyethylene, polypropylene, and PVC, pose a significant restraint for the plastic films and sheets industry. Since these raw materials are derived from crude oil, any disruption in oil supply or changes in global crude oil prices can lead to unpredictable cost variations.

Such price instability directly affects profit margins and manufacturing costs, especially for small and mid-sized players. This also discourages long-term procurement contracts and affects the competitiveness of plastic film products against alternative packaging and construction materials, making market growth more vulnerable to economic swings.

Opportunities in the Plastic Films and Sheets Market

Expansion of Bio-Based and Compostable Film Products

The rising consumer preference for eco-friendly and sustainable packaging is creating lucrative opportunities in the bio-based plastic films segment. Manufacturers are investing in compostable materials made from polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch blends to cater to environmentally conscious markets.

These films offer comparable functionality to traditional plastics while supporting global sustainability goals. The food packaging industry, in particular, is witnessing increased adoption of biodegradable plastic films due to regulatory support and brand-driven green initiatives. This shift toward sustainable packaging solutions is opening new markets and enhancing the overall plastic sheets market growth trajectory.

Growing Application in the Agricultural Sector

Plastic films and sheets are witnessing increased usage in agricultural applications such as greenhouse covering, mulch films, and silage wrap. With the intensification of modern farming practices and rising food demand, plasticulture has become vital for improving crop yields and protecting plants.

UV-resistant, moisture-retentive films made from LDPE and LLDPE are extensively used to control microclimates and enhance photosynthesis. Governments and agribusinesses in developing economies are encouraging the use of plastic films for efficient water use and reduced pesticide dependence. This growing trend offers manufacturers a vast untapped potential in emerging agro-focused regions.

Trends in the Plastic Films and Sheets Market

Shift Towards Multi-Layer and Barrier Films

There is an increasing trend toward the adoption of multi-layer plastic films with superior barrier properties in the food, medical, and industrial packaging sectors. These films enhance shelf life, prevent contamination, and reduce the need for preservatives. The use of EVOH, PA, and metallized layers is becoming common in high-performance packaging solutions.

These laminated and co-extruded films provide excellent resistance to oxygen, moisture, and light, ensuring product integrity. The trend reflects a growing demand for functionally sophisticated plastic film products that cater to strict quality and hygiene requirements across global supply chains.

Digital Printing on Flexible Plastic Films

The integration of digital printing technologies with plastic films is transforming the packaging industry. Digital printing enables high-resolution graphics, shorter print runs, and quicker turnaround, making it ideal for customized and on-demand packaging. Flexible plastic packaging solutions with attractive, informative, and QR-enabled graphics are gaining popularity in food, cosmetics, and healthcare products.

This trend is driving innovation in printable plastic sheets made from PET, BOPP, and PE, allowing brands to enhance consumer engagement and shelf appeal. As personalization and product traceability grow, digitally printed plastic films are becoming a key value-added segment.

Plastic Films and Sheets Market: Research Scope and Analysis

By Material Analysis

Linear Low-Density Polyethylene (LLDPE) / Low-Density Polyethylene (LDPE) is projected to dominate the global plastic films and sheets market by the end of 2025, accounting for approximately 40.6% of the total market share. These materials are favored for their superior flexibility, excellent impact strength, and cost-effectiveness in mass production.

Their extensive application in stretch films, agricultural mulch films, and packaging solutions makes them the material of choice across industries. The rise in demand for protective food films, retail carry bags, and hygiene packaging solutions is also accelerating their usage. Lightweight characteristics and sustainability advantages further enhance their adoption in plastic film manufacturing, aligning with environmental compliance trends across end-use sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Biaxially Oriented Polypropylene Films (BOPP) are anticipated to register the highest CAGR in the plastic films and sheets market by the end of 2025. This growth is driven by increasing demand for high-clarity, high-barrier packaging films in consumer electronics, confectionery, and snack food packaging. BOPP films offer superior tensile strength, excellent printability, and moisture resistance, making them suitable for labeling and decorative purposes.

Their recyclability and compatibility with advanced packaging technologies are enhancing appeal among eco-conscious industries. Emerging economies are witnessing heightened adoption of BOPP films for flexible packaging, supported by expanding e-commerce and rising disposable incomes, fueling demand for attractive, durable packaging solutions.

By Application Analysis

The Packaging segment is projected to dominate the global plastic films and sheets market by the end of 2025, capturing approximately 68.3% of the total market share. The increasing global demand for durable, flexible packaging in industries such as food preservation, personal care, and pharmaceuticals is a primary growth driver. The ability of plastic films to offer excellent moisture resistance, extended shelf life, and clarity makes them ideal for primary and secondary packaging applications.

Rapid urbanization, growth in retail-ready packaging, and a surge in processed food consumption are further strengthening this segment's dominance. Technological advancements such as smart packaging and improved barrier films are also being integrated to meet the evolving consumer expectations and regulatory standards.

The Non-packaging segment is anticipated to record the highest CAGR in the plastic films and sheets market by the end of 2025. Increasing application of plastic sheets in infrastructure insulation, greenhouse film production, and protective medical coverings is fueling this growth. Rising investments in construction projects, healthcare infrastructure, and modernized agricultural practices across developing economies are driving demand for performance-enhancing plastic sheet solutions.

These films offer UV resistance, light diffusion, and waterproofing, which are features critical for industrial and environmental applications. Moreover, growing emphasis on hygienic surfaces and contamination control in medical facilities, coupled with the demand for cost-efficient building materials, is accelerating non-packaging film adoption across sectors.

The Plastic Films and Sheets Market Report is segmented on the basis of the following

By Material

- Linear Low-Density Polyethylene (LLDPE) / Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyamide (PA)

- Polyvinyl Chloride (PVC)

- Biaxially Oriented Polypropylene Films (BOPP)

- Cast Polypropylene (CPP)

- Others

By Application

- Packaging

- Consumer Goods

- Medical

- Food

- Others

- Non-packaging

- Agriculture

- Healthcare

- Construction

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share in the global plastic films and sheets market, accounting for 45.6% by the end of 2025. The dominance is fueled by the region's strong manufacturing base, rapid industrialization, and booming food & beverage and consumer goods sectors. Countries like China, India, and Southeast Asian nations have seen rising demand for flexible packaging solutions, driven by urbanization and growing retail consumption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, favorable government policies supporting agricultural plastic films and increased infrastructure investments are boosting product adoption. The proliferation of e-commerce and a thriving pharmaceutical industry further drives demand for high-performance plastic sheets and films, enhancing the region's leadership in both volume and value.

Region with Highest CAGR

North America is expected to register the highest CAGR in the global plastic films and sheets market by the end of 2025. The region's growth is driven by increasing demand for sustainable and recyclable film materials across the packaging, construction, and healthcare sectors. Innovations in bio-based films and the use of advanced multilayer film technologies are rapidly gaining traction.

The U.S. and Canada are experiencing heightened interest in eco-friendly packaging due to regulatory pressures and shifting consumer preferences. Additionally, the robust presence of medical device manufacturers and the rising use of specialty films in diagnostic and surgical applications are contributing significantly to regional expansion. Smart packaging solutions and digitized supply chains are also aiding this growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Plastic Films and Sheets Market

- Process Optimization and Automation: AI streamlines manufacturing in the plastic films and sheets market by optimizing extrusion, calendaring, and thermoforming processes. Machine learning algorithms analyze equipment data to regulate temperature, pressure, and speed in real time, enhancing product consistency, reducing energy consumption, and minimizing material waste during large-scale production cycles.

- Predictive Maintenance and Downtime Reduction: AI-powered predictive maintenance systems monitor machinery health through sensor data and historical trends. These systems forecast equipment failures before they occur, allowing proactive servicing. This reduces unplanned downtime, increases operational efficiency, and extends machinery lifespan, ultimately lowering operational costs in film and sheet production plants.

- Enhanced Quality Control: AI-based vision systems ensure real-time quality inspection by identifying surface defects, thickness variations, and color inconsistencies. Deep learning models trained on defect datasets enable faster and more accurate detection than manual inspections, ensuring high-quality output, reducing rejects, and maintaining tight tolerances in packaging, agriculture, and industrial applications.

- Sustainability and Waste Reduction: AI assists in developing eco-friendly formulations by analyzing polymer blends, recyclability, and environmental impact. It also enables better inventory and supply chain management, reducing excess material use. These innovations support circular economy initiatives and help manufacturers meet growing regulatory and consumer demands for sustainable plastic film and sheet solutions.

Competitive Landscape

The competitive landscape of the global plastic films and sheets market is characterized by intense rivalry among both multinational corporations and regional manufacturers. Key players are focusing on product innovation, strategic acquisitions, and sustainable material development to strengthen their market position.

Companies such as Berry Global Inc., Toray Industries, Amcor plc, and Mitsubishi Chemical Group are actively investing in biodegradable plastic films and recyclable sheet materials to address growing environmental concerns. The market is also witnessing a surge in R&D activities aimed at enhancing the barrier properties, tensile strength, and heat resistance of plastic films used in food packaging, agricultural films, and medical applications.

Customization of multilayer films for specific end-use industries, such as pharmaceutical packaging and electronic device insulation, is becoming a competitive differentiator. Additionally, manufacturers are leveraging extrusion coating, blown film extrusion, and cast film technologies to improve product performance and reduce production costs.

Strategic partnerships between raw material suppliers and film producers are ensuring consistent supply chains and technological advancement. The growing demand for lightweight, flexible, and cost-effective packaging is further intensifying competition. As sustainability becomes a core focus, companies offering low-carbon, high-performance polyethylene and polypropylene film solutions are likely to gain a significant competitive edge in the evolving market.

Some of the prominent players in the Global Plastic Films and Sheets Market are:

- Berry Global Inc.

- Toray Industries, Inc.

- Amcor plc

- Sealed Air Corporation

- SABIC

- Dow Inc.

- 3M Company

- Mitsubishi Chemical Group Corporation

- UFlex Limited

- Jindal Poly Films Limited

- Polyplex Corporation Limited

- Avery Dennison Corporation

- Mondi Group

- Klöckner Pentaplast

- Coveris Holdings S.A.

- RPC Group plc

- RKW Group

- Toyobo Co., Ltd.

- Cosmo Films Limited

- Inteplast Group, Ltd.

- Other Key Players

Recent Developments

- In February 2025, IPG, a global leader in packaging and protective solutions, introduced a new American brand of plastic sheeting, offering both ultra and performance film variants.

- In February 2025, UFlex revealed a total investment of around USD 90 million, including a new woven polypropylene bags facility in Mexico and a plastic recycling unit in Noida, India, with a 39,600 TPA capacity, to support EPR compliance and expand its presence in the Americas.

- In December 2024, UFlex committed nearly USD 200 million to projects in Egypt, comprising a USD 70 million PET chip manufacturing plant and an aseptic packaging unit costing between USD 125–130 million. This expansion supports backward integration and strengthens supply chains in the Middle East and Europe.

- In June 2024, Sigma Plastics Group boosted its film production capacity by acquiring a facility in Georgia, a move that highlights its dedication to enhancing quality and its role in the plastic films and sheets industry.

- In November 2023, the merger between Rohm's acrylic products division and SABIC's functional forms business led to the creation of Polyvantiis. The proposed film, designed for PC and PMMA extrusion, is still pending government approval.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 162.2 Bn |

| Forecast Value (2034) |

USD 279.5 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 32.1 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material (Linear Low-Density Polyethylene (LLDPE / LDPE), High-Density Polyethylene (HDPE), Polyamide (PA), Polyvinyl Chloride (PVC), Biaxially Oriented Polypropylene Films (BOPP), Cast Polypropylene (CPP), Others), By Application (Packaging, Non-packaging) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Berry Global Inc., Toray Industries, Inc., Amcor plc, Sealed Air Corporation, SABIC, Dow Inc., 3M Company, Mitsubishi Chemical Group Corporation, UFlex Limited, Jindal Poly Films Limited, Polyplex Corporation Limited, Avery Dennison Corporation, Mondi Group, Klöckner Pentaplast, Coveris Holdings S.A., RPC Group plc, RKW Group, Toyobo Co., Ltd., Cosmo Films Limited, Inteplast Group, Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Plastic Films and Sheets Market?

▾ The Global Plastic Films and Sheets Market size is estimated to have a value of USD 162.2 billion in 2025 and is expected to reach USD 279.5 billion by the end of 2034.

Which region accounted for the largest Global Plastic Films and Sheets Market?

▾ Asia Pacific is expected to be the largest market share for the Global Plastic Films and Sheets Market with a share of about 45.6% in 2025.

Who are the key players in the Global Plastic Films and Sheets Market?

▾ Some of the major key players in the Global Plastic Films and Sheets Market are Berry Global Inc., Amcor plc, Sealed Air Corporation, and many others.

What is the growth rate in the Global Plastic Films and Sheets Market?

▾ The market is growing at a CAGR of 6.2% over the forecasted period.

How big is the US Plastic Films and Sheets Market?

▾ The US Plastic Films and Sheets Market size is estimated to have a value of USD 32.1 billion in 2025 and is expected to reach USD 53.4 billion by the end of 2034.