The properties of bio inertness, resistance towards high temperature, high strength-to-weight ratio, & durability, make it the most desired product in various sectors. The growing demand for lightweight vehicles and objects in recent years has led to the replacement of various metals, such as steel, aluminum, etc. with lightweight plastic.

The demand for plastics has been driven by the rising construction sector in emerging economies like Brazil, China, India, & Mexico. The market’s growth can be credited to rising investment in domestic markets, facilitated by the relaxation of Foreign Direct Investment norms & need for improved industrial & public infrastructure development. Additionally, rising emphasis on sustainable packaging solutions is expected to shape the future of the Plastic Market.

In 2022, the demand for plastics in the United States reached a valuation of USD 87.93 billion. The country's growth in the market is the result of its well-established automotive, defense & aerospace, and electronics sectors. The United States is marked by its economic stability, a risk-free environment, and a rising financial sector.

All these factors have opened numerous investment avenues in recent years, leading to increased spending on infrastructure. Consequently, the plastics demand in the United States’s construction sector is expected to experience a positive growth impact. Growing focus on the polymer industry further enhances opportunities in specialty applications, ranging from packaging to automotive materials.

Key Takeaways

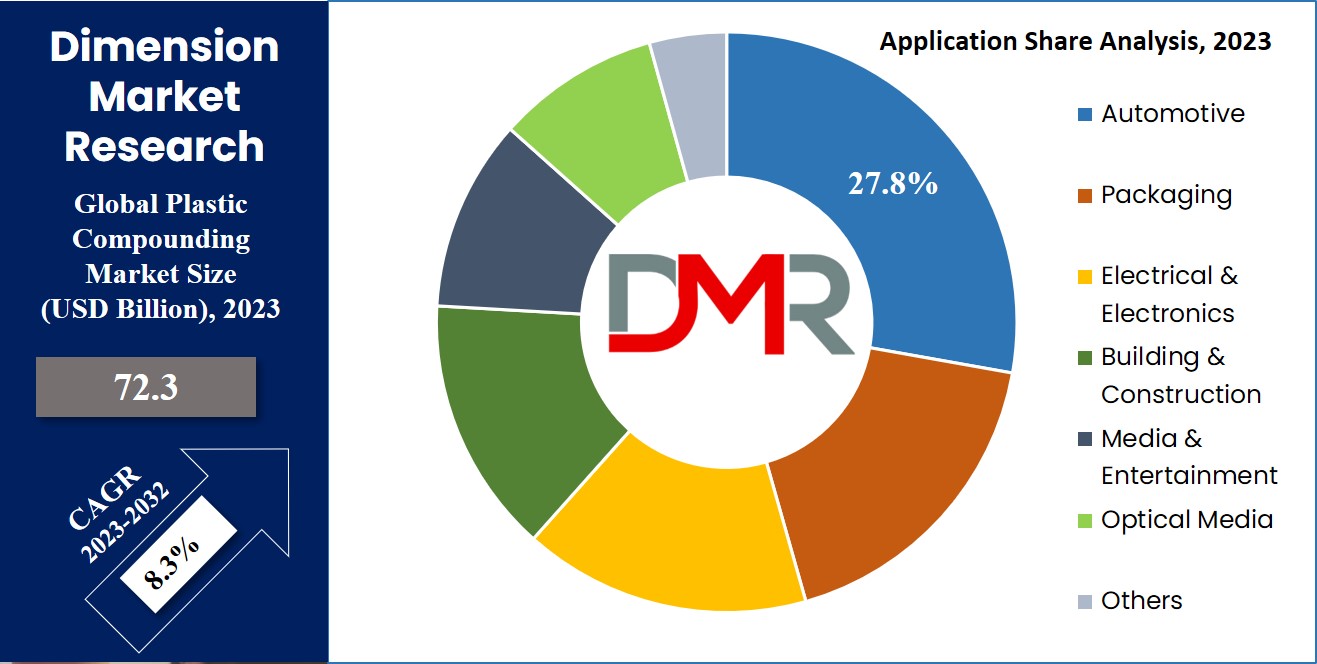

- The Global Plastic Market is projected to reach USD 668.2 billion in 2023, growing at a CAGR of 4.4% between 2023 and 2032.

- Polyethylene (PE) remains the leading product type in 2023 due to its wide applications in bottles, bags, pipes, and geomembranes, while Acrylonitrile Butadiene Styrene (ABS) is expected to witness significant demand in electronics.

- The Packaging segment dominates end-use applications in 2023, driven by rising consumerism, e-commerce adoption, and increasing demand for food & healthcare packaging.

- The Injection Molding segment holds the largest share by application in 2023, with growing usage in consumer goods, automotive, and packaging industries.

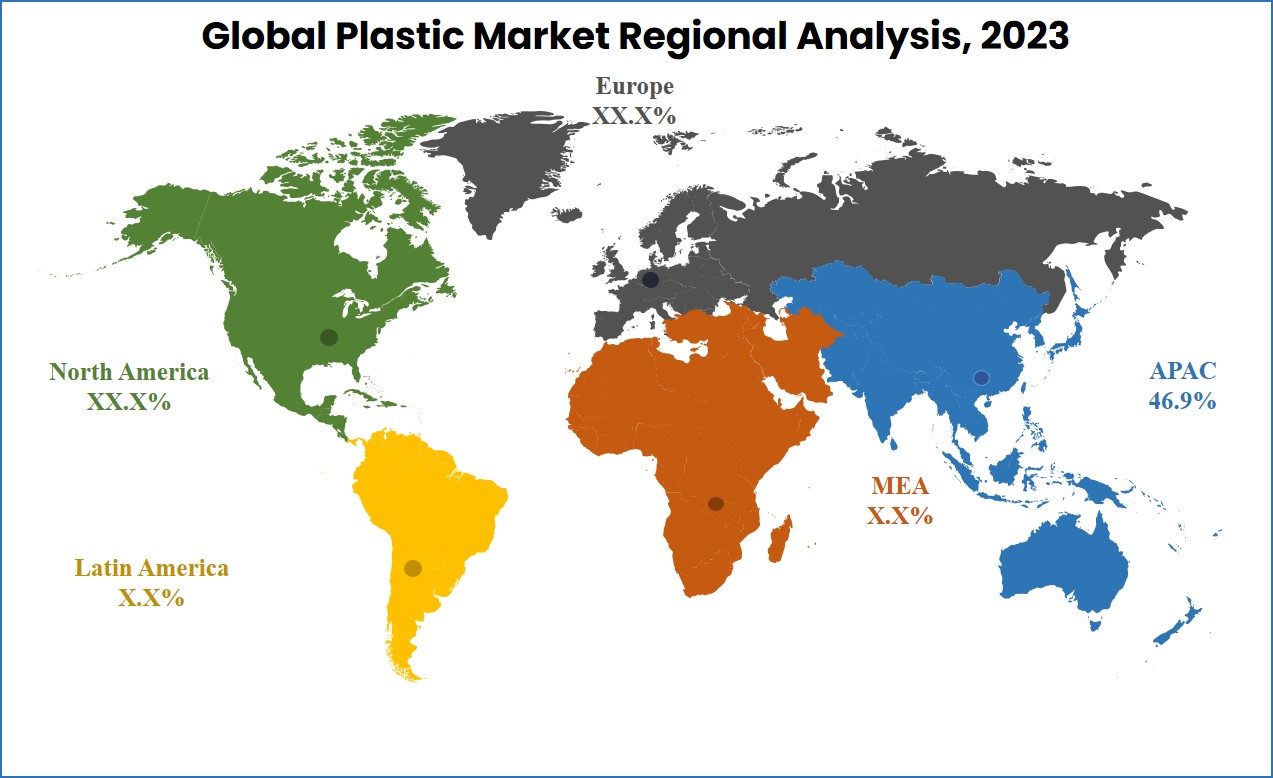

- Asia-Pacific leads the global market with a 46.9% share in 2023, supported by China’s strong position in automotive and electronics manufacturing.

Use Cases

- Packaging Applications: Plastics such as PE, PET, and PC are extensively used in food, beverage, and consumer goods packaging. They provide durability, lightweight properties, and protection, while also supporting emerging trends like e-commerce and sustainable packaging solutions.

- Construction & Infrastructure: Polyethylene, polypropylene, and PVC are increasingly used in pipes, insulation, geomembranes, and building materials. Their durability, chemical resistance, and ease of installation make them a preferred choice in modern construction projects, especially in emerging economies.

- Automotive Applications: Lightweight plastics like PE, PP, and ABS are replacing metals in automotive components, contributing to fuel efficiency, reduced emissions, and enhanced performance in vehicles. This includes interior panels, dashboards, and exterior parts.

- Electrical & Electronics: Plastics such as ABS, PC, and PBT are used in electronic devices, wiring insulation, and electrical enclosures due to their thermal stability, electrical insulation properties, and mechanical strength.

- Medical Devices: Plastics play a vital role in healthcare, including medical containers, IV bags, and disposable equipment. Biocompatible and sterilizable polymers like PE, PP, and PEEK support the growing demand for hygienic and safe medical products.

Market Dynamic

With growing consumerism, urbanization, & technological advancements, usage of plastic has increased to much higher levels in several sectors like infrastructure development, food & packaging, construction, electronics & electrical equipment, automotive, etc. in recent years.

The growing construction activities in several countries like Mexico, Brazil, China, India, etc. are driving the market growth in this segment. Rapid industrialization in China & increased infrastructural projects in India are also driving the market. Developing countries undergoing construction activities have attracted lots of investors which in turn seems to boost the market. The driving factor for this market can be the rising demand for milk containers, boxes, well-processed foods, etc.

However, as concerns related to the environmental impact of polymers have arisen, numerous regions worldwide have implemented stringent policies & taken other measures to curb the harmful impact. In response, several industries & government organizations are involved in a search for environmentally friendly alternatives & plastic-free materials to discourage the usage of plastic. This has further accelerated initiatives in plastics recycling as companies aim to balance demand with sustainability goals.

Research Scope and Analysis

By Product

PPolyethylene dominates the market with a maximum share in 2023. It finds its usage in various places such as in the manufacturing of bottles, geomembranes, & plastic bags, etc. Various types of polymers based on their molecular weight are LDPE, HDPE, & LLDPE. LDPE refers to low-density polyethylene that is used in low-packaging items like plastic wraps, tubing, & lubricants, etc. HDPE refers to high-density polyethylene which is used in strong packaging materials such as drums, bottle caps, plastic pipes, etc. These are used in plastic industries. Whereas, LLDPE refers to linear-low density polyethylene, which is used for coating like stretch wraps, where medium molecular weight polymers are employed as wax miscible with paraffin.

It’s expected that the demand for ABS (Acrylonitrile Butadiene Styrene) will increase as it’s used in electrical products due to its rigidity, & more strength capabilities. It’s highly resistant to corrosion & chemicals. However, Acrylonitrile Butadiene Styrene is not being utilized for high temperatures as it has a low melting point. It finds its usage in various instruments like musical, or electrical such as computer keyboards, etc.

By End Use

In 2023, the Packaging Segment dominates the market with a maximum revenue share. Plastics such as PET & PC are extensively used in the packaging of foods, beverages, consumer goods, toys, etc. An Increase in the manufacturing process due to increasing consumerism & urbanization drives this market. Packaging for groceries & healthcare products has increased sharply due to e-commerce acceptance in recent years.

Moreover, the emergence of bio-based plastics has had a notable impact on packaging applications in the food, pharmaceutical, and beverage sectors. Plastics that are mostly utilized in construction activities & consumer goods include PE, PP, PET, PVC, PBT, PPO, PEEK, PC, PSU, etc.

Polycarbonate and Acrylonitrile butadiene Styrene are the most commonly used polymers in electronic devices. Whereas,

Polypropylene Compounds are the most commonly used plastic for indoor furniture such as chairs, etc. The strongest polymer used for bending is Polycarbonate (PC).

Demand for medical plastic is also rising these days. Medical plastics are used for containers for medical wastes, intravenous blood bags, etc. which seem to drive the market in the healthcare sector, especially in connection with digital innovations such as

Healthcare IT Solutions.

By Application

The injection molding segment shows the largest market share in 2023. There are 4 processes included in this molding, i.e., clamping, injection, cooling, and ejection stages. It’s a process of forming parts by ejecting molten material into molds. It’s a discontinuous process in which plastic parts are produced in molds. Before, being removed they are first allowed to be cooled. The segment is further supported by rising applications of

Injection Molded Plastic, which plays a vital role in consumer goods, automotive parts, and packaging solutions.

Calendering segment is expected to flourish well in the market in the coming years. It consists of 5 steps, i.e., pre-blending, fluxing, calendaring, cooling, & winding up. In this process, thermoplastic materials are converted into films & sheets. Thermoforming is a process of transforming plastic sheets into 3D structures by using vacuum, heat, & pressure.

![]()

The Global Plastic Market Report is segmented on the basis of the following:

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene terephthalate (PET)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyvinyl chloride (PVC)

- Polysulfone (PSU)

- Polyphenylsulfone (PPSU)

- Polyether Ketone (PEEK)

- Liquid crystal polymers

- Epoxy polymers

- Polyphenylene oxide (PPO)

- Polybutylene terephthalate (PBT)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polystyrene (PS)

By End Use

- Packaging

- Construction

- Electrical and Electronics

- Automotive

- Medical devices

- Agriculture

- Others

By Application

- Blow molding

- Injection molding

- Casting

- Compression molding

- Thermoforming

- Calendering

- Others

Regional Analysis

Asia-Pacific region dominates the market with a

share of 46.9% share in the Global Plastic Market in 2023. In order to boost the availability of lightweight vehicles and electronic gadgets, automotive and electrical & electronic segments are increasing their production rate, & hence as these sectors’ demand rises, the growth in the plastic market is also enhanced.

With rising industries in Taiwan, and China for electronic devices and automotive manufacturing, the demand for polymers is also rising. Hence, China became the largest producer & supplier in the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market is characterized by intense competition due to the presence of multiple players. There is significant fragmentation in the global market, with prominent companies like SABIC, BASF SE, Dow Inc., Evonik Industries, DuPont, Arkema, and Celanese Corporation, alongside several regional players operating across different regions.

Many players in the global plastic market employ popular strategies such as capacity expansions, strategic partnerships, and new product developments. For example, in May 2023, LyondellBasell acquired a 50% stake in its plastic recycling joint venture (JV) with Veolia Belgium. This acquisition will enable LyondellBasell to effectively meet the rising demand for sustainable products and solutions

Some of the prominent players in the global plastic market are:

- Evonik Industries

- Arkema

- Covestro AG

- Torey Industries, Inc.

- Mitsui & Co. Plastic Ltd.

- BASF SE

- SABIC

- Dow Inc

- DuPont de Nemours, Inc.

- Formosa Plastic corporation

- Celanese corporation

- Other Key Players

Recent Developments