Market Overview

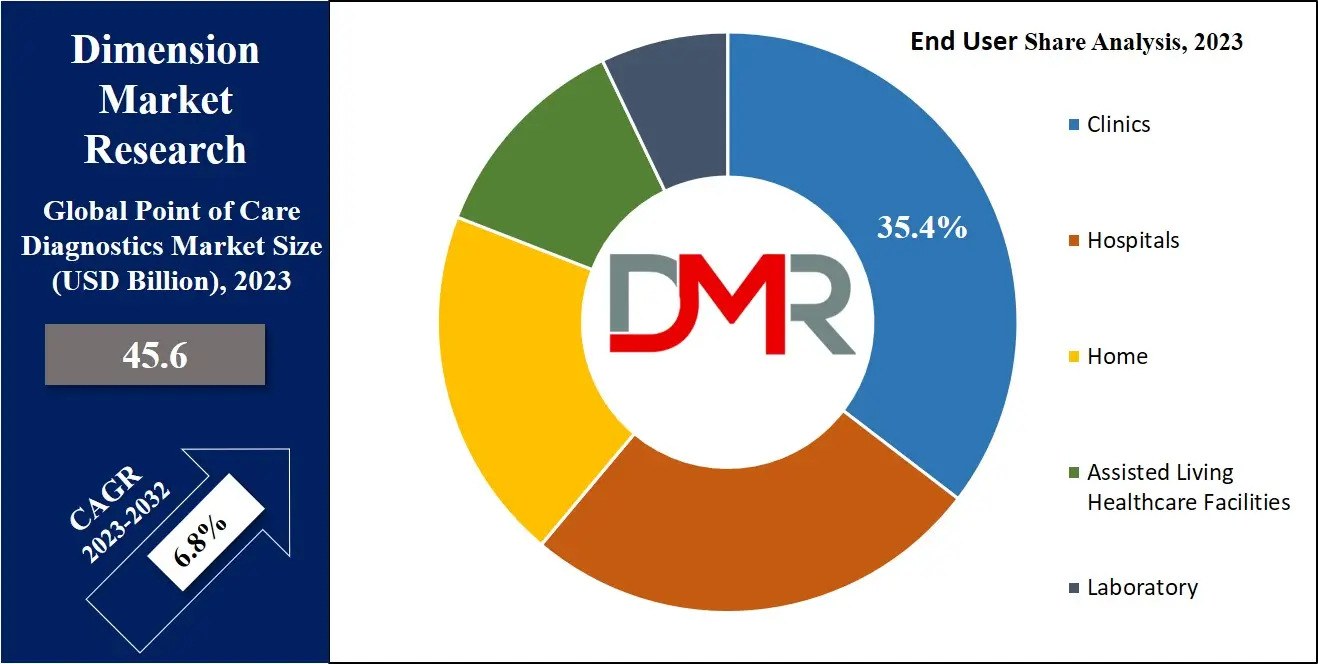

The Global Point of Care Diagnostics Market is expected to reach a value of USD 45.6 billion in 2023, and it is further anticipated to reach a market value of USD 82.0 billion by 2032 at a CAGR of 6.8%.

Point-of-care diagnostics refer to methods that enable the quick & precise detection of diseases, providing early diagnoses and are known for their high sensitivity, affordability, & quick results. These techniques find application in different healthcare settings like clinics, hospitals, home healthcare, & research labs, making them a valuable tool in addressing & managing medical conditions quickly & efficiently.

As per SEC, the Point of Care Diagnostics Market is poised for significant growth, driven by the rising demand in the U.S. healthcare sector. According to the American Hospital Association, there are 5,139 community hospitals in the U.S., with 34.9% situated in non-urban areas. Notably, the majority of these facilities are not-for-profit or government-owned.

These hospitals offer diverse services, including diagnostics, which play a crucial role in enhancing patient outcomes. The increasing adoption of point-of-care solutions in these settings is expected to streamline operations and improve access to timely care, particularly in underserved regions, fostering market expansion.

Point-of-Care (POC) Diagnostics is revolutionizing healthcare by delivering rapid, on-site testing solutions. Events and conferences, such as the Point-of-Care Diagnostics Summit, offer industry insights, showcasing innovations like portable analyzers and AI-driven diagnostics.

These platforms foster collaborations, providing opportunities for healthcare providers, researchers, and businesses to explore partnerships and investments. The growing demand for decentralized healthcare services creates lucrative deals, particularly in emerging markets. POC diagnostics streamline clinical workflows, enhance patient outcomes, and reduce healthcare costs, making them a critical focus for investors and innovators seeking to capitalize on the booming health tech landscape.

Key Takeaways

- Market Growth: The global point-of-care diagnostics market will expand from USD 45.6 billion in 2023 to USD 82.0 billion by 2032, at a CAGR of 6.8%.

- Segment Leaders: Infectious diseases diagnostics remain the largest segment in 2023, followed by glucose testing due to rising chronic conditions and diabetes rates globally.

- Clinic Influence: Clinics, especially pharmacy and retail clinics, contributed over 44.5% of market revenue in 2023, driving adoption of innovative diagnostics.

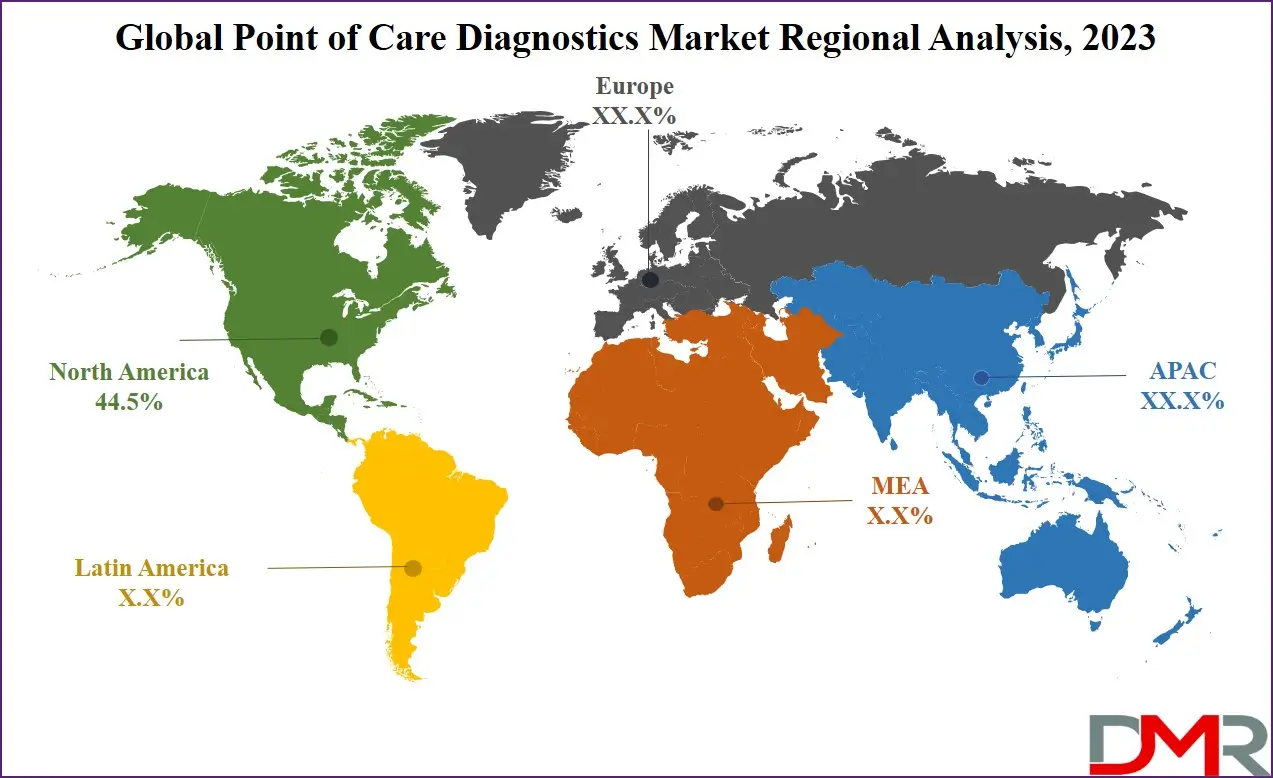

- Regional Trends: North America holds over 44.5% of global market share, with the Asia Pacific region expected to show the fastest growth by 2032.

- Growth Drivers: Rising chronic illnesses, home testing adoption, and rapid technological improvements are fueling continuous global market expansion.

- Regulatory Barriers: Strict regulations, reimbursement reductions, and reluctance to shift from laboratory methods present significant challenges for market growth.

- Competitive Field: Market competition is led by major players like Abbott, Roche, Siemens, and BD who drive innovation and industry development.

Use Cases

- Hospital Rapid Testing: Enables immediate disease detection in emergency rooms and clinics, improving patient triage, reducing wait times, and supporting prompt clinical decisions for better outcomes.

- Home Health Monitoring: Supports at-home patients with chronic diseases like diabetes by offering convenient, reliable self-testing kits, which aid in long-term disease management and early intervention.

- Rural Care Access: Delivers quality diagnostics to underserved or remote locations, empowering healthcare workers to identify and treat conditions quickly without centralized laboratories.

- Pandemic Response Readiness: Provides scalable, on-site diagnostic tools during infectious disease outbreaks, enabling swift containment and targeted resource deployment in crisis situations.

- Retail Clinic Expansion: Integrates rapid tests in pharmacy and retail clinics to boost preventive care offerings, making lab-quality diagnostics more accessible in public and community venues.

- Antibiotic Stewardship: Assists in reducing antibiotic misuse by providing targeted infection detection, supporting better prescription practices, and helping address antimicrobial resistance issues.

Market Dynamic

The growth of the point-of-care diagnostics market is driven by several factors., which includes the growth in the incidence of target health conditions, an increase in government assistance, a rise in CLIA-waived POC tests, & the worldwide rise in healthcare spending. Technological advancements & the adoption of home-based POC devices are major drivers.

Government & non-profit organizations promoting health awareness also play a major role. In addition, developments like POC tests with multiplexing capabilities, healthcare decentralization, & emerging markets are creating new opportunities for this market. Meeting medical regulations & compliance standards is critical & is encouraged by government funding.

However, there are challenges to market growth, including pricing pressure owing to reimbursement cuts & budget constraints, along with strict & time-consuming regulatory policies. Challenges also grow from the lack of alignment with central lab methods, limited knowledge about POC device usage in professional settings, & resistance to changing established diagnostic practices. Despite these challenges, the market benefits from higher healthcare spending, enhanced healthcare infrastructure, & the growth in demand for expanded care delivery.

Research Scope and Analysis

By Product

The infectious diseases segment leads the way in terms of revenue in 2023, marking the largest share, as infectious disease testing has transitioned from centralized to decentralized point-of-care (POC) testing, improving patient care. The growth in demand for rapid tests has driven industry players to provide POC solutions to regions that were previously underserved.

Further, the glucose testing segment secured the second-largest share of revenue in 2023, which is mainly due to the high prevalence of diabetes and the need for ongoing monitoring of blood sugar levels. According to data from the International Diabetes Federation, global diabetes cases are projected to rise from 382 million in 2013 to 592 million in 2035. This increase in diabetes cases, coupled with the introduction of portable diagnostic equipment, is expected to further boost the segment's growth in the years to come.

Also, the

cancer markers segment is expected to have significant growth in the forecast period. Each year, millions of patients present symptoms of heart attacks, & a large number of deaths result from cardiovascular diseases. Industry players are closely monitoring the rising demand & are strategizing product development accordingly to address this critical health concern.

By End User

The clinics' sector took the lead in terms of revenue in 2023, with pharmacy &retail clinics being major contributors to its earnings, which is attributed to growth in access to innovative diagnostic technologies, enhanced healthcare coverage, & affordability, which have expanded the applications of point-of-care (POC) diagnostics. As a result, community pharmacies & retail clinics have become important for lab tests, mainly for

cholesterol & glycosylated hemoglobin (A1C) testing. Advanced healthcare accessibility for the elderly, a higher prevalence of communicable diseases, and the strain on traditional clinics are driving global market growth.

Further, as the adoption of POCT rises in hospitals, regulatory bodies have strengthened the validation and verification requirements for POC devices. Also, the home end-use segment is expected to experience fast growth in the coming years. Home care with POC testing is gaining popularity due to its affordability & the convenience it delivers to patients. POC diagnostics in home healthcare allow patients to manage health challenges at home & make prompt decisions. With an increase in focus on early disease detection & prevention, the POC diagnostics-based home healthcare market is expected to experience significant growth in the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Point of Care Diagnostics Market Report is segmented on the basis of the following

By Product

- Infectious Disease

- Glucose Testing

- Cancer Marker

- Hb1Ac Testing

- Fertility/Pregnancy

- Others

By End User

- Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

Regional Analysis

In the global point-of-care market, North America is leading the way with the largest revenue share, holding over 44.5% of the market, which is set to continue throughout the forecast period, mainly due to the presence of key industry players in the United States &Canada.

In addition, the Asia Pacific region is anticipated to experience rapid growth, emerging as the fastest-growing market in the coming years, which is attributed to the growing number of local manufacturers in the region producing diagnostic kits & reagents.

These local players are offering a wide range of testing solutions for various medical diagnoses including COVID-19, helping to meet the rising demand for testing in the post-pandemic era. Further countries in the Asia Pacific are actively expanding their testing capabilities to address all the required needs for all forms of diagnostics & testing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market for point-of-care diagnostics experiences intense competition & is characterized by the presence of a few key players that have significant influence when it comes to market share. These key players play a major role in shaping the industry's dynamics, driving innovations, & determining the direction in which the market evolves, making them key stakeholders in the field of rapid & accessible diagnostic solutions.

In November 2022, LumiraDx Healthcare, a UK company, introduced a highly sensitive point-of-care C-Reactive Protein (CRP) antigen test in India, which can be used in different

clinical settings, serves the critical purpose of curbing unnecessary antibiotic prescriptions, a practice that contributes to the increase in the problem of antimicrobial resistance (AMR). By providing an efficient way to measure CRP levels, the test assists healthcare professionals in making more informed decisions about antibiotic usage, thereby addressing the critical issue of AMR.

Some of the prominent players in the global Point of Care Diagnostics Market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Biomeriux SA

- BD

- Siemens Healthcare

- Nipro Corp

- Nova Biomedical

- Qiagen Inc

- Danaher Corp

- Johnson & Johnson

- Other Key Players

Recent Developments

- In August 2025, Powerful Medical received over €40 million in non-dilutive funding from the European Commission IPCEI program to expand its AI-enabled point-of-care cardiovascular diagnostics platform.

- In April 2025, Novus Diagnostics secured €4.6 million in equity financing led by BVP Investments, Trinity Biotech, and Irrus Investments, supporting the development of rapid sepsis point-of-care tests.

- In January 2025, bioMérieux acquired SpinChip Diagnostics for EUR 138 million to strengthen its 10-minute whole-blood immunoassay platform for point-of-care diagnostics.

- In August 2023, CrisprBits partnered with Molbio Diagnostics to launch advanced CRISPR-based point-of-care tests for pathogens and genetic markers, leveraging CRISPR technologies for onsite testing.

- In March 2025, Grand Challenges Canada committed $30 million for Phase I of a new grant program focused on developing point-of-care diagnostics in low- and middle-income countries, including $12 million in targeted funding.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 45.6 Bn |

| Forecast Value (2032) |

USD 82.0 Bn |

| CAGR (2023-2032) |

6.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Infectious Disease, Glucose Testing, Cancer Marker, Hb1Ac Testing, Fertility/Pregnancy, and Others), By End User (Clinics, Hospitals, Home, Assisted Living Healthcare Facilities, and Laboratory) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Abbott Laboratories, F. Hoffmann-La Roche Ltd, Biomeriux SA, BD, Siemens Healthcare, Nipro Corp, Nova Biomedical, Qiagen Inc, Danaher Corp, Johnson & Johnson, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Point of Care Diagnostics Market?

▾ The Global Point of Care Diagnostics Market is estimated to reach USD 45.6 billion in 2023, which is further expected to reach USD 82.0 billion by 2032.

Which region accounted for the largest Global Point of Care Diagnostics Market?

▾ North America dominates the Global Point of Care Diagnostics Market with a share of 44.5% in 2023.

Who are the key players in the Global Point of Care Diagnostics Market?

▾ Some of the major key players in the Global Point of Care Diagnostics Market are Siemens Healthcare, Abbott Laboratories, BD, and many others.

What is the growth rate in the Global Point of Care Diagnostics Market?

▾ The market is growing at a CAGR of 6.8 % over the forecasted period