Market Overview

The

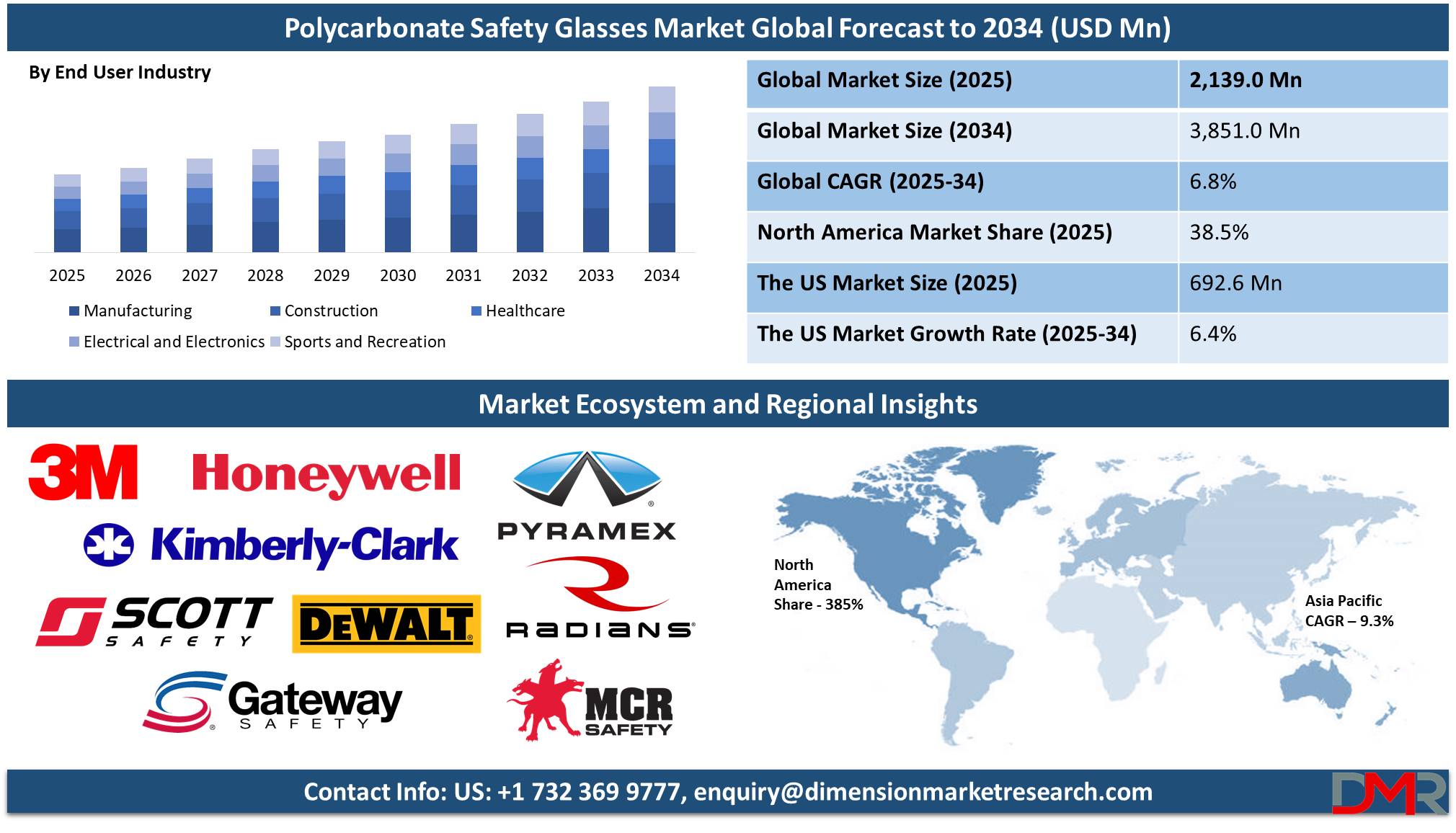

Global Polycarbonate Safety Glasses Market size is expected to be

valued at USD 2,139.0 million in 2025, and it is further anticipated to reach a market

value of USD 3,851.0 million by 2034 at a

CAGR of 6.8%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Polycarbonate safety glasses have emerged as a crucial protective tool across various industries due to their durability, impact resistance, and lightweight properties. The global market for polycarbonate safety glasses is witnessing robust growth owing to rising awareness about workplace safety and stringent regulations mandating the use of personal protective equipment (PPE). These glasses are widely used in industries such as manufacturing, healthcare, and construction, where eye protection is critical. Growth of the market could be fueled by a rise in incidences related to eye injury, coupled with increased employment across different industries around the globe. Other growth factors for this market are improvements in polycarbonate safety glasses themselves, like anti-fog coating or UV protection capabilities.

The market is experiencing significant opportunities due to the growing adoption of safety glasses in emerging economies. With rapid industrialization in countries such as India and China, coupled with government initiatives emphasizing occupational safety, the demand for polycarbonate safety glasses is on the rise. Furthermore, the trend of integrating smart technologies, including sensors for monitoring exposure to hazardous conditions, presents lucrative prospects for market players. This trend corresponds to the growing demand for multifunctional protective equipment that offers increased protection, along with higher levels of operational efficiency.

Although promising, the growth of the market might be inhibited by high initial costs for advanced polycarbonate safety glasses in price-sensitive regions. Besides this, low-cost alternatives from other materials could further affect market penetration. However, these restraints are expected to be outweighed by the long-term benefits of polycarbonate safety glasses, including durability and superior protective features.

Market statistics are anticipated to have a steady CAGR in the coming years through investments in safety measures at work and the increased scope of application. For example, the use of polycarbonate safety glasses for medical purposes skyrocketed after the COVID-19 pandemic, wherein the use of protective eyewear has become a norm for frontline health workers. Construction industries, characterized by high dust and debris exposure, are major consumers of this safety glass.

The increasing emphasis on sustainability is also shaping the market. Manufacturers are exploring recyclable materials and eco-friendly production processes to align with global environmental goals. This development not only meets regulatory requirements but also appeals to environmentally conscious consumers. Innovations in design, such as lightweight frames and adjustable features, are further boosting market growth by ensuring user comfort and compliance.

Growth prospects continue to be very bright as industries around the world take necessary precautions and measures to reduce workplace accidents. The emergence of e-commerce websites has also made polycarbonate safety glasses more accessible, especially to small and medium-scale industries that can now also use quality protection gear. This trend reflects an increasing awareness of occupational safety in all industries, thereby opening up opportunities for continued market growth.

The US Polycarbonate Safety Glasses Market

The US Polycarbonate Safety Glasses Market is projected to be valued at USD 692.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,209.6 million in 2034 at a CAGR of 6.4%.

The United States remains one of the largest markets for polycarbonate safety glasses. The country is known for stringent occupational safety measures and a mature industrial sector. With more and more companies focusing on work-site safety, construction, health care, and manufacturing industries are prime consumers of protective glasses. The Occupational Safety and Health Administration enforces stricter standards for eye and face protection, thereby augmenting the demand for high-quality safety equipment. Additionally, the U.S. workforce benefits from advanced PPE designs that offer superior protection and comfort.

The U.S. market is demographically advantageous because of its large and varied labor force involved in hazardous professions. This demographic trend, coupled with a robust healthcare infrastructure, continues to keep demand high for safety glasses for medical and industrial uses. This includes increased smart PPE adoption, like the integration of sensors in the glasses that are capable of monitoring hazards in real-time, a testament to the technological lead held by the U.S. market. These innovations are in line with the growing emphasis on worker safety and productivity. With the continuous thrust by industries to mitigate risks, the US polycarbonate safety glasses market is set to witness steady growth supported by advances in material science and the introduction of sustainable practices in manufacturing.

Global Polycarbonate Safety Glasses Market: Key Takeaways

- Global Market Size: The Global Polycarbonate Safety Glasses Market size is estimated to have a value of USD 2,139.0 million in 2025 and is expected to reach USD 3,851.0 million by the end of 2034.

- The US Market Size: The US- Polycarbonate Safety Glasses Market is projected to be valued at USD 692.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,209.6 million in 2035 at a CAGR of 6.4%.

- Regional Analysis: North America is expected to have the largest market share in the Global Polycarbonate Safety Glasses Market with a share of about 38.5% in 2024.

- Key Players: Some of the major key players in the Global Polycarbonate Safety Glasses Market are 3M, Honeywell, Scott Safety (Tyco), DEWALT, Radians, MCR Safety, Gateway Safety, Kimberly-Clark, and many others.

- Global Growth Rate: The market is growing at a CAGR of 6.8 percent over the forecasted period.

Global Polycarbonate Safety Glasses Market: Use Cases

- Industrial Manufacturing: Polycarbonate safety glasses offer protection from debris, sparks, and chemical splashes while offering clear vision with features like anti-fog coatings and side shields to provide anti-fog capabilities and further enhance worker protection while mitigating occupational risks. They comply with safety regulations to enhance worker protection while decreasing occupational hazards.

- Healthcare Settings: These glasses protect medical practitioners against infectious fluids and particles during surgeries or medical procedures. Their lightweight anti-fog design provides comfort while decreasing the exposure risks of biohazards in clinical environments.

- Construction Industry: Polycarbonate safety glasses offer protection for construction workers against dust, debris, and UV radiation while operating heavy machinery outdoors or operating heavy equipment indoors. Their strength and compliance with safety standards make them essential in helping reduce eye injuries in demanding workplace environments.

- Laboratory Research: Researchers who conduct laboratory research use anti-scratch and anti-fog glasses as eye protection against hazardous chemicals, splashes, and particles during experiments. Featuring anti-scratch and anti-fog features for clarity and reliability while remaining safe during sensitive procedures in laboratories with potentially hazardous materials or processes.

Global Polycarbonate Safety Glasses Market: Stats & Facts

- Plastic Waste Recycling: As of 2019, only 9 percent of global plastic waste was recycled with the rest being incinerated, landfilled, or mismanaged (OECD 2022). Polycarbonate falls within this category as waste that often cannot be effectively recycled.

- Polycarbonate and Recycling Challenges: Polycarbonate plastic used in safety glasses has an extremely low recycling rate; unfortunately, most recycling systems cannot handle certain forms of polycarbonate plastic which causes difficulties when recycling it.

- Predicted Plastic Waste Trends: By 2040, mismanaged plastic waste is projected to nearly double, and recycling rates for plastics globally could remain below 10% under business as usual (Nordic Council of Ministers and Systemic 2023). This likely applies to polycarbonate waste as well.

- Global Plastic Recycling Rates and Polycarbonate: EU plastic packaging recycling reached 41% by 2024 (Eurostat 2024). However, specialty products like polycarbonate and safety glasses were featured less frequently, leading to lower recycling statistics in 2024 for these specialized plastics.

- Resource Efficiency and Polycarbonate: Polycarbonate has long been used in safety glasses due to its impact resistance and optical clarity, yet producing new polycarbonate has an enormous environmental footprint, as it requires energy-intensive processes for production. Recycling systems could offer significant energy savings if implemented successfully.

- Aluminum and Glass Recycling Comparisons: Recycling polycarbonate materials is still challenging; other materials like aluminum (with over 74.5 percent still used today) and glass have significantly higher recycling rates (Eurostat 2024). This illustrates the need for more effective and widespread polycarbonate product recycling systems.

- U.S. Plastic Recycling Struggles: The US ranks last among developed nations when it comes to plastic recycling rates - only 5 % (Greenpeace 2022), contributing significantly to environmental waste with materials like safety glasses being discarded as opposed to being recycled and reused.

- E-waste and Polycarbonate: Polycarbonate is frequently utilized in electronic devices (for instance lenses on safety glasses that integrate technology), yet recycling of e-waste continues to underperform globally at 3-4% growth per annum (UN, 2024). This illustrates a more general trend toward inefficient recycling for complex materials like polycarbonate.

- Recycling Behavior and Trust: According to Shelton Group 2024 research, nearly 31% of consumers globally lack faith that what they put in the recycling bin will get recycled (Shelton Group). This could impede recycling programs' acceptance of materials like polycarbonate safety glasses that may not easily break down.

- Improved Plastic Recycling Technologies Needed: By adopting global policies designed to extend the life cycle of plastic products, up to 43% of waste could be recycled by 2040 (Nordic Council of Ministers and Systemic 2023). Such policies might incorporate polycarbonate recycling processes as part of this goal (but innovations within recycling processes remain important).

- PET vs. Polycarbonate Recycling: PET bottles have higher recycling rates than polycarbonate ones 60.0% in Europe was collected for recycling by 2022 according to UNESDA estimates (UNESDA 2022). Polycarbonate's recycling potential remains limited due to its complexity.

- Environmental and Energy Impact of Polycarbonate: Recycled polycarbonate could help lower energy use by 84% (ScienceDirect 2024), similar to what PET recycling achieved. Unfortunately due to limited recycling infrastructure, this potential benefit of recycling polycarbonate has yet to be fully realized.

- Public Perception and Recycling Practices: In regions with higher recycling rates such as Europe, 86.0% of consumers believe easy-to-recycle packaging is important (Pro Carton 2023). This indicates an increasing demand for such products - including potential improvements to polycarbonate recycling practices.

Global Polycarbonate Safety Glasses Market Dynamic

Driving Factors in the Global Polycarbonate Safety Glasses Market

Stringent Workplace Safety RegulationsWorkplace safety regulations are the driving force behind the use of polycarbonate safety glasses. Regulatory authorities, such as OSHA (Occupational Safety and Health Administration) in the United States and the EU-OSHA in Europe, have set strict guidelines that require the use of personal protective equipment, including safety glasses, in hazardous working environments.

These regulations are strictly enforced in sectors like construction, mining, manufacturing, and healthcare, where employees face risks of eye injuries from debris, chemicals, or intense light exposure. Failure to comply with these standards can result in hefty fines, lawsuits, or reputational damage for employers. Consequently, businesses are prioritizing investments in high-quality safety glasses to ensure regulatory compliance and protect their workforce, thereby fueling market growth.

Surging Demand from Healthcare and Medical Sectors

The healthcare sector has come to be an important user base for polycarbonate safety glasses, especially with the COVID-19 pandemic. Polycarbonate safety glasses are lightweight, resistant to impact, and provide clear vision, making them ideal for medical settings where infection control and precision are critical. During the pandemic, medical practitioners depended extensively on safety glasses for protection against airborne particles, splashes, and other forms of contamination.

Post-pandemic, the need has remained constant since healthcare facilities emphasize the safety of their employees and observe stricter infection control practices. Further, innovations in medical technology and treatments have created an even greater requirement for specialty protective eyewear, and the market in this segment continues to grow.

Restraints in the Global Polycarbonate Safety Glasses Market

High Cost of Premium Products

Although polycarbonate safety glasses are the best performers in terms of durability, clarity, and impact resistance, they are significantly more expensive than conventional plastic or acrylic ones. This is a significant limitation for widespread acceptance of the product, especially in price-sensitive markets where small businesses and individual consumers would prefer the low-cost variant. The cost is multiplied if other features such as anti-fog coatings, UV protection, or smart functionalities are added.

The budget-constrained nature of many industries involved in low-budget manufacturing or agricultural sectors creates an obstacle for such enterprises to justify investment in premium safety equipment. Cost differences act as a constraint for the penetration of advanced polycarbonate safety glasses into the developing regions, limiting market growth.

Environmental Concerns and Recycling Challenges

An environmental concern is the polycarbonate safety glasses in areas that have stringent regulations about sustainability. Polycarbonate material is not biodegradable, and its recycling is complex because of advanced coatings and other additives. Increasing awareness of plastic waste and adopting a circular economy places tremendous pressure on manufacturers about eco-friendly manufacturing processes.

The production costs of developing sustainable alternatives or efficient recycling solutions may be higher; hence, such companies face significant difficulties in coping with the production costs while retaining competitive pricing. These environmental issues are forcing a few consumers and some industries to search for alternative materials, which can be a challenge to the polycarbonate safety glasses market.

Opportunities in the Global Polycarbonate Safety Glasses Market

Expansion in Emerging Economies

Emerging economies, particularly in regions like Asia-Pacific, Latin America, and parts of Africa, present substantial growth opportunities for the polycarbonate safety glasses market. Rapid industrialization and urbanization in these regions are driving the establishment of new manufacturing facilities, construction projects, and other industries requiring enhanced workplace safety measures.

Governments in these regions are also implementing occupational safety laws to address rising workplace injuries, creating a favorable regulatory landscape for the adoption of safety glasses.

Moreover, increasing disposable incomes and growing awareness about workplace safety among employers and employees are contributing to the rising demand for high-quality protective equipment, including polycarbonate safety glasses. That said, manufacturers entering these markets with cost-effective and innovative solutions stand to win big as untapped potential is being opened up in these regions.

Advancements in Optical Technology

Advancements in advanced optical technologies open avenues for higher market growth of safety glasses made of polycarbonate. Higher resolution lenses, blocking UVA, B, C, or even some harmful UV spectrum together with light-blued filtration and their wider availability make the application scope for more precise industries to include, among other fields being: aerospace, electronic manufacturing, as well as medical application of these security items. Finally, the smart devices along with heads-up displays together with augmented reality introduce further fields that could develop on it.

These smart safety glasses can provide real-time data overlays, assist with complex tasks, and improve overall productivity and safety. The potential for integrating prescription lenses into polycarbonate safety glasses also addresses the needs of a broader customer base, including individuals with vision impairments. As technology continues to evolve, these advancements are expected to drive demand across multiple sectors.

Trends in the Global Polycarbonate Safety Glasses Market

Integration of Anti-Fog and Anti-Scratch Coatings

Some of the major trends driving the market of polycarbonate safety glasses around the world involve anti-fog and anti-scratch coatings, highly advanced and with features to give extended functionality to the product in such a setting that ensures vision does not blur out - thus being suitable for industries where such products have industrial manufacturing, chemical processing, or even a medical environment. Such lens fogging prevents a worker in high humidity conditions from carrying on work with normal efficiency and proper safety.

The anti-fog coatings ensure uninterrupted visibility, while anti-scratch features extend the durability of the glasses by reducing surface wear over time. This trend is gaining traction as manufacturers invest in developing premium products that meet the evolving demands of safety and performance. Furthermore, regulatory requirements for clear vision during hazardous operations are accelerating the adoption of such enhanced safety glasses globally.

Growing Popularity of Lightweight and Stylish Designs

The shift toward lightweight and ergonomically designed safety glasses is transforming user perceptions about protective eyewear. Manufacturers are focusing on creating products that combine functionality with aesthetics, appealing to workers who wear safety glasses for extended periods. The incorporation of sleek frames, vibrant colors, and customizable features makes these glasses suitable for both professional and recreational use. Industries such as construction, healthcare, and automotive are witnessing increased adoption of these stylish designs, as employers seek to enhance employee satisfaction and compliance with safety protocols. This trend has also expanded the use of polycarbonate safety glasses in consumer markets, such as cycling, hiking, and sports, where comfort and durability are essential.

Research Scope and Analysis

By Product Type

Prescription safety glasses are projected to dominate the global polycarbonate safety glasses market due to their ability to cater to a broader audience with specific visual needs. These glasses integrate corrective lenses with impact-resistant and protective features, offering a dual function of vision correction and eye safety. Workers with vision impairments often require prescription glasses to perform their tasks efficiently, particularly in precision-driven industries such as manufacturing, healthcare, and construction. The integration of safety and corrective features eliminates the need for workers to wear additional protective overlays, ensuring comfort and convenience.

The increasing prevalence of vision impairments, such as myopia and hyperopia, further drives the demand for prescription safety glasses. According to industry studies, a significant proportion of the global workforce requires corrective eyewear, emphasizing the importance of prescription safety glasses in occupational environments. Moreover, advancements in lens technology, including anti-fog, anti-scratch coatings, and UV protection, enhance the functionality of prescription safety glasses, making them a preferred choice across industries.

Regulatory compliance also supports the dominance of prescription safety glasses. Safety standards like ANSI Z87.1 in the U.S. and EN 166 in Europe mandate protective eyewear tailored to specific job requirements, including vision correction. These standards have led to widespread adoption among employers aiming to ensure compliance and minimize workplace injuries. While industries are increasingly recognizing the importance of ergonomic and multi-functional PPE, prescription safety glasses remain a dominant segment in the polycarbonate safety glasses market, aligning with worker preference and regulatory mandates.

By Distribution Channel

This distribution channel is anticipated to dominate the global polycarbonate safety glasses market because it involves direct engagement with customers, boosting the hands-on experience in products. Brick-and-mortar stores, industrial supply outlets, and optical retail chains remain the most favored outputs for businesses and individuals seeking quality safety glasses. The tangible nature of offline shopping allows customers to assess product fit, comfort, and design in real-time, which is particularly crucial for safety equipment that requires precise sizing and functionality.

Industrial buyers often rely on offline channels for bulk purchases, leveraging the personalized service and immediate product availability these outlets offer. Offline stores also provide expert advice, ensuring customers select the appropriate safety glasses based on their specific needs and occupational requirements. This is especially important in industries with unique safety challenges, such as construction, manufacturing, and healthcare, where customized solutions are often necessary.

Additionally, offline distribution channels play a vital role in facilitating compliance with safety standards. Retailers and suppliers often ensure that their products meet regulatory certifications such as ANSI, EN, or ISO standards, instilling confidence among buyers. Moreover, partnerships between manufacturers and distributors enable the rapid introduction of innovative products in the offline market.

Despite the rise of e-commerce, the offline channel is still the most prominent because of its reputation and the critical nature of safety glasses as a hands-on product. As industries focus on worker safety, offline outlets continue to cater to demand by combining convenience, reliability, and expert guidance, ensuring their sustained prominence in the market.

By End User

The manufacturing sector is projected to have the highest level of end users in the market for polycarbonate safety glasses, as processes in this area are usually rather dangerous. This industry is exposed to flying debris, sharp particles, sparks, and chemical splashes; hence, safeguarding the eyes is a safety factor. There is a very high demand for polycarbonate safety glasses within manufacturing environments due to their impact resistance, lightweight, and enhanced safety features.

Legislative requirements around the globe typically focus on safety for workers in manufacturing plants, and the use of certified eye protection is a standard. In the United States, compliance with OSHA standards is ensured under these regulations. In other developed countries, this is the same. Non-compliance with these rules is what pushes the manufacturing plant to employ polycarbonate safety glasses. This reduced risk of injury means reduced costs for injuries.

Advancements in safety glass technologies improve worker comfort and efficiency, enhancing manufacturing environments with anti-fog, anti-scratch coatings, and UV protection. Adjustable glasses with ergonomic designs ensure an accurate fit and minimal discomfort when worn for extended hours at work. As employers take such measures to keep their employees safe and productive, the market grows.

The global manufacturing output is expanding further, especially in regions like Asia-Pacific and North America. Thus, the demand for polycarbonate safety glasses continues to be strong. The sector's commitment to safety, coupled with the ongoing adoption of innovative protective solutions, ensures the manufacturing industry's dominance in the end-user segment of the polycarbonate safety glasses market.

The Polycarbonate Safety Glasses Market Report is segmented on the basis of the following

By Product Type

- Prescription Safety Glasses

- Non-prescription Safety Glasses

- Anti-fog Safety Glasses

- Anti-scratch Safety Glasses

- UV Protection Safety Glasses

By Distribution Channel

- Offline

- Specialty Stores

- Retail Stores

- Industrial Distributors

- Online

- E-commerce Platforms

- Manufacturer Websites

By End-user Industry

- Manufacturing

- Construction

- Healthcare

- Electrical and Electronics

- Sports and Recreation

Regional Analysis

North America is projected to dominate the global polycarbonate safety glasses market as it will

hold 38.5% of the market share by the end of 2025. The polycarbonate safety glasses market in North America leads the global segment because of strong regulatory exigencies, an excellent industrial base, and high levels of consumer awareness. These include strict workplace safety standards as directed by OSHA (Occupational Safety and Health Administration) and safety regulations across all industries that require protective eyewear in dangerous environments. This has placed a premium demand for polycarbonate safety glasses across several industries including construction, health care, manufacturing, and chemical processing sectors.

The region's state-of-the-art industrial infrastructure, such as modern manufacturing facilities and research labs, encourages the introduction and implementation of innovative safety products. Polycarbonate safety glasses equipped with advanced features such as anti-fog coatings, UV protection, and smart technologies are widely accepted in industries requiring precision and protection. Moreover, high-risk professions, such as those in mining, oil & gas, and aerospace, significantly influence the market share.

Additionally, a strong presence by key manufacturers like Honeywell International and 3M Company leads to high availability and strong distribution of safety glasses within the region. These firms are highly engaged in R&D activities to cater to evolving consumer needs, bolstering North America's leadership in this segment further. Another major factor in the rising demand is that employers and workers are highly conscious of PPE. Industries, along with health facilities, increased the safety emphasis post-pandemic and further fueled the adoption of polycarbonate safety glasses. A perfect amalgamation of these factors positions North America as the leading region in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Competition is fierce among major players in the polycarbonate safety glasses market, with significant emphasis on product innovation, strategic collaborations, and geographic expansion. Major companies with a leading participation in the market include Honeywell International, 3M Company, Kimberly-Clark, and Pyramex Safety, among others, offering advanced products with additional features such as UV protection, anti-fog coatings, and ergonomic designs.

Some key participants focus on R&D investments to introduce advanced solutions, such as prescription-compatible and smart safety glasses with augmented reality. These players also leverage partnerships and collaborations with industrial safety organizations to gain more customers. For example, strategic partnerships with healthcare facilities and manufacturing firms have been crucial in driving sales.

Regional players also play a significant role, especially in emerging markets where the demand for cost-effective solutions is high. These smaller players usually focus on competitive pricing and localized distribution networks to strengthen their foothold. As the market continues to grow, competition is likely to intensify, driving further innovation and market consolidation.

Some of the prominent players in the Global Polycarbonate Safety Glasses Market are

- 3M

- Honeywell

- Scott Safety (Tyco)

- DEWALT

- Radians

- MCR Safety

- Gateway Safety

- Kimberly-Clark

- MSA

- Pyramex

- Bollé Safety

- Uvex Safety Group

- Dursafety

- Other Key Players

Recent Developments

- January 2025: Pyramex Safety launched lightweight safety glasses with UV protection and anti-fog coatings at the International Safety Expo, emphasizing innovation for enhanced visibility and comfort in industrial, construction, and healthcare sectors.

- December 2024: Honeywell International partnered with a North American construction company to supply polycarbonate safety glasses, strengthening workforce safety compliance and expanding its footprint in industrial protective equipment solutions.

- November 2024: 3M Company announced investments to expand Canadian manufacturing facilities, targeting increased production of polycarbonate safety glasses for growing healthcare and industrial sector demands.

- October 2024: Kimberly-Clark introduced prescription-compatible safety glasses with blue-light blocking technology at the Annual PPE Innovations Conference, catering to workers requiring visual clarity and eye protection.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,139.0 Mn |

| Forecast Value (2033) |

USD 3,851.0 Mn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 692.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Prescription, Non-Prescription, Anti-Fog, Anti-Scratch, UV Protection), By Distribution Channel (Offline, Online), And By End-User Industry (Manufacturing, Construction, Healthcare, Electrical And Electronics, Sports And Recreation) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

3M, Honeywell, Scott Safety (Tyco), DEWALT, Radians, MCR Safety, Gateway Safety, Kimberly-Clark, MSA, Pyramex, Bollé Safety, Uvex Safety Group, Dursafety, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Polycarbonate Safety Glasses Market?

▾ The Global Polycarbonate Safety Glasses Market size is estimated to have a value of USD 2,139.0 million in 2025 and is expected to reach USD 3,851.0 million by the end of 2034.

What is the size of the US Polycarbonate Safety Glasses Market?

▾ The US- Polycarbonate Safety Glasses Market is projected to be valued at USD 692.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,209.6 million in 2035 at a CAGR of 6.4%.

Which region accounted for the largest Global Polycarbonate Safety Glasses Market?

▾ North America is expected to have the largest market share in the Global Polycarbonate Safety Glasses Market with a share of about 38.5% in 2024.

Who are the key players in the Global Polycarbonate Safety Glasses Market?

▾ Some of the major key players in the Global Polycarbonate Safety Glasses Market are 3M, Honeywell, Scott Safety (Tyco), DEWALT, Radians, MCR Safety, Gateway Safety, Kimberly-Clark, and many others.

What is the growth rate in the Global Polycarbonate Safety Glasses Market?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period.