Market Overview

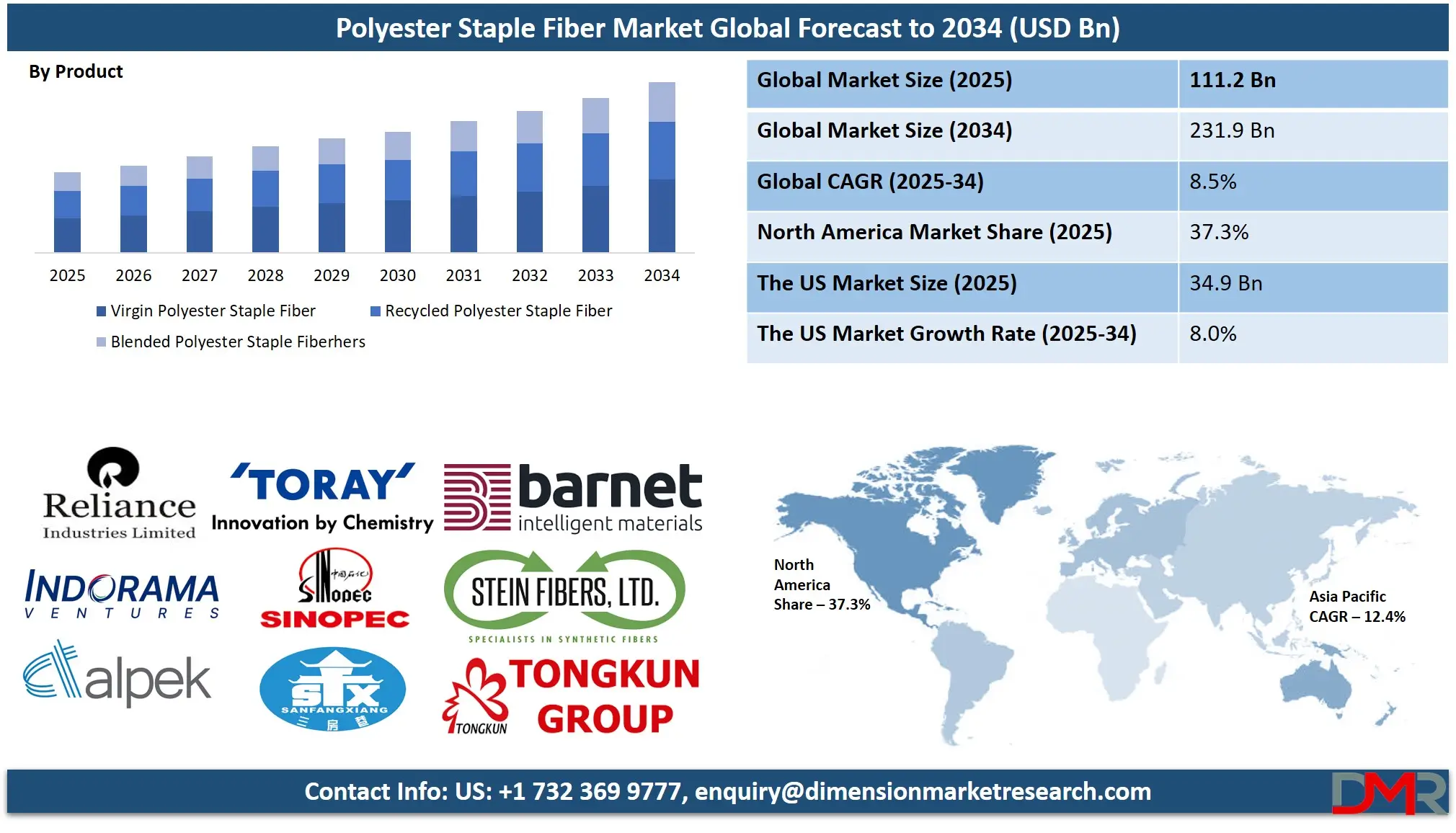

The Global Polyester Staple Fiber Market size is estimated at

USD 111.2 billion in 2025 and is expected to reach

USD 231.9 billion by 2034, at a

CAGR of 8.5% during the forecast period of 2025 to 2034.

The polyester staple fiber (PSF) global market is witnessing a consistent growth rate with growing demands from a variety of industries, from textiles, automotive, construction, to home furnishings. The durability, affordability, and flexibility of PSF have made it a staple in nonwoven fabric manufacturing, upholstery, carpets, as well as in fiberfill application. The market is influenced by growing urbanization, a growing populace, as well as a shift in consumer demands towards more environmentally and recycled-based material. The recycled polyester staple fiber (RPSF) is becoming increasingly preferred as environmental issues compel industries towards more ecologically sound solutions.

Greater emphasis on circular economies as well as government policies in support of sustainable textiles fuel growth in the

Monoethylene Glycol Market. The market is led by Asia-Pacific with the highest CAGR as its key producers as well as consumer countries in China and India, due to its established textile manufacturing industries. North America as well as Europe are also rapidly growing with rising demands for high-performance as well as sustainable fibers. Latin America as well as the Middle East & Africa are also growing steadily in the market. Fluctuations in raw material inputs in terms of purified terephthalic acid (PTA) as well as monoethylene glycol (MEG) are challenges to market stability.

Nonetheless, new technologies in polymers and developments in fibre processing are likely to counterbalance these limitations. Major companies, such as Indorama Ventures, Reliance Industries, and Toray Industries, are making investments in expansion in terms of capacity, innovation in terms of product, and mergers on a strategic level to consolidate market positions. Increased usage in automotive interiors as well as geotextiles is also opening new growth opportunities.

Also, increased application in furniture as well as bedding industries enhances the prospect in the market. The revival in textile as well as apparel industries in a post-pandemic scenario also drives growth in the market. Amidst environmental challenges regarding pollution from microplastics, increased demands for functional as well as environmental fibers also boost the market. Increased awareness as well as regulations will also promote more innovation as well as partnership strategies to produce polyester staple fibers cost-effectively and environmentally.

The US Polyester Staple Fiber Market

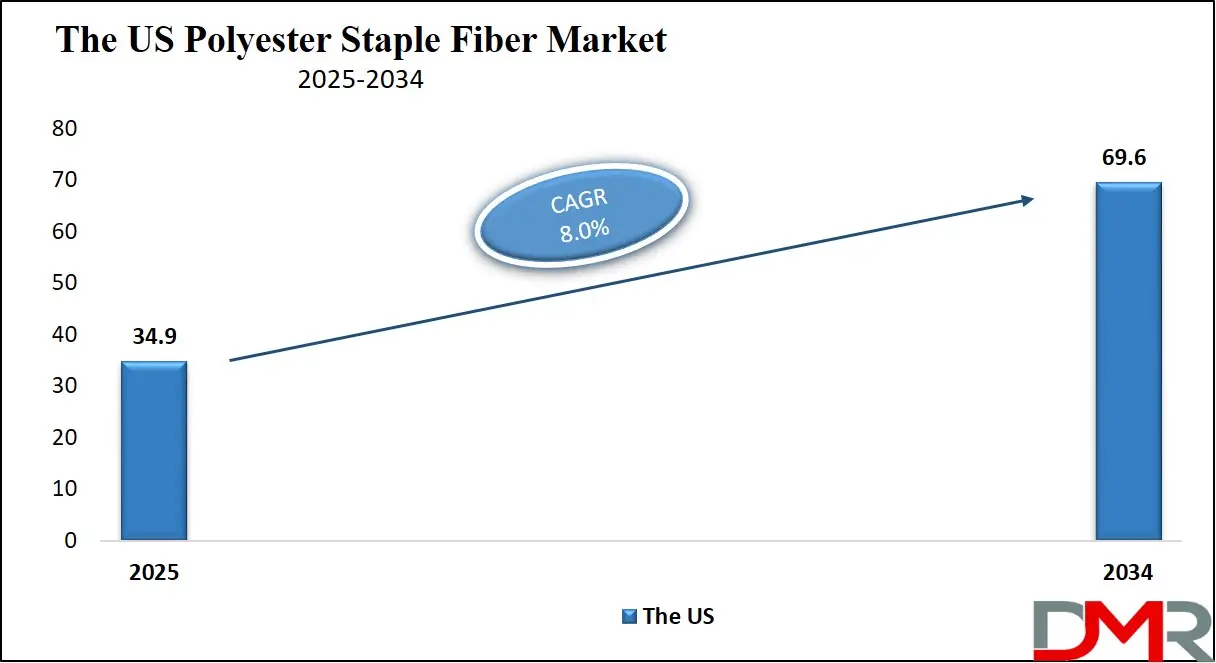

The

US Polyester Staple Fiber Market is projected to be valued at

USD 34.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 69.6 billion in 2034 at a

CAGR of 8.0%.The USA polyester staple fiber (PSF) market experienced remarkable growth with growing consumer awareness, environmental consciousness, as well as advancements in textile technologies. America in 2023 held a leadership role in North America in terms of revenue in the PSF market, a testament to America's high demands in a range of industries from textiles, automotive, home furnishings, as well as industrial sectors.

The revival in local textile manufacturing also proved a growth driver with growing consumer preference towards locally produced goods as well as government-initiated moves towards overhauling the sector. The USA also boasts a massive consumer base with diversified textile demands that translate into demands in a range of goods from apparel in the fashion sector to domestic furnishings.

One of the predominant trends shaping the U.S. PSF market is increased utilization of recycled polyester fiber (RPSF). Amid rising consumer as well as production pressures on sustainability, companies are making a conscious effort towards using recycled material in production. Brands like Patagonia, Adidas, as well as The North Face have made commitments towards procuring recycled polyester from plastic waste to reduce environmental impact as well as address rising governmental as well as consumer pressures on sustainability in fashion.

In addition, government initiatives towards a circular economy as well as textile recycling have encouraged companies towards investing in eco-friendly solutions, which in turn is driving the shift towards recycled PSF.

Aside from textiles, another important growth driver in terms of PSF demand is the automotive sector. The expansion in vehicle production alongside increased focus on light, durable, cost-effective material is spurring polyester fibers' extensive usage in automotive seat covers, carpets, insulation, as well as lining. The electric vehicle (EV) trend is also spurring growth as manufacturers turn towards high-performance, ecologically sound material in a bid to reduce fuel utilization as well as environmental impact.

Global Polyester Staple Fiber Market: Key Takeaways

- The Global Market Value Insights: The Global Polyester Staple Fiber Market size is estimated to have a value of USD 111.2 billion in 2025 and is expected to reach USD 231.9 billion by the end of 2034.

- The US Market Value Insights: The US Polyester Staple Fiber Market is projected to be valued at USD 34.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 69.6 billion in 2034 at a CAGR of 8.0%.

- Regional Analysis: North America is expected to have the largest market share in the Global Polyester Staple Fiber Market with a share of about 37.1% in 2025.

- Regional Analysis: Some of the major key players in the Global Polyester Staple Fiber Market are Reliance Industries Limited, Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Toray Industries, Inc., China Petroleum & Chemical Corporation (Sinopec), and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025.

Global Polyester Staple Fiber Market: Use Cases

- Apparel Manufacturing: Clothing manufacturing utilizes a great deal of polyester staple fibre (PSF), which is also utilized in manufacturing t-shirts, dresses, as well as sporting goods, because it is durable, resistant to wrinkles, moisture-wicking, and can keep its colours intact even with repeated washing.

- Home furnishings: PSF is a central material in upholstery, draperies, and bedding, providing softness, resiliency, and durability. Its resistance to fading and contraction improves the durability as well as aesthetic quality of home furnishings over a longer usage.

- Automotive interiors: Widely utilized in car seat covers, carpets, as well as padding, PSF is a durable, comfortable, as well as cost-effective material. Abrasion, moisture, as well as stain resistance make it a suitable fit in tough automotive interior solutions.

- Nonwoven Fabrics: In hygiene and medical application, PSF is utilized in nonwoven fabrics in surgical gowns, masks, as well as in wipes. It is characterized by its strength, absorbency, as well as hypoallergenic quality, which makes it deliver high-performance disposable medical textiles.

- Building Materials: PSF is blended into geotextiles, insulation, and cement, enhancing durability, thermal insulation, as well as moisture resistance. Being light in weight, it improves construction speed as well as structural durability in the long run.

Global Polyester Staple Fiber Market: Stats and Facts

- Increasing Demand from the Textile Industry: PSF's rising popularity within apparel production can be attributed to its cost-effective and versatile properties as a cotton replacement, which makes PSF an increasingly appealing alternative.

- Demand from Home Furnishings: Consumer spending growth in home furnishings categories such as pillows, sofas, and carpets has contributed significantly to market expansion for PSF home furnishing products such as pillows.

- Rise in Recycled Polyester Staple Fiber Use: Rising awareness of the environmental benefits associated with recycled PSF has contributed to an upsurge in its usage and market growth opportunities as it helps reduce plastic waste and carbon emissions.

- Restraints from Legal and Political Regulations: Stringent regulations on PSF manufacturers, particularly regarding sustainability and environmental standards, pose challenges to market growth.

- Sustainable Fashion Growth: The increasing popularity of sustainable fashion, made from eco-friendly recycled PSF, is boosting market demand due to its vivid colors and designs.

- Safety of Polyester Staple Fiber: PSF is deemed safe for all applications, and its recycled version is an environmentally friendly option, contributing to sustainable practices in various industries.

- China’s Staple Fiber Production Concentration: China’s staple fiber production capacity is highly concentrated in East China, particularly in Jiangsu, Fujian, and Zhejiang, which account for the majority of the country’s production.

- US Safeguard Investigation on PSF: In March 2024, WTO estimated that the U.S. initiated a safeguard investigation into fine denier PSF to assess if increased imports are harming the domestic industry.

Global Polyester Staple Fiber Market: Market Dynamic

Driving Factors in the Global Polyester Staple Fiber Market

Expanding Textile and Apparel IndustryThe booming global apparel and textile sector is a key driver of PSF demand. Being durable, affordable, and versatile, PSF is highly used in apparel manufacturing. Industrial expansion, increased disposable income, as well as urbanization in developing countries, have initiated textile consumption, fueling PSF demand.

Developing countries such as China, India, Bangladesh, as well as Vietnam are dominating textile manufacturing with cost-efficient production costs as well as high overseas marketplaces. In addition, online retailing platforms have raised apparel sales, leading towards high synthetic fiber utilization. The textile market in the Asia-Pacific accounted for a high market revenue of 78.0% in 2023 according to Grand View Research. The demand for high-performance, affordable fibers such as PSF will be high as more fast-fashion brands are increasing product lines.

Rising Demand in Home Furnishings and Automotive Sectors

Besides textiles, PSF is also crucial in home furnishings as well as in automotive. The durability, softness, as well as water resistance, of the fiber makes it a material of preference in upholstery, carpets, bedding, as well as drapes. The booming housing sector in developing nations also drives increased demand in home textiles, which in turn supports PSF consumption. The automotive sector also relies on PSF in terms of seat covers, floor mats, headliners, as well as insulation.

Carmakers' preference towards light weights to achieve fuel economy is also fueling increased demand in terms of PSF in vehicle interiors. The growth in electric vehicle (EV) sales is also fueling growth in terms of PSF as it is used in light weighting a vehicle at a minimal cost in terms of comfort as well as durability.

Restraints in the Global Polyester Staple Fiber Market

Environmental Concerns and Regulatory Pressures

One of the biggest challenges is production environmental impact, in terms of virgin polyester. The material is petrochemical-based, with greenhouse gas emissions as well as pollution from microplastics. Governments across the world are tightening regulations around production from synthetic fibre, as well as transition towards biodegradable fibre, as well as recycled fibre. Such a regulatory context elevates production costs for producers with a need to invest in more environmental production technologies such as bio-based polyester as well as advanced recycling technologies. Producers' failure to comply with environmental regulations can lead to monetary fines, market restriction, as well as reputational damage.

Fluctuations in Raw Material Prices

The volatile cost of crude oil as well as petrochemical derivatives impacts PSF production costs, which in turn impacts market stability. The cost of polyethylene terephthalate (PET) resins is highly susceptible to its impact on the PSF sector, which is tied into global supply/demand fundamentals in terms of crude oil. Supply chain interruptions, geopolitical risks, as well as economic uncertainty, can create volatile raw material costs impacting profit at the manufacturing level. To counter these risks, businesses are investing more in alternative raw material sources as well as looking into recycled polyester solutions to stabilize costs as well as minimize petroleum-based input dependency.

Opportunities in the Global Polyester Staple Fiber Market

Adoption of Circular Economy Practices

Adoption of circular economy principles is a high-revenue growth prospect in the case of the PSF market. Industries are increasingly looking at closed-loop recycling models as environmental awareness is growing, with a focus on waste minimization and reduced reliance on raw material from a virgin source. Global brands are increasingly turning towards recycled PSF from polyester bottles as well as textile waste, cutting down on environmental footprint substantially.

Recycling start-ups, textile producers, as well as waste management companies, are also joining hands in making the supply chain operational in case of second-hand polyester clothes more efficient. Investment in advanced sorting, chemical recycling, as well as mechanical treatment is enhancing quality as well as operational efficiency in case of recycled PSF, making it a viable substitute in case of virgin fibers. Governments' imposition of tougher sustainability measures will give companies with a greener approach a big competitive boost.

Expansion into Emerging Markets

Emerging economies have high growth possibilities in the PSF sector with increased industrial activity, urbanisation, as well as textile and construction material requirements. Growth is highest in the Asian-Pacific region with drivers from nations such as India, China, Bangladesh, as well as Indonesia. The extensive textile manufacturing industries in the region, as well as increased consumer spend on furnishings, as well as clothes, are driving growth in PSF.

The Middle East as well as African nations are also experiencing increased textile production investments, providing new opportunities for PSF producers. Companies with a presence in these regions can capitalize on increased infrastructure development projects, a growing consumer class, as well as increased exports.

Trends in the Global Polyester Staple Fiber Market

Shift Towards Sustainable and Recycled Polyester Staple Fibers (PSF)

The global market for PSF is witnessing a revolutionary shift as sustainability is becoming a primary choice. The manufacturing sector is gravitating more toward recycled PSF as a way of adhering to environmental regulations as well as consumer demands for greener products. The transition is bolstered by stringent plastic waste as well as greenhouse gas emissions regulations, as well as advancements in recycling technologies. Businesses are investing in research as well as development in a move to boost the quality of recycled PSF on par with that of virgin fibers.

A prime example is Frankfurt-based startup Reju that established a chemical recycling process that breaks down polyester into its molecular form to be reconstituted into high-end fibers. The innovation makes endless recycling with no quality loss a possibility, addressing challenges in sustainability at no cost in quality. The more plastic pollution is known around the globe, the more in demand is expected in sustainable PSF as large textile as well as apparel brands are beginning to add recycled fibers into lines.

Technological Advancements in Fiber Production

Fibre manufacturing innovation is increasingly shaping the market for PSF. Recent innovation is focused on improving fibre strength, durability, as well as fibre performance, making PSF more suitable in a broader range of application areas, from industrial textiles, home furnishings, to automotive textiles. Premium-performance PSF is increasingly developed with improved tensile strength, fire resistance, as well as thermal insulation.

Reliance Industries, for instance, recently developed a new high-strength polyester fibre in July 2024 that is specifically designed for automotive applications in upholstery as well as seat belt usages. The fibre is more durable as well as cost-effective, in line with industrial requirements for a durable, as well as light material. In addition, nanotechnology as well as advanced treatments on polymers are increasingly becoming a component in fibre manufacturing, improving functional properties in PSF. The innovation is expanding market scope in terms of industries that can be targeted by PSF, with growing innovation as well as take-up.

Global Polyester Staple Fiber Market: Research Scope and Analysis

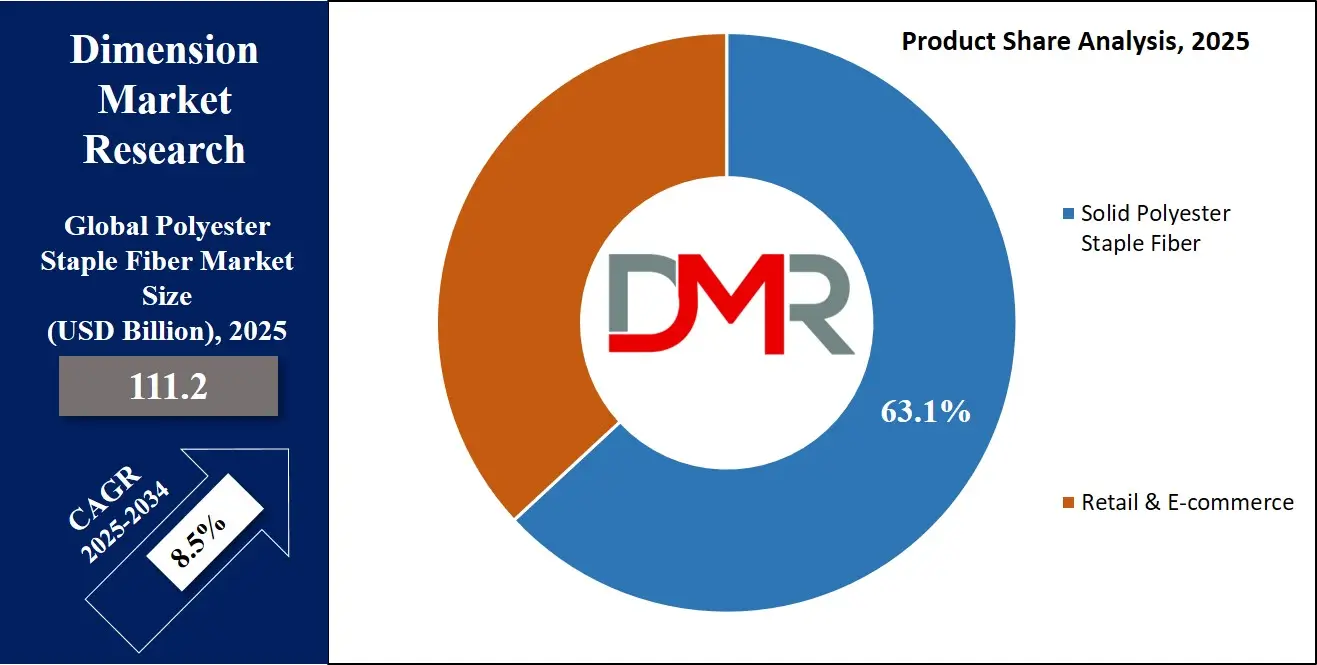

By Product

Solid Polyester Staple Fiber (PSF) is projected to dominate the global PSF market as it is anticipated to hold 63.1% of market share in 2025. This dominance is due to its impressive physical attributes, cost-effectiveness, as well as its widespread usage in a wide range of industries. The high durability as well as high tensile strength are its two key strengths that make it a viable material in high-performance industrial textiles, clothes, as well as domestic furnishings. Solid PSF is more abrasion-resistant in comparison with hollow PSF, making its products durable in both daily usage as well as environmental demands. Its abrasion resistance makes it highly appropriate in case of heavy-duty textiles, upholstery, as well as outdoor textiles that are in requirement of enhanced durability.

Aside from its strength, firm PSF also holds dye tightly and is highly colorfast, giving brilliant, durable colors that do not tend to deteriorate with time. Such a quality is greatly prized in both the apparel and home furnishings industries, in which aesthetic is paramount. In addition, its simple processability and compatibility with other fibers, like cotton and wool, makes fabric more versatile, with producers able to produce a variety of goods suited to a variety of requirements.

From a manufacturing perspective, solid PSF is energy-efficient and cost-effective as it is made with fewer manufacturing steps as compared with its hollow counterpart. The efficiency in manufacturing lowers overall costs, making it a favored product in high-volume manufacturing. In light of industries focusing more on cost-efficient and environmental solutions, solid PSF is still the leading product form, especially in Asian-Pacific regions with textile manufacturing growing at a high rate. Its compatibility with balancing affordability, quality, as well as ease in usage.

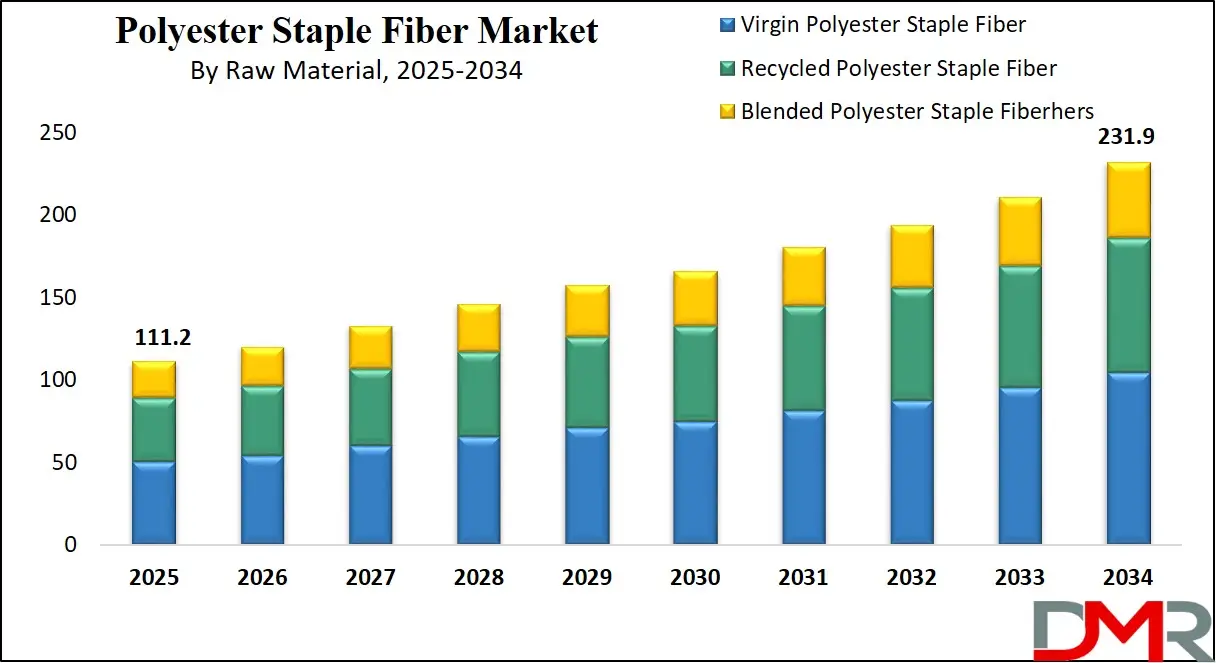

By Raw Material

Virgin Polyester Staple Fiber (PSF) is projected to maintain its market leadership due to its high purity, superior consistency, and enhanced mechanical properties compared to recycled alternatives. Unlike recycled PSF, which may contain impurities or slight inconsistencies due to multiple processing cycles, virgin PSF is manufactured from freshly synthesized petrochemical polymers, ensuring uniformity in fiber properties. This makes it highly reliable for applications requiring strict quality control, such as automotive textiles, medical fabrics, and premium apparel.

One of its largest strengths is that it is highly elastic as well as having high tensile strength, making it ideal for those products that are required to be enduring mechanical stress. Some examples are industrial textiles as well as high-fashion clothes, as well as automotive seat covers. Virgin PSF also has enhanced thermal stability as well as resistance towards shrinkage, which is crucial in those applications that are required to be subjected to varying temperatures as well as repeated launderings, i.e., sporting goods as well as bedding.

Another important driver in the preference for virgin PSF is its hypoallergenic and hygiene quality, which makes it ideal for medical, hygiene, and infant apparel application. Some companies are also preferring virgin fibers to comply with stringent health as well as safety measures, especially in developed regions like North America as well as Europe.

While sustainability trends are shifting the market towards recycled PSF, in high-performance applications in which quality fibers as well as strength cannot be compromised, virgin PSF cannot be substituted. Because global demand for high-performance as well as durable synthetic fibers continues to grow, virgin PSF will remain in a leading position in the market.

By Application

Automobile production is a foremost consumer of Polyester Staple Fiber (PSF), due to its durability, lightness, and affordability. The increased demand from the automotive industry for comfortable, durable, as well as fuel-efficient interiors in vehicles made PSF a material of preference in seat upholstery, carpets, as well as insulation components. The vast application is primarily due to the sector's need for a durable yet light material that not only minimizes vehicle weights, as well as fuel economy.

One key benefit of PSF in automotive is its resistance to environmental stressors, tear, and wear. The interiors of a car are exposed regularly to mechanical friction, UV light, as well as thermal fluctuations. PSF, especially virgin PSF, is highly durable in terms of maintaining its strength, shape, as well as functionality over a long time. Its moisture resistance as well as its resistance to pilling also makes it suitable for extended usage in a vehicle.

Another key reason why it is a market leader in the automotive sector is its acoustic as well as thermal insulation properties. PSF reduces noise as well as vibration in a vehicle, making it more comfortable for occupants. Apart from that, its thermal insulation makes driving comfortable in unfavourable climatic conditions. Such a feature is highly appropriate in electric as well as luxury vehicles, wherein comfort is a prime consideration.

With increased interest in electric vehicles (EVs) as also a move towards more environmentally friendly and recyclable raw material, automotive industries are considering means by which recycled PSF can be made available in interiors with no quality sacrifice. Nonetheless, virgin PSF is still more common, especially in high-performance vehicle interiors, as it is tougher, more reliable, and more durable. Global automotive output is on the rise, particularly in North America as well as in Asia, making the role of PSF in the industry likely to grow.

The Global Polyester Staple Fiber Market Report is segmented on the basis of the following

By Product

- Solid Polyester Staple Fiber

- Semi-dull Optical White

- Bright Optical White

- Black Dope Dyed

- Colored Dope Dyed

- Others

- Hollow Polyester Staple Fiber

By Raw Material

- Virgin Polyester Staple Fiber

- Recycled Polyester Staple Fiber

- Blended Polyester Staple Fiber

By Application

- Automotive

- Home Furnishing

- Apparel

- Filtration

- Others

Global Polyester Staple Fiber Market: Regional Analysis

Region with Highest Market Share

North America is expected to hold

37.3% of market share in the global polyester staple fiber (PSF) market in 2025, driven by its well-established textile production as well as automotive industries. The region is bolstered by a sound supply chain, state-of-the-art manufacturing facilities, as well as high consumer demand, which once more supports its leadership in the sector. The presence of leading textile producers, as well as increasing high-performance fibers demand, supports the competitive position of the region.

Advanced healthcare in North America is also a contributor to the demand for PSF, specifically in medical textiles that are utilized in hygiene products, wound care, as well as in protective clothing. The growing awareness towards sustainability has also seen more investments in recycled PSF with companies incorporating principles in a circular economy to minimize environmental footprint. The early take up on new technologies in terms of bio-based as well as specialty fibers is also making North America a global leader in terms of PSF.

The growth in textile production in Mexico and America is a direct consequence of domestic consumption growth, liberal trade regimes, as well as rising export activity. Mexico is geographically placed in a position that makes it a production hub in North America, with cost-effective production possibilities that attract production in terms of PSF. The expansion in the automotive sector also raised the application of PSF in automotive interiors, enhancing comfort, durability, as well as insulation. All these have made North America a market leader in terms of its hold on the global market of PSF.

Region with Highest CAGR

Asia-Pacific is expected to experience a high compound annual growth rate (CAGR) in its market for PSF due to industrial growth, economic expansion, as well as growing consumer markets. The regions of China, India, as well as Bangladesh have evolved into global textile production powerhouses with competitive costs, a high labor supply, as well as highly advanced infrastructure. Such attributes have established Asia-Pacific as a global textile exporting power with a market share over 55.0%, with PSF as a material that is cost-effective as well as highly versatile.

China remains the largest consumer as also a producer of PSF with government support towards industrial growth as also sustainability in the textile sector. In India, technical textiles, as also high-performance fibers, have seen increased investments with government plans in position, which also involve the Production Linked Incentive (PLI) scheme. Bangladesh, a key apparel player in the global textile sector, is greatly reliant on importing PSF to fuel its rising apparel production, hence a key player in the regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Polyester Staple Fiber Market: Competitive Landscape

The global polyester staple fiber market is marked by fierce competition between key players. They strive for market dominance through innovation, capacity expansion and strategic partnerships; Indorama Ventures, Reliance Industries and Toray Industries among others have invested significantly to expand production capacities to meet rising demands from textiles, automotive, industrial and other applications.

Toray Industries has become an innovative leader in high-performance materials by developing PSF solutions with superior mechanical properties and environmental sustainability. By applying its cutting-edge research to next-generation fiber applications for diverse uses, Toray strives to offer next-gen fibers for various purposes, while regional players in emerging markets expand production capacities to meet domestic and export demand, increasing market competition further.

The PSF market has witnessed increased mergers and acquisitions as major firms acquire smaller firms to boost technological capabilities and diversify product portfolios. Strategic collaborations between manufacturers and end-use industries such as apparel or automotive companies drive product innovations tailored to specific industry demands -reflecting an industry in constant evolution with major players taking steps to remain competitive within the global PSF market.

Some of the prominent players in the Global Polyester Staple Fiber Market are:

- Reliance Industries Limited

- Indorama Ventures Public Company Limited

- Alpek S.A.B. de C.V.

- Toray Industries, Inc.

- China Petroleum & Chemical Corporation (Sinopec)

- Jiangsu Sanfangxiang Group Co., Ltd.

- W. Barnet GmbH & Co. KG

- Stein Fibers, Ltd.

- Tongkun Group Co., Ltd.

- Nan Ya Plastics Corporation

- Far Eastern New Century Corp

- Huvis Corp.

- Other Key Players

Recent Developments in Global Polyester Staple Fiber Market

- February 2025: Reju, a startup based near Frankfurt, Germany, unveiled a revolutionary chemical recycling process capable of converting used polyester into high-quality, reusable polyester. This innovation aims to address the environmental challenges associated with traditional polyester production, reducing plastic waste and promoting a circular economy in the textile industry.

- July 2024: Reliance Industries launched a high-strength polyester fiber specifically tailored for automotive applications, enhancing durability, flame resistance, and cost-efficiency in vehicle interiors. This innovation is expected to improve vehicle safety standards and fuel efficiency by reducing overall weight.

- February 2024: Indorama Ventures announced a 15% increase in its global PSF production capacity to meet the escalating demand from the automotive and textile sectors. The company has also committed to enhancing its sustainability efforts by integrating more recycled materials into its production processes.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 111.2 Bn |

| Forecast Value (2034) |

USD 231.9 Bn |

| CAGR (2025-2034) |

8.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 34.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Solid Polyester Staple Fiber, Hollow Polyester Staple Fiber), By Raw Material (Virgin, Recycled, Blended Polyester Staple Fiber), By Application (Automotive, Home Furnishing, Apparel, Filtration, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Reliance Industries Limited, Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Toray Industries, Inc., China Petroleum & Chemical Corporation (Sinopec), Jiangsu Sanfangxiang Group Co., Ltd., W. Barnet GmbH & Co. KG, Stein Fibers, Ltd., Tongkun Group Co., Ltd., Nan Ya Plastics Corporation, Far Eastern New Century Corp, Huvis Corp., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Polyester Staple Fiber Market size is estimated to have a value of USD 111.2 billion in 2025 and is expected to reach USD 231.9 billion by the end of 2034.

The US Polyester Staple Fiber Market is projected to be valued at USD 34.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 69.6 billion in 2034 at a CAGR of 8.0%.

North America is expected to have the largest market share in the Global Polyester Staple Fiber Market with a share of about 37.1% in 2025.

Some of the major key players in the Global Polyester Staple Fiber Market are Reliance Industries Limited, Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Toray Industries, Inc., China Petroleum & Chemical Corporation (Sinopec), and many others.

The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025.