Market Overview

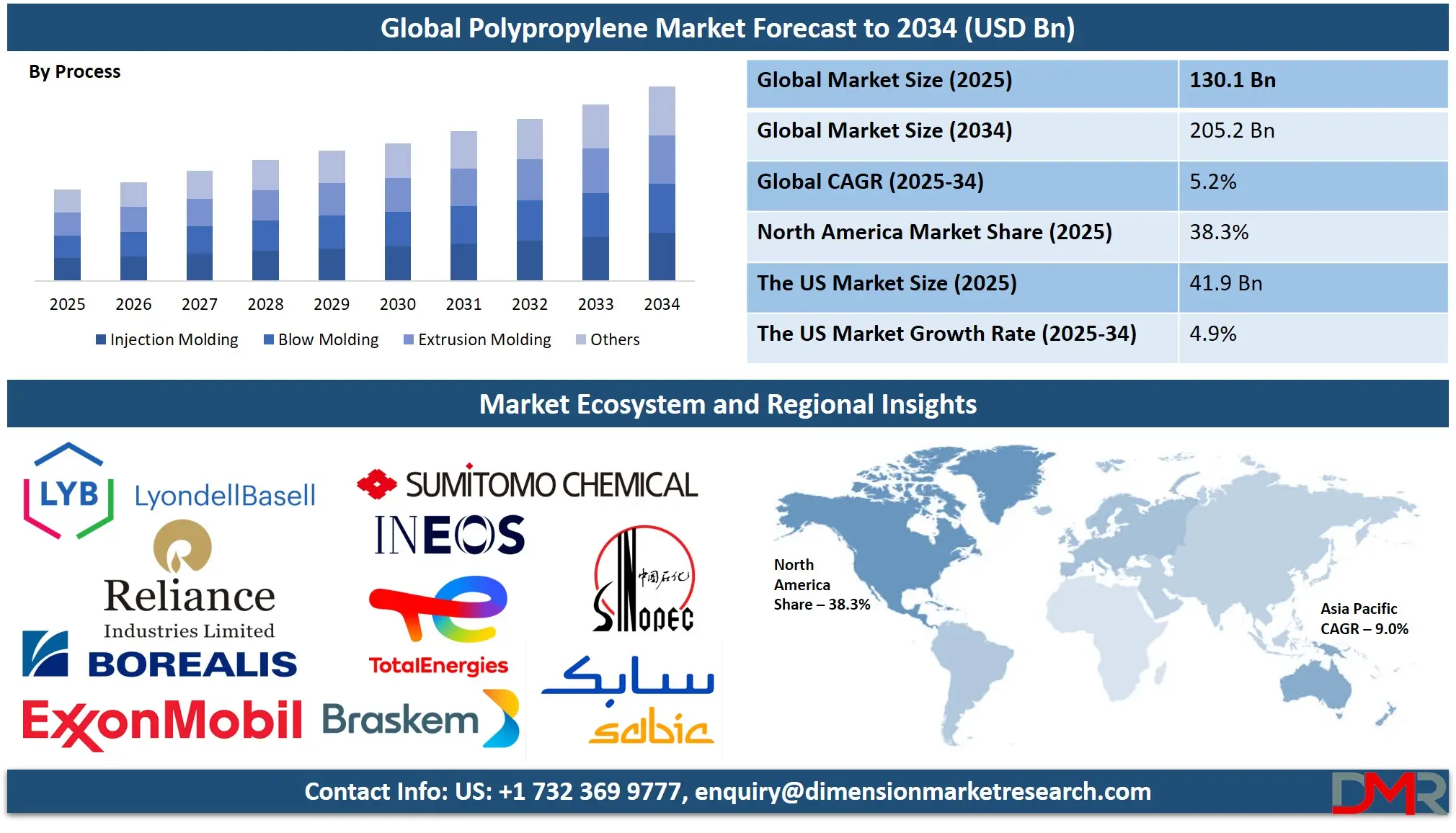

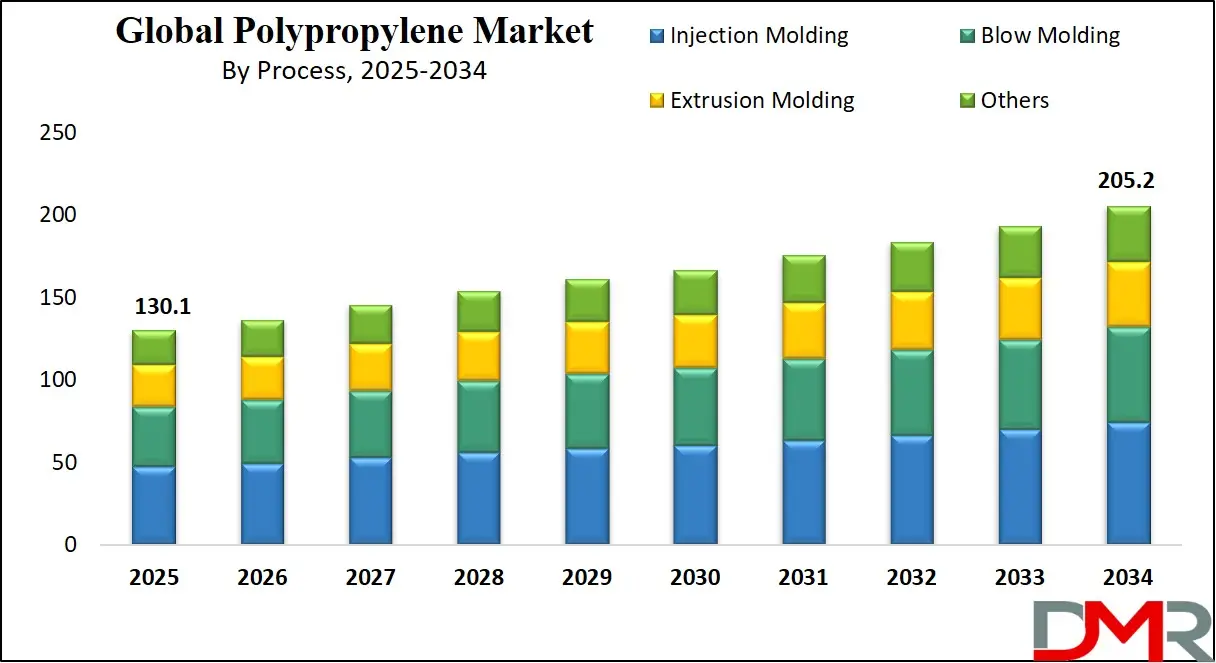

The Global Polypropylene Market is projected to be valued at USD 130.1 billion in 2025 which is further forecasted to reach a market value of USD 205.2 billion in 2034 at a CAGR of 5.2%.

Polypropylene market growth has experienced strong acceleration over recent years due to its widespread usage within the packaging, automotive, construction, and textile industries. Lightweight yet strong materials have long been recognized as market drivers, particularly within the auto sector where these materials can help manufacture lighter components to increase the mileage of vehicles.

E-commerce activity has contributed to an increase in demand for moisture-proof materials used as packaging solutions due to their strong and moisture-proof protection properties. Increased interest in green packaging materials has spurred innovation of biodegradable and recyclable polypropylene material that meets both international environmental protection regulations as well as end users' demands.

Polypropylene market growth may be hindered by several obstacles, including volatility in raw material prices and environmental concerns associated with plastic waste. Fluctuations in crude oil, propylene oxide, and propylene prices directly impact production costs for manufacturers; stringent regulations on single-use plastics have led to industries seeking alternative materials – thus decreasing market expansion; however, advances in recycling technologies and biodegradable polypropylene variants should help counter these challenges, creating opportunities for market participants..

North America and Europe boast significant shares due to technological innovations and key industry participants. Asia-Pacific also represents a sizeable portion due to rapid industrialization, urbanization, and increasing manufacturing activity in China and India, market opportunities are strong due to increased research spending as well as the need for innovative applications that expand end-use industries. With the increasing priority of sustainability, the adoption of green polypropylene solutions is also likely to generate emerging opportunities for growth within the next couple of years.

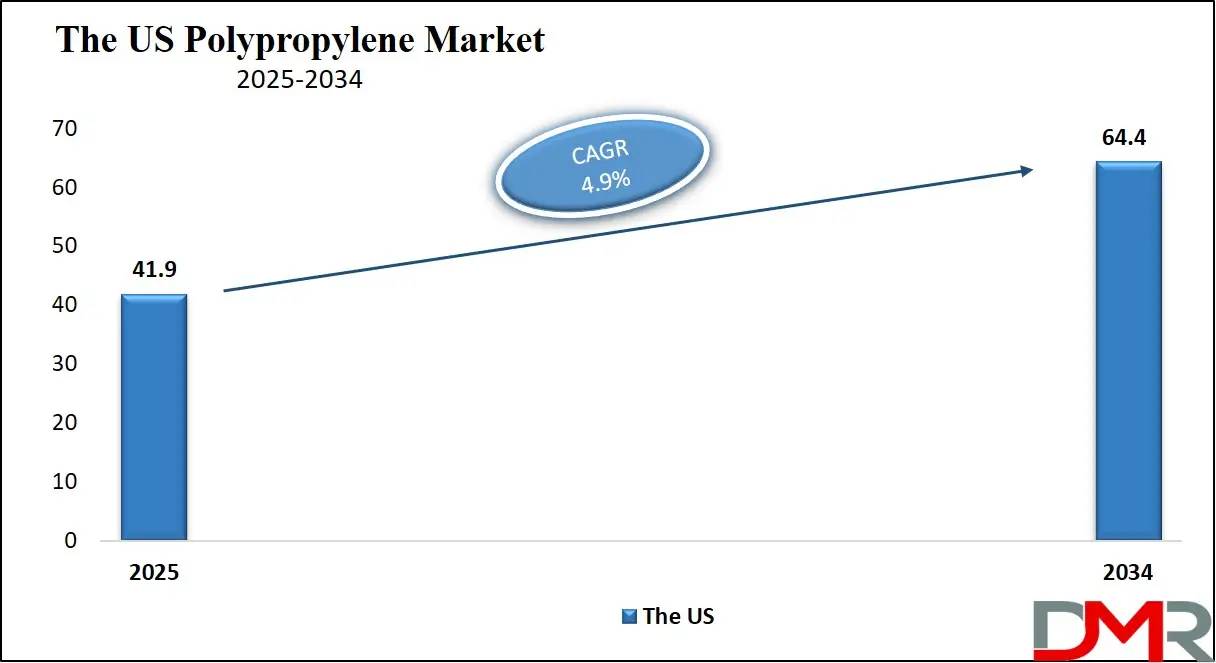

The US Polypropylene Market

The US Polypropylene Market is anticipated to have a market size of USD 41.9 billion in 2025 which is further anticipated to reach USD 64.4 billion in 2034 at a CAGR of 4.9%.

The US polypropylene market is driven by robust demand from key industries like automotive, packaging, and healthcare. Thanks to advanced manufacturing infrastructure and technological innovations that place America as one of the leaders in polypropylene production and consumption. Automotive sectors especially value polypropylene's lightweight properties that meet stringent fuel efficiency and emission regulations while its popularity with online merchants ensures product safety during transit.

Demographically speaking, the US has a diverse consumer population with large disposable incomes who drive demand for everyday polypropylene applications in everyday uses. US business has also seen an upsurge of environmental awareness as investments are made into technologies such as bio-based polypropylene production and recycling that help tackle environmental challenges.

According to recent updates, it is anticipated that the US polypropylene market will experience steady development over the coming decade thanks to sustained industrial expansion and innovation. With an established research-and-development culture and market competitiveness within global polypropylene production.

Global Polypropylene Market: Key Takeaways

- Global Market Size Analysis: The global polypropylene market size is estimated to have a value of USD 130.1 billion in 2025 and is expected to reach USD 205.2 billion by the end of 2034.

- The US Market Size Insights: The US polypropylene market is projected to be valued at USD 41.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 64.4 billion in 2034 at a CAGR of 4.9%.

- Regional Insights: North America is expected to have the largest market share in the global polypropylene market with a share of about 38.3% in 2025.

- Key Players Insights: Some of the major key players in the global polypropylene market are LyondellBasell, ExxonMobil, SABIC, Braskem, INEOS, Borealis, Sinopec, Reliance Industries, TotalEnergies, and many others.

- Global Growth Rate Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period.

Global Polypropylene Market: Use Cases

- Packaging: Polypropylene food packaging solutions are popularly chosen due to their freshness retention properties, durability, and moisture-proof properties. Polypropylene can be seen used to coat containers, film, and wraps which protect products while prolonging shelf life and shelf life is thus extended by using polypropylene as coating material.

- Automotive: Polypropylene has long been recognized for its use in creating lightweight automotive components like bumpers, dashboards, and interior trims - helping reduce vehicle weight while simultaneously increasing fuel economy, decreasing emissions, and helping meet global sustainability objectives.

- Healthcare: Polypropylene holds a top priority within healthcare to create robust, strong, and sterile medical devices such as instruments, IV bags, and syringes that offer maximum protection and trustworthiness to medical applications.

- Textiles: Polypropylene can be found widely applied to non-woven textile applications for diapers, sanitary napkins, and geotextiles - it's often chosen when durability and performance across many applications are desired.

Market Dynamic

Global Polypropylene Market: Driving Factors

Expansion of End-Use Industries

The global polypropylene market is heavily driven by end-use industries like automotive, packaging, healthcare, and construction which continue to experience steady expansion. Automotive applications of lightweight polypropylene parts have seen rapid expansion due to fuel-saving vehicles and electric vehicle production requirements, driving their increased use.

Due to the surge in online retailing and customers' changing requirements, packaging industries have increasingly turned towards polypropylene as it proves cost-effective and flexible for packaging applications. Healthcare sector businesses witnessed an increasing need for strong yet cleanable medical devices like syringes and bags that would support emerging market industries' expansion efforts, driving demand.

Technological Advancements and Innovation

A major driver of growth has been technological advancements made to polypropylene production using technologies such as metallocene-catalyzed polypropylene production or advanced polymerization techniques that have increased material properties to more applications, as well as opening up opportunities through high-performance polypropylene grades with increased strength, heat tolerance & flexibility for use in construction & textile industry applications. Players have invested significantly to automate & digitalize production for optimal processing at lower costs with higher quality output which further boosts market expansion thereby driving market expansion.

Global Polypropylene Market: Restraints

Volatility in Raw Material Prices

A major impediment to global polypropylene market growth is the price volatility of propylene and crude oil raw materials, particularly propylene. Since it is petroleum-derived, its price directly impacts production costs as well as profit levels over time causing issues for manufacturers with their strategies in the long run. Political tension between nations or supply chain disruptions further compound this challenge to the growth of the market. It also causes price variability that can impact the manufacturers' levels of profit to the extent of causing them problems with the issue of strategies in the long run. Political tensions among the nations and supply chain disruptions can also enhance price variability that challenges the growth of the market.

Environmental Concerns and Regulatory Challenges

Pollution, plastic waste, and regulation challenges present polypropylene manufacturing with formidable challenges. Governments around the globe have passed stricter legislations designed to eliminate single-use plastic usage while encouraging sustainable solutions, yet complying with these legislations adds costs for companies while simultaneously inspiring innovation among manufacturers. Consumer awareness regarding pollution using plastic is increasing consumer preferences toward green materials over traditional polypropylene use; organizations must invest in green strategies, waste management, and green product design to compete more successfully against competitors in this market.

Global Polypropylene Market: Opportunities

Emerging Markets in Asia-Pacific and Latin America

The polypropylene market offers significant growth prospects in emerging economies like China, India, Brazil, and Southeast Asian nations such as Indonesia. Rapid urbanization, rising disposable incomes, and government investments into infrastructure development create opportunities for polypropylene use in construction materials, polypropylene compounds, as well as textile production – driving demand further for packaging, automotive, and consumer products made of this plastic resin material. Furthermore, an expanding middle-class population and an expanding e-commerce sector should serve to further drive market expansion here..

Development of Recyclable and Bio-based Polypropylene

Sustainable development bringing tremendous opportunities, such as recyclable and bio-based polypropylene development is on an upswing, fuelled by both government agencies as well as consumers looking for sustainable solutions. Government incentives encourage sustainable manufacturing behavior among manufacturers while collaborative efforts between industry players and recycling sectors enhance this trend, offering businesses additional sources of revenue streams through sustained opportunities that could bring sustained benefits over time.

Global Polypropylene Market: Trends

Shift Toward Sustainable and Bio-based Polypropylene

One of the most notable global trends within polypropylene markets today is their increasing focus on sustainability. With environmental awareness growing and regulations tightening on single-use plastic usage, manufacturers are investing heavily in developing bio-based and recyclable polypropylene material. Technologies such as biodegradable plastics, biodegradable polypropylene, and next-generation recycling technologies are becoming more widely adopted to enable industries to reduce their carbon imprint, with consumers and government both following suit in European and North American markets. Companies have also taken notice, adopting circular economy principles by emphasizing the reuse of materials or recycling polypropylene products to avoid wastefulness.

Rising Demand for Lightweight Materials in Automotive and Packaging

Demand for lightweight yet robust materials is another primary driver behind its growth. Polypropylene has become increasingly prevalent within the automotive industry for making components like bumpers, dashboards, and interior trims that reduce weight while improving fuel economy. Polypropylene's moisture resistance, flexibility, and durability make it the preferred material in food packaging, filmmaking, containers, and e-commerce packaging - further amplified by e-commerce applications that ensure product safety during transit - driving demand globally but particularly within emerging economies.

Research Scope and Analysis

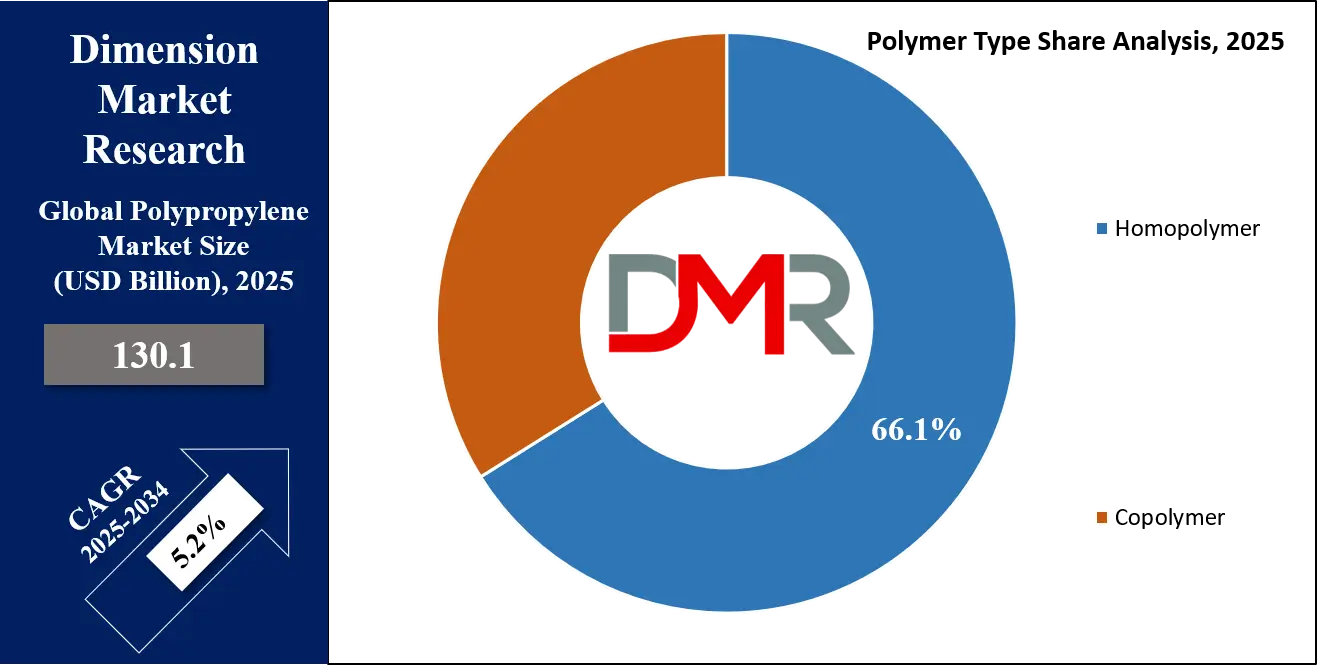

By Polymer Form

Homo-polymer polypropylene is projected to dominate the global market as it will hold 66.1% of the market share by the end of 2025. Homo-polymer polypropylene is the international market leader due to its higher strength, stiffness, and superior properties of chemical resistance. It is composed of a single monomer propylene that imparts a homogeneous molecular structure to the material, and is also finding increasing relevance in sectors such as molecular diagnostics where precision, reliability, and material performance are critical..

For this reason, the material possesses very strong properties of mechanics that are ideally suited to applications that are strength- and rigidity-demanding like car components, housewares, and industrial applications. Its temperature endurance at higher temperatures and corrosion properties also contribute to its popularity with several various industries.

Another reason that accounts for its supremacy is its cost savings and ease of processing. Homo-polymer polypropylene is less costly to manufacture compared to the various copolymer types, thus being a manufacturer's choice of choice due to the need to obtain high-performance material at a lower price tag.

Its adaptability to various processing techniques like injection molding and extrusion enables it to find applications across a broad range of uses. Its light weight also meets the increasing need to cut down the overall weight of the final product, especially among the motor vehicles and the packaging industry. All of this added to the ready supply base of the material and established supply networks cement the status of homo polymer polypropylene as the most dominant polymer form globally.

By Process

Injection molding is anticipated to exert its dominance in the polypropylene processing landscape as it is poised to command over 36.0% of the market share in 2025. Injection molding is the most prevalent processing of polypropylene due to its effectiveness, accuracy, and versatility. Injection molding is a process that entails injecting molten polypropylene into a mold that is then cooled to harden into the final shape. It is very well-suited to the manufacture of complex parts with intricate details with a guaranteed quality which is why injection molding is a favored way of making car parts, housewares, and containers. Its popularity is also due to the ease of manufacture of a lot of parts with little material loss.

Another key benefit of injection molding is that it is cost-effective for large-volume production. Injection molding enables quick cycle times to produce parts at a high rate of output to satisfy high levels of demand with ease. The very good flow properties of polypropylene and its low melting temperature also favor injection molding very much, allowing smooth processing with the end results being of very high quality. The increasing need for lightweight components with strength within the automotive, electronics, and healthcare industries also propels the popularity of injection molding and injection molded plastic. It is also favored by the ease with which it can work with automation and other technologies to improve the processing of the material.

By Application

Polypropylene fibers are expected to dominate the market due to their strength, lightweight, and cost-effectiveness. The fibers are also widely used in the textile industry to manufacture non-woven cloth, rope, and geotextile. With their abrasion resistance and tensile strength, the fibers are ideally suited to harsh uses such as industrial and agricultural uses. The fibers are also hydrophobic, that is, they are not water-absorbing, a quality that makes them ideally suited to marine and outdoor uses where avoiding the presence of water is a priority.

Another reason the polypropylene fibers have a stronghold is their flexibility and versatility. It is easily modified to serve specific needs like UV protection or fire retardation to find applications across a range of industries. The increasing need for non-woven material in hygienic applications like diapers, sanitary napkins, and medical textile products also fueled the market for polypropylene fibers. The light weight of the fibers also helps to lower the cost of transport, making them a cost-effective solution for manufacturers. With applications increasing across the construction, car, and healthcare industries, the market is ruled by polypropylene fibers.

By End-Use Industry

The packaging industry is projected to dominate the global market of polypropylene owing to the material's unique properties of durability, flexibility, and moisture resistance. It is commonly applied to the packaging of foodstuffs, film, containers, and lids since it protects the product and increases shelf life. It is also resistant to high temperatures due to which the material is applied to the packaging of microwaveable products. Transparency of the material increases its value for branding and labeling. Demand for the material has also increased due to the increased e-commerce due to the material providing guaranteed protection while being transported.

Another factor contributing to its supremacy is cost-effectiveness and recyclability. It is comparatively cost-effective to manufacture and can easily be recycled due to the increasing trend of sustainable packaging solutions. Bio-based and biodegradable innovations of polypropylene have also catered to environmental needs to a certain extent, making the material a choice of choice among green-conscious consumers and companies. The versatility of the material to produce lightweight yet strong packaging solutions cemented the material’s status as the number-one material in the packaging sector with uses covering the domains of foodstuffs, beverages, pharmaceuticals, and personal care products.

The Polypropylene Market Report is segmented on the basis of the following:

By Polymer Type

By Process

- Injection Molding

- Blow Molding

- Extrusion Molding

- Others

By Application

- Fiber

- Film & Sheet

- Raffia

- Others

By End-use Industry

- Packaging

- Automotive

- Building & Construction

- Medical

- Electrical & Electronics

- Consumer Products

- Agriculture

- Others

Regional Analysis

Region with Highest Market Share

North America is projected to dominate the global polypropylene market due to its advanced industrial infrastructure, technological innovation, and strong demand from key end-use industries such as automotive, packaging, and healthcare. The region is home to several leading polypropylene manufacturers and has a well-established supply chain, ensuring consistent production and distribution. The automotive industry in North America, particularly in the United States, extensively uses polypropylene for lightweight components to meet stringent fuel efficiency and emission standards.

Additionally, the booming e-commerce sector has driven demand for polypropylene-based packaging solutions. The region's focus on sustainability and recycling has also spurred innovations in bio-based and recyclable polypropylene, further strengthening its market position. High consumer spending, coupled with stringent quality standards, ensures a steady demand for polypropylene products, solidifying North America's dominance in the global market.

Region with Highest CAGR

Asia-Pacific is likely to have the highest CAGR in the polypropylene market due to the increasing industrialization, urbanization, and economic growth of nations like China, India, and the nations of Southeast Asia. The growing manufacturing base of the region, especially the automotive, packaging, and construction sectors, fuels the major demand for polypropylene. Higher disposable incomes and a growing middle-class segment have fueled the consumption of packaged products, contributing to the growing market.

Investments by the government to develop infrastructure and the availability of low-cost labor entice international manufacturers to base their plants within the region. The relocation of major industries to the region due to cost savings and supportive government policies also fuels the market at a greater pace. The region's inclination toward sustainable measures and the growing usage of emerging technologies also support the region with a greater potential to grow at a higher pace, making the Asia-Pacific the highest-growing market of polypropylene.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market of polypropylene is highly competitive with major participants like LyondellBasell Industries, SABIC, ExxonMobil, Sinopec, and Dow at the forefront of the industry. Players are driven by strategic measures like mergers & acquisitions, and alliances, to strengthen their presence in the market and improve their portfolio of products.

For example, LyondellBasell is investing in the latest technologies to manufacture sustainable polypropylene to keep pace with the environmental needs of the world at large. Competition is driven by innovation with the companies launching high-performance and bio-based versions of polypropylene to serve the various needs of the industry.

Regional players within the Asia-Pacific region and the Middle East are also increasing their presence due to cost competitiveness and increasing regional demand. The market is also driven by extensive research and development efforts with manufacturers heavily investing to develop lightweight, strong, and sustainable polypropylene solutions.

The usage of digitalization and automation within the manufacturing process also aids manufacturers in enhancing efficiency while lowering the cost of production. With the growing priority of sustainability, manufacturers are increasingly engaging with recycling companies and the government to support the practice of a circular economy. All this creates a dynamic competitive environment that forces manufacturers to innovate constantly while making the market strong and dynamic to cater to changing industry needs.

Some of the prominent players in the Global Polypropylene Market are:

- LyondellBasell

- ExxonMobil

- SABIC

- Braskem

- INEOS

- Borealis

- Sinopec

- Reliance Industries

- TotalEnergies

- Formosa Plastics Corporation

- Sumitomo Chemical

- SIBUR

- Alpek

- Other Key Players

Recent Developments

- December 2023: LyondellBasell acquired a European recycling firm to expand its sustainable polypropylene portfolio, aligning with global environmental goals and strengthening its circular economy initiatives.

- November 2023: The Global Polypropylene Expo in Dubai showcased breakthroughs in bio-based and recyclable polypropylene, drawing industry leaders to discuss sustainable solutions and future market trends.

- October 2023: SABIC invested $150 million in a new Saudi Arabian facility and acquired a U.S. polypropylene manufacturer, enhancing its production capacity and market presence.

- September 2023: Dow partnered with a recycling firm for a closed-loop initiative, while the International Polypropylene Conference in Houston highlighted lightweight materials for automotive and packaging applications.

- July 2023: Borealis collaborated on developing biodegradable polypropylene, addressing environmental concerns and expanding its portfolio of sustainable polymer solutions.

- June 2023: ExxonMobil invested $200 million in bio-based polypropylene research, aiming to reduce carbon emissions and meet growing demand for eco-friendly materials.

- May 2023: Sinopec partnered with a Chinese university to innovate high-strength polypropylene grades, targeting applications in construction and infrastructure development.

- April 2023: The European Polypropylene Summit in Berlin emphasized sustainability, circular economy practices, and regulatory compliance, shaping the future of the polypropylene industry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 130.1 Bn |

| Forecast Value (2034) |

USD 205.2 Bn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 41.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Polymer Type (Homopolymer, Copolymer), By Process (Injection Molding, Blow Molding, Extrusion Molding, Others), By Application (Fiber, Film & Sheet, Raffia, Others), By End-use Industry (Packaging, Automotive, Building & Construction, Medical, Electrical & Electronics, Consumer Products, Agriculture, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

LyondellBasell, ExxonMobil, SABIC, Braskem, INEOS, Borealis, Sinopec, Reliance Industries, TotalEnergies, Formosa Plastics Corporation, Sumitomo Chemical, SIBUR, Alpek, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global polypropylene market size is estimated to have a value of USD 130.1 billion in 2025 and is expected to reach USD 205.2 billion by the end of 2034.

The US polypropylene market is projected to be valued at USD 41.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 64.4 billion in 2034 at a CAGR of 4.9%.

North America is expected to have the largest market share in the global polypropylene market with a share of about 38.3% in 2025.

Some of the major key players in the global polypropylene market are LyondellBasell, ExxonMobil, SABIC, Braskem, INEOS, Borealis, Sinopec, Reliance Industries, TotalEnergies, and many others.

The market is growing at a CAGR of 5.2 percent over the forecasted period.