Market Overview

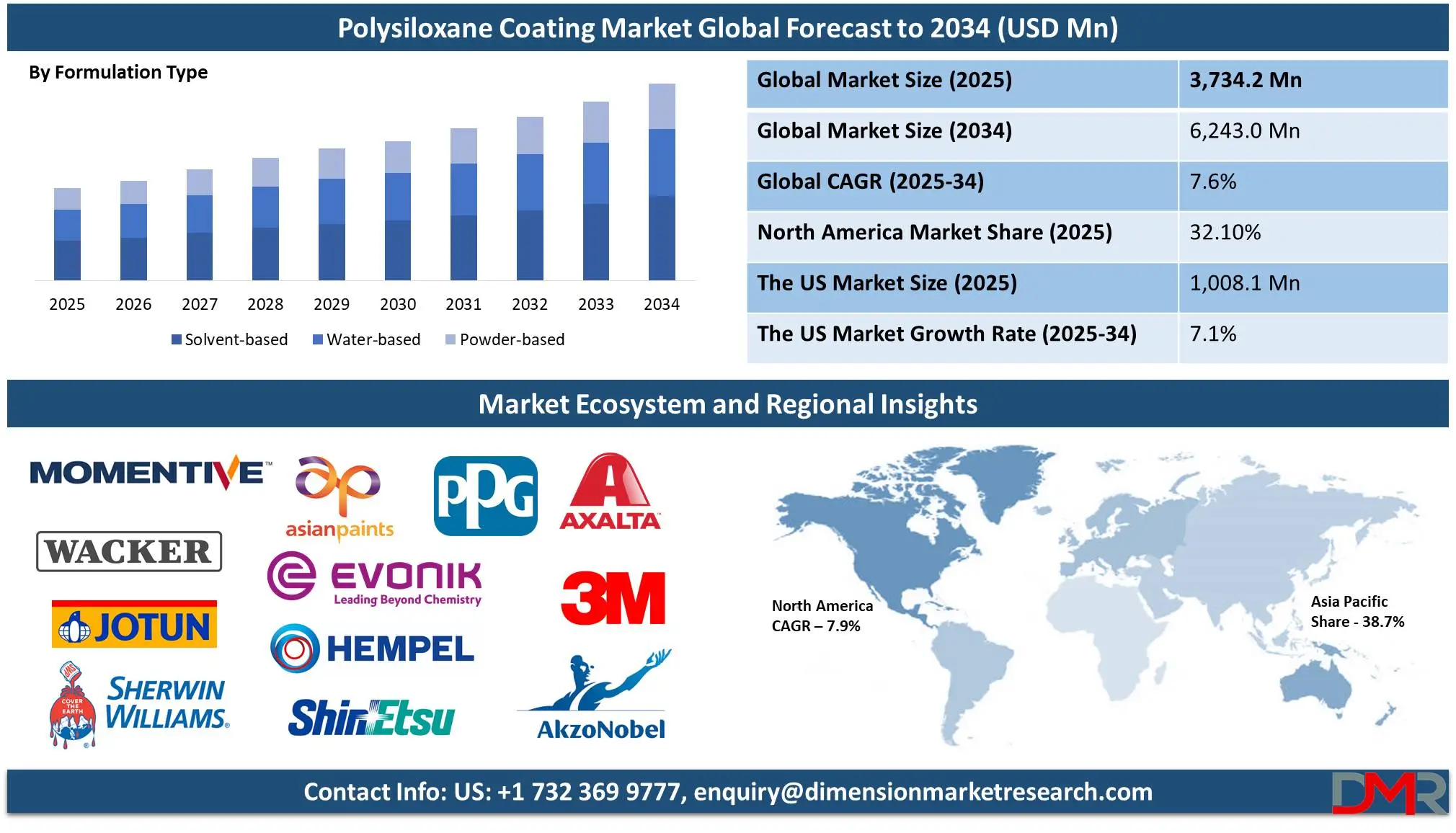

The Global Polysiloxane Coating Market is projected to reach USD 3,734.2 million in 2025 and grow at a compound annual growth rate of 7.6% from there until 2034 to reach a value of USD 6,243.0 million.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global polysiloxane coating market is experiencing high growth due to increased demand from industrial, automotive, aerospace, and marine applications. Polysiloxane coatings offer improved chemical resistance, weatherability, and durability compared to traditional coatings and are, therefore, essential for infrastructure protection and high-performance coating applications. With increased investment in sustainable and durable coating solutions, polysiloxane coatings are gaining traction across industries requiring enhanced corrosion protection and UV resistance.

The market is expanding as stringent environmental regulations force industries to adopt low-VOC and high-performance substitutes, with manufacturers focusing on research and development to enhance formulation efficiency and performance. Additionally, the trend of integrating nanotechnology is leading to the development of high-performance polysiloxane coatings with self-healing and anti-fouling properties.

One of the major opportunities for the polysiloxane coating market is its growing application in the renewable energy sector, namely in wind turbine blades and solar panels. The coatings enhance durability by reducing material degradation from UV light and environmental pollutants. The expansion of offshore wind farms globally further drives demand since the coatings provide superior resistance to corrosion from seawater.

Furthermore, increasing infrastructure development, particularly in developing countries, is driving the demand for protective coatings in construction materials, pipelines, and bridges. Another significant opportunity is the expanding demand for water-based and solvent-free polysiloxane coatings, which are in line with sustainability trends and regulatory compliance, driving wider market acceptance.

Despite its high growth prospects, the market for polysiloxane coatings is held back by high formulation costs and application complexity in comparison with conventional coatings. The need for specialized application methods and substrate preparation increases the overall cost, discouraging price-sensitive end users from using such coatings.

Additionally, fluctuations in the prices of raw materials, especially silicone-based ones, influence the production cost, posing a challenge for producers. Environmental concerns related to some solvent-based polysiloxane formulations also make these subject to regulatory scrutiny, requiring sustained efforts to develop greener alternatives.

The opportunities for growth in the market remain strong as industries persist in requiring increasing longevity, reduced maintenance, and environmental acceptability in coating products. The formulation of hybrid products that combine polysiloxane with epoxy or polyurethane is further enhancing product performance, increasing the variety of applications.

Current research in nanotechnology-based polysiloxane coatings is expected to bring in new functionalities such as self-cleaning and antimicrobial properties, opening up opportunities for next-generation protective coatings.

The US Polysiloxane Coating Market

The US Polysiloxane Coating Market is projected to reach USD 1,008.1 million in 2025 at a compound annual growth rate of 7.1% over its forecast period.

The U.S. polysiloxane coating market is being driven by technological innovation in protective coatings and strong demand from key industries such as aerospace, automotive, and construction. The country’s well-established manufacturing base and stringent environmental regulations are propelling the adoption of high-performance, low-VOC coatings.

Infrastructure expenditures by the government, including bridge rehabilitation projects and smart city developments, are also driving demand for durable and anti-corrosion coatings. Additionally, the U.S. military’s demand for high-performance protective coatings for aircraft, ships, and defense equipment is expanding the market opportunity.

Statistically, the United States holds a significant role in the global polysiloxane coating market, and its demand is expanding at a steady rate due to the increasing industrial applications. The aerospace sector remains one of the most lucrative segments, with major aircraft manufacturers integrating polysiloxane coatings due to their high durability and lightweight nature. Further, the development of electric vehicles is creating new opportunities for polysiloxane coatings in battery enclosures and EV infrastructure.

The demographic advantage of the U.S. is its highly skilled workforce and innovation-driven economy that fuels research and development in high-tech coatings. Premier universities and research institutes, in association with manufacturers, develop green high-performance coatings tailored to industry needs. With growing emphasis on sustainability and compliance with regulations, the U.S. polysiloxane coating market is expected to witness stable growth, with technology innovation and industrial investments accelerating.

Global Polysiloxane Coating Market: Key Takeaways

- Global Market Size Insights: The Global Polysiloxane Coating Market size is estimated to have a value of USD 3,734.2 million in 2025 and is expected to reach USD 6,243.0 million by the end of 2034.

- The US Market Size Insights: The US Polysiloxane Coating Market is projected to be valued at USD 1,008.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,243.0 million in 2034 at a CAGR of 7.1%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Polysiloxane Coating Market with a share of about 38.7% in 2025.

- Key Players Insights: Some of the major key players in the Global Polysiloxane Coating Market are Akzo Nobel N.V., Axalta Coating Systems, LLC, Jotun, PPG Industries, Inc.¸The, The Sherwin-Williams Company, 3M, and many others.

- Global Growth Rate Insights: The market is growing at a CAGR of 7.6 percent over the forecasted period of 2025.

Global Polysiloxane Coating Market: Use Cases

- Marine and Offshore Protection: Polysiloxane coatings are widely used in marine environments to protect ships, offshore platforms, and underwater structures from corrosion by saltwater, biofouling, and UV degradation. Their durability over a long period reduces maintenance costs and enhances the structural integrity of ships, making it a critical coating solution for the shipping industry.

- Automotive Coatings: It is used on the exterior of automobiles; these coatings provide high durability against severe weather, road chemicals, and exposure to UV. With high gloss retention and scratch resistance properties, they enhance the appearance of vehicles while protecting long durations, making them a preference for premium and commercial vehicle coatings.

- Industrial Equipment and Machinery: Heavy-duty industrial machinery requires coatings that can withstand exposure to harsh chemicals, extreme heat, and mechanical wear. Polysiloxane coatings provide excellent chemical resistance and high-temperature stability that extend the service life of equipment in manufacturing, oil and gas, and chemical processing applications.

- Aerospace Applications: Aircraft parts, including landing gear and fuselage, require lightweight yet highly protective coatings to resist extreme temperatures, exposure to the atmosphere, and corrosion danger. Polysiloxane coatings reduce drag to enhance fuel efficiency and extend the life of aircraft by enhancing weatherability.

- Infrastructure and Construction: Bridges, pipelines, and commercial buildings benefit from polysiloxane coatings as they remain resistant to environmental degradation, graffiti, and industrial pollutants. Polysiloxane coatings are increasingly being used for structural steel and concrete protection in urban infrastructural projects to impart longevity and reduced maintenance costs.

Global Polysiloxane Coating Market: Market Dynamics

Driving Factors in the Global Polysiloxane Coating Market

Rising Demand for Corrosion-Resistant Coatings in Infrastructure and Industrial Applications

Corrosion damage poses a significant problem for industries from construction, oil and gas, to transportation. Polysiloxane coatings offer improved resistance to moisture, chemicals, and environmental degradation, making them extremely effective in the protection of bridges, pipelines, industrial equipment, and offshore facilities. Governments and private industry stakeholders are investing more in infrastructure development and maintenance, which is driving demand for high-performance coating solutions.

For example, mega projects under China’s Belt and Road Initiative and U.S. infrastructure renovation plans are expected to drive the use of polysiloxane coatings. As industries seek long-term protection solutions to minimize maintenance costs and maximize the lifespan of valuable assets, the market for polysiloxane coatings is expected to see steady growth.

Expanding Applications in the Aerospace and Automotive Sectors

The aerospace and automotive industries are increasingly using polysiloxane coatings for their high durability, lightweight, and heat-resistant properties. Aircraft manufacturers use such coatings on fuselage, landing gear, and interior components to enhance fuel efficiency and withstand severe atmospheric conditions.

Similarly, the emerging electric vehicle (EV) market is generating the demand for advanced coatings that protect battery enclosures and lightweight vehicle components from environmental degradation. With the push for electric mobility and sustainable aviation, polysiloxane coatings are becoming integral to maintaining energy efficiency and operational life in such applications. As production rates in these markets grow, the demand for high-performance coatings is set to rise exponentially.

Restraints in the Global Polysiloxane Coating Market

High Production and Application Costs

Despite having superior properties, polysiloxane coatings are more expensive to formulate and apply compared to conventional coatings. Increased formulation complexity and the need for special raw materials, such as high-purity silicones, increase the production cost. These coatings also tend to require special application techniques, such as surface preparation and curing, which also add to the labor and operational expenses.

Industries with fewer budgetary funds, particularly in developing economies, prefer to opt for less expensive alternatives, limiting the widespread application of polysiloxane coatings. To surmount this hurdle, manufacturers are trying to develop cost-effective formulations without compromising on performance, but price sensitivity is a significant barrier to market growth.

Fluctuations in Raw Material Availability and Regulatory Challenges

The market for polysiloxane coatings is strongly dependent on raw materials such as silicone-based resins and catalysts that are susceptible to price volatility and supply disruptions. Trade barriers, geopolitical tensions, and supply shortages can influence production costs and margins.

Additionally, evolving environmental laws governing solvent-based coatings are confronting manufacturers with the need to continuously reformulate products to meet compliance requirements. Regulatory bodies worldwide are adopting more stringent VOC emission standards, forcing the industry to switch to water-based products. While the change presents growth opportunities, it also requires enormous investments in R&D and production processes, posing near-term difficulties for industry players.

Opportunities in the Global Polysiloxane Coating Market

Emerging Demand in the Renewable Energy Sector

The rapid expansion of renewable energy infrastructure, including wind farms and solar parks, presents an encouraging prospect for polysiloxane coatings. Wind turbine blades and photovoltaic panels are perpetually exposed to harsh environmental elements, including UV radiation, moisture, and salt spray in marine environments.

Polysiloxane coatings extend the life of these components by providing enhanced weatherability and degradation resistance. Offshore wind farms, in particular, require extremely durable coatings to withstand harsh marine environments. With investments in renewable energy projects continuing to grow, the application of polysiloxane coatings is expected to grow, fueled by the need for extended asset lifetimes and reduced maintenance expenses.

Technological Advancements in Hybrid Coating Formulations

The development of hybrid polysiloxane coatings with the benefits of epoxy, polyurethane, or fluoropolymer coatings is unlocking new market opportunities. Hybrid formulations with enhanced mechanical strength, adhesion, and durability are gaining preference in industrial, automotive, and marine coatings.

Polysiloxane-epoxy hybrid coatings, for example, offer high chemical resistance with flexibility retention, making them suitable for high-performance pipeline coatings. Demand for multi-functional coatings with low environmental impact and high-performance capabilities is driving R&D in emerging hybrid formulations. As industries continue to demand high-efficiency coatings with tailor-made properties, hybrid polysiloxane coatings are poised for high market penetration.

Trends in the Global Polysiloxane Coating Market

Shift Toward Eco-Friendly and Low-VOC Coatings

Increasing emphasis on sustainability and environmental compliance is driving demand for green polysiloxane coatings. Traditional solvent-borne coatings emit volatile organic compounds (VOCs) that contribute to air pollution and are toxic to health. Manufacturers are therefore investing in low-VOC and waterborne polysiloxane formulations to comply with stringent regulatory norms such as the U.S. Environmental Protection Agency (EPA) and the European Union’s REACH legislation.

Demand for green coatings is strongest in the construction, automotive, and aerospace sectors, where companies are looking to reduce their carbon footprint without compromising on long-term durability and corrosion protection. This is driving innovation in polysiloxane formulations with high performance and low environmental impact.

Integration of Nanotechnology for Advanced Coating Performance

Nanotechnology is transforming the polysiloxane coating market by enhancing properties such as self-healing, anti-fouling, and antimicrobial properties. Nanoparticles such as silica and titanium dioxide are being incorporated into polysiloxane coatings to improve surface hardness, UV resistance, and chemical stability. These coatings exhibit improved adhesion and better resistance to extreme weathering conditions and are in high demand in marine, aerospace, and healthcare applications.

Nanostructured polysiloxane coatings are also finding application in electronics and medical devices where biocompatibility and resistance to bacterial growth are necessary. As R&D efforts continue, commercial application of nanotechnology-based polysiloxane coatings will gain wider acceptance, opening up new avenues for high-performance industrial coatings.

Global Polysiloxane Coating Market: Research Scope and Analysis

By Resin Type

Epoxy-polysiloxane hybrids are projected to dominate the polysiloxane coating in the context of the type segment due to their provision of an ideal balance among mechanical strength, chemical resistance, and long-term durability. The coatings possess the high adhesion and toughness of epoxy resins and the weatherability and resistance to UV of polysiloxane, making them ideal for severe industrial uses.

Epoxy-polysiloxane hybrids offer superior resistance to environmental stressors like extreme temperatures, humidity, and corrosive chemicals compared to traditional epoxy or polyurethane coatings, making them the top choice for infrastructure, marine, and industrial uses.

One of the main reasons they have gained prominence is that they can replace conventional three-coat systems with a two-coat application, reducing labor costs and project duration. Such efficiency is particularly worth its weight in gold on large-scale projects such as bridges, offshore platforms, and oil refineries, where downtime and maintenance are expensive and must be minimized. Epoxy-polysiloxane hybrids also demonstrate better color and gloss retention, ensuring aesthetic durability in architectural and commercial applications.

Alongside this, these coatings also conform to growing environmental regulations by offering low-VOC formulations, thereby meeting strict emission standards in the North American and European regions.

Their extended service life, reduced maintenance requirements, and ability to perform under extreme environments have powered widespread use in industries. As sustainability concerns grow and regulatory pressure builds, market demand for durable, high-performance, and sustainable coatings will continue to establish epoxy-polysiloxane hybrids as a global polysiloxane coating market leader.

By Substrate Type

Metals are projected to dominate the substrate type segment in the polysiloxane coating market due to their widespread use in industrial, marine, and transportation applications requiring high degrees of protection against corrosion, oxidation, and wear.

Polysiloxane coatings provide an effective barrier against environmental stressors, preventing rust and degradation of metal substrates exposed to moisture, chemicals, and temperature fluctuations. Polysiloxane coatings extend the life and structural integrity of metal substrates, and as a result, are the material of choice for critical infrastructure such as bridges, pipelines, offshore platforms, and manufacturing equipment.

In aerospace and automotive applications, for instance, where high-strength, lightweight materials are paramount, polysiloxane coatings are used on aluminum and steel components to protect them against harsh operating environments. The aerospace sector, in particular, benefits from the coatings' ability to withstand high-altitude UV exposure, extreme temperature cycling, and fuel spills, which can degrade the integrity of unprotected metal surfaces over time. In the energy sector, on the other hand, metals used in wind turbines, oil rigs, and power plants require high-performance protective coatings to withstand long-term exposure to corrosive environments.

Another reason for the predominance of metals as a substrate type is the increasing focus on sustainability and infrastructure longevity. Private and governmental expenditure on infrastructure renewal is propelling demand for high-performance coatings that optimize asset life and minimize maintenance spending. With industries poised to continue focusing on longevity, efficiency, and regulatory compliance, demand for polysiloxane coatings on metal substrates is expected to retain its dominance.

By Formulation Type

Solvent-based systems are anticipated to dominate the market for polysiloxane coatings due to their superior adhesion, durability, and versatility across a variety of environmental conditions. Solvent-based systems employ organic solvents to solubilize polysiloxane resins, which enables superior wetting properties, smoother application, and better film formation compared to water-based systems. This makes them highly appropriate for use in aerospace, automotive, marine, and infrastructure applications, where coatings are subjected to severe weather, temperature fluctuations, and chemicals.

One of the main reasons for their dominance is their high-performance characteristics that include faster drying, better corrosion resistance, and long-lasting protective barriers. These properties make solvent-based polysiloxane coatings very much sought after for industrial applications where longer service life and longer maintenance cycle intervals are needed.

Solvent-based systems offer the same level of performance irrespective of the diverse climates and therefore assure global application reliability, as opposed to water-based coatings, which may be compromised in humid or cold climates.

Furthermore, solvent-based polysiloxane coatings are compatible with a range of substrates, including metals, concrete, and composites, making them widely used across industries. Despite growing regulatory pressure to reduce VOC emissions, advancements in low-VOC solvent-based formulations have allowed these coatings to maintain market dominance.

As industries continue to demand high-performance coatings that deliver durability, ease of application, and long-term protection, solvent-based polysiloxane coatings will remain the material of choice for challenging industrial and commercial applications.

By Functional Properties

Hydrophobic and oleophobic polysiloxane coatings are poised to lead this segment as they repel water, oil, and contaminants and are thus perfect for industries requiring permanent surface protection. The coatings create a non-stick film that prevents the ingress of moisture, corrosion, and dirt, significantly reducing cleaning efforts and increasing the durability of coated surfaces. Their self-cleaning property is particularly beneficial in applications such as exterior building facades, automotive bodies, and boats, where the impact of environmental exposure causes materials to deteriorate over time.

One of the reasons they are so prevalent is that they have extensive industrial applications that call for anti-fouling, anti-corrosion, and anti-staining characteristics. In the marine industry, for example, hydrophobic and oleophobic coatings prevent biofouling by the repellence of waterborne organisms and salt deposits, which reduces fuel consumption and ship maintenance. Similarly, in the aerospace industry, the coatings protect aircraft surfaces from ice, fuel spillage, and airborne contaminants, ensuring maximum performance and safety.

In addition, advances in nanotechnology have enhanced the performance of hydrophobic and oleophobic polysiloxane coatings, and they are being extensively used in consumer electronics, medical devices, and optical applications.

Smart phones, camera lenses, and eyeglasses utilize the fingerprint and smudge resistance of the coatings to improve durability and usability. With the demand for low-maintenance and high-performance coatings growing across industries, hydrophobic and oleophobic polysiloxane coatings continue to dominate the functional properties market, driving market growth and innovation.

By Application

The aerospace industry is expected to dominate the market for polysiloxane coatings due to its stringent requirements for high-performance, lightweight, and durable coatings that can withstand harsh environmental exposure.

Aircraft components, including fuselage, wings, landing gear, and internal structures, require high-performance coatings to withstand UV exposure, temperature extremes, moisture, and chemical spills. Polysiloxane coatings excel at resisting oxidation, corrosion, and abrasion, which enables long-term structural integrity with reduced maintenance costs.

One of the most important reasons for the dominance of polysiloxane coatings in aerospace applications is that they help improve fuel efficiency by minimizing surface drag and reducing ice formation on aircraft surfaces. Hydrophobic polysiloxane coatings avoid water retention and ice adhesion, leading to better aerodynamics and overall flight performance.

The coatings also offer superior resistance to aviation fuels, hydraulic fluids, and de-icing chemicals, inhibiting material degradation and ensuring safety in operation. As the aerospace industry keeps evolving, the demand for sustainable and lightweight coatings continues to increase.

Polysiloxane coatings are aligned with these requirements by offering low-VOC and high-temperature-resistant formulations in regulatory compliance with Federal Aviation Administration (FAA) and European Aviation Safety Agency (EASA) requirements. As commercial aviation keeps expanding, coupled with defense aircraft production and new space exploration programs, polysiloxane coatings will remain a fundamental part of aerospace applications, retaining their market dominance position.

The Global Polysiloxane Coating Market Report is segmented based on the following

By Resin Type

- Epoxy-Polysiloxane Hybrids

- Acrylic-Polysiloxane Hybrids

- Polyester Modified Polysiloxane

- Other Resin Types

By Substrate Type

By Formulation Type

- Solvent-based

- Water-based

- Powder-based

By Functional Properties

- Hydrophobic & Oleophobic

- Anti-scratch

- Anti-fingerprint

- UV-resistant

- Corrosion-resistant

- Chemical-resistant

By Application

- Aerospace

- Automotive

- Electronics

- Healthcare

- Industrial

Global Polysiloxane Coating Market: Regional Analysis

Region with Highest Market Share in Global Polysiloxane Coating Market

Asia-Pacific is projected to dominate the polysiloxane coating market as it is poised to account for

38.7% of market share in 2025, due to its rapidly expanding industrial, construction, and automotive sectors. Countries such as China, India, Japan, and South Korea are investing heavily in infrastructure development, driving demand for high-performance coatings that provide superior corrosion resistance and durability. The region's extensive shipbuilding and marine industries further contribute to this dominance, as polysiloxane coatings are widely used to protect vessels against biofouling, saltwater exposure, and UV degradation.

Additionally, the Asia-Pacific region benefits from a strong manufacturing base and cost-effective production capabilities, enabling large-scale production and widespread adoption of polysiloxane coatings across various industries. Government initiatives promoting sustainable and low-VOC coatings also fuel market growth, as environmental regulations become stricter in developed markets like Japan and South Korea. The increasing demand for energy-efficient and protective coatings in high-growth sectors, including aerospace and automotive, solidifies Asia-Pacific’s leadership in the global polysiloxane coating market.

Region with Highest CAGR in Global Polysiloxane Coating Market

North America is expected to experience the highest CAGR in the polysiloxane coating market, driven by strong technological advancements, stringent environmental regulations, and a growing focus on sustainable infrastructure.

The United States, in particular, is leading the adoption of high-performance coatings due to its well-established aerospace, defense, and industrial manufacturing sectors, where long-lasting protective coatings are essential. The region's emphasis on low-VOC and environmentally friendly formulations is pushing companies to innovate, resulting in the development of advanced polysiloxane coatings with improved durability and reduced emissions.

Additionally, increased investments in renewable energy and smart infrastructure are accelerating market expansion. The growing use of polysiloxane coatings in wind turbines, bridges, and oil & gas pipelines underscores their role in extending asset lifespan while minimizing maintenance costs. The surge in research and development activities, combined with rising demand for lightweight, corrosion-resistant coatings in the transportation and construction sectors, positions North America as the fastest-growing market for polysiloxane coatings.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Polysiloxane Coating Market: Competitive Landscape

The global polysiloxane coating market is highly competitive, with key players focusing on innovation, product differentiation, and strategic partnerships to occupy market leadership roles. AkzoNobel N.V., PPG Industries, The Sherwin-Williams Company, Hempel A/S, and Jotun are some of the firms ruling the market by supplying high-performance coatings for industrial, marine, and aerospace use. Industry players concentrate on extensive research and development to enhance the durability of coatings, minimize environmental impact, and enhance ease of use.

Mergers and acquisitions and strategic partnerships are reconfiguring the competitive landscape, with market leaders expanding their product lines to meet evolving industry specifications. Distribution channel strengthening and capacity expansions are also increasing among companies to meet surging demand in the Asia-Pacific and North America.

Mounting regulatory pressures to manage VOC emissions are also promoting the production of low-VOC and green polysiloxane coatings. As competition increases, market leaders are turning to high-tech technologies, such as nanocoatings and hybrid materials, to achieve a competitive edge and gain a larger market share.

Some of the prominent players in the Global Polysiloxane Coating Market are

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- Jotun

- PPG Industries, Inc.

- The Sherwin-Williams Company

- 3M

- Evonik Industries

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Hempel

- Asian Paints

- Other Key Players

Recent Developments in Global Polysiloxane Coating Market

- June 2023: Elkem launched the Silcolease UV LED Series, a new UV LED curable silicone solution. This innovation offers an alternative to mercury vapor curing lamps, leveraging UV LED technology for precise radiation curing in silicone chemistry at specific wavelengths.

- February 2023: Evonik’s Coating Additives Business Line introduced TEGO® Wet 290 and TEGO® Wet 296 wetting agents for wood, plastic, and metal substrates. These additives enhance flow, leveling, and wetting in waterborne automotive and wood coatings while preventing craters.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 3,734.2 Mn |

| Forecast Value (2034) |

USD 6,243.0 Mn |

| CAGR (2025-2034) |

7.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,008.1 Mn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Resin Type (Epoxy-Polysiloxane Hybrids, Acrylic-Polysiloxane Hybrids, Polyester Modified Polysiloxane, Other Resin Types), By Substrate Type (Metals, Plastics, Glass, Ceramics, Textiles), By Formulation Type (Solvent-based, Water-based, Powder-based), By Functional Properties (Hydrophobic & Oleophobic, Anti-scratch, Anti-fingerprint, UV-resistant, Corrosion-resistant, Chemical-resistant), and By Application (Aerospace, Automotive, Electronics, Healthcare, Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Akzo Nobel N.V., Axalta Coating Systems LLC, Jotun, PPG Industries, Inc., The Sherwin-Williams Company, 3M, Evonik Industries, Wacker Chemie AG, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Hempel, and Asian Paints., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |