The main trend that shapes the market space of polyurethane foam machines is the incorporation of automation and IoT. Manufacturers are increasingly incorporating smart features in production for higher efficiency, waste reduction of raw materials, and quality consistency in the products manufactured. Such automated systems will provide complete control over the density and composition of the foam, as required by industries needing value-specific solutions. Besides, increasingly friendly methods of producing as a consequence of increased regulations on emission and waste management further contribute to developing machinery that is sustainable and compatible with the green formulation of foams. These are some of the innovations that will continue to drive long-term growth as industries transition to eco-friendly practices.

Still, it has certain growth restraints that are very essential: a rise in initial capital costs for machinery making the machines of polyurethane foam, apart from maintenance which seems to be burdensome, is specifically true for the Small and Medium Enterprise category. Further fluctuation in prices or supply disruption is also affecting market dynamics. Development in machine technologies in current times, through modular design systems, tries to alleviate these with competitive costs and low-maintenance facilities. Regional markets, particularly those with substantial manufacturing bases, like China, the U.S., and Germany, will no doubt be the key to overcoming such challenges and assuring a steady supply.

Other prospects will be provided by emerging economies that have high rates of urbanization and industrialization, which will drive consumption toward polyurethane foam products. In countries such as the Asia-Pacific, Latin America, and the Middle East, construction activities are on overdrive, which raises the requirement for valid insulation materials. Additionally, the increasing demand from the automobile sector to economize on fuel requires that effortless light masses are availed, which lays out several opportunities before the manufacturers of the foam machines. This growth in the e-commerce sector has also created a robust demand for polyurethane foam in the form of protective packaging, further widening the scope of the market.

The growth prospects of the market look promising, as it shows a uniform CAGR in the forecasted period. Strong demand from construction and automotive industries, together with technological development, is likely to continue the growth momentum. Large-scale infrastructure projects across the region, backed by an aspiring middle-class population seeking better-quality consumer goods, have been driving growth. North America and Europe will also hold significant positions in the market due to building energy efficiency regulations.

Besides this, environmental sustainability continues to be a vital area of concern for stakeholders who demand machinery facilitating reduced waste and compatibility with bio-based polyurethane formulation. Increasingly, the circular economy will drive innovation among manufacturers and meet growing consumer expectations. These developments ensure the polyurethane foam machines market is on its course to contribute effectively to enabling industries to reach their sustainability goals without compromising on performance.

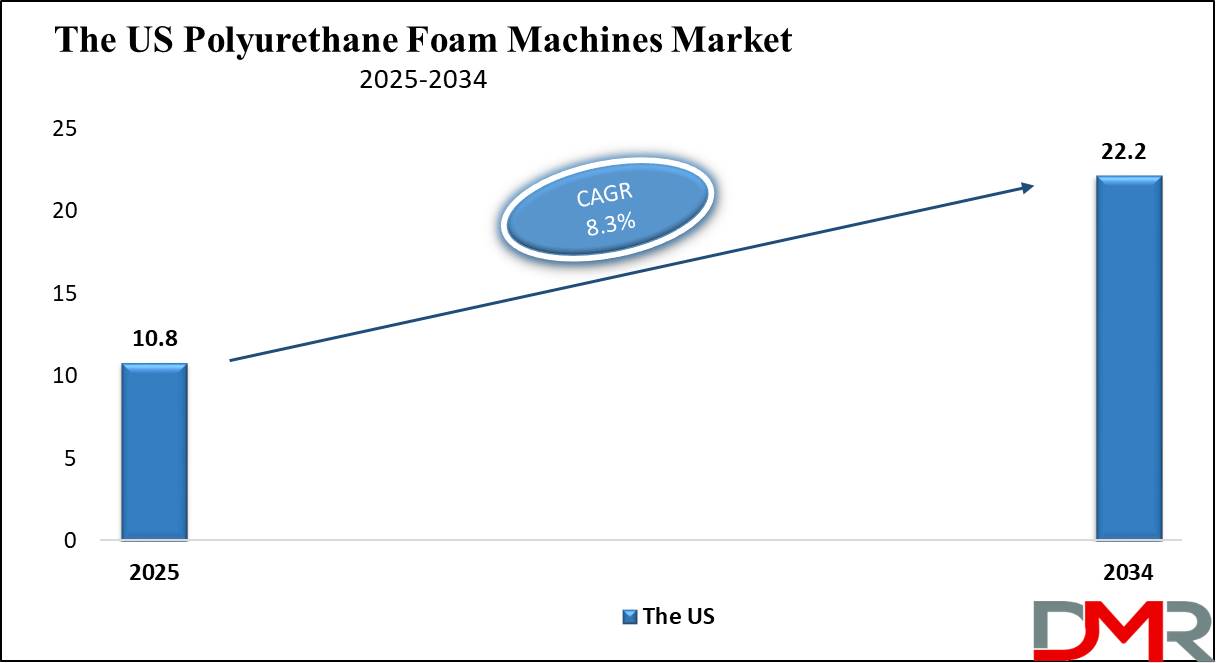

The US Polyurethane Foam Machines Market

The US Activated Carbon Market is projected to be valued at USD 10.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 22.2 billion in 2034 at a CAGR of 8.3%.

The U.S. polyurethane foam machines market is considered one of the major contributors in the global scenario, with strong demand emanating from the construction, automotive, and consumer goods industries. A well-established infrastructure coupled with stringent energy efficiency regulations ensures a surge in the adoption of high-performance polyurethane foam machines for insulation applications. Construction is one of the most significant sectors in the U.S. economy, and thermal insulation using polyurethane foams helps achieve sustainability and cost-efficient goals.

The U.S. was further cemented to be a leading factor owing to key players such as Hennecke GmbH and KraussMaffei. Supported by robust R&D capabilities, along with beneficial government incentives over the promotion of greener technologies, the U.S. market for polyurethane foam machines will continue to see stable growth over the forecast period. Polyurethane foam plays a very important role in energy-efficient buildings due to its excellent thermal insulation properties, reducing energy consumption and enhancing comfort in general. Polyurethane foam machinery is also greatly needed in the automotive industry for the production of seating and interior parts. This kind of foam is integral in enhancing comfort, improving durability, and reducing vehicle weight, which goes hand in glove with the industry's focus on fuel efficiency and performance.

Moreover, the demographic advantages of the growing urbanization-related pressures have a great inclination towards housing, which makes for a greater balance in the investment of the technology of polyurethane foam with their rising preference for energy-efficient houses and sustainable materials. Besides this, automation and the integration of IoT in machines for manufacturing up the production efficiency, driving innovation into applications of foam.

Global Polyurethane Foam Machines Market: Key Takeaways

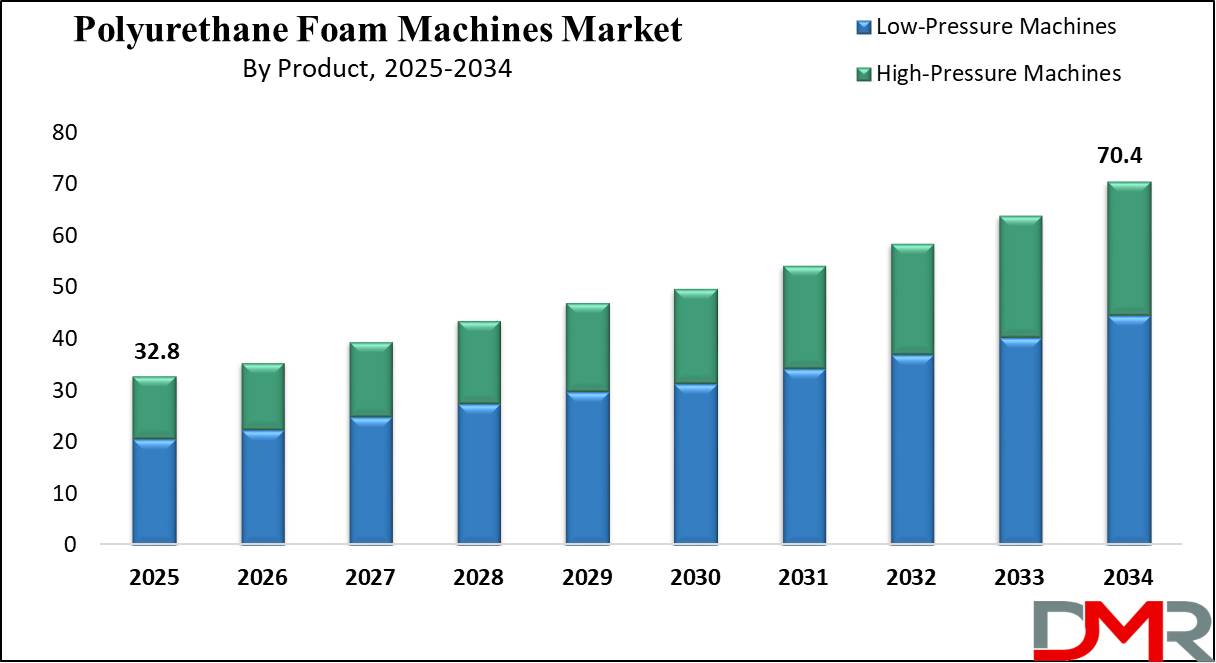

- Global Market Value: The Global Polyurethane Foam Machines Market size is estimated to have a value of USD 32.8 billion in 2025 and is expected to reach USD 70.4 billion by the end of 2034.

- The US Market Value: The US- Polyurethane Foam Machines Market is projected to be valued at USD 10.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 22.2 billion in 2035 at a CAGR of 8.3%.

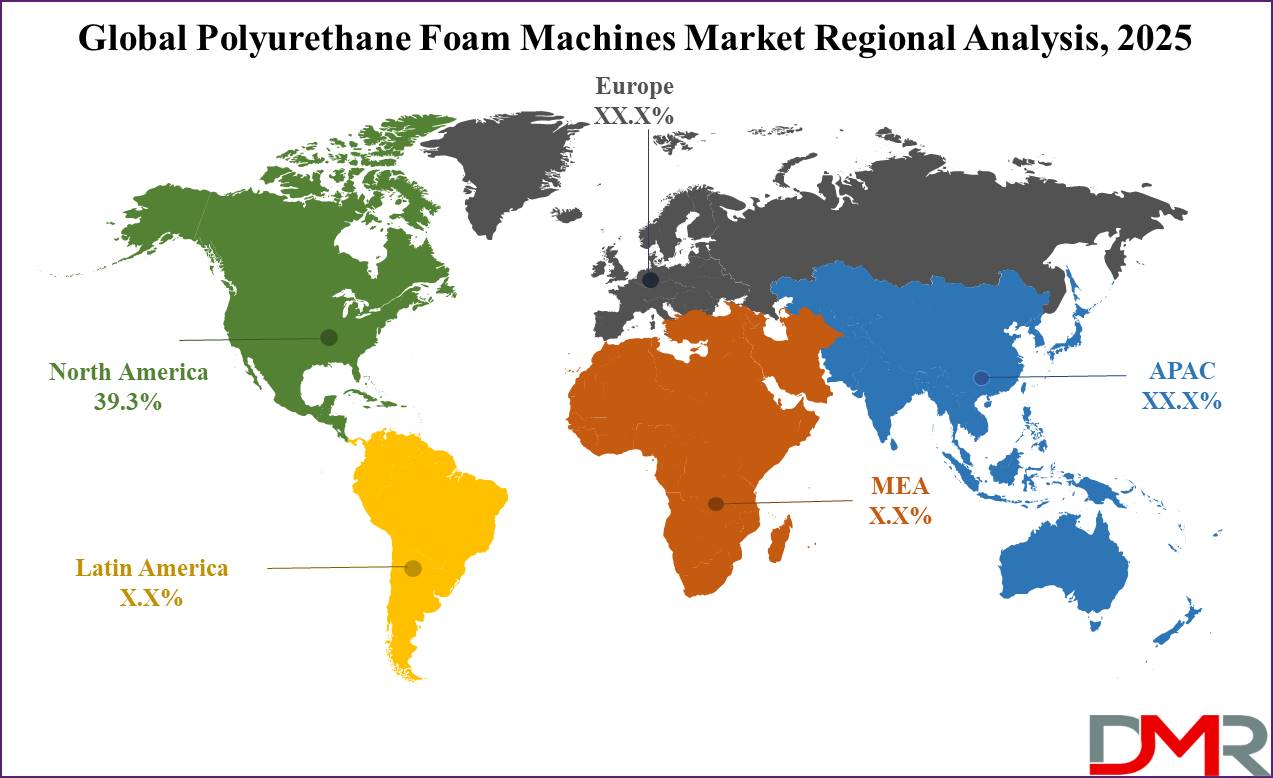

- Regional Analysis: North America is expected to have the largest market share in the Global Polyurethane Foam Machines Market with a share of about 39.3% in 2024.

- Key Players: Some of the major key players in the Global Polyurethane Foam Machines Market are Sunkist Chemical Machinery Ltd., Shandong Reanin Machinery Co., Ltd., BASE SF, Sabtech Technology Limited, Santech Foam Machines, and many others.

- Global Growth Rate: The market is growing at a CAGR of 8.8 percent over the forecasted period.

Global Polyurethane Foam Machines Market: Use Cases

- Construction Insulation: High-pressure polyurethane foam machines play a pivotal role in producing high-density foam used for energy-efficient building insulation. This foam is widely applied in walls, roofs, and floors, ensuring superior thermal regulation and reducing heat transfer, which significantly lowers energy consumption in residential, commercial, and industrial buildings

- Automotive Seating: In the automotive industry, polyurethane foam machines are essential for manufacturing durable and ergonomic car seats. The foam produced ensures superior comfort for passengers and drivers while adhering to safety standards, such as flame resistance and structural durability.

- Furniture Manufacturing: Low-pressure machines are extensively used in the furniture industry to produce flexible polyurethane foam for ergonomic furniture like sofas, mattresses, cushions, and recliners. These foams provide optimal support and comfort, adapting to various consumer needs, including orthopedic and luxury-grade furniture.

- Packaging Materials: Polyurethane foam machines are integral in creating shock-absorbent packaging solutions designed to protect delicate items during storage and transportation. The foam produced offers excellent cushioning properties, making it ideal for packaging electronics, medical equipment, glassware, and other fragile goods.

Global Polyurethane Foam Machines Market: Stats & Facts

- Thermal Insulation (Source: BASF Technical Datasheet, 2023): Due to the property of thermal conductivity as low as 0.022 W/m·K, polyurethane foam is widely praised for its excellence in thermal insulation. Its importance lies in having one of the best material conditions for temperature stabilization. Its scope of applications cuts across various applications in construction industries where energy dissipation is lessened and applications in refrigeration, which means it controls appliance and industrial machinery temperatures with perfect efficiency. These attributes also minimize energy usage and running expenses.

- Automotive Industry Use (Source: Statista, 2024): The automotive industry uses around 30% of the total polyurethane foam produced globally, indicating its high demand in this sector. It is used abundantly in seat cushions, headrests, armrests, and noise-reducing panels for comfort and noise abatement. Moreover, its light weight ensures that vehicles have good fuel efficiency, and it can last for a long time in a vehicle without degrading, thus proving to be an excellent choice for the automobile industry worldwide.

- Raw Material Costs (Source: ICIS Chemical Business, 2024): The primary cost for producing the polyurethane foam consists of key raw material components: diisocyanates, and polyols, which total 70%-80% percent of total expense. Variability in price increases is based largely on dynamics caused by changes in crude oil production and the extent of imbalanced supply-demand distribution. Companies deal with this effect to be afloat, showing stability and high profitability.

- Construction Applications (Source: International Energy Agency, 2023): Rigid polyurethane foam is a backbone in the building sector. As it is incorporated in more than 65 percent energy-efficient building schemes, its strength in insulation benefits the building up to 30–50 % regarding energy consumption which is the new trend of a sustainable construction procedure. It acts as a means of insulator in walls and roofs and a floor, aiming to minimize the carbon footprint related to the buildings.

- Spray Foam Popularity (Source: North American Insulation Manufacturers Association, 2024): Spray polyurethane foam (SPF) is used in North America to achieve nearly 25% market penetration. Its application is widely prominent in the roofing and walls of buildings. In this application, SPF creates a seal that is seamless and leakproof. SPF provides energy savings, considering that air leaks could likely weaken its ability to enhance resistance against heat. It is also versatile in application and can stick to a wide range of surfaces, making it a favorite among builders and homeowners.

- Recyclability (Source: European Chemical Industry Council, 2023): Sustainability is becoming a focal point in the polyurethane foam market, with over 15% of polyurethane foams being recycled annually. Recycling processes such as chemical and mechanical methods enable the recovery and reuse of valuable raw materials, reducing waste and environmental impact. This progress aligns with global efforts to promote circular economy principles and minimize the carbon footprint of industrial activities.

- Leading Manufacturers (Source: Bloomberg Intelligence, 2023): Industry majors like BASF, Dow, Covestro, and Huntsman Corporation account for over 50% of the polyurethane foam market. All these companies, through their substantial R&D infrastructure, cutting-edge production technologies, and wide-scale distribution networks, continue to drive their market supremacy. Innovation, as well as sustainable solutions, remains the top priority for leading manufacturers, leading to changes in the overall polyurethane foam market.

Global Polyurethane Foam Machines Market Dynamic

Driving Factors in the Global Polyurethane Foam Machines Market

Expanding Construction IndustryThe polyurethane foam machines market is driven by the booming construction sector, especially in emerging economies. In addition, superior thermal insulation properties make polyurethane foam indispensable for energy-efficient buildings. Due to urbanization and infrastructure projects across Asia-Pacific, the Middle East, and Latin America, a huge demand for advanced foam machines that can manage large-scale production volumes has emerged. Developed regions such as North America and Europe contribute to this growth, propelled by retrofitting activities and stricter energy efficiency regulations.

Growing Automotive Industry Demand

Strong demand, due to the emphasis of the automotive industry on lightweight for fuel efficiency, has had a positive effect on the demand for polyurethane foam machinery. Polyurethane foam helps to make cars lighter, safer, and more comfortable. It serves to make seats and headrests more pleasant to sit against or lean into. Besides, more people are increasingly showing a preference for electric vehicles; there will be increased use of these efficient foams for protecting the battery efficiently and passenger comfort. As a result, the increasing growth of the automotive sector in Asia-Pacific and the U.S. pushes up the pace for polyurethane foam machine manufacturing continuously.

Restraints in the Global Polyurethane Foam Machines Market

High Initial Costs and Maintenance Complexity

Most of the polyurethane foam machines involve huge investments at the front end, which makes adoption tough to decide on for SMEs. Among these, high-pressure machines are very costly, and their complex maintenance jumps up the operations cost of this equipment. This generally keeps market penetration limited, especially within developing regions. Most of the potential buyers encounter these challenges with a lack of affordable financing options and skilled labor.

Fluctuations in Raw Material Prices

The polyurethane foam industry is highly dependent on the petrochemical derivatives of polyol and isocyanates, which are fairly volatile in price. Hence, the instabilities in crude oil prices and disruptions in supply chains greatly impact production costs; hence, uncertainties in the market also continue. All these geopolitical tensions, trade restrictions, and environmental regulations further dent raw material supplies. These factors, therefore, restrain consistent market growth, particularly for manufacturers and end-users dependent on stable cost structures.

Opportunities in the Global Polyurethane Foam Machines Market

Emerging Markets in Asia-Pacific and Latin America

Rapid urbanization and industrialization in emerging economies present significant opportunities for the polyurethane foam machines market. This is because rapid construction activities, along with increasing automotive production, are accelerating demand for high-performance foam machines in countries like China, India, and Brazil. Additionally, government initiatives for affordable housing and smart cities develop market potential. Local manufacturers and international players can leverage these opportunities by providing cost-effective, scalable solutions designed for regional needs.

Advancements in Recycling and Sustainability Practices

The increasing focus on environmental sustainability opens up a world of possibilities for innovation in recycling technologies and green formulations for manufacturers. Thus, polyurethane foam machines with the capability to handle recyclable materials or that can produce biodegradable foams are gaining traction. This is a great opportunity, with the government offering incentives toward such sustainable practices and consumers beginning to demand greener products. Manufacturers investing in R&D to create machines that align with the principles of the circular economy may find themselves gaining a competitive advantage in this evolving market.

Trends in the Global Polyurethane Foam Machines Market

Integration of Automation and Smart Technology

Automation and IoT-enabled systems are fast becoming the features of polyurethane foam machines, transforming production. With automation, it allows for precise control in terms of density, composition, and application, thereby ensuring that every batch is uniformly qualitative. Features of real-time monitoring and predictive maintenance reduce downtime while enhancing efficiency and machine lifespan. IoT integration means seamless connectivity with other manufacturing processes, hence making the lines of production more agile and responsive to market demand. This is well in keeping with Industry 4.0 and the emerging requirement of smart manufacturing practices that will keep machines in tune with emerging industrial needs.

Shift Toward Eco-Friendly Machines and Materials

Eco-friendly formulation, due to the rise of environmental awareness and increased regulation in terms of emission output, raises demand for polyurethane foam machines. So, manufacturing machines that will be compatible with bio-based or low-GWP foaming agents has turned into developing ways for a manufacturer to reduce environmental impact in manufacturing. This can be perceived by changing consumer preferences on sustainability-sensitive products, and government decisions to go green. Moreover, through technological development, the production of recyclable foams allows for a circular economy. This trend is one way to keep polyurethane foam machines relevant in the future that is sure to be based on sustainability.

Research Scope and Analysis

By Machine Type

Low-pressure machines are projected to dominate the polyurethane foam machines market due to high versatility, low cost, and suitability for most applications, low-pressure polyurethane foam machines account for the larger market share. Low-pressure machines are suitable for producing low-density foams used by furniture, automotive, and the packaging industry. They can process small or medium production volumes with high accuracy, making them more suitable for companies that manufacture custom and specialty foam products.

One of the main reasons for their dominance is the lower initial investment and operational costs compared to high-pressure machines. This makes them accessible to small- and medium-sized enterprises (SMEs), particularly in emerging markets where cost sensitivity is a significant factor. Low-pressure machines are also easier to operate and maintain, requiring less technical expertise, which further reduces operational overheads.

Low-pressure machines are also preferred in applications that need intricate designs and less material waste. The mixing and dispensing process of this machine is regulated, which results in accurate foam output, less consumption of raw material, and quality products. This machine caters to the rising demand for ergonomic furniture, automotive seating, and lightweight packaging solutions, which are currently in high demand in the industry.

In addition, eco-friendly manufacturing practices have fueled the demand for low-pressure machines because they are compatible with bio-based and low-GWP foaming agents, which is in line with sustainability trends and a favorite choice among environmentally conscious manufacturers.

By Type

Machines with a power capacity of 50-100 kW are anticipated to dominate the polyurethane foam machines market due to High-volume output, effective consumption of power energy, well-balanced, easy adoption of machines 50-100 kW. Such attributes of machinery that lead it towards being dominators in the polyurethane foam machine market are well suited between performance and usage.

Due to the versatile application range, from insulation and cushioning up to the production of car parts, 50-100 kW machines can be applied to a variety of industries. Since the power supplied is quite satisfactory to work on the widest variety of foam densities and formulations, they are easily adapted to any industrial-specific demand. Efficiency in both high- and low-density polyurethane foam processing will allow application across all these different end-use industries: construction, furniture, electronics, and more.

Energy efficiency is a primary reason for this segment's domination. With soaring energy prices and increasing concern about sustainability, the manufacturers want machines that would consume less electricity while still being able to give high production rates. Most machines in this range of power feature advanced energy-saving technologies, minimizing operational costs and impact on the environment.

The other advantage of 50-100 kW machines is that they are compact in design, which allows them to fit into existing production lines without significant infrastructure modifications. This makes them an ideal choice for manufacturers looking to upgrade or expand their operations incrementally.

These machines also respond to the emerging demand for cost-effective and scalable solutions in emerging markets. They are affordable and adaptable, making them a preferred option for both established players and new entrants in the polyurethane foam industry.

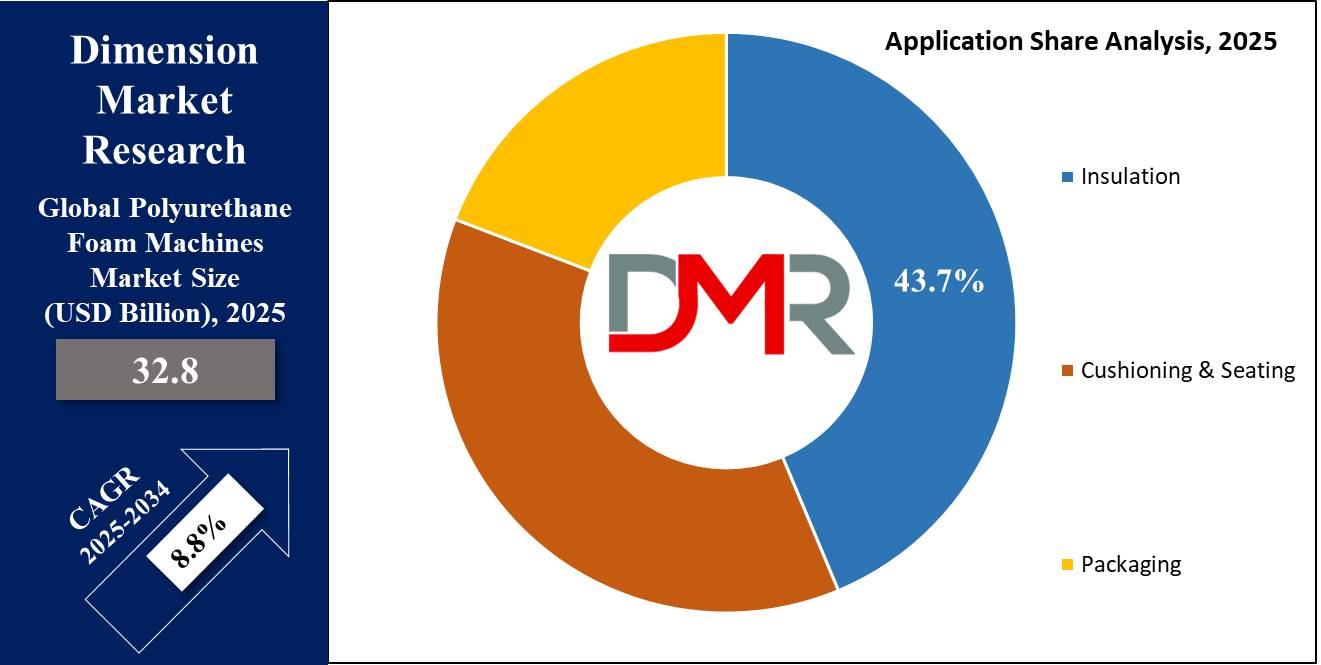

By Application

The insulation application segment is projected to lead the market for polyurethane foam machines because of the increased focus on energy efficiency and sustainable construction. Polyurethane foam is known for its excellent thermal insulation properties, making it a vital component in residential, commercial, and industrial buildings. Increasing energy costs and tighter building energy codes have created an increased demand for high-performance insulation solutions, thus driving the use of polyurethane foam machines specifically designed for insulation.

Polyurethane foam is an excellent insulator, providing both thermal and sound insulation, making it suitable for all types of climates and buildings. High-pressure machines are specifically designed to produce high-density foam that can be attached directly to surfaces without any gaps, creating an effective barrier against heat transfer and noise. Its versatility ensures applicability in walls, roofs, and floors, further cementing its position in the insulation segment.

Moreover, the increased rate of green building certifications and government incentives for energy-efficient construction encourages the use of insulation-grade polyurethane foam. Reduced energy consumption and lower heating and cooling costs by building occupants minimize greenhouse gas emissions through the contribution of polyurethane foam insulation.

Moreover, improvements in polyurethane foam machines have been improving production efficiency by accurately formulating and applying insulation-grade foam. Machines are increasingly being accepted to handle the usage of environment-friendly foaming agents, with trends toward sustainability at the global level. The trend is expected to remain in favor of the insulation segment, especially because of steady innovation in polyurethane foam machines as rapid urbanization and infrastructure development are going to be dominant trends in developing economies.

By End-User

The construction sector is projected to dominate the polyurethane foam machines market since this foam finds so many applications in insulation, structural reinforcement, and sealing. The increasing trend towards energy-efficient buildings and the advances being made in green construction are the reasons why polyurethane foam has become the most prominent material in modern construction projects.

Because polyurethane foam has superior insulation properties, it is the most critical factor in maintaining thermal efficiency within buildings. It is applied to the walls, roofs, and floors to minimize energy consumption and improve occupant comfort. With high-performance machines for polyurethane foam, foams can be produced that have a close bond to varied surfaces for lasting and efficient insulation.

Urbanization and infrastructure development are rapidly advancing, especially in the Asia-Pacific and Middle East regions, increasing demand for polyurethane foam machines in construction activities. In many countries, the government is promoting affordable housing schemes and smart cities, creating demand for sophisticated insulation and sealing applications.

Then, there's the fact that polyurethane foam is much more versatile than a passive insulant. It is used for gap sealing, soundproofing and to impart structural reinforcement to buildings, thus making it an all-purpose material in construction. The high-quality foam production capability of polyurethane foam machines further solidifies their position within this sector.

Technological advancements, including the development of environment-friendly formulations and automated production processes, make polyurethane foam machines more attractive to the construction industry. Being by regulatory mandates regarding environment-friendly building practices, the segment for construction end-users will continue to grow.

The Polyurethane Foam Machines Market Report is segmented on the basis of the following

By Machine Type

- Low-Pressure Machines

- High-Pressure Machines

By Type

- Below 50 kW

- 50-100 kW

- 100-200 kW

- Above 200 kW

By Application

- Insulation

- Cushioning & Seating

- Packaging

By End-Use Industry

- Construction

- Automotive

- Furniture

- Electronics & Appliances

Regional Analysis

North America is projected to dominate the polyurethane foam machines market as it

holds 39.3% of the total revenue share in this market by the end of 2024. Polyurethane foam machines account for the major share in North America primarily because of an advanced industrial base, higher energy efficiency demands from the construction industry, and the ability to adopt advanced technology. In addition, this region has a stronger construction sector triggered by strong regulations on energy use, as indicated by the energy efficiency standards laid down by the U.S. Department of Energy. The majority of the constructions are thus insulating and structural, making them more polyurethane-foam-based.

The North American automotive industry further increases this dominance. Because the head offices of big automobile companies are in the region, the demand for quality foam for seating, cushioning, and noise absorption is high. Polyurethane foam machines make customized car parts that improve fuel efficiency and comfort.

Technological advancements and the presence of leading manufacturers like Hennecke GmbH and Cannon Group also make North America the leader. The companies are continuously innovating and developing high-pressure and low-pressure machines with efficiency and reduced environmental impact, which meets the needs of the changing industry.

In addition, the sustainability and green material focus of North America supports the adoption of polyurethane foam produced using low-GWP agents. Incentives for green buildings and retrofitting further increase machine demand. The region's established supply chain infrastructure, skilled workforce, and access to raw materials solidify its competitive edge.

In particular, rapid urbanization and infrastructural modernization projects in the United States and Canada are sustaining long-term growth in the region. Furthermore, participation in global expos and conferences portrays innovation and gives rise to collaborative efforts, continuing to maintain this market's domination.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for polyurethane foam machines is highly competitive, with innovativeness product diversification, and strategic partnerships as the central focus of these companies. Top companies in this market include Hennecke GmbH, Cannon Group, and KraussMaffei Group, which deliver technologically superior machines with superior efficiency and eco-friendliness. These firms focus on significant R&D to create machines suitable for low-GWP and bio-based foaming agents, based on global trends for sustainability. Shandong Reanin Machinery Co., Ltd. and Santech Foam Machines are servicing cost-sensitive markets with flexible solutions, yet remain affordable. With an increase in regional players coming from the Asian-Pacific and Middle Eastern regions, these also build healthy competition, primarily in price-sensitive segments.

The primary trend in competitors is strategic partnerships and acquisitions. For example, partnerships between machine manufacturers and chemical companies allow for the development of customized foam solutions for end-user industries. Exhibitions and trade expos are a means through which companies can showcase their innovations and increase their customer base. After-sales services and customization of machines also form the core of the competitive landscape to retain customers and develop long-term relationships. With the emergence of IoT-enabled machines, competitive dynamics have been taken a step forward by manufacturers through smart technologies for improved performance and efficiency of the machines.

Some of the prominent players in the Global Polyurethane Foam Machines Market are

- BASF

- Dow

- Covestro

- Huntsman Corporation

- Sabtech Technology Limited

- Santech Foam Machines

- A S Enterprises

- Sinowa

- Allied Tech Machine

- Hennecke GmbH

- Cannon Group

- KraussMaffei Group

- Baumer Group

- Edge-Sweets Company (ESCO)

- Linden Polyurethane

- Other Key Players

Recent Developments

- December 2024: Hennecke GmbH showcased its next-generation high-pressure machines at the International Polyurethane Conference, focusing on the integration of low-GWP (Global Warming Potential) foaming agents. This innovative approach highlights the company’s commitment to sustainability and reducing environmental impact.

- November 2024: Cannon Group announced a strategic partnership with a leading automotive supplier to develop foam solutions for electric vehicle (EV) interiors. The collaboration aims to address the increasing demand for lightweight, durable, and eco-friendly materials for EV seats and interior components.

- October 2024: KraussMaffei Group launched a new series of energy-efficient 50-100 kW machines, specifically targeting medium-scale manufacturers in the Asia-Pacific region. By focusing on energy efficiency, KraussMaffei responds to the rising need for reducing production costs and minimizing environmental impact, particularly within the rapidly growing markets of Asia-Pacific, where industrial production is booming.

- September 2024: Santech Foam Machines participated in the Polyurethane Machinery Expo held in Dubai, where they introduced a cost-effective low-pressure machine tailored for small and medium enterprises (SMEs). This machine aims to provide an affordable yet reliable solution for businesses in the Middle East looking to produce polyurethane foam for insulation, packaging, and furniture.

- August 2024: Baumer Group invested significantly in a new R&D facility in Germany to advance its automation technologies for foam machines. The state-of-the-art facility is expected to enhance Baumer’s ability to develop innovative solutions, improving machine performance and reducing production costs.

- July 2024: Shandong Reanin Machinery Co., Ltd. expanded its production capacity with a new manufacturing plant in China to meet the growing demand for polyurethane foam machines in the region. This strategic move comes in response to the rapid industrialization in China and the increasing demand for polyurethane products in constructio