Market Overview

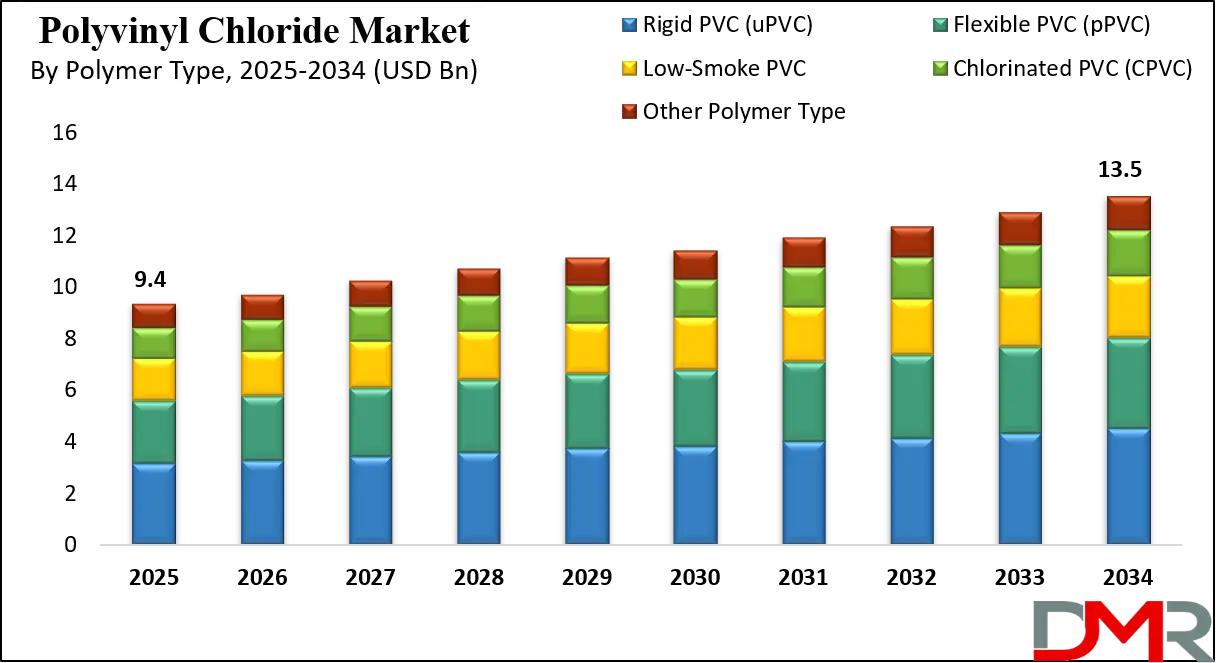

The Global Polyvinyl Chloride (PVC) Market is forecasted to reach USD 9.4 billion by 2025 and is expected to expand steadily at a compound annual growth rate (CAGR) of 4.2% through the forecast period, attaining a market value of USD 13.5 billion by 2034. The growth is driven by rising demand across construction, automotive, packaging, electrical, and healthcare applications, supported by the material’s durability, cost-effectiveness, corrosion resistance, and versatility.

Increasing infrastructure investments, urbanization, and technological advancements in PVC formulations, recycling, and sustainable production are further contributing to market expansion. Additionally, the shift toward lightweight materials, flexible PVC applications, and eco-friendly manufacturing practices enhances long-term growth prospects for the global PVC industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global polyvinyl chloride (PVC) market is witnessing steady growth, driven by its widespread application across industries such as construction, automotive, packaging, and healthcare. PVC’s durability, low cost, and versatility make it a critical material for pipes, profiles, cables, films, and flooring.

According to PlasticsEurope, global plastics production reached over 400 million tonnes in 2022, with PVC contributing around 10% of total polymer demand. The demand surge is fueled by urbanization, infrastructure projects, and water management initiatives, particularly in Asia-Pacific, which remains the largest regional consumer. PVC’s role in sustainable building materials is also expanding as companies integrate bio-attributed and recyclable PVC solutions to align with global decarbonization goals.

Emerging trends highlight a strong shift toward green PVC production, including bio-based feedstocks and recycling technologies. Governments and industry bodies are pushing for innovations in circular economy practices, and companies such as INEOS, Westlake, and LG Chem are investing heavily in eco-friendly PVC manufacturing. Additionally, the adoption of automation and artificial intelligence in production processes is boosting operational efficiency and reducing environmental footprints. These trends are enhancing the competitiveness of PVC as industries demand sustainable, high-performance alternatives to traditional plastics.

Opportunities lie in healthcare, renewable energy, and water infrastructure. PVC’s usage in medical devices such as IV bags and tubing is expanding due to its biocompatibility and safety standards. In renewable energy, PVC is increasingly used in cable insulation for solar and wind projects. Developing nations are investing in large-scale water supply and sewage infrastructure, where PVC pipes offer long-term cost efficiency and resilience. These factors are positioning PVC as a key enabler of sustainable industrial growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these drivers, the market faces restraints related to environmental concerns and regulatory challenges. PVC production relies on chlorine and fossil fuels, which attract scrutiny due to emissions and disposal issues. Strict regulations in Europe and North America are pushing producers to adopt greener technologies, while competition from alternative polymers like polyethylene and polypropylene adds pressure. Balancing cost competitiveness with sustainability will define the growth trajectory. Still, global demand for PVC is projected to grow steadily at around 5% CAGR through 2030, reflecting its indispensable role in modern industries.

The US Polyvinyl Chloride Market

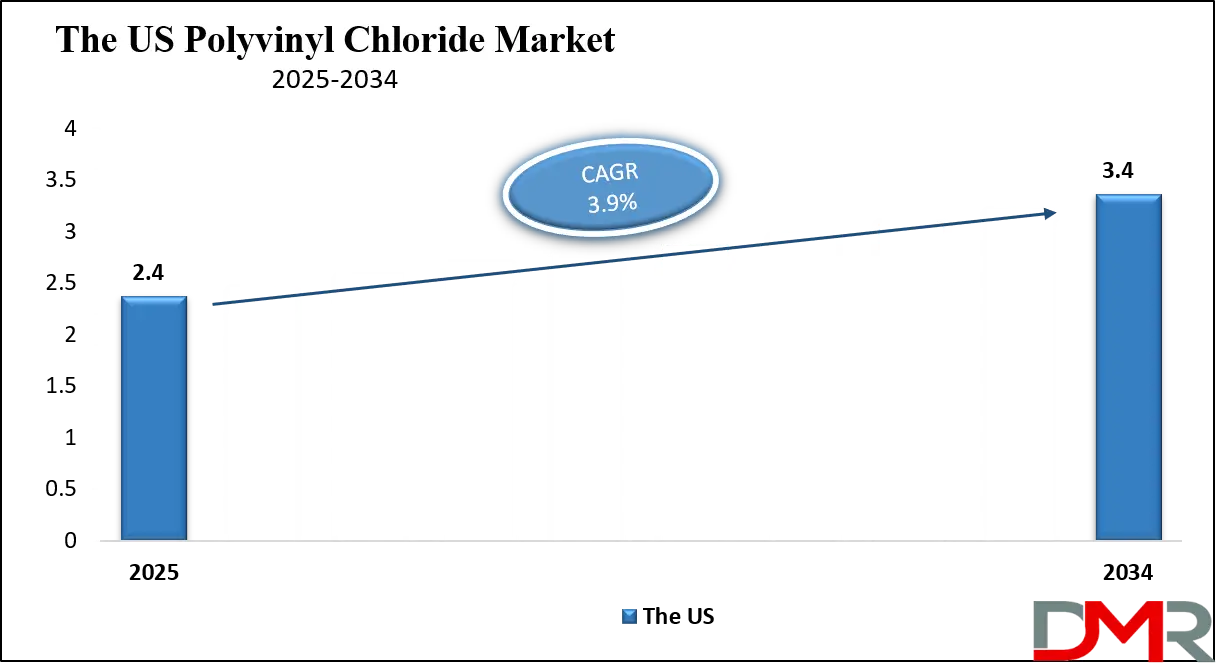

The US Polyvinyl Chloride Market is projected to reach USD 2.4 billion in 2025 at a compound annual growth rate of 3.9% over its forecast period.

The United States PVC market benefits from a strong industrial base and abundant access to natural gas feedstocks that lower production costs. According to the U.S. Energy Information Administration (EIA), the country remains one of the leading producers of ethylene dichloride and vinyl chloride monomer, the two primary precursors of PVC. This advantage supports a highly competitive export capacity, with U.S. PVC resins widely shipped to Latin America and Asia.

The U.S. Census Bureau highlights that over 1.4 million new housing units were authorized in 2023, driving demand for rigid PVC pipes, fittings, and profiles in plumbing, windows, and flooring. Building and construction account for the largest share of PVC use in the U.S., supported by federal infrastructure programs, including the Infrastructure Investment and Jobs Act, which allocates significant funding for modernizing water distribution networks, a key end-use of PVC piping systems.

Demographic advantages include rapid urbanization in Southern and Western states, where population growth drives demand for housing and utilities. The U.S. Department of Transportation underscores investments in transportation infrastructure, where PVC materials are increasingly applied in signage, flooring, and cabling systems. In addition, the U.S. Consumer Product Safety Commission regulates phthalates and additives, pushing manufacturers to innovate safer, low-toxicity PVC compounds.

Overall, the U.S. PVC market is poised for long-term growth due to its feedstock security, construction expansion, infrastructure renewal, and regulatory-driven innovation. This combination ensures its continued dominance as a key player in the global PVC landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Polyvinyl Chloride Market

The Europe Polyvinyl Chloride Market is estimated to be valued at USD 1.4 billion in 2025 and is further anticipated to reach USD 1.9 billion by 2034 at a CAGR of 3.5%.

Europe’s PVC market is characterized by regulatory influence, advanced recycling programs, and a focus on sustainability. According to the European Chemicals Agency (ECHA), strict guidelines on stabilizers and plasticizers have accelerated the transition from lead-based additives to calcium-zinc systems. This regulatory environment promotes innovation in eco-friendly PVC formulations.

The European Commission has emphasized energy-efficient construction, with the Renovation Wave Strategy aiming to double annual building renovation rates by 2030. This directly benefits rigid PVC applications in windows, profiles, and insulation materials, as PVC products help achieve energy savings through durability and thermal efficiency. Moreover, demand for lightweight automotive components aligns with the European Automobile Manufacturers Association (ACEA) initiatives for fuel efficiency and emission reduction, where flexible PVC is increasingly utilized in cables, seals, and interiors.

The Eurostat database reports that Europe’s packaging sector remains robust, supporting flexible PVC in films and sheets. At the same time, advanced circular economy models, such as VinylPlus, have recycled more than 6.5 million tonnes of PVC since 2000, demonstrating the region’s leadership in sustainable PVC management.

Demographic advantages include dense urban populations across Western Europe, stimulating demand for water and sanitation infrastructure, where PVC pipes and fittings remain the material of choice. Transportation networks also expand the use of PVC in cables, flooring, and cladding.

Overall, Europe’s PVC market growth is tempered by regulatory pressure but strengthened by sustainability-driven innovation, construction modernization, and circular economy leadership, ensuring its long-term resilience.

The Japan Polyvinyl Chloride Market

The Japan Polyvinyl Chloride Market is projected to be valued at USD 564.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 800.0 million in 2034 at a CAGR of 4.0%.

Japan’s PVC market is shaped by advanced industrial capabilities, demographic challenges, and sustainability initiatives. According to the Ministry of Economy, Trade and Industry (METI), Japan remains one of the top PVC consumers in Asia, with domestic production focused on meeting demand in construction, electrical, and automotive sectors. The nation’s advanced chemical industry and reliance on acetylene-based PVC routes contribute to efficient and competitive manufacturing.

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) emphasizes continuous investments in earthquake-resistant housing and water infrastructure, where rigid PVC pipes and fittings provide cost-effective and durable solutions. With Japan’s aging population, there is rising demand for healthcare-related PVC applications, including tubing and medical packaging. Moreover, the Japan Automobile Manufacturers Association (JAMA) reports steady automotive production, integrating flexible PVC into wiring, seals, and interiors to reduce weight and enhance safety.

Urban density in Tokyo, Osaka, and other metropolitan regions drives significant consumption of PVC in water distribution, insulation, and floorings. At the same time, the Japan Plastics Industry Federation (JPIF) promotes PVC recycling initiatives, aligning with national environmental policies to reduce waste and advance circular economy goals.

Demographic advantages include Japan’s highly urbanized society, which necessitates large-scale infrastructure maintenance and upgrades, ensuring consistent PVC demand despite overall population decline. Furthermore, high technological adoption supports innovations in bio-based PVC and advanced stabilizer systems.

In summary, Japan’s PVC market maintains strength through infrastructure modernization, automotive innovation, healthcare applications, and sustainability programs, ensuring steady growth despite demographic headwinds.

Global Polyvinyl Chloride Market: Key Takeaways

- The Global Market Size Insights: The Global Polyvinyl Chloride Market size is estimated to have a value of USD 9.4 billion in 2025 and is expected to reach USD 13.5 billion by the end of 2034.

- The Global Market Rate Insights: The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Polyvinyl Chloride Market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.4 billion in 2034 at a CAGR of 3.9%.

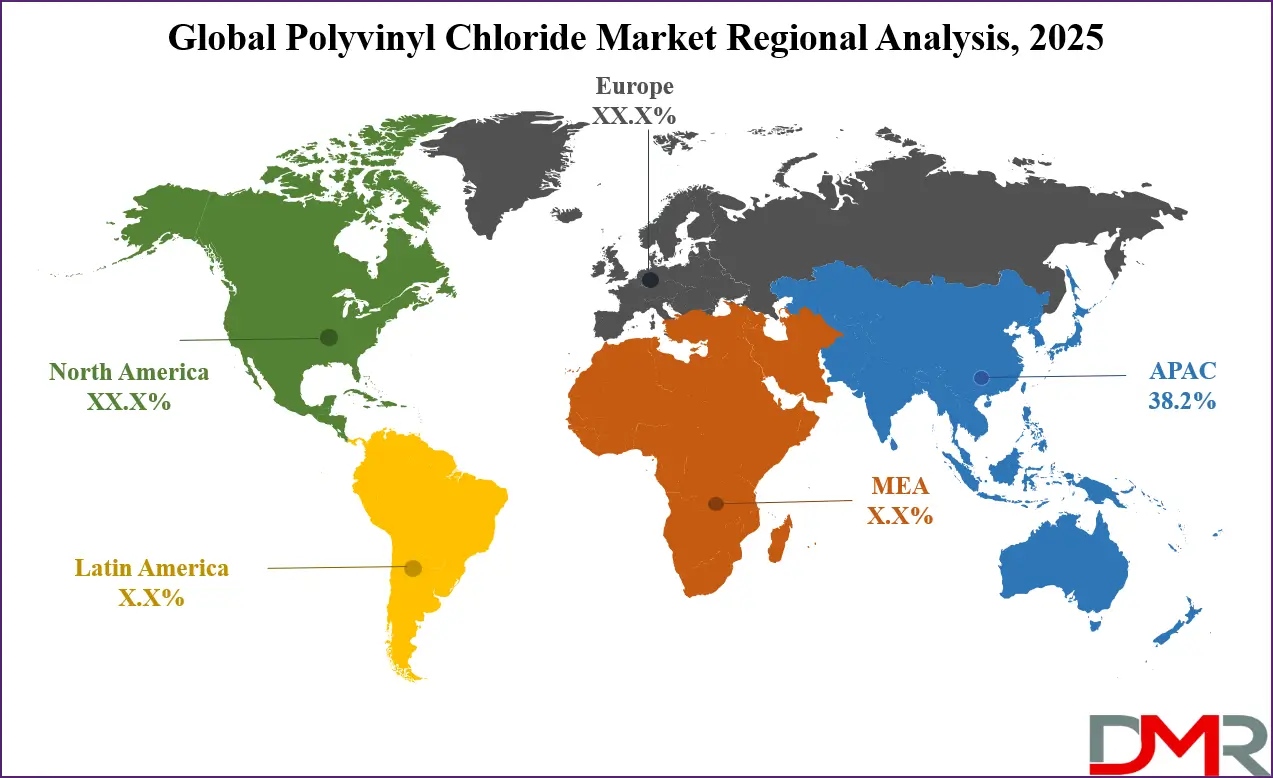

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Polyvinyl Chloride Market with a share of about 38.2% in 2025.

- Key Players Insights: Some of the major key players in the Global Polyvinyl Chloride Market are Shin-Etsu Chemical Co. Ltd., Formosa Plastics Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Chemical Corporation, INEOS Group Holdings S.A., Orbia Advance Corporation (Mexichem), LG Chem Ltd., and many others.

Global Polyvinyl Chloride Market: Use Cases

- Pipes and Fittings: PVC dominates global water distribution and sewage infrastructure due to its corrosion resistance, lightweight handling, and cost-efficiency. Municipal projects in Asia and North America prefer rigid PVC pipes for durability and low maintenance, making them a reliable choice over metals or concrete.

- Automotive Interiors: Flexible PVC is widely used in dashboards, door panels, and cable insulation for vehicles. It provides lightweight solutions that support fuel efficiency and electric vehicle wiring systems. With automotive OEMs focusing on cost reduction and emission control, PVC remains a key polymer for modern car design.

- Electrical & Electronics: PVC’s flame retardance and dielectric properties make it indispensable for wire and cable insulation. Power grids, telecom, and consumer electronics integrate PVC for safety and long life. With rising electricity demand and 5G infrastructure expansion, the electrical sector remains a major PVC end-use industry globally.

- Healthcare Applications: Medical tubing, blood bags, and blister packaging extensively use PVC due to its clarity, flexibility, and biocompatibility. Hospitals worldwide rely on medical-grade PVC products for sterile environments, ensuring patient safety. The pandemic accelerated its demand in disposable healthcare products, positioning PVC as an essential polymer in the medical supply chain.

- Packaging Solutions: PVC films and sheets are used in blister packs, food wrapping, and industrial packaging due to durability and chemical resistance. Their ability to preserve product freshness and integrity supports applications across pharmaceuticals, FMCG, and consumer goods, with growing adoption in Asia-Pacific’s expanding packaging industry.

Global Polyvinyl Chloride Market: Stats & Facts

U.S. Census Bureau

- In 2023, the United States authorized 1,469,800 building permits, started 1,413,100 housing units, and completed 1,452,500 units, underscoring the constant flow of demand for PVC-based pipes, profiles, and flooring materials in the housing sector.

- By July 2025, the seasonally adjusted annual rate for building permits stood at ~1.44 million, showing ongoing residential and non-residential construction activity.

European Commission – Renovation Wave

- The EU’s Renovation Wave Strategy targets the renovation of 35 million buildings by 2030, a huge demand driver for rigid PVC in windows, insulation, and flooring.

- The program seeks to at least double annual energy-renovation rates by 2030, where PVC plays a crucial role in energy-efficient retrofitting.

- About 85% of EU building stock was built before 2000, much of it requiring upgrades, boosting PVC opportunities in pipes, cladding, and fittings.

Japanese Ministry & JAMA (Automotive)

- Japan produced 8.99 million motor vehicles in 2023, according to JAMA, sustaining demand for flexible PVC in wiring, interiors, and seals.

U.S. Energy Information Administration (EIA)

- U.S. ethane exports reached 21.6 million metric tons in 2023, a key feedstock for vinyl chloride monomer (VCM) production, ensuring feedstock security for U.S. PVC producers.

- Ethane exports rose by ~58% in 2023 compared to 2022, reflecting the U.S. leadership in supplying low-cost petrochemical raw materials globally.

U.S. Geological Survey (USGS)

- U.S. salt production in 2023 was ~51 million tons, with a value of ~USD 3.6 billion. Salt is vital in the chlor-alkali process for producing chlorine, which is central to PVC resin production.

Eurostat – Packaging/Plastics

- In 2022, 41% of plastic packaging waste in the EU was recycled, highlighting Europe’s stronger recycling framework compared to many regions.

- Each EU citizen generated 36.1 kg of plastic packaging waste in 2022, with 14.7 kg recycled per person, reflecting the scale of consumer-side demand for sustainable packaging.

- EU packaging waste composition in 2022 included paper/cardboard (41%), plastic (19%), glass (19%), wood (16%), and metal (5%), with PVC playing a role in films, bottles, and rigid packaging.

VinylPlus (European PVC Industry Program)

- Europe recycled 737,645 tonnes of PVC in 2023, demonstrating industry-led sustainability initiatives.

- Since 2000, ~9.5 million tonnes of PVC have been recycled under VinylPlus commitments.

- In 2022, PVC recycling volumes reached 813,266 tonnes, showing a dip in 2023 but still reflecting strong long-term recovery rates.

U.S. Environmental Protection Agency (EPA)

- The U.S. generated 292.4 million tons of municipal solid waste (MSW) in 2018, with plastics making up 35.7 million tons (12.2%).

- Plastics recycled in 2018 totaled 3.09 million tons (8.7%), including PET bottles at 29.1% and HDPE natural bottles at 29.3%.

- Plastics landfilled in 2018 amounted to 27.0 million tons (18.5% of landfilled MSW), while 5.6 million tons (16.3%) were combusted with energy recovery.

- The U.S. national recycling rate was 32.1% in 2021, showing gradual improvements in sustainability performance.

OECD – Global Plastics Outlook

- Global plastic waste reached 353 million tonnes in 2019, with only 9% recycled.

- The OECD projects plastic waste and use could triple by 2060 if stronger policies are not enforced, driving a shift toward circular plastics and recycled PVC.

U.S. Consumer Product Safety Commission (CPSC)

- Federal rules ban eight phthalates (DEHP, DBP, BBP, DINP, DIBP, DPENP, DHEXP, DCHP) in children’s toys and childcare items.

- The limit is set at 0.1% by weight per phthalate, adopted in October 2017, pushing PVC manufacturers toward safer, non-toxic

World Bank (UN System)

- 57% of the global population lived in urban areas in 2023, increasing demand for water, sewage, and housing infrastructure—all heavy PVC applications.

- 83% of the U.S. population and 92% of Japan’s population lived in urban areas in 2023, creating concentrated demand for utilities, cabling, and transportation.

Japanese Automobile Manufacturers Association (JAMA)

- As noted, 8.99 million vehicles were produced in Japan in 2023, reinforcing PVC demand in electrical, interior, and sealing components for automotive OEMs.

Global Polyvinyl Chloride Market: Market Dynamic

Driving Factors in the Global Polyvinyl Chloride Market

Expanding Use of PVC in Healthcare and Medical Devices

The healthcare sector has become a powerful growth driver for the global PVC market. PVC is extensively used in medical tubing, IV bags, catheters, blood bags, and packaging for pharmaceutical products. Its biocompatibility, clarity, flexibility, and ability to be sterilized make it ideal for medical applications.

The COVID-19 pandemic amplified global awareness of the critical role of PVC in ensuring reliable healthcare supplies, particularly for disposable medical products. Additionally, as healthcare systems expand in developing economies such as India, Brazil, and parts of Southeast Asia, the demand for PVC-based medical devices is rising sharply.

Innovations in non-phthalate plasticizers are addressing regulatory concerns over traditional additives, further opening up opportunities in sensitive applications such as neonatal and pediatric care. The World Health Organization (WHO) has emphasized the need for affordable and safe medical devices, aligning perfectly with PVC’s low-cost yet high-performance profile. The healthcare-driven demand ensures steady growth for PVC, with manufacturers increasingly customizing products for advanced biomedical applications.

Government Support for Infrastructure Development and Housing Programs

Governments worldwide are prioritizing infrastructure modernization and affordable housing development, which strongly supports the PVC market. Programs like India’s “Pradhan Mantri Awas Yojana,” China’s Belt and Road Initiative, and large-scale urban renewal projects in the U.S. and EU are boosting demand for PVC pipes, windows, doors, and flooring materials.

PVC’s versatility, lightweight nature, and resilience against harsh environmental conditions make it highly attractive for large-scale infrastructure projects. In water management systems, PVC’s resistance to corrosion and cost-effectiveness offer significant advantages over traditional materials such as steel or concrete. Furthermore, state-backed sustainability initiatives, including recycling mandates and eco-friendly procurement standards, are encouraging the use of advanced PVC products.

For instance, the U.S. Environmental Protection Agency (EPA) promotes the use of recyclable building materials, while European directives strongly advocate energy-efficient PVC windows and insulation solutions. With infrastructure spending expected to remain strong for decades, supported by both developed and emerging economies, government initiatives are cementing PVC’s role as a growth engine in the construction materials market.

Restraints in the Global Polyvinyl Chloride Market

Environmental Concerns and Regulatory Pressures on PVC Production

Despite its widespread use, PVC continues to face significant scrutiny due to environmental concerns associated with its lifecycle. The production of PVC involves chlorine chemistry and, in some cases, additives such as phthalates, which have been linked to health and ecological risks. Disposal and incineration of PVC products can release hazardous emissions, creating challenges for waste management systems.

As a result, regulatory bodies in Europe, North America, and other regions have imposed stringent restrictions on the use of certain additives and are promoting safer alternatives. These regulations increase compliance costs for manufacturers and can delay product approvals in sensitive sectors like healthcare and food packaging. Public opposition to single-use plastics further compounds these challenges, putting pressure on companies to transition toward greener alternatives. While innovations in bio-based and recyclable PVC are mitigating these issues, the ongoing regulatory environment remains a restraint that could limit market growth in certain regions and applications.

Volatility in Raw Material Prices and Supply Chain Disruptions

The PVC industry is heavily reliant on petrochemical feedstocks such as ethylene and chlorine, making it vulnerable to fluctuations in crude oil and natural gas prices. Price volatility in raw materials significantly impacts production costs, squeezing profit margins for manufacturers and influencing end-user pricing. Moreover, supply chain disruptions, such as those caused by the COVID-19 pandemic, geopolitical conflicts, and shipping bottlenecks, have highlighted the fragility of global PVC supply.

In 2021, for example, severe weather in the U.S. Gulf Coast temporarily shut down PVC production plants, causing shortages and price spikes worldwide. With the industry’s dependence on a few major production hubs, regional disruptions often have global repercussions. Additionally, rising energy costs and carbon taxes are increasing operational expenses for PVC manufacturers. These factors create uncertainties in the market and may limit investments in capacity expansion. Addressing these challenges requires diversification of supply chains, improved raw material efficiency, and greater adoption of alternative feedstocks.

Opportunities in the Global Polyvinyl Chloride Market

Rising Demand in Renewable Energy and Smart Grid Applications

One of the emerging growth opportunities for the PVC market lies in renewable energy and smart grid infrastructure. PVC’s excellent electrical insulation properties make it highly suitable for cables, wiring, and coatings used in solar panels, wind turbines, and modern transmission systems. As nations accelerate their clean energy transitions, the expansion of solar and wind capacity is driving demand for durable, weather-resistant PVC products.

Additionally, smart grid modernization efforts require vast amounts of insulated wiring, where PVC provides cost-effective and long-lasting solutions. With global renewable energy capacity expected to double in the next decade, PVC manufacturers are increasingly focusing on specialized formulations that meet the mechanical and safety demands of energy infrastructure. This creates an untapped opportunity for PVC producers to diversify into high-value markets beyond traditional construction. By aligning with the global energy transition and sustainability goals, PVC companies can secure long-term growth while supporting clean energy adoption worldwide.

Opportunities in Circular Economy and Advanced Recycling Technologies

The circular economy represents a major opportunity for the PVC market as industries seek to minimize waste and maximize resource efficiency. Advanced recycling technologies, including chemical recycling and feedstock recovery, are gaining momentum as solutions to the challenge of post-consumer PVC waste. Several global initiatives and partnerships are being established to enhance PVC’s recyclability and incorporate secondary raw materials into production. Companies that invest in closed-loop systems are gaining regulatory support and improving their environmental, social, and governance (ESG) credentials.

For example, in Europe, initiatives under VinylPlus are advancing PVC recycling targets and developing safer, sustainable formulations. Moreover, growing consumer and governmental pressure for sustainable products is incentivizing innovation in recycling infrastructure. By tapping into circular economy practices, PVC manufacturers can differentiate themselves in competitive markets, reduce production costs, and appeal to eco-conscious industries such as packaging, healthcare, and automotive. This creates a long-term growth pathway that complements global sustainability trends and environmental policies.

Trends in the Global Polyvinyl Chloride Market

Increasing Adoption of Sustainable and Bio-based PVC Solutions

The global PVC market is undergoing a major transformation as industries prioritize sustainability and eco-friendly practices. One of the most prominent trends is the rising adoption of bio-based PVC alternatives that reduce reliance on fossil fuels. Traditional PVC production has long been criticized for environmental concerns, particularly regarding chlorine content and additives such as phthalates.

To counter this, manufacturers are investing in green chemistry approaches, recyclable PVC resins, and lower-carbon production processes. Several European Union initiatives and global policies are encouraging companies to cut greenhouse gas emissions and promote circular economy models, further accelerating the push toward sustainable PVC.

Moreover, advances in additives that improve recyclability and enhance product life cycles are becoming central to innovation strategies. The trend is also fueled by consumer demand for eco-conscious materials in sectors such as packaging, construction, and healthcare. Over the next decade, sustainability-driven PVC products are expected to reshape the market, with bio-based PVC gaining increasing market share as an alternative to conventional resins.

Rising Demand for PVC in Infrastructure and Construction Applications

A key trend driving PVC consumption globally is the robust demand from infrastructure and construction sectors. PVC is widely used in pipes, fittings, flooring, roofing membranes, siding, and window frames due to its durability, cost-effectiveness, and corrosion resistance. Urbanization and megacity development, particularly in emerging markets across Asia-Pacific and Africa, are creating unprecedented demand for water supply and sewage management systems, where PVC pipes play an essential role.

The material’s low maintenance requirements, resistance to chemicals, and long lifespan make it an indispensable choice for governments and contractors seeking cost-efficient infrastructure solutions. In addition, green building initiatives are increasingly recognizing PVC for its recyclability and compatibility with sustainable construction practices.

In regions like the U.S. and Europe, renovation of aging infrastructure, coupled with stimulus-backed housing projects, is further boosting PVC applications. The global construction boom, along with ongoing investments in smart cities and modern utilities, ensures that PVC remains a material of choice, driving long-term trends in the industry.

Global Polyvinyl Chloride Market: Research Scope and Analysis

By Polymer Form Analysis

Rigid PVC (uPVC) is projected to dominates the polymer form segment due to its extensive use in building and infrastructure applications such as pipes, fittings, window profiles, and door frames. The material’s high tensile strength, durability, chemical resistance, and low maintenance requirements make it indispensable for long-term applications in construction and municipal infrastructure. Compared to alternatives like steel, copper, or concrete, rigid PVC is significantly lighter and cost-effective, allowing for easier transportation, handling, and installation, which enhances its preference in large-scale projects. Its resistance to corrosion and weathering ensures long service life in outdoor and underground installations, reducing the need for frequent replacements and repairs.

The growing pace of urbanization and industrialization in emerging economies, especially across Asia-Pacific nations like China and India, has resulted in massive infrastructure development projects that rely heavily on uPVC-based pipes, sewage systems, and window frames. North America and Europe also contribute to this dominance, particularly through stringent building energy efficiency standards that encourage the use of uPVC windows for thermal insulation.

While flexible PVC, CPVC, and low-smoke PVC are gaining ground in niche applications such as automotive interiors, electrical insulation, and flame-retardant materials, rigid PVC continues to account for the largest share of global PVC consumption. This dominance is expected to persist as sustainable construction materials and smart cities accelerate the demand for cost-efficient, durable, and eco-friendly infrastructure solutions.

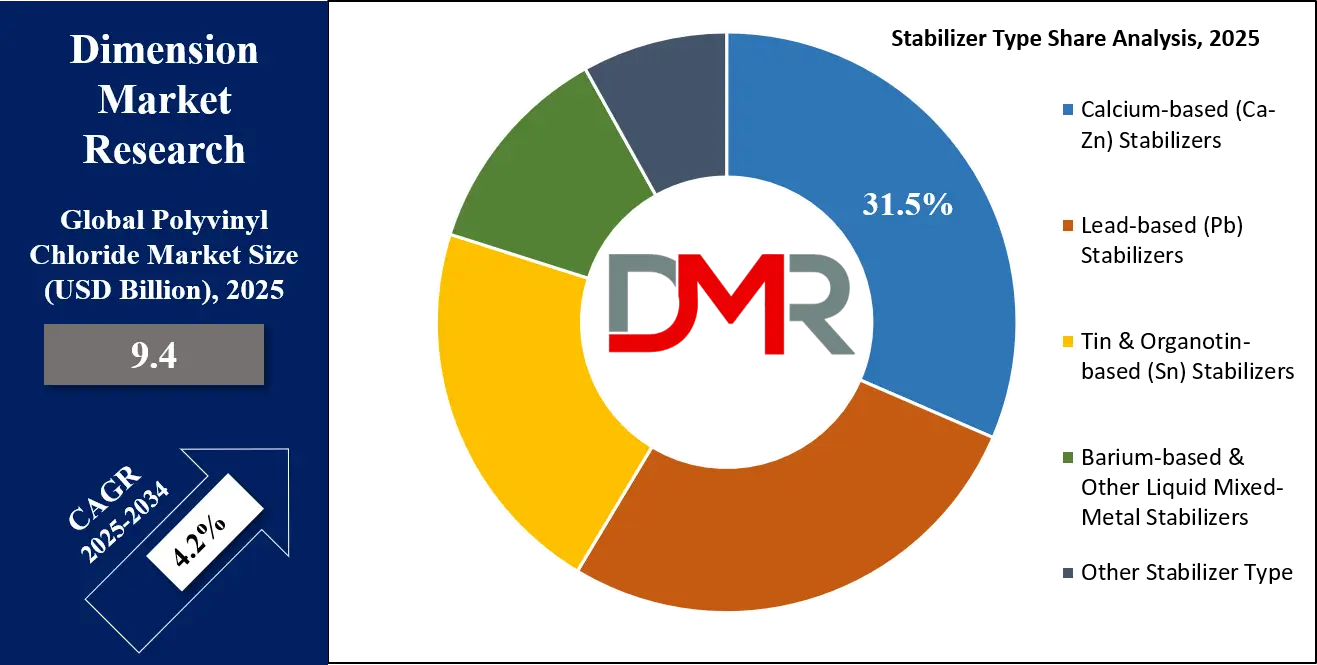

By Stabilizer Type Analysis

Calcium-based (Ca-Zn) stabilizers is poised to dominate the stabilizer type segment of the PVC market, primarily due to growing environmental concerns and the strict enforcement of global regulatory frameworks that discourage the use of toxic lead-based stabilizers. The European Union’s REACH regulations, combined with parallel bans and restrictions in North America and Japan, have pushed the industry toward adopting calcium-based solutions that are environmentally friendly, safe for human health, and suitable for recycling.

These stabilizers provide excellent thermal stability, weather resistance, and processing performance, making them ideal for applications in construction profiles, pipes, sheets, and cables.

As the global shift toward sustainable materials intensifies, calcium-based stabilizers have become the industry benchmark, replacing traditional lead-based and cadmium-based alternatives that pose ecological and health hazards. Their non-toxic profile is particularly important for PVC applications in packaging, medical devices, and water supply pipes, where safety standards are non-negotiable.

Additionally, advancements in stabilizer formulation technologies have improved the cost-performance balance of Ca-Zn stabilizers, making them more commercially attractive compared to organotin or barium-based options. Major industries, particularly packaging and building & construction, are increasingly aligning with sustainability goals, and the choice of stabilizers is crucial in reducing environmental footprints. With governments actively incentivizing greener materials and companies integrating circular economy principles, calcium-based stabilizers are not only the current leader but also poised to dominate future PVC production.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Pipes & fittings is expected to dominate the application segment of the PVC market, accounting for the largest share of global consumption. PVC pipes are widely adopted for water supply, sewage, drainage, irrigation, and industrial applications due to their affordability, corrosion resistance, durability, and ease of installation. Unlike metal pipes, PVC does not corrode, leach contaminants, or degrade under typical underground and water transport conditions, making it a superior option for long-term infrastructure needs. With lifespans exceeding 50 years, PVC pipes ensure lower operational and maintenance costs, which is particularly critical for public utilities and large-scale irrigation projects.

Emerging economies such as India, China, and nations across Africa are seeing rapid urbanization and industrialization, leading to an unprecedented demand for water and sanitation infrastructure. This has fueled significant government investments in irrigation canals, smart city projects, and rural water supply schemes, directly boosting the demand for PVC pipes and fittings.

Additionally, global efforts toward sustainable agriculture further support the use of PVC pipes in efficient drip and sprinkler irrigation systems. The electrical and telecommunication sectors also contribute, as PVC conduits are preferred for wiring and cabling protection due to their insulating and fire-retardant properties. While PVC films, sheets, and flooring are important niche applications, pipes & fittings remain the backbone of PVC demand worldwide, driven by both population growth and infrastructure modernization.

By End User Analysis

Building & construction is projected to be the leading end-use industry for PVC, consuming the majority of the material in applications such as pipes, profiles, window and door frames, flooring, roofing, and wall cladding. PVC’s exceptional durability, chemical resistance, flame-retardant properties, and thermal insulation capacity make it a preferred material in residential, commercial, and industrial construction.

The affordability of PVC compared to metals, wood, or concrete further strengthens its dominance, enabling developers to construct high-quality, sustainable, and cost-effective structures. With rapid global urbanization, the demand for housing, office spaces, and infrastructure is rising, particularly in emerging economies. Governments across Asia-Pacific, Africa, and Latin America are investing heavily in smart city projects, public housing, and urban infrastructure, all of which depend extensively on PVC-based building materials.

Additionally, PVC’s role in energy-efficient construction is expanding, especially in developed markets such as North America and Europe, where stringent building regulations emphasize insulation and sustainability. uPVC windows and doors, for instance, contribute to reduced energy consumption in buildings by improving thermal efficiency.

PVC roofing membranes and flooring solutions are also popular for their ease of maintenance, durability, and resistance to wear and tear. While industries such as packaging, automotive, and electronics utilize PVC in specific applications, their demand share is significantly smaller compared to construction. Given the ongoing global infrastructure boom, coupled with sustainability regulations promoting recyclable building materials, the building & construction sector is expected to remain the single largest driver of PVC consumption in the coming decades.

The Global Polyvinyl Chloride Market Report is segmented on the basis of the following:

By Polymer Form

- Rigid PVC (uPVC)

- Flexible PVC (pPVC)

- Low-Smoke PVC

- Chlorinated PVC (CPVC)

- Other Polymer Form

By Stabilizer Type

- Calcium-based (Ca-Zn) Stabilizers

- Lead-based (Pb) Stabilizers

- Tin & Organotin-based (Sn) Stabilizers

- Barium-based & Other Liquid Mixed-Metal Stabilizers

- Other Stavilizer Type

By Application

- Pipes & Fittings

- Profiles & Tubes

- Films & Sheets

- Wire & Cables

- Flooring

- Pastes (Plastisol)

- Bottles

- Other Application

By End Use

- Building & Construction

- Packaging

- Automotive

- Electrical & Electronics

- Footwear

- Transportation

- Other End User

Impact of Artificial Intelligence in the Global Polyvinyl Chloride Market

- AI-Driven Process Optimization: AI optimizes PVC production by monitoring temperature, pressure, and mixing ratios. It reduces waste, lowers energy use, ensures consistent quality, and enhances sustainability, making PVC manufacturing more efficient and cost-effective.

- Predictive Maintenance: AI-powered predictive maintenance detects equipment failures early in PVC plants. It reduces downtime, minimizes repair costs, extends machinery lifespan, and ensures consistent production, strengthening supply reliability across global PVC demand sectors.

- AI-Enhanced Quality Control: AI-driven visual inspection detects micro-defects in PVC pipes, films, and sheets. It improves accuracy over manual checks, reduces recalls, ensures compliance with standards, and boosts customer trust in high-quality PVC products.

- Sustainable PVC Recycling: AI optimizes PVC recycling through advanced sorting and chemical depolymerization. It enhances efficiency, supports circular economy initiatives, reduces landfill waste, and minimizes carbon footprint, aligning PVC production with global sustainability regulations.

- Demand Forecasting & Supply Chain: AI predicts PVC demand by analyzing construction, packaging, and automotive data. It prevents shortages, avoids overproduction, optimizes logistics, and strengthens supply chain resilience, ensuring steady raw material flow and market stability.

Global Polyvinyl Chloride Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the global polyvinyl chloride (PVC) market due to its rapid industrialization, strong construction sector, and expanding manufacturing base. China and India are the largest contributors, with China alone accounting for a significant portion of global PVC production and consumption. The region’s dominance is primarily driven by large-scale infrastructure projects, residential housing demand, and water management initiatives where PVC pipes and fittings are essential. Additionally, rising urbanization and government-backed smart city projects fuel demand for PVC in profiles, doors, windows, and flooring.

Low-cost labor, availability of raw materials such as chlorine and ethylene, and advanced manufacturing hubs further enhance Asia-Pacific’s leadership. Countries like Japan and South Korea add to regional strength with innovations in specialty PVC products. Moreover, expanding automotive and packaging industries increase PVC consumption for cables, films, and insulation. The presence of leading PVC producers and continuous capacity expansions further solidify dominance.

Environmental regulations in Europe and North America have also shifted global PVC production toward Asia-Pacific, where flexible policies and rising domestic demand create favorable conditions. Overall, the combination of affordability, capacity, and end-use growth cements Asia-Pacific’s leading position in the PVC market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is projected to register the highest CAGR in the global PVC market, fueled by advanced technologies, strong replacement demand, and sustainability-driven innovations. The U.S. dominates regional consumption due to rising investments in residential and commercial construction, particularly in PVC pipes, siding, flooring, and roofing applications. Demand is also rising in energy and telecom infrastructure, where PVC is used extensively for cables, fittings, and insulation materials.

A key growth factor is the region’s shift toward eco-friendly and lead-free PVC production. Strict environmental regulations, such as EPA guidelines, have accelerated adoption of calcium-based stabilizers and recycling technologies, boosting the market for sustainable PVC solutions. Furthermore, industries such as automotive, packaging, and healthcare increasingly rely on flexible PVC for medical tubing, films, and components, creating diversified demand growth.

North America also benefits from technological leadership, with AI, automation, and digitalization integrated into PVC manufacturing processes to enhance efficiency and reduce carbon footprint. Strategic mergers, partnerships, and expansions by regional players strengthen the competitive edge. Government spending on infrastructure renewal, coupled with energy-efficient housing initiatives, ensures continuous PVC consumption growth. Collectively, these factors make North America the fastest-growing PVC market globally, with robust opportunities across industrial and consumer applications.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Polyvinyl Chloride Market: Competitive Landscape

The global polyvinyl chloride (PVC) market is moderately consolidated, with a mix of global giants and regional players competing through capacity expansions, partnerships, and innovation. Leading companies such as Shin-Etsu Chemical Co. Ltd., Formosa Plastics Corporation, Westlake Chemical Corporation, INOVYN (INEOS), LG Chem, and Reliance Industries Limited dominate through extensive production capacities and integrated value chains. These players invest heavily in R&D to develop sustainable PVC grades, including bio-based and recyclable alternatives, aligning with environmental regulations worldwide.

Asian companies, particularly from China and India, are expanding aggressively to meet rising domestic and export demand, further strengthening Asia-Pacific’s market share. North American firms focus on technologically advanced and environmentally compliant production, catering to the region’s sustainable construction and packaging markets. Meanwhile, European players lead in regulatory compliance, with innovations in low-smoke and eco-stabilized PVC products.

Mergers, acquisitions, and joint ventures remain common strategies, allowing companies to expand geographically and enhance portfolios. For example, expansions in chlor-alkali facilities and downstream integration ensure steady supply security. Digital transformation and AI adoption are increasingly shaping competition, as manufacturers optimize production and predictive maintenance.

Overall, competition centers on sustainability, cost efficiency, and innovation, with companies balancing high-volume demand from construction with emerging needs in healthcare, automotive, and renewable energy applications.

Some of the prominent players in the Global Polyvinyl Chloride Market are:

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics Corporation

- Occidental Petroleum Corporation (OxyChem)

- Westlake Chemical Corporation

- INEOS Group Holdings S.A.

- Orbia Advance Corporation (Mexichem)

- LG Chem Ltd.

- Hanwha Solutions Corporation

- Reliance Industries Limited

- Kem One SAS

- SABIC (Saudi Basic Industries Corporation)

- Braskem S.A.

- Vinnolit GmbH & Co. KG (Westlake subsidiary)

- Shintech Inc. (subsidiary of Shin-Etsu)

- Tianjin Dagu Chemical Co., Ltd.

- Xinjiang Zhongtai Chemical Co., Ltd.

- Zhongyan Holding Co., Ltd.

- Tosoh Corporation

- Kaneka Corporation

- Thai Plastic and Chemicals Public Company Limited

- Other Key Players

Recent Developments in the Global Polyvinyl Chloride Market

- July 2024: Shin-Etsu Chemical announced capacity expansion for PVC production in Japan, aimed at meeting growing construction and packaging sector demand across Asia-Pacific, reinforcing its leading role in sustainable, high-performance PVC manufacturing.

- May 2024: Westlake Chemical invested in research partnerships to develop bio-attributed PVC solutions, supporting the shift toward eco-friendly alternatives. The initiative strengthens Westlake’s sustainability strategy while addressing stricter environmental regulations globally.

- March 2024: INEOS Inovyn revealed its participation in the Plastics Recycling Expo Europe, showcasing advancements in circular PVC production. The company highlighted investment in recycling technologies to close the loop for PVC products.

- January 2024: Orbia Polymer Solutions expanded its PVC resin supply network across Latin America, targeting rising construction and water infrastructure projects. The initiative aims to enhance accessibility and strengthen its regional dominance.

- November 2023: Kem One, Europe’s leading PVC producer, announced collaboration with industrial partners to reduce greenhouse gas emissions from PVC production, aligning with EU Green Deal targets and low-carbon industrialization goals.

- September 2023: LG Chem signed a strategic collaboration to develop bio-circular PVC products, leveraging renewable feedstocks. The initiative supports sustainability goals and caters to increasing demand for eco-conscious materials in Asia-Pacific and North America.

- July 2023: Formosa Plastics invested in modernizing its U.S. PVC production plants, integrating automation and digital technologies to increase energy efficiency, production stability, and competitiveness in North America’s rapidly growing PVC market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.4 Bn |

| Forecast Value (2034) |

USD 9.4 Bn |

| CAGR (2025–2034) |

4.2% |

| The US Market Size (2025) |

USD 2.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Polymer Form (Rigid PVC (uPVC), Flexible PVC (pPVC), Low-Smoke PVC, Chlorinated PVC (CPVC), and Other Polymer Form), By Stabilizer Type (Calcium-based (Ca-Zn) Stabilizers, Lead-based (Pb) Stabilizers, Tin & Organotin-based (Sn) Stabilizers, Barium-based & Other Liquid Mixed-Metal Stabilizers, and Other Stabilizer Type), By Application (Pipes & Fittings, Profiles & Tubes, Films & Sheets, Wire & Cables, Flooring, Pastes (Plastisol), Bottles, and Other Application), By End Use (Building & Construction, Packaging, Automotive, Electrical & Electronics, Footwear, Transportation, and Other End User)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Shin-Etsu Chemical Co. Ltd., Formosa Plastics Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Chemical Corporation, INEOS Group Holdings S.A., Orbia Advance Corporation (Mexichem), LG Chem Ltd., Hanwha Solutions Corporation, Reliance Industries Limited, Kem One SAS, SABIC, Braskem S.A., Vinnolit GmbH & Co. KG, Shintech Inc., Tianjin Dagu Chemical Co. Ltd., Xinjiang Zhongtai Chemical Co. Ltd., Zhongyan Holding Co. Ltd., Tosoh Corporation, Kaneka Corporation, Thai Plastic and Chemicals Public Company Limited (SCG Chemicals)., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Polyvinyl Chloride Market?

▾ The Global Polyvinyl Chloride Market size is estimated to have a value of USD 9.4 billion in 2025 and is expected to reach USD 13.5 billion by the end of 2034.

What is the growth rate in the Global Polyvinyl Chloride Market in 2025?

▾ The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

What is the size of the US Polyvinyl Chloride Market?

▾ The US Polyvinyl Chloride Market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.4 billion in 2034 at a CAGR of 3.9%.

Which region accounted for the largest Global Polyvinyl Chloride Market?

▾ Asia Pacific is expected to have the largest market share in the Global Polyvinyl Chloride Market with a share of about 38.2% in 2025.

Who are the key players in the Global Polyvinyl Chloride Market?

▾ Some of the major key players in the Global Polyvinyl Chloride Market are Shin-Etsu Chemical Co. Ltd., Formosa Plastics Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Chemical Corporation, INEOS Group Holdings S.A., Orbia Advance Corporation (Mexichem), LG Chem Ltd., and many others.