Market Overview

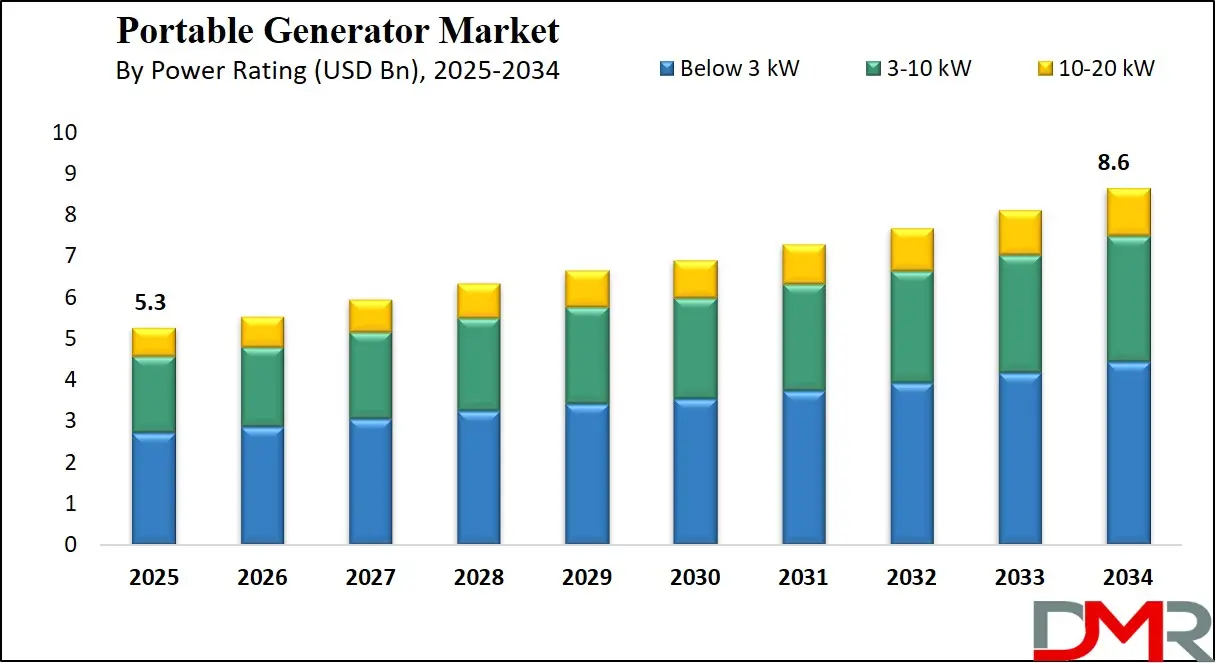

The Global Portable Generator Market size is projected to reach USD 5.3 billion in 2025 and grow at a compound annual growth rate of 5.6% from there until 2034 to reach a value of USD 8.6 billion

Portable generators are compact, movable machines that supply temporary electrical power. They typically run on gasoline, Diesel Generator, or propane and are designed to provide electricity in areas without a permanent power source.

These generators are often used during power outages, outdoor activities like camping, at construction sites using Heavy Construction Equipment and Earthmoving Equipment, or in remote locations. Their portability makes them a useful backup solution for both homes and businesses, especially in emergencies linked to Disaster Preparedness Systems and Public Safety and Security.

The growing demand for portable generators is closely tied to the increasing number of power outages caused by natural disasters, aging power grids, and rising energy needs across Energy and Power Transformer networks.

As more people rely on electronic devices and appliances—especially in residential and small commercial spaces—the need for reliable backup power and Uninterruptible Power Supply systems is rising. Additionally, in rural areas with limited access to stable electricity, portable generators provide a practical and affordable solution.

A major trend driving the market is the shift toward clean and fuel-efficient models, contributing to global Green Technology & Sustainability goals. With growing environmental awareness, there is increased interest in generators that produce fewer emissions and make less noise.

Manufacturers are focusing on inverter technology, which allows for quieter operation, better fuel efficiency, and safer electricity for sensitive devices such as those found in Smart Homes Systems and Home Healthcare setups. Battery-powered and solar-compatible portable generators that complement Photovoltaic and Solar Panel Recycling initiatives are also gaining popularity, especially among eco-conscious users.

The construction and outdoor recreation industries have seen a surge in the use of portable generators. Builders and contractors use them to power tools at sites without a permanent power supply, often working alongside Mobile Cranes, Excavators, and other Construction Equipment.

Outdoor enthusiasts use them to run appliances during camping, tailgating, or RV trips, where they operate as key Outdoor Power Equipment within broader Camping Equipment and Adventure Sports and Activities sectors. These use cases are increasing as more people embrace outdoor lifestyles and remote work options that demand portable electricity.

In recent years, natural disasters such as hurricanes, floods, and wildfires have exposed the vulnerability of power infrastructure. This has increased awareness and preparedness among consumers and businesses alike.

As a result, people are investing in portable generators to avoid the inconvenience and risks associated with unexpected blackouts. Emergency preparedness campaigns and government recommendations have also helped boost adoption, supported by modern Emergency Medical Equipment and Personal Safety App technologies.

Lastly, technological advancements and smart features are shaping the future of portable generators. Newer models offer digital displays, remote start, Bluetooth or app-based controls, and automatic shutoff features integrated into Industrial Automation systems. These improvements enhance safety, user-friendliness, and convenience, making portable generators more appealing to a broader audience.

As technology evolves, these machines are becoming not just a backup power option but a vital part of modern Energy Storage and Micro Combined Heat and Power resilience solutions, supporting Virtual Power Plant ecosystems and Power Purchase Agreement frameworks in advanced Manufacturing environments.

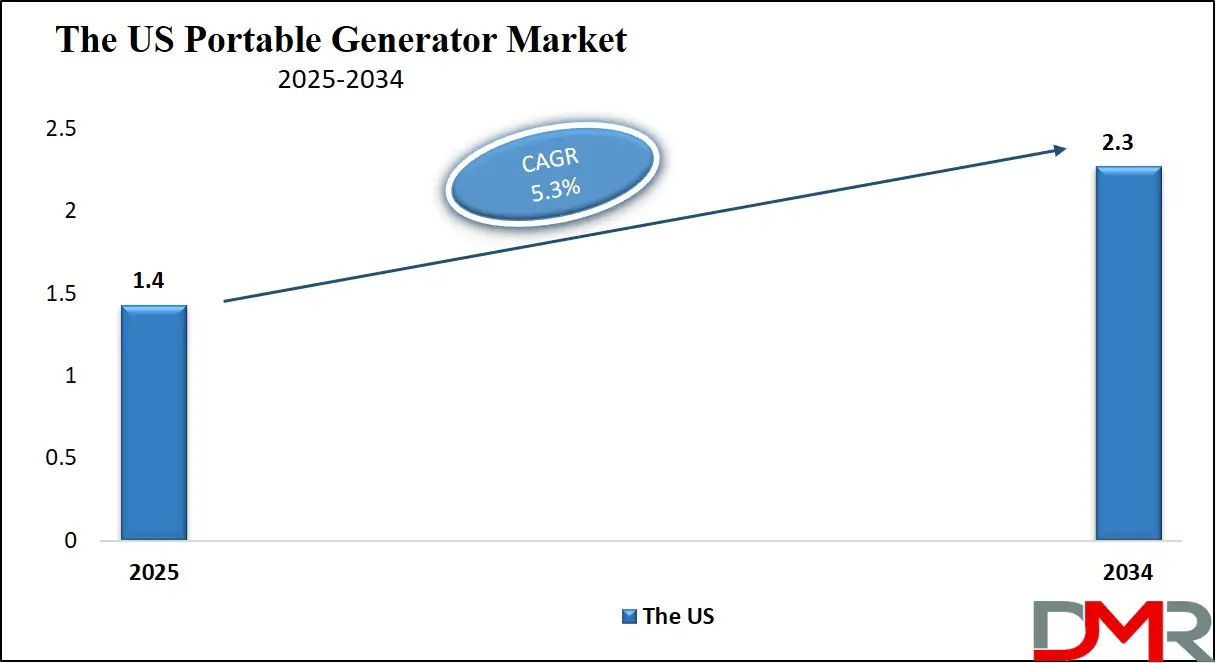

The US Portable Generator Market

The US Portable Generator Market size is projected to reach USD 1.4 billion in 2025 at a compound annual growth rate of 5.3% over its forecast period.

The US plays a major role in the portable generator market due to its high demand for backup power solutions, advanced Energy & Power Systems technology, and frequent weather-related power outages.

With strong consumer awareness and a well-developed Construction Equipment sector, the US sees widespread use of portable generators in homes, job sites, and outdoor activities. Natural disasters like hurricanes, wildfires, and winter storms often lead to increased sales, making the US one of the top markets globally for Diesel Generator and hybrid units.

The country also drives innovation, with manufacturers focusing on quieter, cleaner, and more fuel-efficient models to meet consumer expectations and environmental regulations under Green Technology & Sustainability initiatives.

Additionally, the US market is highly competitive, encouraging continuous product improvement, smart features, and strong after-sales support, further influencing global trends in the generator and Energy Storage industry.

Europe Portable Generator Market

Europe Portable Generator Market size is projected to reach USD 1.1 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

Europe plays a significant role in the portable generator market, driven by the region’s emphasis on clean energy, strict emission regulations, and a growing need for backup power in remote and temporary settings.

Portable generators are widely used in construction, events, emergency services, and rural areas where grid access may be limited. European consumers and businesses often prefer low-noise, eco-friendly models, pushing manufacturers to innovate with inverter and hybrid technologies aligned with Renewable & Alternative Energy policies and Wind Power Generators initiatives.

The rise of outdoor recreation and mobile workspaces has also contributed to demand. Additionally, Europe's regulatory environment encourages the adoption of advanced, low-emission equipment, influencing global manufacturing standards. With a strong focus on sustainability and efficiency, Europe continues to shape the direction of the portable generator and Power Transformer industry.

Japan Portable Generator Market

Japan Portable Generator Market size is projected to reach USD 0.3 billion in 2025 at a compound annual growth rate of 6.0% over its forecast period.

Japan plays an important role in the portable generator market, mainly due to its advanced manufacturing capabilities, focus on compact and efficient designs, and need for reliable emergency power.

The country frequently experiences natural disasters like earthquakes and typhoons, which increases the demand for dependable backup power solutions, integrated with Disaster Preparedness Systems and Public Safety and Security frameworks. Japanese consumers prefer quiet, fuel-efficient, and environmentally friendly generators, encouraging innovation in inverter and hybrid technologies.

Japan is also a global leader in exporting high-quality portable generators and India Gensets alternatives, influencing product standards worldwide. Additionally, with limited space in urban areas, there is strong demand for lightweight and space-saving models. The country’s strong commitment to technology, safety, and environmental compliance continues to drive the development and global competitiveness of the portable generator and Industrial Distribution industry.

Portable Generator Market: Key Takeaways

- Market Growth: The Portable Generator Market size is expected to grow by USD 3.0 billion, at a CAGR of 5.6%, during the forecasted period of 2026 to 2034.

- By Power Rating: Thebelow 3kW segment is anticipated to get the majority share of the Portable Generator Market in 2025.

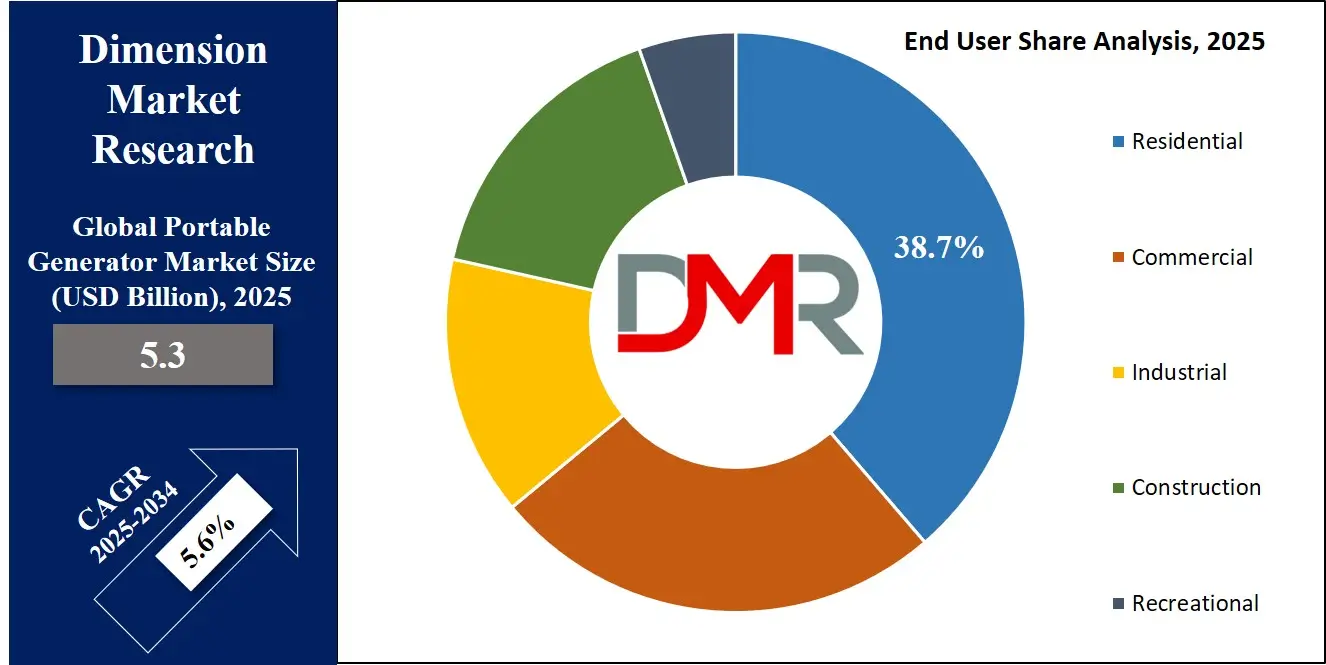

- By End User: The Residential segment is expected to get the largest revenue share in 2025 in the Portable Generator Market.

- Regional Insight: Asia Pacific is expected to hold a 33.7% share of revenue in the Global Portable Generator Market in 2025.

- Use Cases: Some of the use cases of Portable Generator include construction sites, outdoor recreational activities, and more.

Portable Generator Market: Use Cases

- Emergency Home Backup Power: Portable generators are commonly used during power outages to keep essential appliances like refrigerators, lights, and communication devices running. They help households stay safe and comfortable when the main power supply is down. This use case is especially important in areas prone to storms or unreliable grids.

- Construction Sites: Construction projects often take place in remote or undeveloped areas where there’s no access to permanent electricity. Portable generators provide the power needed for tools, lighting, and equipment. Their mobility allows workers to move them easily from one part of the site to another.

- Outdoor Recreational Activities: For camping, RV travel, and outdoor events, portable generators supply power for cooking devices, fans, lights, and entertainment systems. They offer convenience and comfort while enjoying time off-grid. Inverter generators are especially popular for their quiet and clean operation.

- Small Business Continuity: During unexpected power cuts, small businesses like shops, restaurants, or clinics use portable generators to keep operations going. This helps prevent revenue loss and maintains customer service. A reliable backup power source is crucial for businesses that depend on continuous electricity.

Market Dynamic

Driving Factors in the Portable Generator Market

Rising Power Outages and Grid Instability

One of the main drivers of growth in the portable generator market is the increasing number of power outages caused by extreme weather events, aging infrastructure, and growing electricity demand. Storms, floods, wildfires, and heatwaves are occurring more frequently, affecting power supply across both urban and rural areas.

Many countries still rely on outdated grids that are unable to handle modern energy demands, leading to unexpected blackouts. In such situations, portable generators serve as a quick and reliable backup source. Homeowners, small businesses, and healthcare facilities are increasingly adopting them to avoid disruption. The growing awareness of emergency preparedness is also pushing more consumers to invest in portable generators as a necessary household appliance.

Growth in Outdoor Activities and Remote Work

The popularity of outdoor recreation like camping, overlanding, and RV travel has increased significantly in recent years. As people spend more time off-grid for leisure or work, the need for portable power solutions has grown. Portable generators are used to power appliances, tools, and electronic devices in remote areas without access to grid electricity.

Additionally, the rise of remote work and digital nomad lifestyles has created a demand for consistent power in temporary or mobile workspaces. Whether working from a cabin in the woods or traveling across the country, users rely on portable generators to keep their devices running. This lifestyle shift is creating new opportunities for innovation and expansion in the generator market.

Restraints in the Portable Generator Market

Environmental Concerns and Emission Regulations

One of the major restraints in the portable generator market is the growing concern over environmental impact. Traditional generators running on gasoline or diesel emit harmful pollutants such as carbon monoxide and nitrogen oxides. As awareness about air quality and climate change increases, governments and environmental bodies are tightening emission regulations.

In many regions, especially in developed countries, stricter rules are limiting the use of high-emission models. This is putting pressure on manufacturers to invest in cleaner technologies, which often leads to higher production costs. Moreover, consumers are becoming more eco-conscious and are hesitant to purchase products that contribute to pollution. These factors collectively slow down the market growth for conventional portable generators.

Noise Pollution and Safety Issues

Another significant restraint is the noise and safety concerns associated with portable generators. Many traditional models produce loud noise during operation, which makes them unsuitable for residential areas, hospitals, or quiet environments. Prolonged exposure to high noise levels can also be harmful to human health. Additionally, improper use of generators can lead to serious risks such as carbon monoxide poisoning, electrical shocks, or fire hazards.

Inexperienced users may not follow proper ventilation or safety guidelines, leading to accidents. These risks reduce the appeal of portable generators for certain users, especially in densely populated or safety-conscious settings. As a result, potential buyers may look for safer, quieter alternatives or avoid purchase altogether.

Opportunities in the Portable Generator Market

Advancements in Cleaner and Quieter Technologies

One of the key opportunities in the portable generator market lies in the development of low-emission, fuel-efficient, and quieter models. Inverter technology, solar integration, and battery-powered generators are gaining traction among both residential and commercial users. These innovations address growing concerns around environmental impact, noise pollution, and operational safety.

Manufacturers that invest in green technology have the chance to tap into new customer segments that prioritize sustainability and clean energy. Additionally, eco-friendly generators are being favored in regions with strict environmental rules, opening doors to government procurement and urban applications. The trend toward “smart” generators with app-based control and energy monitoring features is also expanding the market’s appeal.

Rising Demand in Emerging and Off-Grid Areas

Expanding access to electricity in remote, rural, and developing regions offers significant growth opportunities. In many parts of Asia, Africa, and Latin America, stable grid infrastructure is still limited or unreliable. Portable generators serve as a practical power solution in these areas for homes, schools, clinics, and small businesses.

Governments and non-profit organizations are also investing in off-grid energy solutions, where portable generators can play a crucial supporting role. Additionally, as small-scale industries grow in these regions, the need for affordable and movable power sources is increasing. This demand creates strong potential for market expansion through localized manufacturing, distribution networks, and targeted marketing strategies.

Trends in the Portable Generator Market

Rise of Smart, Hybrid, and Battery-Integrated Generators

A major shift is underway as manufacturers blend traditional generators with smart technology and battery power. Users now expect inverter-style models that deliver clean electricity, integrate with solar panels, and offer remote control through apps. Some hybrid units even use dual fuel—switching between gas and natural gas—for greater flexibility and lower emissions. Brands are responding with high-capacity portable “power stations” that are quieter, eco-friendlier, and easier on the user, matching consumer demand for efficiency and convenience.

Demand for Portable Whole‑Home Backup Solutions

Beyond small-scale use canisters, there's growing interest in larger “portable” systems that can support entire homes during outages. These units often feature built‑in batteries and modular designs that allow for expansion and automatic activation in emergencies. Especially in regions facing extreme weather or grid instability, users increasingly turn to high-capacity power systems that combine solar, battery storage, and generator backup for seamless resilience.

Research Scope and Analysis

By Fuel Type Analysis

Based on fuel type, gasoline is expected to be the leading in 2025 with a share of 37.4%, playing a key role in the growth of the portable generator market due to its wide availability, affordability, and ease of use. This fuel type is commonly used in residential backup power and outdoor applications like camping, tailgating, and DIY projects. Gasoline-powered portable generators are preferred for their lightweight design and suitability for short-term, low-to-medium power needs.

Their easy start-up mechanism and simple maintenance requirements make them a popular choice among homeowners and small business users. With frequent power disruptions and a growing demand for temporary power, especially in urban and semi-urban areas, gasoline generators continue to see steady demand.

Manufacturers are also enhancing fuel efficiency and reducing emissions, making gasoline units more user-friendly and compliant with environmental standards. As power reliability becomes more important, gasoline-based portable generators are expected to remain a dominant and practical solution.

Dual fuel, as a fuel typ,e is having significant growth over the forecast period in the portable generator market, mainly because of its flexibility, longer runtime, and fuel-switching convenience. These generators can operate on both gasoline and propane, allowing users to choose fuel based on availability, cost, and environmental preferences. This versatility is especially useful during emergencies when one type of fuel may be in short supply.

Dual fuel generators are becoming more popular for residential use, construction sites, and disaster-prone areas, where reliable backup power is essential. They also offer cleaner operation when running on propane, which is a key factor for environmentally conscious users.

As consumers seek more dependable and adaptable power solutions, dual-fuel generators are gaining popularity. Their ability to handle diverse power needs while offering operational flexibility makes them a strong contributor to market growth, especially in regions where power outages and fuel supply challenges are common.

By Power Rating Analysis

3–10kW as a power rating is expected to be leading in 2025 with a share of 51.2%, mainly because it strikes the perfect balance between performance and portability. This range is ideal for households, small businesses, and outdoor use, offering enough power to run multiple appliances or tools without being too bulky. It covers essential backup needs during power outages and is easy to move, store, and operate.

Users appreciate the flexibility of this size range, especially in regions prone to electrical interruptions or natural disasters. With growing interest in DIY tasks, food trucks, and event setups, the demand for reliable mid-range portable generators continues to rise.

Manufacturers are also developing quieter, more fuel-efficient models in this segment, making them suitable for residential areas. As people look for cost-effective, practical power sources, the 3–10kW range is set to play a strong role in shaping the portable generator market.

10–20kW as a power rating is showing significant growth over the forecast period, driven by the rising need for higher-capacity backup power in commercial and industrial settings. This range supports larger homes, offices, workshops, and job sites where multiple heavy-duty devices and machinery need to run simultaneously.

These generators are valued for their ability to provide stable, continuous power during extended outages, making them popular in areas with unreliable electricity or harsh weather conditions.

They also appeal to users who prioritize energy independence and want to avoid business downtime. As industries and large properties seek more robust portable power solutions, this power rating is gaining popularity for its strong performance and fuel efficiency. Innovations in noise control and mobility are also making these larger units more appealing to users who need serious power without compromising on convenience or compliance.

By Technology Analysis

As a technology, conventional will be leading in 2025 with a share of 61.2%, mainly because of its affordability, reliability, and ease of use. These generators are widely used across residential, construction, and commercial spaces where simple, rugged performance is needed.

Conventional portable generators are preferred for heavy-duty tasks and longer runtimes, especially in places where power demands are high and fuel efficiency is less of a concern. Their straightforward design makes them durable and easy to maintain, which appeals to users in rural areas and industries.

They are also readily available in multiple fuel options, adding to their popularity. While newer technologies are gaining attention, conventional generators remain the go-to choice for users who value raw power output and cost-effectiveness. This makes them a strong contributor to the overall growth of the portable generator market despite the rise of advanced alternatives.

Inverter as a technology is seeing significant growth over the forecast period due to its clean power output, quiet operation, and compact design. These generators are ideal for sensitive electronics, such as laptops, mobile devices, and medical equipment, which require stable voltage and frequency. Inverter generators are highly favored for camping, RV trips, and residential backup because they’re lightweight, fuel-efficient, and emit less noise.

Their ability to adjust engine speed based on load also helps save fuel and reduce emissions. With rising environmental concerns and growing demand for quieter, smarter solutions, consumers are shifting toward inverter models. Many modern users are willing to pay more for convenience and eco-friendliness, making inverter generators an increasingly attractive option in both developed and developing markets.

By End User Analysis

Residential as an end user will be leading in 2025 with a share of 33.7%, playing a key role in driving the portable generator market forward. With increasing power outages caused by extreme weather, aging electrical grids, and rising energy demands, more homeowners are turning to portable generators as a backup power solution.

These units help keep essential appliances like refrigerators, lights, and communication devices running during blackouts. Residential users prefer compact, easy-to-use, and quiet models that can be stored easily and used with minimal effort.

Growing awareness of emergency preparedness and home safety is also pushing demand in this segment. Additionally, fuel-efficient and inverter-based portable generators are gaining popularity for their ability to power sensitive electronics.

As more families prioritize self-sufficiency and comfort during outages, residential applications continue to boost the market, especially in urban and suburban areas where access to reliable backup power is becoming increasingly important.

Recreational as an end user is showing significant growth over the forecast period, supported by the increasing popularity of outdoor activities like camping, tailgating, and RV travel. Portable generators are becoming an essential companion for adventure seekers who want access to electricity while staying off-grid.

They provide reliable power for lighting, cooking equipment, mobile devices, and entertainment systems, improving comfort during outdoor trips. The shift toward flexible work setups, such as remote working in natural settings, is also increasing interest in portable power solutions.

Recreational users typically look for lightweight, quiet, and easy-to-carry units that offer clean power for electronics. This demand is encouraging manufacturers to design user-friendly and efficient models tailored to leisure use. As people spend more time outdoors and seek self-reliant lifestyles, the recreational segment continues to create strong growth opportunities within the portable generator market.

The Portable Generator Market Report is segmented based on the following:

By Fuel Type

- Gasoline

- Diesel

- Natural Gas

- Propane (LPG)

- Dual Fuel

By Power Rating

- Below 3 kW

- 3–10 kW

- 10–20 kW

By Technology

- Conventional Portable Generators

- Inverter Portable Generators

By End User

- Residential

- Commercial

- Industrial

- Construction

- Recreational

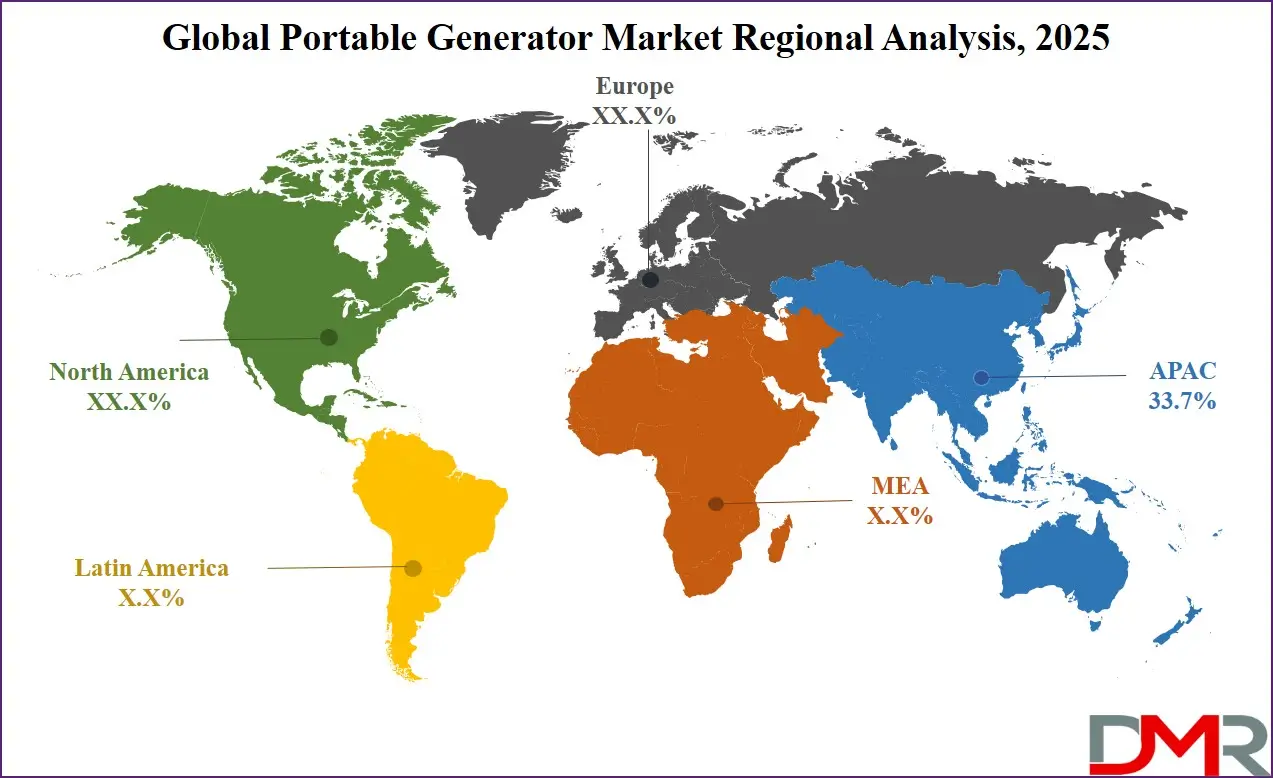

Regional Analysis

Leading Region in the Portable Generator Market

Asia Pacific, leading in 2025 with a share of 33.7%, plays a major role in the growth of the portable generator market. The region’s expansion is supported by rising power demand, frequent electricity shortages, and rapid industrialization in countries like India, China, Indonesia, and Vietnam. Growing construction activities, rising rural electrification efforts, and an increasing number of outdoor and commercial applications are pushing the need for portable power solutions.

In many areas, unreliable power supply and remote locations make portable generators a practical choice for both homes and businesses. Additionally, the booming infrastructure sector and growing awareness of emergency preparedness are driving further adoption.

Manufacturers are also investing more in the Asia Pacific due to its large customer base and low-cost production advantages. The demand for fuel-efficient, low-noise, and easy-to-carry units is shaping product development across the region. Overall, the Asia Pacific continues to be a key growth engine for the global portable generator market in 2025.

Fastest Growing Region in the Portable Generator Market

Latin America is showing significant growth in the portable generator market over the forecast period, driven by increasing power outages, limited grid access in rural areas, and the rise in construction and mining activities. Countries like Brazil, Mexico, and Argentina are seeing higher demand for portable power solutions due to expanding infrastructure and unreliable electricity in some regions.

The need for emergency backup power, especially in residential and commercial sectors, is boosting sales. Growing interest in outdoor events, camping, and small business continuity is also creating more opportunities. With rising awareness of energy security and the benefits of backup power, the region continues to adopt portable generators at a steady pace.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The portable generator market is highly competitive, with many players offering a wide range of products to meet different needs. Companies compete based on features like fuel type, power output, size, noise level, and ease of use. Innovation is a big focus, especially around making generators more fuel-efficient, quieter, and eco-friendly. Some companies focus on lightweight models for home or outdoor use, while others provide heavy-duty options for construction or industrial purposes.

The rise of smart technology is also pushing companies to add features like remote monitoring and automatic start. To stay ahead, manufacturers are improving after-sales services, offering better warranties, and expanding their global reach through partnerships, online platforms, and retail networks. The market continues to evolve quickly.

Some of the prominent players in the global Portable Generator are:

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Generac Power Systems, Inc.

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Cummins Inc.

- Kohler Co.

- Atlas Copco AB

- Deere & Company (John Deere)

- Wacker Neuson SE

- Champion Power Equipment

- Honeywell International Inc.

- Hyundai Power Equipment

- Eaton Corporation

- Siemens AG

- Multiquip Inc.

- WEN Products

- Westinghouse Electric Corporation

- Duromax Power Equipment

- Pulsar Products Inc.

- Other Key Players

Recent Developments

- In April 2025, U.S. manufacturer Ecoflow launched the River 3 Plus, a 286 Wh portable power station designed for outdoor use. It can be expanded with optional modules to reach up to 858 Wh of capacity. A wireless charging version with an integrated 5,000 mAh power bank will be available in May. The unit fully recharges via AC in one hour and supports 220 W solar input for 1.5-hour solar charging, offering versatile power options including car and generator compatibility for off-grid use.

- In February 2025, Rolls-Royce launched its upgraded mtu Series 1600 generator sets for the 50 Hertz market, offering up to 40% more power than previous models. Available in both open and enclosed designs, the gensets feature the 12V1600 engine delivering up to 996 kWm. The enclosed version includes a weatherproof, plug-and-play setup with built-in controls and fuel tank. Compatible with HVO fuel for up to 90% CO2 reduction, these gensets support a wide range of applications and strengthen Rolls-Royce’s position in power generation.

- In September 2024, UL Solutions opened a new portable generator testing lab at its multi-laboratory facility in Toronto. This new lab aims to support global manufacturers in developing safer portable generators and reducing the risk of carbon monoxide (CO) poisoning for both people and pets. With this expansion, UL Solutions continues to advance product safety standards, helping companies meet regulatory requirements and deliver safer power solutions to markets worldwide.

- In July 2024, Bobcat introduced its new PG40 and PG50 portable generators, marking a major advancement in generator design. These updated models are equipped with Stage V D24 engines and Stamford alternators, offering improved performance while being more environmentally friendly. Replacing the older Stage IIIA G40 and G60 units, the PG40 and PG50 deliver higher power output along with better fuel efficiency. This launch reflects Bobcat’s commitment to innovation and sustainability in portable power solutions for a range of industrial and commercial applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.3 Bn |

| Forecast Value (2034) |

USD 8.6 Bn |

| CAGR (2025–2034) |

5.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Fuel Type (Gasoline, Diesel, Natural Gas, Propane (LPG), and Dual Fuel), By Power Rating (Below 3 kW, 3–10 kW, and 10–20 kW), By Technology (Conventional Portable Generators and Inverter Portable Generators), By End User (Residential, Commercial, Industrial, Construction, and Recreational) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Generac Power Systems, Inc, Briggs & Stratton Corporation, Caterpillar Inc., Cummins Inc., Kohler Co., Atlas Copco AB, Deere & Company (John Deere), Wacker Neuson SE, Champion Power Equipment, Honeywell International Inc., Hyundai Power Equipment, Eaton Corporation, Siemens AG, Multiquip Inc., WEN Products, Westinghouse Electric Corporation, Duromax Power Equipment, Pulsar Products Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |