Market Overview

The Global Postoperative Management Market is projected to reach USD 42.5 billion in 2024 and grow at a compound annual growth rate of 5.4% from there until 2033 to reach a value of USD 68.3 billion.

Postoperative pain management is known as the techniques or strategies for easing patients' postoperative pain. Because of the discomfort, patients' hospital stays are long periods, and they experience both physical and mental stress. The goal of postoperative pain management is to lessen patients' discomfort after surgery, making it a critical part of post-surgical care solutions within modern healthcare systems.

Though advances have been made in pain management techniques, nearly 20% of postoperative patients still report severe discomfort within 24 hours after surgery despite recent improvements, showing little change over the past decade. Persistent acute pain not only hinders patient comfort but may also delay recovery time and increase chances of chronic pain development.

An absence of patient knowledge regarding postoperative pain management compounds this issue. According to one study, only 11.61 % of patients demonstrated excellent understanding of pain-management strategies post-op while 23.87% demonstrated poor knowledge. This lack of awareness may lead to misreporting pain levels, delayed medication usage or overall dissatisfaction with care post-op.

Effective postoperative management includes going beyond clinical interventions to include patient education. Empowering patients with accurate information regarding pain expectations, medication schedules and alternative therapies can greatly enhance their recovery experience. Studies have revealed that those more knowledgeable about pain management tend to report lower pain levels and higher satisfaction rates after surgery, reinforcing the need for enhanced recovery protocols supported by better patient engagement.

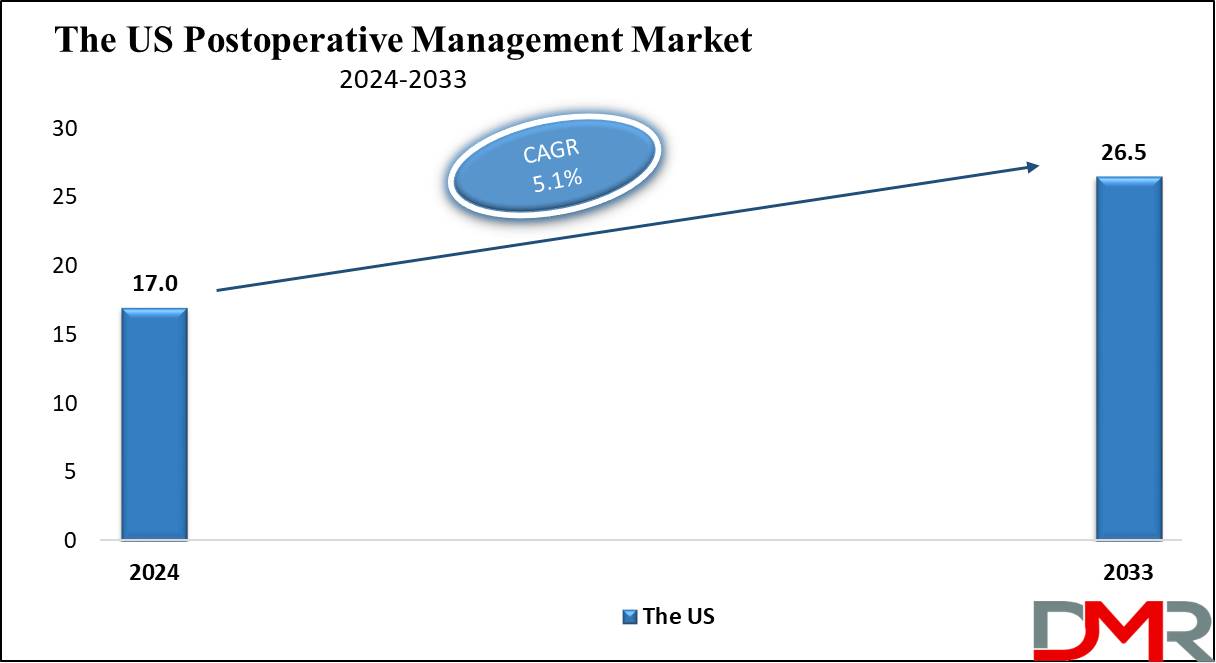

The US Postoperative Management Market

The

US Postoperative Management Market is projected to reach

USD 17.0 billion in 2024 at a compound annual

growth rate of 5.1% over its forecast period.

The growth opportunities in the postoperative management market in the US include the growing adoption of

telehealth services for remote patient monitoring, development in non-opioid pain management therapies, and an emphasis on personalized medicine. In addition, the growth in the number of surgical procedures and the rise in awareness of effective pain management strategies further improve the market potential in the country.

Further, the growth driver in the market is the growth in the number of surgical procedures, which boosts the demand for effective pain management solutions. However, a significant restraint is the growth of scrutiny and regulation surrounding opioid prescriptions due to concerns over addiction and misuse, leading to a shift towards safer pain management alternatives.

Key Takeaways

- Market Growth: The Postoperative Management Market size is expected to grow by 23.7 billion, at a CAGR of 5.4% during the forecasted period of 2025 to 2033.

- By Drug Class: The opioids segment is anticipated to get the majority share of the Postoperative Management Market in 2024.

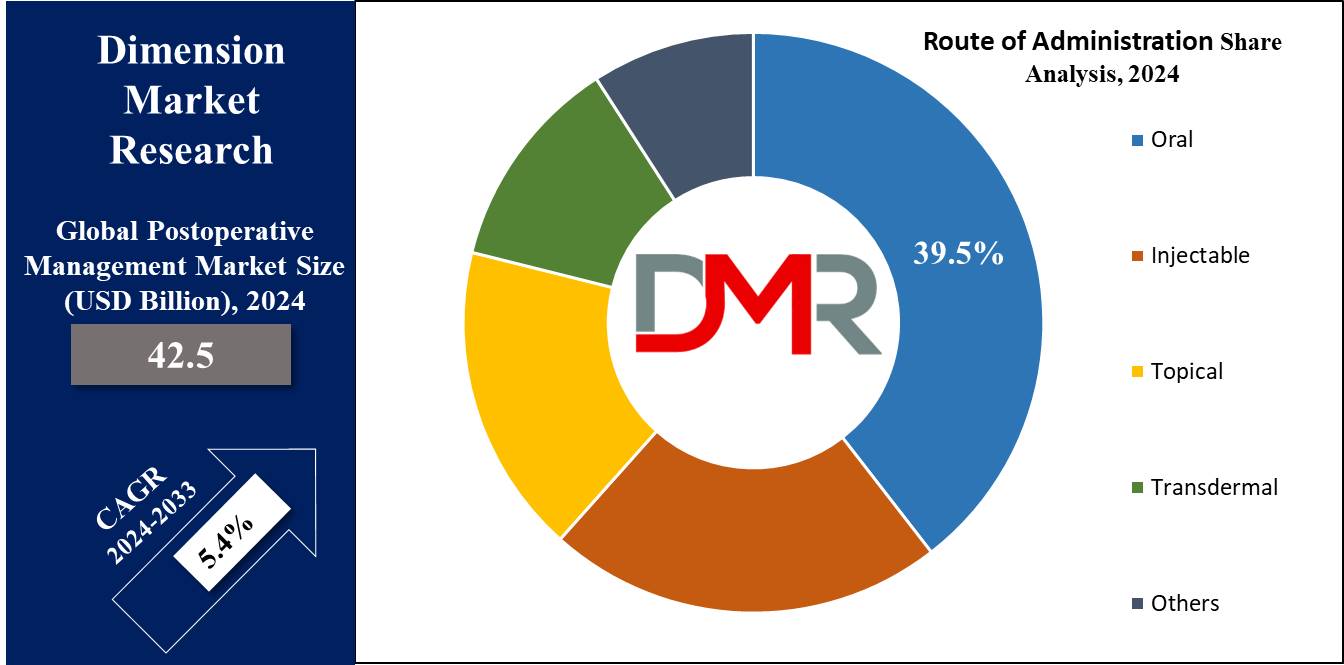

- By Route of Administration: The oral segment is expected to be leading the market in 2024

- By Distribution Channel: Hospital Pharmacies are expected to get the largest revenue share in 2024 in the Postoperative Management Market.

- Regional Insight: North America is expected to hold a 47.5% share of revenue in the Global Postoperative Management Market in 2024.

- Use Cases: Some of the use cases of Postoperative Management include pain control, patient education, and more.

Use Cases

- Pain Control: Effective pain management through medications like opioids, NSAIDs, or local anesthetics supports patients recovering more comfortably after surgery, enhancing overall outcomes and patient satisfaction.

- Recovery Monitoring: Regular assessment of vital signs, wound healing, and pain levels supports healthcare providers to track recovery progress and detect any complications early on.

- Medication Management: Making sure of timely & accurate administration of postoperative medications reduces the risk of infections, and complications, and ensures proper pain relief.

- Patient Education: Educating patients on wound care, medication adherence, and activity restrictions helps promote faster recovery and reduces the risk of post-surgery complications.

Market Dynamic

Driving Factors

Increasing Surgical Procedures

As the growth of surgeries, like elective and emergency procedures, constantly rises globally, the need for effective postoperative pain management solutions grows, driving market expansion.

Advancements in Pain Management

Development in drug formulations, such as long-acting anesthetics & non-opioid alternatives, along with better pain management protocols, is contributing to the growth of the postoperative management market by providing more effective and safer options for patients.

Restraints

Opioid Addiction and Abuse Concerns

The varied use of opioids for managing postoperative pain has created concerns about addiction and misuse, which has led to stricter regulations and less opioid prescriptions, potentially limiting the growth of opioid-based pain management solutions.

High Cost of Advanced Pain Management Solutions

Advanced pain management techniques and medications, like long-acting anesthetics or innovative drug delivery systems, can be costly, which may limit access, mainly in developing regions, restraining market growth.

Opportunities

Growth of non-opioid Alternatives

The growing focus on developing non-opioid pain relief solutions, like nerve blocks, NSAIDs, and other innovative therapies, provides a major opportunity. These alternatives look into the growing demand for safer, less addictive pain management options.

Expansion in Emerging Markets

The rapid development of healthcare infrastructure in developing countries, mainly in regions like Asia Pacific, provides a significant opportunity. As more people gain access to advanced medical care, the need for effective postoperative pain management is expected to rise, driving market growth in these regions.

Trends

Telemedicine and Remote Monitoring

The adoption of

telemedicine for postoperative care has expanded, allowing healthcare providers to monitor patients' recovery remotely, which allows timely interventions, minimizes hospital visits, and enhances patient satisfaction by providing convenience and flexibility in managing postoperative care.

Personalized Pain Management

There is a major focus on personalized medicine in postoperative management. Customizing pain management strategies to individual patient needs, taking into account factors like genetics, pain tolerance, and specific surgical procedures, helps enhance pain relief outcomes and minimize side effects, leading to better recovery experiences.

Research Scope and Analysis

By Drug Class

The opioid drug class is projected to grow steadily during the forecast period and account for the largest portion of the market by 2024, as opioids are commonly prescribed to adults who experience moderate to severe pain after surgery. According to the NIH, opioids have become a vital option for managing post-operative pain, and their utilization has grown. Medications are highly effective in helping patients achieve pain relief and meet their recovery goals.

Opioids are highly recognized as useful for pain management after surgery, which is why they continue to play such a vital role in post-operative care. Their ability to effectively reduce pain levels makes them a popular choice among healthcare providers, contributing to the increase in the demand for these drugs. As a result, the opioid segment is expected to continue expanding and maintaining a significant share in the postoperative pain management market.

By Route of Administration

Oral postoperative pain medication is expected to dominate the postoperative management market in 2024 based on its method of administration, which is high because taking medicine by mouth is easier and more comfortable for most patients, mainly older adults.

The convenience of swallowing a pill, in comparison to other forms of treatment like injections, makes it the preferred option for managing pain after surgery. In addition, most patients find oral medications to be more familiar and less intimidating, further boosting their popularity.

Further, its simplicity, along with patient preference, is driving its higher importance in the market. Since most people, mainly the elderly, prefer this method, it is seen as the most practical and accessible way to provide relief from pain after surgery, contributing to its major role in the overall market.

By Distribution Channel

Hospital pharmacies play a major role in the growth of the postoperative pain management market. They are responsible for making sure that patients have timely access to medications needed for pain relief after surgery. Since hospitals are the main place where surgeries occur, their pharmacies are directly linked to providing the required drugs to manage post-surgery pain, which includes dispensing a variety of pain relief medications, from over-the-counter options to stronger prescription drugs like opioids.

Hospital pharmacists also work closely with doctors to make sure patients receive the right dosage and type of medication customized to their needs, helping to minimize complications and enhance recovery. By efficiently managing medication supply, counseling patients, and monitoring drug use, hospital pharmacies contribute to better patient outcomes and complete satisfaction.

Their involvement in this process is a key driver of market growth, as effective pain management is a critical aspect of post-surgical care, and hospital pharmacies are at the forefront of delivering this service.

The Postoperative Management Market Report is segmented on the basis of the following

By Drug Class

- Opioids

- NSAIDs

- Local Anesthetic

- Acetaminophen

By Route of Administration

- Oral

- Injectable

- Topical

- Transdermal

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Clinics

- Others

How Is Artificial Intelligence (AI) Healp To Improving Regulatory Compliance For Postoperative Management ?

- Automated Documentation and Reporting: AI-powered tools can automatically generate and organize postoperative records to meet regulatory requirements. By using natural language processing (NLP), AI ensures that all necessary details are documented, minimizing human errors that could lead to compliance violations.

- Real-Time Monitoring and Alerts: AI systems integrated with wearable devices and monitoring tools can continuously track patient vitals, such as heart rate, oxygen levels, and blood pressure. Any deviations are flagged immediately, ensuring timely intervention while maintaining compliance with safety protocols.

- Predictive Analytics for Risk Management: Artificial Intelligence algorithms can analyze patient data to identify those at higher risk of complications. This predictive capability allows healthcare providers to implement precautionary measures aligned with regulatory standards, reducing postoperative risks.

- Standardized Protocols: AI ensures adherence to standardized postoperative care protocols by guiding healthcare teams through evidence-based practices. This reduces variability in care and ensures compliance with medical guidelines and regulations.

- Regulatory Audits and Reporting: AI-driven platforms simplify the preparation of compliance reports for audits. They can aggregate and analyze data to demonstrate adherence to regulations, saving time and effort for healthcare providers.

- Patient Education and Informed Consent: AI-powered chatbots and apps can educate patients about postoperative care requirements and obtain informed consent in a manner compliant with legal and ethical standards.

- Data Security and Privacy: AI ensures compliance with data protection regulations, such as HIPAA, by employing advanced encryption and access control mechanisms, safeguarding patient information.

Regional Analysis

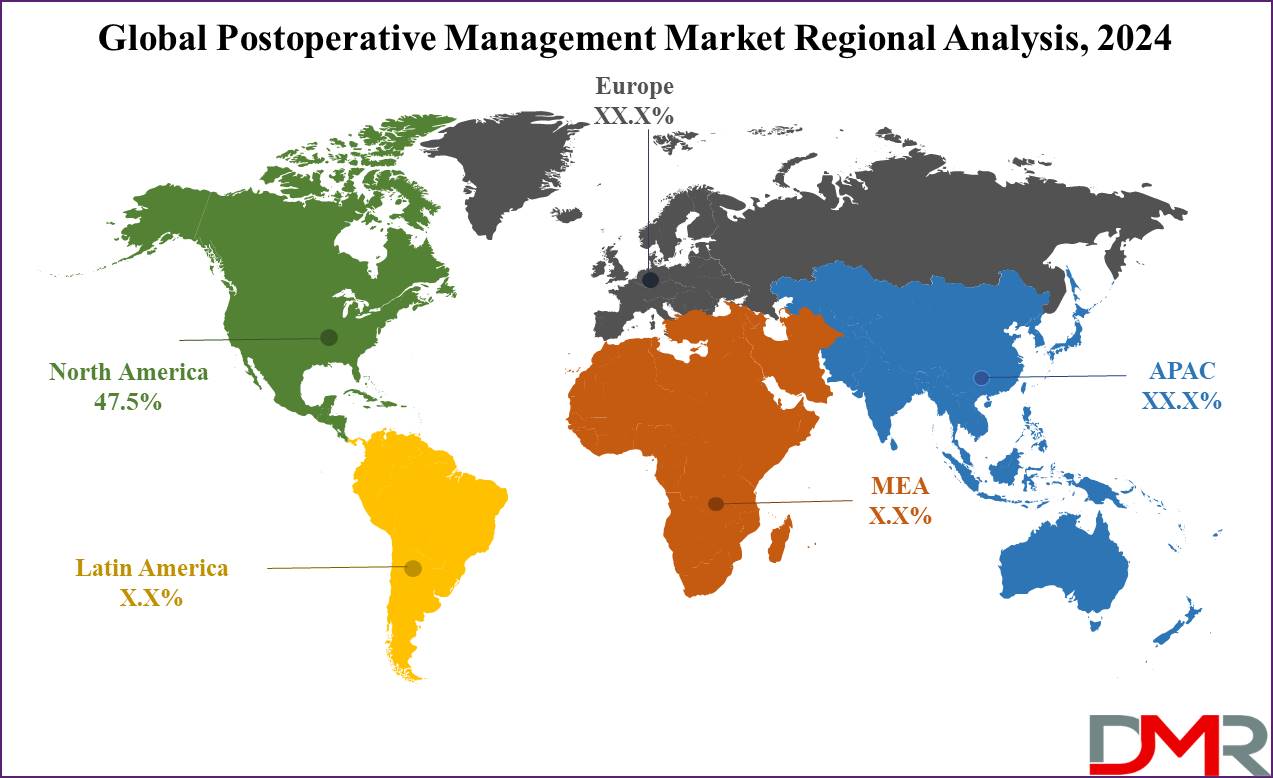

North America plays a major role in the growth of the postoperative pain management market by having a share of

47.5% of the overall market in 2024 due to its advanced healthcare system and the large number of surgeries performed each year. The region has a major focus on pain management, assisted by ongoing R&D of new treatments.

In addition, the presence of key pharmaceutical companies and easy access to innovative pain relief medications support the drive for market growth. With the growth in awareness about effective post-surgery care, North America is expected to be a leading region in advancing the postoperative pain management market.

Further, the Asia Pacific is becoming an important region in the growth of the postoperative pain management market due to its large increase in the population, expanding healthcare infrastructure, and growth in the number of surgeries. As more people in countries like China, India, and Japan gain access to better medical facilities, the need for effective pain management after surgery is increasing.

In addition, the region is experiencing large investments in healthcare and an expanding pharmaceutical industry, which is driving the development and availability of pain relief medications, making Asia Pacific a key player in this market's growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the postoperative management market is characterized by numerous players, like pharmaceutical companies, medical device manufacturers, and healthcare providers. These organizations aim to develop innovative pain management solutions, like advanced medications and effective delivery systems. Further collaborations and partnerships are common as companies look to improve their product offerings and expand their market reach.

In addition, there is a major focus on research and development to create safer, non-opioid alternatives, along with personalized treatment options to better meet patient needs and improve recovery outcomes.

Some of the prominent players in the Global Postoperative Management are

Recent Developments

- In September 2024, A consortium of leading Canadian medtech companies, led by FluidAI Medical in collaboration with Medtronic Canada ULC, Providence Health Care Ventures, Excelar Technologies, and the University of Waterloo, launched the Postoperative Patient Management Platform (PPMP) project under Canada’s Global Innovation Cluster for digital technologies, called DIGITAL, which focuses on to transform postoperative care through advanced artificial intelligence (AI) and machine learning technologies.

- In September 2024, Elutia Inc. announced a major achievement with the first-ever patient implant of EluPro, the world’s first antibiotic-eluting biologic envelope cleared by the U.S. FDS, which was performed by Chief, Division of Cardiology, Director, Cardiology Services, and Program Director of Clinical Cardiac Electrophysiology Fellowship at East Carolina University Health Medical Center in Greenville, North Carolina.

- In April 2024, AtriCure, Inc. unveiled the cryoSPHERE®+ cryoablation probe, using new insulation technology to lower freeze times by one-fourth versus AtriCure’s legacy cryoSHPERE® device, as it is currently in an extended limited launch period in the United States, with complete launch expected in Q2.

- In January 2024, Heron Therapeutics, Inc. announced that the U.S. FDA approved its supplemental New Drug Application ("NDA") for ZYNRELEF to expand the indication for soft tissue and orthopedic surgical procedures like foot & ankle, and other procedures in which straight exposure to articular cartilage is avoided, as it was previously approved for foot and ankle, small-to-medium open abdominal, and lower extremity total joint arthroplasty surgical procedures in adults.

- In June 2022, The Society of American Gastrointestinal and Endoscopic Surgeons (SAGES) announced a series of initiatives to modernize surgical education and improve patient care, which include efforts focusing on bettering surgical data science, testing artificial intelligence-based models, and enhancing training for residents, fellows, and practicing surgeons.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 42.5 Bn |

| Forecast Value (2033) |

USD 68.3 |

| CAGR (2024-2033) |

5.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 17.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Drug Class (Opioids, NSAIDs, Local Anesthetic, and Acetaminophen), By Route of Administration (Oral, Injectable, Topical, Transdermal, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Drug Stores, Clinics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Pfizer, Novartis, Mylan, Allergan, Endo International, Egalet Corporation, Teva Pharmaceutical Industries Ltd, GlaxoSmithKline, Pacira Pharmaceutical, Purdue Pharma, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Postoperative Management Market size is expected to reach a value of USD 42.5 billion in 2024 and is expected to reach USD 68.3 billion by the end of 2033.

North America is expected to have the largest market share in the Global Postoperative Management Market with a share of about 47.5% in 2024.

The Postoperative Management Market in the US is expected to reach USD 17.0 billion in 2024.

Some of the major key players in the Global Postoperative Management Market are Pfizer, Novartis, Mylan, and others.

The market is growing at a CAGR of 5.4 percent over the forecasted period.