Market Overview

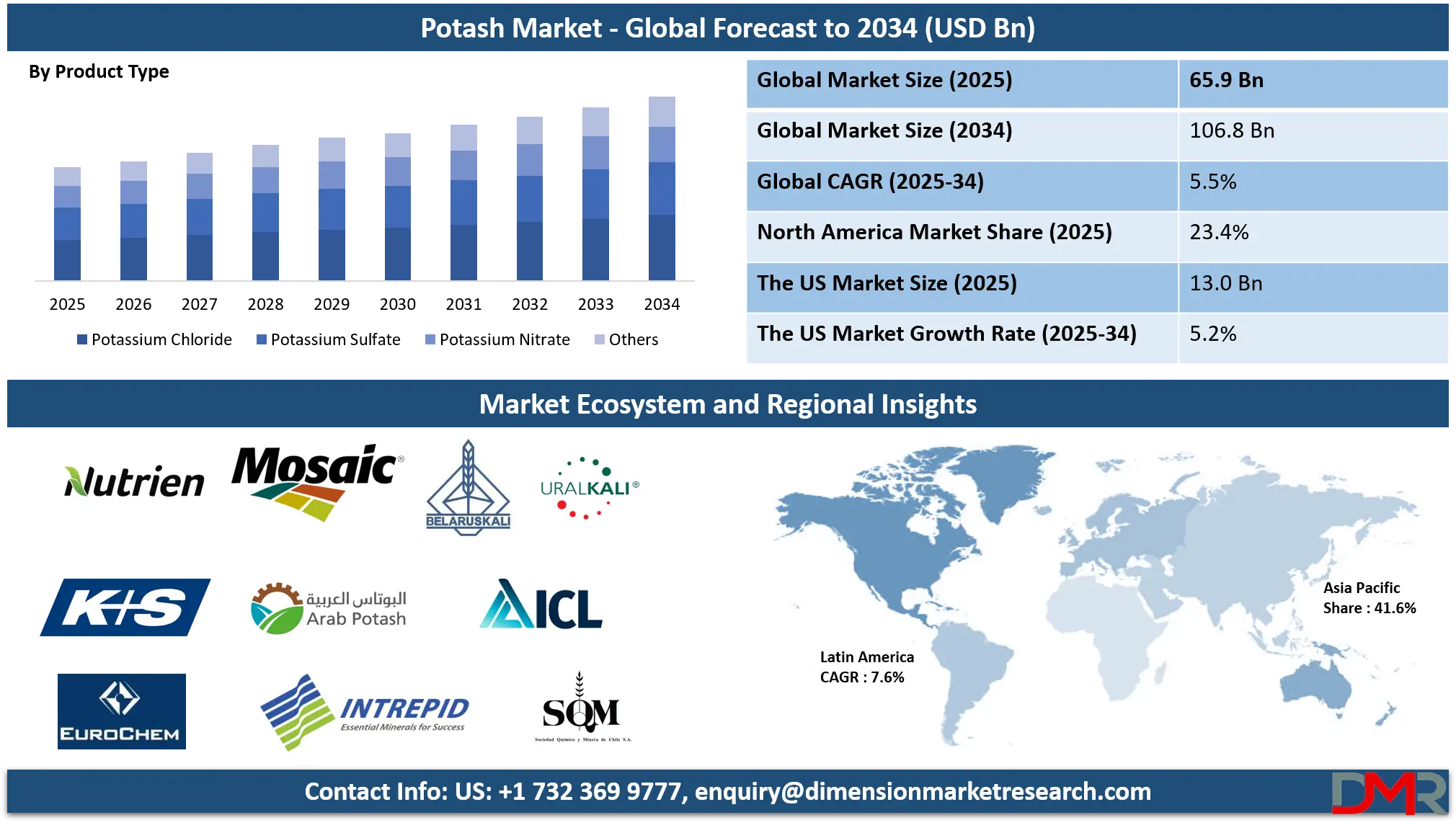

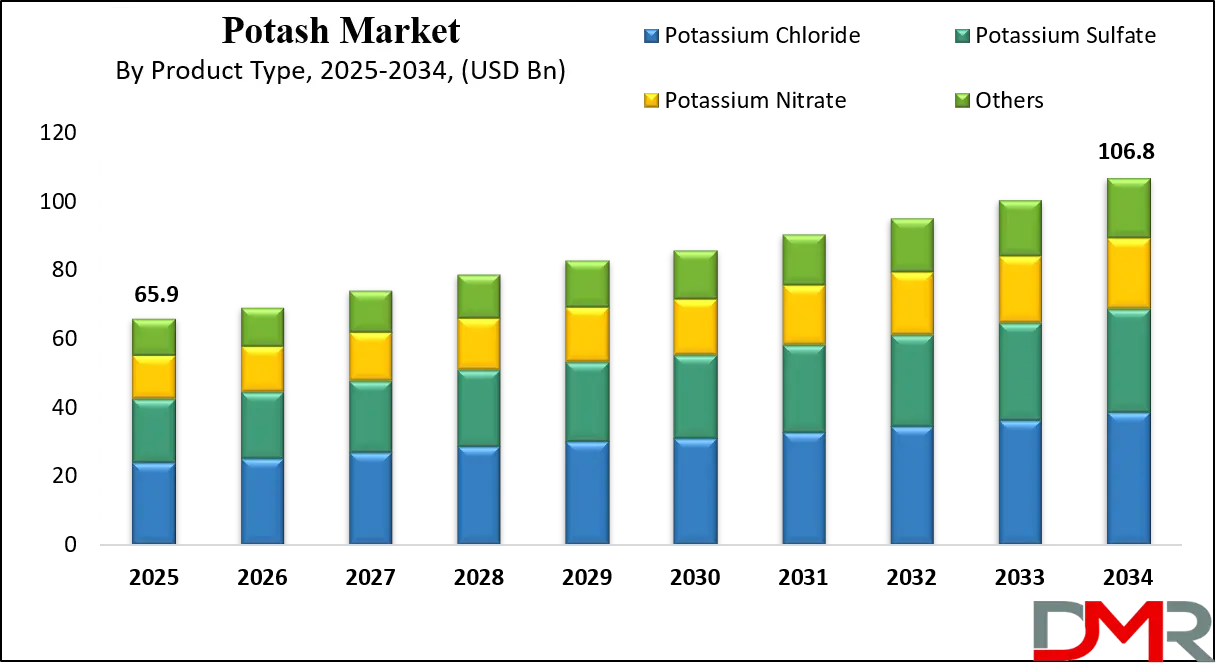

The Global Potash Market is predicted to be valued at USD 65.9 billion in 2025 and is expected to grow to USD 106.8 billion by 2034, registering a compound annual growth rate (CAGR) of 5.5% from 2025 to 2034.

Potash is a term commonly used to describe a variety of mined and manufactured salts that contain potassium in water-soluble form. The most prevalent form is potassium chloride (KCl), which is widely used as a key ingredient in fertilizers to enhance crop yield, quality, and disease resistance.

Potassium is one of the three essential macronutrients for plant growth, alongside nitrogen and phosphorus. Potash helps plants strengthen their root systems, regulate water content, and improve resistance to stress such as drought or pests. It is primarily extracted from underground mineral deposits or produced through evaporation of brine from salt lakes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global potash market plays a critical role in the agriculture industry, driven by the increasing demand for potassium-based fertilizers to enhance soil fertility and crop productivity. As global food security becomes a pressing concern, the need for nutrient-rich fertilizers continues to grow. Potash, particularly potassium chloride, remains a staple input in modern farming systems.

Expanding population and changing dietary patterns are encouraging higher agricultural output, directly influencing potash consumption. Farmers increasingly rely on potassium fertilizers to support intensive farming practices, especially for high-demand crops such as corn, wheat, and rice. The growth of organic farming has also spurred demand for sulfate of potash, a chloride-free alternative.

The potash industry is witnessing technological advancements in mining and production techniques, improving resource efficiency and reducing environmental impacts. The rise in precision agriculture and controlled-release fertilizers is further boosting demand for high-quality potash formulations. Additionally, long-term supply agreements between producers and agricultural cooperatives are fostering market stability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Beyond agriculture, potash finds application in various industrial sectors, including chemical manufacturing, pharmaceuticals, and water treatment. Its use in de-icing, soap production, and glassmaking is also expanding. As sustainability gains importance, companies are focusing on responsible mining, low-carbon operations, and sustainable potash production methods to meet environmental standards and global regulatory frameworks.Bottom of Form

The US Potash Market

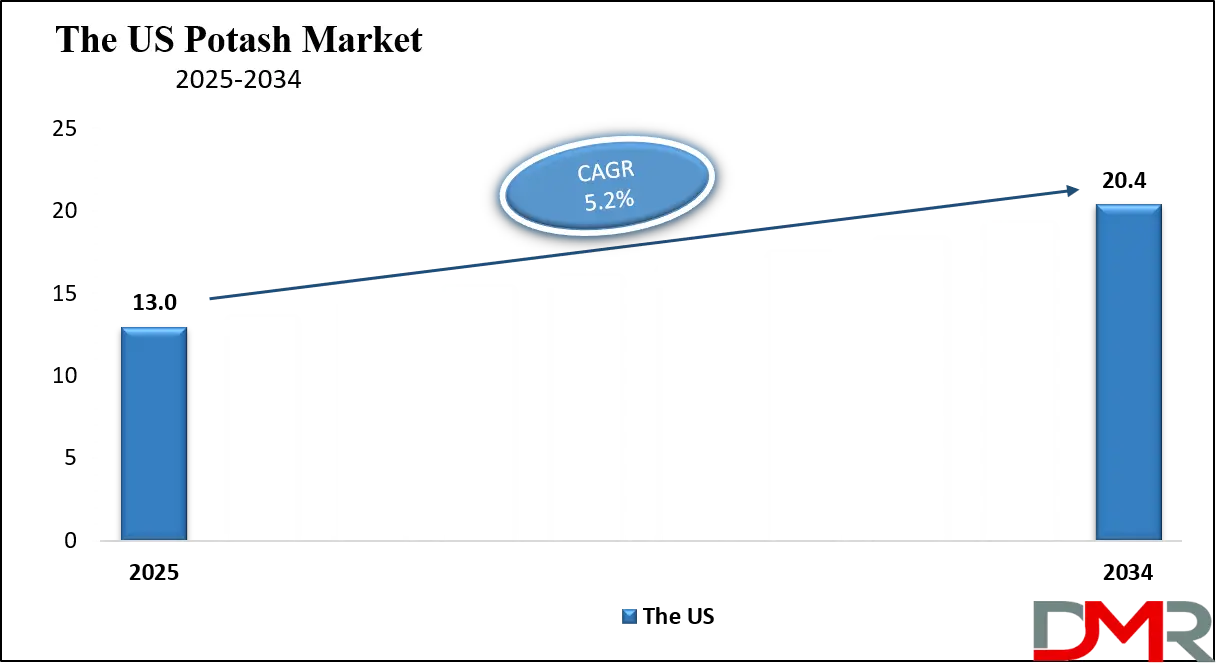

The US Potash Market is projected to be valued at USD 13.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.4 billion in 2034 at a CAGR of 5.2%.

The U.S. potash market is driven by the increasing demand for crop yield optimization and the rising awareness of soil health among farmers. The widespread use of potash-based fertilizers in corn, soybean, and wheat cultivation supports strong domestic demand. Government subsidies and initiatives promoting sustainable agriculture practices further contribute to the market's expansion.

Additionally, the presence of technologically advanced farming systems enhances fertilizer application efficiency. The growing interest in precision agriculture and nutrient management solutions fosters the use of potash, especially in field crops. Robust agribusiness infrastructure and evolving consumer preferences for quality produce also strengthen the potash market outlook.

Emerging trends in the U.S. potash market include the integration of digital agriculture technologies and data analytics in nutrient application. Farmers are increasingly using variable-rate technology and soil mapping to optimize potash use. There's a notable shift toward organic and specialty fertilizers, aligning with consumer demand for sustainable farming.

Companies are investing in controlled-release potash formulations and eco-friendly blends. Domestic potash production is being influenced by supply chain localization efforts, reducing reliance on imports. Furthermore, collaborations between agri-tech firms and fertilizer producers are growing, aiming to offer smart and customized fertilization solutions to boost both productivity and environmental performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Potash Market

The Japan Potash Market is projected to be valued at USD 4.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.9 billion in 2034 at a CAGR of 4.5%.

Japan’s potash market is primarily driven by the need to improve agricultural productivity on limited arable land. The country relies heavily on nutrient-rich fertilizers to maintain soil fertility and crop quality. High-value horticultural crops and rice cultivation create consistent demand for potassium-based nutrients. With aging farmers and shrinking farmland, potash-based fertilizers are seen as vital for maximizing yields with minimal labor.

Government initiatives promoting self-sufficiency in food production and efficient fertilizer management contribute to the market’s growth. Additionally, the country's dependence on potash imports enhances the importance of stable supply chains and efficient distribution networks for agricultural continuity.

A key trend in Japan’s potash market is the growing adoption of integrated nutrient management and precision farming methods. The use of sensor-driven systems and controlled fertigation techniques is rising to ensure targeted application of potash. There's increasing interest in smart agriculture tools that combine real-time soil diagnostics with tailored fertilizer plans. Demand for high-efficiency and slow-release potash products is growing, especially in greenhouse and hydroponic farming.

Furthermore, Japanese agri-tech companies are exploring innovations in sustainable fertilizer formulations. Collaboration with global fertilizer suppliers for R&D and secure procurement is also shaping the market's strategic direction.

The Europe Potash Market

The Europe Potash Market is projected to be valued at USD 11.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.9 billion in 2034 at a CAGR of 5.0%.

The Europe potash market is primarily driven by strong environmental regulations promoting sustainable agriculture. There's a high emphasis on efficient nutrient use and reducing nitrogen runoff, which supports potash consumption. The region's diversified crop base, including cereals, vegetables, and fruits, sustains steady demand for potash-based fertilizers.

Increasing organic farming acreage and government-backed agro-environmental schemes are encouraging the use of natural and low-impact nutrients. Potash also plays a critical role in supporting precision agriculture techniques across key European farming economies. Moreover, advanced farming equipment and awareness of micronutrient balance in soil health further bolster the demand for potassium-based fertilizers.

In Europe, the trend is shifting toward circular and regenerative agriculture, boosting demand for sustainable potash alternatives. Farmers are adopting bio-based fertilizers and blends that incorporate potassium with secondary and micronutrients. Technological integration, such as remote sensing and AI-powered crop monitoring, is influencing potash application practices.

There's growing R&D investment in low-carbon fertilizer production and energy-efficient mining techniques. Local sourcing and strategic partnerships within the EU are being prioritized to reduce dependency on external suppliers. Additionally, policy frameworks like the Common Agricultural Policy (CAP) are reshaping fertilizer usage patterns and encouraging precision fertilization for enhanced environmental compliance.

Potash Market: Key Takeaways

- Market Overview: The global potash market is anticipated to reach a valuation of USD 65.9 billion by 2025 and is projected to grow steadily to approximately USD 106.8 billion by 2034, with a compound annual growth rate (CAGR) of 5.5% throughout the forecast period.

- The US Potash Market: In the United States, the potash market is estimated to be worth USD 13.0 billion in 2025, and it is forecasted to expand further, reaching USD 20.4 billion by 2034, reflecting a CAGR of 5.2% during this time frame.

- By Product Type Analysis: Potassium Chloride is expected to lead the market by 2025, making up around 62.3% of the total market share, establishing its position as the most widely used potash product.

- By Form Insight: The solid form of potash is anticipated to remain the most dominant in 2025, comprising approximately 78.5% of the global market share, due to its ease of handling and application.

- By Mining Method: Underground mining is set to be the leading extraction method by 2025, accounting for roughly 66.4% of the market share, driven by the maturity and efficiency of existing operations.

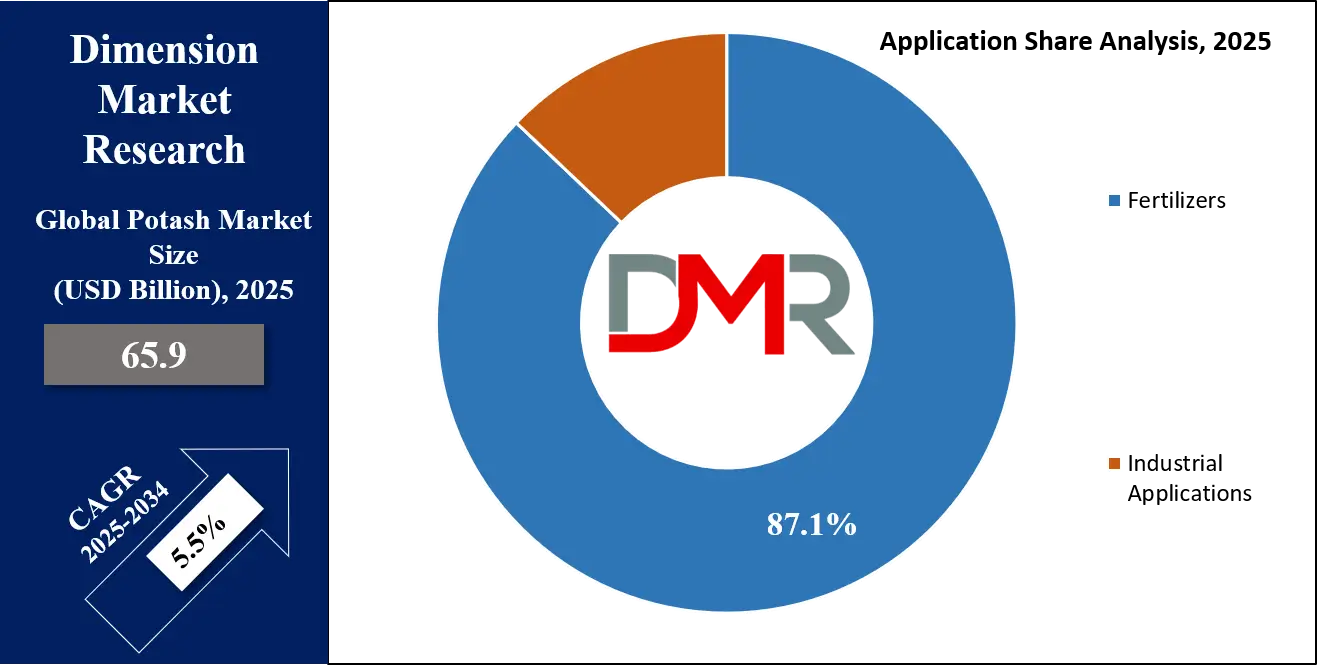

- By Application Analysis: The fertilizer segment is expected to continue dominating the global potash market in 2025, representing an estimated 87.1% share, as potash remains a key nutrient in agricultural production.

- Leading Region: Asia Pacific is projected to be the largest regional market by the end of 2025, capturing nearly 41.6% of the global market, driven by extensive agricultural activities and rising fertilizer demand.

Potash Market: Use Cases

- Fertilizer for Field Crops: Potash is extensively used as a soil amendment in agriculture to enhance crop yields. It improves root strength, water retention, and disease resistance in field crops such as wheat, corn, and soybeans. Its potassium content is vital for plant metabolism and overall health.

- Fruit and Vegetable Cultivation: In horticulture, potash plays a critical role in fruit development and flavor enhancement. It helps in increasing sugar content, improving size, and boosting shelf life of fruits and vegetables. Potassium strengthens plant cell walls and promotes uniform ripening, making it essential in intensive farming practices.

- Turf and Ornamental Plants Maintenance: Potash is used in landscaping and turf management to maintain lush, green lawns and ornamental plants. It enhances drought tolerance, promotes deep root systems, and ensures better stress resistance. Sports fields, golf courses, and public parks often rely on potash-based fertilizers for aesthetic quality.

- Industrial Glass Manufacturing: Potash is used as a fluxing agent in glass production to lower melting points and improve clarity. It enhances chemical durability and brightness in specialty glass, such as optical lenses and cookware. Its chemical stability makes it a preferred alternative to soda ash in certain applications.

- Chemical Processing Industry: Potash serves as a raw material in the production of potassium hydroxide, potassium carbonate, and other compounds. These are widely used in soap making, water softening, and pharmaceuticals. Its high solubility and purity make it a valuable input in industrial chemical reactions and manufacturing processes.

Potash Market: Stats & Facts

- U.S. Geological Survey (USGS) states that global potash production reached approximately 45 million metric tons of potassium oxide equivalent in 2023.

- FAO (Food and Agriculture Organization) highlights that potash fertilizer use was around 37 million metric tons globally in 2022, reflecting rising demand from the agriculture sector.

- International Fertilizer Association (IFA) reveals that potash demand in Asia accounted for nearly 40% of global consumption, driven by rice and vegetable farming.

- Natural Resources Canada estimates that the country exported potash worth over CAD 10 billion in 2023, mainly to the U.S., Brazil, and China.

- European Commission emphasizes that over 90% of potash produced globally is used in fertilizers, essential for improving plant health and yields.

- World Bank data shows potash prices averaged USD 350 per metric ton in 2023, fluctuating due to geopolitical tensions and trade disruptions.

- USGS also notes that potash reserves globally are estimated to exceed 3 billion metric tons, with Canada and Russia holding the largest shares.

- International Plant Nutrition Institute (IPNI) states that potassium, the key nutrient in potash, plays a critical role in over 60 enzymatic plant processes, including photosynthesis and water regulation.

- United Nations COMTRADE database recorded that global potash trade exceeded 25 million metric tons in 2023, with Brazil, China, and India among the top importers.

- Agriculture and Agri-Food Canada reports that Saskatchewan alone contributes nearly 95% of Canada’s potash production, making it a global mining hub.

- International Monetary Fund (IMF) notes that potash price volatility increased by over 15% year-on-year in 2022–2023 due to export restrictions and logistical constraints.

- Environment and Climate Change Canada highlights that modern potash mining uses up to 40% less freshwater than traditional methods, thanks to technological advancements.

- U.S. Department of Agriculture (USDA) states that U.S. potash consumption in fertilizers exceeded 5 million short tons in 2023, primarily for corn and soybean cultivation.

- World Trade Organization (WTO) reveals that global potash tariffs and trade barriers declined by over 10% between 2018 and 2023 to ensure stable food supply chains.

- The Fertilizer Institute (TFI) estimates that balanced potash fertilization can improve crop yields by 15% to 20%, especially in potassium-deficient soils.

Potash Market: Market Dynamic

Driving Factors in the Potash Market

Rising Global Demand for Crop Nutrition

The increasing need for higher agricultural productivity to meet global food demand is a significant driver of the potash market. As potassium-rich fertilizers play a crucial role in enhancing crop yield, improving drought resistance, and strengthening disease tolerance, farmers are increasingly turning to potash-based solutions. The growing popularity of precision farming and sustainable agriculture further boosts demand.

Additionally, potassium chloride (Muriate of Potash) continues to be a widely used soil amendment across key field crops and fruits and vegetables. With expanding populations and shrinking arable land, the emphasis on efficient nutrient management and soil fertility enhancement strengthens the potash fertilizer market globally.

Expanding Application in Industrial Processes

Beyond agriculture, potash compounds are gaining traction in various industrial applications such as glass manufacturing, soaps, and chemical processing. Potassium carbonate and potassium hydroxide are vital in producing detergents, dyes, and batteries. The growth of these downstream industries significantly contributes to market expansion. Industrial-grade potash is especially critical in regions focusing on clean energy and electronics, where advanced material processing is essential. The rise in glass and ceramics production for construction and automotive sectors also drives demand. This diversification of application areas reinforces the relevance of potash in both agronomic and non-agronomic markets, positioning it as a multi-utility mineral resource.

Restraints in the Potash Market

Environmental and Regulatory Challenges

The potash market faces growing scrutiny due to environmental concerns associated with mining activities. Potash extraction can result in groundwater contamination, land subsidence, and waste disposal issues. Strict environmental regulations and pressure from eco-conscious stakeholders often delay new mining projects and raise operational costs for existing ones.

Additionally, emissions linked to processing and transport impact the overall carbon footprint, pushing companies to adopt greener technologies. Regulatory compliance in regions like North America and Europe is becoming more stringent, thereby creating entry barriers and discouraging investment. These challenges can significantly hamper supply chains and reduce the pace of potash market expansion, especially in ecologically sensitive zones.

Volatility in Raw Materials and Freight Costs

Fluctuations in energy prices, transportation costs, and raw material availability are major restraints in the potash market. Since potash mining and processing are energy-intensive, any increase in fuel prices directly impacts the cost structure. Furthermore, logistical disruptions such as port congestion, geopolitical tensions, and container shortages affect global potash supply chains.

Freight volatility can make it difficult for exporters to maintain competitive pricing, especially in developing agricultural markets. Inconsistencies in pricing contracts and shipment delays often lead to uncertainty among distributors and end users. This volatility, when combined with supply-demand imbalances, restricts profitability and long-term planning within the global potash industry.

Opportunities in the Potash Market

Emerging Markets in Asia and Africa

Rising agricultural activity and government support for food security programs in Asia and Africa present significant growth opportunities for the potash market. These regions are witnessing increased adoption of modern farming practices, including the use of balanced fertilizers for improving soil fertility and crop yield.

Countries such as India, China, and Nigeria are expanding their import volumes and domestic blending capacity to meet agricultural needs. In particular, the shift toward high-value crops like fruits, vegetables, and cash crops drives the demand for potassium-based inputs. As rural awareness about soil health and nutrient management grows, potash penetration in these developing economies is expected to accelerate.

Technological Advancements in Fertilizer Blends

The evolution of customized fertilizer solutions, including slow-release and foliar potash formulations, is opening new avenues for market growth. These advanced blends enhance nutrient-use efficiency and minimize environmental impact, aligning with sustainable agriculture goals. Innovations such as water-soluble potassium sulfate and bio-based potash fertilizers are gaining popularity among commercial growers.

Precision agriculture tools further support targeted application of potash, reducing waste and improving yield. Companies investing in R&D to develop specialized nutrient blends tailored to specific crops and soil types are well-positioned to capture market share. This technological shift promotes product differentiation and adds value across the agricultural supply chain.

Trends in the Potash Market

Strategic Collaborations and Vertical Integration

Leading players in the potash market are increasingly adopting vertical integration strategies and forming strategic partnerships to secure raw materials, streamline supply chains, and expand their global footprint. Companies are investing in joint ventures and acquisitions across mining, processing, and distribution stages. This trend helps mitigate supply-side risks and ensures a stable potash supply in key agricultural regions.

For instance, partnerships between fertilizer manufacturers and agri-tech firms support the development of crop-specific potassium solutions. Moreover, long-term contracts with agro-cooperatives and retail networks allow consistent market access, reinforcing brand loyalty and stabilizing revenue streams in a competitive market environment.

Rising Adoption of Organic and Eco-Friendly Fertilizers

As sustainability becomes a central theme in global agriculture, the demand for organic potash sources like sulfate of potash (SOP) is on the rise. Consumers are driving demand for organically grown food, prompting farmers to shift toward eco-friendly nutrient solutions. This shift is supported by regulatory incentives and certification programs for organic farming.

The trend favors low-chloride potash variants that are safer for sensitive crops and soil ecosystems. Additionally, there's growing interest in recycled or waste-derived potassium sources. The integration of green practices and carbon-neutral production methods in potash manufacturing is reshaping market dynamics and offering premium positioning to eco-conscious brands.

Potash Market: Research Scope and Analysis

By Product Type Analysis

Potassium Chloride is predicted to dominate the global potash market by the end of 2025, accounting for approximately 62.3% of the total market share. This dominance is largely attributed to its wide application in large-scale crop production, including corn, wheat, and rice. The high solubility, cost-effectiveness, and ease of availability make it the most preferred type of potash fertilizer among agricultural producers.

The global agriculture industry heavily relies on potassium chloride for enhancing crop yield and improving soil fertility. Its broad usage across conventional farming practices supports its leading position. Moreover, strong demand from developing economies for efficient crop nutrients further solidifies its market share in the overall potash fertilizer sector.

Potassium Sulfate is predicted to grow with the highest CAGR in the global potash market by the end of 2025. Its increasing use in chloride-sensitive crops such as fruits, vegetables, and tobacco is a major growth driver.

Additionally, the added benefit of sulfur content makes potassium sulfate highly suitable for specialty crops, particularly in greenhouse and horticulture applications. Rising demand for high-value crops, precision agriculture practices, and sustainable fertilization techniques is further accelerating its adoption. The shift toward premium fertilizers and improved soil health has positioned this segment as the fastest-growing category, gaining traction across diverse agricultural systems and contributing significantly to overall potash industry expansion.

By Form Analysis

The solid form segment is predicted to dominate the global potash market by the end of 2025, accounting for around 78.5% of the total market share. This dominance stems from the widespread use of solid potash fertilizers such as granules and crystals in conventional farming methods. Solid formulations are easy to store, transport, and apply using common agricultural equipment, making them ideal for broad-acre crops.

Their longer shelf life and compatibility with traditional distribution channels enhance their adoption in the global fertilizer industry. The solid form also aligns with large-scale agricultural practices, especially in emerging economies, where cost-efficiency and practicality remain key factors in nutrient management and crop productivity enhancement.

The liquid form segment is predicted to grow at the highest CAGR in the global potash market by the end of 2025. This growth is driven by rising adoption of fertigation and foliar feeding techniques in modern agriculture. Liquid potash is increasingly preferred in controlled environment farming, hydroponics, and precision agriculture systems, where uniform nutrient delivery and rapid absorption are critical.

The segment also benefits from the increasing popularity of specialty crop cultivation and demand for high-efficiency fertilizers. Enhanced compatibility with drip irrigation systems and growing emphasis on sustainable farming practices are fueling the rapid expansion of the liquid potash segment across diversified agricultural landscapes.

By Mining Method Analysis

Underground mining is predicted to dominate the global potash market by the end of 2025, holding approximately 66.4% of the total market share. This method is extensively used for extracting potash deposits located deep beneath the Earth's surface, especially in regions like Canada, Russia, and Belarus. The technique is well-established, allowing large-scale production and consistent output to meet global fertilizer demand.

Underground mining ensures high purity levels and supports the production of bulk potassium-based fertilizers for key agricultural markets. With significant infrastructure already in place and long-term reserves available, underground extraction remains the backbone of potash production, contributing steadily to global crop nutrient supply and food security through well-established supply chain networks.

Solution mining is expected to grow at the highest CAGR in the global potash market by the end of 2025. This growth is primarily driven by its operational advantages, including lower surface disruption, reduced environmental footprint, and cost-efficiency in suitable geological formations. Solution mining involves injecting water to dissolve potash underground and then pumping the brine to the surface for processing.

This method is gaining popularity in new mining projects and expansions where traditional underground methods are less feasible. With increasing focus on sustainable mineral extraction and flexibility in production scaling, solution mining is becoming a strategic choice for potash producers adapting to modern environmental and regulatory standards.

By Application Analysis

The fertilizers segment is predicted to dominate the global potash market by the end of 2025, capturing approximately 87.1% of the total market share. This dominance is driven by the essential role of potash in enhancing plant health, improving root strength, and increasing crop yields across vast agricultural landscapes. Field crops such as corn, wheat, and soybeans represent the largest sub-segment due to their extensive cultivation worldwide.

The widespread use of potash-based fertilizers is a direct response to the rising global demand for food and the need to improve soil nutrient profiles. Its vital contribution to modern farming practices makes the fertilizer application segment the primary consumer of potash products in the global agrochemical industry.

The fruits & vegetables sub-segment under fertilizers is predicted to grow with the highest CAGR in the global potash market by the end of 2025. The growing emphasis on cultivating high-value crops and the expanding demand for quality produce in domestic and export markets are major contributors to this growth.

Potash supports improved taste, color, and shelf life of produce, which is crucial for commercial fruit and vegetable farming. Increasing investments in greenhouse agriculture, drip irrigation, and organic farming further boost potash usage in this segment. The precision and efficiency required in specialty crop production are driving rapid adoption of potash-based formulations in horticultural practices globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Potash Market Report is segmented on the basis of the following:

By Product Type

- Potassium Chloride

- Potassium Sulfate

- Potassium Nitrate

- Others

By Form

By Mining Method

- Underground Mining

- Solution Mining

By Application

- Fertilizers

- Field Crops

- Fruits & Vegetables

- Turf & Ornamental Plants

- Industrial Applications

- Glass Manufacturing

- Chemical Processing

- Pharmaceuticals

- Water Treatment

- Food Processing

- Animal Feed

Regional Analysis

Region with the largest Share

Asia Pacific is predicted to hold the largest share in the global potash market by the end of 2025, accounting for approximately 41.6% of the total market. This dominance is fueled by the region's extensive agricultural activities, rising population, and growing demand for food security. Countries such as China, India, and Indonesia are major consumers due to their dependence on high-yield crop production.

The region's push toward improving soil fertility and increasing awareness about balanced nutrient management also contributes significantly to potash demand. Government subsidies on fertilizers and efforts to enhance farm productivity further strengthen market growth. Asia Pacific remains a crucial market for potash suppliers due to its scale, agricultural diversity, and policy-driven fertilizer usage.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Latin America is projected to register the highest CAGR in the global potash market by the end of 2025. This rapid growth is primarily driven by the expanding agricultural exports, especially from countries like Brazil and Argentina. The region's focus on cash crops such as soybeans, sugarcane, and coffee creates substantial demand for potash-based fertilizers. Technological advancements in farming practices and increased use of precision agriculture further boost potash consumption.

Additionally, growing investments in agricultural infrastructure, combined with favorable government policies and trade dynamics, support accelerated market expansion. Latin America’s strategic role as a global food supplier positions it as a high-growth region for potash applications in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Global Potash Market

- Enhanced Exploration and Mining Efficiency: Artificial Intelligence (AI) is revolutionizing potash mining by optimizing exploration techniques. Through machine learning algorithms, geological data can be analyzed to predict the most promising mining sites, reducing time and cost. AI-driven remote sensing and autonomous drilling technologies improve precision in locating potash deposits.

- Smart Operations and Automation: AI enables real-time monitoring of potash mining operations. Predictive maintenance powered by AI minimizes equipment downtime, enhancing productivity. Autonomous haulage systems and AI-integrated control rooms streamline logistics, improve safety, and optimize resource use, resulting in more efficient production cycles and lower operational costs.

- Optimized Supply Chain and Market Forecasting: AI tools facilitate better supply chain management in the potash industry. By forecasting demand trends, analyzing weather impacts on agriculture, and tracking global trade flows, AI helps producers make data-driven decisions. Inventory and transportation can be optimized to reduce wastage and increase market responsiveness.

- Sustainable and Environmental Benefits: AI supports sustainability in potash mining through energy optimization and environmental monitoring. AI models can detect and prevent potential ecological risks, manage water usage, and reduce greenhouse emissions. By integrating sustainability metrics into mining processes, AI aligns potash production with global ESG goals and regulatory frameworks.

Competitive Landscape

The global potash market features a moderately consolidated competitive landscape, dominated by a few key players with extensive production capacities and global distribution networks. Leading companies such as Nutrien Ltd., The Mosaic Company, Uralkali, Belaruskali, and K+S AG control a significant share of the supply chain, particularly in potassium chloride production. These market participants invest heavily in expanding mining operations, enhancing logistics efficiency, and developing value-added potash-based fertilizers to meet the evolving demands of the agricultural sector.

Strategic alliances, joint ventures, and long-term supply agreements are common in this space to ensure consistent market presence and strengthen access to high-demand regions like Asia Pacific and Latin America. Companies are also prioritizing innovation in potash processing technology to support sustainable mining practices and meet environmental compliance. The emergence of solution mining techniques and the growing adoption of specialty potash products such as potassium sulfate and potassium nitrate are shaping competitive dynamics.

Furthermore, rising emphasis on vertical integration and digital agriculture platforms enables major producers to offer end-to-end nutrient solutions. As demand for crop nutrition continues to grow globally, competitive positioning in the potash industry will rely on cost leadership, technological advancement, and strategic market penetration across diverse agricultural economies.

Some of the prominent players in the Global Potash Market are:

- Nutrien Ltd.

- The Mosaic Company

- Uralkali

- Belaruskali

- K+S Aktiengesellschaft

- Arab Potash Company

- Israel Chemicals Ltd. (ICL)

- EuroChem Group

- Intrepid Potash, Inc.

- SQM (Sociedad Química y Minera de Chile)

- BHP Group

- Yara International ASA

- APC (Asian Potash Corporation)

- Agrium Inc.

- Sinofert Holdings Limited

- Jordan Phosphate Mines Company

- China National Agricultural Means of Production Group Corp.

- Vale S.A.

- Sichuan Salt Industry Group Co., Ltd.

- Qinghai Salt Lake Industry Co., Ltd.

- Other Key Players

Recent Developments

- In March 2025, Hindustan Zinc, a Vedanta subsidiary, revealed plans to enter potash mining in Rajasthan, aiming to reduce import dependence and develop critical mineral assets through a targeted exploration block.

- In March 2025, Oil India won the Jorkian–Satipura–Khunja block in Rajasthan’s inaugural potash auction, marking a key milestone in India's efforts to boost self-reliant fertilizer mineral production.

- In October 2024, Mosaic faced equipment malfunctions at its Esterhazy and Colonsay sites, cutting quarterly potash output by 200–300 kt. Shipments were further delayed due to hurricane-related logistical disruptions.

- In July 2024, Nutrien explored expanding its West Coast export facilities to meet rising global demand, strengthening distribution capabilities amid growing pressure on fertilizer supply chains.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 65.9 Bn |

| Forecast Value (2034) |

USD 106.8 Bn |

| CAGR (2025–2034) |

5.5% |

| The US Market Size (2025) |

USD 13.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Potassium Chloride, Potassium Sulfate, Potassium Nitrate, Others), By Form (Solid, Liquid), By Mining Method (Underground Mining, Solution Mining), By Application (Fertilizers, Industrial Applications)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Nutrien Ltd., The Mosaic Company, Uralkali, Belaruskali, K+S Aktiengesellschaft, Arab Potash Company, Israel Chemicals Ltd. (ICL), EuroChem Group, Intrepid Potash, Inc., SQM (Sociedad Química y Minera de Chile), BHP Group, Yara International ASA, APC (Asian Potash Corporation), Agrium Inc., Sinofert Holdings Limited, Jordan Phosphate Mines Company, China National Agricultural Means of Production Group Corp., Vale S.A., Sichuan Salt Industry Group Co., Ltd., Qinghai Salt Lake Industry Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Potash Market?

▾ The Global Potash Market size is estimated to have a value of USD 65.9 billion in 2025 and is expected to reach USD 106.8 billion by the end of 2034.

Which region accounted for the largest Global Potash Market?

▾ Asia Pacific is expected to be the largest market share for the Global Potash Market with a share of about 41.6% in 2025.

Who are the key players in the Global Potash Market?

▾ Some of the major key players in the Global Potash Market are Nutrien Ltd., The Mosaic Company, Uralkali, and many others.

What is the growth rate in the Global Potash Market?

▾ The market is growing at a CAGR of 5.5% over the forecasted period.

How big is the US Potash Market?

▾ How big is the US Potash Market?