Market Overview

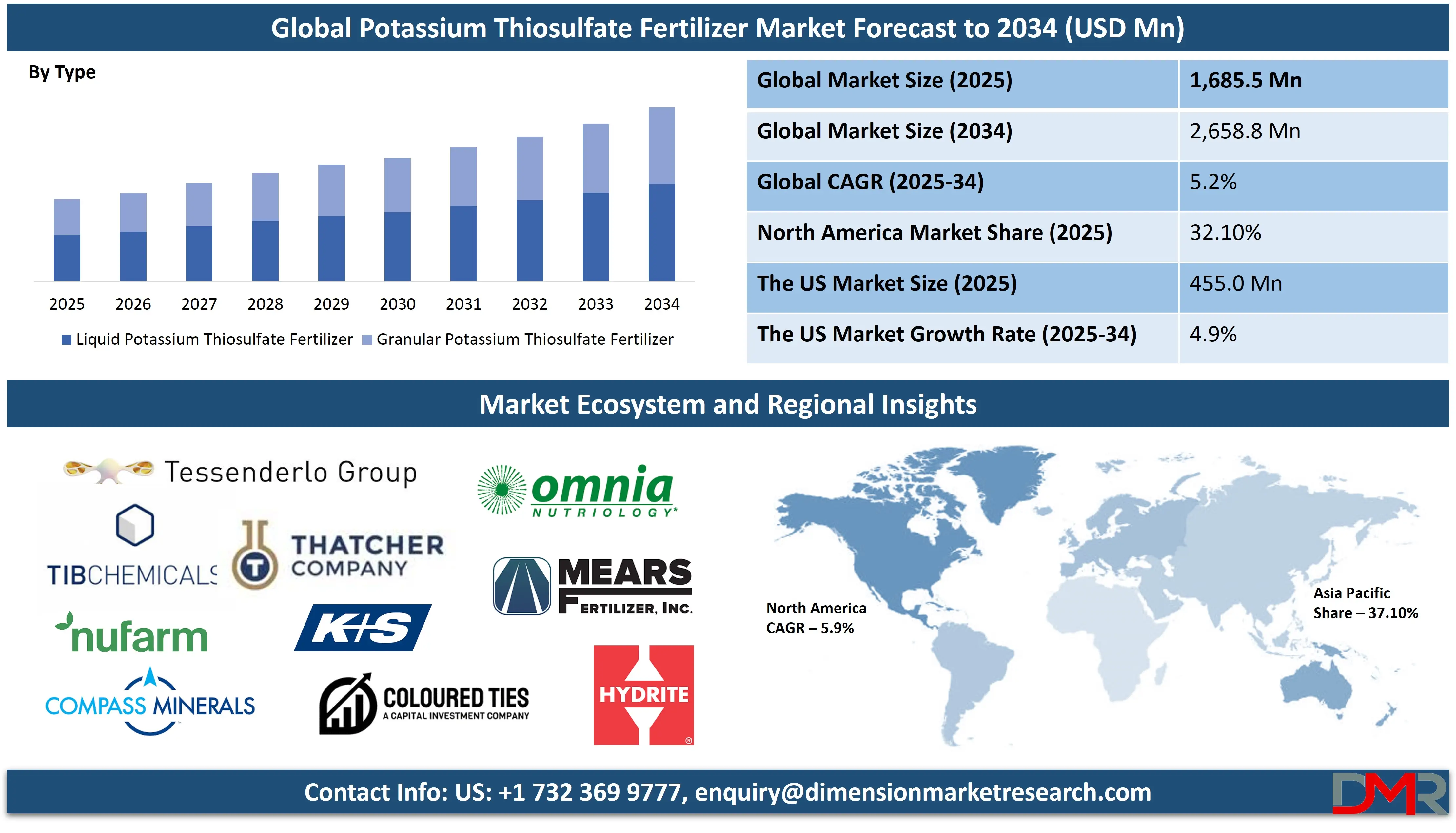

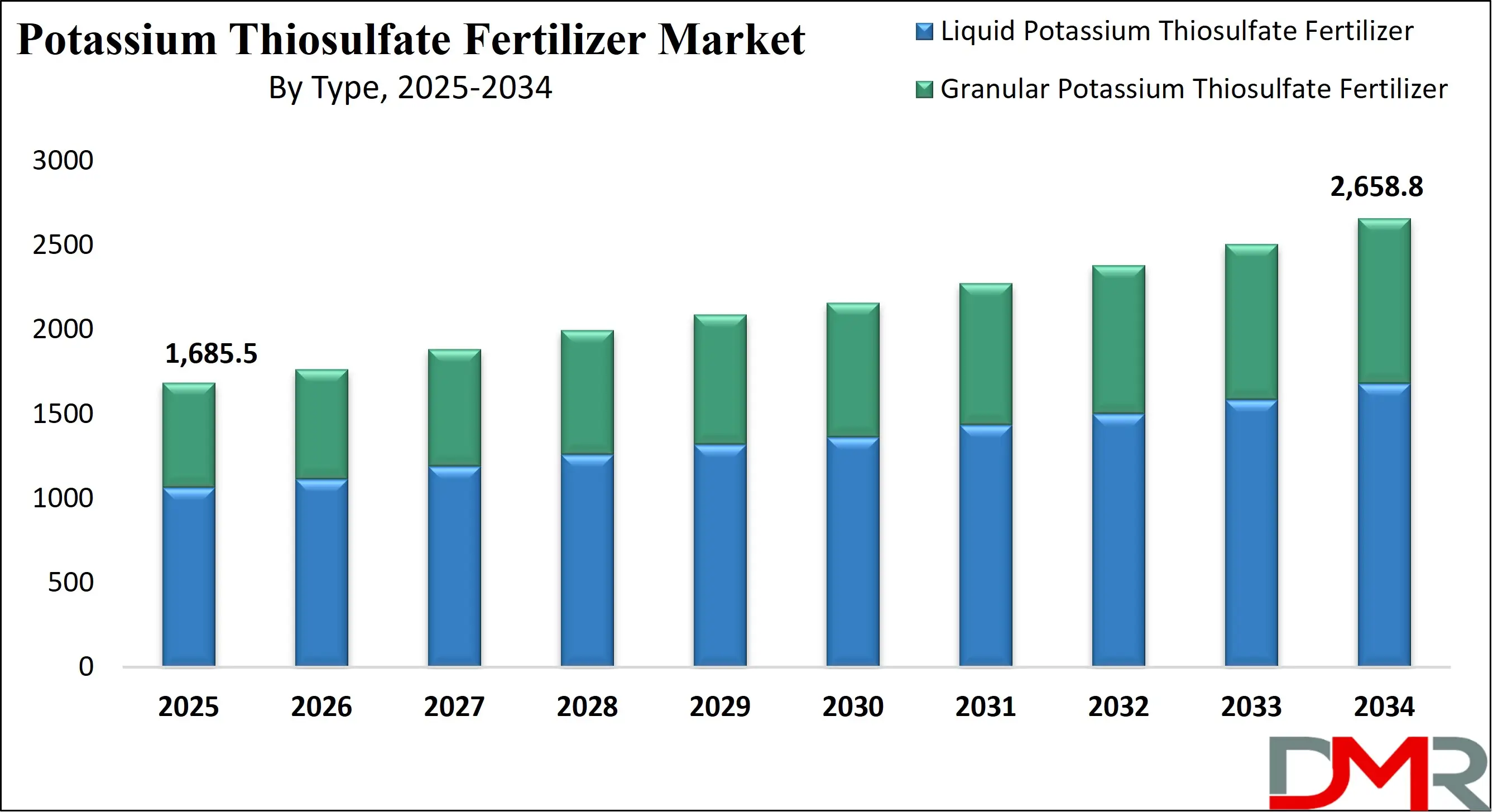

The Global Potassium Thiosulfate Fertilizer Market is predicted to be valued at USD 1,685.5 million in 2025 and is expected to grow to USD 2,658.8 million by 2034, registering a compound annual growth rate (CAGR) of 5.2% from 2025 to 2034.

The current market growth of potassium thiosulfate fertilizers is boosted by farmers who choose liquid fertilizers for their agricultural operations. Professional recognition of potassium thiosulfate has increased because this solution improves nutrient uptake while preserving soil from chloride damage. The farming community adopts potassium thiosulfate because it serves as an effective potassium fertilizer for areas where potassium deficiency occurs. Modern Agricultural Robotics are also being used to precisely apply liquid fertilizers like potassium thiosulfate, increasing efficiency and reducing labor costs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Precise farming methods represent an important market development that shows growing popularity. Many farmers now use data analytics to improve their fertilizer operations, which results in elevated crop output while reducing fertilizer losses. The market transition toward eco-friendly fertilizers compels manufacturers to develop potassium thiosulfate formulations that minimize their effects on the environment. Specialty fertilizers gain more market demand because they help improve nutrient efficiency, along with minimizing pollution from runoff. Integration with Agricultural Robotics is facilitating precision application of fertilizers in both open fields and greenhouse environments.

The market demonstrates its greatest potential by progressing potassium thiosulfate use into non-traditional crops. The benefits of potassium thiosulfate fertilizer lead to rising adoption by horticulture growers and those who cultivate high-value vegetables and fruits because the fertilizer increases nutrient access without generating salt accumulation in the soil. Industrial development in Latin America and African regions creates new market opportunities because their agricultural sectors are modernizing while searching for superior fertilizing solutions. Moreover, smart farm monitoring solutions and Health Intelligent Virtual Assistant systems are enabling growers to track plant nutrient status and optimize fertilizer application schedules.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market encounters several restraints that stem from raw material price volatility. The expense of potassium thiosulfate remains sensitive to market conditions of sulfur and potassium-based raw materials since it relies on these inputs. Some geographic regions enforce limits that restrict the use of fertilizers, thus creating barriers to market growth. The market shows positive conditions because technical innovations alongside environment-conscious agricultural methods will fuel future expansion, including the use of Commercial Display systems for real-time monitoring of nutrient distribution in greenhouse and open-field setups.

The US Potassium Thiosulfate Fertilizer Market

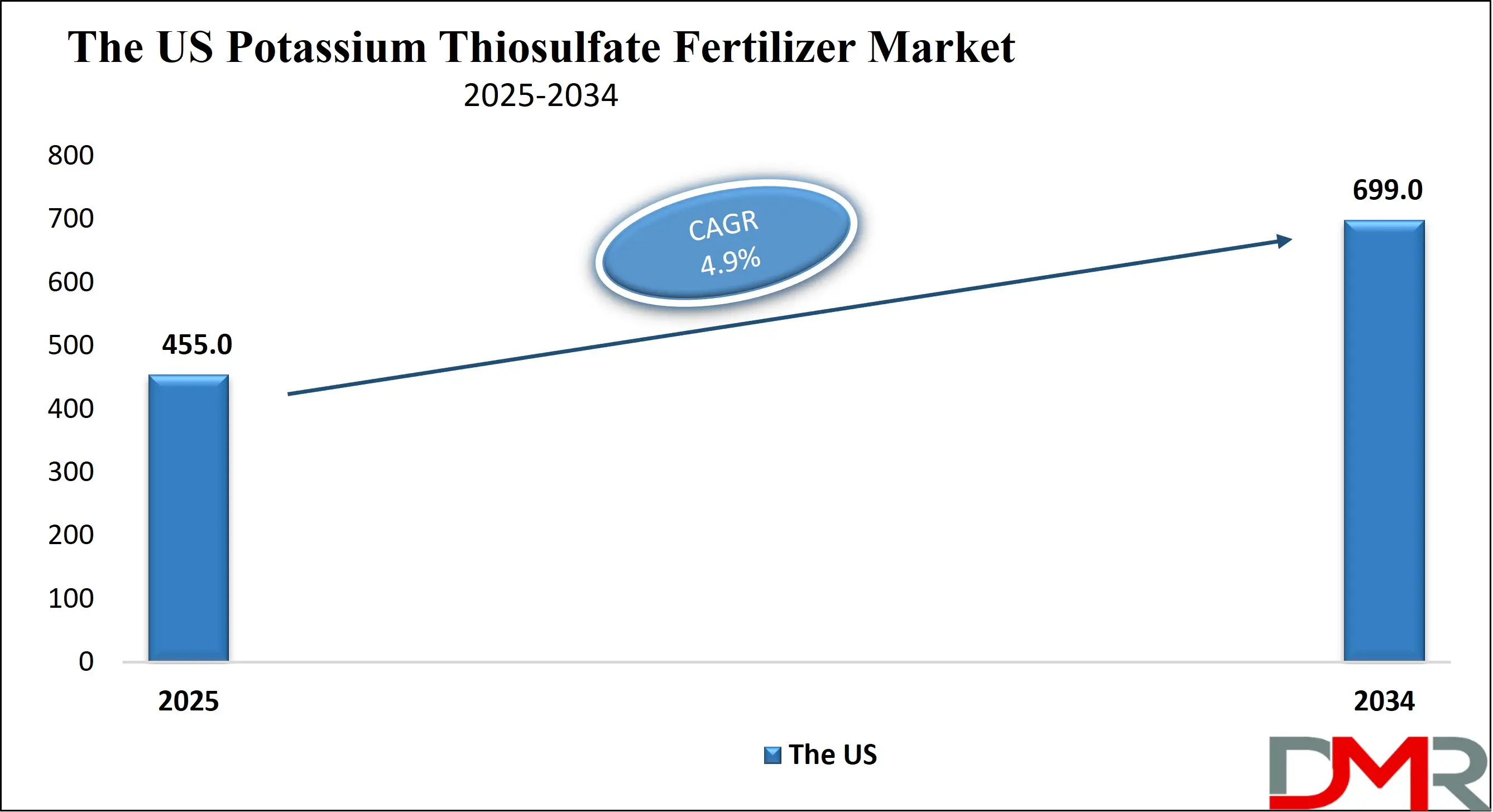

The US Potassium Thiosulfate Fertilizer Market is projected to be valued at USD 455.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 699.0 million in 2034 at a CAGR of 4.9%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. potassium thiosulfate fertilizer market develops as the agricultural industry maintains its strength and adopts advanced high-yield farming technology. Potassium thiosulfate operates among liquid fertilizers as a favored treatment by U.S. agriculture sectors because it provides high solubility alongside minimal disturbances to soil salinity. Market demand increases because farmers embrace precision agriculture and benefit from improved soil tests as well as variable rate fertilization systems. The appeal of potassium thiosulfate increases among farmers because it simultaneously improves potassium access and sulfur availability and works well with irrigation systems, thus making it appropriate for extensive agricultural operations.

The market expands through demographic factors, including large farmland territory, and developed farming equipment sector, and elevated food consumption levels by residents. The United States maintains an established agricultural system for the big crop production of corn, wheat, soybeans, and fruits, and benefits from potassium thiosulfate utilization. Specialty crop farming of nuts and berries, and organic produce, establishes new market opportunities for potassium thiosulfate fertilizer consumption.

Market data shows ongoing growth patterns of potassium thiosulfate usage mainly in farming regions across the Midwest and California due to its vital role in raising high-value crops. The market is changing toward liquid fertilizers since environmental sustainability and soil degradation have become major concerns. The market encounters two primary issues because raw materials show price volatility, while regulatory standards present complex requirements. The U.S. market for potassium thiosulfate will continue growing due to developing fertilizer application methods and increasing interest in sustainable agricultural practices.

Global Potassium Thiosulfate Fertilizer Market: Key Takeaways

- Global Market Size Insights: The Global Potassium Thiosulfate Fertilizer Market size is estimated to have a value of USD 1,685.5 million in 2025 and is expected to reach USD 2,658.8 million by the end of 2034.

- The US Market Size Insights: The US Potassium Thiosulfate Fertilizer Market is projected to be valued at USD 455.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 699.0 million in 2034 at a CAGR of 4.9%.

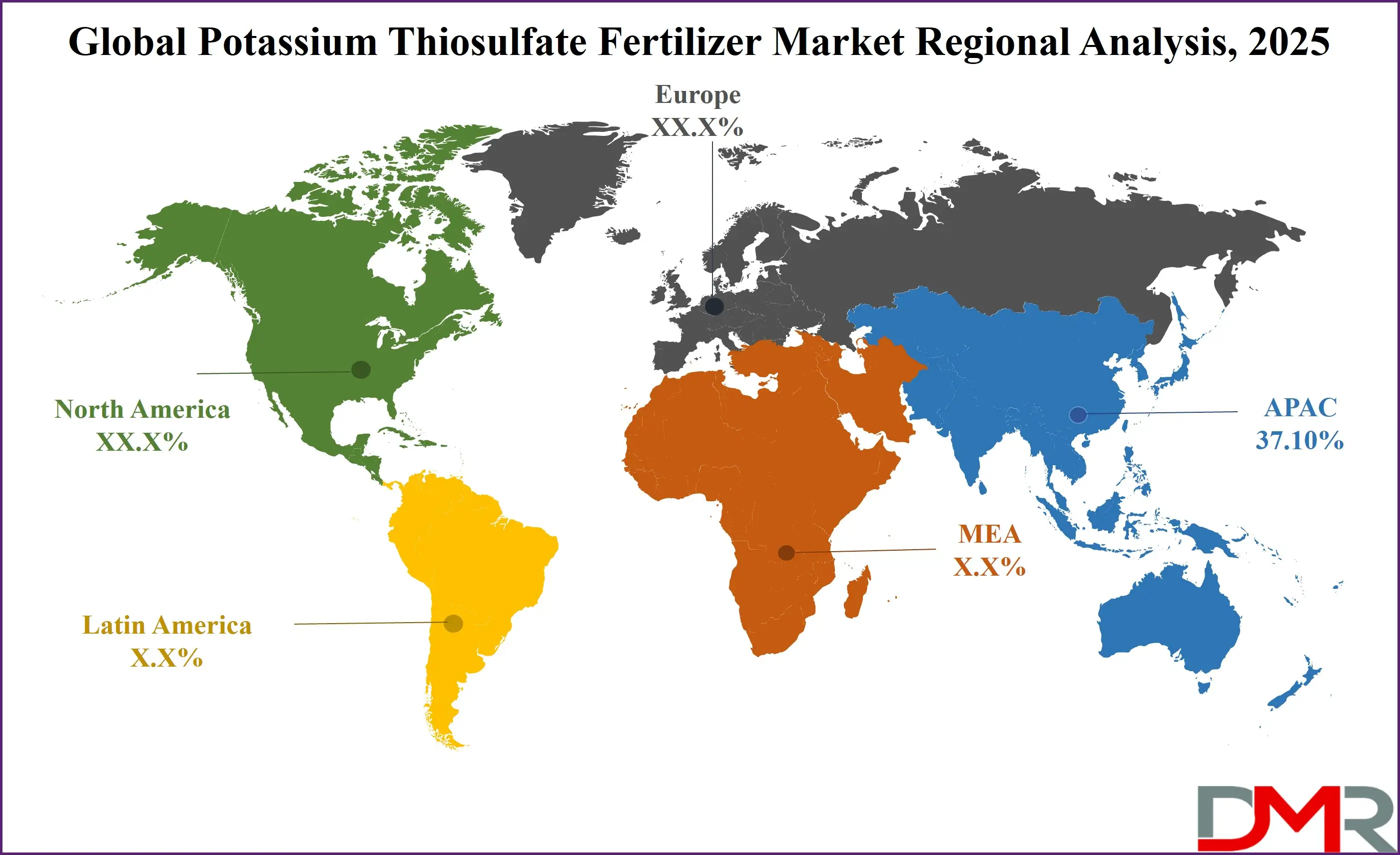

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Potassium Thiosulfate Fertilizer Market with a share of about 37.10% in 2025.

- Key Players: Some of the major key players in the Global Potassium Thiosulfate Fertilizer Market are Tessenderlo Group, TIB Chemicals, Omnia Specialities, Mears Fertilizer, Nufarm, Hydrite Chemical, Thatcher Company, Nantong Jihai Chemical, Spraygro Liquid Fertilizers, Plant Food Company, and many others

- Global Growth Rate Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

Global Potassium Thiosulfate Fertilizer Market: Use Cases

- Row Crop Fertilization: The agricultural use of potassium thiosulfate covers major row crops, including corn, wheat, and soybeans, to boost plant nutrient availability, which results in enhanced growth and improved yield while increasing stress tolerance. The application of potassium thiosulfate typically occurs as a fertigation input while also using spray applications on leaves.

- Horticulture and Fruit Farming: The application of potassium thiosulfate helps three specific high-value crops, including tomatoes, along with citrus fruits and grapes, because it maintains high-quality fruits and optimal sugar content, and maintains soil nutrient levels without creating excess soil salinity.

- Greenhouse Cultivation: Controlled-environment agriculture implements potassium thiosulfate in its hydroponic and greenhouse systems because the substance enables efficient nutrient uptake that produces maximized vegetable and ornamental plant development.

- Turf and Landscape Management: Potassium thiosulfate works as a liquid fertilizer throughout golf courses and ornamental gardens, and sports fields because it aids turf health while boosting drought tolerance and reducing nutrient absence in advanced landscape maintenance.

- Blended Fertilizer Formulations: The incorporation of potassium thiosulfate into liquid fertilizer blends improves the nutrient balance and enhances efficiency, and offers slow potassium release for various agricultural purposes.

Global Potassium Thiosulfate Fertilizer Market: Stats & Facts

- According to FAOSTAT (2022), the global agricultural use of inorganic fertilizers reached 185 million tonnes of nitrogen (N), phosphorus (P₂O₅), and potassium (K₂O), showing a 7% decline from 2021 due to supply chain disruptions.

- Based on IFA (2022) data, nitrogen fertilizer consumption in agriculture was 108 million tonnes, marking a 4% decrease from 2021, primarily attributed to rising production costs and affordability concerns for farmers.

- FAOSTAT (2022) revealed that phosphorus fertilizer use fell by 8% to 42 million tonnes, while potassium fertilizer consumption dropped by 12% to 35 million tonnes, reflecting changing agricultural demand and economic constraints.

- The IFA (2022) reported that compared to 2021, fertilizer production declined, with potassium fertilizers dropping 8%, phosphorus fertilizers 5%, and nitrogen fertilizers 2%, largely due to geopolitical instability and supply chain issues.

- FAOSTAT (2022) indicated that Europe witnessed the largest decline in fertilizer consumption, with a 16% reduction from 2021, driven by high energy prices, policy shifts, and raw material shortages.

- An IFA (2022) analysis found that phosphorus fertilizer use in Europe dropped by 21%, potassium by 18%, and nitrogen by 12%, as farmers faced increasing costs and economic pressure.

- According to Fertilizers Europe (2022), EU-27 nitrogen fertilizer consumption in 2021/22 stood at 9.1 million tonnes, significantly lower than the global total of 112.4 million tonnes, reflecting regional economic and policy challenges.

- FAOSTAT (2022) estimated that 123.8 million hectares of farmland in the EU-27 were fertilized, covering a major portion of the total 162.5 million hectares, underscoring the importance of fertilizers in European agriculture.

- Fertilizers Europe (2022) highlighted that the EU fertilizer industry contributes €12.3 billion in turnover, based on a five-year average, emphasizing its role in sustaining European agricultural production.

- A report by Yara Porsgrunn (2022) found that annual investment in the EU fertilizer industry reached €1.2 billion, demonstrating ongoing efforts toward technological advancement and sustainability improvements.

- The European fertilizer sector, as per Fertilizers Europe (2022), supports 76,000 jobs, making it a critical industry for employment and agricultural productivity in the region.

- The IFA (2022) clarified that fertilizers do not deplete soil but rather restore essential nutrients lost through crop harvesting, ensuring long-term soil fertility and sustainable agricultural production.

- FAOSTAT (2022) explained that fertilizers originate from natural sources, with nitrogen extracted from air, phosphorus from rock phosphate, and potassium from ancient seabeds, making them vital for modern farming.

- Fertilizers Europe (2022) stressed that fertilizers are not pesticides, as they solely provide nutrients for plant growth, unlike pesticides, which focus on controlling weeds, pests, and plant diseases.

- An IFA (2022) report confirmed that fertilizers do not modify plant DNA but enhance plant growth by supplying essential nutrients that improve crop yields, quality, and overall nutritional value.

- FAOSTAT (2022) emphasized that mineral fertilizers are responsible for feeding 50% of the global population, proving their crucial role in global food security and agricultural productivity.

Global Potassium Thiosulfate Fertilizer Market: Market Dynamics

Driving Factors in the Global Potassium Thiosulfate Fertilizer Market

Increasing Global Demand for High-Yield Agriculture

The increasing global population creates a necessity for efficient fertilizers because of rising demands for higher agricultural output. The essential macroelements potassium and sulfur, combined with potassium thiosulfate, help plants achieve higher yields because these minerals protect plants against stress and enable normal metabolic functions and growth processes. The United States, along with China, India, and Brazil, operates large agricultural operations that now use potassium thiosulfate as their primary soil enrichment agent to optimize their farming output. The market shows growth because the commercial farming sector is expanding while farmers adopt high-efficiency fertilizers more frequently.

Growing Popularity of Liquid Fertilizers and Fertigation Systems

Current market dynamics that favor liquid fertilizers expedite the implementation of potassium thiosulfate products. Liquid fertilizers provide three main benefits, which include uniform nutrient delivery, followed by fast plant absorption, combined with matching capabilities with contemporary irrigation methods, particularly drip and sprinkler irrigation systems. Recent farming shifts have farmers implement liquid-based fertilizers instead of granulated fertilizers because these solutions enhance nutrient absorption while reducing leaching accidents. The implementation of fertigation systems enabled by potassium thiosulfate represents a main growth force because this soluble solution readily integrates into irrigation networks, especially in water-limited regions. Market demand for potassium thiosulfate will rise because of this industry trend in both developing and emerging economies.

Restraints in the Global Potassium Thiosulfate Fertilizer Market

Price Volatility of Raw Materials

The market for potassium thiosulfate fertilizer faces a primary obstacle in its raw material cost fluctuations. The production of potassium thiosulfate depends on sulfur and potassium-based compounds, which experience price variations due to supply chain disruptions and geopolitical tensions, together with global commodity demand changes and supply fluctuations. Regular price stability becomes challenging for manufacturers since energy prices and transport costs continue to increase. The market prices of potassium thiosulfate fertilizers become unpredictable due to volatile market conditions in price-sensitive agricultural areas.

Regulatory Constraints on Fertilizer Use and Environmental Compliance

The market expansion for potassium thiosulfate fertilizers encounters restrictions through strict governmental controls that limit chemical fertilizer applications and environmental impacts. Multiple nations have established tough regulations about controlling fertilizer runoffs alongside soil contamination, which limits the availability of specific chemical fertilizers. Manufacturers need to spend on research and development to produce environmentally friendly formulations that conform to sustainability standards during the evolution of regulatory frameworks. Fertilizer market growth faces potential limitations from rising strict regulations concerning production emissions and water quality standards, especially throughout European Union nations and North American territories.

Opportunities in the Global Potassium Thiosulfate Fertilizer Market

Expansion of Specialty Crop Cultivation

The growing market for special crops, including fruits, vegetables, nuts, and floriculture, provides substantial opportunities for potassium thiosulfate fertilizer expansion. High-value crops need exact nutrient applications to optimize product quality attributes, as well as taste and storage duration. The fertilizer potassium thiosulfate serves as an effective solution for sensitive crops because it supplies potassium and sulfur while avoiding the accumulation of salt in the soil. The horticultural and organic farming sectors' expansion in California and Spain, along the Netherlands has increased the market demand for potassium thiosulfate used as a preferred nutritional solution.

Emerging Markets in Latin America, Africa, and Asia-Pacific

Manufacturing enterprises of potassium thiosulfate fertilizer should focus on building agricultural markets throughout Latin America and the Asia-Pacific region, as well as Africa, because these regions have unexplored potential. The regions experience fast-paced agricultural modernization, which receives backing from both government policies focused on agricultural productivity and food security. Brazil, together with Mexico, India, and Indonesia, is raising its liquid fertilizer application to boost its soil productivity levels and agricultural yields. The markets show growing potential for potassium thiosulfate adoption because of investments in irrigation systems as well as precision farming technology advancements. Growing public knowledge about soil health and nutrient management will drive future rises in advanced fertilizer demand.

Trends in the Global Potassium Thiosulfate Fertilizer Market

Rising Adoption of Precision Farming and Smart Agriculture

The potassium thiosulfate fertilizer market shows significant modifications because of the rising precision farming techniques across the industry. The technologies behind precision agriculture use data analytics and IoT-enabled sensors together with satellite imaging to make the best use of fertilizers, which maximizes both nutrient efficiency and yields. The liquid properties of potassium thiosulfate make it well-suited for precision farming since it enables direct nutrient application through both fertigation systems and leaf spraying. In regions characterized by advanced agricultural techniques, such as North America and Europe, farmers actively use digital solutions to minimize waste in fertilizer usage. Potassium thiosulfate demonstrates superior characteristics for nutrient absorption enhancement, together with stress resistance properties, which position it as a perfect solution for data-based agricultural systems.

Shift Towards Sustainable and Eco-Friendly Fertilizers

The demand for potassium thiosulfate increases because environmental issues, together with fertilizer runoff regulations, prompt the industry toward sustainable solutions. Potassium thiosulfate provides better environmental benefits than conventional potassium-based fertilizers since it delivers exceptional nutrient uptake results and minimizes soil damage. Government authorities, alongside regulatory authorities, promote sustainable fertilizers to address contamination risks from excessive synthetic fertilizer utilization in water bodies and soils. Organic and regenerative farming methods continue to grow in popularity, thus creating rising interest in potassium thiosulfate as an eco-friendly replacement. The trend is further amplified by consumer demand for organic and non-GMO food products, encouraging farmers to adopt fertilizers that support long-term soil health and productivity.

Global Potassium Thiosulfate Fertilizer Market: Research Scope and Analysis

By Type

Liquid potassium thiosulfate fertilizer is projected to dominate the market due to its superior efficiency, ease of application, and compatibility with modern agricultural techniques. Liquid potassium thiosulfate exhibits fast absorption and uniform distribution after farmers use it as an additive in their fertilization water and through leaf spray applications. Rapid nutrient dispersion occurs with liquid fertilizers because their quick dissolution process avoids the problems associated with granular fertilizers and creates better plant nutrient absorption.

Liquid potassium thiosulfate fits precision agriculture requirements because it easily functions with irrigation systems. Drip and sprinkler irrigators choose liquid fertilizers because they offer precise nutrient distribution that reduces environmental losses and water waste. The high efficiency level of this solution makes it practical for areas with limited water resources because it helps maximize fertilizer usage effectiveness.

High-efficiency fertilizers, which promote sustainability-driven agriculture, help maintain the dominance of liquid potassium thiosulfate. Soil salinity risk is reduced through the use of liquid potassium thiosulfate over traditional potassium fertilizers because it stands as an optimal choice for salt-sensitive crops. Through its versatile nature, liquid potassium thiosulfate can merge with other liquid fertilizers and agrochemicals, which limits the number of applications while reducing labor requirements for farmers.

By Crop Type

The dominant use of potassium thiosulfate fertilizer is expected to occur within cereals and grains because their extensive global farming numbers lead to substantial nutrient needs. Wheat, together with rice and corn, including barley, forms the foundation of dietary supplies across the world, so their mass cultivation addresses global food requirements. These crops require potassium as an essential nutrient because it enhances their ability to resist drought and disease while substantially improving the final yield. Many farmers apply potassium thiosulfate as a potassium source because of its simple accessibility, thus making it suitable for boosting cereal crop and grain production.

Record-scale adoption of high-yield farming techniques forms a major reason why potassium thiosulfate dominates this segment. The growing world population puts farmers in a position to boost their yield per hectare. The application of Potassium thiosulfate leads to enhanced grain quality by improving kernel dimensions and weight distribution, and nutritional content.

Demand for cereals and grains within food, animal feed, and biofuel industries heightens the importance of effective fertilization strategies.

As cereals and grains can be grown across diverse climatic conditions, potassium thiosulfate's versatility becomes even more crucial to their success. With its ability to improve nutrient uptake efficiency and support plant growth in different soil types and moisture conditions, potassium thiosulfate fertilizer becomes an indispensable choice for large-scale cereal farming operations. Furthermore, government initiatives promoting food security and sustainable agriculture encourage the use of advanced fertilizers, further solidifying cereal's dominance within the potassium thiosulfate market.

By Nutrient Composition

Primary nutrients are expected to dominate this sgment with highest market sharein 2025. Primary nutrients - potassium, nitrogen, and phosphorus - are fundamental for plant development, making up the mainstays in potassium thiosulfate fertilizers. Potassium, in particular, plays an essential role in water movement regulation, enzyme activation, and photosynthesis processes within plants, key elements for crop optimization. As a primary nutrient, potassium requires greater quantities than any secondary or micronutrients to remain the go-to choice in fertilizer industries worldwide.

Potassium thiosulfate fertilizers provide a convenient potassium source while mitigating risk from leaching compared to traditional potassium sources, all at an attractive price point. Furthermore, potassium thiosulfate contains sulfur as well, an essential primary nutrient which enhances protein synthesis and chlorophyll formation in plants - this dual nutrient composition makes potassium thiosulfate an appealing choice for farmers looking to maximize yield and quality simultaneously.

Primary nutrients have long been an integral component of agriculture worldwide, cementing their market dominance further by their wide application in all major crops, from cereals and fruit trees to vegetables and oilseeds, necessitating potassium for proper development and sustained productivity. Due to increasing agricultural intensification and demand for sustainable solutions, such as potassium thiosulfate fertilizers, such as their latter's role as part of sustainable farming solutions - their market dominance will only become greater over time.

By Application

Soil application of potassium thiosulfate fertilizers dominates the market due to its effectiveness at providing nutrients directly to plant roots. This method also ensures deep penetration into the soil for gradual and sustained uptake by roots; farmers prefer this application method over frequent spraying as its results last much longer and reduce the need for frequent reapplication compared with its counterpart, foliar spraying.

.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One reason soil application remains so popular is due to its versatility with different soil types and farming methods, whether conventional field farming or controlled-environment agriculture. When applied directly onto crops with extensive root systems, such as cereals, oilseeds, and tubers, where potassium plays an essential part in optimal growth, potassium thiosulfate provides uniform distribution of essential nutrients while supporting root development and overall plant health.

Soil application decreases nutrient losses caused by volatilization or surface runoff, increasing fertilizer efficiency. Precision agriculture relies heavily on this method; fertilizers are applied based on soil analysis results to optimize crop yield. Furthermore, mechanized application equipment makes soil application even more effective, enabling large farming operations to seamlessly incorporate potassium thiosulfate fertilizers into their nutrient management programs, meaning soil application will continue to dominate the potassium thiosulfate market due to its effectiveness, sustainability, and ease of incorporation into modern farming systems.

By Distribution Channel

Agrochemical stores are the major distribution channel for potassium thiosulfate fertilizers due to their wide availability and farmers' preference for customized purchasing experiences. Farmers benefit directly from accessing high-quality fertilizers while receiving expert guidance regarding selection, application techniques, and dosage recommendations from these stores compared with online or wholesale channels; unlike these options, which offer no real-time assistance or consultation. Agrochemical stores allow farmers to evaluate product quality firsthand while building trust through real-time consultation, thereby reinforcing purchase confidence.

Agrochemical stores' success can also be attributed to their strong supply chains, guaranteeing access to potassium thiosulfate fertilizer products throughout rural and urban farming regions. Many small- and mid-scale farmers rely on local retailers as these stores carry products tailored specifically for soil conditions and crop requirements; further strengthening market position. Government programs and subsidies often channel fertilizer distribution via authorized retailers, thereby further strengthening the market power of such stores.

One factor driving the growth of the potassium thiosulfate fertilizer market is an increasing demand for packaged agricultural solutions. Agrochemical stores typically offer comprehensive collections of fertilizers, pesticides, and farm equipment, allowing farmers to purchase all essential inputs at one convenient place. With personalized customer service offerings, product accessibility, and strong relationships between themselves and local farmers, they become the predominant distributor channel within the potassium thiosulfate market.

The Global Potassium Thiosulfate Fertilizer Market Report is segmented on the basis of the following

By Type

- Liquid Potassium Thiosulfate Fertilizer

- Granular Potassium Thiosulfate Fertilizer

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Turf & Ornamentals

By Nutrient Composition

- Primary Nutrient Source

- Secondary Nutrient Source

- Micronutrient Source

By Application

- Soil Application

- Foliar Application

- Fertigation

- Hydroponics

By Distribution Channel

- Online Retail

- Agrochemical Stores

- Direct Sales

- Cooperative Societies

Global Potassium Thiosulfate Fertilizer Market: Regional Analysis

Region with Highest Market Share

Asia-Pacific is projected to dominate the global potassium thiosulfate fertilizer market as it commands over 37.10% of market share in 2025 due to its expansive agricultural sector, high fertilizer consumption rates, and growing adoption of liquid fertilizers. Countries like China, India and Indonesia make major contributions, driven by large scale cereal, grain and cash crop production that requires efficient potassium and sulfur supplementation for improved crop productivity and increased food demand, plus increasing populations necessitating higher agricultural productivity that necessitate greater agricultural productivity which necessitate advanced fertilizers like potassium thiosulfate for improved nutrient absorption rates among farmers who utilize advanced fertilizers like potassium thiosulfate for better nutrient absorption capabilities of agricultural productivity. As population and food demand necessitate higher agricultural productivity which necessitate higher agricultural productivity necessitate higher agricultural productivity leading farmers adopt advanced fertilizers such as potassium thiosulfate for improved nutrient absorption purposes allowing better absorption, leading to greater agricultural output per unit of produced output per unit of produce produced goods produced.

Government initiatives supporting sustainable agriculture, coupled with subsidies on fertilizers, further propel market expansion. Furthermore, China and India's widespread adoption of precision farming, drip irrigation and fertigation techniques has increased demand for liquid potassium thiosulfate; leading manufacturers such as Haifa Group and Tessenderlo Group investing in regional production facilities only further reinforce supply chains while simultaneously decreasing costs; increased awareness regarding soil health as well as benefits associated with chloride-free potassium fertilizers has driven Asia-Pacific leadership in this market sector.

Region with the Highest CAGR

North America is expected to experience the highest CAGR due to the rapid adoption of precision agriculture, advanced irrigation systems, and sustainable farming practices. In particular, the United States and Canada lead in technological advances related to agriculture, with farmers increasingly adopting potassium thiosulfate into precision fertigation strategies and soil amendment plans using potassium thiosulfate as a fertilizer additive. Large-scale commercial farming operations for corn, wheat, and soybean cultivation create substantial demand for efficient high-efficiency fertilizers from this region, resulting in significant CAGR rates within this market segment.

Environmental concerns regarding nitrogen runoff and chloride accumulation have caused growers to turn toward chloride-free potassium sources like potassium thiosulfate for growing crops. Key industry players like Kugler Company and Nutrien Ltd. facilitate innovation and product availability, while government incentives that support sustainable agriculture as well as research collaboration between universities and agrochemical firms help drive market expansion. With growing awareness around soil health and efficiency, North America will likely experience rapid uptake of potassium thiosulfate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Potassium Thiosulfate Fertilizer Market: Competitive Landscape

The global potassium thiosulfate fertilizer market is marked by intense competition among key players focusing on innovation, product diversification, and strategic partnerships. Industry leaders such as Tessenderlo Group, Kugler Company, and Haifa Group hold dominant positions thanks to their expansive product offerings and advanced manufacturing capacities; furthermore, these firms invest heavily in R&D to maximize fertilizer efficiencies, enhance solubility levels, and create eco-friendly formulations compatible with sustainable farming practices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Strategic partnerships between fertilizer producers and agricultural research institutes have become more frequent, often to optimize potassium thiosulfate application methods and boost crop productivity. Companies are expanding their distribution networks in high-growth regions like Asia-Pacific and Latin America to capitalize on the rising demand for liquid potassium fertilizers. Mergers and acquisitions are also shifting the competitive landscape, with major firms purchasing regional players to strengthen their market positions. Furthermore, sustainable agriculture practices and precision nutrient management have driven companies to introduce innovative liquid fertilizer products, which ensure constant market competition as well as technological progress.

Some of the prominent players in the Global Potassium Thiosulfate Fertilizer Market are

- Tessenderlo Group

- TIB Chemicals

- Omnia Specialities

- Mears Fertilizer

- Nufarm

- Hydrite Chemical

- Thatcher Company

- Nantong Jihai Chemical

- Spraygro Liquid Fertilizers

- Plant Food Company

- Kodia Company Limited

- Sulphur Chemistry

- Candem

- Amgrow

- Haimen Wuyang Chemical

- Zibo Great Wall Chemical Factory

- Shakti Chemicals

- Compass Minerals

- K+S AG

- Coloured Ties Capital Inc.

- Other Key Players

Recent Developments in the Global Potassium Thiosulfate Fertilizer Market

-

March 2025: Haifa Group Expands Liquid Potassium Thiosulfate Production in Asia

Haifa Group announced an important investment to increase liquid potassium thiosulfate (KTS) production capacity across key Asian markets, particularly China and India. As part of Haifa's initiative to meet rising demand for high-efficiency fertilizers in this part of Asia, they plan to establish new production facilities as well as strengthen supply chains so as to cater to precision farming and fertigation techniques in use today.

-

January 2025: Kugler Company Joins CHS Inc. in Adopting KTS Technology Widely

Kugler Company entered into a partnership with CHS Inc., one of the largest agricultural cooperatives in the United States, to promote and enhance the adoption of potassium thiosulfate fertilizers in large-scale farming operations. The collaboration focuses on providing farmers with advanced KTS formulations tailored for row crops such as corn, soybeans, and wheat. The partnership also includes joint research initiatives to assess the impact of KTS on soil health and nutrient absorption efficiency.

-

November 2024: Global Agriculture Expo Showcases Innovative KTS Application Methods

Haifa Group and Yara International demonstrated advanced KTS application fertigation techniques at the Agritechnica 2024 Expo. Exhibitors offered innovative sustainable agriculture systems designed to maximize crop yield while simultaneously decreasing environmental impact; live demonstrations showed how KTS can be seamlessly incorporated into modern irrigation systems to increase potassium and sulfur uptake by crops.

-

September 2024: Tessenderlo Group Acquires Latin American Fertilizer Producer

Tessenderlo Group recently announced its purchase of a regional fertilizer company in Latin America, strengthening its market presence across emerging agricultural economies like Brazil, Argentina, and Mexico. This acquisition aligns with Tessenderlo's strategy of expanding its liquid fertilizer portfolio and meeting growing demands for high-performance potassium-based products like KTS products, further expanding distribution networks while giving local farmers better access to premium-grade KTS products.

- July 2024: Research Collaboration on Long-Term Benefits of KTS on Soil Health

Recently, leading agricultural universities, including Wageningen University (The Netherlands) and the University of California Davis in California, as well as leading fertilizer manufacturers Nutrien Ltd and Mosaic Company, embarked on an innovative research initiative. Their purpose: To assess long-term effects of potassium thiosulfate (KTS) fertilizers on soil fertility, microbial activity, and plant uptake efficiency to develop improved KTS formulations with optimized application strategies for optimal use in crops and agricultural environments.

- April 2024: International Conference in Canada Highlights Sustainable Fertilization with KTS

The International Conference on Sustainable Agriculture held in Toronto, Canada, featured a dedicated session on the advantages of potassium thiosulfate fertilizers. Industry leaders, including representatives from ICL Group, Yara International, and Koch Agronomic Services, discussed the role of KTS in enhancing nutrient efficiency while reducing environmental footprint. The event emphasized best practices for integrating KTS into various cropping systems and highlighted case studies from North American farms implementing KTS-based fertigation and foliar application techniques.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,685.5 Mn |

| Forecast Value (2034) |

USD 28.5 Bn |

| CAGR (2025–2034) |

5.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 455.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

By Component (Solutions and Services), By Organization Size (Small and Medium Enterprises and Large Enterprises), By Encryption Technology (Cryptography, Watermarking, Fingerprinting, Other Encryption Technologies), By Deployment Mode (On-Premises, Cloud), By Application (Mobile Content, Video on Demand (VOD), Mobile Gaming & Apps, eBook, Others), By Industry Vertical (Banking, Financial Services and Insurance (BFSI), Healthcare, Printing and Publication, Educational, Television and Film, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Tessenderlo Group, TIB Chemicals, Omnia Specialities, Mears Fertilizer, Nufarm, Hydrite Chemical, Thatcher Company, Nantong Jihai Chemical, Spraygro Liquid Fertilizers, Plant Food Company, Kodia Company Limited, Sulphur Chemistry, Candem, Amgrow, Haimen Wuyang Chemical, Zibo Great Wall Chemical Factory, Shakti Chemicals, Compass Minerals, K+S AG, Coloured Ties Capital Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global potassium thiosulfate fertilizer market?

▾ The Global Potassium Thiosulfate Fertilizer Market size is estimated to have a value of USD 1,685.5 million in 2025 and is expected to reach USD 2,658.8 million by the end of 2034.

What is the size of the US Potassium Thiosulfate Fertilizer Market?

▾ The US Potassium Thiosulfate Fertilizer Market is projected to be valued at USD 455.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 699.0 million in 2034 at a CAGR of 4.9%.

Which region accounted for the largest global potassium thiosulfate fertilizer market?

▾ Asia Pacific is expected to have the largest market share in the Global Potassium Thiosulfate Fertilizer Market, with a share of about 37.10% in 2025.

Who are the key players in the Global Potassium Thiosulfate Fertilizer Market?

▾ Some of the major key players in the Global Potassium Thiosulfate Fertilizer Market are Tessenderlo Group, TIB Chemicals, Omnia Specialities, Mears Fertilizer, Nufarm, Hydrite Chemical, Thatcher Company, Nantong Jihai Chemical, Spraygro Liquid Fertilizers, Plant Food Company, and many others.

What is the growth rate in the Global Potassium Thiosulfate Fertilizer Market in 2025?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.