Market Overview

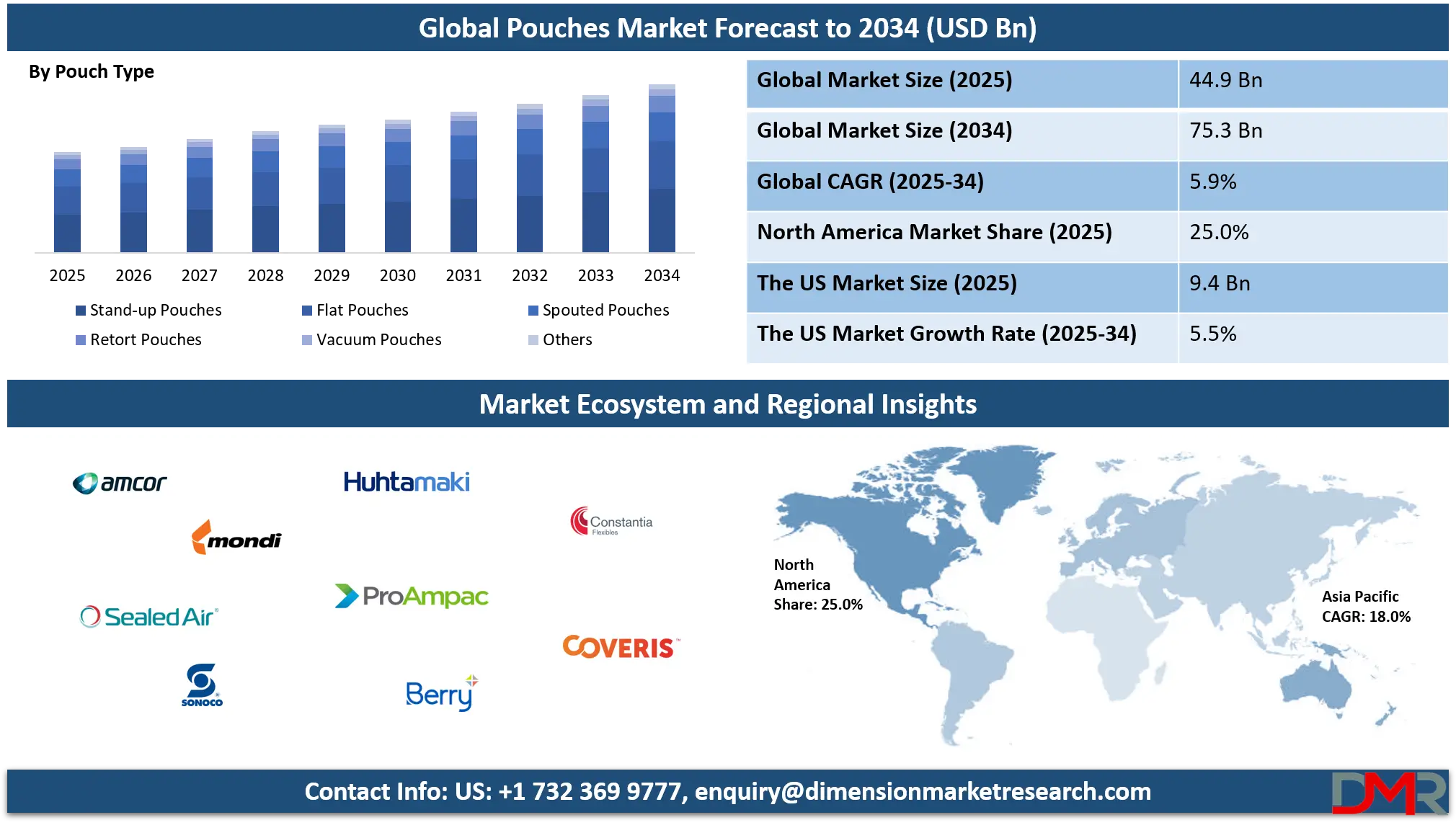

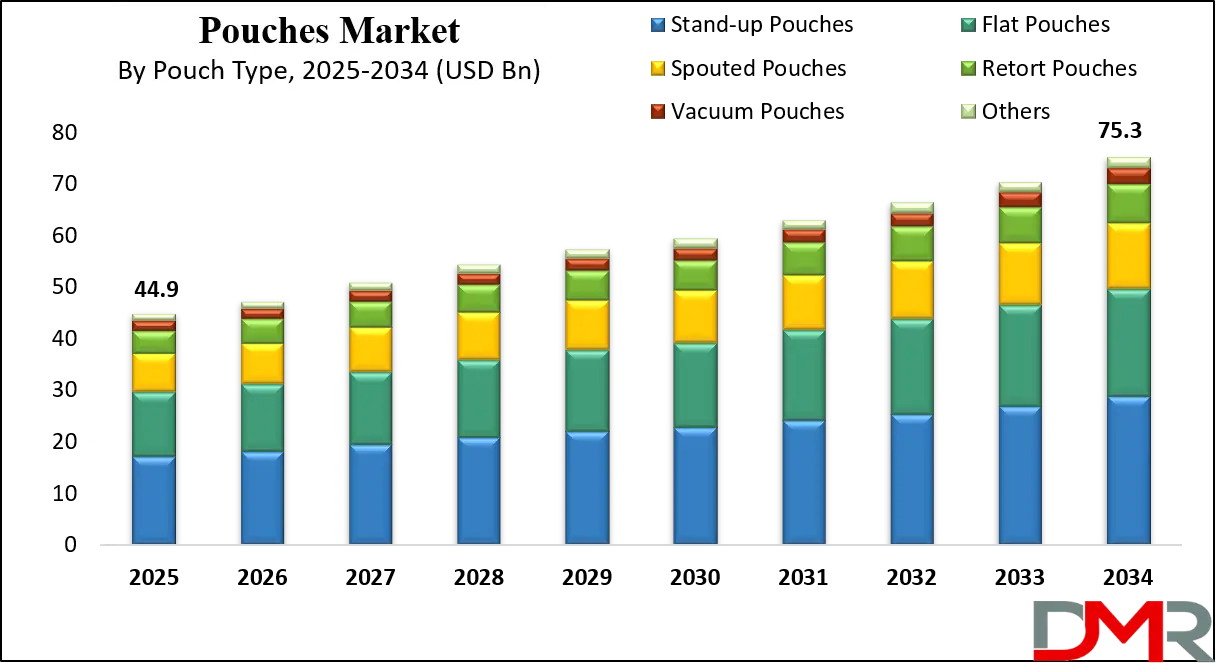

The global pouches market is projected to reach USD 44.9 billion in 2025 and is anticipated to grow to USD 75.3 billion by 2034, expanding at a CAGR of 5.9% during the forecast period. This growth is driven by rising demand for flexible packaging, sustainable pouch solutions, and convenience-focused formats across food, beverage, personal care, and pharmaceutical sectors.

Pouches are flexible packaging formats designed to hold and protect products across various industries, offering a lightweight, durable, and space-efficient alternative to rigid packaging. They are typically made from layers of plastic, foil, paper, or biodegradable films that provide a barrier against moisture, oxygen, light, and contaminants. Pouches are highly customizable in terms of size, shape, and closure types such as zippers, spouts, and tear notches, making them suitable for both solid and liquid contents.

Their appeal lies in user convenience, extended shelf life, and excellent printability, which enhances brand visibility. Commonly used in food, beverage, pharmaceutical, cosmetic, and household applications, pouches are gaining traction due to their portability, ease of use, and lower environmental impact compared to traditional packaging solutions.

The global pouches market represents a rapidly evolving segment of the packaging industry driven by the growing demand for sustainable, efficient, and consumer-friendly packaging formats. Increasing consumption of ready-to-eat meals, snack foods, personal care products, and liquid detergents is fueling the adoption of pouches, particularly in urban and semi-urban areas.

Technological advancements in barrier materials and digital printing have further enabled manufacturers to offer visually appealing, functional, and protective packaging solutions tailored to diverse product needs. Flexible packaging's ability to reduce shipping weight and shelf space requirements also contributes to its growing popularity among manufacturers and retailers alike.

Furthermore, the market is being shaped by evolving consumer preferences and global sustainability trends. Brands are shifting toward recyclable and biodegradable pouch materials to comply with environmental regulations and meet consumer expectations for eco-conscious packaging.

The Asia-Pacific region continues to dominate due to high consumption in countries like China and India, while North America and Europe are witnessing growth driven by innovation in food-grade materials and smart packaging technologies. With the integration of resealable features, interactive QR codes, and extended shelf-life solutions, the global pouches market is poised to become a cornerstone of future-ready, efficient packaging systems across both developed and emerging economies.

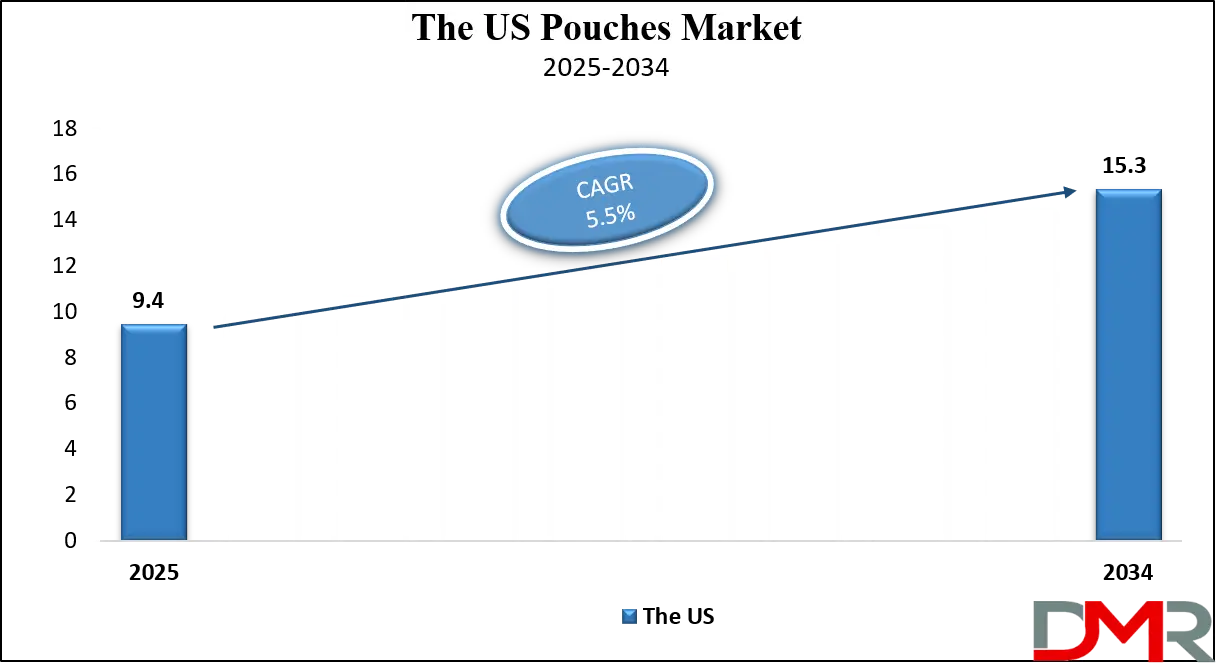

The US Pouches Market

The U.S. Pouches Market size is projected to be valued at USD 9.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 15.3 billion in 2034 at a CAGR of 5.5%.

The U.S. pouches market is witnessing robust expansion, fueled by evolving consumer lifestyles and growing demand for convenience-driven packaging formats. With the rising popularity of single-serve and on-the-go products, flexible pouches have become a preferred choice for packaging snacks, beverages, baby food, and ready-to-eat meals. Their lightweight structure, ease of storage, and ability to preserve product freshness make them particularly attractive to busy households and health-conscious consumers.

Moreover, the proliferation of e-commerce and direct-to-consumer channels has further amplified the adoption of pouch packaging due to its tamper-evident features, reduced shipping costs, and enhanced shelf appeal. The integration of resealable closures and user-friendly spouts has added value for end-users while contributing to reduced product wastage.

Sustainability is also reshaping the U.S. pouch packaging landscape, as both manufacturers and brands respond to growing regulatory pressures and consumer expectations for eco-friendly packaging. The industry is seeing a gradual transition toward recyclable films, compostable materials, and monomaterial laminates to support circular economy initiatives. Innovation in digital printing technologies is enabling high-definition graphics and customization, making pouches a key marketing tool for product differentiation in retail spaces.

Additionally, sectors such as pet food, nutraceuticals, and personal care are rapidly adopting pouches for their protective barrier properties and extended shelf life. With growing emphasis on material innovation, product safety, and smart packaging features, the U.S. pouches market is poised to remain at the forefront of flexible packaging evolution.

The Europe Pouches Market

Europe’s pouches market is projected to be valued at approximately USD 12.1 billion in 2025, making up a significant portion of the global landscape. This dominance is primarily driven by strong consumer demand for sustainable and recyclable packaging formats across major economies such as Germany, France, Italy, and the UK. European regulatory frameworks, such as the EU’s Packaging and Packaging Waste Directive and the Single-Use Plastics Directive, are pushing brands and manufacturers toward the adoption of environmentally friendly materials, including mono-material laminates and compostable films. The food and beverage sector remains the largest end-use industry in the region, where pouch formats are used for snacks, dairy, ready meals, and health drinks due to their lightweight, resealable, and space-efficient characteristics.

Additionally, the region is witnessing an uptick in demand for pouches in personal care, pet food, and household product categories, driven by rising consumer awareness and preference for convenient packaging.

The European pouches market is expected to grow at a steady CAGR of 5.3% from 2025 to 2034, fueled by continuous innovation, rising investment in circular packaging solutions, and growing preference for flexible over rigid packaging. Packaging converters and global players operating in Europe are rapidly shifting toward the development of recyclable and low-carbon packaging structures, with partnerships and R&D initiatives accelerating the rollout of next-gen pouches.

Furthermore, the shift in consumer behavior toward online grocery shopping and health-focused consumption habits is boosting the use of stand-up and resealable pouch formats that offer both functionality and aesthetics. As sustainability and cost-efficiency continue to shape procurement decisions, the demand for flexible pouch packaging across Europe is set to expand consistently over the forecast period.

The Japan Pouches Market

Japan’s pouches market is expected to reach a value of approximately USD 1.5 billion in 2025, reflecting the country's strong orientation toward innovative, compact, and user-friendly packaging formats. With a deeply rooted culture of precision, hygiene, and minimalism, Japanese consumers have long favored flexible pouches for a wide range of applications, from food and beverages to cosmetics and pharmaceuticals.

The demand is particularly robust in the ready-to-eat meals, sauces, functional drinks, and personal care segments, where lightweight, easy-to-carry, and resealable packaging is highly valued. Japan’s mature retail landscape, integrated with widespread usage of vending machines and convenience stores, also contributes significantly to pouch format popularity, as products in smaller, single-serve formats are more desirable in high-density urban living environments.

The Japanese pouches market is projected to grow at a CAGR of 4.6% between 2025 and 2034, supported by continuous advancements in high-barrier film technology, compact packaging innovation, and a growing shift toward sustainable materials. Domestic packaging manufacturers and global players operating in Japan are focusing heavily on introducing recyclable and refillable pouch formats to align with growing environmental consciousness and national circular economy goals.

Additionally, the rise of e-commerce and direct-to-consumer channels in Japan is encouraging brands to adopt flexible packaging that enhances product protection during transit while delivering a premium unboxing experience. This balance of quality, convenience, and sustainability is expected to drive steady demand for pouches across multiple industries in the coming decade.

Global Pouches Market: Key Takeaways

- Market Value: The global pouches market size is expected to reach a value of USD 75.3 billion by 2034 from a base value of USD 44.9 billion in 2025 at a CAGR of 5.9%.

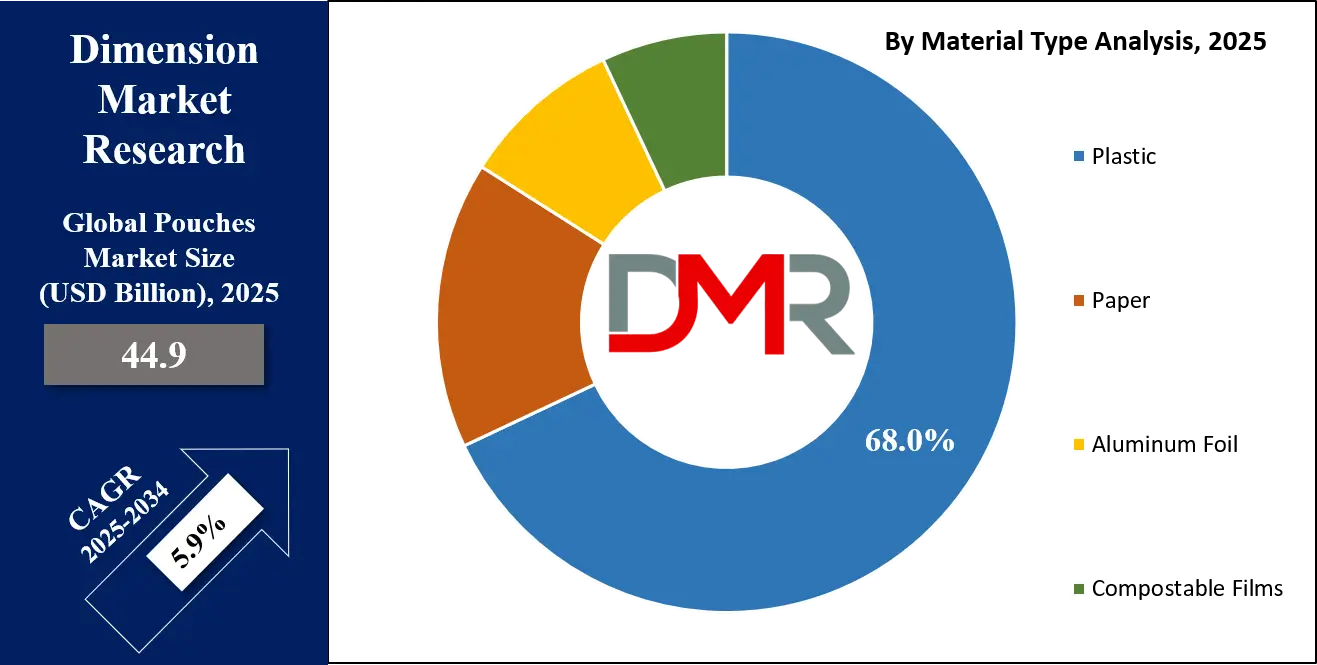

- By Material Type Segment Analysis: Plastic materials are anticipated to dominate the material type segment, capturing 68.0% of the total market share in 2025.

- By Pouch Type Segment Analysis: Stand-up Pouches are poised to consolidate their dominance in the pouch type segment, capturing 38.0% of the total market share in 2025.

- By Closure Type Segment Analysis: Zippers are expected to maintain their dominance in the closure type segment, capturing 34.0% of the total market share in 2025.

- By Application Segment Analysis: Food Packaging applications will lead in the application segment, capturing 64.0% of the market share in 2025.

- By End-Use Industry Segment Analysis: The Food & Beverage industry will lead the end-use industry segment, capturing 67.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global pouches market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global pouches market are Amcor plc, Mondi Group, Sealed Air Corporation, Sonoco Products Company, Huhtamaki Oyj, ProAmpac, Berry Global Inc., Constantia Flexibles, Coveris Holdings, Glenroy Inc., Winpak Ltd., Clondalkin Group, Smurfit Kappa Group, Uflex Ltd., Printpack Inc., Bischof + Klein SE & Co, and Other Key Players.

Global Pouches Market: Use Cases

- Food and Beverage Packaging: The food and beverage industry is the largest consumer of pouches globally, leveraging their lightweight design, extended shelf life, and visual appeal. Stand-up pouches with resealable zippers and spouts are widely used for packaging snacks, sauces, dairy products, frozen foods, and juices. Their multi-layer barrier properties protect contents from moisture, oxygen, and contaminants, ensuring product safety and freshness. Additionally, the ability to print high-resolution graphics directly on the pouch material enhances brand visibility on store shelves. As consumer demand for on-the-go consumption and portion control grows, flexible packaging solutions like pouches continue to replace rigid containers, cans, and glass bottles in this sector.

- Personal Care and Cosmetic Products: Pouches are being adopted in the personal care and beauty sector for packaging products like shampoos, lotions, face masks, and creams. These products benefit from the aesthetic customization and space efficiency that pouches offer. Sachet-sized trial pouches and refill packs have become popular formats, helping brands reduce plastic usage and attract eco-conscious consumers. Flexible packaging also supports airless dispensing systems, preventing contamination and ensuring precise usage. With sustainability and portability becoming major buying factors, resealable and recyclable pouches are helping cosmetic companies enhance their product appeal while minimizing environmental impact.

- Pharmaceuticals and Healthcare: In the pharmaceutical and healthcare industry, pouches serve a critical role in protecting sensitive products such as tablets, medical powders, herbal supplements, and diagnostic kits. Their sterile barrier systems ensure safety, contamination resistance, and controlled humidity levels. Tamper-evident features and child-resistant closures also add a layer of security required for regulated products. Additionally, flexible pouches allow for efficient transportation and storage, which is especially vital in temperature-sensitive drug distribution. Medical-grade pouches also support compliance with global health standards while offering convenient single-dose or unit-dose dispensing.

- Home Care and Cleaning Products: Flexible pouches are transforming the home care segment by offering convenient and sustainable alternatives for packaging laundry detergents, liquid cleaners, and disinfectants. Their reduced material usage compared to rigid bottles lowers production costs and carbon footprint. Spouted pouches are particularly favored for refill applications, allowing consumers to reuse original dispensers and reduce plastic waste. The compact design of these pouches also improves shelf stocking and transport efficiency. As brands shift toward refillable packaging systems to align with circular economy goals, pouches are becoming an essential solution in the eco-conscious cleaning product market.

Global Pouches Market: Stats & Facts

European Union – Eurostat & European Commission

- In 2022, the EU generated approximately 186.5 kg of packaging waste per inhabitant, with plastic accounting for 19.4% (~16.1 million tonnes) and paper/cardboard at 40.8% (~34 million tonnes).

- Plastic packaging waste totaled 16.16 million tonnes in 2022, of which 40.7% (6.58 million tonnes) was recycled.

- About 40% of all plastic produced in the EU is used for packaging, which makes up nearly 50% of marine litter.

- Under the Single-Use Plastics Directive, packaging items comprise approximately 70% of marine litter found on EU beaches.

- Without intervention, packaging waste in the EU was projected to grow by 19% by 2030, and plastic packaging alone by 46%, prompting policy changes under the European Green Deal.

United Kingdom – DEFRA & Food Standards Agency

- The UK’s packaging recycling rate has consistently remained above 65%, rising from 61% in 2008.

- UK producers are now required to submit annual packaging data for Extended Producer Responsibility (EPR) compliance.

- Biodegradable packaging in the UK must achieve at least 90% biodegradation under industrial composting standards.

- The reusable food packaging segment is projected to grow at a 10.4% CAGR through 2027, with growing uptake in foodservice and grocery applications.

United States – USDA (U.S. Department of Agriculture)

- Flexible drink pouches offer a 96% reduction in packaging weight and an 82% decrease in volume compared to glass bottles.

- The use of bioplastics in flexible and rigid packaging is steadily rising, driven by demand for sustainable alternatives across food and consumer goods industries.

Global Pouches Market: Market Dynamics

Global Pouches Market: Driving Factors

Surge in Demand for Convenient and Lightweight Packaging

The rise in urbanization, fast-paced lifestyles, and demand for on-the-go products has led to increased adoption of flexible and lightweight packaging formats such as pouches. Pouches provide portability, ease of storage, and mess-free usage for a wide range of consumer goods including snacks, baby food, and liquid beverages. Resealable pouches and easy-tear notches enhance user convenience, making them a preferred choice over rigid alternatives like bottles and cans. Manufacturers are also embracing flexible laminates for durability and superior shelf appeal.

Growth of Sustainable and Recyclable Packaging Solutions

Environmental awareness and regulatory mandates are prompting brands to adopt eco-friendly pouch packaging. Companies are transitioning to monomaterial pouches, recyclable films, and compostable materials to reduce plastic waste and carbon footprint. This shift is driven by both consumer expectations and extended producer responsibility (EPR) laws in key markets such as Europe and North America. These sustainable initiatives not only support circular economy goals but also enhance brand equity.

Global Pouches Market: Restraints

Limited Recycling Infrastructure for Multi-Layer Pouches

Many pouches are composed of multi-layer films combining plastic, foil, and paper to offer high-barrier protection. However, this complex structure complicates the recycling process and is not compatible with most conventional recycling systems. The lack of widespread infrastructure to process such materials restricts the industry's ability to meet sustainability targets and increases environmental scrutiny.

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatile prices of petrochemical-derived resins like polyethylene and polypropylene can impact the profitability of pouch manufacturers. Additionally, geopolitical tensions, trade restrictions, and supply chain disruptions have created cost pressures and inconsistent raw material availability. These challenges hinder large-scale production and delay product delivery, especially in emerging markets.

Global Pouches Market: Opportunities

Rising Adoption in E-commerce and Direct-to-Consumer Channels

With the global surge in e-commerce, brands are seeking packaging solutions that are lightweight, durable, and tamper-evident for shipping efficiency. Pouches offer a compelling solution for online product delivery, especially in personal care, food supplements, and pet food categories. They require less space, reduce shipping costs, and allow for custom printing, helping D2C brands improve customer experience and reduce environmental impact.

Technological Advancements in Smart and Interactive Pouch Packaging

The integration of smart features like QR codes, temperature indicators, and augmented reality labels is opening new frontiers for pouches in retail and healthcare. These digital tools enhance traceability, product engagement, and transparency. Interactive packaging enables consumers to verify product authenticity, access usage instructions, or learn about brand sustainability initiatives directly through their smartphones.

Global Pouches Market: Trends

Shift toward Monomaterial and Bio-Based Films

To address recyclability challenges, manufacturers are developing monomaterial pouches using single resin types such as PE or PP. These pouches offer better compatibility with existing recycling streams while maintaining barrier properties through advanced coatings. Additionally, bio-based films derived from starch, sugarcane, or cellulose are being explored as viable alternatives to fossil-fuel-based polymers.

Customization and Premiumization in Flexible Packaging

As competition intensifies in retail, brands are leveraging customized pouch packaging to stand out. High-definition digital printing, metallic finishes, window designs, and tactile coatings are enhancing product visibility and shelf appeal. Premium pouch packaging is particularly popular in sectors like gourmet food, nutraceuticals, and cosmetics, where brand storytelling and visual differentiation play a key role.

Global Pouches Market: Research Scope and Analysis

By Material Type Analysis

In the global pouches market, plastic materials are expected to lead the material type segment, accounting for approximately 68.0% of the total market share in 2025. This dominance is attributed to the exceptional versatility, durability, and cost-effectiveness of plastic films such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and others. These materials offer excellent barrier properties, protecting products from moisture, oxygen, and external contaminants, which is essential for packaging perishable and sensitive items.

The flexibility of plastics also allows for a variety of pouch types including stand-up, flat, and spouted formats, making them ideal for a wide range of applications in the food, beverage, personal care, and pharmaceutical sectors. Furthermore, advancements in multilayer laminates and recyclable plastic films are helping manufacturers meet the growing demand for both performance and sustainability.

On the other hand, paper-based pouches are gradually gaining traction in the market due to growing consumer preference for sustainable and biodegradable packaging solutions. While paper pouches currently hold a smaller share compared to plastics, their adoption is rising steadily in dry food packaging, confectionery, and organic product segments. Paper pouches offer an eco-friendly image and are often used in combination with bio-coatings or thin polymer linings to improve barrier performance without compromising recyclability.

Brands aiming to align with environmental commitments and plastic reduction targets are exploring paper-based alternatives, especially in regions with strong regulatory pressure on single-use plastics. However, the limitations of paper in terms of moisture resistance and structural strength may restrict its widespread use in high-barrier or liquid product applications.

By Pouch Type Analysis

Stand-up pouches are projected to maintain a strong position in the global pouches market, capturing around 38.0% of the total market share in 2025. Their growing dominance is primarily driven by their superior shelf presentation, space efficiency, and ability to securely contain both liquid and solid products. The bottom gusset design allows these pouches to stand upright on store shelves, making them visually appealing and easy to display.

Stand-up pouches are extensively used across various sectors such as food and beverages, pet food, household cleaners, and personal care items due to their user-friendly features like resealable zippers, spouts, and tear notches. They are also favored for their cost-effective manufacturing, lightweight nature, and reduced environmental impact compared to rigid containers. The demand for convenience, portability, and sustainability continues to fuel their growth globally.

Flat pouches, while less dominant than stand-up variants, play a significant role in applications requiring single-use or low-volume packaging. These pouches are widely used for items like condiments, pharmaceutical products, single-serve snacks, and small cosmetic samples. Their simple structure, lower production cost, and ease of storage make them ideal for cost-sensitive products and promotional items.

Flat pouches are often selected for their minimal material usage and suitability for high-speed packaging lines. Though they lack the shelf-standing capability of stand-up pouches, their compact form and excellent barrier protection continue to make them a preferred choice in sectors focused on portion control, hygiene, and short-term consumption.

By Closure Type Analysis

Zippers are projected to remain the most dominant closure type in the global pouches market, holding approximately 34.0% of the total market share in 2025. Their popularity is driven by the growing demand for resealable and reusable packaging formats, especially in the food, personal care, and household product categories.

Zipper closures offer consumers the convenience of easy opening and secure re-closing, which helps maintain product freshness, reduce waste, and extend shelf life. They are particularly favored in packaging dry snacks, pet food, powdered goods, and baby food where repeated access to contents is required without compromising hygiene or quality. In addition, zipper pouches align well with consumer expectations for portion control and storage flexibility, while supporting sustainability efforts by reducing the need for secondary packaging or containers.

Spout closures, although a smaller segment, are gaining traction due to their suitability for liquid and semi-liquid product packaging. These closures are commonly used in the packaging of juices, sauces, detergents, baby food purees, and health supplements. Spouts provide controlled dispensing, reduced spillage, and a resealable format that enhances user convenience.

They are especially valuable in on-the-go product formats and single-serve applications, where ease of use and portability are essential. Spouted pouches also offer brands opportunities for differentiation through ergonomic designs and tamper-evident features. While they require more complex manufacturing processes than zippers, the demand for spouted pouches is expected to rise with the growing popularity of squeezable, refillable, and travel-friendly packaging across multiple consumer sectors.

By Application Analysis

Food packaging is anticipated to dominate the application segment of the global pouches market in 2025, accounting for approximately 64.0% of the total market share. This stronghold is attributed to the versatility, protective qualities, and cost-efficiency of pouch formats in preserving and presenting a wide range of food products. Pouches are widely used in packaging snacks, ready-to-eat meals, frozen foods, sauces, dry goods, and beverages, thanks to their excellent barrier properties that shield contents from moisture, oxygen, and contamination.

The lightweight and compact design of pouches makes them ideal for transportation and storage, while features like resealable zippers, tear notches, and spouts enhance consumer convenience. Growing consumer demand for portable, portion-controlled, and eco-friendly food packaging continues to drive pouch adoption, particularly in urban markets and emerging economies with growing processed food consumption.

In the personal care and cosmetics segment, pouches are gaining momentum as a sustainable and innovative packaging solution for a variety of products including shampoos, lotions, facial cleansers, creams, and wipes. These flexible formats offer advantages such as reduced plastic usage, space efficiency, and ease of dispensing. Many brands are introducing refill pouches to support zero-waste goals and meet consumer demand for environmentally responsible packaging.

Pouches also allow for creative shapes, tactile finishes, and custom printing, helping cosmetic companies stand out in a competitive retail environment. Additionally, the growth of travel-sized and sample packaging in the beauty industry is fueling the demand for small, single-use pouch formats. Though currently a smaller segment compared to food, personal care and cosmetics applications for pouches are expected to see strong growth in the coming years due to innovation in materials and design.

By End-Use Industry Analysis

The food and beverage industry is set to lead the end-use industry segment of the global pouches market, capturing approximately 67.0% of the total market share in 2025. This dominance is driven by the growing consumer demand for convenient, lightweight, and sustainable packaging solutions for a variety of food categories such as snacks, sauces, dairy products, frozen meals, and beverages. Pouches offer excellent barrier properties that help maintain freshness, prevent contamination, and extend shelf life, making them ideal for perishable and processed foods.

Their flexibility and adaptability allow for different shapes, closures, and sizes, enhancing usability and shelf appeal. Features like resealable zippers and spouts further improve consumer experience by supporting portion control and ease of storage. Additionally, the rise of on-the-go lifestyles, e-commerce grocery sales, and demand for single-serve packaging formats continues to fuel pouch usage in both developed and emerging markets.

The pharmaceutical industry, while a smaller segment, is turning to pouches for packaging various medical and healthcare products, including tablets, powders, topical gels, and diagnostic kits. Pouches in this sector are valued for their ability to offer high levels of product protection against moisture, light, and air, which are critical for maintaining the integrity and efficacy of pharmaceutical products. They are also designed to meet regulatory standards and often feature child-resistant closures, tamper-evident seals, and unit-dose formats to ensure safety and compliance.

In addition to functional benefits, flexible pouches reduce packaging volume and weight, helping lower transportation costs and improve supply chain efficiency. As demand for over-the-counter medicines, supplements, and home healthcare products grows, pharmaceutical applications of pouch packaging are expected to expand steadily.

The Pouches Market Report is segmented on the basis of the following:

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- PET (Polyester)

- Others

- Paper

- Aluminum Foil

- Compostable Films

By Pouch Type

- Stand-up Pouches

- Flat Pouches

- Spouted Pouches

- Retort Pouches

- Vacuum Pouches

- Others

By Closure Type

- Zipper

- Spout

- Tear Notch

- Flip-Top/Press-to-Close

- Heat Sealed

By Application

- Food Packaging

- Snacks

- Dairy Products

- Beverages

- Ready-to-Eat-Meals

- Meat, Poultry, Seafood

- Others

- Personal Care & Cosmetics

- Healthcare & Pharma

- Homecare Products

- Industrial

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Home Care

- Industrial/Automotive

Global Pouches Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to dominate the global pouches market in 2025, accounting for approximately 38.0% of the total market revenue. This regional leadership is driven by a combination of factors including rapid urbanization, a rising middle-class population, and growing consumption of packaged food, beverages, and personal care products across countries like China, India, Japan, and Southeast Asian nations. The region's expanding retail and e-commerce sectors, along with growing demand for affordable and convenient packaging formats, have significantly boosted the adoption of flexible pouch solutions.

Moreover, strong manufacturing capabilities, investment in sustainable packaging technologies, and the presence of major food and FMCG brands contribute to Asia Pacific's robust market growth in this segment.

Region with significant growth

The Middle East and Africa region is expected to register the highest CAGR in the global pouches market during the forecast period. This rapid growth is fueled by rising demand for flexible and cost-effective packaging solutions across emerging economies, particularly in the food, beverage, and personal care sectors. Factors such as growing urbanization, expanding retail infrastructure, and a growing young population with changing consumption patterns are accelerating the uptake of pouches.

Additionally, the rising focus on sustainability and lightweight packaging, integrated with gradual improvements in local manufacturing capabilities, is further propelling market expansion in this high-potential region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Pouches Market: Competitive Landscape

The global competitive landscape of the pouches market is highly fragmented and characterized by the presence of numerous international and regional players competing on factors such as product innovation, sustainability, pricing, and customization. Leading companies like Amcor plc, Mondi Group, Sealed Air Corporation, and Huhtamaki Oyj dominate the market with strong global supply chains, diversified product portfolios, and continuous investments in recyclable and monomaterial pouch solutions.

These key players are focusing on expanding their production capacities and forming strategic collaborations to cater to the growing demand for eco-friendly, lightweight, and resealable packaging across sectors such as food and beverages, personal care, pharmaceuticals, and household products. Meanwhile, smaller and regional manufacturers are gaining traction by offering tailored solutions and serving niche markets, especially in emerging economies where local consumption and regulatory trends are shaping packaging choices.

Some of the prominent players in the global pouches market are:

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki Oyj

- ProAmpac

- Berry Global Inc.

- Constantia Flexibles

- Coveris Holdings

- Glenroy, Inc.

- Winpak Ltd.

- Clondalkin Group

- Smurfit Kappa Group

- Uflex Ltd.

- Printpack Inc.

- Bischof + Klein SE & Co. KG

- Gualapack S.p.A.

- American Packaging Corporation

- AR Packaging Group

- Innovia Films Ltd.

- Other Key Players

Global Pouches Market: Recent Developments

Product Launches

- March 2025: Amcor introduced its AmFiber Performance Paper stand‑up pouch for instant coffee and dry beverages, featuring 85% fiber content and certified recyclability, reducing carbon footprint by up to 73%.

- April 2025: Amcor launched its Liquiflex AmPrima mono‑material pouches in Europe for bulk foodservice applications, offering fully recyclable flexible packaging when PE recycling streams are available.

Mergers & Acquisitions

- April 2025: Mondi completed the acquisition of Schumacher Packaging’s Western Europe assets, enhancing corrugated and pouch packaging capacity across Germany, the UK, and Benelux.

- March 2025: Mondi finalized its €634 million purchase of Schumacher Packaging’s Western Europe operations after receiving approval from the European Commission.

Funding & Investments

- March 2025: Cologne-based Vytal Global, specializing in smart reusable packaging including pouches, secured €14.2 million in growth funding led by Inven Capital and NRW.Venture for expansion into the US market.

- February 2025: Paptic, a Finnish startup developing recyclable wood‑fiber pouches and mailers, raised €27.5 million in growth financing to scale its eco-friendly packaging solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 44.9 Bn |

| Forecast Value (2034) |

USD 75.3 Bn

|

| CAGR (2025–2034) |

5.9% |

| The US Market Size (2025) |

USD 9.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Plastic, Paper, Aluminum Foil, Compostable Films), By Pouch Type (Stand-up Pouches, Flat Pouches, Spouted Pouches, Retort Pouches, Vacuum Pouches, Others), By Closure Type (Zipper, Spout, Tear Notch, Flip-Top/Press-to-Close, Heat Sealed), By Application (Food Packaging, Personal Care & Cosmetics, Healthcare & Pharma, Homecare Products, Industrial), and By End-Use Industry (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Home Care, Industrial/Automotive).

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amcor plc, Mondi Group, Sealed Air Corporation, Sonoco Products Company, Huhtamaki Oyj, ProAmpac, Berry Global Inc., Constantia Flexibles, Coveris Holdings, Glenroy Inc., Winpak Ltd., Clondalkin Group, Smurfit Kappa Group, Uflex Ltd., Printpack Inc., Bischof + Klein SE & Co, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global pouches market size is estimated to have a value of USD 44.9 billion in 2025 and is expected to reach USD 75.3 billion by the end of 2034.

The US pouches market is projected to be valued at USD 9.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.3 billion in 2034 at a CAGR of 5.5%.

Asia Pacific is expected to have the largest market share in the global pouches market, with a share of about 38.0% in 2025.

Some of the major key players in the global pouches market are Amcor plc, Mondi Group, Sealed Air Corporation, Sonoco Products Company, Huhtamaki Oyj, ProAmpac, Berry Global Inc., Constantia Flexibles, Coveris Holdings, Glenroy Inc., Winpak Ltd., Clondalkin Group, Smurfit Kappa Group, Uflex Ltd., Printpack Inc., Bischof + Klein SE & Co, and Other Key Players.

The market is growing at a CAGR of 5.9 percent over the forecasted period.