Market Overview

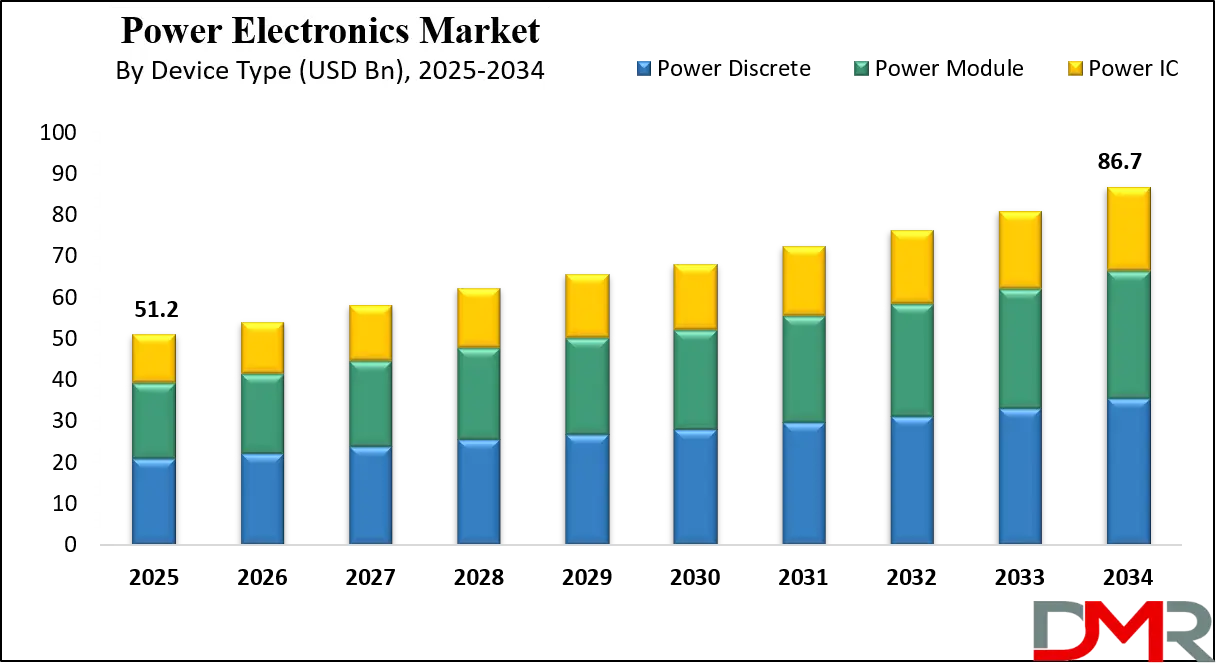

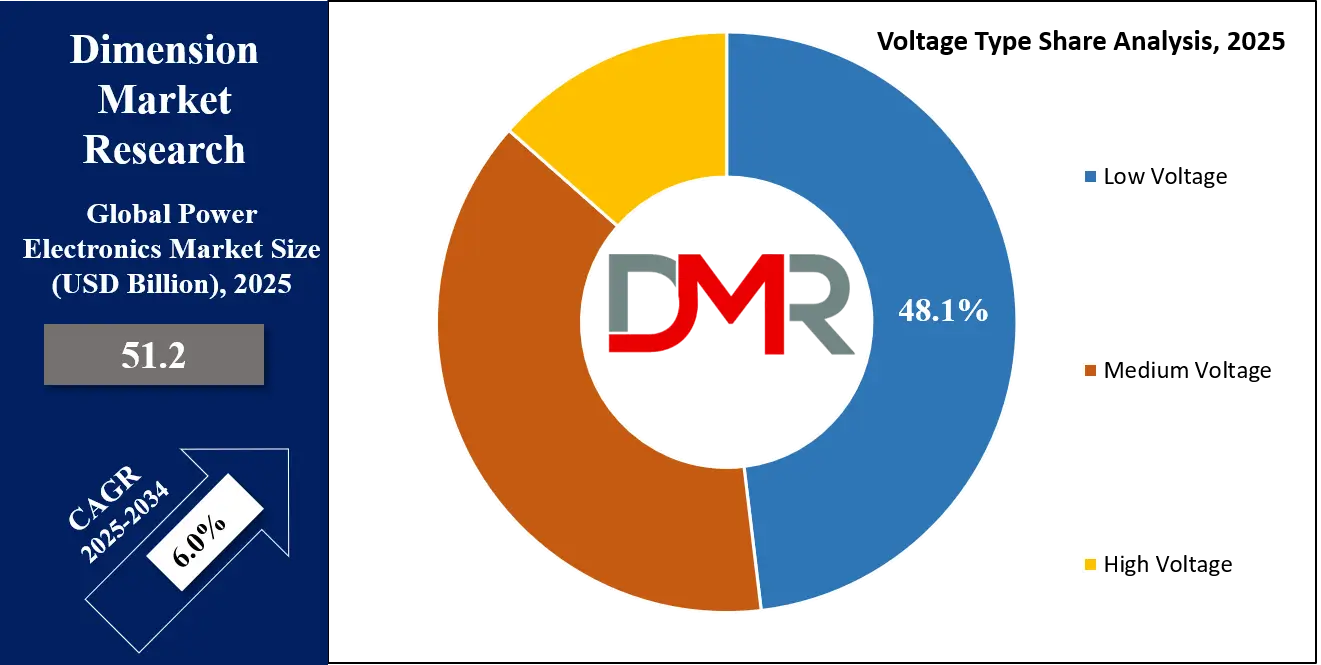

The Global Power Electronics Market size is projected to reach USD 51.2 billion in 2025 and grow at a compound annual growth rate of 6.0% from there until 2034 to reach a value of USD 86.7 billion.

Power electronics is a field of electrical engineering that deals with converting and controlling electrical power using electronic devices. It mainly involves the use of components like diodes, transistors, and thyristors to manage the flow of electricity efficiently. These systems are crucial in a wide range of applications, including electric vehicles (EVs), renewable energy systems, industrial machines, and household electronics. Simply put, power electronics makes sure that energy is used in the most effective way by switching, converting, and managing power from one form to another.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, the need for efficient energy use has pushed industries and governments to adopt power electronics on a large scale. With the growing focus on clean energy, electric mobility, and smart grids, power electronics has become a vital component of modern technology. For example, solar panels and wind turbines depend on these systems to convert their output into usable electricity. Similarly, EVs use power electronics to control the flow of power between the battery and the motor. The growing number of electronic devices in homes and offices also increases the need for these systems.

Several trends have shaped the power electronics industry in recent years. One major trend is the move towards wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN). These materials allow devices to operate at higher temperatures and voltages, improving performance and reducing energy losses. Another trend is miniaturization, where systems are becoming smaller and more compact, which is useful in mobile and space-limited applications. Also, artificial intelligence is slowly being integrated into power management systems for real-time control and efficiency.

Important global events have influenced the industry as well. The shift to electric mobility, supported by government policies in many countries, has pushed auto companies to invest heavily in power electronics. The growth of renewable energy, especially solar and wind, has made power electronics vital for integrating these sources into national grids. The global supply chain issues during the pandemic also led to more interest in local manufacturing and research in semiconductor technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The industry is also seeing rising collaboration between research institutions and manufacturers. Universities are working with tech companies to develop new designs that are more efficient and reliable. At the same time, several companies are focusing on making their products environmentally friendly by reducing harmful materials and improving product life cycles. This push toward sustainability is creating opportunities for innovation and new business models in the power electronics field.

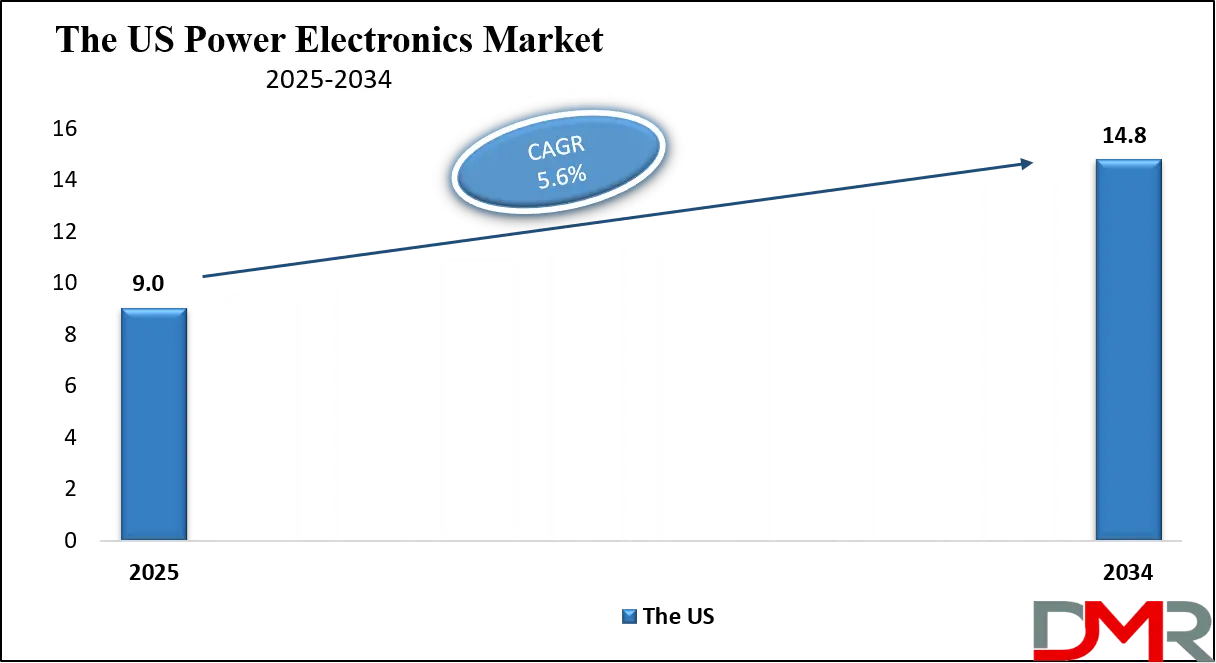

The US Power Electronics Market

The US Power Electronics Market size is projected to reach USD 9.0 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

The US plays a key role in the global power electronics market through innovation, research, and advanced manufacturing. It is home to leading technology firms, research institutions, and semiconductor manufacturers driving the development of wide-bandgap materials like silicon carbide and gallium nitride. The US government also supports the sector through clean energy initiatives, electric vehicle incentives, and funding for smart grid development.

Defense and aerospace applications further boost domestic demand for high-reliability power electronics. In addition, the US is investing in reshoring semiconductor production to reduce dependence on foreign supply chains. With a strong focus on digitalization, sustainability, and technological leadership, the US continues to shape the direction and pace of innovation in the power electronics industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Power Electronics Market

Europe Power Electronics Market size is projected to reach USD 11.8 billion in 2025 at a compound annual growth rate of 5.4% over its forecast period.

Europe plays a significant role in the power electronics market, driven by its strong focus on clean energy, sustainability, and advanced industrial automation. The region is leading in the adoption of renewable energy technologies like solar and wind, which require efficient power conversion and control systems. European automotive companies are also pushing the electric vehicle transition, increasing demand for high-performance power electronics.

Governments across Europe support the sector through strict emission regulations, green energy targets, and funding for R&D in semiconductor technologies. The region is also known for innovation in industrial power systems and smart grid solutions. With a well-developed manufacturing base and strong environmental policies, Europe is shaping the future of energy-efficient and sustainable power electronics.

Japan Power Electronics Market

Japan Power Electronics Market size is projected to reach USD 4.6 billion in 2025 at a compound annual growth rate of 6.7% over its forecast period.

Japan holds a vital position in the global power electronics market due to its long-standing expertise in electronics, precision engineering, and energy technologies. The country is a major hub for semiconductor innovation, particularly in power devices used in electric vehicles, industrial automation, and consumer electronics. Japanese companies are pioneers in developing advanced materials like silicon carbide, which enable more efficient and compact power systems.

The government supports clean energy and e-mobility initiatives, boosting demand for power electronics in solar, wind, and EV infrastructure. Japan also emphasizes energy efficiency and technological reliability, driving innovation in high-quality, durable components. With strong R&D capabilities and a focus on next-generation energy systems, Japan continues to influence global trends in power electronics development and manufacturing.

Power Electronics Market: Key Takeaways

- Market Growth: The Power Electronics Market size is expected to grow by USD 32.7 billion, at a CAGR of 6.0%, during the forecasted period of 2026 to 2034.

- By Device Type: The Power Discrete segment is anticipated to get the majority share of the Power Electronics Market in 2025.

- By Voltage Type: The Low Voltage segment is expected to get the largest revenue share in 2025 in the Power Electronics Market.

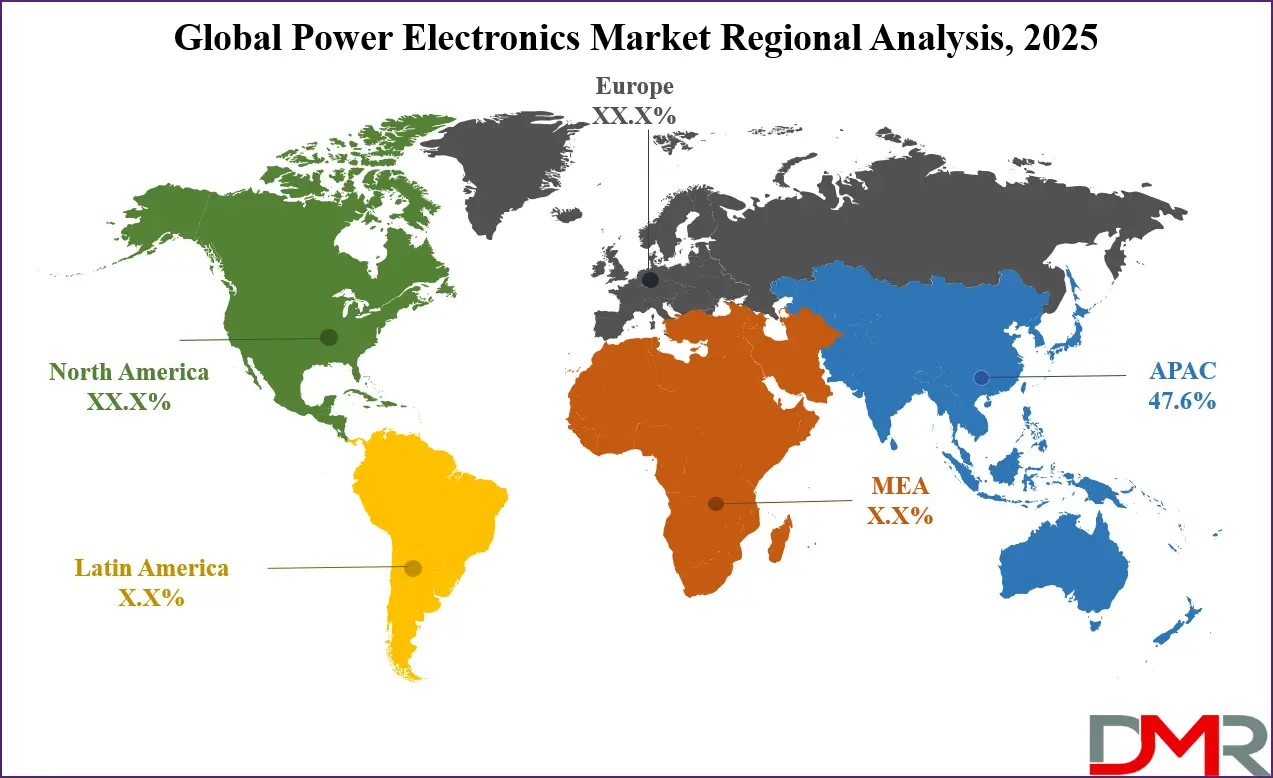

- Regional Insight: Asia Pacific is expected to hold a 47.6% share of revenue in the Global Power Electronics Market in 2025.

- Use Cases: Some of the use cases of Power Electronics include EVs, Consumer Electronics, and more.

Power Electronics Market: Use Cases

- Electric Vehicles (EVs): Power electronics is used to control the flow of electricity between the EV battery and motor. It helps manage charging, motor speed, and braking efficiency. This ensures smooth vehicle performance and longer battery life.

- Renewable Energy Systems: In solar and wind power systems, power electronics convert variable energy outputs into stable electricity. It also supports grid connection and energy storage integration. This helps make renewable energy more reliable and usable.

- Consumer Electronics: Devices like laptops, TVs, and chargers use power electronics to manage voltage and power conversion. It ensures safe, efficient operation and protects circuits from damage. This improves product safety and energy savings.

- Industrial Automation: Power electronics control motors and machinery in factories, improving energy use and process precision. It supports automation systems by delivering stable power under varying loads. This boosts productivity and reduces power wastage.

Stats & Facts

-

As per IBEF,

- India is rapidly emerging as a global hub for electronics manufacturing and exports, supported by strong policy backing, rising investments, and robust demand across sectors.

- India is the second-largest mobile phone manufacturer in the world and is projected to become the fifth-largest consumer of electronic products by 2025, driven by growing digital infrastructure and consumer adoption.

- Electronics exports from India reached USD 29.11 billion in FY24, up from USD 23.57 billion in FY23, showing a solid 23% year-on-year growth in global shipments from India.

- Apple’s iPhone exports from India touched USD 5 billion in the first five months of FY25, marking a sharp 54% rise from USD 3.2 billion in the same period last year, strengthening India’s role in global high-end electronics production.

- India has set a target of achieving USD 300 billion in electronics manufacturing and US$ 120 billion in electronics exports by 2025–26, supported by government incentives and domestic production capacity expansion.

- The country has strong R&D and design capabilities in auto and industrial electronics, creating opportunities in electric mobility, industrial automation, and next-gen electronics systems.

- The Production-Linked Incentive (PLI) scheme is encouraging global and domestic companies to set up electronics manufacturing plants in India by offering financial incentives and policy stability.

- Key national programs like ‘Digital India’ and ‘Make in India’, along with a favorable FDI policy, have simplified the setup of electronics manufacturing units and are drawing major global players to India.

- Tata Consultancy Services (TCS) is collaborating with Tata Electronics to help India produce its first domestically manufactured semiconductor chips by 2026, marking a milestone in chip self-sufficiency.

- Investments worth INR 8,803 crore (around USD 1.06 billion) have already been made under schemes promoting the manufacturing of electronic components and semiconductors, signaling strong industry-government alignment.

Market Dynamic

Driving Factors in the Power Electronics Market

Rising Adoption of Electric Vehicles (EVs)

One of the biggest growth drivers for the power electronics market is the rapid adoption of electric vehicles across the world. EVs rely heavily on power electronic components for efficient battery management, motor control, regenerative braking, and fast charging. Governments are introducing supportive policies, offering subsidies, and setting strict emission targets to encourage EV use. Automakers are also investing heavily in EV production, increasing demand for high-performance power electronic systems.

As battery technology improves and EV prices fall, more people are expected to make the shift from traditional vehicles. This shift drives the need for advanced inverters, converters, and chargers. As a result, the EV boom is fueling consistent and long-term growth in the power electronics market.

Expansion of Renewable Energy Installations

The growing focus on clean and sustainable energy sources like solar and wind power is creating strong demand for power electronics. These systems are essential for converting the variable output of renewables into stable, usable electricity for homes, industries, and the grid. As countries aim to reduce their carbon footprint and invest in energy transition, renewable power capacity is increasing rapidly.

Power electronics help in integrating these sources into the grid, ensuring stability and efficiency. The need for energy storage, microgrids, and smart grid technologies further boosts the market. Moreover, the ongoing drop in renewable energy costs is making them more attractive, pushing governments and businesses to adopt them faster. This trend significantly supports the growth of power electronics globally.

Restraints in the Power Electronics Market

High Cost of Advanced Materials and Components

One of the major restraints in the power electronics market is the high cost of advanced materials like silicon carbide (SiC) and gallium nitride (GaN), which are essential for next-generation devices. These materials offer better performance but are significantly more expensive than traditional silicon. In addition, manufacturing processes for these materials are complex and require specialized equipment, adding to overall production costs.

This makes it difficult for smaller companies to enter the market or scale quickly. For cost-sensitive industries or regions, the price barrier may delay adoption. Even though costs are gradually coming down, affordability remains a concern. This limits the widespread use of advanced power electronic solutions in emerging markets.

Technical Complexity and Integration Challenges

Power electronics systems require precise design, high reliability, and seamless integration with other components, which makes development technically demanding. Designing devices that can handle high voltages, temperatures, and switching speeds without compromising safety is complex. Engineers must also deal with electromagnetic interference and thermal management issues. In applications like EVs or renewable energy systems, power electronics must work flawlessly under varying conditions, which adds to testing and quality assurance needs.

Additionally, integrating these systems with digital controls and communication protocols can create compatibility issues. These challenges often increase development time and slow down product rollouts, especially for newer players in the market.

Opportunities in the Power Electronics Market

Emergence of Smart Grids and Energy Storage Systems

The rise of smart grids and advanced energy storage systems presents a major opportunity for the power electronics market. Smart grids rely on digital communication and control technologies, where power electronics play a key role in monitoring and managing power flow efficiently. As electricity demand becomes more dynamic, there is a growing need for real-time energy conversion and distribution.

Energy storage systems like lithium-ion and solid-state batteries also require inverters and converters for charge control and discharge optimization. With the push toward decentralization and energy resilience, microgrids are becoming more popular, further expanding the role of power electronics. This creates vast potential for innovation in grid-tied converters and bidirectional power flow solutions.

Industrial Automation and Industry 4.0 Integration

The global move toward Industry 4.0 and smart manufacturing is opening up new opportunities for power electronics. In automated factories, power electronics are vital for controlling motors, robotic systems, and high-efficiency drives. These systems require fast, precise, and energy-efficient power management to ensure smooth operation and reduced downtime. As more industries invest in automation and digital control technologies, the demand for high-performance, programmable power electronic devices is rising.

The trend toward energy-efficient operations and predictive maintenance also relies on advanced power electronics with monitoring features. As manufacturing continues to evolve with artificial intelligence and IoT integration, power electronics will be at the heart of these smart industrial systems.

Trends in the Power Electronics Market

Widespread Adoption of Wide-Bandgap Semiconductors (SiC & GaN)

A major trend in power electronics is the quick shift toward wide-bandgap materials like silicon carbide (SiC) and gallium nitride (GaN). These advanced semiconductors handle higher temperatures, frequencies, and voltages more effectively than traditional silicon devices.. That means power systems can be more compact, efficient, and faster—especially important in applications like electric vehicle inverters, fast chargers, and renewable energy converters.

As datacenters and telecom infrastructure require higher power densities and reliability, SiC and GaN are speeding up adoption even more . Over time, their costs are expected to drop further, accelerating their adoption and enabling smaller, cooler, and greener power systems.

Digital Intelligence, Cybersecurity & System Integration

Power electronics are evolving into smart, connected systems—integrating AI, digital twins, IoT sensors, and cloud analytics to monitor, optimize, and autonomously manage power flows . AI-powered control enhances efficiency and enables predictive maintenance, but also opens up new cyber risks. Recent studies warn that poorly secured smart inverters in solar and grid systems could be hijacked to destabilize power networks . This convergence of advanced hardware and software means designers must balance high performance with robust cybersecurity and seamless integration—ushering in a new era of intelligent, trustworthy power electronics.

Research Scope and Analysis

By Device Type Analysis

Power discrete is expected to be the leading device type in 2025 with a share of 40.7%, driven by its wide use in high-efficiency power management and switching applications. These components are essential in electric vehicles, industrial drives, solar inverters, and consumer electronics, where compact size and cost-effectiveness are important. Their ability to handle high voltage and current with low power loss makes them a preferred choice for improving energy performance.

Growing demand for better thermal performance and high-speed switching in applications like power supplies and telecom systems is also increasing their use. As industries continue to focus on energy-saving solutions and reliable circuit protection, power discrete devices are playing a key role in supporting the expansion of the power electronics market across multiple sectors, especially in Asia Pacific and North America where manufacturing and EV adoption are rising rapidly.

Power module is expected to have significant growth over the forecast period due to its advantages in system integration and thermal efficiency. These modules are used to combine several power devices into a single package, helping reduce space, improve reliability, and simplify design in complex power systems. They are widely adopted in electric vehicles, renewable energy installations, rail traction systems, and industrial automation where high power handling and compact layout are essential.

As demand rises for faster, more efficient, and scalable power solutions, power modules offer a flexible way to meet these needs. Their role is especially important in next-generation applications that require high voltage and current performance with minimal energy loss. With advancements in packaging technologies and increasing use of wide-bandgap materials, power modules are becoming more efficient, cost-effective, and suitable for harsh environments, further supporting their strong growth in the power electronics market.

By Material Analysis

Silicon will lead the power electronics material segment in 2025 with a projected share of 67.2%, thanks to its long-standing presence, proven reliability, and cost-effective manufacturing. Its widespread use in diodes, transistors, and thyristors makes it the backbone of traditional power devices found in consumer electronics, industrial machinery, and power supplies. Silicon offers a well-understood performance profile and is supported by a mature global supply chain, which ensures consistent availability and affordability.

Though newer materials are emerging, silicon remains the preferred choice for low- to mid-power applications due to its balance of performance and price. With ongoing upgrades in fabrication and packaging technologies, silicon-based devices continue to improve in energy efficiency and integration, maintaining their relevance. The large-scale adoption of electronics in developing regions further drives the need for silicon power devices in the expanding global market.

Silicon carbide is experiencing significant growth over the forecast period as industries push for higher efficiency and compact power systems. Known for its ability to operate at high voltages, frequencies, and temperatures, silicon carbide is gaining ground in demanding applications such as electric vehicle inverters, solar inverters, industrial drives, and fast chargers. It offers lower switching losses and better thermal conductivity compared to traditional silicon, allowing devices to run cooler and more efficiently.

This leads to smaller, lighter systems with longer lifespans and reduced energy costs. While more expensive than silicon, the long-term savings and performance benefits are drawing attention from the automotive, renewable energy, and aerospace sectors. As production scales up and costs come down, silicon carbide is becoming a practical choice for high-power and next-generation designs, strengthening its role in the growth of the power electronics market globally.

By Voltage Analysis

Low voltage will take the lead in the voltage level segment of the power electronics market in 2025, with an estimated share of 48.1%, mainly driven by its broad use in consumer electronics, electric vehicles, telecom equipment, and portable devices. The increasing demand for compact, energy-efficient gadgets and smart appliances has accelerated the need for low-voltage power management solutions. These systems help regulate and convert power safely in devices like smartphones, laptops, home automation tools, and EV battery systems.

Low-voltage power electronics are also easier to integrate and more cost-effective for manufacturers, making them ideal for high-volume applications. As digital transformation and smart city projects expand, low voltage systems play a key role in supporting infrastructure with reliable, efficient power control. The trend toward miniaturization and energy savings keeps low voltage technology at the center of innovation and growth in global markets.

High voltage is having significant growth over the forecast period due to rising applications in power transmission, renewable energy, rail traction, and electric vehicle fast-charging systems. These systems require robust and efficient handling of high voltages to reduce energy losses and improve overall power delivery. As nations upgrade their grid infrastructure and expand solar and wind power generation, high voltage power electronics ensure stable and efficient energy flow over long distances.

They also support high-capacity storage and high-power industrial applications. With growing demand for high-speed rail and commercial EV fleets, fast-charging and traction systems rely on high voltage devices to deliver performance and safety. The shift toward smart grids and decentralized energy systems further boosts the adoption of high voltage technologies, reinforcing their vital role in the evolving power electronics landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End Use Industry Analysis

Automotive will lead the power electronics market in 2025 with a projected share of 31.7%, driven by the fast-paced shift toward electric vehicles, hybrid models, and advanced driver assistance systems. Power electronics are essential in EVs for managing battery power, motor control, on-board chargers, and regenerative braking. As automakers race to meet emission targets and government mandates, the demand for high-efficiency inverters, converters, and charging infrastructure is growing rapidly.

The rise of connected cars, autonomous driving features, and vehicle-to-grid technology is also increasing the complexity and role of power management systems. Lightweight, compact, and thermally efficient components are in high demand to support better range and performance. With growing investments in EV manufacturing and strong policy support in Asia Pacific, Europe, and North America, the automotive sector is powering a major wave of innovation and adoption in the global power electronics market.

Further, ICT is showing significant growth over the forecast period as global reliance on digital infrastructure, cloud computing, and telecommunications continues to expand. In this space, power electronics play a key role in data centers, servers, base stations, and networking equipment by ensuring energy-efficient power conversion, voltage regulation, and thermal management.

As data traffic and processing needs rise with technologies like 5G, AI, and IoT, the ICT sector demands compact and reliable power solutions to maintain uptime and reduce energy use. Power electronics help minimize energy losses, lower heat generation, and support high-density server racks, which are critical for modern digital operations. With increasing investments in broadband networks and hyperscale data centers, especially in North America and Asia, the ICT industry is becoming an important driver of the power electronics market’s evolution.

The Power Electronics Market Report is segmented on the basis of the following:

By Device Type

- Power Discrete

- Power Module

- Power IC

By Material

- Silicon (Si)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Others

By Voltage Level

- Low Voltage

- Medium Voltage

- High Voltage

By End Use Industry

- Automotive

- Consumer Electronics

- Industrial

- Energy & Utilities

- ICT

- Aerospace & Defense

- Healthcare

Regional Analysis

Leading Region in the Power Electronics Market

Leading in 2025 with a share of 47.6%, the Asia Pacific region plays the most important role in driving the growth of the power electronics market. This strong position comes from the rapid development of electric vehicles, renewable energy projects, and industrial automation across major countries like China, India, South Korea, and Japan. The rising demand for energy-efficient systems in consumer electronics and smart home devices also boosts the market.

Governments in the region are actively supporting clean energy and local manufacturing through favorable policies, subsidies, and investment in infrastructure. With large-scale production facilities, skilled labor, and strong supply chains, Asia Pacific has become a global manufacturing hub for power electronics components. The increasing focus on digitization, along with growing adoption of power management systems in railways, telecom, and data centers, further adds to the region’s momentum. As 2025 progresses, Asia Pacific is expected to maintain its leadership, shaping future developments in the global power electronics industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Power Electronics Market

North America is showing significant growth over the forecast period in the power electronics market, supported by strong demand in electric vehicles, renewable energy systems, and smart grid technologies. The region benefits from advanced R&D, government support for clean energy, and early adoption of wide-bandgap semiconductors like silicon carbide and gallium nitride. With increasing investments in data centers, industrial automation, and aerospace power systems, the need for high-efficiency power conversion is rising.

The expansion of EV charging infrastructure and energy storage solutions is also boosting market momentum. As companies focus on energy-efficient devices and smart power management, North America is estimated to become a major contributor to global power electronics innovation and adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The power electronics market is highly competitive, with many global and regional players offering a wide range of products and solutions. Companies in this space are constantly working on making their systems smaller, faster, and more efficient to stay ahead. There is strong competition in areas like electric vehicles, renewable energy, and industrial automation, where demand for better energy control is rising.

Businesses are also investing heavily in research to improve performance and reduce costs. Some are focusing on advanced materials like silicon carbide, while others are strengthening their software and digital capabilities. The market sees frequent partnerships, technology licensing, and product launches, making innovation a key to success. Overall, it’s a fast-moving space where staying updated is crucial.

Some of the prominent players in the global Power Electronics are:

- Infineon Technologies

- ON Semiconductor (onsemi)

- STMicroelectronics

- Texas Instruments

- Mitsubishi Electric

- Toshiba Electronic Devices & Storage

- Fuji Electric

- Renesas Electronics

- NXP Semiconductors

- ROHM Semiconductor

- Vishay Intertechnology

- Analog Devices

- Semikron Danfoss

- Hitachi Energy

- Broadcom Inc.

- Microchip Technology

- Panasonic Industry

- ABB Ltd

- Power Integrations

- Littelfuse

- Other Key Players

Recent Developments

- In June 2025, RIR Power Electronics Ltd. expanded its 1200V Silicon Carbide (SiC) diode production through a strategic partnership with Taiwan’s Pro Asia Semiconductor Corporation (PASC), marking a key milestone in strengthening India’s semiconductor capabilities. This collaboration supports RIR’s go-to-market plans and accelerates production from its upcoming Odisha facility. PASC has already manufactured and shipped 1200V Schottky Barrier Diodes (2A–60A) to India. RIR has secured purchase orders from Richardson Electronics (USA) and Ankit Plastics (India) for diverse applications, including industrial and defence sectors.

- In April 2025, the Ministry of Electronics and Information Technology (MeitY) signed several key technology transfer agreements under the National Mission on Power Electronics Technology (NaMPET) to commercialize innovations developed in India. Announced by MeitY Secretary S. Krishnan at a ceremony in New Delhi, the initiative underscores the push for self-reliance in power electronics. The technologies, backed by MeitY, have undergone full-scale testing and certification. A key milestone was the transfer of the indigenous 1.5 kW Wireless Charger technology to Global Business Solution Pvt. Ltd.

- In April 2025, Tamil Nadu Chief Minister MK Stalin launched the Electronics Components Manufacturing Scheme to enhance the state’s electronic component production. The initiative is a key step toward significantly increasing electronics exports, with a target of reaching approximately USD 50 billion over the next two to three years, up from the current USD 14 billion. The scheme is expected to attract new investments, strengthen the manufacturing ecosystem, and position Tamil Nadu as a major hub in the electronics export sector.

- In February 2025, Impulse, creator of the world’s first high-performance battery-integrated cooktop, is expanding its reach through a strategic partnership with THOR Kitchen. At the 2025 Kitchen & Bath Industry Show (KBIS) in Las Vegas on February 25, Impulse will unveil its modular electronics platform. Built on the award-winning Impulse Cooktop technology, it features powerful battery packs, precision inverters, and advanced temperature sensors. The system supports up to 10kW per element, global compatibility, and seamless installation—enabling other appliance brands to boost energy efficiency and performance.

- In December 2024, ABB announced an agreement to acquire the power electronics business of Gamesa Electric in Spain from Siemens Gamesa, aiming to boost its position in high-powered renewable power conversion. The deal will enhance ABB’s portfolio for renewables OEMs and support its Motion business growth strategy. The acquisition includes DFIG wind converters, BESS solutions, and solar inverters, along with two factories in Spain and around 400 employees worldwide. The transaction is expected to close in the second half of 2025, pending regulatory approvals.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 51.2 Bn |

| Forecast Value (2034) |

USD 51.2 Bn |

| CAGR (2025–2034) |

6.0% |

| The US Market Size (2025) |

USD 9.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Device Type (Power Discrete, Power Module, and Power IC), By Material (Silicon (Si), Silicon Carbide (SiC), Gallium Nitride (GaN), and Others), By Voltage Level (Low Voltage, Medium Voltage, and High Voltage), By End Use Industry (Automotive, Consumer Electronics, Industrial, Energy & Utilities, ICT, Aerospace & Defense, and Healthcare) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Infineon Technologies, ON Semiconductor (onsemi), STMicroelectronics, Texas Instruments, Mitsubishi Electric, Toshiba Electronic Devices & Storage, Fuji Electric, Renesas Electronics, NXP Semiconductors, ROHM Semiconductor, Vishay Intertechnology, Analog Devices, Semikron Danfoss, Hitachi Energy, Broadcom Inc., Microchip Technology, Panasonic Industry, ABB Ltd, Power Integrations, Littelfuse, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Power Electronics Market?

▾ The Global Power Electronics Market size is expected to reach a value of USD 51.2 billion in 2025 and is expected to reach USD 86.7 billion by the end of 2034.

Which region accounted for the largest Global Power Electronics Market?

▾ Asia Pacific is expected to have the largest market share in the Global Power Electronics Market, with a share of about 47.6% in 2025.

How big is the Power Electronics Market in the US?

▾ How big is the Power Electronics Market in the US?

Who are the key players in the Global Power Electronics Market?

▾ Some of the major key players in the Global Power Electronics Market are Infineon Technologies, ON Semiconductor (onsemi), STMicroelectronics, and others

What is the growth rate in the Global Power Electronics Market?

▾ The market is growing at a CAGR of 6.0 percent over the forecasted period.