Market Overview

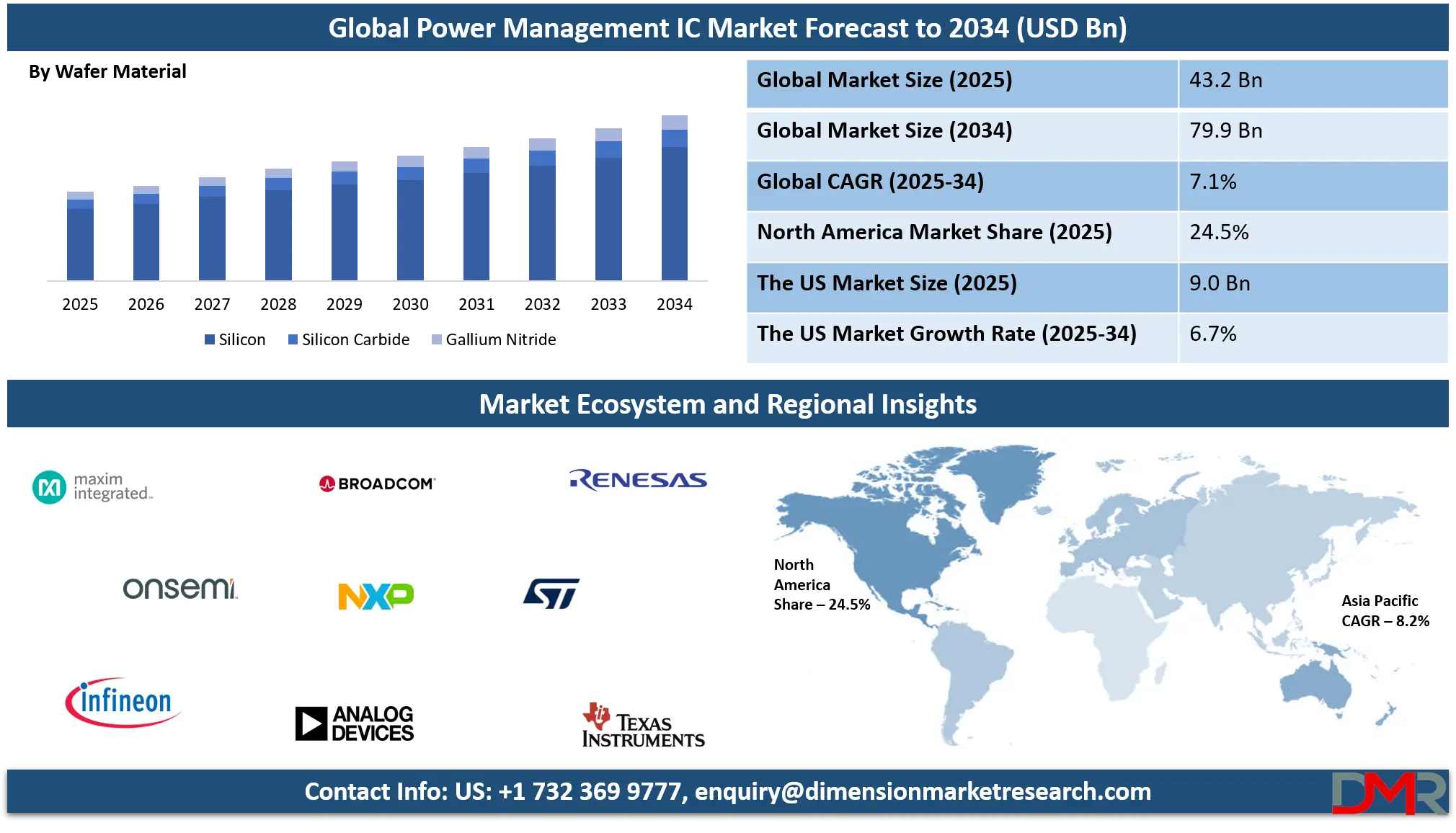

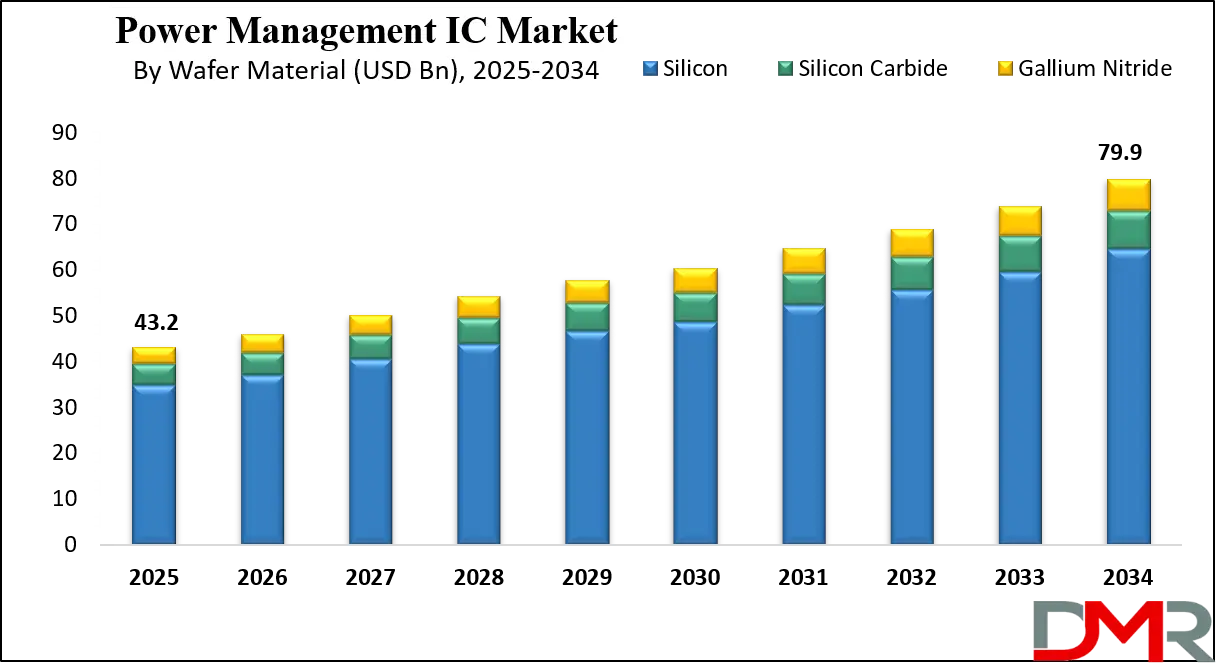

The Global Power Management IC Market size is projected to reach USD 43.2 billion in 2025 and grow at a compound annual growth rate of 7.1% from there until 2034 to reach a value of USD 79.9 billion.

Power Management Integrated Circuits (PMICs) are specialized chips used to manage the distribution and regulation of electrical power within electronic devices. They help ensure that each component inside a device, such as a smartphone or electric vehicle, receives the correct voltage and current. These chips combine several power control functions, such as voltage conversion, battery charging, and power sequencing, into a single compact package. This helps in saving space, improving energy efficiency, and extending battery life in portable and embedded devices.

The demand for PMICs has grown rapidly with the rise of advanced electronics. Consumer electronics such as smartphones, wearables, laptops, and tablets rely heavily on efficient power management. As devices become more compact and power-hungry, the need for highly integrated and energy-efficient PMICs has increased. Additionally, the growth of electric vehicles (EVs), 5G infrastructure, and renewable energy systems has further pushed the market forward, as all these technologies require complex power regulation.

One major trend in recent years is the push for miniaturization. Manufacturers are designing smaller and thinner PMICs that still deliver strong performance. This trend is essential for devices like wireless earbuds and smartwatches, where space is very limited. Another trend is the integration of digital control features within PMICs, allowing for smarter power distribution and real-time monitoring. These advanced features make the devices more reliable and help save power.

Recent events have also shaped the PMIC landscape. The global chip shortage, which affected the electronics industry during and after the COVID-19 pandemic, highlighted the importance of having a secure and flexible supply chain for PMICs. Many companies began looking for ways to localize production and invest in domestic semiconductor capabilities. This shift is expected to create more stable supply chains and reduce dependency on a few regions.

PMICs are also gaining attention due to sustainability concerns. As governments and industries aim to reduce carbon emissions, energy-efficient power management has become a priority. PMICs play a critical role in reducing energy waste in electronics and optimizing the performance of renewable energy systems, such as solar panels and wind turbines. This makes them essential for building greener technologies.

Overall, PMICs are no longer just background components; they are crucial for the smooth and efficient operation of modern electronic systems. Their importance is growing as technology continues to evolve, and they are set to remain at the core of innovations in mobility, communication, and sustainable energy.

The US Power Management IC Market

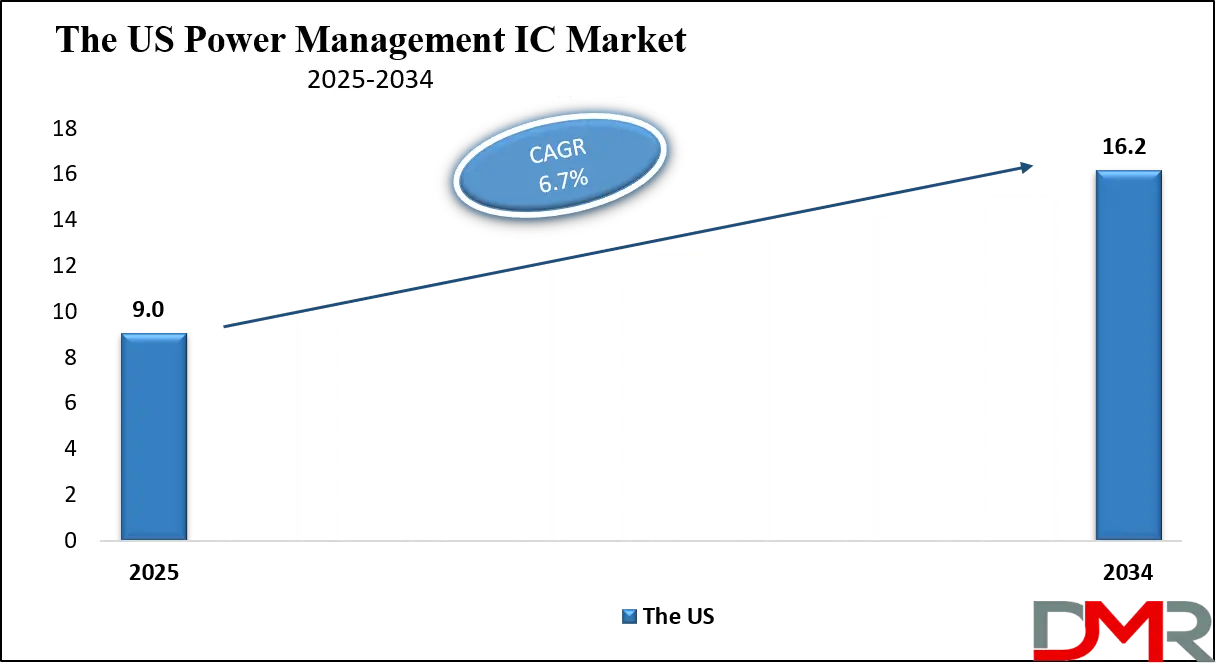

The US Power Management IC Market size is projected to reach USD 9.0 billion in 2025 at a compound annual growth rate of 6.7% over its forecast period.

The US plays a key role in the global Power Management IC (PMIC) market through innovation, advanced semiconductor design, and strong demand across sectors. US-based companies lead in developing cutting-edge PMIC solutions for consumer electronics, electric vehicles, and cloud infrastructure. The country’s tech ecosystem, including major OEMs and chipmakers, drives continuous R&D and miniaturization of PMICs.

Additionally, the growing electric vehicle market and 5G rollout in the US are increasing the need for efficient power control systems. The US government is also investing heavily in domestic semiconductor manufacturing to reduce reliance on overseas supply chains. This enhances the country’s strategic position in the global PMIC landscape and supports long-term market stability and technological leadership.

Europe Power Management IC Market

Europe Power Management IC Market size is projected to reach USD 7.8 billion in 2025 at a compound annual growth rate of 6.3% over its forecast period.

Europe plays a significant role in the Power Management IC (PMIC) market through its strong focus on energy efficiency, automotive innovation, and sustainability. The region is home to major automotive manufacturers that are rapidly shifting to electric vehicles, driving high demand for advanced power management solutions.

Europe also emphasizes green energy and smart grid development, where PMICs are essential for managing and optimizing power flow. The region’s regulatory support for low-power electronics and carbon reduction further encourages the use of efficient PMIC technologies. European semiconductor firms contribute to innovation in industrial and consumer applications, while public funding and research initiatives promote local chip design and production. This positions Europe as a key contributor to both demand and innovation in the PMIC market.

Japan Power Management IC Market

Japan Power Management IC Market size is projected to reach USD 2.2 billion in 2025 at a compound annual growth rate of 7.3% over its forecast period.

Japan plays a crucial role in the Power Management IC (PMIC) market through its expertise in precision electronics, automotive technology, and advanced manufacturing. Japanese companies are known for producing high-quality components used in smartphones, consumer electronics, and industrial machinery, all of which require efficient power management. The country’s strong presence in the automotive sector, especially in hybrid and electric vehicles, drives significant demand for reliable PMICs.

Japan also invests heavily in robotics, automation, and energy-efficient systems, further boosting PMIC usage. Its semiconductor industry, supported by government initiatives and global partnerships, continues to develop compact and high-performance PMIC solutions. With a focus on innovation, quality, and energy conservation, Japan remains a key player in shaping the global PMIC landscape.

Power Management IC Market: Key Takeaways

- Market Growth: The Power Management IC Market size is expected to grow by USD 33.9 billion, at a CAGR of 7.1%, during the forecasted period of 2026 to 2034.

- By Wafer Material: The Silicon segment is anticipated to get the majority share of the Power Management IC Market in 2025.

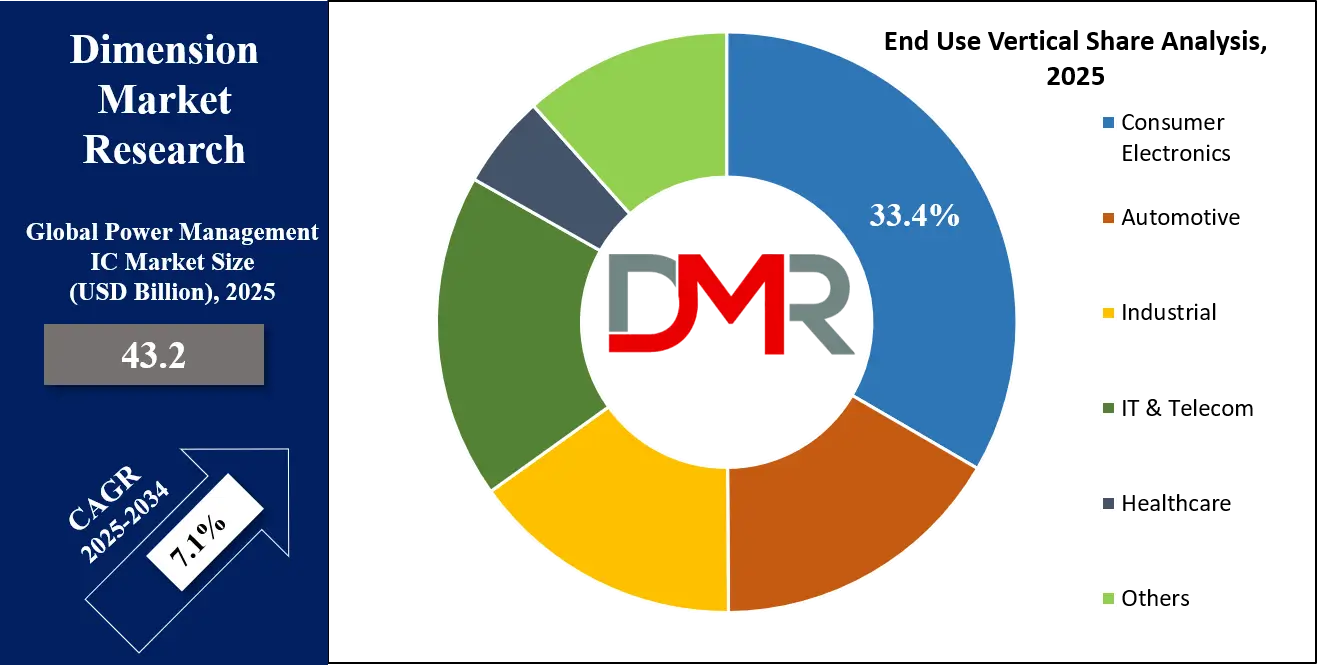

- By End Use Vertical: The Consumer Electronics segment is expected to get the largest revenue share in 2025 in the Power Management IC Market.

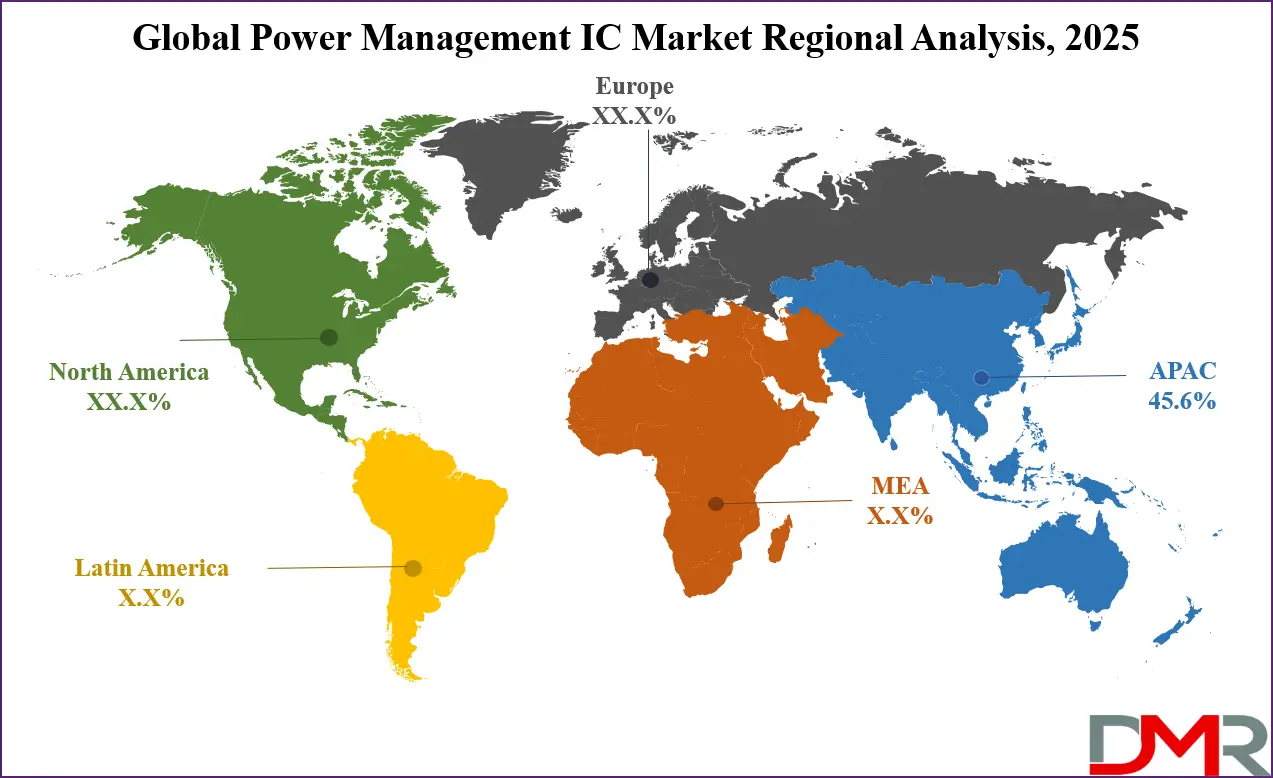

- Regional Insight: Asia Pacific is expected to hold a 45.6% share of revenue in the Global Power Management IC Market in 2025.

- Use Cases: Some of the use cases of Power Management IC include consumer electronics, industrial automation, and more.

Power Management IC Market: Use Cases

- Consumer Electronics: Power management ICs help smartphones, tablets, and laptops manage energy efficiently by controlling voltage levels and extending battery life. They also support fast charging and heat management in compact devices. This improves performance while conserving power.

- Electric Vehicles (EVs): PMICs regulate power flow between the battery and vehicle systems, ensuring efficient energy use across motor control, infotainment, and lighting. They also help in battery charging and thermal control. This is essential for EV range and safety.

- Industrial Automation: In factories and automated equipment, PMICs maintain stable power delivery to sensors, controllers, and robotics. This prevents downtime due to voltage fluctuations and enhances equipment longevity and reliability in harsh environments.

- Telecommunications Infrastructure: PMICs support power delivery in 5G base stations and networking equipment by managing high-power loads and optimizing energy efficiency. They help reduce energy costs while ensuring continuous operation in data-intensive communication networks.

Stats & Facts

- According to the U.S. Energy Information Administration (EIA):

- In 2023, utility-scale electricity generation in the United States reached about 4,178 billion kilowatthours (kWh), while small-scale solar photovoltaic (PV) systems generated an additional 73.62 billion kWh, most of which came from rooftop installations, showing growing decentralization in solar power generation.

- Roughly 60% of utility-scale electricity generation came from fossil fuels, led by natural gas at 43.1%, followed by coal at 16.2%, while nuclear energy contributed 18.6% and renewables made up 21.4%, with nonhydroelectric renewables like wind and solar accounting for 15.6% of that share.

- Total U.S. utility-scale electricity-generation capacity at the end of 2023 stood at 1,189,492 MW (or about 1.19 billion kW), with natural gas making up the largest portion at 42.7%, followed by renewables at 28.1%, of which 21.3% came from nonhydroelectric sources and 6.7% from hydro.

- The share of coal-fired capacity declined drastically from 42% in 1990 to 15.2% in 2023, and its contribution to total generation fell from 52% to 16.2% over the same period, illustrating a major long-term shift away from coal.

- Natural gas-fired generation capacity rose from 17% in 1990 to 43% in 2023, with its share of total electricity generation more than tripling from 12% to 43%, reflecting increased investment and reliability in gas-fired power plants.

- Nuclear power’s share has remained stable, hovering around 20% of total annual utility-scale generation since 1990, despite the fact that most U.S. nuclear plants were built prior to that year and few new ones have come online since.

- Hydropower, historically the top renewable source until 2014, now accounts for 5.7% of total generation, with its output fluctuating year to year based on rainfall and water availability, limiting its consistency as a power source.

- Petroleum-fueled generation capacity was a small fraction at 2.4% in 2023, while other minor sources together made up 3.5%, indicating a continued decline in oil-based power and greater diversity in alternative energy solutions.

- The rise in small-scale solar PV systems contributed about 0.07 trillion kWh in 2023, showing gradual growth in behind-the-meter solar generation, especially in residential and commercial rooftop installations.

Market Dynamic

Driving Factors in the Power Management IC Market

Rising Demand for Energy-Efficient Consumer Devices

The growing popularity of portable electronics like smartphones, smartwatches, and wireless earbuds is driving demand for advanced power management solutions. As these devices become more powerful and feature-rich, managing power consumption becomes crucial to ensure long battery life and safe operation. PMICs play a central role by regulating voltage, reducing energy loss, and supporting fast-charging capabilities.

The push for slimmer and lighter devices further increases the need for compact, multi-functional power management ICs. Additionally, the adoption of OLED displays, AI features, and 5G connectivity adds complexity to power distribution, making PMICs more essential than ever. Consumers also expect better thermal management and faster charging, which PMICs enable. These factors make consumer electronics a steady growth engine for the market.

Expansion of Electric Vehicles and Charging Infrastructure

The accelerating shift toward electric vehicles (EVs) globally is another major driver for the power management IC market. EVs rely heavily on PMICs to manage battery charging, power conversion, motor control, and infotainment systems. As more automotive manufacturers develop electric and hybrid models, the need for efficient power control solutions grows.

Beyond vehicles, the development of EV charging stations and related infrastructure also demands high-performance PMICs to ensure safe and efficient power flow. Governments and industries are investing in clean mobility, further boosting PMIC integration. The complexity and safety standards in EVs push demand for high-reliability ICs capable of handling multiple voltages and power levels. This automotive transformation creates long-term growth opportunities for power management technologies.

Restraints in the Power Management IC Market

High Design Complexity and Integration Challenges

As devices become smaller and more powerful, integrating power management ICs with multiple functions into a single compact chip becomes increasingly complex. Designing PMICs that can handle varied power requirements, support multiple components, and maintain thermal stability is a significant engineering challenge. This complexity leads to longer development cycles and higher design costs.

Manufacturers must also ensure the chips are compatible with various end-user applications, which adds further design pressure. Any error or inefficiency in design can impact the entire device's performance. Additionally, as more digital control features are added, testing and validation become more demanding. These technical hurdles slow down time-to-market and create barriers, especially for smaller or new companies.

Supply Chain Disruptions and Semiconductor Shortages

The power management IC market is vulnerable to global semiconductor supply chain disruptions, which have been more evident in recent years. Events such as the pandemic, geopolitical tensions, and natural disasters have caused shortages in key materials and components. These disruptions lead to production delays and fluctuating prices, affecting both manufacturers and end-users.

Since PMICs are crucial in many high-demand products like smartphones, EVs, and 5G devices, any delay in their availability can halt or delay entire production lines. Furthermore, dependence on a few global foundries for chip manufacturing makes the market more fragile. These supply-side restraints limit the industry's ability to scale up rapidly to meet growing demand.

Opportunities in the Power Management IC Market

Emergence of Smart Homes and IoT Devices

The rapid growth of smart homes and Internet of Things (IoT) devices presents a major opportunity for the power management IC market. From smart speakers and security systems to connected appliances and sensors, these devices require reliable and efficient power management to operate seamlessly. PMICs enable longer battery life, efficient power distribution, and real-time power monitoring, all of which are crucial for IoT functionality.

As the number of connected devices multiplies, the demand for specialized PMICs tailored for low-power and compact designs is set to increase. The need for always-on connectivity and minimal energy usage makes PMICs a foundational component in smart environments. Their ability to manage multiple power sources and ensure uninterrupted operation adds value in this expanding market segment.

Adoption of Renewable Energy Systems

The global shift towards renewable energy sources such as solar and wind is opening new avenues for PMIC applications. In these systems, PMICs are vital for regulating power from variable sources, managing energy storage, and optimizing the performance of inverters and converters. They help stabilize the power supply by adjusting output based on demand and input fluctuations.

As microgrids, home solar installations, and battery storage systems gain popularity, efficient power control becomes critical. PMICs enhance energy efficiency, reduce power loss, and support smart energy management in off-grid and hybrid systems. Governments and businesses investing in clean energy are further accelerating demand. This trend creates long-term growth opportunities for advanced and specialized power management ICs across both residential and industrial renewable setups.

Trends in the Power Management IC Market

Adoption of Wide-Bandgap Semiconductors (GaN & SiC)

Power management ICs are transitioning from traditional silicon to advanced materials like Gallium Nitride (GaN) and Silicon Carbide (SiC). These wide-bandgap semiconductors offer higher efficiency, increased power density, faster switching, and less energy loss. This trend is particularly gaining traction in high-demand applications such as electric vehicle chargers, renewable energy systems, and data center power supplies, where performance and thermal control are critical.

Smarter, AI-Driven Power Control

PMICs are increasingly integrating digital control with built-in AI and machine-learning algorithms. This enables adaptive voltage scaling, real-time power optimization, and predictive energy management. By dynamically adjusting power delivery based on workload and operating conditions, these intelligent PMICs enhance battery life, reduce heat, and boost reliability in devices ranging from smartphones to data centers.

Research Scope and Analysis

By Product Type Analysis

Voltage regulators, leading in 2025 with a share of 31.3%, will play a crucial role in driving the growth of the Power Management IC market due to their essential function in maintaining stable voltage levels across various electronic devices. As electronic systems become more compact and power-sensitive, the need for precise voltage control increases, making voltage regulators critical for ensuring device safety, performance, and energy efficiency. Widely used in smartphones, computers, industrial automation, and automotive electronics, these components help prevent damage from voltage fluctuations.

The growing demand for fast-charging devices, electric vehicles, and efficient computing systems is pushing manufacturers to develop advanced voltage regulator ICs with compact size, thermal management, and digital control features. As innovation in electronics continues, voltage regulators are expected to remain at the core of power management solutions, supporting the global shift toward smarter, more energy-efficient technologies in both consumer and industrial segments.

Battery management ICs, having significant growth over the forecast period, are set to become a key driver in the Power Management IC market. These ICs are essential for monitoring, protecting, and balancing rechargeable batteries in devices such as electric vehicles, smartphones, wearables, and energy storage systems. As the shift towards battery-powered technologies accelerates, the demand for efficient battery management becomes even more critical.

Battery management ICs support longer battery life, enhanced safety, and accurate state-of-charge readings, which are especially important in high-density lithium-ion batteries. With rising focus on clean mobility, smart devices, and grid-tied solar storage, the need for smarter battery control systems is increasing. These ICs help prevent overcharging, overheating, and battery failures, making them a vital component in the development of sustainable and reliable electronics across both consumer and industrial applications.

By Wafer Material Analysis

Silicon, leading in 2025 with an 80.7% share, will remain the dominant force in the growth of the Power Management IC market due to its proven performance, wide availability, and cost efficiency. For decades, silicon has been the most preferred wafer material used in manufacturing integrated circuits across various power applications. Its mature processing technology, compatibility with high-volume production, and ability to meet the needs of consumer electronics, automotive systems, and industrial devices make it a dominant choice.

Silicon-based PMICs offer reliable voltage regulation, power conversion, and thermal management, supporting everything from smartphones to electric vehicles. As manufacturers continue to focus on balancing performance and affordability, silicon will stay central to innovation, particularly in devices where power density and precise voltage control are key. Its broad ecosystem and strong supply chain reinforce its continued dominance in both low-power and high-power electronic systems worldwide.

Gallium Nitride, also known as GaN, having significant growth over the forecast period, is rapidly gaining attention as a high-performance wafer material in the Power Management IC market. Known for its ability to operate at higher voltages, frequencies, and temperatures than traditional silicon, GaN is ideal for compact, fast-switching, and energy-efficient power devices.

Its growing use in applications such as electric vehicle fast chargers, data centers, and advanced industrial systems is driving demand for GaN-based PMICs. The material’s high efficiency reduces heat generation and improves system reliability, making it especially valuable in space-constrained designs. As industries push for more powerful and energy-saving solutions, Gallium Nitride is emerging as a promising alternative to silicon in next-generation power management. With ongoing advancements in manufacturing and falling production costs, GaN is expected to see wider adoption, creating new possibilities for performance-driven power control systems.

By End Use Vertical Analysis

Consumer electronics, leading in 2025 with a share of 33.4%, will continue to be the backbone of growth in the Power Management IC market, driven by rising demand for smart, portable, and energy-efficient devices. Smartphones, tablets, wearables, laptops, and gaming consoles all depend heavily on power management ICs to ensure smooth performance, longer battery life, and safe charging. With technology evolving rapidly, these devices require compact, high-efficiency ICs that can manage power precisely while minimizing heat and energy loss.

The rollout of 5G, AI features, high-resolution displays, and fast-charging functions has made PMICs more important than ever. Consumers increasingly expect devices that are powerful yet energy-conscious, creating steady demand for advanced power control systems. As digital lifestyles expand, this segment is set to drive sustained innovation, making consumer electronics a vital vertical in the global expansion of power management technologies.

Automotive, having significant growth over the forecast period, is emerging as a key vertical in the Power Management IC market thanks to the ongoing shift toward electric and hybrid vehicles. Modern cars rely on complex electronic systems for engine control, battery management, infotainment, lighting, and advanced driver-assistance features—all of which require stable and efficient power delivery. Power Management ICs help ensure safe voltage regulation, reduce energy losses, and support high-performance battery charging.

As governments push for cleaner transportation and consumers demand smarter, more connected vehicles, the use of PMICs across the automotive value chain is growing fast. This trend also extends to commercial fleets and charging infrastructure, further widening the scope. With the automotive sector embracing electrification and digitalization, the demand for high-reliability, temperature-tolerant PMICs is expected to rise sharply, solidifying its role as a fast-growing end-use vertical in the power management landscape.

The Power Management IC Market Report is segmented on the basis of the following:

By Product Type

- Voltage Regulators

- Linear Regulators

- Switching Regulators

- Battery Management ICs

- Integrated PMICs

- Motor Control ICs

- Energy Management ICs

- Others

By Wafer Material

- Silicon (Si)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

By End Use Vertical

- Consumer Electronics

- Smartphones and Tablets

- Laptops

- Televisions

- Wearables

- Others

- Automotive

- Engine Management

- Infotainment Systems

- Others

- Industrial

- Factory Automation

- Energy Management Systems

- Others

- IT & Telecommunications

- Servers

- Data Centers

- Networking Equipment

- Others

- Healthcare

- Others

Regional Analysis

Leading Region in the Power Management IC Market

Asia Pacific, leading in 2025 with a share of 45.6%, plays the most important role in the growth of the Power Management IC market due to its strong electronics manufacturing base and rapid industrial development. Countries like China, South Korea, Taiwan, and India are home to major consumer electronics producers, chipmakers, and automotive companies, all of which rely heavily on efficient power management ICs.

The region also sees high demand for smartphones, laptops, electric vehicles, and industrial automation systems, which directly boosts the need for PMICs. With rising investments in semiconductor infrastructure, expanding renewable energy projects, and growing adoption of 5G technology, Asia Pacific continues to be the most dynamic market.

In addition, favorable government policies and skilled labor support local production and innovation in power management technologies. As the demand for compact, energy-efficient devices grows, Asia Pacific is estimated to maintain its dominance in the Power Management IC market throughout the year and beyond.

Fastest Growing Region in the Power Management IC Market

The Middle East and Africa (MEA) is showing significant growth over the forecast period in the Power Management IC market due to rising investments in smart infrastructure, industrial automation, and renewable energy projects. Countries across the region are focusing on modernizing their power grids and expanding telecom networks, which increases the demand for energy-efficient power management solutions. With the growing adoption of consumer electronics, electric vehicles, and solar energy systems, the need for advanced power control and voltage regulation is also rising. MEA is estimated to witness steady development in semiconductor use, supported by government initiatives and digital transformation, making it an emerging contributor to the global Power Management IC market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The power management IC market is highly competitive, with many global and regional players offering a wide range of solutions. Companies compete by improving chip efficiency, reducing size, and adding smart features that help save power and extend battery life. Innovation, strong R&D, and fast adaptation to new technologies are key to standing out in this space. Players also focus on customizing their products for different end-use industries like consumer electronics, automotive, and industrial equipment. The market sees frequent product launches and collaborations to meet growing demands in electric vehicles, 5G, and renewable energy systems. As demand rises and technology advances, the competition continues to grow stronger, pushing companies to develop more compact, reliable, and energy-efficient power management solutions.

Some of the prominent players in the global Power Management IC are:

- Texas Instruments

- Analog Devices

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- ON Semiconductor (onsemi)

- Renesas Electronics

- Qualcomm

- Broadcom Inc.

- MediaTek

- Samsung Electronics

- Intel Corporation

- Rohm Semiconductor

- Microchip Technology

- Maxim Integrated

- Toshiba Electronic Devices & Storage

- Skyworks Solutions

- Dialog Semiconductor

- Vishay Intertechnology

- Cirrus Logic

- Other Key Players

Recent Developments

- In April 2025, Navitas Semiconductor announced that its high-power GaNSafe™ ICs have achieved AEC-Q100 and AEC-Q101 automotive qualifications, marking a major step for GaN in the automotive sector. The 4th-generation GaNSafe family combines control, drive, sensing, and protection features, offering exceptional reliability. With short-circuit protection (350ns), 2kV ESD on all pins, and programmable slew rate control, it operates with just four pins, simplifying use like a discrete GaN FET without a VCC pin.

- In March 2025, Power Integrations introduced the TinySwitch™-5, boosting output power in its popular off-line switcher IC family to 175 W. Achieving up to 92% efficiency with diode rectification and optocoupler feedback, TinySwitch-5 suits applications across appliances, computing, communications, and more. Known for simplicity and high light-load efficiency, TinySwitch ICs have seen over six billion units shipped. Featuring EcoSmart™ technology, they’ve helped save around 200 terawatt-hours of energy since 1998.

- In February 2025, Infineon has expanded its OPTIREG Power Management IC (PMIC) portfolio with the addition of the TLF35585, a multi-rail power supply solution designed for demanding automotive systems. This PMIC supports AURIX and other microcontrollers, delivering efficient voltage regulation with integrated DC/DC and linear regulators, trackers, and control features. It ensures reliable performance in safety-critical automotive applications, particularly in chassis, powertrain, and domain control. The TLF35585 includes a boost-buck pre-regulator and provides stable power to both onboard components and off-board sensors.

- In October 2024, Renesas Electronics Corporation announced partnered with Intel to develop a specialized power management solution for laptops using the new Intel Core™ Ultra 200V series. Together, they created a tailored PMIC that meets the advanced power needs of Intel’s latest processors. This integrated PMIC, along with a pre-regulator and battery charger, offers a complete power solution for next-generation laptops. Designed with AI workloads in mind, the system enhances battery efficiency and supports the high energy demands of modern client devices.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 43.2 Bn |

| Forecast Value (2034) |

USD 79.9 Bn |

| CAGR (2025–2034) |

7.1% |

| The US Market Size (2025) |

USD 9.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Voltage Regulators, Battery Management ICs, Integrated PMICs, Motor Control ICs, Energy Management ICs, and Others), By Wafer Material (Silicon (Si), Silicon Carbide (SiC), and Gallium Nitride (GaN)), By End Use Vertical (Consumer Electronics, Automotive, Industrial, IT & Telecommunications, Healthcare, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, NXP Semiconductors, ON Semiconductor, Renesas Electronics, Qualcomm, Broadcom Inc., MediaTek, Samsung Electronics, Intel Corporation, Rohm Semiconductor, Microchip Technology, Maxim Integrated, Toshiba Electronic Devices & Storage, Skyworks Solutions, Dialog Semiconductor, Vishay Intertechnology, Cirrus Logic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Power Management IC Market size is expected to reach a value of USD 43.2 billion in 2025 and is expected to reach USD 79.9 billion by the end of 2034.

Which region accounted for the largest Global Power Management IC Market?

The Power Management IC Market in the US is expected to reach USD 9.0 billion in 2025.

Some of the major key players in the Global Power Management IC Market are Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, and others

The market is growing at a CAGR of 7.1 percent over the forecasted period.