Market Overview

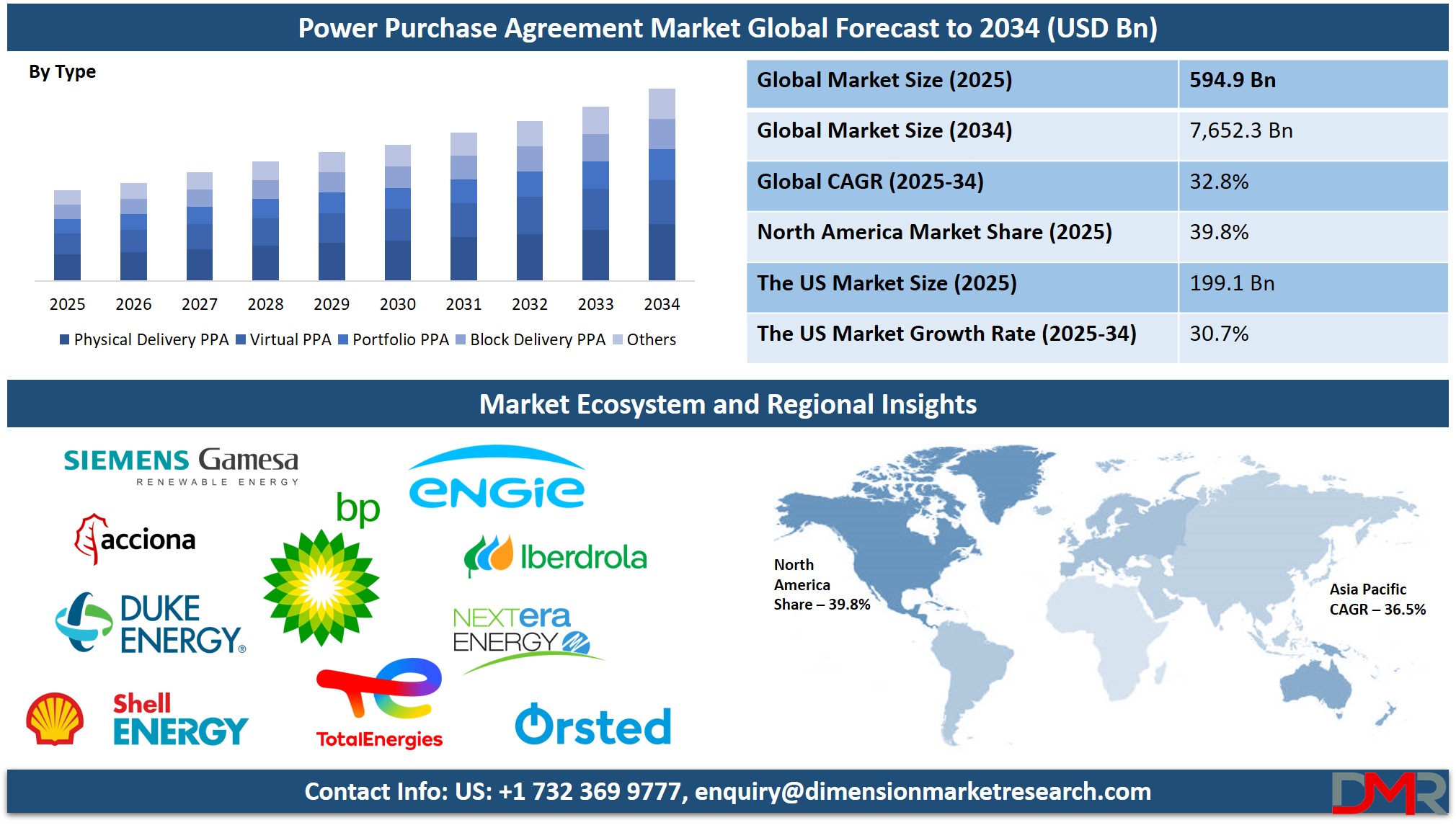

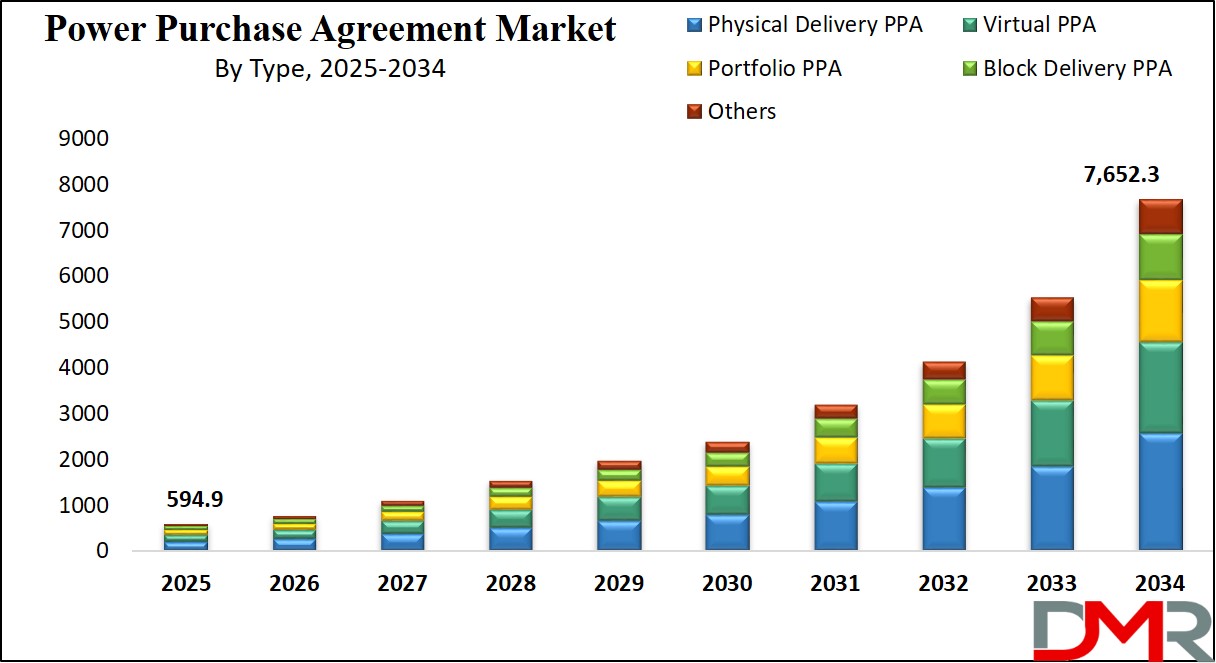

The Global Power Purchase Agreement Market is projected to be valued at

USD 594.9 billion by the end of 2025 and is further expected to reach a market value of

USD 7,652.3 billion in 2034 at a

CAGR of 32.8%.

The rising demand for renewable energy, sustainability goals of corporations, and government incentives surge the global power purchase agreement market upward. PPAs are long-term contracts between any electricity generator and buyer shaping the pivot to energy transition strategies. Corporations, utilities, and governments use PPAs to achieve cost predictability along with the reduction of GHG emissions, hence raising the pace at which PPAs are being adopted. Very specifically, high activity can be observed in states that have open or deregulated markets for electricity and where national renewable portfolio obligation policies are encouraging.

An important trend in the market is that corporate companies are signing PPAs to achieve their sustainability goals, from Google, Amazon, and Microsoft signing huge contracts to power their operations with renewable energy, while virtual and aggregated PPAs open the market for smaller companies and entities in various locations. Meanwhile, innovations such as virtual and aggregated PPAs will extend the market to smaller companies and entities in various locations, thereby enabling them to harness clean energy. Additionally, digital platforms facilitating PPA negotiations give further thrust to its adoption.

Despite the growth witnessed, challenges persist in the market. Complex regulatory processes, especially for developing economies, and fluctuating electricity prices present a barrier to the expansion of the market. Besides, intermittent renewable energy requires advanced technologies to manage the grid; thus, dependence on other complementary systems such as battery storage. These factors would impede further adoption in areas that lack supporting infrastructure or policy.

Opportunities abound in the developing markets characterized by high potential for renewable energy with limited electricity access. An example includes potential instruments to attract investments and stabilize the power grid in Africa and Southeast Asia, respectively. Similarly, innovations such as blockchain-based PPAs and smart contracts are very likely to smoothen processes of transactions, hence attracting investment while lowering entry barriers. Growing demand from industries like manufacturing and transport for complete decarbonization gives way to further lucrative growth avenues.

The outlook, however, appears well for the Global PPA Markets as a force of renewable energy mandates and greater investor focus on Environmental, Social, and Governance (ESG) criteria continues to provide steam. Overall, major players in key markets should place substantial interest in investments in digital tools that allow developers of all sizes greater access to liquidity in financings that optimize and standardize VPPAs in behind-the-meter distributed solar and local electricity storage technology to enable the more prevalent adoption of a 'group PPAs' of VPPA 2.0. Conclusion In this transforming period, PPAs stand out for securing predictable revenues for generators. Their demand or purchasing price drives efficient costs among consuming parties. To reach this scenario faster, PPAs ensure the necessary stability toward faster adoption for all clean energy installations around the globe.

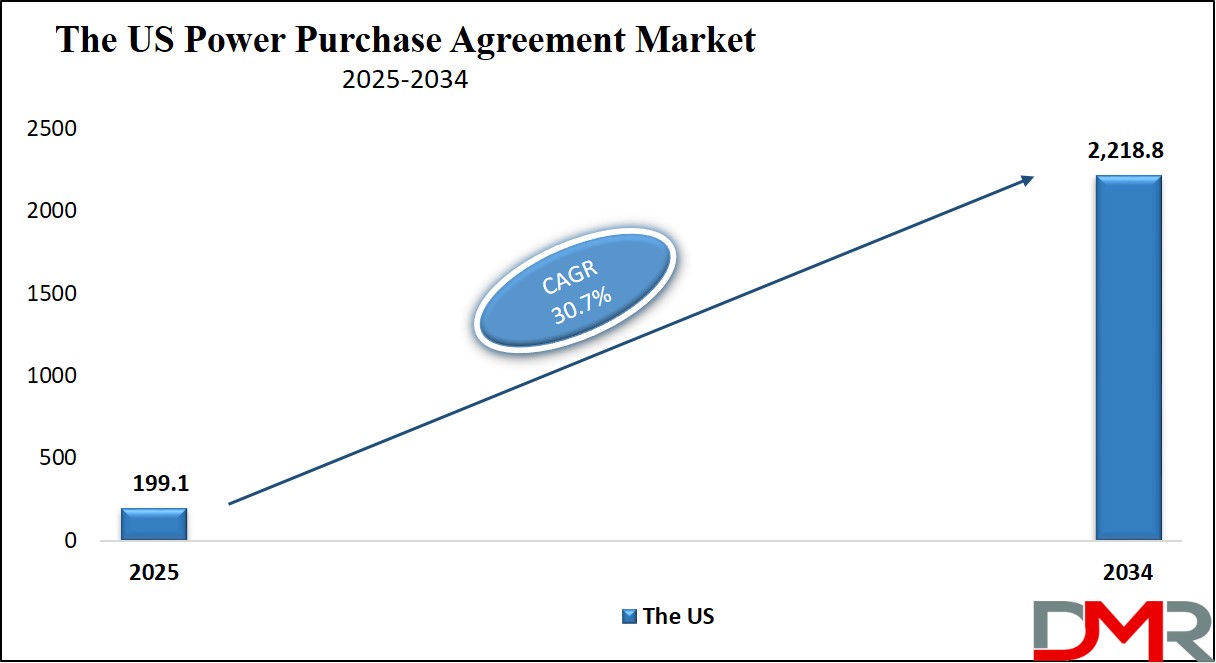

The US Power Purchase Agreement Market

The US Power Purchase Agreement Market is projected to reach USD 199.1 billion in 2025 at a compound annual growth rate of 30.7% over its forecast period.

It is also among the most developed in the world, impelled by strong renewable policies and corporate sustainability objectives. The contribution of corporate PPAs alone marks more than 25 GW of contracted renewable energy capacity in this region, while their contribution to the global market has been very great. The US has been among the leading adopters of renewable energy due to its deregulated electricity markets and rich solar and wind resources. Key states include Texas, California, and Iowa, as the wind or solar-based energy sources there can easily meet or exceed those targets, with friendly conditions for the generation of renewable energy, and their regulatory environment supports that.

This leads to a wide variety of energy consumers, from multinational corporations to local municipalities, which demands various innovative PPA structures. The advanced grid infrastructure and breakthroughs in energy storage further add to the market's attractiveness. Corporate giants like Amazon and Meta are setting the bar with their entry into multi-gigawatt agreements for the achievement of net-zero emissions goals, showing the potential of PPAs as a critical tool for decarbonization.

However, despite its strengths, policy uncertainties and transmission constraints still hinder the further expansion of the market. The US nevertheless remains the global model for PPA adoption because of its very unique blend of technology, policy support, and corporate engagement that sustains its growth which PPAs are expected to continue playing a vital role in its clean energy transition.

Key Takeaways

- Global Market Value: The Global Power Purchase Agreement Market size is estimated to have a value of USD 594.9 billion in 2025 and is expected to reach USD 7,652.3 billion by the end of 2034.

- The US Market Value: The US Power Purchase Agreement Market is projected to be valued at USD 2,218.8 billion in 2034 from a base value of USD 199.1 billion in 2025 at a CAGR of 30.7%.

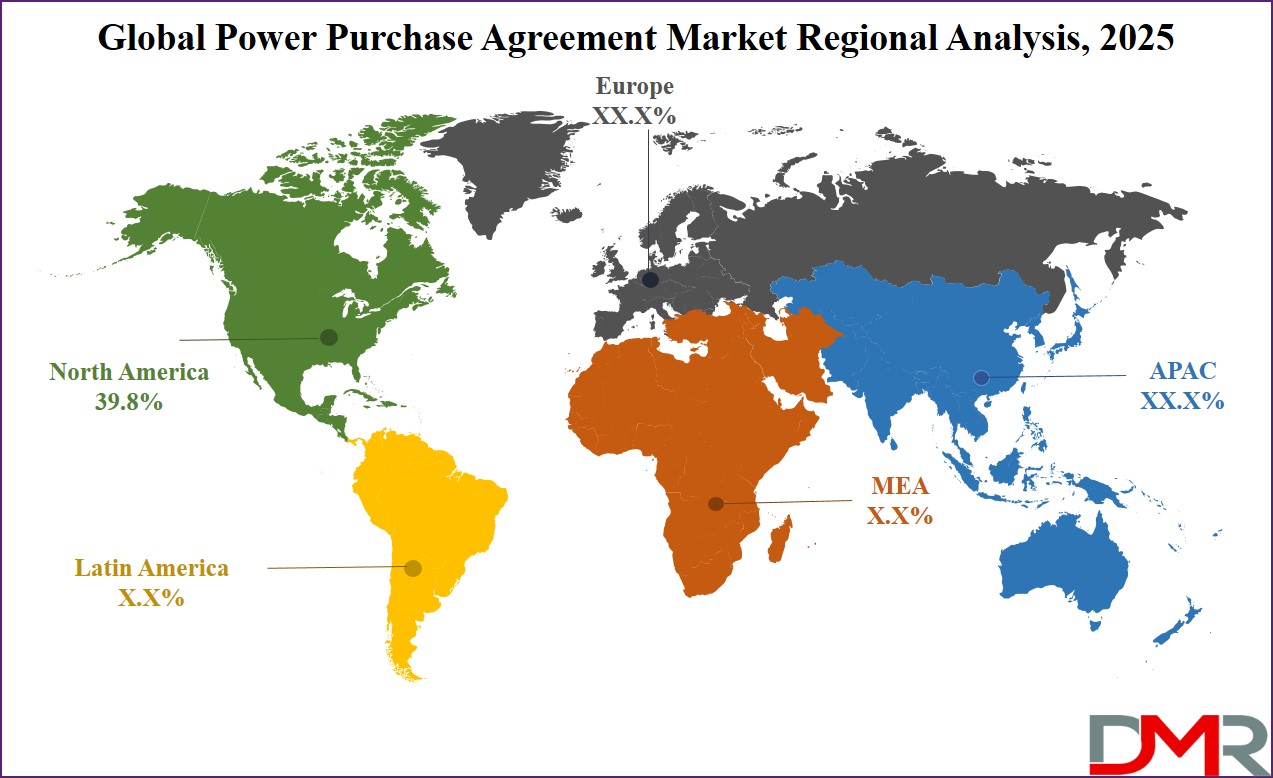

- Regional Analysis: North America is expected to have the largest market share in the Global Power Purchase Agreement Market with a share of about 39.8% in 2025.

- Key Players: Some of the major key players in the Global Power Purchase Agreement Market are ENGIE, Enel Green Power, EDF Renewables, NextEra Energy Resources, Ørsted, Iberdrola, BP Renewable Energy, TotalEnergies, Acciona, and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 32.8 percent over the forecasted period.

Use Cases

- Corporate Sustainability: Companies like Apple and Google are using PPAs in their quest for renewable energy to reduce carbon emissions and provide stable energy costs, which helps with the sustainability commitment to maintain a very dependable, environmentally friendly energy supply.

- Utility-Scale Projects: Utility-scale solar and wind farms are financed through PPAs by energy providers for the assurance of steady revenue streams. These agreements support grid stability, meet growing energy demands, and accelerate the transition toward clean, sustainable power generation.

- Community Energy Programs: Municipalities and small businesses achieve the aggregated power purchasing agreement in a combined manner to tap into cheap renewable energy resources. This approach democratizes the adoption of clean energy by decreasing the overall costs while local communities realize some important environmental objectives about energy self-sufficiency.

- Industrial Decarbonization: Heavy industries purchase PPAs for renewable energy, which assists them in complying with decarbonization and ESG mandates. In the process, compliance is guaranteed; carbon footprints are minimized and sustained for the long-term sustainability of manufacturing and production in energy-intensive industries.

Market Dynamic

Driving Factors

Renewable Energy Mandates

Global renewable energy mandates are the key growth drivers. Ambitious targets set by countries to fight climate change include the EU's goal of

45% renewable energy by 2030. These mandates spur the development of projects in renewable energy, which usually are linked with PPAs for financial viability. Incentives such as tax credits under the U.S. Inflation Reduction Act and feed-in tariffs in Asian markets have created favorable environments for PPAs. This has made governments start using carbon pricing mechanisms to penalize the use of fossil fuels, which in turn nudges corporations toward renewable energy via PPAs.

Corporate Climate Commitments

Another driver would be corporate climate goals company globally has a conversation around net zero. PPAs help companies decarbonize their energy supply chains. Large deals in renewable energy by industry leaders such as Amazon and Meta drive this trend. Deals in corporate power purchase agreements of 36.7 GW for renewable energy were signed worldwide in 2022, against 23.7 GW in the year 2020. Their growing importance related to ESG compliances, with greater pressure from the demands of stakeholders, made PPAs inevitable for corporate entities on the pathway of their sustainability.

Restraints

Regulatory and Policy Challenges

With the lack of standardized, coherent regulatory structures across nations, PPA faces growth constraints. Fluctuating, inconsistent policies in addition to bureaucracy pose a greater impediment to the attraction of private-sector participation in several emerging markets. As an example, changes in India's energy policies have sparked several cancellations in projects and also knocked the investor community's confidence. The infrequent approval of administrative procedures and unidentified legal framework constraints make it pretty difficult for either a power purchaser or a developer to arrive at mutual long-term decisions. The harmonization of regulations, with clarity and consistency across all regions, will go a long way in scaling the PPA market.

Grid Infrastructure Limitations

One of the major barriers to PPA adoption is poor grid infrastructure. Most renewable energy projects require heavy and expensive grid extension to the demand centers. Delays in building transmission lines have congested the network and capped the deployment of new wind and solar projects in the United States. This generally means that old grid systems around the world are not fit for the variability of new renewable sources of energy. Modernization and expansion of the grid should be invested in to allow easier integration of renewable energy, which will truly open up the possibilities with PPAs.

Opportunities

Emerging Markets

Developing regions like Africa, Latin America, and Southeast Asia have huge potential for PPAs. These regions are rich in renewable resources in Africa and wind in Latin America but are plagued by energy deficits and unreliable grids. PPAs can attract foreign investments, enabling countries to harness their natural resources effectively. For example, Kenya's Lake Turkana Wind Power Project is the largest wind farm in Africa, thanks to its long-term PPA. Conclusion: A project of this nature fast-tracks economic development and reduction of energy poverty, hence the speed of renewable energy deployment in underdeveloped markets. It opens up vistas presented by new technological breakthroughs.

Technological Innovations

Advantages created by evolving technologies in areas such as advanced batteries and smart grid systems create ways to break barriers that exist because of the use of renewable resources. Storage solutions balance out the volatility of these intermittently generating energy resources with reliable energy delivery, while smart grids enhance efficiency in electricity distribution by accommodating renewable sources on existing grid architecture. Besides, deployment involving a virtual power plant that combines several small individual, distributed energy resources for control purposes expands the PPA market. These make projects more viable and attract more private and institutional investments.

Trends

Corporate Sustainability Integration

The incorporation of sustainability objectives in corporate strategies rebalances the markets for PPAs. Firms are increasingly giving priority to renewable energy as part of the net-zero carbon commitments to enhance their environmental credentials. PPAs let companies stabilize predictable energy prices while reducing a company's carbon footprint.

Virtual PPAs are also catching on, whereby corporate buyers can site their renewable project investment remotely and count the emission offsets anywhere in the world. Technology and manufacturing are leading the charge of late, such that companies as diverse as Microsoft and Unilever have initiated PPAs to manage energy price volatility, comply with ESG Disclosure requirements, or gain a strategic competitive advantage over their peers in the market.

Emergence of Digital Platforms

The emergence of digital platforms is bringing a major change in the PPA marketplace by making negotiations simpler and more transparent. Blockchain-enabled digital platforms reduce contract management to a minimum, allowing buyers and sellers to engage in secure, tamper-proof transactions.

Artificial intelligence tools help optimize pricing and match buyers with suitable renewable energy projects.

This digital transformation is especially impactful in fragmented markets with multiple stakeholders. For instance, PexaGrid improved grid integration for corporates in Europe and further optimized the performance of PPAs. These technologies are those that decrease transaction costs and complexities toward the wide adoption of decentralized renewable energy solutions at a global scale.

Research Scope and Analysis

By Type

Physical delivery PPAs are projected to become the largest share in the global market, as they are capable of directly supplying renewable energy from the producer to the buyer. In this contract, there is an actual transfer of electricity hence, buyers get energy without intermediaries. Huge consumers of energy, such as industrial facilities, data centers, and municipalities, prefer this model because it provides a stable and predictable energy supply. These physical delivery PPAs also shield the buyers from volatile wholesale electricity prices by providing cost stability, which is essential for long-term operational planning.

Clarity on the regulatory framework also enhances the attractiveness of physical PPAs. Many governments and energy regulators have come up with clear frameworks for the agreements, therefore reducing the transactional risks to the buyer and seller. This trust inspires confidence and promotes uptake in many countries that have deregulated energy markets. Another factor that is attractive in the purchase of physical PPAs is transparency in real-time monitoring of energy generation and consumption.

Advancing the grid infrastructure, like adding dedicated transmission lines or using smart grid technologies, further extends the effectiveness of physical PPAs. These tools minimize transmission losses and make the processes of energy delivery smooth. Another critical factor relates to companies trying to be suitable for sustainability goals. With a physical PPA, it is simpler to attribute how much renewable energy that consumption comes directly from specific projects. This generally grants them better environmental standing and helps corporate ESG commitments.

By Location

Onsite PPAs are projected to dominate this market in the context of this segment as they hold the highest market share by the end of 2024. Onsite PPAs boast unparalleled advantages in cost savings, energy self-sufficiency, and sustainable development, commanding sway in the marketplace. Onsite PPAs avoid energy transmission costs and the energy distribution cost of the purchaser if the on-premise location is hosting renewable systems, such as solar panels or wind turbines.

In other words, onsite generation helps to reduce the electrical bills with very minimal risk of grid outages; hence, buyers can ensure electric supply for key operations. Onsite PPAs are particularly attractive to companies with significant amounts of real estate, such as warehouses, factories, and corporate campuses, which can utilize otherwise underutilized space for energy generation.

Of course, on-site PPAs have also been made more efficient with the integration of distributed energy technologies like microgrids and battery storage. All these have allowed companies to store excess energy for use when demand is particularly high or to sell excess power back onto the grid. On-site installations of renewable energy sources visually show a commitment to sustainability; these types of on-site installations create brand image enhancement and stakeholder confidence.

These projects are highly dependent on government incentives in the form of tax credits, grants, and subsidies. Onsite PPAs have much to offer: simplified regulatory requirements without the complicated logistical issues of offsite arrangements. The potential to combine economic, operational, and environmental benefits cements this model's continued dominance.

By Category

Corporate PPAs are projected to lead the market, with companies increasingly recognizing the strategic value of renewable energy in achieving sustainability goals, reducing energy costs, and mitigating regulatory risks. These agreements enable companies to secure predictable, long-term energy supplies that protect them from the volatility of markets. Leading corporations, including such tech giants as Amazon, Google, and Microsoft, lead this trend through PPAs, they aim to reach ambitious net-zero emission targets and power operations with 100% renewable energy.

The growing momentum of ESG factors, or Environmental, Social, and Governance, has driven the use of corporate PPAs. Companies that adopt such agreements boost their sustainability credentials by attracting investors and appealing to consumer demands for environmentally responsible practices. Furthermore, the renewable energy tax incentives-for instance, PTCs and ITCs-make corporate PPAs economically attractive by reducing overall energy procurement costs.

Other reasons these deals dominate include scalability and flexibility in corporate PPAs. Starting from the supply of power for a single facility to global operations, the contracts can be tailored based on varied needs. Virtual PPAs are one such innovation that allows smaller companies to move into renewable energy procurement without always having to invest in direct grid connections. Corporate PPAs, therefore, continue to be dominant in the market, setting business operations for alignment with the global energy transition.

By Deal Type

Large-volume wholesale PPAs are anticipated to dominate the market, as they can provide a large volume of renewable energy at competitive prices. These agreements are ideal for utilities, energy-intensive industries, and large-scale buyers that require significant energy capacities. Since the buyer buys energy directly from the producer at wholesale rates, he avoids the margins that the intermediary would add to it, thus saving a substantial amount in costs.

Dominance has been driven chiefly by the scalability of wholesale PPAs. In instances of large-scale renewable energy projects such as utility-scale wind farms and solar parks, it usually relies on these contracts to provide them with long-term, stable revenue streams for financial viability. To buyers, wholesale PPAs offer price stability and help corporations and regulatory sustainability goals comply with renewable energy mandates.

Wholesale PPAs do dance in line with worldwide decarbonization. They make the utilities incorporate more renewable energies into their wheel, reduce over-dependence on fossil fuels, and further augment the sustainability level in the grid. Moreover, these help cater to consumers with a bigger desire for cleaner forms of energy-thereby essentially giving a final thrust to an overall energy transition. While renewable energy sources continued to propagate the growth experienced across the large energy markets of late, wholesale PPAs became the landmark procurement mechanism well-equipped to deliver financial savings in parallel to sustainability.

By Capacity

It is the 50–100 MW range that is anticipated to lead the PPA market, offering the sweetest spot of scalability, economic feasibility, and operational manageability. A project of such size is big enough to reach substantial scale economies and thus dramatically lowers the dollar amount per megawatt produced. Simultaneously, they are still sufficiently limited regarding permitting, infrastructure, and grid integration. This is the capacity range ideal for mid-sized utilities, corporations, and municipalities that have substantial energy volume needs but without the complications of mega-scale projects.

Most renewable energy installations are below this capacity level, such as medium-sized wind farms and solar parks. This is likely to continue to be the most dominant range in the foreseeable future, partly because 50–100 MW projects have shorter development times, lesser environmental impact, and smoother regulatory processes. Further technological advances in modular renewable energy technologies as the increased use of prefabricated solar systems projects in this range increasingly cost-effective and thus easier to realize.

For corporate buyers, this capacity multiplied by the annual number of hours of operation extends to their annual energy consumption needs, hence meeting their sustainability objectives efficiently. This capacity range is also being supported through targeted subsidies and streamlined approvals by governments to ensure consistent growth in this segment. The range of 50–100 MW is a sweet spot for renewable energy PPAs, combining financial, operational, and environmental advantages.

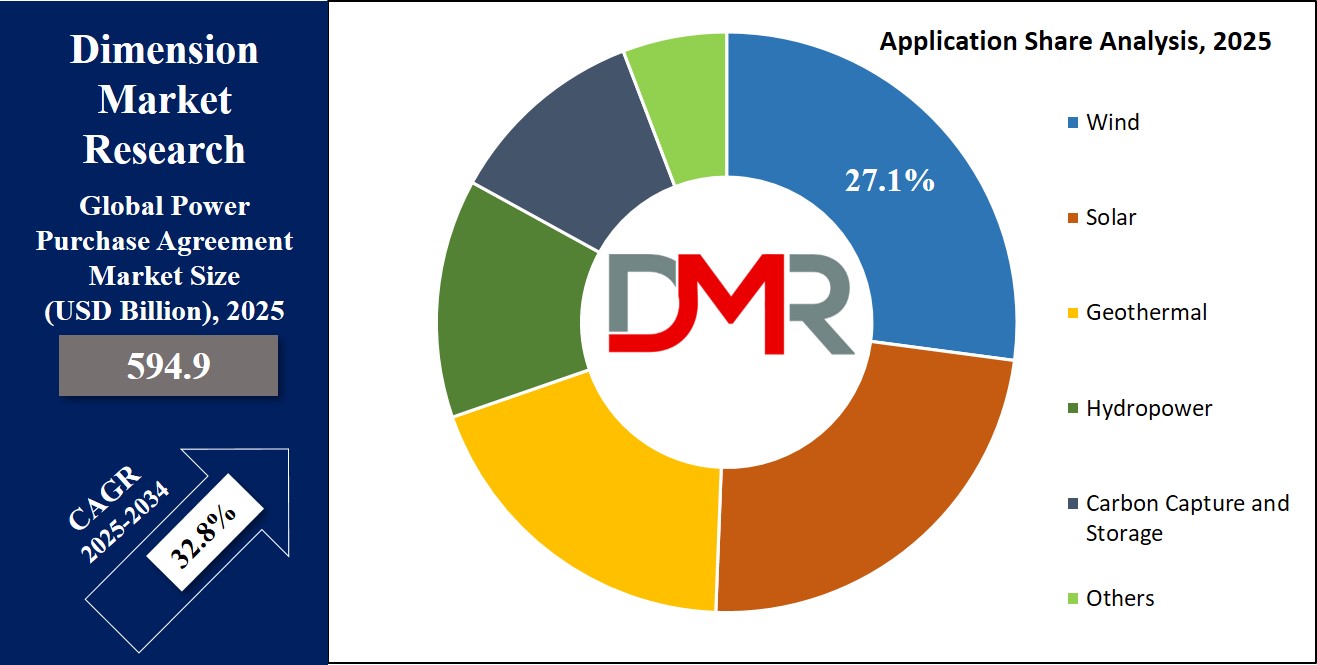

By Application

Wind energy is expected to lead the PPA market due to its cost competitiveness, scalability, and reliability. In particular, onshore wind projects are among the lowest LCOE from renewable sources, making them attractive for long-term PPAs. With technological advances, modern wind turbines can generate significant energy outputs even in low-wind conditions, further enhancing their efficiency and market appeal.

Wind resources being available across the globe enhance its market position. Regions in the U.S. Midwest, Europe's North Sea, and parts of Asia have plentiful wind potential and thus can accommodate big projects. The latest growth in the number of offshore wind projects is adding more to these capacity factors by offering high values and very steady energy output from these farms. This consolidates the predominance of wind energy.

Wind energy would especially attract those corporate buyers eager to reach their renewable energy goals. Their physical evidence gives a symbol-like value to achieving sustainability. On-site projects generate work opportunities and thereby infrastructures with jobs to boost the local economies. With the said merits and features, one may count the same on the continued wide usage of Wind in the prevalent PPA world.

By End User

Commercial entities are projected to dominate the PPA market due to the mounting pressure for the accomplishment of sustainability goals, the reduction of operation costs, and the assurance of long-term sources of energy, today the leading PPA market is driven by commercial organizations. PPAs provide a way for enterprises in many fields to own renewable energy at stable rates and avoid the volatility in the wholesale price of electricity.

This is further driven by the fact that the commercial industry can reap benefits accruing from renewable energy tax credits and incentives. It is due to these renewable energy tax credits and incentives, such as the U.S. Investment Tax Credit (ITC), that PPAs are financially attractive for commercial entities. Businesses enhance operational cost stability by securing fixed energy prices under a PPA, thus supporting their long-term competitiveness.

Demand from consumers and stakeholders for corporate responsibility is another driving force that enables the use of PPAs within the commercial sector. Firms purchasing renewable energy through PPAs improve their ESG profile, gain access to environmentally conscious investors, and engender consumer trust. Virtual PPAs allow smaller businesses to join in on renewable energy procurement, making the spread across the commercial sector widespread. The ability to align with global trends in sustainability and achieve energy cost predictability ensures that commercial entities remain the leading end-users in the PPA market.

The Power Purchase Agreement Market Report is segmented on the basis of the following:

By Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

By Location

By Category

- Corporate

- Government

- Others

By Deal Type

By Capacity

- Up to 20 MW

- 20–50 MW

- 50–100 MW

- Above 100 MW

By Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and Storage

- Others

By End-User

- Commercial

- Residential

- Industrial

Regional Analysis

North America is expected to dominate the power purchase agreement market as it is anticipated to command over

39.8% of total revenue by the end of 2025. North America is currently the leading region in the PPA market, driven by a combination of policy support, rich renewable resources, and high corporate demand. The United States leads the region with a well-institutionalized regulatory framework; it has several incentives for on-site installations, including the Investment Tax Credit and Production Tax Credit.

This has driven billions of dollars in investment into solar and wind energy, developing projects that are economically viable for developers and buyers. The availability of superior quality renewable resources from North America serves to further solidify their positions of dominance. Exceptional winds found in the US Midwest notwithstanding, states like California and Arizona present hot spots of solar energies. Meanwhile, Canada provides vast amounts of hydropower, providing a diversified region of renewable energies.

The other major driver is Human Corporate demand: North American companies lead in this area because tech giants such as Google, Amazon, and Meta have set ambitious net-zero targets. Still, virtual PPAs have opened the market to smaller companies. North America, on the other hand, has a more developed grid infrastructure, enabling it to easily integrate renewable energy.

Deregulated electricity markets, especially in the U.S., give ample freedom to both buyers and sellers to negotiate favorable terms. New ways of energy storage and digital tools increase PPA efficiency. Also, North America leads in climate action through the Inflation Reduction Act of 2022, ensuring further growth and continued leadership within the global PPA market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- • Rest of MEA

Competitive Landscape

The global PPA market has a very diverse player mix of pure-play renewable energy developers, utilities, and technology companies. Leading the fray in this space are Ørsted, Iberdrola, Enel Green Power, NextEra Energy, and Engie, the very ones who are at the front in driving renewable energy capacity and structuring PPA.

In particular, they develop projects ranging from wind to solar to hydropower, while deploying their core competency to win long-term contracts with corporate and industrial off-takers. Tech giants like Google, Amazon, and Microsoft are among the major influencers in the demand for PPAs.

These companies sign multi-gigawatt agreements to meet their ambitious renewable energy and carbon neutrality targets. Their large-scale energy requirements have spurred the development of dedicated renewable projects, reinforcing the need for structured and efficient PPAs. Utilities such as Dominion Energy and Xcel Energy are also expanding their involvement in the PPA market to meet renewable energy mandates, often entering agreements with corporations, municipalities, and other large buyers. These utilities are being increasingly involved in renewable energy procurement, driven by the global push toward sustainability.

More so, online marketplaces, such as LevelTen Energy, are reworking the face of PPA markets with comprehensive contracting mechanisms and full market visibility. These platforms employ artificial intelligence and blockchain to simplify the process at much lower transactional costs, with the added capability of allowing for much wider market participation. The competition in the market is high, with companies working toward the expansion of their renewable portfolios, capturing large-scale contracts, and adopting innovative PPA models such as virtual and aggregated PPAs.

Some of the prominent players in the Power Purchase Agreement are:

- ENGIE

- Enel Green Power

- EDF Renewables

- NextEra Energy Resources

- Ørsted

- Iberdrola

- BP Renewable Energy

- TotalEnergies

- Acciona

- Vattenfall

- Shell Energy

- Duke Energy

- Siemens Gamesa Renewable Energy

- Other Key Players

Recent Developments

- December 2024: Amazon signed a landmark 1.5 GW PPA in North America, encompassing both wind and solar energy projects. This agreement reinforces Amazon’s leadership in renewable energy procurement and its commitment to achieving net-zero carbon emissions by 2040.

- November 2024: Microsoft partnered with Ørsted to finalize a 900 MW offshore wind PPA in Europe. This agreement will supply clean energy to power Microsoft’s data centers across the region, contributing to its goal of becoming carbon-negative by 2030. The offshore wind farms, located in the North Sea, will feature advanced turbines and are expected to significantly enhance Europe’s renewable energy capacity.

- October 2024: Enel Green Power inaugurated a 500 MW solar park in Texas, developed under a PPA with Walmart. The project is part of Walmart’s strategy to achieve 100% renewable energy across its operations by 2030. The solar park will provide affordable and sustainable energy to Walmart’s distribution centers and stores, further strengthening Texas's position as a renewable energy hub.

- September 2024: Google signed a 1 GW PPA for solar energy projects across Asia, targeting its operations in countries like India, Japan, and Thailand. This agreement supports Google’s ambition to operate entirely on carbon-free energy by 2030. The projects will also contribute to local energy transitions, creating jobs and reducing dependence on fossil fuels.

- August 2024: NextEra Energy collaborated with Meta on a 600 MW wind farm project in Iowa under a long-term PPA. The partnership aims to provide renewable energy for Meta’s data centers in the region while boosting Iowa’s wind energy footprint. The project highlights Meta’s leadership in sourcing sustainable energy for its growing digital infrastructure.

- July 2024: Siemens hosted the Global Renewable Energy Conference in Germany, attracting over 10,000 industry stakeholders. The event focused on innovations in PPAs, including blockchain-based transaction platforms and advancements in energy storage. Siemens also showcased its latest technologies for integrating renewables into the grid.

- June 2024: Iberdrola secured a 700 MW PPA with a consortium of Spanish corporations. The deal focuses on supplying wind energy from Iberdrola’s new projects in northern Spain. This collaboration underscores the growing role of corporate buyers in Europe’s energy transition, as companies seek reliable and sustainable energy sources.

- May 2024: LevelTen Energy launched AI-powered tools to streamline PPA negotiations in North America. The platform integrates predictive analytics and market insights, enabling buyers and sellers to identify optimal contract terms quickly. This innovation addresses challenges related to market complexity and accelerates deal closure.

- April 2024: Dominion Energy signed a 400 MW solar PPA with several Virginia-based universities. The agreement will supply clean energy to campuses, reducing operational carbon footprints while supporting local renewable energy development. The initiative aligns with academic institutions’ growing focus on sustainability and climate leadership.

- March 2024: Engie and IKEA partnered on a 200 MW wind PPA in France. This agreement will power IKEA’s retail and logistics operations in the country, contributing to the company’s goal of achieving climate-positive operations by 2030. The wind project will also

benefit local communities through job creation and infrastructure development.

Contents