Market Overview

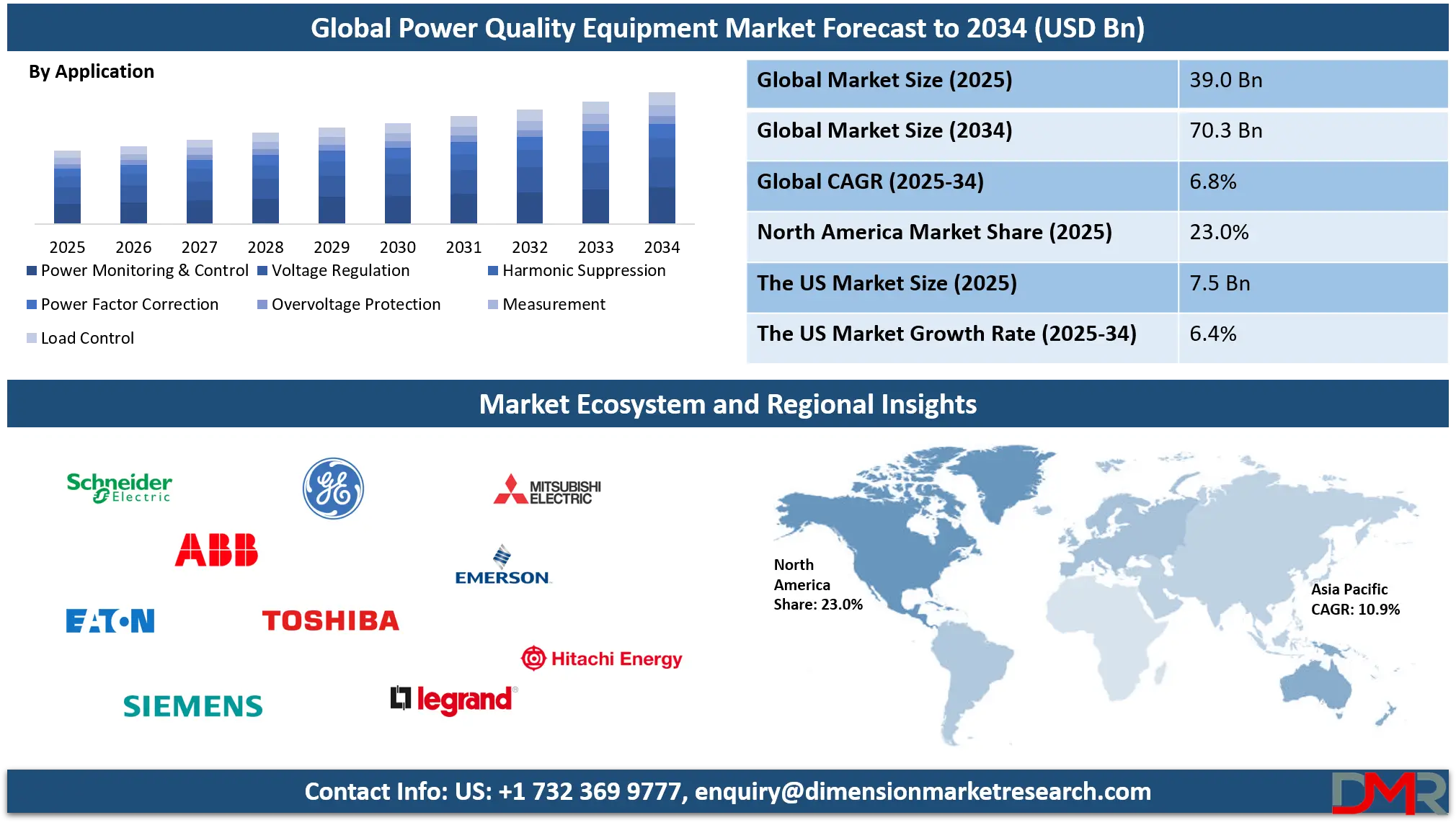

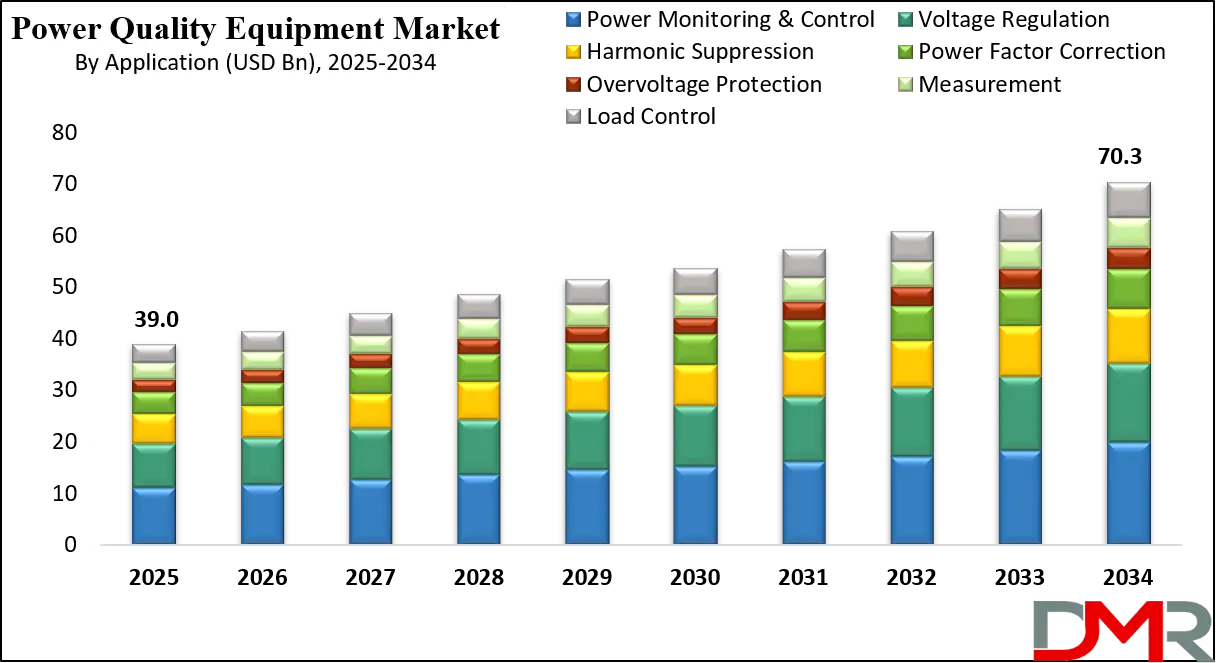

The global power quality equipment market is projected to reach USD 39.0 billion in 2025 and is expected to grow to USD 70.3 billion by 2034, registering a CAGR of 6.8%. This growth is driven by rising demand for voltage regulation systems, harmonic filters, and power monitoring solutions across industrial and commercial applications.

Power quality equipment refers to a range of devices and systems designed to maintain, monitor, and improve the electrical power supplied to end-users. These solutions are essential for minimizing disruptions caused by voltage sags, surges, harmonics, transients, and other power-related anomalies that can damage sensitive electronic equipment or reduce energy efficiency.

This category includes uninterruptible power supplies, voltage regulators, harmonic filters, power conditioning systems, surge protectors, and monitoring instruments, all of which work together to ensure stable and reliable power delivery across industrial, commercial, and residential settings.

The global power quality equipment market has grown significantly due to the rising dependence on electronic devices and automated systems across multiple industries. As manufacturing plants, data centers, and smart infrastructure demand uninterrupted and distortion-free power, the role of power quality solutions has become increasingly vital. This growth is also driven by the expansion of renewable energy integration and the complexity it brings to electrical grids, requiring robust voltage control, load balancing, and harmonic suppression solutions to maintain consistent power standards.

In addition, increased investments in power distribution networks, along with regulatory mandates promoting energy efficiency and grid stability, are propelling market expansion. The surge in electric vehicle infrastructure, growing deployment of industrial automation, and proliferation of IoT devices have heightened the need for advanced power monitoring and protection systems. As emerging economies continue to upgrade their grid systems and digitize utility infrastructure, the demand for comprehensive power conditioning and control equipment is expected to remain strong in the coming years.

The US Power Quality Equipment Market

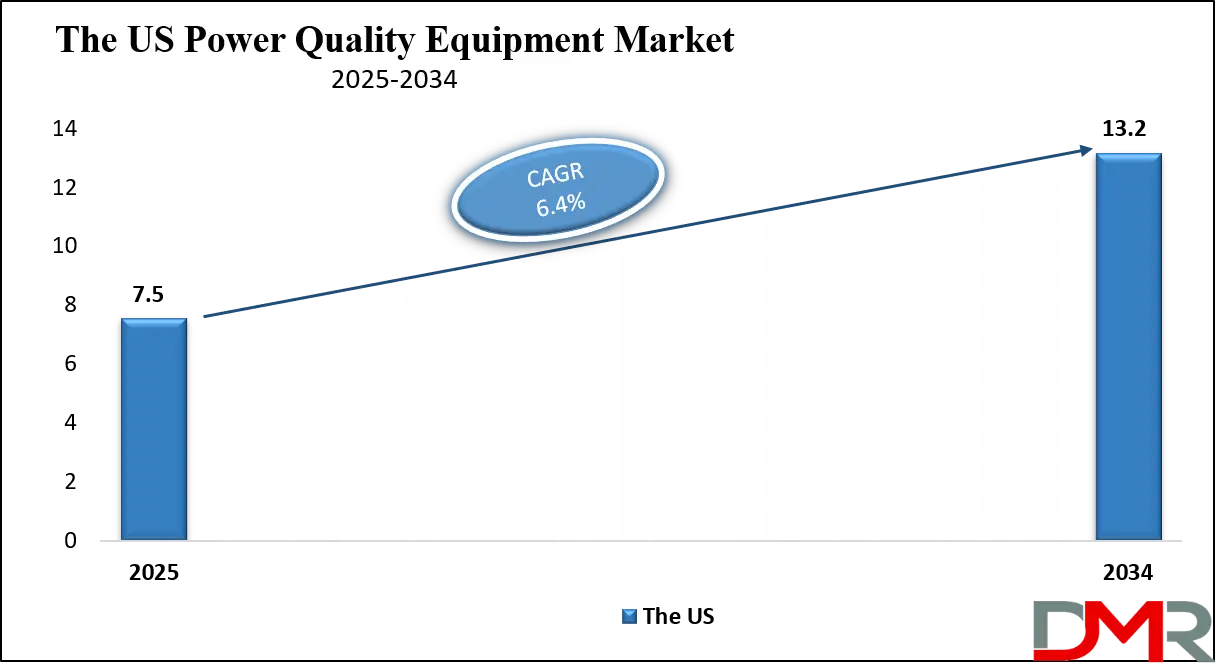

The U.S. Power Quality Equipment market size is projected to be valued at USD 7.5 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.2 billion in 2034 at a CAGR of 6.4%.

The US power quality equipment market is witnessing substantial growth driven by the growing adoption of sensitive electronic devices, automation systems, and smart grid technologies across various industries. With the rising need for uninterrupted power supply in data centers, manufacturing plants, and healthcare facilities, demand for advanced power conditioning solutions such as uninterruptible power supplies (UPS), voltage regulators, and surge protection devices is accelerating.

Moreover, the growing penetration of renewable energy sources like solar and wind into the national grid is adding complexity to power distribution, thereby boosting the need for equipment that can stabilize voltage fluctuations, suppress harmonics, and improve power factor performance.

Additionally, strict regulatory frameworks by organizations such as the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) are promoting energy-efficient electrical infrastructure, further propelling the market. The integration of electric vehicles (EVs), expansion of smart buildings, and investment in grid modernization initiatives are encouraging the deployment of real-time power quality monitoring systems, load control devices, and harmonic suppression technologies.

As industries prioritize operational reliability and reduced downtime, the US remains a key market for innovative power quality solutions catering to both legacy infrastructure and next-generation energy systems.

Europe Power Quality Equipment Market

The Europe power quality equipment market is projected to reach a valuation of USD 8.9 billion in 2025, reflecting the region’s growing emphasis on reliable power infrastructure and sustainable energy systems. As industries in Europe accelerate the adoption of renewable energy sources, the need for power conditioning, voltage regulation, and harmonic suppression equipment is rising steadily. Utilities and industrial plants are increasingly deploying uninterruptible power supplies (UPS), power factor correction units, and surge protection devices to ensure seamless operations and avoid costly downtimes.

Additionally, the rollout of smart grids and the growing digitalization of industrial processes have further intensified the demand for advanced power quality management solutions across the region. With a CAGR of 5.6% from 2025 to 2034, the market is expected to experience stable and sustained growth, supported by government initiatives aimed at modernizing energy infrastructure and improving energy efficiency standards. Countries like Germany, the UK, and France are investing in upgrading aging electrical networks, which is boosting the deployment of power quality equipment in both urban and semi-urban regions.

Moreover, the shift toward electrification in transportation and the integration of EV charging infrastructure are contributing to voltage fluctuation challenges, thereby reinforcing the need for robust power quality solutions. The region’s regulatory framework and proactive stance on grid stability are anticipated to keep driving the market forward through the forecast period.

Japan Power Quality Equipment Market

Japan's power quality equipment market is estimated to be valued at USD 1.7 billion in 2025, driven by the country’s continued investments in grid modernization and resilience. The nation's vulnerability to natural disasters such as earthquakes and typhoons has necessitated the integration of highly reliable power infrastructure, including advanced surge protection, voltage regulation, and power backup systems.

Moreover, Japan’s energy sector is undergoing a gradual but steady transformation with increased adoption of renewable sources like solar and wind, which often introduce power quality challenges such as harmonics, voltage sags, and flickers, amplifying the need for specialized equipment. Key industries including manufacturing, data centers, and transportation are prioritizing power stability to maintain operational efficiency.

With a projected CAGR of 8.7% from 2025 to 2034, Japan’s market is poised for robust growth, significantly outpacing several developed economies. Government support for energy security, the deployment of smart energy management systems, and the growing integration of electric vehicles and distributed energy resources are collectively fueling demand for power quality equipment.

The corporate sector is also actively investing in energy efficiency and power conditioning technologies to align with Japan’s carbon neutrality goals. As urban infrastructure continues to digitize and the population relies more heavily on uninterrupted electrical systems, the country will remain a vital market for innovative and compact power quality solutions throughout the forecast period.

Global Power Quality Equipment Market: Key Takeaways

- Market Value: The global power quality equipment market size is expected to reach a value of USD 70.3 billion by 2034 from a base value of USD 39.0 billion in 2025 at a CAGR of 6.8%.

- By Equipment Type Segment Analysis: UPS is anticipated to dominate the equipment type segment, capturing 15.0% of the total market share in 2025.

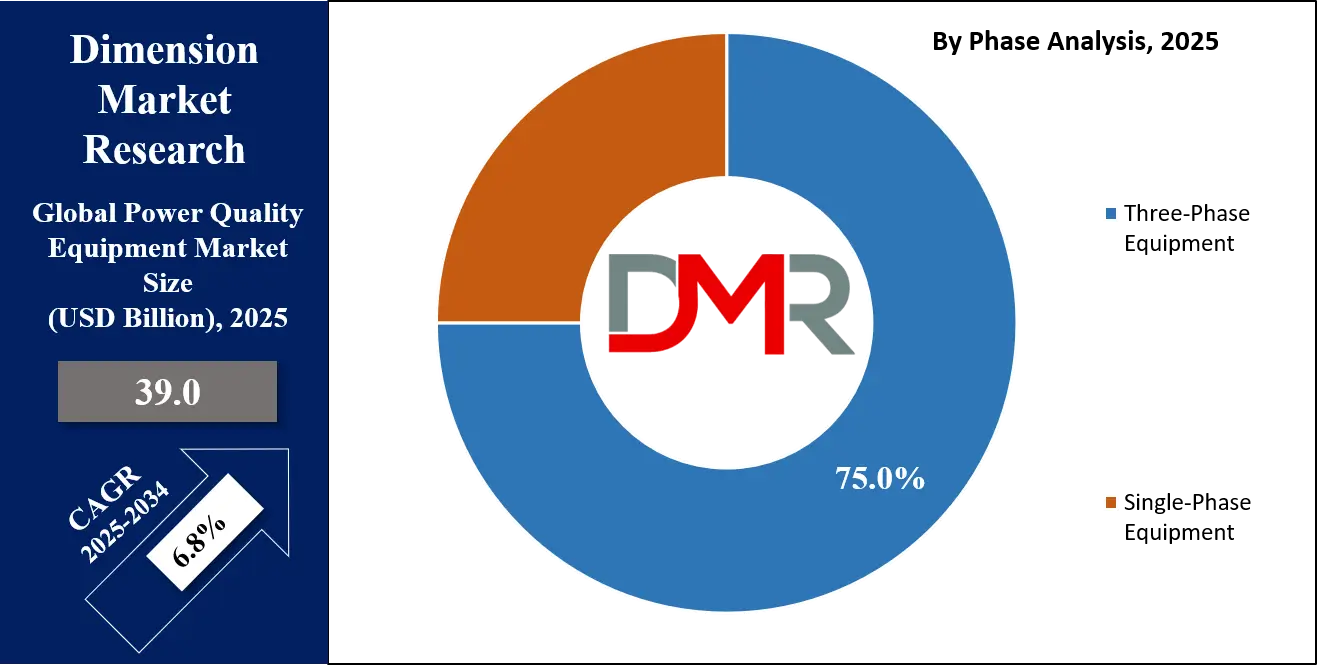

- By Phase Segment Analysis: Three‑Phase is expected to maintain its dominance in the phase segment, capturing 75.0% of the total market share in 2025.

- By Sales Channel Segment Analysis: Direct sales channels are poised to consolidate their dominance in the sales channel segment, capturing 81.0% of the market share in 2025.

- By Application Segment Analysis: Power Monitoring & Control applications will hold the maximum market share in the application segment, capturing 22.0% of the market share in 2025.

- By End-User Segment Analysis: The Industrial users will dominate the end-user segment, capturing 19.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global power quality equipment market landscape with 43.0% of total global market revenue in 2025.

- Key Players: Some key players in the global power quality equipment market are Schneider Electric, ABB Ltd., Eaton Corporation, Siemens AG, General Electric (GE), Toshiba Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Legrand SA, Hitachi Energy, Vertiv Group Corp., AMETEK Inc., Hubbell Incorporated, and Others.

Global Power Quality Equipment Market: Use Cases

- Data Centers and IT Infrastructure: With the explosive growth of cloud computing, digital services, and AI applications, data centers require highly reliable and clean power to ensure 24/7 uptime. Power quality equipment like UPS systems, harmonic filters, and static transfer switches are critical for minimizing voltage sags, transients, and frequency variations. Even minor disruptions can lead to significant downtime and data loss. Advanced power monitoring systems are increasingly deployed in hyperscale and colocation facilities to enhance load control, optimize energy efficiency, and protect mission-critical hardware.

- Industrial Automation and Manufacturing Plants: Modern industrial environments operate with complex machinery, robotics, and programmable logic controllers (PLCs) that are sensitive to electrical disturbances. Power quality equipment such as voltage regulators, power factor correction units, and surge protection devices are essential to prevent costly equipment failures and unplanned downtime. Industries like automotive, metal processing, and food & beverage manufacturing use real-time power monitoring and conditioning solutions to ensure consistent power supply and maintain productivity under varying load conditions.

- Renewable Energy Integration: The integration of solar panels, wind turbines, and energy storage systems into existing power grids introduces variability and power quality challenges. Inverters, frequency converters, and harmonic suppression devices are used to stabilize output and reduce voltage fluctuations. Power quality equipment plays a crucial role in balancing grid load, managing reactive power, and ensuring compatibility with legacy grid infrastructure. Utilities and energy service companies are increasingly deploying smart power quality analyzers to monitor performance and grid health in real-time.

- Commercial Buildings and Smart Infrastructure: Modern commercial spaces, including hospitals, malls, and office complexes, are adopting smart building systems that rely on stable and efficient power. Lighting control systems, HVAC units, elevators, and communication networks all require protection from electrical noise, spikes, and voltage dips. Power conditioners, surge arresters, and energy measurement tools help maintain optimal performance while supporting sustainability goals. Building owners are investing in integrated power quality solutions to improve energy savings, equipment lifespan, and occupant safety.

Impact of Artificial Intelligence on Power Quality Equipment Market

Artificial Intelligence (AI) is transforming the power quality equipment market by enabling smarter, predictive, and more adaptive energy management systems. With the growing complexity of modern electrical grids and increased integration of distributed energy resources, AI-powered solutions are enhancing the ability to detect, analyze, and respond to power disturbances in real time. Intelligent power quality analyzers and monitoring devices now utilize machine learning algorithms to identify patterns, predict potential faults, and optimize load balancing, thereby reducing downtime and improving overall power reliability.

AI is also playing a vital role in predictive maintenance of power quality equipment such as UPS systems, harmonic filters, and voltage regulators. By analyzing historical and real-time data, AI models can forecast equipment failures before they occur, minimizing costly disruptions and extending the lifecycle of critical infrastructure.

Moreover, in industrial and commercial environments, AI-driven control systems are helping optimize power factor correction, manage reactive power, and automatically adjust voltage levels based on dynamic load conditions. As the adoption of AI accelerates, it is reshaping how utilities, data centers, and manufacturing facilities manage power quality, driving demand for intelligent, self-learning, and data-integrated power quality solutions.

Global Power Quality Equipment Market: Stats & Facts

United States – U.S. Energy Information Administration (EIA), Department of Energy (DOE), Grid Strategies, Deloitte, ASCE

- In 2023, U.S. electric utilities' total spending reached USD 320 billion, marking a 12% rise from USD 287 billion in 2003.

- In 2023–2024, the DOE’s Grid Deployment Office disbursed USD 1.3 billion in funding across three high-voltage transmission lines, adding around 3.5 GW of grid capacity.

- In the same period, CAISO committed USD 6 billion, SPP committed USD 7 billion, and BPA announced USD 3 billion for regional transmission development and capacity growth.

- U.S. electricity demand increased by 1.8% in 2024, reversing a 1.7% decline recorded during the same period in 2023.

- In 2023, the U.S. added 18.4 GW of new solar energy capacity.

- In 2024, U.S. solar capacity additions surged to 36 GW, nearly doubling from 2023.

- U.S. battery storage capacity expanded from 15.5 GW in 2023 to 29.8 GW in 2024, adding 14.3 GW in one year.

- As of 2022 (reported in 2023), the U.S. had 80.58 GW of conventional hydropower and 22 GW of pumped-storage hydropower capacity.

India – Ministry of Power (India)

- As of March 31, 2025, India’s total installed power generation capacity stood at 467.885 GW.

- Out of the total, renewables including large hydro accounted for 46.3%, reflecting significant policy momentum.

- Thermal power still dominates with around 56% of the total grid capacity as of early 2025.

- India aims to install 500 GW of non-fossil fuel capacity by 2030, and it is on track, having crossed the 370 GW mark by end of 2024.

European Union – Eurostat & ENTSO-E

- In 2023, the EU derived 23.2% of total electricity from wind and solar energy.

- The total installed electricity generation capacity across the EU-27 reached 1,020 GW in 2024.

- Germany, France, and Spain accounted for more than 45% of the EU’s total renewable generation in 2024.

- Grid-related investments across the EU reached €55 billion in 2024, marking a 20% rise from 2022.

- Smart grid funding under EU Recovery and Resilience Plans totaled over €12 billion by end of 2024.

Japan – Ministry of Economy, Trade and Industry (METI)

- Japan’s total installed power generation capacity stood at 297 GW in 2024, with renewables accounting for 26.5%.

- METI projected a 10.5% growth in smart grid deployment investment between 2023 and 2025.

- Japan aims to raise its renewable share to 38% by 2030, supported by significant upgrades to grid monitoring and control equipment.

- Government funding for grid digitalization and power quality systems exceeded ¥280 billion between 2023 and 2025.

International Energy Agency (IEA)

- In 2024, global energy investment crossed USD 3 trillion for the first time in history.

- Of this total, around USD 2 trillion was directed towards clean energy technologies and infrastructure.

- Grid modernization and power quality management accounted for nearly USD 150 billion of the clean energy spend.

- Electric grid investment grew at 8.1% CAGR globally between 2023 and 2025, according to IEA data.

- The share of digital infrastructure in grid investments increased from 15% in 2023 to 22% in 2025.

United Kingdom – Ofgem & UK Department for Energy Security and Net Zero

- By 2024, the UK had allocated £22 billion to grid resilience and quality programs under its Strategic Innovation Fund.

- 2025 targets include achieving zero grid outages longer than 3 minutes in critical zones through AI and sensor-based fault detection.

- Renewable energy contribution to total electricity generation reached 48% in 2024, up from 43.3% in 2023.

Global Power Quality Equipment Market: Market Dynamics

Global Power Quality Equipment Market: Driving Factors

Surge in Demand for Reliable and Uninterrupted Power Supply

The growing reliance on digital technologies, automation, and connected devices across industries is significantly driving the need for stable and high-quality power. Power quality equipment like UPS systems, voltage stabilizers, and surge protectors are being widely deployed in data centers, healthcare facilities, and manufacturing plants to prevent outages and protect sensitive electronics. This demand is amplified by the growing usage of smart devices and IoT infrastructure, where even minor electrical disturbances can lead to system failures.

Expansion of Industrial and Infrastructure Projects Globally

Rapid industrialization in emerging economies, integrated with the modernization of existing grid infrastructure, is accelerating the adoption of advanced power conditioning systems. Countries investing in renewable energy integration, smart grid development, and electric vehicle charging infrastructure are increasingly deploying harmonic filters, static VAR compensators, and energy monitoring systems to maintain voltage stability and grid efficiency.

Global Power Quality Equipment Market: Restraints

High Initial Investment and Maintenance Costs

Despite long-term efficiency gains, the upfront cost of installing advanced power quality systems can be prohibitive, particularly for small and medium enterprises. Equipment like dynamic voltage restorers and smart power analyzers often require customized installation, continuous monitoring, and periodic maintenance, which increases total cost of ownership and slows market penetration in cost-sensitive regions.

Limited Awareness in Developing Markets

In several developing countries, lack of awareness regarding the impact of poor power quality on equipment performance and energy efficiency continues to hinder adoption. Many end-users rely on basic protection systems, underestimating the long-term benefits of comprehensive power quality solutions such as load control devices and real-time monitoring systems.

Global Power Quality Equipment Market: Opportunities

Integration of AI and IoT in Power Quality Solutions

The convergence of artificial intelligence and IoT with power quality equipment is opening new avenues for predictive analytics, remote monitoring, and automated fault detection. Smart UPS units, cloud-based power analyzers, and machine-learning-powered voltage control systems are gaining traction, particularly in critical infrastructure sectors like telecom, banking, and industrial automation.

Rising Focus on Renewable Energy and Smart Grids

As the shift toward decentralized energy systems accelerates, there is growing demand for equipment that can stabilize power from renewable sources like solar and wind. Power quality solutions are essential to address issues such as voltage fluctuations, harmonics, and frequency instability in smart grid applications. This is creating strong growth potential in markets investing heavily in clean energy and digital substations.

Global Power Quality Equipment Market: Trends

Increasing Adoption of Modular and Scalable Solutions

End-users are increasingly preferring modular power quality systems that offer scalability and flexibility. Modular UPS systems, plug-and-play surge suppressors, and configurable voltage regulators allow businesses to expand capacity based on demand, reducing the need for overinvestment and enabling efficient space utilization in data centers and commercial facilities.

Shift toward Energy-Efficient and Eco-Friendly Equipment

Growing environmental concerns and stringent energy regulations are pushing manufacturers to design energy-efficient power quality products. Devices with low standby losses, high power factor efficiency, and minimal harmonic distortion are being prioritized across industrial and commercial applications. This aligns with global sustainability goals and helps reduce energy costs while ensuring grid reliability.

Global Power Quality Equipment Market: Research Scope and Analysis

By Equipment Type Analysis

In the power quality equipment market, uninterruptible power supplies (UPS) are projected to lead the equipment type segment, accounting for 15.0% of the total market share in 2025. This dominance is driven by the growing need for continuous power supply across critical applications such as data centers, healthcare facilities, and industrial automation systems. UPS systems are essential for preventing power interruptions, voltage dips, and data loss during outages, making them a core component of modern power infrastructure. Their integration with advanced battery technologies, smart monitoring, and remote diagnostics further enhances their appeal across sectors that require high reliability and real-time protection against power disturbances.

Surge protection devices also play a crucial role within the equipment type segment, addressing a different but equally important aspect of power quality. These devices are designed to shield sensitive electrical equipment from voltage spikes caused by lightning strikes, switching operations, or grid disturbances. With the growing use of electronics and smart systems in both residential and commercial environments, the demand for surge protectors has surged.

Industries such as telecommunications, banking, and manufacturing rely heavily on surge protection to avoid operational disruption and equipment damage. The growing awareness of power-related risks and compliance with safety standards are further encouraging the adoption of surge protection devices across global markets.

By Phase Analysis

In the phase segment of the power quality equipment market, three-phase systems are anticipated to maintain a dominant position, accounting for approximately 75.0% of the total market share in 2025. This dominance is largely attributed to the widespread use of three-phase power in industrial and commercial facilities, where high power loads and heavy machinery require stable and efficient energy distribution.

Three-phase systems offer better power density, reduced conductor material costs, and improved efficiency, making them ideal for large-scale operations such as manufacturing plants, data centers, and infrastructure projects. Their ability to handle higher loads with minimal voltage fluctuations contributes to the growing demand for advanced three-phase power quality equipment like voltage regulators, harmonic filters, and uninterruptible power supplies tailored for industrial use.

On the other hand, single-phase systems continue to play a significant role, particularly in residential and light commercial applications. These systems are typically used for lower load requirements such as household appliances, small offices, and standalone equipment. Although they represent a smaller portion of the overall market share, the adoption of single-phase power quality equipment is steadily growing in developing regions where residential electrification is expanding.

Devices like single-phase surge protectors, voltage stabilizers, and compact UPS systems are commonly deployed to improve energy reliability in areas prone to voltage fluctuations or inconsistent grid performance. As urbanization and small business growth continue, the need for cost-effective single-phase power solutions remains relevant.

By Sales Channel Analysis

Direct sales channels are expected to retain a dominant hold over the power quality equipment market, capturing approximately 81.0% of the total market share in 2025. This strong position is largely due to the preference of large-scale buyers such as utility companies, industrial players, and data centers to engage directly with manufacturers for customized solutions, after-sales support, and long-term service agreements.

Direct sales enable manufacturers to maintain control over pricing, customer relationships, and technical specifications, which is particularly important in projects requiring tailored installation, maintenance, or integration with existing electrical infrastructure. As power quality equipment often involves complex configurations like three-phase UPS systems, harmonic filters, and voltage correction devices, end users tend to rely on direct channels for in-depth consultation, warranties, and reliability.

Distributors and channel partners, while holding a smaller share, still play a vital role in expanding market reach, especially in small and mid-sized business segments or emerging regions. These intermediaries are essential for improving product availability and local service capabilities, particularly where direct manufacturer presence is limited.

Channel partners help in navigating regional regulatory standards, offering stock availability, and managing logistics efficiently. For products like surge protectors, single-phase stabilizers, or compact power monitoring units, distributors provide a more accessible purchasing option for residential and small commercial buyers. As awareness of power quality increases in less industrialized markets, the contribution of channel partners is expected to grow steadily, supporting market penetration across diverse geographies.

By Application Analysis

Power monitoring and control applications are projected to lead the application segment of the power quality equipment market, capturing 22.0% of the total market share in 2025. This growth is driven by the growing need for real-time visibility into energy consumption, voltage conditions, and system performance across critical infrastructure.

Power monitoring systems help identify inefficiencies, prevent equipment failure, and optimize energy usage, which is particularly important in sectors such as manufacturing, data centers, and commercial facilities. These applications enable better load management, predictive maintenance, and compliance with energy regulations. With the integration of IoT-enabled sensors and advanced analytics, power monitoring and control solutions are becoming smarter and more essential for improving overall electrical system reliability.

Voltage regulation, on the other hand, plays a crucial role in maintaining consistent voltage levels within acceptable limits, regardless of load changes or supply fluctuations. This function is vital for the smooth operation of sensitive equipment in industries like healthcare, telecommunications, and precision manufacturing. Voltage regulators ensure that electronic systems are protected from under-voltage or over-voltage scenarios, reducing the risk of malfunction or damage.

In regions with unstable grid infrastructure or frequent power disturbances, voltage regulation equipment like automatic voltage regulators (AVRs) and static VAR compensators are increasingly being adopted. As energy consumption patterns evolve with the rise of electric vehicles and distributed energy resources, the demand for reliable voltage regulation solutions continues to gain momentum.

By End-User Segment Analysis

Industrial users are set to lead the end-user segment of the power quality equipment market, capturing 19.0% of the market share in 2025. This dominance is primarily driven by the critical need for uninterrupted and high-quality power in industries such as manufacturing, oil and gas, mining, and heavy machinery. These sectors rely heavily on equipment that is highly sensitive to voltage fluctuations, harmonics, and power interruptions.

As a result, industries are increasingly investing in solutions like uninterruptible power supplies (UPS), harmonic filters, and voltage regulators to ensure operational efficiency, avoid costly downtimes, and meet production targets. Moreover, the trend toward automation, smart factories, and digital transformation is further amplifying the demand for advanced power quality solutions that can support high-load, continuous operations.

In the commercial segment, the demand for power quality equipment is also rising steadily, driven by the growing reliance on electronic systems across office buildings, shopping malls, hospitals, and data centers. Commercial users are particularly vulnerable to power disturbances that can affect computers, HVAC systems, elevators, and security infrastructure.

To address these challenges, businesses are increasingly deploying surge protection devices, power conditioners, and monitoring systems. With the expansion of cloud services, e-commerce, and digital payments, data integrity and power reliability are becoming non-negotiable in the commercial space. As a result, power quality solutions are being integrated into building management systems and energy efficiency strategies, making them a key enabler of operational continuity and service quality.

The Power Quality Equipment Market Report is segmented on the basis of the following:

By Equipment Type

- UPS (Uninterruptible Power Supply)

- Surge Protection Devices

- Voltage Regulators

- Power Quality Meters

- Harmonic Filters

- Static VAR Compensators

- Digital Static Transfer Switches

- Power Conditioners

- Isolation Transformers

- Power Distribution Units (PDU)

- Solid-State Switches

- Dynamic Voltage Restorers (DVR)

By Phase

By Sales Channel

- Direct Sales (OEMs)

- Distributors & Channel Partners

- System Integrators

- E-commerce

By Application

- Power Monitoring & Control

- Voltage Regulation

- Harmonic Suppression

- Power Factor Correction

- Overvoltage Protection

- Energy Measurement

- Load Control

By End-User

- Industrial

- Manufacturing

- Oil & Gas

- Mining

- Metals

- Automotive

- Heavy Engineering

- Commercial

- Data Centers

- IT & Telecom

- Corporate Offices

- Banking & Financial Institutions

- Residential

- Utilities

- Power Generation

- Power Transmission

- Power Distribution

- Healthcare Facilities

- Transportation

- Government and Military

Global Power Quality Equipment Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to maintain a leading position in the global power quality equipment market, capturing approximately 43.0% of the total market revenue in 2025. This dominance is primarily driven by rapid industrialization, expanding manufacturing bases, and growing investments in renewable energy infrastructure across key countries like China, India, Japan, and South Korea.

Additionally, growing demand for uninterrupted power supply in sectors such as data centers, telecommunications, and transportation is fostering the need for advanced power quality solutions in the region. Government initiatives promoting energy efficiency and grid modernization further contribute to the region’s strong market performance.

Region with significant growth

North America is expected to witness significant growth in the power quality equipment market during the forecast period, driven by growing demand for reliable and efficient power infrastructure across various industries. The rising integration of renewable energy sources, expansion of smart grid technologies, and growing concerns over equipment downtime in sectors such as healthcare, manufacturing, and IT are propelling the adoption of advanced power quality solutions. Additionally, government incentives and regulatory mandates focused on energy efficiency and grid reliability are further accelerating market growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Power Quality Equipment Market: Competitive Landscape

The global competitive landscape of the power quality equipment market is characterized by the presence of several established players and a growing number of niche technology providers, each striving to expand their market presence through innovation, strategic collaborations, and geographic expansion. Leading companies like Schneider Electric, ABB, Siemens, Eaton, and General Electric dominate the market with comprehensive product portfolios and robust global distribution networks. These firms are heavily investing in research and development to integrate smart technologies, IoT, and AI-driven monitoring systems into their offerings, enhancing system efficiency and predictive maintenance capabilities.

Meanwhile, regional players and specialized manufacturers are focusing on cost-effective, application-specific solutions tailored for emerging markets. The growing emphasis on energy efficiency regulations, grid modernization, and electrification of industries is further intensifying competition, prompting firms to differentiate themselves through customization, service offerings, and strong after-sales support.

Some of the prominent players in the global power quality equipment market are:

- Schneider Electric

- ABB Ltd.

- Eaton Corporation

- Siemens AG

- General Electric (GE)

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Legrand SA

- Hitachi Energy

- Vertiv Group Corp.

- AMETEK Inc.

- Hubbell Incorporated

- Acumentrics

- Active Power (Piller Group)

- MTE Corporation

- Socomec

- Power Quality International

- Smiths Interconnect

- Raycap

- Other Key Players

Global Power Quality Equipment Market: Recent Developments

- July 2025: GE Vernova announced plans to acquire French AI company Alteia, aiming to enhance its GridOS Visual Intelligence solution by adding improved visual and operational data analytics for utility grid monitoring and inspection.

- July 2025: Quality Power Electrical Equipments and Yash Highvoltage signed a binding agreement to jointly acquire Sukrut Electric Company, a Pune-based transformer components manufacturer, from a German multinational, aiming to modernize and scale its offerings globally.

- July 2025: The South Australian government unveiled a USD 20 million funding program to help small and medium-sized businesses invest in energy-efficient equipment, such as batteries and solar systems, with grants of up to USD 75,000 to cut power bills and enhance energy sustainability.

- June 2025: Siemens Energy reported replacing an €11 billion government-backed funding facility originally established in 2023. The move signifies improved financial stability, boosting margins, cash flow, and laying the groundwork to resume dividends from fiscal 2026.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 39.0 Bn |

| Forecast Value (2034) |

USD 70.3 Bn |

| CAGR (2025–2034) |

6.8% |

| The US Market Size (2025) |

USD 7.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Equipment Type (UPS, Surge Protection Devices, Voltage Regulators, Power Quality Meters, Harmonic Filters, Static VAR Compensators, Digital Static Transfer Switches, Power Conditioners, Isolation Transformers, Power Distribution Units (PDU), Solid-State Switches, Dynamic Voltage Restorers (DVR)), By Phase (Single-Phase and Three-Phase), By Sales Channel (Direct Sales (OEMs), Distributors & Channel Partners, System Integrators, and E-commerce), By Application (Power Monitoring & Control, Voltage Regulation, Harmonic Suppression, Power Factor Correction, Overvoltage Protection, Energy Measurement, and Load Control), and By End-User (Industrial, Commercial, Residential, Utilities, Healthcare Facilities, Transportation, Government and Military)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schneider Electric, ABB Ltd., Eaton Corporation, Siemens AG, General Electric (GE), Toshiba Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Legrand SA, Hitachi Energy, Vertiv Group Corp., AMETEK Inc., Hubbell Incorporated, and Others

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |