Market Overview

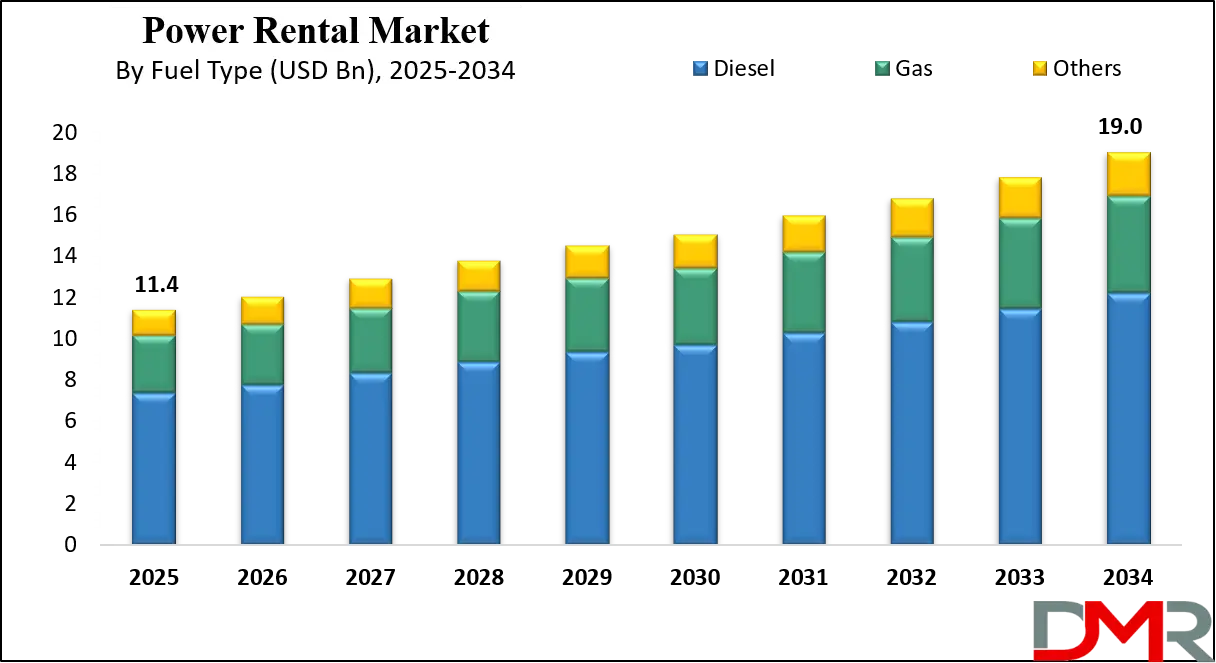

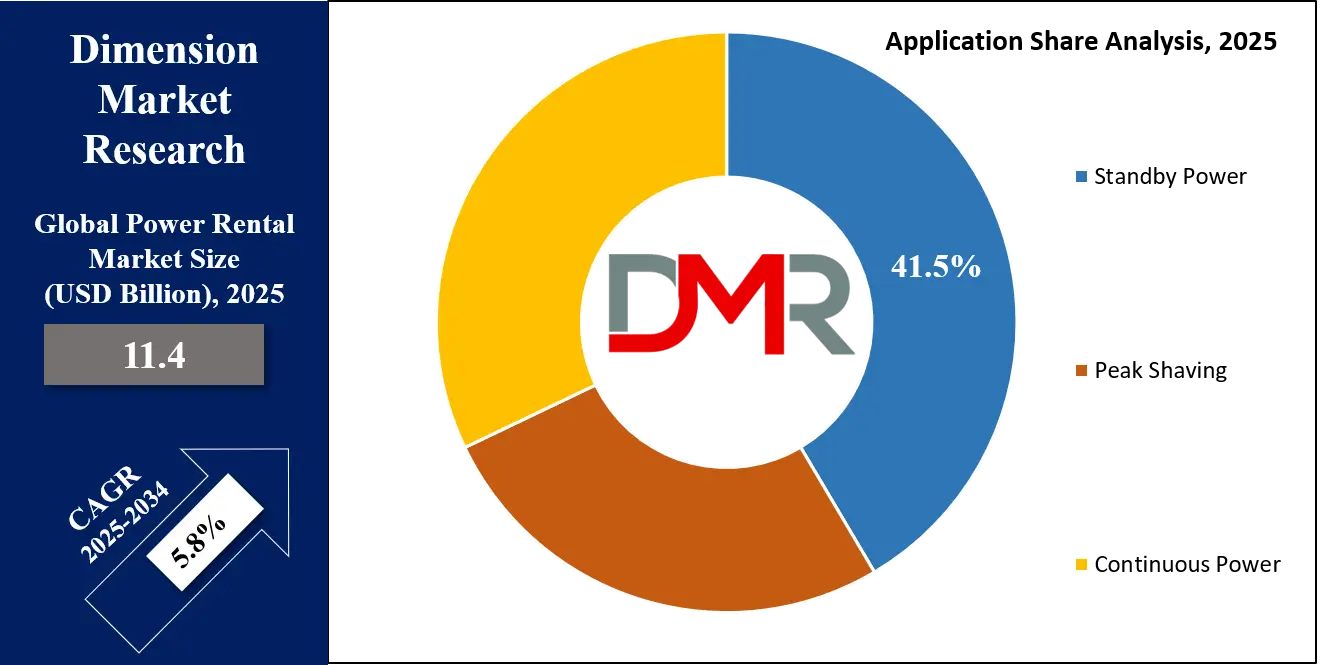

The Global Power Rental Market size is projected to reach USD 11.4 billion in 2025 and grow at a compound annual growth rate of 5.8% from there until 2034 to reach a value of USD 19.0 billion.

.Power rental refers to the temporary use of power generation equipment like diesel or gas generators, load banks, or transformers to supply electricity when the main power source is unavailable or insufficient. These solutions are typically used during emergencies, peak load periods, planned maintenance, or at remote locations without grid access. Companies, government bodies, event organizers, and construction firms often rent these units instead of purchasing them, as it offers flexibility, speed, and lower upfront costs.

The demand for power rental has been rising steadily due to several global factors. One of the key drivers is the increasing frequency of natural disasters, which damage electrical infrastructure and lead to power outages. In such cases, power rental becomes a quick fix to restore electricity to essential services like hospitals, water facilities, and emergency response units. In addition, growing infrastructure projects in developing nations often need temporary power, especially in rural or underdeveloped areas where grid access is limited or unreliable.

Another major driver is the rising need for continuous electricity in industries such as oil & gas, mining, and construction, which often operate in remote locations. These industries rely on rental power to keep operations running smoothly without investing in permanent setups. Moreover, the rising demand for stable power during public events, concerts, festivals, and large-scale gatherings has also contributed to the growth of the rental power sector.

In recent years, several important developments have shaped the power rental market. Many companies have shifted towards using gas-powered and hybrid generators that are more environment-friendly than traditional diesel units. There's also a growing trend of integrating digital monitoring tools that allow for remote operation and better fuel management. These innovations help reduce downtime, increase efficiency, and lower emissions, making power rental more appealing for eco-conscious clients.

Furthermore, global events such as the COVID-19 pandemic and regional energy crises have highlighted the importance of backup power solutions. During the pandemic, temporary medical facilities and isolation centers needed quick and reliable power. Similarly, countries facing energy shortages have relied on rental solutions to meet urgent power demands without the delay of building new permanent capacity.

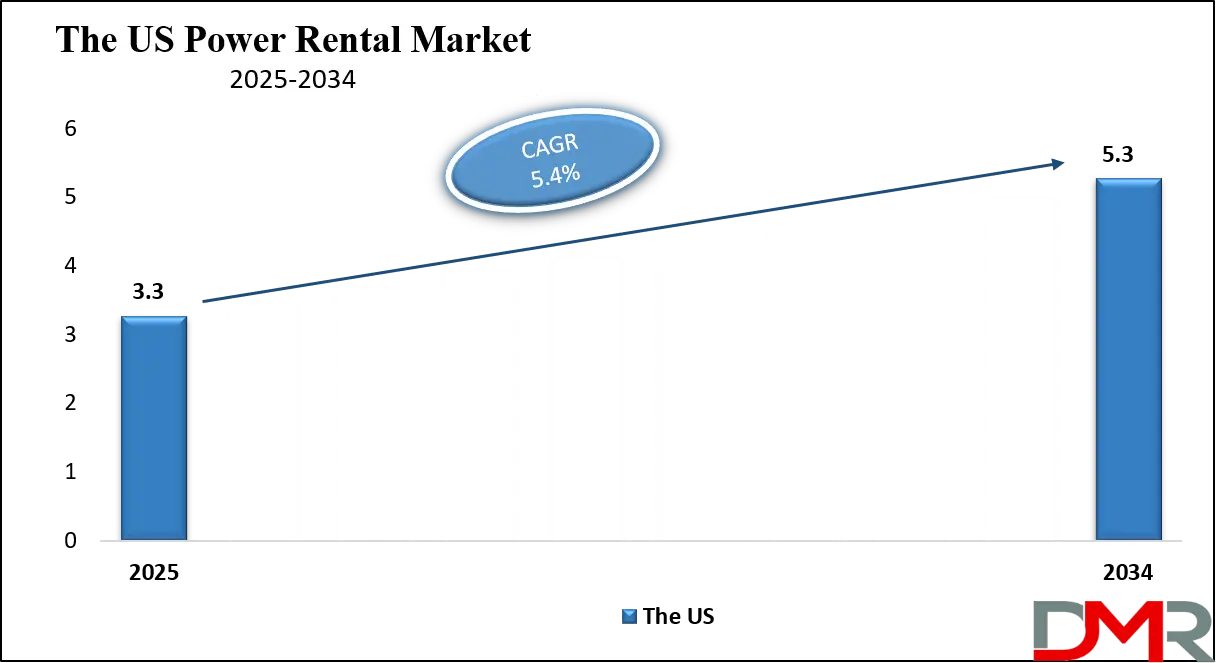

The US Power Rental Market

The US Power Rental Market size is projected to reach USD 3.3 billion in 2025 at a compound annual growth rate of 5.4% over its forecast period.

The US plays a major role in the global power rental market due to its strong demand across various sectors like construction, oil and gas, utilities, and disaster response. Frequent weather-related events such as hurricanes and wildfires create a consistent need for emergency power solutions. The country also has a large number of infrastructure and industrial projects requiring temporary power setups.

Additionally, the US is a leader in adopting hybrid and low-emission rental technologies, driven by stringent environmental regulations. Advanced digital tools for fleet monitoring and remote management are widely used by rental providers in the US, setting global standards. With a mature rental ecosystem and innovation-led approach, the US continues to influence trends and growth in the global power rental industry.

Europe Power Rental Market

Europe Power Rental Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 5.7% over its forecast period.

Europe holds a significant position in the power rental market, driven by its focus on clean energy, strict environmental standards, and increasing infrastructure upgrades. Many countries in Europe are phasing out older, polluting power systems, encouraging rental solutions that use gas or hybrid technologies. The region also sees steady demand for temporary power in events, industrial projects, and seasonal energy peaks. Frequent maintenance and upgrades of aging grid infrastructure often require temporary backup power, further supporting the rental market.

Additionally, Europe's push for digitization has led to greater use of smart monitoring and energy management tools in rental equipment. With a strong emphasis on sustainability and innovation, Europe continues to shape the transition toward greener, more efficient rental power solutions across industries.

Japan Power Rental Market

Japan Power Rental Market size is projected to reach USD 0.5 billion in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Japan plays a key role in the power rental market, largely driven by its vulnerability to natural disasters such as earthquakes and typhoons, which create a strong need for emergency and backup power. The country also relies on temporary power solutions during grid maintenance, infrastructure upgrades, and large-scale public events. Following the Fukushima nuclear disaster, Japan has focused more on diversified energy sources, including rental power as a flexible option.

The country places high value on energy efficiency and low emissions, pushing the adoption of advanced, cleaner generator technologies. Japan’s strong technological base supports the use of digital tools for remote monitoring and fleet management. With its focus on reliability, innovation, and rapid response, Japan remains a critical market for power rental solutions.

Power Rental Market: Key Takeaways

- Market Growth: The Power Rental Market size is expected to grow by USD 7.0 billion, at a CAGR of 5.8%, during the forecasted period of 2026 to 2034.

- By Fuel Type: The Diesel segment is anticipated to get the majority share of the Power Rental Market in 2025.

- By Application: The Standby power segment is expected to get the largest revenue share in 2025 in the Power Rental Market.

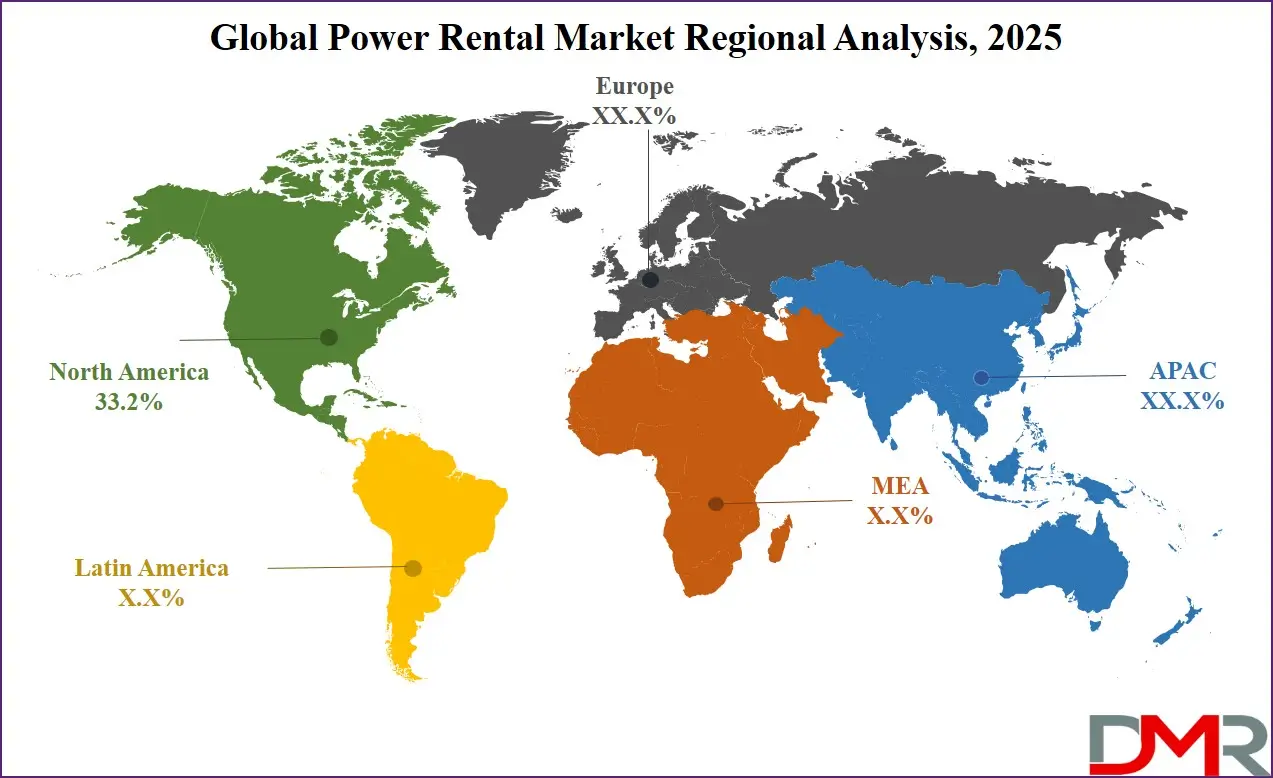

- Regional Insight: North America is expected to hold a 33.2% share of revenue in the Global Power Rental Market in 2025.

- Use Cases: Some of the use cases of Power Rental include construction sites, events & festivals, and more.

Power Rental Market: Use Cases

- Construction Sites: Construction projects often take place in remote or undeveloped areas where grid power is not available. Power rental ensures that heavy machinery, lighting, and site offices operate smoothly. It also provides flexibility as power needs change throughout different project phases.

- Emergency Power Backup: During natural disasters, power outages, or grid failures, rental power systems offer immediate backup. They help restore electricity to essential services like hospitals, communication networks, and relief shelters. This ensures safety and continuity of critical operations.

- Events and Festivals: Large public gatherings, concerts, and festivals require temporary and reliable power setups. Rental generators power stages, lighting, sound systems, and food stalls. They offer a clean and quiet power source tailored to short-term needs.

- Industrial Operations: Industries like mining, oil and gas, and manufacturing often operate in remote locations. Power rental supports these operations without needing permanent infrastructure. It also helps during equipment maintenance or seasonal demand spikes, ensuring no downtime.

Stats & Facts

- According to IBEF:

- Power Grid Corporation is projected to unlock INR. 2 lakh crore (USD 23.10 billion) in capital expenditure through renewable energy and transmission infrastructure development.

- The PM-Surya Ghar: Muft Bijli Yojana aims to install rooftop solar systems in one crore homes across India, promoting clean energy access and reducing household electricity expenses.

- India is the third-largest producer and consumer of electricity in the world, with an installed power capacity of 442.85 GW as of April 30, 2024. Power consumption grew by 9.5% in FY23, reaching 1,503.65 Billion Units (BU), with further momentum driven by increasing electrification, a growing population, and rising per-capita energy use.

- Insights from the Ministry of Power and IBEF:

- India plans to expand its non-fossil fuel-based electricity generation capacity to over 500 GW by 2031–32, as part of its broader clean energy strategy.

- To reduce coal dependence, 81 thermal plants are scheduled to be converted to renewable energy generation by 2026, addressing supply challenges and supporting decarbonization goals.

- A INR. 9.15 lakh crore (USD 109.50 billion) investment blueprint is underway to strengthen grid infrastructure and meet the expected power demand of 458 GW by 2032.

- According to Motilal Oswal:

- India’s power sector is poised to attract INR. 40 lakh crore (USD 461.95 billion) in investment over the next decade, driven by growing energy needs, infrastructure expansion, and clean energy transition efforts.

- From the 2024 Union Budget:

- Government allocation to the power sector has increased by 50%, with key funding directed toward green hydrogen development, solar power expansion, and building green energy corridors to reach 2030 climate targets.

- As per GEAPP:

- GEAPP is investing INR. 861.10 crore (USD 100 million) to scale up clean energy technologies in India, including artificial intelligence-powered grid optimization projects in Rajasthan.

- Based on the National Electricity Plan (NEP):

- The power generation sector in India will require INR. 33 lakh crore (USD 400 billion) and around 3.78 million skilled professionals by 2032 to meet rising electricity demand across the country.

- As per the National Infrastructure Pipeline 2019–2025:

- Energy sector projects make up 24% of the planned INR. 111 lakh crore (USD 1.4 trillion) capital expenditure, making it the largest investment share across India’s infrastructure development roadmap.

Market Dynamic

Driving Factors in the Power Rental Market

Rising Infrastructure Development and Urban Expansion

The global rise in infrastructure development, especially in emerging economies, is a significant growth driver for the power rental market. Large-scale construction of roads, bridges, commercial buildings, and residential complexes often takes place in areas with limited or no grid access. Power rental solutions offer a flexible and immediate electricity source, supporting continuous work without project delays.

As governments push for smart cities, industrial parks, and modern transportation networks, temporary power needs grow alongside. Power rental is also cost-effective for short-to-medium term projects where investing in permanent setups is not feasible. The ability to scale power supply up or down depending on project phases makes rental options highly attractive. This trend is likely to continue with the rise in global urbanization and infrastructure investment.

Increasing Frequency of Natural Disasters and Power Grid Failures

The growing frequency of extreme weather events—such as hurricanes, floods, and wildfires—has put pressure on power grids and highlighted the need for reliable backup electricity. In many regions, aging electrical infrastructure is also prone to breakdowns, blackouts, and load shedding. Power rental solutions play a crucial role in restoring electricity quickly during such emergencies.

Hospitals, disaster response centers, and water facilities especially rely on temporary power to stay operational. Even during planned maintenance or peak power demands, rental units provide seamless electricity without disrupting services. The ability to deploy generators and support systems rapidly makes them a key part of disaster recovery plans. As climate risks and grid instability rise, so does the demand for dependable rental power solutions.

Restraints in the Power Rental Market

Environmental Concerns and Emission Regulations

One of the major restraints facing the power rental market is the increasing pressure from environmental regulations and sustainability goals. Most rental power systems, especially diesel generators, emit greenhouse gases and pollutants like nitrogen oxides and particulate matter. As countries tighten their emission norms, rental companies are being forced to upgrade or replace existing fleets, which can be costly and time-consuming.

Clients in environmentally sensitive areas may avoid traditional generator rentals altogether. In addition, the public and government push for cleaner energy solutions limits the long-term use of high-emission rental equipment. This shift also means companies must invest in newer, greener technologies, increasing operational costs. These environmental concerns are making it difficult for traditional power rental businesses to grow without adopting cleaner alternatives.

High Operational and Maintenance Costs

Another significant challenge in the power rental market is the high cost associated with maintaining, transporting, and operating rental equipment. Generators and related systems require regular servicing, skilled technicians, and access to quality fuel to ensure reliable performance. Transporting heavy machinery to remote or disaster-hit areas adds further logistical expenses.

Additionally, any breakdowns or delays can lead to customer dissatisfaction and financial penalties. Smaller rental companies often struggle to manage these recurring costs while competing with larger firms offering more competitive pricing. As customer expectations for 24/7 support and real-time monitoring grow, rental providers must invest in advanced tools and staff training, which adds to their overhead. These high operating costs can limit profitability and market expansion for many players.

Opportunities in the Power Rental Market

Shift Toward Renewable and Hybrid Power Solutions

The major global emphasis on sustainability presents a major opportunity for the power rental market to evolve. Customers are mainly looking for cleaner, fuel-efficient alternatives to traditional diesel generators. This opens the door for rental companies to invest in hybrid systems that combine solar, battery storage, and gas-powered generators. These solutions not only reduce emissions but also lower fuel costs and provide quieter operations—making them ideal for urban, remote, or environmentally sensitive areas.

Rental firms that adapt early to this trend can position themselves as eco-friendly partners, gaining a competitive edge. Governments and industries pushing for green energy adoption further support this shift through incentives and project preferences. As renewable technologies become more affordable, demand for such rental systems is expected to rise steadily.

Digitalization and Smart Monitoring Technologies

The integration of digital tools into power rental services is creating new value for both providers and customers. Real-time tracking, remote diagnostics, predictive maintenance, and fuel usage monitoring help improve efficiency and reduce downtime. These smart technologies allow rental companies to offer better service through proactive support and transparent usage data, which enhances customer trust.

Clients can also monitor energy consumption in real time, optimize generator usage, and minimize waste. This data-driven approach is especially useful for complex operations in construction, mining, or events where managing multiple units is critical. The rise of IoT and cloud-based platforms enables even smaller rental firms to deliver intelligent services at lower costs. As industries become more digital-first, tech-enabled rental solutions are becoming a strong market opportunity.

Trends in the Power Rental Market

Growing Adoption of Low-Emission and Hybrid Generator Solutions

A major trend in the power rental market is the rapid shift toward low-emission and hybrid generator systems. Customers across sectors—from cities hosting public events to industries working in sensitive areas—are increasingly demanding cleaner alternatives to traditional diesel units. Providers are responding by adding solar‑plus‑battery and gas‑hybrid sets to their fleets, offering quieter and more eco‑friendly performance.

This not only addresses regulatory concerns but also brings cost savings through reduced fuel use. As awareness of carbon footprints rises, rental companies investing in green technology are finding stronger market positioning and customer trust, making sustainable power rentals a lasting trend.

Smart Fleet Management and Remote Monitoring

Another emerging trend is the use of digital technologies to improve fleet management and service delivery. Rental providers are installing IoT sensors and cloud-based software on generator units to enable real-time remote monitoring of fuel levels, output, and maintenance needs. This allows for predictive servicing and quicker response to potential issues, minimizing downtime for clients. Customers benefit from live usage dashboards and data insights into operational efficiency. Even small rental operators can now compete with larger ones by offering tech-enabled services that enhance reliability and transparency. As digital innovation continues, smart power rental solutions are becoming the industry norm.

Research Scope and Analysis

By Fuel Type Analysis

Diesel, leading the power rental market in 2025 with a share of 64.2%, continues to be the most widely used fuel type due to its high energy density, quick start-up capabilities, and easy availability across regions. It is especially favored in remote areas, construction sites, and emergency power applications where grid connectivity is limited or unreliable. Diesel generators offer strong performance, reliability, and flexibility, making them ideal for temporary and mobile power needs.

Despite growing environmental concerns, the demand remains strong because of their ability to deliver large-scale power quickly. Many industries still rely on diesel-powered rental equipment during peak demand or maintenance shutdowns. Although hybrid and gas-based systems are gaining traction, diesel continues to dominate due to its established supply chain, low initial cost, and familiarity among users. It is expected to maintain its lead in the power rental segment while gradually adapting to cleaner fuel technologies and emission control upgrades.

Gas, having significant growth over the forecast period, is becoming a preferred fuel type in the power rental market due to its cleaner emissions, lower operating costs, and growing availability through pipeline infrastructure or LNG supply. As environmental regulations tighten and industries look for greener power solutions, gas-powered generators are gaining popularity in both developed and developing regions. They are especially suited for long-duration rentals and urban applications where noise and emission control are crucial.

The shift toward sustainable power sources is also encouraging rental providers to include more gas units in their fleets. Gas offers smoother operation, better fuel efficiency, and compatibility with hybrid systems, making it attractive for event power, utility backup, and industrial operations. It is expected to see strong adoption in markets focused on reducing carbon footprints while still needing dependable temporary power solutions for varied applications across sectors.

By Power Rating Analysis

501–2500 kW, set to lead the power rental market in 2025 with a 37.8% share, plays a crucial role in supporting high-demand applications across sectors like mining, oil and gas, manufacturing, and utilities. This power range is ideal for operations requiring large-scale, stable electricity over extended periods, such as during peak load support, plant shutdowns, or grid failures. Its ability to handle heavy-duty industrial loads makes it the preferred choice for critical infrastructure projects and large construction activities.

Many businesses choose this rating due to its balance between high output and fuel efficiency. The 501–2500 kW segment also fits well into multi-generator installations, making it flexible for temporary power plants or mobile units. As global industries grow and infrastructure expands, the need for this power class is expected to rise, especially in regions with limited or aging power grid infrastructure requiring reliable rental power solutions.

51–500 kW, having significant growth over the forecast period, continues to gain traction in the power rental market for its versatility and ease of deployment across medium-scale applications. Widely used in commercial buildings, retail centers, events, and small industrial facilities, this power range meets the temporary electricity needs where lower capacity is sufficient but performance cannot be compromised. Its compact size, lower fuel consumption, and simpler logistics make it a practical solution for clients seeking fast setup and reliable power for short to medium durations.

Additionally, this segment is well-suited for emergency backup during grid failures or planned outages, especially in urban and semi-urban locations. Growing demand from event organizers, telecom towers, and smaller construction sites is pushing rental providers to expand offerings in this range. As flexible energy needs continue to grow in both developed and developing markets, the 51–500 kW power band is expected to play a key role in powering temporary and portable infrastructure efficiently.

By Equipment Type Analysis

Generators, projected to lead the power rental market in 2025 with a 70.7% share, continue to be the most essential equipment type driving industry growth. Their ability to deliver immediate and reliable power makes them the first choice across sectors like construction, oil and gas, manufacturing, events, and emergency services. Generators are valued for their portability, quick setup, and flexibility in output, which make them suitable for both short-term needs and longer operational demands.

They are available in a wide range of power ratings and fuel options, including diesel, gas, and hybrid models, meeting diverse customer requirements. The widespread use of generators for backup power, peak shaving, and off-grid operations contributes to their dominance. As demand rises for temporary and mobile energy solutions, especially in areas with unreliable grid access, rental generators remain central to ensuring uninterrupted operations in various industries and challenging environments.

Further, load banks, having significant growth over the forecast period, are becoming primarily important in the power rental market due to their role in testing and maintaining power systems. These units simulate electrical loads to ensure generators and backup systems are working properly under real-world conditions, which is mainly useful in industries such as data centers, hospitals, and utilities, where equipment reliability is critical. Load banks are also essential during commissioning, maintenance, and repair of rental generators, helping prevent failures during actual operations.

As more businesses adopt rental power solutions, the need for regular testing and performance checks is rising. This is pushing rental providers to offer load banks as part of complete service packages. Their ability to verify generator health and performance is making load banks a valuable asset in maintaining operational stability across various applications.

By Rental Type Analysis

Short-term rental is set to lead the power rental market in 2025 with a 58.1% share, and continues to dominate due to its flexibility and quick deployment for urgent and temporary power needs. This rental type is mainly used during emergencies, sudden power outages, public events, and short construction jobs where immediate power supply is crucial. Businesses prefer short-term solutions to avoid the high cost of permanent installations, especially for seasonal or project-based operations.

It also suits companies that require backup power during equipment maintenance or grid interruptions. The ease of access, lower upfront commitment, and fast turnaround make short-term rental the go-to choice across various industries. Its demand is further supported by the rising frequency of natural disasters and unplanned power disruptions. As industries seek dependable, scalable energy on demand, short-term rental remains central to keeping operations running without delays or downtime.

Long-term rental, having significant growth over the forecast period, is gaining momentum as industries mainly need stable power for extended durations without investing in permanent systems. This type of rental is especially valuable for infrastructure projects, mining operations, oil and gas fields, and remote facilities where grid power is unreliable or unavailable. Businesses benefit from predictable costs, ongoing technical support, and the ability to scale up or down as needs evolve.

Long-term power rentals also help companies manage energy needs during long maintenance schedules, delays in grid expansion, or extended production cycles. With increasing focus on cost efficiency and operational reliability, more organizations are adopting long-term rentals as part of their energy strategies. This trend is expected to grow as industries seek flexible, sustained power solutions that avoid large capital expenditures while maintaining business continuity.

By Application Analysis

Standby power, forecast to lead the power rental market in 2025 with a 41.5% share, plays a central role in ensuring uninterrupted operations during unexpected power outages. It is a top choice for industries, commercial buildings, hospitals, and data centers where even a short power failure can result in heavy losses or operational risks. This application offers a reliable safety net during grid failures, natural disasters, or scheduled maintenance by providing instant backup electricity.

Its growing adoption is also linked to rising concerns about energy reliability, particularly in areas with aging infrastructure or unstable power supply. Businesses are increasingly renting standby power units to avoid the cost of permanent installations while still ensuring operational continuity. With the growing need for emergency readiness and the rise of remote infrastructure, demand for standby power rental is expected to grow steadily across both mature and emerging markets.

Continuous power, having significant growth over the forecast period, serves as a backbone for industries and sites that require a non-stop energy supply over extended periods. Unlike standby systems, this application supports daily operations where grid access is unavailable or insufficient, such as in remote mining sites, oil rigs, construction camps, and isolated communities. Its rising use comes from the expansion of large-scale industrial activities and infrastructure development, especially in regions with unreliable grids. The ability to provide stable, consistent electricity without interruption makes continuous power rental a dependable solution for critical operations.

Rental providers are seeing growing interest in this segment due to its operational importance and flexibility. As companies seek long-term, scalable energy alternatives without heavy capital investment, continuous power is becoming an increasingly valuable option for supporting productivity in challenging environments.

By End User Analysis

Utilities are expected to lead the power rental market in 2025 with a 21.8% share, and are a key driver of demand due to their ongoing need for backup and supplemental power during grid upgrades, emergency outages, and seasonal peak loads. Power rental solutions help utility providers maintain service reliability while avoiding large capital investments in temporary infrastructure. When natural disasters damage transmission lines or sub-stations, rental generators provide fast, mobile power restoration to critical areas. Utilities also use rented power during planned maintenance or testing of electrical systems, ensuring uninterrupted supply to consumers.

The flexibility, speed, and scalability of power rental options make them a preferred choice for utilities dealing with aging infrastructure and increasing energy demand. With grid modernization efforts underway across various regions, utilities continue to rely on power rental services as a practical and cost-effective part of their energy continuity and risk management strategies.

Construction Equipment Rental, having significant growth over the forecast period, continues to be one of the most active end users in the power rental market due to the constant need for temporary electricity at project sites. Whether building roads, bridges, buildings, or industrial facilities, construction equipment rental firms often operate in areas where grid access is not available or is unreliable. Power rental equipment supports lighting, machinery, tools, and on-site offices throughout different phases of development. The flexibility to scale power supply according to changing needs makes rental solutions highly practical in fast-paced construction environments.

As global infrastructure development accelerates, particularly in developing countries, demand for on-site power support is growing. Construction companies prefer rental options to avoid long-term investments and gain the advantage of easy deployment and mobility. This makes power rental a strategic asset in meeting energy needs quickly and efficiently on short- to medium-term projects.

The Power Rental Market Report is segmented on the basis of the following:

By Fuel Type

By Power Rating

- Below 50 kW

- 51–500 kW

- 501–2500 kW

- Above 2500 kW

By Equipment Type

- Generators

- Transformers

- Load Banks

- Others

By Rental Type

- Short-Term Rental

- Long-Term Rental

By Application

- Standby Power

- Peak Shaving

- Continuous Power

By End User

- Utilities

- Oil & Gas

- Construction

- Mining

- Events

- Manufacturing

- Shipping & Marine

- Others

Regional Analysis

Leading Region in the Power Rental Market

North America, leading the power rental market in 2025 with a share of 33.2%, continues to show strong growth due to high demand from construction, oil and gas, mining, and utility sectors. The region often faces weather-related disruptions like hurricanes, snowstorms, and wildfires, which increase the need for emergency and backup power solutions. Ongoing infrastructure projects, including roads, bridges, and public utilities, further drive demand for temporary power sources. The region also benefits from advanced technologies and widespread adoption of remote monitoring systems, improving the efficiency of rental operations.

In the United States and Canada, strict environmental regulations are pushing companies to invest in low-emission and hybrid rental equipment. Rental solutions are also used heavily during peak power demand and grid maintenance. With a well-established network of service providers, strong industrial base, and rapid emergency response systems, North America remains a critical region in shaping the direction and innovation of the global power rental market in 2025.

Fastest Growing Region in the Power Rental Market

Asia Pacific is showing significant growth over the forecast period in the power rental infrastructure market due to rapid urbanization, rising industrial activity, and ongoing infrastructure development across countries like India, China, and Southeast Asian nations. Frequent power shortages, unreliable grid supply in rural areas, and the rising need for temporary electricity during construction and public events are boosting demand for rental power solutions.

The region’s growing construction sector, combined with rising investments in mining, oil and gas, and manufacturing, is creating strong demand for temporary power infrastructure. It is estimated that this momentum will continue, supported by government initiatives and increasing focus on flexible, on-demand power supply systems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The power rental market is highly competitive, with many local and international players offering similar services across different regions. Companies compete on factors like quick delivery, equipment availability, rental flexibility, fuel efficiency, and strong after-sales support. Some providers focus on specific industries like oil and gas, construction, or events, while others offer a wide range of services.

The market is also seeing a shift toward cleaner energy solutions, so companies offering hybrid or gas-powered generators have a growing edge. Digital tools for remote monitoring and fuel tracking are also becoming a key differentiator. Overall, success in this market depends on reliability, service quality, fast response during emergencies, and the ability to meet complex customer needs with tailored rental solutions.

Some of the prominent players in the global Power Rental are:

- Aggreko

- United Rentals

- Ashtead Group (Sunbelt Rentals)

- Caterpillar Inc.

- Cummins Inc.

- Atlas Copco

- APR Energy

- Herc Rentals

- Speedy Hire

- Generac Power Systems

- Kohler Co.

- Wacker Neuson

- Doosan Portable Power

- Rental Solutions & Services (RSS)

- Altaaqa Global

- Trinity Power Rentals

- Bredenoord

- Power Electrics

- Sudhir Power

- Modern Hiring Service

- Other Key Players

Recent Developments

- In June 2025, United Rentals, Inc., the world’s largest equipment rental company, launched Workspace Ready Solutions—customizable accessory packages for mobile and container offices tailored to construction project needs. These solutions simplify jobsite setup by providing fully equipped, professional workspaces upon delivery. Project managers can choose from a wide range of accessories, including office furniture, appliances, and supplies. Multiple packages and bundles are available, allowing companies to scale and customize their mobile offices as project demands change.

- In May 2025, Cummins Inc.’s Power Generation business introduced new Battery Energy Storage Systems (BESS) to its global lineup, supporting customers’ sustainability and energy transition goals. The solutions come in 10ft (200–400kWh) and 20ft (600kWh–2MWh) containers, featuring LFP batteries, liquid cooling, and a three-tier fire safety system. With plug-and-play design, they ensure easy transport and installation. Serving 50Hz markets, key applications include off-grid locations, EV charging and energy management, and critical facilities like data centers and hospitals.

- In April 2025, Integrated Rental (IR), a leader in rental software for heavy equipment dealerships, has partnered with Microsoft to bring its solutions to Microsoft Dynamics 365 users. This collaboration aims to enhance performance, profitability, and visibility in rental operations. By integrating with Dynamics 365 ERP, IR enables dealerships to scale rentals across locations, improve fleet management through unified data, streamline workflows for faster onboarding, and drive AI adoption using rental-specific tools. The alliance underscores both companies' commitment to customer success and industry innovation.

- In July 2024, Solaris Oilfield Infrastructure, Inc. announced that the company signed a definitive agreement to acquire Mobile Energy Rentals LLC (MER), a leading provider of distributed power solutions for the energy and commercial & industrial sectors, in a deal valued at USD 200 million. The transaction includes USD 60 million in cash and approximately 16.5 million shares of Solaris Class B common stock issued to MER’s founders and management, who will join Solaris following the closing of the acquisition.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.4 Bn |

| Forecast Value (2034) |

USD 19.0 Bn |

| CAGR (2025–2034) |

5.8% |

| The US Market Size (2025) |

USD 3.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Fuel Type (Diesel, Gas, and Others), By Power Rating (Below 50 kW, 51–500 kW, 501–2500 kW, and Above 2500 kW), By Equipment Type (Generators, Transformers, Load Banks, and Others), By Rental Type (Short-Term Rental and Long-Term Rental), By Application (Standby Power, Peak Shaving, and Continuous Power), By End User (Utilities, Oil & Gas, Construction, Mining, Events, Manufacturing, Shipping & Marine, and Others ) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Aggreko, United Rentals,Ashtead Group (Sunbelt Rentals), Caterpillar Inc., Cummins Inc., Atlas Copco, APR Energy, Herc Rentals, Speedy Hire, Generac Power Systems, Kohler Co., Wacker Neuson, Doosan Portable Power, Rental Solutions & Services (RSS), Altaaqa Global, Trinity Power Rentals, Bredenoord, Power Electrics, Sudhir Power, Modern Hiring Service, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Power Rental Market size is expected to reach a value of USD 11.4 billion in 2025 and is expected to reach USD 19.0 billion by the end of 2034.

North America is expected to have the largest market share in the Global Power Rental Market, with a share of about 33.2% in 2025.

The Power Rental Market in the US is expected to reach USD 3.3 billion in 2025.

Some of the major key players in the Global Power Rental Market are Aggreko, United Rentals, Ashtead Group, and others

The market is growing at a CAGR of 5.8 percent over the forecasted period.