Market Overview

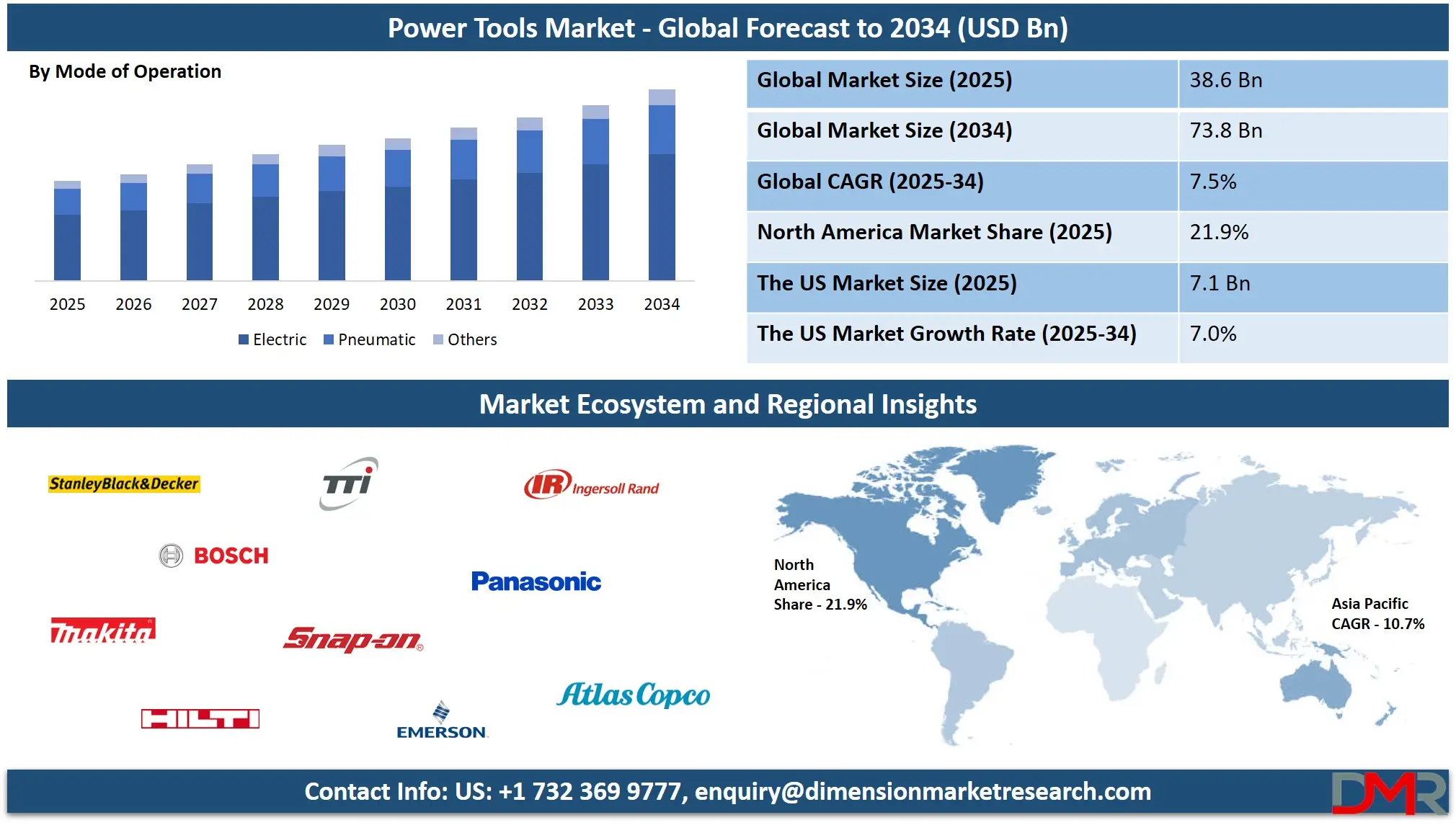

The Global Power Tools Market is estimated to be valued at

USD 38.6 billion in 2025 and is further anticipated to reach

USD 73.8 billion by 2034 at a

CAGR of 7.5%.

Power tools are mechanical or electrical devices that aid in performing various tasks with greater efficiency, precision, and speed compared to manual tools. They are driven by a power source such as electricity, compressed air, or internal combustion, and are commonly used in construction, manufacturing, woodworking, metalworking, and home improvement applications. These tools include drills, saws, grinders, sanders, wrenches, and hammers, each tailored for specific functions. Their ability to handle repetitive, high-intensity work with ease has made them indispensable across industries and among professionals and DIY enthusiasts alike.

The global power tools market represents a dynamic and rapidly evolving industry characterized by technological innovation, rising demand for automation, and the growing emphasis on productivity and efficiency. As industrial sectors continue to modernize their processes, power tools are playing a central role in enhancing workflow and reducing manual labor. The proliferation of cordless power tools has been particularly transformative, enabling greater mobility, ease of use, and versatility across various working environments. These advancements significantly reshape user expectations, especially in construction, automotive, and manufacturing.

Consumer behavior is also influencing the structure of the global power tools market. A rise in DIY culture, particularly in North America and parts of Europe, is fueling demand for user-friendly and affordable tools. Additionally, the home renovation trend, supported by online tutorials and digital platforms, has empowered a larger consumer base to purchase and use power tools independently. In developing regions, rapid urbanization and infrastructure development are generating robust demand from professional sectors, especially in residential and commercial construction, thereby expanding the market footprint.

Sustainability and smart technology integration are emerging as key focus areas among manufacturers. Companies are investing in tools that are energy-efficient, lightweight, and embedded with features like Bluetooth connectivity, diagnostics, and app-based monitoring. These smart tools not only improve user experience but also provide valuable insights for predictive maintenance and workflow optimization. Moreover, the push for greener operations and compliance with global emission standards is influencing material choices, battery development, and packaging. As a result, the power tools market is not only expanding in size but also maturing in terms of product sophistication and consumer engagement.

The US Power Tools Market

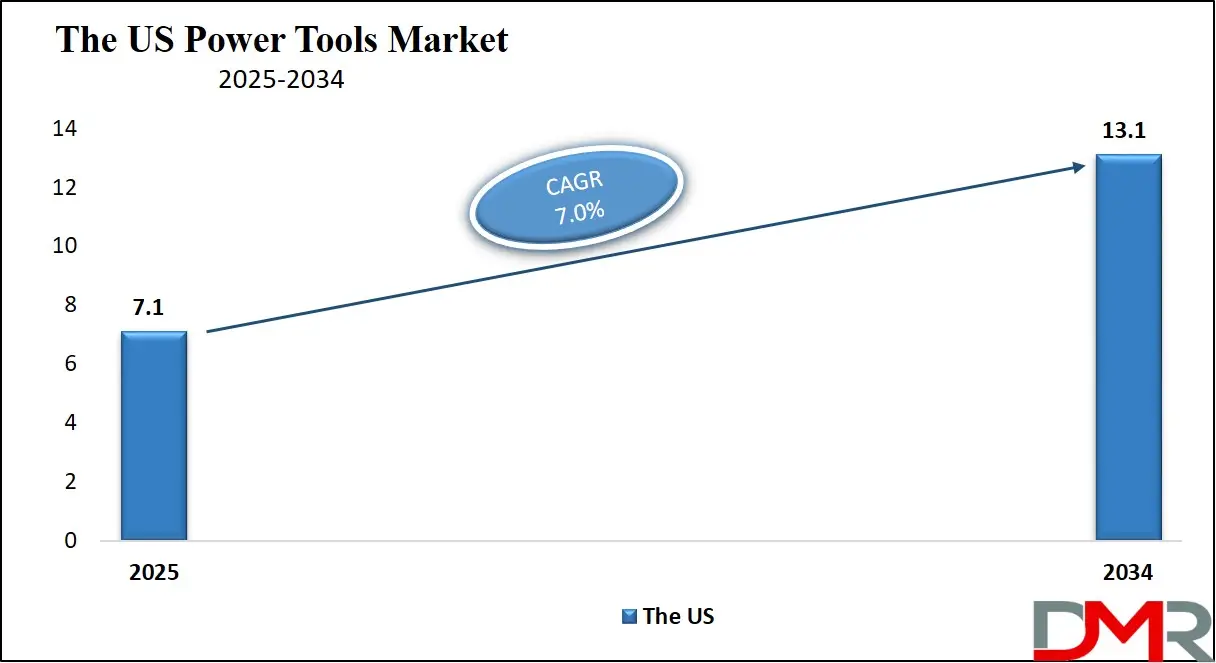

The U.S. Power Tools Market is projected to be valued at USD 7.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.1 billion in 2034 at a CAGR of 7.0%.

In the U.S., the power tools market has matured into a highly competitive and innovation-driven segment, supported by the country’s robust construction, manufacturing, and home improvement industries. The U.S. is one of the largest consumers of power tools globally, with a well-established base of both professional users and DIY enthusiasts. The market benefits from a culture that values efficiency, precision, and innovation traits that align perfectly with the capabilities of modern power tools. Government spending on infrastructure, integrated with strong residential housing and renovation activities, continues to fuel demand across multiple sectors, keeping the market active and lucrative.

A significant driver in the U.S. power tools market is the widespread adoption of cordless technology. Consumers and professionals alike have favored lithium-ion battery-powered tools for their mobility, reduced downtime, and lighter weight. Major brands such as DEWALT, Milwaukee, and Makita have heavily invested in developing extensive cordless tool ecosystems, offering users compatibility across multiple devices with a single battery platform. This shift has also been influenced by job site regulations that favor quieter and emission-free tools, especially in urban construction environments. The emphasis on convenience, safety, and productivity has led to a steady migration away from traditional corded tools.

Global Power Tools Market: Key Takeaways

- Market Value: The global power tools market size is expected to reach a value of USD 73.8 billion by 2034 from a base value of USD 38.6 billion in 2025 at a CAGR of 7.5%.

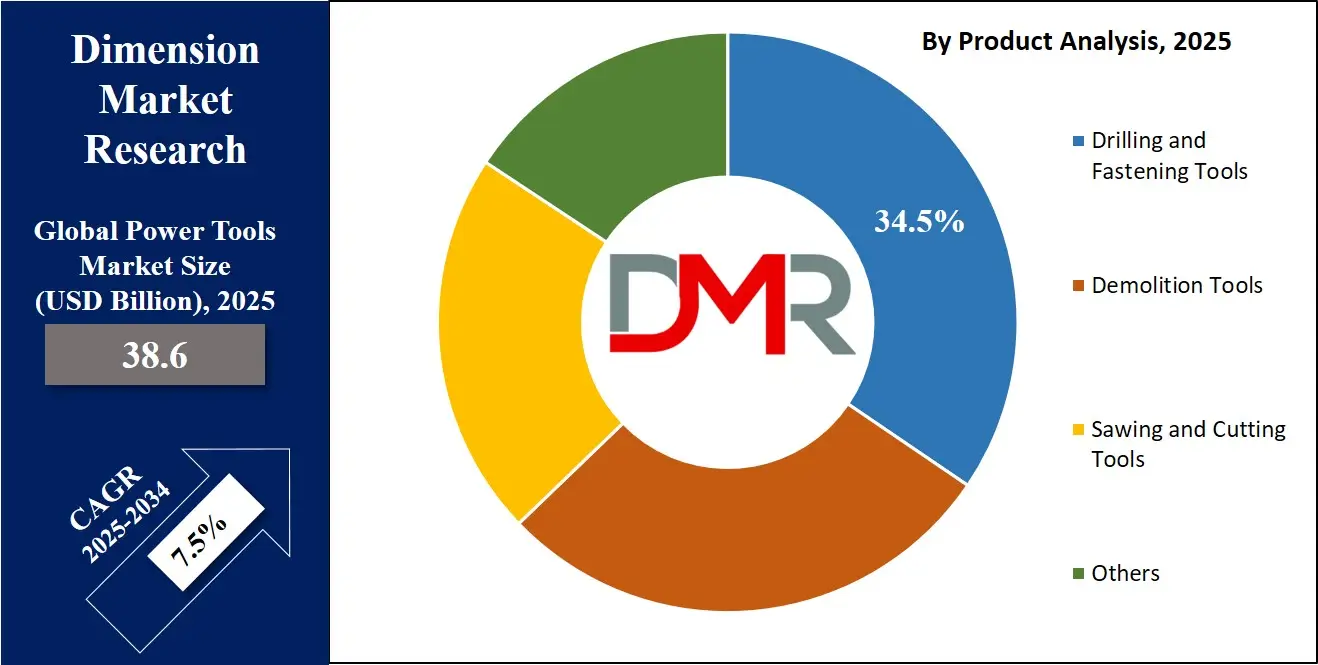

- By Product Segment Analysis: Drilling and Fastening Tools are poised to consolidate their dominance in the product segment, capturing 34.5% of the total market share in 2025.

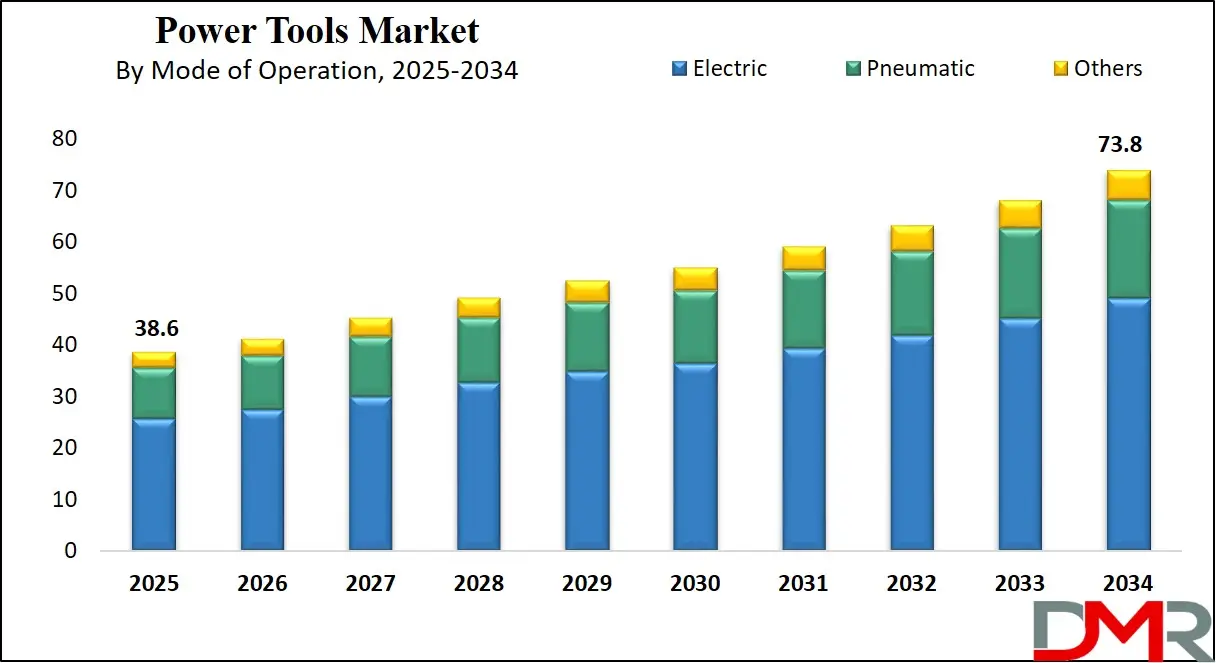

- By Mode of Operation Type Segment Analysis: Electric mode is anticipated to maintain its dominance in the mode of operation type segment, capturing 66.3% of the total market share in 2025.

- By Mobility Type Segment Analysis: Portables are expected to maintain their dominance in the mobility type segment, capturing 70.5% of the total market share in 2025.

- By Application Type Segment Analysis: Industrial applications are poised to consolidate their market position in the application type segment, capturing 62.8% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global power tools market landscape with 34.6% of total global market revenue in 2025.

- Key Players: Some key players in the global power tools market are Stanley Black & Decker, Bosch, Makita Corporation, Hilti Corporation, Techtronic Industries (TTI), Snap-on Incorporated, Emerson Electric Co., Panasonic Corporation, Atlas Copco, Ingersoll Rand, Koki Holdings Co., Ltd. (HiKOKI), Ryobi Limited, Festool GmbH, DEWALT, Milwaukee Tool, Metabo, WORX (Positec Tool Corporation), Chervon Holdings, Einhell Germany AG, Husqvarna Group, and Other Key Players.

Global Power Tools Market: Use Cases

- Construction and Infrastructure Development: Power tools are essential in commercial and residential construction for tasks like drilling, cutting, grinding, and fastening. High-powered drills, rotary hammers, and impact drivers are extensively used by contractors and construction crews for efficient and precise operations on large-scale projects globally.

- Automotive Manufacturing and Maintenance: In the automotive sector, power tools are used for assembly, disassembly, and maintenance of vehicles. Pneumatic wrenches, grinders, polishers, and torque tools help improve speed and consistency in production lines and workshops, supporting both original equipment manufacturers (OEMs) and aftermarket service providers.

- DIY Home Improvement and Renovation: With the rise in global DIY culture, especially post-pandemic, consumers are using portable power tools for home repairs, furniture assembly, gardening, and remodeling. Cordless drills, jigsaws, and sanders are popular among homeowners for handling small to medium-scale projects without professional help.

- Manufacturing and Industrial Fabrication: In manufacturing plants, power tools support metalworking, woodworking, and composite fabrication. These tools ensure precision, reduce labor intensity, and improve productivity in sectors like aerospace, shipbuilding, and heavy machinery, where consistency and durability are critical.

Global Power Tools Market: Stats & Facts

- According to the U.S. Department of Commerce:

- The SelectUSA initiative reports that in 2022, there were 1,118 establishments in the machinery and equipment industry, with over 85,000 workers estimated in mid-2024.

- The machinery subsector includes equipment used in construction and mining, with 666 establishments and an estimated 76,000 workers in mid-2024.

- The energy machinery manufacturing subsector had 908 establishments and over 92,000 employees in mid-2024.

- The motor vehicle parts manufacturing subsector had 4,640 establishments and over 1 million workers in mid-2024.

- The aerospace product and parts manufacturing subsector had 1,840 establishments and approximately 555,000 employees in mid-2024.

- The motor vehicle body and trailer manufacturing subsector had 2,166 establishments and over 1 million workers in mid-2024.

- The motor vehicle manufacturing subsector had 359 establishments and over 1 million workers in mid-2024.

Global Power Tools Market: Market Dynamics

Global Power Tools Market: Driving Factors

Urbanization and Industrial Growth in Emerging EconomiesCountries in Asia-Pacific, the Middle East, and Africa are undergoing large-scale infrastructure expansion, including housing, transportation, and commercial projects. This surge in construction activity demands efficient and reliable tools that can improve workforce productivity and meet tight deadlines. Power tools, particularly portable and cordless variants, are becoming indispensable on construction sites for their ability to deliver speed, precision, and versatility. The growing emphasis on modernization and mechanization of labor-intensive sectors is significantly pushing market adoption, especially in regions that are leapfrogging directly to advanced tools without going through slower traditional methods.

Technological Advancements and Smart Tool Integration

Advancements such as brushless motors, lithium-ion batteries, and IoT connectivity are transforming user experiences and setting new standards in performance and convenience. For example, smart power tools now offer real-time diagnostics, tool-tracking, and app-controlled customization, making them invaluable in professional environments where efficiency and data-driven decision-making are crucial. At the same time, improvements in battery capacity, charging speed, and overall energy efficiency are extending tool lifespan and reducing downtime. These innovations not only enhance productivity but also align with global trends toward sustainability and digital transformation.

Global Power Tools Market: Restraints

High Initial Investment and Maintenance Costs

One of the primary restraints in the global power tools market is the high upfront cost associated with purchasing advanced tools, especially those equipped with smart technologies or industrial-grade capabilities. For small businesses, individual contractors, or DIY consumers in price-sensitive regions, the investment required to acquire a full set of power tools along with compatible batteries, chargers, and accessories can be prohibitive. Additionally, certain power tools require periodic maintenance, replacement parts, and proper storage conditions to maintain performance and safety standards. These ongoing costs can discourage adoption, particularly in markets where access to service centers and spare parts is limited.

Safety Concerns and Regulatory Challenges

Despite advancements in safety features such as automatic shutoffs and overload protection, accidents remain a concern, especially among untrained users or in unregulated work environments. This has led to stricter workplace safety regulations and compliance requirements in many countries, which can complicate the procurement and usage of certain types of power tools. Manufacturers are also under growing pressure to meet regional safety certifications, which can slow down product launches or limit availability in specific markets, especially where regulatory frameworks differ widely.

Global Power Tools Market: Opportunities

Expansion in Emerging Markets

As countries in regions like Asia-Pacific, Africa, and Latin America continue to urbanize and industrialize, there is a growing demand for both professional-grade and consumer-level power tools. The rise in residential and commercial construction, integrated with government investments in infrastructure, creates new market prospects for manufacturers. Additionally, as these regions develop, there's a rising need for advanced, efficient, and durable power tools to meet the growing demands of these industries, especially as local markets shift from manual to mechanized labor.

Adoption of Smart and Connected Tools

The market is seeing a growing interest in tools that feature IoT connectivity, real-time diagnostics, and app-based management systems. These innovations enable users to monitor tool performance, manage battery life, track usage patterns, and receive maintenance alerts, all of which improve efficiency and reduce downtime. With industries looking for ways to optimize workflows and reduce costs, the demand for smart tools is expected to grow, particularly in sectors such as construction, manufacturing, and automotive. As smart technology continues to evolve, manufacturers have the opportunity to create more sophisticated, data-driven tools, further enhancing user experience and productivity.

Global Power Tools Market: Trends

Cordless and Battery-Powered Tools

As technology improves, tools with lithium-ion batteries are becoming more efficient, lighter, and longer-lasting. This trend is driving the demand for portable power tools, which offer greater convenience and mobility for both professional users and DIY enthusiasts. Cordless tools allow workers to operate in areas without a power source, making them ideal for job sites, home improvement projects, and remote locations. The development of more powerful batteries with shorter charging times is contributing to the widespread use of these tools across various industries.

Integration of Smart Technology and Connectivity

Manufacturers are embedding tools with Bluetooth, GPS, and IoT capabilities, enabling users to track tool performance, monitor battery life, and even diagnose issues remotely. These smart tools are especially valuable in industrial settings where efficiency, precision, and real-time monitoring are critical. With smart tools, professionals can optimize their workflow, predict maintenance needs, and reduce downtime. As IoT and data analytics continue to evolve, the demand for connected power tools is expected to grow, offering users more insights and control over their equipment.

Global Power Tools Market: Research Scope and Analysis

By Product Analysis

Drilling and fastening tools have long been a dominant category in the global power tools market, and they are expected to continue consolidating their leadership, projected to capture 34.5% of the total market share in 2025. This dominance can be attributed to the essential nature of these tools across a wide range of industries, from construction to automotive and general manufacturing.

Drilling tools, such as electric drills, impact drivers, and rotary hammers, are indispensable for creating holes and driving fasteners in various materials like wood, metal, and concrete. Fastening tools, including screwdrivers, impact wrenches, and torque wrenches, are crucial for securing components in assembly and repair tasks. These tools are not only widely used but also come with evolving features such as better ergonomics, higher power output, and increased battery life, making them more efficient and versatile, further driving their market share.

Demolition tools also represent an important subsegment within the broader drilling and fastening category. These tools are designed to break, cut, or crush materials, which is a critical function in the demolition and renovation sectors. Tools like rotary hammers, demolition hammers, and jackhammers are specifically engineered for heavy-duty applications, where sheer force is required to break through concrete, stone, or steel. Demolition tools are essential in construction and industrial projects, such as building deconstruction, road construction, and foundation work.

By Mode of Operation Analysis

The electric mode of operation is set to continue its dominance in the global power tools market, with a projected market share of 66.3% in 2025. This significant share can be attributed to the convenience, versatility, and efficiency that electric-powered tools offer across a wide range of applications. Electric power tools, including drills, saws, grinders, and sanders, are widely used due to their ease of use, availability of various models (corded and cordless), and consistent performance. The growing preference for electric tools is driven by the advancements in battery technology, especially with lithium-ion batteries, which provide longer runtimes and shorter charging times compared to older battery technologies. Additionally, electric power tools tend to be lighter and more compact, making them highly appealing for both professional users and DIY enthusiasts. Electric tools are not only more efficient but also provide better precision, less maintenance, and quieter operation compared to some of the other power tools in the market.

Pneumatic tools, which are powered by compressed air, represent a distinct mode of operation within the power tools market. While not as widely adopted as electric tools, pneumatic power tools are essential in certain industrial settings, particularly where high power output, durability, and safety are critical. Pneumatic tools, such as impact wrenches, air drills, and sanders, are commonly used in automotive, manufacturing, and heavy-duty construction applications. Their ability to deliver consistent power without the need for electric motors or batteries makes them particularly valuable in environments where electrical hazards could pose risks or where air supply systems are already in place.

By Mobility Analysis

Portables are expected to maintain their dominant position in the mobility type segment of the global power tools market, with a projected share of 70.5% in 2025. This trend reflects the growing demand for mobility, flexibility, and convenience, especially in construction, home improvement, and industrial applications. Portable power tools, such as drills, saws, impact drivers, and sanders, are highly favored for their ease of use, versatility, and ability to perform tasks in various environments. The portability factor allows users to take these tools to different job sites, whether on construction projects, outdoor tasks, or for home repairs, making them indispensable for both professional tradespeople and DIY enthusiasts. The rise of cordless power tools further enhances their appeal, as they eliminate the need for a constant power source, allowing users to work in remote locations or areas where traditional power outlets are not available.

In contrast, stationary power tools occupy a more specialized niche within the market. Stationary tools, such as table saws, drill presses, and bench grinders, are typically used in fixed workshop settings where high precision, consistent performance, and the ability to work on larger or heavier materials are required. These tools are primarily found in professional environments such as manufacturing plants, industrial fabrication shops, and woodworking workshops, where tasks demand repeatability and fine control over the workpiece. While stationary tools are not as portable as their handheld counterparts, they offer advantages that make them indispensable for certain tasks. For example, table saws and drill presses provide a stable platform that ensures accuracy and safety during cutting or drilling operations. Stationary tools are ideal for tasks that require a high level of precision, such as fine woodworking, metalworking, or heavy-duty industrial applications.

By Application Analysis

Industrial applications are set to strengthen their position in the global power tools market, with a projected market share of 62.8% in 2025. This growth is driven by the growing demand for power tools across a variety of industries, including manufacturing, construction, automotive, and aerospace. Industrial settings often require high-performance, heavy-duty tools that can withstand prolonged use and deliver precise results. The need for efficiency, speed, and safety in these environments makes power tools indispensable, as they allow workers to complete complex tasks more quickly and with less physical effort. Tools such as drills, grinders, saws, and impact wrenches are used daily on factory floors, assembly lines, and construction sites to perform everything from metal cutting and drilling to fastening and surface preparation.

Other applications in the power tools market include residential, commercial, and DIY sectors. The residential and DIY segments have seen significant growth in recent years, fueled by a surge in home improvement projects and a growing interest in self-reliant renovations. With the rise of digital platforms that offer how-to tutorials and easy access to power tools via e-commerce, more consumers are opting for power tools to carry out projects like furniture assembly, gardening, and light construction. Cordless drills, screwdrivers, and sanders are particularly popular in this segment due to their ease of use and accessibility for non-professional users. While these tools may not require the same industrial-grade performance, they still need to offer reliability, affordability, and ease of maintenance for consumers who use them less frequently.

The Power Tools Market Report is segmented on the basis of the following

By Product

- Drilling and Fastening Tools

- Drills

- Impact Drivers

- Impact Wrenches

- Demolition Tools

- Sawing and Cutting Tools

- Jigsaws

- Reciprocating Saws

- Circular Saws

- Band Saws

- Others

By Mode of Operation

- Electric

- Pneumatic

- Others

By Mobility

By Application

- Industrial

- Automotive

- Construction

- Aerospace & Defense

- Energy & Utilities

- Manufacturing

- Agriculture

- Others

- Others

Global zwer Tools Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global power tools market with a substantial share of

34.6% of total global market revenue in 2025. This dominance can be attributed to several key factors, including the region's rapid industrialization, urbanization, and large-scale infrastructure development projects. Asia Pacific is home to some of the world's fastest-growing economies, such as China, India, and Southeast Asian nations, all of which are witnessing significant growth in both industrial output and consumer demand for power tools. As a result, the region presents a vast market for power tool manufacturers looking to cater to both industrial and consumer needs.

One of the major drivers of this growth is the booming construction and manufacturing industries across Asia Pacific. The demand for power tools is being propelled by the ongoing development of residential, commercial, and infrastructure projects, particularly in countries like China and India, where urbanization is occurring at an unprecedented pace.

Region with significant growth

Asia Pacific is expected to experience the highest CAGR in the global power tools market, driven by a combination of industrial, economic, and technological advancements. The rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations are major factors contributing to the region's strong growth. As these economies continue to develop, there is an increased need for power tools in sectors such as construction, manufacturing, and infrastructure development.

Large-scale infrastructure projects, including the construction of roads, buildings, and transportation networks, are creating a consistent demand for a variety of power tools necessary for tasks like drilling, cutting, and fastening. The expanding middle class and rising disposable income in emerging economies are fueling demand for power tools in the residential and DIY sectors. As urbanization progresses and people gain access to better living standards, home improvement projects have become more common.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Power Tools Market: Competitive Landscape

The global competitive landscape for the power tools market is dynamic and highly competitive, with several large multinational companies, along with a growing number of regional players, driving innovation, market expansion, and competition. The competition is marked by a combination of product offerings, technological advancements, pricing strategies, and regional market dominance. Key players in the market continually innovate to capture a larger market share, adapt to consumer demands, and leverage emerging trends such as smart tools, cordless technology, and energy-efficient solutions.

At the forefront of the market are well-established global companies such as Bosch, Stanley Black & Decker, Makita, and Hitachi. These companies have established a significant presence globally, primarily due to their comprehensive product portfolios, including drills, saws, grinders, and impact tools. These manufacturers offer both professional-grade and consumer-grade power tools that cater to diverse applications across residential, commercial, and industrial sectors. Their global reach, strong brand recognition, and consistent focus on product quality have positioned them as leaders in the market.

Some of the prominent players in the Global Power Tools industry are

- Stanley Black & Decker

- Bosch

- Makita Corporation

- Hilti Corporation

- Techtronic Industries (TTI)

- Snap-on Incorporated

- Emerson Electric Co.

- Panasonic Corporation

- Atlas Copco

- Ingersoll Rand

- Koki Holdings Co., Ltd. (HiKOKI)

- Ryobi Limited

- Festool GmbH

- DEWALT

- Milwaukee Tool

- Metabo

- WORX (Positec Tool Corporation)

- Chervon Holdings

- Einhell Germany AG

- Husqvarna Group

- Other Key Players

Global Power Tools Market: Recent Developments

- December 2024: Robert Bosch announced it’s largest-ever acquisition, planning to acquire Irish company Johnson Controls in an USD 8 billion deal. This move aims to strengthen Bosch's presence in the heat pump and air conditioning sectors, aligning with its strategy to expand into energy-efficient technologies.

- August 2024: Bosch Group acquired Johnson Controls International’s Residential and Light Commercial HVAC business for USD 8.1 billion. The acquisition includes the North America Ducted business and a global residential joint venture with Hitachi, enhancing Bosch's Home Comfort Group and nearly doubling its sales in this segment.

- February 2024: Robert Bosch Power Tools acquired a 49% stake in FerRobotics Compliant Robot Technology GmbH, an Austrian provider specializing in contact-sensitive automation. This strategic investment aims to bolster Bosch's capabilities in automation technologies.

- October 2023: Fortive Corporation acquired German manufacturer Elektro-Automatik for USD 1.45 billion. This acquisition strengthens Fortive's position in the electronic test and measurement market, expanding its portfolio in industrial automation.

- April 2023: Emerson Electric finalized the acquisition of National Instruments in an all-cash transaction valued at USD 8.2 billion. This deal enhances Emerson's automation technology capabilities, adding advanced testing and measurement technologies to its product portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 38.6 Bn |

| Forecast Value (2034) |

USD 73.8 Bn |

| CAGR (2025–2034) |

7.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Drilling and Fastening Tools, Demolition Tools, Sawing and Cutting Tools, and Others), By Mode of Operation (Electric, Pneumatic, and Others), By Application (Industrial, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Stanley Black & Decker, Bosch, Makita Corporation, Hilti Corporation, Techtronic Industries (TTI), Snap-on Incorporated, Emerson Electric Co., Panasonic Corporation, Atlas Copco, Ingersoll Rand, Koki Holdings Co., Ltd. (HiKOKI), Ryobi Limited, Festool GmbH, DEWALT, Milwaukee Tool, Metabo, WORX (Positec Tool Corporation), Chervon Holdings, Einhell Germany AG, Husqvarna Group., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global Power Tools market size is estimated to have a value of USD 38.6 billion in 2025 and is expected to reach USD 73.8 billion by the end of 2034.

The US Power Tools market is projected to be valued at USD 7.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.1 billion in 2034 at a CAGR of 7.0%.

Asia Pacific is expected to have the largest market share in the global Power Tools market, with a share of about 34.6% in 2025.

Some of the major key players in the global Power Tools market are Stanley Black & Decker, Bosch, Makita Corporation, Hilti Corporation, Techtronic Industries (TTI), Snap-on Incorporated, Emerson Electric Co., Panasonic Corporation, Atlas Copco, Ingersoll Rand, Koki Holdings Co., Ltd. (HiKOKI), Ryobi Limited, Festool GmbH, DEWALT, Milwaukee Tool, Metabo, WORX (Positec Tool Corporation), Chervon Holdings, Einhell Germany AG, Husqvarna Group, and Other Key Players.

The market is growing at a CAGR of 7.5 percent over the forecasted period.