Market Overview

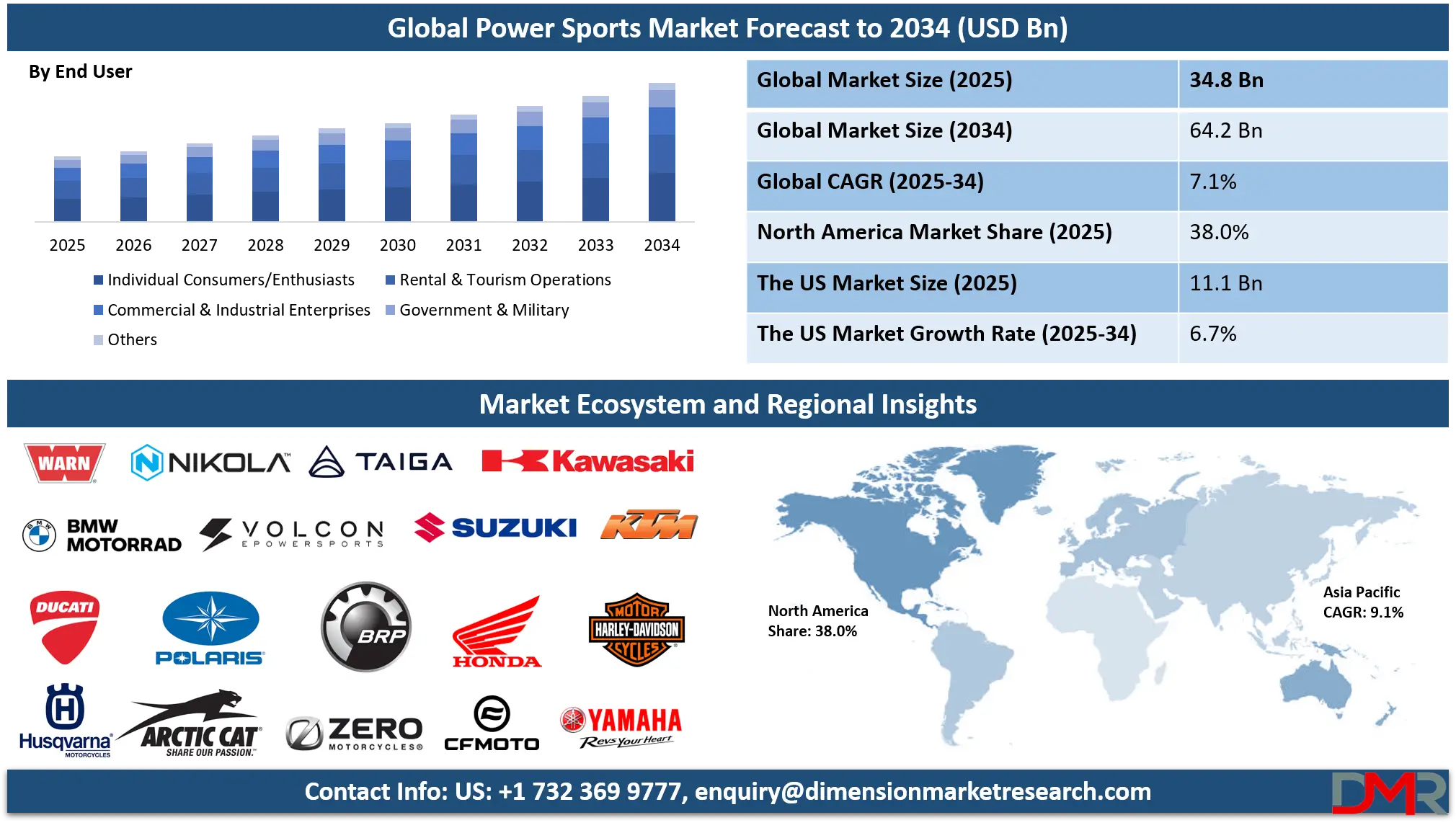

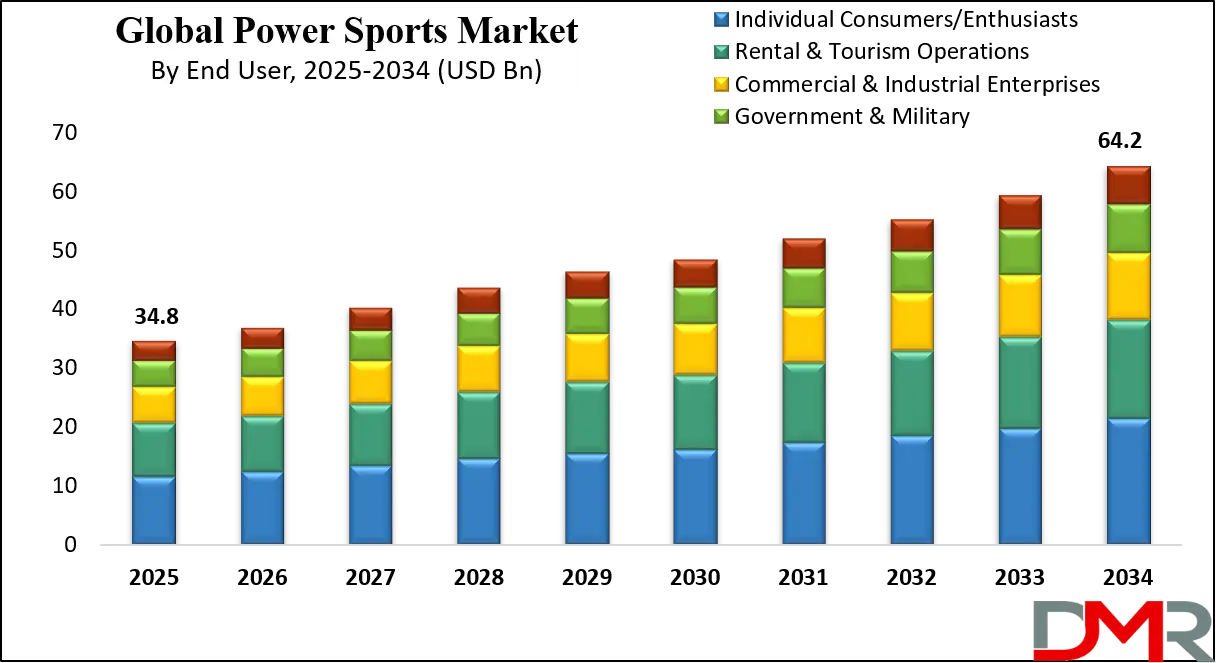

The global powersports market size is anticipated to stand at USD 34.8 billion in 2025 and is expected to witness robust growth at a CAGR of 7.1% throughout the forecast period (2025–2034), driven by rising demand for recreational vehicles, off-highway vehicles, and performance motorcycles, reaching USD 64.2 billion by 2034.

This trajectory reflects a robust industry adapting to evolving consumer behaviors, technological paradigms, and macroeconomic conditions. Powersports, once a niche hobbyist domain, has transformed into a sophisticated industry intertwining recreation, utility, and lifestyle. The market's growth is anchored in a fundamental human desire for exploration and escape, amplified by modern society's shift towards experiential consumption over material ownership.

Digitalization of marketing through social media platforms like Instagram and YouTube has created a powerful visual culture around powersports, inspiring new generations of participants and transforming vehicles into aspirational lifestyle products. The democratization of adventure, facilitated by more accessible financing options and a burgeoning used vehicle market, continues to lower the entry barrier for new enthusiasts globally.

Simultaneously, the industry faces a pivotal technological inflection point centered on sustainability. Stricter global emissions regulations, particularly in Europe and North America, are acting as a powerful catalyst, compelling manufacturers to accelerate the development of electric and hybrid powertrains. This shift is not merely regulatory compliance but a strategic realignment, opening new segments of environmentally conscious consumers and enabling access to noise-sensitive riding areas previously off-limits.

The parallel evolution in connectivity featuring integrated telematics, over-the-air updates, and immersive digital dashboards is creating vehicles that are not just modes of transport but connected nodes in a digital ecosystem. This enhances safety through real-time diagnostics, fosters community via shared ride data, and unlocks new revenue streams through subscription-based services for navigation, security, and performance tuning.

However, this promising growth is tempered by significant systemic challenges. The industry's inherent cyclicality ties its fortunes closely to consumer confidence and discretionary income, making it vulnerable to economic downturns and inflationary pressures. A persistent and growing threat is the constriction of land access. Environmental preservation efforts, urban expansion, and competing land-use priorities are systematically reducing the legal trails and open spaces essential for off-road recreation, posing an existential challenge in key markets.

Furthermore, the industry grapples with a skilled labor shortage in dealership service departments and manufacturing, while navigating complex, fragmented regulations that differ not just by country but often by county or municipality. The convergence of these driving and restraining forces will define the competitive landscape, demanding agile strategies from manufacturers who must balance innovation with operational resilience, and niche marketing with global scale, through the forecast period.

The US Power Sports Market

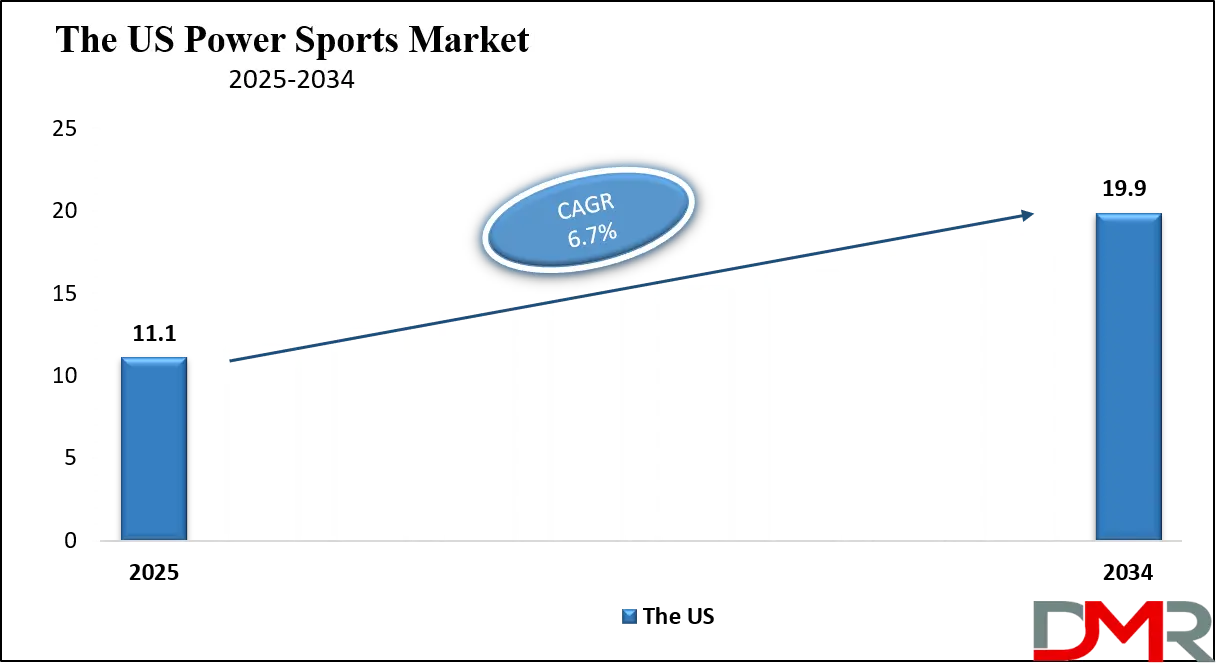

The U.S. Powersports Market, projected to reach USD 11.1 billion in 2025 and grow at a CAGR of 6.7% to USD 19.9 billion by 2034, stands as the unequivocal epicenter of the global industry. Its dominance is built upon a unique triad of cultural embeddedness, favorable geography, and mature economic infrastructure. The American relationship with motorized recreation is profound, woven into the national fabric through events like the Sturgis Motorcycle Rally, the King of the Hammers off-road race, and countless local trail-riding communities. This cultural foundation creates a persistent, multi-generational demand that sustains the market through economic cycles.

Geographically, the U.S. offers an unparalleled variety of legal riding terrains from the sand dunes of Michigan and Oregon, to the mountain trails of Colorado and Appalachia, to the vast desert open areas of the Southwest. Federal and state land management agencies, such as the Bureau of Land Management (BLM) and the U.S. Forest Service, formally designate millions of acres for Off-Highway Vehicle (OHV) use, a level of institutional support unmatched elsewhere. This infrastructure is complemented by a dense network of over 10,000 dedicated dealerships, which serve not just as sales points but as community hubs, service centers, and gateways to the hobby.

The market's current evolution is characterized by a pronounced segmentation and premiumization trend. The Side-by-Side (SxS) segment continues its meteoric rise, fragmenting into highly specialized sub-categories: ultra-high-performance sport models (e.g., Polaris RZR Pro R, Can-Am Maverick R), luxury-focused family/recreation models with premium audio and climate control, and heavy-duty utility models capable of replacing small tractors.

This fragmentation allows manufacturers to command higher average selling prices and build deeper brand loyalty. Concurrently, the electric transition is moving beyond novelty. Startups like Taiga Motors (electric snowmobiles and PWCs) and Volcon (electric UTVs) are pushing incumbents, while established players like Polaris (via its Ranger XP Kinetic) and Harley-Davidson's LiveWire are leveraging their scale. The U.S. market's true strength lies in this dynamic: a deep-rooted traditional core demand simultaneously being reshaped by cutting-edge innovation, ensuring its leadership role through 2034.

The Europe Power Sports Market

The Europe Powersports Market, projected at USD 9.8 billion in 2025 and reaching USD 17.2 billion by 2034 at a CAGR of 6.5% which presents a contrasting model of growth defined by premiumization, regulation, and a focus on structured tourism. Unlike the open-access culture of North America, European participation is more channeled through formalized structures touring clubs, licensed off-road parks, and guided adventure travel companies. This creates a market that is smaller in volume but often higher in value per unit, with a strong emphasis on technology, safety, and design sophistication.

The single most dominant market force in Europe is regulatory. The European Union's progressively stringent emissions standards (Euro 5 and beyond) are effectively acting as a mandated technology roadmap, compelling a rapid pivot away from pure internal combustion engines. This has made Europe a primary testing ground and launch market for electric and hybrid recreational vehicles. Manufacturers are investing heavily in R&D within the region, not just for compliance but to establish technological leadership. This regulatory environment dovetails with a strong consumer ethic favoring sustainability, making "green" powertrains a significant marketing advantage.

Market growth is further fueled by Europe's robust adventure and motorcycle tourism industry. The Alps, Pyrenees, and Scandinavian wilderness offer world-class touring routes for both motorcycles and 4x4 vehicles, attracting enthusiasts globally and supporting a thriving rental and guide service economy. Countries like Germany and Italy, with their storied motorcycling heritage (BMW, Ducati, KTM), maintain strong demand for high-end on- and off-road motorcycles.

Meanwhile, the Nordic nations are global leaders in snowmobile adoption, integral to winter transport and tourism. The European consumer is typically well-informed, values engineering quality, and is willing to invest in advanced safety features and connectivity. Consequently, the region's growth, while steady, is inherently linked to technological advancement, high disposable income segments, and the preservation of access within a tightly regulated environmental framework.

The Japan Power Sports Market

The Japan Powersports Market size is anticipated at reach USD 1.5 billion in 2025 and expanding to USD 2.6 billion by 2034 at a CAGR 7.1% in the forecasted period, exemplifies innovation-driven growth within spatial and demographic constraints. Japan's unique market drivers stem from its advanced aging society, technological prowess, and dense urban landscapes. With nearly 30% of the population over 65, there is a growing demand for accessible recreational mobility, fueling interest in easy-to-ride, stable three-wheeled motorcycles (trike conversions), low-speed electric utility vehicles, and comfortable touring motorcycles for senior riders.

Japan's global leadership in precision manufacturing, robotics, and battery technology directly translates into powersports innovation. Domestic giants Honda, Yamaha, Kawasaki, and Suzuki are not merely vehicle manufacturers but broad-based technology companies. This allows for rapid cross-pollination of technology from other divisions for instance, applying robotics expertise to develop advanced stability control systems, or leveraging EV battery research from automotive units for electric dirt bikes. Japan is at the forefront of developing compact, high-energy-density batteries crucial for the feasibility of electric off-road vehicles, where range anxiety is a significant barrier.

The market is strategically segmented. In hyper-urban areas like Tokyo and Osaka, the focus is on convenience and space-saving: small-displacement motorcycles for commuting, compact storage solutions, and a growing network of urban experience centers and rental kiosks that introduce city dwellers to riding in a controlled, accessible way. In contrast, rural prefectures are leveraging powersports as a tool for regional revitalization (kasseika).

Local governments are investing in off-road parks, scenic touring routes, and water sports facilities to attract tourism. The Japanese concept of "Connected Ecosystems" is particularly advanced, with OEMs developing platforms where the vehicle, the rider's gear (helmets with heads-up displays), and regional tourism services (hotel bookings, guided tour info) are seamlessly integrated via smartphone. Japan's path is thus one of leveraging its technological and demographic realities to cultivate a sophisticated, high-value, and experience-focused market niche.

Global Power Sports Market: Key Takeaways

- Steady Global Market Growth Outlook: The Global Powersports Market is expected to be valued at USD 34.8 billion in 2025 and is projected to reach USD 64.2 billion by 2034, showcasing consistent expansion supported by rising recreational spending and technological adoption.

- Solid CAGR Driven by Recreational Mobility: The market is expected to grow at a CAGR of 7.1% from 2025 to 2034, fueled by growing outdoor activity participation, vehicle electrification, and the expansion of adventure tourism globally.

- Strong Market Presence in the United States: The U.S. Powersports Market poised to stand at USD 11.1 billion in 2025 and is projected to reach USD 19.9 billion by 2034, expanding at a CAGR of 6.7% due to a deep-rooted recreational vehicle culture and extensive distribution networks.

- North America Maintains Regional Dominance: North America is expected to capture approximately 38.0% of the global market share in 2025, supported by high vehicle ownership rates, favorable terrains, and a strong aftermarket industry.

- Rapid Advancement in Powersports Technologies: Innovations including electric powertrains, advanced suspension systems, digital dashboards, rider connectivity, and GPS-enabled trail systems are significantly enhancing performance, safety, and the user experience.

- Growing Interest in Outdoor Recreation Boosts Adoption: Rising consumer pursuit of adventure, escape, and experiential activities is driving sustained demand for off-road vehicles, watercraft, and snowmobiles, particularly in regions with developed tourism and access to natural landscapes.

Global Power Sports Market: Use Cases

- Off-Road Trail Riding & Exploration: Enthusiasts use ATVs and Side-by-Sides to explore remote trails, national parks, and off-road recreational areas, often as part of organized groups or family adventures.

- Utility & Agricultural Applications: SxS vehicles and heavy-duty ATVs are employed on farms, ranches, and industrial sites for transportation, towing, and material handling, blurring the line between recreation and work.

- Snowmobiling in Winter Tourism: Snowmobiles are central to winter tourism in mountainous and northern regions, used for trail riding, backcountry exploration, and resort-based activities.

- Personal Watercraft for Marine Recreation: PWCs are used for recreational riding, towing watersports participants, and coastal exploration, popular in warm climates and vacation destinations.

- Adventure & Touring Motorcycling: Motorcycles designed for long-distance travel and mixed-terrain touring are used for road trips, adventure rallies, and global overland expeditions.

- Racing & Competitive Motorsports: Dedicated vehicles for motocross, cross-country racing (GNCC), hill climb events, and watercraft racing form a high-performance niche that drives technological innovation and brand marketing.

- First-Response & Security Applications: Specialized, rugged SxS and ATV platforms are used by police, fire departments, and search-and-rescue teams for mobility in crowded events, natural disasters, or difficult terrain.

Global Power Sports Market: Stats & Facts

U.S. Department of Transportation (USDOT) / Bureau of Transportation Statistics

- The United States had over 8.8 million registered motorcycles in the most recent reporting year.

- Motorcycle registrations in the U.S. increased by more than 90% between 2002 and 2023.

- Motorcycles account for less than 3% of all registered motor vehicles in the United States.

Motorcycle Industry Council (MIC) – Industry Body Using Official Registration Data

- The U.S. powersports industry supports over 30 million participants annually.

- There are approximately 11 million motorcycles in operation in the United States, including on-road and off-road.

- The powersports industry contributes over USD 50 billion annually to the U.S. economy.

- Off-highway vehicles (ATVs and side-by-sides) represent over 40% of powersports unit sales in the U.S.

- More than 1,600 powersports manufacturers and distributors operate across North America.

U.S. Consumer Product Safety Commission (CPSC)

- An average of more than 800 deaths per year in the U.S. are associated with off-highway vehicles.

- ATVs account for over two-thirds of all off-highway vehicle fatalities.

- Approximately 100,000 emergency room visits annually are linked to off-highway vehicle injuries.

- Nearly 25% of ATV-related fatalities involve riders under the age of 16.

- Rollovers are involved in over half of ATV fatal accidents.

European Commission / Eurostat

- The European Union records over 35 million registered motorcycles and mopeds.

- Motorcycles represent around 8% of total motor vehicle registrations in the EU.

- Southern European countries account for more than 60% of EU motorcycle ownership.

- Recreational and off-road motorcycles are among the fastest-growing vehicle segments in Eastern Europe.

United Nations Economic Commission for Europe (UNECE)

- UNECE motorcycle safety regulations are adopted by over 50 countries globally.

- Global adoption of standardized helmet and braking regulations covers more than 70% of powered two-wheelers worldwide.

- Electric-powered two-wheelers are included in UNECE vehicle category L regulations.

World Health Organization (WHO)

- Powered two- and three-wheelers account for nearly 30% of global road traffic deaths.

- Low- and middle-income countries represent over 90% of motorcycle-related fatalities worldwide.

- Helmet use reduces the risk of death by over 40% among motorcycle riders.

U.S. Bureau of Land Management (BLM) / U.S. Forest Service

- The U.S. federal government manages over 260 million acres of public land open to off-highway vehicle use.

- National Forests include over 400,000 miles of roads and trails accessible to off-highway vehicles.

- Recreational off-highway vehicle use is one of the top five recreational activities on federal public lands.

Transport Canada / Provincial Governments

- Canada has more than 1.3 million registered off-highway vehicles, including ATVs and snowmobiles.

- Off-highway vehicle registrations in some Canadian provinces grew by over 15% between 2020 and 2022.

- Snowmobiles account for nearly 30% of Canada’s off-highway vehicle fleet.

International Energy Agency (IEA)

- Electric two-wheelers represent over 50% of the global electric vehicle stock.

- Small electric motorcycles and scooters dominate electric vehicle adoption in Asia.

- Battery-powered recreational vehicles are among the fastest-growing electrified transport segments.

National Park Service (United States)

- Off-highway vehicle recreation contributes billions of dollars annually to rural tourism economies.

- OHV activities support tens of thousands of jobs in gateway communities near public lands.

Global Power Sports Market: Market Dynamic

Driving Factors in the Global Powersports Market

Growing Participation in Outdoor Recreation

The post-pandemic "experience economy" has fundamentally accelerated the desire for outdoor activities. Consumers are prioritizing spending on travel and adventures over material goods. Powersports vehicles are the enabling tools for this shift, providing access to remote natural wonders and thrill-based experiences. This is not just a North American phenomenon; emerging middle classes in Asia-Pacific and Latin America are increasingly seeking these forms of leisure. Social media acts as a powerful amplifier, with stunning visuals of off-road adventures and touring expeditions inspiring participation and creating aspirational lifestyle branding for vehicles.

Technological Innovation and Electrification

Innovation is a multi-pronged driver. Electrification addresses regulatory pressure and consumer demand for quieter, cleaner vehicles, while also offering performance benefits like instant torque. Advanced materials (carbon fiber, high-grade aluminum) reduce weight and increase durability. Digitalization is revolutionizing the user interface: high-resolution TFT displays offer GPS navigation, vehicle telematics, and smartphone mirroring.

Rider-assist technologies (cornering ABS, wheelie control, crawl modes) make powerful machines safer and more accessible to novices, thereby expanding the potential customer base. This constant technological refresh cycle also stimulates replacement demand among existing enthusiasts.

Restraints in the Global Powersports Market

High Ownership and Operational Costs

The total cost of ownership remains a formidable barrier. A new premium SxS can exceed USD 30,000, with a similarly equipped adventure motorcycle reaching USD 25,000. To this, add insurance (which is high for high-performance vehicles), storage (garage or trailer), maintenance, fuel, and mandatory safety gear. This positions powersports as a discretionary luxury purchase, making demand highly elastic and vulnerable to economic recessions, rising interest rates, and inflation that erodes disposable income. The cyclical nature of the industry is a direct result of this cost sensitivity.

Regulatory and Land-Access Challenges

This is arguably the most significant long-term restraint. Emissions and Noise Regulations are becoming stricter globally, increasing R&D and manufacturing costs for ICE vehicles and forcing a costly transition to new powertrains. More critically, Land Access is shrinking. Environmental advocacy, urban sprawl, and competing uses for public lands are leading to the closure of trails and riding areas.

The process to open new legal riding areas is often lengthy and politically contentious. This "trail squeeze" threatens the very utility of the product, potentially stifling demand in key markets. Additionally, a complex patchwork of local regulations regarding vehicle registration, safety equipment, and where vehicles can be operated creates confusion and discourages cross-regional travel and tourism.

Opportunities in the Global Powersports Market

Expansion of Electric Vehicle Portfolio

The electric transition is not a threat but the industry's largest greenfield opportunity. It allows manufacturers to redefine performance parameters (instant torque, precise throttle control), attract entirely new customer segments (tech-savvy, eco-conscious urbanites), and access new markets with strict noise ordinances (e.g., near residential areas or in protected natural parks).

Opportunities extend beyond the vehicle to ancillary businesses: home and destination charging solutions, battery subscription/leasing models, battery swap station networks for adventure touring, and advanced software for battery management and performance tuning. Early movers can establish defining brand leadership in this new space.

Growth in Rental, Tourism, and Experience Economy

This B2B segment offers immense scalability. Opportunities include developing turnkey rental franchise models for entrepreneurs, creating OEM-certified vehicle packages specifically designed for the durability and safety needs of rental fleets, and forming strategic partnerships with global tourism operators, hotel chains, and cruise lines to offer branded powersports excursions. Furthermore, digital platforms that aggregate and book powersports experiences globally (an "Airbnb for adventures") present a software-based opportunity that leverages the growing demand without carrying vehicle inventory risk.

Trends in the Global Powersports Market

Rise of the Side-by-Side (SxS) Segment

The SxS segment's dominance is the defining trend of the past decade and continues unabated. The trend is towards extreme segmentation and specialization. We see: 1) Hyper-Performance Sport Models: Turbocharged, long-travel suspension machines pushing 200+ horsepower for dune and desert racing. 2) Ultra-Luxury Family Models: Featuring automotive-level amenities like heated/ventilated seats, premium audio systems, and expansive cargo beds with dump functions. 3) Heavy-Duty Utility Models: With diesel options, increased towing (over 2,500 lbs) and payload capacities, and PTO connections for implements, they directly compete with small tractors. This segmentation allows brands to capture maximum value across a wide spectrum of use cases and budgets.

Digital Integration and Connected Riders

The vehicle is becoming a "smartphone on wheels." The trend is moving beyond basic Bluetooth to fully integrated ecosystems. Key aspects include: Native Telematics and OTA Updates: Vehicles continuously report health data, receive software updates for performance or features, and enable stolen vehicle tracking. Group Ride Connectivity: Mesh network systems allow large groups of riders to communicate via helmet intercoms and see each other's locations on a shared map, even without cellular service. Immersive Digital Dashboards: High-resolution screens display not just speed, but detailed mapping, pitch/roll angles, suspension travel, G-forces, and media. Deep Smartphone App Integration: Apps log rides, analyze performance data, schedule service, order OEM parts, and share adventures directly to social media.

Global Power Sports Market: Research Scope and Analysis

By Product Type Analysis

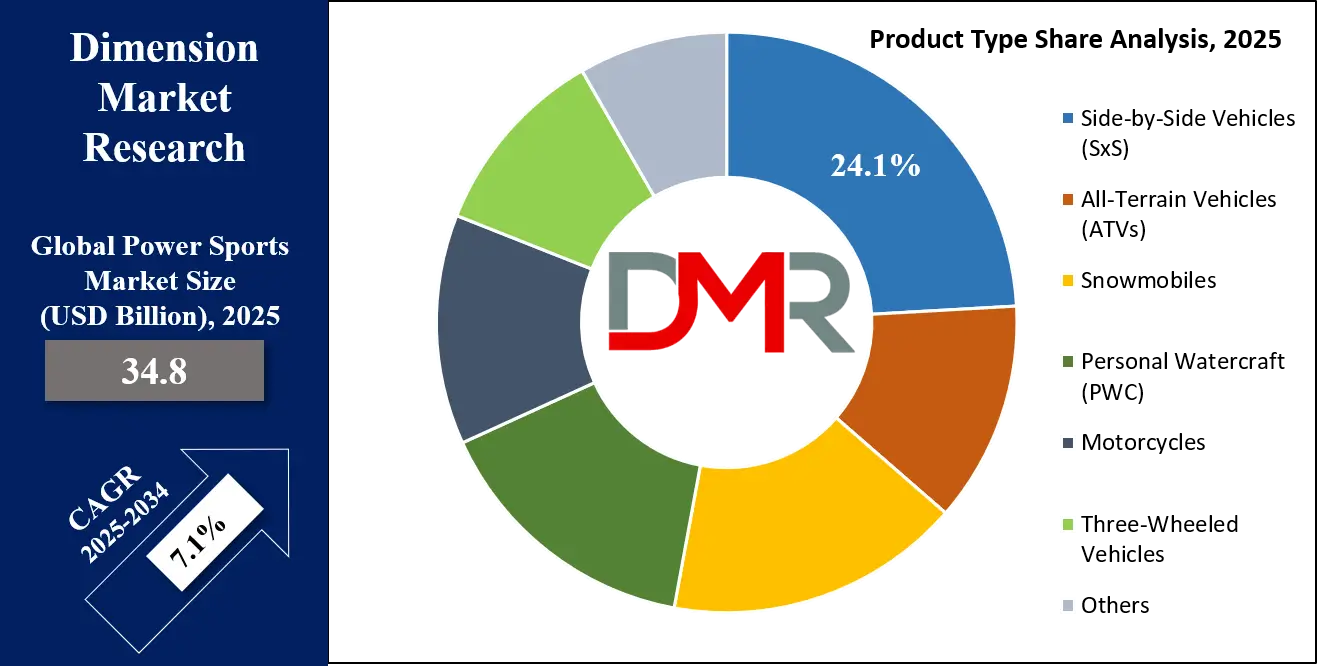

The Side-by-Side Vehicles (SxS) segment is projected to dominate the global market due to its unparalleled versatility, appealing to both recreational riders and utility users. Its growth is fueled by continuous innovation in power, comfort, safety features, and cargo/towing capacity. The segment benefits from strong demand in North America for ranch and farm work, as well as family trail riding. OEMs are expanding model lineups with everything from sport-performance to utility-focused and luxury-trim vehicles, ensuring broad market coverage. This dual-purpose nature, combined with aggressive marketing and a vibrant aftermarket, secures the SxS segment's leading position through the forecast period.

All-Terrain Vehicles (ATVs) remain a core and stable segment, valued for their agility, lower cost point compared to SxS, and deep roots in recreational and utility applications. They are particularly popular for solo trail riding, hunting, and lighter agricultural tasks. The segment is seeing a refresh with new models featuring independent rear suspension (IRS) for better comfort, power steering as standard, and electronic fuel injection for reliability, keeping it relevant.

Motorcycles represent the highest-volume segment by unit sales, though often lower in average selling price than premium SxS. It is highly fragmented into sub-segments: Cruiser/Touring (Harley-Davidson, Indian), Adventure Touring (BMW, KTM), Sport/Street (Kawasaki Ninja, Yamaha YZF-R), Dual-Sport/Enduro, and Dirt/Off-road. Growth is strongest in the Adventure and Dual-Sport categories, aligning with the outdoor exploration trend.

Personal Watercraft (PWC) and Snowmobiles are highly seasonal and regionally concentrated segments. PWC growth is tied to coastal and lake-based tourism, with trends towards larger, more stable models suitable for towing and luxury "cruiser" models with seating for three. Snowmobile growth is intrinsically linked to winter snowfall and tourism, with innovation focused on smoother rider-forward ergonomics, advanced track and ski technology for deep snow, and the emergence of electric models to address noise concerns in backcountry areas.

By Application Analysis

The Recreational/Adventure segment is poised to be the largest and most dominant application in the powersports market. This encompasses trail riding, off-road exploration, dune bashing, touring, and general leisure use. The primary driver is the global consumer shift toward spending on experiences and outdoor activities. This application benefits directly from tourism marketing, social media influence, showcasing powersports adventures, and the growing infrastructure of off-road parks and trail networks. Its dominance is reinforced as manufacturers design vehicles increasingly with enhanced comfort, technology, and performance features tailored for the recreational user, ensuring this segment retains the largest market share through the forecast period.

The Utility segment ranks as the second-largest application, driven by the commercial and agricultural use of SxS and ATV platforms. Their ability to navigate difficult terrain and perform tasks like towing, spraying, and equipment transport makes them invaluable tools, creating a consistent demand stream less susceptible to recreational spending cycles. This segment prioritizes durability, payload capacity, and accessory compatibility (winches, sprayers, seeders) over high-speed performance.

The Sports & Racing segment, while smaller in volume, is critically important as the innovation and marketing spearhead for the industry. Technologies developed for the grueling demands of motocross, rally raid (Dakar), and cross-country racing often trickle down to consumer models. This segment drives brand prestige, attracts aspirational buyers, and supports a dedicated ecosystem of race teams, aftermarket performance parts manufacturers, and specialized media.

By End User Analysis

Individual Consumers/Enthusiasts are anticipated to dominate the powersports market as the primary end user. This group drives demand through direct purchases for personal recreation, hobby participation, and vehicle customization. Their spending powers the core vehicle market and a significant portion of the aftermarket.

Brand loyalty, community involvement (clubs, events), and discretionary income levels are key determinants within this segment. The rise of financing options and a robust used vehicle market further enables consumer access, solidifying their position as the largest end-user segment. This group can be further segmented into hardcore enthusiasts (high involvement, multiple vehicles, frequent participants) and casual participants (seasonal or occasional users, often entering via rental experiences).

Rental & Tourism Operations represent the second-largest end-user segment. This includes businesses such as off-road adventure tour companies, resort rental outlets, watercraft rental marinas, and snowmobile guide services. This segment is critical for market expansion as it introduces the activity to novices, drives ancillary revenue, and supports consistent fleet sales to operators. Growth in global tourism and the experience economy directly fuels demand in this segment. These operators demand vehicles with exceptional durability, ease of maintenance, and specific safety features, often leading to the development of "Commercial" or "Fleet" editions by OEMs.

Commercial & Industrial Enterprises form a stable and high-utilization segment. This includes agriculture, forestry, mining, oil & gas, and large estate management. For them, SxS and ATVs are capital equipment, valued for productivity and total cost of ownership. Demand here is driven by replacement cycles and economic activity in extractive and agricultural industries.

Government & Military agencies worldwide utilize specialized powersports vehicles for patrol, border security, disaster response, and park ranger duties. This segment, while not large in volume, offers high-margin opportunities for sales of armored, communications-equipped, or otherwise highly modified vehicles built to stringent technical specifications.

The Global Power Sports Market Report is segmented on the basis of the following:

By Product Type

- Side-by-Side Vehicles (SxS)

- All-Terrain Vehicles (ATVs)

- Snowmobiles

- Personal Watercraft (PWC)

- Motorcycles

- Three-Wheeled Vehicles

- Others

By Application

- Recreational/Adventure

- Utility

- Sports & Racing

- Defense & Law Enforcement

- Others

By End User

- Individual Consumers/Enthusiasts

- Rental & Tourism Operations

- Commercial & Industrial Enterprises

- Government & Military

- Others

Impact of Artificial Intelligence in the Global Power Sports Market

- Electric Powertrain Adoption: The integration of electric motors and advanced battery systems reduces emissions and noise, opens new riding areas, lowers long-term operating costs, and attracts a new demographic of environmentally conscious riders, fundamentally reshaping product development. It necessitates new supply chains for batteries and motors, new dealer service technician training, and novel marketing around range, charging, and performance characteristics distinct from ICE vehicles.

- Advanced Rider-Assistance Systems (ARAS): Technologies like electronic stability control, traction control, hill descent control, and linked braking enhance safety and rider confidence, making powerful vehicles more accessible to a broader range of skill levels and reducing accident rates. This is particularly crucial for SxS vehicles, which have a higher center of gravity. The next frontier includes radar- or camera-based systems for adaptive cruise control and blind-spot monitoring on touring motorcycles and luxury UTVs.

- Digital Connectivity and Telematics: Integrated GPS, smartphone app connectivity, vehicle health monitoring, and group ride communication systems enhance the user experience, enable new services (like stolen vehicle tracking, usage-based insurance), and create data-driven insights for manufacturers on how vehicles are used, informing future design. This creates a recurring software/service revenue model potential (e.g., subscription maps, performance data clouds).

- Advanced Materials and Lightweighting: Use of high-strength steel, aluminum alloys, and composites reduces vehicle weight, improving performance, handling, and fuel efficiency (or electric range), while maintaining durability in harsh off-road conditions. This includes innovations like carbon-fiber wheels, aluminum subframes, and polymer composite body panels. Lightweighting is especially critical for electric vehicles to offset heavy battery weight.

- Autonomous & Semi-Autonomous Features for Utility: Development of follow-me modes, terrain-sensing throttle mapping, and assisted driving features for utility applications increases operator efficiency and safety in demanding commercial and agricultural settings. For example, a sprayer vehicle could autonomously follow a pre-mapped path in an orchard, or a utility SxS could maintain a steady crawl speed for a ground crew without constant throttle input from the driver.

Global Power Sports Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Powersports Market with approximately 38.0% of market share by the end of 2025. This dominance is owed to a powerful combination of a deeply ingrained riding culture, vast and accessible public lands, high per-capita disposable income, and the world's most mature and extensive dealership and aftermarket network. The United States is the single-largest national market, driven by strong sales of Side-by-Side vehicles, ATVs, and personal watercraft.

Supportive state-level ORV programs, a well-developed trail infrastructure, and major industry events and trade shows (like the Dealer Expo) solidify its leadership. Furthermore, early and aggressive adoption of electric models by both startups and legacy manufacturers ensures North America remains at the forefront of industry evolution. Canada complements this with a strong snowmobile culture and vast wilderness areas for adventure touring.

Region with the Highest CAGR

Asia-Pacific is expected to register the highest CAGR and is poised for significant market share gains in the powersports market. This growth is fueled by a rising middle class with increasing disposable income, growing interest in Western-style recreational activities, and improving tourism infrastructure, particularly in Southeast Asia. Countries like China, India, Australia, and Thailand are key growth engines. While the market base is smaller than North America's, the growth rate is accelerated by low ownership penetration, offering massive headroom for expansion.

Government initiatives to develop adventure tourism, coupled with the local manufacturing prowess of major players (especially in India and China for two-wheelers), are making vehicles more affordable and available. The region is also becoming a hotbed for electric two-wheeler innovation, which will spill over into the recreational electric vehicle segment. Challenges include limited legal off-road land in densely populated countries and varying regulatory maturity.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Power Sports Market: Competitive Landscape

The Global Powersports Market is moderately fragmented and highly competitive, characterized by the presence of established global OEMs, strong regional players, and a wave of new entrants focusing on electrification. Leading manufacturers such as Polaris Inc., BRP Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., and Kawasaki Heavy Industries dominate the landscape with broad portfolios spanning ATVs, SxS, motorcycles, snowmobiles, and watercraft. These companies compete on brand heritage, performance, extensive dealer networks, and continuous innovation in engine technology and vehicle design.

The market is seeing intense competition in the Side-by-Side segment, with Polaris (RZR, Ranger), BRP (Can-Am Maverick, Defender), Honda (Pioneer), and others fiercely vying for market share through model proliferation and feature wars. The electric vehicle segment is becoming a new battleground, with traditional OEMs launching electric models (like Polaris' Ranger XP Kinetic) while competing with dedicated EV startups like Taiga Motors, Zero Motorcycles, and Volcon.

The aftermarket and accessories sector is a vital part of the ecosystem, with companies like Warn Industries, Rigid Industries, and many specialized firms driving significant revenue through customization, performance parts, and protective gear. This competitive dynamic ensures rapid product evolution and a strong focus on consumer preferences across different regions and riding disciplines.

Some of the prominent players in the Global Power Sports Market are:

- Polaris Inc.

- BRP Inc. (Bombardier Recreational Products)

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Suzuki Motor Corporation

- Textron Inc. (Arctic Cat)

- Harley-Davidson, Inc.

- KTM AG

- CFMOTO

- Taiga Motors

- Zero Motorcycles, Inc.

- Nikola Corporation

- Volcon Inc.

- BMW Motorrad

- Ducati Motor Holding S.p.A. (part of Volkswagen Group)

- Husqvarna Motorcycles (Pierer Mobility Group)

- Warn Industries

- Other Key Players

Recent Developments in the Global Power Sports Market

- November 2025: BRP unveiled its new integrated Rotax electric powertrain system, designed for Can-Am and Sea-Doo models, featuring improved range, faster charging, and a modular battery architecture.

- October 2025: The Power Sports Expo 2025 was held in the United States, bringing together OEMs, aftermarket suppliers, and dealers to showcase new ATVs, UTVs, motorcycles, electric power sports vehicles, and performance accessories.

- September 2025: Yamaha Motor Co. announced expanded global investment in electric power sports R&D, focusing on off-road electric motorcycles and hybrid recreational vehicles.

- August 2025: KTM AG confirmed strategic capital infusion and operational collaboration with Bajaj Auto to strengthen its global power sports portfolio and accelerate new platform development.

- July 2025: Polaris Inc. introduced new smart connectivity and ride-command upgrades across its UTV and ATV lineup, integrating cloud-based diagnostics and over-the-air updates.

- June 2025: CFMOTO launched new UFORCE utility side-by-side vehicles globally, emphasizing enhanced payload capacity, durability, and fleet applications.

- May 2025: Harley-Davidson and Hero MotoCorp expanded their collaboration to explore additional mid-capacity motorcycles and power sports platforms for emerging markets.

- April 2025: Fox Powersports completed acquisitions of multiple regional dealership groups in the United States, strengthening its retail footprint and multi-brand powersports distribution network.

- March 2025: AIMExpo 2025 was held in North America, serving as a major international conference and exhibition for motorcycles, ATVs, UTVs, snowmobiles, and power sports aftermarket technologies.

- February 2025: Suzuki Motor Corporation announced a strategic collaboration with TVS Motor Company to jointly develop electric two-wheelers and compact quad-based power sports vehicles.

- January 2025: Honda Motor Co. revealed plans to expand localized manufacturing of power sports vehicles in Asia and Latin America to support growing recreational and utility demand.

- November 2024: Yamaha Motor Company made a minority investment in Electric Motion, an electric off-road motorcycle manufacturer, to accelerate development of electric trials and recreational power sports bikes.

- October 2024: Taiga Motors expanded commercial deployment of electric snowmobiles through partnerships with North American ski resorts, supporting zero-emission recreational mobility.

- September 2024: BRP announced capacity expansion at its North American manufacturing facilities to support rising global demand for ATVs, UTVs, and personal watercraft.

- August 2024: Polaris Inc. launched next-generation Ranger and Sportsman models featuring improved fuel efficiency, enhanced suspension systems, and advanced safety features.

- July 2024: Kawasaki Heavy Industries introduced new high-performance side-by-side recreational vehicles targeting desert racing and adventure tourism segments.

- June 2024: Vidde Mobility, in collaboration with Pininfarina, unveiled a premium electric snowmobile concept aimed at sustainable power sports markets in Europe and North America.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 34.8 Bn |

| Forecast Value (2034) |

USD 64.2 Bn |

| CAGR (2025–2034) |

7.1% |

| The US Market Size (2025) |

USD 11.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Side-by-Side Vehicles (SxS), All-Terrain Vehicles (ATVs), Snowmobiles, Personal Watercraft (PWC), Motorcycles, Three-Wheeled Vehicles, Others), By Application (Recreational/Adventure, Utility, Sports & Racing, Defense & Law Enforcement, Others), and By End User (Individual Consumers/Enthusiasts, Rental & Tourism Operations, Commercial & Industrial Enterprises, Government & Military, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Polaris Inc., BRP Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, Textron Inc., Harley-Davidson, Inc., KTM AG, CFMOTO, Taiga Motors, Zero Motorcycles, Inc., Nikola Corporation, Volcon Inc., BMW Motorrad, Ducati Motor Holding S.p.A., Husqvarna Motorcycles, Warn Industries, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The market is growing at a CAGR of 7.1 percent over the forecasted period of 2025 to 2034.

The Global PowerSports Market size is estimated to have a value of USD 34.8 billion in 2025 and is expected to reach USD 64.2 billion by the end of 2034.

The US PowerSports Market is projected to be valued at USD 11.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 19.9 billion in 2034 at a CAGR of 6.7%.

North America is expected to have the largest market share in the Global Power Sports Market with a share of about 38.0% in 2025.