Prepaid card markets have experienced remarkable expansion over the past decade due to rising consumer and business demand for flexible payment solutions that offer convenient cashless transactions worldwide. Digital payment technology adoption, combined with its increased usage by unbanked populations has furthered prepaid cards' expansion; making prepaid cards essential financial tools both developed and emerging market countries alike.

Prepaid cards have quickly become an indispensable component of corporate payment strategies, providing cost-efficient means of administering payroll, employee benefits and expense reimbursements. Furthermore, businesses increasingly employ them for customer loyalty programs, gift cards and incentives as part of customer engagement strategies that ultimately promote greater retention rates and greater engagement rates among customer.

Prepaid card market projections indicate continued expansion across sectors such as e-commerce, gig economy and cross-border remittances. Furthermore, new innovations will likely emerge to support adoption across various industries and demographics.

Key Takeaways

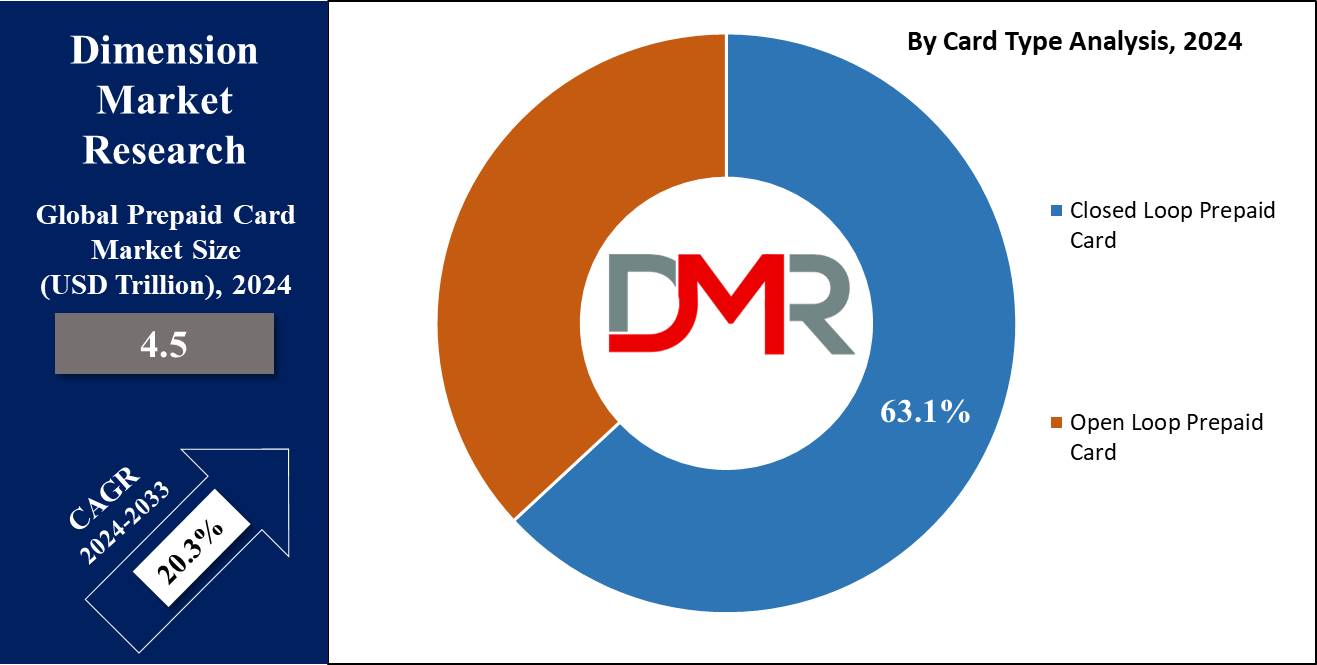

- Prepaid card market revenues reached USD 4.5 trillion in 2024 and are projected to surpass USD 23.8 trillion by 2034 with a CAGR of 20.3%.

- U.S. Prepaid Card Market Size is projected to grow from USD 1.48 trillion in 2023 to reach USD 10.72 trillion by 2034 at a CAGR of 19.4%.

- Gift cards accounted for an impressive share of the market in 2023 by offering these gifts.

- By card type, Closed Loop Prepaid Card accounts held the highest share in the 2023 prepaid card market share.

- By end-user segment, Retail Establishments was the clear leader in 2023's prepaid card market.

- North America held the highest market share at 61.68% for Prepaid Card Sales during 2023.

Use Cases

- Budget Management: Prepaid cards make budget management simpler by enabling users to load an amount onto them for spending. Doing this helps users stick within their spending plan without incurring overdraft fees and penalties.

- Online Shopping Security: Prepaid cards provide shoppers with greater protection from fraud by not connecting directly to bank accounts; therefore limiting potential exposure and spending control issues.

- Travel Expenses: Travelers use prepaid cards as an effective tool to budget their trips more effectively while taking advantage of competitive foreign exchange rates and eliminating the need to carry large sums of cash with them.

- Corporate Expense Control: Many organizations issue pre-paid cards to employees for travel and petty cash expenses, simplifying expense reporting while decreasing administrative overhead costs.

Driving Factors

Consumer Preference for Cashless Transactions Drives Prepaid Card Adoption

As consumers increasingly opt for cashless transactions, prepaid card markets have rapidly expanded worldwide. Prepaid cards offer convenient, safe, and accessible alternatives that have seen this shift accelerate since 2025 as digital payments reach over

60% of global transactions (and with that increasing digital payments penetration across developed and emerging markets alike).

Preloaded prepaid cards that can be preloaded without bank accounts or credit histories cater to wide demographic groups including unbanked/underbanked people as they provide them a means of payments while expanding prepaid penetration within these segments of market development!

Advancements in Card Security Features Strengthen Consumer Confidence

Improved security features like EMV (Europay, Mastercard and Visa) chips have played a crucial role in increasing prepaid card adoption across sectors. EMV technology combined with tokenization and biometric authentication solutions has reduced fraud-related card incidents significantly in high risk environments like eCommerce e-commerce sites resulting in consumers feeling confident when using prepaid cards which has further expanded their usage across various fields.

Travel and Tourism Boom Stimulate Prepaid Travel Card Market

Travel and tourism growth has also played a crucial role in driving growth of the prepaid card market, fuelling increased popularity for travel cards such as prepaid travel cards. International tourists in particular often turn to these cards when managing expenses abroad - offering multiple advantages including preloading funds in different currencies to avoid fluctuating exchange rates and better managing overseas spending.

International tourist arrivals rebounded strongly following pandemic with international tourist arrivals exceeding nearly 80% of pre-pandemic levels during 2022 - fuelling increased interest for these tools which offer convenience while cost effective managing their travel expenses while abroad.

Growth Opportunities

Partnerships With Mobile Wallet Providers to Expand Market Reach

One of the most promising opportunities in 2023 for the prepaid card market lies with partnerships between providers and mobile wallet platforms. By connecting prepaid cards to popular wallet apps, providers can tap into an expanded customer base among young, tech-savvy customers who favor mobile-first solutions such as wallets.

Such integration offers users greater convenience for both online and offline transactions using the card potentially increasing its usage rates in general and increasing usage rates by consumers overall. Furthermore, such collaborations may streamline payment processes to enhance overall user experiences making prepaid cards an even more desirable payment solution in an increasingly competitive payment landscape

Cryptocurrency Adoption: Capitalising on Niche Market

Prepaid cards and cryptocurrency form an exciting nexus that could significantly expand the market. Linking prepaid cards directly with cryptocurrency accounts enables users to spend digital currencies more conveniently within traditional economies; not only is this beneficial in driving mainstream adoption of cryptocurrencies but it broadens prepaid card usage to meet market segmentations values innovation and financial flexibility.

Development of Prepaid Healthcare Cards to Meet Specific Needs

Prepaid healthcare cards present another area with great growth potential. Designed to streamline payments for

healthcare services or manage health savings accounts (HSAs), these cards can offer an efficient means of tracking healthcare expenditure. By offering customized features to address healthcare payments specifically, card issuers may capture significant marketshare.

Innovations in Biometric Verification: Strengthening Security and User Confidence

Biometric verification technologies like fingerprint and facial recognition, when integrated into prepaid cards, can significantly boost security - an integral component to user adoption. Incorporating

biometric security can significantly decrease fraud risks as well as unauthorised usage thereby building consumer confidence and strengthening brand recognition of these advanced payment cards within their industries. Innovation in this space not only addresses security concerns associated with payment cards but also positions them as technologically superior options within this evolving sector.

Key Trends

Virtual Prepaid Cards Are Revolutionizing Online Shopping Convenience

2023 is witnessing a notable surge in the use of virtual prepaid cards due to an increasing volume of online shopping. Virtual cards provide consumers with an efficient, safe method for making payments without needing physical cards - meeting modern consumers' preference for quick digital solutions like this trend is. Digital platforms and e-retailers in particular find this trend helpful, as it simplifies transaction processes while decreasing barriers for immediate purchases, thus improving overall customer experiences while driving sales growth.

Shifting towards Contactless Payments as a Response to Health and Safety Concerns

The global health crisis has fundamentally altered consumer behaviors toward contactless payments - such as prepaid cards. Contactless prepaid cards provide a safer, faster method to transact without physical contact - meeting both public health guidelines and consumer expectations for convenience. This shift may endure long after pandemic has subsided as both users and merchants appreciate both its hygiene advantages as well as speed of transactions conducted using contactless technology.

Increased E-commerce Usage: Fostering Flexible Consumer Spending

E-commerce growth remains one of the primary forces driving adoption of prepaid cards, particularly among consumers who shop online. Prepaid cards offer shoppers who require controlled spending an effective solution. Prepaid cards especially appeal to individuals who may be wary about sharing banking details online or who strictly manage budgets as an easy, safe payment option that meets both budgetary constraints.

Prepaid Cards for Subscription Models: Creating Controlled Recurring Payments

Prepaid cards have also become a prominent trend within subscription-based models. As subscription services such as streaming platforms or software-as-a-service become more widespread, consumers are opting to use prepaid cards as they provide noncommittal ways of paying without incurring auto-renewal charges or linking their subscription expenses directly with bank accounts or credit cards.

Restraining Factors

Low Consumer awareness Encumber Market Penetration

Prepaid card markets face several key barriers, chief among them a lack of consumer awareness in many regions. Although prepaid cards provide benefits like budget control and no bank account requirement, their full potential remains underutilized due to insufficient knowledge among potential users.

As consumers remain comfortable using more familiar payment methods instead, educational and marketing initiatives highlighting the advantages of using prepaid cards may help mitigate barriers to growth while simultaneously driving market expansion.

Fraud and Security Concerns Stifle Adoption

Prepaid cards, like other payment forms, are susceptible to fraud that can threaten consumer confidence and adoption rates. Scams and fraudulent transactions that take place through them may discourage potential users from choosing it as their payment option compared with debit or credit cards where banks often provide fraud protection services. Thus enhancing security features and improving consumer protection mechanisms are necessary in mitigating concerns and instilling trust when using prepaid cards.

Competition from Established Payment Methods Stifles Growth

Prepaid cards face stiff competition from established payment options like debit and credit cards as well as emerging technologies like mobile wallets. These alternatives typically provide additional advantages that prepaid cards cannot match, such as reward programs and wide acceptance.

Mobile wallets in particular benefit from smartphones' increasing penetration which facilitates digital and in-person transactions more easily compared to prepaid cards; to remain viable alternatives they must innovate by offering unique features that set them apart, such as budget control without credit checks or operating independently of traditional bank accounts.

Research Scope and Analysis

By Offering

Gift Cards were the clear leader in the Offering segment of the Prepaid Card market in 2023, reflecting their broad appeal and versatility as personal use gifts as well as corporate incentives across retail platforms like e-commerce platforms.

Government Benefit and Disbursement Cards represent an increasingly crucial subsegment of the prepaid card market. Used mainly for dispersing government aid such as social security payments, unemployment aid payments and public assistance funds directly to recipients, these prepaid cards offer a secure, cost-effective and efficient means to ensure timely distribution to those most in need. With governments seeking reliable ways of quickly dispersing funds during emergencies or economic downturns, this segment has seen increased adoption and has become more widely adopted than ever.

Businesses have shown strong growth in the adoption of incentive/payroll cards as an innovative solution for payroll management and employee rewards, providing employers with a direct way of disbursing salaries and bonuses without incurring additional bank costs or delays in processing them. Furthermore, employees benefit from instantaneous access to funds while supporting financial inclusion; plus they offer the convenience of direct purchases, online shopping or bill payment with these cards.

GPR cards have quickly become an accessible financial solution for consumers searching for an alternative to conventional banking. GPR cards provide consumers with an efficient alternative that caters to unbanked individuals, budget-minded consumers and young adults navigating finances for the first time. GPR cards support everyday financial activities like shopping, bill payment and withdrawal of cash withdrawal with budget control benefits as well as reduced overdraft risk.

By Card Type

Closed Loop Prepaid Cards were the top sellers among Card Type segment of Prepaid Card market in 2023. Issued by specific retailers or service providers and designed only to work within their network or store location, these cards create tailored marketing strategies as customers are incentivized to return. Closed Loop Prepaid Cards became particularly prevalent within retail sectors because they encourage repeat business as well as increased consumer engagement - fueling considerable growth within this vertical.

Open Loop Prepaid Cards have experienced strong growth over time and provide invaluable insight into the dynamics of the broader prepaid card market. Backed by major payment networks like Visa, MasterCard and American Express, Open Loop cards allow greater flexibility compared to their Closed Loop counterparts; making these products particularly appealing among travelers or consumers who seek more inclusive alternatives than traditional banking products.

By End User

Retail Establishments were the top market contender for End User Prepaid Card Market Segment sales in 2023. Their dominance can be attributed to widespread consumer adoption of prepaid cards as convenient and secure ways of making everyday purchases, and retailers capitalized on this trend by creating custom prepaid cards which not only facilitate transactions but also strengthen customer engagement through loyalty programs or promotional incentives that encourage repeat visits or spending; making these highly effective marketing tools for their businesses.

Corporate sectors also play a significant role in the prepaid card market, employing these financial tools for various operational uses. Prepaid cards in this arena typically serve to manage employee expenses like travel and entertainment as well as disperse payroll for gig workers without traditional bank accounts - they also allow companies to streamline payment processes while decreasing administrative costs while offering employees flexible alternatives to cash and checks payments.

Government/Public Sector has recognized the advantages of using prepaid cards for disbursing benefits and payments from government agencies. Prepaid cards provide a secure, efficient, cost-effective method for government agencies to distribute funds without using checks and cash; prepaid cards offer beneficiaries immediate access with decreased risk of theft or loss while supporting financial inclusion by offering essential banking services for underserved populations.

The Prepaid Card Market Report is segmented based on the following:

By Offering

- Gift Cards

- Government Benefit/Disbursement Card

- Incentive/Payroll Card

- General Purpose Reloadable Card

- Others

By Card Type

- Closed Loop Prepaid Card

- Open Loop Prepaid Card

By End User

- Retail Establishments

- Corporate

- Government/Public sector

Regional Analysis

North America dominates the prepaid card market with 61.68% share due to its advanced financial infrastructure, high consumer spending power and rapid adoption of digital payment solutions such as prepaid cards. North American consumers overwhelmingly prefer convenient and secure transaction methods over cash payments for personal spending as well as corporate disbursements - this driving factor behind North American market dominance can be found through regional dynamics that determine adoption rates and market expansion.

Europe largely follows, where prepaid cards have seen rapid expansion thanks to stringent financial regulations that enhance security measures and an awareness of financial products among consumers. Furthermore, Europe boasts both an inclusive population as well as fintech innovations that seamlessly incorporate prepaid solutions into broader digital finance ecosystems.

Asia Pacific is experiencing rapid expansion of their prepaid card markets due to rising e-commerce penetration and mobile internet access expansion. Countries like China, India and Southeast Asia have witnessed a rapid increase in adoption of prepaid cards among consumers and businesses alike as more adopt flexible yet low-cost financial services provided through them.

Middle East & Africa show remarkable potential, with prepaid cards becoming an indispensable means of financial inclusion. Mobile networks and secure payment solutions in areas with limited banking infrastructure are spurring market expansion while governments in this region increasingly utilize them for disbursing social aid - further driving market adoption and driving it upward.

Latin America, though smaller in comparison, is rapidly adopting prepaid cards at an increasing pace, driven by higher smartphone penetration and the rise in preference for digital financial solutions over traditional bank methods. Furthermore, their adoption may also help ensure secure transactions in countries with significant levels of informal economic activity.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

JPMorgan Chase and Co. continues to leverage its vast network and financial services expertise in order to expand its prepaid card segment offerings for corporate clients, with solutions designed specifically for payroll expenses and operational expenditures. This strategic emphasis enhances client engagement while streamlining financial processes at larger organizations.

Mastercard and Visa Inc. have long been at the forefront of innovation within prepaid payments, developing technologies and features designed to increase card security while improving user experience. Their global reach and strong brand recognition allow them to set standards within this sector - especially open loop prepaid cards which are accepted worldwide.

American Express Company has long been revered as a provider of premium consumer-oriented financial products, such as prepaid cards. American Express excels at offering value-added services that enhance usability and appeal of their prepaid offerings such as no monthly fees and rewarding programs designed specifically to appeal to high net-worth individuals.

PayPal Holdings Inc. and Green Dot Corporation are leading innovators of digital and mobile-first prepaid card offerings. PayPal excels at this, as its expansive presence online enables it to integrate prepaid services seamlessly within its wallet system - giving the company a powerful foothold in online payment applications for e-commerce prepaid applications.

Some of the prominent players in the Global Prepaid Card Market are:

- JPMorgan Chase And Co.

- Mastercard

- NetSpend Corporation

- American Express Company

- Mango Financial Inc.

- PayPal Holdings Inc.

- Kaiku Finance LLC

- Green Dot Corporation

- Visa Inc.

- Travelex Foreign Coin Services Limited

Recent developments

- In 2024, Berhan Bank in Ethiopia collaborated with Mastercard to introduce an international online transaction prepaid card designed specifically to facilitate digital payments at merchants, point-of-sale terminals, e-commerce sites and ATMs with an initial recharge limit of US$4,000.

- In 2024, Eastern Bank in collaboration with Mastercard launched a medical tourism prepaid card targeting Bangladeshi patients seeking healthcare in India. This dual currency card offers numerous benefits to Bangladeshis seeking inpatient care at over 120 hospitals located throughout major Indian cities such as Delhi, Chennai and Mumbai, such as 10% discounts off inpatient stays plus complimentary dental and eye checkups.

- In 2024, Airtel Payments Bank and National Payments Corporation of India announced in April 2024 the introduction of a National Common Mobility Cards enabled Prepaid card that can facilitate payments at merchant outlets accepting RuPay as well as be used for transit payments across metros, buses and parking services in India.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 4.5 trillion |

| Forecast Value (2032) |

USD 23.8 trillion |

| CAGR (2023-2032) |

20.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering(Gift Cards, Government Benefit/Disbursement Card, Incentive/Payroll Card, General Purpose Reloadable Card, Others), By Card Type(Closed Loop Prepaid Card, Open Loop Prepaid Card), By End User(Retail Establishments, Corporate, Government/Public sector) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

JPMorgan Chase And Co., Mastercard, NetSpend Corporation, American Express Company, Mango Financial Inc., PayPal Holdings Inc., Kaiku Finance LLC, Green Dot Corporation, Visa Inc., Travelex Foreign Coin Services Limited |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |