Prescription Lens Market Overview

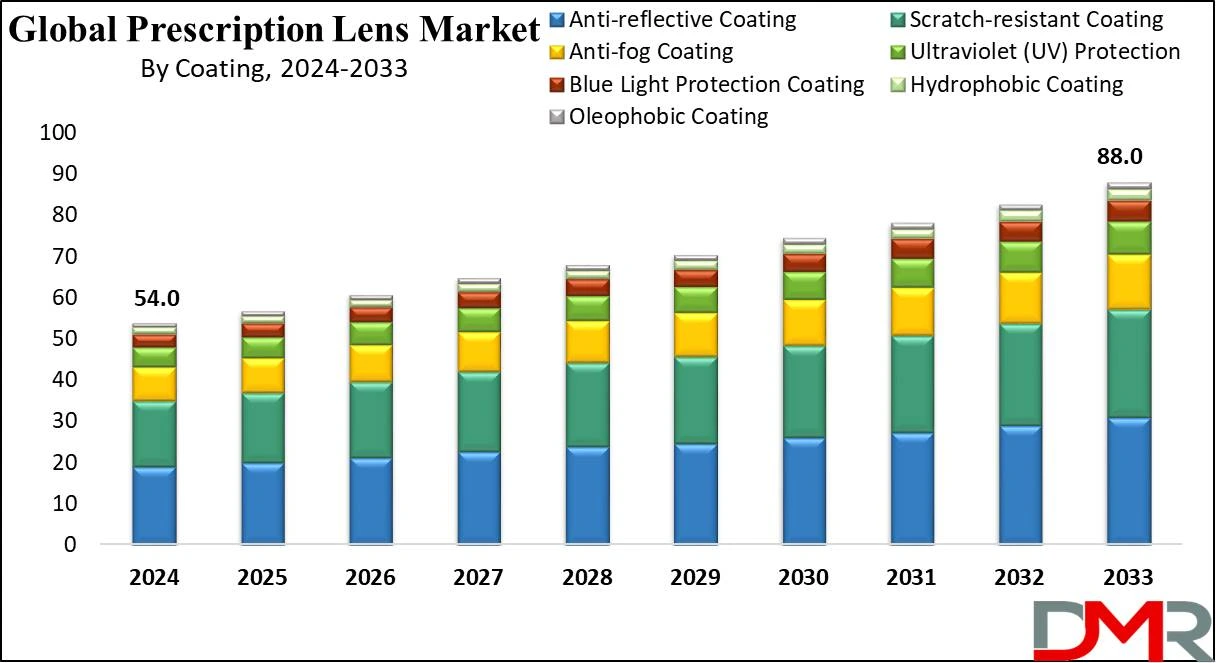

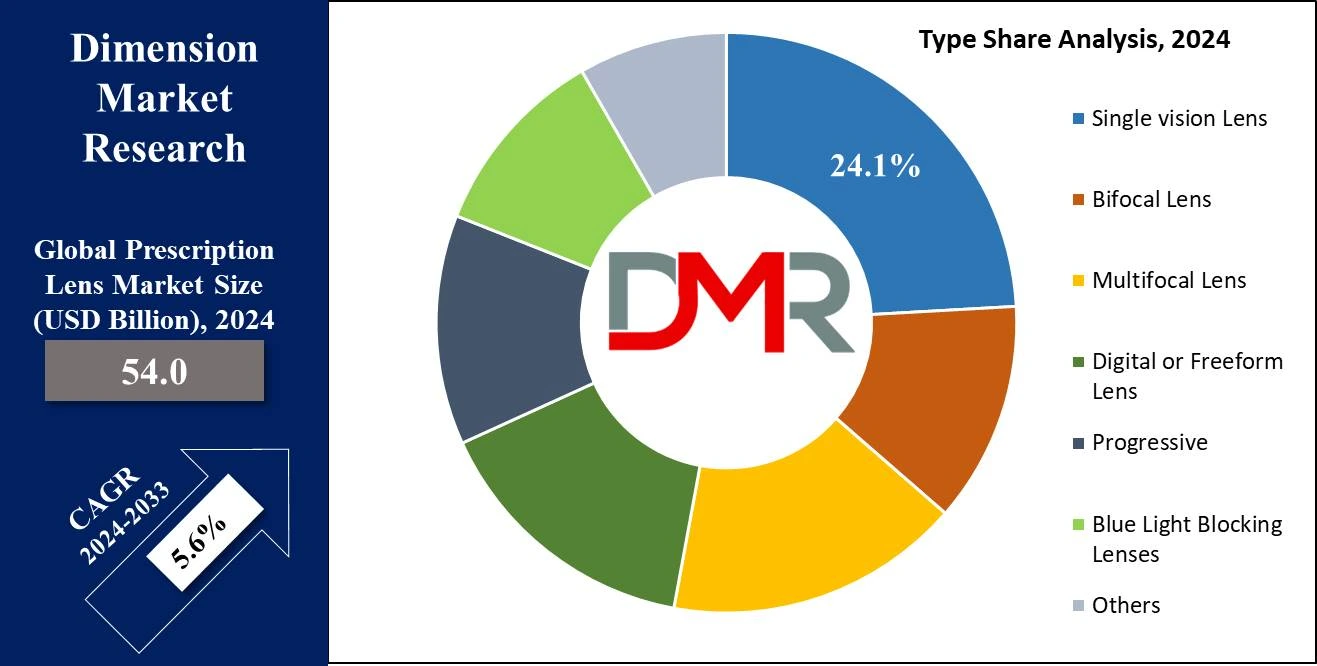

The Global Prescription Lens Market size is expected to reach a value of USD 54.0 billion in 2024, and it is further anticipated to reach a market value of USD 88.0 billion by 2033 at a CAGR of 5.6%.

The global prescription lens market has been growing steadily, with increased demand for corrective lenses due to the rising prevalence of refractive errors such as myopia, hyperopia, astigmatism, and presbyopia. An increase in screen time and pervasiveness of digital devices is leading to a rise in digital eye strain, further increasing demand for advanced prescription lenses with features like blue light blocking and anti-reflective coating, contributing to the broader expansion of the vision correction market.

The market's growth is leveraging an increase in the aging population worldwide for its benefits. Bifocal, trifocal, and progressive lenses see their demand get louder due to presbyopia affecting a large section of the population in developed regions like North America and Europe. With increased awareness regarding eye health and better access to vision care services in emerging markets, the pool of prescription eyewear customers has increased more than ever, strengthening the landscape of the optical lenses industry.

The advancement of technology in manufacturing lenses has also caused the growth of this market, including digital freeform lenses and personalized lens design. Such innovation provides higher precision and comfort for people with complex disabilities in vision. Key players in the market keep investing heavily in R&D to create lighter, thinner lenses, and more efficient ones suitable for diversified consumer demand.

The prescription lens market has experienced steady expansion, driven by rising prevalence of vision disorders globally, increased awareness about eye health issues, and better access to healthcare services. According to WHO estimates, as of August 2023 approximately 2.2 billion people globally were suffering near or distance vision problems with nearly 1 billion cases being preventable or unaddressed vision impairment cases resulting from refractive errors and cataracts being the leading causes.

Furthermore, changing fashion trends and growing consumer interest for customizable eyewear are fuelling further market expansion.

The US Prescription Lens Market

The US Prescription Lens Market is projected to be valued at USD 17.3 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 27.5 billion in 2033 at a CAGR of 5.3%.

While it has a high prevalence of refractive errors, which includes myopia and presbyopia, the U.S. itself constitutes a significant share of the global prescription lens market. The rising aging population and increased screen time across demographics have contributed much to the demand for prescription lenses in this region.

Amongst those key market trends in the U.S., one could expect an increasing demand for progressive lenses, thus facilitating smooth transitioning for correction in multiple distances of vision compared to traditional bifocals and trifocals.

Anti-reflective coatings are also very much in demand, together with blue light filtering lenses due to growing concerns over digital eye strain and excess screen exposure. E-commerce development has added a whole new twist to how prescription eyewear is being bought by U.S. consumers. Major retail chains like Warby Parker have managed to make it easier to order one's lenses online with prescriptions.

This, in turn, has contributed to the growth of the market by making products not only more accessible but also economically more attainable. Considering the progress of digital technologies in eyewear lenses, such as digital free-form lenses, prescription lens market growth is expected to continue for the next few years, further supported by advancements in

digital health that enhance vision care solutions and personalized eyewear services.

Prescription Lens Market Key Takeaways

- Global Market Value: The Global Prescription Lens Market size is estimated to have a value of USD 54.0 billion in 2024 and is expected to reach USD 88.0 billion by the end of 2033.

- The US Market Value: The US Prescription Lens Market is projected to be valued at USD 17.3 billion in 2024, which is further expected to grow up holds USD 27.5 billion in 2033 at a CAGR of 5.3%.

- By Type Segment Analysis: Single-vision lenses are projected to dominate the type segment of this market as they hold 24.1% of the market share in 2024.

- By Coating Segment Analysis: Anti-reflective (AR) coating is anticipated to dominate the coating segment in this market with 35.0% of the market share in 2024.

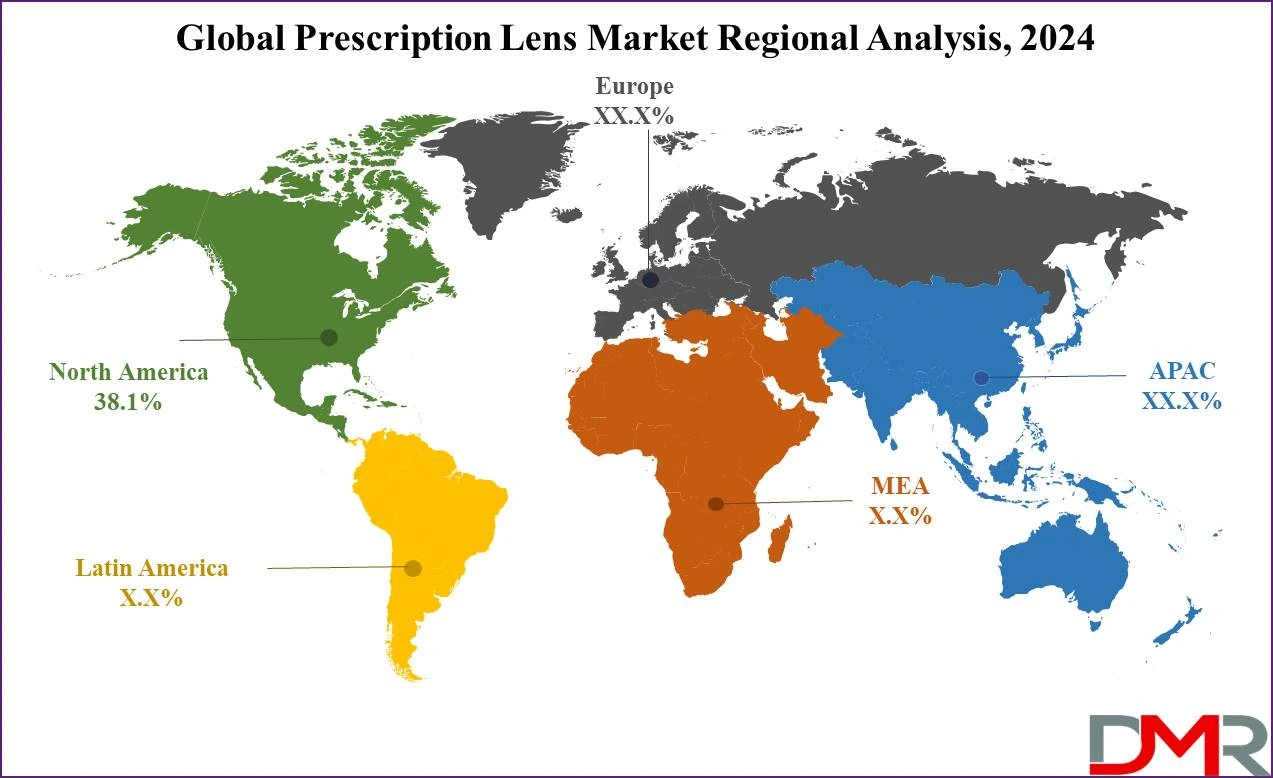

- Regional Analysis: North America is expected to have the largest market share in the Global Prescription Lens Market with a share of about 38.1% in 2024.

- Key Players: Some of the major key players in the Global Prescription Lens Market are EssilorLuxottica, Hoya Corporation, Carl Zeiss AG, Rodenstock GmbH, Seiko Optical Products Co. Ltd., and many others.

- Global Growth Rate: The market is growing at a CAGR of 5.6 percent over the forecasted period.

Prescription Lens Market Use Cases

- Myopia Correction: Single vision lenses are greatly used for the correction of myopia, where the individual can see objects that are within their vicinity but are far from mid-vision.

- Digital Eye Strain Reduction: People spend a long time in front of computers, smartphones, and tablets these days, therefore, digital eye strain is a common problem among them. Prescription lenses with filtering coatings against blue light help alleviate this strain.

- Presbyopia Treatment: Progressive lenses and bifocals are conventional for individuals over 40 years who develop presbyopia, a loss of eye-focusing ability on nearby objects. The aim of the two is to confer clear vision at several distances and, therefore, very practical in everyday applications.

- Astigmatism Correction: This is a refractive mistake causing blurry vision because of the weirdly shaped cornea. These are corrected with cylindrical lenses, giving sharper vision. They are one of the biggest markets for prescription lenses.

Market Dynamic

Market Trends

Increasing Prevalence of Digital Eye Strain

In everyday life, as screen time has become an intrinsic part of life, the digital eye strain, or computer vision syndrome, is gaining momentum. Thus, the prolonged use of computers, smartphones, and other electronic devices has resulted in the increased demand for prescription lenses that can be specially made to alleviate symptoms of the disease. These lenses now can filter out blue light and come with an anti-reflective coating, due to which one can reduce glare and feel lesser fatigue in the eyes.

This is more evident in the young generation and people who work for very long intervals in front of their computers. This increased demand is forcing companies to introduce advanced technologies in these lenses, thus driving market growth.

Shift Towards Online Retail

The prescription lens market is experiencing a significant shift towards online retail platforms, toward online retail platforms that allow customers to purchase eyewear from their homes for convenience. The pandemic accelerated this trend, with many turning to e-commerce for buying eyewear. Companies such as Warby Parker and Zenni Optical leveraged that with offerings of home try-on services and online eye exams for further reach in accessibility.

In turn, this development increases convenience for the consumer, makes competition fiercer in the marketplace, and encourages a lot of innovation in product offerings and pricing.

Growth Drivers

Aging Population

The global population is aging, and there is a considerable increase in the population above 65 years. This acts as the main key factor for growth in the prescription lens market since this age group suffers from various vision problems related to presbyopia and cataracts. Since vision correction requirements go up with increasing age, demand for bifocal, trifocal, and progressive lenses will increase accordingly.

This is, in fact, the demographic trend in most developed nations where access to healthcare is more available. Companies offering specialized lenses and adaptive eyewear, targeting older customer needs, would be very well-placed to capture a bigger market share.

Technological Advancements

This is driven by the rapid development of lens technology. Developments include Digital Freeform Technology, which now allows prescriptions personalized to an individual's needs and even lifestyle. These innovations improve quality and performance in prescription eyewear through thinner, lighter, and more comfortable lenses.

These lenses manage the increasingly high demands of consumers on functionality and style. Besides this, new materials for lenses are in development that can last longer and be more scratch-resistant, adding to consumer appeal. Further, the introduction of sophisticated technologies in lenses is expected to drive the market growth further as more and more manufacturers invest in R&D.

Growth Opportunities

Emerging Market

New opportunities for prescription lenses are likely to emerge from markets in India, China, and Africa. The growing awareness of eye health and accessibility to health services enables demand for prescription glasses. As disposable incomes increase with rising urbanization, more people look toward vision correction.

Other local manufacturers also enter the market to make affordable options with specifications that can address their local needs. Companies that invest in marketing and distribution strategies orientated to local tastes and habits will be in a good position to take advantage of their great growth potential.

Innovative Lens Solutions

Major market players are innovating in areas pertaining to myopia control lenses that help slow the further development of myopia in children and teenagers. Advancing the design and technologies in these lenses mostly provides clear vision by understanding and eliminating the root cause of myopia.

With increasing awareness among people about myopia and its long-term possible effects, parents are seeking solutions to save the vision of their children. Companies focused on the development of effective myopia control products, coupled with education for consumers, are likely to achieve significant growth in this segment.

Restraints

High Cost of Advanced Lenses

While technological advancements in the prescription lens market are driving growth, the high cost of advanced lenses can act as a barrier for some consumers. Anti-reflective or digitally customized freeform lenses need even higher costs, unaffordable by certain demographics in some countries, which also include emerging markets. This pricing issue tends to reduce the possibility of market penetration, thus setting a limit to the growth of the market.

For this reason, manufacturing companies will need to find cheaper modes of production or offer products at variable prices to appeal to a broad range of consumer markets.

Competition from Alternative Vision Correction Methods

The growing popularity of alternative vision correction methods, such as contact lenses and refractive surgical interventions like LASIK, threatens the prescription lens market. For instance, convenience and aesthetic factors may be some reasons people would want to try these options. Also, developments made in contact lens technology, such as scleral lenses or ortho-k lenses for myopia control, it give competitive alternatives that may shift attention away from prescription eyewear.

Prescription lenses have advantages in customizable design and comprehensive eye care solutions that will make companies emphasize them at the forefront in order for them to maintain their market share.

Prescription Lens Market Research Scope and Analysis

By Type

Single-vision lenses are projected to dominate the type segment of the global prescription lens market as they hold 24.1% of the market share in 2024. Single-vision lenses dominate the segment type in the global prescription lens market, as they are the most used for general refractive errors involving a defect in myopia, hyperopia, and astigmatism. These kinds of lenses involve a single corrective power throughout the lens and are suitable for people who need correction either for distance or near vision.

Single-vision lenses, being versatile and low-cost, dominate the global market as they can be prescribed to any age group. They can almost be used to correct all major types of visuals. The increasing prevalence of myopia in the global population, especially among the younger population in geographical regions like the Asia-Pacific, has also influenced the market demand for single-vision lenses.

Also, with the introduction of digital eye fatigue, there is more usage of single vision lenses with special coatings that increase comfort while minimizing visual fatigue-anti-reflective and blue light blocking coatings. The added functionality brought about by the coatings makes the lenses more attractive to individuals who are exposed to screens for extended periods. Single-vision lenses are also preferred by practitioners and customers because they are the simplest to manage and use.

Since they are also able to correct a wide range of refractive errors at a relatively affordable cost, single-vision lenses remain the most prescribed form of lens on the market and therefore dominate this segment.

By Coating

Anti-reflective (AR) coating is anticipated to dominate the coating segment of the global prescription lens market with 35.0% of the market share in 2024. Anti-reflective coatings are dominating the coating segment in the global prescription lens market, as these improve the clarity of vision and reduce glare, especially in poor light conditions. AR coating on prescription lenses minimizes the reflection from screens, headlights, and overhead lights to the user's eye, hence preventing discomfort and tiredness in the eyes.

As a result, they would be very useful for people working in bright-light conditions or even those who spend extended hours facing their digital screens. Among the primary reasons for prescription eyewear, anti-reflective coating is globally spreading due to improvements in both functional and aesthetic aspects of prescription lenses. With AR coaxing, there is reduced glare, hence, wearers can have quality and clear vision at such moments when lighting appears poorly. Equally, the coating makes lenses look almost invisible, improving the user's looks and, thus, a common choice for glass users.

The increased use of electronic devices has generally led to a rise in the prevalence of digital eye strain, increasing the demand for anti-reflective coatings. Consumers are increasingly demanding lenses that can protect them from colloquially termed "damages" contributed by exposure to screens for extended periods, and AR coatings address this issue comprehensively when combined with blue light filtering.

Anti-reflective coatings have been a staple in high-prescription lenses due to an increasing demand for advanced visual comfort and protection, which has tightened its grip on the coating segment of the global prescription lens market.

By Application

Myopia is projected to dominate the application segment in the global prescription lens market in 2024. This may be due to the increasing prevalence of the condition globally. Myopia, often referred to as nearsightedness, is a condition that affects one's vision to see things that are kept far away from them clearly, and its incidence has also been growing at an alarming rate, particularly among younger sections of the population.

In 2023, it was estimated that 30% of the global population suffered from myopia, which is expected to increase to almost 50% by 2050, according to World Health Organization estimates. The main driving factors for rising myopia incidents are long hours spent on digital devices that encompass smartphones, computers, and pads, coupled with lifestyle reasons like less outdoor activity. This increasing prevalence has resulted in a high demand for prescription lenses; more precisely, single-vision lenses are most frequently used to correct myopia.

The effect of myopia is especially high in areas like the Asia-Pacific, since the inhabitants, a great proportion of whom are children and young adults, have a high prevalence. There has been an increasing demand for prescription lenses that correct myopia, and this may be expected to continue with increased awareness of the importance of early detection and treatment of the condition. Besides that, technological developments concerning lens design-myopia control lenses further drive the growth of this segment, as such special lenses support the deceleration of myopia, especially in younger people.

The Prescription Lens Market Report is segmented on the basis of the following

By Type

- Single Vision Lens

- Convex

- Concave

- Cylindrical

- Bifocal Lens

- Multifocal Lens

- Digital or Freeform Lens

- Progressive Lens

- Blue Light Blocking Lenses

- Others

By Coating

- Anti-reflective Coating

- Scratch-resistant Coating

- Anti-fog Coating

- Ultraviolet (UV) Protection

- Blue Light Protection Coating

- Hydrophobic Coating

- Oleophobic Coating

By Application

- Myopia

- Hyperopia

- Astigmatism

- Presbyopia

- Computer Vision Syndrome (CVS)

- Post-Surgical Vision Correction

How Does Artificial Intelligence Contribute To Improve Prescription Lens Market ?

- Personalized Lens Recommendations: AI analyzes individual vision requirements, facial dimensions, and lifestyle preferences to recommend lenses tailored to specific needs.

- Advanced Vision Testing: AI-powered tools improve the accuracy of vision tests, enabling precise prescriptions and reducing errors.

- Smart Lens Design: Artificial Intelligence optimizes lens manufacturing by simulating optical performance, ensuring superior quality and functionality.

- Virtual Try-On Technology: AI-driven virtual try-on solutions allow customers to preview how prescription glasses will look, improving satisfaction and reducing return rates.

- Predictive Maintenance for Equipment: AI monitors lens manufacturing equipment, predicting potential issues and minimizing downtime.

- Inventory Optimization: AI forecasts demand for specific lens types and coatings, streamlining inventory management and reducing waste.

- Customer Support: AI-powered chatbots provide instant assistance, guiding customers through lens options and care instructions.

- Innovation in Smart Lenses: AI facilitates the development of smart lenses, such as those with augmented reality features or health-monitoring capabilities.

Regional Analysis

North America is projected to dominate the global prescription lens market as it commands over

38.1% of the total revenue by the end of 2024. The major share in the prescription lens market is held by North America as this region holds a highly developed healthcare system that, indirectly, provides comprehensive eye care services for the timely diagnosis and treatment of refractive errors.

Market reports indicate that the North American prescription lens is set to further increase with the rise in the aging population and consciousness toward eye health. The rising prevalence of refractive errors among its population is the primary reason for such dominance. With the rise in myopia, hyperopia, and presbyopia, prescription lens demand has also risen. Moreover, health-conscious customers are focusing on regular eye examinations due to deteriorating health conditions; hence, it is also one of the added reasons for increasing prescription lenses.

The market is also characterized by investments in research and development by leading players, which have brought about innovative products targeted at answering the diverse needs of different consumers. Digital freeform lenses and other specialty coatings have further increased the appeal of prescription eyewear. This is, besides, changing the purchasing scenario of eyeglasses in North America due to the increasing trend of online retailing.

From big players down to starting companies, all are using e-platforms to reach customers and making prescription lenses more reachable than ever. All these factors combined make North America the biggest and most lucrative market for prescription lenses, hence leaving the region well-positioned for further growth over the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global prescription lens market is characterized by the presence of several major players that dominate the market through innovation, quality, and distribution channels. Some key participants in the marketplace include Essilor Luxottica, Inc., Zeiss, Hoya Corporation, Johnson & Johnson Vision Care, and Carl Zeiss AG, among others. These companies maintain leading positions in the market and are involved in significant research and development of new generations of advanced lenses to meet the diversified needs of consumers.

As a leader in the segment, EssilorLuxottica developed an extended product portfolio comprising single vision, bifocal, and progressive lenses, besides different kinds of lens coatings. Its strong distribution network and brand recognition provide it with a competitive edge. Another large player, Hoya Corporation, designs innovative solutions for lenses, photochromic, and anti-reflective, which improve visual comfort and protection. The company's concentration on R&D provides it with a development Ober edge in the market and the demands of customers.

Besides, new entrants and local players are emerging in the market, especially in regions with burgeoning middle-class citizens. Such competition is likely to flourish more in the way of innovating and setting prices to provide better products to consumers. It is, therefore, expected that the Prescription Lens market will reflect a dynamic competitive landscape where established and new players compete through continuous innovations in products and better distribution strategies.

Some of the prominent players in the Global Prescription Lens Market are

Recent Developments

- September 2024: EssilorLuxottica announced the launch of its new line of sustainable prescription lenses, focusing on environmentally friendly materials and production processes.

- August 2024: Hoya Corporation introduced advanced digital freeform lenses that provide enhanced vision correction tailored to individual lifestyle needs.

- July 2024: Carl Zeiss AG unveiled a new coating technology designed to improve scratch resistance and reduce glare for outdoor use, targeting consumers engaged in sports and outdoor activities.

- June 2024: Johnson & Johnson Vision expanded its range of contact lenses, including options for users with myopia and presbyopia, leveraging its expertise in vision care to cater to evolving consumer preferences.

- April 2024: EssilorLuxottica announced a partnership with a tech startup to develop augmented reality lenses, paving the way for innovative applications in prescription eyewear.

- March 2024: Hoya Corporation expanded its production facilities in Asia to meet the increasing demand for prescription eyewear, focusing on sustainability and efficiency.

- January 2024: The U.S. FDA approved a new lens design aimed at better myopia control in children, reflecting the growing focus on addressing childhood vision issues.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 54.0 Bn |

| Forecast Value (2033) |

USD 88.0 Bn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 17.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Single Vision Lens, Bifocal Lens, Multifocal Lens, Digital or Freeform Lens, Progressive Lens, Blue Light Blocking Lenses, and Others), By Coating (Anti-reflective Coating, Scratch-resistant Coating, Anti-fog Coating, Ultraviolet (UV) Protection, Blue Light Protection Coating, Hydrophobic Coating, and Oleophobic Coating), By Application (Myopia, Hyperopia, Astigmatism, Presbyopia, Computer Vision Syndrome (CVS), and Post-Surgical Vision Correction) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Essilor Luxottica, Hoya Corporation, Carl Zeiss AG, Rodenstock GmbH, Seiko Optical Products Co., Ltd., Nikon Corporation, Johnson & Johnson Vision Care, Inc., Vision Ease (Younger Optics), Shamir Optical Industry Ltd., VSP Vision Care, Warby Parker, Zoff (Intermestic, Inc.), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Prescription Lens Market size is estimated to have a value of USD 54.0 billion in 2024 and is expected to reach USD 88.0 billion by the end of 2033.

The US Prescription Lens Market is projected to be valued at USD 17.3 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 27.5 billion in 2033 at a CAGR of 5.3%.

North America is expected to have the largest market share in the Global Prescription Lens Market with a share of about 38.1% in 2024.

Some of the major key players in the Global Prescription Lens Market are EssilorLuxottica, Hoya Corporation, Carl Zeiss AG, Rodenstock GmbH, Seiko Optical Products Co. Ltd., and many others.

The market is growing at a CAGR of 5.6 percent over the forecasted period.