Pressure Sensitive Tapes (PSTs) are adhesive tapes developed to adhere to surfaces when light pressure is applied without needing heat, water, or solvents for adhesion. Made of acrylics, silicones, or rubber-based adhesives; single-sided for sealing or bundling purposes, while double-sided ones bond materials together.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

PSTs have proven highly useful across industries like packaging, electronics, automotive, healthcare, and construction due to their strong adhesion strength, flexibility, and ease of use. They're popularly used across packaging industries including electronics, automotive, healthcare, and construction, as they provide strong adhesion strength combined with flexibility and user-friendliness.

As they're easy to use for heavy objects to stick firmly against surfaces when light pressure is applied, PSTs provide strong adhesion strength while being flexible enough to stick securely but easily release products. PSTs come in single or double sided forms for sealing/bundling/bonding purposes depending on how you intend to use them. Mainly used across packaging industries, like electronics and automotive healthcare construction sectors, due to providing strong adhesion strength combined with flexibility.

They make an easy-to-use tape solution. Broadly used by packaging industries, like electronics, automotive, and healthcare construction industries, as these tapes provide strong adhesion strength with flexibility & ease of use! Widely used across packaging electronics electronics automotive healthcare construction, as these provide strong adhesion strength with flexibility & ease of use & ease.

The need for pressure-sensitive tapes has steadily been rising with their use in various industries. E-commerce has substantially accelerated this growth trend; medical grade tapes are essential in wound care, wearable medical devices, and surgical applications in healthcare; automotive applications use PSTs for bonding lightweight materials to replace traditional fasteners like screws and rivets; rapid industrialization, urbanization, and technological advances are expected to cause this market for PSTs to expand further in the coming years.

Recent trends indicate that manufacturers are shifting towards eco-friendly pressure-sensitive tapes due to increasing environmental concerns. Many companies are providing biodegradable or recyclable adhesive tapes to cut plastic waste, as well as high-performance tapes that can withstand extreme temperatures, humidity levels, and mechanical stresses, such as in the aerospace or electronics industries. Another emerging trend involves wearable technology utilizing specialty tapes that attach sensors without irritating skin surfaces.

Over the past few years, industry developments in adhesive technologies have produced higher-performing tapes with stronger bonding abilities and longer durability. Furthermore, companies have introduced tapes with enhanced optical clarity suitable for touchscreen devices and optical sensors; the recent pandemic increased demand for medical and hygiene-related adhesive products like tapes used for personal protective equipment (PPE) applications in healthcare applications as well as personal protective equipment (PPE) applications used during PPE manufacturing processes; robotic assembly lines are utilizing tapes as assembly components as well.

Although the industry has experienced strong growth, its challenges include raw material price fluctuations and regulatory restrictions on certain adhesive chemicals. Competition among manufacturers has led to price pressure, as has an increase in pressure-sensitive tape usage for lightweight electric vehicles (EVs) along with demand for smart tapes with temperature-sensitive or conductive properties for advanced applications. Companies investing in research and development for innovative, sustainable, and high-performance tapes are likely to gain an edge.

The pressure-sensitive tape industry looks bright, with continual innovations and expanding applications in multiple industries. A shift to sustainable and high-performance adhesive solutions will drive market expansion; as healthcare, electronics, and electric vehicle sectors continue to advance, demand will increase for advanced tapes. Manufacturers who provide environmentally friendly products with durable construction that adapt well to modern technologies will shape this industry's future, making pressure-sensitive tape an indispensable component in many consumer and industrial applications.

The US Pressure Sensitive Tapes Market

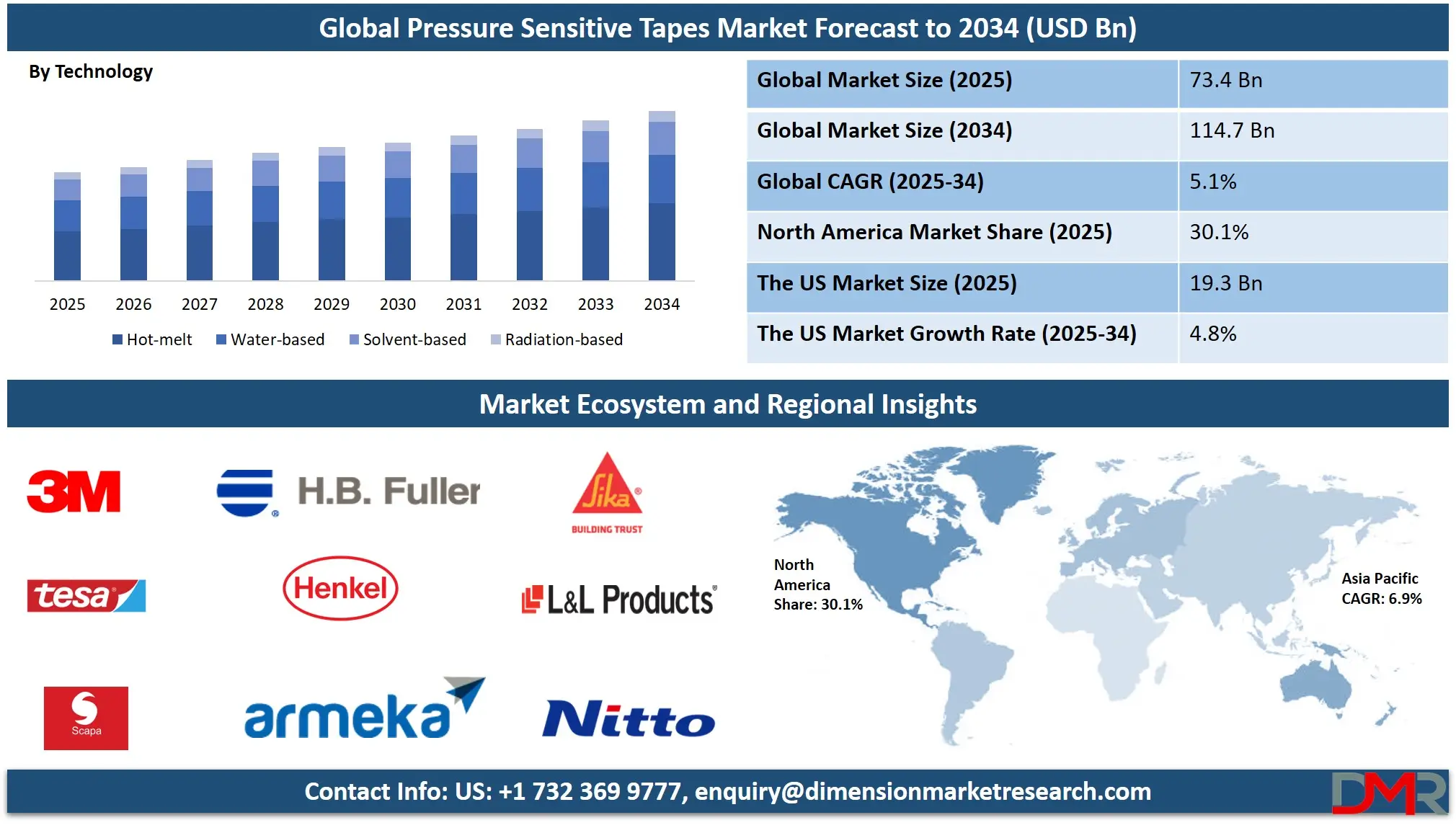

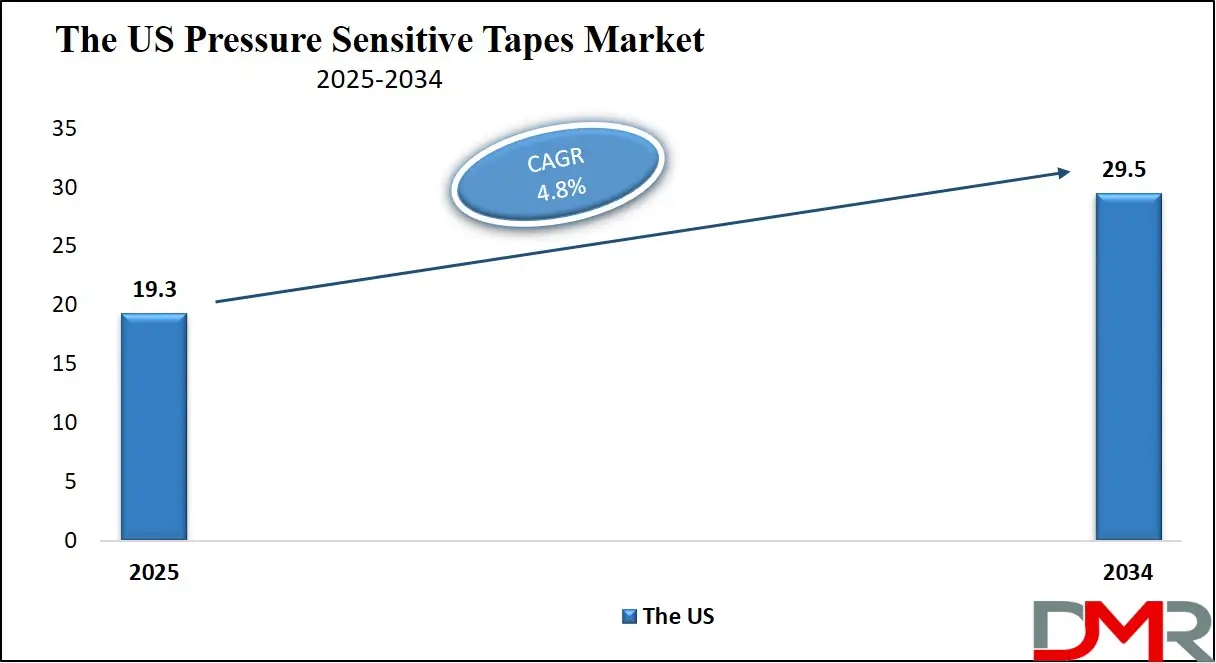

The US Pressure Sensitive Tapes Market is projected to reach USD 19.3 billion in 2025 at a compound annual growth rate of 4.8% over its forecast period.

The US pressure-sensitive tapes market holds numerous growth opportunities due to rising demand from the automotive, construction, and healthcare sectors. Increased use of eco-friendly adhesive tapes with advanced manufacturing technology is driving market expansion, while the growth in online commerce fuels an upsurge in packaging tape demand; innovations supporting healthcare applications provide additional growth potential.

Further, the market growth is driven by rising demand from industries like automotive, electronics, and construction, where strong adhesives are essential. Innovations in adhesive technology and lightweight materials also fuel growth; however, restraints such as fluctuating raw material costs and environmental concerns related to solvent-based adhesives force manufacturers toward costly research on sustainable alternatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Pressure Sensitive Tapes Market: Key Takeaways

- Market Growth: The Pressure Sensitive Tapes Market size is expected to grow by USD 38.0 billion, at a CAGR of 5.1% during the forecasted period of 2026 to 2034.

- By Technology: The hot-melt segment is anticipated to get the majority share of the Pressure Sensitive Tapes Market in 2025.

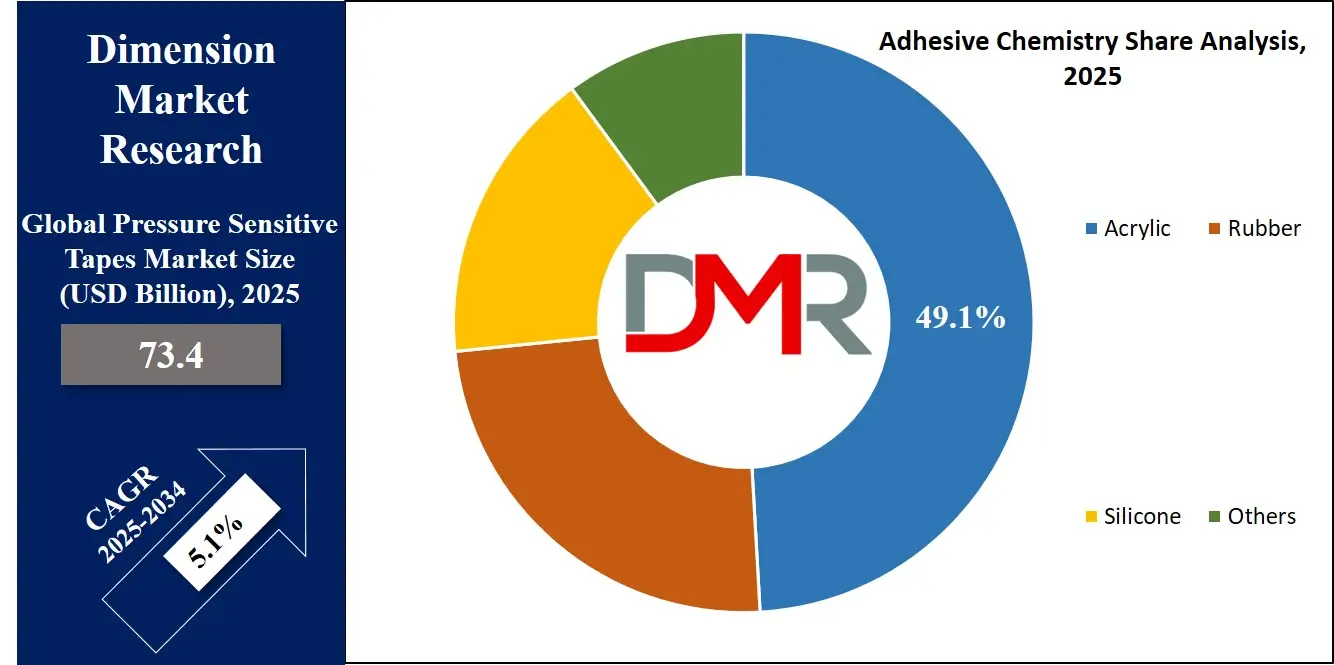

- By Adhesive Chemistry: The acrylic segment is expected to get the largest revenue share in 2025 in the Pressure Sensitive Tapes Market.

- Regional Insight: Asia Pacific is expected to hold a 38.4% share of revenue in the Global Pressure Sensitive Tapes Market in 2025.

- Use Cases: Some of the use cases of Pressure Sensitive Tapes include packing & shipping, medical & healthcare, and more.

Pressure Sensitive Tapes Market: Use Cases

- Packaging & Shipping: Used in sealing cartons, securing packages, and bundling goods in logistics and e-commerce industries owing to their strong adhesion and ease of application.

- Medical & Healthcare: Vital for wound care, surgical tapes, transdermal patches, and wearable medical devices, providing secure adhesion without causing skin irritation.

- Automotive & Electronics: Used for bonding lightweight materials, wire harnessing, insulation, and mounting components in vehicles, smartphones, and electronic devices, replacing traditional fasteners.

- Construction & Industrial Applications: Applied in sealing, insulation, surface protection, and assembling materials in construction, aerospace, and manufacturing industries for durability and efficiency.

Stats & Facts

- According to Volza's Global Import data, the world imported 649 shipments of Pressure Sensitive Tape from March 2023 to February 2024, supplied by 185 exporters to 157 global buyers, marking a 9% growth compared to the previous year. In February 2024 alone, 55 shipments were imported, showing a year-on-year decline of 20% from February 2023 but a 5% sequential increase from January 2024.

- In addition, the top three suppliers of Pressure Sensitive Tape globally are the United States, China, and Japan, while the top three importers are Vietnam with 971 shipments, India with 781 shipments, and the Philippines with 361 shipments.

- Pressure Sensitive Adhesives (PSAs) are typically composed of soft polymer-based materials such as acrylics, silicones, or polyurethanes in the form of supported tapes, thin films, or foams. Acrylic PSAs are the most widely used due to their low glass transition temperature (Tg), which allows high interfacial strength under low pressure, making them ideal for wearable applications. Their high transparency also makes them suitable for optical sensors by minimizing optical losses and interferences.

- Further, studies show that acrylic PSAs retain strong adhesive performance under high humidity, underwater exposure, high temperature, and mechanical stress, but their long-term stability in harsh environments has rarely been addressed. To assess this, researchers evaluated five commercial medical-grade double-sided PSAs used in wearable applications under challenging conditions, including underwater exposure, extreme humidity levels, temperature variations, and cyclic shear loading.

- In the long-term stable adhesion is crucial for maintaining continuous human-sensor-machine interfaces, essential for wearable monitoring applications. Three PSAs with superior adhesive performance were tested over 28 days, revealing that changes in morphology and material properties significantly influence long-term PSA adhesion. Mechanical, optical, and chemical property changes were also analyzed to understand their effects on PSA behavior.

- According to ACS Applied Materials & Interfaces, evaluating PSAs under real-world environmental conditions provides insights into how adhesion performance adapts at the human-machine interface, which is vital for wearable devices, prosthetics, and robotics. Future research should explore additional factors affecting PSA adhesion, including material degradation under extended wear conditions, cyclic loading impact, and strategies to enhance adhesion consistency over time.

- In addition, developing PSAs with enhanced environmental resistance could expand their applications in extreme conditions, such as space missions or deep-sea exploration. Next-generation PSAs may integrate smart functionalities like self-healing or temperature-sensitive adhesion properties, improving their performance in biomedical, industrial, and consumer electronics applications.

- As per ACS Applied Materials & Interfaces, medical-grade PSAs must undergo rigorous testing to ensure performance in high-humidity and temperature-variable conditions. Optimizing PSA morphology and formulation can lead to improved adhesion retention, and future research should also focus on sustainable and biodegradable PSA materials to reduce environmental impact.

Market Dynamic

Driving Factors in the Pressure Sensitive Tapes Market

Rising E-commerce Demand Drives Pressure-sensitive Tape Market

E-commerce's explosive growth has dramatically fueled pressure-sensitive tape demand in packaging applications. Businesses require secure yet cost-effective methods of shipping products online, and PSTs offer easy, effective tamper-evident sealing that keeps consumers satisfied. Furthermore, consumers demand eco-friendly packaging options like biodegradable PSTs, this further driving market growth.

Expansion of Healthcare and Medical Applications

Pressure Sensitive Tapes have become an indispensable part of medical devices and wound care settings, providing substantial opportunities for market expansion. Pressure-sensitive tapes play an integral role in applications like securing bandages, surgical tapes, wearable health devices, and transdermal patches, and their use has increased with chronic diseases, the aging population, and advances in wearable medical technology, resulting in rising demand for these tapes, especially their secure adhesion that's gentle against skin, making them critical components within healthcare environments while opening up ample market expansion potential opportunities in medical settings where PST's use has only further expanded over the years.

Restraints in the Pressure Sensitive Tapes Market

Fluctuating Raw Material Prices

A key challenge experienced in the pressure-sensitive tape market is fluctuating raw material prices, particularly for adhesives and backing materials such as plastics and paper. Price fluctuations are often due to global supply chain disruptions, economic instability, or changes in the availability of the raw material itself. As these costs increase, manufacturers are faced with either increasing prices or absorbing them all themselves, both of which have serious ramifications on profitability and market competitiveness. Furthermore, many types of adhesives rely heavily on petroleum-based products, which makes them particularly vulnerable to price volatility within that industry sector.

Environmental Impact and Regulatory Pressures

Pressure Sensitive Tapes made from non-biodegradable materials like plastic are becoming an increasing cause for environmental concern, particularly as regulations around waste management, plastic usage, and environmental sustainability tighten. Manufacturers face higher pressure to develop eco-friendly products; recycling or biodegradable PSTs may become increasingly desirable as regulations tighten further, but developing eco-friendly alternatives may prove costlier and technically challenging due to restrictions placed upon certain adhesive chemicals used within disposable PSTs limiting growth or imposing compliance issues that create compliance challenges within markets limiting growth or creating compliance issues within markets where they operate.

Opportunities in the Pressure Sensitive Tapes Market

Growing Demand for Eco-friendly Tapes

With the growing environmental awareness and stringent regulations on plastic waste, there is a significant opportunity for the pressure-sensitive tape market to expand with sustainable products. Consumers and industries are mainly looking for eco-friendly alternatives, like biodegradable, recyclable, or solvent-free adhesive tapes. This growing demand for sustainable solutions is making manufacturers innovate and develop environmentally friendly pressure-sensitive tapes, which not only help address environmental concerns but also appeal to the green-conscious market. Companies investing in the development of such products can differentiate themselves and tap into a rising market segment.

Advancements in Healthcare and Wearable Technology

The rise of wearable technology and the growing healthcare sector present an exciting opportunity for the pressure-sensitive tape market. These tapes are used in medical devices, wound care, and wearable sensors, where their gentle yet secure adhesion is crucial for user comfort and performance. As the demand for wearable health devices, such as fitness trackers and medical monitoring equipment, increases, the need for advanced adhesive solutions grows. Pressure-sensitive tapes that are skin-friendly, durable, and capable of maintaining performance under many environmental conditions can capture a substantial share of this expanding market, offering manufacturers significant growth potential.

Trends in the Pressure Sensitive Tapes Market

Shift Towards Smart and Functional Tapes

A notable recent trend in the pressure-sensitive tape market is the development of smart and multifunctional adhesive tapes. These tapes are being integrated with advanced features like temperature sensitivity, conductive properties for electronic applications, and even self-healing capabilities. Smart PSTs are highly being used in applications like wearable technology, electronics, and automotive industries, where the tape demands to perform under variable conditions. These innovations allow manufacturers to provide enhanced performance and versatility, catering to the growing demand for high-tech, adaptable solutions in various industries.

Sustainability and Eco-friendly Solutions

Another major trend in the pressure-sensitive tape market is the growing focus on sustainability and eco-friendly alternatives. Manufacturers are focusing on producing recyclable, biodegradable, or solvent-free PSTs in response to the growth in consumer demand for environmentally responsible products, which is driven by both regulatory pressure and consumer preference for green products. Companies are investing in R&D to create PSTs that reduce environmental impact, like tapes made from renewable resources or those with low environmental footprints, which is likely to shape the future of the market.

Research Scope and Analysis

By Product

Packaging tapes are projected to become the leading in the pressure-sensitive tapes market by 2025 and further expand over time. Packaging may be flexible or rigid, and pressure-sensitive adhesives (PSAs) must meet the individual requirements of each industry in terms of flexibility. PSAs provide strong bonding properties for secure package transport across industries. PSA tapes are commonly used in packaging electronics, electrical devices, medical products, drug delivery systems, and construction transit packaging. PSAs also prove reliable solutions for the automotive sector and consumer goods industries that rely heavily on them for efficient packaging solutions; their strong adhesion, durability, and ease of use make them the go-to option for businesses that require reliable packaging for transportation and storage needs.

Further, the need for packaging tapes such as polypropylene tapes is expected to drive market expansion across various industries such as transportation, warehousing, and logistics. With international trade and e-commerce expanding rapidly, businesses relying on global commerce require high-quality adhesive tapes to protect their goods during shipping and handling processes.

PSAs not only offer functional benefits to packaging aesthetics, but they can also add visual interest by increasing consumer appeal through vibrant graphics and branding elements, which is particularly essential in industries depending on eye-catching packaging like retail and consumer electronics where eye-catching packaging attracts customers. With ongoing advancements in adhesive technology and growing interest in efficient, sustainable, and attractive packaging solutions, pressure-sensitive tapes are likely to experience steady market expansion over the coming years.

By Technology

Hot melt adhesive tapes are anticipated to lead the pressure-sensitive tapes market by 2025 due to their large usage across North America. Hot melt adhesive tapes have proven themselves as strong bonding agents with quick adhesion speeds and durability features that make them popular across industries. Hot melt pressure-sensitive tapes play a vital part in industries like automotive and aerospace, where components need reliable mounting and bonding solutions.

As these industries expand and use more innovative materials, hot melt pressure-sensitive tapes will likely become even more in demand. The strength of adhesion even under extreme conditions makes them an attractive option for manufacturers looking for efficiency and long-term performance. Furthermore, their rise in the use of packaging and industrial assembly applications strengthens their market leadership even further.

Further, water-based packaging solutions are expected to experience faster growth throughout the forecast period due to their eco-friendly properties. Water-based adhesive tapes contain lower volatile organic compound (VOC) emissions than their solvent-based counterparts, making them a more sustainable option than their traditional counterparts. But despite their environmental benefits, these tapes may struggle to secure major market shares in North America and Europe. Hot melt and solvent-based adhesive technologies have long been prevalent in these markets and preferred due to their superior adhesion strength and fast setting times. Industries are gradually transitioning towards greener alternatives; water-based tapes may see increased growth in regions where environmental regulations are stricter and sustainability takes precedence.

By Adhesive Chemistry

Acrylic resin tapes are projected to become a dominant segment in 2025 due to their exceptional durability, UV resistance, and ability to withstand extreme temperatures. These tapes have become ubiquitous across various industries, like packaging, construction, automotive, and electronics, owing to their strong adhesive properties and adaptability.

They can securely adhere to surfaces like plastic, metal, and glass, making them suitable for both indoor and outdoor applications. Acrylic resin tapes have the distinct ability to maintain adhesion even under harsh conditions, making them the go-to solution for industries requiring long-term and reliable bonding solutions. Furthermore, their flexible nature allows them to conform easily to various surfaces without losing strength, making them useful in an array of industrial applications.

Also, one of the primary advantages of acrylic resin tapes is their resistance to moisture and UV exposure, ensuring they continue to perform even in challenging environments. No matter the environment be it sunlight, rain, or temperature fluctuations these tapes constantly maintain their adhesive strength without becoming compromised, making them mainly valuable in outdoor applications like construction and automotive manufacturing where durability is key.

Their combination of strength, flexibility, and environmental resistance has made acrylic resin tapes an indispensable product in several industries, driving their rising global popularity. As more industries shift toward high-performance materials for use in manufacturing processes, demand for acrylic resin tapes is anticipated to expand further, further solidifying their position as market leaders.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Backing Material

The woven and non-woven segment is projected to become one of the main drivers in 2025 for the pressure-sensitive tapes market, accounting for an impressive share. These backing materials are typically found in the medical and hygiene industries due to their softness, flexibility, and breathability properties, making them suitable for wound care applications like surgical tapes and hygiene products.

As the world's aging population rapidly increases, medical products that provide comfort and strong adhesion have become ever more essential, further driving up demand for both woven and non-woven tapes. As healthcare expenditure continues to rise globally, hospitals, clinics and home care services are increasing their investments in high-quality medical supplies to maintain steady growth of this segment. Their use in wearable medical devices contributes to this market expansion as they can secure sensors or patches without irritating skin.

Further, Polyvinyl chloride (PVC) pressure-sensitive tapes are expected to experience rapid expansion over the coming years, as predicted by industry forecasters. PVC tapes are prized for their elasticity, durability, and excellent flame retardant qualities - qualities that make them highly sought-after industrial solutions. PVC tape's strong adhesion to multiple materials such as plastic, metal, and aluminum further increases its versatility across numerous sectors. One key driver of PVC tape demand is its widespread application in electrical insulation applications that protect from heat and fire hazards. As industries increasingly emphasize safety-oriented materials like PVC tapes, their demand is expected to continue rising globally and further propel this segment's expansion in global markets.

By Application

Automotive will become the top consumer of pressure-sensitive tapes in 2025, as these adhesives play an integral part in manufacturing, assembly, and fastening components. These tapes provide strong adhesion, exceptional sealing, and reliable insulation three features that make them an essential component for automotive applications. Common applications for these tapes include securing instrument panels, door liners, and electrical connections to improve both functionality and durability.

Their ability to withstand harsh conditions, including temperature shifts, UV exposure, and constant vibrations, makes them perfect for use in vehicles. In comparison with traditional fasteners, these lightweight tapes provide greater fuel efficiency and overall vehicle performance benefits.

With the rising popularity of electric vehicles (EVs) and increased use of lightweight and advanced metallic materials, pressure-sensitive tapes are increasingly in demand in the automotive sector.

Automakers' desire to reduce vehicle weight while increasing strength and efficiency requires these tapes as an efficient alternative to mechanical fasteners or welding; additionally, electric vehicle battery components require them for security along with insulation purposes, guaranteeing both safety and performance. As automobile technology evolves and moves towards sustainability initiatives, pressure-sensitive tapes are expected to become even more desirable in this market sector.

The Pressure Sensitive Tapes Market Report is segmented on the basis of the following:

By Product

- Specialty Tapes

- Packaging Tapes

- Consumer Tapes

By Technology

- Hot Melt

- Water-based

- Solution Based

- Emulsion Based

- Solvent-based

- Radiation-based

By Adhesive Chemistry

- Acrylic

- Rubber

- Silicone

- Others

By Backing Material

- Woven/Nonwoven

- PVC

- PP

- PET

- Foam

- Metal

- Others

By Application

- Automotive

- Packaging

- Electronics

- Others

Regional Analysis

Leading Region in the Pressure Sensitive Tapes Market

Asia Pacific is projected to lead the pressure-sensitive tapes market in 2025 with an anticipated 38.4% share, due to an advanced manufacturing industry in which major players are making investments to expand production capacity. India, China, and Japan are currently witnessing rapid expansion across key industries like construction, automotive, and aerospace, driving an upsurge in demand for tapes and their usage. Asia Pacific's flourishing e-commerce sector plays a major role, as packaging tapes are broadly used for sealing and protecting shipments.

In addition, healthcare industries across this region are expanding steadily, prompting a surge in the need for medical-grade pressure-sensitive tapes to care for wounds and wearable medical devices. Rising disposable incomes across these nations further fuel demand as people spend more money on consumer goods, electronics, and automobiles—industries that mainly depend on adhesive solutions like tape.

Region with steady growth in the Pressure Sensitive Tapes Market

North America is expected to experience sustained growth in its pressure-sensitive tapes market during the forecast period. Both economies in North America, specifically in the U.S. and Canada, contribute significantly to expanding construction industries, which use pressure-sensitive tapes largely as end users. Wind loads and changing weather conditions provide unique challenges in Canada, so pressure-sensitive tapes are preferred over mechanical fasteners for bonding architectural panels due to their superior adhesion and durability.

Insulation tapes have become indispensable tools in building projects due to their use in insulation and surface protection applications, making them invaluable components of any building project. Development in adhesive technology combined with increasing demand for durable weather-resistant tapes will fuel market expansion across North America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Pressure-sensitive tapes market is highly competitive, with numerous players striving to expand their market presence through innovation, product development and strategic partnerships. Companies specialize in producing advanced adhesive solutions with improved durability, environmental friendliness, and strong adhesion for various applications.

The market is driven by technological advancements, rising demand in industries like automotive, healthcare, packaging, and construction; increasing preferences for eco-friendly tapes; competition driven by factors like pricing, product quality, and regional market expansion; as demand rises businesses invest more and more in research and development to improve performance and sustainability of their product offerings.

Some of the prominent players in the Global Pressure Sensitive Tapes are:

- 3M

- HB Fuller

- Sika AG

- Tesa SE

- Henkel

- Arkema Group

- Nitto Denko

- L&L Products

- Scapa

- Advance Tapes International Ltd.

- Other Key Players

Recent Developments

- In December 2024, Ahlstrom launched MasterTape Cristal, a paper-based transparent tape backing to reduce plastic waste and promote a more sustainable future. About 80% of the PSA (pressure-sensitive adhesive) packaging tape used currently is made of plastic. But MasterTape® Cristal is a revolutionary transparent tape backing made entirely from renewable materials. This innovative tape-backing solution is not only strong and versatile but also recyclable1 and suitable for compostability2, thus reducing plastic waste and environmental impact.

- In February 2024, Rogers Corporation announced the availability of DeWAL Plasma X tape, its thinnest single-ply masking tape in the DeWAL thermal spray masking tape product family. Made up of silicone rubber & glass cloth laminate, DeWAL Plasma X tape consists of an aggressive and high-temperature silicone adhesive, making it a great fit for applications with plasma spraying, flame spraying, grit blasting, and more.

- In May 2023, Duraco Specialty Materials announced the acquisition of Strata-Tac, Inc. a leading manufacturer of custom-engineered pressure-sensitive self-adhesive products and top-coated films, from private sellers. Terms of the transaction were not disclosed.

- In January 2023, H.B. Fuller launched Swift melt 1515-I, its first bio-compatible product compliant in IMEA India, Middle East, and Africa. The product is for medical tape applications to be utilized in stick-to-skin under distinctive climatic conditions, like the high temperatures and humidity in the Indian subcontinent.