Market Overview

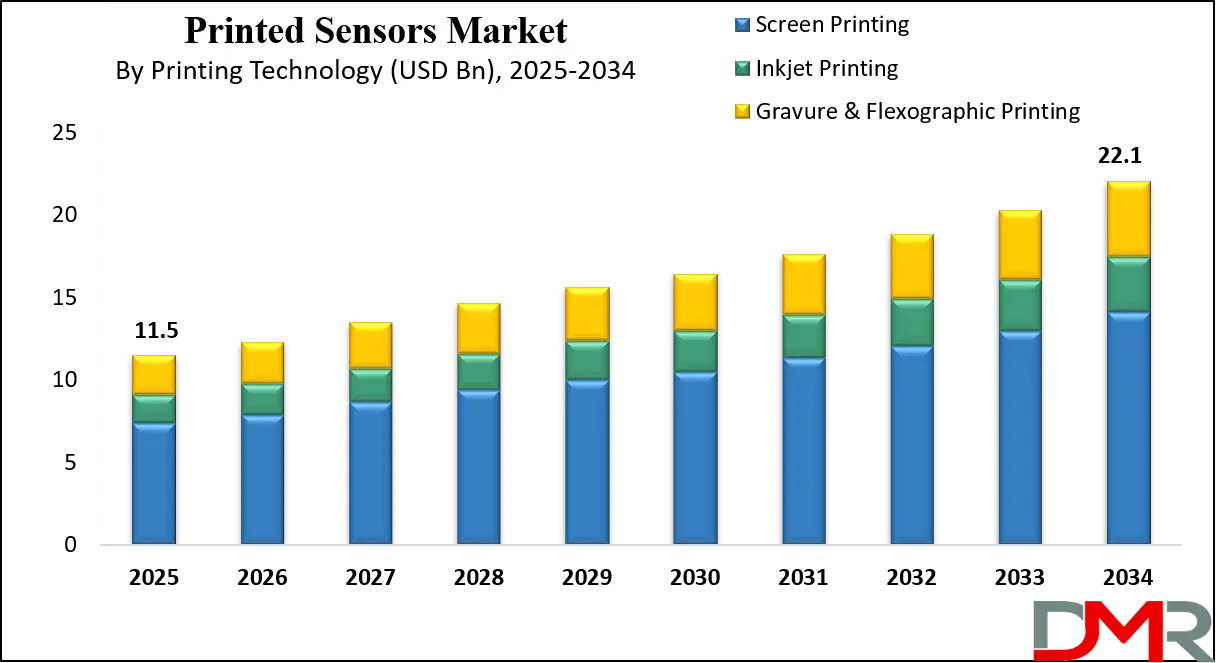

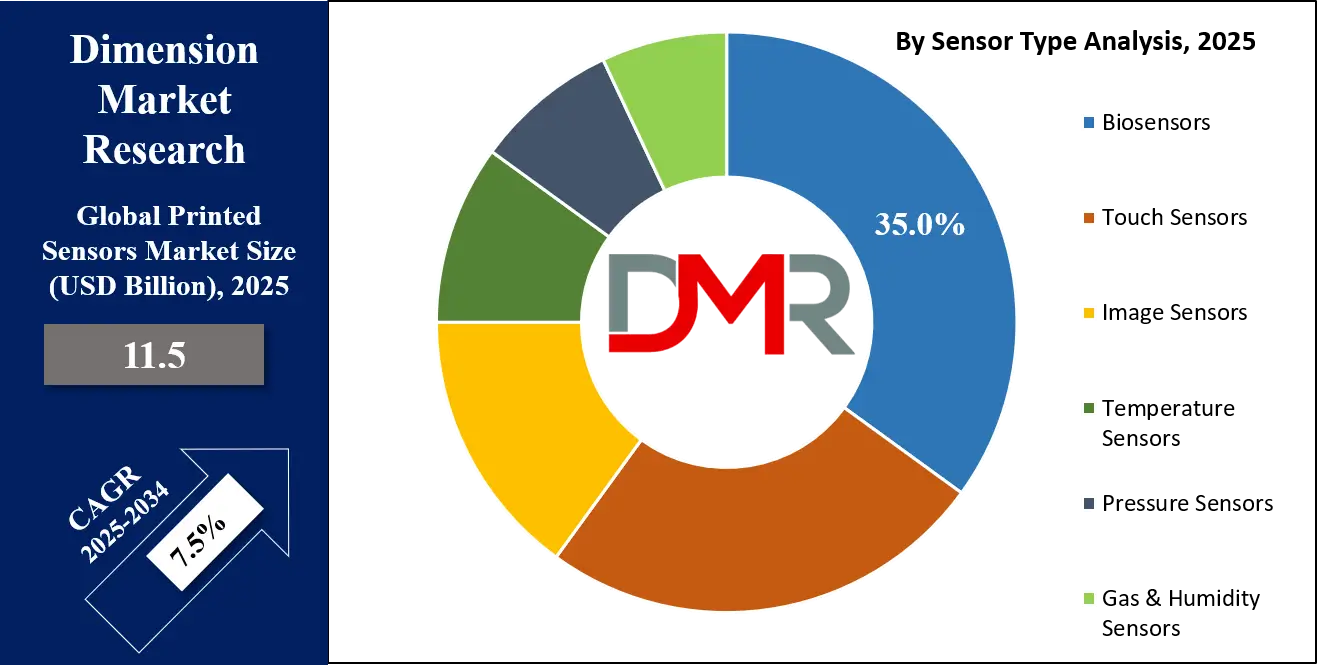

The global printed sensors market is projected to grow from USD 11.5 billion in 2025 to USD 22.1 billion by 2034, registering a CAGR of 7.5%. Rising adoption of flexible electronics, wearable devices, and smart packaging solutions is driving demand, while advancements in inkjet and screen printing technologies are enabling scalable, cost-effective sensor production across healthcare, consumer electronics, automotive, and industrial applications.

Printed sensors are devices created using advanced printing technologies such as screen printing, inkjet printing, and flexographic printing. These sensors are thin, lightweight, and flexible, allowing them to be integrated into materials like plastics, textiles, and paper. They can detect and measure physical parameters such as pressure, temperature, humidity, force, and gas concentration. The major advantages of printed sensors are their low production costs and scalability, achieved through roll-to-roll manufacturing, which reduces material waste. Because of these properties, printed sensors are widely used in consumer electronics, healthcare, automotive applications, and smart packaging, where traditional rigid sensors are less practical.

The global printed sensors market is growing rapidly due to the increasing demand for flexible, lightweight, and cost-efficient sensing solutions across multiple industries. Rising adoption of wearable healthcare devices, smart packaging, and interactive electronics is driving market expansion. Manufacturers are leveraging innovative materials and printing techniques to produce sensors that are both reliable and versatile, enabling applications in automotive, industrial monitoring, and environmental sensing.

The market is projected to expand steadily over the coming years as industries seek smarter, more integrated sensing technologies. Technological advancements in materials and printing processes, combined with the push for miniaturization in electronics, are expected to create significant opportunities for market players. Regions with strong electronics manufacturing bases, especially in Asia Pacific and North America, are likely to dominate market growth while emerging economies are gradually increasing their adoption of printed sensors in healthcare and consumer applications.

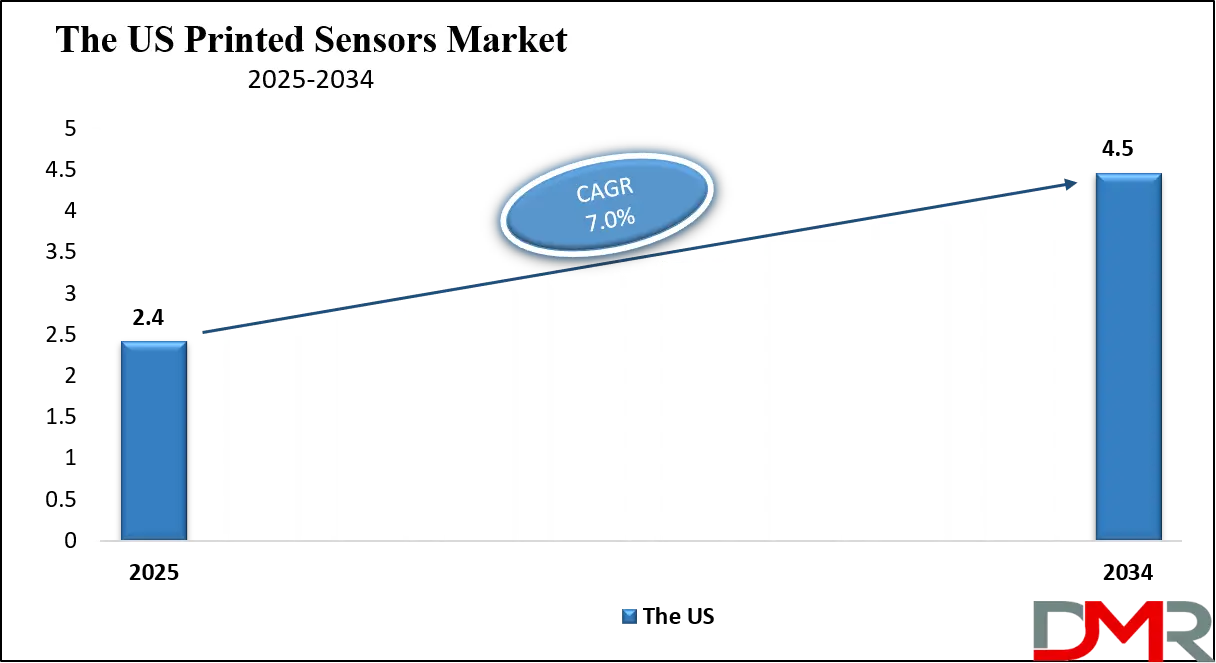

The US Printed Sensors Market

The U.S. Printed Sensors market size is projected to be valued at USD 2.4 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.5 billion in 2034 at a CAGR of 7.0%.

The United States printed sensors market is witnessing robust growth due to the rising integration of flexible electronics and wearable devices across healthcare, consumer electronics, and automotive sectors. The adoption of smart packaging and interactive electronic solutions is further fueling demand, as manufacturers prefer lightweight, bendable sensors that can be embedded seamlessly into products.

Innovations in printing techniques, including inkjet and screen printing, have enabled high-precision, cost-efficient sensor production, making them attractive for applications where traditional rigid sensors are impractical. Increasing focus on miniaturization and device portability is also driving the deployment of printed sensors in emerging IoT and connected device ecosystems.

Technological advancements in materials and fabrication processes are enhancing the performance and durability of printed sensors, supporting their use in industrial monitoring, environmental sensing, and consumer applications. Collaboration between electronics manufacturers, startups, and research institutions is fostering innovation, allowing for the development of multi-functional sensors capable of detecting pressure, temperature, humidity, and gas concentrations. Growing interest in personalized healthcare devices and intelligent packaging solutions further encourages the adoption of printed sensors, positioning the U.S. market as a key driver of innovation and adoption in flexible sensing technologies globally.

Europe Printed Sensors Market

The Europe printed sensors market is poised for steady growth, with an estimated market value of approximately USD 2.3 billion in 2025. The growth is primarily driven by the increasing adoption of flexible and wearable electronics, particularly in consumer electronics, healthcare, and industrial applications. Manufacturers in the region are leveraging advanced printing technologies such as screen printing and inkjet printing to produce high-performance sensors on flexible substrates. These sensors offer advantages such as lightweight design, low production cost, and compatibility with various materials, which make them highly suitable for integration into smart devices, medical wearables, and industrial monitoring systems.

The market in Europe is expected to grow at a compound annual growth rate (CAGR) of around 6.8% over the forecast period. Strong research and development initiatives, coupled with government support for innovation and smart manufacturing, are fostering technological advancements in sensor design and material development.

Additionally, the increasing focus on sustainable and energy-efficient solutions is encouraging the adoption of printed sensors across sectors such as automotive, aerospace, and environmental monitoring. As a result, Europe is emerging as a key region for the deployment of flexible and next-generation sensing technologies in the global printed sensors market.

Japan Printed Sensors Market

The Japan printed sensors market is projected to reach approximately USD 400 million in 2025, reflecting steady growth driven by the increasing adoption of flexible and wearable electronics. Industries such as consumer electronics, healthcare, and automotive are key contributors, leveraging printed sensors for applications like touch interfaces, health monitoring devices, and vehicle safety systems.

Advanced printing technologies such as inkjet and screen printing enable the production of high-precision, lightweight sensors that can be integrated into a wide variety of substrates, including plastics, textiles, and other flexible materials, supporting the region’s demand for innovative and compact sensing solutions.

The market in Japan is expected to grow at a compound annual growth rate (CAGR) of approximately 6.4% over the forecast period. Growth is supported by strong research and development activities, government initiatives promoting smart manufacturing, and increasing investment in wearable medical devices and IoT-enabled industrial solutions. Additionally, the emphasis on miniaturization, energy efficiency, and high-performance sensor integration is driving the adoption of printed sensors across various sectors, positioning Japan as a significant contributor to the global printed sensors market.

Global Printed Sensors Market: Key Takeaways

- Market Value: The global Printed Sensors market size is expected to reach a value of USD 22.1 billion by 2034 from a base value of USD 11.5 billion in 2025 at a CAGR of 7.5%.

- By Sensor Type Analysis: Biosensors are anticipated to dominate the sensor type segment, capturing 35.0% of the total market share in 2025.

- By Printing Technology Segment Analysis: Screen Printing is expected to maintain its dominance in the printing technology segment, capturing 64.0% of the total market share in 2025.

- By Material Segment Analysis: Plastic Films will dominate the material segment, capturing 55.0% of the market share in 2025.

- By Application Segment Analysis: Consumer Electronics applications will account for the maximum share in the application segment, capturing 40.0% of the total market value.

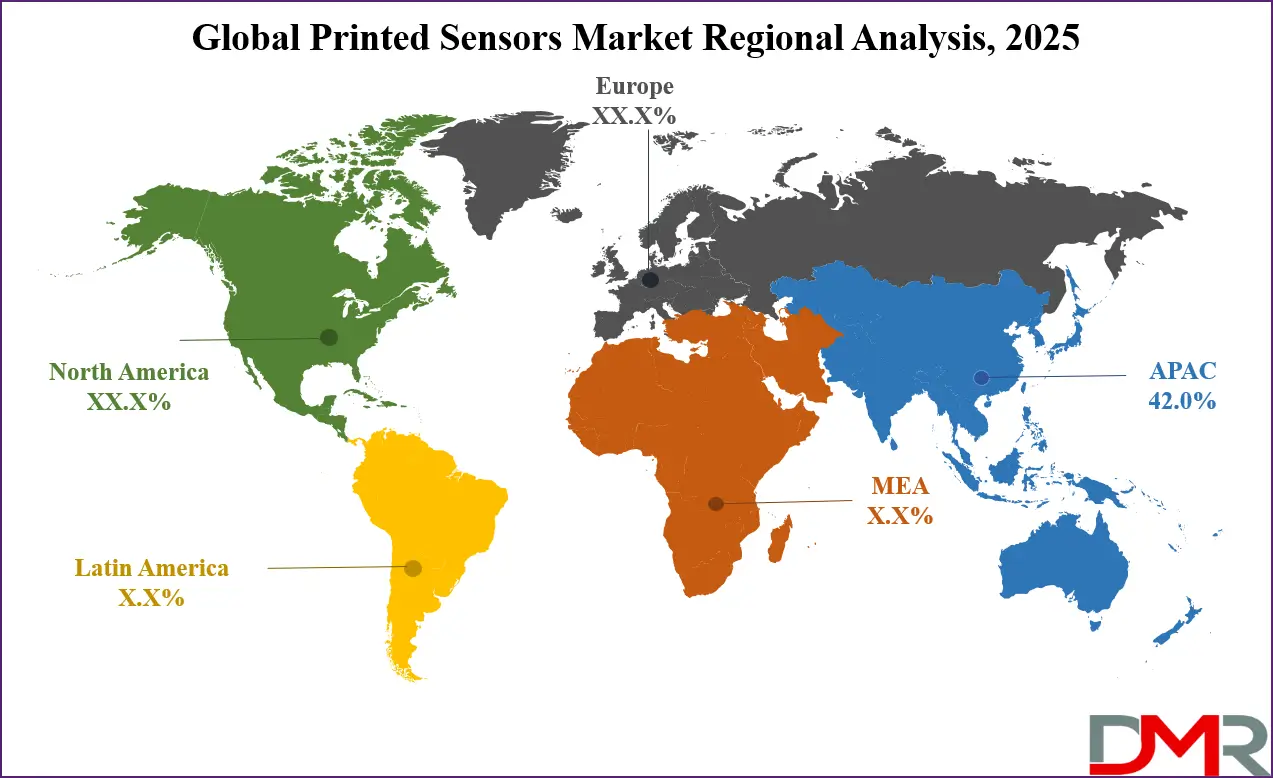

- Regional Analysis: Asia Pacific is anticipated to lead the global Printed Sensors market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Printed Sensors market are Fujifilm Holding Corporation, Canatu Oy, Interlink Electronics, Inc., Tekscan, Inc., ISORG SA, Peratech Holdco Limited, KWJ Engineering Inc., T+Ink, Inc., Renesas Electronics Corporation, Thin Film Electronics ASA, Molex LLC, Nissha Co., Ltd., PolyIC GmbH & Co. KG, FlexEnable Limited, and Others.

Global Printed Sensors Market: Use Cases

- Wearable Health Monitoring Devices: Printed sensors are increasingly used in wearable health devices such as fitness trackers, smartwatches, and continuous glucose monitors. Their flexibility and lightweight nature allow seamless integration into fabrics or skin-contact patches, enabling real-time monitoring of vital signs, temperature, and movement. The use of printed biosensors in healthcare applications improves patient comfort and allows continuous, non-invasive data collection, supporting personalized medicine and telehealth solutions.

- Smart Packaging and Supply Chain Tracking: Smart packaging utilizes printed sensors to monitor environmental conditions such as temperature, humidity, and pressure during transportation and storage. These sensors ensure product quality and safety in pharmaceuticals, food, and perishable goods. Integration with IoT and cloud-based analytics allows real-time tracking, reducing spoilage and improving inventory management, which enhances supply chain efficiency and sustainability.

- Automotive Safety and Comfort Systems: In the automotive sector, printed sensors are used for seat occupancy detection, touch interfaces, tire pressure monitoring, and climate control systems. Their thin, flexible design allows embedding into dashboards, seats, and panels without affecting vehicle aesthetics or ergonomics. By enabling real-time data collection, these sensors improve vehicle safety, passenger comfort, and predictive maintenance capabilities.

- Industrial and Environmental Monitoring: Printed sensors are deployed in industrial equipment and environmental monitoring systems to detect pressure, humidity, gas levels, and temperature fluctuations. Their scalability and low-cost production make them suitable for large-area sensing applications in factories, smart buildings, and agricultural fields. By providing accurate and real-time measurements, these sensors support process optimization, energy efficiency, and environmental safety compliance.

Impact of Artificial Intelligence on Printed Sensors Market

Artificial Intelligence is significantly transforming the printed sensors market by enhancing data processing, predictive analytics, and real-time decision-making capabilities. AI algorithms enable sensors to not only detect physical parameters such as pressure, temperature, and humidity but also interpret complex patterns for advanced applications in healthcare, industrial automation, and smart devices. Integration of AI with printed sensors facilitates predictive maintenance, personalized health monitoring, and adaptive environmental controls, driving higher efficiency and accuracy. Additionally, AI supports the optimization of sensor design and manufacturing processes, reducing production costs and enabling smarter, more reliable flexible sensing solutions.

Global Printed Sensors Market: Stats & Facts

- The National Nanotechnology Initiative (NNI) has been a significant driver, with its budget increasing from USD 1.99 billion in 2023 to a requested USD 2.16 billion for 2024. This sustained investment underscores the government's commitment to advancing nanotechnology research, which is foundational for the development of printed sensors.

- Additionally, the CHIPS and Science Act of 2022 allocated USD 50 billion to bolster semiconductor research, development, and manufacturing in the U.S. This funding aims to revitalize the U.S. position in semiconductor technologies, indirectly supporting the printed sensors market, which relies on advancements in semiconductor and microelectronics technologies.

Global Printed Sensors Market: Market Dynamics

Global Printed Sensors Market: Driving Factors

Rising Adoption of Wearable and Flexible Electronics

The growing demand for wearable health monitoring devices, smartwatches, and fitness trackers is fueling the printed sensors market. Their lightweight and flexible design allows seamless integration into fabrics and skin-contact patches, providing real-time monitoring of vital signs, motion, and environmental conditions. Increasing consumer preference for personalized healthcare and connected devices is accelerating the deployment of printed biosensors and touch sensors across healthcare and consumer electronics applications.

Advancements in Printing Technologies

Innovations in inkjet, screen, and roll-to-roll printing techniques are enabling cost-effective and high-precision production of printed sensors. These technologies allow scalable manufacturing on flexible substrates, reducing material waste and enhancing sensor performance. The ability to produce multi-functional sensors at lower costs is driving adoption across automotive, industrial, and environmental monitoring applications, making printed sensors a preferred choice over traditional rigid sensing solutions.

Global Printed Sensors Market: Restraints

Limited Durability and Reliability Concerns

Printed sensors can face challenges related to long-term durability and sensitivity, especially under harsh environmental conditions. Factors such as temperature fluctuations, mechanical stress, and exposure to chemicals may degrade performance, limiting adoption in critical applications like automotive safety systems and industrial machinery monitoring. Ensuring consistent accuracy and lifespan remains a significant barrier for widespread market growth.

High Initial Investment for R&D and Material Development

Developing advanced printed sensors requires substantial investment in research, development, and specialized conductive inks and substrates. Small and medium-sized enterprises may find it difficult to compete due to high production costs, limiting market penetration in emerging regions. The need for precision manufacturing equipment and skilled personnel further adds to the initial barriers.

Global Printed Sensors Market: Opportunities

Expansion in Smart Packaging and IoT Applications

The increasing demand for intelligent packaging solutions and IoT-enabled devices presents significant growth opportunities for printed sensors. Sensors embedded in packaging can monitor temperature, humidity, and product integrity, enabling real-time tracking and supply chain optimization. Integration with cloud analytics and mobile applications allows manufacturers to enhance product quality, reduce waste, and improve consumer trust.

Growth in Industrial and Environmental Monitoring

Printed sensors offer scalable, low-cost solutions for monitoring industrial equipment, smart buildings, and agricultural fields. By detecting pressure, gas concentration, and environmental parameters, these sensors support energy-efficient operations, predictive maintenance, and regulatory compliance. Rising interest in smart manufacturing and sustainable industrial practices further encourages adoption, creating new revenue streams for sensor manufacturers.

Global Printed Sensors Market: Trends

Integration with Artificial Intelligence and Machine Learning

Combining printed sensors with AI and machine learning is a growing trend, allowing real-time data analysis and predictive decision-making. AI-enabled sensors can detect complex patterns, optimize device performance, and improve accuracy in healthcare, industrial, and environmental applications. This trend is driving the development of smarter, adaptive, and multi-functional sensor solutions.

Development of Biocompatible and Stretchable Sensors

Emerging research in biocompatible materials and stretchable substrates is enabling the production of sensors suitable for wearable medical devices and soft robotics. These sensors offer high flexibility, comfort, and durability, supporting continuous health monitoring and human-machine interface applications. Adoption of eco-friendly and recyclable materials is also gaining traction, aligning with sustainability initiatives.

Global Printed Sensors Market: Research Scope and Analysis

By Sensor Type Analysis

In the printed sensors market, biosensors are expected to be the leading segment by sensor type, capturing around 35% of the total market share in 2025. These sensors are increasingly adopted in healthcare and medical applications due to their ability to detect biological parameters such as glucose levels, heart rate, and other vital signs. Their flexible and lightweight design allows seamless integration into wearable devices and health monitoring patches, enabling continuous and non-invasive tracking. The scalability of printed biosensors through cost-effective manufacturing techniques like screen and inkjet printing further enhances their attractiveness to manufacturers and consumers, supporting growth across both consumer electronics and medical industries.

Touch sensors also represent a significant portion of the sensor type segment, widely used in consumer electronics, automotive interfaces, and smart home devices. These sensors enable intuitive user interaction by detecting touch or proximity on surfaces such as screens, control panels, and dashboards. Printed touch sensors benefit from flexible substrates and thin-film technologies, allowing them to be incorporated into curved displays and wearable devices without compromising performance. Their increasing application in interactive devices, combined with the rising demand for seamless human-machine interfaces, is contributing to the steady growth of the touch sensor segment within the printed sensors market.

By Printing Technology Analysis

In the printed sensors market, screen printing is expected to continue its dominance in the printing technology segment, capturing around 64% of the total market share in 2025. This technique is widely preferred due to its cost-effectiveness, scalability, and ability to produce high-quality sensors on a variety of flexible substrates such as plastics and textiles.

Screen printing allows precise deposition of conductive inks, making it ideal for large-scale production of biosensors, touch sensors, and other sensor types. Its versatility and reliability in producing uniform, high-performance sensor layers contribute significantly to its sustained adoption across consumer electronics, healthcare, automotive, and industrial applications.

Gravure and flexographic printing also hold an important place within the printing technology segment, offering specialized solutions for high-resolution and large-area sensor applications. Gravure printing provides fine detailing and consistent ink distribution, making it suitable for complex sensor designs that require precision.

Flexographic printing, on the other hand, is advantageous for rapid, high-volume production on flexible materials, supporting applications in smart packaging and industrial monitoring. Both techniques complement other printing methods by enabling customization, scalability, and integration into emerging applications, thereby contributing to the overall growth of the printed sensors market.

By Material Analysis

In the printed sensors market, plastic films are expected to dominate the material segment, capturing approximately 55% of the market share in 2025. Plastic films are favored due to their smooth surface, flexibility, and durability, which allow for precise deposition of conductive inks and consistent sensor performance. Their lightweight nature and ease of handling make them ideal for a wide range of applications, including wearable health devices, consumer electronics, and industrial monitoring systems. The cost-effectiveness of plastic substrates, combined with their compatibility with scalable printing techniques like screen and inkjet printing, further reinforces their widespread adoption in the production of printed sensors.

Textiles and elastomers are also gaining traction in the material segment, particularly for applications in wearable electronics and flexible medical devices. These materials provide stretchability and comfort, enabling sensors to conform to the human body or other irregular surfaces without compromising functionality. Printed sensors on textiles and elastomers are used in smart clothing, fitness bands, and rehabilitation devices, offering real-time monitoring of physiological parameters such as heart rate, motion, and muscle activity. The growing interest in wearable technology and human-machine interfaces is driving the adoption of these flexible materials, expanding the opportunities for printed sensors in innovative consumer and healthcare applications.

By Application Analysis

In the printed sensors market, consumer electronics applications are expected to account for the largest share of the application segment, capturing approximately 40% of the total market value. Printed sensors are increasingly integrated into smartphones, tablets, wearable devices, and smart home products, enabling touch functionality, gesture recognition, and environmental sensing.

Their thin, flexible design allows for seamless incorporation into compact electronic devices without compromising aesthetics or performance. The growing demand for interactive and connected devices, combined with advancements in flexible and low-cost printing technologies, is driving the adoption of printed sensors in the consumer electronics sector, making it the leading application area in the market.

Healthcare applications also represent a significant segment within the printed sensors market. These sensors are widely used in wearable medical devices, continuous health monitoring patches, and diagnostic equipment to measure vital signs, glucose levels, and other physiological parameters.

The flexibility and lightweight nature of printed sensors allow for comfortable, non-invasive monitoring, supporting personalized medicine and telehealth solutions. Increasing focus on remote patient monitoring, chronic disease management, and the development of smart medical devices is propelling the growth of printed sensors in healthcare, creating opportunities for innovation in wearable diagnostics and patient-centered monitoring systems.

The Printed Sensors Market Report is segmented on the basis of the following:

By Sensor Type

- Biosensors

- Touch Sensors

- Image Sensors

- Temperature Sensors

- Pressure Sensors

- Gas & Humidity Sensors

By Printing Technology

- Screen Printing

- Gravure & Flexographic Printing

- Inkjet Printing

By Material

- Plastic Films

- Textiles/Elastomers

- Others

By Application

- Consumer Electronics

- Healthcare

- Automotive

- Industrial

- Smart Packaging & Others

Global Printed Sensors Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global printed sensors market, capturing around 42.0% of total market revenue in 2025. The region benefits from a strong electronics manufacturing ecosystem, rapid adoption of wearable devices, and growing demand for smart packaging and consumer electronics. Technological advancements in printing techniques and the availability of cost-effective materials further support the integration of printed sensors across healthcare, automotive, and industrial applications. Rising investment in research and development, coupled with increasing consumer awareness of connected devices and flexible electronics, positions Asia Pacific as the dominant market for printed sensors globally.

Region with significant growth

North America is poised to experience significant growth in the printed sensors market due to the increasing adoption of wearable healthcare devices, smart industrial monitoring systems, and advanced consumer electronics. The region benefits from a strong technological infrastructure, extensive research and development activities, and early adoption of innovative printing techniques. Growing demand for connected devices, IoT-enabled solutions, and predictive maintenance systems in industrial and healthcare applications is driving market expansion.

Additionally, supportive government initiatives and investments in smart manufacturing and digital healthcare technologies are expected to accelerate the growth of printed sensors in North America over the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Printed Sensors Market: Competitive Landscape

The global printed sensors market features a competitive landscape with key players focusing on innovation, strategic partnerships, and expansion of manufacturing capabilities to maintain market leadership. Companies are investing in research and development to enhance sensor performance, introduce multi-functional and flexible designs, and adopt advanced printing technologies such as inkjet and screen printing.

Collaboration with electronics manufacturers, healthcare providers, and industrial solution providers enables the integration of printed sensors into diverse applications, from wearable devices and smart packaging to automotive and environmental monitoring. This competitive environment drives continuous technological advancements, cost optimization, and broader market penetration across regions.

Some of the prominent players in the global printed sensors market are:

- Fujifilm Holding Corporation

- Canatu Oy

- Interlink Electronics, Inc.

- Tekscan, Inc.

- ISORG SA

- Peratech Holdco Limited

- KWJ Engineering Inc.

- T+Ink, Inc.

- Renesas Electronics Corporation

- Thin Film Electronics ASA

- Molex LLC

- Nissha Co., Ltd.

- PolyIC GmbH & Co. KG

- FlexEnable Limited

- Plastic Logic

- Canatu Oy (Finland)

- Brewer Science

- E2IP Technologies

- Quad Industries

- Pressure Profile Systems Inc.

- Other Key Players

Global Printed Sensors Market: Recent Developments

- July 2025: STMicroelectronics announced plans to acquire NXP Semiconductors' MEMS sensors business for approximately USD 950 million. This acquisition aims to strengthen ST's position in the automotive and industrial sensor markets, leveraging complementary technologies.

- December 2024: Interlink Electronics acquired Conductive Transfers Limited (CT) and Global Print Solutions (GPS), gaining access to their patented processes for integrating electronics with textiles. This move enhances Interlink's capabilities in developing functional e-textiles and wearable technologies.

- September 2024: Researchers Budhathoki-Uprety and Ware received a seed grant from the Integrated Center for Sensors (IConS) to develop next-generation optical biosensors. Their project focuses on combining advanced materials and 3D printing techniques to create high-throughput, precision sensors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.5 Bn |

| Forecast Value (2034) |

USD 22.1 Bn |

| CAGR (2025–2034) |

7.5% |

| The US Market Size (2025) |

USD 2.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Sensor Type (Biosensors, Touch Sensors, Image Sensors, Temperature Sensors, Pressure Sensors, Gas & Humidity Sensors), By Printing Technology (Screen Printing, Gravure & Flexographic Printing, Inkjet Printing), By Material (Plastic Films, Textiles/Elastomers, Others), By Application (Consumer Electronics, Healthcare, Automotive, Industrial, Smart Packaging & Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Fujifilm Holding Corporation, Canatu Oy, Interlink Electronics, Inc., Tekscan, Inc., ISORG SA, Peratech Holdco Limited, KWJ Engineering Inc., T+Ink, Inc., Renesas Electronics Corporation, Thin Film Electronics ASA, Molex LLC, Nissha Co., Ltd., PolyIC GmbH & Co. KG, FlexEnable Limited, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Printed Sensors market size is estimated to have a value of USD 11.5 billion in 2025 and is expected to reach USD 22.1 billion by the end of 2034.

The US Printed Sensors market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.5 billion in 2034 at a CAGR of 7.0%.

Asia Pacific is expected to have the largest market share in the global Printed Sensors market, with a share of about 42.0% in 2025

Some of the major key players in the global Printed Sensors market are Medtronic, Philips Healthcare, GE HealthCare, Siemens Healthineers, Abbott Laboratories, Johnson & Johnson, Boston Scientific, Stryker Corporation, Becton Dickinson and Company (BD), Baxter International, ResMed, Dexcom, Omron Healthcare, Honeywell Life Sciences, Qualcomm Life, Cerner Corporation (Oracle Health), Cisco Systems, Microsoft Healthcare Solutions, IBM Watson Health, and Others.

The market is growing at a CAGR of 7.5 percent over the forecasted period.