Market Overview

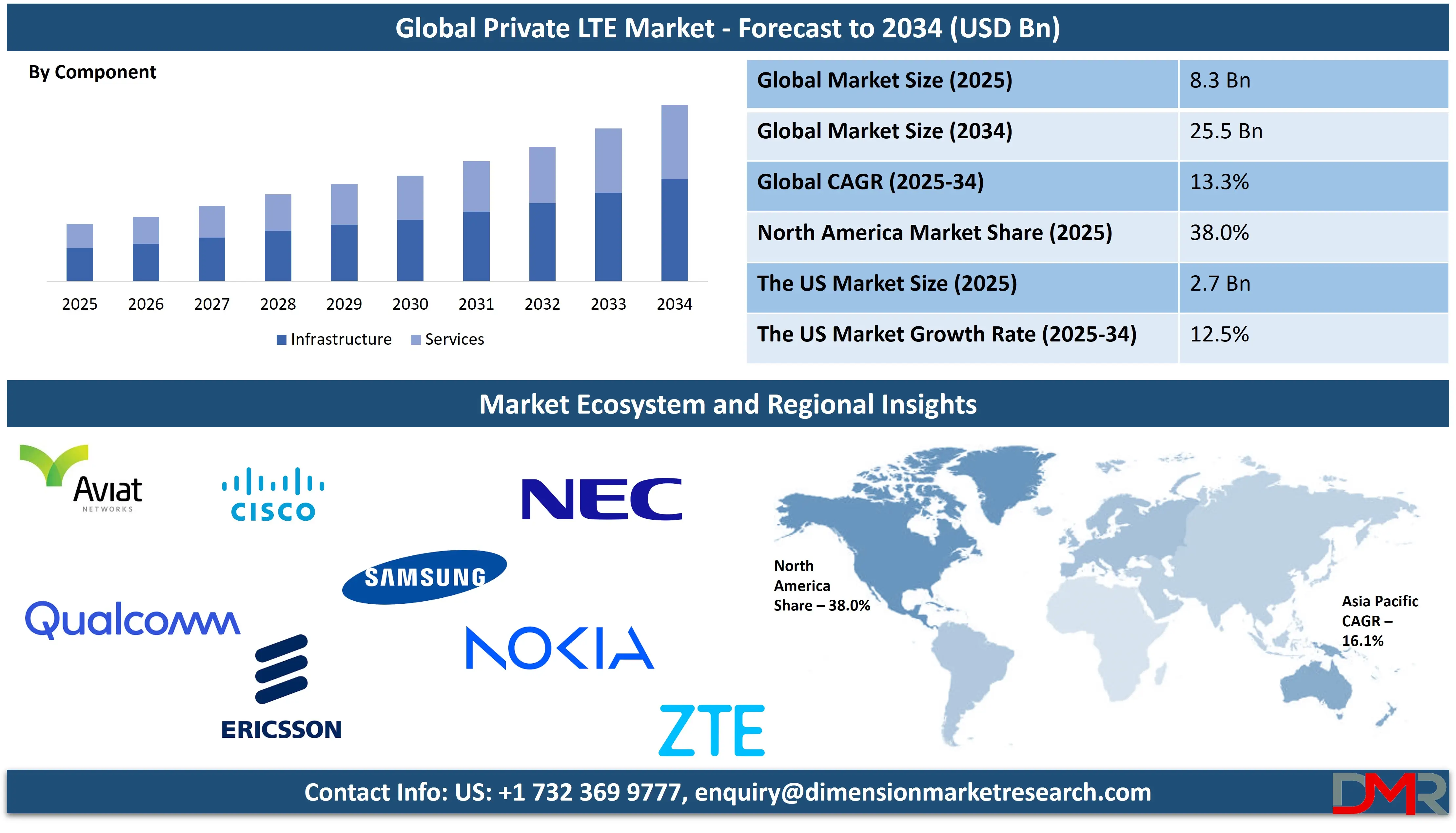

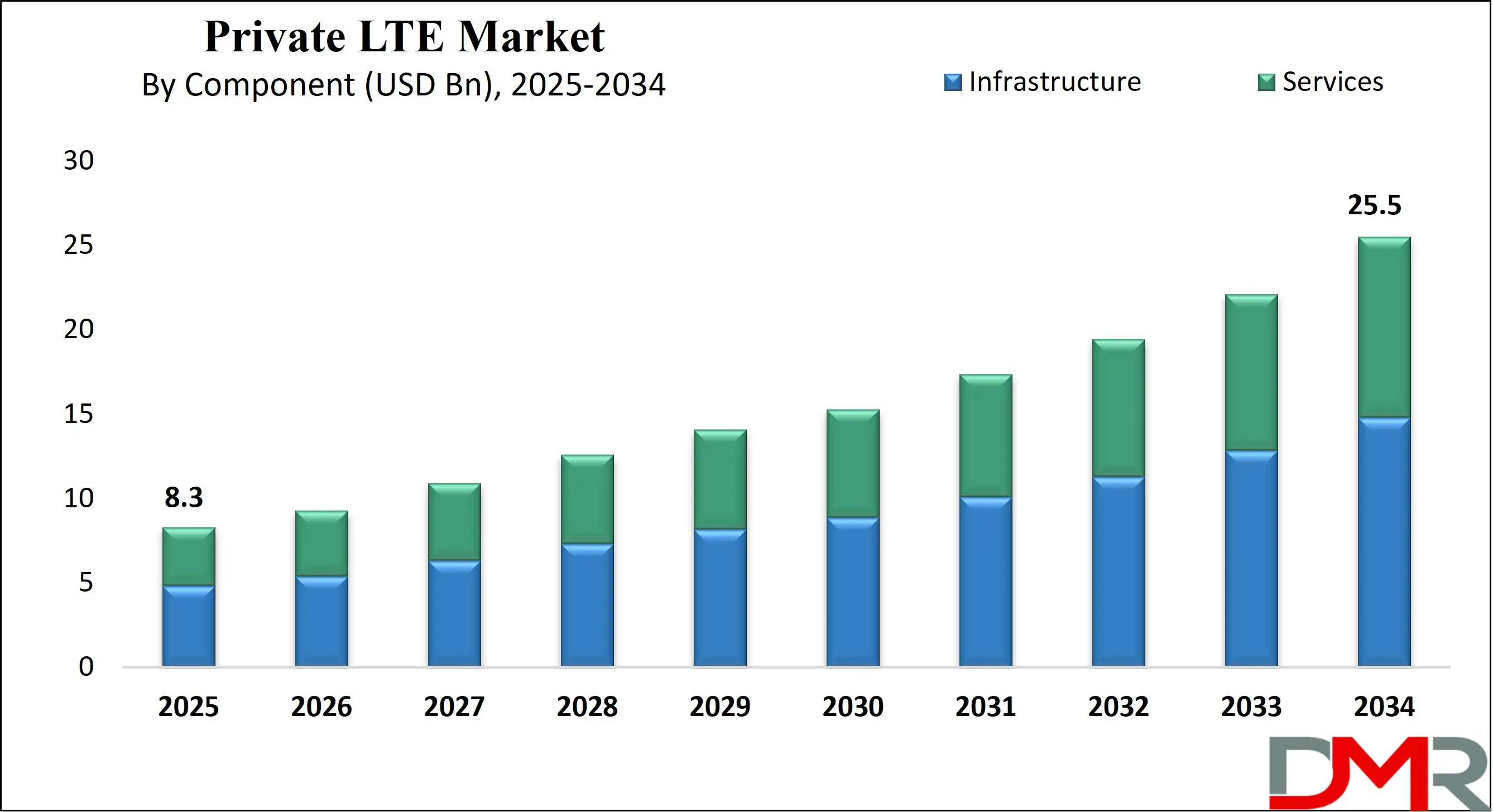

The Global Private LTE Market size is projected to reach USD 8.3 billion in 2025 and grow at a compound annual growth rate of 13.3% to reach a value of USD 25.5 billion in 2034.

The Private LTE market is a specialized sector of the telecommunications industry that focuses on providing dedicated LTE (Long-Term Evolution) wireless networks for businesses and organizations. Unlike public cellular networks, Private LTE networks offer customized coverage, security, and control for enterprises across various sectors, including manufacturing, logistics, energy, and healthcare. This market involves both infrastructure components such as radio access networks (RAN) and core networks, and services including deployment, integration, and managed services.

The significance of Private LTE lies in its ability to support critical communications, IoT devices, and enable business-specific applications. Emerging trends such as the rise of 5G, increasing demand for automation, and the shift towards Industry 4.0 are reshaping this market, pushing it towards rapid growth.

The key drivers of the Private LTE market include the increasing need for high-speed, secure, and reliable networks within private organizational environments. Technological advancements in LTE and 5G technologies, along with the growing demand for enhanced industrial IoT connectivity, are major factors propelling this market forward. Regulatory incentives in certain regions, particularly for enterprise-specific spectrum access, also support market adoption.

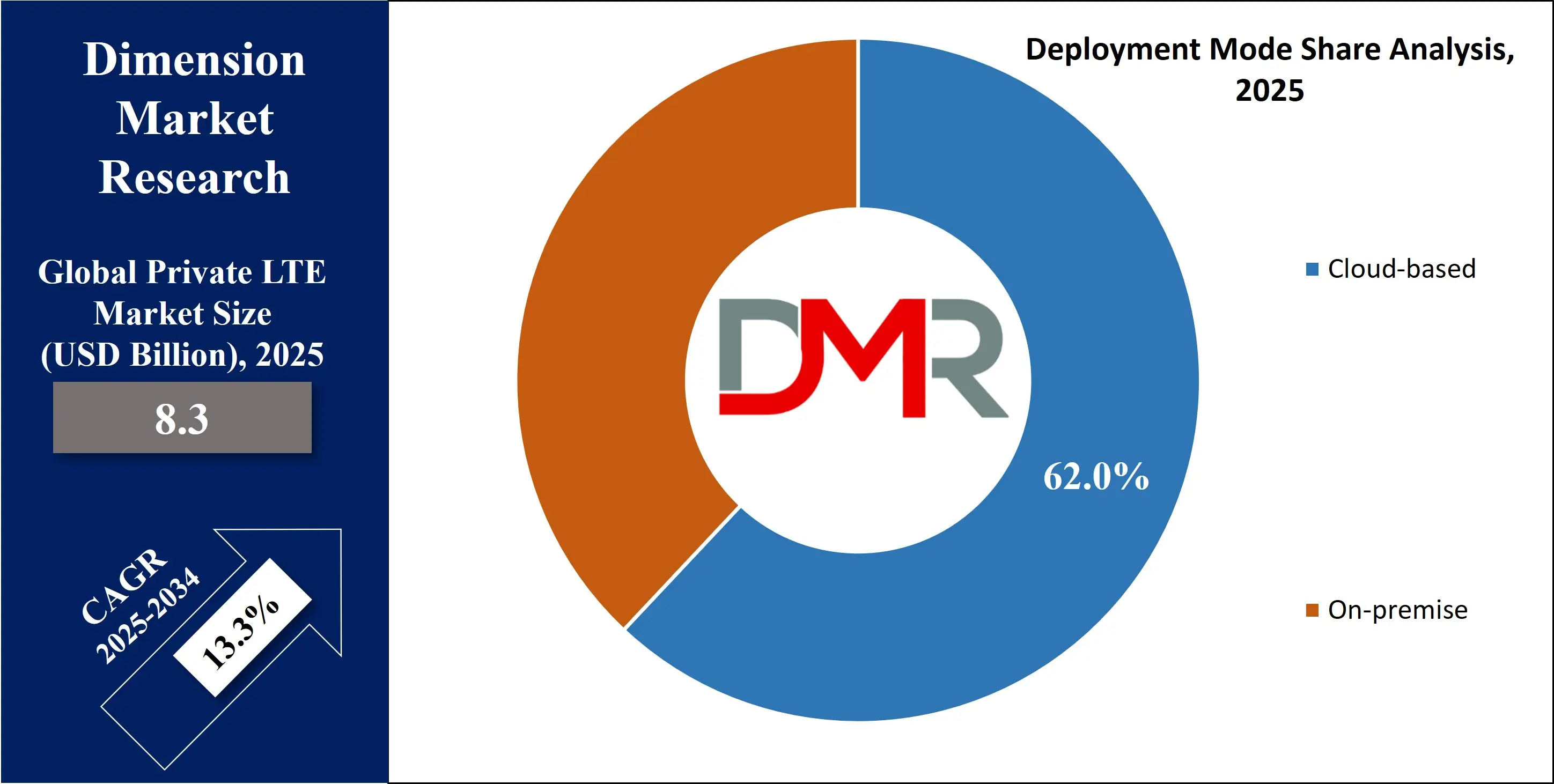

Notably, Private LTE networks are evolving from isolated, on-premises setups to more dynamic and flexible cloud-based solutions. Market maturity is progressing with increased industry-specific applications, such as mission-critical communications, asset tracking, and remote monitoring.

Key developments in the Private LTE market have centered on innovations that allow enterprises to scale their networks more efficiently. For instance, advancements in spectrum sharing technologies and edge computing are enabling more cost-effective deployments.

Mergers and acquisitions between telecom companies and equipment manufacturers are also contributing to the expansion of market capabilities. Government regulations and policies, such as spectrum licensing for private networks, are pivotal in shaping the market’s future. Notable investments in 5G technologies and collaborations with industries such as automotive, energy, and healthcare indicate that the Private LTE market is poised for significant evolution in the coming years.

The US Private LTE Market

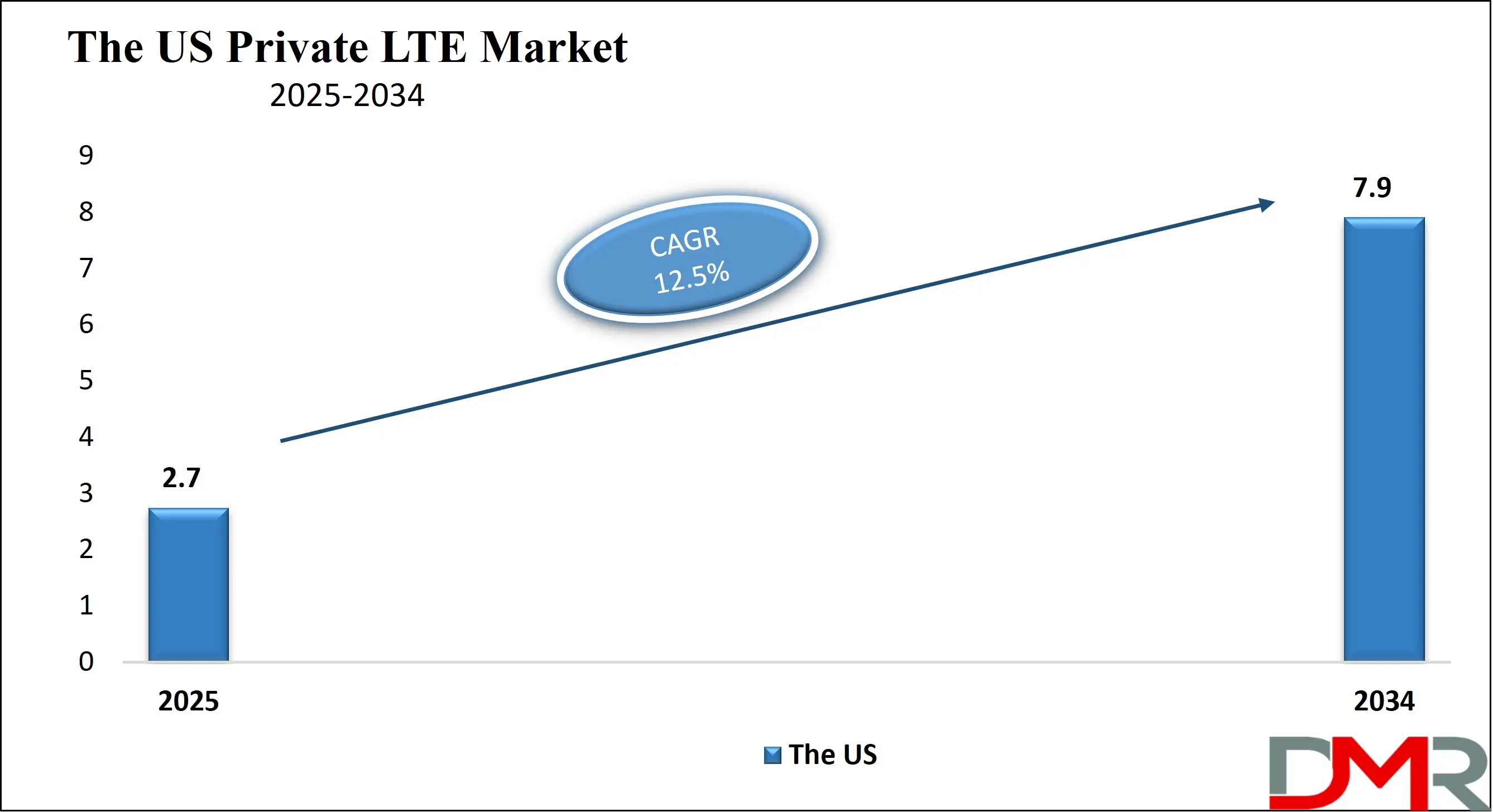

The US Private LTE Market size is projected to reach USD 2.7 billion in 2025 at a compound annual growth rate of 12.5% over its forecast period.

The US Private LTE market is experiencing rapid growth driven by increased demand for secure, high-speed networks across various industries such as manufacturing, logistics, and energy. Key factors influencing growth include government incentives for enterprise spectrum access, rising demand for Industrial IoT, and the shift towards Industry 4.0 technologies. Telecom providers, such as Verizon and AT&T, have also played a significant role in offering private LTE solutions tailored to specific industries. Furthermore, the US government’s promotion of 5G technology and the growing emphasis on digital infrastructure are set to accelerate adoption in the private sector.

Europe Private LTE Market

Europe Private LTE Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 12.7% over its forecast period.

The European Private LTE market is evolving under the influence of the European Green Deal, which encourages digital and green technology adoption in industrial sectors. The region is seeing strong demand for private LTE networks from industries focused on automation, logistics, and energy efficiency. Policies promoting 5G deployment and private network solutions have further spurred growth. Countries like Germany and the UK are at the forefront, with significant investments in private LTE infrastructure. Adoption is accelerating as more businesses explore the benefits of secured, low-latency networks to enhance productivity and operational control.

Japan Private LTE Market

Japan Private LTE Market size is projected to reach USD 581 million in 2025 at a compound annual growth rate of 14.2% over its forecast period.

Japan’s Private LTE market is growing rapidly due to the country’s focus on advanced industrial automation, robotics, and IoT connectivity. The government’s initiatives to promote 5G and advanced wireless networks are fueling adoption in key sectors such as manufacturing, energy, and public safety. With a strong focus on digital transformation, Japan’s industrial base is increasingly adopting private LTE solutions to improve operational efficiency. Challenges in the region include high infrastructure costs and competition from global telecom players, but the expanding role of 5G and smart city initiatives are driving future market growth.

Private LTE Market: Key Takeaways

- Market Growth: The Private LTE Market size is expected to grow by USD 16.2 billion, at a CAGR of 13.3%, during the forecasted period of 2026 to 2034.

- By Component: The Infrastructure segment is anticipated to get the majority share of the Private LTE Market in 2025.

- By Deployment Mode: The cloud-based segment is expected to get the largest revenue share in 2025 in the Private LTE Market.

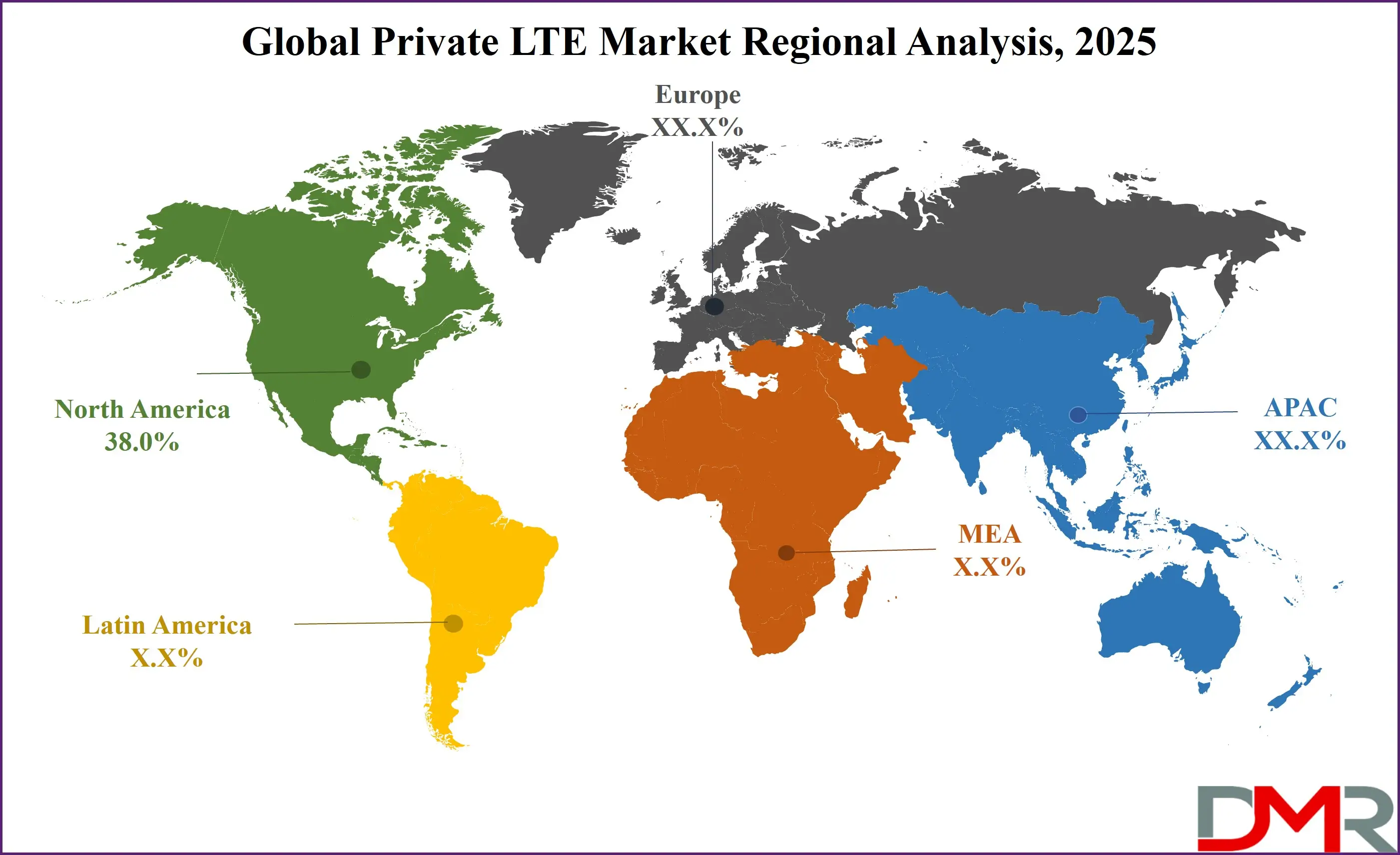

- Regional Insight: North America is expected to hold a 38.0% share of revenue in the Global Private LTE Market in 2025.

- Use Cases: Some of the use cases of Private LTE include industry IoT Connectivity, Asset tracking, and more

Private LTE Market: Use Cases

- Industrial IoT Connectivity: Private LTE networks provide a secure, low-latency infrastructure for connecting industrial IoT devices, enabling real-time monitoring and automation across manufacturing facilities and warehouses.

- Mission-Critical Communications: These networks are used in sectors like emergency services, healthcare, and utilities to ensure uninterrupted, reliable communication for critical operations.

- Asset Tracking: Businesses can leverage Private LTE to monitor and track assets in real-time, improving operational efficiency and reducing loss or theft in industries like logistics and manufacturing.

- Smart Cities: Private LTE networks can support a range of smart city applications, such as traffic management, surveillance, and energy grid management, contributing to improved urban living.

Stats & Facts

- US Federal Communications Commission (FCC) 2024 stated that over 1,000 private LTE networks have been deployed across the US, with a 22% annual increase in private network rollouts since 2022.

- GSMA Intelligence, 2024 report that by 2025, the global private LTE and 5G network market is expected to reach USD 12.3 billion, with enterprises increasingly adopting these technologies to enable automation.

- Japan Ministry of Internal Affairs and Communications, 2024, reported that Japan’s private LTE market is anticipated to see a 17% increase in adoption by 2026, driven by the manufacturing and logistics sectors.

- Telecom Regulatory Authority of India (TRAI), 2025, unveiled that the demand for private LTE in emerging markets, particularly in India, is set to increase by 25% year-on-year due to government-backed 5G spectrum auctions and industrial automation.

Market Dynamic

Driving Factors in the Private LTE Market

Technological Advancements

The continuous development of 5G and LTE technologies is a key driver of the Private LTE market. These advancements offer improved speeds, lower latency, and better coverage, making them ideal for industrial and mission-critical applications. Businesses are increasingly adopting private LTE networks to support IoT systems, autonomous operations, and real-time data analytics. These networks also facilitate the transition to digital-first operations, which is crucial for industries focused on automation and smart technologies.

Government Incentives

Several governments are offering incentives and creating policies that encourage the adoption of private LTE networks. In the US, spectrum allocations for private networks are becoming more accessible to industries, while the European Union has pushed for digital infrastructure development under its Green Deal. These regulatory measures are aimed at fostering economic growth and innovation while ensuring that critical industries benefit from secure, reliable networks.

Restraints in the Private LTE Market

High Infrastructure Costs

The initial investment required for deploying private LTE networks, including infrastructure, equipment, and ongoing maintenance, remains a significant challenge. While costs are expected to decrease over time, businesses, particularly SMEs, are hesitant to invest in such systems without clear long-term ROI. This financial barrier may slow down adoption, especially in industries with less capital to spend on advanced technologies.

Technological Limitations

The complexity of deploying a private LTE network, especially for businesses without in-house telecom expertise, poses a challenge. Integration with existing infrastructure, as well as the continuous need for updates and support, can be overwhelming. Additionally, current LTE networks are limited in their ability to handle high-bandwidth applications compared to emerging 5G networks, which could further hinder growth in certain sectors.

Opportunities in the Private LTE Market

5G Adoption

The growing interest in 5G is opening up new opportunities for Private LTE networks to evolve into more advanced solutions. 5G will enable faster speeds, greater connectivity, and enhanced network performance, which is essential for supporting advanced IoT systems, augmented reality, and industrial automation. As industries seek to future-proof their networks, the demand for hybrid LTE-5G systems will likely rise.

Industry-Specific Solutions

Industries such as healthcare, manufacturing, and logistics are increasingly looking for secure and reliable communication systems to enhance operational efficiency. The ability to offer customized Private LTE networks tailored to specific industry needs presents significant opportunities for market players. This is particularly true in sectors where data security and real-time processing are critical.

Trends in the Private LTE Market

Edge Computing Integration

The integration of edge computing with Private LTE networks is a growing trend. This combination allows for data processing at the network's edge, reducing latency and improving performance. Edge computing is especially crucial for industries requiring real-time decision-making, such as autonomous vehicles and manufacturing, making it a key trend driving the market forward.

Automation and Industry 4.0

The rise of Industry 4.0, characterized by automation, smart manufacturing, and the Internet of Things (IoT), is driving the demand for robust private LTE networks. These networks enable low-latency, high-bandwidth communication needed to support the increased number of connected devices and systems in industrial environments. The trend towards more autonomous operations is expected to be a key growth driver in the Private LTE sector.

Impact of Artificial Intelligence in Private LTE Market

- Network Optimization: AI is used to analyze traffic patterns and optimize the performance of private LTE networks by adjusting bandwidth allocation and prioritizing traffic dynamically.

- Predictive Maintenance: AI algorithms help predict and prevent network failures by analyzing operational data and providing early warnings for maintenance needs.

- Enhanced Security: AI-driven threat detection systems can quickly identify and mitigate cybersecurity risks on private LTE networks, improving data protection.

- Automation of Network Management: AI-powered network management tools automate routine tasks, reducing the need for manual intervention and improving operational efficiency.

- Improved Customer Experience: AI can enhance customer service and engagement by enabling predictive analytics, thereby improving user experience and operational responsiveness.

Research Scope and Analysis

By Component Analysis

The Infrastructure segment dominates the Private LTE infrastructure market, accounting for 58% of the market share. RAN is the foundation of any LTE network, responsible for establishing wireless communication between devices and network towers. This segment is vital for industries like manufacturing, logistics, and industrial IoT, where devices and sensors need to communicate in real-time with minimal latency. As industries embrace Industry 4.0, the demand for highly reliable and robust RAN infrastructure continues to surge, supporting automation, predictive maintenance, and smart factory systems that require seamless connectivity.

The Service segment is expanding rapidly, driven by the increasing need for secure, scalable, and high-performance network solutions to handle large volumes of data traffic. With industries increasingly reliant on mission-critical applications, including remote healthcare, asset management, and public safety, the core network must ensure efficient data management, secure traffic routing, and real-time monitoring. The rapid growth of IoT devices in sectors like healthcare and energy is further propelling the demand for more advanced and resilient core network solutions.

By Spectrum Analysis

Licensed spectrum holds 68% of the market share in the Private LTE market due to its superior security, coverage, and reliability. Licensed spectrum provides exclusive access to a particular frequency band, which makes it ideal for mission-critical and high-performance applications. Industries like manufacturing, energy, and logistics rely on licensed spectrum to ensure uninterrupted communication and avoid interference, particularly in remote or high-density areas. It guarantees high-quality service, low latency, and network predictability, which are essential for applications such as real-time monitoring, automation, and safety.

Unlicensed spectrum is growing rapidly, especially for more cost-effective and smaller-scale deployments. It accounts for a growing portion of Private LTE adoption, particularly in localized applications where extensive coverage is not required. Industries like retail, logistics, and small-scale manufacturing are gravitating toward unlicensed spectrum to lower deployment costs. Although it lacks the exclusivity and security benefits of licensed spectrum, unlicensed spectrum offers flexibility and is increasingly used in private network setups, especially where rapid deployments and budget-friendly solutions are priorities.

By Deployment Model Analysis

Cloud-based deployments dominate the Private LTE market, holding 62% of the market share. Cloud-based solutions offer scalability, flexibility, and cost efficiency, which are highly beneficial for enterprises seeking to expand their networks without heavy upfront investments in hardware. As organizations shift toward digital transformation, cloud deployment allows them to quickly scale their network infrastructure while benefiting from continuous updates, remote management, and on-demand resources. This deployment model is particularly popular in industries like manufacturing, retail, and healthcare, where agility and remote access are essential for smooth operations.

Despite the cloud-based model leading, on-premises deployment is experiencing rapid growth, particularly in industries with strict security and compliance regulations, such as government, defense, and healthcare. With on-premises solutions, enterprises retain full control over their network infrastructure, ensuring better data privacy, compliance with local regulations, and enhanced security. As concerns over data sovereignty and regulatory requirements increase, industries that handle sensitive data or critical operations are opting for on-premises deployments to maintain tighter control over their networks.

By End User Analysis

Industrial manufacturing leads the Private LTE market with 43% of the market share. As manufacturing plants increasingly adopt automation, robotics, and Industrial IoT (IIoT) technologies, the need for high-performance, secure, and low-latency private LTE networks has surged. These networks support real-time communication between machines, sensors, and control systems, enabling automation and predictive maintenance. Additionally, the adoption of smart factory technologies demands high bandwidth and reliable connectivity, positioning private LTE as a critical enabler of the digital transformation of manufacturing facilities globally.

The energy and utilities sector is the fastest-growing segment in Private LTE adoption. As the demand for secure, reliable, and high-performance communication networks increases, energy and utility companies are leveraging private LTE to support mission-critical applications such as grid management, remote monitoring of assets, and predictive maintenance. With the growing complexity of managing large-scale infrastructure and the need for secure communications in areas with critical safety concerns, the adoption of private LTE in this sector is accelerating rapidly, helping improve operational efficiency and reduce risks.

By Application Analysis

Mission-critical communications is the leading application segment, holding 52% of the market share. This segment encompasses applications in sectors such as public safety, emergency services, healthcare, and military operations, where reliable, real-time communication is vital for coordinating activities and ensuring safety. Private LTE networks are uniquely suited for these environments, providing secure, dedicated channels that prevent downtime and minimize communication disruptions during critical moments. With growing needs for high-availability networks, this segment continues to dominate the market as public safety and emergency response agencies upgrade their communications infrastructure.

The fastest-growing application segment is industrial IoT (IIoT) connectivity, as the number of connected devices across industries like manufacturing, logistics, and energy continues to increase. The need for secure, scalable, and low-latency networks to support real-time data exchange between machines, sensors, and control systems is driving this growth. Industrial IoT applications—ranging from predictive maintenance to automation—require stable and high-bandwidth communication, which private LTE networks are uniquely positioned to provide. This segment is growing rapidly, fueled by the broader trends of digitalization, automation, and the expanding use of connected devices across industrial sectors.

The Private LTE Market Report is segmented on the basis of the following

By Component

- Infrastructure

- Radio Access Network

- Core Network

- Services

- Deployment & Integration

- Managed Services

By Spectrum

- Licensed Spectrum

- Unlicensed Spectrum

- Shared Spectrum

By Deployment Model

By End User

- Industrial Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Public Safety

By Application

- Mission-Critical Communications

- Industrial IoT Connectivity

Regional Analysis

Leading Region in the Private LTE Market

North America leads the Private LTE market, holding 38% of the global market share. The region’s dominance is primarily driven by the increasing demand for secure, high-performance networks across various sectors, including manufacturing, logistics, energy, and healthcare. The United States, with its robust industrial base and favorable government policies, has been a key contributor to this growth.

Policies promoting 5G technology and spectrum availability, combined with significant investments in private LTE deployments, are accelerating adoption. Major telecom providers like Verizon, AT&T, and T-Mobile are playing a pivotal role by offering customized solutions to meet the diverse needs of enterprises, ensuring North America’s continued leadership in the market.

Fastest Growing Region in the Private LTE Market

The fastest-growing region for the Private LTE market is expected to be Asia-Pacific. Countries such as India, China, and South Korea are investing heavily in digital infrastructure and advanced telecommunications technologies. Government policies supporting smart cities, digital manufacturing, and 5G networks are propelling the adoption of private LTE in these regions. Furthermore, the rapid industrialization and the increasing demand for connected devices are driving growth in sectors like manufacturing and energy.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Private LTE market is characterized by a focus on strategic alliances, research and development (R&D), and customized solutions. Market players are continuously innovating to maintain their competitive edge, with many focusing on developing scalable, cost-effective solutions for industries like manufacturing, logistics, and energy. Strategic partnerships with telecom infrastructure providers and system integrators are common, as companies work to offer comprehensive solutions that include not just connectivity, but also automation, edge computing, and cybersecurity.

Some of the prominent players in the global Private LTE are:

- Nokia

- Ericsson

- Huawei

- ZTE

- NEC Corporation

- Qualcomm

- Samsung Electronics

- Cisco Systems

- Aviat Networks

- Affirmed Networks

- Athonet

- Airspan Networks

- ASOCS

- Boingo Wireless

- Casa Systems

- Comba Telecom

- CommScope

- Druid Software

- ExteNet Systems

- Fujitsu

- Other Key Players

Recent Developments

- In October 2024, Nokia acquired a crucial spectrum license to enhance its private LTE offerings. The license provides exclusive access to a radio frequency, ensuring more secure, high-performance networks for industries like manufacturing and energy. This acquisition strengthens Nokia's competitive position, enabling customized, reliable LTE solutions for mission-critical IoT applications.

- In September 2024, Verizon launched private LTE solutions for smart manufacturing offering secure, low-latency connectivity for automation and industrial IoT. The service enables real-time data processing, enhancing efficiency and operational control. This move supports the growing demand for Industry 4.0 technologies in manufacturing, positioning Verizon as a key player in enterprise connectivity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.3 Bn |

| Forecast Value (2034) |

USD 25.5 Bn |

| CAGR (2025–2034) |

13.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.7 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Infrastructure and Services), By Spectrum (Licensed Spectrum, Unlicensed Spectrum, and Shared Spectrum), By Deployment Model (On-Premises and Cloud-Based),By End User (Industrial Manufacturing, Energy & Utilities, Transportation & Logistics, and Public Safety), By Application (Mission-Critical Communications and Industrial IoT Connectivity) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Caterpillar, Komatsu, Volvo Construction Equipment, Sandvik, Epiroc, Hitachi Construction Machinery, Liebherr, Bobcat, Wacker Neuson, JCB, Takeuchi, Doosan, Hyundai Construction Equipment, XCMG, Sany Heavy Industry, Zoomlion, Normet, MacLean Engineering, GHH Fahrzeuge, Herrenknecht, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Private LTE Market size is expected to reach a value of USD 8.3 billion in 2025 and is expected to reach USD 25.5 billion by the end of 2034.

North America is expected to have the largest market share in the Global Private LTE Market, with a share of about 38.0% in 2025.

The Private LTE Market in the US is expected to reach USD 2.7 billion in 2025.

Some of the major key players in the Global Private LTE Market include Nokia, Ericsson, Huawei and others

The market is growing at a CAGR of 13.3 percent over the forecasted period.