Market Overview

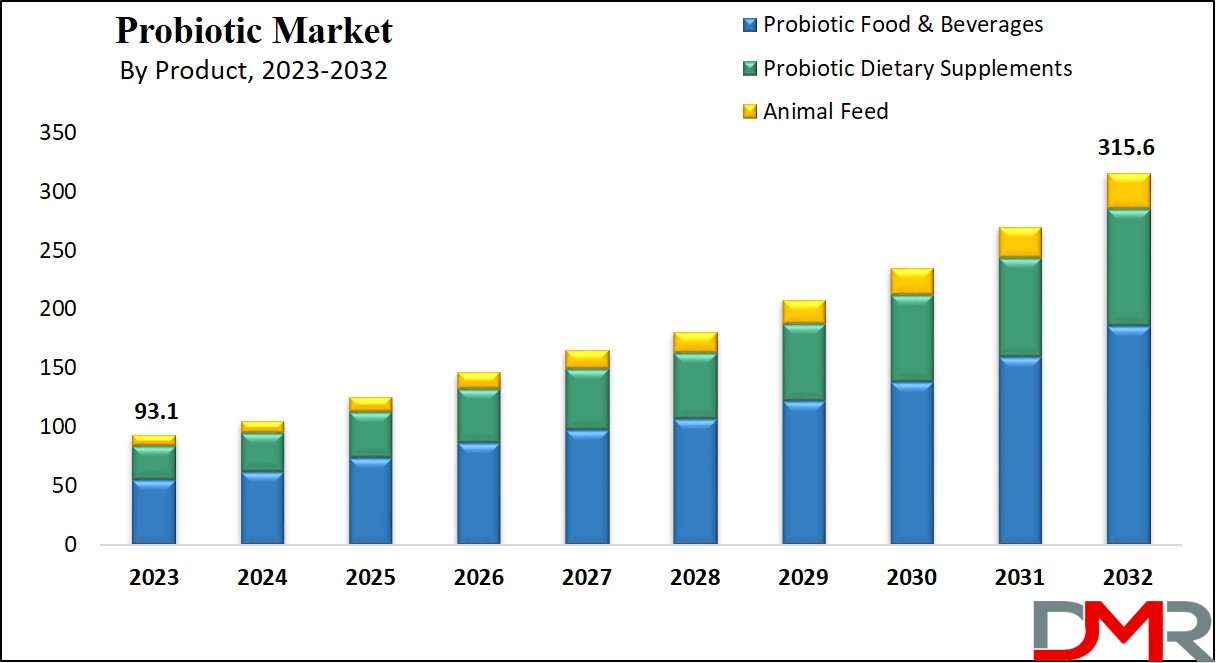

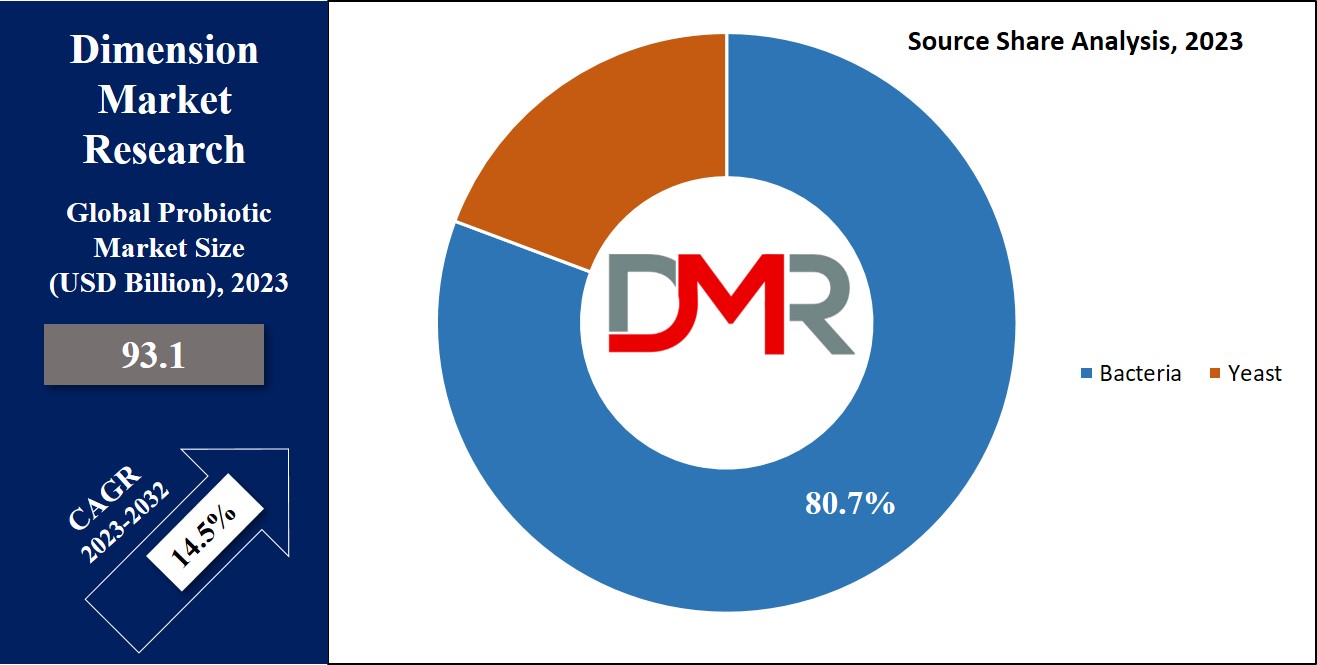

The Global Probiotic Market is expected to reach a value of

USD 93.1 billion in 2023, and it is further anticipated to reach a market value of

USD 315.6 billion by 2032 at a

CAGR of 14.5%.

Probiotics, consisting of bacteria & yeast, play an essential role in preserving a healthy balance of microorganisms in both human & animal intestines. They assist the production of digestive juices & enzymes, ensuring effective digestion, while safeguarding beneficial bacteria from harmful counterparts. Probiotics are highly employed to address digestive problems, mental health issues, &

neurological disorders, boosting the immune system, shielding proteins & lipids from oxidative harm, & combating infections within the body.

Market Dynamic

The use of probiotics in the form of dietary supplements within food & beverages offers significant

health benefits for the human digestive system. With

over 70% of people looking at dietary adjustments to boost their health, and immunity, & reduce stress & anxiety, there is a growth in consumer preference for healthy foods, driving the probiotics market's expansion. Moreover, technological advancements have become a major trend in the probiotic market, with many industry players dedicated to developing innovative solutions to enhance the quality & lifespan of probiotic products.

However, the increase in costs associated with researching & developing new probiotic strains creates a limitation to the market's growth. The significant expenses related to hiring skilled personnel, current R&D investments, & significant financial outlays for laboratories & research equipment act as barriers that hinder the market's progress.

Research Scope and Analysis

By Product

The probiotic food and beverage segment takes the lead in market revenue in 2023. Manufacturers are constantly enhancing food & drink products with enzymes & probiotics, driven by consumer demand for items that provide more nutrition & fiber. Probiotic ingredients are highly integrated into products like fish oil & yogurt to promote better gut health. The growing awareness of the importance of a better quality of life & the rise in disposable incomes have allowed consumers to turn to probiotics as a solution to their health concerns. In response to the growing demand for probiotics in food & beverages, manufacturers are expanding their businesses in this sector.

By Source

The category of bacteria-based ingredients commands a significant portion of the market's revenue in 2023, as these products bring various health advantages to both humans & animals, functioning as agents that assist in countering aflatoxin, minimize the risk of colon cancer, & provide protection against oral diseases, respiratory infections, urinary tract infections, gastrointestinal issues, & many internal

bacterial infections. The market is on a growth trajectory due to the growing popularity of functional foods, the inclusion of probiotic ingredients in emerging economies, & the increase in disposable incomes, collectively fueling the growing need for these beneficial bacteria-infused products that promote well-being.

By End User

The human probiotic sector holds a prominent position in the market, commanding a substantial share of revenue in 2023, as the global aging population is on the rise, leading to an increased prevalence of chronic diseases. In addition, there is a rise in the need for microorganisms like probiotics to help reduce the risk of major chronic illnesses, including inflammatory bowel disease (IBD), colon cancer, & diarrheal diseases.

In addition, there is a growth in demand for animal probiotics in the upcoming period. In recent years, there has been a notable growth in the use of probiotics in the feed of farm animals, with such adoption, they have yielded positive outcomes, including enhanced immune systems, better animal performance, & improved digestion. In addition, the growth in emphasis on animal welfare & a desire to minimize antibiotic usage in animal farming has further driven the demand for animal probiotics.

By Distribution Channel

A significant portion of probiotic sales is driven by hypermarkets/ supermarkets, contributing to a major share of revenue in 2023, which is due to the convenience & variety these stores offer, making it easy for consumers to find & purchase a variety of probiotic products in one place, solidifying the dominance of supermarkets & hypermarkets as distribution channels in the market.

The distribution of probiotics through pharmacies or drugstores is influenced by regulatory guidelines. Probiotic supplements are often classified as over-the-counter (OTC) products, meaning they can be bought without any prescription, which makes probiotics readily available in pharmacies or drugstores, enhancing their accessibility to consumers. The regulatory framework thus plays a major role in how probiotics reach the market through these channels.

The Probiotic Market Report is segmented on the basis of the following:

By Product

- Probiotic Food & Beverages

- Probiotic Dietary Supplements

- Animal Feed

By Source

By End User

By Distribution Channel

- Supermarkets

- Pharmacies

- Specialty Stores

- Online Stores

- Others

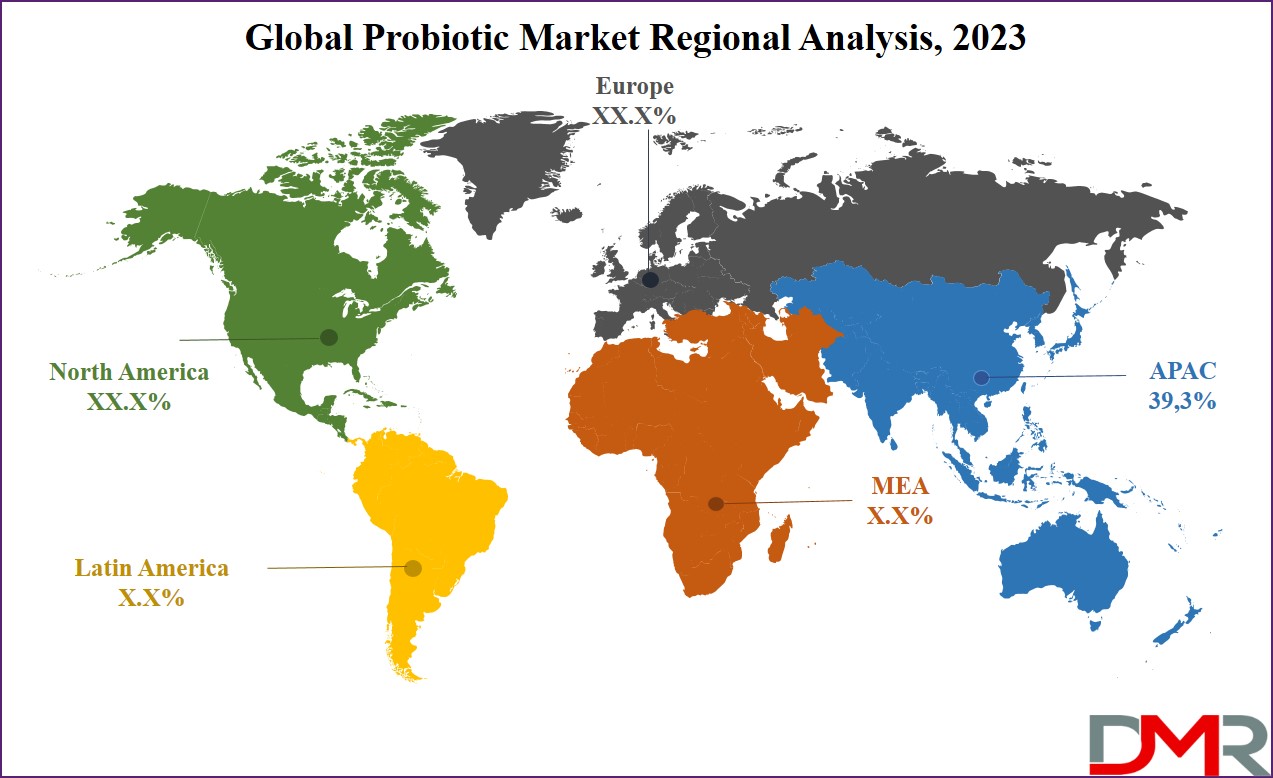

Regional Analysis

The Asia Pacific region represented a significant portion of the probiotic market with a

39.3% revenue share in 2023, which can be attributed to the growing health consciousness among consumers who are constantly looking for products that promote fitness & maintain good digestive health. Factors like rising disposable incomes, improved living standards, & a growing acceptance of functional foods are driving the industry's growth. Moreover, the increasing recognition of gut health's importance in overall well-being has led to a growth in demand for products that assist in a healthy gut microbiome, with probiotic supplements gaining popularity among health-conscious consumers, mainly in India.

Further, in North America, the need for probiotics is also anticipated to rise in the forecasted period, as North America is a major market for probiotics, mainly due to the high market penetration in developed economies, as benefits from growing awareness of healthy lifestyles & rising disposable incomes, which are key drivers of market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The probiotic market is highly competitive, with many major players looking for dominance, as they gain a strong competitive edge by setting their products apart through different means like unique ingredients, pricing strategies, & added features, which drives intense rivalry within the market. To stay ahead, these companies are pouring resources into R&D. Moreover, they're working on creating products that look into consumer tastes & needs, focused on growing their market footprint & upholding their positions.

In January 2023, the brand KeVita owned by Tropicana, expanded its selection of Sparkling Probiotic Lemonade by introducing a new mango flavor along with the already existing classic & peach options, which can be found on the shelves of popular retail chains in the United States, including Kroger & Walmart, making them more accessible to consumers looking for a variety of probiotic lemonade choices to enjoy.

Some of the prominent players in the global Probiotic Market are:

- Nestle

- Yakult Honsha Co Ltd

- i-Health Inc

- Danone

- PepsiCo Inc

- Amway Corp

- BioGaia

- Now Foods

- Lifeway Foods Inc.

- Aria Foods

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Probiotic Market:

The COVID-19 pandemic had a mixed impact on the global probiotic market, on one side, it raised awareness about the importance of maintaining good health 7 a strong immune system, driving increased interest in probiotics known for their potential health benefits, which led to an increase in demand for probiotic supplements, foods, & beverages. However, the economic recession that followed the pandemic created financial uncertainties for many consumers, causing some to cut back on non-essential expenses, like probiotic products.

As a result, the market experienced both increased demand due to health-conscious consumers & decline in sales due to economic challenges. The net effect depended on the region & the specific product segments within the probiotic market, with fluctuations in supply chains & consumer behavior influencing the market's overall performance.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 93.1 Bn |

| Forecast Value (2032) |

USD 315.6 Bn |

| CAGR (2023-2032) |

14.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Probiotic Food & Beverages, Probiotic

Dietary Supplements, and Animal Feed), By Source

(Bacteria and Yeast), By End User (Human and

Animal), By Distribution Channel (Supermarkets,

Pharmacies, Specialty Stores, Online Stores, and

Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nestle, Yakult Honsha Co Ltd, i-Health Inc, Danone,

PepsiCo Inc, Amway Corp, BioGaia, Now Foods,

Lifeway Foods Inc., Aria Foods, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Probiotic Market size is estimated to have a value of USD 93.1 billion in 2023 and is expected

to reach USD 315.6 billion by the end of 2032.

North America has the largest market share for the Global Probiotic Market with a share of about 39.3%

in 2023.

Some of the major key players in the Global Probiotic Market are Nestle, PepsiCo Inc, Danone, and many

others.

The market is growing at a CAGR of 14.5 percent over the forecasted period.