Market Overview

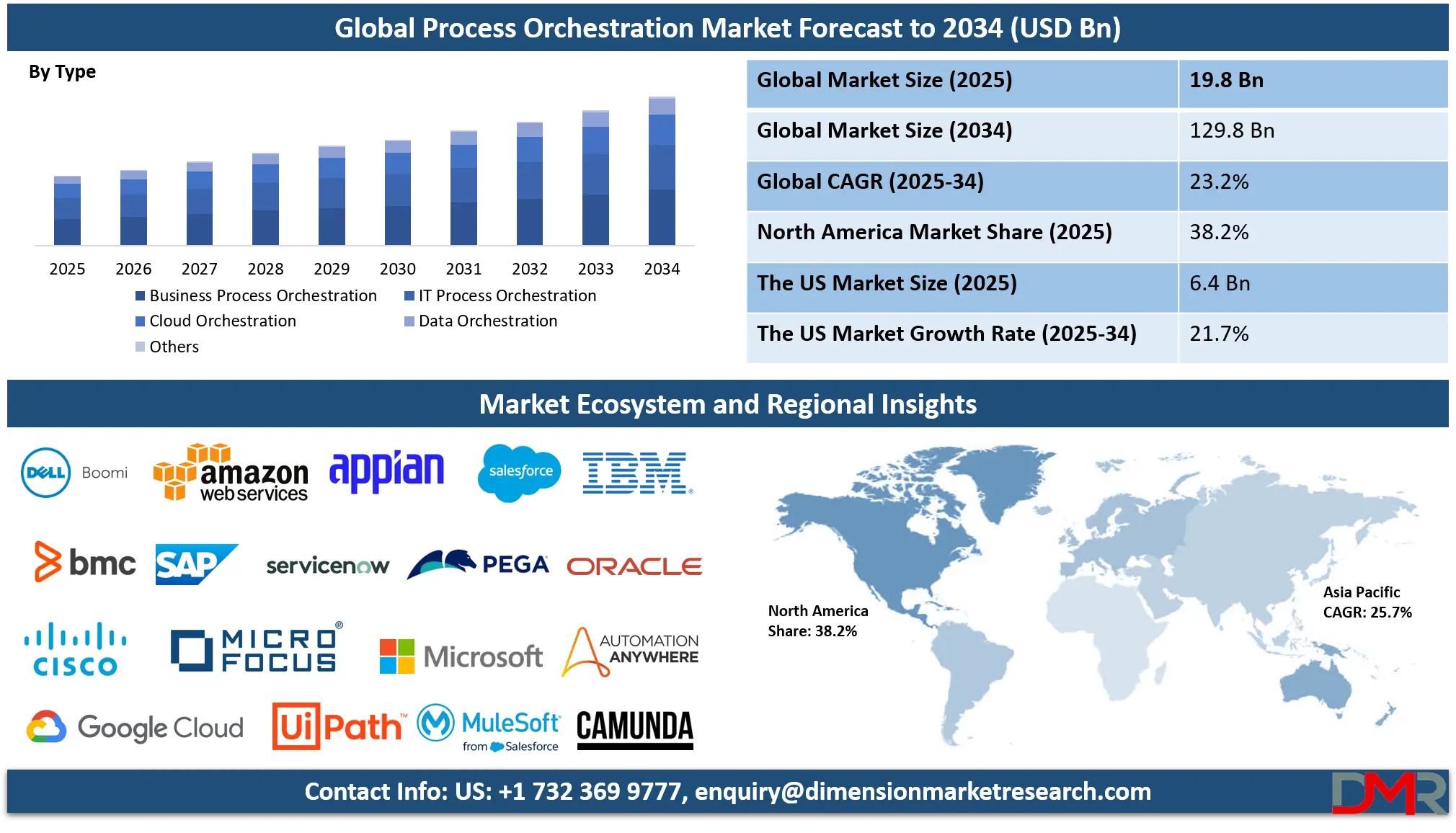

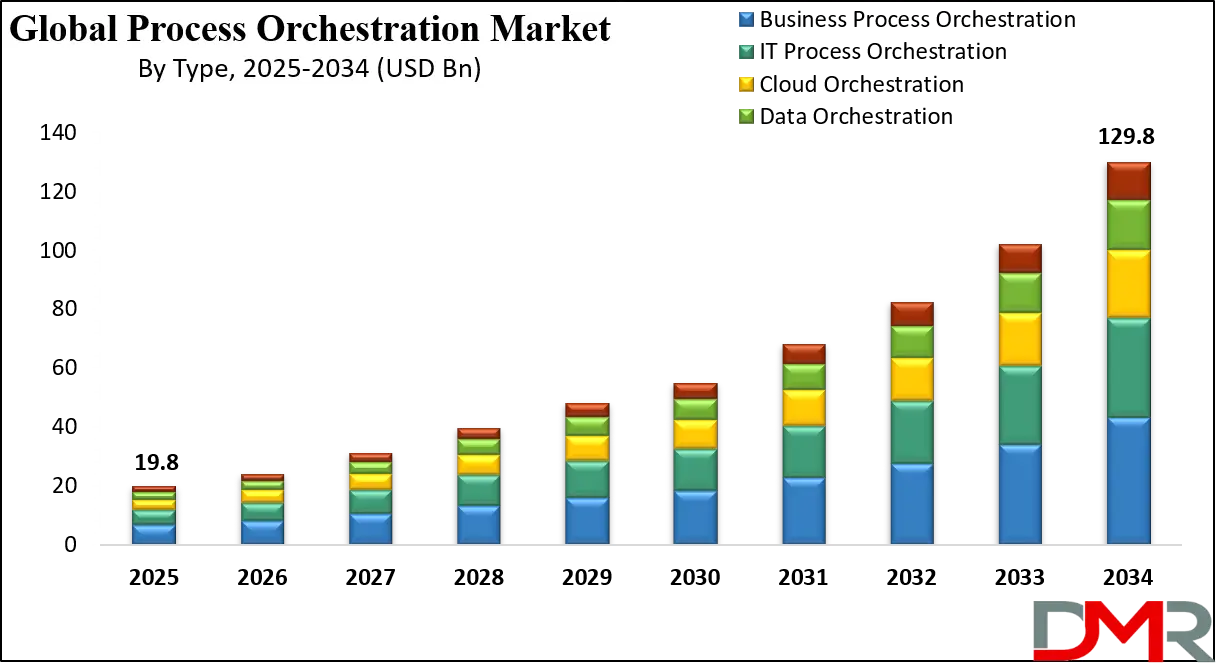

The global process orchestration market is forecast to reach USD 19.8 billion in 2025 and is set to expand at a robust CAGR of 23.2% between 2025 and 2034, ultimately achieving a market size of USD 129.8 billion by 2034.

This strong growth is driven by rising adoption of business process automation, workflow orchestration platforms, low-code/no-code solutions, and cloud-native integration tools. Increasing demand for end-to-end process visibility, system interoperability, digital transformation, and AI-driven orchestration across industries such as BFSI, healthcare, IT & telecom, and manufacturing is further accelerating market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This exponential growth is underpinned by the relentless enterprise pursuit of end-to-end automation, operational resilience, and digital dexterity. As organizations navigate post-pandemic economic landscapes, supply chain volatility, and escalating customer expectations, the imperative to move beyond isolated task automation to holistic, intelligent workflow orchestration has become a strategic cornerstone.

Process orchestration provides the critical control plane that seamlessly integrates human tasks, digital workers (RPA), diverse applications (SaaS, legacy), APIs, and data streams into cohesive, dynamic, and auditable business processes. It is the technological backbone enabling hyperautomation, allowing enterprises to achieve unprecedented levels of efficiency, agility, and innovation. By automating complex, cross-functional workflows from customer onboarding and order fulfillment to IT incident resolution and financial reporting orchestration eliminates silos, reduces manual errors, and accelerates time-to-value.

The market's evolution is further catalyzed by the pervasive adoption of cloud-native architectures, microservices, and event-driven paradigms, which inherently demand sophisticated orchestration to function cohesively. The convergence of Artificial Intelligence (AI) and Machine Learning (ML) with orchestration platforms is birthing a new era of 'intelligent orchestration,' where processes are not only automated but also predictive, adaptive, and self-optimizing. Despite challenges related to integration debt, skill shortages, and change management, the strategic value proposition of process orchestration in driving competitive advantage ensures its central role in the global digital transformation agenda through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Process Orchestration Market

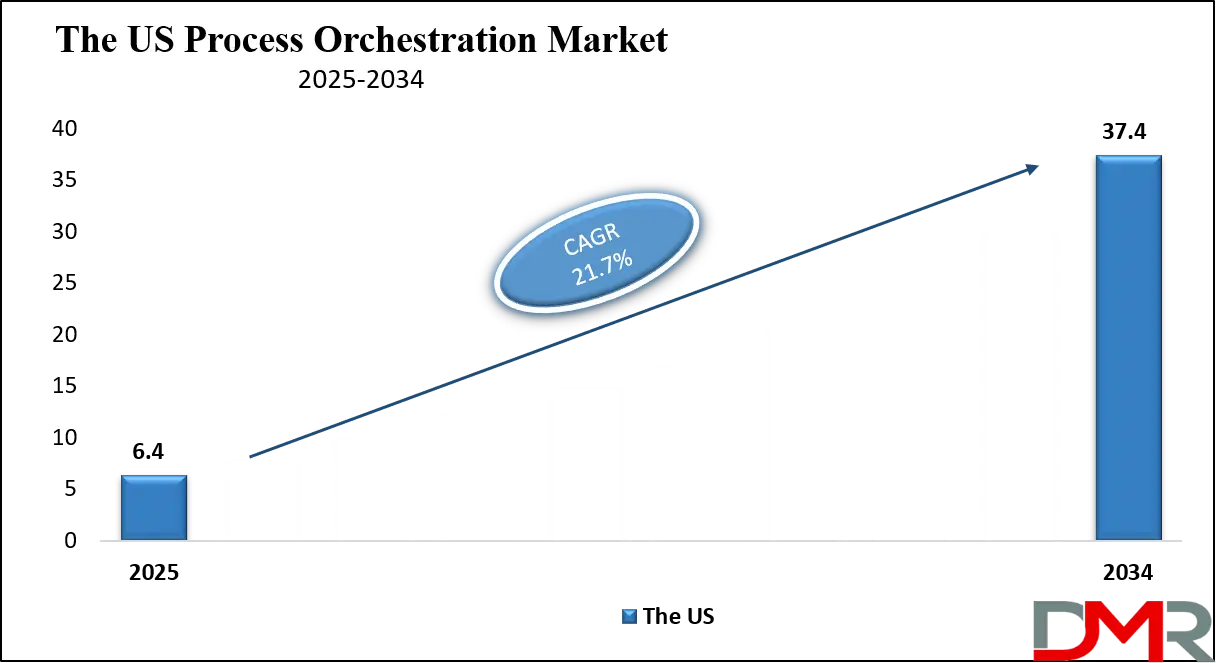

The U.S. Process Orchestration Market is projected to reach USD 6.4 billion in 2025 and grow at a CAGR of 21.7%, reaching USD 37.4 billion by 2034. The United States stands as the epicenter of process orchestration innovation and adoption, fueled by a mature technological ecosystem, a high density of Fortune 500 companies undergoing digital overhauls, and a robust venture capital landscape funding next-generation automation startups.

American enterprises across financial services, healthcare, technology, and retail are leveraging orchestration to tackle intricate challenges: banks are orchestrating regulatory compliance and fraud detection workflows; healthcare providers are automating patient care coordination across electronic health records (EHRs) and diagnostic systems; and retailers are creating seamless omnichannel fulfillment processes. The country's leadership is also reinforced by its "cloud-first" mandates in both private and public sectors, with federal agencies utilizing orchestration to modernize citizen services.

The U.S. market benefits from a well-defined regulatory environment that, while stringent, creates a clear demand for compliant, auditable automated processes. Furthermore, the strong presence of industry consortia and standardization bodies helps shape best practices. The rapid maturation of AI-driven process intelligence tools, offering deep insights into operational bottlenecks and automation opportunities, is propelling the market beyond basic automation towards truly intelligent business operations management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Process Orchestration Market

The Europe Process Orchestration Market is projected to be valued at approximately USD 4.1 billion in 2025 and is projected to reach around USD 22.3 billion by 2034, growing at a CAGR of about 21.2% from 2025 to 2034. Europe's market is characterized by a strong impetus from regulatory-driven digitalization, a commitment to industrial sovereignty, and advanced manufacturing sectors embracing Industry 4.0.

The European Union's twin transitions digital and green are powerful catalysts. Regulations like the Digital Services Act (DSA) and Digital Markets Act (DMA), alongside GDPR, compel organizations to build transparent, efficient, and compliant digital operations, for which orchestration is a key enabler. In manufacturing, the German-led "Plattform Industrie 4.0" initiative exemplifies how orchestration is critical for connecting cyber-physical systems, optimizing production lines, and enabling mass customization.

National health services, particularly the UK's NHS, are employing process orchestration to streamline patient pathways, manage resources, and integrate telehealth services, addressing both efficiency and equity of care. The region also shows strong adoption in financial services for anti-money laundering (AML) checks and customer lifecycle management. Europe's focus on ethical AI and human-centric automation is shaping the development of orchestration platforms that emphasize control, explainability, and augmentation rather than mere replacement of human labor.

The Japan Process Orchestration Market

The Japan Process Orchestration Market is anticipated to be valued at approximately USD 1.3 billion in 2025 and is expected to attain nearly USD 8.9 billion by 2034, expanding at a CAGR of about 24.1% during the forecast period. Japan represents a unique high-growth market where acute demographic pressures a super-aging society and a shrinking workforce intersect with world-leading prowess in robotics, precision engineering, and quality management.

The national Society 5.0 vision explicitly calls for a human-centered society that balances economic advancement with the resolution of social problems by highly integrating cyberspace and physical space. Process orchestration is the essential "nervous system" to realize this vision, connecting IoT data from smart cities and factories with AI analytics and robotic actuators to automate public services, logistics, and healthcare delivery.

Japanese corporations, known for methodologies like Kaizen (continuous improvement), are natural adopters of process mining and orchestration tools to perpetually identify and eradicate operational waste. In sectors like electronics manufacturing and automotive, orchestration platforms manage complex, global supply chains and orchestrate robotic assembly lines with minimal human intervention. The market is further driven by public-private partnerships aimed at solving national challenges, such as using orchestration to coordinate elder care services across providers, family, and municipal systems.

Global Process Orchestration Market: Key Takeaways

- Exponential Market Expansion: The Global Process Orchestration Market is on track to grow nearly six-fold from 2025 to 2034, from USD 19.8 billion to USD 129.8 billion, signaling its transition from a niche IT tool to a foundational enterprise platform.

- Hyperautomation as the Primary Growth Engine: The market's impressive 23.2% CAGR is directly fueled by the hyperautomation trend, where organizations strategically combine RPA, BPM, AI, and integration tools under a unified orchestration layer to automate increasingly complex business scenarios.

- U.S. Maintains Value Leadership: With a projected 2034 value of USD 37.4 billion, the U.S. market remains the largest in absolute terms, driven by massive enterprise IT budgets, cloud maturity, and a culture of rapid technological adoption.

- APAC Emerges as the Growth Epicenter: The Asia-Pacific region is poised to register the highest CAGR, fueled by digital-native economies, government-led industrial modernization programs (e.g., Make in India, China's 14th Five-Year Plan), and the rapid scaling of regional tech giants.

- Intelligence Becomes Native: A defining trend is the shift from static, rule-based orchestration to AI-native orchestration, where machine learning models are embedded for predictive routing, dynamic resource optimization, and autonomous exception handling.

- Strategic Imperative Across C-Suite: Process orchestration is evolving from an IT-centric project to a boardroom priority, recognized as critical for achieving strategic goals like customer-centricity, supply chain resilience, regulatory agility, and sustainable operations.

Global Process Orchestration Market: Use Cases

- Intelligent Claims Processing in Insurance: Orchestration automates the entire claims lifecycle from first notice of loss through fraud detection, adjuster assignment, damage assessment via image recognition, payment processing, and customer communication dramatically reducing settlement time and costs.

- Unified Composable Commerce Platform: For retailers, orchestration seamlessly connects e-commerce frontends, order management systems (OMS), warehouse management systems (WMS), third-party logistics (3PL) providers, and payment gateways to enable flexible fulfillment options like buy-online-pickup-in-store (BOPIS) and ship-from-store.

- Zero-Touch IT Infrastructure Provisioning: In IT, orchestration platforms execute fully automated workflows to provision cloud resources, configure networks, deploy applications, and apply security policies based on a single service request, enabling DevOps and infrastructure-as-code (IaC) at scale.

- End-to-End Pharmaceutical Drug Discovery Pipeline: In life sciences, orchestration coordinates data flows between lab information management systems (LIMS), AI-based molecule modeling software, high-performance computing (HPC) clusters, and regulatory document repositories, accelerating time to market for new therapies.

- Smart City Incident Response Coordination: Municipalities use orchestration to integrate feeds from traffic cameras, environmental sensors, emergency call systems, and public service departments to automatically coordinate responses to incidents like accidents, floods, or public safety events.

Global Process Orchestration Market: Stats & Facts

Eurostat – European Union Official Statistics

- 95.36% of EU enterprises used a fixed broadband connection.

- 52.9% of EU enterprises conducted remote online meetings.

- 20.05% of EU enterprises employed ICT specialists.

- 15.09% of EU enterprises used internet connections of at least 1 Gb/s.

- Large enterprises show 94.36% adoption of online collaboration tools versus 47.04% for small enterprises.

- Over 90% of EU enterprises use digital systems to support internal business processes.

European Commission – Digital Economy and Society Index (DESI)

- EU Member States allocated EUR 127 billion for digital transformation reforms and investments.

- On average, 26% of Recovery and Resilience Facility funds are dedicated to digitalization.

- Integration of digital technologies (cloud, ERP, AI) is a core DESI measurement pillar.

- Cloud adoption is identified as a key enabler for cross-enterprise process integration.

UK Government – Central Government Digital Services

- UK central government delivers approximately 1 billion citizen-facing transactions annually.

- Around 143 million government transactions are repetitive and suitable for automation.

- 84% of complex public-sector transactions are considered highly automatable.

- Automating repetitive workflows could save over 1,200 person-years annually.

United States Government Accountability Office (GAO)

- Federal agencies operate thousands of fragmented legacy systems requiring integration.

- Poor system coordination increases operational costs across federal departments.

- Process automation is a priority under federal IT modernization programs.

U.S. Office of Management and Budget (OMB)

- Federal IT modernization emphasizes workflow automation and interoperability.

- Cloud-based orchestration is promoted to reduce manual service delivery processes.

- Shared services models require centralized orchestration of workflows across agencies.

Ministry of Electronics and Information Technology (MeitY), Government of India

- India allocated INR 1.47 trillion for digital government and IT modernization programs.

- Digital public service platforms rely on integrated, automated backend workflows.

- Process automation is a core pillar of India’s Digital Governance initiatives.

OECD – Digital Government Indicators

- Over 70% of OECD governments prioritize automation to improve service efficiency.

- Integrated digital processes reduce administrative burdens on citizens and businesses.

- Workflow orchestration is critical for cross-agency service delivery.

United Nations – E-Government Development Index (UN DESA)

- Countries with higher digital integration scores show stronger automation maturity.

- End-to-end digital workflows are linked to improved public service outcomes.

National Institute of Standards and Technology (NIST), USA

- Interoperable digital workflows are essential for secure enterprise system coordination.

- Standardized process integration reduces operational risk and manual intervention.

Global Process Orchestration Market: Market Dynamic

Driving Factors in the Global Process Orchestration Market

Rising Demand for Digital Transformation and Operational Efficiency

The pressing need for organizations to modernize legacy systems, automate complex workflows, and achieve end-to-end process visibility is a major driver. Industries across BFSI, healthcare, manufacturing, and retail are investing in orchestration to enhance agility, reduce costs, and improve customer experience. The shift to hybrid work models and cloud-first strategies further amplifies the need for coordinated, automated processes across distributed environments. Additionally, the growing emphasis on data-driven decision-making requires seamless integration and orchestration of data pipelines to ensure timely and accurate insights, making process orchestration a foundational element of the modern data ecosystem.

Technology Innovation and Hyperautomation Trends

Process orchestration benefits heavily from advancements in AI/ML, low-code platforms, cloud-native architectures, IoT integration, and API ecosystems. The convergence of Robotic Process Automation (RPA), Business Process Management (BPM), and Integration Platform as a Service (iPaaS) under the hyperautomation umbrella creates powerful, intelligent orchestration capabilities. These innovations enable dynamic process adaptation, predictive analytics, and seamless cross-system coordination. The emergence of generative AI further accelerates this trend by enabling natural language-driven process design, automated documentation, and intelligent exception handling, lowering the barrier to entry and expanding the scope of automatable processes.

Restraints in the Global Process Orchestration Market

Integration Complexity and High Initial Costs

Integrating orchestration platforms with legacy systems, diverse SaaS applications, and proprietary databases can be highly complex and costly. Many organizations face significant technical debt and lack the internal expertise for seamless implementation. The total cost of ownership, including licensing, customization, integration, and ongoing management, can be a barrier for mid-sized enterprises. Moreover, the scarcity of skilled professionals proficient in both business process design and modern integration technologies can lead to project delays, cost overruns, and suboptimal implementations that fail to deliver expected ROI.

Security, Compliance, and Change Management Concerns

Orchestrating processes across multiple systems expands the attack surface and raises data security and privacy concerns, especially under stringent regulations like GDPR, CCPA, and industry-specific mandates such as HIPAA or PCI-DSS. Ensuring compliance within automated workflows adds layers of complexity, requiring built-in audit trails, data governance, and policy enforcement mechanisms.

Additionally, organizational resistance to changing established processes, coupled with the need for extensive employee upskilling, poses significant adoption challenges. The cultural shift from siloed, manual operations to transparent, automated orchestration can meet internal resistance, slowing down enterprise-wide deployment and limiting the full realization of benefits.

Opportunities in the Global Process Orchestration Market

Expansion of AI-Driven Process Intelligence and Autonomous Operations

The integration of AI for process mining, predictive analytics, and autonomous decision-making within orchestration platforms presents a major growth opportunity. AI can identify optimization opportunities, predict bottlenecks, and auto-remediate issues, moving towards self-healing, intelligent business operations. This is particularly valuable for complex sectors like finance and supply chain, where real-time adaptability is crucial. The next frontier is autonomous process orchestration, where systems can independently redesign workflows based on changing conditions, market dynamics, or performance data, creating a continuous cycle of improvement without human intervention.

Growth in SME Adoption and Vertical-Specific Solutions

As cloud-based, subscription-model orchestration tools become more affordable and user-friendly (e.g., low-code), the market is expanding beyond large enterprises to small and medium-sized businesses (SMEs). Furthermore, developing pre-built, vertical-specific orchestration templates and solutions for industries like healthcare (patient journey orchestration), logistics (shipment orchestration), or retail (unified commerce orchestration) opens new revenue streams. These tailored solutions reduce implementation time and complexity, making advanced automation accessible to organizations without deep technical resources. The rise of Orchestration-as-a-Service (OaaS) offerings further democratizes access, allowing SMEs to leverage enterprise-grade capabilities on a pay-as-you-go basis.

Trends in the Global Process Orchestration Market

Convergence of BPM, RPA, and iPaaS into Hyperautomation Platforms

The market is seeing a clear trend where standalone BPM, RPA, and integration tools are converging into unified hyperautomation platforms with strong orchestration at their core. This provides a single pane of glass for designing, executing, monitoring, and optimizing automated business processes that span human tasks, digital workers, and system integrations. This convergence reduces tool sprawl, simplifies governance, and enables more cohesive and intelligent automation strategies. Vendors are aggressively expanding their portfolios through both organic development and strategic acquisitions to offer these comprehensive suites.

Rise of Event-Driven Process Orchestration

Modern applications are increasingly built as microservices communicating via events. This is driving the adoption of event-driven architecture (EDA) for process orchestration. Instead of rigid, predefined workflows, event-driven orchestration allows processes to dynamically react in real-time to business events (e.g., "payment received," "inventory low"), enabling greater agility and responsiveness. This paradigm supports more resilient and scalable systems, as processes are decoupled and can adapt instantly to changing circumstances, making it ideal for dynamic environments like e-commerce, IoT, and real-time customer engagement.

Global Process Orchestration Market: Research Scope and Analysis

By Type Analysis

Business Process Orchestration (BPO) is projected to dominate the global market due to its direct impact on core operational efficiency, customer experience, and compliance. It focuses on coordinating tasks, data, and systems involved in end-to-end business workflows (e.g., order-to-cash, procure-to-pay). The drive for hyperautomation and digital transformation across all industries makes this segment the largest. It is increasingly powered by low-code platforms and AI, making it accessible to business users and central to strategic agility. The segment's growth is further propelled by the need to create composable business capabilities, where orchestration dynamically assembles services and applications to meet specific customer or market demands rapidly.

Cloud Orchestration is anticipated to be the fastest-growing segment, driven by the mass migration to hybrid and multi-cloud environments. It involves the automated arrangement, coordination, and management of cloud computing resources, services, and applications. Tools for container orchestration (e.g., Kubernetes), infrastructure as code (IaC), and multi-cloud management are essential for modern IT agility, fueling this segment's rapid expansion. The growing complexity of managing serverless functions, microservices, and cloud-native databases across different providers makes sophisticated cloud orchestration not just an advantage but a necessity for scalability, cost control, and resilience.

Data Orchestration is emerging as a critical and rapidly evolving segment. It focuses on automating the movement, transformation, and governance of data across the enterprise from ingestion through processing to delivery. As organizations strive to become data-driven, the ability to orchestrate complex data pipelines that blend batch and real-time data, ensure quality, and enforce governance policies is paramount. This segment is closely tied to the rise of DataOps and Analytics Engineering practices.

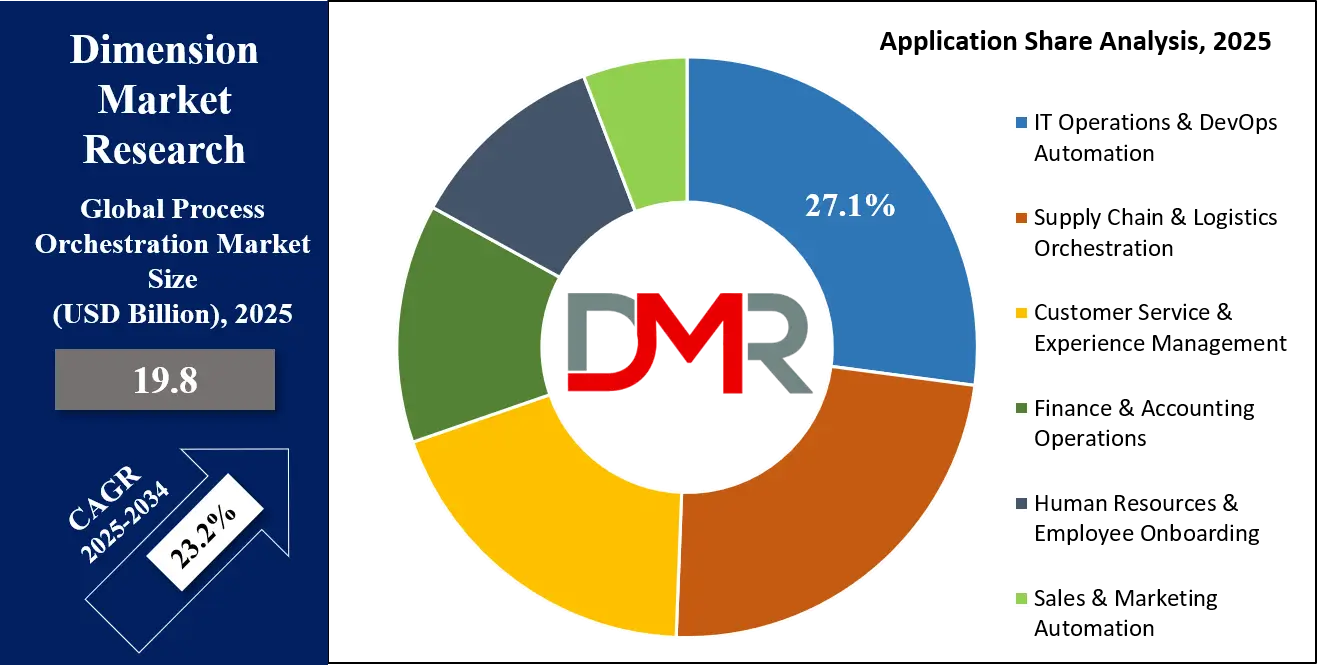

By Application Analysis

IT Operations & DevOps Automation is poised to be the largest and most dominant application segment. The need to automate software delivery pipelines (CI/CD), infrastructure provisioning, incident response, and cloud resource management is critical for business speed and resilience. Process orchestration is the backbone of modern DevOps and Site Reliability Engineering (SRE) practices, enabling seamless coordination across development, security, and operations tools. The trend towards AIOps sees orchestration platforms acting on AI-driven insights to automatically execute remediation workflows, making IT operations increasingly proactive and self-healing.

Supply Chain & Logistics Orchestration ranks as a major application segment due to the globalization and complexity of modern supply chains. Orchestration platforms integrate data from ERP, WMS, TMS, IoT sensors, and partner systems to provide real-time visibility, optimize routes, automate replenishment, and coordinate responses to disruptions. This segment's growth is fueled by e-commerce expansion and the need for resilient supply networks. Advanced use cases include dynamic rerouting based on weather or port delays, autonomous procurement, and circular economy orchestration for managing product returns and recycling.

Customer Service & Experience Management is experiencing explosive growth. Here, orchestration is used to create seamless, personalized customer journeys by coordinating interactions across contact centers, CRM systems, marketing automation platforms, and self-service portals. It enables capabilities like contextual routing (sending a customer to the best-equipped agent based on their history and issue), proactive service (orchestrating outreach based on product usage signals), and omni-channel consistency, ensuring a unified experience whether the customer engages via web, mobile, chat, or in-store.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

BFSI are anticipated to dominate the process orchestration market because they have the most complex, cross-functional processes, significant IT estates, and the resources to invest in comprehensive transformation programs. They use orchestration to achieve scale, ensure governance, and integrate acquisitions. Industries like BFSI, Telecommunications, and Manufacturing lead adoption. Within large enterprises, the establishment of Centralized Automation CoEs (Centers of Excellence) is a common pattern, using orchestration platforms as the central technology to govern and scale automation initiatives across the organization, ensuring standardization, reuse, and measurable ROI.

IT & Telecommunications is a key end-user vertical and is expected to be a major adopter, driven by the need to orchestrate network provisioning, service fulfillment, customer support, and 5G network slicing. The sector's inherent complexity and rapid technological change make process orchestration essential for operational efficiency and service innovation. For telecom operators, orchestration is critical for zero-touch service fulfillment, automating the entire process from customer order to the activation of network services. In the IT sector, Managed Service Providers (MSPs) leverage orchestration extensively to deliver and manage services for their clients efficiently at scale.

Healthcare & Life Sciences is rapidly ascending as a critical end-user vertical. The imperative to improve patient outcomes while controlling costs is driving massive digital transformation. Orchestration is key to care coordination workflows, prior authorization automation, clinical trial management, pharmaceutical supply chain integrity, and interoperability between disparate EHR and lab systems. The integration of IoT data from wearable devices into patient management pathways further expands the need for robust, secure, and compliant orchestration in this highly regulated sector.

The Global Process Orchestration Market Report is segmented on the basis of the following:

By Type

- Business Process Orchestration

- IT Process Orchestration

- Cloud Orchestration

- Data Orchestration

- Others

By Application

- IT Operations & DevOps Automation

- Supply Chain & Logistics Orchestration

- Customer Service & Experience Management

- Finance & Accounting Operations

- Human Resources & Employee Onboarding

- Sales & Marketing Automation

By End User

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecommunications

- Healthcare & Life Sciences

- Manufacturing

- Retail & E-commerce

- Government & Public Sector

- Others

Impact of Artificial Intelligence in the Global Process Orchestration Market

- Generative AI for Process Design & Documentation: Generative AI models can automatically draft process flow diagrams, write workflow specifications, and even generate the underlying orchestration code or configuration based on natural language descriptions from business users, collapsing design time from weeks to hours.

- Prescriptive Process Analytics & Optimization: Moving beyond descriptive insights, AI provides prescriptive recommendations for process improvement. It can suggest where to insert automation, predict the impact of re-routing a workflow, or recommend optimal staffing levels for human-in-the-loop tasks based on real-time demand forecasting.

- Cognitive Handoffs and Human-in-the-Loop Orchestration: AI enhances the interaction between automated workflows and human workers. It can intelligently decide when to escalate a case to a human expert, pre-fetch relevant information for them, and learn from their decisions to automate similar future cases, creating a synergistic human-AI partnership.

- Sentiment-Aware Process Routing: In customer-facing processes, AI analyzes customer sentiment (from voice, text, or interaction history) in real-time and dynamically routes the interaction to the most appropriate agent or automated response pathway, improving resolution rates and customer satisfaction.

- Autonomous Process Governance & Compliance: AI models continuously monitor orchestrated workflows for compliance with internal policies and external regulations. They can automatically flag deviations, generate audit reports, and even initiate corrective actions, reducing compliance overhead and risk.

Global Process Orchestration Market: Regional Analysis

Region with the Largest Revenue Share

North America's dominance, with a projected 38.2% share in 2025, is unshakable and multi-faceted. It is not merely a function of size but of depth and sophistication. The region boasts owing to its mature digital economy, high concentration of large enterprises and technology vendors, aggressive cloud adoption, and strong focus on operational efficiency. The United States, in particular, is home to leading platform providers (e.g., IBM, Microsoft, ServiceNow) and early-adopter enterprises across finance, tech, and retail.

The region's well-established IT infrastructure, favorable investment climate for automation technologies, and the presence of a skilled workforce drive dominance. Furthermore, stringent regulatory requirements in sectors like finance and healthcare necessitate robust, auditable process orchestration solutions. High demand for cloud migration services and DevOps transformation also fuels the market.

The market is further fueled by a strong ecosystem of system integrators (SIs) and managed service providers (MSPs) who help enterprises navigate the implementation journey.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised for the most rapid growth, driven by its explosive digital economic expansion, massive investments in cloud infrastructure, government-led digitalization initiatives (e.g., "Digital India," "Made in China 2025"), and a burgeoning startup ecosystem. The region's rapid industrialization and the need to compete globally are forcing enterprises to modernize operations quickly.

Countries like India, China, Japan, and Australia are seeing massive adoption of orchestration tools to manage scale, improve supply chain efficiency, and enhance customer engagement in fast-growing markets. The relative greenfield nature of digital systems in many APAC organizations allows them to leapfrog to modern, cloud-native orchestration platforms without heavy legacy constraints, contributing to the high growth rate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Process Orchestration Market: Competitive Landscape

The Global Process Orchestration Market is moderately fragmented and highly competitive, featuring a mix of established enterprise software giants, pure-play automation vendors, and innovative cloud-native startups. Leading platform providers IBM, Microsoft, ServiceNow, Salesforce, and SAP dominate with comprehensive suites that embed orchestration within broader BPM, CRM, ERP, and IT service management solutions.

Pure-play orchestration and hyperautomation specialists like UiPath, Automation Anywhere, Camunda, and Appian compete with strong capabilities in RPA integration, low-code development, and workflow automation. Cloud infrastructure leaders Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure offer native orchestration services (e.g., AWS Step Functions, Azure Logic Apps) that are deeply integrated with their cloud ecosystems.

The market also sees active participation from integration-focused players like MuleSoft (Salesforce), Boomi (Dell), and Workato, whose iPaaS platforms are central to API-led process orchestration. This diverse ecosystem drives continuous innovation in AI integration, user experience, and industry-specific solutions.

Some of the prominent players in the Global Process Orchestration Market are:

- IBM Corporation

- Microsoft Corporation

- ServiceNow

- Salesforce Inc.

- SAP SE

- Oracle Corporation

- UiPath

- Automation Anywhere

- Appian

- Camunda

- Pegasystems Inc.

- BMC Software

- Micro Focus

- AWS (Amazon Web Services)

- Google Cloud

- Cisco Systems, Inc.

- MuleSoft (Salesforce)

- Boomi (Dell Technologies)

- Workato

- TIBCO Software

- Other Key Players

Recent Developments in the Global Process Orchestration Market

- November 2025: ServiceNow introduced generative AI capabilities into its Now Platform to automate complex IT and employee workflow creation. The update focuses on intelligent task routing, predictive SLA management, and natural-language process definition, strengthening its enterprise orchestration leadership.

- October 2025: Microsoft announced deeper integration of its AI Copilot into the Power Automate orchestration platform, enabling users to describe processes in natural language for automatic workflow generation and optimization, significantly lowering the barrier to automation.

- September 2025: UiPath completed a major acquisition to bolster its process discovery and intelligence capabilities, aiming to create a more closed-loop hyperautomation platform where insights from process mining directly fuel AI-driven orchestration.

- August 2025: AWS introduced a new version of its Step Functions serverless orchestration service featuring built-in machine learning for conditional routing and anomaly detection, targeting data pipeline and microservices orchestration at scale.

- July 2025: SAP and Google Cloud announced a strategic partnership to develop pre-packaged orchestration solutions for specific industries like automotive and retail, combining SAP's business process expertise with Google's AI/ML and cloud infrastructure.

- April 2025: The open-source process orchestration engine Camunda reported a 40% year-over-year increase in enterprise adoption, driven by its flexibility for custom, developer-centric automation projects in cloud-native environments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.8 Bn |

| Forecast Value (2034) |

USD 129.8 Bn |

| CAGR (2025–2034) |

23.2% |

| The US Market Size (2025) |

USD 6.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Business Process Orchestration, IT Process Orchestration, Cloud Orchestration, Data Orchestration, and Others), By Application (IT Operations & DevOps Automation, Supply Chain & Logistics Orchestration, Customer Service & Experience Management, Finance & Accounting Operations, Human Resources & Employee Onboarding, and Sales & Marketing Automation), By End User (BFSI, IT & Telecommunications, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Government & Public Sector, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM Corporation, Microsoft Corporation, ServiceNow, Salesforce Inc., SAP SE, Oracle Corporation, UiPath, Automation Anywhere, Appian, Camunda, Pegasystems Inc., BMC Software, Micro Focus, AWS (Amazon Web Services), Google Cloud, Cisco Systems, Inc., MuleSoft (Salesforce), Boomi (Dell Technologies), Workato, TIBCO Software, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Process Orchestration Market?

▾ The Global Process Orchestration Market size is estimated to have a value of USD 19.8 billion in 2025 and is expected to reach USD 129.8 billion by the end of 2034.

What is the growth rate in the Global Process Orchestration Market?

▾ The market is growing at a CAGR of 23.2 percent over the forecasted period of 2025 to 2034.

What is the size of the US Process Orchestration Market?

▾ The US Process Orchestration Market is projected to be valued at USD 6.4 billion in 2025. It is expected to witness subsequent growth, reaching USD 37.4 billion in 2034 at a CAGR of 21.7%.

Which region accounted for the largest Global Process Orchestration Market?

▾ North America is expected to have the largest market share in the Global Process Orchestration Market with a share of about 38.2% in 2025.

Who are the key players in the Global Process Orchestration Market?

▾ Some of the major key players in the Global Process Orchestration Market are IBM Corporation, Microsoft Corporation, ServiceNow, Salesforce Inc., SAP SE, UiPath, Automation Anywhere, Appian, and many others.