Market Overview

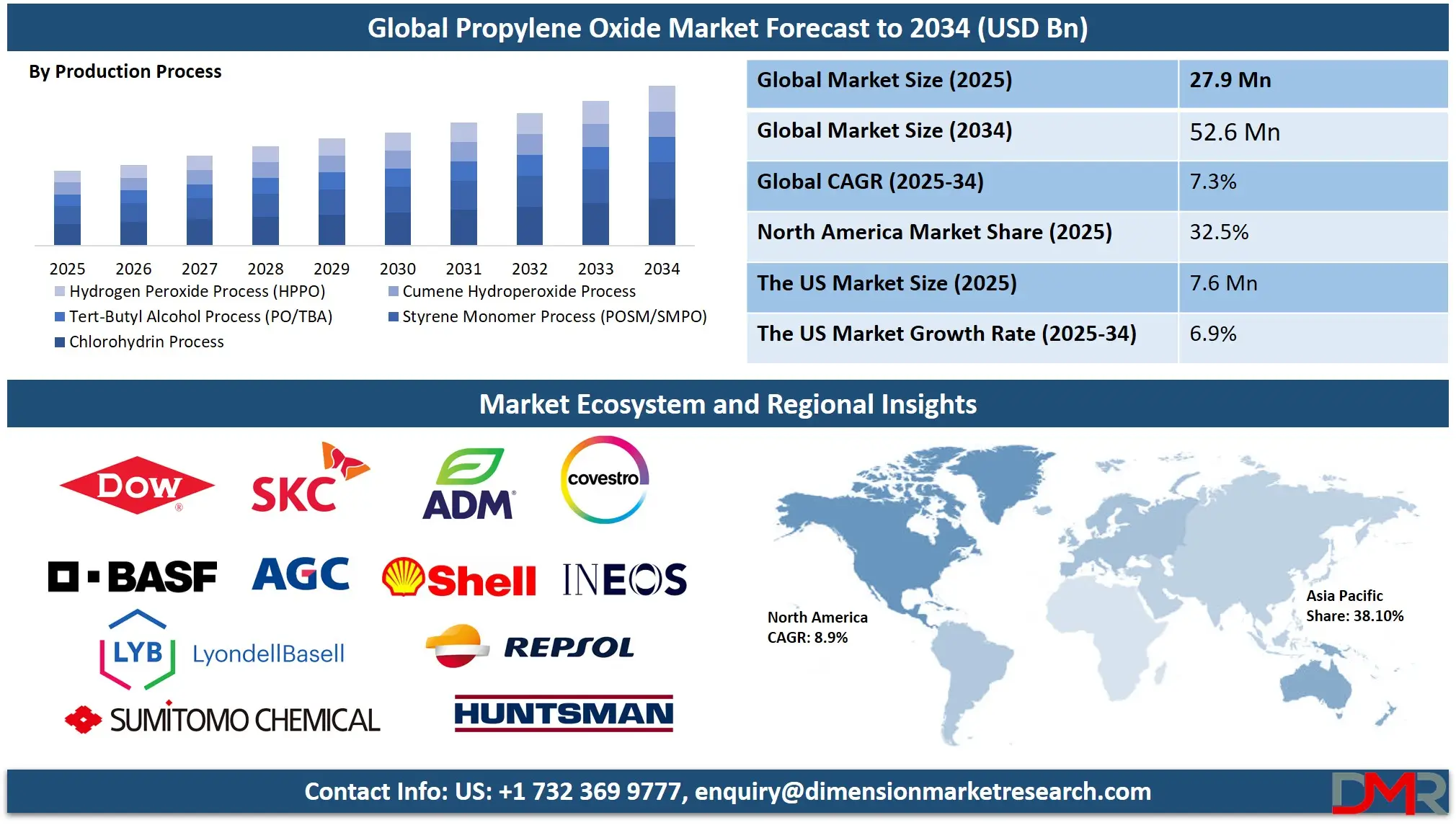

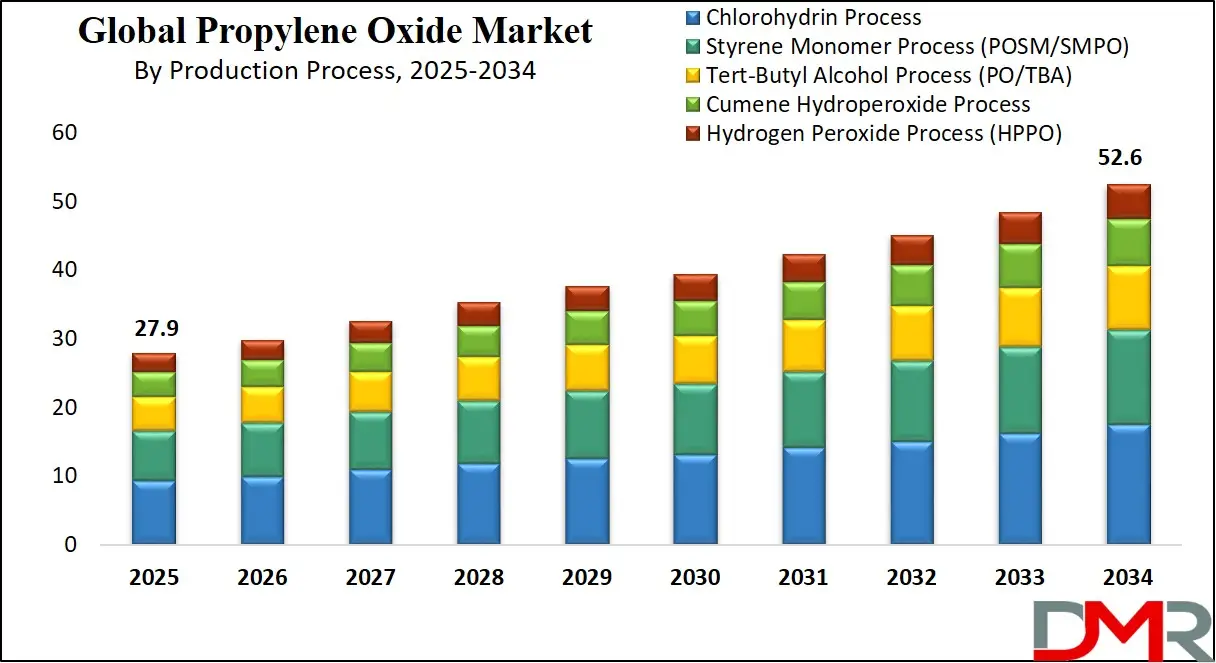

The Global Propylene Oxide Market is predicted to be valued at USD 27.9 billion in 2025 and is expected to grow to USD 52.6 billion by 2034, registering a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034.

The propylene oxide market has been steadily rising over the years due to its widespread application as an industrial chemical used for producing polyether polyols, propylene glycol, and derivative products used by the automotive, construction, and packaging industries. Demand is particularly driven by expansions within polyurethane insulation applications like furniture applications, as well as rising automotive production, where propylene oxide products play a crucial role in weight reduction and fuel efficiency, propelling market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Major trends influencing this market include manufacturers' transition toward bio-based propylene oxide as they strive to limit environmental impacts and meet stringent regulatory requirements. Businesses are investing more heavily in green production methods utilizing hydrogen peroxide-based methods that lower carbon emissions; additionally, energy-efficient building are driving demand for polyurethane foams using propylene oxide as raw material; advances in catalyst technology are helping improve yield efficiencies thus increasing cost-effectiveness among producers.

Lightweight materials derived from propylene oxide have become essential in improving battery efficiency and the vehicle range of electric vehicles (EVs). Furthermore, propylene oxide's rapid expansion in healthcare and personal care industries, such as pharmaceutical formulations and cosmetics, offers another potential growth avenue. Emerging Asian markets - specifically China and India - are experiencing rising consumption due to booming manufacturing sectors and urbanization trends that boost consumption levels further.

Even as its growth potential expands, this market continues to face restraints such as volatile raw material prices caused by fluctuations in crude oil costs and stringent environmental regulations governing propylene oxide manufacturing are creating difficulties for manufacturers who must adhere to them or invest in cleaner technologies and sustainable practices for production of propylene oxide production and use. Supply chain disruptions or geopolitical tensions affecting trade may further damage market stability; yet, continuous R&D efforts on alternative production methods or recycling technologies are expected to help address such challenges and contribute to market stability over time.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Propylene Oxide Market

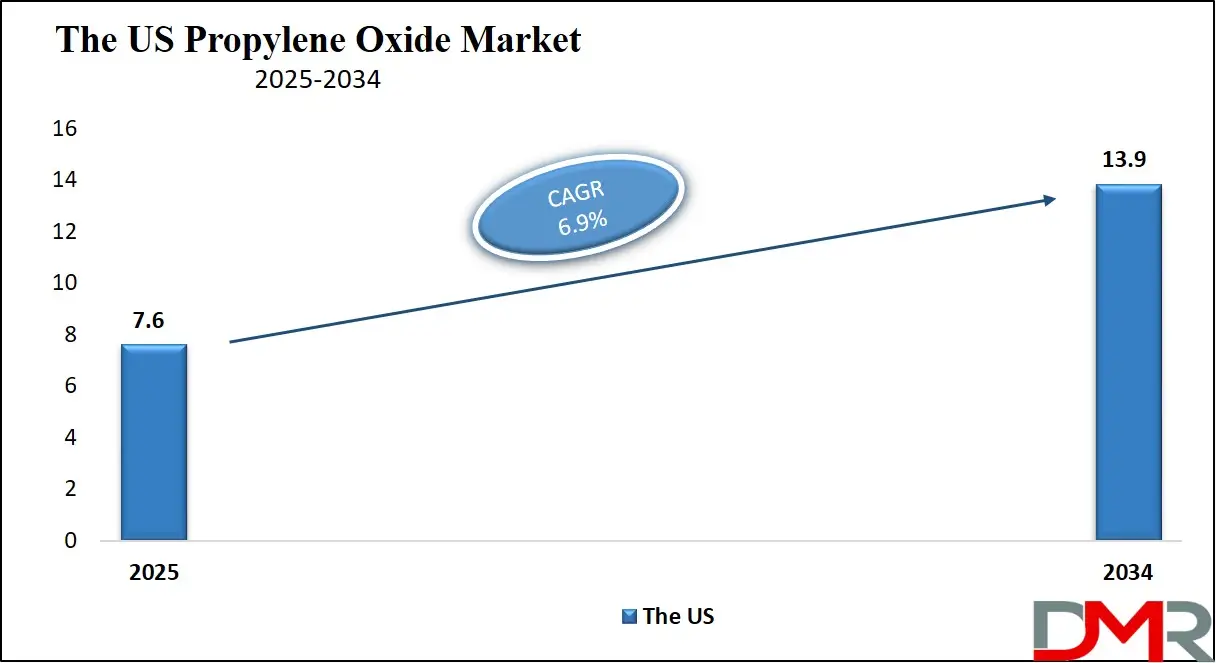

The US Propylene Oxide Market is projected to be valued at USD 7.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.9 billion in 2034 at a CAGR of 6.9%.

The U.S. propylene oxide market is an integral segment within the global industry, benefiting from advanced manufacturing capabilities, an efficient supply chain, and increasing end-user industries such as automotive, construction, and consumer goods. Furthermore, its strong industrial base, growing population, and high disposable income boost consumption of consumer products, including pharmaceuticals and personal care items derived from propylene oxide.

Technological innovations in production methods, like switching to hydrogen peroxide-based propylene oxide production, are dramatically reducing environmental impacts while increasing cost efficiencies for manufacturers. The automotive sector's increasing reliance on lightweight materials for fuel efficiency and electric vehicle performance is fuelling this demand, as is residential/commercial construction activity across America, requiring high-performance insulation materials such as polyurethane foam insulation that play an essential part.

However, challenges relating to regulatory constraints regarding emissions and handling hazardous chemicals have an adverse impact on market dynamics. Supply chain disruptions and fluctuating raw material prices also present threats. Yet significant investments in R&D along with sustainable production processes should lead to innovative thinking and increase market stability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Propylene Oxide Market: Key Takeaways

- Global Propylene Oxide Market Size and Growth: The Global Propylene Oxide Market is projected to value of USD 27.9 billion in 2025 and is projected to reach USD 52.6 billion by 2034, registering a CAGR of 7.3% during the forecast period.

- U.S. Propylene Oxide Market Growth: The U.S. Propylene Oxide Market is expected to estimate at USD 7.6 billion in 2025, growing to USD 13.9 billion by 2034 at a CAGR of 6.9%, driven by industrial expansion and rising demand.

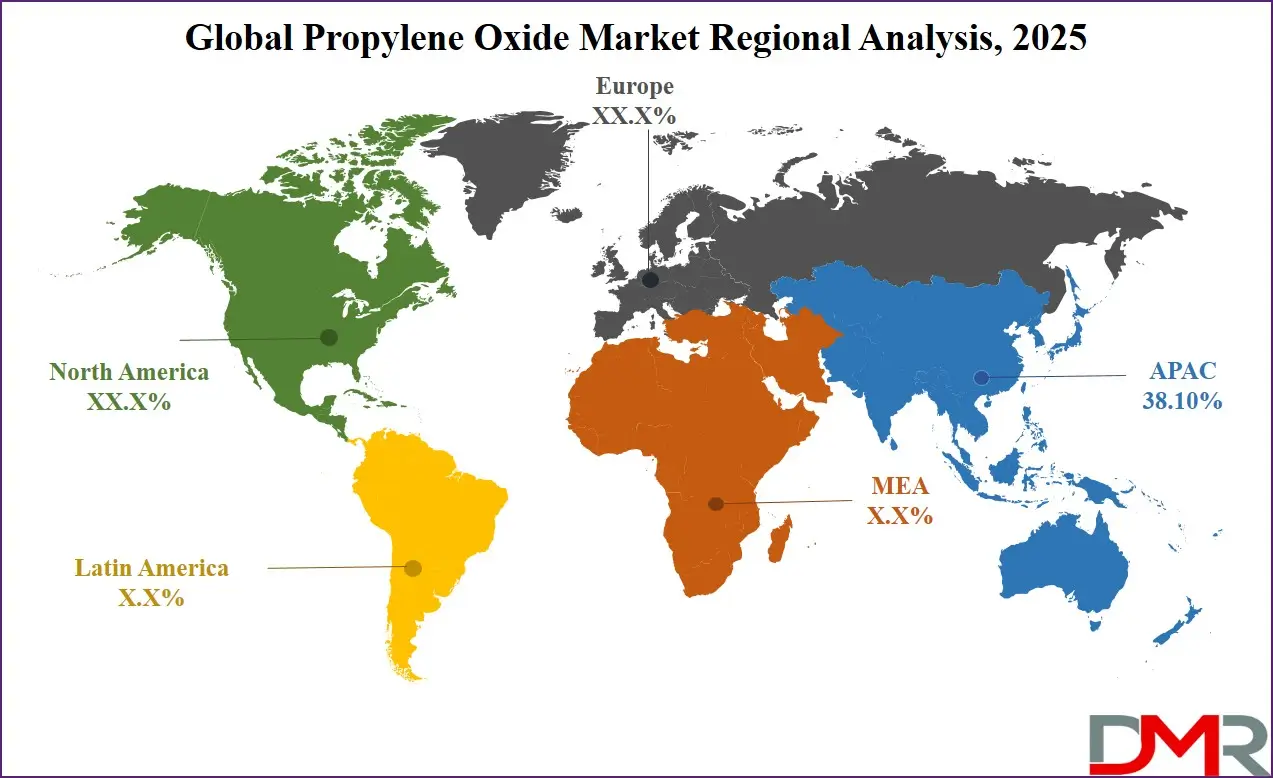

- Asia Pacific Dominance in the Market: Asia Pacific is anticipated to hold the largest market share of 38.10% in 2025, attributed to strong industrial production, increasing infrastructure projects, and rising demand for polyurethane-based materials.

- Key Players in the Market: Major companies in the Global Propylene Oxide Market include LyondellBasell Industries N.V., Dow Inc., BASF SE, Covestro AG, Royal Dutch Shell Plc, Huntsman Corporation, and Repsol S.A., among others.

- The Global Market Growth Rate: The market is projected to grow at a CAGR of 7.3 percent during the forecast period of 2025.

Global Propylene Oxide Market: Use Cases

- Polyurethane Foam Manufacturing: Propylene oxide is one of the key raw materials required in producing polyether polyols used to manufacture polyurethane foams, widely used across furniture, bedding, automotive interiors, and insulation materials to improve energy efficiency and comfort across multiple applications. These foams contribute significantly towards increased energy efficiency while simultaneously offering increased comfort across multiple markets.

- Automotive Lightweighting: When it comes to automotive lightweighting, propylene oxide-derived materials such as polyurethane foams and thermoplastic polyurethanes help reduce vehicle weight for improved fuel economy and performance. With electric vehicle sales rising exponentially worldwide, propylene oxide-based lightweight high performance materials become even more essential.

- Pharmaceutical and Personal Care Products: Propylene oxide is used in the manufacturing of propylene glycol, an essential component in pharmaceutical formulations, personal care items and food additives. Propylene glycol finds use as part of drug delivery systems, skin care solutions as well as solvent applications across several industrial settings.

- Construction and Insulation: With demand for energy-efficient buildings on the rise, more insulation materials made of propylene oxide polyurethane have become widely utilized to meet sustainability goals by providing superior thermal insulation solutions in residential and commercial properties alike. These polyurethane foam boards reduce energy use in both buildings, supporting sustainability goals with reduced consumption costs for energy use in both.

- Packaging and Coatings: Propylene oxide derivatives play an essential role in producing adhesives and sealants used by the packaging industry, increasing durability, moisture resistance, product lifespan as well as providing protective and specialty packaging solutions.

Global Propylene Oxide Market: Market Dynamics

Driving Factors in the Global Propylene Oxide Market

Expansion of End-Use Industries Such as Automotive, Packaging, and Consumer Goods

Propylene oxide market expansion mainly results from its broad usage across the automotive and packaging together with the consumer goods industry. The automotive sector uses polyurethane foams and coatings as well, and the packaging sector adopts propylene oxide derivatives for protective coatings and adhesive applications. Consumer demand for high-quality packaging solutions, especially in e-commerce and food applications, has resulted in expanding market demand for materials derived from propylene oxide. The personal care along pharmaceutical sectors support market expansion through their usage of propylene oxide derivatives in cosmetics and drug formulations, as well as skincare products. Propylene oxide exists as a key chemical element within the global industrial sector because it maintains consistent usage across multiple businesses.

Rapid Industrialization and Urbanization in Emerging Markets

The rapid industrial growth, along with urban development in Asia-Pacific countries, especially India and China, drives up propylene oxide consumption. The expansion of the construction industry, because of infrastructure development along with housing expansion projects, drives increased demand for polyurethane-based insulation materials. The rise of disposable income, together with urban population patterns and growing automotive production and consumer goods consumption, effectively drives the propylene oxide market demand. Regional governments follow investment schemes in manufacturing together with infrastructure development to expand production possibilities for propylene oxide manufacturers, therefore creating expanded market reach options. Asia-Pacific has become the center of global manufacturing, where cost-competitive factors with favorable investment policies drive rising propylene oxide market demand, thus powering the market's growth for emerging markets.

Restraints in the Global Propylene Oxide Market

Volatility in Raw Material Prices and Supply Chain Disruptions

Market volatility in propylene oxide originates from the unstable prices of both propylene and crude oil derivatives. The petrochemical nature of propylene oxide production means that crude oil price volatility directly affects manufacturing expenses because the production requires petroleum-based feedstocks. Price stability remains difficult to preserve for manufacturers because of market uncertainties involving geopolitical tensions and trade restrictions, as well as raw material price volatility. Additionally, supply chain disruptions, as witnessed during the COVID-19 pandemic, have led to production delays and logistical challenges. Companies must invest in supply chain resilience strategies, including diversifying raw material sources and optimizing procurement processes, to mitigate the impact of price volatility and supply chain disruptions.

Stringent Environmental Regulations and Health Concerns

The production and handling of propylene oxide are subject to stringent environmental regulations due to its classification as a hazardous chemical. Regulatory bodies, including the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have imposed strict guidelines on emissions, waste disposal, and worker safety in propylene oxide manufacturing. Exposure to propylene oxide poses potential health risks, including respiratory and carcinogenic effects, necessitating stringent workplace safety measures. Compliance with these regulations requires significant investment in environmental management systems, emission control technologies, and worker protection protocols, increasing operational costs for manufacturers. Additionally, regulatory uncertainties and evolving emission norms in different regions create compliance challenges, potentially impacting production capacity and market expansion.

Opportunities in the Global Propylene Oxide Market

Technological Advancements in Production Processes

Innovations in propylene oxide production processes present significant growth opportunities for market players. The adoption of the HPPO method, which eliminates harmful chlorine-based byproducts and reduces energy consumption, has gained traction among leading chemical manufacturers. Research and development (R&D) efforts are also focused on improving catalyst efficiency, reducing raw material dependency, and enhancing overall production yield. Organizations need to develop resilient supply chain strategies by expanding their raw material sources alongside better procurement systems, which help reduce price instability alongside supply chain breakdowns.

Expansion of Electric Vehicle and Renewable Energy Markets

The utilization and management processes of propylene oxide come under intense environmental control because this substance belongs to the hazardous chemical category. The EPA, together with ECHA, establishes strict environmental criteria surrounding propylene oxide manufacturing processes that control pollutant releases and disposal protocols, and worker protection requirements. Organizations engaged in propylene oxide handling must implement strict safety protocols because the chemical creates health hazards that affect the lungs and can cause cancer. The implementation of environmental regulations pushes manufacturers to invest heavily in systems for environmental management and emission control technology, and worker safety procedures, which leads to increased operational costs. Production capacity and market expansion can be impaired by regulatory uncertainties resulting from changing emission norms across different regions.

Trends in the Global Propylene Oxide Market

Shift Toward Bio-Based and Sustainable Propylene Oxide Production

The development of improved production techniques for propylene oxide creates new business possibilities for stakeholders within the market. Leading chemical manufacturers are implementing HPPO as their preferred method because it removes chlorine-based toxic substances during production while lowering energy requirements. Research teams concentrate on optimizing catalyst performance because this work aims to decrease material requirements and increase manufacturing outputs. The bio-based propylene oxide manufacturing using renewable resources shows promise for sustainable business development. The adoption of advanced production technologies gives businesses a competitive advantage through their delivery of efficient, sustainable solutions that comply with worldwide sustainability objectives. Production process optimization through continued pursuit will advance both long-term profitability and market enlargement opportunities.

Rising Demand for Polyurethane-Based Products in Construction and Automotive Sectors

The global propylene oxide market undergoes a major change to clean production strategies constructed from biological materials to reduce environmental damage. The construction sector demands more energy-efficient materials because polyurethane foams act as essential components for thermal efficiency improvements in both residential and commercial buildings through better heat conservation. The automotive sector implements both polyurethane foams and coatings to make vehicles lighter and more efficient despite their enhanced fuel mileage. The quick growth of electric vehicles (EVs) supports this development because lightweight products are essential for attaining both enhanced battery performance and greater operational range. The worldwide initiative to find green energy-efficient alternatives will encourage the broad adoption of polyurethane materials produced through propylene oxide processes.

Global Propylene Oxide Market: Research Scope and Analysis

By Production Process Analysis

The chlorohydrin process is projected to dominate the production process segment of the global propylene oxide market as it holds 33.2% of market share in 2025. The chlorohydrin process rules the market because it has been successfully industrialized for years with large capacity production facilities across many locations worldwide. The chlorohydrin process maintains its position as the main production method for making propylene oxide, which advances worldwide supply levels. The reaction sequence starts with propylene and chlorine, and water, then leads to neutralization along with extraction while yielding large quantities of propylene oxide. The chlorohydrin process maintains its position as the dominant method in propylene oxide production because it combines scalability with existing petrochemical complex integration, despite growing interest in the environmentally advantageous hydrogen peroxide to propylene oxide (HPPO) method.

The chlorohydrin production process remains dominant because refineries, along with chemical plants, effectively use their available raw materials as feedstocks. Major manufacturers across the board have established extensive chlorohydrin-based production centers, which make moving to alternative methods impossibly expensive. The chlorine-based chemical industries in Asia-Pacific sustain the chlorohydrin production process because they possess strong supply chain networks and chemical production proficiency. While chlorine-based waste poses environmental issues, continuous technological developments in waste management and process enhancement have addressed certain environmental concerns. The chlorohydrin process provides businesses with versatile raw material choices, which establishes it as their top selection when seeking both production consistency and budget-friendly operations.

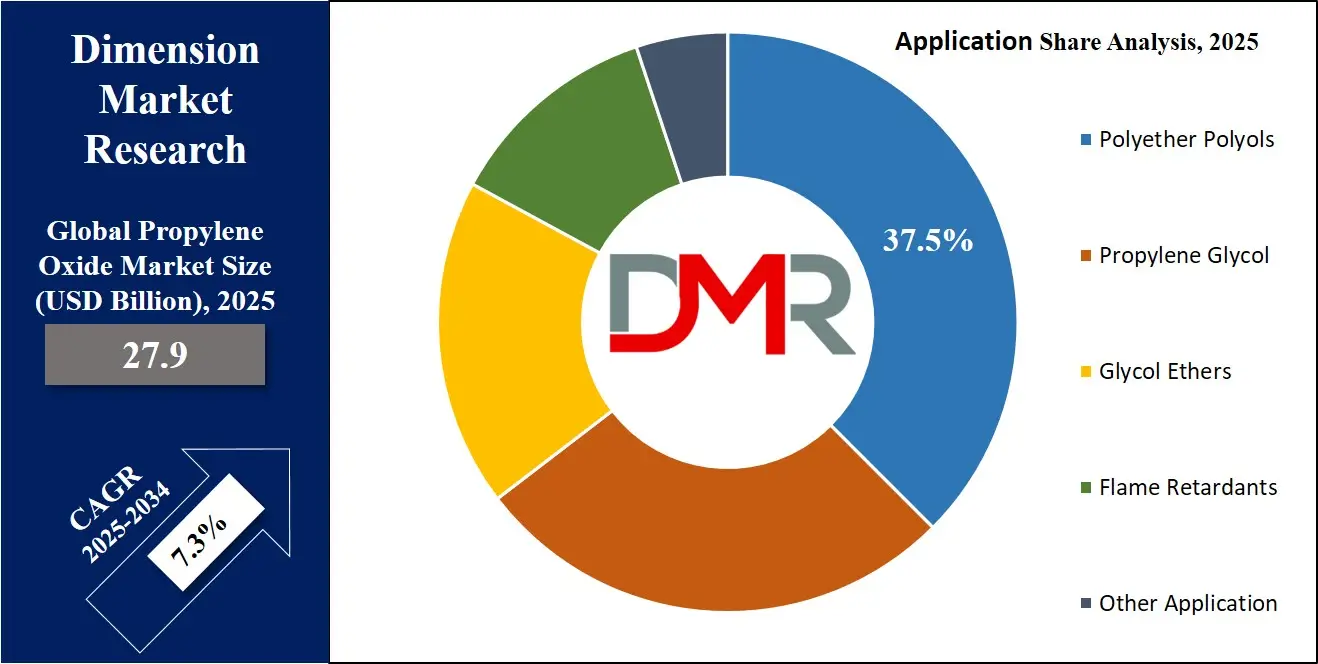

By Application Analysis

The global propylene oxide market application segment is controlled by Polyether polyols because these chemicals are necessary for creating polyurethane-based materials, extensively used throughout various industries. Polyether polyols obtained from propylene oxide act as essential components for creating polyurethane foams alongside elastomers and coatings for wide applications within construction, along with automotive and furniture, and packaging industries. Polyurethane-based insulation materials are expanding at a rapid pace because they require polyether polyols, which have established their position as leaders in this application segment.

Polyether polyols serve as core components that the automotive industry requires to make flexible and rigid polyurethane foams, which end up in vehicle interiors and seating, and structural components. Polyurethane foam production has surged as manufacturers seek lightweight materials for electric vehicles, and now polyether polyols dominate the market owing to this surge. Polyether polyols serve numerous applications in industrial coatings because they show excellent performance traits, which include flexible properties along with durability and resistance to multiple chemicals.

Manufacturers maintain their prominence by constantly innovating polyurethane technology, which allows polyether polyols to serve more applications. Market growth has benefited from the continuous development of bio-based polyether polyols as these products support sustainability goals. The wide industrial usage of polyether polyols assures their position as the market's top propylene oxide application, which continues to expand at a high pace.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End-User Analysis

The automotive and transportation field is anticipated to leads this segment because polyurethane-based components extensively appear in vehicle production together with marine and aviation applications. The basic building blocks of automotive vehicle efficiency and durability and passenger comfort are formed by using propylene oxide-derived polyether polyols for creating polyurethane foams together with coatings and adhesives and elastomers. Polyurethane foams support fuel-efficient designs because they enable weight reductions through lightweight constructions that maintain construction integrity.

The transportation industry heavily relies on polyurethane foams because these materials provide unmatched insulation for refrigerated transportation, as well as cold storage logistics and aircraft cabin insulation systems. Polyurethane materials provide temperature regulation abilities for perishable products while delivering energy-efficient performance to long-distance shipping operations. Lightweight composites made from polyurethane materials enhance both aircraft fuel efficiency and lower aircraft weight in the aviation sector. Similarly, the marine industry employs polyurethane coatings and insulation for corrosion protection and improved vessel performance.

The demand for polyurethane-based materials has increased due to their role in automotive lightweighting that optimizes electric vehicle battery performance as EVs gain popularity in markets worldwide. The automotive transportation market will remain prominent in propylene oxide consumption trends because electric vehicles drive this rising demand.

The Global Propylene Oxide Market Report is segmented on the basis of the following

By Production Process

- Chlorohydrin Process

- Styrene Monomer Process (POSM/SMPO)

- Tert-Butyl Alcohol Process (PO/TBA)

- Cumene Hydroperoxide Process

- Hydrogen Peroxide Process (HPPO)

By Application

- Polyether Polyols

- Propylene Glycol

- Glycol Ethers

- Flame Retardants

- Other Application

By End-Use Industry

- Automotive

- Construction

- Furniture & Bedding

- Textiles

- Packaging

- Electronics

- Pharmaceuticals

- Other End User Industries

Global Propylene Oxide Market: Regional Analysis

Region with the Highest Market Share

Asia-Pacific is projected to dominate the global propylene oxide market as it commands over 38.10% of the market share in 2024. Asia-Pacific rules the market due to its strong industrial infrastructure, together with growing polyurethane product requirements and expanding manufacturing operations throughout the region. The rapid development of the automotive construction and electronics sectors in China, India, Japan, and South Korea has made these nations become leading producers and users of propylene oxide. The growing urbanization, combined with region-wide infrastructure developments, has substantially raised the need for polyurethane foam products in insulation and coating applications and adhesive manufacturing, which supports propylene oxide market expansion.

China holds the status of being the globe's largest producer of propylene oxide because it operates large petrochemical facilities, together with industrial support from its government for business expansion. Asia-Pacific dominates the propylene oxide market because of its economical raw material resources and solid supply chain systems. Consumer goods and packaging industries in the region have driven up the need for polyether polyols, which constitute a main propylene oxide application. Strict investments into production facilities and technological enhancements ensure Asia-Pacific will keep its status as the world's top propylene oxide market leader.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR in the Global Propylene Oxide Market

The propylene oxide market shows its fastest growth in North America because different industries require sustainable high-performance materials at a strong pace. The market experiences substantial growth because industries continue to adopt advanced polyurethane foams as they transform automotive vehicles and create energy-efficient construction while developing high-performance coatings. The growing market demand for electric vehicles throughout the United States and Canada requires polyurethane-based insulation and lightweight materials which supports propylene oxide market consumption.

Rapid market growth results from leading chemical production technologies and advanced manufacturing capabilities that include the hydrogen peroxide to propylene oxide (HPPO) method. Bio-based propylene oxide production in North America has increased rapidly because this region aims to achieve sustainability goals. Government requirements for energy-efficient residential and vehicular construction have driven up polyurethane market demand through regulatory support. The total market value of North America will increase substantially due to both industrial investment growth and the rising demand from various end-use industries.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Propylene Oxide Market: Competitive Landscape

The competitive nature of the propylene oxide market forces leading companies to focus on capacity growth, along with technological improvements and strategic networking to extend their market dominance. The propylene oxide industry is controlled by major players, including Dow Inc., along with LyondellBasell Industries and BASF SE, Shell Chemicals, and Sumitomo Chemical Co. Ltd., that use their broad production networks along with integrated distribution systems.

Companies are investing more heavily in environmentally-friendly production processes such as the HPPO method to lower environmental impact and enhance cost efficiencies. Companies like Dow and BASF have introduced advanced HPPO production technologies designed to minimize wastewater generation while optimizing yield efficiencies; major players also continue expanding in Asia-Pacific due to strong polyurethane product demand in that region.

Strategic collaborations and mergers are also redefining the competitive landscape, with companies joining forces to secure feedstock supply and enhance production efficiency. Companies like LyondellBasell and Covestro have formed alliances to secure feedstock supply while improving production efficiencies; for instance, LyondellBasell and Covestro recently collaborated in joint ventures that strengthen their propylene oxide output. With increasing competition and evolving regulatory standards becoming an ever-increasing challenge to their lead positions on this global propylene oxide market, leaders are prioritising innovation over sustainability as an advantage over their market rivals to remain market leaders on this global propylene oxide market.

Some of the prominent players in the Global Propylene Oxide Market are

- LyondellBasell Industries N.V.

- Dow Inc.

- BASF SE

- Covestro AG

- Royal Dutch Shell Plc

- Huntsman Corporation

- Repsol S.A.

- Sumitomo Chemical Co., Ltd.

- SKC Co., Ltd.

- AGC Inc.

- INEOS Group

- China National Petroleum Corporation (CNPC)

- Sinopec Limited

- Sasol Limited

- Wanhua Chemical Group Co., Ltd.

- Tokuyama Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Corporation

- PCC Rokita SA

- Braskem S.A.

- Other Key Players

Recent Developments in the Global Propylene Oxide Market

- March 2025: LyondellBasell and Covestro announced the permanent closure of their Propylene Oxide Styrene Monomer production unit located at the Maasvlakte site, Netherlands due to global overcapacities, rising imports from Asia, and high European production costs. This decision was driven by global overcapacity issues combined with increasing Asian imports as well as rising European production costs.

- October 2023: BASF expanded its production capacities at its Verbund facility in Antwerp, Belgium, by approximately 400,000 tons annually to meet growing customer demands and increase output by this measure. This expansion supports BASF's strategy of meeting rising customer needs through innovation.

- October 2023: Dow and Evonik successfully launched in Hanau, Germany a pilot plant to convert hydrogen peroxide to propylene glycol (HPPG), featuring groundbreaking technology related to propylene oxide derivatives.

- September 2023: Dow recently introduced "PG RDC," "PG REN," and "PG CIR," three novel propylene glycol solutions featuring lower carbon emissions, bio-based feedstocks, circular processes, and circular feedstocks in Europe - intended for applications across agriculture, pharmaceuticals, cosmetics, textiles food.

- August 2023:

- Digital Platform Launch: BASF unveiled "xarvio Agro Experts," an initiative linking agronomic consultancies to farmers through its FIELD MANAGER crop optimization platform and further increasing the productivity of soybean, corn, and cotton crops.

- May 2023: Strategic Partnership: Dow and New Energy Blue partnered together to establish New Energy Freedom, an industrial facility located near Mason City in Iowa, which will process an expected 275,000 tons per year of corn stover to create second-generation ethanol and eco-friendly lignin products.

- February 2023: Air Liquide and Sasol have entered into renewable power purchase agreements with TotalEnergies and Mulilo to procure a long-term supply of 260MW of renewable electricity to Sasol's Secunda site in South Africa to support sustainable production initiatives.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 27.9 Bn |

| Forecast Value (2034) |

USD 52.6 Bn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Production Process (Chlorohydrin Process, Styrene Monomer Process (POSM/SMPO), Tert-Butyl Alcohol Process (PO/TBA), Cumene Hydroperoxide Process, Hydrogen Peroxide Process (HPPO)), By Application (Polyether Polyols, Propylene Glycol, Glycol Ethers, Flame Retardants, Other Applications), By End-Use Industry (Automotive, Construction, Furniture & Bedding, Textiles, Packaging, Electronics, Pharmaceuticals, Other End-User Industries |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

LyondellBasell Industries N.V., Dow Inc., BASF SE, Covestro AG, Royal Dutch Shell Plc, Huntsman Corporation, Repsol S.A., Sumitomo Chemical Co., Ltd., SKC Co., Ltd., AGC Inc., INEOS Group, China National Petroleum Corporation (CNPC), Sinopec Limited, Sasol Limited, Wanhua Chemical Group Co., Ltd., Tokuyama Corporation, Formosa Plastics Corporation, Hanwha Solutions Corporation, PCC Rokita SA, Braskem S.A., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Propylene Oxide Market?

▾ The Global Propylene Oxide Market size is estimated to have a value of USD 27.9 billion in 2025 and is expected to reach USD 52.6 billion by the end of 2034.

What is the size of the US Propylene Oxide Market?

▾ The US Propylene Oxide Market is projected to be valued at USD 7.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.9 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Propylene Oxide Market?

▾ Asia Pacific is expected to have the largest market share in the Global Propylene Oxide Market with a share of about 38.10% in 2025.

Who are the key players in the Global Propylene Oxide Market?

▾ Some of the major key players in the Global Propylene Oxide Market are LyondellBasell Industries N.V., Dow Inc., BASF SE, Covestro AG, Royal Dutch Shell Plc, Huntsman Corporation, Repsol S.A., and many others.

What is the growth rate in the Global Propylene Oxide Market in 2025?

▾ The market is projected to grow at a CAGR of 7.3 percent during the forecast period of 2025.