Prosthetics and orthotics markets are poised for strong expansion due to demographic shifts, technological innovations, and increasing healthcare investments. An aging global populace coupled with conditions requiring amputations such as diabetes or vascular diseases drives demand for these devices; innovations like 3D printing, smart sensors and material sciences provide enhanced functionality, comfort, mobility, customization options for these critical products thereby expanding global health investments for these essential healthcare devices.

Lightweight materials combined with digital technologies enhance not only individual device adaptability but also their acceptance among various user groups. Furthermore, market growth is propelled forward by an ever-increasing trend toward patient-centric care models which emphasize custom healthcare solutions designed to complement various lifestyles seamlessly.

Although on an upward trend, this market still faces substantial hurdles; they include high costs associated with cutting-edge prosthetic and orthotic devices as well as inadequate reimbursement frameworks in less economically developed regions. Furthermore, regulatory environments present difficulty that delays new innovations' introduction.

Strategy in healthcare ecosystem is driven by three strategic imperatives for stakeholders across all layers--from device makers and healthcare providers alike--innovation, alliance building and penetrating emerging markets to take advantage of ever-increasing demand. Prosthetics and Orthotics market stands as an indispensable healthcare segment with enormous growth prospects as well as lasting effects on quality of life for people living with physical impairments.

Key Takeaways

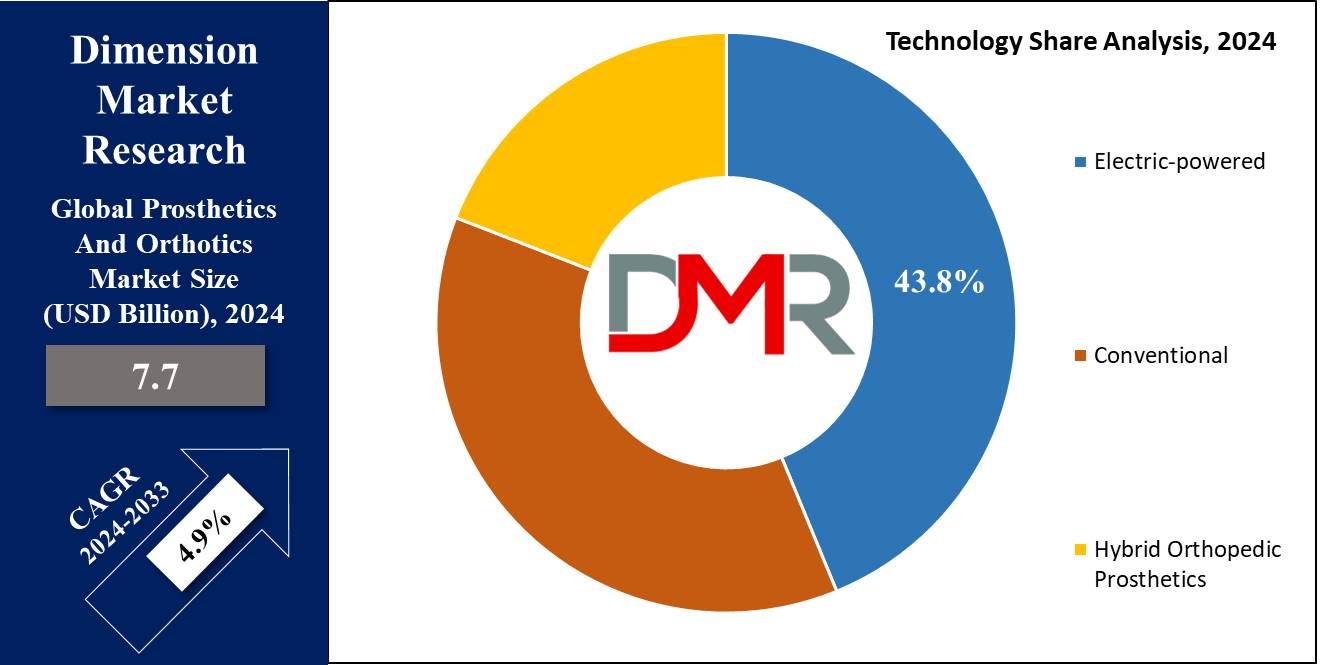

- Market Growth Projection: The global Prosthetics and Orthotics market is projected to grow from USD 7.7 billion in 2024 to USD 11.08 billion by 2033, at a CAGR of 4.9%.

- Technology Segment Leadership: Electric-powered prostheses dominated the technology segment of the market in 2023, holding a 43.8% share due to their ability to provide users with greater control and improved quality of life.

- Dominance in Type Segment: Orthotics maintained a dominant position in the Type segment in 2023, capturing more than 56.7% market share, valued for their pain relief and mobility enhancement capabilities.

- Key End-User Insight: Prosthetics Clinics were the leading end-users of prosthetic devices in 2023, accounting for a 32.7% market share, reflecting their role in providing specialized and customized care.

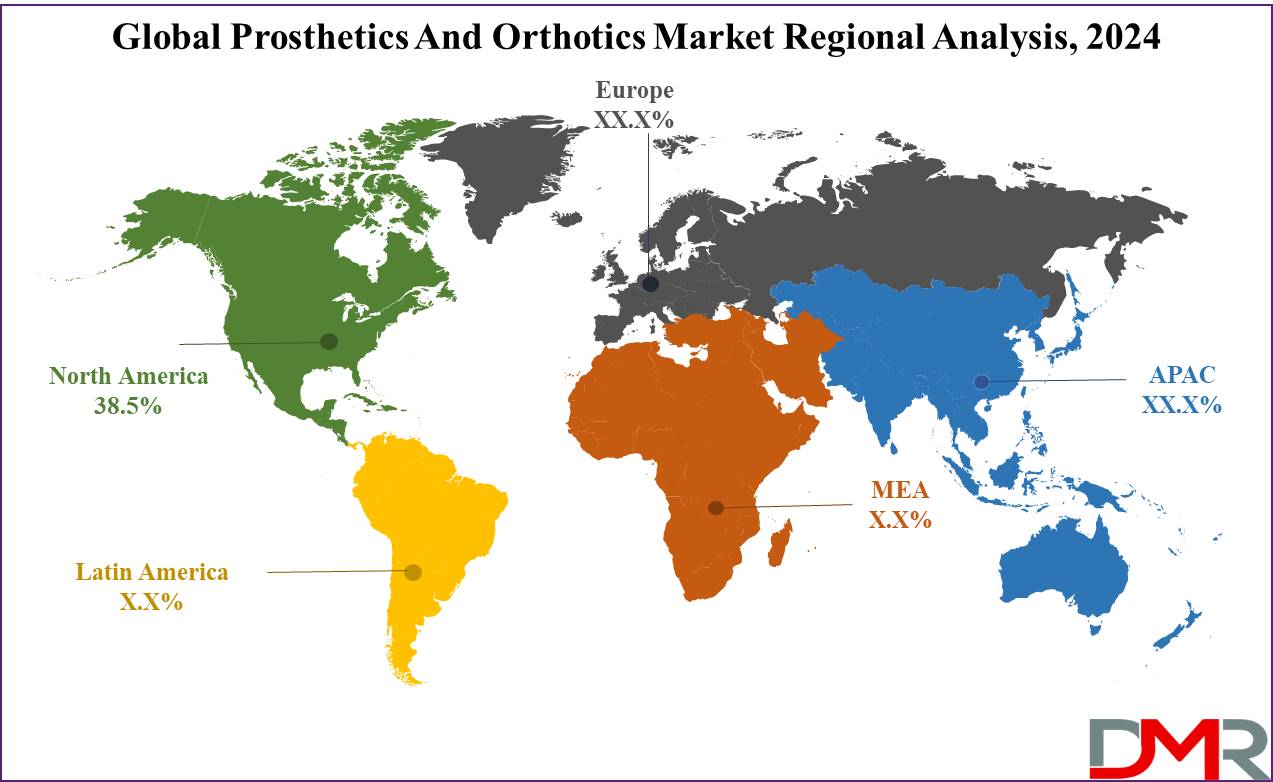

- Regional Market Dominance: North America led the global market with a 38.5% share, driven by advanced healthcare infrastructure, significant R&D investments, and the adoption of innovative technologies like 3D printing and AI.

- Impact of Chronic Conditions: Increasing prevalence of conditions such as diabetes and stroke, which often lead to amputations and mobility challenges, continues to drive demand for prosthetic and orthotic solutions.

- Technological Breakthroughs: 2023 marked a significant advancement in 3D printing for prosthetics, making custom-fit devices more affordable and accessible, especially in regions with inadequate medical infrastructure.

Use Cases

- Emergency Response Enhancements: Integrating real-time location tracking of emergency response vehicles for greater dispatch efficiency and faster responses during critical incidents is expected to improve dispatch efficiency, shorten response times and ensure adequate resources can be deployed quickly to respond.

- Healthcare Monitoring: Wearable devices provide continuous care and timely medical interventions to people living with chronic conditions remotely, enabling continuous medical monitoring.

- Smart Agriculture: Drone technology allows farmers to precisely monitor crop health and soil conditions for precise agriculture that optimizes resource usage like water and fertilizers.

- Retail Customer Experience: Implementation of AI-powered analytics within retail environments in order to track customer behaviors and preferences for personalized marketing purposes as well as enhanced service delivery.

- Urban Planning: Big data analytics allows city planners to analyze traffic patterns and public transportation usage to design more cost-efficient mobility solutions in cities.

Driving Factors

Prevalence of Orthopedic and Neurological Disorders on the Rise

As chronic conditions such as diabetes, osteoarthritis, stroke and vascular diseases become increasingly prevalent, their prevalence drives up demand for prosthetics and orthotics. These medical issues frequently result in the loss of limbs, mobility challenges and severe muscle or bone pain requiring supportive devices as a solution. World Health Organization estimates that 422 million people globally suffer from diabetes - which can lead to amputation - which dramatically drives up prosthetic device needs. Stroke prevalence continues to climb at over 13 million annually worldwide and its subsequent neurological and physical impairments lead to greater adoption of orthotic aids for rehabilitation and daily functioning purposes.

Impact of Aging Global Population

An expanding elderly demographic contributes greatly to the Prosthetics and Orthotics market's expansion. Because older adults are often susceptible to mobility-impairing conditions such as osteoarthritis or fractures from falls, orthotic support systems or prosthetic solutions become essential in maintaining independence and quality of life for these senior individuals. According to United Nations projections, by 2050 there will be nearly 1.5 billion aged 65 or over globally - this major demographic trend driving demand for essential healthcare devices as older people strive for active lives that promote independence.

New Technological Advancements Expand Market Attractivity

Technological innovations in prosthetics and orthotics are revolutionizing device functionality and user engagement. 3D printing technology enables the creation of highly customized prosthetic limbs at reduced costs and turnaround times, making solutions like these more accessible. Advanced materials, like carbon fiber and titanium, help these devices achieve durability and comfort, while innovations like robotic prostheses and microprocessor-controlled joints provide users with increased mobility that closely replicates natural limb movements. Such technological developments not only increase quality of life for users but also expand market by making prosthetics and orthotics more adaptable and appealing across more conditions and lifestyles.

Growth Opportunities

Expanding Horizons: 3D Printing and Custom Prosthetics

2023 marks an exciting breakthrough for 3D printing technology in Prosthetics and Orthotics markets, providing custom-fit prosthetics tailored precisely to individual anatomical requirements, improving comfort and functionality while remaining affordable and accessible - particularly in regions lacking adequate medical infrastructure. As 3D printer costs continue to decrease while precision increases exponentially, their potential market expansion becomes even greater and penetration into previously underserved areas increases even further - creating an invaluable growth vector in 2023.

Utilizing Innovation: Wearable Robots and Exoskeletons

Wearable robotics and exoskeleton technology is set to transform orthotics support. Not only are they improving physical capabilities of individuals with disabilities but they are also designed to blend seamlessly into daily lives for increased independence and quality of life. Furthermore, as this field grows exponentially it will open new growth avenues by catering for broader mobility issues, such as those related to elderly populations or neurological conditions - representing an enormous market opportunity by 2023.

Explore ways of capitalizing on geographical expansion: emerging markets

2023 is set to bring significant opportunities in emerging markets, particularly Asia-Pacific and Latin America regions where healthcare investments are rising significantly. Increased economic growth and healthcare expenditure is set to fuel increased demand for prosthetic and orthotic devices; as local governments and international health organizations prioritize improving healthcare outcomes, market participants may find significant entry points or growth in this space. Market participants should carefully consider investments or partnerships in these regions so as to take full advantage of expanding healthcare infrastructure as well as rising patient awareness regarding available prosthetic and orthotic solutions.

Key Trends

Emphasizing Comfort and Durability: Transition to Advanced Materials

Prosthetics and Orthotics markets around the globe have observed an increasingly noticeable trend toward lightweight materials like carbon fiber and titanium for prosthetic devices, due to their strength, durability, patient comfort, ease of management and improved functional capabilities. This shift not only improves functional capabilities of prosthetic and orthotic devices but also positively influences user satisfaction and daily wearability - which leads to adoption rates growth as a result of market expansion.

Enhancing patient care via remote monitoring and Telehealth

One key market trend this year has been the integration of remote monitoring and telehealth capabilities into prosthetic and orthotic devices, providing real-time tracking of patient progress and device functionality, which allows more timely adjustments or interventions to occur. Furthermore, seamless telehealth consultations reduce in-person visits which is especially advantageous in rural or underserved regions; further contributing to market expansion. These advancements are vital components for improving patient outcomes as well as operational efficiencies within healthcare systems while driving market expansion.

Rise of AI-Powered Prosthetics

Artificial Intelligence (AI) is revolutionizing the Prosthetics market by providing smarter, adaptive prosthetic limbs. AI-enhanced prosthetic devices have the ability to learn from users' movements and environments and adapt accordingly for an easy experience - which enhances functionality as they become more responsive to individual needs, increasing practicality and appeal - becoming an increasingly significant trend by 2023.

Restraining Factors

Economics Are Restrained Due to High Costs

Costly prosthetic and orthotic devices severely limit market growth by making many potential users' access too prohibitively costly - particularly those living in economically vulnerable regions. Advanced technologies used in prosthetics, such as microprocessor-controlled limbs or carbon fiber materials, can skyrocket their costs into the thousands. One high-end prosthetic can cost between $5,000 to $50,000, making them out of reach of many individuals in low-income countries with limited healthcare funding and patient purchasing power. This economic barrier hinders individual accessibility as well as national healthcare systems' efforts to implement advanced prosthetic solutions thereby restricting market expansion.

Accessibility Issues Exist in Developing Regions

Accessibility issues exacerbate market growth restrictions in developing nations with inadequate healthcare infrastructure and insufficient numbers of trained prosthotic and orthotic professionals available to fit and maintain sophisticated prosthetic devices. Some regions, for instance, suffer a dearth of orthotists and prosthetists necessary for the fitting and user training necessary for advanced prosthetic technology to function as intended, further hindering its benefits from effective utilization. Geographic and logistical constraints further limit accessibility; regular maintenance visits would enable optimal use.

Research Scope and Analysis

Technology Analysis

Electric-powered prostheses were the market leaders in 2023 for Technology market segment of Prosthetics and Orthotics market, accounting for

43.8% share in technology segment of market. Electric powered solutions offered greater control, natural movement and provided users with improved mobility as well as higher quality of life for improved mobility and improved quality of life.

Conventional prosthetic devices continue to hold an essential place in the market due to their cost-effectiveness and reliability, particularly among users in markets sensitive to higher costs. They're an economical alternative that's especially popular in less developed regions where advanced tech may not be accessible or economically feasible.

Hybrid Orthopedic Prosthetics, devices which combine mechanical functioning with electronic components, have become an increasingly popular segment within the market. They offer users seeking more functionality than purely mechanical prosthetics can offer but at lower costs than fully electric powered models a suitable balance of cost and functionality. Furthermore, hybrids allow more personalized adjustments and improved efficiency - an attractive proposition to an expanding demographic looking for advanced features without paying full retail cost of fully electric powered prosthetics.

Type Analysis

In 2023, Orthotics held a dominant market position in the Type segment of the Prosthetics and Orthotics market, capturing more than a 56.7% share. Their widespread appeal, relieving pain relief, and improving mobility made orthotic devices essential tools in providing support, alleviating discomfort and increasing mobility for individuals with various musculoskeletal ailments.

Prosthetics also play an integral part of the market, although with less market share compared to Orthotics. Prosthetic devices play a pivotal role in restoring functionality and improving quality of life for amputees as well as those born with limb deficiencies, with continued technological innovations like microprocessors, advanced materials, AI integration improving adaptability and performance of prosthetic devices enhancing adaptability and performance of this segment of devices

Although their market share may be less substantial compared with orthotics devices, their impactful presence makes their impact felt by individuals greatly; further technological developments should further propel growth of this segment of this segment over time.

End-User Analysis

In 2023, Prosthetics Clinics held an overwhelming market share for End-User prosthetic devices in 2016, accounting for 32.7%. Their leading market position reflected their specialized care and customized prosthetic devices which met individual's specific needs, satisfying them completely while meeting ongoing support services requirements - making them a top choice among many patients seeking comprehensive prosthetic services.

Hospitals represent another key segment in the market. Hospitals offer comprehensive prosthetic and orthotic services integrated with other medical treatments for people recovering from surgery or trauma, often integrated into other forms of therapy as part of recovery programs. Hospitals benefit from having access to specialist teams as well as cutting-edge medical technologies which improve care delivery quality while increasing patient outcomes; presence of in-house prosthetic services ensure immediate, coordinated care delivery thereby contributing to their strong market standing.

Rehabilitation Centers are another vital end-user within the Prosthetics and Orthotics market, serving to assist patients adapt quickly and use efficiently their new prosthetic or orthotic devices. They focus on comprehensive therapy programs essential to successful rehabilitation - an invaluable resource in aiding physical recovery and independence for their clients.

The Others category encompasses various facilities like community health centers and specialty clinics which also distribute prosthetic and orthotic devices. Although their market share may be small, these centers play an essential role in providing accessible care in less central locations.

The Prosthetics And Orthotics Market Report is segmented based on the following:

By Technology

- Electric-powered

- Conventional

- Hybrid Orthopedic Prosthetics

By Type

- Orthotic

- Lower Limb

- Upper Limb

- Spinal Orthotics

- Prosthetics

- Lower Extremity

- Upper Extremity

- Sockets

- Modular Components

- Liners

By End-User

- Prosthetics Clinics

- Hospitals

- Rehabilitation Centre

- Others

Regional Analysis

North America dominates the global healthcare landscape with an impressive market share of 38.5%, driven by advanced healthcare infrastructure and expenditure as well as strong market players such as U.S. leaders who make significant investments in R&D while adopting cutting edge innovations such as 3D printing or AI enhanced prosthetic devices - the latter particularly being prevalent due to diabetes or obesity-related limb amputations, increasing its demand in this region.

Europe closely trails North America when it comes to prosthetics and orthotics markets, marked by stringent regulatory standards and increasing patient awareness levels. Germany, UK and France lead this market segment, investing heavily in healthcare technologies while simultaneously building up an expansive network of healthcare facilities offering prosthetic services and prosthesis devices. Furthermore, European healthcare solutions emphasize sustainable yet cost-effective care solutions which explains their high adoption of innovative prostheses and orthotic devices.

Asia Pacific is currently the fastest-growing Prosthetics and Orthotics market due to increasing healthcare infrastructures, expenditure, awareness, and emerging economies like China and India experiencing fast growth due to large populations that need prosthetic products for chronic illnesses such as Parkinson's and Lupus that necessitate these devices.

Middle East & Africa represents an emerging market with great promise of expansion due to government initiatives to enhance healthcare systems and establish local manufacturing capabilities. Countries like Saudi Arabia and South Africa have committed resources towards reforms that should increase access to advanced medical treatments including prosthetics and orthotics.

Latin America is experiencing steady expansion of their Prosthetics and Orthotics market due to gradual healthcare improvements as well as increasing diabetes incidence and vehicular accidents which require rehabilitation support. Brazil and Mexico have taken lead on improving accessibility and affordability within healthcare for wider population needs.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Ossur has played an instrumental role in developing bionic prosthetic technologies with more natural movement and adaptability, while Ottobock has taken huge strides forward by integrating sensor/microprocessor technologies that increase functionality while providing greater user comfort.

Blatchford Limited and Fillauer LLC have made notable contributions to the prosthetic market through biomechanical solutions that offer greater support and mobility, particularly Blatchford's use of advanced hydraulic systems to make his prostheses responsive to various terrains and activities - setting new benchmarks in device responsiveness and adaptability for responsive device performance.

Emerging players such as Aether Biomedical and Mobius Bionics have made remarkable inroads into the market through innovations like signal processing and robotics for prosthetic devices that dramatically improve users' lives. Aether Biomedical has focused on high signal fidelity bionic limbs to produce more realistic movements while Mobius Bionics emphasizes high signal fidelity bionic limbs to produce lifelike movements for users.

Bauerfeind and WillowWood Global LLC both specialize in both prosthetics and orthotics for comprehensive patient solutions that emphasize comfort and wearability. Bauerfeind stands out with high quality materials designed specifically to relieve specific symptoms, providing substantial relief across many conditions.

Some of the prominent players in the Global Prosthetics And Orthotics Market are:

- Össur

- Blatchford Limited

- Fillauer LLC

- Bauerfeind

- Aether Biomedical

- Mobius Bionics

- Ultraflex Systems Inc.

- Steeper Group

- Ottobock

- WillowWood Global LLC.

- Hanger, Inc.

Recent developments

- In September 2024, Mable Health expanded its operational scope by acquiring Design Prosthetics and Orthotics, aiming to enhance its product and service offerings in Ontario. This strategic move is expected to bolster Mable Health’s capabilities in delivering integrated healthcare services and reinforce its market presence in the region.

- In February 2024, Hanger, Inc.'s acquisition of Fillauer, a globally recognized leader in orthotic and prosthetic manufacturing. This merger is set to enrich Hanger’s portfolio with advanced manufacturing technologies and extend its leadership in innovative patient care solutions across the orthotics and prosthetics industry.

- In June 2023, UC San Diego made a landmark investment of $250,000 in LIMBER Prosthetics and Orthotics Inc., a startup launched by its former students. This investment highlights the university's active role in promoting entrepreneurial initiatives within its community and marks a historic moment as the first direct investment by any University of California campus in one of its spinoffs.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 7.7 Bn |

| Forecast Value (2033) |

USD 11.08 Bn |

| CAGR (2024-2033) |

4.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology(Electric-powered, Conventional, Hybrid Orthopedic Prosthetics), By Type(Orthotic, Prosthetics), By End-User(Prosthetics Clinics, Hospitals, Rehabilitation Centre, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Össur, Blatchford Limited, Fillauer LLC, Bauerfeind, Aether Biomedical, Mobius Bionics, Ultraflex Systems Inc., Steeper Group, Ottobock, WillowWood Global LLC., Hanger, Inc. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |