Market Overview

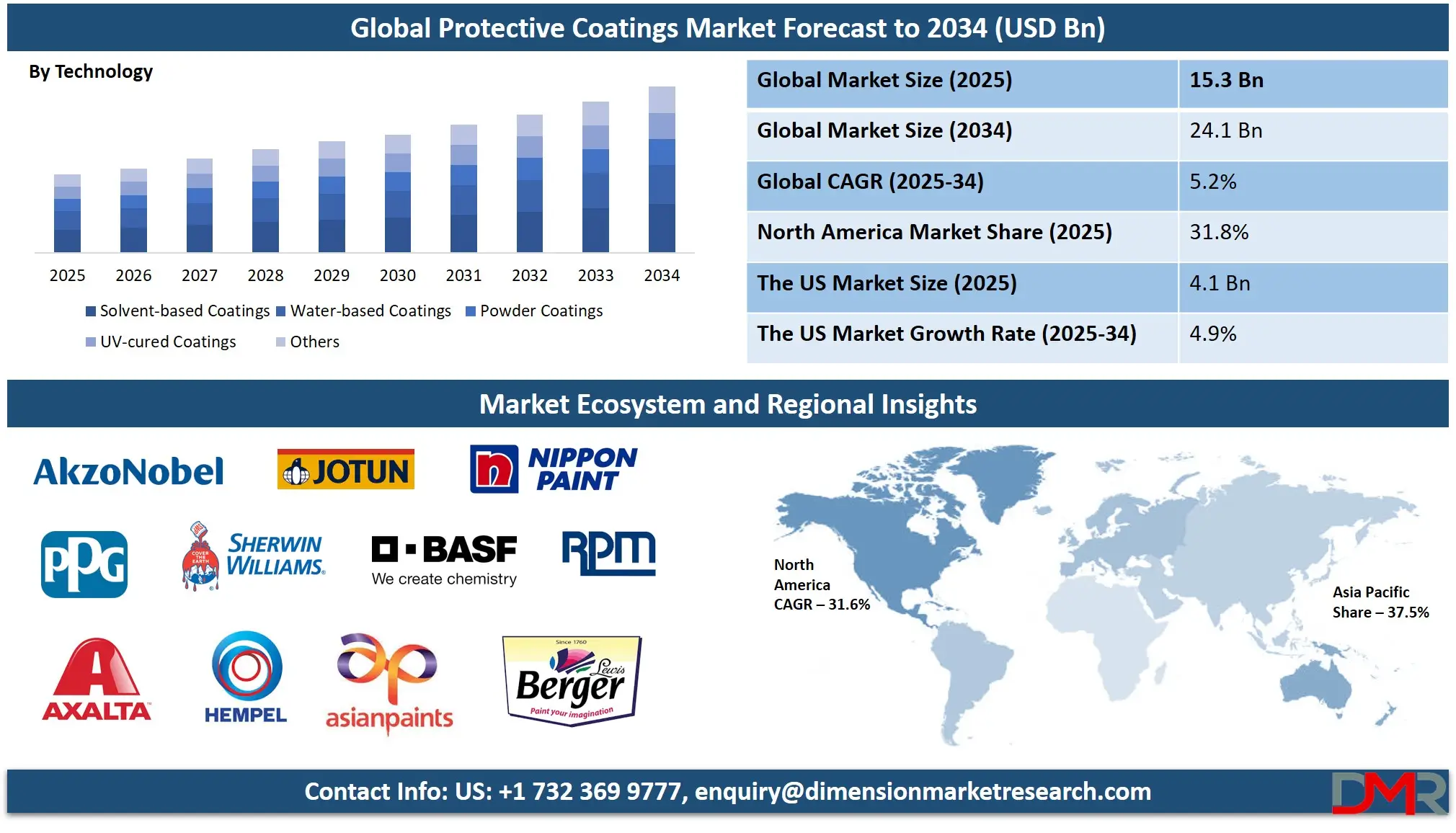

The Global Protective Coatings Market is expected to reach a value of USD 15.3 billion in 2025, and it is further anticipated to reach a market value of USD 24.1 billion by 2034 at a CAGR of 5.2%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

The Global Protective Coatings Market is witnessing steady growth driven by increasing demand across key industries such as oil & gas, marine, infrastructure, and power generation. The market is benefiting from rapid industrialization, particularly in emerging economies, and rising investments in public infrastructure and offshore energy assets. The market growth is fueled by the need for long-lasting protection against corrosion, chemicals, and environmental degradation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A prominent trend in the market is the shift toward eco-friendly and low-VOC coatings, especially water-based and high-solids formulations. Governments worldwide are enforcing stricter environmental regulations, prompting manufacturers to innovate in sustainable protective technologies. Additionally, smart coatings with self-healing, anti-fouling, and anti-microbial properties are gaining traction in highly sensitive and mission-critical industries.

Opportunities are emerging in the renewable energy sector, where wind turbines and solar equipment require advanced surface protection. Rapid expansion of civil infrastructure in Asia-Pacific and Middle Eastern nations is also creating new avenues for protective coatings manufacturers. Furthermore, refurbishment projects in aging industrial plants in developed economies are expected to contribute to sustained demand.

However, the market faces restraints from fluctuating raw material prices and the high cost of advanced formulations. The application of protective coatings also requires skilled labor, and delays in large-scale infrastructure projects can limit near-term consumption. Despite these challenges, the market holds robust long-term potential, backed by growing awareness of asset longevity and cost-efficient maintenance.

The US Protective Coatings Market

The US Protective Coatings Market is projected to be valued at USD 4.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.2 billion in 2034 at a CAGR of 4.9%.

The U.S. Protective Coatings Market stands as one of the largest globally, driven by extensive infrastructure assets, industrial manufacturing, and an advanced energy sector. The country’s aging infrastructure bridges, highways, pipelines, and power facilities creates consistent demand for long-lasting protective solutions to prevent corrosion, mechanical wear, and environmental degradation.

The U.S. government’s multi-trillion-dollar infrastructure bill and initiatives targeting the rehabilitation of critical transportation and energy networks are providing strong tailwinds to the protective coatings market. Additionally, refurbishment and maintenance projects in older industrial plants, chemical facilities, and refineries further accelerate product consumption. Water-based and powder coatings are gaining momentum due to the Environmental Protection Agency’s (EPA) stringent VOC regulations, which are pushing manufacturers and users toward eco-friendly alternatives.

Demographically, the U.S. benefits from a mature, skilled workforce and advanced R&D capabilities, which facilitate the development of next-generation coatings such as nanocoatings and smart, self-healing formulations. The demand for specialized coatings in the defense, aerospace, and renewable energy sectors is also contributing to growth. Protective coatings are extensively used in wind turbine towers, battery storage units, and electric vehicle infrastructure, aligning with the country’s clean energy ambitions.

While the U.S. market faces pressures from fluctuating raw material costs and competition from global players, its strong technological base, regulatory support, and stable demand outlook make it a cornerstone for innovation and revenue generation in the global protective coatings landscape.

Global Protective Coatings Market: Key Takeaways

- The Global Market Size Insights: The Global Protective Coatings Market size is estimated to have a value of USD 15.3 billion in 2025 and is expected to reach USD 24.1 billion by the end of 2034.

- The US Market Size Insights: The US Protective Coatings Market is projected to be valued at USD 4.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.2 billion in 2034 at a CAGR of 4.9%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Protective Coatings Market with a share of about 37.5% in 2025.

- Key Players Insights: Some of the major key players in the Global Protective Coatings Market are Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Jotun A/S, Hempel A/S, Axalta Coating Systems Ltd., RPM International Inc., and many others.

- Global Market Size Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

Global Protective Coatings Market: Use Cases

- Offshore Oil Platforms: Protective coatings are essential in offshore oil platforms to combat corrosion caused by constant exposure to saltwater, high humidity, and harsh weather conditions. Epoxy and zinc-rich coatings extend the lifespan of metal structures and ensure safety and operational efficiency.

- Steel Bridges and Infrastructure: Coatings applied to steel bridges prevent rusting, especially in coastal and urban environments. Polyurethane and fluoropolymer coatings are used for weathering resistance, minimizing maintenance costs, and ensuring structural durability for decades.

- Power Plants and Piping Systems: In power generation facilities, especially thermal and nuclear plants, heat-resistant coatings protect boiler systems, pipes, and chimneys from high temperatures and chemical exposure, ensuring system efficiency and safety.

- Cargo Ships and Marine Vessels: Marine coatings protect ship hulls from biofouling, saltwater corrosion, and mechanical wear. Anti-fouling coatings improve fuel efficiency and reduce maintenance downtime, which is vital for commercial fleet operators.

- Food & Beverage Manufacturing Plants: Protective coatings in food-grade environments resist chemical cleaning agents, microbial contamination, and moisture, ensuring hygienic surfaces on walls, floors, and processing equipment, compliant with safety regulations.

Global Protective Coatings Market: Market Dynamics

Driving Factors in the Global Protective Coatings Market

Emerging Markets in Asia-Pacific and Latin America

Asia-Pacific and Latin America represent untapped reservoirs of growth potential for the protective coatings market, with nations like China, India, Indonesia, and Brazil at the forefront. These regions are experiencing rapid industrial expansion, population growth, urban migration, and an expanding middle class with increased purchasing power. Consequently, the construction of residential complexes, commercial infrastructure, factories, and transportation networks is accelerating. Simultaneously, domestic automotive production is surging, creating a heightened need for protective coatings in both OEM and aftermarket applications.

Local governments are offering incentives to attract foreign investment in manufacturing and infrastructure, further driving demand. Moreover, the relative under-penetration of premium and high-performance coatings in these regions provides opportunities for global players to introduce innovative products tailored to local climates and regulations. International companies are increasingly setting up local manufacturing plants and forming joint ventures with regional players to gain a competitive advantage and address market-specific needs efficiently.

Advancements in Eco-Friendly and High-Performance Coatings

With increasing environmental consciousness and stringent global VOC (volatile organic compounds) regulations, the protective coatings industry is undergoing a significant transformation toward greener alternatives. Water-based, powder, and UV-cured coatings are becoming mainstream due to their low environmental impact, reduced flammability, and minimal odor. These eco-friendly options are especially attractive in sectors such as residential construction, food processing, and healthcare, where emissions and worker safety are tightly regulated.

Innovations in nanotechnology, bio-based materials, and smart coatings are opening new frontiers in performance, enabling features like self-healing, anti-microbial resistance, thermal insulation, and corrosion sensing. For instance, smart coatings that change color in response to corrosion initiation or pH changes are gaining interest in marine and oil & gas applications. R&D investments aimed at improving adhesion, mechanical strength, and long-term stability are creating highly specialized solutions tailored to the demands of various industries. These advances not only address regulatory concerns but also provide new value-added propositions that enhance competitiveness.

Restraints in the Global Protective Coatings Market

Volatility in Raw Material Prices

One of the most pressing challenges faced by protective coatings manufacturers is the unpredictable fluctuation in raw material prices. The cost structure of coatings is heavily dependent on key ingredients such as binders, resins (epoxy, polyurethane, alkyd), pigments, and solvents—many of which are derived from petrochemicals. Since petroleum-based materials are directly affected by global crude oil prices, any geopolitical tension, supply chain disruption, or production cuts by oil-producing nations can lead to cost spikes. Additionally, inflationary pressures, transportation costs, and shortages in specialty chemicals due to global logistics constraints have further strained profit margins.

Small and mid-sized coating companies are particularly vulnerable, as they often lack the financial buffers to absorb sudden cost increases. To remain competitive, some manufacturers are forced to compromise on quality or delay product innovation, which can negatively impact brand reputation and customer trust. Consequently, raw material volatility remains a persistent restraint to steady growth and long-term pricing strategies.

Stringent Environmental Regulations

Protective coatings, particularly solvent-based formulations, are subject to increasingly stringent environmental and safety regulations related to VOC emissions, hazardous air pollutants (HAPs), and the use of heavy metals. Regulatory bodies such as the U.S. EPA, REACH in Europe, and various Asian agencies mandate strict compliance with emissions standards, disposal practices, and worker safety norms. Meeting these standards often requires reformulating existing products, investing in eco-friendly technologies, and conducting expensive compliance testing. Additionally, obtaining certifications and approvals can delay time-to-market for new products.

This regulatory pressure places a disproportionate burden on smaller players with limited R&D and compliance budgets, potentially stifling innovation. Moreover, evolving standards across different regions lead to complexity in developing globally compliant products. These constraints can hinder market entry, increase operational costs, and slow down commercialization efforts. Therefore, navigating regulatory frameworks remains a key challenge for protective coatings manufacturers striving for global scale and competitiveness.

Opportunities in the Global Protective Coatings Market

Expanding Infrastructure and Construction Activities

The global surge in infrastructure development has become a pivotal force propelling the protective coatings market. Across regions such as Asia-Pacific, the Middle East, and Africa, rapid urbanization, industrialization, and increasing investments in public infrastructure have led to extensive construction projects. Protective coatings are critical for enhancing structural integrity and service life by shielding steel, concrete, and composite materials from harsh environmental conditions, including corrosion, thermal stress, UV degradation, moisture, and chemical exposure.

For example, bridges, tunnels, airports, highways, and stadiums require high-performance protective systems to maintain safety and reduce maintenance costs. Governments are launching large-scale smart city initiatives and transportation corridors, which further fuel demand. Additionally, tax rebates, subsidies, and favorable public-private partnership (PPP) policies have amplified the pace of infrastructure development, especially in India, China, and GCC countries. This continual need for durable, low-maintenance infrastructure directly translates into a robust long-term demand for advanced protective coatings across civil engineering applications.

Rise in Automotive and Aerospace Industries

The automotive and aerospace sectors account for a significant portion of protective coatings consumption due to their stringent performance and aesthetic requirements. In the automotive domain, increasing vehicle production, especially in emerging markets, combined with evolving consumer preferences for corrosion-resistant, long-lasting, and visually appealing finishes, is boosting coating demand. Moreover, the industry's shift toward lightweight and fuel-efficient vehicles has led to greater use of aluminum and advanced composites—materials that require specialized coatings to prevent oxidation and wear.

In aerospace, protective coatings are essential for ensuring aircraft components withstand extreme environmental conditions, including UV radiation, temperature fluctuations, and high-altitude pressure. The rise in commercial air travel, defense spending, and global airline fleet expansion, particularly in Asia and the Middle East, has intensified demand for high-performance coatings with minimal weight contribution and enhanced lifecycle durability. Together, the upward trajectories in both the automotive and aerospace sectors ensure sustained market momentum.

Trends in the Global Protective Coatings Market

Technological Advancements and Integration of Smart Coatings

The protective coatings industry is experiencing a significant shift toward the development and adoption of smart coatings. These advanced materials are engineered to respond dynamically to environmental stimuli, offering functionalities such as self-healing, corrosion detection, and antimicrobial properties. The integration of nanotechnology has further enhanced these capabilities, leading to coatings that provide superior protection against wear and tear.

Industries such as aerospace and automotive are increasingly investing in these innovations to extend the lifespan of their assets and reduce maintenance costs. This trend is driven by the growing demand for high-performance coatings that can withstand extreme conditions and provide real-time monitoring of structural integrity.

Shift Toward Sustainable and Eco-Friendly Coatings

Environmental concerns and stringent regulations regarding volatile organic compounds (VOCs) have propelled the industry toward sustainable practices. There is a notable shift from solvent-borne coatings to water-borne and powder coatings, which emit fewer VOCs and have a reduced environmental footprint. Consumers and industries are increasingly prioritizing eco-friendly products, prompting manufacturers to innovate in green technologies. The development of bio-based resins and the adoption of low-VOC formulations are becoming standard practices. This trend not only aligns with global sustainability goals but also caters to the growing market segment that values environmental responsibility.

Global Protective Coatings Market: Research Scope and Analysis

By Technology Analysis

Solvent-based coatings are projected to dominate the global protective coatings market due to their superior performance in harsh environments and wide-ranging applicability across industrial sectors. These coatings consist of organic solvents that facilitate strong adhesion, fast drying, and durable finishes even under extreme weather conditions, including high humidity or low temperatures—conditions that often impair the curing of water-based alternatives. Their high resistance to abrasion, chemicals, and corrosion makes them particularly suitable for applications in oil & gas, marine, infrastructure, and heavy machinery.

In regions with challenging environmental conditions, especially in offshore and onshore industrial zones, solvent-based coatings provide a consistent and reliable protective barrier that ensures asset longevity and structural integrity. Despite rising environmental concerns over volatile organic compound (VOC) emissions, these coatings remain preferred in critical infrastructure and industrial maintenance applications where performance and reliability are paramount. Additionally, ongoing innovations have led to the development of low-VOC and compliant solvent-based formulations, allowing them to meet regulatory standards while maintaining high performance.

Their compatibility with a broad range of substrates, including steel, aluminum, and concrete, also gives them a competitive edge in multi-surface applications. Furthermore, their superior film-forming ability and long shelf life make them a go-to solution in regions lacking controlled application environments or advanced spray systems. While alternative technologies like water-based and powder coatings are gaining traction in specific markets, the unmatched versatility, resilience, and proven effectiveness of solvent-based coatings continue to uphold their dominant position in the global market landscape.

By Resin Type Analysis

Epoxy resins are anticipated to dominate the global protective coatings market owing to their exceptional mechanical strength, adhesion properties, and chemical resistance. These coatings form a highly durable barrier that protects surfaces from corrosion, abrasion, and environmental degradation, making them indispensable in industries such as oil & gas, marine, power generation, and infrastructure. Epoxy coatings are especially known for their outstanding performance in challenging environments, including underwater and chemical exposure conditions, which is critical for protecting pipelines, storage tanks, and offshore platforms.

Their application versatility—ranging from primers to intermediate and topcoats—enhances their value across multi-layer protective systems. Additionally, epoxy coatings have excellent bonding capabilities with both ferrous and non-ferrous materials, allowing them to be used widely on steel and concrete substrates. Their ability to cure at both ambient and low temperatures broadens their use in diverse climates and geographies. Technological advancements have further expanded their performance spectrum, with modern formulations offering increased flexibility, UV resistance, and faster curing times. These innovations have improved their usability in both protective and aesthetic applications without compromising on strength.

Moreover, epoxy systems are cost-effective over the long term due to their extended service life and reduced maintenance requirements, which aligns well with industrial goals of operational efficiency and asset lifecycle management. The global trend toward infrastructure development and industrial expansion, especially in emerging economies, is accelerating demand for high-performance resins, further solidifying epoxy’s dominance. In sum, epoxy resins strike an ideal balance between performance, versatility, and cost, sustaining their leadership in the resin segment of protective coatings.

By Application Analysis

Abrasion resistance is projected to remain the leading application segment in the global protective coatings market due to its critical role in preserving equipment and structural integrity across a wide array of heavy-duty industrial settings. Surfaces subjected to continuous mechanical wear, friction, and particulate impact, such as pipelines, mining equipment, manufacturing machinery, and transportation infrastructure, require coatings that can significantly reduce surface degradation over time.

Abrasion-resistant coatings are engineered to protect against surface erosion caused by sliding or rolling contact, making them vital in sectors like oil & gas, marine, power generation, and mining. These coatings ensure minimal maintenance, extended operational life, and decreased downtime, directly impacting productivity and cost efficiency.

Additionally, advancements in coating formulations using materials like epoxy, polyurethane, and ceramic-reinforced compounds have led to enhanced durability and higher performance, meeting the rigorous demands of modern industrial operations. The rising emphasis on asset protection in high-capital investment projects, including offshore rigs, pipelines, and large-scale processing facilities, further fuels the adoption of abrasion-resistant coatings. Industries are also increasingly deploying automation and high-speed machinery that intensifies surface wear, amplifying the need for advanced abrasion-resistant solutions.

Moreover, governments and corporations are investing in infrastructure and transportation projects where high-traffic surfaces such as bridges, tunnels, and highways benefit significantly from abrasion-resistant coatings. These coatings not only enhance physical endurance but also provide resistance to environmental stressors like moisture, chemicals, and temperature fluctuations, offering multi-functional protection. This combination of mechanical strength, environmental resilience, and cost-saving benefits solidifies the dominance of abrasion-resistant coatings in protective applications globally.

By End-user Analysis

The oil & gas sector is expected to dominant end-user of protective coatings due to its reliance on long-lasting, high-performance surface protection in extremely harsh operational environments. Exploration, drilling, transportation, and refining activities expose infrastructure and equipment to extreme conditions such as saltwater, abrasive particles, corrosive chemicals, and high pressures. Protective coatings are essential to ensure the integrity and safety of oil rigs, pipelines, storage tanks, refineries, and offshore platforms, where failure could result in catastrophic financial and environmental consequences.

Epoxy and zinc-rich coatings are commonly used in this sector to prevent corrosion and mechanical degradation, particularly in submerged or atmospheric zones. In addition to corrosion and abrasion resistance, coatings in this industry must offer fire retardancy and heat resistance to meet stringent safety standards. The global expansion of oil & gas projects, particularly in deepwater exploration and shale gas development, has further escalated the demand for protective coatings that offer specialized performance under extreme conditions.

Moreover, regulatory bodies across regions are enforcing strict compliance measures to minimize asset failures, pushing operators to invest in advanced protective solutions. Oil & gas companies are also turning to predictive maintenance and long-term cost savings, and protective coatings play a vital role in extending asset lifespan while reducing repair frequency and operational disruptions. In emerging markets, the growth of national oil companies and foreign investments in new production capacities also drives demand. The sector’s high capital intensity, safety-critical environment, and massive infrastructure requirements secure its position as the leading consumer of protective coatings worldwide.

The Global Protective Coatings Market Report is segmented on the basis of the following

By Technology

- Solvent-based Coatings

- Water-based Coatings

- Powder Coatings

- UV-cured Coatings

- Others

By Resin type

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc-rich

- Silicone

- Fluoropolymer

- Others

By Application

- Abrasion Resistance

- Chemical Resistance

- Fire Protection

- Heat Resistance

- Corrosion Resistance

- Pipe Coatings

- Others

By End-use Industry

- Oil & Gas

- Petrochemicals

- Marine & Offshore Structures

- Cargo Containers

- Power Generation

- Water & Wastewater Treatment

- Civil Infrastructure & Commercial Buildings

- Transportation

- Food & Beverage Processing Facilities

- Mining & Metallurgy

- Others

Global Protective Coatings Market: Regional Analysis

Region with the Highest Market Share

Asia Pacific holds the largest share in the global protective coatings market, primarily due to its robust industrial base, rapid urbanization, and large-scale infrastructure development across countries such as China, India, Japan, and South Korea. The region is witnessing high demand for protective coatings in sectors including oil & gas, marine, construction, power generation, and transportation. China alone contributes significantly, driven by its expansive manufacturing activities, ongoing energy projects, and massive public infrastructure initiatives under the Belt and Road Initiative. India’s growing focus on industrial corridors and smart cities further fuels market growth.

Additionally, the presence of numerous domestic manufacturers and lower labor costs has made Asia Pacific a global hub for production, boosting regional supply and export capacity. The favorable regulatory frameworks, foreign direct investments, and increasing demand for durable coatings in the automotive and heavy engineering sectors also contribute to the region’s dominance. Furthermore, a rising middle-class population and increasing awareness of asset protection are encouraging the adoption of high-performance coatings in residential and commercial applications.

Region with the Highest CAGR

North America is projected to register the highest CAGR in the global protective coatings market, driven by increasing investments in advanced industrial technologies, infrastructure rehabilitation, and stringent environmental regulations that promote sustainable coatings. The U.S. government’s infrastructure revitalization plans, focusing on highways, bridges, water systems, and energy assets, are significantly boosting the demand for protective coatings to ensure structural durability and compliance. The region’s leadership in R&D and innovation fosters the rapid development of eco-friendly, low-VOC, and high-performance coatings, aligning with evolving environmental standards.

The oil & gas sector in the U.S. also plays a critical role, with extensive pipeline and shale activities requiring corrosion-resistant and fire-protective coatings. Moreover, the shift toward smart and energy-efficient buildings increases the use of durable coatings in both commercial and residential construction. High consumer awareness, digital supply chains, and strong manufacturer presence, such as PPG, Sherwin-Williams, and Axalta, enhance regional competitiveness. Combined, these factors drive a strong growth trajectory, establishing North America as the fastest-growing market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Protective Coatings Market: Competitive Landscape

The global protective coatings market is highly competitive and characterized by the presence of well-established multinational corporations, regional players, and specialized coating solution providers. Key market participants include Akzo Nobel N.V., PPG Industries, The Sherwin-Williams Company, BASF SE, and Jotun A/S, each holding significant market shares due to their expansive product portfolios, global distribution networks, and consistent innovation in high-performance and sustainable coatings.

These companies focus heavily on R&D to develop low-VOC, water-based, and solvent-free formulations to comply with evolving environmental standards and customer preferences for eco-conscious solutions.

Strategic partnerships, mergers & acquisitions, and regional expansions are common competitive tactics aimed at strengthening market positions and accessing new customer bases. For instance, Sherwin-Williams has made multiple acquisitions to expand its industrial coatings division, while Jotun and Hempel are investing in production facilities across Asia and the Middle East.

Emerging players and regional manufacturers also play a critical role by offering cost-effective solutions and catering to local demand. Additionally, digitalization and automation in the coatings supply chain, along with growing demand for customized solutions, are pushing companies to invest in smart manufacturing technologies. Overall, intense competition is driving innovation, pricing strategies, and global expansion across this dynamic market.

Some of the prominent players in the Global Protective Coatings Market are

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- BASF SE

- Jotun A/S

- Hempel A/S

- Axalta Coating Systems Ltd.

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- Berger Paints India Limited

- Asian Paints Ltd.

- Tnemec Company, Inc.

- Teknos Group Oy

- Wacker Chemie AG

- Chugoku Marine Paints, Ltd.

- WEG S.A.

- DuluxGroup Ltd.

- Carboline Company

- Other Key Players

Recent Developments in the Global Protective Coatings Market

- March 2025: The U.S. Federal Trade Commission (FTC) filed a lawsuit to block the $627 million acquisition of Surmodics, a medical device coatings manufacturer, by private equity firm GTCR. The FTC argued that this merger would reduce competition in the market for specialized coatings used in medical devices like catheters.

- January 2025: The Coatings Summit 2025 held from January 15-17, 2025, in Berlin, Germany, this summit gathered global leaders from the coatings industry to discuss market outlooks, sustainability, and innovation. Notable speakers included CEOs from BASF Coatings, Benjamin Moore, and Berger Paints.

- August 2024: Azelis, a leading distributor of specialty chemicals and food ingredients, expanded its footprint in South Africa by acquiring CPS Chemicals, a company specializing in coatings. This strategic move aims to strengthen Azelis' market position and service capabilities in the South African coatings sector.

- July 2024: Ansell announced a $640 million deal to acquire Kimberly-Clark's protective equipment assets, including brands like Kimtech and KleenGuard. This acquisition is expected to enhance Ansell's reach in sectors such as cleanroom manufacturing and the scientific market.

- October 2023: PPG Industries planned to lay off approximately 1,800 employees, primarily in the U.S. and Europe, as part of a cost-cutting initiative. Concurrently, PPG agreed to sell its U.S. and Canadian architectural coatings business to American Industrial Partners for $550 million, including brands like Liquid Nails and Glidden.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.3 Bn |

| Forecast Value (2034) |

USD 24.1 Bn |

| CAGR (2025–2034) |

5.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Solvent-based Coatings, Water-based Coatings, Powder Coatings, UV-cured Coatings, Others), By Resin Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc-rich, Silicone, Fluoropolymer, Others), By Application (Abrasion Resistance, Chemical Resistance, Fire Protection, Heat Resistance, Corrosion Resistance, Pipe Coatings, Others), By End-use Industry (Oil & Gas, Petrochemicals, Marine & Offshore Structures, Cargo Containers, Power Generation, Water & Wastewater Treatment, Civil Infrastructure & Commercial Buildings, Transportation, Food & Beverage Processing Facilities, Mining & Metallurgy, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Jotun A/S, Hempel A/S, Axalta Coating Systems Ltd., RPM International Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Sika AG, Berger Paints India Limited, Asian Paints Ltd., Tnemec Company, Inc., Teknos Group Oy, Wacker Chemie AG, Chugoku Marine Paints, Ltd., WEG S.A., DuluxGroup Ltd., Carboline Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Protective Coatings Market?

▾ The Global Protective Coatings Market size is estimated to have a value of USD 15.3 billion in 2025 and is expected to reach USD 24.1 billion by the end of 2034.

What is the size of the US Protective Coatings Market?

▾ The US Protective Coatings Market is projected to be valued at USD 4.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.2 billion in 2034 at a CAGR of 4.9%.

Which region accounted for the largest Global Protective Coatings Market?

▾ Asia Pacific is expected to have the largest market share in the Global Protective Coatings Market with a share of about 37.5% in 2025.

Who are the key players in the Global Protective Coatings Market?

▾ Some of the major key players in the Global Protective Coatings Market are Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Jotun A/S, Hempel A/S, Axalta Coating Systems Ltd., RPM International Inc., and many others.

What is the growth rate in the Global Protective Coatings Market in 2025?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.