Market Overview

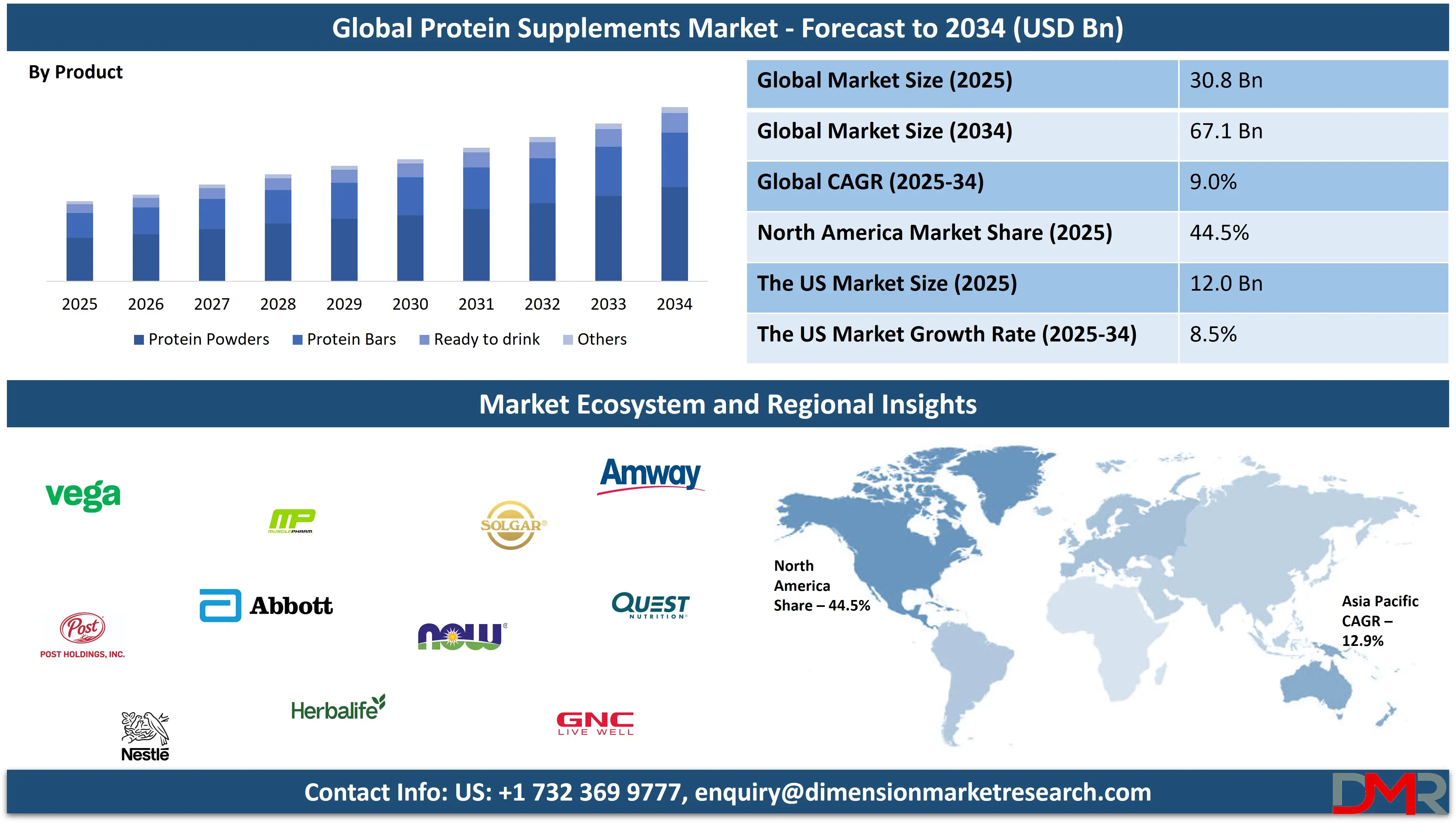

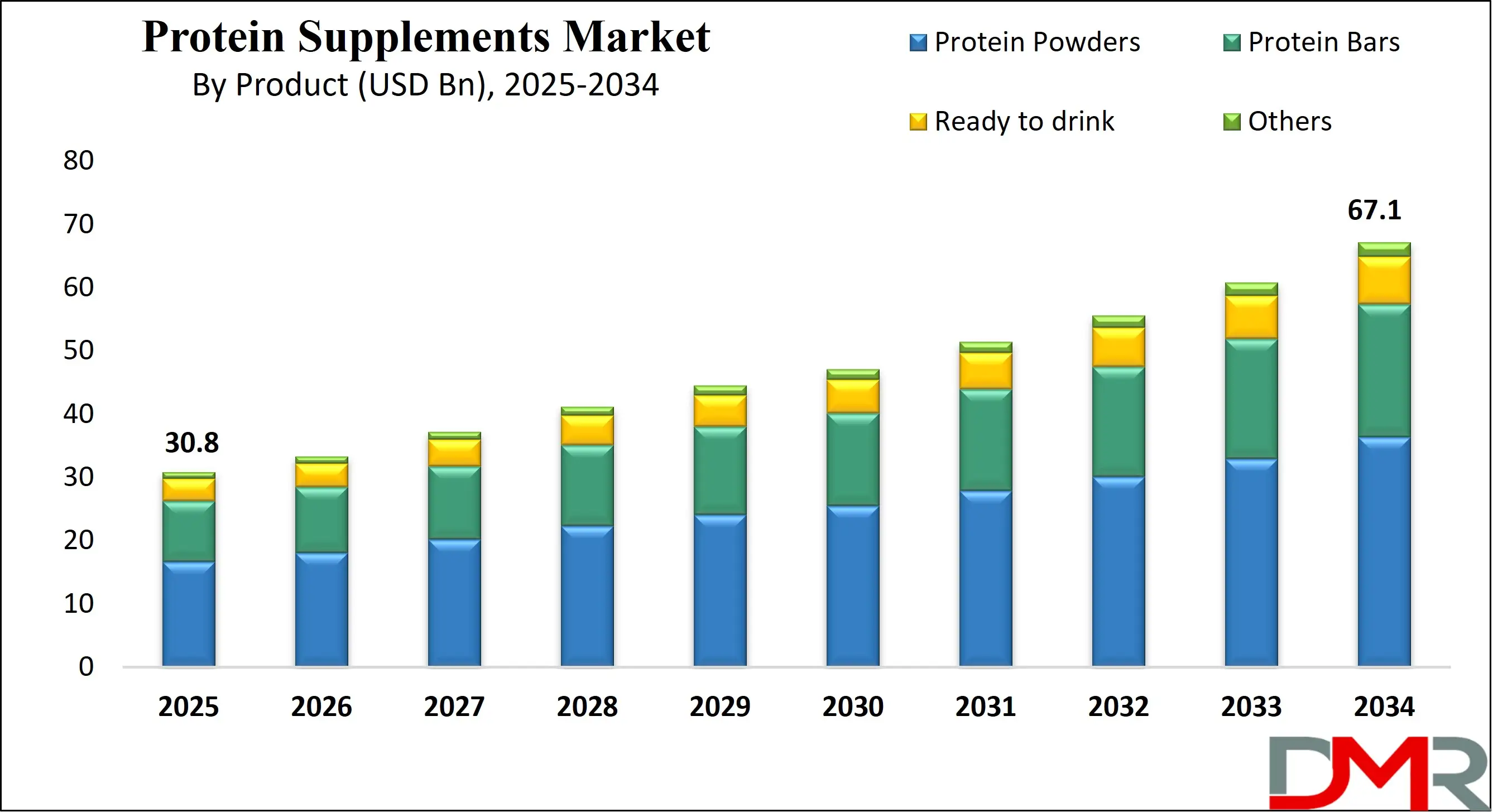

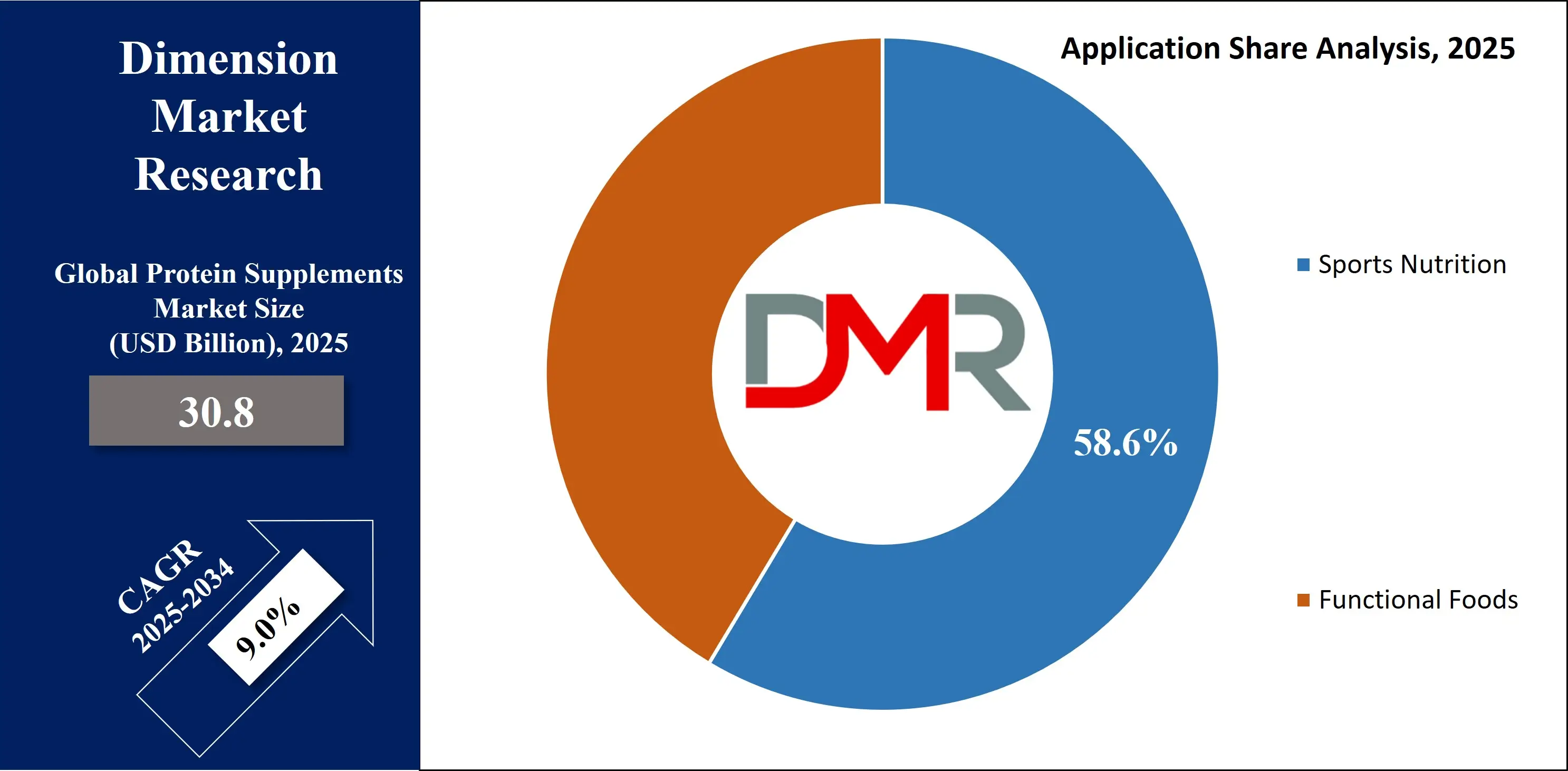

The Global Protein Supplements Market size is projected to reach USD 30.8 billion in 2025 and grow at a compound annual growth rate of 9.0% to reach a value of USD 67.1 billion in 2034.

Protein supplements refer to concentrated nutritional products derived from animal and plant protein sources that are formulated to support muscle growth, post-exercise recovery, weight management, and overall dietary nutrition. These products are commonly available in forms such as protein powders, protein bars, and ready-to-drink beverages, and are widely used in sports nutrition and functional food applications. Protein supplementation has become an integral part of modern health and wellness practices, supported by growing awareness of protein’s role in metabolic health, physical performance, and healthy aging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The growth across this market is driven by rise in fitness participation, greater emphasis on preventive healthcare, and dietary shifts toward higher protein intake. Advancements in plant-based protein extraction, clean-label formulations, and lactose-free alternatives have expanded consumer accessibility and acceptance. Clearer nutritional labeling requirements and improved quality standards have strengthened consumer confidence, supporting broader adoption beyond traditional athletic users.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Recent years have witnessed increased investment in sustainable protein sources, precision nutrition, and personalized supplementation solutions. Strategic collaborations between nutrition brands and food technology companies are accelerating product innovation, while rising demand for transparency, traceability, and ethically sourced ingredients continues to influence competitive strategies and long-term industry direction.

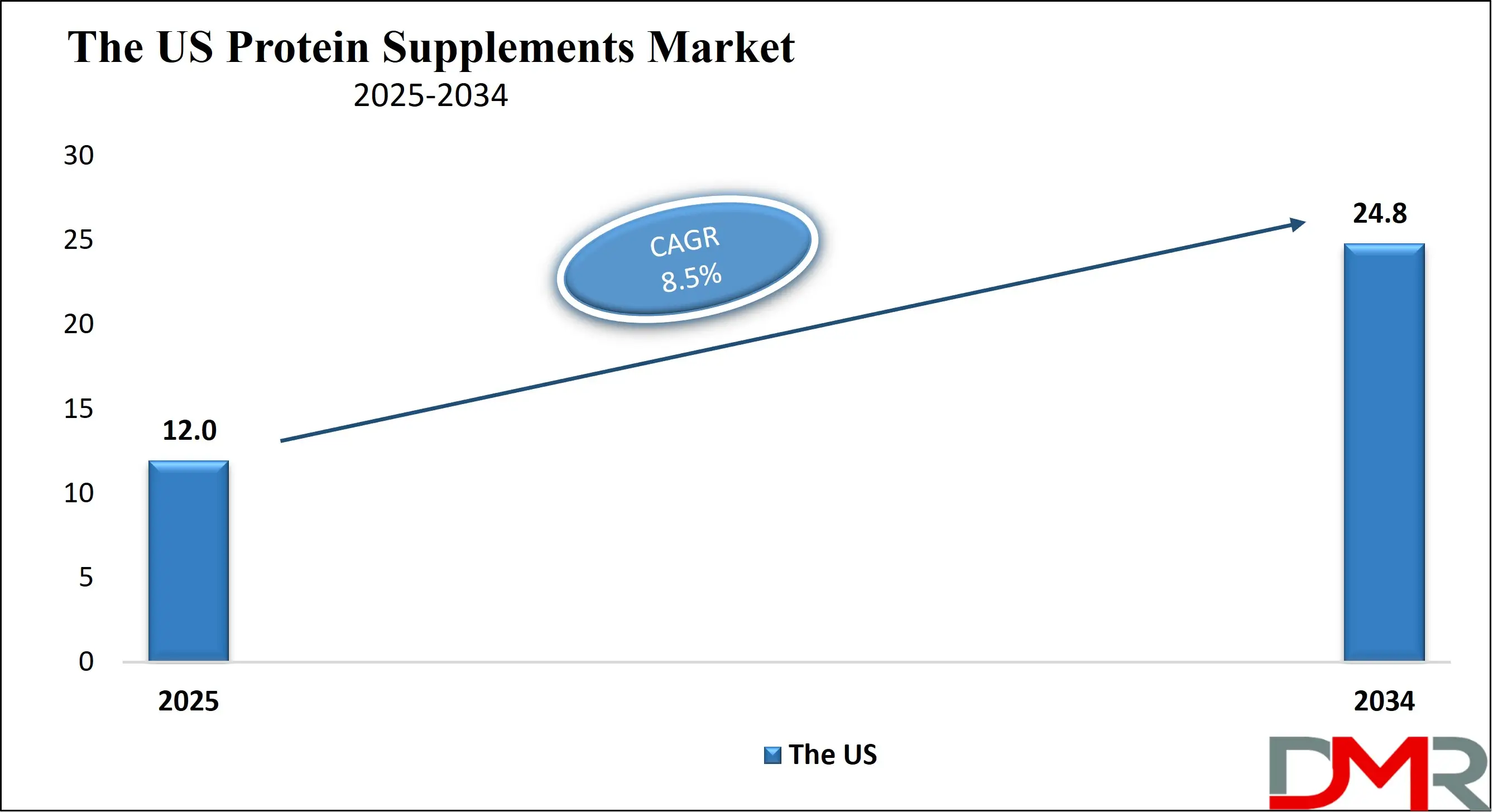

The US Protein Supplements Market

The US Protein Supplements Market size is projected to reach USD 12.0 billion in 2025 at a compound annual growth rate of 8.5% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Protein Supplements market is driven by high consumer awareness, strong fitness culture, and widespread adoption of dietary supplements. A mature retail ecosystem, including online platforms and specialty nutrition stores, supports market penetration. Regulatory oversight by food safety authorities has improved product standardization and labeling transparency. Innovation in plant-based and functional protein blends is prominent, supported by strong R&D investment. The presence of established manufacturers and private-label brands intensifies competition while promoting continuous product differentiation and premiumization.

Europe Protein Supplements Market

Europe Protein Supplements Market size is projected to reach USD 8.6 billion in 2025 at a compound annual growth rate of 8.9% over its forecast period.

Europe’s Protein Supplements market benefits from strong regulatory frameworks emphasizing product safety, sustainability, and clean labeling. Regional policies promoting health-conscious diets and reduced meat consumption support demand for plant-based proteins. The European Green Deal has indirectly accelerated sustainable sourcing and eco-friendly packaging adoption. Sports nutrition, clinical nutrition, and functional foods are key growth sectors, with Western Europe leading in innovation and Eastern Europe showing rising adoption driven by affordability and urbanization.

Japan Protein Supplements Market

Japan Protein Supplements Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 9.4% over its forecast period.

Japan’s Protein Supplements market is influenced by aging demographics, preventive healthcare culture, and functional nutrition demand. Protein supplementation is increasingly used for muscle preservation, elderly nutrition, and clinical dietary support. Government-backed health initiatives promoting active aging and balanced diets encourage market expansion. Challenges include strict regulatory approval processes and consumer preference for mild flavors and natural ingredients. Opportunities exist in collagen-based proteins, ready-to-drink formats, and fortified functional foods tailored to local dietary habits.

Protein Supplements Market: Key Takeaways

- Market Growth: The Protein Supplements Market size is expected to grow by USD 33.8 billion, at a CAGR of 9.0%, during the forecasted period of 2026 to 2034.

- By Product: The protein powders segment is anticipated to get the majority share of the Protein Supplements Market in 2025.

- By Application: The sports nutrition segment is expected to get the largest revenue share in 2025 in the Protein Supplements Market.

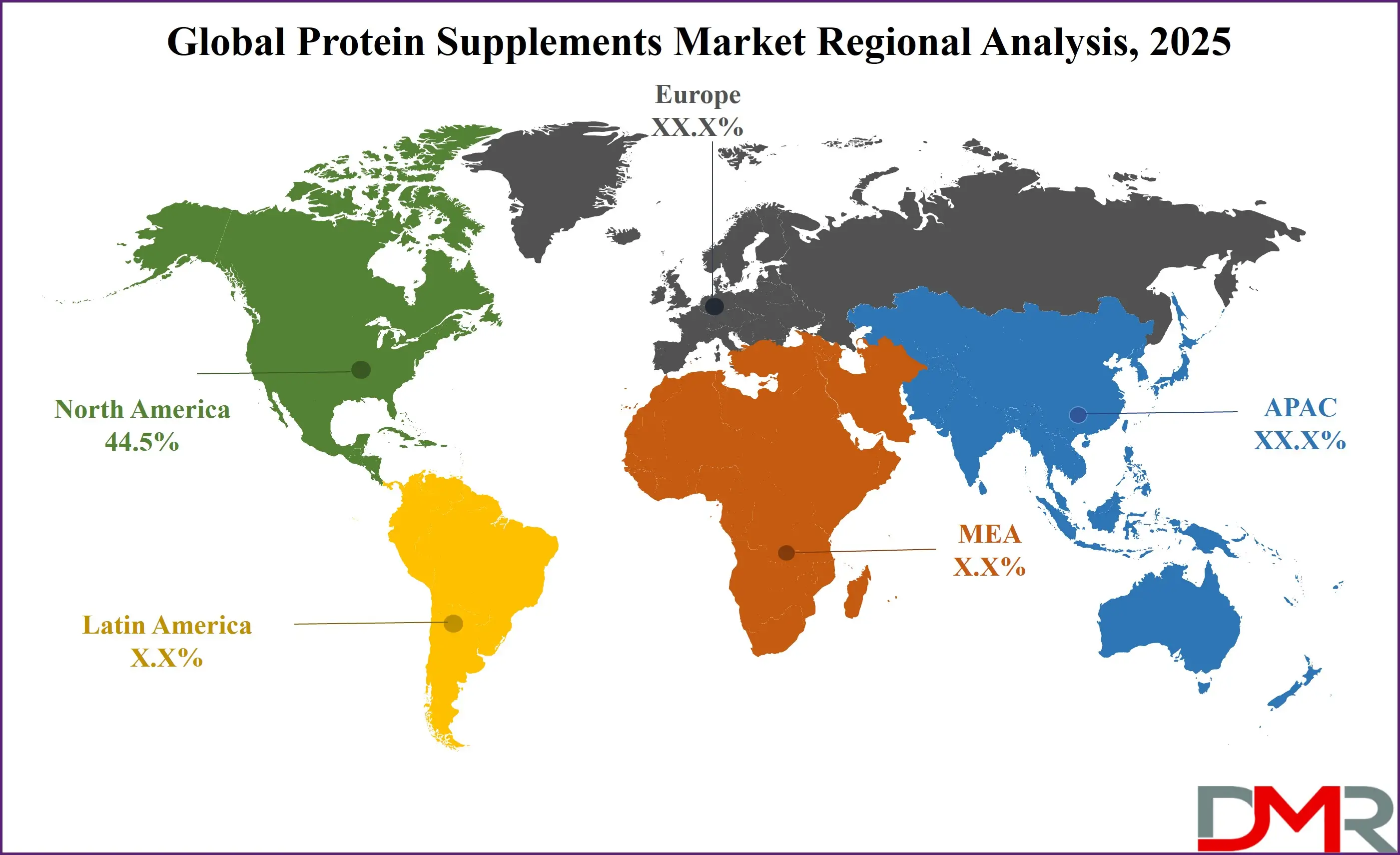

- Regional Insight: North America is expected to hold a 44.5% share of revenue in the Global Protein Supplements Market in 2025.

- Use Cases: Some of the use cases of Protein Supplements include sports performance nutrition, lifestyle & functional foods, and more.

Protein Supplements Market: Use Cases

- Sports Performance Nutrition: Supports muscle recovery, endurance, and strength enhancement for athletes and fitness enthusiasts.

- Weight Management: Used in meal replacements and satiety-focused diets to support fat loss and metabolic health.

- Clinical & Elderly Nutrition: Helps prevent muscle loss, improve recovery, and support nutritional adequacy in aging populations.

- Lifestyle & Functional Foods: Integrated into daily diets through snacks and beverages for general wellness and convenience.

Stats & Facts

- U.S. Department of Agriculture reports that average per capita protein availability exceeded 110 grams per day in 2024, reflecting sustained high-protein dietary patterns.

- Food and Drug Administration recorded a 14% increase in dietary supplement product registrations between 2024 and 2025.

- European Commission indicates that plant-based protein production capacity grew by over 18% across the EU in 2024.

- Japan Ministry of Health, Labour and Welfare noted a 21% rise in functional nutrition product approvals in 2025.

- World Health Organization highlighted increased protein intake recommendations for aging populations in updated 2024 nutrition guidelines.

Market Dynamic

Driving Factors in the Protein Supplements Market

Rising Health and Fitness Awareness

Growing awareness of lifestyle-related diseases and preventive healthcare has significantly increased protein supplement consumption. Consumers now associate adequate protein intake with muscle health, immunity, and metabolic balance. Fitness participation, home workouts, and personalized nutrition plans have expanded protein usage beyond professional athletes. Governments and healthcare organizations advocating balanced macronutrient intake further reinforce demand. The shift toward proactive health management positions protein supplements as an essential dietary component rather than a discretionary product.

Innovation in Plant-Based and Functional Proteins

Advancements in plant protein extraction, fermentation, and blending technologies have improved taste, digestibility, and amino acid profiles. This innovation addresses lactose intolerance, vegan preferences, and sustainability concerns. Functional enhancements such as added probiotics, vitamins, and adaptogens increase product value. Supply chain improvements and ingredient diversification have reduced costs, enabling broader market access and accelerating category expansion.

Restraints in the Protein Supplements Market

Regulatory and Quality Compliance Challenges

Protein supplements face strict regulatory scrutiny regarding ingredient safety, labeling accuracy, and health claims. Compliance costs increase barriers for new entrants and smaller manufacturers. Variations in global regulatory standards complicate cross-border trade. Product recalls and contamination concerns can damage consumer trust, impacting brand credibility and slowing market expansion despite strong underlying demand.

Price Sensitivity and Market Saturation

Premium protein products often carry higher prices due to specialized ingredients and branding. In price-sensitive markets, this limits adoption. Additionally, intense competition and product commoditization in mature regions reduce differentiation, leading to margin pressure. Consumers may shift to whole-food protein alternatives when economic conditions tighten, restraining growth potential.

Opportunities in the Protein Supplements Market

Personalized and Precision Nutrition

Advances in digital health, biomarker testing, and AI-driven diet planning create opportunities for personalized protein supplementation. Tailored formulations addressing age, gender, activity level, and health conditions are gaining traction. This customization enhances consumer engagement, loyalty, and willingness to pay premium prices, opening high-margin growth avenues.

Expansion in Emerging Economies

Rising disposable incomes, urbanization, and growing fitness culture in emerging markets support protein supplement adoption. Improved retail infrastructure and e-commerce penetration enhance accessibility. Government initiatives promoting nutrition security and sports participation further strengthen long-term growth prospects in these regions.

Trends in the Protein Supplements Market

Clean-Label and Sustainable Proteins

Consumers increasingly demand transparency, minimal processing, and environmentally responsible sourcing. Clean-label formulations free from artificial additives and sustainably sourced proteins are becoming standard. Brands investing in traceability and eco-friendly packaging gain competitive advantage as sustainability influences purchasing decisions.

Ready-to-Drink and Convenience Formats

Busy lifestyles drive demand for ready-to-consume protein beverages and snacks. Ready-to-drink products offer portability and precise dosing, appealing to urban professionals and younger consumers. This trend supports premiumization and cross-category integration with functional beverages.

Impact of Artificial Intelligence in Protein Supplements Market

- Product Formulation Optimization: AI accelerates ingredient selection and nutrient balancing for improved efficacy.

- Personalized Nutrition Solutions: Algorithms tailor protein intake recommendations based on individual health data.

- Demand Forecasting: AI improves inventory planning and reduces supply chain inefficiencies.

- Quality Control Automation: Machine learning detects contamination and formulation inconsistencies.

- Consumer Engagement: AI-driven insights enhance targeted marketing and customer retention strategies.

Research Scope and Analysis

By Source Analysis

Animal-based protein supplements accounted for 62.4% share in 2025, primarily due to their high bioavailability and complete essential amino acid profiles. Whey and casein proteins dominate this segment because of their proven effectiveness in muscle protein synthesis, strength development, and post-exercise recovery. These proteins are widely supported by clinical research, reinforcing trust among athletes, bodybuilders, and healthcare professionals. Well-established dairy supply chains ensure consistent raw material availability and cost efficiency. Continuous innovation in whey isolates, hydrolyzed forms, and low-lactose variants has improved digestibility and absorption, supporting sustained demand across sports nutrition, medical nutrition, and elderly care applications globally.

Plant-based protein supplements represent the fastest-growing source segment, driven by rising veganism, flexitarian diets, and sustainability concerns. Proteins derived from pea, soy, rice, and blends are gaining traction as manufacturers improve amino acid balance, taste, and solubility. Advancements in processing technologies have addressed earlier concerns related to texture and digestibility. Growing consumer awareness around environmental impact and animal welfare further supports adoption. Regulatory support for plant-based nutrition and clean-label positioning enhances credibility. While still smaller in share compared to animal-based proteins, rapid innovation and expanding mainstream acceptance position this segment for strong long-term growth.

By Product Analysis

Protein powders held a 54.1% share in 2025, supported by their versatility, cost-effectiveness, and ease of customization. They are widely consumed across fitness, sports performance, and clinical nutrition due to flexible dosing and compatibility with various diets. Long shelf life and efficient storage make powders a preferred format for manufacturers and distributors. Product innovation through flavor diversification, functional ingredient additions, and improved solubility continues to strengthen consumer appeal. Powders also dominate online and subscription-based sales channels, reinforcing repeat purchases. Their ability to cater to beginners and advanced users alike sustains their leadership across global protein supplement consumption.

Ready-to-drink protein products are experiencing rapid growth due to convenience, portability, and alignment with busy consumer lifestyles. These products appeal strongly to urban professionals, students, and on-the-go consumers seeking immediate nutrition without preparation. Advancements in shelf-stable packaging, cold-chain logistics, and flavor masking technologies have improved product quality and shelf life. Premium positioning, clean-label claims, and functional enhancements such as added vitamins or electrolytes further boost demand. Although priced higher than powders, increasing willingness to pay for convenience and lifestyle compatibility continues to accelerate adoption across developed and emerging regions.

By Application Analysis

Sports nutrition accounted for 58.6% share in 2025, driven by consistent demand from athletes, fitness enthusiasts, and recreational exercisers. Protein supplementation is integral to muscle recovery, endurance improvement, and strength development within structured training programs. Rising gym memberships, home fitness trends, and sports participation support continued consumption. Brands heavily invest in performance-focused formulations and scientific validation to maintain credibility. Endorsements by athletes and fitness influencers further strengthen visibility. The segment benefits from early adoption of new protein formats and functional innovations, reinforcing its dominant position within overall protein supplement usage.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Functional food applications are growing rapidly as protein supplementation expands into everyday dietary routines. Consumers increasingly seek protein-enriched snacks, beverages, and meal replacements that support satiety, energy, and general wellness. This segment benefits from convergence between nutrition and convenience food categories. Demand is particularly strong among working professionals, aging populations, and weight-conscious consumers. Manufacturers focus on taste, texture, and clean-label positioning to encourage habitual consumption. As protein becomes a standard ingredient in mainstream food products, functional foods are expected to play a key role in driving volume growth and expanding consumer reach.

By Distribution Analysis

Online channels captured 39.8% share in 2025, supported by price transparency, product variety, and subscription-based purchasing models. Direct-to-consumer platforms allow brands to educate customers, offer personalized recommendations, and build long-term loyalty. E-commerce also enables easy access to niche and premium protein products unavailable in physical stores. Influencer marketing, digital advertising, and user reviews significantly influence purchasing decisions. The convenience of home delivery and recurring orders strengthens repeat consumption. As digital payment systems and logistics infrastructure improve globally, online channels are expected to remain a major driver of distribution growth.

Supermarkets and hypermarkets continue to play a vital role in mass-market penetration of protein supplements. These outlets provide high visibility, impulse purchasing opportunities, and trust through established retail environments. Consumers often prefer physical stores for first-time purchases to assess product labels, packaging, and authenticity. Competitive pricing and promotional offers further support sales volumes. Large retailers also facilitate private-label protein supplement expansion. While growth is slower than online channels, supermarkets and hypermarkets remain essential for reaching broader demographics and supporting consistent, high-volume distribution.

By Gender Analysis

Male consumers accounted for 61.2% share in 2025, largely driven by strong association between protein supplementation and muscle building, strength training, and sports performance. Higher participation rates in resistance training and competitive sports support sustained demand. Marketing strategies traditionally focus on performance enhancement, physique development, and recovery benefits, reinforcing male dominance. Established consumption habits and brand loyalty further contribute to repeat purchases. Although growth has stabilized in mature regions, continued fitness culture and product innovation ensure that male consumers remain a core demand base.

Female protein supplement adoption is rising rapidly, supported by increasing focus on wellness, weight management, and active lifestyles. Women increasingly view protein as essential for toning, metabolic health, and overall nutrition rather than only muscle gain. Clean-label formulations, plant-based options, and low-calorie products resonate strongly with female consumers. Targeted marketing and product formats such as flavored beverages and bars encourage regular consumption. As awareness grows and social barriers decline, female consumers represent a significant growth opportunity across global markets.

By Age Group Analysis

Millennials held 44.7% share in 2025, supported by strong health awareness, fitness engagement, and convenience-driven consumption habits. This group actively seeks functional nutrition solutions aligned with busy lifestyles. High digital engagement influences purchasing through online platforms, subscriptions, and influencer recommendations. Millennials are also more willing to experiment with new flavors, formats, and plant-based alternatives. Their long-term consumption potential and brand loyalty make them a strategically important demographic for sustained revenue growth.

Generation Z represents the fastest-growing age group, influenced by social media trends, fitness content, and functional beverage popularity. This demographic favors ready-to-drink formats, clean ingredients, and sustainability-driven branding. High responsiveness to digital marketing and peer recommendations accelerates adoption. Although current spending power is lower than older groups, early habit formation and rising health consciousness position Generation Z as a key future consumer base for protein supplements.

The Protein Supplements Market Report is segmented on the basis of the following

By Source

By Product

- Protein Powders

- Protein Bars

- Ready to drink

- Others

By Application

- Sports Nutrition

- Functional Foods

By Distribution Channel

- Supermarkets & Hypermarket

- Pharmacy

- Online

- Others

By Gender

By Age Group

- Millennials

- Generation Z

- Baby Boomers

Regional Analysis

Leading Region in the Protein Supplements Market

North America accounted for 44.5% market share in 2025, driven by high consumer awareness regarding protein intake and its health benefits. The region benefits from a well-developed retail ecosystem, including specialty nutrition stores, supermarkets, and advanced e-commerce platforms that ensure wide product accessibility. Strong regulatory clarity around dietary supplements enhances consumer trust and product standardization. High disposable income levels support premium product adoption, while continuous innovation in formulations and flavors reinforces regional leadership. An established fitness culture, high gym membership rates, and widespread participation in sports further drive consistent demand. Additionally, strong investment in research and product development enables rapid commercialization of new protein formats, sustaining North America’s dominant position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Protein Supplements Market

Asia-Pacific represents the fastest-growing region for protein supplements, supported by rapid urbanization, rising disposable incomes, and increasing health and fitness awareness. Growing middle-class populations across countries such as China, India, and Southeast Asian nations are adopting protein supplementation as part of lifestyle and preventive healthcare routines. Government-led nutrition and wellness initiatives promote balanced diets and active living, indirectly supporting demand. The expansion of e-commerce platforms and mobile payment systems improves product accessibility, particularly in urban and semi-urban areas. Additionally, younger demographics, increasing gym penetration, and influence of social media fitness trends contribute to accelerated adoption, positioning Asia-Pacific as a key growth engine for the global protein supplements industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Protein Supplements market is highly competitive, characterized by product differentiation, brand positioning, and innovation-led strategies. Companies focus on clean-label formulations, sustainable sourcing, and premium offerings to maintain market share. Entry barriers include regulatory compliance and supply chain complexity. Strategic partnerships, investment in R&D, and digital marketing optimization are key competitive tools. Pricing strategies balance affordability and premiumization to address diverse consumer segments while sustaining margins.

Some of the prominent players in the global Protein Supplements are

- Abbott

- Glanbia plc

- Nestlé

- Herbalife Nutrition

- Amway

- GNC Holdings

- Iovate Health Sciences

- Quest Nutrition

- The Hut Group (Myprotein)

- Post Holdings

- NOW Foods

- BellRing Brands

- Dymatize Enterprises

- Universal Nutrition

- Vitaco Health Group

- Solgar

- MusclePharm

- CytoSport (Muscle Milk)

- Garden of Life

- Vega

- Other Key Players

Recent Developments

- In January 2026, Bloom Nutrition launcged Bloom Clear Protein, a modern take on protein powder designed to deliver both performance and beauty benefits in a refreshingly light format, it says. Further, made with clear whey protein isolate and grass-fed collagen peptides, Clear Protein provides 20 grams of protein in an easy-to-digest format that fits seamlessly into daily routines, and when mixed with water, Bloom Clear Protein transforms into a fresh, fruit-forward beverage, offering 30% of daily protein needs without the heaviness of creamy shakes

- In December 2025, Abbott announced two new shakes designed to support muscle health and nutrition goals as part of the Ensure Max Protein line: Ensure Max Protein 42g and Ensure Max Protein 2 in 1 Muscle Support, where Ensure Max Protein 42g is designed for active adults pushing their limits, while Ensure Max Protein 2 in 1 Muscle Support is scientifically formulated with 30g of high-quality protein to support muscle health, 1.5g of CaHMB to help slow the breakdown of muscle, and 26 vitamins and minerals to fill nutrition gaps.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 30.8 Bn |

| Forecast Value (2034) |

USD 67.1 Bn |

| CAGR (2025–2034) |

9.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 12.0 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Segments Covered |

By Source (Animal-based and Plant-based), By Product (Protein Powders, Protein Bars, Ready to drink, and Others), By Application (Sports Nutrition, and Functional Foods), By Distribution Channel (Supermarkets & Hypermarket, Pharmacy, Online, and Others), By Gender (Male and Female), By Age Group (Millennials, Generation Z, and Baby Boomers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Abbott, Glanbia plc, Nestlé, Herbalife Nutrition, Amway, GNC Holdings, Iovate Health Sciences, Quest Nutrition, The Hut Group (Myprotein), Post Holdings, NOW Foods, BellRing Brands, Dymatize Enterprises, Universal Nutrition, Vitaco Health Group, Solgar, MusclePharm, CytoSport (Muscle Milk), Garden of Life, Vega, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Protein Supplements Market?

▾ The Global Protein Supplements Market size is expected to reach USD 30.8 billion by 2025 and is projected to reach USD 67.1 billion by the end of 2034.

Which region accounted for the largest Global Protein Supplements Market?

▾ North America is expected to have the largest market share in the Global Protein Supplements Market, with a share of about 44.5% in 2025.

How big is the Protein Supplements Market in the US?

▾ The US Protein Supplements market is expected to reach USD 12.0 billion by 2025.

Who are the key players in the Protein Supplements Market?

▾ Some of the major key players in the Global Protein Supplements Market include Nestle, Amway, Abbott and others

What is the growth rate in the Global Protein Supplements Market?

▾ What is the growth rate in the Global Protein Supplements Market?